Introduction

Following the global financial crisis, governments have imposed a raft of new regulatory instruments designed to strengthen the stability of the financial system, from higher capital requirements to tougher rules on banking standards (see introduction to this Special Issue). But the most persistent problem has been how to address the problem of Too-Big-To-Fail (TBTF): the notion that some banks are simply so significant in economic terms that no government could permit them to fail. This, in effect, amounts to an implicit state subsidy and exacerbates risk-taking behavior through problems of moral hazard.Footnote 1 The need to protect taxpayers by restricting the ability of retail banks to engage in higher risk trading activities was a central theme of the 2009 G20 Pittsburgh Summit.Footnote 2 Yet efforts to develop a coordinated approach at the international level have been limited, with the result that countries have pursued their own reforms.Footnote 3 The aim of this article is to explain the divergence of structural reforms adopted in different countries, despite the shared nature of the TBTF problem and the commitment by political leaders at the height of the crisis to make banks safer.

Our analysis focuses on the three European Union (EU) member states with the largest economies and banking systems: the United Kingdom, France, and Germany. In the decades prior to the financial crisis, the banking systems of all three countries shared a number of important features.Footnote 4 Governments and regulators championed the growth of large, universal banks engaged in “market-based banking” activities, characterized by the rapid expansion of trading assets on bank balance sheets and the increased dependence of banks on wholesale finance to fund lending.Footnote 5 While hugely profitable, market-based banking also brought greater vulnerability and weakness to disruption in financial markets, meaning that relatively small losses were amplified by the banks’ large trading books.Footnote 6 As a result, all three banking systems were hit hard by the financial crisis, resulting in a plummeting share price, credit rating downgrades, and debt write-downs for many of the largest banks. The impact of the crisis also necessitated unprecedented levels of state support, in the form of liquidity injections, government bail outs, and credit guarantees.Footnote 7

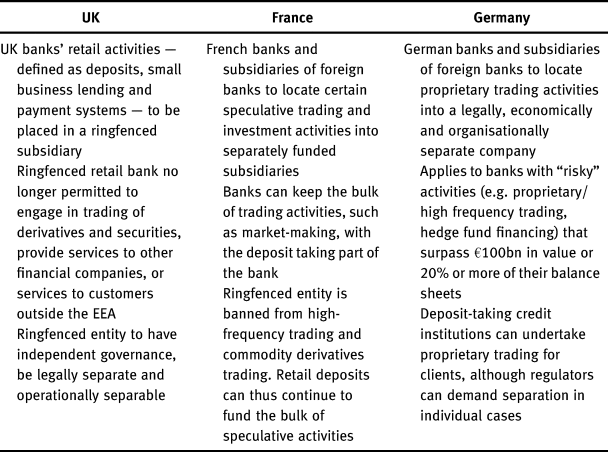

At the height of the crisis, governments in all three countries came under sustained political pressure to crack down on their large banks. This was given added impetus by electoral dynamics, with national legislative elections taking place in the United Kingdom in 2010, in France in 2012 (legislative and presidential), and in Germany in 2013. Political leaders in all three countries responded by making clear political commitments to pursue structural reform of the banking sector: in the United Kingdom in 2010, Prime Minister David Cameron promised to curtail banks’ trading activities and established an Independent Commission on Banking (ICB) to make policy recommendations; in France, President François Hollande was elected in 2012 following a campaign that included a pledge to implement a full split between retail and investment banking; while in Germany, Chancellor Angela Merkel moved to undermine opposition criticism by promising to introduce tough, new ringfencing rules. Here, however, the similarity ends. In the United Kingdom, the Conservative-Liberal Democrat coalition government moved quickly in the face of fierce industry opposition. The reforms set out to ringfence banks’ retail activities in legally separate entities, prohibiting them from trading in a range of financial instruments and imposing capital requirements significantly in excess of international or EU standards. By contrast, the French and German governments chose to defend the interests of their largest banks and backtracked on their earlier commitment to substantial structural reform. In particular, both sought to implement much weaker measures that would force banks to ringfence only a narrow set of proprietary trading activities (see table 1). Unlike the changes in the United Kingdom, which tightly circumscribe what universal banks can and cannot do, the reforms adopted in France and Germany do little to curtail the activities of the largest banks.Footnote 8

Table 1. Overview of bank structural reforms in the United Kingdom, France, and Germany

To explain this puzzle, our article proceeds as follows. The next section details the explanatory limitations of prevailing theoretical accounts of financial regulatory reform. The second section presents our analytical framework, which focuses attention on three key dynamics of agenda setting: issue framing, conflict expansion, and venue shifting. By analyzing each of these in turn, we set out to explain the opening / closing of policy windows on banking reform in the three countries over time. The conclusion reflects on the added value of our contribution to analyzing business power and agenda setting dynamics.

The limitations of Comparative Political Economy and business power approaches

Existing approaches to financial regulation fail to provide a convincing account of the divergence in post-crisis structural reforms. We review the two main theoretical perspectives here. Explanations rooted in Comparative Political Economy (CPE) and Varieties of Financial Capitalism (VoFC) emphasize the institutional configuration of national economic and / or financial systems, suggesting that governments will seek to protect the comparative institutional advantage of industry.Footnote 9 From this perspective, government preferences on bank structural reform should derive from features of the national banking system and the distributive implications of structural separation.

However, it is difficult to reconcile these assumptions with the pattern of post-crisis regulation found in the three countries. From a VoFC perspective, the United Kingdom (and the United States) is traditionally viewed as a neoliberal regime favoring light touch “market making” regulation, based on a benign view of efficient markets.Footnote 10 By contrast, France and Germany are frequently seen as having a “market shaping” approach, which assumes that financial markets are prone to instability and advocates constraints on the activities of banks.Footnote 11 Paradoxically, however, it is the United Kingdom that has intervened decisively to address TBTF by restricting the trading activities of its largest global banks, thereby potentially placing them at a competitive disadvantage. By contrast, France and Germany have sought to defend the universal banking model, leaving the market-based banking activities of their largest banks largely untouched.

An alternative CPE explanation might emphasize the international scope of banking activities as a key driver of banking reform in different counties. For example, higher internationalization—both in terms of assets held abroad by domestically headquartered banks, and the presence of foreign bank assets as a percentage of the total—might be expected to increase government support for ringfencing in order to minimize exposure to international instability. In the UK case, however, this leads to different expectations. On the one hand, three of the largest UK headquartered banks had substantial overseas assets, and a strong presence in domestic retail lending, leading us to expect tough ringfencing rules. On the other hand, with only one exception—Santander—the subsidiaries of large foreign banks in the United Kingdom lacked a significant retail presence. Consequently, UK ringfencing rules would have a negligible impact on foreign bank operations in the United Kingdom, while placing three of the largest UK headquartered banks at a potentially significant competitive disadvantage.

In the French and German cases, patterns of internationalization did not correlate with industry or government preferences on structural reform. Both banking systems had a far lower foreign bank presence, measured in terms of bank assets held by the subsidiaries and branches of foreign banks.Footnote 12 But the four biggest universal banks in France—which also dominated the domestic retail market—had a significant international presence (albeit lower than the UK banks). However, this did not translate into French government support for tough new ringfencing rules. In Germany, several features of its banking system would lead us to expect divergent preferences on reform: the large internationally-focused universal banks—notably Deutsche Bank—should oppose ringfencing; but the smaller, domestically-focused savings and cooperative banks should favor reform as it could improve their competitive position. The substantial political influence of the smaller banks, and their relative importance in the German retail market, therefore lead to the expectation of German government support for ringfencing. On the contrary, however, the small banks joined their bigger commercial rivals in opposing a strong ringfence and the German government adopted weak structural reform, foregoing the opportunity to tame the hyper-internationalised Deutsche Bank.

We argue that CPE approaches present a structurally-deterministic explanation of national preferences, and thus fail to explain how or why these may change over time. Explanations that rest on narrow economic advantage or patterns of bank internationalization leave little room for the role of political agency or policy choice. The variability of regulatory outcomes ultimately reflects the heterogeneity of industry preferences, divisions amongst interest groups, and the discretion, autonomy, and resources wielded by elected officials and national regulators.Footnote 13 We seek to add value to these comparative accounts by applying an analytical framework better placed to capture how economic interests are mediated by political and bureaucratic actors and channelled through institutional processes.

A second set of theoretical approaches focuses on the power of business, which derives from both the state's structural dependence on firms for investment and growth, and the instrumental lobbying capabilities of business.Footnote 14 In an important contribution, Culpepper argues that business power relies on “quiet politics,” characterized by low levels of public interest and informal governance arenas.Footnote 15 However, as the salience of regulatory issues increases, the influence of economic interests declines as policy issues are escalated to “noisy” political arenas and formal governance institutions. In this context, business power is more likely to be challenged by the mobilization of other societal groups, such as consumers or taxpayers. Applying this framework to post-crisis reform, for instance, Bell and Hindmoor show how heightened salience, strengthened institutions, and new ideas have constrained the power of large banks since the crisis, enabling regulators to impose tough new capital rules.Footnote 16

However, two important aspects of business power remain under-specified. First, political salience is usually treated as an exogenous variable that constrains business power. But this tells us little about the conditions or causal factors that cause salience to vary over time. In order better to explain these factors, we need to treat salience as endogenous to explanations of business power. It is self-evident that interest groups do not simply respond to public pressure, but actively cultivate public awareness and political attention about issues. Moreover, the institutional context in which decisions are made shapes—as much as it is shaped by—political salience because certain venues are more visible and attract greater attention than others. Second, although business power helps to explain why policy change is possible in the face of determined industry opposition, less is known about the reverse process: how opportunities that appear ripe for policy change may be deliberately closed down. We know little about how issues become less salient over time, when non-business groups demobilize, or why issues are moved from “noisy” public to “quiet” private institutional venues. Here the influence of business may be more pernicious as it relates to the second face of power and “non-decision making”:Footnote 17 the ability of business to keep issues off the policy agenda or—more intriguingly—to have them deliberately downplayed.

In the following section, we outline how an agenda setting approach addresses these points by providing a framework for analyzing how business power is mediated by political processes. This has two advantages. First, the focus on agenda setting helps to explain the causal mechanisms through which policy issues, such as banking reform, become the focus of increasing (or decreasing) public salience and heightened (or declining) government attention. Second, agenda setting provides an agency-oriented account of policy stability and change by analyzing the interaction of strategic policy actors within institutional opportunity structures. We argue that this potentially offers a richer account of how business power is mediated by political processes.

Agenda setting approaches

Agenda setting examines the mechanisms though which policy issues rise and fall, and the conditions under which this produces policy stability and change.Footnote 18 This analytical framework posits that long periods of policy continuity can be interrupted by sudden shifts or punctuations in the policy agenda.Footnote 19 These are often associated with heightened public attention, leading to the “alarmed discovery” of a new or existing issue by government.Footnote 20 Similarly, Kingdon argues that policy change is most likely when policy entrepreneurs are able to couple policy problems with policy solutions at a particular point in time, creating a relatively short “window of opportunity” for change.Footnote 21

Policy agendas are shaped by several factors. The first, conflict expansion, refers to the increased mobilization of policy actors around an issue, beyond the narrow range of participants that normally occupy a policy subsystem.Footnote 22 Conflict expansion can challenge the balance of power and resources that exists between powerful interests and coalitions, the stability of which underpins prevailing issue understandings and sustains particular policy outcomes. Second, policy choices are influenced by how an issue is defined or “framed.”Footnote 23 Policy framing refers to the process of selecting, emphasizing, and organizing aspects of complex issues according to an overriding evaluative or analytical criterion.Footnote 24 By re-framing an issue in a particular way, the link between policy problems and solutions can be redrawn and the boundary between opponents and supporters of a policy can be reconfigured. Third, institutional venues are central to our understanding of agenda setting. Institutions constitute opportunity structures, which can underpin policy stability by granting access to certain actors, being more receptive to particular arguments, and formalizing veto points. Policy change is most likely when debates and decision making shift to new institutional venues.Footnote 25 By altering venues, new policy windows may open up as a different set of actors are empowered and different decision rules structure the process.Footnote 26

We explain how business power is mediated by the agenda setting process. Figure 1 summarizes how the role and influence of large firms—in our case, banks—is shaped by the dynamics of issue framing, conflict expansion, and venue shifting. These three causal variables account for the emergence of policy windows; the opening or closing of which, we argue, helps to explain the diversity of banking reform across our three cases. On this basis, we would expect to find in the case of the United Kingdom that 1) banks were unable to prevent the framing of the crisis around the issue of TBTF, 2) a range of non-business groups mobilized around the banking reform issue, and 3) structural reform was managed through new or altered institutional venues. By contrast, in France and Germany, we would expect that 1) banks successfully re-framed the crisis away from TBTF banks, 2) the mobilization of non-business groups was limited, and 3) structural reform was managed through pre-existing institutional channels.

Figure 1. The mediation of business power by the agenda setting process

In methodological terms, our comparison of banking reform in the United Kingdom, France, and Germany provides important advantages. The three cases are similar with respect to salience in that banking reform was at the top of the political agenda in the immediate aftermath of the financial crisis, and was given added impetus by the timing of important national elections. But they differ significantly with respect to basic political and institutional features, which enables us to rule out alternative explanations. For example, we can exclude partisan explanations that would predict that left-wing governments would be more likely to introduce radical structural reform than a right-wing government. This is because coalition governments led by centre-right parties were in power in the United Kingdom and Germany at this time, whereas France had a centre-left Socialist government. Another possibility is that structural reform is greater in countries where executive power is less constrained by legislative or judicial checks. Yet this does not fit with the empirical evidence: although Germany is traditionally characterized as a consensual system with limited executive power, the United Kingdom and France both share important features of majoritarianism. The comparison therefore promises to provide new insights into how identical policy issues are mediated by agenda dynamics, which are independent of these basic political and institutional features, giving rise to divergent policy outcomes.

Our analysis uses process tracing to chart the rise (and fall) of structural reform on the policy agenda of the three countries over time. This article draws on a series of anonymized interviews conducted by the authors over a four-year period from 2013 to 2017. In total, approximately twenty-seven interviews were conducted with elected officials, senior regulators, and banking industry representatives based in London, Paris, Berlin, and Frankfurt. This evidence is corroborated by an extensive analysis of public documents, industry publications and financial media coverage of the banking reform process in the three countries.

Policy windows for banking reform

We begin with a brief overview of developments in each banking sector in the run up to the crisis. In the United Kingdom and France, the problem of TBTF was rooted in the concentrated, expansive, and highly leveraged nature of the domestic-headquartered retail banking sectors.Footnote 27 Consolidation in the decade prior to the crisis meant that both the UK and French retail banking sectors were dominated by just four (five in the case of France before 2009) large universal banks, which significantly expanded their balance sheets in the decade prior to the crisis.Footnote 28 While hugely profitable, this business strategy brought greater vulnerability to disruption in financial markets, meaning that relatively small losses were amplified by the banks’ large trading books.Footnote 29 UK banks’ use of securitization meant that they became highly leveraged, with the average exceeding 35:1 by 2007,Footnote 30 depleting their liquidity reserves and leaving them dependent on wholesale funding. When inter-bank lending dried up from late 2007, three UK banks (Northern Rock, RBS, and HBOS) collapsed, while HSBC and Barclays were forced to write off huge volumes of toxic assets, with total bank sector losses reaching 6.3 percent of GDP in 2008–9. In response, the UK government acted to stem the contagion through emergency liquidity assistance and direct taxpayer support, culminating in the bailout of two high-street banks. Although French banks were less exposed to securitization or subprime assets, they were hit particularly hard by losses in southern European banks in which they had invested heavily prior to the crisis. Hence, although French bank losses overall were lower than in the United Kingdom as a proportion of GDP (1.8 percent), write-downs at individual banks (notably BNP Paribas, Societie General, and Credit Agricole) were comparable to those of the largest British and German banks.Footnote 31 In recognition of this, the government chose to shore up the banking system by recapitalizing six of its largest institutions in return for commitments to maintain lending to the real economy.

The German banking system is one of the least concentrated in Europe—thanks to a large number of smaller savings and cooperative banks, regional public banks (Landesbanks) and a number of smaller commercial banks. Despite this, banking reform was (briefly) a key concern for policy makers on account of the fact that the German system was one of the worst hit in terms of both total write-downs and write-downs to GDP.Footnote 32 Several German banks faced substantial losses (totalling 2.4 percent of GDP) during the crisis, principally due to their purchase of securitized assets from U.S. banks. For example, Deutsche Bank, one of Europe's largest banks, recorded its first loss in fifty years, resulting in a plunging share price, huge debt write-offs, and heralding years of upheaval. Four German banks, including the country's third largest—Dresdner Bank—effectively collapsed, and only massive federal and regional government intervention—including the creation of a bad bank to soak up toxic assets and the purchase of shares—saved them. The regional Landesbanken, known for their domestic retail and commercial lending, were also severely impacted.

In the aftermath of the banking crisis, the new Conservative-led coalition government in the United Kingdom moved swiftly to agree to major reforms to bank structure. The Banking Reform Bill, passed in December 2013, requires bank retail activities to be placed in a separate and “operationally separable” ringfenced subsidiary, which is no longer permitted to trade most derivatives and securities.Footnote 33 The ringfenced bank must also hold an additional ringfence capital buffer, taking total equity (tier 1) capital up to 10 percent. These reforms go significantly beyond international guidelines (Basel III), imposing some of the highest capital requirements in the world on UK banks. The United Kingdom's actions are puzzling for two reasons. First, the Conservative party manifesto for the 2010 parliamentary elections made no explicit commitment to structural reform, pledging only to “pursue international agreement” on banning forms of proprietary trading so as to avoid damaging the city's competitiveness.Footnote 34 Second, as much of the UK financial industry was at pains to point out, it was debatable that TBTF universal banks were a major problem. Although RBS had, in effect, been nationalized, other large universal banks like HSBC and Barclays had avoided direct taxpayer support. Moreover, some of the highest profile bank failures (HBOS, Bradford and Bingley, and Northern Rock) were a result of lax mortgage lending practices, not high risk market making activities.

The reforms introduced in France and Germany were significantly weaker than those implemented in the United Kingdom.Footnote 35 The reforms eventually agreed on in 2013 (in France) and 2014 (in Germany) only curtail large banks from engaging in a narrow set of proprietary trading activities.Footnote 36 In France, for example, it is widely anticipated that this will have a minimal impact on bank business models.Footnote 37 In the case of Germany, it is estimated that only one bank (Deutsche) is likely to be affected, and only marginally.Footnote 38 The timidity of these changes is particularly surprising given the heightened public salience of banking reform, and the political commitments given by prominent political leaders to tackling the issue, in both countries at the height of the crisis. In France, the Socialist Party pledged to reform its largest banks during the 2012 presidential and legislative election campaigns. During the French presidential election campaign, François Hollande announced that his “main adversary was finance” and made an explicit pledge to introduce the “separation of banking activities contributing to investment (or employment) and speculative operations.”Footnote 39

The leadership of the German Christian Democratic Union party (CDU) was more cautious with its statements on reform. German Chancellor Angela Merkel announced, in the aftermath of the crisis, plans to consider “how to make sure that banks and financial institutions do not become so large that they ultimately pose the potential risk of exerting pressure on countries.”Footnote 40 However, the CDU's coalition partners, the Christian Social Union party (CSU), came out more forcefully in favor of structural reform, while on the Left, support for ringfencing was near universal. In July 2012, Social Democratic Party (SPD) leader Sigmar Gabriel launched a vitriolic attack against the banks, calling for them to be broken up because they were holding countries ransom and dictating government policy. Peer Steinbrück, finance minister of the Grand Coalition government from 2008 to 2013, and nominated as the SPD's challenger to Chancellor Merkel for the 2013 elections, presented his own detailed set of proposals for banking reform in late September 2012. Even Philipp Rösler, Minister of Economics and leader of the economically liberal Free Democratic Party (FDP), came out in favor of Steinbrück's proposals, which were similar to the recommendations of the EU's High-level Expert Group on Bank Structural Reform, chaired by Erkki Liikanen. However, despite the widespread political support for structural reform in Germany, the changes eventually adopted fell far short of the “Liikanen Group” proposals, and the timing of the reforms (adopted in early 2014) were seen as an attempt to pre-empt the adoption of an EU-level directive.Footnote 41

To explain the divergence of structural reform across our cases, we assess the extent to which a policy window for regulatory change opened in each of our three countries. We do so by assessing how the role and influence of the banking industry was mediated by the dynamics of the agenda setting process—our three explanatory variables—issue framing, conflict expansion, and venue shifting.

Issue framing

At the height of the crisis, the financial industry in the United Kingdom and France attempted to frame the issue of TBTF by presenting a united front in opposition to structural reform. Although the German banking industry was more divided in terms of the potential impact of reform—given that none of the savings and cooperative banks were affected directly by it—both the association representing German commercial banks (BVD) and the association representing all German banks (Die Deutsche Kreditwirtschaft / German Banking Industry Committee, GBIC) were opposed to structural reform, including the Liikanen Group proposal.Footnote 42 The largest banks in all three countries, represented by the British Bankers’ Association (BBA) and the French Banking Federation (FBF) and the two German associations, sought to defend the universal banking model on the grounds that there was no evidence that it was an important cause of the financial crisis. They argued that universal banking lowered bank funding costs and reduced risk through diversification, and that reform would damage the economy and international competitiveness.Footnote 43 In the case of France—where the large banks had a weaker capital position than the largest British banks—structural reform was presented as particularly dangerous and threatened foreign take-overs and a significant cut to lending to the real economy. In Germany, despite the importance of smaller savings and cooperative banks to retail banking, the largest commercial banks made similar claims.Footnote 44 These arguments were supported by powerful business associations in all three countries (the UK CBI, the French MEDEF, and several German business associations), which warned that structural separation threatened the provision of trade finance to SMEs and would undermine economic recovery.

A major difference in financial industry efforts to water down structural reform was that while the French and German banks remained united in opposition to change, the UK banks did not. Once it became clear that the ICB favored some form of ringfencing, divisions between the main UK banks began to emerge. As reform threatened to impact bank business models in different ways, individual banks faced incentives to lobby separately to try to secure firm-specific concessions.Footnote 45 Broadly speaking, the UK banking sector divided into two camps. Those with large investment operations—HSBC, Barclays, Standard Chartered, and RBS—continued to defend universal banking.Footnote 46 HSBC and Standard Chartered publicly threatened to move their headquarters to Asia, while Barclays speculated that it would shift its investment bank subsidiary to New York.Footnote 47 In contrast, Lloyds and Santander UK, together with new challenger banks, were relatively relaxed about the prospect of structural reform because most of their business would fall within the ringfence. In fact, Lloyds made the strategic decision to break ranks and come out publicly in favor of ringfencing from the start.Footnote 48 These sectoral divisions were also mirrored in the wider business community: while the CBI sought to represent the views of large manufacturers concerned about the impact on trade finance, the SME sector (represented by the FSB and BCC) supported structural reform on the grounds that it would bring greater financial and economic stability.Footnote 49

In France, despite significant differences in bank business models and the relative importance of trading activities in bank balance sheets, all four of the country's largest banks—BNP Paribas, Société Générale, Crédit Agricole, and BPCE (Banques Populaires, Caisses d'Epargne)—maintained a united front. They were joined by the main association representing big business in France, the Mouvement des entreprises de France (MEDEF), which repeatedly noted the dangers of ringfencing to the French economy. In Germany, we might have expected greater divisions in the banking and non-financial industries, given the three-pillar banking system and profoundly different funding of both different banking types and non-financial companies. However, although only the large commercial banks undertook a concerted lobbying effort on structural reform, other parts of the banking sector were very supportive, and the associations representing savings banks (Finanzgruppe Deutscher Sparkassen- und Giroverban), cooperative banks (BVR), and the regional public Landesbanks (VÖB) all came out in favor of German universal banks.Footnote 50 The largest German commercial banks—notably Deutsche Bank and Commerzbank—maintained a common front on structural reform through the main association of private sector banks (BDB). They were joined by DZ Bank, the second largest bank in Germany by assets and the main universal banking arm of German cooperative banks, and Dekabank, the main investment bank linked to the 420 German savings banks. In their opposition to structural reform, the banks were joined by all the main German business associations.Footnote 51

We argue that divisions fatally weakened the capacity of UK industry to prevent the framing of the financial crisis as being caused by TBTF banks, fuelled by the rapid expansion of high risk market trading activities. Consequently, this created a window of opportunity for other policy actors to frame the issue in their own terms. On the contrary, the largest French and German banks proved highly effective in defending the universal banking model by warning of the dangers to the real economy that would be created by far-reaching structural reform. Ultimately, the alliance between banks and the wider business community in both countries successfully deflected political attention away from the issue of TBTF banks.

Conflict expansion

The issue of banking reform became a highly salient issue in all three countries following the bank bailouts in 2008, leading to mounting public criticism of the financial industry. This was compounded by a series of high-profile scandals that engulfed the sector from 2012, the most important of which involved the manipulation of interest and exchange rate swaps, and the London Interbank Offered Rate (Libor). Investigations by the European Commission and national authorities led to the imposition of record fines on a number of prominent banks, including Barclays, Deutsche Bank, and Société Générale.Footnote 52 This created the perfect conditions for conflict expansion, whereby we would expect a broad range of actors and societal groups to mobilize to push for tighter regulation aimed at curbing the excesses and illegal activities of the banks. Below we explain how and why significant conflict expansion took place in the UK context, while there was little evidence of conflict expansion in France or Germany.

Conflict expansion in the United Kingdom was driven by three sets of actors. At the political level, the Liberal Democrats provided a constant source of political pressure for structural reform from within the Conservative-led coalition government. Business Secretary Vince Cable, the Liberal Democrats’ spokesperson on banking reform, was a firm supporter of ringfencing and regularly intervened to ensure that the TBTF issue remained at the top of the political agenda.Footnote 53 Non-financial groups also played an important agenda setting role in the run up to the creation of the ICB. In particular, the consumer group Which? convened its own Future of Banking Commission in 2009, which brought together a number of experienced politicians to propose reforms to the industry.Footnote 54 Its proposal that the core lending and deposit functions of UK banks should be “ringfenced” placed the policy option firmly on the agenda and was influential in framing the thinking of the ICB.Footnote 55 The third important source of pressure came from the bureaucratic level. Bank of England governor Mervyn King viewed TBTF banks as a fundamental source of financial instability in the UK economy and advocated a full split between retail and investment banking activities, based on the 1933 Glass-Steagall Act in the United States.Footnote 56 From the Bank of England's perspective, strict separation would complement its new macroprudential role by reducing the risk and costs of future supervisory failure.

The Bank of England (BOE) lobbied publicly and privately in favor of bank structural reform.Footnote 57 During the early stages of the process, the central bank provided valuable advice to the ICB members during private sessions and produced research that was important in strengthening the hand of policy makers vis-à-vis industry. Following the publication of the ICB's Final Report, senior BOE officials maintained pressure on the government by launching stinging attacks on bank lobbying tactics, while the BOE's Financial Policy Committee urged ministers to implement the Vickers recommendations in full.Footnote 58 Furthermore, the BOE worked closely with parliamentarians—particularly members of the Treasury Select Committee—in their efforts to strengthen the implementation of ringfencing rules in the Banking Reform Bill.Footnote 59 Consequently, a small number of powerful policy actors, principally led by the BOE, successfully expanded the conflict by mobilising a broad coalition of regulators, parliamentarians, and non-business groups in favor of banking reform.Footnote 60 In doing so, they were able to challenge the industry's defence of the status quo and re-frame the crisis explicitly in terms of TBTF banks.

Efforts in France by political, bureaucratic, and non-business groups to increase the salience of the TBTF issue were comparatively modest. No politicians with the political influence of Vince Cable, or the bureaucratic and intellectual influence of Mervyn King, spearheaded a campaign to reinforce the ring-fence. This is surprising given François Hollande's loud and unambiguous promises during the presidential election campaign. In government, there was considerable frustration within Socialist party ranks with the limited nature of the government's proposed structural reform. This frustration resulted in a modest reinforcement of the government's draft law through two amendments proposed by Socialist members of the parliamentary commission tasked to examine the legislation.Footnote 61 The mainstream right in opposition in the lower house (Union for a Presidential Majority [UMP]), came out strongly in favor of the Socialist-led government's draft, which eliminated any significant politicisation of the TBTF issue in parliament.Footnote 62 In defence of the government's draft law, the Socialist finance minister Pierre Moscovici argued that national economic interests and the interests of Paris as a financial centre had to be defended and that a stricter separation risked “giving a gift to Anglo-Saxon banks.”Footnote 63 This conflation of large bank interests—as national champions—and national interests, was absent in the British debate on structural reform. The government's decision to add structural reform into the same law focused principally upon the transparency of banks in their use of tax havens, further undermined the singular attention that the issue of structural reform attracted in the United Kingdom.

Finally, the French technocratic elite also stood firmly behind the Socialist-led government's draft law. Bank of France governor Christian Noyer repeatedly came to the defence of the Socialist-led government, arguing that its reform plans were not “a minima” and that a stricter separation, as adopted in the United Kingdom, would have been “against the national interest” by weakening French banks.Footnote 64 Unlike in the United Kingdom, where central bank officials facilitated parliamentary scrutiny of the final ringfencing legislation, parliamentary opposition to the government's plans in France was limited to the far Left, while media and academic engagement with banking reform was similarly muted.

Efforts by German politicians, public officials, or non-business groups to increase the political salience of the TBTF issue were also limited in nature. The leader of the SPD, former Grand Coalition finance minister Peer Steinbrück, supported the government's draft law in 2013, despite his previous demands for significant structural reform. Only the Green party and the far Left Die Linke actively criticized the Grand Coalition's draft legislation as inadequate. The failure to widen conflict was despite a number of significant banking scandals involving Deutsche Bank, which provided politicians with a huge amount of potential ammunition to challenge the country's largest bank.Footnote 65 There is also no evidence of bureaucratic actors (for example, top Bundesbank and BaFin officials) cultivating the salience of structural reform. Jens Weidmann, Bundesbank president, deemed the ringfencing recommendations of the Liikanen Group and the European Commission as “sensible” but did not push actively on the matter and focused rather upon the reduction of “incentives to expand to ever greater size” through systemic risk buffers and higher capital requirements for systemically important institutions.Footnote 66

In the United Kingdom, political and bureaucratic actors deliberately cultivated the salience of banking reform through conflict expansion. This was achieved through a series of political actions designed to mobilize new coalitions of support in favor of structural separation and to re-frame the issue around TBTF and financial stability. In contrast, there was little evidence of conflict expansion in France or Germany. Political efforts to increase the salience of banking reform were limited to a small number of left-wing politicians with marginal influence in parliament. Moreover, prominent bureaucratic actors (notably, central bank officials and senior financial regulators) actively sought to play down concerns about TBTF banks and, more often than not, echoed many of the arguments put forward by industry. To understand why, we need to examine the institutional venues through which banking reform was managed.

Venue shifting

We argue that the institutional context was also critical to the opening of a policy window on banking reform in the three countries. In the United Kingdom, political imperatives in early 2010 created the conditions for venue shifting with the establishment of the ICB. The turmoil of the financial crisis and the fiscal burden of bailing out two of the UK's largest banks meant that protecting taxpayers became an acute electoral priority for all the main political parties. However, this task was complicated by the outcome of the 2010 general election, which led to the formation of a coalition government between the Conservative and Liberal Democrats with diametrically opposed views on what form reform should take. The decision in June 2010 to establish the ICB under the former BOE chief economist Sir John Vickers was a political solution that suited both parties: the Conservatives, sceptical of any change hoped to delay and dilute reform; while the Liberal Democrats viewed an independent process as more likely to propose major reforms. The ICB was tasked with making recommendations on structural and non-structural measures that would promote both stability and competition in banking.Footnote 67 The second institutional innovation resulted from the Libor rate-rigging scandal in mid-2012. Under pressure from the Liberal Democrats to respond, the government agreed to establish a Parliamentary Commission on Banking Standards (PCBS) in September 2012, chaired by independent-minded Conservative MP Andrew Tyrie. Crucially, the PCBS was also given responsibility for completing pre-legislative scrutiny of the Banking Reform Bill.

Venue shifting to the ICB and PCBS widened the policy window for banking reform in four ways. First, delegation of critical stages of the process to “independent” bodies helped to insulate policy makers from attempted industry framing. The Vickers process in particular was less conducive to traditional political lobbying because its high-profile membership was “independent minded,” and it demanded a level of technical expertise that traditional trade associations did not have.Footnote 68 Second, by extending the consultation and scrutiny processes, the ICB and PCBS were able to accumulate extensive knowledge and expertise. The ICB was well-resourced by the standards of British parliamentary commissions with a fourteen-strong secretariat drawn mainly from the Treasury and the BOE. To reduce its dependence on information supplied by the banks, the ICB issued two separate calls for evidence to elicit analysis from a range of expert sources. These informational resources enabled the ICB to consider the full spectrum of reform options and to directly rebut industry estimates of the economic costs of ringfencing.Footnote 69

Third, the two commissions reconfigured the rules of the game to facilitate conflict expansion. The ICB created a structured process of engagement involving closed, private evidence sessions with individual banks, calls for written evidence, public roadshows and debates, and formal hearings with senior bank executives.Footnote 70 This was designed to mobilize a broad range of policy actors, including representatives of small businesses, consumer groups, and charities, in an effort to secure wider public legitimation and push back against industry influence. Finally, venue shifting generated commitments, which were politically binding on government. Although the ICB's recommendations were not legally binding, the credibility of the process and the status of its membership minimized ministers’ room for discretion when it came to implementation.Footnote 71 Similarly, the PCBS provided a public platform for senior officials to reopen fundamental questions about structural reform.Footnote 72 Under the threat of further amendments in the House of Lords, the Treasury relented to the PCBS's demands to toughen the bill by granting regulators additional “reserve powers” to forcibly break-up individual banks if they breach the new rules (known as ringfence “electrification”).Footnote 73

In the case of France, there was little, if any, attempt at venue shifting. French political and technocratic elites repeatedly presented the financial crisis as a consequence of the excesses of Anglo-American investment banking.Footnote 74 From this perspective, there was therefore no need to overhaul France's regulatory or supervisory framework for banks. The main non-parliamentary venue for the consideration of banking reform was the Comité consultatif du secteur financier (CCSF). Crucially, unlike the ICB in the United Kingdom, this was not a new body and it lacked meaningful independence from government: the CCSF was a committee of the Ministry of Finance created prior to the outbreak of the financial crisis, which involved representatives from the ministry, the financial sector, consumer groups, and independent financial experts.Footnote 75 This committee, which met monthly, considered bank structural reform, among dozens of major financial issues, but did not dedicate significant time to examining the issue until 2013, after the proposal of the draft law. The CCSF then focused on specific matters, in order to add helpful details to the law.

The parliamentary commission that examined the draft law provided the potential for venue shifting. However, this commission consisted of fourteen National Assembly deputies and Senators, only two of whom—the Socialists, Laurent Baumel, and Karine Berger, the commission rapporteuse—could be seen to be even moderately critical of the government's draft law.Footnote 76 The commission proposed only two amendments, which only slightly reinforced the ringfencing required by the draft law. The commission failed to interview any government or bank official or independent expert. The rate manipulation scandal (Libor, Euribor and Tibor) resulted in two French banks being placed under investigation by the European Commission, which imposed fines on Société Générale. However, unlike in the United Kingdom, this scandal neither resulted in significant domestic political debate nor resulted in the organization of a special parliamentary commission and thus failed to increase the political salience of TBTF banks. The absence of venue shifting in France meant that the standard channels of bank influence in the country remained and, notably, the interpenetration of elites. In late 2012, the heads of three of the country's five largest banks were former Treasury officials, had served as financial advisors to the president or prime minister and were members of the elite Financial Inspection: Xavier Musca (Crédit agricole, former head of the French Treasury), Gilles Briatta (Société Générale), and Michel Pébereau (BNP Paribas).

In Germany, an opportunity for venue shifting did arise at the start of the crisis. From 2008 to 2011, the Merkel government established an “expert commission” (Expertenkommission) called the “Neue Finanzmarktarchitektur” or Issing Kommission, named after its chair, the former European Central Bank chief economist and Executive Board member, Otmar Issing. This commission consisted of a small number—at most six members including Issing—of very high-level public sector and academic experts on finance. But the principal focus of the commission was reforms at the international level, and specifically it sought to make recommendations for a new financial framework and systemic risk control that would be adopted at the G20 level. Its focus was not domestic per se, although a number of recommended international guidelines would have to be introduced at the EU and national levels.Footnote 77 It therefore dedicated surprisingly little time and resources to the issue of bank structural reform.Footnote 78 Although the commission continued working in an unofficial capacity from 2011,Footnote 79 it did not contribute in any direct and / or official way to the Merkel government's Reference Government2013 draft law on structural reform.

In parliament, only the small German Green party called for the creation of an independent commission similar to the British ICB with a remit to focus on structural reform, especially for the largest, systemically important German banks.Footnote 80 However, this proposal was blocked by the governing Grand Coalition. The Bundestag created a special commission to focus upon the management of specific failed institutions—notably HRE and Dresdner Bank—but this commission did not examine broader banking reform issues. The German law on structural reform was discussed and debated in the select committee on financial affairs of the Bundestag (Finanzausschuss). However, this committee and the economics and financial committee of the Bundesrat (upper house) passed no amendments to the government's draft law—which was presented as “a fait accompli.”Footnote 81 As for the Libor scandal, no dedicated committee / commission was established by parliament. There was a day-long hearing in the Finanzausschuss in November 2012 (28 November 2012).Footnote 82 Infamously, the head of Deutsche Bank, Anshu Jain, was invited to appear before the select committee to answer questions on his bank's involvement in rate manipulation but he failed to show up and there was no subsequent follow up.Footnote 83 Only members of the marginal Green and Die Linke parties drew a link between the rate manipulation scandal at Deutsche Bank and the need for major structural reform.Footnote 84

Venue shifting is therefore critical to explaining the divergence in policy outcomes across our three cases. In the United Kingdom, political imperatives—the inconclusive outcome of the 2010 election and the Libor scandal—led to the issue of banking reform being removed from the government's immediate control and placed into the hands of independent expert commissions. By helping to insulate the process from industry lobbying, and facilitating the mobilization of a broader coalition of non-business interests, venue shifting widened the policy window for banking reform. In the case of France and Germany, however, banking reform was largely managed through pre-existing institutional venues, which lacked meaningful independence from government and therefore did not challenge the influence of powerful banking interests. These venues enabled government ministers and the financial industry to maintain de facto control of the structural reform agenda, thereby narrowing and limiting the window of opportunity for policy change.

Conclusion

The aim of this article was to explain the difference of bank structural reform between, on the one hand, the United Kingdom, and, on the other, France and Germany. This difference is puzzling because all three cases shared a number of important economic and political features, including the growth of market-based banking, bank bailouts, and public and political pressure for reform. In response, the UK government introduced new ringfencing rules, requiring a major overhaul of banks’ trading activities. By contrast, the French and German governments implemented weaker measures targeting a narrow set of proprietary trading activities. Using an agenda setting framework, our article explains policy divergence by examining the rise (and fall) of structural reform on the policy agenda. By analysing three key agenda dynamics—issue framing, conflict expansion, and venue shifting—this article explains how and why the policy window for structural reform widened in the United Kingdom over time, but gradually narrowed in France and Germany. We argue that by delegating structural reform to new institutional venues, the UK government helped to insulate the process from industry framing away from TBTF, and facilitated conflict expansion by mobilizing a wider coalition of actors. In the case of France and Germany, however, the agenda was tightly managed through existing institutional venues. This led to conflict contraction by limiting the mobilization of non-business groups, and enabling large banks to successfully frame the crisis as a problem of “Anglo-Saxon” banking.

Explaining banking reform through the lens of comparative policy analysis addresses important limitations of CPE approaches. While this article challenges structurally-deterministic accounts of regulatory change, we also seek to avoid an explanation that is over-reliant on contingent and agential factors. Comparative policy analysis addresses this by drawing attention to how policy processes mediate the relationship between structure and agency. In particular, agenda setting dynamics show how shared political pressures for reform can lead to divergent outcomes, which have less to do with maintaining comparative economic advantage, and more to do with how policy processes (dis)empower different groups of public and private actors with resources. Integrating an agenda-setting perspective into the business power literature—which we do for the first time—also adds important value in two ways. First, it builds upon recent work which emphasizes the contingency and variability of business power over time, rather than relegating it to a constant background condition.Footnote 85 In particular, the findings point to the way in which the influence of large firms is mediated by political and bureaucratic actors, and channelled through institutional processes. We suggest that this political-institutional context generates particular incentive structures for collective action in different countries. This helps to explain why the scope and influence of financial industry lobbying varies across our cases: specifically, why French and German banks remained unified in their opposition to bank structural reform, while the UK banks did not. Second, we seek to endogenize issue salience rather than treat it as an exogenous variable. Viewed through the lens of key agenda setting dynamics, we get a richer understanding of how and why business power can be challenged (or entrenched) by key policy actors using policy processes to cultivate (or contain) issue salience.

Our study also contributes to the policy agenda literature by responding to the call for further analysis of agenda setting from a comparative perspective.Footnote 86 Comparative analysis is better placed to explain, rather than simply describe, the causal factors that shape policy change. By examining shared policy issues on a cross-national basis, it is also well suited to explaining instances of both policy change and non-policy change: that is, how and why policy windows open in some countries, but close or fail to open in other countries.Footnote 87 In this respect, our comparative analysis of banking reform points to the importance of dynamics of both conflict “expansion” (in the United Kingdom) and conflict “contraction” (in France and Germany). We define the latter as a process by which a policy issue becomes less prominent on the policy agenda. In the case of bank structural reform in France and Germany, conflict contraction was characterized by the decline or demobilization of actors around the policy issue. This decline resulted from the particular framing of the banking reform issue (so that it appealed to fewer actors) and the choice of existing institutional venues (which limited access and entrenched the power of vested interests, here the representatives of large banks). Our analysis suggests that, like conflict expansion, contraction can be generated endogenously through the actions of policy actors. Intriguingly, our analysis also points to the fact that these actions can be either intentional or unintentional—indeed, in the UK case, we argue that conflict expansion was the unintended consequence of venue shifting.

Finally, we suggest that the analysis of venue shifting and conflict expansion/contraction could provide significant explanatory leverage in other areas of regulatory reform, and in other regulatory jurisdictions (countries) and negotiating arenas (at the international and EU levels). For example, the reform of bank capital requirements highlights the importance of conflict expansion at the international level by U.S. and UK policy makers in their pursuit of tougher standards. But it also reveals the risks of this strategy, as expansion at the EU level led to the mobilization of new actors (the Commission and European Parliament) with different policy priorities (for example, the imposition of bankers’ bonus caps).Footnote 88 Conversely, the example of hedge fund regulation highlights the limits of conflict contraction as a strategy for maintaining the regulatory status quo: while the UK government (with the support of the United States) was able to dilute reform at the international level, it could not resist political pressure from France and Germany in favour of EU-level conflict expansion.Footnote 89 These brief examples illustrate how conflict expansion/contraction is shaped by the distinct characteristics of the institutional context. Further analysis of how these dynamics operate across different regulatory arenas and levels—for example, by comparing the closed and technocratic realm of global financial regulatory bodies, with the more pluralistic and politicized nature of EU regulation—could provide valuable new insights into the conditions for policy change and non-change in financial regulation.