Cost–benefit assessment of investments is an ongoing preoccupation for public authorities. Indeed, France has a long tradition in this regard. On several occasions, under the aegis of the Policy Planning Commission,Footnote 1 commissions met to define and improve evaluation procedures. Their findings were then converted into instructions and directives issued by the competent governmental authorities. Looking back over the past 30 years, a commission chaired by Marcel Boiteux in Reference Boiteux1994 established the doctrine that makes project evaluation an integral part of the doctrine of economic calculation, including the statement, still topical today that “economic calculation, despite its shortcomings, remains the best way to evaluate investment projects.”

The requirement for CBA of investments was long enshrined in the legislation concerning only certain sectors, transport for instance. It has been extended in 2012 to all public investments the requirement of CBA, by a public finance Act of 31 December 2012 (i). The law also introduced a general recourse to independent second opinions (ii), and initiated a committee of experts to question and improve methods (iii). That is the “global approach” we are going to develop and explain.

1. The Public Finance Act of 31 December 2012

1.1. A mapping of public investment programs

France is characterized by a high level of public investment: public spending on investment represents approximately 15 % of total investment. It concerns many sectors essential for the development of our society such as transport, energy, health, and education. In absolute terms, France is the country in the European Union with the highest public investment (€79.7 bn in 2018, compared with €78.9 bn for Germany). As a proportion of Gross Domestic Product, France is at the same level of public investment as the “new” EU countries that are still in the process of economic catching-up, particularly those in Central and Eastern Europe.

Public investment is a key factor driving growth and competitiveness. Since it is also a guarantee of high-quality public service, decisions concerning public investment must be made with the aim of reconciling development and control of public finances. Are investment choices today sufficiently justified? Do evaluation and decision-making procedures make it possible to prioritize projects, and retain the ones most useful to the community?

To get an answer to those questions, in 2012, the French Prime Minister asked the General Secretariat for Investment for a mapping of public investment programs and projects, so as to identify the methods of their assessments, and analyze the quality assessment of projects.

This mapping of public investment concerned all projects over 50 million euros (55 million $) receiving more than 20 % public funding (coming from state or local authorities).

The methodology used for the mapping was based on a deliberately very simple grid to facilitate the census process requested from ministerial departments. 286 grids identifying investment projects were collected, a great majority concerning transports (see Table 1).

Table 1. Public investment projects by area.

The final report submitted in 2012 to the GovernmentFootnote 2 showed that cost–benefit assessment only took place systematically in the transport sector, and to a lesser degree in the energy sector. Where it was used, wide variations were encountered in its implementation, making it difficult to compare different projects. The results needed more transparency and clarity to guide decision-makers, and to inform the public. Hence, decision-making processes rarely used these calculations.

Several ministerial departments did not deliver any grid because they did not have projects over 50 million €. Anyway, the first conclusion was that the census showed a forecast volume of investment and an appeal to public funding incompatible with the provisional investment budgets for coming years, and thus with the requirement for fiscal consolidation.

The types of evaluation undertaken using data provided by ministerial departments (and without checking their understanding of the terms) are rather wide as shown in Table 2.

Table 2 Types of evaluations (socio-economic, environmental) by area.

The study also showed that very few projects were submitted to independent second opinions.

1.2. Public decisions for a reform

From the results of these studies, three important decisions were taken by the Government by the end of 2012.

First, the Prime minister decided to keep a permanent inventory of investment projects. An annual mapping of major public investment projects is now requested. It is published in a “yellow paper,” annexed to the draft budget and submitted to Parliament before the annual vote of the budget; the declaration of any project in the inventory is therefore mandatory.

Second, the Finance Law for 2012–2017 (Act no. 2012–1558)Footnote 3 stipulates in Article 17 that “civil investment projects financed by the State, public establishments, public health facilities or health cooperation organizations are subject to a preliminary cost–benefit assessment.”

A standardization of the evaluation process was organized and published, to answer essential questions about public choices: Will the project envisaged lead to benefits exceeding the costs born collectively? How can choices among different variants of the same project be made? How can a set of several projects likely to bring the greatest benefit to a given budget envelope be determined?

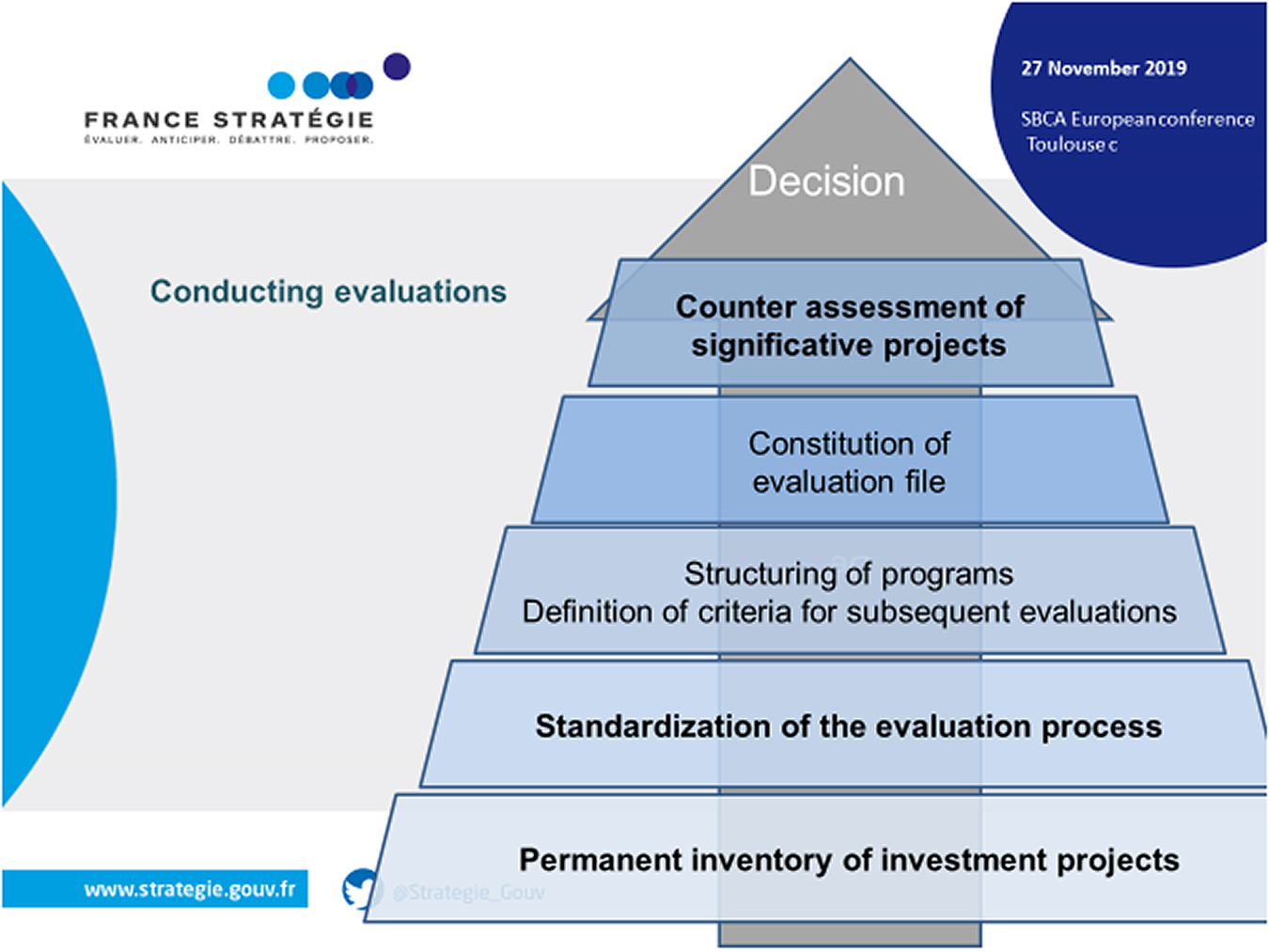

Third, the law also specifies that “when the total cost of the project and the share of funding provided by these public bodies exceeds the thresholds set by decree, this evaluation is subject to a prior independent second opinion.” Therefore, significant projects meet a counter assessment before a decision, positive or negative, is taken by the Prime minister or the Minister in charge (as shown in Figure 1).

Figure 1 Decision process for French Public Investments.

The Finance law states that the government must inform the Parliament of these evaluations, and the corresponding independent second opinions; they figure each year in the “yellow paper.”

2. The counter-expert assessment

2.1. Organization

As we have seen, Act no. 2012–1558 extends the ex-ante socioeconomic evaluation of public investments obligation to all sectors, making it mandatory for a project to be funded by the State, its public institutions, its public health institutions, or its health cooperation structures. This obligation applies to projects for which funding provided by the State and its public institutions exceeds 20 million euros (22 million $).Footnote 4

For the largest projects, those for which funding by the State and its public institutions exceeds 100 million euros (110 million $), an independent counter-expert assessment of the ex-ante socioeconomic evaluation carried out by the project sponsor must be organized.

This counter-expertise is paid for by the budget of the project. It is organized and conducted by the services of Commissioner General for Investment (CGI) reporting directly to the office of the Prime Minister. For each project, CGI gathers a team of several independent counter-experts. The number of counter-experts on a project depends on the complexity and skills required to assess the evaluation document and can range from 2 to 5 experts (average is 2.8).

Counter-experts are chosen for their competency, a selection made in the absence of any conflict of interest on a project under review. They provide a curriculum vitae, and a complete a declaration of interest as well as an undertaking of confidentiality and impartiality. The expert team is usually composed of at least one sector specialist and one economist. In the hospital sector, however, the team (which remains anonymous) includes a specialist in the supply of care, an expert in programming, and an expert in hospital finance.

The counter-expertise report is a collegial report that presents the project and its evaluation, then discusses the assumptions of the figures made, the relevance of the methods used, and later the results of the evaluation. It validates and, if necessary, updates the hypotheses retained in the socio-economic assessment file. It also checks the relevance of the methods used and evaluates the resulting results.

2.2. First results

As of 31 December 2019, 84 counter-experts have been mobilized by the CGI and were called upon 1 to 6 times (average: 1.9). Six years after the launch of the process, 68 projects, for a total value of €55 billion, have been examined. Figure 2 shows the number of reports from 2013 to 2019.

Figure 2 Reports of counter assessment.

(Source: GSFI, 2020)

The reports have been in a variety of areas:

(i) 24 hospital real estate projects (median cost: 193 M€),

(ii) 16 transport infrastructure projects (median cost: 1907 M€),

(iii) 8 projects relating to higher education and research (median cost: €211 million) submitted by the institutions concerned,

(iv) 4 projects related to urban planning (median cost: 309 M€),

(v) 16 other projects in more varied fields: penitentiary establishments, Broadband coverage of public initiative areas, real estate.

Table 3 and Figure 3 break down the reports by area, cost, and year.

Table 3 Counter-assessment reports by area (2013–2019).

Figure 3 Number of projects by cost and fields.

(Source: CGI, 2020).

The counter-expert’s approach is usually guided by the following questions:

(i) Does the socio-economic assessment file comply with the specifications: the detailed description of the investment project; variants and alternatives to the investment project; the main data on its dimensioning and its provisional timetable; relevant socio-economic indicators; performance indicators concerning public policies; comparative analysis of financing methods; the opinions required by law and regulations; risk mapping?

(ii) Do socio-economic assessment methods selected for the project comply with methodological guides, especially those published by French Policy Planning Commission,Footnote 5 or with other instructions from the ministry or the institution? In particular, are guardianship values well respected?

(iii) How are the non-monetized but nevertheless critical, aspects taken into account for the evaluation of the project?

(iv) Is the scope of the evaluation adequate or, on the contrary, has it been too circumscribed?

(v) Are the choices (parameters, hypotheses) coherent and realistic, given the state of the art of evaluation and the availability of data?

From the socio-economic evaluation and the counter-expertise assessment, the CGI makes its own conclusion and provides the project owner and the Prime Minister with a notification. As we said, the independent counter-expertise report as well as the notification of CGI are open to the public and transmitted to the Parliament (Figure 4).

Figure 4 Opinions delivered after counter-expertise.

(Source: CGI, 2020)

2.3. Suites given

The opinions delivered (60 since 2013) by CGI are largely positive (26); few completely negative opinions were issued (two). When the file assessment of the project leader is not convincing, the CGI expresses reservations in its opinion (26 reserved opinions), which have led to the reconfiguration of certain projects.

The summary opinion of CGI may go further than the conclusions of experts in the operational recommendations for the implementation of a project. Reservations and recommendations are schematically focused on two headings: the project itself and its evaluation.

For instance, among the most frequent remarks, the medical (hospitals) or pedagogical/scientific (research/higher education) project of an establishment should not be guided by the real estate project; or the gains related to the mutualism of operating costs between institutions have to be optimized; and the file must ensure consistency between the project and the program to which it belongs, or between the project and the offers/needs of its territory of influence.

A correct consideration of the risk or its absence also appears clearly during the expertise.

According to the last inventory (2019), more than a 100 projects, for a total amount of €117 bn, should be the subject of a counter-expertise in the near future. These projects are mainly in the fields of transport (40), hospitals (26), and justice (14), and in higher education and research.

3. Research and methodology

3.1. Introducing the committee of experts on methods for the socioeconomic evaluation of public investments

Projects must be evaluated using a standardized process. The research of a harmonized methodology has been built, step after step, since the works of Jules Dupuit (Reference Dupuit1844). Policy Planning Commission has been since 1946 a public think tank on these economic subjects. A place of exchange and consultation, it has brought together working teams to complete the bases of cost–benefit analysis, covering the main externalities in many major fields and produced reports: describing economic calculation as a tool for public decision-making, unifying practices, and extending it to environmental effects (Boiteux, Reference Boiteux1994Footnote 6); reassessing the effects on the environment or safety, and value of statistical life (Boiteux, Reference Boiteux2001Footnote 7); making a review of the public discount rate (Lebègue, Reference Lebègue2005Footnote 8); proposing developments about the social value of CO2 (Alain Quinet, Reference Quinet2008Footnote 9); offering an economic approach to biodiversity and ecosystem services (Chevassus-au-Louis, Reference Chevassus-au-Louis2009Footnote 10); analyzing risk calculation in public investments (Christian Gollier, Reference Gollier2010Footnote 11).

The last baseline report “Cost–benefit assessment of public investments” (Emile Quinet, Reference Quinet2013) focusses on revising the recommendations of previous reports, seeking to enhance the evaluation, leveraging advances in economics concerning domains like spatial analysis, the problems of governing evaluations, and the extension of cost–benefit assessments beyond their traditional sectors of application – transport and energy. It concludes with four recommendations: substantially increase the valuation of amenities; consider a broader range of effects; systematically integrate uncertainties; and evaluate investments in a long-term perspective.

To update methodology, reflection, and outlook, regularly, a permanent committee of experts dealing with methods for the socioeconomic evaluation of public investments was established in January 2017.Footnote 12 The mandate of the Committee is (1) to specify the methodological rules for socioeconomic evaluation; (2) to define the studies and research necessary to be undertaken for this purpose; (3) to strengthen the use of socioeconomic calculation within the State, and its institutions; and (4) to promote the practice of socioeconomic evaluation.

The aim is to specify the socioeconomic calculation rules for each sector based on the general methodology to create a common culture of evaluation of public investment by ensuring that the various administrations involved adapt and improve the doctrine and promote its use.

3.2 The guide to the socioeconomic evaluation of public investments

A guide to the socioeconomic evaluation of public investments,Footnote 13 explaining how evaluations must be conducted has been drafted under the authority of the committee of experts. The guide was published in FrenchFootnote 14 in 2017 and then in English.Footnote 15

This operational guide is intended for departments in charge of projects within different ministries (transport, health, culture, justice, etc.), and public bodies, the State’s public institutions, and health institutions. The guide outlines the guiding principles, concepts, and operational methods that can be used by project sponsors to assess a project. In addition, it can be used to assess programs composed of several relatively homogeneous and interdependent investment projects. And it enables project sponsors to apply a common analysis framework to all public investments. While each sector has its own specificities, the methodology used in evaluation is rooted in certain common principles that the guide is designed to present. The following chart depicts the systematic stages of socioeconomic evaluation.

An important question is: at what stage of investment appraisal should socioeconomic evaluation occur? Evaluation can only be performed when sufficient elements about costs and benefits of the project are available.

There are systematic interdependent stages for an ex-ante socioeconomic assessment; these are listed briefly (Figure 5).

Figure 5 The systematic stages of socioeconomic evaluation.

3.3. Doctrine review

The committee thought it necessary to accompany the guide with specialized supplements to clarify methodological aspects common to all sectors. The following supplements have already been approved:

(i) National macroeconomic determinants, as GDP growth rate possible gains in labor productivity, growth rates of household final consumption, population growth, and foreseeable evolutions of the environmental situation. Those are necessary to set the reference scenario.Footnote 16

(ii) Official social values for valuing non-market goods.Footnote 17

(iii) Market impacts and non-market direct impacts: externalities and their monetization.Footnote 18

Others should be published soon, for instance, Discount rate and net present value (NPV): France is currently the only country in the world in which public investment projects should be evaluated by using a discount rate sensitive to the project’s risk profile. The method is based on the CCAPM with a risk-free rate of 2.5 %, decreasing to 1.5 % after 2070, and a risk premium of 2 % increasing to 3 % after 2070 The Quinet reportFootnote 19 recommended carrying out calculations with a unique discount rate of 4.5 % during a transitional period that will be devoted to studying lessons learned regarding the system, specifying the methods concerning project eligibility and fine-tuning the parameters that the new system brings to bear.

3.4. Reports on specific topics

Three reports have been approved by the committee of experts in 2019.

(i) Action for climate (Alain Quinet, 2019) Footnote 20:

France’s ambition is to eliminate greenhouse gas emissions on national soil by 2050. This is the “Net-Zero” goal: net zero greenhouse gas emissions from human activities, with residual gross emissions to be absorbed by carbon sinks – which include forests, grasslands, and later, carbon capture and storage technology.

This ambition must translate into public and private investments, and more generally, into measures coming under public and private policy alike.

Attributing a socio-economic value to climate action is an essential condition for ecological transition. The report, which is the fruit of the work of the Commission chaired by Alain Quinet, proposes a new trajectory for the tutelary value of carbon: from 54 € (60 $) now, to 250 € in 2030 and 500 € in 2040. It is revised upwards, reflecting the importance of the path to be taken to move away from fossil fuels and achieve carbon neutrality. A higher value has the effect of broadening the scope of sectoral actions and relevant public investments in the fight against climate change.

The following chart shows the social value of CO2 according to the Quinet report (Figure 6).

(ii) Real estate projects for higher education and research, under the supervision of Émile Quinet (2018) Footnote 21:

Figure 6 The social value of the mitigation of carbon.

(Source : Alain Quinet, 2019)

At the request of the Ministry of Higher Education and Research, the General Secretariat for Investment (CGI), and Policy Planning Commission set up a working group to develop a method for the socioeconomic evaluation of real estate projects in support of higher education and research activities, and to respond to the concern to better appreciate the collective interest of the investments for which this Ministry is responsible.

The SE evaluation is not placed from the point of view of the project-bearing entity but from that of the national community as a whole by including in the analysis all the agents affected by the project. This perspective implies evaluating the consequences of the investment, not only for the staff, particularly those who offer teaching or conduct research but for those who benefit from the teaching provided or the research as well. It requires the implementation of new concepts such as the effects of the externalities of higher education and the benefits to the community of the results of research. It also leads to the question of demand, which from a geographical point of view, represents the area of influence of real estate investment in question in terms of attracting students and researchers.

The methodology used to estimate the value of French Higher Education diplomas was developed by Chéron and Courtioux (Reference Cheron and et Courtioux2018).Footnote 22 The computation is based on the identification of wage premium for different education levels (two-year degrees, three-year degrees, five-year degrees, etc.), and different fields (Sciences, Arts, and Literature, etc.). It also includes unemployment differences over the life cycle and a large definition of fiscal returns (income tax, social contribution, VAT). This framework is also used to compute the social cost of repeating and drop-out in higher education (the drop out level is very high for French higher education, up to 30–35 % for 2-year vocational degrees) and to compute the loss in social benefit corresponding to a postponement of education latter in the life cycle. Results show that the benefits for a tertiary degree completion are high. However, repeating and drop-out decrease substantially this value.

The recommendations contained in the report are intended to accompany and to guide the promoter of higher education, or a research investment project aiming to raise and address the essential points for the project.

(iii) Social investment: how to implement cost–benefit analyses for employment, health, and education policies, Denis Fougère (2019). Footnote 23

Social investment refers to policies that aim to foster human capital accumulation or preservation for their beneficiaries. The concept can be applied to markedly different policies such as early childhood education and care, reducing class size, preventing high-school dropout, youth protection, support, and training for job seekers or access to health coverage. The application of socioeconomic calculations to social investment, currently very limited, would be especially useful because these policies can be quickly reconfigured based on evaluation results; this is not the case for a physical public investment (a school, a hospital, a road, a prison, etc.).

Two main conclusions were made. There are no structural obstacles to applying socioeconomic evaluation methods to social investment. Precisely like an infrastructure project, a social investment affects society over a distant horizon – and for some non-monetary outcomes – that must be monetized and discounted.

And the application of socioeconomic evaluation to social investments faces the difficulty of estimating the gross effects of these policies, even before monetization and discounting. Often diffuse and heterogeneous within populations, these effects can often prove more complicated to anticipate than the impact, say, of a new transport infrastructure.

This difficulty can lead to the promotion of field-randomized trials, and the generalization of longitudinal data for beneficiary populations to improve knowledge of the long-term effects of social investment policies. It is also desirable to conduct systematic literature reviews to identify the effects recorded for similar policies, as well as to carry out meta-analyses to calibrate the parameters of simulations necessary for a socioeconomic assessment.

From now on, education policies are among the most invested fields, certainly the richest in quality evaluations both in France and abroad. These would benefit from being supplemented by socioeconomic assessments, which require the development of a methodological guide that proposes specific reference monetization values.

3.5. Program of the Committee for 2020

The committee of experts has decided to focus in 2020 on two important subjects:

(i) First, analyzing the risks and uncertainties surrounding the results of socioeconomic evaluations.

SE evaluation must take into consideration the many risks and uncertainties surrounding construction costs, demand, economic context, energy costs, operating, and running costs. Risks and uncertainties are unknown factors affecting the valuation of NPV components; more specifically, risk is an unknown factor that can be quantified probabilistically, whereas uncertainty is an unknown factor that cannot be quantified probabilistically. Socioeconomic evaluation must consider all risks likely to influence a project’s socioeconomic result, including environmental and health risks. Analysis of risks and uncertainties is fundamental to the socioeconomic evaluation of investments, especially in testing the vulnerability of the creation of collective value, enabled by the investment options, to the identified risks and uncertainties. Econometric work carried out on the past series of GDP per capita, and Monte Carlo simulations, made it possible to highlight the role of past growth rates and their volatility. The revision of the discount rate refers to the future: the key parameters are the expectation and the variance of the annual growth rate of GDP per capita in the future.

(ii) Second, reviewing valuation concerning health (value of human life, morbidity costs, or years of life gained) about health effects: to what extent do we want to include these effects in the socioeconomic assessment of public investment projects?

4. Conclusion

During the last 10 years, a major breakthrough has been made in France on cost–benefit analysis of public projects, though much remains to be done. The decision taken in 2012 by the French government to subject all public projects of a certain importance to a socioeconomic assessment has led to the generalization of this type of assessment, hitherto reserved for certain areas such as transport.

The rapid and effective implementation of this policy orientation, which has been translated into a legal and regulatory obligation by Act of 31 December 2012 about Public Finance Planning, is largely linked to the conditions under which it was developed.

It has been based on two pillars. The support of project leaders and the organization of counter-expertise was ensured by CGI.Footnote 24 For its part, Policy Planning Commission has developed a methodology for comparing projects, with the support of a Permanent committee of experts to specify the methodological rules for socioeconomic evaluation and define the studies and research necessary.

Economic calculation is still the best way to evaluate investment projects, to stop bad projects, and to prevent good projects from being rejected. But the evaluations of these projects should be expressed in everyday language, and accessible to non-expert opinion. These imperatives represent a way of using common sense to refine complex techniques, and offer an assurance that these techniques will be understood to facilitate dialogue, and finally, to ensure the development of cost–benefit assessment.

In this process, comparison with other experiences and exchanges play an essential role. The November 2019 European conference organized by the SCBA in Toulouse provided us a welcome opportunity for comparison with other countries’ research and practices, and confirmed that the main topics to be studied in greater depth were widely shared.