1. Introduction

Anti-dumping actions in the United States remained the predominant feature of rising protectionism, especially since the late 2010s. The annual average anti-dumping duty (ADD) rate, as shown in Figure 1, has moved upward since it reached 60.4% in 2010, reaching an abnormally high rate of 136.6% in 2018. It is noted that when the target group is split into market and non-market economies, the increased ADD rates have been largely attributable to those applied to non-market economies. For non-market economies, Figure 1 shows the punitive size of the average ADD rate rising to 189.8% in 2020, implying how adversely the United States has treated non-market economies to counteract the unfair trade practice of dumping.Footnote 1

Figure 1. Yearly trend of average anti-dumping duty rates in the US anti-dumping investigations Note: Calculated using firm-specific anti-dumping duty rates retrieved from the final/preliminary determinations announced in the US Federal Registers as of 26 March 2021. The cases cover anti-dumping original investigations initiated from 1 January 2008 to 31 December 2020.

Compared to the nominal size of anti-dumping duties against non-market economies, those against market economies appear relatively modest. However, it has been found that the Department of Commerce (DOC) has developed discretionary practices for the past decade to inflate dumping margins for ‘market economy (ME)’ exporters specifically, especially since 2015 when the Trade Preferences Extension Act of 2015 was enacted. This study attempts to identify specific practices that have evolved in a manner that heightens anti-dumping duties for ‘market economy’ exporters. We focus particularly on how the practices known as targeted dumping and the market situation, which began to gain attention in the 2010s, have affected the extent of dumping margins and explain, through empirical analysis and case studies, how they evolved in a manner that inflates dumping margins. We also explore relevant World Trade Organization (WTO) jurisprudence to see the extent to which the discretion of an investigating authority in anti-dumping proceedings can be condoned in the WTO. This study contributes to the literature by analysing the idea that US anti-dumping practices have evolved against market economies, which might have otherwise been assigned smaller dumping margins, leading in turn to rising protectionism for market economy exporters.

The rest of this paper is organized as follows. Section 2 provides a literature review of the effect of anti-dumping practices on the margins of dumping, along with a description of new or intensified anti-dumping practices in the 2010s. Section 3 provides an empirical analysis of whether and how the effects of various discretionary practices on anti-dumping duty rates differ between market and non-market economies. In Section 4, we supplement case studies for our empirical analysis and examine the evolution of WTO jurisprudence, which gives greater deference to the investigating authority's determination, instead of filling a gap in the covered Agreement. Finally, Section 5 concludes the study.

2. Literature Review of and Recent Development in US Anti-Dumping Practices

Anti-dumping duties as a result of an investigative process are determined by a set of various substantive and procedural rulesFootnote 2. Previous studies have identified the main practices in which the DOC is engaged when establishing dumping margins, some of which have been associated with higher dumping margins. Baldwin and Moore (Reference Baldwin, Moore, Boltuck and Litan1991) show that use of facts available (FA) lead to dumping margins that are 38% points higher than the average 29% margin based on the respondents’ own data. Lindsey's (Reference Lindsey1999) data show that dumping margins calculated using the exporter's own domestic prices or third-country prices as normal values are much lower than those calculated using constructed value, non-market economies, or facts available. Lindsey and Ikenson (Reference Lindsey and Ikenson2002) examine discretionary practices, including the use of constructed value, cost of production tests, zeroing, model comparison, arm's length test, and several types of price adjustments, which were found to exert a substantial impact on increasing dumping margins. Blonigen (Reference Blonigen2006) also shows, in a statistical analysis using data on all firm-specific dumping margins calculated for cases filed from 1980 to 2000, that the use of adverse facts available (AFA) increases dumping margins by 62.98% points. Importantly, he added the variables of discretionary practices such as cost of production test, constructed value, third-country prices, or non-market economy (NME) to his analysis to examine the evolving impact of such practices over time. The results indicate that the FA, AFA, and NME variables contribute to higher dumping margins while the effects of other discretionary practices on dumping margins are not statistically significant.

Extending previous research, we identified what specific practices have emerged or developed over the recent decade unfavourably to market economy exporters. One prominent practice affecting the extent of dumping margins is ‘zeroing’ – an asymmetrical calculation methodology that treats any negative dumping margins as zero when export prices exceed normal values. Zeroing existed long before the 2010s, and appeared as a brand-new methodology to detect the so-called ‘targeted dumping’ in 2008. We delve into this development in greater detail in Section 4.1.

The amendment to the US AD law by the Trade Preferences Extension Act (TPEA) of 2015 appears to have played a major role in affording the DOC broader discretions. Two significant amendments are worth noting; one concerns the use of adverse facts available and the other relates to a new practice known as the particular market situation (PMS).

First, Section 776 of the Tariff Act of 1930 (the Act) granted the DOC discretion to apply an adverse inference regarding facts otherwise available to the respondent who failed to cooperate by not acting to the best of its ability to comply with the request for information from the DOC. While the Act had previously required the DOC to corroborate the adverse rate that the DOC assigned with the commercial reality of uncooperative respondents, Section 502 of the TPEA eliminated that requirement. In particular, it became possible that if the DOC uses an adverse inference in selecting among the facts otherwise available, it may use ‘any dumping margin from any segment of the proceeding under the applicable anti-dumping order’, and has the discretion to apply the highest rate under these circumstances.

Second, Section 504 of the TPEA provides room to inflate dumping margins by clarifying the sales made in a PMS as being ‘outside the ordinary course of trade’. If a PMS is found to exist, the DOC may establish a normal value based on the constructed value, rather than on a respondent's sales price in the home market. Furthermore, Section 504 (c) of the TPEA clearly allows the DOC to use ‘another calculation methodology’ in a situation in which ‘a particular market situation exists such that the cost of materials and fabrication or other processing of any kind does not accurately reflect the cost of production in the ordinary course of trade’. In other words, the DOC may disregard a respondent's cost of production in a particular market situation, which might lead to an increased dumping margin.

Among the many techniques utilized by the DOC, zeroing under targeted dumping situations, the use of adverse facts available with broader discretion, and the application of particular market situation are all key features that emerged in the 2010s. Now, we will examine how each practice affects the size of the anti-dumping duty, and whether and how those effects differ by market and non-market economies.

Table 1 summarizes the average dumping margins by each discretionary practice and by market and non-market economies. The underlying data were obtained from 389 cases that were initiated between January 2008 and December 2020. Specifically, we collected firm-specific dumping margins from the DOC final – or if not applicable, preliminary – determinations announced in the Federal Register Notices.

Table 1. Average dumping margins by discretionary practices and by types of economies

Notes: 1. Parentheses denote the number of firms.

2. Calculated using firm-specific anti-dumping duty rates retrieved from the final/preliminary determinations announced in the US Federal Registers as of 26 March 2021. The cases cover anti-dumping original investigations initiated from 1 January 2008 to 31 December 2020.

There is a significant difference in the extent of the dumping margins between market and non-market economies. The dumping margin established for non-market economies amounted to 149.06% on average, which is approximately three times higher than that for market economies, that is, 53.47%. Interestingly, the cases in which facts available, partial adverse facts available, the exceptional comparison method under the targeted dumping situation, or a particular market situation were applied led to smaller dumping margins than the average margin of dumping. Arguably, these kinds of investigation techniques in many cases have been used to inflate dumping margins for cooperative respondents who would have experienced much smaller dumping margins had the DOC not relied on such techniques in calculating the margin. In Section 3, we conduct an empirical analysis to see how the effects of the practices mentioned above on anti-dumping duty rates differ by market and non-market economies and to what extent each practice increases dumping margins.

3. Empirical Analysis

3.1 Methodology and Data

To present an empirical analysis, we use the dumping margin information of any foreign firm designated as a mandatory respondent in the Federal Register Notices as an observation, based on 389 cases from January 2008 to December 2020. The NME-wide rates for non-market economies are also included as observations.Footnote 3 To identify information on the DOC's discretionary practices, we examined unpublished final or preliminary decision memoranda, analysis memos, or calculation memos prepared by the DOC. As a result, the final sample comprises 798 specific dumping margin calculations, collected from 351 final determinations and 27 preliminary determinations.Footnote 4

To control for DOC's discretionary practices, we included separate indicator variables for each discretionary practice. For example, each indicator variable for ‘Market Economy’ or ‘Non-Market Economy’ takes ‘1’ when the firm is from a market economy or non-market economy country. Although previous literature regarded ‘Adverse Facts Available’ as a subset of ‘Facts Available’, we treated ‘Facts Available’, ‘partial Adverse Facts Available’, and ‘total Adverse Facts Available’ as three different variables because the amendment to the US anti-dumping law in 2015 only concerned ‘adverse Facts Available’, leaving the application of ‘Facts Available’ intact. Each variable of ‘Facts Available’, ‘partial Adverse Facts Available’, and ‘total Adverse Facts Available’ takes ‘1’ when its practice is referred to as applied in the DOC's preliminary or final determinations. The ‘Targeted Dumping’ variable takes ‘1’ if an analysis memo states that the weighted to transaction comparison method with zeroing is applied fully or in part in comparing the normal value with the export price. Even if the DOC tested for targeted dumping, the indicator variable also takes ‘0’ if the criteria are not met, thereby applying the normal comparison method without zeroing. The ‘Particular Market Situation’ variable takes ‘1’ when there is an adjustment as particular market situation is found to exist. Table 2 provides the descriptive statistics of the variables mentioned above. As discretionary practices are not necessarily mutually exclusive, more than one indicator variable may take ‘1’. For example, if a Chinese firm obtained the individual rate based on facts available, both ‘Non-Market Economy’ and ‘Facts Available’ variables are applied to this firm.

Table 2. Descriptive statistics

Notes: All variables are dummy variables with a value of 0 or 1, with the exception of the dumping margin. Dumping margin has a minimum value of 0% and a maximum value of 1,732%.

1 Since all variables except the Anti-Dumping Duty Rate are indicator variables, the mean value can be interpreted as the share of the total observation.

Discretionary practices are not necessarily mutually exclusive as a case may use more than one discretionary practice. The use of a practice for only part of a case (e.g., a subset of the investigated products) is included and treated identically to cases where the practice was fully used. Data are retrieved from the final/preliminary determinations announced in the US Federal Registers as of 26 March 2021. The cases cover anti-dumping original investigations initiated from 1 January 2008 to 31 December 2020.

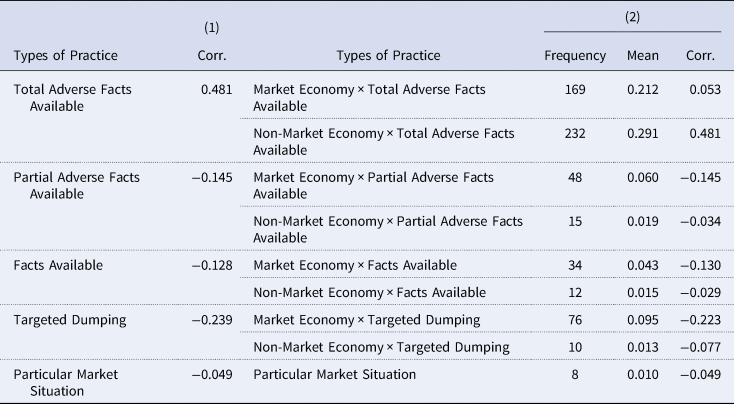

Based on this dataset, the correlation in column (1) of Table 3 shows that the dumping margin decreases when variables such as Facts Available, partial Adverse Facts Available, Targeted Dumping, or Particular Market Situation are applied. Furthermore, this trend appears even stronger in market economies, as shown in column (2) of Table 3. The negative correlation coefficients of market economies are larger than those of non-market economies for the Facts Available, partial Adverse Facts Available, Targeted Dumping, and Particular Market Situation variables.

Table 3. Correlations between discretionary practice and the margin of dumping

Source: Compiled by authors from final (or preliminary) determinations and decision memoranda retrieved from the US Federal Register and http://access.trade.gov (last visited 26 March 2021).

These results are likely, not because the application of these practices resulted in a reduced dumping margin, but because they were applied to respondents who would have received a low dumping margin. We used each discretionary practice to control for this low trend in dumping margins and included a product term to see how the effect of discretionary practices on dumping margins differs depending on market and non-market economies. For example, the ‘Targeted Dumping’ variable explains a relatively low dumping margin trend in cases where the exceptional comparison method with zeroing is used fully or in part. On the other hand, the product term of ‘Market Economy × Targeted Dumping’ explains the effect of targeted dumping imposed on market economy countries. Taking the extent of dumping margins as the dependent variable and the dummy variables mentioned above as independent variables, we conducted an empirical analysis using the ordinary least squares method.Footnote 5

In Table 3, total adverse facts available are applied to 401 observations, which account for almost 50% of the total observations we collected. Among these, 169 observations are exporters from market economies, and 232 are from non-market economies. Total adverse facts available are also applied to non-market economies with a higher proportion than that of market economies, that is, 65% of 359 observations from non-market economies and 38% of 439 observations from market economies. Accordingly, the positive correlation coefficient of the non-market economy is overwhelmingly larger than that of the market economy.

3.2 Econometric Analysis

Column (1) of Table 4 presents the empirical results derived when we incorporate our recent dataset into Blonigen's (Reference Blonigen2006) model. The results show a strongly significant positive effect of the total adverse facts available on the dumping margins. Given the size and significance of its coefficient, the ‘total Adverse Facts Available’ variable appears to be the most influential in determining the extent of dumping margins. Consistent with the previous literature, the significant positive effects of total AFA on dumping margins are commonly found in columns (1) to (7) of Table 4. In contrast, ‘Facts Available’, ‘partial Adverse Facts Available’, ‘Targeted Dumping’, and ‘Particular Market Situation’ variables are not statistically significant. In particular, ‘Facts Available’ and ‘Targeted Dumping’ variables seem to have negative effects on the dumping margin, which is similar to the correlations shown in Table 3.

Table 4. Effects of discretionary practices on the margin of dumping in US AD investigations

Note: Estimated coefficients were obtained by least-squares regressions. Robust standard errors are indicated in parentheses. * denotes statistical significance at the 10%, ** at the 5%, and *** at the 1% level. The dependent variable is the final (whether the case ends at final/preliminary determinations) rates of anti-dumping on firms. The coefficients for the various fixed-effect dummies are not reported. The year dummy and the product dummy (base category is chapter for the Harmonized System code) were included in all models. Country dummies are also included for China, EU, Korea, India, Vietnam, Taiwan, Mexico, Turkey, Japan, and Canada, which cover 84% out of 798 observations.

Our main empirical result distinguished from earlier literature begins with column (2) of Table 4.Footnote 6 It shows that although the ‘partial Adverse Facts Available’, ‘Facts Available’, and ‘Targeted Dumping’ variables have significant negative coefficients, they all have significant positive coefficients for the product term along with ‘Market Economy’. This result implies that after controlling for the low trend of dumping margins, employing the practices of FA, partial AFA, and targeted dumping increases the dumping margins of exporters in market economies. The marginal effect of ‘Targeted Dumping’ on dumping margins is negative. Targeted dumping seems to apply to market economy exporters with very low dumping margins. The ‘Particular Market Situation’ variableFootnote 7 is found to be relatively insignificant in our empirical analysis due to the limited number of observationsFootnote 8. However, the inflation effect of PMS on dumping margins for ME exporters is supported by the case study in Section 4.2.1.

Similarly, the results in column (3) of Table 4 show that the ‘Facts Available’, ‘partial Adverse Facts Available’, and ‘Targeted Dumping’ variables show significant negative coefficients. Unlike market economy countries, however, there are no significant results for the product terms designed to indicate whether each practice would have the effect of inflating dumping margins if they were applied to non-market economies.

We tested the effect of the legal amendment by the TPEA 2015 on the use of discretionary practices in establishing dumping margins by dividing the observations into two groups: ‘pre-TPEA 2015’ and ‘post-TPEA 2015’. We include the observations collected from final (or preliminary) decisions published prior to the date of the enactment of TPEA 2015, that is, 29 June 2015, in the ‘Pre-TPEA 2015’ group, as shown in columns (4) and (5). The observations collected from final (or preliminary) decisions published after 29 June 2015 are included in the ‘Post-TPEA 2015’ group, as shown in columns (6) and (7).

The results in columns (4) to (7) of Table 4 show that the ‘total Adverse Facts Available’ variable increases the extent of dumping margins more significantly, from 58.93% to 89.35% for market economies and from 103.04% to 133.49% for non-market economies. It means that ‘total Adverse Facts Available’ leads to steeper dumping margins for uncooperative exporters of market economies and NME-wide entities after the legal amendment by the TPEA in 2015. It is otherwise stated that the TPEA 2015 brought about – at least in part – apparent changes in the more intensive use of total adverse facts available in establishing dumping margins by explicitly allowing the DOC's broader discretion.

For market economies, the ‘partial Adverse Facts Available’, ‘Facts Available’, and ‘Targeted Dumping’ variables have much larger negative coefficients for the ‘Post-TPEA 2015’ group than the ‘Pre-TPEA 2015’ group. This indicates that these practices are more likely to be imposed on respondents who received significantly much lower dumping margins after the TPEA 2015 was enacted. However, the coefficients of product terms of ‘partial Adverse Facts Available’ and ‘Targeted Dumping’ with ‘Market Economy’ are significantly positive for the ‘Post-TPEA 2015’ group. This suggests that the practices of partial AFA and targeted dumping have significantly inflated the dumping margins of market economy exporters since the TPEA 2015 was enacted. For non-market economies, the ‘Targeted Dumping’ variable is statistically significant in having a negative coefficient, but there is no significant positive effect of the product terms with ‘Non-Market Economy’ on the extent of dumping margin for the ‘Post-TPEA 2015’ group.

4. Case and Legal Analysis

Evidently, the legal amendment by the TPEA in 2015 appears to have helped the DOC intensify its application of the adverse facts available in establishing dumping margins. The recent WTO dispute, United States – Anti-dumping and Countervailing Duties on Certain Products and the Use of Facts Available Footnote 9 examines the inconsistent aspect of the manner in which the DOC used facts available after the TPEA 2015 was enacted and reaffirms certain limitations on the investigating authority's use of the facts available in order to overcome a lack of information.

Except for AFA, our empirical evidence shows that the inflating effect of many other practices on the dumping margin is statistically significant only for market economy exporters, not non-market economy exporters. This propensity appears stronger for the observations collected in the late 2010s, that is, after the TPEA 2015 was enacted. To supplement the empirical findings above, the sub-section below analyses whether and how the practices of targeted dumping and a particular market situation have led to an increased dumping margin for market economy exporters. An examination of WTO jurisprudence on these practices also follows.

4.1 Targeted Dumping

The notable practice particularly prevalent during the 2010s was the use of the exceptional comparison methodology with zeroing for the purpose of detecting targeted dumping. The WTO jurisprudence to prohibit all kinds of zeroing regardless of the type of AD proceedings under the normal comparison methodologies has brought about an explicit change in the DOC's approach towards the zeroing practice. The DOC started to invoke the exceptional comparison methodology under Article 2.4.2 – that is, the weighted average to transaction (W-T) comparison method – the last resort where it might have been allowed to engage in zeroing. To this end, the DOC created a brand-new test for targeted dumping called the ‘Nails Test’ in 2008 and then changed its methodology to the ‘Differential Pricing Methodology (DPM)’ in 2013.Footnote 10 While the DOC has tested alleged targeted dumping transactions under the Nails Test, it now tests all export transactions, regardless of whether they were alleged or not. As a result, Table 5 shows that the DOC resorted to targeted dumping with much greater frequency, making 13 affirmative targeted dumping determinations in 2020. The exceptional comparison methodology has now become a normal practice in establishing dumping margins.

Table 5. Number of affirmative targeted dumping determinations

Source: Compiled by the authors from final (or preliminary) determinations and analysis memo for anti-dumping original investigations retrieved from the US Federal Register and http://access.trade.gov (last visited 26 March 2021).

Table 5 indicates that targeted dumping determinations are tilted towards market economy firms rather than non-market economy firms. Table 1 in Section 2 also showed that targeted dumping is associated with foreign firms assigned smaller dumping margins. Why are market economy exporters more likely to be subject to targeted dumping determinations, and why is the dumping margin based on the targeted dumping finding much smaller than the average dumping margin based on other discretionary practices?

The margins of dumping are normally established based on a comparison of a normal value with an export price. If total adverse facts available is applied because an exporter fails to cooperate with the DOC, the normal process of establishing dumping margins is entirely disregarded. Instead, firms subject to adverse facts available receive dumping margins calculated by adverse inference, such as dumping margins alleged by petitioners. Thus, offsetting negative dumping margins in comparison to a normal value with an export price, that is, zeroing, is mutually exclusive with the practice of total adverse facts available.

The DPM allows zeroing the negative dumping margin generated for certain transactions. For firms that have ‘inherently’ dumped products at much lower prices to the US markets, zeroing might not be an effective tool to increase dumping margins because these firms usually maintain export prices much cheaper than normal values. Therefore, the targeted dumping methodology is more likely to be applied to firms for which dumping would not otherwise be found, or the dumping margin would be innately small. The data collection in Figure 2 indicate that the application of the W-T method under the DPM inflated the ADD rate to a level almost 2.6 times higher than the W-W method (from 2.13% on average under the W-W method to 5.61% on average under the W-T method).

Figure 2. Dumping margins under the weighted-to-weighted comparison method and the weighted-to-transaction comparison method with zeroing

Note: The left panel illustrates the annual dumping margins calculated without using the differential pricing methodology and the right panel illustrates the annual dumping margins calculated using the differential pricing methodology. The analysis is based on 60 exporters for whom the dumping margin established under the W-W method and the W-T method is publicly identifiable. For 5 of the 60 exporters, we were unable to obtain the dumping margins established in the final phase, so the dumping margins established in the preliminary phase were used. Source: Kim (Reference Kim2021).

Zeroing has been contentious over the past two decades, resulting in dozens of WTO disputesFootnote 11. The US's zeroing practice in the context of targeted dumping has been challenged in three WTO disputes. While the Appellate Body in two disputes affirmed that the use of zeroing was prohibited even under the exceptional comparison methodology, the panel in the most recent dispute once again found zeroing permissible in the context of the W-T comparison,Footnote 12 leaving the controversy over the permissibility of zeroing under the W-T comparison method legally unresolved. That said, the WTO jurisprudence of the three recent disputes involving the use of the DPM unanimously confirms the identification of targeted dumping in a very strict and narrow fashion to the extent that an ordinary dumping case cannot be camouflaged with an exceptional targeted dumping case.

4.2 Particular Market Situation

4.2.1 Case Study

The sudden emergence of legal amendments governing PMS in the United States was understood as an attempt to replace the methodology applied to non-market economies, such as China.Footnote 13 Contrary to expectations, however, the targets in anti-dumping cases involving PMS were exporters from market economies. The PMS after the passage of TPEA 2015 was first applied in an administrative review of the anti-dumping duty order for oil country tubular goods (OCTG) from South Korea in April 2017. In the final determination of the OCTG case, the DOC found a PMS based on the ‘cumulative effect on the Korean OCTG market through the cost of the OCTG inputs’Footnote 14. Having confirmed the existence of PMS with respect to production costs for OCTG, the DOC made an upward adjustment to respondents’ reported cost for hot-rolled coils (HRC) by the subsidy rates calculated for Korean HRC producers in the countervailing duty investigation on hot-rolled steel flat products from Korea.

The basic reasoning behind the affirmative PMS determination has been repeated in other investigations and reviewsFootnote 15 but has also evolved with minor tweaks. The DOC had quantified the impact of HRC subsidies granted by the exporting country in early cases, but it had just started to account for the effect of Chinese overcapacity on the steel market of the exporting country. Quantifying the effect of global uneconomic capacity on the price of HRC inputs based on the petitioner's regression analysisFootnote 16 has now become a normal practice of the DOC in adjusting the cost of HRC.

With regard to the DOC's affirmative PMS determinations and evolving techniques, the US Court of International Trade (CIT) largely concedes that the DOC is legally authorized to choose the appropriate methodology for finding a PMS and subsequent adjustmentFootnote 17. However, in many cases, it remanded the DOC's determinations because the PMS finding was not supported by substantial evidence.Footnote 18 Even if the PMS was found to exist on the basis of substantial evidence, the CIT found it illegal for the DOC to fail to demonstrate how the alleged distortion prevented a ‘proper comparison’ between the US price and home market pricesFootnote 19.

In response to the remand order by the CIT, the DOC provided further consideration or explanation, disagreed with the Court's decision, or recalculated the dumping margin without applying a PMS adjustment, notwithstanding such disagreement. Table 6 shows that the difference in dumping margins between the original one and the recalculated margins after the DOC conforms to the CIT's order ranges from 2.01% points to 28.42% points.

Table 6. Changes in dumping margin calculations by DOC's redetermination on PMS

Note: This table summarizes the redeterminations of the Department of Commerce by the remand of the Court of International Trade in which the Department of Commerce recalculates dumping margins without the application of a ‘particular market situation’ adjustment. If recalculated dumping margins are affected by factors other than a particular market situation, these cases are not included in this table.

Source: Retrieved from http://access.trade.gov as of 6 April 2021.

4.2.2 Legal Analysis

The US's determination to impose anti-dumping duties against certain exporters on the basis of finding a PMS is likely to violate the WTO obligation ‘as applied’. The established WTO jurisprudence, however, does not entirely prevent an investigating authority from finding a particular market situation per se and from making certain adjustments to the cost of production when constructing a normal value.

Previously, neither the Anti-Dumping Agreement (ADA) nor WTO adjudicators have defined what exactly a ‘particular market situation’ means. The pertinent provision, Article 2.2, only prescribes that a normal value can be constructed when domestic sales do not permit a proper comparison because of ‘particular market situation’. In Australia – Anti-Dumping Measures on A4 Copy Paper, the panel appears to leave open the possibility of defining the notion of PMS by the investigating authority's own criteria. With respect to the issue of what makes a situation ‘particular’, the panel opined that ‘the market situation must be distinct, individual, single, specific, but that does not necessarily make it unusual or out of the ordinary – i.e. exceptional’.Footnote 20 With the emphasis on ‘fact-specific and case-by-case analysis’, the panel rejected the argument that certain situations are necessarily disqualified for the definition of PMS.Footnote 21

In particular, the panel leaves flexibility in defining PMS by clarifying that PMS itself is not required to be ‘capable of preventing a proper comparison’.Footnote 22 In other words, a situation may exist where a proper comparison of domestic sales with an export price is available despite the existence of a PMS, and in that case an investigating authority cannot disregard domestic sales in establishing a normal value.Footnote 23 The panel in Australia – Anti-Dumping Measures on A4 Copy Paper ruled that Australia's measure is inconsistent with Article 2.2 because, in constructing a normal value, Australia failed to examine whether, because of the particular market situation, the domestic sales do not permit ‘a proper comparison’. In light of this ruling, the DOC's determination to rely on constructed normal value based on the finding of PMS is also likely to be inconsistent with Article 2.2 insofar as the DOC does not access the relative effect of the PMS on ‘proper comparison’ between domestic and export prices. However, it should be noted that WTO rulings also provided flexibility to the investigating authority in determining what circumstances constitute a ‘particular market situation’.

Another issue is whether the DOC's determination to make an upward adjustment to respondents’ reported cost is inconsistent with Article 2.2.1.1 of the ADA. The first sentence of Article 2.2.1.1 requires an investigating authority to calculate production costs ‘normally’ based on the records of the investigated exporters/producers if two conditions are met. These conditions are (1) that costs are recorded in accordance with the generally accepted accounting principles, and (2) that the records ‘reasonably reflect’ the costs associated with production and sale of the product under consideration. EU – Anti-Dumping Measures on Biodiesel from Argentina (EU – Biodiesel (Argentina)) elucidates what the term ‘reasonably reflect’ in the second condition means and whether any other alternative to the exporter's record can be used to determine production costs even where both conditions are fulfilled.

The Appellate Body interpreted the second condition in the first sentence of Article 2.2.1.1 as ‘whether the records kept by the exporter or producer suitably and sufficiently correspond to or reproduce those costs incurred by the investigated exporter or producer that have a genuine relationship with the production and sale of the specific product under consideration’.Footnote 24 In other words, the second condition requires the records to ‘reasonably reflect’ the costs, not the ‘reasonableness of the costs’.Footnote 25 The Appellate Body also acknowledged situations in which the records do not ‘reasonably reflect’ the costs associated with the production and sale of the product under consideration. These situations include where costs are related to the production of the product under consideration and of other products, or where transactions involving input costs are made at arm's length.Footnote 26

While the exporter's records, as a rule, should be the preferred source for cost of production data, the panel in EU – Biodiesel (Argentina) recognized a possible derogation that the term ‘normally’ implies under certain conditions.Footnote 27 However, the panel and the Appellate Body in this case refrained from expressing any views on what other circumstance may exist in order to not ‘normally’ base the calculation of costs on the record kept by the investigated exporter/producer. Similarly, the panel in Australia – Anti-Dumping Measures on A4 Copy Paper also confirmed certain circumstances in which the authority may depart from the obligation to use the records kept by the investigated exporter/producer even if such records satisfied the two conditions in the first sentence of Article 2.1.1.1.Footnote 28 The panel, however, abstained from defining ‘not normal’ circumstances that provide an investigating authority room to reject the exporter's record.Footnote 29

The DOC's current practice of making an upward adjustment is likely to violate Article 2.1.1.1 because the previous rulings oblige the investigating authority to establish that the two conditions in the first sentence of Article 2.1.1.1 are satisfied when disregarding the recorded costs on the basis of the term ‘normally’. If the DOC fulfilled the obligations clarified by WTO jurisprudence, the DOC may be free to make certain adjustments to the original production cost of the exporter, given the flexibility that the term ‘normally’ suggests.

Section 504(d) of the TPEA provides that ‘if a particular market situation exists such that the cost of materials and fabrication or other processing of any kind does not accurately reflect the cost of production in the ordinary course of trade, the administering authority may use another calculation methodology’. As prescribed in Article 2.2 of the ADA, the term ‘particular market situation’ only serves as a basis for an investigating authority to rely on constructed normal value when ‘a proper comparison’ is not permitted because of a particular market situation. Although it seems hard to find that this provision violates the WTO obligation ‘as such’ given its discretionary nature, a controversy may still arise in that the term ‘particular market situation’ pursuant to Section 504(d) of the TPEA may serve as a basis for an investigating authority to use ‘another calculation methodology’ instead of using ‘records kept by the exporter’ pursuant to Article 2.2.1.1 of the ADA.

5. Conclusion

Steep increases in anti-dumping investigation numbers and anti-dumping duty rates in the late 2010s demonstrated the prevalence of US protectionism in international trade. Given that the United States has imposed several trade-restrictive tools from Section 232 measures to Section 301 tariffs, anti-dumping measures against market economies are portrayed as relatively modest restrictions. However, our findings show that discretionary practices in US anti-dumping investigations have evolved greatly over the past decade to increase dumping margins against market economy exporters. Empirical evidence confirms the positive effect of ‘Facts Available’, ‘partial Adverse Facts Available’, and ‘Targeted Dumping’ in raising dumping margins for market economy exporters. Although such practices are associated with smaller dumping margins than the overall dumping margins, they appear to inflate dumping margins for exporters of market economy countries after adjusting for the low trend of dumping margins. This inflation effect becomes more significant after the legal amendment to the US anti-dumping law in 2015. Furthermore, case studies document that discretionary practices, such as targeted dumping and particular market situation, have not only increased dumping margins but have also led to positive dumping determinations for market economy exporters who could otherwise have received a negative determination without such practices.

We empirically find that ‘total Adverse Facts Available’ is the most influential variable in inflating dumping margins for market and non-market economies. Importantly, we statistically identified that the amendment to the US anti-dumping law in 2015 brought an apparent change in the use of adverse facts available in a way that led to much higher dumping margins against exporters. Although it seems partially true that the legal amendment in 2015 contributes to counteracting the unfair trade practice of dumping, regardless of the status of the (non) market economy of the exporters, it is explicitly market economy exporters that have been affected by the overall development of US anti-dumping practices in the past decade.

WTO case laws have arguably developed in such a way that they provide flexibility for the investigating authority in tackling market distortions – whatever the source – within the anti-dumping framework.Footnote 30 It remains to be seen the extent to which the WTO jurisprudence, for example, on zeroing under the targeted dumping situation or on a particular market situation – will evolve to give deference to the investigating authority's own decision, or it will evolve to provide room to rein in the discretionary practices that unduly contribute to unnecessary non-tariff barriers.

Acknowledgements

We especially thank Dan Ikenson for his invaluable feedback on an earlier draft. We are also grateful to Dukgeun Ahn and Jee-Hyeong Park for their helpful comments. This work was supported by the Yeungnam University Research Grant.