Countries’ engagement with international trade includes both their choice of trading partners—the extensive marginFootnote 1—and the intensity with which they and their trading partners transact—the intensive margin. Any evaluation of political institutions’ impact on trade must consider their effects on both margins. On the extensive margin, democracies are more likely to trade with one another,Footnote 2 and countries with stable domestic property rights and contractual institutions are more likely to trade products with “relation-specific” inputs than other types of products.Footnote 3 On the intensive margin, some have argued that legislative constraints allow an executive to make a credible commitment to liberalization and mutual reduction in trade barriers,Footnote 4 while democracy favors the owners of domestically abundant factors.Footnote 5 In contrast, others argue that the large number of veto players and greater fragmentation of political authority in democracies make them more responsive than autocracies to protectionist demands,Footnote 6 raising tariffs and erecting nontariff barriers to protect domestic interests.Footnote 7

Yet there are few studies that simultaneously consider both the extensive and intensive margins when evaluating the effects of political institutions on international trade. The “gravity” model of international trade focuses exclusively on bilateral trade volumes, that is, the intensive margin. Even when the distinction between the extensive and intensive margins is made explicit,Footnote 8 a lack of attention to political determinants of international trade on the two margins pervades economic models ranging from the “old” to the “new” trade theories.Footnote 9 The majority of empirical studies of bilateral trade in international political economy examine institutional effects on trade excluding country pairs that do not trade,Footnote 10 a practice that opens the door to selection bias in the analysis of the intensive margin.Footnote 11

We develop a theoretical framework that encompasses both the extensive and intensive margins of trade. We incorporate the standard domestic market structure with the CES (constant elasticity of substitution) demand into a game-theoretic network model to investigate the dictator's dilemma that autocrats face toward international trade. On the one hand, opening their country to trade generates economic benefits. On the other hand, these pecuniary gains come at a political cost: trade entails increased cross-border interactions and communication among the citizenry,Footnote 12 potentially facilitating rebellion.Footnote 13 However, once the connections are made, the dictator seeks to extract the full economic benefit. Hence our model predicts that political calculations will affect the extensive margin of trade but not the intensive margin. It also shows that the government's ambivalence toward trade stems from the threat of being overthrown, and therefore the political influences on extensive-margin trade hinge upon regime security rather than on democracy per se.Footnote 14 Our theoretical analysis calls for a broader consideration of domestic political externalities of international trade beyond the conventional focus on its distributional consequences.Footnote 15 In contrast with models that emphasize the mass public's preferences that drive domestic political considerations, our model draws attention to freedom of association, information flows, and their impact on regime security.

To assess our predictions, we analyze an extensive data set, encompassing fine-grained annual dyad-level trade data for 131 countries, covering a time span of fifty-one years on 450 SITC (Standard International Trade Classification) four-digit products.Footnote 16 Including directed dyads with no trade, we analyze about 390 million observations of product-level trade.Footnote 17 Our covariates include standard elements of the canonical “gravity” model of trade, a battery of institutional variables, and component variables of the Polity IV measure.Footnote 18 We capture the density of the networks inherent to trade in various goods using the tripartite taxonomy developed by Rauch.Footnote 19 By working with data disaggregated to the four-digit product level, we do not rely on the common assumption that demand elasticities and political effects are the same across products, an assumption implicit in the practice of analyzing dyadic trade flows aggregated across all productsFootnote 20 for product-level trade policy data.

Our estimator encompasses both margins of trade using a sparse Bayesian version of the “type-two Tobit model.”Footnote 21 Our sparse estimator is designed to cope with the high levels of collinearity endemic to empirical studies in international political economy. Numerous factors that might affect bilateral trade flows are also correlated with political institutions and with each other. A partial list includes economic size;Footnote 22 preferential trading blocks;Footnote 23 membership in the General Agreement on Tariffs and Trade (GATT) or World Trade Organization (WTO);Footnote 24 other domestic institutions such as contracting institutions;Footnote 25 security alliances;Footnote 26 trade resistance;Footnote 27 and multilateral resistance,Footnote 28 to say nothing of importer-, exporter-, year-, and even dyad-specific effects. To select from a set of highly collinear covariates, our estimator incorporates recent advances in variable selection methods.Footnote 29

Our empirical analysis yields results consistent with our theory. First, we show that political variables affect the existence of trade at the extensive margin, but do not affect trade flows in the intensive margin. Among the significant political variables here is regime security. Second, we find political variables have a greater impact on products whose trade entails more extensive interpersonal contact. Third, we show that unpacking the widely used portmanteau Polity IV measure into its component parts significantly improves the fit of the proposed estimator to the data. This is because only some Polity components have an impact on trade. Finally, our analysis also highlights the importance of working with fine-grained product data because the effects of our explanatory variables show remarkable variation across product categories.

Modeling Political Institutions and the Margins of Trade

We present a network model that isolates the effects of political institutions on the two margins of trade. Motivated by stylized facts in the literature, we present a network model relating domestic market structure to political networks. Finally, we characterize equilibrium behavior on the extensive margin and intensive margin.

Motivation

Our model is motivated by three consistent empirical findings in the literature. First, most countries do not trade in a given product, highlighting the centrality of the extensive margin. Second, among dyads that do trade, there is significant heterogeneity across products. Third, for many goods, networks of interpersonal contacts are crucial to facilitating trade.

A striking feature of the trade data is the prevalence of zero trade flows. More than half of country pairs do not engage in any trade at all.Footnote 30 Among country pairs that do engage in trade, the products that a given pair trades are usually a relatively small subset of products that are traded globally. Figure 1 shows just how prominent zero trade is at the product-level.Footnote 31 We group each country pair for a given product into one of three categories: (1) each country exports the product to the other, (2) only one country exports to the other, and (3) neither country in the dyad exports the given product to its partner. Despite the trend of increasing numbers of trading partners, in no year does the fraction of actively trading product-specific dyads exceed 20 percent. Most dyadic trade that does take place is unidirectional.

Figure 1. Distribution of dyads based on the direction of trades

Pervasive product-level heterogeneityFootnote 32 in both extensive and intensive margins of trade constitutes a second key feature of the data on international trade. This heterogeneity exists because goods differ in demand elasticities, transportation costs, and the concentration of production and demand. The relative simplicity of trade networks in primary products stands in stark contrast with the complex global production networks that characterize commerce in manufactured goods.Footnote 33

A third key feature of cross-border commerce is its dependence on networks of personal contacts.Footnote 34 Specifically, networks of informal contacts convey information about trading opportunities, market structure, and previous violations of trade-related contracts—information that makes it possible for producers to overcome trade barriers.Footnote 35 The system of informal contacts has various spillover effects, such as transfers of technology and learning through increased interaction.Footnote 36 As Rauch and Trindade noted, actors engaged in international trade will serve as “nodes for information exchange.”Footnote 37

These information transfers do not take place in a political vacuum. Russett and Oneal note that trade exposes citizens to the ideas and perspectives of foreign citizens.Footnote 38 Trade networks facilitate direct contact, which is important for the formation of antigovernment conspiracies.Footnote 39 Metternich and colleaguesFootnote 40 highlight the importance of network structures in the emergence of violence, while Larson and Lewis find that rebel groups can repurpose co-ethnic networks.Footnote 41 In other words, foreign trade can have domestic political consequences.

The Model

Our model encompasses two regime archetypes: an “open” society and an “autocratic” society. In the open society, each individual is free to communicate and exchange with anyone else, whereas in the autocratic society, all communication and trade must pass through the autocrat. The autocrat's power comes at a price: the people he exploits can, at some cost to themselves, rebel against him.

Networks and insurrection

We begin by illustrating the workings of our model with Figure 2. Communication links are represented by solid lines. The left-hand side depicts an autocracy: actors are arranged in a star-shaped network structure with the dictator, d, in the middle and the three citizens, a, b, and c, connected to the dictator but disconnected from each other. This shape is intended to capture an autocrat who has inserted himself into society and saturated the environment with spies, informants, and police so that no communication is secure from the possibility of being reported to the authorities. In this setting, potential rebels are unable to communicate confidentially with each other because the autocrat has effective control of political contacts.Footnote 42 The right-hand side of Figure 2 portrays an open society with three citizens, a, b, and c, each of whom can communicate directly with both of the others without being monitored or interfered with by a third party.

Figure 2. Political networks and international trade

Suppose that a society of n individuals is divided into T components, where all individuals in a particular component are connected by a series of links that exclude the autocrat's node, while no such connection exists between two individuals in distinct components.Footnote 43 We index the components by t ∈ {1, …, T}, with a fraction s t individuals in the t th component. We measure interconnectivity with the parameter θ, which calibratesFootnote 44 the extent to which society is interlaced with networks that bypass the autocrat:

$$\theta = \mathop \sum \limits_{t = 1}^T s_t^2. $$

$$\theta = \mathop \sum \limits_{t = 1}^T s_t^2. $$ In the extreme, if society is fragmented into a star network, with each individual isolated in her own component, the network has n components, with ![]() $s_t = {1 \over n}$ each, so that

$s_t = {1 \over n}$ each, so that ![]() $\theta = {1 \over n}$. At the other extreme, if all of society is joined into a single component as in a free society, then θ = 1. Intermediate levels of interconnectivity correspond to indices on the interval

$\theta = {1 \over n}$. At the other extreme, if all of society is joined into a single component as in a free society, then θ = 1. Intermediate levels of interconnectivity correspond to indices on the interval ![]() $\left( {{1 \over n},1} \right)$, with higher values corresponding to greater interconnectivity. For the autocracy on the left-hand side of Figure 2,

$\left( {{1 \over n},1} \right)$, with higher values corresponding to greater interconnectivity. For the autocracy on the left-hand side of Figure 2, ![]() $\theta = {1 \over 3}$, while for the open society on the right, θ = 1.

$\theta = {1 \over 3}$, while for the open society on the right, θ = 1.

Rebels are more effective when they are joined in a shared network, and also when the monitoring technologies (e.g., secret police) are inefficient. We thus model the probability of success in overthrowing the government as given by what we might call the Tullock-Rousseau contest function:Footnote 45

where θ > 0 is the networking measure given in expression (1), while ρ > 0 is an inverse measure of the effectiveness of the autocrat's security apparatus. Consulting equation (2), we see that ![]() $\Pr {\rm \;} \lpar {{\rm RebelSuccess}} \rpar $ is increasing in both θ and ρ.Footnote 46

$\Pr {\rm \;} \lpar {{\rm RebelSuccess}} \rpar $ is increasing in both θ and ρ.Footnote 46

The logic of our model can be described by Jean-Jacques Rousseau's characterization that in a maximally fragmented society, the effectiveness of rebels “evaporates and is lost as they become spread out like the effect of gunpowder scattered on the ground, that only ignites grain by grain.”Footnote 47 Alternatively, in a maximally connected society, the tangle of network contacts is dense, and the organizers of a rebellion are free to deliberate “as secure in their rooms as the prince in his council, and the crowd assembles as quickly in the public square as the troops in their barracks.”Footnote 48 While Rousseau's remarks focused on the effects of population density, he provides an apposite description of a densely connected network's importance for any insurrection.

Political spillover effects of international trade

A key element of our framework is the impact of trade on the interconnectivity of citizens. Suppose that the autocrat chooses to allow trade with the foreign country and that the trading partner has an open society, with no autocrat of its own.Footnote 49 As illustrated by the red dashed lines in Figure 2, when the two countries exchange goods the process of trade puts citizen b in contact with foreign national B, while citizen c is linked to foreign citizen C. The size of the network of potential rebels remains n = 3. However, because B and C are linked, there is now a pathway connecting citizens b and c, passing from b to B to C and on to c, a pathway that does not pass through the autocrat at node d. Opening to trade makes the network less legible to the autocrat, allowing citizens b and c to communicate with each other without being “overheard,” which causes θ to rise from ![]() ${1 \over 3}$ to

${1 \over 3}$ to ![]() ${5 \over 9}$. This, in turn, increases the probability that a rebellion would succeed if it was attempted.Footnote 50

${5 \over 9}$. This, in turn, increases the probability that a rebellion would succeed if it was attempted.Footnote 50

As we noted earlier, there exists ample evidence that personal contacts play an important role in cross-border trade. Given the threat posed by trade-induced interpersonal contact, despots’ ambivalence toward international commerce is unsurprising. For example, North Korea not only monitored communication between southern managers and northern workers in the (now closed) Kaesong Industrial complex, it also spied on its own workers and their friends.Footnote 51 Likewise, the former Soviet Union not only restricted international telephone connections, it even limited the publication of telephone directories,Footnote 52 an economically costly move. To this day, “relationship-specific” exports are hamstrung by the Russian Federation's extensive insistence on visas.Footnote 53

Note that the spillovers in our model bear some resemblance to what Bueno De Mesquita and Downs call “coordination goods” in that they facilitate contact among individuals. However, coordination goods are “public goods that critically affect the ability of political opponents to coordinate but that have relatively little impact on economic growth,”Footnote 54 whereas our spillovers pertain to privately transacted goods whose exclusion from trade would be economically costly.

The political spillover effects may differ in degree depending on the type of products being traded.Footnote 55 To illustrate this, we represent the added network density implied by trade in differentiated products with the blue dotted line in Figure 2, which connects citizen a with foreign national A. While a potential rebellion can still draw on only the three individuals a, b, and c, these individuals now form a single component, with each individual able to communicate with any of the others while bypassing the autocrat's node at d, so that θ = 1.Footnote 56

The market structure and international trade

Next, we formally examine the decision to trade (extensive margin) as well as the trade volume conditional on trading (intensive margin) for the case of a small economyFootnote 57 (hereafter the “home country”) endowed with two goods, g ∈ {D, F}. The home country has n citizens, n D of whom are endowed with one unit of the home country's abundant good D and with no units of good F, while the remaining n F = n − n D citizens are endowed with one unit of good F and no units of good D. We use good D as the numeraire good. The citizens’ heterogeneous endowments imply domestic exchange of the two goods even if there is no foreign trade. In the context of a star network, the domestic traders are able to engage in commerce, though they do so under the autocrat's watchful eye.

Individuals have constant elasticity of substitution (CES) utility of the form commonly employed in the trade literature:Footnote 58

where q D and q F denote the consumption of the goods D and F respectively. Note that σ > 1 is the elasticity of substitution between the two goods.Footnote 59

Consumption will depend on p (the relative price of good F compared to the numeraire good D) and on the value of the individual's endowment I. Under autarky, the domestic price for good F will be:Footnote 60

$$p^{{\rm autarky}} = \left( {\displaystyle{{n_F} \over {n_D}}} \right)^{-{1 \over \sigma}}, $$

$$p^{{\rm autarky}} = \left( {\displaystyle{{n_F} \over {n_D}}} \right)^{-{1 \over \sigma}}, $$whereas if the home country opens to trade the cheaper world price for good F prevails:

In the absence of transfers, opening to trade will benefit individuals whose sole endowment consists of a unit of the domestically plentiful good D, while it will hurt their counterparts endowed only with the domestically scarce good F. To keep track of how prices and income affect welfare, it is useful to formulate the “indirect utility function”:

Not only do individuals’ incomes vary with the price of good F, so too do aggregate income I(p) and average income ![]() $\bar{I}\lpar p \rpar $:

$\bar{I}\lpar p \rpar $:

If the economy opens to trade, the gains from the reduced price of the relatively scarce good are sufficient to allow the winners from trade to compensate the losers, leaving everyone better off under trade than with autarky.Footnote 61

The Decision to Trade: The Extensive Margin

Now suppose that an autocrat is the one to decide how to allocate resources and whether to trade. The autocrat lives in the shadow of potential rebellion. We use a game to illustrate the process at work.

The sequence of events is as follows. First, the autocrat d decides whether to open or block trade, affecting the extensive margin of trade. If he chooses to trade, the network and price parameters are (θ trade, p trade), while if he instead opts for autarky the parameters are (θ autarky, p autarky). Figure 3 depicts the ensuing decisions. At the top node, the autocrat d reallocates citizens’ endowments, confiscating all output, then transferring A i to each individual i. Next, before the bundles are consumed, “Nature” (N) randomly selects a representative citizen j who has an opportunity to lead a rebellion. This represents the inherent unpredictability of rebellions. Notice that each citizen is equally likely to be chosen, making it impossible for the government to target “likely suspects.” If the chosen citizen opts to Acquiesce rather than Rebel, she garners the allocation A j already assigned to her by the autocrat before being tapped by nature. This renders her a utility of ψ(p, A j). Other individuals i receive utility of ψ(p, A i), while the autocrat consumes everything that was not shared with citizens, capturing a utility level of ![]() $\psi \big( {p,I\lpar p \rpar -\mathop \sum_i A_i} \big)$. If instead citizen j opts for rebellion, only a fraction

$\psi \big( {p,I\lpar p \rpar -\mathop \sum_i A_i} \big)$. If instead citizen j opts for rebellion, only a fraction ![]() $\omega \in \left[ {0,{1 \over 2}} \right]$ of each endowment survives the conflict.Footnote 62 With probability

$\omega \in \left[ {0,{1 \over 2}} \right]$ of each endowment survives the conflict.Footnote 62 With probability ![]() ${{\rho \theta} \over {1 + \rho \theta}} $ the rebellion succeedsFootnote 63 ousting the autocrat, who gets a payoff of 0, and all citizens share equally in the surviving surplus. Should the rebellion fail, the autocrat seizes all available resources, leaving the citizens with nothing.

${{\rho \theta} \over {1 + \rho \theta}} $ the rebellion succeedsFootnote 63 ousting the autocrat, who gets a payoff of 0, and all citizens share equally in the surviving surplus. Should the rebellion fail, the autocrat seizes all available resources, leaving the citizens with nothing.

Figure 3. The extensive margin of trade

Anticipating the random outcome of a potential insurrection, the dictator prefers to appease the public rather than risk rebellion (see Appendix A1.2 for details). The autocrat brings citizens to the edge of indifference between rebellion and acquiescence by offering everyone the same amount,Footnote 64 A*, equal to the per capita income available if the rebellion prevails, weighted by the probability the rebels succeed:

Working backwards through the game, the autocrat will open to trade provided that the extra threat posed by greater network connectivity does not overshadow the additional rents he is able to capture. We formalize this in terms of the maximum extra network connectivity, θ*(p trade), the dictator would tolerate to access a price p trade instead of facing the autarkic price of p autarky.Footnote 65 The connection between this threshold and p trade is depicted on the left-hand side of Figure 4, where the horizontal axis corresponds to the price for good F that could be accessed by opening to trade, while values for θ, our network parameter, can be found along the vertical axis. At a price of p trade the dashed blue line indicates the values for θ trade that would lead the regime to open to trade at a price of p trade, while the red dotted line corresponds to θ trade levels that would deter the regime from opening. As p trade varies, the solid parabola marked θ*(p) traces out the set of θ that would leave the regime indifferent between opening to trade and remaining autarkic. For (p, θ) combinations in the gray shaded region above the curve, the price reduction is not sufficient to tempt the regime to accept the higher θ that trade would entail, whereas below and to the left of the solid line, the regime stands ready to accept the extra θ in exchange for the more favorable price. Notice that as the trade price approaches p autarky, θ*(p trade) likewise approaches θ*(p autarky). We summarize this with Proposition 1.

Proposition 1.

(Regime Security and the Extensive Margin of Trade): The maximum degree of network spillovers an authoritarian regime will accept in order to trade, θ*(ptrade), is a decreasing function of ptrade. (Proof is in Appendix A1.3).

Figure 4. The expansion of the extensive margin of trade

As an autocrat becomes more effective at controlling political communication, ρ falls and the locus of equilibrium cut-off values shifts upward, making the regime more amenable to trade. In other words, as the level of network externalities decreases, it is more likely that the autocrat decides to trade. Figure 4 shows this mechanism by contrasting θ*(p trade) of a vulnerable autocrat (the parabola in the left panel) with the greater tolerance for connectivity associated with a low value for ρ (the solid parabola in the right panel).

In an open society network, spillovers are politically irrelevant, making all trading possibilities potentially attractive. To be sure, a society that can organize a set of transfers leaving everyone better off as the result of trade might still choose not to trade. However, if an interest group is powerful enough to block trade, it may also enjoy sufficient influence to allow the trade and then compel the winners to compensate.

Trade Volumes: The Intensive Margin of Trade

Now consider the equilibrium trade volume conditional on trade, that is, the intensive margin. To compare the demand under autarky and free trade, we express net exports of x D units of good D as the difference between endowments and demand, and likewise for good F:

Under autarky both of these quantities are, by definition, equal to 0. If the country opens to trade, the relative price of good F falls to p trade < p autarky, and the country becomes a net exporter of good D and an importer of good F:

Notice that after a country opens to trade, total imports and exports depend on aggregate income, not on how income is distributed among the citizens. In a free society, aggregate income is given by I free = I(p trade),Footnote 66 and net exports for each good coincide with those given in expression (10).

Next, consider a country ruled by an autocrat who opts to trade. We have seen the autocrat will appease, so there will be no rebellion, hence aggregate income will be the sum of the A i = A* handed out to the citizenry plus the residual endowment of the autocrat:

$$I^{{\rm autocracy}} = \mathop \sum \limits_{{i}^{\prime}} A_{{i}^{\prime}} + \left( {I\lpar {\,p^{{\rm trade}}} \rpar -\mathop \sum \limits_{{i}^{\prime}} A_{{i}^{\prime}}} \right) = \mathop \sum \limits_{{i}^{\prime}} A^{^\ast} + \left( {I\lpar {\,p^{{\rm trade}}} \rpar -\mathop \sum \limits_{{i}^{\prime}} A^{^\ast}} \right) = \lpar {n_D + n_F} \rpar A^{^\ast} + \lpar {I\lpar {\,p^{{\rm trade}}} \rpar -\lpar {n_D + n_F} \rpar A^{^\ast}} \rpar = I\lpar {\,p^{{\rm trade}}} \rpar. $$

$$I^{{\rm autocracy}} = \mathop \sum \limits_{{i}^{\prime}} A_{{i}^{\prime}} + \left( {I\lpar {\,p^{{\rm trade}}} \rpar -\mathop \sum \limits_{{i}^{\prime}} A_{{i}^{\prime}}} \right) = \mathop \sum \limits_{{i}^{\prime}} A^{^\ast} + \left( {I\lpar {\,p^{{\rm trade}}} \rpar -\mathop \sum \limits_{{i}^{\prime}} A^{^\ast}} \right) = \lpar {n_D + n_F} \rpar A^{^\ast} + \lpar {I\lpar {\,p^{{\rm trade}}} \rpar -\lpar {n_D + n_F} \rpar A^{^\ast}} \rpar = I\lpar {\,p^{{\rm trade}}} \rpar. $$Thus, an open society's aggregate income with free trade will be identical to aggregate income in a society ruled by an autocrat who chooses to trade. Consequently, imports and exports will also coincide with those set forth in expression (10) for both regime types, provided of course that they trade at all.Footnote 67

Empirical Implications of Our Theory

Our analysis predicts that regime type matters for the extensive margin of trade:

H1

Insecure authoritarian regimes will be more reluctant to engage in any trade at all.

At the same time, our analysis also implies that regime type does not affect the intensive margin:Footnote 68

H2

Conditional on trade actually taking place, regime type will not affect the intensive margin.

Finally, holding θ*(p trade) fixed, the effects of regime type will be mediated by the network externalities associated with each industry because the success of rebellion depends on the density of political networks. We operationalize these network effects using the taxonomy of goods that Rauch developedFootnote 69 in which differentiated products entail more extensive interpersonal contact, and so greater information spillovers, than do reference-priced articles or exchange-traded commodities:

H3

Insecure authoritarian regimes will be more reluctant to trade on the extensive margin in differentiated products than they are to traffic in reference-priced and exchange-traded goods.

Data and Methods

We assemble an extensive set of trade data, including GATT and WTO membership, along with measures of colonial history and military alliances, merged with the Polity IV data decomposed into its constituent variables. We construct a Bayesian statistical estimator that accounts for the joint endogeneity of the extensive and intensive margins of trade and that applies a sparse prior to contend with the collinearity endemic to our extensive roster of explanatory variables.

Data

Differences in production technology and consumers’ tastes imply that even the typical economic factors in the gravity specification of trade, such as distance and size of the economy, can have differential effects on trade flows across dissimilar products on both margins. For example, distance might matter more for industries with high transportation costs, whereas the consequence of the importing country's market size will be magnified for industries with greater increasing returns to scale. Yet most studies of institutional effects on trade implicitly assume homogeneous effects across products by considering only the total volume of bilateral trade, aggregating across a diverse set of products.Footnote 70

To minimize compositional bias caused by different countries trading different bundles of goods, we analyze SITC four-digit product-level trade flows, the most finely disaggregated trade data available that spans our entire 1962–2012 time period.Footnote 71 This taxonomy, maintained by the UN, classifies each product based on its market uses, on the materials used in its production, and on the processing phase, adjusting for technological change.

We include countries that have existed as sovereign states during the period, listed in Appendix A6. These nations account for more than 90 percent of total world trade. Using the concordance table available in the United Nations Statistics Division, we track all 450 unique SITC four-digit product categories that are comparable across years. This cross-matching addresses the appearance and disappearance of product categories over time, reducing the bias arising from the heterogeneity across products in different periods.Footnote 72 Finally, we compute the volume of trade for each product, leaving us with a data set distinguishing imports and exports for each year covering all 450 products and every dyad. Considering all directed dyads, including those without trade to account for the pattern observed in Figure 1, results in ![]() $\left( {\matrix{ {131} \cr 2 \cr}} \right) \times 2 \times 450 \times 51 = 390,838,500$ observations for our analysis.

$\left( {\matrix{ {131} \cr 2 \cr}} \right) \times 2 \times 450 \times 51 = 390,838,500$ observations for our analysis.

Gravity variables

We include a canonical list of dyad-level “gravity” variables from RoseFootnote 73 and Goldstein, Rivers, and Tomz,Footnote 74 including the log of population for each country, (importer population, exporter population), and their logged incomes (importer gdp, exporter gdp).Footnote 75 We also include dyad-level covariates: the logged distance between the members of the dyad (distance), an indicator for a contiguous land border (land border), a common language (common language), a past colonial relationship (colony), and a common former colonizer (common colony).Footnote 76 To control for the effects of institutional membership in GATT/WTO, we include indicators for whether both elements of a dyad are formal members of the WTO (both formal members) or participants (both participants), for whether only one of the countries in a dyad is a formal WTO member (one formal member), or a WTO participant (one participant), and we code for whether each member of a directed dyad is a nonmember participant (e.g., importer formal member, exporter participant).Footnote 77 In addition, we include an indicator for an alliance relationship (alliance) from the Correlates of War ProjectFootnote 78 to control for security relations among trading partners.Footnote 79 Even though this is not an exhaustive list, these variables capture the key economic forces identified in the literature as affecting bilateral trade.Footnote 80

Unpacking Polity IV

Our theory suggests that multiple features of regime type will influence a government's receptiveness to trade. Rather than impose a portmanteau measure of democracy, such as the Polity IV variable polity,Footnote 81 or one of the alternatives,Footnote 82 we separate polity into its six constituent components to capture various aspects of political institutions.Footnote 83 The first four variables, competitiveness of executive recruitment, openness of executive recruitment, constraint on chief executive, and competitiveness of political participation, possess natural orders of their own, with lower values generally corresponding to more autocratic institutions, while higher scores are earned by institutions associated with more open societies.Footnote 84 We incorporate two other measures from the Polity IV data set: regulation of executive recruitment, a three-point scale measuring the “regularity” of the current leader's accession to power; and regime durability, operationalized as the length of time the current regime has endured.Footnote 85 We shall see that these component measures better capture institutions’ impact on trading relationships than does the polity measure alone. Note that while the regime durability variable is related to regime stability, it is by no means synonymous with democracy.

The Methodology: Bayesian Two-Stage Selection Specification

We make several methodological contributions by overcoming three key challenges. First, a proper test of our theory requires a model that integrates both the extensive and intensive margins. Second, our theory relies on claims about regime security rather than a level of “democracy” per se. This forces us to consider a broad set of highly correlated domestic institutional measures that pose a challenge in identifying the relevant subset that drives trade flows. Third, we need a principled way to conduct statistical inference on variables and models across margins. We propose a Bayesian two-stage variable selection random effects method that seamlessly integrates both margins, while drawing our attention to the most relevant predictors. Posterior inference allows us to assess whether political variables affect trade flows at each margin.

The covariates and outcomes

We consider two outcomes, one for each margin. On the extensive margin, the binary variable δ ijtk takes on a value of 1 if country i imports good k to i from country j at time t, or else it equals 0. For the intensive margin ![]() $\tilde{Y}_{ijtk}$ is the value of imports of k to I from j at time T. We will work with the more tractable log-transformed outcome

$\tilde{Y}_{ijtk}$ is the value of imports of k to I from j at time T. We will work with the more tractable log-transformed outcome ![]() $Y_{ijtk} = \log {\rm \;} (1 + \tilde{Y}_{ijtk})$.Footnote 86

$Y_{ijtk} = \log {\rm \;} (1 + \tilde{Y}_{ijtk})$.Footnote 86

We let xijtk denote the observed covariates, which we decompose into a vector of gravity variables ![]() ${\vector x}_{ijtk,G}$, augmented with an intercept, and another consisting of Polity variables

${\vector x}_{ijtk,G}$, augmented with an intercept, and another consisting of Polity variables ![]() ${\vector x}_{ijtk,P}$:

${\vector x}_{ijtk,P}$: ![]() ${\vector x}_{ijtk} = [{\vector x}_{ijtk,G}^\top {\rm \;} :{\rm \;} {\vector x}_{ijtk,P}^\top ]^\top $.

${\vector x}_{ijtk} = [{\vector x}_{ijtk,G}^\top {\rm \;} :{\rm \;} {\vector x}_{ijtk,P}^\top ]^\top $.

Estimating the extensive margin

We use a probit specification at the extensive margin for each product k, comparing two versions: ![]() ${\rm {\cal E}}_k^P $, which includes gravity and political variables, and

${\rm {\cal E}}_k^P $, which includes gravity and political variables, and ![]() ${\rm {\cal E}}_k^G $, which is identical with the first, save that it excludes the political variables:

${\rm {\cal E}}_k^G $, which is identical with the first, save that it excludes the political variables:

where {b ik, c jk, d tk} are importer, exporter, and time random effects, respectively,Footnote 87 while Φ(z) denotes the cumulative distribution function of a standard normal random variable. According to H1, ![]() ${\rm {\cal E}}_k^P $ should receive more support from the data than

${\rm {\cal E}}_k^P $ should receive more support from the data than ![]() ${\rm {\cal E}}_k^G $.

${\rm {\cal E}}_k^G $.

Estimating the intensive margin

Here we also consider two specifications for each product k: ![]() ${\rm {\cal I}}_k^P $, which contains both the gravity and political variables, and

${\rm {\cal I}}_k^P $, which contains both the gravity and political variables, and ![]() ${\rm {\cal I}}_k^G $, with the same structure, save that it excludes the polity variables. For dyads with positive trade flows we have:

${\rm {\cal I}}_k^G $, with the same structure, save that it excludes the polity variables. For dyads with positive trade flows we have:

$$\eqalign{{\rm {\cal I}}_k^P :Y_{ijtk} = {\vector x}_{ijtk,G}^\top {\bi \gamma} _{k,G} + {\vector x}_{ijtk,P}^\top {\bi \gamma} _{k,P} + f_{ik} + g_{\,jk} + h_{tk} + \lambda _km_{ijtk}^P + \epsilon _{ijtk};\;\; \cr \quad \epsilon _{ijtk}\sim {\rm {\cal N}}\lpar {0,\sigma_k^2} \rpar $$

$$\eqalign{{\rm {\cal I}}_k^P :Y_{ijtk} = {\vector x}_{ijtk,G}^\top {\bi \gamma} _{k,G} + {\vector x}_{ijtk,P}^\top {\bi \gamma} _{k,P} + f_{ik} + g_{\,jk} + h_{tk} + \lambda _km_{ijtk}^P + \epsilon _{ijtk};\;\; \cr \quad \epsilon _{ijtk}\sim {\rm {\cal N}}\lpar {0,\sigma_k^2} \rpar $$where {f ik, g jk, h tk} are importer, year, and time random effects, respectively. Because we estimate this specification for only dyads that actually trade, our estimator for ![]() ${\rm {\cal I}}_k^P $ contains a bias-correction factor, known as the “inverse Mills ratio”:Footnote 88

${\rm {\cal I}}_k^P $ contains a bias-correction factor, known as the “inverse Mills ratio”:Footnote 88

$$E\{ \tilde{u}_{ijtk} \vert \delta _{ijtk} = 1,{\rm {\cal E}}_k^P \} = -\displaystyle{{\phi \lpar {{\vector x}_{ijtk,G}^\top {\bi \beta}_{k,G} + {\vector x}_{ijtk,P}^\top {\bi \beta}_{k,P} + f_{ik} + g_{\,jk} + h_{tk}} \rpar } \over {\Phi \lpar {{\vector x}_{ijtk,G}^\top {\bi \beta}_{k,G} + {\vector x}_{ijtk,P}^\top {\bi \beta}_{k,P} + f_{ik} + g_{\,jk} + h_{tk}} \rpar }} = m_{ijtk}^P $$

$$E\{ \tilde{u}_{ijtk} \vert \delta _{ijtk} = 1,{\rm {\cal E}}_k^P \} = -\displaystyle{{\phi \lpar {{\vector x}_{ijtk,G}^\top {\bi \beta}_{k,G} + {\vector x}_{ijtk,P}^\top {\bi \beta}_{k,P} + f_{ik} + g_{\,jk} + h_{tk}} \rpar } \over {\Phi \lpar {{\vector x}_{ijtk,G}^\top {\bi \beta}_{k,G} + {\vector x}_{ijtk,P}^\top {\bi \beta}_{k,P} + f_{ik} + g_{\,jk} + h_{tk}} \rpar }} = m_{ijtk}^P $$ Including ![]() $m_{ijtk}^P $ as an additional covariate protects the intensive margin coefficients from selection bias.Footnote 89

$m_{ijtk}^P $ as an additional covariate protects the intensive margin coefficients from selection bias.Footnote 89

Prior specification

We are conducting a fine-grained analysis not just in terms of data but in terms of our specification. After including gravity variables, the Polity IV component variables, and allowing for time-varying effects, we are left with numerous other explanatory variables. To estimate and select from this subset, we turn to recent advances in machine learning developed for fitting high-dimensional linear structures.Footnote 90 We use this variable-selection technology to estimate parsimonious specifications and select the most relevant explanatory variables.

Our estimator implements a statistical method for “sparse structures,” an approach designed for specifications fraught with a large number of correlated explanatory variables, many of which are likely redundant. The estimator is designed to explain the data well in terms of a small subset of the variables. In our case, we estimate numerous coefficients corresponding with political or economic covariates. Without a sparse estimator, using a p-value threshold in a likelihood-based context, we would expect to encounter many “false positives”—irrelevant variables that the likelihood-based approach would highlight as significant. Our Bayesian approach with a sparse prior, in contrast, sidesteps this inferential problem. The approach we use has been found in other contexts to be both powerful in identifying true effects and effective at not falsely including spurious effects that are in truth equal to 0.Footnote 91 A full, formal description of our estimator appears in Appendix A2.

Assessing the fit of our specification

The Bayes factor is a summary used to select between competing specifications.Footnote 92 We use this criterion to compare ![]() ${\rm {\cal E}}_k^P $ and

${\rm {\cal E}}_k^P $ and ![]() ${\rm {\cal E}}_k^G $.Footnote 93 Denoting the observed data for good k as

${\rm {\cal E}}_k^G $.Footnote 93 Denoting the observed data for good k as ![]() ${\rm {\cal D}}_k$, the Bayes factor assessing the weight of the evidence in favor of specification

${\rm {\cal D}}_k$, the Bayes factor assessing the weight of the evidence in favor of specification ![]() ${\rm {\cal E}}_k^P $ over specification

${\rm {\cal E}}_k^P $ over specification ![]() ${\rm {\cal E}}_k^G $, and hence in favor of H1, is:

${\rm {\cal E}}_k^G $, and hence in favor of H1, is:

Analogously, we can compare the competing versions of our intensive margin specification to evaluate H2:

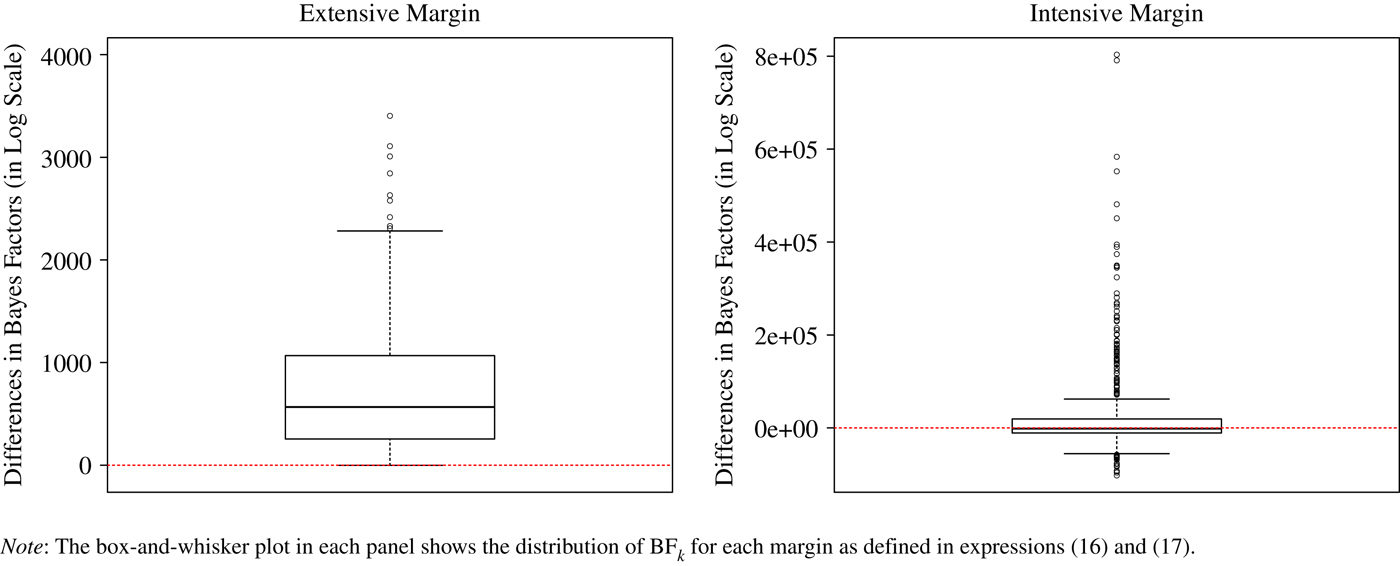

Because we encounter some very large magnitudes, we report logged values of the Bayes factor, so a positive value provides evidence that the version with both gravity and politcal variables receives more support from the data. Ultimately one's posteriors depend on one's priors, but several rules of thumb have been suggested. Kass and RafteryFootnote 94 assert that a logged Bayes factor greater than 6 (corresponding to BF ≈ 20) implies “strong” evidence, while any value above 10 (corresponding to BF ≈ 150) constitutes “very strong” evidence.Footnote 95

Empirical Results

We present a large number of coefficients in our model using heat maps. First, we show that the gravity variables behave as convention would lead us to expect. Second, the extensive margin coefficient estimates for constraint on chief executive and competitiveness of political participation reveal a trade-inhibiting effect for autocracy while regime durability promotes trade. Our finding suggests that regime security plays an important role on the extensive margin. In contrast, our estimates on the intensive margin indicate that regime type exercises little influence. We also present evidence that the intensive margin impact of political institutions is more pronounced in industries that involve greater interpersonal contact.

Reading the Heat Maps

We have a massive amount of data. We estimate the extensive and intensive margins of trade separately for each of the 450 SITC four-digit products, generating thousands of parameter estimates and corresponding credible intervals (13,500 = 450 × (18 + 12)) to report for each margin. Inspired by genomic studies,Footnote 96 we display them concisely using a “heat map.”

The products are ordered by SITC four-digit code, with the first-digit industry groupings on the vertical axis and explanatory variables on the horizontal axis. Coefficients with at least 95 percent posterior mass below 0 are represented by narrow blue bands, while coefficients with more than 95 percent of posterior mass above 0 are colored red. The greater the median of the posterior density, the more darkly shaded the color.

To illustrate, Figure 5 portrays our estimated extensive margin coefficients for one variable, the logged distance. On the left-hand side of the panel, each dot represents the median of the posterior density for each product, while the horizontal lines present 95 percent credible intervals—thanks to the precision of our estimates, many of these intervals are so narrow they coincide with the medians. On the right-hand side, we color code each coefficient (the heat map representation).

Figure 5. Effects of logged distance on the extensive margin of trade

This figure shows that the effect of distance varies by product, though greater distance generally reduces the likelihood of trade. The lack of red stripes confirms that distance never stimulates trade, though for some industries it appears not to matter. The white shaded band of the heat map corresponding to “ores and concentrates of uranium and thorium” (SITC 2860) within the “crude materials, inedible, except fuels” industry (SITC 2), indicates that the 95 percent posterior credible interval contains 0. Likewise, “ammoniacal gas liquors produced in gas purification” (SITC 5213) corresponds with the figure's other white color band.

Figure 6 zooms in on a row of Figures 7 and 9, displaying the extensive margin coefficients for “coated or impregnated textile fabrics” (SITC 6554). The 95 percent credible interval for the exporter GDP coefficient lies well above 0, represented by a dark red band of color, while the posterior mode of the distance coefficient is well below 0, represented by a dark blue streak in the corresponding line of the heat map. The posterior density of the regulation of executive recruitment coefficient for importers is relatively small and positive, thus it is represented on the heat map as a faded pink stripe. The corresponding effect for exporters is small and negative, represented by a washed-out strip of blue color.

Figure 6. Effects of gravity and polity variables on product-level trade

Figure 7. Extensive margin (gravity variables)

Figure 8. Intensive margin (gravity variables)

Figure 9. Extensive margin (polity variables)

Parameter Estimates

We first assess the validity of our model by examining the estimates of the gravity models. We then turn to the estimated impact of regime type on trade.

The Gravity Variables

Figures 7 and 8 display heat maps across all products for the coefficients of the gravity variables on the extensive and intensive margins of trade, respectively. Turning first to Figure 7, the standard gravity variables have their expected effects. Distance impedes trade on the extensive margin, while increased income in either the exporting or the importing country is associated with a greater likelihood that two countries trade a given product. A higher GDP for the exporting country is associated with an even higher likelihood of trade in chemicals and manufactures than other products, indicated by the vivid lines in the top segments of the fifth column. The bright red column corresponding with the colony variable shows that a former colony/colonizer relationship is trade enhancing. More sporadic and attenuated trade-enhancing effects are associated with sharing a common language or border, being linked by a defensive alliance, or sharing a former colonial power, each of which has been identified in the literature.

Our GATT/WTO variables have mixed effects on the extensive margin, though the exporter being a formal member appears to encourage trade in chemicals and manufactures. In contrast, the effect of formal membership on exports of primary products appears to be negative, whereas for the same industries, having participant status is strongly export promoting.

Figure 8 presents results on the intensive margin. Higher incomes are trade promoting for both the exporter and the importer, at least for chemicals and manufactures, though the estimated effects are less pronounced than on the extensive margin. Greater distance impedes trade, while one country being the former colony of the other enhances it, but the magnitudes pale, literally in the context of our heat map, by comparison with the corresponding effects of these variables on the extensive margin.

As for the GATT/WTO measures, the exporter participant variable sporadically impedes the intensive margin trade. This suggests that even industries with low potential trading volumes enter into export trade when a country is a participant. The remaining effects of the intensive margin GATT/WTO variables are severely etiolated. This is consistent with Dutt, Mihov, and Van ZandtFootnote 97 who find that the effect of GATT/WTO is driven “almost exclusively” by the extensive margin.

Institutions Promoting Extensive Margin Trade

We now turn to the effects of our regime type variables on the extensive margin of trade. In accordance with H1, Figure 9 shows that political institutions matter on the extensive margin (indicated by the lack of white space). In particular, the coefficient estimates for constraint on chief executive and competitiveness of political participation are consistent with the idea that autocracy inhibits exports (corresponding to low values for these variables), while regime durability emerges as export promoting. In all three cases, the impact of regime type is more pronounced among manufactured products than it is for primary products.Footnote 98 This is consistent with H3, which implies a greater impact of regime type on trade in differentiated products. While our theoretical model does not posit a tendency for exports to involve greater network externalities than imports, the empirical results suggest this may be the case.

Beyond the predictions of our theoretical analysis, two fairly similar components of democracy emerge as having opposite effects on imports across product categories: openness of executive recruitment, corresponding to hereditary autocrats rather than constitutional monarchs, inhibits imports while regulation of executive recruitment, low values of which correspond with coup-prone polities, is associated with an elevated probability of importing and a lower probability of exporting a given product. Most of the countries in our sample appear at the same end of both scales, where the effects of these two variables on imports tend to cancel each other out. What remains is the export-inhibiting effect we estimate for the regulation of executive recruitment. This appears to be a byproduct of the economic dislocations caused by coups.

Political Institutions and the Intensive Margin

Next, we turn to the impact of regime type on the intensive margin of trade. Figure 10 shows the estimated parameters on the polity variables. Many more bands in this figure are white compared to Figure 9, which indicates that these variables simply do not affect the intensive margin of trade as they do in the extensive margin. This evidence supports H2. The impact of the constraint on chief executive measure disappears almost entirely, while the sporadic and faint red strips corresponding to competitiveness of political participation and regime durability are pallid reflections of the corresponding extensive margin coefficients. The executive recruitment coefficients are likewise enfeebled—the faint blue of the remaining regulation of executive recruitment coefficients suggests that perhaps in more stable systems, trade extends to goods with low volumes that would not be traded at all in a coup-prone political environment. We evaluate more formally whether this faded collection of parameters is simply the byproduct of an over-parameterized specification.

Figure 10. Intensive margin (polity variables)

To gain insight into the selection effects, Figure 11 presents the results for the estimated parameter on the inverse Mills correction term (this is λ k in equations (13) and (14)). The majority—over 90 percent—of the credible intervals are negative and exclude 0 (black lines), providing strong evidence that selection affects trade. Note that almost all of the significant coefficients are negative. This is in line with the fact that commodities that are actually transacted have above-average potential trade volumes relative to the commodities that are not traded.Footnote 99 The remaining tenth of cases for which the credible intervals include 0 provide little evidence either for or against a selection effect.

Figure 11. The impact of the inverse Mills ratio

Regime Type, Spillovers, and the Extensive Margin of Trade

The coefficient estimates indicate that the impact of regime type on trade is concentrated on the extensive margin. More importantly, we see that these effects are heterogenous, with polity exercising a much more profound effect on some industries than on others. Our theory tells us to expect that these effects will be greater for industries that involve more interpersonal contact, which we operationalize using Rauch's taxonomy. While scanning the heat maps is useful, we now turn to Bayes factors to help select among specifications across each model that we estimate for each product.

Figure 12 presents the Bayes factors comparing our political and gravity-only specifications. The data universally favor the inclusion of the Polity variables at the extensive margin, consistent with H1. In contrast, the right panel of Figure 12 fails to provide systematic support for including political institutions on the intensive margin, just as H2 would lead us to expect. The distribution of Bayes factors is centered on and includes 0. This finding suggests that existing studies might overestimate the effect of political institutions on trade volume, the intensive margin, by excluding country pairs that do not trade, that is, disregarding the extensive margin of trade.Footnote 100

Figure 12. Institutional variables matter for extensive margins

We further assess H3 by comparing the distribution of Bayes factors across all products within the three distinct categories of product differentiation.Footnote 101 Specifically, we examine whether the distribution of Bayes factors for differentiated products first order stochastically dominates that of other products with reference prices and goods traded in organized exchanges.Footnote 102 Stochastic dominance is often used to compare lotteriesFootnote 103 but here we use it to compare the tendency of one class of goods to generate higher Bayes factors in favor of including political variables. This allows us to evaluate our prediction across the entire range of percentiles in the distribution (see Appendix A3 for further exposition of first-order stochastic dominance).

Consulting the left panel of Figure 13, we see that the red line, corresponding to the fraction of Bayes factors among the differentiated products that exceed any threshold, lies above the corresponding lines for the other categories. Similarly, the blue line for reference-priced goods also exceeds or equals the line for the products traded on organized exchanges. Support for including our political variables in the specification is stronger for industries that involve greater interpersonal contact, and more extensive exchange of information. In contrast, the analogous curves for the intensive margin show no such tendency, with the interlaced cumulative densities crossing each other at various points. This is consistent with H2, which implies political factors will not affect the intensive margin of trade.

Figure 13. First-order stochastic dominance by differentiated products

Concluding Remarks

We make several contributions. First, we develop a model of political networks that explicitly distinguishes the effects of political institutions on the extensive and intensive margins of trade. Our model focuses on the tendency for trade to facilitate communication among the people involved in producing and marketing products across borders. For democracies and consolidated authoritarian regimes, this poses little or no threat, but for vulnerable autocracies this communication can spill over into the political realm by allowing regime opponents to better coordinate their activities. Thus vulnerable regimes block cross-border commerce on the extensive margin for products whose network spillovers are high relative to the potential gains from trade that they offer. These spillovers appear to be greatest in differentiated products.

Second, we employ an estimation strategy that simultaneously deals with the selection issue and the substantial collinearity that emerges from analyzing various features of political institutions. Our estimator, based on the recent development of machine learning techniques in variable selection methods,Footnote 104 identifies systemic patterns of international trade using extensive product-level trade data while ensuring compatibility across products over a half century. We merge the trade flows data with a panoply of country- and dyad-level covariates that previous work has identified as affecting bilateral trade. To the best of our knowledge, the size, scope, and level of disaggregation in our data set expands the empirical frontier for the political economy of trade literature.

Our estimates show that the impact of our political variables falls primarily on the extensive margin. We also find that the impact of political institutions varies across industries, with the largest effects manifesting among differentiated products. These are products for which we expect the political spillovers resulting from personal contacts to be more significant, thereby making vulnerable authoritarian regimes more reluctant to trade. Our findings suggest that regime security, rather than democracy per se, is particularly relevant to the extensive margin. In fact, the profile that emerges from our empirical analysis of a regime that promotes extensive margin trade does not coincide with democracy. We do find that some Polity IV components of democracy—competitiveness of political participation and constraint on chief executive—promote extensive margin trade, and that they do so primarily for differentiated products. But this is also the case for regime durability, which is not a part of the polity composite democracy measure. While our theory does not distinguish between the network externalities entailed by exports and imports, our empirical finding is that the impact of all three of the variables is concentrated on the extensive margin for exports but not for imports. This is consistent with the idea that an exporter of a differentiated product will need to make extensive contacts in the importing country to serve the market, beyond the watchful gaze of the exporting country's secret police.

Our finding that the polity variables affect differentiated products on the extensive margin, while they have little systematic effect on the intensive margin, is consistent with our theory, and highlights the importance of interpersonal contact for the effects of regime type on trade. Generating better measures of networks is a high priority for ongoing investigation.

Supplementary Material

Supplementary material for this article is available at <https://doi.org/10.1017/S0020818319000237>.

Acknowledgments

We thank Avinash Dixit, Nikhar Gaikwad, Benjamin E. Goldsmith, Joanne Gowa, Robert Gulotty, Adeline Lo, Edward Mansfield, Kyle Marquardt, Helen Milner, Walter Mebane, Eliza Riley, and Rachel Wellhausen for helpful comments. We also thank the seminar and conference participants in the International Relations Speaker Series at the University of Texas at Austin, the 2015 Asian Political Methodology Meetings, the International Political Economy Society (IPES), the Midwest Political Science Association, and the V-Dem Institute, Gothenburg, Sweden. The editor and the two anonymous reviewers provided helpful comments that significantly improved this article.