INTRODUCTION

In 2020, e-commerce transactions in China totaled $5.58 trillion,[Footnote 1] while online retail surpassed $1.76 trillion including $1.46 trillion worth of merchandise, which accounted for 24.9% of national retail sales of consumer goods (Ministry of Commerce, the People's Republic of China, hereinafter MCPRC, 2021). Behind these numbers were 782 million online consumers, over 60 million labors employed in related industries, and 83.4 billion parcels delivered by couriers in 2020 (MCPRC, 2021).

All of this started in the late 1990s, marked by the foundation of Alibaba in 1998 in particular. As the early mover and front runner in e-commerce, Alibaba quickly captured the lion's share of the online retail market, 87% in 2010 but went down to 53% in 2021, as it faced strong completion from JD.com in the B2C market and Pinduoduo (Buy together) in social commerce and group purchase, with 20% and 15% of the market share respectively in 2021 (Sohu, 2022). In fact, the e-commerce landscape is increasingly competitive and diverse in the mobile Internet era, as the two-leading live-streaming platforms TikTok and Kwai jumped on the bandwagon of online retail and quickly captured 9% of the market by 2021 (Sohu, 2022), drawing over 500 million online shoppers (monthly active users, MAUs) together.

This research commentary responds to Jiang and Murmann (Reference Jiang and Murmann2022), by offering further explanations for the miraculous growth of the digital economy in China from both the demand and supply perspectives. We aim to complement their assessment and develop a comprehensive model to account for this phenomenon, with a focus on e-commerce in particular.

In general, we agree with Jiang and Murmann's assessment (Reference Jiang and Murmann2022), which attributes the rise of China's digital economy to three key factors, market-oriented innovations by e-commerce service providers, government-driven massive investment in infrastructures, which is often ahead of its time, and far-reaching penetration of and low-cost access to the Internet. Furthermore, the latest figures show that, by the end of 2021, the number of base stations (cell sites) of mobile networks has reached 996 million nationwide, which provided Internet access to 81.3% of the urban residents and 57.6% of the rural population, according to a 2022 report by MIITPRC.[Footnote 2] Over 536 million Internet users have adopted the broadband network, and 498 million or 93% of them enjoy high speed access at least 100 Mbps (MIITPRC, 2022). The number of mobile phones in use stands at 1.64 billion, that is, 116.3 mobile phones per 100 people on average, 181.4 and 176.9 per 100 people in Beijing and Shanghai, the two most affluent cities in China. The average data flow per month per user (or dataflow of usage, DOU) jumped from 0.76 GB in 2016 to 13.36 GB in 2021, an increase of nearly 20 times in five years (MIITPRC, 2022).

In addition to telecommunication infrastructure, transportation infrastructure, which is essential for e-commerce logistics, also leapfrogged. By the end of 2020, the total length of national railway jumped to 146,000 kilometers including 38,000 kilometers of high-speed railway (Ministry of Transport, the People's Republic of China, hereinafter MTPRC, 2021), from 73,000 kilometers and no high-speed railway back in 2003 (National Railway Administration, the People's Republic of China, 2013). To a greater extent, the total driveway mileage increased from 1.81 million kilometers in 2003 to 5.20 million kilometers by the end of 2020 (MTPRC, 2021), nearly tripled.

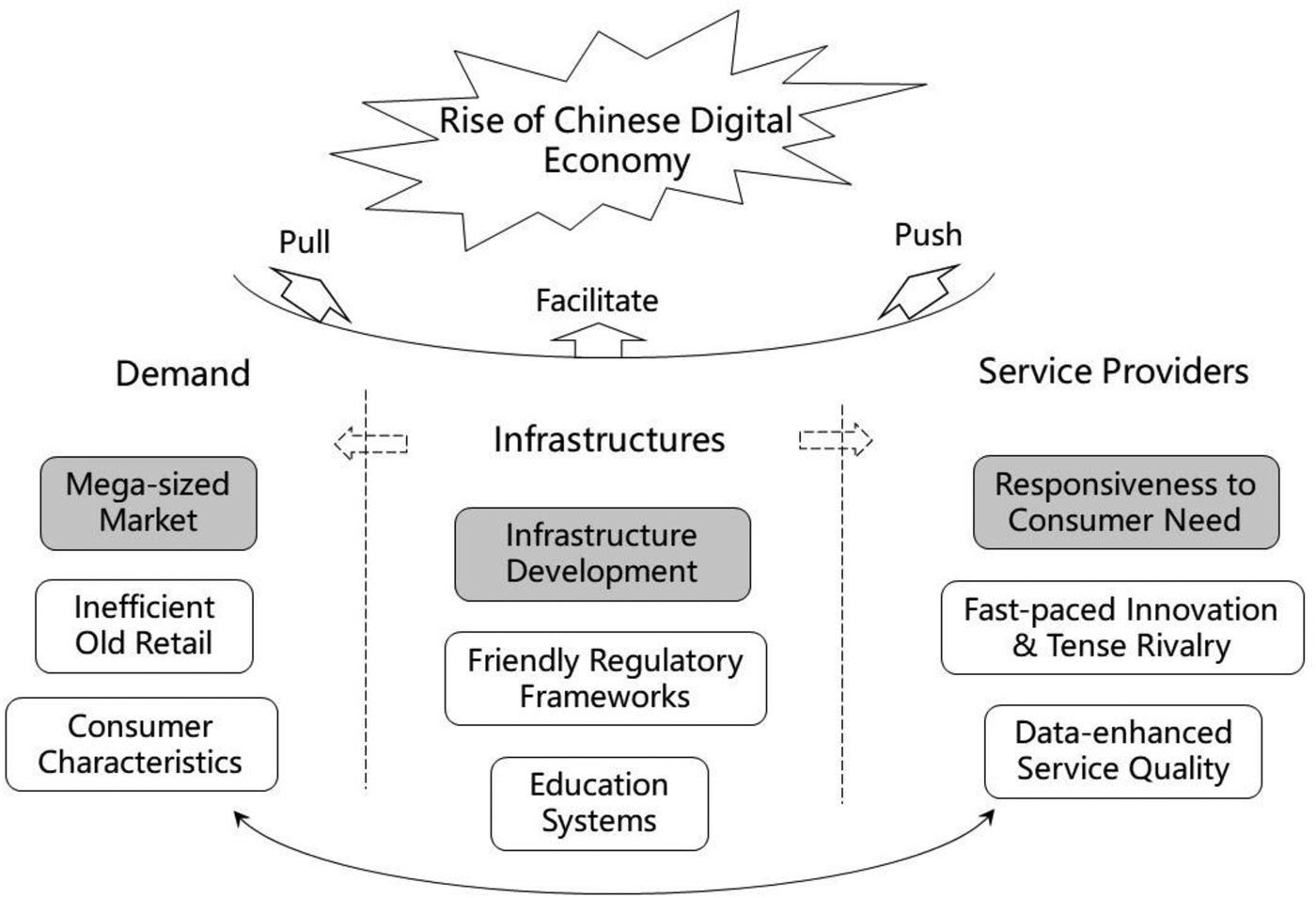

To complement Jiang and Murmann (Reference Jiang and Murmann2022), we identify several additional important factors, and classify them in three categories in an explanatory model. We believe that factors on the demand side played a primary role, along with innovative and entrepreneurial e-commerce service providers on the supply side. Infrastructures and government policies provided the foundation and a facilitating environment. In the following sections, we shall discuss each of the three clusters of factors.

STRONG PULL FROM THE DEMAND SIDE

This section focuses on three key factors on the demand side. We concur with Jiang and Murmann's observation (Reference Jiang and Murmann2022) that the huge number of online consumers in China is likely the strongest pulling force, but also explore a bit further to substantiate it, and identify two additional factors, the inefficient fragmented traditional retail industry, and three distinctive characteristics of the Chinese consumers.

A Mega-Sized Consumer Basis

Obviously, the huge number of consumers represents tremendous purchasing power for e-commerce, coupled with the rapid economic growth over the past decades. By December 2021, the number of netizens in China topped the one billion mark, and Internet penetration rate reached 73% (China Internet Network Information Center, hereinafter CNNIC, 2022). Nearly all netizens (99.7% or 1.029 billion) use smartphones to access the Internet (CNNIC, 2022). Not only does the size of the consumer basis allow economies of scale for e-Commerce platforms (interchangeable with marketplaces, thereafter), but it is also essential to sustaining innovations with sufficient payback. Without sufficient transaction data, many AI and analytics algorithms, which are essential for service quality, cannot be applied.

Moreover, the structure of the consumer basis is also conducive for e-commerce. First, a high population density lowers the unit delivery cost. The average population density in China is 143 per square meter compared to 34 in the US in 2016 (The Boston Consulting Group, 2017). This helps explain that online sales in the more developed and densely populated Eastern China accounted for 85% of the national total of online retail (MCPRC, 2021), according to statistics from the top 31 online retail platforms and services providers. Second, the 1.4 billion population form a single but largely homogeneous market protected by the Chinese language, culture and traditions, legal systems, and other market forces. This unique market environment protects indigenous e-commerce service providers from international competition, and these protections allow late mover advantages gained by learning from global leaders. As a result, indigenous e-commerce firms could take advantage of a protected and yet sufficiently large market to develop their technologies, and to explore solutions that fit consumer need. In sum, it takes both the size and structure of the consumer basis for service providers to stay profitable and innovative.

The Inefficient Traditional Retail Industry

Compared with the US and Japan, China's traditional retail industry is highly fragmented and inefficient, consisting of numerous small independent retailers and complicated distribution systems. Moreover, the industry is hurt by an irrationally exuberant real-estate market, which inflated rental and labor costs for retailers, as employees need to pay for high housing expenses disproportional to their disposable income. As a result, merchandise sold in brick-and-mortar stores tend to be of high prices and poor services due to cost-saving pressure. Small independent retailers have little incentive to curb fake and inferior products, which can offer higher profit margins. As a result, e-commerce service providers are in a clearly advantageous position, allowing them to offer more attractive value propositions to consumers.

In comparison, the US retail market is dominated by mega-sized chain stores and loyalty clubs, as retail giants claim a high proportion of market shares. For example, Walmart sold over $500 billion merchandise annually, whereas Costco and Kroger's sales also exceeded $100 billion (National Retail Federation, hereinafter NRF, 2022). In addition, there exist well-established brand stores to serve diverse consumer segments, which is also an indicator of the maturity of the retail market in the US. Similarly, in Japan, the highly developed retail industry features operation of big three convenience store franchise chains. According to a survey by Japan Franchise Association, there were 55,950 convenience stores in operation, including over 20,000 7/11 shops, both FamilyMart and Lawson also had over 10,000 shops (Jfa-fc, 2022). Their stores are densely located near subway stations and traffic hubs, offering high levels of convenience and efficiency, and a variety of shopping channels.

In contrast, the retail industry in China consists of numerous small independent stores, without any dominant chain stores. Husband-wife stores sold 53% of the consumer goods, compared with 47% only by modern chain stores, in 2005, right before the take-off of e-commerce in China. The comparable US numbers were 18% versus 82%, respectively. Furthermore, another indicator of deficiency of the traditional retail industry in China is the average store space per 1,000 people, which was merely 18 square meters, compared with 1,105 square meters in the US (The Boston Consulting Group, 2017).

Centralized operation of online retailers creates comparative advantages, in terms of convenience, efficiency and economies of scale in operations, and extended reach. Online retail is indeed much more efficient, measured by revenue divided by the amount of operational expenses (input). One unit of input generated only 11.7 units of offline sales versus 39.6 units of online sales in 2009, 12.6 versus 44.9 in 2010, and 12.5 versus 49.6 in 2011, respectively (The Boston Consulting Group, 2017).[Footnote 3] On average, online turnover rate in this three-year period was 3.64 times of the offline rate, and the gap widened to nearly four times in 2011. Therefore, it is not surprising that e-commerce disrupted the retail industry more radically in China than in developed markets such as the US and Japan.

Characteristics of Chinese Consumers

Chinese people are known to have low uncertainty avoidance (Hofstede, Reference Hofstede1984). Since the reform and open-up in 1978, changes have become a constant fact of life, often for the better. As a result, people are used to embracing changes including frequent policy changes and technological innovations. Urban residents, in particular, experienced a radical transformation of life over a relatively short period of time, while their disposable income increased by multiple folds, as Chinese GNI per capita (Atlas method, in current US$) surged from merely $940 in 2000 to $10,310 in 2019, according to the World Bank (2022a). Moreover, Chinese people have shown a high degree of readiness to adopt new tech gadgets and enthusiasm for new inventions, especially convenience afforded by the Internet. For example, it took 14 years for Amazon to reach the 50% penetration rate in the US, but only 9 years for Taobao in China. By 2019, online sales accounted for 26% of retail, which was 2.4 times higher than that of developed countries, and the adoption rate of mobile payment made on smartphones in China was 81%, 2.8 times higher than that in developed countries (Bain & Company, 2021).

Younger generations of consumers exhibit a high level of acceptance of the Internet, especially those born in 1990s and 2000s, who are considered Internet natives. By December 2021, the number of adolescent (aged between 6 and 18) netizens was 183 million in China, and the Internet penetration rate in this age group was 94.9%, much higher than adult groups (CNNIC, 2022). Those born between 1980 and 1995 have the highest adoption rate of online shopping, 93%. About 42% of generation Z (born after 1995) make at least one-third of their shopping spending online, which is higher than that of consumers in other age groups (CNNIC, 2022).

Moreover, three distinctive cultural characteristics of Chinese consumers also played a role in their enthusiastic adoption of e-commerce. First, consumers’ tolerance to privacy intrusion, or lack of concerns for privacy, might have played a role in their readiness to sacrifice privacy in exchange for convenience offered by online shopping. For a long time, Chinese people had lived in a society that strongly emphasized collective thinking with little protection of individual privacy. Second, in this society, which not only has been under rapid and radical transformation, but also endured serious damages from the Cultural Revolution (1966–1976) on traditional behavioral norms, culture, ethics, and a low degree of inter-personal trust. The lack of trust is a major hindrance for commercial transactions. However, as alluded to by Jiang and Murmann (Reference Jiang and Murmann2022), problems caused by the lack of trust were largely resolved with the help of mobile payment solutions.[Footnote 4] Third and lastly, Chinese consumers used to be highly price sensitive due to decades of life in poverty, and thus, the price advantage of online shopping becomes particularly attractive. Price sensitivity is high for the large number of the bottom of the pyramid population, as 600 million Chinese people live on a monthly income of 1,000 RMB (about $150), according to a remark by Premier Li Keqiang in a press release in May 2020, though GNI per capita has reached $4,340 as early as 2010 (World Bank, 2022a). Online marketplaces such as JD.com are able to not only offer significant price discounts but also to eradicate counterfeits to a large extent, which is a clear advantage over brick-and-mortar shops.

Other consumer characteristics may have shaped the business model of online retail in some ways. For example, Chinese consumers strongly prefer commission-free transactions. In response, Taobao catered to this preference by choosing to make money from advertisement, which gave it an edge in competing with eBay. Moreover, the style of visual display of Chinese online marketplaces, which fits Chinese consumers’ habits better, is distinctively different from their Western counterparts. In fact, some consider the name Taobao (meaning treasure-hunting in Chinese) is more appealing to Chinese consumers than the eBay translation in Chinese. Clearly, it would be relatively easier for indigenous online service providers to recognize and cater to these distinct characteristics of Chinese consumers.

THE SUPPLY SIDE: INNOVATIVE AND ENTREPRENEURIAL SERVICE PROVIDERS

Here, we examine the effect of innovations by entrepreneurial service providers, in terms of their responsiveness to consumer need, fast-paced innovation and tense rivalry, and big-data enhanced service quality.

Responsiveness to Consumer Need

We agree with Jiang and Murmann's observation (Reference Jiang and Murmann2022) that successful service providers have a common capability in recognizing characteristics of Chinese consumers (as discussed above), and quickly responding to consumer need. For example, to meet Generation Z's high individuality and enthusiasm to share experiences via social media, Taobao adopted a new motto in July 2021 to target the younger generation of consumers, and upgraded its product lines. In particular, a new ‘strolling around’ online community was created for younger consumers to share and socialize. ‘Buyers’ show and tell’ and ‘Ask the crowd’ features on Taobao allow consumers to communicate with peers during online shopping. Moreover, online marketplaces created new channels and marketing events. For example, a variety of online shopping festivals were invented by the online marketplaces during traditional low sales seasons, such as the Double 11 (November 11th) and 618 (June 18th) Shopping Festival, which have become major shopping events of the year for many consumers and vendors, comparable to Boxing Day shopping in North America.

Fast-Paced Innovation and Tense Rivalry

Over the past two decades, the digital economy in China has evolved toward an increasingly diverse ecosystem beyond online retail to cover nearly every aspect of life including travel booking, accommodation reservation, ride-hailing, healthcare, entertainment, and catering services. Meanwhile, live-streaming has become the latest and hottest form of online retail (Sohu, 2022). The competition landscape has always been crowded and fast moving, frequently disrupted by cross-boundary new players. For example, Alibaba launched Tmall (an online marketplace for brand stores) in 2012 after Taobao in 2003 for small vendors. Starting trials in 2016, Alibaba fully rolled out live-streaming based retail in 2019 as soon as it saw the potential of this new mode of online shopping. In fact, Alibaba has launched or acquired over 200 new businesses to date, ranging from travel booking to online maps and healthcare. Just when the online retail market appeared to have become highly saturated and run out of space for new rivals, Pinduoduo (Buy together) suddenly burst onto the scene in 2015, and quickly emerged as the dominant player in social commerce and group purchase, with a particularly strong presence in the lower end of the market, which is highly price sensitive. In fact, Pinduoduo has already surpassed Alibaba in the number of registered shoppers, and seized 15% of the online retail market in 2021 (Sohu, 2022).

To thrive in such a highly competitive environment, service providers must compete on the pace of innovation to become and stay as the front runner. Only this way can they lead in a new track of competition and achieve economies of scale due to the strong network externality effect, which has proven to be the winning formula. For example, the iOS version of Taobao App released 22 upgrades in one year from April 2021 to March 2022. JD.com had an even higher frequency of upgrades, releasing 9 versions of its App between January and March 2022, to keep abreast of competition and consumer need. Consequently, employees in Internet companies receive much higher salaries than those in comparable positions in traditional industries. But they also have to work extremely long hours, to the extent that a ‘996’ schedule (from 9 am to 9 pm, 6 days a week) becomes the norm. Interestingly, Alibaba founder, Jack Ma, drew criticism for acknowledging the widespread practice with a remark that ‘employees should feel privileged to be able to work 996’.

Indigenous service providers’ fast-paced innovation and quick response to the market makes it difficult for international giants to compete in the Chinese market. Their centralized decision-making at the global headquarters further slows down their responsiveness, which is often cited as part of eBay's failure in its battle with Taobao and eventual exit from China. Moreover, Amazon ceased to serve third-party vendors in China in July 2019. Recently in early 2022, Amazon announced to discontinue its Kindle bookstore operation in China after nine years in the market, whereas Airbnb also announced its decision to discontinue domestic reservation services in China. Whereas the reasons for these exits probably are multifaceted, strong competition based on fast-paced innovation from indigenous service providers are likely an important factor. Murmann and Zhu (Reference Murmann and Zhu2021) clearly showed this for the instant messaging sector where Tencent’s Wechat and QQ products pushed out foreign rivals.

Big-Data Enhanced Service Quality

Though earlier generations of e-commerce relied upon consumers’ search and ‘self-display’, in the mobile Internet age, when over 95% of the consumers shop with smart devices (on much smaller display than PCs), personalized shopping recommendations become essential. Sources from Alibaba suggest that purchases drawn by recommendations have exceeded search-based purchases since 2018 (Sohu, 2018). It means that online shoppers’ experience depends on the quality of recommendations based on big data, information sharing by other consumers, and analytic algorithms. As a result, leading online marketplaces such as Alibaba and JD.com can leverage their massive data accumulation, AI and big data analytics to improve consumer experience.

FACILITATION OF INFRASTRUCTURES

In addition to physical infrastructures, the Chinese government's regulations and policies related to e-commerce can be best described as tolerant and prudent, till late 2020 when the Ant Group's[Footnote 5] IPO process was abruptly postponed two days before its official listing. Moreover, the ‘mass entrepreneurship and innovation’ movement launched by the government in 2014 helped create a favorable entrepreneurial ecosystem, consisting of venture capital funds, private equity funds, and industrial funds, along with the proven success of Alibaba and Tencent. Consequently, there are abundant entrepreneurs and supply of capital for e-commerce startups to achieve fast-paced growth, as it appears easier for brands to achieve national reach beyond their home-base region via online channels than the traditional approach. For example, the dominant ride-hailing service provider, DiDi, could not have gone public in the US in 2021 if it had not successfully raised 22 rounds of capital in seven years in the amount of $12 billion, which was necessary for the company to quickly achieve market dominance. Though the mighty market power of dominant online marketplaces such as Alibaba, Meituan, DiDi, and C-trips has given them near monopoly power in their industry, the government had not launched anti-monopoly investigation until 2020.

On the one hand, consumer privacy protection has been weak, far lagging behind the rapidly evolving digital economy, and quite lax in enforcement, despite rampant infringements on consumer privacy and widespread unethical or even illegal practices by service providers. On the other hand, partly due to compliance issues with the Chinese laws and concerns, the absence of international players in the digital economy provided late mover advantages for indigenous service providers, and reduced their trial-and-error cost. For example, since the exit of Google from the online search market in China, the local search engine Baidu captured 84.3% of the market share (Statcounter, 2022).

Lastly, the digital economy in China benefited from the education system, which provided abundant supply of not only IT engineers but also well-educated online consumers. China's higher education system produces well over 100,000 college graduates in computer science, electronic engineering, and telecommunication annually, according to statistics of the Ministry of Education (Gaokao, 2022a). In addition, the number of software engineering-majored college graduates was in the 85,000 to 90,000 range (Gaokao, 2022b). Furthermore, since 1986 nine-year primary and secondary education became compulsory by law, and the completion rate rose to 95.2% in 2020 (MEPRC, 2021). As a result, new generations of well-educated consumers eagerly embraced digital economy, exhibiting a much stronger dependence on the Internet in all aspects of life including shopping, socializing, and entertainment.

DISCUSSION

The three clusters driving forces discussed above can be summarized in an explanatory model shown in Figure 1, in mutually reinforcing relationships. We believe that the pulling forces on the demand side are the most important ones, which represent a tremendous need and hunger for improved retail services. Meanwhile, innovative and entrepreneurial service providers are able to respond to the unfilled need. Driving forces from the two sides reinforce each other in the following way: service providers accumulate massive data from online consumer behaviors, and make use of the data and AI to improve consumer experience and to provide personalized services. In return, improved consumer experience attracts more consumers, forming a network externality effect. Lastly, infrastructures provide a facilitating environment, space, and fuel to grow the digital economy, though there have been signs of tighter regulations and severe penalties for monopoly practices since 2021.

Figure 1. An explanatory model for the phenomenal rise of the digital economy in China (Shaded boxes represent factors identified by Jiang and Murmann (Reference Jiang and Murmann2022))

This model may help researchers and practitioners better understand the digital economy in China. Researchers might be able to draw insights and inspiration for further studies. For example, the phenomenal rise of the digital economy provides fertile ground to investigate a wide range of organizational issues, for example, how firms compete, innovate, migrate to overseas markets, develop and maintain dynamic capabilities, and frequently change organizational structures, in a highly dynamic and competitive environment from multiple theoretical perspectives. For example, many online service providers such as Alibaba and JD.com have not only developed world-class capacities in FinTech and MarTech, but also adopted a new IT architecture called ‘middle-platform’ to support frequent additions of new sales channels and organizational changes. In short, the digital economy in China offers unprecedented research opportunities, in terms of new phenomena, insights, and data, for management and organization researchers to make theoretical contributions.

In terms of practical significance, this model may have implications for market regulators, investors, and service providers in other nations, and multinational firms’ competition in China and entrance strategy in particular. For example, it would be interesting to examine the success of the MIH group of South Africa and Softbank group in Japan for being the largest shareholders of Tencent and Alibaba, respectively, and the biggest beneficiary of China's digital economy, in contrast to many international giants’ unsuccessful attempt and exit from the Chinese market. Meanwhile, downsides of the thriving digital economy in China need to be closely monitored and curbed, such as the widespread intrusion to consumer privacy, side effects of natural monopoly of online marketplaces, sustainability and environment issues caused by excessive packaging of goods ordered online, and health issues and lifestyle changes associated with online entertainment and fast food delivery, which are all prices paid for convenience offered by e-commerce.

A number of emerging trends are also worth taking notice. First, the growth rate of e-commerce is slowing down in China, at 4.5% annually in 2020 compared 32.9% in 2015 (MCPRC, 2021), as is the case of many sectors of digital economy including online games in particular. Moreover, the Chinese economy is experiencing the most serious challenges and lowest growth rate since the reform and open-up started in 1978. For example, national retail volumes registered a low increase of 1.7% only in December 2021, down from 4.9% and 3.9% in the previous two months, respectively; online retail sales dipped 0.76%, down from 6.1% and 6.3% (NBSC, 2022). As a result, there has been news about rare massive layoffs from Internet giants such as Alibaba and Tencent in response to slowdowns in growth and long-term uncertainties.

Second, we expect, nevertheless, the growth of digital economy will continue albeit in different areas, for example, convergence between e-commerce (also known as the consumer Internet) and industrial Internet (Su, An, & Mao, Reference Su, An and Mao2021). The booming industrial Internet (intelligent manufacturing) and digital transformation in general have gained momentum in China lately, thanks to the readiness of related technologies such as AI and Internet of things (IOT) and demand from e-commerce. The proportion of firms that have made significant progress in digital transformation rose from 9% in 2019 to 16% in 2021 (Accenture, 2019, 2021). The breakout of the COVID-19 pandemic has fast-forwarded digital transformation of traditional industries, which will become the next wave of digital economy stronger than the previous wave of e-commerce.

Looking into the future, we expect additional turbulence and uncertainties in the environment in the short term. In particular, Sino-US trade frictions and recent disengagement initiatives have created uncertainties that have not been seen for the past several decades. One of the issues related to the intensifying dispute between securities regulators of the two nations concerning the access to audit work papers of US-listed Chinese firms, including most of the Chinese online service providers and the digital economy at large. In particular, DiDi's recent delisting from the US stock market partly reflects this and concerns over sensitive transportation data, which is considered of national security interest by the Chinese government. These uncertainties have not only raised concerns for future investment but also seriously dampened the stock prices of the Chinese Internet companies. The US stock market is favored by Chinese technology firms for listing because it offers the highest valuation and liquidity, but this may change as some firms are under pressure to consider delisting from the US stock market.

Despite short-term turbulences, we expect that the digital economy in China will make big-stride progress in the long term, with strong potential to continue its growth. On the demand side, as a developing country with $10,310 GNI per capita in 2019 (World Bank, 2022a) compared with $65,970 in the US (World Bank, 2022b), Chinese consumers’ purchasing power will continue to rise, and to keep the momentum going for digital economy. On the supply side, investment in telecommunication is on the rise, 5G networks and AI applications appear to be fueling the next round of growth. For example, in 2021, the $28 billion investment in 5G accounted for 45.6% of the $61 billion capital investment in the telecommunication sector, an 8.9% increase over 2020. With the new addition of 650,000 5G base stations in 2021, the total number amounted to 1.425 million, but is far short of the 9.96 million base stations in operation. By and large, with 355 million users in China, the 5G penetration rate remains low at 21.6% (MIITPRC, 2022). Increasing 5G adoption is likely to boost future digital economy with its faster speed and reliability and create new modes of applications such as Metaverse. All in all, the digital economy in China is poised for the next round of high growth.

Target article

Forum on ‘The Rise of China's Digital Economy’

Related commentaries (3)

Semiconductor Catch-Up Is Not Enough: Twigging the Context of China's Ambitions

The Driving Forces Behind the Phenomenal Rise of the Digital Economy in China

The Rise of China's Digital Economy: An Overview