1. Introduction

In the past few decades, optimal reinsurance problems for various risk models have attracted the attention of a large number of scholars in actuarial sciences area, and the technique of stochastic control theory and the corresponding Hamilton–Jacobi–Bellman (HJB) equation are widely used to cope with these problems. See, for example, Browne (Reference Browne1995), Schmidli (2001, Reference Schmidli2002), Promislow & Young (Reference Promislow and Young2005), Bai et al. (Reference Bai, Cai and Zhou2013), Liang & Bayraktar (Reference Liang and Bayraktar2014), Liang & Yuen (Reference Liang and Yuen2016) and Bi et al. (Reference Bi, Liang and Xu2016). The main popular criteria include maximising the expected utility of the terminal wealth, minimising the probability of ruin of the insurer and so on.

Our paper falls naturally within the area of optimally controlling wealth to reach a goal, which is an important research topic. It began with the seminal work of Dubins & Savage (Reference Dubins and Savage1976 [1965]), and continued with the work of Pestien & Sudderth (Reference Pestien and Sudderth1985), Sudderth et al. (Reference Sudderth, William and Ananda1989), Browne (1997, 1999a, Reference Browne1999b ), Young (Reference Young2004), Moore et al. (Reference Moore, Kristen and Young2006), Wang & Young (2012a, Reference Wang and Young2012b ) and Yener (Reference Yener2015). A typical problem considered in this research area is to control a process to minimise the probability of ruin. See, for example, Promislow & Young (Reference Promislow and Young2005) found the optimal investment and quota-share reinsurance strategies to minimise the probability of ruin of an insurer who faces a claim process that follows Brownian motion with drift. Bayraktar & Young (Reference Bayraktar and Young2008) considered the minimum probability of ruin when an agent’s rate of consumption is ratcheted; i.e., it forms a non-decreasing process. Azcue & Muler (Reference Azcue and Muler2013) also studied the minimum probability of ruin, assuming that the decision-maker can invest dynamically part of the reserve in an asset that has a positive fixed return. Bäuerle & Bayraktar (Reference Bäuerle and Bayraktar2014) obtained that the optimal investment strategy to minimise the probability of ruin is the one that maximises the ratio of drift of a diffusion divided to its volatility squared, which was also shown in Pestien & Sudderth (Reference Pestien and Sudderth1985).

Drawdown, measuring the decline of portfolio value from its historic high-water mark, is a frequently quoted risk metric to evaluate the performance of portfolio managers in the fund management industry. A significant drawdown not only leads to large portfolio losses but may also trigger a long-term recession. It is also considered as a key determinant of sustainable investments since investors tend to overestimate their tolerance to risk. Besides, investors prefer to assess their investment success by comparing their current portfolio value to the historical maximum value. Therefore, portfolio managers have strong incentives to adopt strategies with low drawdown risks. Recently, Angoshtari et al. (Reference Angoshtari, Bayraktar and Young2016a ) investigated the minimum drawdown probability problem over an infinite-time horizon and showed that the optimal strategy which minimises the probability of ruin also minimises the probability of drawdown if drawdown does not happen. Besides, Chen et al.(Reference Chen, Landriault, Li and Li2015) and Angoshtari et al. (Reference Angoshtari, Bayraktar and Young2016b ) both studied a lifetime investment problem aiming at minimising the risk of drawdown occurrence. They found that the optimal strategy for a random (or finite) maturity setting such as lifetime drawdown is very different from that of the corresponding ruin problem. We can see other works involving drawdown such as Grossman & Zhou (Reference Grossman and Zhou1993), Cvitanić & Karatzas (Reference Cvitanić and Karatzas1995) and Elie & Touzi (Reference Elie and Touzi2008) for early references.

Even though lots of literature on optimal reinsurance problems in controlling wealth to reach a goal has been worked out, there are still many aspects being worthily further explored. For example, most of the literature about reinsurance optimisation is based on independent aggregate claims. However, in practice, insurance businesses are usually dependent in some way. A typical example is that an earthquake, hurricane or tsunami often leads to various kinds of insurance claims such as death claims, medical claims and household claims. That is to say, a single event generates claims from different lines of insurance. To depict such a dependence structure among several classes of insurance business, the so-called common shock risk model may be of some practical relevance. Research on risk models with dependent risk is increasing rapidly in recent years. See, for example, Wang (Reference Wang1998), and Yuen et al. (2002, Reference Yuen, Guo and Wu2006). Meanwhile, some researchers are devoted to solving the problem of optimal reinsurance. Bai et al. (Reference Bai, Cai and Zhou2013) sought the optimal excess of loss reinsurance to minimise the ruin probability for the diffusion approximation risk model. Liang & Yuen (Reference Liang and Yuen2016) adopted the variance premium principle to study the optimal proportional reinsurance problem for both the compound Poisson risk model and the diffusion approximation risk model. Yuen et al. (Reference Yuen, Liang and Zhou2015) extended the work of Liang & Yuen (Reference Liang and Yuen2016) to the case with the reinsurance premium calculated by the expected value principle and to the model with two or more classes of dependent risks. Liang et al. (Reference Liang, Bi, Yuen and Zhang2016) also studied the optimal reinsurance–investment problems in a financial market with jump-diffusion risky asset, where the insurance risk model is modulated by a compound Poisson process, and the two jump number processes are correlated by a common shock. However, among these papers with common shock dependence, few of them are related to the problem of minimising the probability of drawdown.

As we know, with drawdown, the decision-maker wants to choose the optimal strategy which minimises the probability that the value of the surplus process reaches some fixed proportion, say α∈[0,1), of its maximum value to date. Naturally, it seems more reasonable for insurers to bear drawdown than ruin, where the wealth drops below a fix level, such as 0. It is obvious that, when α=0, minimising the probability of drawdown is equal to minimising the probability of ruin. Therefore, in our paper, we consider the optimal proportional reinsurance problem in a risk model with two dependent classes of insurance business in two different cases, where the criterion is minimising the probability of drawdown. In the first case, the level we set is a fixed one. Based on the method of maximising the ratio of drift of the surplus process divided to its volatility squared in Bäuerle & Bayraktar (Reference Bäuerle and Bayraktar2014), we obtain the optimal results. In the second case, the level is not necessarily a fixed one, then the method mentioned above does not apply. Thus, following the analysis of Chen et al. (Reference Chen, Landriault, Li and Li2015) and Angoshtari et al. (2016a, 2016 Reference Angoshtari, Bayraktar and Youngb ), we use the technique of stochastic control theory and the corresponding HJB equation to tackle the optimisation problem. In particular, since we constrain the reinsurance proportion in the interval [0,1] for each case, the optimisation problems are discussed in three different situations, which makes the problem more challenging. By some interesting analytic technique, we obtain the explicit solutions for the optimal proportional reinsurance strategy and the minimum probability of drawdown, which strongly depend on the value of the surplus wealth. In addition, we come to the conclusion that the optimal proportional reinsurance strategy for the drawdown problem coincides with the one for the ruin problem if drawdown does not happen. Moreover, we can see that, for the optimisation problem with common shock dependent risk model, the way of solving the HJB equation to gain the optimal results is relatively easier than the way of maximising the ratio of the drift of the surplus process to its volatility squared, but the latter makes the analysis of the constrained control variables more convenient.

The remainder of this paper is organised as follows. In section 2, the model and the optimisation problem are presented. With constraint on the reinsurance strategy, explicit expressions of the optimal strategy and the corresponding minimum probability of drawdown are obtained in sections 3 and 4. In section 5, we present some numerical examples which show the impact of some model parameters on the optimal results. Finally, we conclude the paper in section 6.

2. Model and Problem Formulation

Suppose that an insurance company has two dependent classes of insurance business such as motor and life insurance. Let {X i , i≥1} be the claim size random variables for the first class following a common distribution F X (x) with F X (x)=0 for x≤0, and 0<F X (x)≤1 for x>0; and {Y i , i≥1} be the claim size random variables for the second class following a common distribution F Y (y) with F Y (y)=0 for y≤0, 0<F Y (y)≤1 for y>0. Then, the aggregate claims process generated from these two classes of business is given by

where N i (t)+N(t) (i=1, 2) is the claim number process for class i (i=1, 2), and N 1(t), N 2(t) and N(t) are three independent Poisson processes with parameters λ 1, λ 2 and λ, respectively. Assume that X i and Y i are independent claim size random variables, and that they are independent of N 1(t), N 2(t) and N(t). It is obvious that the dependence of the two classes of business is due to a common shock governed by the counting process N(t).

We allow the insurance company to continuously reinsure a fraction of its claim with the retention levels q 1(⋅)∈[0,1] and q 2(⋅)∈[0,1] for X i and Y i , respectively, and the reinsurance premium rate at time t is δ(q 1(⋅), q 2(⋅)). Let {U t , t≥0} denote the associated surplus process, i.e., U t is the surplus of the insurer at time t under the strategy (q 1(U t ), q 2(U t )). This controlled surplus process can be given by

where the constant c is the premium rate. Moreover, from Grandell (Reference Grandell1991), we know that the Brownian motion risk model given by

with a

1=(λ

1+λ)E(X) and

![]() $b_{1}^{2} {\equals}\left( {\lambda _{1} {\plus}\lambda } \right)E\left( {X^{2} } \right)$

can be seen as a diffusion approximation to the compound Poisson process S

1(t). Similarly,

$b_{1}^{2} {\equals}\left( {\lambda _{1} {\plus}\lambda } \right)E\left( {X^{2} } \right)$

can be seen as a diffusion approximation to the compound Poisson process S

1(t). Similarly,

with a

2=(λ

2 + λ)E(Y) and

![]() $b_{2}^{2} {\equals}\left( {\lambda _{2} {\plus}\lambda } \right)E\left( {Y^{2} } \right)$

can be treated as a diffusion approximation to the compound Poisson process S

2(t). Here, B

1t

and B

2t

are standard Brownian motions with the correlation coefficient

$b_{2}^{2} {\equals}\left( {\lambda _{2} {\plus}\lambda } \right)E\left( {Y^{2} } \right)$

can be treated as a diffusion approximation to the compound Poisson process S

2(t). Here, B

1t

and B

2t

are standard Brownian motions with the correlation coefficient

Thus, E[B 1t B 2t ]=ρt. With expected value principle:

and the reinsurance premium rate at time t is

where θ i (i=1, 2) and η i (i=1, 2) are the insurer’s and reinsurer’s safety loading of the two classes of the insurance business, respectively. Without loss of generality, we assume that η i ≥θ i , and η i >θ i holds at least for one i (i=1,2), otherwise the problem becomes trivial.

Replace S

i

(t)(i=1, 2) by

![]() $\hat{S}_{i} (t){\rm }(i{\equals}1,2)$

in (2.1). Furthermore, we assume that the insurer is allowed to invest all its surplus in a risk-free asset (bond or bank account) with interest rate r. Then the process evolves as

$\hat{S}_{i} (t){\rm }(i{\equals}1,2)$

in (2.1). Furthermore, we assume that the insurer is allowed to invest all its surplus in a risk-free asset (bond or bank account) with interest rate r. Then the process evolves as

$$\eqalignno{ d\hat{U}_{t} {\equals} & \left[ {r\hat{U}_{t} {\plus}a_{1} \left( {\theta _{1} {\minus}\eta _{1} {\plus}\eta _{1} q_{1} \left( {\hat{U}_{t} } \right)} \right)} \right.\left. {{\plus}a_{2} \left( {\theta _{2} {\minus}\eta _{2} {\plus}\eta _{2} q_{2} \left( {\hat{U}_{t} } \right)} \right)} \right]dt \cr & {\rm }{\plus} b_{1} q_{1} \left( {\hat{U}_{t} } \right)dB_{{1t}} {\plus}b_{2} q_{2} \left( {\hat{U}_{t} } \right)dB_{{2t}} $$

$$\eqalignno{ d\hat{U}_{t} {\equals} & \left[ {r\hat{U}_{t} {\plus}a_{1} \left( {\theta _{1} {\minus}\eta _{1} {\plus}\eta _{1} q_{1} \left( {\hat{U}_{t} } \right)} \right)} \right.\left. {{\plus}a_{2} \left( {\theta _{2} {\minus}\eta _{2} {\plus}\eta _{2} q_{2} \left( {\hat{U}_{t} } \right)} \right)} \right]dt \cr & {\rm }{\plus} b_{1} q_{1} \left( {\hat{U}_{t} } \right)dB_{{1t}} {\plus}b_{2} q_{2} \left( {\hat{U}_{t} } \right)dB_{{2t}} $$

or equivalently:

$$\eqalignno{ d\hat{U}_{t} {\equals} & \left[ {r\hat{U}_{t} {\plus}a_{1} \left( {\theta _{1} {\minus}\eta _{1} {\plus}\eta _{1} q_{1} \left( {\hat{U}_{t} } \right)} \right){\plus}a_{2} \left( {\theta _{2} {\minus}\eta _{2} {\plus}\eta _{2} q_{2} \left( {\hat{U}_{t} } \right)} \right)} \right]dt \cr & {\rm }{\plus} \sqrt {b_{1}^{2} q_{1}^{2} \left( {\hat{U}_{t} } \right){\plus}b_{2}^{2} q_{2}^{2} \left( {\hat{U}_{t} } \right){\plus}2b_{1} b_{2} q_{1} \left( {\hat{U}_{t} } \right)q_{2} \left( {\hat{U}_{t} } \right)\rho } dB_{t} $$

$$\eqalignno{ d\hat{U}_{t} {\equals} & \left[ {r\hat{U}_{t} {\plus}a_{1} \left( {\theta _{1} {\minus}\eta _{1} {\plus}\eta _{1} q_{1} \left( {\hat{U}_{t} } \right)} \right){\plus}a_{2} \left( {\theta _{2} {\minus}\eta _{2} {\plus}\eta _{2} q_{2} \left( {\hat{U}_{t} } \right)} \right)} \right]dt \cr & {\rm }{\plus} \sqrt {b_{1}^{2} q_{1}^{2} \left( {\hat{U}_{t} } \right){\plus}b_{2}^{2} q_{2}^{2} \left( {\hat{U}_{t} } \right){\plus}2b_{1} b_{2} q_{1} \left( {\hat{U}_{t} } \right)q_{2} \left( {\hat{U}_{t} } \right)\rho } dB_{t} $$

with

![]() $\hat{U}_{0} {\equals}u$

and

$\hat{U}_{0} {\equals}u$

and

![]() $B_{t} $

is a standard Brownian motion. The similar model has also been studied in the literature; see, for example, Yuen et al. (Reference Yuen, Liang and Zhou2015), Liang & Yuen (Reference Liang and Yuen2016), Bi et al. (Reference Bi, Liang and Xu2016) and the references therein.

$B_{t} $

is a standard Brownian motion. The similar model has also been studied in the literature; see, for example, Yuen et al. (Reference Yuen, Liang and Zhou2015), Liang & Yuen (Reference Liang and Yuen2016), Bi et al. (Reference Bi, Liang and Xu2016) and the references therein.

Define the maximum surplus value M t at time t by

where M 0=m>0. Note that we allow the surplus process to have a financial past, and that m is no less than the initial surplus u by definition. We mean that when the value of the surplus process reaches α∈[0,1) times its maximum value, then drawdown occurs. Define the corresponding hitting time by

We can see that, if α=0, then we are in the case of minimising the probability of ruin for the fixed ruin level 0. Besides, if the value of the investment fund is big enough, say, at least

then the insurer can transfer all the risk, and the surplus value will never decrease, i.e., drawdown cannot occur in this case. We generalise from this case in the following Remark 2.1.

Remark 2.1. Throughout this paper, we know there exists a unique

such that

and

If

![]() $\hat{U}_{0} {\equals}u\geq u_{s} $

, then we can set

$\hat{U}_{0} {\equals}u\geq u_{s} $

, then we can set

![]() $q_{1}^{{\rm {\asterisk}}} (\hat{U}_{t} ){\equals}0$

,

$q_{1}^{{\rm {\asterisk}}} (\hat{U}_{t} ){\equals}0$

,

![]() $q_{2}^{{\rm {\asterisk}}} (\hat{U}_{t} ){\equals}0$

for all t≥0, which implies

$q_{2}^{{\rm {\asterisk}}} (\hat{U}_{t} ){\equals}0$

for all t≥0, which implies

Under this reinsurance strategy, the value of the surplus process is non-decreasing, so drawdown will never occur. For this reason, we call u s safe level as defined in Angoshtari et al. (Reference Angoshtari, Bayraktar and Young2016a ).

In the following definition, we give the admissible set of

![]() $$\left( {q_{1} \left( {\hat{U}_{t} } \right),q_{2} \left( {\hat{U}_{t} } \right)} \right)$$

.

$$\left( {q_{1} \left( {\hat{U}_{t} } \right),q_{2} \left( {\hat{U}_{t} } \right)} \right)$$

.

Definition 2.1 Let

![]() $(\Omega ,{\cal F},{\cal P})$

be a probability space equipped with a complete filtration

$(\Omega ,{\cal F},{\cal P})$

be a probability space equipped with a complete filtration

![]() ${\cal F}_{t} $

which is generated by

${\cal F}_{t} $

which is generated by

![]() $\hat{U}_{s} \left( {0\leq s\leq t} \right)$

. A strategy

$\hat{U}_{s} \left( {0\leq s\leq t} \right)$

. A strategy

![]() $$\left( {q_{1} \left( {\hat{U}_{t} } \right),q_{2} \left( {\hat{U}_{t} } \right)} \right)$$

is said to be admissible if the following conditions are satisfied:

$$\left( {q_{1} \left( {\hat{U}_{t} } \right),q_{2} \left( {\hat{U}_{t} } \right)} \right)$$

is said to be admissible if the following conditions are satisfied:

(a)

$\left( {q_{1} \left( {\hat{U}_{t} } \right),q_{2} \left( {\hat{U}_{t} } \right)} \right)$

is

$\left( {q_{1} \left( {\hat{U}_{t} } \right),q_{2} \left( {\hat{U}_{t} } \right)} \right)$

is

${\cal F}_{t} $

-progressively measurable;

${\cal F}_{t} $

-progressively measurable;(b)

$q_{i} \left( {\hat{U}_{t} } \right)\in[0,1]$

for i=1, 2;

$q_{i} \left( {\hat{U}_{t} } \right)\in[0,1]$

for i=1, 2;(c) Equation (2.2) for

$\hat{U}_{t} $

has a unique strong solution.

$\hat{U}_{t} $

has a unique strong solution.

The set of all admissible strategies is denoted by

![]() ${\cal D}$

.

${\cal D}$

.

Now assume that the insurer is interested in minimising the probability of drawdown, we denote the minimum probability of drawdown by ϕ(u, m), which depends on the initial surplus u and the maximum (past) value m. Specifically, ϕ is the minimum probability of τ α <∞, thus, we derive the objective function

Here, P

u,m

and E

u,m

denote the probability and expectation, respectively, conditional on

![]() $\hat{U}_{0} {\equals}u$

and

$\hat{U}_{0} {\equals}u$

and

![]() $M_{0} {\equals}m$

. Then, the corresponding value function is given by

$M_{0} {\equals}m$

. Then, the corresponding value function is given by

3. Minimising the Probability of Drawdown When m≥u s

We first consider the case for which m≥u

s

. Note that if αm>u

s

, then the probability of drawdown ϕ(u,m)=1 for all u≤αm, and when u≤αm, we have u>u

s

, then according to Remark 2.1, the value of the surplus will consistently increase, and thus the probability of drawdown ϕ(u,m)=0 for all u >αm. In the following context, we shall investigate the case of αm≤u

s

in detail. When

![]() $\hat{U}_{0} {\equals}u\geq u_{s} $

, the drawdown is impossible; and when

$\hat{U}_{0} {\equals}u\geq u_{s} $

, the drawdown is impossible; and when

![]() $\hat{U}_{0} {\equals}u\leq \alpha m$

, then the drawdown has occurred and the game is over. Therefore, we assume that

$\hat{U}_{0} {\equals}u\leq \alpha m$

, then the drawdown has occurred and the game is over. Therefore, we assume that

![]() $\hat{U}_{0} {\equals}u\in[\alpha m,u_{s} ]$

.

$\hat{U}_{0} {\equals}u\in[\alpha m,u_{s} ]$

.

![]() $\hat{U}_{0} {\equals}u\leq u_{s} $

implies that either

$\hat{U}_{0} {\equals}u\leq u_{s} $

implies that either

![]() $\hat{U}_{t} \,\lt\,u_{s} $

almost surely, for all t≥0, or

$\hat{U}_{t} \,\lt\,u_{s} $

almost surely, for all t≥0, or

![]() $\hat{U}_{t} {\equals}u_{s} $

for some t>0. Since

$\hat{U}_{t} {\equals}u_{s} $

for some t>0. Since

![]() $m\geq u_{s} $

, M

t

=m holds almost surely for all t≥0. Therefore, avoiding drawdown is equivalent to avoiding ruin with a (fixed) ruin level of αm.

$m\geq u_{s} $

, M

t

=m holds almost surely for all t≥0. Therefore, avoiding drawdown is equivalent to avoiding ruin with a (fixed) ruin level of αm.

From Bäuerle & Bayraktar (Reference Bäuerle and Bayraktar2014), we can see that the optimal proportional reinsurance strategy with no constraint is the one that maximises the ratio of the drift of the surplus process to its volatility squared in (2.2). Thus, when the arguments u and m indicate the initial surplus and the maximum (past) value, respectively, the Proposition 3.1 can be derived.

Proposition 3.1. If m≥u s , the optimal proportional reinsurance strategy with no constraint is

$$ \scale98% { \left\{ \matrix{ \hat{q}_{1} (u){\equals}{{2\left[ {{\rm \Delta }_{1} {\plus}ru} \right]\left( {a_{2} \eta _{2} \rho b_{1} b_{2} {\minus}a_{1} \eta _{1} b_{2}^{2} } \right)} \over {{\rm \Delta }_{2} }} \hfill \cr \hat{q}_{2} (u){\equals}{{2\left[ {{\rm \Delta }_{1} {\plus}ru} \right]\left( {a_{1} \eta _{1} \rho b_{1} b_{2} {\minus}a_{2} \eta _{2} b_{1}^{2} } \right)} \over {{\rm \Delta }_{2} }} \hfill \cr} \right.$$

$$ \scale98% { \left\{ \matrix{ \hat{q}_{1} (u){\equals}{{2\left[ {{\rm \Delta }_{1} {\plus}ru} \right]\left( {a_{2} \eta _{2} \rho b_{1} b_{2} {\minus}a_{1} \eta _{1} b_{2}^{2} } \right)} \over {{\rm \Delta }_{2} }} \hfill \cr \hat{q}_{2} (u){\equals}{{2\left[ {{\rm \Delta }_{1} {\plus}ru} \right]\left( {a_{1} \eta _{1} \rho b_{1} b_{2} {\minus}a_{2} \eta _{2} b_{1}^{2} } \right)} \over {{\rm \Delta }_{2} }} \hfill \cr} \right.$$

in which Δ1 and Δ2 are defined by

Proof. From (2.2), we denote the ratio of the drift to its volatility squared by ξ(u), thus we have

Differentiating ξ(u) with respect to q 1(u) and q 2(u), respectively, we have

$$ \scale98% { \left\{ \matrix{ a_{1} \eta _{1} \left( {b_{1}^{2} \hat{q}_{1}^{2} \left( u \right){\plus}b_{2}^{2} \hat{q}_{2}^{2} \left( u \right){\plus}2b_{1} b_{2} \hat{q}_{1} \left( u \right)\hat{q}_{2} \left( u \right)\rho } \right) \hfill \cr {\minus}\left[ {a_{1} \left( {\theta _{1} {\minus}\eta _{1} {\plus}\eta _{1} \hat{q}_{1} \left( u \right)} \right){\plus}a_{2} \left( {\theta _{2} {\minus}\eta _{2} {\plus}\eta _{2} \hat{q}_{2} \left( u \right)} \right){\plus}ru} \right]\left( {2\hat{q}_{1} \left( u \right)b_{1}^{2} {\plus}2\hat{q}_{2} \left( u \right)b_{1} b_{2} \rho } \right){\equals}0 \hfill \cr a_{2} \eta _{2} \left( {b_{1}^{2} \hat{q}_{1}^{2} \left( u \right){\plus}b_{2}^{2} \hat{q}_{2}^{2} \left( u \right){\plus}2b_{1} b_{2} \hat{q}_{1} \left( u \right)\hat{q}_{2} \left( u \right)\rho } \right) \hfill \cr {\minus}\left[ {a_{1} \left( {\theta _{1} {\minus}\eta _{1} {\plus}\eta _{1} \hat{q}_{1} \left( u \right)} \right){\plus}a_{2} \left( {\theta _{2} {\minus}\eta _{2} {\plus}\eta _{2} \hat{q}_{2} \left( u \right)} \right){\plus}ru} \right]\left( {2\hat{q}_{2} \left( u \right)b_{2}^{2} {\plus}2\hat{q}_{1} \left( u \right)b_{1} b_{2} \rho } \right){\equals}0 \hfill \cr} \right.$$

$$ \scale98% { \left\{ \matrix{ a_{1} \eta _{1} \left( {b_{1}^{2} \hat{q}_{1}^{2} \left( u \right){\plus}b_{2}^{2} \hat{q}_{2}^{2} \left( u \right){\plus}2b_{1} b_{2} \hat{q}_{1} \left( u \right)\hat{q}_{2} \left( u \right)\rho } \right) \hfill \cr {\minus}\left[ {a_{1} \left( {\theta _{1} {\minus}\eta _{1} {\plus}\eta _{1} \hat{q}_{1} \left( u \right)} \right){\plus}a_{2} \left( {\theta _{2} {\minus}\eta _{2} {\plus}\eta _{2} \hat{q}_{2} \left( u \right)} \right){\plus}ru} \right]\left( {2\hat{q}_{1} \left( u \right)b_{1}^{2} {\plus}2\hat{q}_{2} \left( u \right)b_{1} b_{2} \rho } \right){\equals}0 \hfill \cr a_{2} \eta _{2} \left( {b_{1}^{2} \hat{q}_{1}^{2} \left( u \right){\plus}b_{2}^{2} \hat{q}_{2}^{2} \left( u \right){\plus}2b_{1} b_{2} \hat{q}_{1} \left( u \right)\hat{q}_{2} \left( u \right)\rho } \right) \hfill \cr {\minus}\left[ {a_{1} \left( {\theta _{1} {\minus}\eta _{1} {\plus}\eta _{1} \hat{q}_{1} \left( u \right)} \right){\plus}a_{2} \left( {\theta _{2} {\minus}\eta _{2} {\plus}\eta _{2} \hat{q}_{2} \left( u \right)} \right){\plus}ru} \right]\left( {2\hat{q}_{2} \left( u \right)b_{2}^{2} {\plus}2\hat{q}_{1} \left( u \right)b_{1} b_{2} \rho } \right){\equals}0 \hfill \cr} \right.$$

Solving these equations yields the solution (3.1).

On the other hand, by the technique of stochastic control theory and the corresponding HJB equation, we can also get the candidate optimiser (see e.g., (4.3)) along the same lines in section 4, which is exactly the same as the one in (3.1). Therefore, we can directly come to the conclusion that the solution given by (3.1) is indeed the optimal proportional reinsurance strategy for the case with no constraint.□

From Bäuerle & Bayraktar (Reference Bäuerle and Bayraktar2014, theorem 4.1) and Karatzas & Shreve(Reference Karatzas and Shreve1991: 339), we have the following lemma.

Lemma 3.1. Let ξ(⋅) be given in (3.3), in which the reinsurance strategy is the optimal one. Then, the minimum probability of ruin is given by

where g is defined by

Note that g in (3.4) is the scale function associated with the diffusion process in (2.2).

Next, we shall focus on discussing the optimal reinsurance strategy which minimises the probability of drawdown when m≥u s .

Because of the constraints of

![]() $\left( {q_{1}^{{\rm {\asterisk}}} \left( u \right),q_{2}^{{\rm {\asterisk}}} \left( u \right)} \right)$

and the result of

$\left( {q_{1}^{{\rm {\asterisk}}} \left( u \right),q_{2}^{{\rm {\asterisk}}} \left( u \right)} \right)$

and the result of

![]() $${{{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} } \mathord{\left/ {\vphantom {{{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} } {{{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} {\equals}{1 \over {\rho ^{2} }}\,\gt\,1}}} \right. \kern-\nulldelimiterspace} {{{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} {\equals}{1 \over {\rho ^{2} }}\,\gt\,1}}$$

, to get the optimal strategy and the minimum probability of drawdown, we need to discuss the following three cases:

$${{{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} } \mathord{\left/ {\vphantom {{{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} } {{{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} {\equals}{1 \over {\rho ^{2} }}\,\gt\,1}}} \right. \kern-\nulldelimiterspace} {{{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} {\equals}{1 \over {\rho ^{2} }}\,\gt\,1}}$$

, to get the optimal strategy and the minimum probability of drawdown, we need to discuss the following three cases:

$$\left\{ {\matrix{ {{\rm Case}\quad 1\,\colon\,\quad {{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} } & {\left( {{\rm i}{\rm .e}{\rm .,}\hat{q}_{1} \left( u \right)\,\gt\,0,\hat{q}_{2} \left( u \right)\,\gt\,0} \right)} \cr \hskip-38pt {{\rm Case}\quad 2\,\colon\,\quad \eta _{1} \leq {{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} } & {\left( {{\rm i}{\rm .e}{\rm .,}\hat{q}_{1} \left( u \right)\leq 0,\hat{q}_{2} \left( u \right)\,\gt\,0} \right)} \cr \hskip-38pt {{\rm Case}\quad 3\,\colon\,\quad \eta _{1} \geq {{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} } & {\left( {{\rm i}{\rm .e}{\rm .,}\hat{q}_{1} \left( u \right)\,\gt\,0,\hat{q}_{2} \left( u \right)\leq 0} \right)} \cr } } \right.$$

$$\left\{ {\matrix{ {{\rm Case}\quad 1\,\colon\,\quad {{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} } & {\left( {{\rm i}{\rm .e}{\rm .,}\hat{q}_{1} \left( u \right)\,\gt\,0,\hat{q}_{2} \left( u \right)\,\gt\,0} \right)} \cr \hskip-38pt {{\rm Case}\quad 2\,\colon\,\quad \eta _{1} \leq {{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} } & {\left( {{\rm i}{\rm .e}{\rm .,}\hat{q}_{1} \left( u \right)\leq 0,\hat{q}_{2} \left( u \right)\,\gt\,0} \right)} \cr \hskip-38pt {{\rm Case}\quad 3\,\colon\,\quad \eta _{1} \geq {{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} } & {\left( {{\rm i}{\rm .e}{\rm .,}\hat{q}_{1} \left( u \right)\,\gt\,0,\hat{q}_{2} \left( u \right)\leq 0} \right)} \cr } } \right.$$

Since the proof of Case 3 is similar to Case 2, in the following context, we just need to present the proof of Case 1 and Case 2 in detail.

Case 1:

![]() ${{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

.

${{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

.

In this case,

![]() $\hat{q}_{1} (u)\,\gt\,0$

and

$\hat{q}_{1} (u)\,\gt\,0$

and

![]() $\hat{q}_{2} (u)\,\gt\,0$

. Let

$\hat{q}_{2} (u)\,\gt\,0$

. Let

$$\left\{ \matrix{ u_{1} {\equals}{1 \over r}\left[ {{{{\rm \Delta }_{2} } \over {2\left( {a_{2} {\rm \eta }_{2} \rho b_{1} b_{2} {\minus}a_{1} \eta _{1} b_{2}^{2} } \right)}}{\minus}{\rm \Delta }_{1} } \right] \hfill \cr u_{2} {\equals}{1 \over r}\left[ {{{{\rm \Delta }_{2} } \over {2\left( {a_{1} \eta _{1} \rho b_{1} b_{2} {\minus}a_{2} \eta _{2} b_{1}^{2} } \right)}}{\minus}{\rm \Delta }_{1} } \right] \hfill \cr} \right.$$

$$\left\{ \matrix{ u_{1} {\equals}{1 \over r}\left[ {{{{\rm \Delta }_{2} } \over {2\left( {a_{2} {\rm \eta }_{2} \rho b_{1} b_{2} {\minus}a_{1} \eta _{1} b_{2}^{2} } \right)}}{\minus}{\rm \Delta }_{1} } \right] \hfill \cr u_{2} {\equals}{1 \over r}\left[ {{{{\rm \Delta }_{2} } \over {2\left( {a_{1} \eta _{1} \rho b_{1} b_{2} {\minus}a_{2} \eta _{2} b_{1}^{2} } \right)}}{\minus}{\rm \Delta }_{1} } \right] \hfill \cr} \right.$$

It’s easy to see that

![]() $\hat{q}_{1} (u_{1} ){\equals}1$

,

$\hat{q}_{1} (u_{1} ){\equals}1$

,

![]() $\hat{q}_{2} (u_{2} ){\equals}1$

.

$\hat{q}_{2} (u_{2} ){\equals}1$

.

For convenience, we assume that u

1<u

2 as similar results can be obtained for u

1>u

2. From (3.1), we can see that

![]() $\hat{q}_{1} (u)$

,

$\hat{q}_{1} (u)$

,

![]() $\hat{q}_{2} (u)$

are decreasing functions w.r.t. u. Thus, when u

2≤u≤u

s

, we have

$\hat{q}_{2} (u)$

are decreasing functions w.r.t. u. Thus, when u

2≤u≤u

s

, we have

![]() $0\leq \hat{q}_{1} (u)\,\lt\,1$

,

$0\leq \hat{q}_{1} (u)\,\lt\,1$

,

![]() $0\leq \hat{q}_{2} (u)\leq 1$

, and hence

$0\leq \hat{q}_{2} (u)\leq 1$

, and hence

![]() $q_{1}^{{\rm {\asterisk}}} (u){\equals}\hat{q}_{1} (u)$

,

$q_{1}^{{\rm {\asterisk}}} (u){\equals}\hat{q}_{1} (u)$

,

![]() $q_{2}^{{\rm {\asterisk}}} (u){\equals}\hat{q}_{2} (u)$

. One can show that, under this optimal reinsurance strategy given in (3.1), we have

$q_{2}^{{\rm {\asterisk}}} (u){\equals}\hat{q}_{2} (u)$

. One can show that, under this optimal reinsurance strategy given in (3.1), we have

On the other hand, when

![]() $u\leq u_{2} $

, we obtain

$u\leq u_{2} $

, we obtain

![]() $\hat{q}_{2} (u)\geq 1$

. Then we have to choose

$\hat{q}_{2} (u)\geq 1$

. Then we have to choose

![]() $q_{2}^{{\rm {\asterisk}}} (u){\equals}1$

. Inserting

$q_{2}^{{\rm {\asterisk}}} (u){\equals}1$

. Inserting

![]() $q_{2}^{{\rm {\asterisk}}} (u){\equals}1$

into (3.3) and maximising the ratio of the drift of the surplus process to its volatility squared, we can get

$q_{2}^{{\rm {\asterisk}}} (u){\equals}1$

into (3.3) and maximising the ratio of the drift of the surplus process to its volatility squared, we can get

in which A, B, C are defined by

$$\left\{ \matrix{ A{\equals}{\minus}{{a_{1}^{2} \eta _{1}^{2} } \over {2b_{1}^{2} }} \hfill \cr B{\equals}a_{1} \left( {\theta _{1} {\minus}\eta _{1} {\minus}{{\rho b_{2} \eta _{1} } \over {b_{1} }}} \right){\plus}a_{2} \theta _{2} \hfill \cr C{\equals}{1 \over 2}b_{2}^{2} \left( {1{\minus}\rho ^{2} } \right) \hfill \cr} \right.$$

$$\left\{ \matrix{ A{\equals}{\minus}{{a_{1}^{2} \eta _{1}^{2} } \over {2b_{1}^{2} }} \hfill \cr B{\equals}a_{1} \left( {\theta _{1} {\minus}\eta _{1} {\minus}{{\rho b_{2} \eta _{1} } \over {b_{1} }}} \right){\plus}a_{2} \theta _{2} \hfill \cr C{\equals}{1 \over 2}b_{2}^{2} \left( {1{\minus}\rho ^{2} } \right) \hfill \cr} \right.$$

From (3.6), we know that

![]() $\tilde{q}_{1} (u)$

is also a decreasing function w.r.t. u and when

$\tilde{q}_{1} (u)$

is also a decreasing function w.r.t. u and when

we have

![]() $\tilde{q}_{1} (\tilde{u}_{1} ){\equals}1$

. Before we continue our analysis on the optimal results with constraint, we present the following Lemma first.

$\tilde{q}_{1} (\tilde{u}_{1} ){\equals}1$

. Before we continue our analysis on the optimal results with constraint, we present the following Lemma first.

Lemma 3.2. Under the assumption of

![]() $u_{1} \,\lt\,u_{2} $

, we have

$u_{1} \,\lt\,u_{2} $

, we have

![]() $\tilde{u}_{1} \,\lt\,u_{2} $

.

$\tilde{u}_{1} \,\lt\,u_{2} $

.

Proof. Note that

$$\eqalignno{ u_{2} {\minus}\tilde{u}_{1} {\equals} & {1 \over r}\left[ {{{{\rm \Delta }_{2} } \over {2\left( {a_{1} \eta _{1} \rho b_{1} b_{2} {\minus}a_{2} \eta _{2} b_{1}^{2} } \right)}}{\minus}{\rm \Delta }_{1} } \right]{\minus}{1 \over r}\left[ {{{a_{1} \eta _{1} \left( {b_{2}^{2} {\minus}b_{1}^{2} } \right)} \over {2\left( {b_{1}^{2} {\plus}b_{1} b_{2} \rho } \right)}}{\minus}\left( {{\rm \Delta }_{1} {\plus}a_{2} \eta _{2} } \right)} \right] \cr {\equals} & {{b_{1}^{4} a_{2}^{2} \eta _{2}^{2} {\plus}b_{1}^{3} b_{2} \rho a_{2}^{2} \eta _{2}^{2} {\plus}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{4} {\minus}b_{1}^{2} b_{2}^{2} a_{1}^{2} \eta _{1}^{2} {\minus}a_{1}^{2} \eta _{1}^{2} b_{1}^{3} b_{2} \rho {\minus}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{2} b_{2}^{2} } \over {2r\left( {b_{1}^{2} {\plus}b_{1} b_{2} \rho } \right)\left( {a_{2} \eta _{2} b_{1}^{2} {\minus}a_{1} \eta _{1} \rho b_{1} b_{2} } \right)}} $$

$$\eqalignno{ u_{2} {\minus}\tilde{u}_{1} {\equals} & {1 \over r}\left[ {{{{\rm \Delta }_{2} } \over {2\left( {a_{1} \eta _{1} \rho b_{1} b_{2} {\minus}a_{2} \eta _{2} b_{1}^{2} } \right)}}{\minus}{\rm \Delta }_{1} } \right]{\minus}{1 \over r}\left[ {{{a_{1} \eta _{1} \left( {b_{2}^{2} {\minus}b_{1}^{2} } \right)} \over {2\left( {b_{1}^{2} {\plus}b_{1} b_{2} \rho } \right)}}{\minus}\left( {{\rm \Delta }_{1} {\plus}a_{2} \eta _{2} } \right)} \right] \cr {\equals} & {{b_{1}^{4} a_{2}^{2} \eta _{2}^{2} {\plus}b_{1}^{3} b_{2} \rho a_{2}^{2} \eta _{2}^{2} {\plus}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{4} {\minus}b_{1}^{2} b_{2}^{2} a_{1}^{2} \eta _{1}^{2} {\minus}a_{1}^{2} \eta _{1}^{2} b_{1}^{3} b_{2} \rho {\minus}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{2} b_{2}^{2} } \over {2r\left( {b_{1}^{2} {\plus}b_{1} b_{2} \rho } \right)\left( {a_{2} \eta _{2} b_{1}^{2} {\minus}a_{1} \eta _{1} \rho b_{1} b_{2} } \right)}} $$

Because of the assumption of u 1<u 2, we have

then,

$$ \eqalignno{ & {\rm }b_{1}^{4} a_{2}^{2} \eta _{2}^{2} {\plus}b_{1}^{3} b_{2} \rho a_{2}^{2} \eta _{2}^{2} {\plus}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{4} {\minus}b_{1}^{2} b_{2}^{2} a_{1}^{2} \eta _{1}^{2} {\minus}a_{1}^{2} \eta _{1}^{2} b_{1}^{3} b_{2} \rho {\minus}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{2} b_{2}^{2} \cr & \,\gt\,b_{1}^{2} \left( {a_{1} \eta _{1} b_{2}^{2} {\plus}a_{1} \eta _{1} \rho b_{1} b_{2} } \right){\plus}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{4} {\minus}b_{1}^{2} b_{2}^{2} a_{1}^{2} \eta _{1}^{2} {\minus}a_{1}^{2} \eta _{1}^{2} b_{1}^{3} b_{2} \rho {\minus}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{2} b_{2}^{2} \cr & {\equals}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{4} {\minus}b_{1}^{2} b_{2}^{2} a_{1}^{2} \eta _{1}^{2} {\plus}a_{1} \eta _{1} a_{2} \eta _{2} b_{1}^{3} b_{2} \rho {\minus}a_{1}^{2} \eta _{1}^{2} b_{1}^{3} b_{2} \rho \cr & \,\gt\,a_{1} \eta _{1} b_{1}^{2} \left( {a_{1} \eta _{1} \rho b_{1} b_{2} {\minus}a_{2} \eta _{2} \rho b_{1} b_{2} } \right){\minus}a_{1} \eta _{1} b_{1}^{2} \left( {a_{1} \eta _{1} \rho b_{1} b_{2} {\minus}a_{2} \eta _{2} \rho b_{1} b_{2} } \right) {\equals}0 $$

$$ \eqalignno{ & {\rm }b_{1}^{4} a_{2}^{2} \eta _{2}^{2} {\plus}b_{1}^{3} b_{2} \rho a_{2}^{2} \eta _{2}^{2} {\plus}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{4} {\minus}b_{1}^{2} b_{2}^{2} a_{1}^{2} \eta _{1}^{2} {\minus}a_{1}^{2} \eta _{1}^{2} b_{1}^{3} b_{2} \rho {\minus}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{2} b_{2}^{2} \cr & \,\gt\,b_{1}^{2} \left( {a_{1} \eta _{1} b_{2}^{2} {\plus}a_{1} \eta _{1} \rho b_{1} b_{2} } \right){\plus}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{4} {\minus}b_{1}^{2} b_{2}^{2} a_{1}^{2} \eta _{1}^{2} {\minus}a_{1}^{2} \eta _{1}^{2} b_{1}^{3} b_{2} \rho {\minus}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{2} b_{2}^{2} \cr & {\equals}a_{1} a_{2} \eta _{1} \eta _{2} b_{1}^{4} {\minus}b_{1}^{2} b_{2}^{2} a_{1}^{2} \eta _{1}^{2} {\plus}a_{1} \eta _{1} a_{2} \eta _{2} b_{1}^{3} b_{2} \rho {\minus}a_{1}^{2} \eta _{1}^{2} b_{1}^{3} b_{2} \rho \cr & \,\gt\,a_{1} \eta _{1} b_{1}^{2} \left( {a_{1} \eta _{1} \rho b_{1} b_{2} {\minus}a_{2} \eta _{2} \rho b_{1} b_{2} } \right){\minus}a_{1} \eta _{1} b_{1}^{2} \left( {a_{1} \eta _{1} \rho b_{1} b_{2} {\minus}a_{2} \eta _{2} \rho b_{1} b_{2} } \right) {\equals}0 $$

In Case 1, it’s clear that

then we have

![]() $\tilde{u}_{1} \,\lt\,u_{2} .$

□

$\tilde{u}_{1} \,\lt\,u_{2} .$

□

Therefore, when

![]() $\tilde{u}_{1} \leq u\leq u_{2} $

, we have

$\tilde{u}_{1} \leq u\leq u_{2} $

, we have

![]() $0\,\lt\,\tilde{q}_{1} (u)\leq 1$

, thus

$0\,\lt\,\tilde{q}_{1} (u)\leq 1$

, thus

![]() $q_{1}^{{\rm {\asterisk}}} (u){\equals}\tilde{q}_{1} (u)$

. Under the optimal reinsurance strategy of

$q_{1}^{{\rm {\asterisk}}} (u){\equals}\tilde{q}_{1} (u)$

. Under the optimal reinsurance strategy of

![]() $(q_{1}^{{\rm {\asterisk}}} (u),q_{2}^{{\rm {\asterisk}}} (u)){\equals}(\tilde{q}_{1} (u),1)$

, it follows that

$(q_{1}^{{\rm {\asterisk}}} (u),q_{2}^{{\rm {\asterisk}}} (u)){\equals}(\tilde{q}_{1} (u),1)$

, it follows that

$$\xi _{{12}} (u){\equals}{{\mu \left( {u,q_{1}^{{\rm {\asterisk}}} ,q_{2}^{{\rm {\asterisk}}} } \right)} \over {\sigma ^{2} \left( {u,q_{1}^{{\rm {\asterisk}}} ,q_{2}^{{\rm {\asterisk}}} } \right)}}{\equals}{{{\minus}2A\sqrt {\left( {B{\plus}ru} \right)^{2} {\minus}4AC} } \over {\left[ {{\minus}(B{\plus}ru){\plus}\sqrt {\left( {B{\plus}ru} \right)^{2} {\minus}4AC} } \right]^{2} {\minus}4AC}}$$

$$\xi _{{12}} (u){\equals}{{\mu \left( {u,q_{1}^{{\rm {\asterisk}}} ,q_{2}^{{\rm {\asterisk}}} } \right)} \over {\sigma ^{2} \left( {u,q_{1}^{{\rm {\asterisk}}} ,q_{2}^{{\rm {\asterisk}}} } \right)}}{\equals}{{{\minus}2A\sqrt {\left( {B{\plus}ru} \right)^{2} {\minus}4AC} } \over {\left[ {{\minus}(B{\plus}ru){\plus}\sqrt {\left( {B{\plus}ru} \right)^{2} {\minus}4AC} } \right]^{2} {\minus}4AC}}$$

Finally, when

![]() $\alpha m\leq u\leq \tilde{u}_{1} $

, we have to choose

$\alpha m\leq u\leq \tilde{u}_{1} $

, we have to choose

![]() $q_{1}^{{\rm {\asterisk}}} (u){\equals}1$

and

$q_{1}^{{\rm {\asterisk}}} (u){\equals}1$

and

![]() $q_{2}^{{\rm {\asterisk}}} (u){\equals}1$

. Inserting

$q_{2}^{{\rm {\asterisk}}} (u){\equals}1$

. Inserting

![]() $\left( {q_{1}^{{\rm {\asterisk}}} (u),q_{2}^{{\rm {\asterisk}}} (u)} \right){\equals}\left( {1,1} \right)$

into (3.3), and we obtain

$\left( {q_{1}^{{\rm {\asterisk}}} (u),q_{2}^{{\rm {\asterisk}}} (u)} \right){\equals}\left( {1,1} \right)$

into (3.3), and we obtain

To summarise, we give the optimal reinsurance strategy and the corresponding minimum probability of drawdown for the case of m≥u

s

with

![]() ${{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

in Theorem 3.1.

${{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

in Theorem 3.1.

Theorem 3.1. Suppose that

![]() ${{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

. Let Δ1, Δ2 be given in (3.2), A,B,C be given in (3.7), and ξ

11(u),ξ

12(u),ξ

13(u) be given in (3.5), (3.8), (3.9), respectively. Then, for any u∈[αm,u

s

], the minimum probability of drawdown for the surplus process (2.2) is

${{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

. Let Δ1, Δ2 be given in (3.2), A,B,C be given in (3.7), and ξ

11(u),ξ

12(u),ξ

13(u) be given in (3.5), (3.8), (3.9), respectively. Then, for any u∈[αm,u

s

], the minimum probability of drawdown for the surplus process (2.2) is

$$\phi (u,m){\equals}\left\{ {\matrix{ {1{\minus}{{g_{{11}} (u,m)} \over {g_{{13}} (u_{s} ,m)}},} & {\alpha m\leq u\,\lt\,{\rm max}(\alpha m,\tilde{u}_{1} )} \cr {1{\minus}{{g_{{12}} (u,m)} \over {g_{{13}} (u_{s} ,m)}},} & {{\rm max}(\alpha m,\tilde{u}_{1} )\leq u\,\lt\,{\rm max}(\alpha m,u_{2} )} \cr {1{\minus}{{g_{{13}} (u,m)} \over {g_{{13}} (u_{s} ,m)}},} & {{\rm max}(\alpha m,u_{2} )\leq u\leq u_{s} } \cr } } \right.$$

$$\phi (u,m){\equals}\left\{ {\matrix{ {1{\minus}{{g_{{11}} (u,m)} \over {g_{{13}} (u_{s} ,m)}},} & {\alpha m\leq u\,\lt\,{\rm max}(\alpha m,\tilde{u}_{1} )} \cr {1{\minus}{{g_{{12}} (u,m)} \over {g_{{13}} (u_{s} ,m)}},} & {{\rm max}(\alpha m,\tilde{u}_{1} )\leq u\,\lt\,{\rm max}(\alpha m,u_{2} )} \cr {1{\minus}{{g_{{13}} (u,m)} \over {g_{{13}} (u_{s} ,m)}},} & {{\rm max}(\alpha m,u_{2} )\leq u\leq u_{s} } \cr } } \right.$$

and the optimal reinsurance strategy is

$$\left( {q_{1}^{{\rm {\asterisk}}} ,q_{2}^{{\rm {\asterisk}}} } \right){\equals}\left\{ {\matrix{ {\left( {1,1} \right),}\hfill & {\alpha m\leq u\,\lt\,{\rm max}(\alpha m,\tilde{u}_{1} )} \cr {(\tilde{q}_{1} (u),1),}\hfill & {{\rm max}(\alpha m,\tilde{u}_{1} )\leq u\,\lt\,{\rm max}(\alpha m,u_{2} )} \cr {(\hat{q}_{1} (u),\hat{q}_{2} (u)),} & {{\rm max}(\alpha m,u_{2} )\leq u\leq u_{s} } \cr } } \right.$$

$$\left( {q_{1}^{{\rm {\asterisk}}} ,q_{2}^{{\rm {\asterisk}}} } \right){\equals}\left\{ {\matrix{ {\left( {1,1} \right),}\hfill & {\alpha m\leq u\,\lt\,{\rm max}(\alpha m,\tilde{u}_{1} )} \cr {(\tilde{q}_{1} (u),1),}\hfill & {{\rm max}(\alpha m,\tilde{u}_{1} )\leq u\,\lt\,{\rm max}(\alpha m,u_{2} )} \cr {(\hat{q}_{1} (u),\hat{q}_{2} (u)),} & {{\rm max}(\alpha m,u_{2} )\leq u\leq u_{s} } \cr } } \right.$$

in which g 1i (u,m) (i=1,2,3) are defined by

$$\eqalignno{ \scale98% \left\{ \matrix{ g_{{11}} (u,m){\equals}{\int}_{\alpha m}^u {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{13}} (w)dw} {\rm \ztbnd }} \right\}dy,\hfill \cr g_{{12}} (u,m){\equals}{\int}_{\alpha m}^{\alpha m\vee\tilde{u}_{1} } {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{13}} (w)dw} } \right\}dy\hfill \cr \hskip45pt {\plus}{\int}_{\alpha m\vee\tilde{u}_{1} }^u {{\rm exp}} \left\{ {{\minus}2\left( {{\int}_{\alpha m}^{\alpha m\vee\tilde{u}_{1} } {\xi _{{13}} (w){\plus}} {\int}_{\alpha m\vee\tilde{u}_{1} }^y {\xi _{{12}} (w)} } \right)dw} \right\}dy \hfill\cr g_{{13}} (u,m){\equals}{\int}_{\alpha m}^{\alpha m\vee\tilde{u}_{1} } {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{13}} (w)dw} {\rm \ztbnd }} \right\}dy \hfill\cr \hskip45pt {\plus}{\int}_{\alpha m\vee\tilde{u}_{1} }^{\alpha m\vee u_{2} } {{\rm exp}} \left\{ {{\minus}2\left( {{\int}_{\alpha m}^{\alpha m\vee\tilde{u}_{1} } {\xi _{{13}} (w){\plus}} {\int}_{\alpha m\vee\tilde{u}_{1} }^y {\xi _{{12}} (w)} } \right)dw} \right\}dy \hfill\cr \hskip45pt {\plus}{\int}_{\alpha m\vee u_{2} }^u {{\rm exp}} \left\{ {{\minus}2\left( {{\int}_{\alpha m}^{\alpha m\vee u_{1} } {\xi _{{13}} (w)} {\plus}{\int}_{\alpha m\vee\tilde{u}_{1} }^{\alpha m\vee u_{2} } {\xi _{{12}} (w){\plus}} {\int}_{\alpha m\vee u_{2} }^y {\xi _{{11}} (w)} } \right)dw} \right\}dy $$

$$\eqalignno{ \scale98% \left\{ \matrix{ g_{{11}} (u,m){\equals}{\int}_{\alpha m}^u {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{13}} (w)dw} {\rm \ztbnd }} \right\}dy,\hfill \cr g_{{12}} (u,m){\equals}{\int}_{\alpha m}^{\alpha m\vee\tilde{u}_{1} } {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{13}} (w)dw} } \right\}dy\hfill \cr \hskip45pt {\plus}{\int}_{\alpha m\vee\tilde{u}_{1} }^u {{\rm exp}} \left\{ {{\minus}2\left( {{\int}_{\alpha m}^{\alpha m\vee\tilde{u}_{1} } {\xi _{{13}} (w){\plus}} {\int}_{\alpha m\vee\tilde{u}_{1} }^y {\xi _{{12}} (w)} } \right)dw} \right\}dy \hfill\cr g_{{13}} (u,m){\equals}{\int}_{\alpha m}^{\alpha m\vee\tilde{u}_{1} } {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{13}} (w)dw} {\rm \ztbnd }} \right\}dy \hfill\cr \hskip45pt {\plus}{\int}_{\alpha m\vee\tilde{u}_{1} }^{\alpha m\vee u_{2} } {{\rm exp}} \left\{ {{\minus}2\left( {{\int}_{\alpha m}^{\alpha m\vee\tilde{u}_{1} } {\xi _{{13}} (w){\plus}} {\int}_{\alpha m\vee\tilde{u}_{1} }^y {\xi _{{12}} (w)} } \right)dw} \right\}dy \hfill\cr \hskip45pt {\plus}{\int}_{\alpha m\vee u_{2} }^u {{\rm exp}} \left\{ {{\minus}2\left( {{\int}_{\alpha m}^{\alpha m\vee u_{1} } {\xi _{{13}} (w)} {\plus}{\int}_{\alpha m\vee\tilde{u}_{1} }^{\alpha m\vee u_{2} } {\xi _{{12}} (w){\plus}} {\int}_{\alpha m\vee u_{2} }^y {\xi _{{11}} (w)} } \right)dw} \right\}dy $$

Remark 3.1. We can see that ϕ(⋅,m) is a non-increasing and continuous function, which satisfies the following boundary conditions: ϕ(αm,m)=1, ϕ(u s ,m)=0. Furthermore, note that u s is a constant and g 13(u s ,m) is finite. Indeed, the integrand in the expression for g 13 is bounded by 1, then we can get g 13(u s ,m)≤u s −αm<∞. In addition, we know g(u,m) defined in (3.4) is non-decreasing, thus, g 11 and g 12 are also finite

Remark 3.2. Note that the relationship between αm and

![]() $\tilde{u}_{1} (u_{2} )$

is uncertain. Since we are only interested in u∈[αm,u

s

], the notations of

$\tilde{u}_{1} (u_{2} )$

is uncertain. Since we are only interested in u∈[αm,u

s

], the notations of

![]() ${\rm max}(\alpha m,\tilde{u}_{1} )$

and

${\rm max}(\alpha m,\tilde{u}_{1} )$

and

![]() ${\rm max}(\alpha m,u_{2} )$

are used in the expressions for the optimal results. In this sense, the optimal reinsurance strategy depends on the values of α and m. This remark is also applicable for the following theorems.

${\rm max}(\alpha m,u_{2} )$

are used in the expressions for the optimal results. In this sense, the optimal reinsurance strategy depends on the values of α and m. This remark is also applicable for the following theorems.

By the same way, we can get the optimal results for the other two cases as follows:

Case 2:

![]() $\eta _{1} \leq {{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} $

.

$\eta _{1} \leq {{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} $

.

In this case,

![]() $\hat{q}_{1} (u)\leq 0$

,

$\hat{q}_{1} (u)\leq 0$

,

![]() $\hat{q}_{2} (u)\,\gt\,0$

. Then we have to choose

$\hat{q}_{2} (u)\,\gt\,0$

. Then we have to choose

![]() $q_{1}^{{\rm {\asterisk}}} (u){\equals}0$

, and thus we derive the minimiser

$q_{1}^{{\rm {\asterisk}}} (u){\equals}0$

, and thus we derive the minimiser

Let

it is easy to see that

![]() $\bar{q}_{2} (u_{2}^{{\rm '}} ){\equals}1$

.

$\bar{q}_{2} (u_{2}^{{\rm '}} ){\equals}1$

.

In particular, when

![]() $u_{2}^{{\rm '}} \leq u\leq u_{s} $

, we have

$u_{2}^{{\rm '}} \leq u\leq u_{s} $

, we have

![]() $0\leq \bar{q}_{2} (u)\leq 1$

, then it follows that

$0\leq \bar{q}_{2} (u)\leq 1$

, then it follows that

![]() $q_{2}^{{\rm {\asterisk}}} (u){\equals}\bar{q}_{2} (u)$

. Under the optimal reinsurance strategy

$q_{2}^{{\rm {\asterisk}}} (u){\equals}\bar{q}_{2} (u)$

. Under the optimal reinsurance strategy

![]() $\left( {q_{1}^{{\rm {\asterisk}}} (u),q_{2}^{{\rm {\asterisk}}} (u)} \right){\equals}\left( {0,\bar{q}_{2} (u)} \right)$

, we have

$\left( {q_{1}^{{\rm {\asterisk}}} (u),q_{2}^{{\rm {\asterisk}}} (u)} \right){\equals}\left( {0,\bar{q}_{2} (u)} \right)$

, we have

However, when

![]() $\alpha m\leq u\leq u_{2}^{{\rm '}} $

, we have

$\alpha m\leq u\leq u_{2}^{{\rm '}} $

, we have

![]() $\bar{q}_{2} (u)\geq 1$

, thus we have to choose

$\bar{q}_{2} (u)\geq 1$

, thus we have to choose

![]() $q_{2}^{{\rm {\asterisk}}} (u){\equals}1$

, and then we obtain

$q_{2}^{{\rm {\asterisk}}} (u){\equals}1$

, and then we obtain

Therefore, we have the following theorem:

Theorem 3.2. Suppose that

![]() $\eta _{1} \,\lt\,{{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} $

. Let Δ1 and Δ2 be given in (3.2), and ξ

21(u),ξ

22(u) be given in (3.13), (3.14), respectively. Then, for any u∈[αm,u

s

], the minimum probability of drawdown for the surplus process (2.2) is

$\eta _{1} \,\lt\,{{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} $

. Let Δ1 and Δ2 be given in (3.2), and ξ

21(u),ξ

22(u) be given in (3.13), (3.14), respectively. Then, for any u∈[αm,u

s

], the minimum probability of drawdown for the surplus process (2.2) is

and the optimal reinsurance strategy is

in which g 2i (u,m)(i=1,2) are defined by

$$\left\{ \matrix{ g_{{21}} (u,m){\equals}{\int}_{\alpha m}^u {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{22}} (w)dw} } \right\}dy, \hfill \cr g_{{22}} (u,m){\equals}{\int}_{\alpha m}^{\alpha m\vee u_{2}^{{\rm '}} } {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{22}} (w)dw} } \right\}dy \hfill \cr {\plus}{\int}_{\alpha m\vee u_{2}^{{\rm '}} }^u {{\rm exp}} \left\{ {{\minus}2\left( {{\int}_{\alpha m}^{\alpha m\vee u_{2}^{{\rm '}} } {\xi _{{22}} (w)} {\plus}{\int}_{\alpha m\vee u_{2}^{{\rm '}} }^y {\xi _{{21}} (w)} } \right)dw} \right\}dy \hfill \cr} \right.$$

$$\left\{ \matrix{ g_{{21}} (u,m){\equals}{\int}_{\alpha m}^u {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{22}} (w)dw} } \right\}dy, \hfill \cr g_{{22}} (u,m){\equals}{\int}_{\alpha m}^{\alpha m\vee u_{2}^{{\rm '}} } {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{22}} (w)dw} } \right\}dy \hfill \cr {\plus}{\int}_{\alpha m\vee u_{2}^{{\rm '}} }^u {{\rm exp}} \left\{ {{\minus}2\left( {{\int}_{\alpha m}^{\alpha m\vee u_{2}^{{\rm '}} } {\xi _{{22}} (w)} {\plus}{\int}_{\alpha m\vee u_{2}^{{\rm '}} }^y {\xi _{{21}} (w)} } \right)dw} \right\}dy \hfill \cr} \right.$$

We can see that ϕ(u,m) in this case also satisfies the properties in Remark 3.1.

Case 3:

![]() $\eta _{1} \geq {{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

.

$\eta _{1} \geq {{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

.

In this case,

![]() $\hat{q}_{1} (u)\,\gt\,0$

,

$\hat{q}_{1} (u)\,\gt\,0$

,

![]() $\hat{q}_{2} (u)\leq 0$

. Along the same lines in Case 2, we can get the following result:

$\hat{q}_{2} (u)\leq 0$

. Along the same lines in Case 2, we can get the following result:

Theorem 3.3. Suppose that

![]() $\eta _{1} \,\gt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

. Let Δ1 and Δ2 be given in (3.2). Then, for any u∈[αm,u

s

], the minimum probability of drawdown for the surplus process (2.2) is

$\eta _{1} \,\gt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

. Let Δ1 and Δ2 be given in (3.2). Then, for any u∈[αm,u

s

], the minimum probability of drawdown for the surplus process (2.2) is

and the optimal reinsurance strategy is

in which g 3i (u,m)(i=1,2) are defined by

$$\left\{ \matrix{ g_{{31}} (u,m){\equals}{\int}_{\alpha m}^u {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{32}} (w)dw} {\rm \ztbnd }} \right\}dy, \hfill \cr g_{{32}} (u,m){\equals}{\int}_{\alpha m}^{\alpha m\vee u_{1}^{{\rm '}} } {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{32}} (w)dw} {\rm \ztbnd }} \right\}dy \hfill \cr \hskip45pt {\plus}{\int}_{\alpha m\vee u_{1}^{{\rm '}} }^u {{\rm exp}} \left\{ {{\minus}2\left( {{\int}_{\alpha m}^{\alpha m\vee u_{1}^{{\rm '}} } {\xi _{{32}} (w){\plus}} {\int}_{\alpha m\vee u_{1}^{{\rm '}} }^y {\xi _{{31}} (w)} {\rm \ztbnd }} \right)dw} \right\}dy \hfill \cr} \right.$$

$$\left\{ \matrix{ g_{{31}} (u,m){\equals}{\int}_{\alpha m}^u {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{32}} (w)dw} {\rm \ztbnd }} \right\}dy, \hfill \cr g_{{32}} (u,m){\equals}{\int}_{\alpha m}^{\alpha m\vee u_{1}^{{\rm '}} } {{\rm exp}} \left\{ {{\minus}2{\int}_{\alpha m}^y {\xi _{{32}} (w)dw} {\rm \ztbnd }} \right\}dy \hfill \cr \hskip45pt {\plus}{\int}_{\alpha m\vee u_{1}^{{\rm '}} }^u {{\rm exp}} \left\{ {{\minus}2\left( {{\int}_{\alpha m}^{\alpha m\vee u_{1}^{{\rm '}} } {\xi _{{32}} (w){\plus}} {\int}_{\alpha m\vee u_{1}^{{\rm '}} }^y {\xi _{{31}} (w)} {\rm \ztbnd }} \right)dw} \right\}dy \hfill \cr} \right.$$

and ξ

3i

(i=1,2),

![]() $u_{1}^{{\rm '}} $

and

$u_{1}^{{\rm '}} $

and

![]() $\bar{q}_{1} (u)$

are given by

$\bar{q}_{1} (u)$

are given by

$$\left\{ {\matrix{ {\xi _{{31}} (u){\equals}{\minus}{{a_{1}^{2} \eta _{1}^{2} } \over {4b_{1}^{2} \left( {{\rm \Delta }_{1} {\plus}ru} \right)}}} \cr {\xi _{{32}} (u){\equals}{\minus}{{{\rm \Delta }_{1} {\plus}a_{1} \eta _{1} {\plus}ru} \over {b_{1}^{2} }}} \cr \hskip35pt {u_{1}^{{\rm '}} {\equals}{1 \over {2r}}\left( {{\minus}a_{1} \eta _{1} {\minus}2{\rm \Delta }_{1} } \right)} \cr \hskip-9pt {\bar{q}_{1} (u){\equals}{{{\minus}2({\rm \Delta }_{1} {\plus}ru)} \over {a_{2} \eta _{2} }}} \cr } } \right.$$

$$\left\{ {\matrix{ {\xi _{{31}} (u){\equals}{\minus}{{a_{1}^{2} \eta _{1}^{2} } \over {4b_{1}^{2} \left( {{\rm \Delta }_{1} {\plus}ru} \right)}}} \cr {\xi _{{32}} (u){\equals}{\minus}{{{\rm \Delta }_{1} {\plus}a_{1} \eta _{1} {\plus}ru} \over {b_{1}^{2} }}} \cr \hskip35pt {u_{1}^{{\rm '}} {\equals}{1 \over {2r}}\left( {{\minus}a_{1} \eta _{1} {\minus}2{\rm \Delta }_{1} } \right)} \cr \hskip-9pt {\bar{q}_{1} (u){\equals}{{{\minus}2({\rm \Delta }_{1} {\plus}ru)} \over {a_{2} \eta _{2} }}} \cr } } \right.$$

Remark 3.3. We can see clearly that the optimal proportional reinsurance strategies given by Theorems 3.1–3.3 are strongly depend on the value of surplus u. Besides, if α=0 in Theorems 3.1–3.3, then we are in the case of minimising the probability of ruin for the fix level 0, and the corresponding optimal results can be derived directly. Moreover, as the wealth increases towards u s , the optimal reinsurance proportion approaches 0. It makes sense because when the value of the surplus increases, the insurer can transfer all the risk to reinsurer, and thus the wealth will never decrease, then drawdown cannot happen.

4. Minimising the Probability of Drawdown When m<u s

In the previous section, we show the minimum probability of drawdown and the corresponding optimal strategy for the case of m≥u s . In this section, we will consider the same problem for the case of m<u s . Since M t can be larger than m, i.e., the level that we set is not necessarily a fixed one, the special method in Bäuerle & Bayraktar (Reference Bäuerle and Bayraktar2014) does not apply anymore. Therefore, following the analysis of Chen et al. (Reference Chen, Landriault, Li and Li2015) and Angoshtari et al. (2016a, 2016 Reference Angoshtari, Bayraktar and Youngb ), we use the technique of stochastic control theory and the corresponding HJB equation to tackle the optimal problem.

Again, we only need to consider function f on the domain

![]() ${\cal O}\,\colon\,{\equals}\{ (u,m)\in(R^{{\plus}} )^{2} \,\colon\,\alpha m\leq u\leq m,m\,\lt\,u_{s} \} $

. Let C

2,1 denote the space of f(u,m) such that f and its partial derivatives f

u

, f

uu

, f

m

are continuous on

${\cal O}\,\colon\,{\equals}\{ (u,m)\in(R^{{\plus}} )^{2} \,\colon\,\alpha m\leq u\leq m,m\,\lt\,u_{s} \} $

. Let C

2,1 denote the space of f(u,m) such that f and its partial derivatives f

u

, f

uu

, f

m

are continuous on

![]() ${\cal O}$

. It follows from the standard arguments that if the value function ϕ(u,m)∈C

2,1, then ϕ satisfies the following HJB equation:

${\cal O}$

. It follows from the standard arguments that if the value function ϕ(u,m)∈C

2,1, then ϕ satisfies the following HJB equation:

where

$$\eqalignno{ {\cal A}^{{q_{1} q_{2} }} \phi (u,m){\equals} & \left[ {ru{\plus}a_{1} (\theta _{1} {\minus}\eta _{1} {\plus}\eta _{1} q_{1} (u)){\plus}a_{2} (\theta _{2} {\minus}\eta _{2} {\plus}\eta _{2} q_{2} (u))} \right]\phi _{u} \cr {\rm }{\plus} & {1 \over 2}\left( {q_{1}^{2} (u)b_{1}^{2} {\plus}q_{2}^{2} (u)b_{2}^{2} {\plus}2\rho b_{1} b_{2} q_{1} (u)q_{2} (u)} \right)\phi _{{uu}} $$

$$\eqalignno{ {\cal A}^{{q_{1} q_{2} }} \phi (u,m){\equals} & \left[ {ru{\plus}a_{1} (\theta _{1} {\minus}\eta _{1} {\plus}\eta _{1} q_{1} (u)){\plus}a_{2} (\theta _{2} {\minus}\eta _{2} {\plus}\eta _{2} q_{2} (u))} \right]\phi _{u} \cr {\rm }{\plus} & {1 \over 2}\left( {q_{1}^{2} (u)b_{1}^{2} {\plus}q_{2}^{2} (u)b_{2}^{2} {\plus}2\rho b_{1} b_{2} q_{1} (u)q_{2} (u)} \right)\phi _{{uu}} $$

Applying the method of Angoshtari et al. (Reference Angoshtari, Bayraktar and Young2016a ), we can get the following Verification Theorem.

Theorem 4.1. (Verification Theorem): Suppose that

![]() $h\,\colon\,{\cal O}\to R$

is a bounded, continuous function, which satisfies the following condition:

$h\,\colon\,{\cal O}\to R$

is a bounded, continuous function, which satisfies the following condition:

(i) h(⋅,m)∈C 2(αm,m) is a non-increasing convex function,

(ii) h(u,⋅) is continuously differentiable, except possibly at u s ,

(iii) h m (m,m)≥0 if m<u s ,

(iv) h(αm,m)=1,

(v) h(u s ,m)=0 if m≥u s ,

(vi)

${\cal A}^{{q_{1} ,q_{2} }} h\geq 0$

for all

${\cal A}^{{q_{1} ,q_{2} }} h\geq 0$

for all

$q_{1} ,q_{2} \in{\cal D}$

.

$q_{1} ,q_{2} \in{\cal D}$

.

Then, h(u,m)≤ϕ(u,m) on

![]() ${\cal O}$

. Furthermore, suppose that the function h satisfies the conditions mentioned above in such a way that conditions (iii) and (vi) hold with equality for some admissible strategy

${\cal O}$

. Furthermore, suppose that the function h satisfies the conditions mentioned above in such a way that conditions (iii) and (vi) hold with equality for some admissible strategy

![]() $(q_{1}^{{\rm {\asterisk}}} (u)$

,

$(q_{1}^{{\rm {\asterisk}}} (u)$

,

![]() $q_{2}^{{\rm {\asterisk}}} (u))$

, which is defined in feedback form

$q_{2}^{{\rm {\asterisk}}} (u))$

, which is defined in feedback form

![]() $(q_{1}^{{\rm {\asterisk}}} (\hat{U}_{t} ),q_{2}^{{\rm {\asterisk}}} (\hat{U}_{t} ))$

. Then, we have h(u,m)=ϕ(u,m) on

$(q_{1}^{{\rm {\asterisk}}} (\hat{U}_{t} ),q_{2}^{{\rm {\asterisk}}} (\hat{U}_{t} ))$

. Then, we have h(u,m)=ϕ(u,m) on

![]() ${\cal O}$

, and

${\cal O}$

, and

![]() $(q_{1}^{{\rm {\asterisk}}} (u)$

,

$(q_{1}^{{\rm {\asterisk}}} (u)$

,

![]() $q_{2}^{{\rm {\asterisk}}} (u))$

is the optimal reinsurance strategy.

$q_{2}^{{\rm {\asterisk}}} (u))$

is the optimal reinsurance strategy.

For convenience, we denote

Differentiating

![]() $\hat{f}(q_{1} (u),q_{2} (u))$

w.r.t q

i

(u) (i=1,2) yields

$\hat{f}(q_{1} (u),q_{2} (u))$

w.r.t q

i

(u) (i=1,2) yields

$$\left\{ \matrix{ {{\partial ^{2} \hat{f}} \over {\partial q_{1}^{2} (u)}}{\equals}b_{1}^{2} h_{{uu}} ,{\rm }{{\partial ^{2} \hat{f}} \over {\partial q_{2}^{2} (u)}}{\equals}b_{2}^{2} h_{{uu}} \hfill \cr {{\partial ^{2} \hat{f}} \over {\partial q_{1} (u)\partial q_{2} (u)}}{\equals}\rho b_{1} b_{2} h_{{uu}} \hfill \cr} \right.$$

$$\left\{ \matrix{ {{\partial ^{2} \hat{f}} \over {\partial q_{1}^{2} (u)}}{\equals}b_{1}^{2} h_{{uu}} ,{\rm }{{\partial ^{2} \hat{f}} \over {\partial q_{2}^{2} (u)}}{\equals}b_{2}^{2} h_{{uu}} \hfill \cr {{\partial ^{2} \hat{f}} \over {\partial q_{1} (u)\partial q_{2} (u)}}{\equals}\rho b_{1} b_{2} h_{{uu}} \hfill \cr} \right.$$

It is not difficult to see that the Hessian matrix of

![]() $\hat{f}$

is positive definite, and thus

$\hat{f}$

is positive definite, and thus

![]() $\hat{f}(q_{1} (u),q_{2} (u))$

is a convex function with respect to q

i

(u) (i=1,2). Therefore, the minimiser of

$\hat{f}(q_{1} (u),q_{2} (u))$

is a convex function with respect to q

i

(u) (i=1,2). Therefore, the minimiser of

![]() $\hat{f}(q_{1} (u),q_{2} (u))$

is obtained at

$\hat{f}(q_{1} (u),q_{2} (u))$

is obtained at

$$\left\{ \matrix{ \hat{q}_{1} (u){\equals}{{\rho b_{1} b_{2} a_{2} \eta _{2} {\minus}b_{2}^{2} a_{1} \eta _{1} } \over {b_{1}^{2} b_{2}^{2} \left( {1{\minus}\rho ^{2} } \right)}}{{h_{u} } \over {h_{{uu}} }} \hfill \cr \hat{q}_{2} (u){\equals}{{\rho b_{1} b_{2} a_{1} \eta _{1} {\minus}b_{1}^{2} a_{2} \eta _{2} } \over {b_{1}^{2} b_{2}^{2} \left( {1{\minus}\rho ^{2} } \right)}}{{h_{u} } \over {h_{{uu}} }} \hfill \cr} \right.$$

$$\left\{ \matrix{ \hat{q}_{1} (u){\equals}{{\rho b_{1} b_{2} a_{2} \eta _{2} {\minus}b_{2}^{2} a_{1} \eta _{1} } \over {b_{1}^{2} b_{2}^{2} \left( {1{\minus}\rho ^{2} } \right)}}{{h_{u} } \over {h_{{uu}} }} \hfill \cr \hat{q}_{2} (u){\equals}{{\rho b_{1} b_{2} a_{1} \eta _{1} {\minus}b_{1}^{2} a_{2} \eta _{2} } \over {b_{1}^{2} b_{2}^{2} \left( {1{\minus}\rho ^{2} } \right)}}{{h_{u} } \over {h_{{uu}} }} \hfill \cr} \right.$$

If Theorem 4.1 (1) holds, we must have

![]() ${{h_{u} } \over {h_{{uu}} }}\leq 0$

. Because of the constraints of

${{h_{u} } \over {h_{{uu}} }}\leq 0$

. Because of the constraints of

![]() $(q_{1}^{{\rm {\asterisk}}} ,q_{2}^{{\rm {\asterisk}}} )$

and the result of

$(q_{1}^{{\rm {\asterisk}}} ,q_{2}^{{\rm {\asterisk}}} )$

and the result of

![]() ${{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} \,/\,{{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} {\equals}{1 \over {\rho ^{2} }}\,\gt\,1$

, we also need to discuss the three cases mentioned in the previous section.

${{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} \,/\,{{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} {\equals}{1 \over {\rho ^{2} }}\,\gt\,1$

, we also need to discuss the three cases mentioned in the previous section.

Case 1:

![]() ${{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

.

${{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

.

In this case,

![]() $\hat{q}_{1} (u)\,\gt\,0$

,

$\hat{q}_{1} (u)\,\gt\,0$

,

![]() $\hat{q}_{2} (u)\,\gt\,0$

. If

$\hat{q}_{2} (u)\,\gt\,0$

. If

![]() $0\leq \hat{q}_{1} (u)\leq 1$

and

$0\leq \hat{q}_{1} (u)\leq 1$

and

![]() $0\leq \hat{q}_{2} (u)\leq 1$

hold, then

$0\leq \hat{q}_{2} (u)\leq 1$

hold, then

![]() $q_{1}^{{\rm {\asterisk}}} (u){\equals}\hat{q}_{1} (u)$

,

$q_{1}^{{\rm {\asterisk}}} (u){\equals}\hat{q}_{1} (u)$

,

![]() $q_{2}^{{\rm {\asterisk}}} (u){\equals}\hat{q}_{2} (u)$

. Inserting

$q_{2}^{{\rm {\asterisk}}} (u){\equals}\hat{q}_{2} (u)$

. Inserting

![]() $\left( {q_{1}^{{\rm {\asterisk}}} (u),q_{2}^{{\rm {\asterisk}}} (u)} \right){\equals}\left( {\hat{q}_{1} (u),\hat{q}_{2} (u)} \right)$

into (4.1) and putting

$\left( {q_{1}^{{\rm {\asterisk}}} (u),q_{2}^{{\rm {\asterisk}}} (u)} \right){\equals}\left( {\hat{q}_{1} (u),\hat{q}_{2} (u)} \right)$

into (4.1) and putting

![]() ${\cal A}^{{q_{1} ,q_{2} }} h(u,m){\equals}0$

, we obtain

${\cal A}^{{q_{1} ,q_{2} }} h(u,m){\equals}0$

, we obtain

in which ξ

11(u) is defined by (3.5). Substituting

![]() ${{h_{u} } \over {h_{{uu}} }}$

back into (4.2), then we have

${{h_{u} } \over {h_{{uu}} }}$

back into (4.2), then we have

$$\left\{ \matrix{ \hat{q}_{1} (u){\equals}{{2\left[ {{\rm \Delta }_{1} {\plus}ru} \right]\left( {a_{2} \eta _{2} \rho b_{1} b_{2} {\minus}a_{1} \eta _{1} b_{2}^{2} } \right)} \over {{\rm \Delta }_{2} }} \hfill \cr \hat{q}_{2} (u){\equals}{{2\left[ {{\rm \Delta }_{1} {\plus}ru} \right]\left( {a_{1} \eta _{1} \rho b_{1} b_{2} {\minus}a_{2} \eta _{2} b_{1}^{2} } \right)} \over {{\rm \Delta }_{2} }} \hfill \cr} \right.$$

$$\left\{ \matrix{ \hat{q}_{1} (u){\equals}{{2\left[ {{\rm \Delta }_{1} {\plus}ru} \right]\left( {a_{2} \eta _{2} \rho b_{1} b_{2} {\minus}a_{1} \eta _{1} b_{2}^{2} } \right)} \over {{\rm \Delta }_{2} }} \hfill \cr \hat{q}_{2} (u){\equals}{{2\left[ {{\rm \Delta }_{1} {\plus}ru} \right]\left( {a_{1} \eta _{1} \rho b_{1} b_{2} {\minus}a_{2} \eta _{2} b_{1}^{2} } \right)} \over {{\rm \Delta }_{2} }} \hfill \cr} \right.$$

which is identical to (3.1) and satisfies

![]() $\hat{q}_{1} (u_{1} ){\equals}1$

and

$\hat{q}_{1} (u_{1} ){\equals}1$

and

![]() $\hat{q}_{2} (u_{2} ){\equals}1$

.

$\hat{q}_{2} (u_{2} ){\equals}1$

.

Here, we also suppose that u

1<u

2. Along the same lines, we can get the results for u

1>u

2. Thus, when

![]() $0\leq \hat{q}_{1} (u)\leq 1$

,

$0\leq \hat{q}_{1} (u)\leq 1$

,

![]() $0\leq \hat{q}_{2} (u)\leq 1$

, we have u

2≤u≤u

s

. On the other hand, if

$0\leq \hat{q}_{2} (u)\leq 1$

, we have u

2≤u≤u

s

. On the other hand, if

![]() $0\leq \hat{q}_{1} (u)\leq 1$

and

$0\leq \hat{q}_{1} (u)\leq 1$

and

![]() $\hat{q}_{2} (u)\,\gt\,1$

, then we have to choose

$\hat{q}_{2} (u)\,\gt\,1$

, then we have to choose

![]() $q_{2}^{{\rm {\asterisk}}} (u){\equals}1$

, and derive the minimiser

$q_{2}^{{\rm {\asterisk}}} (u){\equals}1$

, and derive the minimiser

Therefore, when

![]() $0\leq \tilde{q}_{1} (u)\leq 1$

, we have

$0\leq \tilde{q}_{1} (u)\leq 1$

, we have

![]() $q_{1}^{{\rm {\asterisk}}} (u){\equals}\tilde{q}_{1} (u)$

,

$q_{1}^{{\rm {\asterisk}}} (u){\equals}\tilde{q}_{1} (u)$

,

![]() $q_{2}^{{\rm {\asterisk}}} (u){\equals}1$

. Substituting them into (4.1) and letting

$q_{2}^{{\rm {\asterisk}}} (u){\equals}1$

. Substituting them into (4.1) and letting

![]() ${\cal A}h(u,m){\equals}0$

, we get

${\cal A}h(u,m){\equals}0$

, we get

in which ξ 12(u) is defined by (3.8). Then it is easy to show that

Under the assumption of u

1<u

2, we come to the conclusion that

![]() $\tilde{u}_{1} \leq u\,\lt\,u_{2} $

when

$\tilde{u}_{1} \leq u\,\lt\,u_{2} $

when

![]() $0\leq \tilde{q}_{1} (u)\leq 1$

holds. Finally, if

$0\leq \tilde{q}_{1} (u)\leq 1$

holds. Finally, if

![]() $\tilde{q}_{1} (u)\,\gt\,1$

, then we have to choose

$\tilde{q}_{1} (u)\,\gt\,1$

, then we have to choose

![]() $q_{1}^{{\rm {\asterisk}}} (u){\equals}1$

. Inserting

$q_{1}^{{\rm {\asterisk}}} (u){\equals}1$

. Inserting

![]() $(q_{1}^{{\rm {\asterisk}}} (u),q_{2}^{{\rm {\asterisk}}} (u)){\equals}(1,1)$

into (4.1) yields

$(q_{1}^{{\rm {\asterisk}}} (u),q_{2}^{{\rm {\asterisk}}} (u)){\equals}(1,1)$

into (4.1) yields

in which ξ

13(u) is defined by (3.9). In this case, we can get

![]() $\alpha m\leq u\,\lt\,\tilde{u}_{1} $

. It is clear that the optimal reinsurance strategy in this case equals to the one when m≥u

s

.

$\alpha m\leq u\,\lt\,\tilde{u}_{1} $

. It is clear that the optimal reinsurance strategy in this case equals to the one when m≥u

s

.

Now considering the following boundary-value problem, we wish to find a solution at which a certain function is minimised according to Theorem 4.1. When αm≤u≤m≤u s , we have

$$\left\{ \matrix{ {{h_{u} } \over {h_{{uu}} }}{\equals}{\minus}{1 \over {2\xi (u)}} \hfill \cr h(u_{s} ,u_{s} ){\equals}0,h_{m} (m,m){\equals}0 \hfill \cr h(\alpha m,m){\equals}1 \hfill \cr} \right.$$

$$\left\{ \matrix{ {{h_{u} } \over {h_{{uu}} }}{\equals}{\minus}{1 \over {2\xi (u)}} \hfill \cr h(u_{s} ,u_{s} ){\equals}0,h_{m} (m,m){\equals}0 \hfill \cr h(\alpha m,m){\equals}1 \hfill \cr} \right.$$

We first present the solution of (4.4) for m∈[max(αm,u

2),u

s

) in the next proposition, the solutions for the other two cases of

![]() $m\in[{\rm max}(\alpha m,\tilde{u}_{1} ),{\rm max}(\alpha m,u_{2} ))$

and

$m\in[{\rm max}(\alpha m,\tilde{u}_{1} ),{\rm max}(\alpha m,u_{2} ))$

and

![]() $m\in[\alpha m,{\rm max}(\alpha m,\tilde{u}_{1} ))$

can be derived by the same way.

$m\in[\alpha m,{\rm max}(\alpha m,\tilde{u}_{1} ))$

can be derived by the same way.

Proposition 4.1. When

![]() ${{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

, the solution of (4.4) on {(u,m)∈(R

+)2: αm≤u≤m, max(αm,u

2)≤m<u

s

} is given by

${{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

, the solution of (4.4) on {(u,m)∈(R

+)2: αm≤u≤m, max(αm,u

2)≤m<u

s

} is given by

$$h(u,m){\equals}\left\{ {\matrix{ {1{\minus}{\rm exp}\left\{ {{\int}_m^{u_{s} } {{\minus}f_{{13}} (y)dy} } \right\} \cdot {{g_{{11}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {\alpha m\leq u\,\lt\,{\rm max}(\alpha m,\tilde{u}_{1} )} \hfill \cr {1{\minus}{\rm exp}\left\{ {{\int}_m^{u_{s} } {{\minus}f_{{13}} (y)dy} } \right\} \cdot {{g_{{12}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {{\rm max}(\alpha m,\tilde{u}_{1} )\leq u\,\lt\,{\rm max}(\alpha m,u_{2} )} \cr {1{\minus}{\rm exp}\left\{ {{\int}_m^{u_{s} } {{\minus}f_{{13}} (y)dy} } \right\} \cdot {{g_{{13}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {{\rm max}(\alpha m,u_{2} )\leq u\leq m\,\lt\,u_{s} }\hfill \cr } } \right.$$

$$h(u,m){\equals}\left\{ {\matrix{ {1{\minus}{\rm exp}\left\{ {{\int}_m^{u_{s} } {{\minus}f_{{13}} (y)dy} } \right\} \cdot {{g_{{11}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {\alpha m\leq u\,\lt\,{\rm max}(\alpha m,\tilde{u}_{1} )} \hfill \cr {1{\minus}{\rm exp}\left\{ {{\int}_m^{u_{s} } {{\minus}f_{{13}} (y)dy} } \right\} \cdot {{g_{{12}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {{\rm max}(\alpha m,\tilde{u}_{1} )\leq u\,\lt\,{\rm max}(\alpha m,u_{2} )} \cr {1{\minus}{\rm exp}\left\{ {{\int}_m^{u_{s} } {{\minus}f_{{13}} (y)dy} } \right\} \cdot {{g_{{13}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {{\rm max}(\alpha m,u_{2} )\leq u\leq m\,\lt\,u_{s} }\hfill \cr } } \right.$$

in which g 1i (i=1,2,3) are given in (3.10), and f 13 is defined by

$$f_{{13}} (y){\equals}\left\{ {\matrix{ {\alpha \left[ {{1 \over {g_{{13}} (y,y)}}{\minus}2\xi _{{11}} (\alpha y)} \right],} & {{\rm if}\,u_{2} \,\lt\,\alpha m} \hfill \cr {\alpha \left[ {{1 \over {g_{{13}} (y,y)}}{\minus}2\xi _{{12}} (\alpha y)} \right],} & {{\rm if}\,\tilde{u}_{1} \leq \alpha m\leq u_{2} } \cr {\alpha \left[ {{1 \over {g_{{13}} (y,y)}}{\minus}2\xi _{{13}} ({\rm \alpha }y)} \right],} & {{\rm if}\,\alpha m\,\lt\,\tilde{u}_{1} } \hfill \cr } } \right.$$

$$f_{{13}} (y){\equals}\left\{ {\matrix{ {\alpha \left[ {{1 \over {g_{{13}} (y,y)}}{\minus}2\xi _{{11}} (\alpha y)} \right],} & {{\rm if}\,u_{2} \,\lt\,\alpha m} \hfill \cr {\alpha \left[ {{1 \over {g_{{13}} (y,y)}}{\minus}2\xi _{{12}} (\alpha y)} \right],} & {{\rm if}\,\tilde{u}_{1} \leq \alpha m\leq u_{2} } \cr {\alpha \left[ {{1 \over {g_{{13}} (y,y)}}{\minus}2\xi _{{13}} ({\rm \alpha }y)} \right],} & {{\rm if}\,\alpha m\,\lt\,\tilde{u}_{1} } \hfill \cr } } \right.$$

Proof. Because of h in (4.4) satisfying the differential equation as well as the boundary conditions, taking the integral of h u over [αm,u], we get

where g(u,m) is given in (3.4) and c 1(m) is a function of m to be determined.

Differentiating h w.r.t m, it follows that

Next, we discuss the solution on cases. When max(αm,u 2)≤u≤m≤u s , we have

with

Since h m (m,m)=0, one can show that

with f 13 given by (4.5). It then follows that

According to the continuity of h, the result for the other two cases, i.e.,

![]() ${\rm max}(\alpha m,\tilde{u}_{1} )\leq u\,\lt\,{\rm max}(\alpha m,u_{2} )$

and

${\rm max}(\alpha m,\tilde{u}_{1} )\leq u\,\lt\,{\rm max}(\alpha m,u_{2} )$

and

![]() $\alpha m\leq u\,\lt\,{\rm max}(\alpha m,\tilde{u}_{1} )$

, can be obtained along the same lines. We complete the proof.□

$\alpha m\leq u\,\lt\,{\rm max}(\alpha m,\tilde{u}_{1} )$

, can be obtained along the same lines. We complete the proof.□

Combining the results of Theorem 4.1 and Proposition 4.1, we get the following theorem:

Theorem 4.2. Suppose that

![]() ${{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

. Let g

1i

(i=1,2,3) be given in (3.10) and f

13 be given in (4.5). Then,

${{a_{2} \rho b_{1} } \over {a_{1} b_{2} }}\eta _{2} \,\lt\,\eta _{1} \,\lt\,{{a_{2} b_{1} } \over {a_{1} \rho b_{2} }}\eta _{2} $

. Let g

1i

(i=1,2,3) be given in (3.10) and f

13 be given in (4.5). Then,

(i) if

${\rm max}(\alpha m, \tilde{u}_{2} )\leq m\,\lt\, u_{s} $

, for any u∈[αm,m], the minimum probability of drawdown for the surplus process (2.2) is given by

${\rm max}(\alpha m, \tilde{u}_{2} )\leq m\,\lt\, u_{s} $

, for any u∈[αm,m], the minimum probability of drawdown for the surplus process (2.2) is given by

$$\phi (u,m){\equals}\left\{ {\matrix{ {1{\minus}k_{{13}} (m) \cdot {{g_{{11}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {\alpha m\leq u\,\lt\,{\rm max}(\alpha m,\tilde{u}_{1} )} \cr {1{\minus}k_{{13}} (m) \cdot {{g_{{12}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {{\rm max}(\alpha m,\tilde{u}_{1} )\leq u\,\lt\,{\rm max}(\alpha m,u_{2} )} \cr {1{\minus}k_{{13}} (m) \cdot {{g_{{13}} (u,{\rm m})} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {{\rm max}(\alpha m,u_{2} )\leq u\leq m\,\lt\,u_{s} } \cr } } \right.$$

$$\phi (u,m){\equals}\left\{ {\matrix{ {1{\minus}k_{{13}} (m) \cdot {{g_{{11}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {\alpha m\leq u\,\lt\,{\rm max}(\alpha m,\tilde{u}_{1} )} \cr {1{\minus}k_{{13}} (m) \cdot {{g_{{12}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {{\rm max}(\alpha m,\tilde{u}_{1} )\leq u\,\lt\,{\rm max}(\alpha m,u_{2} )} \cr {1{\minus}k_{{13}} (m) \cdot {{g_{{13}} (u,{\rm m})} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {{\rm max}(\alpha m,u_{2} )\leq u\leq m\,\lt\,u_{s} } \cr } } \right.$$

in which

(ii) if

${\rm max}\,(\alpha m,\,\tilde {u} _{1})\le m \,\lt\, {\rm max}(\alpha m,\tilde{u}_{2} )$

, for any u∈[αm,m], the minimum probability of drawdown for the surplus process (2.2) is given byin which

${\rm max}\,(\alpha m,\,\tilde {u} _{1})\le m \,\lt\, {\rm max}(\alpha m,\tilde{u}_{2} )$

, for any u∈[αm,m], the minimum probability of drawdown for the surplus process (2.2) is given byin which $$\phi (u,m){\equals}\left\{ {\matrix{ {1{\minus}k_{{12}} (m) \cdot {{g_{{11}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {\alpha m\leq u\,\lt\,{\rm max}(\alpha m,\tilde{u}_{1} )} \cr {1{\minus}k_{{12}} (m) \cdot {{g_{{12}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {{\rm max}(\alpha m,\tilde{u}_{1} )\leq u\leq m\,\lt\,u_{2} } \cr } } \right.$$

(4.6)with

$$\phi (u,m){\equals}\left\{ {\matrix{ {1{\minus}k_{{12}} (m) \cdot {{g_{{11}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {\alpha m\leq u\,\lt\,{\rm max}(\alpha m,\tilde{u}_{1} )} \cr {1{\minus}k_{{12}} (m) \cdot {{g_{{12}} (u,m)} \over {g_{{13}} (u_{s} ,u_{s} )}},} & {{\rm max}(\alpha m,\tilde{u}_{1} )\leq u\leq m\,\lt\,u_{2} } \cr } } \right.$$

(4.6)with $$k_{{12}} (m){\equals}{\rm exp}\left\{ {\left( {{\int}_m^{u_{2} } {{\minus}f_{{12}} (y){\minus}} {\int}_{u_{2} }^{u_{s} } {f_{{13}} (y)} } \right)dy} \right\}$$

$$k_{{12}} (m){\equals}{\rm exp}\left\{ {\left( {{\int}_m^{u_{2} } {{\minus}f_{{12}} (y){\minus}} {\int}_{u_{2} }^{u_{s} } {f_{{13}} (y)} } \right)dy} \right\}$$

$$f_{{12}} (y){\equals}\left\{ {\matrix{ {\alpha \left[ {{1 \over {g_{{12}} (y,y)}}{\minus}2\xi _{{12}} (\alpha y)} \right],} & {{\rm if}\,\tilde{u}_{1} \leq \alpha m} \cr {\alpha \left[ {{1 \over {g_{{12}} (y,y)}}{\minus}2\xi _{{13}} (\alpha y)} \right],} & {{\rm if}\,\alpha m\,\lt\,\tilde{u}_{1} } \cr } } \right.$$

$$f_{{12}} (y){\equals}\left\{ {\matrix{ {\alpha \left[ {{1 \over {g_{{12}} (y,y)}}{\minus}2\xi _{{12}} (\alpha y)} \right],} & {{\rm if}\,\tilde{u}_{1} \leq \alpha m} \cr {\alpha \left[ {{1 \over {g_{{12}} (y,y)}}{\minus}2\xi _{{13}} (\alpha y)} \right],} & {{\rm if}\,\alpha m\,\lt\,\tilde{u}_{1} } \cr } } \right.$$

(iii) if αm≤m<max(

$\alpha m,\tilde{u}_{1} $

), for any u∈[αm,m], the minimum probability of drawdown for the surplus process (2.2) is given by

$\alpha m,\tilde{u}_{1} $

), for any u∈[αm,m], the minimum probability of drawdown for the surplus process (2.2) is given by

in which

with

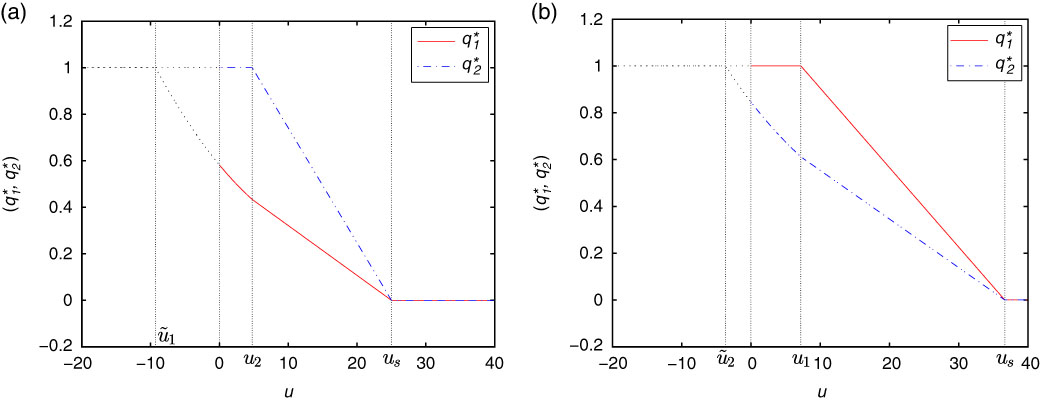

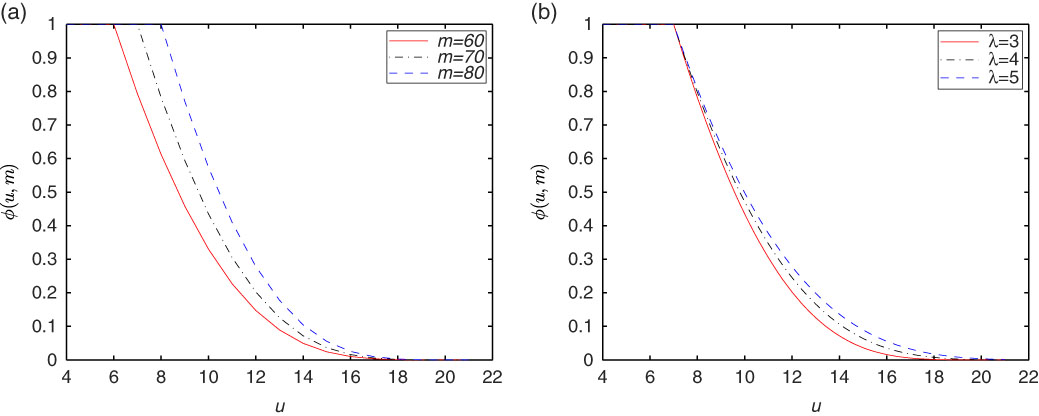

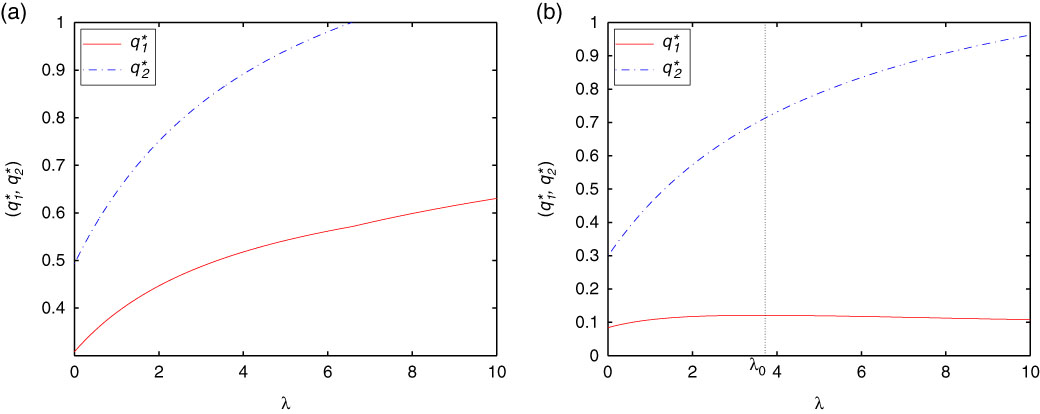

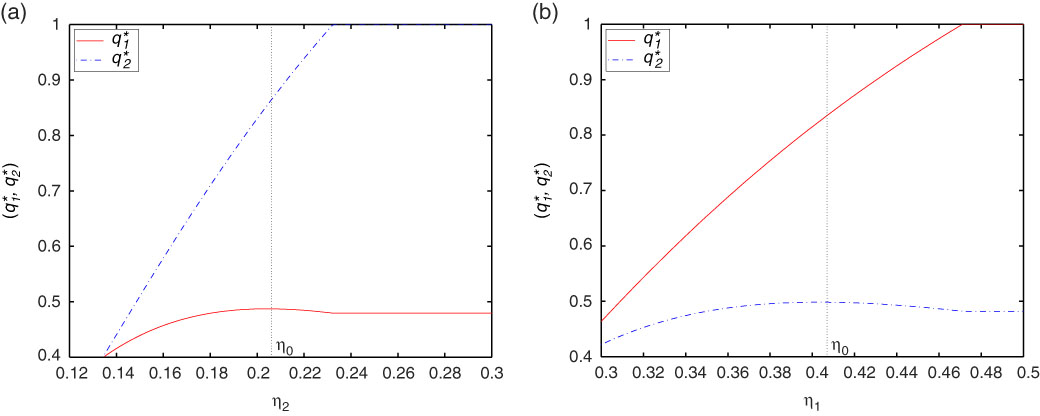

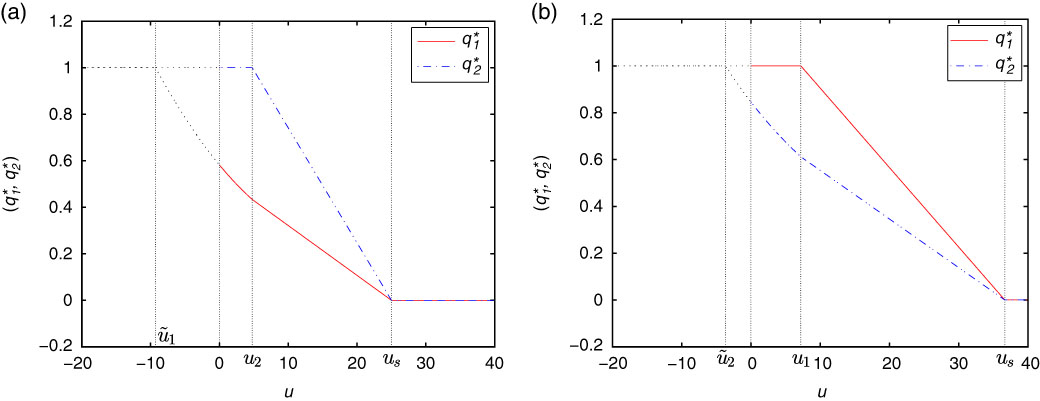

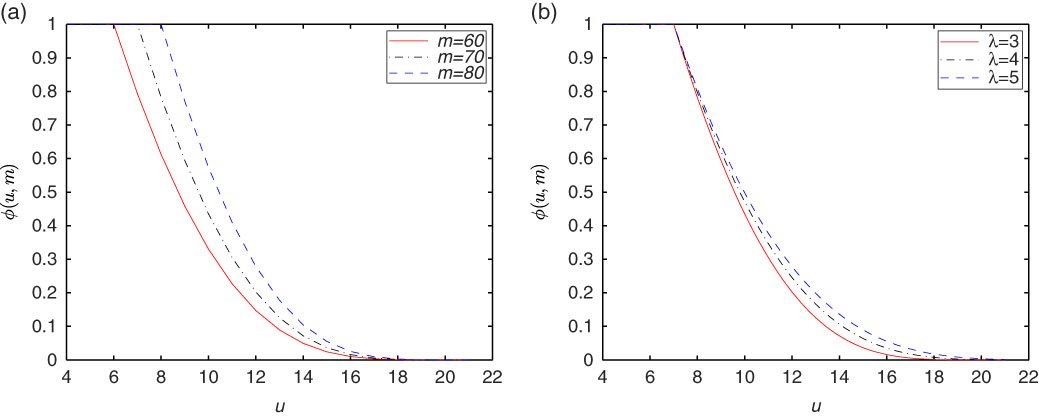

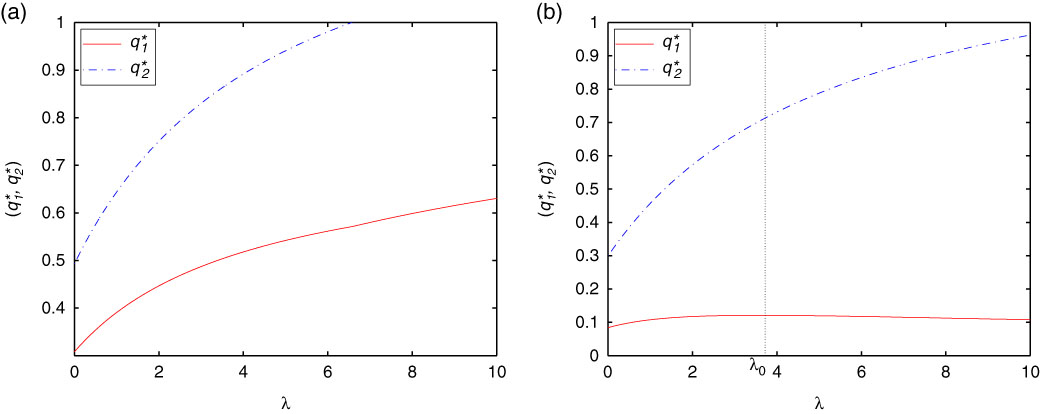

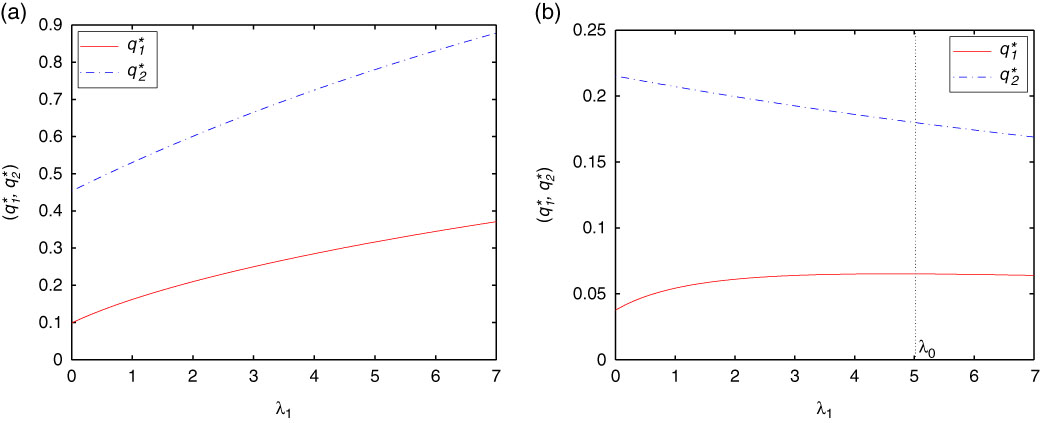

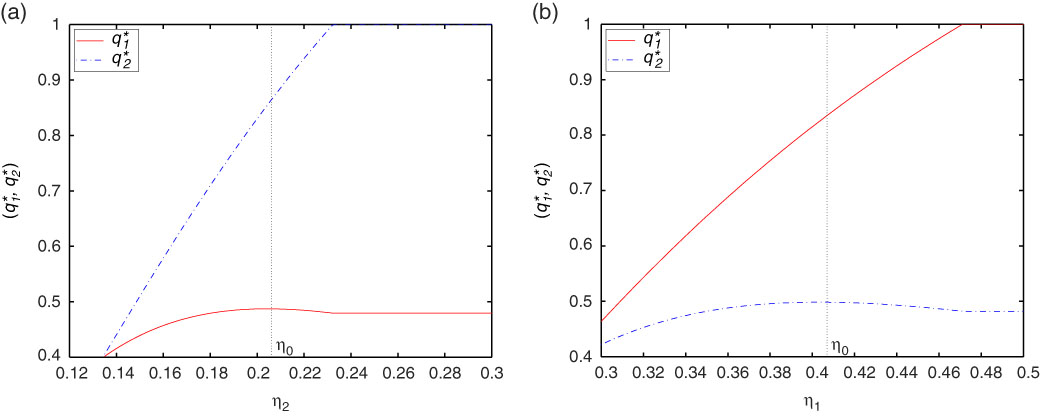

Also, the corresponding optimal reinsurance strategy has the form