1. Introduction

1.1 Motivation

The mechanism of interest to the present paper is how diversification across different insurance business lines can be exploited to reduce prices in some of them. Offsetting relationships between different product lines are often studied in the aim of reducing the risk of the combined portfolio. In the insurance industry, the combination of business lines is commonly known as natural hedging and consists in determining optimal product mixes (Kahane Reference Kahane1977; Cummins and Nye Reference Cummins and Nye1981; GrÜndl et al. Reference GrÜndl, Post and Schulze2006; Tsai et al. Reference Tsai, Wang and Tzeng2010; Wang et al. Reference Wang, Huang, Yang and Tsai2010; Wang et al. Reference Wang, Huang and Hong2013; Li and Haberman Reference Li and Haberman2015; Luciano et al. Reference Luciano, Regis and Vigna2017).

Natural hedging is an ex post exercise performed after the products have been launched. Exploiting the offsetting relationship between cash flows from different business lines can serve another purpose, which is price reduction. In particular, by incorporating the diversification effect ex ante in the price, joint pricers (i.e. insurers exploiting the interaction between future liabilities of the policies in the pricing) could gain a competitive advantage over stand-alone pricers (i.e. insurers relying only on individual characteristics of the policies). Specifically, offsetting effects can be anticipated by reducing the safety loadings that reflect the insurer’s risk. Cox and Lin (Reference Cox and Lin2007) find empirically that firms providing both annuities and life assurance policies tend to charge lower premiums, which supports this intuition for longevity and mortality risks. The questions that arise are (i) what are the implications of incorporating information on offsetting relationships between two policies into the pricing process? and (ii) what market conditions are most propitious for the implementation of joint pricing strategies?

1.2 Main findings

This paper studies joint and stand-alone pricing of insurance policies underwritten in exchange for a premium determined from an actuarial premium principle. On top of the expected present value of future payouts, a safety loading, or risk premium, is charged to reflect the insurer’s risk. It is assumed that the loading is proportional to the pure premium, and that it satisfies a risk reduction constraint at portfolio level. Under this constraint, the insurer’s risk reductions are equal under the two competing pricing strategies.

As a first step, the paper analyses the required safety loading conditionally on the proportion of policies in each business line. It is shown that there exists a competitiveness region for joint pricers where the actual premium can be set, and that the liabilities need not be negatively correlated for this region to exist. It is also shown that there exists a critical threshold in the proportion of the business line with the highest standard deviation per unit of expected payout (henceforth, the most risky business line), beyond which joint pricing might lead to a competitive disadvantage on the least risky business line. Additionally, it is shown that the choice of competitiveness comes with the burden of portfolio monitoring; for a given price in the competitiveness region, a joint pricer has to maintain the proportion of policies within a specific interval in order for the actual loading to be at least equal to the required one.

In line with earlier studies on product mix but from an ex ante perspective, the first part of the analysis draws attention to the importance of the numbers of contracts in each business line. The knowledge about these numbers is crucial in the pricing process, because they are influenced by the potential competitive advantage of the joint pricer, which is itself influenced by portfolio composition. Three elements are essential determinants of the relationship between premiums and the number of customers. The first determinant is the total market demand in each business line, which provides information on how many customers in the market are willing to buy each type of contract. The second determinant is the number of competitors in each business line, with whom the joint pricer would share the total market demand. The third determinant is the sensitivity of potential customers to the premium discount offered by the joint pricer.

Taking into account these factors, the paper goes a step further by analysing the total collected premiums at portfolio level under each setting. It is found that the decision on the pricing strategy can be inferred from the reaction factors of policyholders, or on a related conceptual ground, from the price elasticity of demand of the joint pricer. In particular, in order for joint pricing to be rewarding in terms of total collected premiums, the riskier line has to be relatively elastic. The least risky line has to be either relatively elastic if the corresponding demand is lower than that of the riskier line, or relatively inelastic if demand is higher. The proportion of demand beyond which conditions change is related to the critical threshold found in the conditional analysis and is also influenced by the number of competitors.

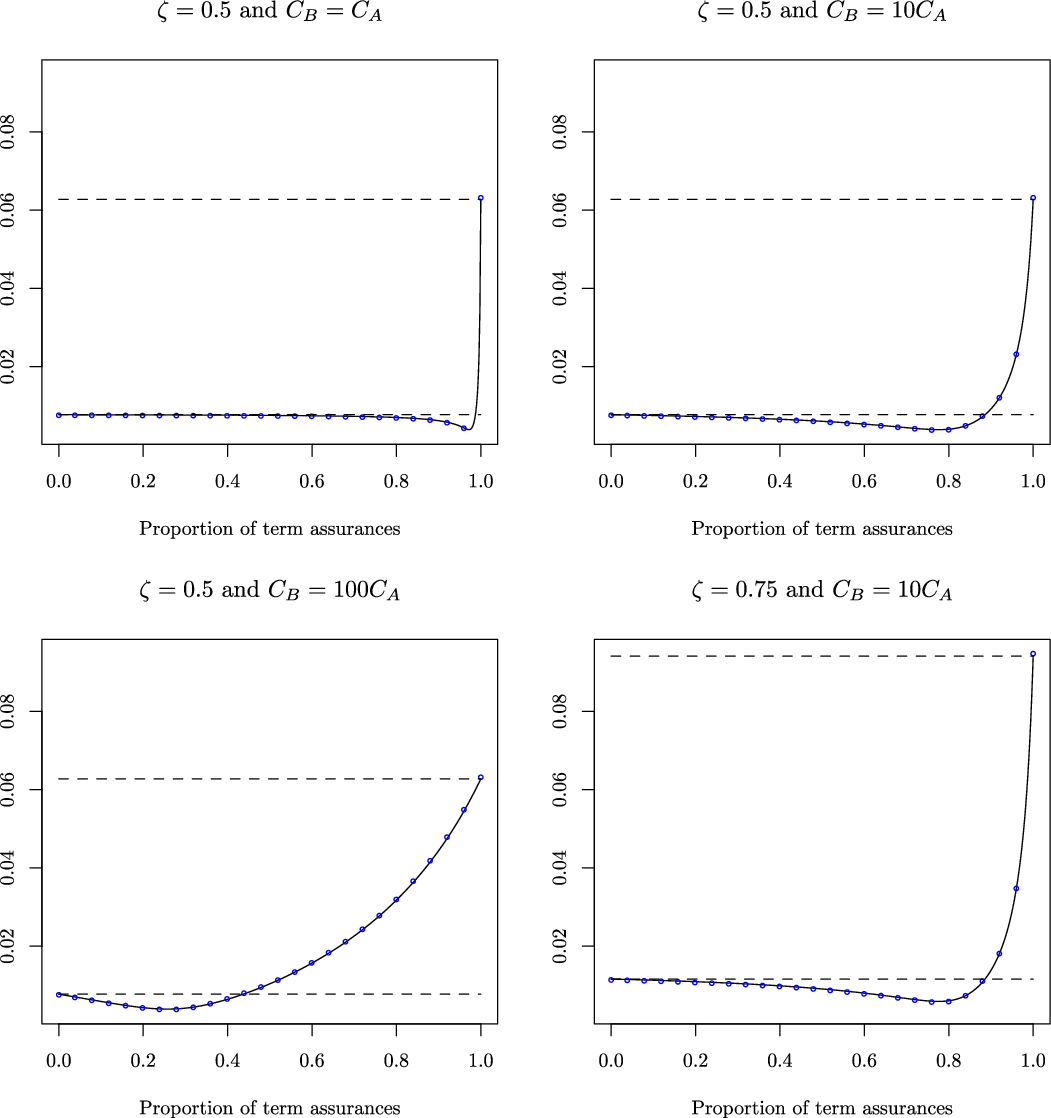

The theoretical modelling is illustrated for a portfolio of term annuities and term assurances. The results show that, as is expected, the competitiveness region exists for these two business lines, and that it is influenced by the ratio between the survival and death benefits. The results also illustrate the impact of the reaction factors on the total collected premiums.

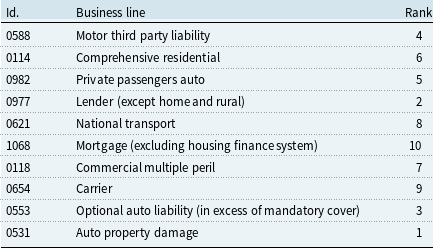

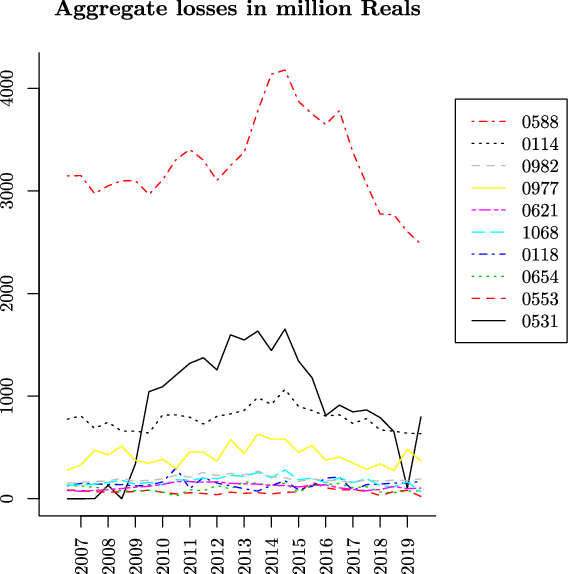

The analysis is substantiated using loss data from the Brazilian non-life insurance market. The empirical exploration of losses from different business lines suggests that a high number of pairs satisfy the condition for being priced jointly. The importance of both individual risks and the correlation between the losses is further highlighted, thereby complementing Leland (Reference Leland2007)’s argument on the importance of riskiness and correlation of cash flows in the context of combining financial activities. More specifically, it is found that a competitiveness region can exist even if the correlation is high. This is the case of optional auto liability and auto property damage which exhibit a correlation of 0.86, and yet, have a positive competitiveness region.

1.3 Contribution

The present paper adds to the literature on combining financial activities and natural hedging (GrÜndl et al. Reference GrÜndl, Post and Schulze2006; Leland Reference Leland2007; Tsai et al. Reference Tsai, Wang and Tzeng2010; Wang et al. Reference Wang, Huang and Hong2013; Li and Haberman Reference Li and Haberman2015; Luciano et al. Reference Luciano, Regis and Vigna2017; Boonen et al. Reference Boonen, De Waegenaere and Norde2017). In contrast with these studies where the offsetting effect is exploited ex post, the goal here is to investigate how this effect can be incorporated ex ante in the pricing. A related work in Bayraktar and Young (Reference Bayraktar and Young2007) suggests that the sum of pure endowment and term assurance prices are lower when their offsetting relationship is exploited. The present paper provides further insights into the mechanisms that lead to lower premiums, and studies when such pricing strategies are favourable, as well as what challenges insurers could face if they implement them. Unlike in Bayraktar and Young (Reference Bayraktar and Young2007), the safety loading depends on portfolio composition, which provides a richer understanding of joint pricing. In particular, the results show that joint pricing leads to more favourably priced policies only under some conditions, and that factors influencing the underwriting volume must be taken into account. Further, echoing arguments on the importance of monitoring requirements and agency costs in firms’ decisions to diversify (Acharya et al. Reference Acharya, Hasan and Saunders2006; de Figueiredo and Rawley Reference de Figueiredo and Rawley2011), this paper shows that the competitive advantage offered by offsetting relationships has a cost in terms of underwriting flexibility and portfolio balancing.

A related strand of the literature has focused on developing pricing models for multiple business lines under the option-pricing framework of Doherty and Garven (Reference Doherty and Garven1986), which incorporates the company’s default risk through an insolvency put option. Contributions in this direction include the model of Phillips et al. (Reference Phillips, Cummins and Allen1998) that inspired a number of subsequent papers. Myers and Read (Reference Myers and Read2001) study surplus allocation rules across different business lines; see Dhaene et al. (Reference Dhaene, Tsanakas, Valdez and Vanduffel2012) for a review on capital allocations. Myers and Read argued that these allocation rules can be used to determine prices, and the approach was further investigated in, e.g., Zanjani (Reference Zanjani2002) and Sherris and van der Hoek (Reference Sherris and van der Hoek2006). GrÜndl and Schmeiser (Reference GrÜndl and Schmeiser2007a) argue against this claim by showing that capital allocations are not required for pricing, and that they may even lead to inappropriate prices; see also Meyers (Reference Meyers2003) and GrÜndl and Schmeiser (Reference GrÜndl and Schmeiser2007b).

Ibragimov et al. (Reference Ibragimov, Jaffee and Walden2018) used the capital allocation model based on option-pricing to compare multi-line structures (or joint pricing in the present terminology) to their mono-line counterparts (or stand-alone pricing in the present terminology). Their model suggests that multi-line risk-neutral firms would proliferate in markets with a large number of independent risks. Mono-line companies would still operate, mostly serving lines of business with asymmetric or heavy-tailed distributions, or specialising in those exhibiting high correlation with other lines. The intuition behind the results of the present paper does not conflict with those of Ibragimov et al. (Reference Ibragimov, Jaffee and Walden2018). Nevertheless, the present paper adopts a different setting and adds to their insights at several levels. One difference with their study is that the central quantity of interest here is the price, and not the capital allocation. Besides the debate raised against pricing based on capital allocation (Phillips et al. Reference Phillips, Cummins and Allen1998; Meyers Reference Meyers2003; GrÜndl and Schmeiser Reference GrÜndl and Schmeiser2007a; GrÜndl and Schmeiser Reference GrÜndl and Schmeiser2007b) in which the present work does not intend to participate, focusing on price is also relevant if firms pursue growth. Recent survey studies show that the purchasing decision in some business lines, and especially in retail insurance, is influenced by prices rather than default levels (Suter et al. Reference Suter, Duke, Harms, Joshi, Rzepecka, Lechardoy, Hausemer, Wilhelm, Dekeulenaer and Lucica2017). Another difference is that the focus here is put on the effect of contract features, portfolio composition, and market characteristics. Additionally, the analysis of the effect of demand is based on the total collected premiums, which is an important indicator of growth that shapes business decisions (Zweifel and Eisen Reference Zweifel and Eisen2012). One of the additions of the present paper to their findings consists in revealing that contract features and portfolio composition are two distinct dimensions in the joint pricing decision. For instance, the diversification effect induced by negative correlation may be undermined if the overall portfolio is unbalanced with more high-risk policies. Analogously, diversification may still be beneficial even under positive correlation depending on the individual risks (as it is found for optional auto liability and auto property damage in the Brazilian market), especially if the overall portfolio is unbalanced with more low-risk policies. Another insight is that even in the absence of diversification effects, insurers may still be better off with joint pricing when their price elasticity of demand is low on the subsidising line.

Other studies on the impact of demand and supply on the competitive advantage of insurers can be found in Taylor (Reference Taylor1986), Emms (Reference Emms2011), Pantelous and Passalidou (Reference Pantelous and Passalidou2017), and references therein. These studies aim at deriving optimal expressions for premiums in the case of a single business line. Under comparable settings, Emms (Reference Emms2012), Dutang et al. (Reference Dutang, Albrecher and Loisel2013), and Asmussen et al. (Reference Asmussen, Christensen and ThØgersen2019) investigate properties of insurance market equilibria. The goal of the present contribution is neither to derive expressions for optimal premiums nor to study market equilibria. Instead, the aim is to provide results which support insurance companies active on two business lines in the decision of pricing them jointly or separately.

1.4 Structure of the paper

The remainder of the paper is organised as follows. Section 2 contains some preliminary notations and the expressions of the premiums. The analysis of the required proportional loading under joint pricing is performed in section 3, conditionally on the proportion of policyholders in each business line. The section also discusses the competitiveness region, the critical threshold, and the burden of portfolio monitoring. Section 4 is devoted to the unconditional analysis, under a functional assumption linking policyholders’ behaviour and market structure to the number of policies underwritten in each business line. Section 5 illustrates the theoretical results for a portfolio of term annuities and term assurances. An empirical exploration of non-life business lines is performed in section 6 using data from the Brazilian insurance market. This section studies the competitiveness region for the top 10 non-life business lines in terms of gross premiums. It is found that a majority of

![]() $75.55\%$

among the total number of candidate pairs can be priced jointly. Section 7 summarises the paper and discusses possible future research. The closing section also reviews some legal limitations preventing insurers from operating in some business lines simultaneously and discusses the particular case of bundling. All proofs are relegated to the appendix.

$75.55\%$

among the total number of candidate pairs can be priced jointly. Section 7 summarises the paper and discusses possible future research. The closing section also reviews some legal limitations preventing insurers from operating in some business lines simultaneously and discusses the particular case of bundling. All proofs are relegated to the appendix.

2. Pricing Models

2.1 Preliminaries

Consider an insurance market with two types of policies, A and B. These policies are from two different business lines, and it is assumed that there is a single risk profile of policyholders in each business line. The per-policy present values of future payments to policyholders in each business line are denoted by

![]() $V_{A}$

and

$V_{A}$

and

![]() $V_{B}$

, respectively. The positive and finite expected values of

$V_{B}$

, respectively. The positive and finite expected values of

![]() $V_A$

and

$V_A$

and

![]() $V_B$

are denoted by

$V_B$

are denoted by

![]() $\pi_A$

and

$\pi_A$

and

![]() $\pi_B$

, respectively. The corresponding positive and finite standard deviations are denoted by

$\pi_B$

, respectively. The corresponding positive and finite standard deviations are denoted by

![]() $\sigma_A$

and

$\sigma_A$

and

![]() $\sigma_B$

. Without loss of generality, the ratio

$\sigma_B$

. Without loss of generality, the ratio

![]() $b=\frac{\sigma_B\pi_A}{\sigma_A\pi_B}$

is assumed to satisfy

$b=\frac{\sigma_B\pi_A}{\sigma_A\pi_B}$

is assumed to satisfy

![]() $b\geq1$

, i.e.

$b\geq1$

, i.e.

![]() $\frac{\sigma_B}{\pi_B}\geq\frac{\sigma_A}{\pi_A}$

, which means that business line B has a higher standard deviation per unit of average benefit. Business line B is sometimes said to be riskier than business line A. The correlation coefficient between

$\frac{\sigma_B}{\pi_B}\geq\frac{\sigma_A}{\pi_A}$

, which means that business line B has a higher standard deviation per unit of average benefit. Business line B is sometimes said to be riskier than business line A. The correlation coefficient between

![]() $V_A$

and

$V_A$

and

![]() $V_B$

is denoted by

$V_B$

is denoted by

![]() $\rho$

, with

$\rho$

, with

![]() $-1\leq \rho<1$

; the liabilities

$-1\leq \rho<1$

; the liabilities

![]() $V_A$

and

$V_A$

and

![]() $V_B$

are not perfectly positively correlated.

$V_B$

are not perfectly positively correlated.

The policies are underwritten in exchange for single premiums paid at policy issue. The premiums are composed of a pure premium derived from the actuarial equivalence principle, and a safety loading, or risk premium. This loading allows the insurer to compensate for the un-diversifiable part of the risk and takes into account the fact that the actual realisations of

![]() $V_A$

and

$V_A$

and

![]() $V_B$

are likely to depart from their expected values; more on premium principles can be found in Kaas et al. (Reference Kaas, Goovaerts, Dhaene and Denuit2008) and Zweifel and Eisen (Reference Zweifel and Eisen2012), among others. Here, the loading is assumed to be proportional to the expected value.

$V_B$

are likely to depart from their expected values; more on premium principles can be found in Kaas et al. (Reference Kaas, Goovaerts, Dhaene and Denuit2008) and Zweifel and Eisen (Reference Zweifel and Eisen2012), among others. Here, the loading is assumed to be proportional to the expected value.

Two actuarial pricing strategies are considered. The first one is when the loadings are determined separately based on the features of each contract, and this approach is referred to as stand-alone pricing. The second one is when an insurer active on both business lines exploits their offsetting relationship by charging the same loading for both contracts, and this approach is referred to as joint pricing. The two approaches are described in the remainder of this section.

2.2 Stand-alone pricing

The pure premiums correspond to the expected present values of the contracts, i.e.

![]() $\pi_A$

and

$\pi_A$

and

![]() $\pi_B$

. Charging a loading allows the insurance company to reduce its exposure to a certain level. In case of stand-alone pricing, the loadings are set according to the specific risk of each contract. The loss random variables without loadings are given by

$\pi_B$

. Charging a loading allows the insurance company to reduce its exposure to a certain level. In case of stand-alone pricing, the loadings are set according to the specific risk of each contract. The loss random variables without loadings are given by

![]() $V_A-\pi_A$

and

$V_A-\pi_A$

and

![]() $V_B-\pi_B$

. It is assumed that the insurer determines the loaded premiums such that the loss, measured by some appropriate risk measure, for each contract separately is reduced by a certain factor chosen by the insurer. This implies that the insurance company charges policyholders for (part of) the risk in the form of a safety loading.

$V_B-\pi_B$

. It is assumed that the insurer determines the loaded premiums such that the loss, measured by some appropriate risk measure, for each contract separately is reduced by a certain factor chosen by the insurer. This implies that the insurance company charges policyholders for (part of) the risk in the form of a safety loading.

The stand-alone loaded premiums for contracts A and B are denoted by

![]() $P_{A}^{\textit{sa}}$

and

$P_{A}^{\textit{sa}}$

and

![]() $P_{B}^{\textit{sa}}$

, respectively, with:

$P_{B}^{\textit{sa}}$

, respectively, with:

where

![]() $\psi_A$

and

$\psi_A$

and

![]() $\psi_B$

are the loadings for each contract. Denoting by

$\psi_B$

are the loadings for each contract. Denoting by

![]() $\zeta\in(0,1)$

the risk reduction factor set by the insurer, and by

$\zeta\in(0,1)$

the risk reduction factor set by the insurer, and by

![]() $\varphi$

the risk measure, the risk reduction equations of

$\varphi$

the risk measure, the risk reduction equations of

![]() $P_{A}^{\textit{sa}}$

and

$P_{A}^{\textit{sa}}$

and

![]() $P_{B}^{\textit{sa}}$

are written as follows:

$P_{B}^{\textit{sa}}$

are written as follows:

and

These equations mean that the insurer’s risk with the loading (i.e.

![]() $\varphi\left[V-P^{sa}\right]$

) is reduced by a factor

$\varphi\left[V-P^{sa}\right]$

) is reduced by a factor

![]() $\zeta$

compared to the case where there is no loading (i.e.

$\zeta$

compared to the case where there is no loading (i.e.

![]() $\varphi\left[V-\pi\right]$

).

$\varphi\left[V-\pi\right]$

).

Different risk measures can be used in practice. For instance, the value-at-risk would allow to reduce the insurer’s risk for some specific quantile level. This measure is used in practice to determine regulatory capital for financial institutions in many countries. It is however also subject to some criticisms, for instance because it is not sub-additive, i.e. the quantile of the sum is not necessarily less than the sum of the quantiles. The conditional value-at-risk, prescribed in, e.g., the Swiss Solvency Test, is sub-additive. However, the conditional value-at-risk would not allow to derive explicit closed-form expressions, especially in the first part of the present analysis.

This paper uses the mean-standard deviation (MSD) risk measure, defined for some random variable V as follows:

where

![]() $\pi$

and

$\pi$

and

![]() $\sigma$

are the expectation and standard deviation of V, respectively. The choice of this risk measure is justified by four arguments. First, it satisfies positive homogeneity (i.e.

$\sigma$

are the expectation and standard deviation of V, respectively. The choice of this risk measure is justified by four arguments. First, it satisfies positive homogeneity (i.e.

![]() $\varphi[aV]=a\varphi[V]$

for

$\varphi[aV]=a\varphi[V]$

for

![]() $a>0$

), translation invariance (i.e.

$a>0$

), translation invariance (i.e.

![]() $\varphi[V+a]=\varphi[V]+a$

), as well as sub-additivity. Second, it is convenient to manipulate and provides deeper insights into the dynamics of the offsetting relationship between the contracts. Third, taking into account that it is sometimes used as a premium principle, the standard deviation is meaningful in the context of pricing, as in Chen et al. (Reference Chen, Cheung, Choi and Yam2020); see also Asimit and Boonen (Reference Asimit and Boonen2018) for a recent applications. Fourth, as illustrated in section 5 and depending on the marginal distributions of

$\varphi[V+a]=\varphi[V]+a$

), as well as sub-additivity. Second, it is convenient to manipulate and provides deeper insights into the dynamics of the offsetting relationship between the contracts. Third, taking into account that it is sometimes used as a premium principle, the standard deviation is meaningful in the context of pricing, as in Chen et al. (Reference Chen, Cheung, Choi and Yam2020); see also Asimit and Boonen (Reference Asimit and Boonen2018) for a recent applications. Fourth, as illustrated in section 5 and depending on the marginal distributions of

![]() $V_A$

and

$V_A$

and

![]() $V_B$

, the coefficient

$V_B$

, the coefficient

![]() $\gamma$

can be tuned to match with great precision the results from other risk measures, such as the (conditional) value-at-risk. Nevertheless, this later property does not hold for all marginal distributions of

$\gamma$

can be tuned to match with great precision the results from other risk measures, such as the (conditional) value-at-risk. Nevertheless, this later property does not hold for all marginal distributions of

![]() $V_A$

and

$V_A$

and

![]() $V_B$

.

$V_B$

.

Solving the risk reduction equations using the MSD risk measure leads to:

and the notations

![]() $\psi_A=\zeta\gamma\frac{\sigma_A}{\pi_A}$

and

$\psi_A=\zeta\gamma\frac{\sigma_A}{\pi_A}$

and

![]() $\psi_B=\zeta\gamma\frac{\sigma_B}{\pi_B}$

are introduced. Note that since

$\psi_B=\zeta\gamma\frac{\sigma_B}{\pi_B}$

are introduced. Note that since

![]() $b\geq 1$

, it immediately follows that

$b\geq 1$

, it immediately follows that

![]() $\psi_B\geq \psi_A$

.

$\psi_B\geq \psi_A$

.

2.3 Joint pricing

Consider now the case where the insurer exploits the offsetting relationship between the two business lines. The notations

![]() $N_{A}$

and

$N_{A}$

and

![]() $N_B$

, with

$N_B$

, with

![]() $N_A,N_B>0$

, are used for the number of underwritten policies in business lines A and B, respectively. The proportion of policies sold in business line B is denoted by

$N_A,N_B>0$

, are used for the number of underwritten policies in business lines A and B, respectively. The proportion of policies sold in business line B is denoted by

![]() $n=\frac{N_B}{N_{A}+N_B}$

. Note that there are two possible assumptions regarding the set to which

$n=\frac{N_B}{N_{A}+N_B}$

. Note that there are two possible assumptions regarding the set to which

![]() $N_A$

and

$N_A$

and

![]() $N_B$

belong. Namely,

$N_B$

belong. Namely,

![]() $N_A,N_B \in \mathbb{N}^{*}$

, or

$N_A,N_B \in \mathbb{N}^{*}$

, or

![]() $N_A,N_B \in \mathbb{R}^{*}_+$

. The analysis in section 3 focuses essentially on the proportion n, and hence, specifying the choice of the assumption is not necessary. On the other hand, in section 4, the model used for the numbers

$N_A,N_B \in \mathbb{R}^{*}_+$

. The analysis in section 3 focuses essentially on the proportion n, and hence, specifying the choice of the assumption is not necessary. On the other hand, in section 4, the model used for the numbers

![]() $N_A$

and

$N_A$

and

![]() $N_B$

assumes that they belong to

$N_B$

assumes that they belong to

![]() $\mathbb{R}^{*}_+$

.

$\mathbb{R}^{*}_+$

.

Determining the loaded premiums when the contracts are priced jointly requires some knowledge about the numbers

![]() $N_{A}$

and

$N_{A}$

and

![]() $N_B$

. However, these quantities are unknown when the loaded premiums are set, and are likely to be impacted by the prices. Therefore, the loaded premiums in the present and following sections shall be interpreted as the conditional premiums associated with some values of

$N_B$

. However, these quantities are unknown when the loaded premiums are set, and are likely to be impacted by the prices. Therefore, the loaded premiums in the present and following sections shall be interpreted as the conditional premiums associated with some values of

![]() $N_{A}$

and

$N_{A}$

and

![]() $N_B$

. These conditional premiums may as well be interpreted as the required premiums associated with the value of n as it unfolds. Section 4 introduces further assumptions on these numbers.

$N_B$

. These conditional premiums may as well be interpreted as the required premiums associated with the value of n as it unfolds. Section 4 introduces further assumptions on these numbers.

Let

![]() $P_{A}^{\textit{jp}}(n)$

and

$P_{A}^{\textit{jp}}(n)$

and

![]() $P_{B}^{\textit{jp}}(n)$

be the required loaded premiums when the insurer prices the two business lines jointly, such that:

$P_{B}^{\textit{jp}}(n)$

be the required loaded premiums when the insurer prices the two business lines jointly, such that:

where

![]() $\psi(n)$

is the required loading proportion associated with n and is the same for both contracts.

$\psi(n)$

is the required loading proportion associated with n and is the same for both contracts.

The required loaded premiums

![]() $P_{A}^{\textit{jp}}(n)$

and

$P_{A}^{\textit{jp}}(n)$

and

![]() $P_B^{\textit{jp}}(n)$

can be determined analogously to the stand-alone case, implying that the insurer has the same risk reduction regardless of the pricing method. In particular, the loading for the combined portfolio is such that the overall loss is reduced by the same factor

$P_B^{\textit{jp}}(n)$

can be determined analogously to the stand-alone case, implying that the insurer has the same risk reduction regardless of the pricing method. In particular, the loading for the combined portfolio is such that the overall loss is reduced by the same factor

![]() $\zeta$

. Thus,

$\zeta$

. Thus,

![]() $\psi(n)$

satisfies:

$\psi(n)$

satisfies:

Using the MSD risk measure, the required conditional risk premium is given by:

where

![]() $\tilde{n} = \frac{n\pi_B}{(1-n)\pi_A+n\pi_B}$

, and

$\tilde{n} = \frac{n\pi_B}{(1-n)\pi_A+n\pi_B}$

, and

The overall risk of the joint pricer is also reduced under the present setting. In particular, the difference between the overall portfolio risk when the contracts are priced separately and the overall portfolio risk when the contracts are priced jointly is:

where

![]() $\sigma_{\textit{ptf}}$

is the standard deviation of

$\sigma_{\textit{ptf}}$

is the standard deviation of

![]() $N_AV_A+N_BV_B$

. Since the standard deviation is sub-additive, this difference is always positive. Thus, on top of the potential competitive advantage that the insurer could achieve with the joint loading

$N_AV_A+N_BV_B$

. Since the standard deviation is sub-additive, this difference is always positive. Thus, on top of the potential competitive advantage that the insurer could achieve with the joint loading

![]() $\psi(n)$

, there is also a reduction in the level of risk. In an alternative setting, it is possible to include this difference in the joint pricing, which would accentuate the potential competitive advantage of the joint pricer. Note that depending on the marginal distributions of

$\psi(n)$

, there is also a reduction in the level of risk. In an alternative setting, it is possible to include this difference in the joint pricing, which would accentuate the potential competitive advantage of the joint pricer. Note that depending on the marginal distributions of

![]() $V_A$

and

$V_A$

and

![]() $V_B$

, this observation may not hold if the MSD risk measure is replaced by the value-at-risk.

$V_B$

, this observation may not hold if the MSD risk measure is replaced by the value-at-risk.

3. Conditional Analysis of Joint Pricing

This section investigates joint pricing in a conditional setting. Namely, it compares the premiums

![]() $P^{sa}$

and

$P^{sa}$

and

![]() $P^{jp}(n)$

as a function of the proportion n, and hence, implicitly assumes that n is given.

$P^{jp}(n)$

as a function of the proportion n, and hence, implicitly assumes that n is given.

3.1 Competitiveness region

The joint pricer is said to have a competitive advantage over stand-alone pricers if the policies can be more favorably priced using the offsetting relationship between their liabilities. This would be the case if there exist values of

![]() $n\in(0,1)$

such that

$n\in(0,1)$

such that

![]() $\psi(n)<\psi_A$

and

$\psi(n)<\psi_A$

and

![]() $\psi(n)<\psi_B$

. Since

$\psi(n)<\psi_B$

. Since

![]() $\psi(0)=\psi_A$

,

$\psi(0)=\psi_A$

,

![]() $\psi(1)=\psi_B$

and

$\psi(1)=\psi_B$

and

![]() $b\geq1$

, a competitiveness region exists if the minimum value of

$b\geq1$

, a competitiveness region exists if the minimum value of

![]() $\psi(n)$

is less than

$\psi(n)$

is less than

![]() $\psi_A$

.

$\psi_A$

.

The first question investigated in this section is whether such a competitiveness region exists. Namely, whether there exists a range of values of the proportion n such that the joint loading

![]() $\psi(n)$

is smaller than the smallest stand-alone loading

$\psi(n)$

is smaller than the smallest stand-alone loading

![]() $\psi_A$

. The following lemma provides a condition on the contracts’ features such that a competitiveness region always exists, i.e. such that there exists n satisfying

$\psi_A$

. The following lemma provides a condition on the contracts’ features such that a competitiveness region always exists, i.e. such that there exists n satisfying

![]() $\psi(n)<\psi_A$

. A proof can be found in Appendix A.1.

$\psi(n)<\psi_A$

. A proof can be found in Appendix A.1.

Lemma 3.1. A competitiveness region exists for the joint pricer if and only if:

Under Condition (3.1), the minimum loading proportion

![]() $\psi^{\min}$

is given by:

$\psi^{\min}$

is given by:

\begin{equation}\psi^{\min} = \psi(n^{\min}) =\psi_A\sqrt{\frac{\lambda_1-\lambda_2^2}{\lambda_1}}<\psi_A,\end{equation}

\begin{equation}\psi^{\min} = \psi(n^{\min}) =\psi_A\sqrt{\frac{\lambda_1-\lambda_2^2}{\lambda_1}}<\psi_A,\end{equation}

where

![]() $n^{\min}=\frac{\lambda_{2}\pi_A}{\lambda_{2}\pi_A+\left(\lambda_1-\lambda_2\right)\pi_B }\in(0,1)$

, with

$n^{\min}=\frac{\lambda_{2}\pi_A}{\lambda_{2}\pi_A+\left(\lambda_1-\lambda_2\right)\pi_B }\in(0,1)$

, with

![]() $n^{\min}=0$

for

$n^{\min}=0$

for

![]() $b\rho=1$

and

$b\rho=1$

and

![]() $n^{\min}=1$

for

$n^{\min}=1$

for

![]() $b=\rho=1$

, whereas the maximum loading proportion is given by

$b=\rho=1$

, whereas the maximum loading proportion is given by

![]() $\psi^{\max}=\psi(1)=\psi_B$

.

$\psi^{\max}=\psi(1)=\psi_B$

.

Along the lines of previous research on optimal product mix, Lemma 3.1 states that there exists a unique proportion of underwritten businesses which minimises the value of the required loaded premium. Through the lens of pricing, this result implies the existence of a competitiveness region for the joint pricer. More specifically, in order for the premium to be sufficient and for the joint pricer to gain a competitive advantage over stand-alone pricers, the actual premium for each business line should be at least equal to the minimum required loaded premium, and at most equal to the stand-alone premium. Note that for

![]() $\pi_A=\pi_B$

and

$\pi_A=\pi_B$

and

![]() $\sigma_A = \sigma_B$

, it follows that

$\sigma_A = \sigma_B$

, it follows that

![]() $n^{\min}=\frac{1}{2}$

. This means that when the contracts have identical expected values and standard deviations, the minimum required loading is reached when the portfolio is equally balanced. If in addition, the two business lines exhibit an extreme negative correlation

$n^{\min}=\frac{1}{2}$

. This means that when the contracts have identical expected values and standard deviations, the minimum required loading is reached when the portfolio is equally balanced. If in addition, the two business lines exhibit an extreme negative correlation

![]() $\rho=-1$

, then it follows from the expressions of

$\rho=-1$

, then it follows from the expressions of

![]() $\lambda_1$

and

$\lambda_1$

and

![]() $\lambda_2$

that

$\lambda_2$

that

![]() $\psi^{\min}=0$

, i.e. the minimum loaded premiums correspond to the pure premiums.

$\psi^{\min}=0$

, i.e. the minimum loaded premiums correspond to the pure premiums.

A sufficient condition for the existence of the competitiveness region is a negative correlation between the liabilities of the business lines. Indeed, Condition (3.1) is always satisfied for

![]() $\rho\leq0$

. A prime example is when one business line pays a survival benefit and the other pays a death benefit. This is the typical case on which most of the literature on natural hedging has focused. Lemma 3.1, however, states that the existence of the competitiveness region is not limited to contracts with negatively correlated liabilities. Joint pricing can be implemented when there is a positive correlation as well, as long as Condition (3.1) is satisfied.

$\rho\leq0$

. A prime example is when one business line pays a survival benefit and the other pays a death benefit. This is the typical case on which most of the literature on natural hedging has focused. Lemma 3.1, however, states that the existence of the competitiveness region is not limited to contracts with negatively correlated liabilities. Joint pricing can be implemented when there is a positive correlation as well, as long as Condition (3.1) is satisfied.

Recall that by definition,

![]() $b=\frac{\sigma_B \pi_A}{\sigma_A \pi_B}$

with

$b=\frac{\sigma_B \pi_A}{\sigma_A \pi_B}$

with

![]() $b\geq 1$

, i.e.

$b\geq 1$

, i.e.

![]() $\frac{\sigma_B}{\pi_B}\geq \frac{\sigma_A}{\pi_A}$

. Condition (3.1) gives

$\frac{\sigma_B}{\pi_B}\geq \frac{\sigma_A}{\pi_A}$

. Condition (3.1) gives

![]() $\frac{\sigma_B}{ \pi_B}\rho<\frac{\sigma_A}{\pi_A}$

. Thus, Condition (3.1) can be interpreted as a requirement that the diversification effect between the business lines, which is captured in the correlation

$\frac{\sigma_B}{ \pi_B}\rho<\frac{\sigma_A}{\pi_A}$

. Thus, Condition (3.1) can be interpreted as a requirement that the diversification effect between the business lines, which is captured in the correlation

![]() $\rho$

, should decrease the risk of the riskiest business line B relatively to business line A in order to limit the effect of subsidisation across the two lines. An example where this cannot occur is when the liabilities

$\rho$

, should decrease the risk of the riskiest business line B relatively to business line A in order to limit the effect of subsidisation across the two lines. An example where this cannot occur is when the liabilities

![]() $V_A$

and

$V_A$

and

![]() $V_B$

are highly positively correlated. In which case, the diversification effect would be too small to reduce the gap of riskiness between the two business lines. For instance, the competitiveness region does not exist for

$V_B$

are highly positively correlated. In which case, the diversification effect would be too small to reduce the gap of riskiness between the two business lines. For instance, the competitiveness region does not exist for

![]() $\rho=1$

.

$\rho=1$

.

Let

![]() $P^{\kern1pt\star}_A$

and

$P^{\kern1pt\star}_A$

and

![]() $P^{\star}_B$

be the actual loaded premiums set by the joint pricer for the respective contracts, such that

$P^{\star}_B$

be the actual loaded premiums set by the joint pricer for the respective contracts, such that

![]() $P^{\star}_A=(1+\psi^{\star})\pi_A$

and

$P^{\star}_A=(1+\psi^{\star})\pi_A$

and

![]() $P^{\kern1pt\star}_B=(1+\psi^{\star})\pi_B$

, with

$P^{\kern1pt\star}_B=(1+\psi^{\star})\pi_B$

, with

![]() $\psi^{\star}\in\left[\psi^{\min},\psi^{\max}\right]$

. In particular,

$\psi^{\star}\in\left[\psi^{\min},\psi^{\max}\right]$

. In particular,

![]() $\psi^{\star}$

is a loading under joint pricing, which may be set within the competitiveness region, i.e.

$\psi^{\star}$

is a loading under joint pricing, which may be set within the competitiveness region, i.e.

![]() $[\psi^{min},\psi_A)$

, or outside of that region, i.e.

$[\psi^{min},\psi_A)$

, or outside of that region, i.e.

![]() $[\psi_A,\psi_B]$

. Suppose that the condition

$[\psi_A,\psi_B]$

. Suppose that the condition

![]() $b\rho<1$

is satisfied. Despite the potential competitive advantage of the joint pricer, setting a portfolio loading

$b\rho<1$

is satisfied. Despite the potential competitive advantage of the joint pricer, setting a portfolio loading

![]() $\psi^{\star}$

within the competitiveness region raises two issues, to which the remainder of this section is devoted. The first one is portfolio monitoring, which originates from the convexity of the function

$\psi^{\star}$

within the competitiveness region raises two issues, to which the remainder of this section is devoted. The first one is portfolio monitoring, which originates from the convexity of the function

![]() $\psi(n)$

. The second one is the existence of a critical threshold beyond which the joint pricer loses its competitive advantage on business line A, and this arises when

$\psi(n)$

. The second one is the existence of a critical threshold beyond which the joint pricer loses its competitive advantage on business line A, and this arises when

![]() $\psi_A\neq\psi_B$

as well.

$\psi_A\neq\psi_B$

as well.

3.2 Portfolio monitoring

One implication of the convexity of

![]() $\psi(n)$

for joint pricers is that the choice of competitiveness comes with the burden of portfolio monitoring. More specifically, in order for the required premium to be lower than or equal to the actual premium (i.e.

$\psi(n)$

for joint pricers is that the choice of competitiveness comes with the burden of portfolio monitoring. More specifically, in order for the required premium to be lower than or equal to the actual premium (i.e.

![]() $P^{\kern1pt\star}_A$

or

$P^{\kern1pt\star}_A$

or

![]() $P^{\star}_B$

), the proportion n has to be maintained within the interval

$P^{\star}_B$

), the proportion n has to be maintained within the interval

![]() $[n^{\star}_{l},n^{\star}_{u}]$

, where

$[n^{\star}_{l},n^{\star}_{u}]$

, where

![]() $n^{\star}_{l}$

and

$n^{\star}_{l}$

and

![]() $n^{\star}_{u}$

are solutions of the equation:

$n^{\star}_{u}$

are solutions of the equation:

Solving the second-order equation

![]() $\psi(\tilde{n})^2=\left(\psi^{\star}\right)^2$

for

$\psi(\tilde{n})^2=\left(\psi^{\star}\right)^2$

for

![]() $\tilde{n}$

, and then determining the corresponding solution for n, leads to:

$\tilde{n}$

, and then determining the corresponding solution for n, leads to:

with

\begin{equation}\tilde{n}^{\star}_{l} = \frac{\lambda_2}{\lambda_1} - \sqrt{ \frac{\lambda_2^2}{\lambda_1^2} - \frac{1}{\lambda_1}\left(1-\left(\frac{\psi^{\star}}{\psi_{A}}\right)^2\right)},\end{equation}

\begin{equation}\tilde{n}^{\star}_{l} = \frac{\lambda_2}{\lambda_1} - \sqrt{ \frac{\lambda_2^2}{\lambda_1^2} - \frac{1}{\lambda_1}\left(1-\left(\frac{\psi^{\star}}{\psi_{A}}\right)^2\right)},\end{equation}

and

\begin{equation}\tilde{n}^{\star}_{u} = \frac{\lambda_2}{\lambda_1} + \sqrt{ \frac{\lambda_2^2}{\lambda_1^2} - \frac{1}{\lambda_1}\left(1-\left(\frac{\psi^{\star}}{\psi_{A}}\right)^2\right)}.\end{equation}

\begin{equation}\tilde{n}^{\star}_{u} = \frac{\lambda_2}{\lambda_1} + \sqrt{ \frac{\lambda_2^2}{\lambda_1^2} - \frac{1}{\lambda_1}\left(1-\left(\frac{\psi^{\star}}{\psi_{A}}\right)^2\right)}.\end{equation}

In case the proportion n remains within the interval

![]() $[n^{\star}_{l},n^{\star}_{u}]$

, the actual loaded premiums

$[n^{\star}_{l},n^{\star}_{u}]$

, the actual loaded premiums

![]() $P^{\kern1pt\star}_A$

and

$P^{\kern1pt\star}_A$

and

![]() $P^{\star}_B$

would be higher than their required counterparts

$P^{\star}_B$

would be higher than their required counterparts

![]() $P^{\textit{jp}}_A(n)$

and

$P^{\textit{jp}}_A(n)$

and

![]() $P^{\textit{jp}}_B(n)$

. Otherwise, the joint pricer would be underwriting at a loss for a given risk reduction factor

$P^{\textit{jp}}_B(n)$

. Otherwise, the joint pricer would be underwriting at a loss for a given risk reduction factor

![]() $\zeta$

.

$\zeta$

.

The flexibility of the insurer in terms of portfolio monitoring can be measured by the length of the interval

![]() $[n^{\star}_{l},n^{\star}_{u}]$

, i.e.

$[n^{\star}_{l},n^{\star}_{u}]$

, i.e.

![]() $n^{\star}_u-n^{\star}_l$

. Suppose that the joint pricer sets the actual premiums equal to the lowest possible ones given by the competitiveness region, i.e.

$n^{\star}_u-n^{\star}_l$

. Suppose that the joint pricer sets the actual premiums equal to the lowest possible ones given by the competitiveness region, i.e.

![]() $\psi^{\star}=\psi^{\min}$

. In this case,

$\psi^{\star}=\psi^{\min}$

. In this case,

![]() $\tilde{n}^{\star}_u=\tilde{n}^{\star}_l=\frac{\lambda_2}{\lambda_1}$

, and in particular,

$\tilde{n}^{\star}_u=\tilde{n}^{\star}_l=\frac{\lambda_2}{\lambda_1}$

, and in particular,

![]() $n^{\star}_u=n^{\star}_l=n^{\min}$

. Hence, the length of this interval is 0. This means that setting the premium equal to the lower bound of the competitiveness region, as this may arise from an analogy with previous studies on optimal product mix, is in fact the most risky choice for the insurer. More precisely, setting

$n^{\star}_u=n^{\star}_l=n^{\min}$

. Hence, the length of this interval is 0. This means that setting the premium equal to the lower bound of the competitiveness region, as this may arise from an analogy with previous studies on optimal product mix, is in fact the most risky choice for the insurer. More precisely, setting

![]() $\psi^{\star}=\psi^{\min}$

implies that there is only a single proportion n for which the conditional loaded premium matches the actual one.

$\psi^{\star}=\psi^{\min}$

implies that there is only a single proportion n for which the conditional loaded premium matches the actual one.

3.3 Critical threshold

For

![]() $\psi^{\star}\in[\psi^{\min},\psi_A)$

, the joint pricer has a competitive advantage over stand-alone pricers on both business lines. For

$\psi^{\star}\in[\psi^{\min},\psi_A)$

, the joint pricer has a competitive advantage over stand-alone pricers on both business lines. For

![]() $\psi^{\star}\in(\psi_A,\psi_B)$

, the joint pricer has a competitive advantage on business line B, and a competitive disadvantage on business line A. Therefore, the required loaded premium for the contract with the highest standard deviation per unit of average benefit will always be lower under joint pricing compared to its stand-alone counterpart. In contrast, for the contract with the lowest risk per unit of average benefit, there always exists a critical threshold in the proportion n beyond which the required loaded premium under joint pricing is higher than its stand-alone counterpart. In other words, beyond the critical threshold, the safer business line subsidises the riskier one. This is formally stated in the following lemma; see Appendix A.2 for a proof.

$\psi^{\star}\in(\psi_A,\psi_B)$

, the joint pricer has a competitive advantage on business line B, and a competitive disadvantage on business line A. Therefore, the required loaded premium for the contract with the highest standard deviation per unit of average benefit will always be lower under joint pricing compared to its stand-alone counterpart. In contrast, for the contract with the lowest risk per unit of average benefit, there always exists a critical threshold in the proportion n beyond which the required loaded premium under joint pricing is higher than its stand-alone counterpart. In other words, beyond the critical threshold, the safer business line subsidises the riskier one. This is formally stated in the following lemma; see Appendix A.2 for a proof.

Lemma 3.2. For

![]() $b> 1$

, there always exists

$b> 1$

, there always exists

![]() $n_{\textit{ct}}\in(0,1)$

given by:

$n_{\textit{ct}}\in(0,1)$

given by:

such that:

with

![]() $\psi(n_{\textit{ct}})=\psi_A$

.

$\psi(n_{\textit{ct}})=\psi_A$

.

The existence of the critical threshold is all the more pertinent given that the competitive advantage of the joint pricer is higher on business B than on business line A. Indeed, denoting again by

![]() $P^{\star}_A$

and

$P^{\star}_A$

and

![]() $P^{\star}_B$

the actual loaded premiums set by the joint pricer for the respective contracts, an immediate consequence of

$P^{\star}_B$

the actual loaded premiums set by the joint pricer for the respective contracts, an immediate consequence of

![]() $b>1$

is that:

$b>1$

is that:

This implies that the joint pricer could attract more policyholders on business B than on business line A. Thus, the actual proportion n may turn out to be close to 1, and hence, beyond the critical threshold.

A practical solution for the joint pricer to cope with the issues raised by the critical threshold consists in constraining some contract features (e.g. the benefit amounts) such that

![]() $b=1$

, or equivalently,

$b=1$

, or equivalently,

![]() $\psi_A=\psi_B$

. In this case, the joint pricer has the same competitive advantage on both business lines, leading to

$\psi_A=\psi_B$

. In this case, the joint pricer has the same competitive advantage on both business lines, leading to

![]() $n_{\textit{ct}}=1$

, which means that there is no critical threshold. In practice, it may not always be possible to control all contract features. Nevertheless, insurers could still identify pairs of business lines satisfying

$n_{\textit{ct}}=1$

, which means that there is no critical threshold. In practice, it may not always be possible to control all contract features. Nevertheless, insurers could still identify pairs of business lines satisfying

![]() $\psi_A\approx \psi_B$

and

$\psi_A\approx \psi_B$

and

![]() $b\rho<1$

without constraining contract features.

$b\rho<1$

without constraining contract features.

4. Unconditional Analysis of Joint Pricing

So far, the main conclusion of the conditional analysis is that joint pricers can gain a competitive advantage over stand-alone pricers on both business lines, but this competitive advantage costs insurers their flexibility in terms of portfolio monitoring. Therefore, the number of underwritten contracts is crucial to determine the required premiums for the joint pricer.

This section seeks further insights into the pricing decision by modelling explicitly the relationship between the number of policyholders attracted in each business line and the corresponding competitive advantage. Unlike in section 3, the analysis here is not in function of the proportion n. In particular, the comparison between the competing strategies is performed by assuming a model for the number of policyholders. The goal is to identify conditions on market characteristics under which insurers active on both business lines can benefit from joint pricing.

4.1 Market model

Consider a market with

![]() $N^{T}_{A}$

and

$N^{T}_{A}$

and

![]() $N^{T}_{B}$

policyholders willing to buy contracts A and B, respectively. The proportion

$N^{T}_{B}$

policyholders willing to buy contracts A and B, respectively. The proportion

![]() $w^{d}=\frac{N^{T}_{B}}{N^{T}_{A}+N^{T}_{B}}$

represents the market proportion of demand for business line B. The market is composed of

$w^{d}=\frac{N^{T}_{B}}{N^{T}_{A}+N^{T}_{B}}$

represents the market proportion of demand for business line B. The market is composed of

![]() $k_{A}$

providers of contract A and

$k_{A}$

providers of contract A and

![]() $k_{B}$

providers of contract B, with

$k_{B}$

providers of contract B, with

![]() $2\leq k_{A}<N^{T}_{A}$

and

$2\leq k_{A}<N^{T}_{A}$

and

![]() $2 \leq k_{B}<N^{T}_{B}$

. Among these insurers, it is assumed that there is a single insurer considering the joint pricing strategy. Thus, there are

$2 \leq k_{B}<N^{T}_{B}$

. Among these insurers, it is assumed that there is a single insurer considering the joint pricing strategy. Thus, there are

![]() $k_{A}-1$

insurers providing contract A at its stand-alone price

$k_{A}-1$

insurers providing contract A at its stand-alone price

![]() $P^{\textit{sa}}_A$

, and

$P^{\textit{sa}}_A$

, and

![]() $k_{B}-1$

insurers providing contract B at its stand-alone price

$k_{B}-1$

insurers providing contract B at its stand-alone price

![]() $P^{\textit{sa}}_B$

.

$P^{\textit{sa}}_B$

.

The joint pricer sets the premiums

![]() $P^{\star}_{A}$

and

$P^{\star}_{A}$

and

![]() $P^{\kern1pt\star}_B$

for the respective business line, such that:

$P^{\kern1pt\star}_B$

for the respective business line, such that:

where

![]() $\psi^{\star}\in\left[\psi^{\min},\psi_B\right]$

is derived according to the risk reduction constraint introduced in section 2. The quantities

$\psi^{\star}\in\left[\psi^{\min},\psi_B\right]$

is derived according to the risk reduction constraint introduced in section 2. The quantities

![]() $c^{\star}_{A}$

and

$c^{\star}_{A}$

and

![]() $c^{\star}_B$

are defined as follows:

$c^{\star}_B$

are defined as follows:

The joint pricer is said to have a competitive advantage over stand-alone pricers on one of the business lines if the corresponding

![]() $c^{\star}$

is negative. The lower the values of

$c^{\star}$

is negative. The lower the values of

![]() $c^{\star}_{A}$

or

$c^{\star}_{A}$

or

![]() $c^{\star}_B$

, the higher the competitive advantage on the corresponding business line.

$c^{\star}_B$

, the higher the competitive advantage on the corresponding business line.

Let

![]() $N^{\star}_A$

and

$N^{\star}_A$

and

![]() $N^{\star}_B$

be the numbers of policyholders attracted by the joint pricer for the loading

$N^{\star}_B$

be the numbers of policyholders attracted by the joint pricer for the loading

![]() $\psi^{\star}$

. Using the MSD risk measure, and following the reasoning that leads to (2.1), the portfolio loading proportion

$\psi^{\star}$

. Using the MSD risk measure, and following the reasoning that leads to (2.1), the portfolio loading proportion

![]() $\psi^{\star}$

solves the equation:

$\psi^{\star}$

solves the equation:

with

![]() $\tilde{n}^{\star}=\frac{n^{\star}\pi_B}{(1-n^{\star})\pi_A+n^{\star}\pi_B}$

, and

$\tilde{n}^{\star}=\frac{n^{\star}\pi_B}{(1-n^{\star})\pi_A+n^{\star}\pi_B}$

, and

![]() $n^{\star}=\frac{N^{\star}_B}{N^{\star}_A+N^{\star}_B}$

is the proportion of policies B underwritten by the insurance company active on both business lines.

$n^{\star}=\frac{N^{\star}_B}{N^{\star}_A+N^{\star}_B}$

is the proportion of policies B underwritten by the insurance company active on both business lines.

The loading proportion

![]() $\psi^{\star}$

depends on the numbers of policyholders who buy each contract, which in turn depend on

$\psi^{\star}$

depends on the numbers of policyholders who buy each contract, which in turn depend on

![]() $\psi^{\star}$

. In particular, the loading

$\psi^{\star}$

. In particular, the loading

![]() $\psi^{\star}$

appears in both sides of Equation (4.1). Different functions could be applied to model this relationship. It is assumed that for

$\psi^{\star}$

appears in both sides of Equation (4.1). Different functions could be applied to model this relationship. It is assumed that for

![]() $c^{\star}_{A}=c^{\star}_B=0$

, the total number of policyholders is shared equally among all insurance companies. This means that in case the insurance company active on both business lines prices the contracts separately, then all companies active on A underwrite

$c^{\star}_{A}=c^{\star}_B=0$

, the total number of policyholders is shared equally among all insurance companies. This means that in case the insurance company active on both business lines prices the contracts separately, then all companies active on A underwrite

![]() $\frac{N^{T}_{A}}{k_{A}}$

contracts, and all those active on B underwrite

$\frac{N^{T}_{A}}{k_{A}}$

contracts, and all those active on B underwrite

![]() $\frac{N^{T}_{B}}{k_{B}}$

contracts.

$\frac{N^{T}_{B}}{k_{B}}$

contracts.

A candidate function satisfying this property is the logistic function, such that the numbers

![]() $N^{\star}_{A}$

and

$N^{\star}_{A}$

and

![]() $N^{\star}_{B}$

of contracts A and B sold by the joint pricer are given by:

$N^{\star}_{B}$

of contracts A and B sold by the joint pricer are given by:

\begin{equation*}\begin{array}{ll}N^{\star}_A &= N^T_A \left(1 - \frac{k_A-1}{k_A-1 +\exp\left(-q_Ac^{\star}_A\right)}\right),\\[5pt] N^{\star}_B &= N^T_B \left(1 - \frac{k_B-1}{k_B-1 +\exp\left(-q_Bc^{\star}_B\right)}\right).\end{array}\end{equation*}

\begin{equation*}\begin{array}{ll}N^{\star}_A &= N^T_A \left(1 - \frac{k_A-1}{k_A-1 +\exp\left(-q_Ac^{\star}_A\right)}\right),\\[5pt] N^{\star}_B &= N^T_B \left(1 - \frac{k_B-1}{k_B-1 +\exp\left(-q_Bc^{\star}_B\right)}\right).\end{array}\end{equation*}

where

![]() $q_A>0$

and

$q_A>0$

and

![]() $q_B>0$

are the reaction factors of policyholders in each business line. These reaction factors are related to the joint pricer’s price elasticity of demand, such that a 1% change in the price of a given contract is perceived by policyholders willing to buy the corresponding contract from the joint pricer as a

$q_B>0$

are the reaction factors of policyholders in each business line. These reaction factors are related to the joint pricer’s price elasticity of demand, such that a 1% change in the price of a given contract is perceived by policyholders willing to buy the corresponding contract from the joint pricer as a

![]() $q\%$

change.

$q\%$

change.

The logistic function is bounded from below by 0, and from above by the total market demand. In other words, the number of policyholders attracted by the joint pricer is at least 0 for

![]() $\psi^{\star}\rightarrow +\infty$

, and at most equal to

$\psi^{\star}\rightarrow +\infty$

, and at most equal to

![]() $N^T_A$

and

$N^T_A$

and

![]() $N^{T}_B$

for

$N^{T}_B$

for

![]() $\psi^{\star}\rightarrow -\infty$

. However, these bounds are unlikely to be reached. Indeed, under the present setting, and provided the insurer does not underwrite at a loss, realistic values of

$\psi^{\star}\rightarrow -\infty$

. However, these bounds are unlikely to be reached. Indeed, under the present setting, and provided the insurer does not underwrite at a loss, realistic values of

![]() $\psi^{\star}$

lie within the interval

$\psi^{\star}$

lie within the interval

![]() $\left[\psi^{\min},\psi_B\right]$

, which is expected to be relatively narrow. Thus, for sufficiently small values of

$\left[\psi^{\min},\psi_B\right]$

, which is expected to be relatively narrow. Thus, for sufficiently small values of

![]() $c^{\star}_A$

and

$c^{\star}_A$

and

![]() $c^{\star}_B$

, the cumbersomeness of the logistic function can be circumvented by applying a Taylor expansion, which leads to the following conveniently linear demand functions:

$c^{\star}_B$

, the cumbersomeness of the logistic function can be circumvented by applying a Taylor expansion, which leads to the following conveniently linear demand functions:

4.2 Pricing decision

The decision criterion used to determine the optimal pricing strategy is the total collected premiums. In case the insurer prices the contracts jointly, the total premiums collected in each business line are

![]() $N_{A}^{\star}P^{\star}_{A}$

and

$N_{A}^{\star}P^{\star}_{A}$

and

![]() $N_{B}^{\star}P^{\star}_{B}$

. In case the insurer prices the contracts separately, the total market demand is shared equally among all insurers, and hence, the total premiums collected in each business line by each of the

$N_{B}^{\star}P^{\star}_{B}$

. In case the insurer prices the contracts separately, the total market demand is shared equally among all insurers, and hence, the total premiums collected in each business line by each of the

![]() $k_A$

and

$k_A$

and

![]() $k_B$

insurers are

$k_B$

insurers are

![]() $\frac{N^{T}_{A}}{k_A}P^{\textit{sa}}_{A}$

and

$\frac{N^{T}_{A}}{k_A}P^{\textit{sa}}_{A}$

and

![]() $\frac{N^{T}_{B}}{k_B}P^{\textit{sa}}_B$

, respectively. Therefore, the difference between the total collected premiums with and without joint pricing is given by:

$\frac{N^{T}_{B}}{k_B}P^{\textit{sa}}_B$

, respectively. Therefore, the difference between the total collected premiums with and without joint pricing is given by:

\begin{equation*}\mathcal{D}_{\textit{ptf}} = \left(N_A^{\star}P^{\kern1pt\star}_A - \frac{N^{T}_A}{k_A}P^{\textit{sa}}_A\right)+\left(N_B^{\star}P^{\star}_B - \frac{N^{T}_B}{k_B}P^{\textit{sa}}_B\right).\end{equation*}

\begin{equation*}\mathcal{D}_{\textit{ptf}} = \left(N_A^{\star}P^{\kern1pt\star}_A - \frac{N^{T}_A}{k_A}P^{\textit{sa}}_A\right)+\left(N_B^{\star}P^{\star}_B - \frac{N^{T}_B}{k_B}P^{\textit{sa}}_B\right).\end{equation*}

Consider the proportion

![]() $\eta$

defined as follows:

$\eta$

defined as follows:

\begin{equation}\eta = \frac{N^T_B\frac{1}{k_B}\pi_B(\psi_B-\psi^{\min})}{N^T_A\frac{1}{k_A}\pi_A(\psi_A-\psi^{\min})+N^T_B\frac{1}{k_B}\pi_B(\psi_B-\psi^{\min})}.\end{equation}

\begin{equation}\eta = \frac{N^T_B\frac{1}{k_B}\pi_B(\psi_B-\psi^{\min})}{N^T_A\frac{1}{k_A}\pi_A(\psi_A-\psi^{\min})+N^T_B\frac{1}{k_B}\pi_B(\psi_B-\psi^{\min})}.\end{equation}

Consider as well the critical threshold

![]() $w_{\textit{ct}}$

in the proportion of market demand for contracts B:

$w_{\textit{ct}}$

in the proportion of market demand for contracts B:

where

![]() $n_{\textit{ct}}$

is the critical threshold derived from the conditional analysis in (3.5). In particular,

$n_{\textit{ct}}$

is the critical threshold derived from the conditional analysis in (3.5). In particular,

![]() $w_{\textit{ct}}$

corresponds to the proportion of market demand for contracts B (i.e.

$w_{\textit{ct}}$

corresponds to the proportion of market demand for contracts B (i.e.

![]() $w^{\textit{d}}$

) such that

$w^{\textit{d}}$

) such that

![]() $\psi^{\star}=\psi_{A}$

. It follows that

$\psi^{\star}=\psi_{A}$

. It follows that

![]() $\psi^{\star}<\psi_A$

for

$\psi^{\star}<\psi_A$

for

![]() $w^{\textit{d}}<w_{\textit{ct}}$

, and

$w^{\textit{d}}<w_{\textit{ct}}$

, and

![]() $\psi^{\star}>\psi_A$

for

$\psi^{\star}>\psi_A$

for

![]() $w^{\textit{d}}>w_{\textit{ct}}$

.

$w^{\textit{d}}>w_{\textit{ct}}$

.

The following theorem provides sufficient conditions on policyholders’ reaction factors to support the decision on the pricing strategy. These conditions involve information on the market demand and supply, as well as on the contracts’ features. A proof is given in Appendix A.3, which also contains the derivations for

![]() $\eta$

and

$\eta$

and

![]() $w_{\textit{ct}}$

.

$w_{\textit{ct}}$

.

Theorem 4.1. An insurer active on both business lines A and B collects more premiums at portfolio level by pricing them jointly rather than separately, if the following conditions are satisfied:

and

\begin{equation}\left\{\begin{array}{ll} (1-\eta)q_A\frac{k_A-1}{k_A}\frac{1+\psi^{\min}}{1+\psi_A}+\eta q_B\frac{k_B-1}{k_B}\frac{1+\psi^{\min}}{1+\psi_{B}}>1, & \qquad \text{for } w^d<w_{\textit{ct}},\\ q_A <\frac{k_A}{k_A-1}\frac{1+\psi_A}{1+\psi_B},& \qquad \text{for } w^d>w_{\textit{ct}}, \end{array}\right.\end{equation}

\begin{equation}\left\{\begin{array}{ll} (1-\eta)q_A\frac{k_A-1}{k_A}\frac{1+\psi^{\min}}{1+\psi_A}+\eta q_B\frac{k_B-1}{k_B}\frac{1+\psi^{\min}}{1+\psi_{B}}>1, & \qquad \text{for } w^d<w_{\textit{ct}},\\ q_A <\frac{k_A}{k_A-1}\frac{1+\psi_A}{1+\psi_B},& \qquad \text{for } w^d>w_{\textit{ct}}, \end{array}\right.\end{equation}

and inequality (4.4) is sufficient for

![]() $w^d=w_{\textit{ct}}$

.

$w^d=w_{\textit{ct}}$

.

An insurer active on both business lines A and B collects more premiums at portfolio level by pricing them separately rather than jointly, if the following conditions are satisfied:

and

\begin{equation}\left\{\begin{array}{ll}q_A<\frac{k_A}{k_A-1},& \qquad \text{for } w^d<w_{\textit{ct}},\\ q_A>\frac{k_A}{k_A-1},& \qquad \text{for } w^d>w_{\textit{ct}},\end{array}\right.\end{equation}

\begin{equation}\left\{\begin{array}{ll}q_A<\frac{k_A}{k_A-1},& \qquad \text{for } w^d<w_{\textit{ct}},\\ q_A>\frac{k_A}{k_A-1},& \qquad \text{for } w^d>w_{\textit{ct}},\end{array}\right.\end{equation}

and inequality (4.6) is sufficient for

![]() $w^d=w_{\textit{ct}}$

.

$w^d=w_{\textit{ct}}$

.

Theorem 4.1 states that the choice of the pricing strategy can be inferred from the values of the reaction factors

![]() $q_A$

and

$q_A$

and

![]() $q_B$

. In general, it is possible to determine the values of the contract features, the number of competitors

$q_B$

. In general, it is possible to determine the values of the contract features, the number of competitors

![]() $k_A$

and

$k_A$

and

![]() $k_B$

, and the proportion of market demand

$k_B$

, and the proportion of market demand

![]() $w^d$

. Thus, the remaining task of the insurer is to estimate

$w^d$

. Thus, the remaining task of the insurer is to estimate

![]() $q_A$

and

$q_A$

and

![]() $q_B$

based on its own experience.

$q_B$

based on its own experience.

These conditions imply that the insurer should reduce (resp. increase) its premiums only if the reaction of policyholders is high (resp. low) enough in order for the premium reduction (resp. increase) to result in an increase of the total premiums. In case the joint pricer does not expect to attract a sufficient number of policyholders in business line B, then joint pricing is not necessarily desirable. Another important implication of Theorem 4.1 is that even if business line A subsidises B (i.e. beyond the critical threshold), joint pricing may still be rewarding for the insurer in terms of total collected premiums.

The following corollary, whose proof can be found in Appendix A.4, provides simpler rules to support the decision on the pricing strategy.

Corollary 1. An insurer active on both business lines collects more premiums at portfolio level by pricing both contracts jointly rather than separately, if the following conditions are satisfied:

and

\begin{equation*}\left\{\begin{array}{ll} q_A>2\frac{1+\psi_A}{1+\psi^{\min}}, & \qquad \text{for } w^d<w_{\textit{ct}},\\ q_A<\frac{1+\psi_A}{1+\psi_B},& \qquad \text{for } w^d>w_{\textit{ct}}. \end{array}\right.\end{equation*}

\begin{equation*}\left\{\begin{array}{ll} q_A>2\frac{1+\psi_A}{1+\psi^{\min}}, & \qquad \text{for } w^d<w_{\textit{ct}},\\ q_A<\frac{1+\psi_A}{1+\psi_B},& \qquad \text{for } w^d>w_{\textit{ct}}. \end{array}\right.\end{equation*}

An insurer active on both business lines collects more premiums at portfolio level by pricing both contracts separately rather than jointly, if the following conditions are satisfied:

and

From Corollary 1, the results of this section can be summarised as follows. Consider an insurance company active on business lines A and B, such that

![]() $\psi_A\leq\psi_B$

. Suppose that this insurance company aims at increasing its total collected premiums by pricing business lines A and B jointly. The company could do so if:

$\psi_A\leq\psi_B$

. Suppose that this insurance company aims at increasing its total collected premiums by pricing business lines A and B jointly. The company could do so if:

-

• business line B is relatively elastic, and

-

• business line A is relatively elastic if it has a lower demand than B, or is relatively inelastic if it has a higher demand than B.

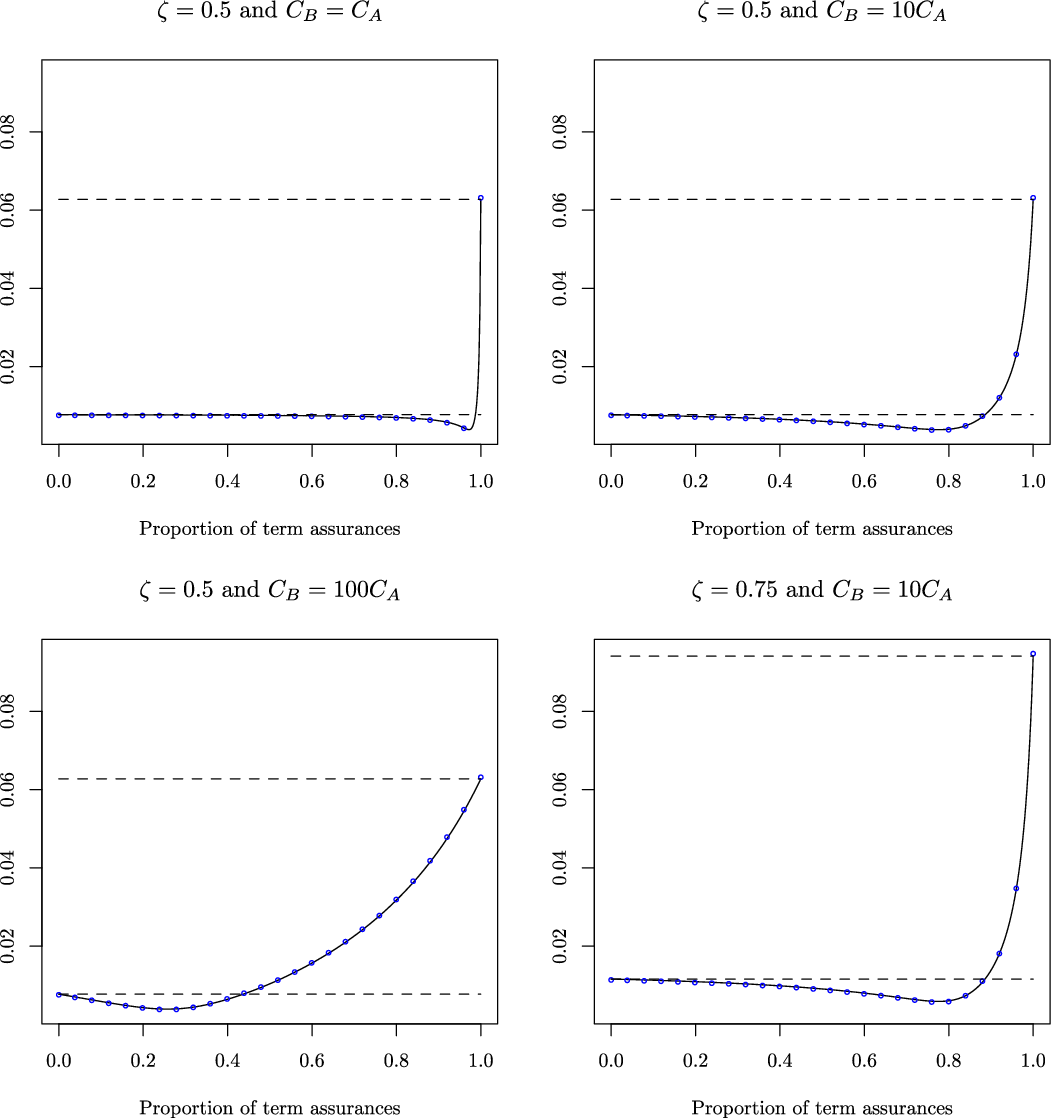

5. Numerical Illustration for Annuities and Life Assurances

This section illustrates the theoretical results for term annuities (business line A) and term assurances (business line B). These two business lines received substantial interest in the context of natural hedging. Early contributions include Cox and Lin (Reference Cox and Lin2007) and GrÜndl et al. (Reference GrÜndl, Post and Schulze2006). A number of papers provided further insights into the natural hedging opportunities of life contingent liabilities, such as Tsai et al. (Reference Tsai, Wang and Tzeng2010); Wang et al. (Reference Wang, Huang, Yang and Tsai2010); Wang et al. (Reference Wang, Huang and Hong2013); Zhu and Bauer (Reference Zhu and Bauer2014), and Boonen et al. (Reference Boonen, De Waegenaere and Norde2017).

In what follows, the first subsection describes the random present values and the mortality model used to obtain the distribution of

![]() $V_A$

and

$V_A$

and

![]() $V_B$

. The second subsection illustrates the competitiveness region under the conditional setting. The third subsection illustrates the total collected premiums and the effect of policyholders’ reaction factors.

$V_B$

. The second subsection illustrates the competitiveness region under the conditional setting. The third subsection illustrates the total collected premiums and the effect of policyholders’ reaction factors.

5.1 Business lines, simulation models, and data

The random variables

![]() $V_A$

and

$V_A$

and

![]() $V_B$

are the per-policy random present values at policy issue of the annuity and assurance business lines, respectively, such that:

$V_B$

are the per-policy random present values at policy issue of the annuity and assurance business lines, respectively, such that:

\begin{equation*} V_{A}=C_{A} \sum_{k=1}^{T_{A}}\text{ }_kp_x^{(A)}v(0,k),\end{equation*}

\begin{equation*} V_{A}=C_{A} \sum_{k=1}^{T_{A}}\text{ }_kp_x^{(A)}v(0,k),\end{equation*}

and

\begin{equation*} V_{B}=C_{B} \sum_{k=1}^{T_{B}}\text{ }_{k-1}p_y^{(B)}\left(1-p_{y+k-1}^{(B)}\right)v(0,k),\end{equation*}

\begin{equation*} V_{B}=C_{B} \sum_{k=1}^{T_{B}}\text{ }_{k-1}p_y^{(B)}\left(1-p_{y+k-1}^{(B)}\right)v(0,k),\end{equation*}

where

![]() $T_A$

and

$T_A$

and

![]() $T_B$

are the terms of the annuity and the assurance, respectively,

$T_B$

are the terms of the annuity and the assurance, respectively,

![]() $C_A$

is the yearly annuity benefit payable at the end of the year, and

$C_A$

is the yearly annuity benefit payable at the end of the year, and

![]() $C_B$

is the death benefit payable at the end of the year of death. The probability

$C_B$

is the death benefit payable at the end of the year of death. The probability

![]() $\text{ }_kp_x^{(A)}$

is the k-year survival probability in the term annuity business line, where all policyholders are aged x. The probabilities

$\text{ }_kp_x^{(A)}$

is the k-year survival probability in the term annuity business line, where all policyholders are aged x. The probabilities

![]() $\text{ }_{k-1}p_y^{(B)}$

and

$\text{ }_{k-1}p_y^{(B)}$

and

![]() $p_{y+k-1}^{(B)}$

are the

$p_{y+k-1}^{(B)}$

are the

![]() $(k-1)$

-year and 1-year survival probabilities, respectively, in the term assurance business line. In order to take into account longevity and mortality risks, all probabilities are assumed to be random variables. Market risk is not included in this analysis, and the discounting factor v(0,k) is assumed to be constant, with

$(k-1)$

-year and 1-year survival probabilities, respectively, in the term assurance business line. In order to take into account longevity and mortality risks, all probabilities are assumed to be random variables. Market risk is not included in this analysis, and the discounting factor v(0,k) is assumed to be constant, with

![]() $v(0,k)=v^k$

.

$v(0,k)=v^k$

.

The group of policyholders in the annuity business line (i.e. business line A) are all aged

![]() $x=60$

, whereas the group of policyholders in the assurance business line (i.e. business line B) are all aged

$x=60$

, whereas the group of policyholders in the assurance business line (i.e. business line B) are all aged

![]() $y=30$

. All contracts are assumed to expire after 30 years, i.e.

$y=30$

. All contracts are assumed to expire after 30 years, i.e.

![]() $T_A=T_B=30$

.

$T_A=T_B=30$

.

The distributions of

![]() $V_A$

and

$V_A$

and

![]() $V_B$

are obtained by simulating the survival probabilities

$V_B$

are obtained by simulating the survival probabilities

![]() $p^{(A)}$

and

$p^{(A)}$

and

![]() $p^{(B)}$

from the Li-Lee two-population model (Li and Lee Reference Li and Lee2005), which allows to take into account the dependence between the mortality in the two business lines. Specifically, under the Li-Lee model, the central death date

$p^{(B)}$

from the Li-Lee two-population model (Li and Lee Reference Li and Lee2005), which allows to take into account the dependence between the mortality in the two business lines. Specifically, under the Li-Lee model, the central death date

![]() $\mu^{(i)}_{x,t}$

at age x and time t in population i is given by:

$\mu^{(i)}_{x,t}$

at age x and time t in population i is given by:

where

![]() $\beta_x\kappa_t$

represents the common mortality improvement for a given age x, and

$\beta_x\kappa_t$

represents the common mortality improvement for a given age x, and

![]() $\beta_x^{(i)}\kappa_t^{(i)}$

represents the population-specific mortality improvement for that age. The processes

$\beta_x^{(i)}\kappa_t^{(i)}$

represents the population-specific mortality improvement for that age. The processes

![]() $\kappa_t^{(A)}$

,

$\kappa_t^{(A)}$

,

![]() $\kappa_t^{(B)}$

, and

$\kappa_t^{(B)}$

, and

![]() $\kappa_t$

are simulated from correlated random walks.

$\kappa_t$

are simulated from correlated random walks.

The English and Welsh population data are used for the annuity business line, and the US population data are used for the term assurance business line. Using data from two different populations allows to incorporate in the analysis the fact that mortality experience in annuity and assurance businesses tend to be different. The data sets cover the period 1950–2018 and ages 30–90 and were obtained from the Human Mortality Database (www.mortality.org). The models are estimated using singular value decomposition.

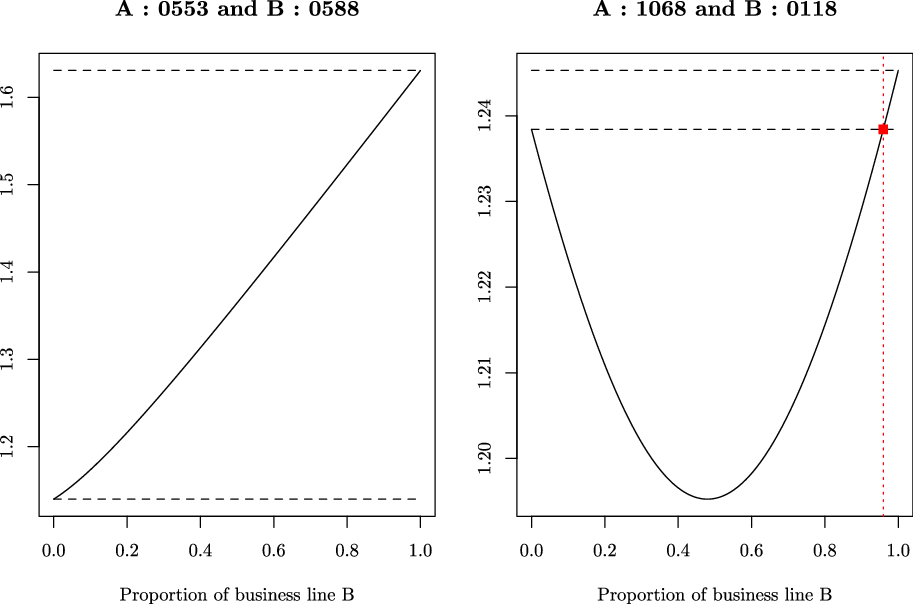

5.2 Competitiveness region

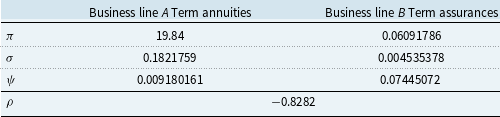

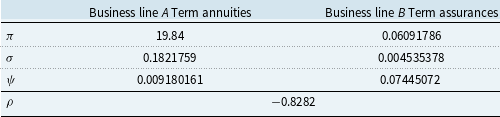

Table 1 reports the values of the pure premiums per unit of benefits (i.e.

![]() $\pi_A$

and

$\pi_A$

and

![]() $\pi_B$

for

$\pi_B$

for

![]() $C_A=C_B=1$

), the corresponding standard deviations, the ratio of the pure premiums and standard deviations (i.e.

$C_A=C_B=1$

), the corresponding standard deviations, the ratio of the pure premiums and standard deviations (i.e.

![]() $\psi$

for

$\psi$

for

![]() $\zeta \gamma=1$

), and the correlation coefficient

$\zeta \gamma=1$

), and the correlation coefficient

![]() $\rho$

. The table shows that the business lines satisfy the condition

$\rho$

. The table shows that the business lines satisfy the condition

![]() $\psi_A<\psi_B$

, i.e.

$\psi_A<\psi_B$

, i.e.

![]() $b>1$

. Further, since the correlation coefficient is negative, the condition

$b>1$

. Further, since the correlation coefficient is negative, the condition

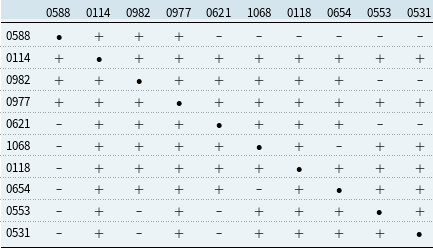

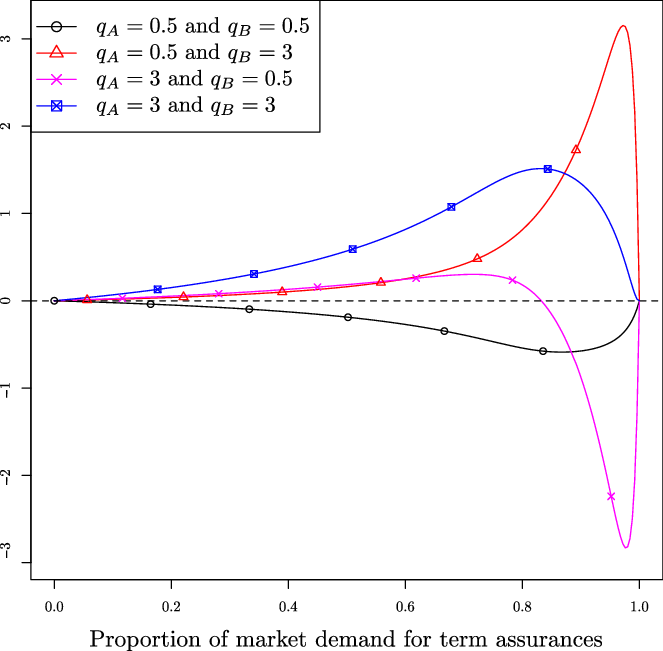

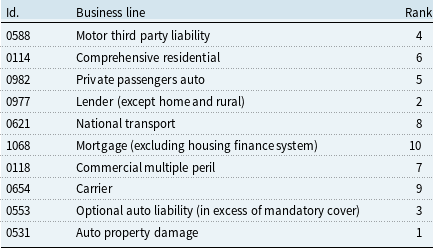

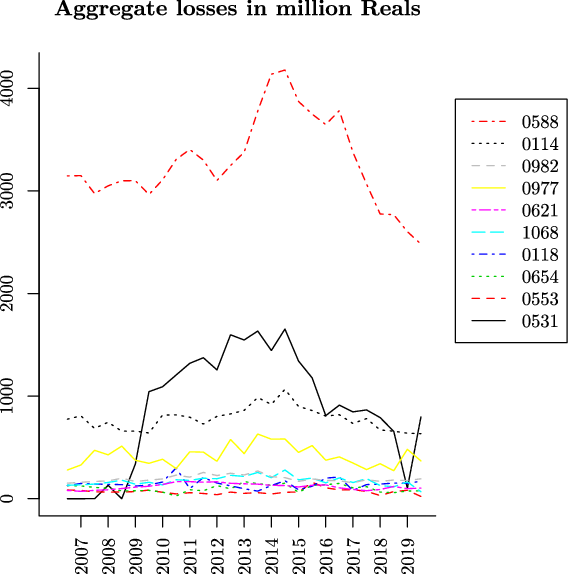

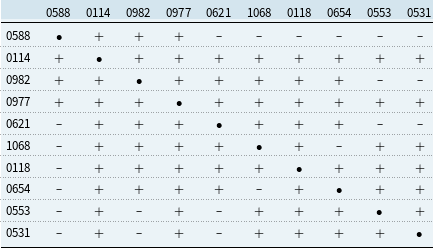

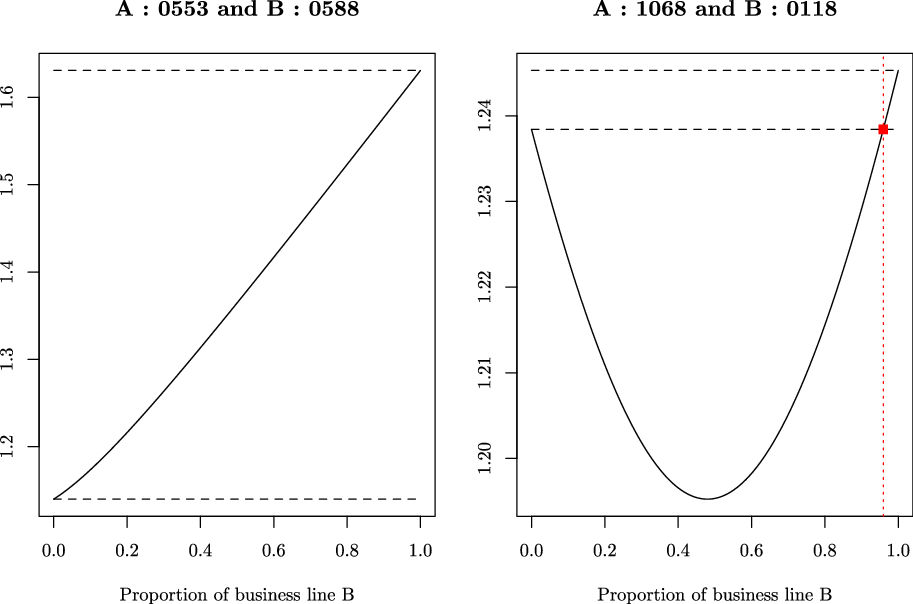

![]() $b\rho<1$