1. Introduction

The recent global financial crisis has called for the need to examine the factors that affect banking stability across the world. There appears to be no convergence in literature on the definition of banking stability even though some researchers postulate it to be the absence of banking crises (Ozili, Reference Ozili2018; Segoviano and Goodhart, Reference Segoviano and Goodhart2009). For the Sub-Saharan African (SSA) region where the banking sector forms a major part of the financial system, the stability of the sector is critical. The region has the lowest banking stability with the highest ratio of nonperforming loans (NPLs) to gross loans and the second lowest Z-score compared to other regions (see Figure 1). Consequently, the development of the financial sector is relevant to economic outcomes in the region; hence, an understanding of the determinants of banking stability is key for policy making. Consequent to this, many studies have explored factors such as competition, profitability, income sources, institutional quality, economic growth and banking access (Beck et al., Reference Beck, De Jonghe and Schepens2013; Dwumfour, Reference Dwumfour2017; Kasman and Carvallo, Reference Kasman and Carvallo2014) among others to explain banking stability in SSA. There is however a lack of literature that explores the impact of fractionalization and polarization on banking stability, particularly in SSA. While some studies on developed countries have related culture to some financial outcomes (Chui et al., Reference Chui, Titman and Wei2010; Fahlenbrach et al., Reference Fahlenbrach, Prilmeier and Stulz2012; Shao et al., Reference Shao, Kwok and Guedhami2010; Zheng, et al., Reference Zheng, El Ghoul, Guedhami and Kwok2012), little to no studies have been done even relating fractionalization and polarization to financial stability.

Figure 1. Regional comparison of key variables. NB: Ethhpol, Ethfrac, Relpol and Refrac are as defined earlier. NIM, Z-score and NPL are the period averages.

Indeed, people generally differ in terms of opinions, views and behaviours because of their religious and ethnic backgrounds and associations. Ethnic diversity refers to the existence of people from different ethnic backgrounds with different cultures in a particular country. Religious diversity is the presence of people with different religious beliefs in a country. That is, ethnic and religious pluralism relates to some attitudes or policies regarding diverse cultural and religious belief systems that co-exist in a society. These diversities or heterogeneities of religion and ethnicity are key to the development of the people and can thus consequently influence various development issues in a country. Indeed, as indicated by Montalvo and Reynal-Querol (Reference Montalvo and Reynal-Querol2021), the scale of analysis of the development impact of diversity is agnostic. Following from this, empirical studies have been done on how diversity is linked to economic phenomena like trade, democracy, education and economic growth among others (Alesina et al., Reference Alesina, Devleeschauwer, Easterly, Kurlat and Wacziarg2003; Glaeser and Sacerdote, Reference Glaeser and Sacerdote2008; Lewer and Van den Berg, Reference Lewer and Van den Berg2007; Tavares and Wacziarg, Reference Tavares and Wacziarg2001). Suffice to say that most studies have been done on diversity-growth analysis. Generally, diversity has been seen to reduce economic growth. For instance, one of the earlier studies done by Easterly and Levine (Reference Easterly and Levine1997) in a cross-country analysis of ethnic diversity found that the poor performance of African economies in their economic development is attributed to its high degree of ethnic heterogeneity. Also using cross-country data, Alesina et al. (Reference Alesina, Devleeschauwer, Easterly, Kurlat and Wacziarg2003) and Alesina and La Ferrara (Reference Alesina and Ferrara2005) similarly show a consistent negative effect of ethnic fractionalization on growth. This adverse effect is more pronounced in countries with poor institutional quality (Easterly, Reference Easterly2001) and low-income levels (Alesina and Ferrara, Reference Alesina and Ferrara2005). Montalvo and Reynal-Querol (Reference Montalvo and Reynal-Querol2005) found that there is a direct negative impact of ethnic diversity on growth, while ethnic polarization has an indirect negative impact on growth mainly through the reduction of investment rate and the higher likelihood of conflict.

However, other studies like that of Ottaviano and Peri (Reference Ottaviano and Peri2005, Reference Ottaviano and Peri2006) found heterogeneity to positively influence indicators such as wages or productivity. The difference in the literature is mainly attributable to the size of the unit of analysis. Most of the studies that found a positive impact were done for cities while the negative impact was for countrywide or cross-country analysis. All of these theories generally imply that there is a size at which benefits and costs are equalized, implying that on a smaller scale I should find a positive effect of ethnic diversity and on a larger scale I should find a negative effect (Montalvo and Reynal-Querol, Reference Montalvo and Reynal-Querol2021). This suggests that, as the size of the unit of analysis increases, heterogeneity tends to hurt development outcomes. The literature, however, is limited on the impact of diversity on banking stability.

In this study, I use a cross-country analysis of the SSA region, which has been found to have unusually high levels of variations in diversity (Green, Reference Green2013). In this context, the impact of heterogeneity on the stability of the banking system is examined. Banks do not operate in isolation but rather in a cultural, religious and political environment, suggesting that national culture may influence bank performance, beyond the effect of the regulatory environment, bank characteristics and diversification (Barth et al., Reference Barth, Caprio and Levine2008). Indeed, two-thirds of the participants of a survey done by PWC and Economist Intelligence Unit in 2008 identified culture, in addition to excessive risk-taking, as the major cause for the banking crisis of 2007–2008 (Kanagaretnam et al., Reference Kanagaretnam, Lim and Lobo2011).

I conjecture that, the more ethnically/religiously fractionalized and polarized a country, the poorer the asset quality (bank bad loans) of banks and hence less banking stability. Thus, banks that operate in more ethnically and religiously fractionalized and polarized countries are bound to face instability and bad loans resulting from the poor performance of borrowers. These borrowers are operating in an environment where there are more diverse views and opinions resulting from their ethnic and religious backgrounds. In these environments, there are bound to be mistrust, corruption and cronyism (Mauro, Reference Mauro1995; Shleifer and Vishny, Reference Shleifer and Vishny1993; Tanzi, Reference Tanzi1994). This is because in heterogeneous societies, people tend to have more trust in and feel more comfortable interacting or dealing with those similar to themselves in terms of ethnicity or race (Alesina and La Ferrara, Reference Alesina and La Ferrara2000; Knack and Keefer, Reference Knack and Keefer1997). This leads to a mindset of us versus them (Coffé, Reference Coffé2009) as these groups distinguish themselves from others and can even avoid or mistrust other groups (Abrams et al., Reference Abrams, Hogg and Marques2005; Portes, Reference Portes1998). These may lead to poor business decisions and consequently, high NPLs and instability of banks. For instance, in more heterogeneous environments, businesses are less likely to form strategic partnerships because of mistrusts and corruption which may limit their growth potential. That is, even trade may be restricted to individuals of the same ethnic group. As indicated by Cooter and Landa (Reference Cooter and Landa1984) and Greif et al. (Reference Greif, Milgrom and Weingast1994), the prevalence of these intra-ethnic transactions may limit private markets, credit and financial contracting between economic agents. This would have negative consequences for the development of the banking sector and hence affect their stability. Again, it is argued that in heterogeneous societies, the diffusion of technological innovations is more difficult. In these environments also government expenditure and even provision of government infrastructure may favour some ethnic groups to the detriment of others. These consequences limit the ability of businesses to grow and expand to be profitable and to repay their loans.

Again, diversity may lead loan examiners to be selective and biased in loan approvals particularly to their friends, clansmen and members of their ethnic or religious groups. This may lead to moral hazards and adverse selection, resulting in bad loans and threatening bank stability. There are a number of empirical evidences that show that minorities have either been denied credit or have less access to credit and have been charged higher interest compared to some observably similar non-minorities for different types of loans including mortgage, auto, small business and consumer loans (Bayer et al., Reference Bayer, Ferreira and Ross2018; Blanchflower et al., Reference Blanchflower, Levine and Zimmerman2003; Charles Hurst and Stephens, Reference Charles, Hurst and Stephens2008; Cohen-Cole, Reference Cohen-Cole2011; Pope and Sydnor, Reference Pope and Sydnor2011). For instance, Pope and Sydnor (Reference Pope and Sydnor2011) show that blacks are more likely to be rejected for peer-to-peer loans than observably similar whites while Ross et al. (Reference Ross, Turner, Godfrey and Smith2008) and Hanson et al. (Reference Hanson, Hawley, Martin and Liu2016) show that loan officers treat fictitious blacks and Hispanic mortgage applicants worse than identical fictitious white applicants.

Due to these adverse effects of diversity, I postulate that banks in ethnically and religiously heterogeneous countries in order to make up for this uncertainty, work more to maintain their stability as well as limit losses from NPLs by charging higher margins on loans. Thus, due to the heterogeneous nature of the communities in which banks operate, and the associated mistrust and corruption, banks are more likely to charge higher margins in these countries in order to make up for the associated risks. As found by Dwumfour (Reference Dwumfour2017), net interest margin (NIM) is the major determinant of bank stability in SSA and the primary means to achieve stability during crisis periods. Dwumfour (Reference Dwumfour2017) also find a threshold effect of NIM on stability. Hence, I postulate that, certain levels of NIM could make up for the adverse effect of diversity on stability. Again, I conjecture that opening up the banking system to foreign entry can reduce or eliminate the adverse effect of ethnic and religious heterogeneities on banking stability. This is because these foreign banks normally have less or no ethnic or religious ties locally and are thus considered as neutrals in the market. These banks are less likely to lend on ethnic and religious grounds and thus ameliorate the negative impact of heterogeneity on bank stability.

Thus, in attempting to explain the determinants of bank stability, one has to incorporate the heterogeneity of the environment in which the banks operate. This study, therefore, examines the impact of diversity on bank stability and examines how bank pricing behaviour and the presence of foreign bank offset any adverse effects.

The empirical results show that diversity has a negative effect on bank stability. The study also finds that NIM can help offset the adverse impact of diversity on bank stability. The results further reveal that the higher presence of foreign banks can compensate for the negative impact of diversity on bank stability. The study contributes to the empirical literature in the following ways: First, I give additional insights into the determinants of bank stability by adding the impact of ethnic/religious fractionalization and polarization, and by extending the analysis to include the moderating role of NIM and foreign banks in the diversity–stability relationship. Empirical analysis of banking stability may have to incorporate ethnic and religious fractionalization and polarization as regressors. Second, I advance existing knowledge on diversity which has been studied in relation to conflicts, political instability and economic growth by examining diversity as a historical institution driving the behaviour of individuals and decision-makers and showing that indeed diversity affects banking stability.

The rest of the study is presented as follows: section 2 gives a brief theoretical argument of the thesis of this study as well as a brief review of the empirical literature; section 3 deals with the methodology adopted for the study; section 4 gives some stylized facts and preliminary data observations; section 5 discusses the descriptive statistics; section 6 presents the empirical results; section 7 provides policy discussions and recommendations; section 8 gives the conclusion.

2. Review of literature

Heterogeneity has been linked to various economic outcomes with different theoretical arguments. Here, I elaborate on some of the arguments espoused in literature and also situate them in building the arguments on how the banking system can be affected by more diverse societies. In this study, diversity or heterogeneity is used to mean ethnic and religious fractionalization and polarization. Diversity and the spread of religion can be a double-edged sword since it has a good and bad side (Kodila-Tedika and Agbor, Reference Kodila-Tedika and Agbor2014). As indicated earlier, the economic and development problems of SSA have been synonymous with its level of ethnic diversity. Interestingly, few studies have been done relating diversity to banking stability. I discuss some of these studies relating diversity to economic outcomes.

First, heterogeneity has been seen to breed corruption and cronyism (Mauro, Reference Mauro1995). It is argued that corruption reduces private investment and consequently reduces economic growth. In a more diverse society where there are several ethnic groups, one is more likely to find more harmful types of corruption (Shleifer and Vishny, Reference Shleifer and Vishny1993). In these societies, individuals are more likely to favour their family members, close associates and members of their religious groups. While I do not directly examine the effect of diversity on corruption, I argue that, when societies are more heterogeneous, there is the likelihood of mistrust among the people especially those of different ethnic and religious backgrounds. People are more likely to work with family members, and people of the same ethnic and religious group. Thus, heterogeneity leads to a ‘bonding’ social capital or lacking ‘bridging’ social capital (Abrams et al., Reference Abrams, Hogg and Marques2005; Coffé, Reference Coffé2009; Portes, Reference Portes1998). When this happens, strategic partnerships will be limited since people are less likely to join resources with potential partners or investors from different ethnic and religious backgrounds. Both individuals and firms who borrow from these financial institutions will therefore limit their potential for growth and thus their ability to repay their loans is limited. Also, firms and individuals will end up employing or working with or giving contracts to their family members, church members, Muslim brothers and sisters, and their tribesmen who may not be qualified or be the right partners to work with. Thus, trade may be limited to people of the same ethnic or religious group. Again, in more corrupt societies, entrepreneurs know that some of their profits and future proceeds will be paid as bribes to corrupt officials. These profits that could be reinvested into the business to grow and finance their loans end up being paid as bribes either for contracts or to obtain some licenses for business.

Second, diversity has been seen to reduce investment, affect financial system and reduce economic growth. There are numerous mechanisms through which diversity can affect these outcomes. To begin with, a more diverse society is likely to have higher chances of ethnic or religious conflicts which may lead to ethnic or religious wars. This is the reason I use the polarization index developed by Montalvo and Reynal-Querol (Reference Montalvo and Reynal-Querol2005). This index is a significant variable in the explanation of the incidence of civil wars. Again, these activities can affect the political stability of a country and thus adversely affect actors such as financial institutions. This may also discourage investment both local and foreign. This means that banks in more heterogeneous societies are likely to experience instability that arises from civil conflicts or political instability. Of course, a politically unstable environment will be difficult for banks to operate. How would businesses grow and be able to repay their loans when there are ethnic or religious conflicts and political instability? In these environments, investments are discouraged since people cannot be certain of the future and hence major long-term investments would be limited for fear of loss. This has been empirically examined by some previous studies. For instance, Easterly and Levine (Reference Easterly and Levine1997) found that in SSA, high ethnic fragmentation accounts for the underdeveloped financial systems. The authors also found that the high ethnic fractionalization accounted for Africa's growth tragedy and that ethnic diversity is strongly linked to high black-market premiums, low provision of infrastructure and low levels of education. Again, Buhaug (Reference Buhaug2006) argues that ethnic diversity has been responsible for political instability and conflict in Africa. Emenalo et al. (Reference Emenalo, Gagliardi and Hodgson2018) study four theories that identify historical institutional determinants of financial system development in SSA. The study found that none of the theories (legal origins theory, disease endowment theory, religion-based theory and ethnic fractionalization theory) explains the variations in financial system development as measured by financial depth but finds that three theories (legal origins, disease endowment and ethnic fractionalization theories) are supported when access measures of financial systems are used. Kodila-Tedika and Agbor (Reference Kodila-Tedika and Agbor2014) also examined the relationship between religious diversity and economic development. They found that while religious fractionalization and polarization does not affect institutional outcomes, religious fractionalization reduces investment while religious polarization increases investment.

Alesina and Spolaore (Reference Alesina and Spolaore2003) and Spolaore (Reference Spolaore2006) also suggest that ethnic heterogeneity leads to poorer public goods provision due to diverse preferences and that as a result, citizens from ethnically heterogeneous states have the incentive to secede and create new, smaller states. In China, Dincer and Wang (Reference Dincer and Wang2011) find a negative relationship between ethnic diversity and economic growth throughout Chinese provinces. Although ethnic diversity does not fully explain the growth differentials between Chinese coastal and inland provinces, the authors find that, the high level of ethnic diversity in inland China nevertheless appears to be an important factor. Mauro (Reference Mauro1995) shows that a high level of ethnolinguistic diversity implies a lower level of investment. Easterly and Levine (Reference Easterly and Levine1997) show that ethnic diversity has a direct negative effect on economic growth. Bluedorn (Reference Bluedorn2001), based on the study of Easterly and Levine (Reference Easterly and Levine1997), presents empirical evidence of democracy's positive role in ameliorating the negative growth effects of ethnic diversity. In this study, the role of NIM in ameliorating the negative effects of diversity on bank stability is examined.

The third channel through which diversity can affect banking stability is through the management decisions of firms and banks. As indicated by Fahlenbrach et al. (Reference Fahlenbrach, Prilmeier and Stulz2012), the behaviours of people, their values and preferences which are influenced by the national culture tend to drive the supply of capital by banks and hence their performance. Other decisions such as strategic decisions, capital structure and debt maturity choices and dividend policy decisions have also been found to be influenced by the culture of the country (Chui et al., Reference Chui, Titman and Wei2010; Shao et al., Reference Shao, Kwok and Guedhami2010; Zheng et al., Reference Zheng, El Ghoul, Guedhami and Kwok2012). Even for financial firms, studies like those of Ashraf et al. (Reference Ashraf, Zheng and Arshad2016), Kanagaretnam et al. (Reference Kanagaretnam, Lim and Lobo2014) and Kanagaretnam et al. (Reference Kanagaretnam, Lim and Lobo2011) link financial firms and culture by finding an impact of culture on bank risk-taking and accounting conservatism as well as bank earnings' quality. Emenalo et al. (Reference Emenalo, Gagliardi and Hodgson2018) also find that ethnic fractionalization reduces financial development.

As indicated earlier, firms in more heterogeneous societies are more exposed to risks because of corruption, cronyism, political instability and conflicts. Thus, when firms operate in these societies, they are more likely to take more risky decisions resulting from corruption and cronyism which would lead to lower performance. For banks, riskier decisions can be taken because of moral hazard and adverse selection. Some loan officers may favour their family members, tribesmen and members of their religious groups in giving them loans and even lower interest rates. These people otherwise may not be so qualified. These actions put banks at a higher risk of poor asset quality and thus threaten their stability. As a result of these actions, there is the likelihood to find more NPLs in these societies. The consequences of these actions not only affect the economy as a whole but also affect the banking sector as these banks operate in the country. These negative effects of diversity on the development of the financial system and the growth of the economy can lead to an unstable banking system. The study specifically examines how this affects banking stability in SSA.

I argue that, banks in these societies are likely to charge higher margins as a price for the risks from a higher probability of non-repayment of loans resulting from the heterogeneous environment. To mitigate these risks resulting from diversity, financial institutions should maintain a minimum margin that will ensure their stability. Foreign banks however are less likely to face the adverse effects of diversity and can contribute to stabilizing the banking system where the country is more fractionalized and polarized. This study therefore examines this in the context of SSA to inform policy decision.

3. Methodology

Dataset

I use county-level data for the estimations from 1996 to 2014. Thirty-nine SSA counties are sampled for this study. Data are sourced from Global Financial Development Database (GFDD), World Governance Indicators (WGI) and World Development Indicators (WDI) of the World Bank. Data on ethnic/religious fractionalization and polarization are taken from Montalvo and Reynal-Querol (Reference Montalvo and Reynal-Querol2005). Regarding diversity itself, it is unlikely to change: Williamson (Reference Williamson2000) argues that the values and beliefs of individuals are very slow to change, in the order of every 100–1,000 years. I, therefore, use these variables for this study.

Model specification

To address the main hypothesis of the study, I specify the model below to understand the impact of diversity on banking stability. I follow the model of Dwumfour (Reference Dwumfour2017) with modifications. Unlike Dwumfour (Reference Dwumfour2017), I include measures of diversity (ethnic and religious fractionalization and politicization) to examine their roles in banking stability. I also include interaction terms to examine the moderating roles of NIM and foreign banks on the diversity-stability nexus. I also examine the role of legal origins in these relationships.

where Stab i,t is the stability measure (Z-score or NPL) of country i at time t. This is estimated in separate models. Diverse i is the diversity measure which includes ethfrac, ethpol, relfrac and relpol, representing ethnic fractionalization, ethnic polarization, religious fractionalization and religious polarization, respectively. The diversity variables are used in separate estimations. NIM it is the net interest margin of country i at time t and NONIM it is the ratio of net non-interest income to total income. CONCEN i,t is the level of concentration of country i at time t. Foreign i,t is the percentage of foreign banks of the total banks in country i at time t. Boone it is the level of competition as measured by the Boone indicator of country i at time t. Inflation it is the log of the average consumer price index for a year for country i at time t. RegQ i,t is the institutional quality variable as measured by regulatory quality of country i at time t. ɛit is the error term.

I proceed to identify the interaction of diversity and NIM and also identify any threshold effect in the relations between diversity and financial stability. As explained earlier, I expect diversity to reduce banking stability. However, at certain levels of NIM, financial stability could be improved. I, therefore, follow the model below:

where Diverse i × NIM it is the interaction between diversity and net interest margin. All other variables are as defined earlier. As indicated earlier, when I use z-score (NPL) as stability measure, I expect β 1 to be negative (positive) indicating diversity to reduce stability. When I use Z-score (NPL) as stability measure, I expect β 2 to be positive (negative) indicating that NIM can offset the adverse effect of diversity on stability and turn it to improve stability.

Variables description

The stability measures used are: Z-score and the ratio of NPLs to gross loans. Z-score is calculated as (ROA + (equity/assets))/sd (ROA), where sd (ROA) is the standard deviation of return on assets (ROA). To measure Diverse, the study uses the ethnic and religious fractionalization and polarization indices developed by Montalvo and Reynal-Querol (Reference Montalvo and Reynal-Querol2005).Footnote 1 The fractionalization index has a simple interpretation as the probability that two randomly selected individuals from a given country will not belong to the same ethnic or religious group. The polarization index accounts for conflict dimensions.

On the controls, NIM is the accounting value of a bank's net interest revenue as a share of its average interest-bearing (total earning) assets. Non-interest income to total income (NONIM) is bank's income that has been generated by non-interest-related activities as a percentage of total income (net-interest income plus non-interest income). Bank asset concentration (CONCEN) is the assets of the three largest commercial banks as a share of total commercial banking assets. Foreign entry (Foreign) is the percentage of the number of foreign-owned banks to the number of the total banks in an economy. Boone indicator (Boone) is a measure of degree of competition, calculated as the elasticity of profits to marginal costs. An increase in the Boone indicator implies a deterioration of the competitive conduct of financial intermediaries.Footnote 2

Inflation is the log of the average consumer price index per year. Regulatory quality (RegQ) is the regulatory quality index from the WGI of the World Bank. This is used to measure institutional quality. The WGI is made up of six indicators namely, voice and accountability, political stability and non-violence, government effectiveness, regulatory burden, rule of law, and control of corruption. Higher values indicate better or strong institutional quality. These indices for the SSA region are highly correlated with approximately 0.70 correlation coefficient (Dwumfour and Ntow-Gyamfi, Reference Dwumfour and Ntow-Gyamfi2018); hence, the justification of selecting one index (RegQ) to measure institutional quality. I also construct an equally weighted institutional index (Quality) of the six indicators to use as robustness checks. These indicators are set from approximately −2.5 (weak) to 2.5 (strong). Thus, higher values indicate better or strong institutional quality.

Estimation technique

I use an instrumental variables (IV) approach namely, the system Generalized Method of Moments (sys-GMM) developed by Blundell and Bond (Reference Blundell and Bond1998) which addresses endogeneity issues in the models. The structure of models 1 and 2 gives rise to autocorrelations. To reduce the potential biases and imprecision associated with the usual estimator (difference GMM), I use a new estimator (sys-GMM) that combines in a system the regression in differences with the regression in levels. Greene (Reference Greene2018) shows that GMM encompasses a class of estimators of which 2SLS and 3SLS are special cases. The single equation GMM estimates and GMM estimates of simultaneous equations may offer an advantage over 2SLS and 3SLS counterparts in that they are more efficient in the presence of arbitrary heteroscedasticity (Greene, Reference Greene2018; Wooldridge, Reference Wooldridge2002).

Roodman (Reference Roodman2009) presented conditions that need to be fulfilled when employing GMM estimations, namely (a) some regressors may be endogenously determined; (b) the nature of the relationship is dynamic, implying that current stability is affected by previous ones; (c) the idiosyncratic disturbances are uncorrelated across individual; (d) some regressors may not necessarily be strictly exogenous; and finally, (e) the time periods in panel data, T, may be small (i.e. ‘small T, large N’). Thus, the GMM model, which is generally used for panel data, provides consistent results in the presence of different sources of endogeneity, namely ‘unobserved heterogeneity, simultaneity and dynamic endogeneity’ (Wintoki et al., Reference Wintoki, Linck and Netter2012: 588). Two-step system GMM relies on internal instruments (lagged values, internal transformation) to address the different sources of endogeneity. I use the two-step system GMM which helps to address the possible endogeneity issues associated with the various determinants of bank stability. For instance, the introduction of lagged stability is necessary because it is likely that the previous year's stability is likely to influence the following period's stability levels. This estimator has been widely used by other studies including those of Dwumfour and Ntow-Gyamfi (Reference Dwumfour and Ntow-Gyamfi2018) and Dwumfour et al. (Reference Dwumfour, Agbloyor and Abor2017).

It is also typically quite easy to implement GMM counterparts to 2SLS and 3SLS with modern econometric packages (Cameron and Trivedi, Reference Cameron and Trivedi2010). This is because, the use of the 2SLS and 3SLS requires finding instrumental variables which are generally not easy to find and sometimes can even be impossible (Antonakis et al., Reference Antonakis, Bendahan, Jacquart and Lalive2010). Following Roodman (Reference Roodman2009), the lags of the independent variables were used as instruments. Since this reduces the number of observations and power of regressions, I employ the collapsing method of Holtz-Eakin et al. (Reference Holtz-Eakin, Newey and Rosen1988) and the Arellano and Bover (Reference Arellano and Bover1995) forward orthogonalization procedure to limit the number of instruments. I test the instrument validity by using Hansen's J statistic of over-identifying restrictions. The Hansen's J statistic is used in place of the Sargan test of over-identifying restrictions because of its consistency in the presence of autocorrelation and heteroscedasticity (Roodman, Reference Roodman2009). The Hansen's J statistics tests the null hypothesis that the over-identifying restrictions are valid. I make sure to check whether deeper lags of the instrumented variables are correlated with deeper lags of the disturbances. The study uses the Arellano and Bond (Reference Arellano and Bond1991) AR (1) and AR (2) tests to check for first and second-order serial autocorrelation. For sys-GMM, I only check for the absence of second-order serial autocorrelation.

4. Stylized facts and preliminary data observations

Here, I present some facts about the fractionalization and polarization indices of SSA and compare with other regional groupings according to the World Bank classification. Comparison is also made for the stability measures and net interest margin. These are shown in Figure 1. Adding up the indices, from Figure 1a, it can be seen that, SSA region is the most heterogeneous region followed by the Latin American and Caribbean (LAC) region. The least heterogeneous region is the East and Central Asia (ECA). It is interesting to note that, while the LAC region is the most ethnically polarized, the SSA region is the most ethnically and religious fractionalization and the most religiously polarized region. This justifies why I selected the region for the purposes of this study.

Again, in Figures 1b and 1c, a comparison is made of the banking stability of various regions. From Figure 1b, when Z-score is observed, the SSA region has one of the lowest average Z-score only leading the ECA region. From Figure 1c, when NPL is compared among the regions, I see that the SSA region has the most unstable banking system with the highest average NPL among the various regions. These observations further show the importance of studying the stability of the SSA region. With this low average Z-score value and the highest NPL values, it is important to study the factors that drive banking stability in the region so as to inform policy decisions.

Further, as I argued earlier, banks in more heterogeneous societies are likely to set higher margins to offset the risks associated with heterogeneity. Unsurprisingly, from Figure 1d, the SSA region which is the most heterogeneous region has the highest NIM among all the other regions of the world. This further justifies why it is important to examine the role of NIM in offsetting the risk associated with diversity and for that matter, determining the threshold NIM is key. From Figure 1 also, ECA which is the least heterogeneous region has the least NIM.

5. Descriptive statistics

Here, the study presents the summary statistics and correlation matrix of the data used in the study. From Table 1, the Z-score shows wide variations from −1.31 to 95.28 with the mean score of 11.23 indicating some countries' banking markets are far below the sub-regional average stability. The mean and median NPL values were 11.31% and 8.23%, respectively, with the highest NPL score of 74%. This shows that half of the countries in the continent have above approximately 8% NPLs as a ratio of gross loans while the other half falls below this rate. From the table, countries in the SSA are more religiously polarized (relpol, mean = 0.7451, median = 0.8428) while ethpol has mean and median values of 0.5491 and 0.5756, respectively. This shows that, the continent is more likely to experience conflicts and the associated adverse effects of polarization resulting more from religion than from ethnicity. When fractionalization is used, the region is more ethnically fractionalized with ethfrac averaging 0.6657 with a median value of 0.7325 and relfrac having a mean of 0.45 and a median of 0.4974. Thus, in picking two random individuals, there is a higher probability of ethnically fractionalized society than religious fractionalization. The table also shows the average regq −0.6365 showing the region has weak regulatory quality. The median nim for the continent is 6.8% indicating half of the continent charge below and above 6.8% of NIM. nonnim however recorded a higher median value of 43.1%. The table shows a more concentrated banking market in the region with an average of 78.9% of the three-largest banks controlling the assets of the sector. Almost 50% of banks in the region are foreign owned. The average inflation for the region is 12.3%.

Table 1. Descriptive statistics

Source: Author's calculations. Note: Z-score is the z-score variable, NPL is the ratio of nonperforming loans to gross loans, ethpol is the ethnic polarization index, ethfrac is the ethnic fractionalization index, relpol is the religious polarization index, and relfrac is the religious fractionalization index, Regq is the institutional quality variable measured by regulatory quality, nim is the net interest margin, nonim is the ratio of non-interest income to total income, concen is the assets of three largest commercial banks as a share of total commercial banking assets, boone is the boone indicator as a measure of competition, foreign is the ratio of foreign banks to total banks in a country, and cpi is the natural logarithm of the consumer price index (CPI).

6. Empirical results and discussion

All estimation diagnostics point to a significant fit of the regression models. The test of the validity of the results as indicated by the Arrellano-Bond test, AR (2), and the Hansen's J tests suggests that all the regressions are valid. The estimates indicate that the lag of the dependent variables is significant in all the regressions. This indicates that the previous year's banking stability affects the subsequent year's banking stability justifying the dynamic nature of this relationship, hence the use of sys-GMM.

Fractionalization, polarization and bank stability (Z-score)

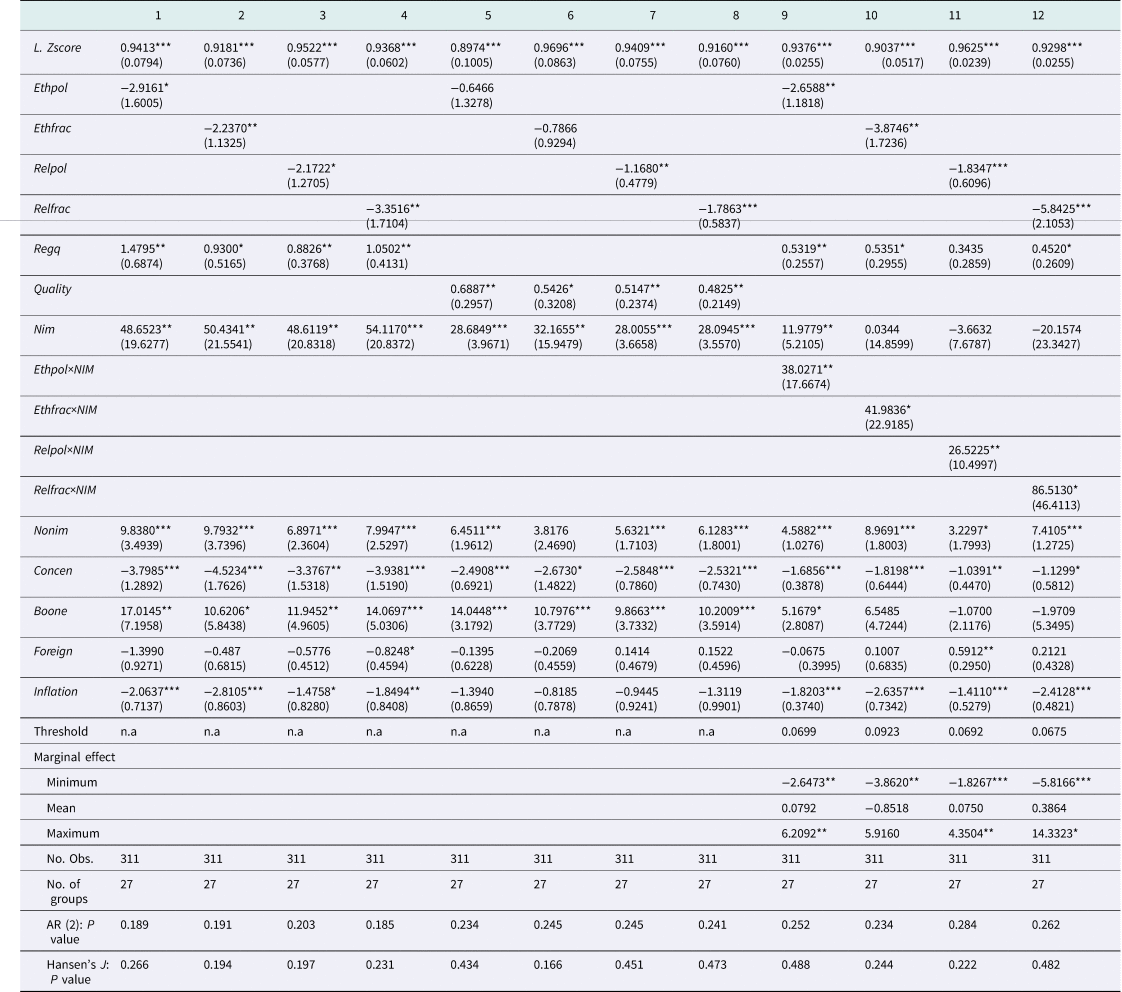

The results are presented in Table 2. From the table, all the heterogeneity variables (ethpol, ethfrac, relpol and relfrac) have a significant negative impact on banking stability. This is consistent when both regq and quality are used as institutional quality variables. Each of the heterogeneity variables was estimated first without the interaction and second with the interaction with NIM. From the table, when the variables interact with NIM (columns 9–12), ethnically fractionalized countries require the highest threshold NIM of 9.23% to offset the negative impact of ethfrac on stability (column 10) followed by Ethpol which requires a threshold NIM of 6.99% to offset its negative effect on bank stability (column 9). Relpol follows with a threshold NIM of 6.92% to offset any negative impact on stability (column 11) while religiously fractionalized countries require a threshold NIM of 6.75% (column 12) to offset the negative impact on stability. From the results, it may seem that extra effort is required to offset the negative impact of the ethnic heterogeneity on banking stability compared to NIM required to offset the negative impact of religious heterogeneity on bank stability. This may be that, it is more difficult to manage (using NIM) the risk exposure of banks in societies that are more ethnically heterogeneous than religiously heterogeneous societies. From the table, the average threshold NIM required to offset the negative impact of heterogeneity on bank stability as measured by the Z-score is 7.47%.

Table 2. Fractionalization, polarization and banking stability (Z-score)

Source: Based on research data. Note: ***significance at 1%, **significance at 5%, *significance at 10%. All other variables are as defined earlier.

Having established the existence of moderating effect, the next step is to compute the marginal effect. The marginal effects show that fractionalization and polarization have a significant negative effect on banking stability at minimum levels of NIM. However, at mean NIM, the impact is generally positive even though not significant. The results however show that at maximum levels of NIM, there is a significant positive impact of fractionalization and polarization on banking stability.

Fractionalization, polarization and bank stability (NPL)

Here, the study uses NPL as a banking stability measure. Again, from Table 3, all the heterogeneity variables (ethpol, ethfrac, relpol and relfrac) have a significant positive impact on NPL showing that heterogeneity reduces bank stability. This is consistent when regq and quality are used as institutional quality variables. Here also, each variable was estimated first without the interaction and second with the interaction with NIM. From the table, when the variables interact with NIM, consistent with the earlier results, ethnically fractionalized countries require the highest threshold NIM of 9.07% to offset the negative impact of ethfrac on banking stability (column 10). This was followed by relpol, with a threshold NIM of 5.29% required to offset any negative impact of relpol on stability (column 11) while ethnically polarized (ethpol) countries require a threshold NIM of 4.82% (column 9) to offset the negative impact on stability. From column 12, the interaction of relfrac and NIM was not significant hence threshold was not calculated. Again, these results generally show that banks in ethnically heterogeneous societies will require more by setting higher NIM to offset any negative impact on stability resulting from the heterogeneous nature of the society. From the table, the average threshold NIM required to offset the negative impact of heterogeneity on stability as measured by NPL is 6.39%. The estimation of the marginal effects shows that at minimum levels of NIM, the impact of fractionalization and polarization on NPL is significantly positive. It is only at maximum levels of NIM where the net impact of fractionalization and polarization on NPL is negative showing a benefit to banking stability. At mean NIM, the impact is mostly negative though not significant indicating that high NIM can help improve stability.

Table 3. Fractionalization, polarization and banking stability (NPL)

Source: Based on research data. Note: ***significance at 1%, **significance at 5%, *significance at 10%. All other variables are as defined earlier.

From Tables 2 and 3, the overall threshold NIM required to offset the negative impact of heterogeneity on bank stability is 7.01%. This is almost equal to the average NIM for the continent of 7.36%. This indicates that, banks in SSA countries that achieve the average or above average level of profitability for the continent= are likely to mitigate the negative impact of diversity on bank stability.

Impact of controls on bank stability

From Tables 2 and 3, the results show that NIM is the major determinant of bank stability in SSA. This shows that NIM which is a traditional income of banks improves banking stability. Caution should however be taken as Dwumfour (Reference Dwumfour2017) finds a threshold effect of NIM on stability. The results also generally show that non-traditional activities of banks also improve banking stability. I however find an ambiguous impact of concen on stability depending on the stability measure used. From Table 3 when I use Z-score, I find that concen has a negative impact on stability showing that more concentrated markets lead to less stability. This supports the concentration-fragility hypothesis. However, when NPL is used as in Table 3, concen generally has a significant negative impact on NPL except in column 2 supporting the concentration-stability view. Thus, the impact of concentration on stability may be an empirical issue. Again, from Table 3, boone has a positive impact on Z-score while in Table 3, boone has a negative impact on NPL. This shows that less competition improves stability. The evidence generally shows that inflation reduces stability both for Z-score and NPL. The results also generally show that foreign reduces stability. This shows that a high share of foreign banks may lead to unstable banking markets. It is important to examine how the opening up of the banking system to foreign entry can be targeted to realize the net benefit.

The role of foreign banks and legal origins

Here, the study examines the role of foreign banks and legal origins in the heterogeneity-stability nexus.Footnote 3 I conjecture that the inflow of foreign banks can help mitigate the negative impact of heterogeneity on bank stability. I find that the presence of foreign banks helps to reduce and eliminate the negative effect of heterogeneity on banking stability depending on the percentage share of foreign banks in a country. Also, by classifying the samples into British common law origin and French civil law origin, the results are generally consistent with the estimations for the whole sample.

7. Policy discussion

The study examined the impact of ethnic and religious fractionalization and polarization on bank stability. The results show that ethnic and religious fractionalization and polarization are negatively related to banking stability. As I argued earlier, more polarized and fractionalized communities may bring about mistrust in business engagements. These businesses are less likely to form strategic partnerships and would either remain small or trade among those of their ethnic and religious affiliations. This may be prevalent because of Africa's informal sector being among the largest in the world (Medina et al., Reference Medina and Jonelis2017). These businesses in the informal sector are mostly characterized by small-scale businesses with the owners normally taking most of the decisions with less organized structures compared to a more formal, structured and possibly listed companies. The mistrusts may also be between lenders and the borrowers. This may lead to lending discrimination. The issue of lending discrimination has been widely documented in other regions and countries like the U.S. particularly on racial lines (Bayer et al., Reference Bayer, Ferreira and Ross2018; Charles and Hurst, Reference Charles and Hurst2002). Other studies (Alesina et al., Reference Alesina, Lotti and Mistrulli2013; Deku et al., Reference Deku, Kara and Molyneux2016) in many European countries also show large disparities in interest rates and credit usage across ethnic and gender lines where these disparities are not explained by any disparity in creditworthiness. Thus, loan officers/examiners or banks may be biased towards lending to people or business owners of certain ethnic and religious groups. When majority shareholders or managers are of a certain religious affiliation or ethnic group, there is likely to be lending discrimination. These actions are not profit-maximizing (Arrow, Reference Arrow1972). This may limit the potential of the bank to lend to other borrowers who may be more profitable and diligent in loan repayment. Even if these lenders lend to other ethnic or religious groups, they may charge higher interest on loans that will be expensive for these businesses repay becuase it limits their ability to make enough profit to expand to be able to repay the loans.

As a policy implication, banks should adopt more advanced forms of vetting loan application that limit human or face-to-face interaction as much as possible. Investment in technology that uses unbiased algorithms in vetting borrowers (especially consumer lending) can help in this regard. Bank supervisory authorities should open up the banking system to foreign entry. These foreign banks are likely to be devoid of any ethnic lines hence would greatly reduce this bias. Banks engaging in such behaviours may find it hard to survive under a strong lending competitive environment or at least reduce their level of bias. Banking authorities in Africa should have fair-lending or antidiscrimination laws that eliminate ethnic and religious discrimination but make creditworthiness a common discrimination factor. Proper channels of such grievances should be created and easily accessed. These results are consistent when I observe countries that have British common law and French civil law origins. Indeed, Leeson (Reference Leeson2005) observes that cooperation among people was inhibited mainly due to colonial influence which also inhibited trade between diverse agents.

The results also show that banks charge higher margins to offset the negative impact of fractionalization and polarization on banking stability. The average threshold of NIM when Z-score is used is 7.47% and 6.39% when NPL is used. The marginal effects at minimum levels of NIM showed a slight decrease in the negative effect of diversity on stability. In most of the cases, the marginal effect at the mean turned to improve stability with marginal effect at the maximum NIM completely improving stability in almost all cases. This seems to suggest that the vestiges of diversity as explained earlier may contribute to why banks in SSA seem to have higher NIM compared to other regions. It is however important to caution that this should not be pursued in isolation as very high NIM may also hurt stability. Thus, it is important for countries to consider their own realities in pursuing these policies and not to simply adopt the highest NIM on the continent. As a policy implication, one possible way to have lower NIM is to limit the influence of diversity on banking stability through the various measures discussed above. When the risks associated with more heterogeneous markets reduce, the level of NIM may also reduce signalling efficiency and lowering the cost of borrowing.

Alternatively, I find that though the high presence of foreign banks may itself exert some negative impact on bank stability, foreign banks help to eliminate the negative impact of fractionalization and polarization on bank stability. As discussed earlier, as a policy implication, regulatory bodies in countries with high ethnic and religious fractionalization and polarization should open up their banking system to foreign entry in order to limit the negative effect of heterogeneity on banking stability. Countries should examine their own realities and characteristics with regards to the level of ethnic and religious fractionalization and polarization and combine policies as discussed above with policies on foreign entry to help mitigate any negative effect of diversity on bank stability. Caution should however be taken to not expose the banking system to too much risk associated with a very high number of foreign banks. One possible policy direction for central banks or supervisory authorities is to ensure a diversified roaster of foreign banks in order to limit the exposure of the banking system to parent institutions of the foreign banks from particular countries.

8. Conclusion

Most empirical studies that have examined determinants of banking stability have generally related stability to bank, industry and macroeconomic variables without paying attention to the historical institution relating to ethnic and religious environment within which the banks operate. The ethnic and religious orientation of the citizens who access banking products and that of the loan officers who give out loans could have an impact on banking stability. The study examined the impact of ethnic and religious diversity on the stability of banks in SSA. The study generally found that banks in more heterogeneous societies in SSA are more exposed to instability, especially for banks in more ethnically fractionalized societies. I however find that, bank margins are the major means for banks to offset the risk from heterogeneity. This happens at a threshold NIM of about 7.01%. I also found that increasing the roaster of foreign banks in a country can help mitigate the negative effect of heterogeneity on banking stability. Further, the study recommends that, while banks institute strong internal risk management tools that check loan decisions by bank officers, more modern technologies like unbiased algorithms can also be deployed for loan vetting to reduce the face-to-face interactions and hence any negative effect of heterogeneity on banking stability. Further studies are needed to develop the theoretical basis of the diversity-banking stability nexus. Other empirical studies can also look at various means through which any negative effect of diversity on bank stability can be mitigated. Further studies can also be done using bank-level data to explore different ownership structures of banks and how these can influence the diversity-stability nexus.

Acknowledgements

I am grateful to the Editor, Prof. Goeffrey Hodgson, four anonymous reviewers, and Matthew Ntow-Gyamfi for useful comments and suggestions. The usual disclaimer applies.