INTRODUCTION

Good economic institutions are a prerequisite for economic growth. From an economic perspective, institutions are created when the social benefits of building them exceed the transaction costs involved (Demsetz, Reference Demsetz1967; North, Reference North1981, Reference North1990). A quality government, for instance, can improve economic development not only through providing tangible public goods to the economy, such as infrastructure, but also by reducing transaction costs, e.g., speedy approval of foreign investment. Acemoglu, Johnson, and Robinson (Reference Acemoglu, Johnson and Robinson2001, Reference Acemoglu, Johnson and Robinson2002) estimate that the effects of political institutions on income per capita are significant. Similarly, Bertocchi and Canova (Reference Bertocchi and Canova2002) find that colonial indicators add significant explanatory power to worldwide growth regressions, while Beck, Demirguc-Kunt, and Levine (Reference Beck, Demirguc-Kunt and Levine2003) find that initial institutional endowments explain national variation in the development of financial intermediaries and stock markets of former colonies.

At least three theories are relevant to the impact of the quality of government on firm performance. Since a government is a political institution, primary theoretical support should be found in theories of institutions and political science. Institutional theory (North, Reference North1981, Reference North1990) argues that the efficacy of institutions is an essential prerequisite to economic performance. La Porta, Lopez-de-Silanes, Shleifer, and Vishny (Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny1997, Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny1998, Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny2000, Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny2002) specifically emphasize the role of law and legal tradition on governance and performance of firms. Political science theory (Marx, Reference Marx1872; Olson, Reference Olson1993) suggests that political institutions are shaped by those in power in an effort to fortify their hold and channel resources to augment their private benefit. Rajan and Zingales (Reference Rajan and Zingales2003) find that most nations have only recently surpassed their 1913 levels of financial development, a finding explained by the political interest group theory of financial development where incumbents oppose development because it breeds competition. From this perspective, interest groups formulate inefficient government policies and regulations that will benefit themselves regardless of economic efficiencies and costs. Moreover, a government is also a collection of interest groups, including bureaucrats. Agency theory (Jensen & Meckling, Reference Jensen and Meckling1976; Schleifer & Vishny, Reference Shleifer and Vishny1998) – as it relates to government interactions – posits that rent-seeking bureaucrats can either help or hurt firms, depending on whether the marginal benefits of the firm's association with officials outweigh marginal costs.Footnote [1] Large government shareholding has the potential to produce both positive and negative effects on firm performance. By providing close oversight and adding to possible sanctions, government ownership can serve to mitigate agency behavior on the part of the CEO and senior officers (La Porta et al., Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny2002). At the same time, government ownership may expropriate company wealth at the expense of other shareholders, interfere with firm decision-making, and introduce negative norms such as patronage and complacency. Shleifer (Reference Shleifer1998) argues that state ownership reduces the capitalist incentive to innovate and consequently hampers firm performance.Footnote [2]

In sum, the government is a political institution, whose quality and mode of operation impact key features such as regulation, competition, resource munificence and allocation, business infrastructure and the availability of an independent and properly enforced legal system, among other factors. La Porta et al. (Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny1999) document that the quality of national government is positively associated with economic growth.

The above literature is concerned with national institutions, that is, it is set to determine the role of the national government as well as other national-level variables in the economy. This misses the key role played by local government in guiding economic activity, including, for instance, resource collection, reallocation, regulation, and infrastructure development. This is especially true where the local government plays a substantial economic and political role. Figure 1 shows the 2001 local share of government expenditure and revenue in twenty nations included in an OECD study (2005), indicating that local authorities play a substantial and sometimes decisive role in resource allocation. Compared to the national level, regional research, as well as firm-level analysis, provides a fine-grained disaggregate analysis that is more closely aligned with the economic and political realities on the ground. Regional variation in countries such as China is very substantial with local authorities accounting for most spending and revenues, so the regional level is at least as relevant as the national level for economic activity. Moreover, as clearly illustrated by the case of China, regional variation and change are often a precursor and an experimental ground for national transformation.

Figure 1. Local share of government expenditure and revenue, 2001

Notes: Chinese data include on-budget and off-budget accounts and central government bond issues on behalf of local governments. Sources: OECD Economic Survey China, 2005/13 (based on Ministry of Finance study by Joumard & Kongsrud, Reference Joumard and Kongsrud2003)

Building on the work of Kornai (Reference Kornai1990, Reference Kornai1992), Walder (Reference Walder1995) argues that the organizational characteristics of local governments can explain regional divergence in Chinese industrial dynamism. Two World Bank studies – Dollar, Hallward-Driemeier, and Mengistae (Reference Dollar, Hallward-Driemeier and Mengistae2005) and Dethier, Hirn, and Straub (Reference Dethier, Hirn and Straub2011) – provide firm-level evidence for the relationship between business climate and enterprise performance. Another World Bank study by Cull, Xu, Yang, Zhou, and Zhu (Reference Cull, Xu, Yang, Zhou and Zhu2013) reports survey-based evidence that government provision of market information as well as government loans is positively associated with firm efficiency in China. Firth, Gong, and Shan (Reference Firth, Gong and Shan2013), however, point to the cost of provincial government such as administrative expenditure that can lower firm values in China. Li, Li, and Zhang (Reference Li, Li and Zhang2000) developed an institutional framework on how decentralization and competition among local governments stimulated firm performance in China. Still, no existing empirical work examines the array of local government services that affects the quality of local government and its impact on firm performance in a comprehensive fashion in China or in any other country.

The present paper empirically examines the impact of the quality of regional government on listed firms using a dataset of 7,873 firm-year observations in China over a thirteen year period from 1994 to 2006. There are a number of reasons why China provides an ideal setting for this study: First, it is a vast and diverse country differentiated along linguistic, ethnic, and regional culture lines, where local administration has been an integral part of the bureaucratic apparatus for thousands of years. Second, over two-thirds of government spending in China occurs at the sub-national level, a very high proportion by international standards (OECD, 2005). Third, China is an economy strongly influenced by its political institutions, permitting a close attention to their impact. It is also the first major economy to undergo economic liberalization while retaining an autocratic government. Finally, China is a major emerging economy which is on a path to become the world's largest, augmenting interest in the workings of its economy and the performance of its enterprises.

We use data from the National Bureau of Statistics and other sources and develop fourteen proxies for local government quality in the spirit of La Porta et al. (Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny1999), including being relatively laissez-faire (Smith, Reference Smith1776), the quality of bureaucracy (Rauch, Reference Rauch1995), the quality of public service (North, Reference North1981, Reference North1990), political freedom (Hayek, Reference Hayek1944), protection of ethnic minorities (Landes, Reference Landes1998), and public sector size (Barro, Reference Barro1991; Shleifer & Vishny, Reference Shleifer and Vishny1994, Reference Shleifer and Vishny1998). For robustness, we use a marketization index, i.e., the National Economic Research Institute Index of Marketization (NERIIM) by Fan, Wang, and Zhang (Reference Fan, Wang and Zhang2001). To take account of local variation in variables unrelated to direct government action, we control for local economic growth, natural resources, income distribution, ethno-linguistic homogeneity, foreign trade activities, and the existence of major maritime ports. We also control for firm- and industry- specific variations such as size and growth in addition to a host of firm ownership and governance factors.

We find that the quality of provincial government is positively associated with firm performance as measured by market-to-book ratio, return on assets, and labor productivity. Among the various aspects of government quality, the most important is to have a free economic zone in the region with low taxation, bureaucratic efficiency, and quality public service – in a macro context this variable depicts the level of public sector efficiency. This provides new evidence on what constitutes a good local government. The next most important factors are marketization index and an efficient and effective property registration process. It is followed by environmental protection, a probable reflection of an alarmingly worsening environment in China.

Most intriguingly, political freedom has a significant impact on firm performance and productivity, even in a regime where it is not practiced, although this result is based largely on the regional coverage of the Voice of America. This has never been documented before at a microeconomic level and barely so at a macro level, vindicating Hayek (Reference Hayek1944). Helliwell (Reference Helliwell1994) shows linkages between democracy and economic growth, using international country-level data for 1960–1985, but our paper is the first to show that political freedom is conducive to improved firm performance using firm-level and regional government data within a country that permits certain economic freedoms but does not allow political freedom.

In the following section, we briefly discuss China's system of government and the role of the Communist Party of China (CPC) at the central and local level. It is followed by data description and proposed empirical models. We then carry out the empirical test and explain the findings, followed by a discussion of additional issues, and conclude with a summary and suggestions for further research.

GOVERNMENT AND FIRMS IN CHINA

China is an oligarchy in which political power and personal advancement depends on gaining and retaining the support of an informal body of people who constitute the leadership of various political and government organizations. Despite its autocratic nature, central government leaders must build consensus for new policies among key stakeholders, including party members, local and regional leaders, influential non-party constituencies, and the population at large. Control, perceived vital to the regime's very survival, is maintained through propaganda and censorship (most notably the Internet and the press), among other measures, as well as through an intricate control apparatus spanning all facets of life in which the CPC plays a central role. The CPC, in turn, is closely interlocked into the government (central and local) and the People's Liberation Army as well as the labor union and other institutions where its members, roughly 87 million strong, occupy most key positions. The Party is also represented in all state owned and controlled enterprises and indirectly oversees other firms as well (for instance, all Foreign Invested Enterprises are required to admit a party-controlled union).

Immediately below the central government seat in Beijing are twenty-two provinces, five autonomous regions located in areas with a large proportion of ethnic minorities, and five administrative cities under the direct control of central government.Footnote [3] The provincial-level administration has been around for millennia as an integral part of the bureaucracy of Imperial China and has been key to its ability to control a vast and diverse territory with a relatively small number of officials. Although governors were appointed by the central government, the provincial administration enjoyed considerable autonomy as long as it did not openly violate critical policies of the center articulated in the form of imperial edicts. This was particularly true in regions distant from the capital, such as the South, where a saying still popular today was ‘the mountain (the sky, in another version) is high and the emperor is far away’.

The same tension between center and provinces regarding policies and their implementation exists today. Differences among provinces on regional culture, social mores, lifestyle, dialects, and the like remain, and some differences have actually been accentuated by variable exposure to the outside world (which tends to be much higher in coastal versus inland provinces). Provincial interests often diverge, for instance, in times of shortage, provinces have been known to block the outflow of vital raw materials to other provinces. Leadership at the central level requires careful balancing of regional interests and representation, and the importance of regional autonomy cannot be overemphasized. For instance, when then President Hu Jintao met with the US President Barack Obama, he agreed to disband rules on local design nationally. Yet such agreement was ignored at provincial levels, and multinationals were back complaining about a major problem they thought was resolved months ago (Wall Street Journal, April 18, 2011). Still, China's provinces (and to a somewhat lesser extent the autonomous regions) share a common written language, strong national culture, a sense of shared history, and a basic institutional structure which has been replicated throughout the country and which reports to central institutions at every level (for instance, the Ministry of Water Resources in Beijing will have parallel reporting departments in every province). This provides for an ideal setting in which to test the impact of provincial government quality on firm performance.

Appendix A provides a description of all listed Chinese firms by province and industry, reflecting large regional differences. Tibet has the smallest number of listed firms, 8, while Shanghai boasts the highest, at 147. Although not reported separately, the Pearson correlation between the regional share distribution, defined as the number of listed firms in each province, and the regional political power distribution in the CPC, defined as the number of people from each province in the National People's Congress, is 0.42, with one percent level of significance.

DATA DESCRIPTION

Most of our data pertaining to the quality of provincial governments and other local factors (e.g., ethno-linguistic homogeneity) comes from China's National Bureau of Statistics. The publications include China Statistical Yearbooks, China Population Statistical Yearbooks, China Industrial Economy Statistical Yearbooks, China Industry Census, Urban Statistical Yearbooks of China, and the Almanac of China's Urban Economy and Society. In addition, we use information from the Party's official mouthpiece, the People's Daily, and from the China Information Center and State Administration of Radio, Film, and Television that are on government web portals. Various work reports by the Central Disciplinary Commission delivered to the National Congresses of the CPC are also utilized. Political freedom data come from the Voice of America, a US Government agency. A series of economic efficiency factors are obtained from Doing Business in China (a World Bank publication). Following the World Bank definitions, we cross-reference these performance indicators with local government websites, in case the database points out local efficiency directly. NERIIM data for marketization is adapted from Fan et al. (Reference Fan, Wang and Zhang2001). We use the China Stock Market and Accounting Research (CSMAR) and the China Corporate Governance Research (CCGR) database for corporate ownership and governance data, cross-referencing with the Taiwan Economic Journal (TEJ) database. The data source for the control variables is the CSMAR. Although the data are available from 1990, the year the Shanghai Stock Exchange was opened, the comparable accounting data using International Accounting Standards was not adopted until July 1993. Thus, 1994 is chosen as the starting point for the research, and 2006 is chosen as the end point to avoid the large exogenous shock by the 2007 global financial crisis. We include all listed firms yearly during the sample period, excluding those with missing necessary firm variable observations.

To assess the government impact on firm performance, we follow the convention in the corporate finance literature and La Porta et al. (Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny1999) study. The general model is

The firm performance variable is function of the quality of local government, other local factors, and firm-specific variables. For performance, we use three specifications: Market-to-book equity ratio as a market performance proxy; Return on Assets (ROA) as operating performance proxy; and Productivity, measured as the log of sales per employee in a listed firm.

Table 1 provides detailed data definitions and sources, while Table 2 reports descriptive statistics for sample firms. The variance inflation factors range from 1.0 to 2.9 among government quality variables in Table 2 (A), indicating that multicollinearity is not an issue for these variables. There is also no such concern for other variables in Table 2 with the exception of state versus institutional ownership; we include these two variables separately in our regressions.

Table 1. The list of variables for the quality of government, local factors, and firm characteristics

Table 2. Descriptive statistics (January 1994–June 2006)

Notes: See Table 1 for specific definition of variables. N is the number of firm-year observations (or the number of ones in the case of dummy variables).

Quality of Government

Table 1 Section A presents the list of quality of government factors, grouped into categories of economic efficiency, political freedom, public service, and low corruption. The first dummy variable is whether a local government is relatively non-interventionist and efficient in its bureaucratic processes. It identifies whether a listed company is located in a Special Economic Zone (SEZ) or an Open City in which firms enjoy, among other local government support, preferential tax treatment and a relatively speedy administrative process. The binary dummy variable is assigned one if a firm is located in this special status area, zero otherwise.

Wang (Reference Wang2013) reports that the SEZs boost productivity growth and significantly increase foreign direct investment in a region via a policy package that includes tax breaks and land use. Such regions also subscribe to the market as a primary driver of economic activity. While the establishment of SEZs ultimately requires an approval from the central government, it also represents a significant initiative and drive by the local authorities.Footnote [4] SEZs are listed separately in national economic development initiatives and have provincial-level authority on economic administration. They also have a local congress and government with legislative authority.

To provide additional evidence of the effect of local government quality, we also use the marketization variable (NERIIM), which provides a measure of the degree to which the provincial economy is subject to market mechanisms. Marketization has been used in a recent working paper analyzing its firm effect (Cheng, Wang, Li, & Tong, Reference Chen, Wang, Li and Tong2014). Since the NERIIM has changed its methodology significantly after 1999, we use the 1999 NERIIM.Footnote [5]

As a further robustness check, we collect three economic efficiency variables from Doing Business in China, covering a range of government regulations pertaining to starting a business, registering property, and contract enforcement. Doing Business in China is an affiliate of the World Bank and International Finance Corporation and reports whether a provincial capital city is ranked above the national average in each of the categories. We also cross-reference it with provincial government websites to ensure accuracy and application. Djankov, La Porta, Lopez-de-Silanes, and Shleifer (Reference Djankov, La Porta, Lopez-de-Silanes and Shleifer2002) find the regulatory cost of startup entry to be very high, which hampers economic growth. Shleifer (Reference Shleifer and Daniel Kessler2011) argues that in a country where courts fail to resolve contract and tort disputes cheaply, predictably, and impartially, which seemingly applies to the Chinese case, efficient government regulation is necessary.

The next index covers the size of the public sector in each region. We first rank order provinces based on the share of state enterprises in the local economy. Each of the 32 provincial governments is assigned a 1–8 score based on its group-of-four rank (shared with three other provinces or regions). A higher share of output from state enterprises yields a lower score on public sector size in a province.

Political freedom is difficult to measure, particularly in a one party system where political control is paramount. We resort first to the Voice of America (VOA) short-wave radio broadcast China, the official voice of the US government. According to desensitized reports by the US Office of Inspector General (OIG), ‘(t)he Government of the PRC is openly hostile to many of the branch's activities, having declared VOA to be a “subversive organization”. . . The Government of the PRC consistently has blocked VOA transmissions from reaching its citizens’. In politically sensitive regions such as Beijing or Tibet, the VOA is jammed to a point where no one can listen to its programming on all seven or eight broadcasting shortwave frequencies.Footnote [6] However, as the Chinese government tolerates certain VOA programs, in certain provinces such as Sichuan, it is possible to receive all VOA regional station transmissions in Chinese and English. The VOA provided a listening guide on its website, advising listeners where, when, and on what frequencies its broadcasts might be received.Footnote [7] We collected those data before VOA broadcasting was switched over to satellite and Internet media for budgetary reasons by the US government in 2011. If the VOA can be received in a province, we take it as a signal for comparatively high political freedom. We assign one to the political freedom dummy variable if this is the case, and zero otherwise. 1,569 observations, or 19.9 percent of the total sample, are from provinces where VOA can be received.

Another variable used to measure political freedom is whether the region is designated as an autonomous region. While more than 90 percent of China's population is Han Chinese, dozens of ethnic and religious minorities (e.g., Hui, Uyghurs) are unevenly dispersed throughout the country. The five autonomous regions are province-level administrative territories where ethnic minorities represent a substantial portion of the overall population. Under the Chinese constitution, these regions are supposedly guaranteed more rights, including religious freedom, than the provinces. At the same time, these regions are subject to stricter oversight from the central government. For example, Xinjiang has been plagued with ethnic and religious violence in recent years, leading to tightening controls in the region. We assign 1 to the autonomous region dummy variable if the province is an autonomous region, 0 otherwise. Both Appendix A and Table 2 indicate that very few listed firms hail from autonomous regions.

A third measure of political freedom is the concentration of broadcast media such as radio and television. A dummy variable indicates whether the number of local broadcast media adjusted by provincial population is above the national average. 1 indicates yes; 0 means no or missing information from the provincial branch of the State Administration of Radio, Film, and Television. On the one hand, higher media concentration fosters competition and encourages investigative reporting to attract audience, thus contributing to democracy; on the other hand, it may invite strict communist party controls, particular in big cities. Zhao (Reference Zhao1998) calls this ginger balancing act as a walk between ‘the Party Line and the Bottom Line’.

We use four factors to measure the quality of public services provided by the local government. The first counts the number of telephones per thousand persons in each province or region, which is a proxy for infrastructure. Wong (Reference Wong2004) finds that telephone traffic has a large effect on income per worker and total factor productivity, even more so than trade. Telephone lines per thousand people vary from 30 to 598 with a provincial median of 145 (see Table 2). The data pertains to landlines only since we believe that the pricing differential between landlines and cell phones in China during the sample period makes landlines a superior proxy. For regression purposes, we use the natural logarithm of these numbers. The second variable is the population literacy rate, representing the quality of education provided by the government. It ranges from 68.2 to 99.5 percent, with a nationwide average of 94.9 percent during the data period. The third proxy, infant mortality, a common indicator of health care quality, ranges from 1.0 to 4.2 percent.

Recent literature, e.g., Kahn, Li, and Zhao (Reference Kahn, Li and Zhao2013) and Zheng, Sun, Qi, and Kahn (Reference Zheng, Sun, Qi and Kahn2013), shed light on the interaction between firms, local governments, and the central government that codetermine the new economic landscape in China, in particular regarding the environment. We use an environmental protection dummy as our fourth variable, which examines whether a province had a municipality honored in the annual surveys by the State Environmental Protection Administration as one of the top five cities that are either most environmentally friendly or most effective in pollution control. Survey results cover roughly 90 percent of China's cities and are widely published, including on the website of the State Environmental Protection Administration and in the People's Daily. This proxy has potentially mixed impact on firm value: Stringent environmental protection will add significant cost to a firm's daily operation, yet it reduces pollution-related costs such as healthcare and eventual cleanup.

The low corruption variable examines the level of local corruption prosecuted – these data are culled from various work reports by the Central Disciplinary Commission and adjusted for population size. We then rank order the 32 provinces and regions (the higher the rank, the lower the corruption) and divide them into groups of four so that each local government is assigned one of eight rungs on the low corruption index. This index measures the extent of corruption, although it may also reflect the strength of law enforcement. However, prosecutor's power may be constrained because defendants may not be without political connections and influences. In addition, government officials cannot be prosecuted unless their party membership is stripped by the CCP. Thus, in practice, prosecutions are largely driven by periodic Party's anti-corruption campaigns, as courts are not independent but rather answerable to the Party; judgments are often reached behind closed doors and conviction rates are above 99 percent. Foreign news media often suggest that anti-corruption campaigns are seldom aimed at fighting corruption as such, but at other goals such as the consolidation of political power. On balance, we believe that the corruption index measures the extent of corruption rather than law enforcement; hence, the higher the value of the corruption measure, the lower the level of corruption given exogenous prosecution rate and near perfect conviction rate.

Local Controls

The vast provincial variation in such factors as geographic endowment needs to be controlled for in assessing the relationship between the quality of provincial government and firm performance. We use the following local variables as controls: GDP growth rate, natural resource endowment, Gini index measuring income distribution, and a scaled index for the percentage of Han, the majority ethnicity in China (a higher score means lower heterogeneity). We also use foreign trade activities and whether there are major seaports in the region. These are proxies for how international the local economy is. Exact definitions and sources of these variables are included in Table 1, section B.

Firm-specific Controls

We list three ownership variables in section C of Table 1. The first two are the proportions of state shares and legal person shares among total shares outstanding. These two variables are proxies for state and institutional ownership. Concentrated state and institutional ownership could have major ramifications for firm performance though the direction of the impact is debatable. Holderness (Reference Holderness2003) concludes that concentrated ownership in the US can be either positive or negative. Various studies such as Faccio and Lang (Reference Faccio and Lang2002) have documented much higher concentrated ownership for non-US economies, with concentration most often having a positive effect on firm value. La Porta et al. (Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny2000, Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny2002) view this as a response to a relatively weak legal shareholder protection. In China, state ownership implies not only concentration but also a potentially detrimental impact on corporate culture and mode of operation that are not conducive to performance (for instance, state owned enterprises are known for overstaffing); the OECD (2005) finds that total factor productivity for state owned firms is significantly lower than for collective and private enterprises.

The third ownership variable – foreign ownership – is a dummy variable examining whether the listed firm also has dual listed H-shares outside Mainland China and/or domestically listed B-shares that are restricted to foreign investors. While foreign ownership accounts for a small portion of listed Chinese firms, it could have a significant impact on firm value.

The percentage of outside board directors is used to measure effectiveness of internal corporate governance. Chinese boards are by-and-large weak insider boards, so a board with a large portion of outsiders could provide for more effective governance. There were only few independent directors in China until 2001 when CSRC introduced guidelines mandating at least one-third independent board members by June 30, 2003. Given the scarcity of independent directors during much of our sample period, we use outside directors not on company payroll as a proxy for internal governance effectiveness, as verified from the China Corporate Governance Research (CCGR) database. Other internal and external governance mechanisms such as executive compensation and the takeover market cannot be tested due to lack of data. For example, nominal executive compensation in Chinese firms consists mainly of fixed salaries which are not much higher than those of rank-and-file employees. However, executives enjoy a myriad of benefits ranging from free luxury housing and first class travel to deeply discounted company shares for which data are not disclosed.

Table 2 shows that the average state holding in the sample for 1994–2006 is 30.1 percent, while the average institutional holding is 32.9 percent. About 14.3 percent of sample firms have foreign ownership and 56.3 percent have outside directors. Firm variables include size, measured by the log of annual sales and leverages by total debt ratio. The average leverage (defined as total debt to asset ratio) of 40.6 percent is high vs. listed firms in most economies.Footnote [8] Media and communications, utilities and related industries, military, air and sea transportation, and financial services are presently regulated. Overall, 7.9 percent of sample firms are in a regulated industry. While shielding firms from foreign competition, regulation lessens pressure to stay innovative and competitive. Therefore the sign of the regression coefficient for the regulatory dummy variable is undetermined. The Shanghai Listing variable checks whether the firm is listed on the Shanghai Stock Exchange. Among listed shares, 64.8 percent of sample firms are listed on the Shanghai exchange, with the rest listed on the other national exchange in Shenzhen. We also have 21 industrial dummies and twelve annual dummies to control for industry and time effects.

RESULTS

The Impact of the Quality of Government on Firm Performance

Table 3 Section A reports the impact of the quality of government on firm performance. To handle firm and time clustering problems, we follow Petersen's two-way clustering approach (Petersen, Reference Petersen2009; Thompson, Reference Thompson2011). Overall, the quality of provincial government (including province-level autonomous regions and administrative cities) is positively associated with firm performance and productivity. The Special Economic Zone (SEZ) dummy variable covers both the market-oriented and efficiency sides of local government. We document that firms located in SEZ have on average a higher market-to-book ratio than non-SEZ firms by 0.163, and higher productivity by 0.151, in addition to having better ROA by 0.7 percentage point. All factors are significant at a 5% level in two-tailed tests. This is consistent with La Porta et al. (Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny1999) and the view that a good government is less interventionist (Knack & Keefer, Reference Knack and Keefer1997; North, Reference North1981; Smith, Reference Smith1776).Footnote [9]

Table 3. The effect of the quality of provincial government on firm performance

Notes: Estimation is done by pooled panel regression for the period of 1994–2006. The dependent variable is firm performance, measured by market-book ratio, ROA, or labor productivity (the log of sales per employee). Because of high correlation between state and institutional ownership, we only use one in each regression. To handle firm and time clustering problems, we use Petersen two-way clustering approach. The main results presented here are based on estimations with institutional ownership (in separate regressions, results are qualitatively identical except for state ownership which is statistically insignificant). * and ** denote 10% and 5% significance levels, respectively, on two-tailed tests.

Another dimension of government quality is the quality of the bureaucracy, which determines whether, when the government does intervene, it will be done speedily and efficiently, or with delays and corruption (Mauro, Reference Mauro1995; Treisman, Reference Treisman2000). Shleifer and Vishny (Reference Shleifer and Vishny1993) posit that greater interventionism is associated with lower efficiency, since entrusting officials with greater regulatory and taxing powers invites corruption and bureaucratic delay. The SEZ variable identifies local governments that are non-interventionist as well as administratively efficient. The results on SEZ are consistent with this view. In addition, the coefficient for marketization shows that for every point increase in this index, there is an average increase of 0.017 in market-to-book ratio (10% significance), though it appears to have little effect on ROA or productivity.

Among the three variables from Doing Business in China, the coefficient of the Registering Property variable shows that the market-to-book ratios are higher by 0.104 for firms located in high property registration efficiency regions. Labor productivity is also higher by 0.105 in the former, at 10% statistical significance level. As China shifted from a centralized to a market-driven economy, property rights and related issues such as property registration have been a key to its economic surge (Nee, Reference Nee1992). In March 2004, China's parliament voted on landmark changes to the constitution that protected private property for the first time since the 1949 revolution. Our results corroborate the importance of property rights.

The third variable used to capture economic efficiency is the size of the public sector. Barro (Reference Barro1991) argues that high government expenditure may reflect the willingness of the governed to pay taxes because they like what the government is doing. Shleifer and Vishny (Reference Shleifer and Vishny1994, Reference Shleifer and Vishny1998), however, suggest that public sector size is more indicative of political and distributive government policies than a reflection of public consent. We use the size of the state-owned enterprise sector, which is shown to be associated with higher firm productivity at 10% significant level in Table 3. This is consistent with Shleifer and Vishny's view (Reference Shleifer and Vishny1994, Reference Shleifer and Vishny1998) rather than Barro's (Reference Barro1991).

Another dimension of the quality of government is political freedom, based on the assumption that it generally accompanies economic freedom (Hayek, Reference Hayek1944). Friedman (Reference Friedman1962) and Ludwig von Mises (Reference von Mises1962) argue that economic freedom and political freedom are mutually dependent. We find that political freedom – measured by the availability of VOA in a local region – has a positive impact on firm performance and productivity. This is a very significant finding because being a one party authoritarian system overseeing a quasi-free market, China seems to defy the conventional wisdom regarding the relationship between economic and political freedom, and since prior studies at the macro-economic level generally fail to find a direct relationship between democracy and economic success (Barro Reference Barro1996a, Reference Barrob).Footnote [10] We expand further on this finding later in this paper.

Landes (Reference Landes1998) believes that ethnic and religious intolerance is responsible for the decline of many Catholic and Muslim countries. One measure of political freedom we use is whether a local government is an autonomous region with a high concentration of ethnic minorities, and thus subject to tight controls by the central government. In our sample, an autonomous region is linked with lesser productivity at 10% significance level (See Table 3). This indicates that less political freedom is associated with lower productivity. At the same time, it is possible that the finding should be attributed to the lower literacy rate in autonomous regions, which, in turn, is associated with low productivity. Some autonomous regions such as Xinjiang have also suffered from conflict between minority groups and the Han majority or government authorities. Conflicts of this kind could engender absenteeism and other disruptions, producing lower productivity numbers. We also used the concentration of broadcast media as yet another measure of political freedom. We did not find any statistically significant results here. This may be partially explained by the fact that many provincial branches of State Administration of Radio, Film, and Television failed to disclose the information on their websites.

The quality of provincial government is also related to the quality of public goods they provide such as schools, public health, and infrastructure. Availability of high quality public goods is a sign of a well-functioning government. The result in Table 3, however, does not show any statistically significant evidence: a proxy for infrastructure, e.g., the number of phones per thousand persons, does not show an impact on firm performance although its coefficient is positive. This may be because a large portion of landline telephones in China are extensions rather than direct-dialed numbers, making an accurate tally challenging. However, better education provided by local governments, as reflected by literacy rates, has a positive impact on firms’ productivity at the 5% level. This is in line with a suggestion by Glaeser, La Porta, Lopez-de-Silanes, and Shleifer (Reference Glaeser, La Porta, Lopez-de-Silanes and Shleifer2004) that human capital is a fundamental macro-economic source of growth. Quality healthcare furnished by local government, gauged by infant mortality rate, shows a positive but statistically insignificant effect on firm performance.

Environmental protection is an indicator of government quality with multiple dimensions. Natural environment preservation and improvement are considered a public service that private parties seldom have an incentive to undertake. At the same time, environmental sustainability could be a gauge of local political stability. Fredriksson and Svensson (Reference Fredriksson and Svensson2003) find that political instability has a negative effect on the stringency of environmental regulation if corruption is low, but a positive effect when corruption is high. Corruption reduces the stringency of environmental regulation, but the effect disappears as political instability rises. The correlation between the corruption index and the environmental protection variable is relatively low. However, we find that firms located in regions with good environmental protection have better performance. All market performance and productivity indicators are largely and significantly improved where environmental protection is in place. While stringent environmental regulations will increase a firm's operating cost, the extra burden is offset by a better government, which provides quality services. This is consistent with the OECD (2005) assessment of air pollution, which indicates that the benefits from reduced pollution in China are likely to exceed costs (a position increasingly taken by the Chinese leadership) though by a smaller margin than in developed economies.

Although not reported separately, environmental protection has much stronger results in the post-WTO (2001) period. This suggests that the greater attention devoted to environmental issues by central and local government has had an impact on firm performance, especially during the recent period. The State Environmental Protection Administration (SEPA) was elevated to a ministry level at the end of March 1998, and environmental metrics have been introduced by the central government and its agencies to measure the effectiveness of local governments. Environmental protection is prominently displayed in the most recent Five Year Plans and has been the subject of major speeches by the leadership in recent Party Congresses.

A form of government inefficiency is corruption stemming from lack of transparency. Our findings could be indicative of the extent of the problem at local levels, or, it could be showing the proclivity of local government to prosecute corruptions, a function that is highly restrictive in practice as discussed above. The positive sign of the variable's coefficient corroborates our presumption that the corruption proxy variable may reflect the extent of corruption rather than weak law enforcement.

Controls for Other Local Factors

Table 3 Section B reports a series of exogenous provincial factors that may have a significant impact on the firm's value, but have little to do with the quality of government. These factors serve as control variables. As expected, regional economic growth is positively associated with firm performance and productivity. Natural resource endowment does not have any loading on firm performance or productivity. Similarly, at a macro-economic level, Easterly and Levine (Reference Easterly and Levine2003) find no evidence that natural endowments such as tropics, germs, and crops directly affect national income. The coefficient of provincial Gini Index, measuring income distribution, is negative, suggesting that income inequality among the local population is negatively associated with firm performance and productivity. However, this is not statistically significant. Alesina, Devleeschauwer, Easterly, Kurlat, and Wacziarg (Reference Alesina, Devleeschauwer, Easterly, Kurlat and Wacziarg2003) study the impact of ethnic, linguistic, and religious fractionalization on economic growth for about 190 economies, and find that homogeneity has a significant economic impact. In our sample, ethno-linguistic homogeneity does not affect firm performance, which may be attributed to the overwhelming dominance of Han Chinese. We also find that the percentage of foreign trade to local GDP, indicating the degree of internationalization of the local economy, is positively related to firm performance.

Firm-specific Factors

Results on ownership and governance factors (Table 3 Section C) are generally consistent with prior literature. State ownership shows a negative but insignificant impact on firm performance, since it will only provide a positive impact when the marginal benefit outweighs the marginal cost (Faccio, Reference Faccio2006). Both firm size and leverage have a negative impact on firm performance while other factors are insignificant. Neither listing on the Shanghai Stock Exchange nor being in a regulated industry has a significant bearing on firm performance. This conforms to the findings in the general finance and China-specific literature (e.g., Sun & Tong, Reference Sun and Tong2003).

There exists a positive impact of institutional ownership on firm performance, a result similar to that reported by Sun and Tong (Reference Sun and Tong2003), indicating that institutional ownership plays a positive role in enhancing firm performance and valuation. Foreign ownership plays a positive but statistically insignificant role for listed Chinese firms. These are consistent with Sun and Tong (Reference Sun and Tong2003) as well as McGuckin and Dougherty (Reference McGuckin and Dougherty2002). Foreign ownership alleviates the information asymmetry problem, but it is also possible that Chinese firms with less foreign ownership enjoy a more supportive institutional environment from local government as is argued by Huang and Di (Reference Huang and Di2004). Such environment may enhance the bargaining power of those domestic firms when negotiating with foreign firms to form alliances and reduce some of the auxiliary benefits associated with foreign direct investment, e.g., greater property rights granted to foreign investors, thereby reducing the incentive to form alliances with foreign firms.

We do not find a statistically significant impact for board structure on performance. The coefficient of outside director is positive but statistically insignificant. This may reflect the weak role the board plays in Chinese firms as well as management that is more attuned to the upper government echelons that appoint, promote and support them than to formal shareholders nominally represented by the board. This differs from results reported by Choi, Park, and Yoo (Reference Choi, Park and Yoo2007) who find a significant and positive effect of outside directors, including foreigners, in Korea following the Asian financial crisis. In addition to the predominance of the state apparatus, the different results for China may be explained as a network effect, where outside directors have been carefully presorted to represent the interests of internal members in return for past or future favors.

DISCUSSION

An important unanswered question is which dimensions of government have the most impact on the economy at a microeconomic level. La Porta et al. (Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny1999) argue, at the macro level, that some of the most vital aspects of government are non-interventionist: protection of property rights, minimization of regulatory and taxation burden, maintaining an efficient and high quality bureaucracy, providing quality public services, preventing excessive public sector growth, and protecting democracy and political rights. To find which quality of government factors are the most conducive for firm performance, we conduct factor analysis. Figure 2 from a factor analysis of book-to-market ratios of firms shows that the most important government factor is the Special Economic Zone, which is a measure of government efficiency. The results of the marketization index (NERIIM) and efficient property registration provide additional evidence of the importance of local government efficiency for firm performance, as they are essential ingredients to ensure economic development, particularly in a transitional economy such as China.

Figure 2. Factor analysis on the quality of provincial government factors

Notes: This shows the result of factor analysis for common factors among the quality of provincial government variables using market-book ratio as the dependent variable. The graph plots eigenvalues for each variable estimated by the maximum likelihood method and illustrates what percentage of explained variance is accounted for by each quality-of-government variable. A Chi-square test of the null hypothesis of no common factors is rejected at the 1% level.

While the final authority over SEZ lies with the central government, implementation is largely left to the local government. The central government provides incentives to local governments in terms of revenue creation and economic development and allows regions to experiment with autonomous policies in SEZ (Qian & Weingast, Reference Qian and Weingast1996). The Chinese economic reform including the creation of SEZ or marketization in general is essentially a story of devolution of power from central to local government (Nee, Reference Nee1992). As such, SEZ embedded incentives such as retention of tax revenue and other income to promote the efficiency of the local government administration. Park, Li, and Tse (Reference Park, Li and Tse2006: 129) maintain that ‘(t)his increased incentive makes local governments want to be more effective in monitoring firms and to establish additional institutional arrangements to enhance market competition and to reduce transaction costs’. They document that firms in SEZs or coastal regions achieve higher performance because of infrastructure, investment incentives, and polices to attract foreign investments by the local government. Hence, we believe that SEZ partly reflects the bureaucratic efficiency of the local government within the broad parameters and incentives envisioned by the central government.

The above discussion concerning SEZ may also apply to marketization since SEZ is in effect a special form of marketization. However, we adopted the specific marketization index measure from Fan, Wang, and Zhang (Reference Fan, Wang and Zhang2001), which delineates the quality of local government more directly – it measures the condition of one province relative to another: ‘the relative position in the progress towards market economy compared to other provinces’. Wong (Reference Wong1992) and Park, Li, and Tse (Reference Park, Li and Tse2006) argue that firms tied to lower-level governments are likely to perform better than those tied to higher-level governments. This again highlights the importance of local governments.

The next factor that stands out is environmental protection, a variable that measures the quality of public service provided by a government, and is not considered by La Porta et al. (Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny1999). Until recently, environmental protection was not regarded a defining measure of the quality of government in the United States. In China, dramatically worsening water and air pollution has stirred public resentment and, occasionally, even riots. Concerned with its impact on social stability as well as a potential drag on the economy, the Chinese leadership has gradually changed its policy from benign neglect to enhanced vigilance, and has set improvement benchmarks. Local governments are expected to implement central policies, develop their own, and meet or exceed the benchmarks. Our results show that having a supportive and effective environmental policy is not only the right thing to do but is also good for business. Compared to other Chinese government benchmarks such as local GDP growth, environmental indices are more reliable as they are much harder to fudge by local government. For example, PM2.5, an air quality indicator, is monitored and published daily in most cities. Reliability is one reason why Beijing started to use it as one of the criteria in monitoring local government, and, more recently, to directly gauge individual officials’ performance.

At the firm level, it is challenging to measure the effect of political freedom on the economy, particularly in a single-country setting under Communist rule. Using the Voice of America reception as a proxy, we find not only that political freedom has a significant impact on firm performance and productivity, but also that its significance is higher than all but four government factors. Previously, the only notably successful documentation of a relation between democracy and economic success was that presented by Delong and Shleifer (Reference DeLong and Shleifer1993), whose study was conducted in a cross-country context over a long time period (Western Europe from 1000 to 1800 A.D). We also find a relation between autonomous regions and lower regional firm productivity, as shown in Table 3. Our findings not only provide confirmation from another country and time period, but also show that they hold at a local government and firm level. Perhaps most importantly, our findings show that even in a Communist regime that seems to have severed the hitherto-taken-for-granted connection between political and economic freedom, democracy is a harbinger of economic growth. Other government factors in our study appear to have a very small additional effect on firm performance.

Our results suggest that the magnitude of the effect of government quality on firm performance can be large. For example, a firm located in a SEZ, with local government providing good property registration and environment protection, may on average have a market-to-book ratio that is 0.384 higher than one located in a region without those factors.

It is worth noting that while Figure 2 graphically shows SEZ and marketization as the two largest contributing factors, this is only illustrative because it is based only on one (market-to-book) of the three performance measures (market to book, ROA, and labor productivity) used in Table 3, and even there other variables are also significant (albeit less so than the two variables indicated). In fact, the public service variables such as literacy are most significant in the productivity regression.

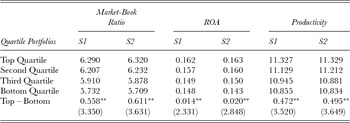

We use alternative performance measures to further examine economic impact of quality government on firms in Table 4. Panel A reports various performance measures by quartile portfolios of firms sorted out by the government quality score. Kaplan and Zingales (Reference Kaplan and Zingales1997) constructed an index of financial constraints where the coefficients of each firm-specific variables are estimated (as in Table 3), and the coefficients are then used to determine the weights for each of the variables to compute the overall financial constraints index. This method is superior to an alternative index, such as the one offered by Gompers, Ishii, and Metrick (Reference Gompers, Ishii and Metrick2003), which calculates the overall governance index as a simple average of individual dummy variables. We calculate the overall quality of government index, following the Kaplan and Zingales method because our government quality variables, which include both dummy and raw data, make the Gompers et al. method inappropriate.Footnote [11] The table reports results where scores are constructed with all government quality factors (S1) and with significant government quality factors only (S2). Next, all observations are sorted by score and quartile portfolios are formed. For market performance, firms in the top quartile of government quality scores are 0.558 higher in market-book ratio and 1.4% higher in return on assets than the firms in the bottom quartile, all significant at a 5% level. Furthermore, the means for firm productivity are higher with higher quartiles of government quality in both S1 and S2. We also computed medians but the results are qualitatively identical to those based on means and hence not reported. Finally, we constructed overall factor scores (also not reported) by aggregating the factor loading coefficients of each quality of government variables. The results are also qualitatively similar in that firm performance is better with a higher factor score.

Table 4. Firm performance by government scores and by controlling government

(A) Firm Performance by the Quartile of the Quality of Government Scores

Notes: This panel shows the mean performance measures by quartile portfolios of firms sorted out by the quality of government scores. The scores are constructed based on the weighted aggregation method used by Kaplan and Zingales (Reference Kaplan and Zingales1997), and for all quality of government factors listed in Table 1 (S1) and for only those variables significant in Table 3 (S2). Performance measures are compared for the top and the bottom quartile portfolios, with a significance test for the value of top minus bottom portfolios. The number of observations is 7,873 and covers the period of 1994–2006. ** denotes 5% level of significance in two-tail tests. Numbers in parentheses are t values.

(B) Firms Controlled by Local versus Central Government

Notes: This panel shows the mean performance measure by firms controlled by local and central government. The controlling shareholders are disclosed through financial statements, company websites, or the state-owned Assets Supervision and Administration Commission. Numbers in parentheses are t values.

We also follow Chen et al. (Reference Chen, Wang, Li and Tong2014), and examine in Table 4, Panel B the performance differences for firms controlled by the central and local governments. We find that firms controlled by local government have better performance at 10% significance level and higher productivity at 5% level. This reiterates that local government quality matters for firm performance.

We consider the possibility that some factors common to both local government quality and firm performance are driving the results. For example, Karl Marx (Reference Marx1872) posits that political superstructure is built upon economic foundations. Thus, regional economic growth might be thrusting government quality and firm performance at the same time. First, we address this issue by including economic growth in regressions. Second, while not reported separately, we find that regional economic growth, in both concurrent and lag forms, is not a significant explanatory variable for government quality. Another possibility is that regions with a large state sector and small private sector have larger government that is likely to perform better according to La Porta et al. (Reference La Porta, Lopez-de-Silanes, Shleifer and Vishny1999). However, we find the size of public economy in its natural form, as opposed to the ordinal scale used in regressions, is not statistically significant in explaining firm performance.

We also checked whether a coastal location could affect both firm performance and the likelihood of a local government being an SEZ. Coastal provinces are more developed and more open to the outside world; they also have a higher ratio of large cities, which has been associated with higher productivity (OEDC, 2005) and higher inflows of foreign direct investment. This may pose a selection bias due to omitted variables. Another potential concern is endogeneity due to simultaneous causality, e.g., more profitable firms contribute more tax revenues to the local government, and may also have more economic and political power to sway the local government to make decision favoring them. To address these issues, we estimate Heckman's (Reference Heckman1978) two-step model (reported in Appendix B), with the treatment indicator variable of whether a firm is located in a province with better than average overall quality of government scores as in S1 in Table 4(A). In the first stage, a probit model is estimated for the local government quality indicator on two instrumental variables – a coastal province dummy indicating whether a firm is located in a coastal province; and real GDP growth rate in the province. In the second stage, the same firm performance model as in Table 3 is estimated with the addition of predicted local government quality indicator plus an inverse Mills ratio correcting for selection bias. The results of the second stage regression are similar to those reported in Table 3.

CONCLUSION

While economists have recognized that the quality of government has a significant impact on economic growth, empirical tests have been limited to the national, macro-economic level. These studies had to contend with the problem of inherent internal variation in institutional factors which exert a direct impact on the economy as well as an indirect impact through influence on the quality of government, making accurate measurement on the effect of government difficult. In addition, these studies do not answer the question whether the quality of government has a direct impact at the firm level. Our study is aimed at filling this gap and complement national level studies by examining local government whose impact on firms is often more visible and pronounced. By studying China we observe a diverse set of local governments and environments in a rapidly evolving economy, thus being tuned to longitudinal changes.

Using a large sample of Chinese listed firms between 1994 and 2006 and various factors that cover different dimensions of government, we find that the quality of provincial government is positively correlated with firm performance. This conclusion is robust in regard to different econometric and time period specifications, and with numerous control factors on local-, firm-, and industry-specific variations. We find that having a quality provincial government, characterized by modest taxation and speedy bureaucratic processes, high degree of marketization, efficient and effective property registration, effective environmental protection, political freedom, low corruption, a relatively small public sector, and good infrastructure – which measure economic efficiency, political freedom, public service and the extent of corruption of provincial governments – is conducive to productivity and firm performance.

Further, we document that among many aspects of a quality government, the most important is to have a relatively small and efficient government, measured by a special economic zone, marketization index, and efficient property registration. This confirms the Western view on what constitutes a good government but is also consistent with the traditional Chinese perspective dating back to imperial times that a small cadre of highly qualified officials can provide for effective oversight. Somewhat surprisingly but reflecting increasing concerns about worsening environmental conditions in the country, environmental protection comes out as the fourth most important factor determining the quality of government. And, most intriguingly, political freedom has a significant impact on firm performance and productivity. This has never been directly documented before at a microeconomic level and barely at a macro-level, vindicating Hayek's (Reference Hayek1944) theory in a non-democratic context. This finding also comes at a time when the Chinese leadership is sending limited signals regarding the possibility of future political liberalization and bodes well for the prospects of such change even if very incremental.

A promising direction for future research is the interaction between the quality of government and firm-specific political connections with bureaucrats. Firm-specific political connections, representing a micro-political factor, are studied by Faccio (Reference Faccio2006) in cross-national settings and by Fan, Wong, and Zhang (Reference Fan, Wong and Zhang2007) in Chinese IPO samples. The quality of government, however, is a macro-political factor. The interactive impact on firms is particularly important in economies that are politically directed and characterized by a personal network culture such as China. Future research may also seek to extend the study to the sub-provincial level, which also plays a prominent role in guiding and facilitating economic activity as well as consider the interaction between the national, local and sub-local levels.

APPENDIX A:

Number of Firms Issuing A-Shares by Region and Industry (as of June 30, 2006)

APPENDIX B:

Heckman Two-stage Estimation Results

SUPPLEMENTARY MATERIAL

To view supplementary material for this article, please visit http://dx.doi.org/10.1017/mor.2015.46