The U.S. charitable-contribution income tax deduction marked its centennial in 2017. Relative to nearly every other aspect of the federal income tax, the workings of the deduction have changed little since its creation in 1917. For the largely higher-income minority of households who are able to make use of the contribution deduction, charitable giving is done with pretax money, lessening the cost of giving. The highest-income households have the highest tax rates and therefore the greatest tax savings. The deduction has been subject to recent demands for reform by lawmakers of both major U.S. political parties, who dislike both the narrow criteria for who is able to benefit from the deduction and the heightened subsidy of the deduction for those of the greatest means.Footnote 1

Yet historically, high-income households have always been the main targets of the charitable-contribution deduction. Except for two brief periods (1942–1943 and 1982–1986), it has always been the case that fewer than half of Americans are eligible to deduct their giving from taxable income, and the mechanics of the deduction necessarily mean that high-income households are more likely to be eligible for the deduction and to receive the greatest benefit for their giving.

This article traces the policy history of the charitable contribution from its conception and enactment, through its reform in the middle of the twentieth century, to changes legislated in the final days of 2017. It does so in two ways. First, it catalogs every change in federal income tax law affecting the contribution deduction over the historical span of the modern U.S. federal income tax; every such federal law and a summary of its key points are tabulated in the appendix. Second, this article traces the highlights of those legal changes, relating a narrative of the evolution of philanthropy and taxation in order to give those changes appropriate context from congressional debates and reports, contemporaneous news accounts, data on giving behavior and taxation over time, and relevant secondary historical sources.

As this history makes clear, the contribution deduction was created to protect voluntary giving to public goods by rich industrialists who had made their fortunes in business. After World War II, these business founders discovered that under postwar tax rates, they were better off giving away their wealth than consuming it directly. This incentive precipitated a surge in charitable giving and foundation establishment that transformed American civil society and led to a new public controversy over the appropriate role of donors in policymaking and the legitimate uses of the contribution deduction. The backlash to these reforms created both the modern identity of a “nonprofit sector” encompassing diverse organizations of wildly different sizes and missions and a new conservative politics that emphasized philanthropy and voluntarism over public provision of social services.

This article contributes to two bodies of literature: it incorporates the importance of the U.S. tax system into the literature on the history of philanthropy, and it provides the literature on the economics of tax policy and charitable giving with the historical context it currently lacks.Footnote 2 Regarding the former, the history of philanthropy to date has been preoccupied largely with the social context of individual philanthropists—how their giving acted as an outgrowth of their austere childhoods and their successful business philosophies.Footnote 3 Personal factors were and continue to be important influences on philanthropy, of course. But these narratives overlook the importance of tax incentives, particularly their role in the massive expansion (and sometimes misuse) of foundations by the very wealthy in the middle of the twentieth century. The tax code of the 1950s and 1960s gave the entrepreneurially wealthy a powerful incentive to donate their wealth rather than liquidate it, even if they had minimal philanthropic inclinations.

Likewise, economic analyses of the contribution deduction overlook the history of the tax code. The philanthropy of the very rich has always been the object of the tax deduction, and the modern conception of it as an incentive for giving more broadly is a new element of our discourse. Economists’ preoccupation with the deduction's effectiveness at inducing giving, relative to its reduction in tax revenue, would have struck the deduction's author as a strange way to conceptualize the policy problem.Footnote 4

Last, this article seeks not only to expand the historical and policy-focused understanding of philanthropy and taxation but also to understand how the two have influenced each other over the past century. As we will see, philanthropy inspired the tax deductibility of giving, which in turn changed philanthropy in ways that led inexorably to further tax reform in a repeating cycle of change and response. This back-and-forth coevolution of philanthropy and taxation drives the history of the deduction.

The Great Foundations and the Income Tax

Modern American philanthropy did not begin as a response to tax policy; indeed, the great foundations of Andrew Carnegie and John D. Rockefeller predated the Sixteenth Amendment entirely. Rather, lawmakers saw philanthropists as a source of social capital that should be protected from the new tax on high incomes, lest the government find itself having to pay for programs philanthropy had previously funded voluntarily, out of the donors’ own pockets.

The existence of charities funded by private gifts—and suspicion of those charities and gifts—has been a distinguishing feature of the United States since its Revolution, well before the creation of a federal income tax. The Dartmouth College Supreme Court case, for instance, is best known as a seminal event in American corporate law, but the specific finding of the Supreme Court was that private donations to a nonprofit college could not be seized by a populist state government.Footnote 5 The propriety of charities outside the control of state government developed in a regional pattern; the South and the central United States distrusted charitable institutions as undemocratic and tended to establish state-controlled universities and hospitals, whereas the Northeast and upper Midwest chartered private institutions quite freely. The distribution of private nonprofits in the eastern United States still follows this pattern.Footnote 6

Philanthropy as we know it, however, truly came into its own after the American Civil War, when a new class of business elites—who were so rich that they struggled to dispose of their wealth effectively—arose. Economic inequality grew rapidly as entrepreneurial industrialists like Carnegie and Rockefeller grew their businesses from humble beginnings into sources of breathtaking fortune. From the 1870s to the start of the Great War, the top income share of the top 1 percent of households roughly doubled.Footnote 7

To the industrialists, this presented the problem of how to dispose of unprecedented sums of money in a methodical and socially valuable way. Cash grants to the poor were not only impractical but also thought to encourage dependency on handout “charity.” It was Carnegie who articulated a vision of the rich philanthropist in whose hands resources had been efficiently concentrated by industrial competition and who therefore justly wielded unchecked powers to construct institutions that would allow the poor to lift themselves up by their bootstraps, writing that

even the poorest can be made to … agree that great sums gathered by some of their fellow-citizens and spent for public purposes, from which the masses reap the principal benefit, are more valuable to them than if scattered among them through the course of many years in trifling amounts.Footnote 8

Whereas Carnegie successfully turned his vision into a network of thousands of public libraries, Rockefeller struggled to identify worthy causes quickly enough to keep pace with the millions of dollars Standard Oil generated every year.Footnote 9 Rockefeller eventually decided to create a charitable foundation that would professionalize the task of carefully giving away a large fortune. He sought a corporate charter with direct congressional control from the federal government, only to be rebuffed by bipartisan populists angry about Rockefeller's ruthlessness in business; instead, Rockefeller chartered his foundation in New York State, with no public role in its governance, in 1913.Footnote 10

Carnegie and Rockefeller could not have been motivated by tax considerations—the federal income and estate taxes would not be established until shortly before Carnegie's death and after both men had begun their philanthropic activities. Nor is it easy to reconcile their aggressive empire building and rent seeking in business with purely altruistic motivations. More plausibly, the philanthropy of the Gilded Age was motivated at least partially by a desire to enhance the social status and prestige of the philanthropist by acting as a “hyper-agent” seeking not only to fund the public good but to permanently reshape social institutions.Footnote 11 In this sense, the great philanthropic foundations and charities of Carnegie and Rockefeller and their peers were not only efficient vehicles for the processing and distribution of charitable grants but new and powerful institutions designed to demonstrate the philanthropist's institution-forging social power.

The Creation of the Modern U.S. Income Tax and the Contribution Deduction

The same year Rockefeller chartered his foundation, Congress passed legislation creating the first modern income tax. Initially, the tax was less important for revenue itself than for mitigating the unfairness of the overall federal tax system. Even as Rockefeller, Carnegie, and their peers grew fantastically wealthy, the federal government was overwhelmingly reliant on excise taxes that fell disproportionately on lower-income households; the income tax was an opportunity to redistribute the tax burden upwards. In the first years of the income tax, less than 1 percent of households were subject to it, and it had rates no higher than 15 percent.Footnote 12 Quickly, however, the tax became an important revenue instrument; in 1917 the top rate was abruptly raised to 67 percent to pay for World War I.

The Congress added a deduction for gifts to charitable organizations to the bill implementing these high rates, not to encourage the wealthy to give their fortunes away (which the most influential and richest men were already doing) but to not discourage their continued giving in light of a larger tax bill. Senator Henry F. Hollis of New Hampshire—who was also a regent of the nonprofit Smithsonian Institution—proposed that filers be permitted to exclude from taxable income gifts to “corporations or associations organized and operated exclusively for religious, charitable, scientific, or educational purposes, or to societies for the prevention of cruelty to children or animals.”Footnote 13

The senator argued for the change not because he thought it was wise public policy to change the “price” of charitable contributions via a subsidy but because of worries that reduced after-tax income of the very rich would end their philanthropy, shifting burdens the philanthropists had been carrying onto the backs of a wartime government. As Hollis explained,

Usually people contribute to charities and educational objects out of their surplus. After they have done everything else they want to do … if they have something left over, they will contribute it to a college or to the Red Cross or for some scientific purpose. Now, when war comes and we impose these very heavy taxes on incomes, that will be the first place where the wealthy men will be tempted to economize, namely, in donations to charity. They will say, “Charity begins at home.” . . . Look at it this way: For every dollar that a man contributes for these specific charities . . . the public gets 100 percent. . . . If it were undertaken to support such institutions through the Federal Government or local governments and the taxes were imposed for the amount . . . [i]nstead of getting the full amount they would get a third or a quarter or a fifth.Footnote 14

That is, Hollis conceived of charity as the hobby of the very rich households obligated to pay income tax and worried that if they responded to high marginal rates by keeping more after-tax income for their own uses, the government would find itself compelled to step into the gap, undoing the very goal of making more revenue available for war. If anything, Hollis was concerned with the government's price of philanthropy rather than the individual's, comparing some foregone fraction of a dollar in tax revenue to “100 percent” of the donation going to “the public.” Hollis's amendment to the War Revenue Act of 1917 was accepted unanimously and without controversy.

Direct changes to the contribution deduction since its enactment have been few and relatively modest. The appendix presents a tabular summary of U.S. federal income tax legislation, noting both broadly important features and changes specific to charities and to the charitable-contribution deduction; describing each federal tax law in detail is beyond the scope of this narrative. The most important changes to the deduction have been the indirect changes in its value to donors as tax rates (and therefore the value of avoiding tax). Immediately following the end of the Great War, rates were reduced, only to rise to even higher levels during the Great Depression and another world war.Footnote 15 Nor did the congressional perception of the purpose of the deduction evolve noticeably over this period; consistent with Hollis's policy justification, a 1938 House report claimed that

the exemption from taxation of money or property devoted to charitable or other purposes is based upon the theory that the Government is compensated for the loss of revenue by its relief from financial burden which would otherwise have to be met by appropriations from public funds, and by the benefits resulting from the promotion of the general welfare.Footnote 16

In the same vein, in 1947 the president of the American Hospital Association reminded members of the House in testimony that the contribution deduction served to “reduce the burden which might otherwise fall upon government Itself.”Footnote 17

The equivalence of private philanthropy with government spending would not be challenged until after World War II. Further wartime changes to the income tax system turned the contribution deduction into a vehicle for purposes that were not purely philanthropic. Change would come when foundations and charities were swept up in a national debate about tax equity and the public purposes of philanthropic giving.

The Mechanics of the Charitable-Contribution Deduction for the Entrepreneurially Wealthy

To understand what happened to philanthropy after World War II, we must take an arithmetical detour into the workings of the charitable-contribution deduction. For the very rich, especially entrepreneurs like Carnegie and Rockefeller who grew their wealth through business expansion, charitable gifts of corporate stock avoided multiple taxes. Most obviously, their giving reduced their income tax, but under the deduction's rules such gifts additionally avoided capital gains taxation. Furthermore, wealth given away was wealth not held at death, so giving during life also reduced the size of the donor's taxable estate. When the U.S. Congress raised income tax rates to pay for the war and defense costs of the mid-twentieth century, it created a situation where many of the richest American families found that by giving their fortunes to a foundation they avoided more in taxation than they would have received in proceeds for selling shares of stock. Foundations flourished.

To be eligible for a tax deduction, a donor must irrevocably transfer property to a public charity or foundation serving one of a set of narrowly defined eligible purposes; these include churches, schools, hospitals, arts institutions, human services, and child or animal welfare organizations. Eligible organizations are a subset of nonprofit organizations generally and are organized under section 501(c) of the tax code.Footnote 18 Within quite broad limitations, what a donor gives to an eligible charity or foundation within a calendar year can be taken as an itemized deduction against taxable income at filing.

The value of the deduction depends on whether it is optimal for the taxpayer to itemize and their marginal tax rate. Federal taxable income is computed by subtracting deductions and exemptions from gross income:

Taxable income ≡

Adjusted gross income (AGI)

− max {Standard deduction,

itemized deductions}

− personal exemptions

Itemized deductions ≡

charitable contributions

+ state and local taxes paid

+ mortgage interest

+ excessive medical expenses

+ other items

Taxable income is then used for calculation of tax owed according to a progressive rate schedule; what is subtracted from taxable income is not taxed.Footnote 19

Most U.S. taxpayers are better off taking the standard deduction and therefore receive no tax subsidy for charitable giving.Footnote 20 Let us instead consider the case of a high earner who always prefers to take itemized deductions. If this person gives a dollar in cash to an eligible charity, then the taxable income is reduced by one dollar, and the tax owed is reduced by the marginal rate on ordinary income, τO, or the donor faces a marginal “tax price,” p, of charitable contributions equal to

The total after-tax cost is the difference between the dollar given and the tax-payment reduction received.Footnote 21

However, donors need not give cash; noncash donations are also tax-deductible at their market value. For middle-income Americans, noncash gifts might include contributions of surplus canned goods to a food drive or of used clothing to a thrift shop. Itemizers may deduct reasonable estimates of the cash value of such gifts from taxable income.

Similarly, gifts of corporate stock are noncash contributions, deductible at the fair market value of the shares at the time of the donation. And because the shares are not sold by the donor, that donor avoids paying any capital gains tax, in addition to deducting the full value of the shares from the taxable income.Footnote 22 Therefore, if a taxpayer donates stock instead of selling it, the tax price, p*, of giving is

where τO is the tax rate on ordinary income, τCG is the capital gains tax rate, and θ is the share of that market value composed of unrealized, taxable capital gain.Footnote 23 The gift of stock allows the donor to avoid two taxes: ordinary income tax and capital gains tax.Footnote 24 Gifts of corporate stock will yield a greater tax savings than gifts of cash as long as that corporate stock has risen in value since the donor purchased it.

A vast literature in public economics has estimated the importance of this tax price of charitable giving. Estimates vary substantially depending on methodological choices about how to handle important unobserved quantities, such as expectations regarding future income and tax rates, stock of wealth, and the degree of capital gains available to the donor (θ), but a rough consensus has emerged that the tax incentive probably motivates slightly more additional giving than the U.S. Treasury foregoes in counterfactual revenues.Footnote 25

What has not been thoroughly studied is the role of the contribution deduction in the common transition of entrepreneurial founders of large firms into philanthropists later in life.Footnote 26 Titans of industry can and do give away large fortunes. And because company founders generally build their companies up with “sweat equity,” virtually all of the value in their stock is taxable capital gain (θ ≈ 1), making gifts of company stock especially tax advantaged for this group. Nearly 100 percent of any stock sold would be subject to the capital gains tax.

Indeed, when θ ≈ 1 and both ordinary and capital gains tax rates are high enough, it is possible for p* to be less than zero—that is, for successful entrepreneurs to be better off by donating their corporate stock than liquidating it. This has not been possible under the rates that have prevailed in recent years, but for several years in the middle of the twentieth century, it was quite possible for stock donations to be strictly better than sales of shares for households with high incomes and high capital gains.

Figure 1 plots the tax price of donating stock for various high-income tax brackets and capital gains ratios over the period 1917–2017. During World War I and for several years following World War II, wealthy industrialists with large unrealized capital gains facing the very highest tax rates were better off donating shares than selling them, even if they had no interest in philanthropy. Taxpayers with lower θ or with taxable incomes not quite in the highest tax bracket may not have been literally better off making a donation in each of these years, but they nevertheless surrendered very little after-tax income by making a donation relative to selling their stock. Note, too, that this figure presents only tax savings relative to federal income and capital gains taxation; many donors quite likely received additional savings in the form of charitable-contribution deductions from state income taxation and by reducing their taxable estates.Footnote 27

Figure 1. Top earners’ tax price of giving appreciated assets, 1917–2017. Notes: Tax prices are shown relative to after-tax consumption of liquidated assets in the same year. “Top 0.1%” tax rates are for ordinary income at the threshold of Thomas Piketty and Emmanuel Saez (2003) for the top 0.1 percent of taxpayers by income (excluding capital gains income). (Sources: Thomas Piketty and Emmanuel Saez, “Income Inequality in the United States, 1913–1998,” Quarterly Journal of Economics 118 [May 2003]: 1–41; Tax Foundation, “Federal Individual Income Tax Rates History 1913–2011,” data file published online 2013, https://taxfoundation.org/us-federal-individual-income-tax-rates-history-1913-2013-nominal-and-inflation-adjusted-brackets/; Citizens for Tax Justice, “Top Federal Income Tax Rates Since 1913,” mimeo published online 2011, http://www.ctj.org/pdf/regcg.pdf; Nicolas J. Duquette, “Inequality and Philanthropy: High-Income Giving in the United States 1917–2012,” Explorations in Economic History, 70 [Oct. 2018]: 25–41.)

Congress Expands Subsidies for Major Gifts

Congress did not intend to create such a powerful incentive. High tax rates were enacted to improve tax fairness during the Depression and to pay for the heightened defense needs of World War II and the Cold War. When the postwar Congress did reform the tax code, the focus was for the most part on reforms that would make the federal income tax more equitable and tolerable for middle-income households that had been added to the tax base during wartime.

However, the few reforms that did substantially affect the contribution deduction were unambiguously in the direction of increasing its generosity for an elite set of major donors. Four times over the 1950s and 1960s, Congress increased the share of income that filers could deduct for charitable giving. These changes specifically increased the generosity of the deduction for those who gave out of wealth that far exceeded their income, such as the entrepreneurially rich. The limited congressional debate on these changes demonstrated a continued belief that private giving was a cheap way to avoid greater public spending.

The 1917 act limited the deductibility of charitable contributions to 15 percent of income; any donations beyond that received no special tax treatment. In the debate over the Revenue Act of 1939, Republican Congressman Robert Jones of Ohio proposed raising this limitation to 25 percent, asserting both that the 15 percent limit crimped giving by donors who would otherwise give more and that the New Deal federal relief projects had crowded out voluntary aid through churches and federated giving.Footnote 28 Charities, too, pleaded with Congress for a higher limitation on deductible giving. In 1951, James Rhyne Killian, president of MIT, delivered a statement to the Senate Finance Committee specifically proposing that “the 15 percent limitation should be substantially raised or eliminated.”Footnote 29

As tax rates rose to a top rate of 94 percent under the demands of the Cold War and the Korean War, a Republican administration and Congress reluctant to play too active a role in domestic policy found themselves unable to cut rates as their predecessors had in the 1920s after World War I. In 1952, the limit was increased to 20 percent of income, which Senator Walter George (D-GA) claimed would specifically benefit “hospitals, small colleges, and charitable institutions.”Footnote 30 The president of the University of Pennsylvania testified that higher education was dependent on a small number of rich and generous donors and pleaded with Congress not to lower the AGI limitation below the 20 percent level in the revised code. For these reasons, the 1954 Internal Revenue Code increased the limit from 20 percent to 30 percent of income, but only for donations to churches, conventions of churches, hospitals, and educational institutions.Footnote 31

The merits of a changing AGI limitation do not seem to have been extensively discussed in congressional debate; the primary objective of the 1954 reform was the creation of new rules to increase equity and fairness among middle-class taxpayers by including features such as the childcare deduction and retirement credits that had not been necessary when the tax fell only on high earners.Footnote 32 The debate in the House simply noted that the limitation increase “is designed to aid certain institutions in obtaining the additional funds they need, in view of their rising costs and the relatively low rate of return they are receiving on endowment funds.”Footnote 33 The discussion in the Senate was confined to testimony before the Finance Committee confirming that the details of the bill had not been considered in depth. After Eugene Butler of the Catholic Welfare Conference complained in testimony that the higher limit excluded many types of charities, Chairman Eugene Millikin posed two questions:

The Chairman [Sen. Eugene Millikin]. Just a minute. Mr. Smith, was there any debate, any reason given for the distinction that the gentleman is pointing out?

Mr. Smith. There was some thought of changing the limitation from 20 percent to 40 percent or 50 percent, but some members didn't think it should go quite that far, and they recommended the extra 10 percent but limited it to these particular organizations at the time.

The Chairman. Was there any particular discussion on the point which the gentleman is making?

Mr. Smith. No, sir. Footnote 34

Congress would raise the AGI limitation two more times, extending the 30 percent limitation to other charities in 1964 and raising it to 50 percent of AGI for gifts of cash in 1969.Footnote 35 Rather than limit the high rate of subsidy that high marginal rates had created for wealthy donors, the midcentury reforms extended those subsidies to even larger gifts.

Even as lawmakers expanded the contribution deduction for the very rich by increasing the income limitation, they effectively withdrew eligibility for the contribution deduction from a majority of Americans. Figure 2 plots the share of American tax units filing income tax returns and eligible to take the contribution deduction over time.

Figure 2. Shares of American tax units by individual income tax incentive for charitable contributions, 1917–2015. Notes: Diagonal lines represent the period 1982–1986, when nonitemizers were able to deduct a portion of their charitable giving. Counts of itemizer and nonitemizer returns are taken from IRS reports 1917–1959 and 2013–2015; counts are computed from IRS Statistics of Income data files 1960–2012. Total number of tax units per year taken from Thomas Piketty and Emmanuel Saez (2003). (Sources: Internal Revenue Service, “Individual Public-Use Microdata Files” [multiple years], data files hosted by National Bureau of Economic Research, http://users.nber.org/~taxsim/gdb/. Internal Revenue Service, “Statistics of Income Report” [multiple years], available through IRS-Tax Stats historical records, https://www.irs.gov/statistics/soi-tax-stats-archive. Thomas Piketty and Emmanuel Saez, “Income inequality in the United States, 1913–1998,” Quarterly Journal of Economics, 2003, 118 [May 2003]: 1–41, updated data obtained from Emmanuel Saez [Department of Economics, University of California, Berkeley website] https://eml.berkeley.edu/~saez/.)

The Revenue Act of 1944 added the standard deduction to the tax code, giving most middle-income Americans a better tax reduction by not itemizing their charitable contributions. In 1943, 75 percent of U.S. households were eligible to take the charitable-contribution deduction (whereas the other quarter of households did not file tax returns). In 1944, only 14 percent of households itemized their deductions, even as the share of households not required to file fell to just 20 percent; the other 66 percent took the standard deduction. Since then, the share of U.S. households who file itemized returns—and who therefore receive a tax subsidy for charitable giving—has never exceeded 45 percent. Even as the income tax fell on a rapidly increasing share of American households, reforms kept the subsidy for charitable contributions focused on the elite minority who were its original beneficiaries.

The Midcentury Surge in Foundations and Giving

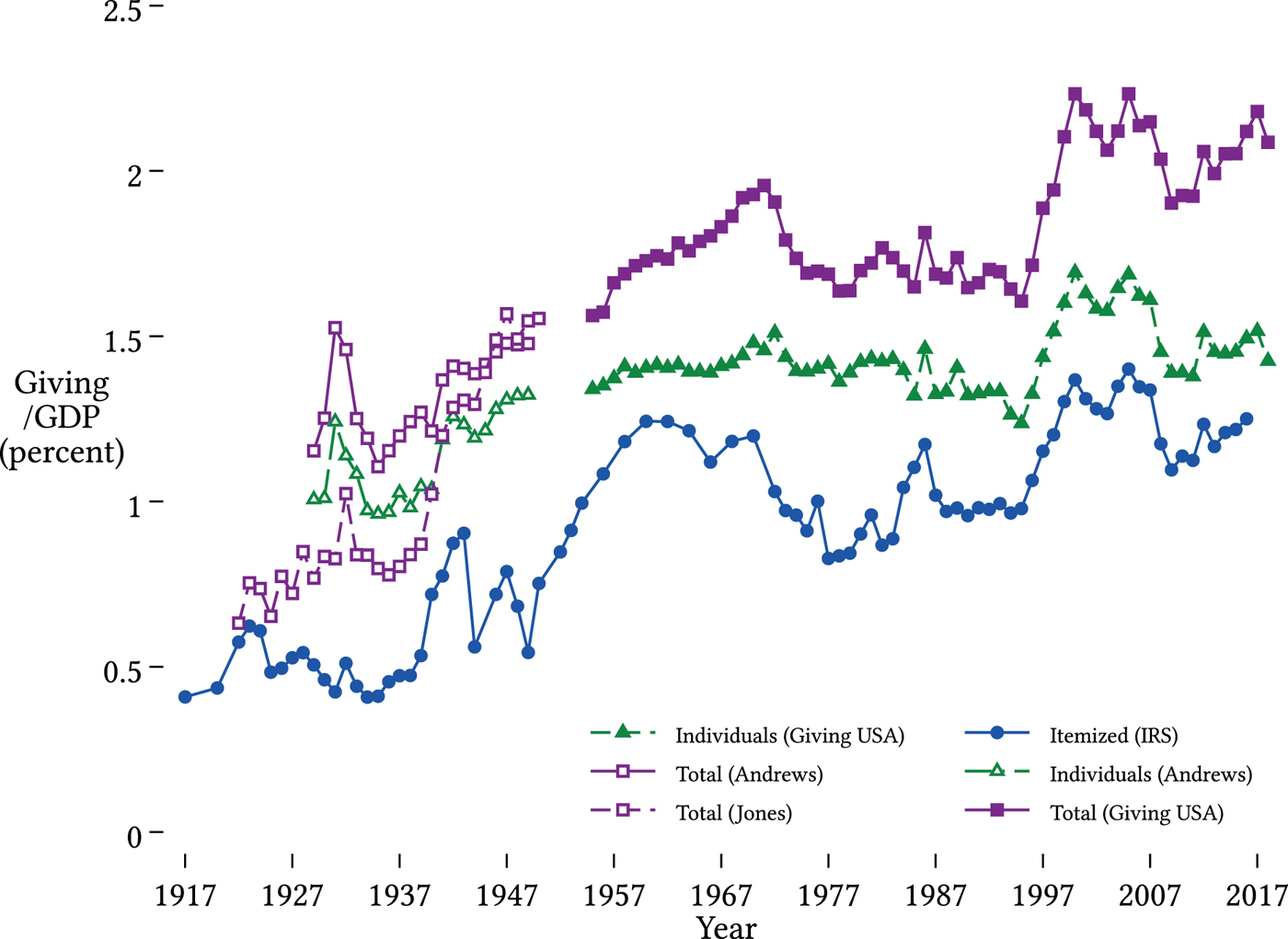

The combination of a more generous share-of-income limit on the contribution deduction, high tax rates, a booming postwar economy, and favorable social forces led to a surge in charitable contributions during the 1950s. Figure 3 plots charitable contributions’ share of U.S. gross domestic product (GDP) over nearly a century according to a variety of measures. Charitable contributions surged to over 2 percent of GDP from 1945 to 1965, with most of the change coming from shifts in contributions by (living) individuals, not estates or corporations. The richest households, those in the top 0.1 percent of the income distribution, roughly tripled their contribution rates over the 1945–1965 period, both as a share of their income and in real dollars per capita, thanks to a mix of high social capital, high social equality, and strong tax incentives. At the same time, techniques for mass fundraising targeting middle-income households pioneered by the March of Dimes and the United Way during the Depression and World War II met renewed success in the booming postwar economy.Footnote 36

Figure 3. United States giving per gross domestic product, 1917–2018. Notes: Total contributions include charitable giving not out of living persons’ income, such as bequests, gifts out of foundations, and corporate contributions. Individual giving excludes estates and organizations. Itemized contributions are those claimed on an individual tax return. (Sources: F. Emerson Andrews, Philanthropic Giving [New York, 1950]; John Price Jones, The American Giver: A Review of American Generosity [New York, 1954]; Lilly Family School of Philanthropy, Giving USA [Indianapolis, 2017]; Susan B. Carter, Scott Sigmund Gartner, Michael R. Haines, Alan L. Olmstead, Richard Sutch, and Gavin Wright, eds., Historical Statistics of the United States Millennial Edition Online [Cambridge, MA, 2006]; Internal Revenue Service, “Individual Public-Use Microdata Files” [multiple years], data files hosted by National Bureau of Economic Research, http://users.nber.org/~taxsim/gdb/. Internal Revenue Service, “Statistics of Income Report” [multiple years], available through IRS-Tax Stats historical records, https://www.irs.gov/statistics/soi-tax-stats-archive. See also Nicolas J. Duquette, Fiscal Policy and the American Nonprofit Sector [PhD diss., University of Michigan, 2014], chap. 1.)

Importantly, however, tax policy over this period encouraged the entrepreneurially wealthy to donate their stock even if they had minimal interest in traditional motivations of “giving back,” accumulating social capital, or transforming institutions. Once tax rates were sufficiently high that the tax savings from donating stock met or exceeded the after-tax proceeds from selling stock, there was no reason not to make a donation. As one philanthropist told anthropologist Teresa Odendahl,

[Taxes] were extremely important because I could give away securities and end up with the same amount of money, after tax, as if I sold them. And if I gave them away, they went where I wanted. If I sold them, they went to the U.S. Government.Footnote 37

With a bit of advance planning, philanthropists could give their shares away while continuing to receive important benefits from those shares. Before 1969, there were few checks on the governance of family foundations or their handling of shareholder power. To entrepreneurs who had built large enterprises from scratch, the foundations presented an appealing way to have the benefit of selling shares without losing control of the business. Corporate shares sold to strangers could not be voted in line with the seller's preferences; shares given to heirs and the heirs of heirs could lead to familial factionalism and, eventually, sales of shares by the least committed cousins; but a family foundation holding shares of stock and voting those shares as a bloc could maintain family control of a firm, however much the siblings and cousins may have squabbled at the foundation's board meetings. Even better, family foundations could pay family members generous salaries to direct and manage the foundation, allowing them to continue to benefit from the profits redounding to the foundation's stockholding. Although many industrialists gave directly to specific charities, the foundation vehicle had the additional benefit of being able to leave corporate control to one's heirs through a single untaxed legal entity. Without the structure of a foundation, meeting the costs of the estate tax might force a family to sell shares below the 51 percent level of corporate control, or heirs might not coordinate their share voting as a bloc.Footnote 38

There is significant evidence that business founders chose the foundation vehicle over this period for these reasons of tax reduction and corporate control. Henry and Edsel Ford, for example, made the Ford Foundation an order of magnitude more wealthy than the second-largest foundation at the time with a special class of shares convertible to a controlling interest in Ford Motor Company.Footnote 39 A 1982 survey found that half of the largest foundations established from 1940 to 1969 were begun with a gift of stock large enough to control a firm and that founders rated tax motivations as an important factor. This was true for few foundations established before 1939, when the wealthy would not have been better off giving than selling their shareholdings.Footnote 40

Ultimately, the incentives in the federal tax code attracted the attention and then the outrage of the U.S. Congress. The relationship of the contribution deduction to philanthropy, and of philanthropy to charity, would be permanently changed.

Philanthropic Foundations under Scrutiny

Even as the postwar Congress expanded incentives for private charitable contributions, individual lawmakers began to question whether donations really saved the government from spending on social services or whether abuse of the foundation vehicle was instead eroding the tax base, costing the Treasury money, and undermining the public interest. Large charitable foundations were swept up in the Red Scare and accused by isolationist conservatives of diverting resources from needy Americans to support “un-American and subversive activities or for purposes not in the interest or tradition of the United States.”Footnote 41 Although the committees that investigated the foundations uncovered no pro-Communist activity, they did reveal to lawmakers the ways in which foundations gave their donors unaccountable power, extensive social influence, and means to maintain dynastic control over large corporations.

The power of foundations caught the attention of populist Texas Democrat Wright Patman, who began to gather financial data and hold his own hearings in the 1960s. His colorful and pugnacious assertions that philanthropy had been “perverted” got the attention of the media, leading to one notable press conference in which the normally articulate President John F. Kennedy responded to a question about Patman's hearings with the bland assertion that foundations were good but tax evasion was bad.Footnote 42 With time, a steady stream of documented abuses of foundations turned the issue into a popular cause, fueling the sales of books with titles like Who Rules America? and The Rich and the Super-Rich.Footnote 43

Patman's investigations did not damn foundations in general in quite the way he seemed to believe, but they did uncover serious abuses. Some corporate foundations were demonstrated to have made loans at below-market rates or to have made other suspicious business deals with their sponsoring firms.Footnote 44 Private foundations further extended the insider control of corporations through maneuvering to conceal financial information or consolidate votes during shareholder elections.Footnote 45 Of the thirteen largest foundations that accounted for a large share of all foundation assets, twelve were controlled by a tight-knit and highly interlocked “power elite,” undermining the case that tax benefits to foundations served the public.Footnote 46

The controversy culminated in the passage of the Tax Reform Act of 1969, which increased oversight of nonprofits in general and foundations in particular. The law increased the public's access to charities’ IRS filings, required more detailed disclosure and documentation of charitable contributions on individual returns, and imposed payout requirements and conflict-of-interest rules on foundations. Some legislators proposed a maximum life of forty years followed by closure for foundations, but those provisions ultimately did not become law.Footnote 47

The 1969 law also came close to eliminating the favorable treatment for the entrepreneurially wealthy's gifts of appreciated stock. Several drafts of the bill taxed the capital gain on any appreciated property donated.Footnote 48 The final version of the law did limit donors’ ability to give ordinary income property (but not capital gains property) at full market value.Footnote 49 The 1969 law also increased the share-of-income limit on the tax deduction from 30 percent to 50 percent—but only for gifts that did not include unrealized capital gains.

More worrisome for donors and nonprofits, the assumption that private donations reduced demands on government had been examined by lawmakers and found wanting, not just for foundations but for charities as well. Complained Senator Albert Gore Sr. of Tennessee to the Senate Finance Committee,

We are finally beginning, just beginning, to focus upon the problem of tax exemption for foundations. I suggest that our Government and our society need to focus upon charity and upon our policy, Government policy, with respect to charity. . . . [The poor quality of available data suggests] the need to focus finally in the development of our organized society upon governmental policy with respect to charity. I hope no one would think this statement would indicate an uncharitable attitude on my part toward charity. But a great many selfish acts of various, myriad kinds have been undertaken under the cloak of charity. We are subsidizing bogus, phony charities.Footnote 50

It is a matter of random chance that Congress did not further curtail the tax privileges of foundations and charities. Representative Wilbur Mills (D-AR), the powerful chairman of the Ways and Means Committee, had been expected to lead another round of tax reform targeting charities and foundations but instead left office abruptly after multiple incidents of public intoxication in the company of an Argentine burlesque dancer; his departure and the weakening of committee power within Congress disrupted the old lawmaking process and priorities.Footnote 51 When the tax benefit for elite philanthropy was finally reformed, the change came not from the reformist center but from the rejuvenated, small-government right.

The “Nonprofit Sector” and the New Politics of Charitable Contributions

Despite its extensive reform of private foundations, the 1969 act did not fundamentally change the workings of the contribution deduction. Nevertheless, lawmakers and philanthropists alike would never again take each other's goodwill for granted. The result was a shift from the long-standing perspective of policymakers that the deduction protected philanthropic contributions to social goods and saved the Treasury money to a more skeptical and economistic perspective that the deduction was an implicit cost that must be justified by its benefits.

This point of view was formalized by advances in econometric research supported by the philanthropists themselves. John D. Rockefeller III recognized that foundation critics had identified important problems, and even before 1969 he foresaw declining legislative support for nonprofits. Rockefeller called for the creation of a federation of foundations and charities in conjunction with or in addition to any new federal oversight body, and he financed two successive commissions to study the importance of tax incentives for charitable giving and to propose new regulations for charities.Footnote 52 New groups like the Independent Sector and Coalition of Voluntary Sector Organizations, which sprang up in the 1970s, “invented” the nonprofit sector as a coherent identity.Footnote 53 The Association for Research on Nonprofit Organizations and Voluntary Action (ARNOVA) and a network of foundation-funded university research centers began to organize scholarly research into these institutions.Footnote 54 Rockefeller's second commission itself produced six volumes of quantitative research on nonprofits.

This body of research included a new perspective on the purpose of the contribution deduction that would permanently change the way policymakers considered its costs and benefits. In particular, Martin Feldstein's groundbreaking econometric studies of the deduction's effectiveness, supported by Rockefeller III, reframed the deduction as a “tax expenditure.” Instead of asking how much less the government needed to spend thanks to philanthropy, Feldstein asked how much the deduction cost the Treasury relative to the additional giving it induced. This tax price (described above) could be quantified relative to “treasury neutrality”—that is, whether it induced more dollars in giving than the federal government lost in tax revenue for having it.Footnote 55 Feldstein's answer was reassuring. He found that the deduction encouraged more giving than it cost in uncollected taxes. But his work elided the long-standing distinction between the philanthropy of the very rich and the mere giving of ordinary people.Footnote 56 This perspective persists in economics to the present: while economists are aware that the deduction primarily affects higher-income households, this fact is typically treated as a methodological obstacle (because nonitemizers’ giving is generally unobserved in tax-return data) rather than as a policy decision of direct interest.Footnote 57

Rockefeller's commissions failed to have an immediate influence on the public debate, publishing their reports to little media attention, but the shift in perspective appeared in government at around the same time. Starting in 1975, “tax expenditures,” including the charitable-giving deduction, began to be reported in federal budgetary documents.Footnote 58 The government's accounting no longer embodied the view, originally articulated by Senator Hollis and held for decades, that charitable giving was a public good that substituted for government spending; instead, the contribution deduction was another subsidy program that happened to be implemented through the tax system. Future tax reforms and budgetary frameworks would treat the contribution deduction as a burden to government.

This shift would not be fully realized until the Reagan era radically reoriented fiscal politics. Ronald Reagan assumed office in 1981 with a message that synthesized calls for renewed charitable and voluntary activity with a high priority on reduced marginal tax rates and a simplified tax code. The 1980s tax reforms would eliminate the supercharged incentives for giving by the entrepreneurially wealthy. Top marginal rates fell to their lowest levels since the 1920s. In addition, a 1986 tax law sharply limited the additional tax benefit for giving large amounts of corporate stock and abolished the ability to deduct appreciation in the value of nonfinancial assets (for example, donations of paintings to museums).Footnote 59 These changes greatly reduced the incentives for the entrepreneurially wealthy to make contributions until the changes were reversed in 1993.

As shown in Figure 1, the after-tax cost of giving for high earners rose sharply with these tax cuts, reaching its highest level at any point since the Depression and definitively ending the era when the entrepreneurially wealthy received nearly as much by donating stock as selling it. The same philanthropist who told Teresa Odendahl that “I could give away securities and end up with the same amount of money, after tax, as if I sold them” now remarked that “the laws have changed so it is not so advantageous to give away securities rather than selling them.”Footnote 60 Oddly, though tax reform was motivated by incentive arguments, Reagan claimed that cuts in tax rates would not reduce giving because Americans “are the most generous people on earth.”Footnote 61

Contemporaries criticized Reagan for allegedly failing to understand that most government funding for human services was channeled through the nonprofit sector.Footnote 62 Yet these changes make more sense if Reagan's agenda was not to induce giving by the rich but to reform the attitudes of ordinary Americans and their elected lawmakers toward charitable organizations.

Voluntarism was a regular motif in Reagan's small-government rhetoric. In a September 1981 speech on cutting social spending, Reagan said, “The truth is we've let Government take away many things we once considered were really ours to do voluntarily out of the goodness of our hearts and a sense of community pride and neighborliness. . . . We are launching a nationwide program to encourage our citizens to join with us in finding where need exists and to organize volunteer programs to meet that need.”Footnote 63 To that end, the Reagan administration created a presidential task force and advisory council to study ways to support voluntarism, pledging that

with the same energy that Franklin Roosevelt sought government solutions to problems, we will seek private solutions. The challenge before us is to find ways once again to unleash the independent spirit of the people and their communities. . . . Voluntarism is an essential part of our plan to give the government back to the people.Footnote 64

Some policy choices reflect this rhetoric. A 1981 law cut tax rates, but it also allowed nonitemizers to deduct some of their contributions for the first time since the introduction of the standard deduction. That deduction would be repealed in the 1986 tax code, but the president himself intervened to protect the itemized contribution deduction against his own Treasury Department's recommendation to limit the deduction to donations in excess of 2 percent of income.Footnote 65 This preserved the deduction for relatively modest contributions at the cost of further reductions to tax rates.

Whatever Reagan's intentions, the tax laws of 1981 and 1986 removed a powerful incentive for founders to donate rather than sell their stock. To be sure, the rich give for many reasons besides tax incentives: altruism, social signaling, social reciprocity, and “hyper-agency” are all important.Footnote 66 Nevertheless, with reduced tax incentives, giving by the rich fell sharply. Households in the top 0.1 percent of the income distribution reduced the share of income they donated by half from 1980 to 1990, concurrent with the reduced value of the deduction over that period.Footnote 67 In the aggregate, charitable giving overall fell from just over 2 percent of GDP in 1971 to its lowest postwar level, 1.66 percent of GDP, in 1996 (Figure 3).

The decades-long surge in American generosity receded with the end of the founders’ extreme tax incentive. With time, the new understanding of the contribution tax deduction as a public expenditure supporting mass charity—and not as a cost-saving strategy to leave elite philanthropy untaxed—took root in popular discourse and economic thought.

Philanthropy and Tax Policy Today

This article has traced the history of the charitable-contribution income tax deduction in the United States and demonstrated that many of its stranger features are rooted in historical tax-code structures and ideas about the relationship between tax policy, government spending, and philanthropy. Contrary to the economistic depiction of charitable-giving tax subsidies that arose in the 1970s and 1980s, the charitable-contribution deduction was implemented by legislators who sought to protect the public purse from having to replace philanthropy—and not as a way for implicit spending to subsidize greater giving. This mindset, which viewed deductible philanthropy as a benefit to the Treasury and not an expense, explains why the deduction has almost always disproportionately benefited a relatively high-income minority of households—it does so by design. And this explains how the U.S. Congress could have continually expanded the AGI limitation on the credit in the 1950s and 1960s, even as lawmakers became increasingly aware that perverse incentives for wealthy entrepreneurs were spurring the creation of dubious foundations. Though the deduction itself has never been radically altered, the perverse incentives of the mid-twentieth century were undone by the increased regulation of 1969 and the tax reforms of the 1980s.

In light of this history, otherwise inscrutable choices embedded in the 2017 federal tax reform make sense. Because of increases in the standard deduction and the elimination or limitation of other itemized deductions, the 2017 Tax Cut and Jobs Act is expected to reduce the share of U.S. households eligible to take a deduction for charitable giving from its longtime share of about one-third to just over 10 percent, its lowest share since 1936.Footnote 68 Proposals from both parties and both houses of Congress sought to address this by creating a new deduction for nonitemizers, but those amendments failed to be included in the final legislation.Footnote 69 Yet one change did expand the deduction: for the first time since the 1960s, the limitation on the deductible share of income increased in 2017 from 50 to 60 percent.Footnote 70 This increase matters to few people, but it matters quite a bit to a small number of very wealthy people whose giving is large relative to their income. As in 1917, policymakers have chosen to protect the philanthropy of a small number of very generous wealthy donors with favorable tax treatment, even as the contribution deduction will be newly unavailable to millions of more ordinary donors.

The arguments presented in this article complement the existing historical narratives of why and how philanthropy developed in the United States. A copious literature has explored how Rockefeller, Carnegie, and other industrialists-turned-philanthropists invented the modern conception of philanthropy. Although these men were not motivated by taxation, their giving inspired the contribution tax deduction, which in turn shaped the growth and transformation of giving behavior in subsequent decades. The structure of the income tax deduction for charitable giving was a critical factor in the acceleration of giving by the very rich in the middle of the twentieth century, and the nature of that giving—often to foundations with ulterior motives of corporate control and tax avoidance—brought about increased regulatory oversight of the foundation sector. Though those incentives are now gone, the foundations they begat still exist today, an enduring part of American philanthropic social capital.

Appendix

Federal Income Tax Laws Affecting Charitable Contributions