INTRODUCTION

In initial public offerings (IPOs), the uncertainty and information asymmetry between firm insiders and external investors often introduce difficulties for potential investors to discern the potential value of IPO firms, thereby enabling organizational reputation to serve as a valid signal used by investors to gauge potential firm value. By contrast, certain factors, such as underwriter reputation (Carter & Manaster, Reference Carter and Manaster1990), board structures (Certo, Reference Certo2003), and management stability (Perkins & Hendry, Reference Perkins and Hendry2005), are widely accepted as valid signals of firm value; as yet, the role of organizational reputation has hardly been considered.

Organizational reputation is seminally defined as ‘a perceptual representation of a company's past actions and future prospects that describes the firm's overall appeal to key constituents when compared to other leading rivals’ (Fombrun, Reference Fombrun1996: 72). Following prior research, we argue that organizational reputation is directly linked to investor evaluation of firms at IPOs because investors associate reputation with potential organizational value. Furthermore, past research has devoted limited attention to the signaling recipients. Signal receivers may also play a critical role in affecting how investors understand firm IPOs (Connelly, Certo, Ireland, & Reutzel, Reference Connelly, Certo, Ireland and Reutzel2011). In other words, organizational reputation may serve as an important signal of value in IPOs but only such that those investors become aware of those signals. Therefore, we draw from research on signaling theory to examine how organizational reputation, acting as an important signal, influences investor behavior and choices during the IPO process. In this manner, we contribute to the substantive body of research on firm IPO in three primary ways.

First, our study adds to the scant literature that has emphasized the multidimensionality of organizational reputation (Deephouse & Carter, Reference Deephouse and Carter2005; Lange, Lee, & Dai, Reference Lange, Lee and Dai2011; Rindova, Petkova, & Kotha, Reference Rindova, Petkova and Kotha2007; Wei, Ouyang, & Chen, Reference Wei, Ouyang and Chen2017) but has seldom explored the possible effects of such dimensions. Investors must evaluate relatively new firms, particularly during the IPO process, in which they have access to imperfect firm-specific information. Different dimensions of organizational reputation contain various types of evaluator perceptions (Lange et al., Reference Lange, Lee and Dai2011). Thus, understanding the influences of the different dimensions of organizational reputation on IPO performance is of particular theoretical value.

Second, we apply a signaling theory framework to understand IPOs in terms of the magnitude of underpricing. We argue that when information about a firm's economic potential is rare, evaluators rely on two important dimensions of organizational reputation to understand and form impressions of a relatively new firm: (1) ‘the degree to which stakeholders evaluate an organization positively on a specific attribute’, which is called being known for quality (Lange et al., Reference Lange, Lee and Dai2011: 155; Rindova & Martins, Reference Rindova, Martins, Barnett and Pollock2012; Wei et al., Reference Wei, Ouyang and Chen2017); and (2) the perceived degree of a firm's aggregate favorability based on multiple overall corporate attributes or characteristics, which is called generalized favorability (Lange et al., Reference Lange, Lee and Dai2011; Wei et al., Reference Wei, Ouyang and Chen2017). Thus, our study sheds light on how external investors in the IPO process make decisions with reputational signals. Moreover, our results make a conceptual contribution to the IPO literature by highlighting the role of two dimensions of organizational reputation as signals and the relevance of investor attention that mediate the effect of organizational reputation on IPO underpricing.

Third, although the issue of organizational reputation has elicited widespread attention, most empirical results are based on US data, and this study is one of the few that are based on large emerging markets. With the development of China's capital market and the shareholding reform, China has emerged as a major IPO market. Chinese investors received IPOs enthusiastically and the phenomenon of IPO underpricing, well documented in other stock markets of the world, was also observed in China. To our knowledge, this is the first study that empirically examines the effects of two dimensions of organizational reputation on IPO underpricing of Chinese companies, addressing a noticeable absence in the literature.

THEORETICAL BACKGROUND AND HYPOTHESES DEVELOPMENT

Information Asymmetry, Signaling, and IPO Underpricing

IPO underpricing is a common phenomenon in most stock markets in developed and emerging countries (Loughran, Ritter, & Rydquist, Reference Loughran, Ritter and Rydquist1994). When an offering price is lower than the first-day closing prices, an offering is said to be underpriced. A common perception in academia is that IPO underpricing may hurt new publicly listed firms attempting to raise capital for expansion (Arthurs, Hoskisson, Busenitz, & Johnson, Reference Arthurs, Hoskisson, Busenitz and Johnson2008). This situation has spawned extensive literature that attempts to explain the reasons for relieving this phenomenon. One of the most popular is Rock's (Reference Rock1986) argument that IPO underpricing stems from an information asymmetry problem between the issuing firms and public investors.

An IPO exhibits information asymmetry (Cohen & Dean, Reference Cohen and Dean2005; Pollock & Rindova, Reference Pollock and Rindova2003). During a firm IPO, investors are incentivized to evaluate relatively new firms with which they are unacquainted. Unlike the current owners of the firm, public market investors encounter challenges in evaluating newly public firms and may be uncertain about the company's potential value and behavioral tendency (Certo, Reference Certo2003; Cohen & Dean, Reference Cohen and Dean2005; Stiglitz, Reference Stiglitz2000). The reasons for this situation are as follows. First, IPO firms have no established and clear performance records in public markets. Firm capabilities and propensities are typically not directly observable, and corporations are complex, multifaceted entities (Lange et al., Reference Lange, Lee and Dai2011; Schultz, Mouritsen, & Gabrielsen, Reference Schultz, Mouritsen and Gabrielsen2001). Second, most firm information received by the public is sifted or embellished by company insiders. Especially in the IPO process, top managers tend to show only the bright side of the firm to the investors. Third, ‘most organizations are a complex creation of leadership, culture, technology, products, and strategy, placed within a market and industry context that adds to that complexity’ (Cohen & Dean, Reference Cohen and Dean2005: 684).

Signaling theory provides a valuable framework to explain the influence of information asymmetry in economics and how external investors value newly issued stocks. Most of the studies on signaling theory are based on the seminal work of Spence (Reference Spence1973), which indicated that potential employers do not have complete information about the quality of job applicants. Thus, they may actively screen job applicants by discerning observable information when the desired attribute cannot be observed. To reduce information asymmetry, which hampers the selection ability of employers, job applicants tend to invest in reliable and observable indicators that signal their worth (e.g., high educational attainment).

From the perspective of signaling theory, underpricing is a costly signal by which high-quality firms choose to separate themselves from low-quality firms. High-quality firms deliberately sell their shares at lower prices than the market believes they are worth, thereby deterring low-quality firms from imitating (Welch, Reference Welch1989). However, underpricing is so substantially prevalent that many finance researchers have explained it as an equilibrium phenomenon because it is expected to be a function of the information asymmetry between IPO firms and potential investors (Carter & Manaster, Reference Carter and Manaster1990; Cohen & Dean, Reference Cohen and Dean2005). Thus, IPO underpricing is often considered a type of compensation to uninformed investors for the risk of trading against superior information (Carter & Manaster, Reference Carter and Manaster1990; Cohen & Dean, Reference Cohen and Dean2005). For present study purposes, underpricing can be viewed as a reasonable ‘indicator of the information asymmetry that exists between the issuer and investors and can be used as a gauge of the extent to which certain signals are utilized by investors’ (Cohen & Dean, Reference Cohen and Dean2005: 685). As a result, information available about firm value prior to an IPO will reduce information asymmetry and reduce underpricing (Rock, Reference Rock1986).

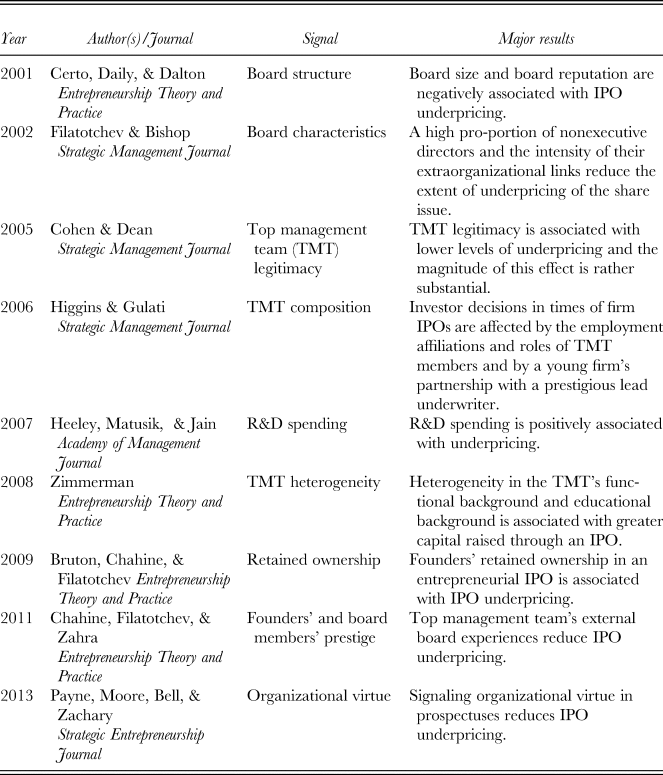

Signaling theory has been applied to explain firm IPO performance in numerous management studies (Table 1). For example, leaders of a firm in an IPO stack their top management team with older, more qualified and experienced managers can send a message to external investors about the firm's quality and reduce IPO underpricing (Cohen & Dean, Reference Cohen and Dean2005). To date, previous corporate management research has indicated that the heterogeneity of top management team (Zimmerman, Reference Zimmerman2008), upper echelon backgrounds (Higgins & Gulati, Reference Higgins and Gulati2006), R&D spending (Heeley, Matusik, & Jain, Reference Heeley, Matusik and Jain2007), founders’ retained ownership and prestige (Bruton, Chahine, & Filatotchev, Reference Bruton, Chahine and Filatotchev2009; Chahine, Filatotchev, & Zahra, Reference Chahine, Filatotchev and Zahra2011), board structures and characteristics (Certo, Daily, & Dalton, Reference Certo, Daily and Dalton2001; Filatotchev & Bishop, Reference Filatotchev and Bishop2002), and organizational virtue (Payne, Moore, Bell, & Zachary, Reference Payne, Moore, Bell and Zachary2013) can serve as valid signals and influence IPO performance. In sum, positive attributes or characteristics that just a part of IPO firms can achieve may serve as signals to decrease IPO underpricing.

Table 1. Select review of firm IPO management research using signaling theory and empirical data

While most empirical results above are based on US data, the signaling theory is also effective in the Chinese stock market (e.g., Mok & Hui, Reference Mok and Hui1998; Su & Fleisher; Reference Su and Fleisher1999; Tian, Reference Tian2003; Wei et al., Reference Wei, Ouyang and Chen2017; Yu & Tse, Reference Yu and Tse2006). Due to the high level of uncertainty and information asymmetry in the Chinese market, there may be incentives for high-quality firms to underprice in order to signal their value. Moreover, frequent seasoned equity offerings among Chinese firms suggest that signaling may be a reasonable explanation for underpricing (Yu & Tse, Reference Yu and Tse2006).

Effect of Being Known for Firm Quality and Generalized Favorability

Given the information asymmetry during the IPO process, potential investors become increasingly likely to neglect some information (e.g., listing prospectus) released by the firm. Consequently, investors become especially sensitive to effective signals of firm quality (Cohen & Dean, Reference Cohen and Dean2005). Podolny (Reference Podolny1994: 459) argued that ‘when the quality or value of commodities potentially exchanged is difficult to discern, actors cannot compare exchange opportunities by focusing on the commodities themselves’. In other words, investors evaluate firm value on the basis of the signal that they feel genuinely and ignore information deemed dubious and manipulated. Furthermore, the effectiveness of the signaling mechanism is determined partly by the credibility and observability of the signal (Connelly et al., Reference Connelly, Certo, Ireland and Reutzel2011). First, the signal should be highly correlated with the unobservable value of a firm. In fact, the signal must be difficult and costly for low-value firms to imitate (Davila, Foster, & Gupta, Reference Davila, Foster and Gupta2003; Spence, Reference Spence1976; Zhang & Wiersema, Reference Zhang and Wiersema2009). Second, the signal should be highly observable; that is, receivers can notice the information to a certain extent (Connelly et al., Reference Connelly, Certo, Ireland and Reutzel2011).

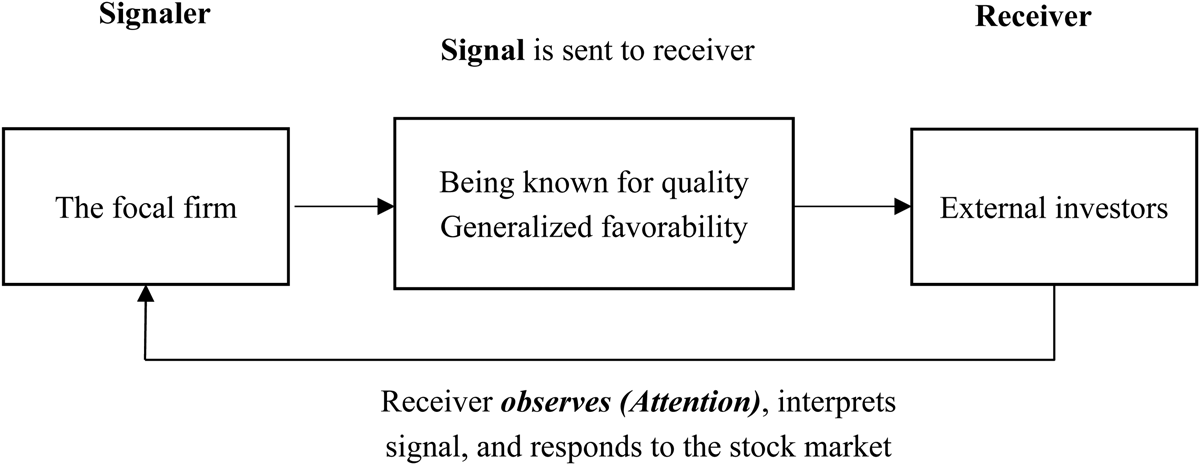

Organizational reputation can play an important role by assisting investors in judging the probable outcomes of interacting with a newly public firm. Organizational reputation is often regarded as a multidimensional construct (Lange et al., Reference Lange, Lee and Dai2011; Love & Kraatz, Reference Love and Kraatz2009; Rindova et al., Reference Rindova, Petkova and Kotha2007; Rindova, Williamson, Petkova, & Sever, Reference Rindova, Williamson, Petkova and Sever2005; Wei et al., Reference Wei, Ouyang and Chen2017). Lange et al. (Reference Lange, Lee and Dai2011) identified three dimensions of reputation, namely, familiarity with an organization (‘being known’), expectations for specific corporate attributes or outcomes (‘being known for something’), and perceptions of the firm's general favorability (‘generalized favorability’). The two latter dimensions of reputation involve perceivers’ evaluation by investors and can thus be regarded as signals (Connelly et al., Reference Connelly, Certo, Ireland and Reutzel2011). Figure 1 provides a schematic of the role of organizational reputation in signaling.

Figure 1. Stock-market signaling model in times of firm IPOs

Three characteristics of the two dimensions of reputation make them important in the signaling process. First, they can create competitive advantages. The resource-based view suggests that these dimensions of reputation can be understood as social approval assets that are based on stakeholders’ favorable collective perceptions of a companies’ culture, leadership, and identities, thereby providing firms with sustainable competitive advantages (Deephouse, Reference Deephouse2000; Lange et al., Reference Lange, Lee and Dai2011). Second, these dimensions are not easily imitated. They form and develop over time by a complex social interaction process that involves top managers, the firm, stakeholders, the media, and other infomediaries (Deephouse, Reference Deephouse2000). Third, the costs of building a reputation are high. A low-quality or unfavorable firm must exert additional effort to attract stakeholders’ attention and evoke positive emotional responses. In summary, these dimensions of reputation have the signal properties of being valuable, inimitable, and improving value creation.

Being Known for Quality and Underpricing

Being known for a quality dimension of reputation is formed on the cognitive basis of social influence and information exchange among different stakeholders (Rindova et al., Reference Rindova, Williamson, Petkova and Sever2005; Rindova & Martins, Reference Rindova, Martins, Barnett and Pollock2012). Most empirical studies have shown that being known for firm quality is the dominating driving force of reputation-related outcomes. Accordingly, it ‘entails expectations about future organizational outputs as held by perceivers who have an interest in those outputs’ (Lange et al., Reference Lange, Lee and Dai2011: 174). Scholars working from this perspective have shown that evaluators tend to look directly at an organization-specific attribute with a limited information context (Deutsch & Ross, Reference Deutsch and Ross2003). By contrast, many firms have a limited history operating within the context of an IPO; therefore, investors can rely on track records of specific organizational attributes or characteristics in judging a firm's economic value and potential for growth (Pollock, Rindova, & Maggitti, Reference Pollock, Rindova and Maggitti2008). Being known for firm quality can serve as a deliberate communication of positive information to convey positive organizational attributes. Thus, we expect that being known for firm quality will be negatively related to IPO underpricing, and we hypothesize that:

Hypothesis 1:

Being known for firm quality will be negatively related to IPO underpricing on the first day of trading.

Generalized Favorability and Underpricing

Firm performance and generalized favorability are related (Deephouse, Reference Deephouse2000). Past research has determined that this concept is an important strategic resource that leads to competitive advantage (Deephouse, Reference Deephouse2000). Some scholars have even linked value preservation to generalized favorability when a firm encounters a negative event (Wei et al., Reference Wei, Ouyang and Chen2017). Rindova et al. (Reference Rindova, Williamson, Petkova and Sever2005) suggested that generalized favorability reflects the collective recognition of stakeholders on the ‘demonstrated ability’ of a firm to create value. Thus, the generalized favorability conferred on a firm enhances the expectation of stakeholders that the firm will operate in ‘reputation-consistent’ ways. Thus, the generalized favorability dimension of corporate reputation can be used as a cognitive shorthand by investors to infer about newly public firms when additional firm-specific knowledge is either unavailable or substantially costly to observe (e.g., Fombrun & Shanley, Reference Fombrun and Shanley1990; Mishina, Block, & Mannor, Reference Mishina, Block and Mannor2012).

In addition, a firm's generalized favorability is generated from the interactions of such a firm with its stakeholders and from information about the firm's activities and actions circulated among stakeholders. Generalized favorability reflects the overall evaluation of an organization by multiple audiences, thereby serving as a source of ‘social proof’ that can reduce stakeholder uncertainty (Lange et al., Reference Lange, Lee and Dai2011; Rao, Greve & Davis, Reference Rao, Greve and Davis2001; Wei et al., Reference Wei, Ouyang and Chen2017). Stakeholders are likely to favor well-liked organizations when making economic choices because such firms are likely to possess ‘desirable character traits’ (Love & Kraatz, Reference Love and Kraatz2009). Thus, generalized favorability can be considered an activating signal of good prospect. We predict that generalized favorability is associated with considerably low underpricing, and we hypothesize that:

Hypothesis 2:

Generalized favorability will be negatively related to IPO underpricing on the first day of trading.

Mediator Role of Investor Attention

Management researchers have determined that signaling effectiveness is partially determined by the characteristics of the receiver (Connelly et al., Reference Connelly, Certo, Ireland and Reutzel2011). For example, the signaling process will not work when investors do not observe the signal. Many listed firms are confronted by the challenges of improving public attention and attracting investors to their stock to improve liquidity and the cost of capital (Bushee & Miller, Reference Bushee and Miller2012). Public attention is defined as the extent to which the public vigilantly scans the environment for signals (Gruszczynski, Reference Gruszczynski2013). In business, Davenport and Beck (Reference Davenport and Beck2001) largely defined attention similarly: as focused mental engagement on a particular item of information. Implicit in the statement that potential investors may purchase corporate stock is the assumption that the public attends to firm information (e.g. Geissler, Zinkhan, & Watson, Reference Geissler, Zinkhan and Watson2006). Consumers are not generally closely tied to firms and do not typically communicate directly with firm representatives (Carroll, Reference Carroll2010). That is, potential consumers must attend to a firm's new products before they can be expected to purchase them. Therefore, we argue that the signaling role of organizational reputation requires that the investors focus to process information and incorporate organizational reputation into their decisions. In the face of a complex informational environment, processing in detail all the information that individuals perceive is impossible. Attention determines the information that should be processed in priority because individuals have limited cognitive abilities (March & Simon, Reference March and Simon1958; Ocasio, Reference Ocasio1997; Pollock et al., Reference Pollock, Rindova and Maggitti2008). Scholars have shown that attention effectively plays an important role in an individual's investment decision-making and have investigated the relationship between stock market activity and investors’ limited attention (Mondria, Wu, & Zhang, Reference Mondria, Wu and Zhang2010; Peng & Xiong, Reference Peng and Xiong2006). Scholars have suggested that investor attention interacts with certain cognitive biases that affect the manner by which investors react to information. In general, investors’ attention is limited by sets of publicly available information. Therefore, organizational reputation is insufficiently incorporated into investors’ evaluation and decision-making.

Hypothesis 3a:

Investor attention will partially mediate the relationship between being known for quality and IPO underpricing on the first day of trading.

Hypothesis 3b:

Investor attention will partially mediate the relationship between generalized favorability and IPO underpricing on the first day of trading.

METHODS

Data

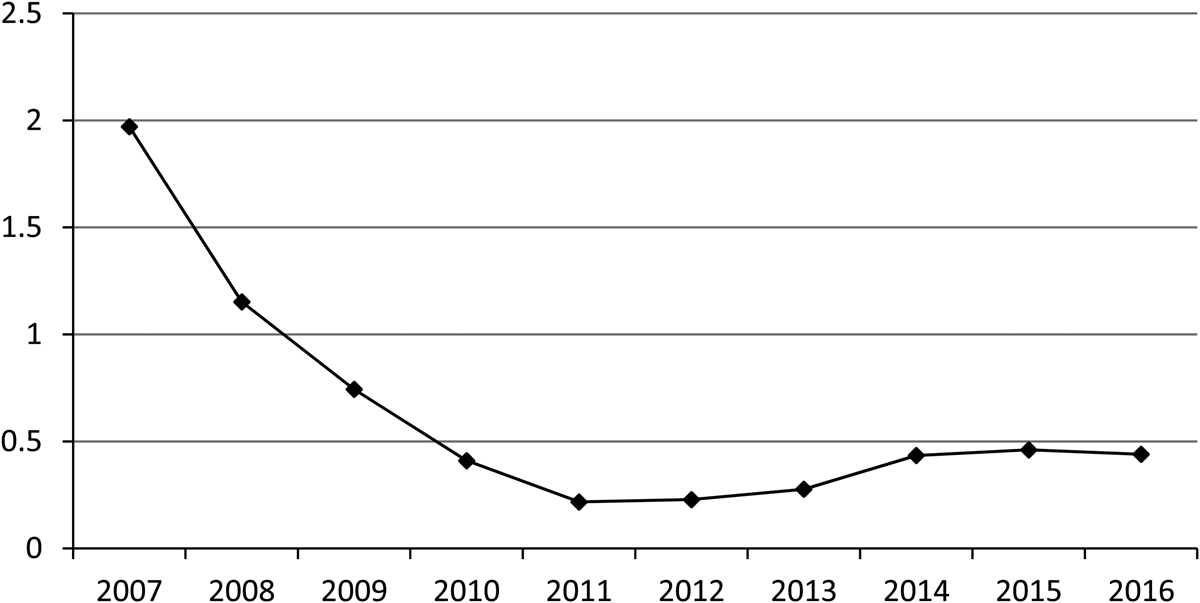

We obtained the identities of the 828 Chinese IPOs firms that issued A-shares for the first time in the period of January 1, 2010 to December 31, 2016, which was a relatively stable period for offerings and had an average level of underpricing (35%). The extreme underpricing magnitude in the Chinese IPO market has elicited considerable attention (Chen, Firth, & Kim, Reference Chen, Firth and Kim2004; Mok & Hui, Reference Mok and Hui1998; Su & Fleisher, Reference Su and Fleisher1999). Figure 2 shows the annual mean underpricing from 2007 to 2016. The average underpricing is 63.34%. Our sample starts in 2010 because in May 2009, the China Securities Regulatory Commission issued a new regulation that indicated that IPO pricing was no longer based on regulated PE ratios. We excluded firms that were founded over 15 years before the IPO to focus on the typical IPO firm that over a ‘normal’ period of time (Cohen & Dean, Reference Cohen and Dean2005). The final sample consisted of 564 IPO firms. Deleting 101 firms with missing data left us with the final sample of 463 IPOs. The primary sources of data were the China Stock Market and Accounting Research Database (CSMAR) and the IPO prospectus of each firm.

Figure 2. Annual mean underpricing between 2007 to 2016

Dependent Variables

We measured underpricing as the percent change in stock price on the first day of public trading and adjusted for the contemporaneous return in the broader stock market. The data used to calculate underpricing came from two sources, namely, the CSMAR database and the IPO firm prospectuses.

Independent Variables

Being known for quality. Past studies have used the factors identified by Gutterman (Reference Gutterman1991) as the characteristics used by the investment community to assess IPO firm quality (Pollock & Rindova, Reference Pollock and Rindova2003; Pollock et al., Reference Pollock, Rindova and Maggitti2008). We standardized the following firm-specific characteristics by transforming them into Z-scores and combining them into a single firm quality index to measure being known for firm quality. Those firm-specific characteristics include firm sales and net income over the period of one year before the IPO, the number of risk factors included in the offering prospectus, and percentage of an offering represented by managers selling of stock.

Generalized favorability. Our measure of generalized favorability is based on Lange et al. (Reference Lange, Lee and Dai2011), who recommended that ‘generalized favorability might be derived from content analysis measuring the positive, neutral, or negative tones of each firm's press coverage’. Communication research has stated that the public's evaluation of certain issues or subjects closely follow media coverage (Deephouse & Carter, Reference Deephouse and Carter2005). Newspaper stories are better retrieved than other media sources (DeFleur, Davenport, Cronin & DeFleur, Reference DeFleur, Davenport, Cronin and DeFleur1992), and prior research has suggested that newspapers should be the best information source for stakeholders to form their impression about a firm (Fiske & Taylor, Reference Fiske and Taylor1991). Thus, compared with other media, newspaper articles should be the most influential source of firms’ reputation.

Thus, we analyzed the degree of positive and negative affective language used in each newspaper article to construct generalized favorability. The selected newspapers were from the China Core Newspapers Full-text Database, which retrieves news stories from 593 major newspapers in China, thereby serving as a relatively comprehensive source for determining the attributes of media coverage. We searched and downloaded full texts (entire articles) using a set of keywords (i.e., corporate full name and abbreviated form of the corporate name). We also collected media coverage associated with IPO firms over a one-year period before the IPOs. A total of 7190 articles were obtained using this sampling procedure.

To analyze the degree of positive and negative affective language used in each article, two of the colleagues were instructed to code full-text versions of all sampled articles separately. Following recent research, an article was rated ‘favorable’ (‘unfavorable’) if the number of positive (negative) phrases was at least two-thirds (two-thirds or above) of the total number of phrases. Otherwise, the article was rated ‘neutral’. The two coders agreed on 84% of the codes and disagreement was resolved by discussion. One of the co-authors of the current research used the same coding scheme on the 358 articles from 2016. The two coders agreed 87% of the time, thereby suggesting high inter-coder reliability (Weber, Reference Weber1990). Thereafter, we used the Janis–Fadner coefficient of imbalance to estimate the overall rating of media coverage (Deephouse, Reference Deephouse2000). The coefficient of generalized favorability was calculated using the following formula:

$$ \eqalign{& {\rm Coefficient\; of\; }generalized\; favorability{\rm \; } = \displaystyle{{\left( {{\rm P}^2-{\rm PN}} \right)} \over {{\rm V}^2}} \cr& {\rm \; if\; P} \gt {\rm N};0 {\rm \; if\; P} = {\rm N};{\rm and}\displaystyle{{\left( {{\rm PN}-{\rm N}^2} \right)} \over {{\rm V}^2}}{\rm if\; N} \gt {\rm P\; }} $$

$$ \eqalign{& {\rm Coefficient\; of\; }generalized\; favorability{\rm \; } = \displaystyle{{\left( {{\rm P}^2-{\rm PN}} \right)} \over {{\rm V}^2}} \cr& {\rm \; if\; P} \gt {\rm N};0 {\rm \; if\; P} = {\rm N};{\rm and}\displaystyle{{\left( {{\rm PN}-{\rm N}^2} \right)} \over {{\rm V}^2}}{\rm if\; N} \gt {\rm P\; }} $$where P = number of favorable news articles in a given year; N = number of unfavorable news articles in a given year; and V = the total number of news articles about a firm in a given year, including articles that received neutral ratings. The range of this variable is −1 to 1, where −1 is equal to all unfavorable coverage and 1 is equal to all favorable coverage.

Investor attention. Investor attention is typically measured as daily turnover, which is the percentage of the total shares a firm offers that are traded on the first day of public trading (Pollock et al., Reference Pollock, Rindova and Maggitti2008). Higher turnover represents greater investor attention to the IPO firm (Pollock & Rindova, Reference Pollock and Rindova2003; Pollock et al., Reference Pollock, Rindova and Maggitti2008). The data used to calculate this variable were from the CSMAR database.

Control Variables

Several control variables may have affected the investor behavior and reaction under consideration in the current research. Media attention may influence the evaluations that an IPO firm receives in the other community (Pollock et al., Reference Pollock, Rindova and Maggitti2008). We used the average daily number of news articles that mentioned the firms’ names to control the influence of media attention. The data used to measure the media attention were drawn from all news reports on Baidu News[1] the largest Chinese news search platform, for each IPO firm for the first trading day before the IPO. The natural logarithm transformation of this variable was used to achieve a univariate normal distribution. The characteristics of a firm substantially affect the performance of and demand for the offering. First, we included firm age because it may influence IPO performance (Ritter, Reference Ritter1998) and suggest difficulty in valuing a firm (Carter & Manaster, Reference Carter and Manaster1990; Cohen & Dean, Reference Cohen and Dean2005). Firm age was measured as the number of years between the incorporation of a firm and the IPO. Second, underwriter reputation was controlled because it can bring resources and send positive signals to investors, e.g., when a high-status underwriter takes a firm public (Carter & Manaster, Reference Carter and Manaster1990). Underwriter reputation was a dummy variable coded 1 if an underwriter's market share was one of the top ten underwriters in the period. Third, dummy variables for industries were included to control for systematic differences among companies in various industries for the independent variables. Five industry dummy variables were controlled in the analysis, namely, manufacturing, transportation, wholesale, retail, and finance (Cohen & Dean, Reference Cohen and Dean2005).

RESULTS

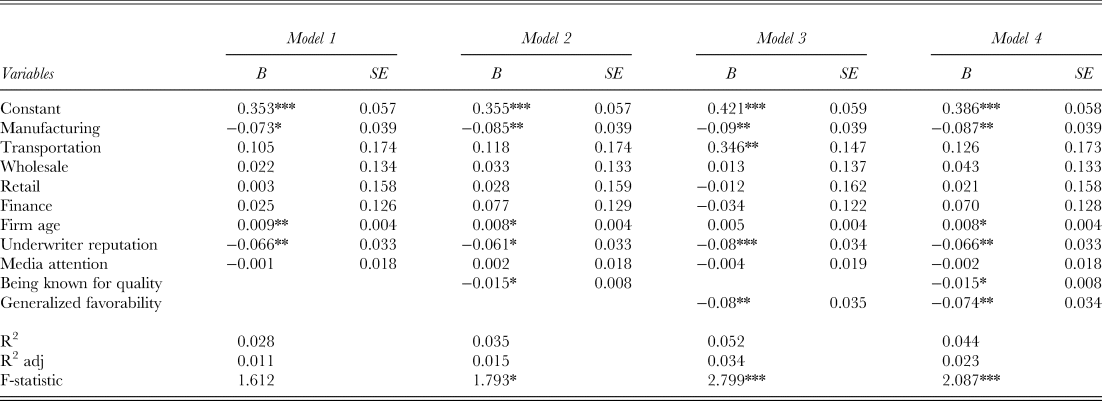

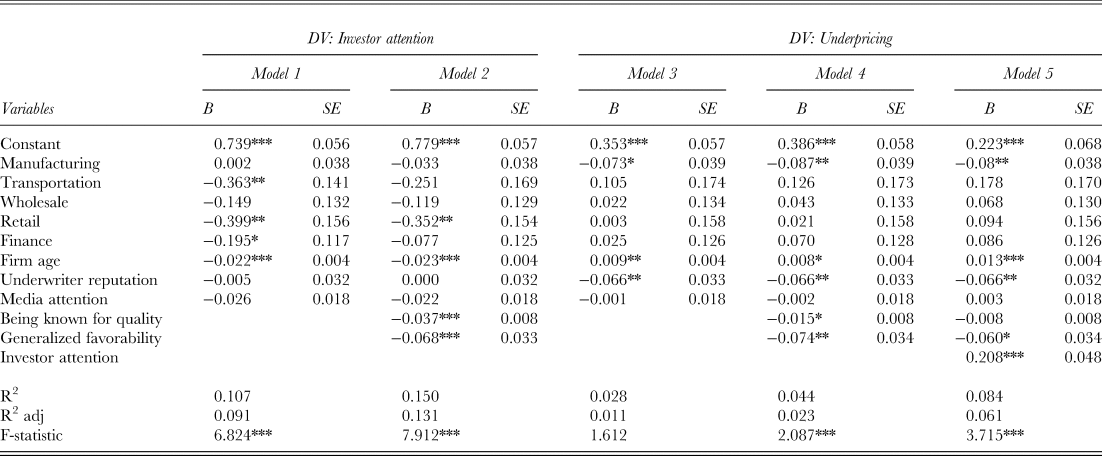

Table 2 presents the means, standard deviations, and correlations for the variables of interest. Table 3 shows the unstandardized regression coefficients for the ordinary least squares (OLS) regressions that tested the hypotheses. We used the full model to test all the variables for the presence of multicollinearity. The highest variance inflation factor is 1.219; thus, multicollinearity is not a concern. Model 1 estimates the coefficients of our control variables. Models 2 and 3 estimate the main effects of each theorized variable for each organizational reputation dimension hypothesized to influence underpricing. Model 4 contains all of these main effects.

Table 2. Descriptive statistics and correlations

Notes: n = 463, *p < 0.05; **p < 0.01,a Logarithm.

Table 3. Results of regression analyses predicting underpricing

Notes: n = 463, *p < 0.10; **p < 0.05, ***p < 0.01

Firm age is positively related to underpricing (0.009, p < 0.05), showing that old firms are more likely to discount to reduce risk. This is inconsistent with Ritter (Reference Ritter1998)’s assertion that longer track records will outperform younger ones. Underwriter reputation is negatively related to underpricing (−0.066, p < 0.05), in line with the findings in the literature that a high-status underwriter can send signals to the market about the relative quality of an offering (Cohen & Dean, Reference Cohen and Dean2005). The coefficient of media attention is negative but not significant (−0.001, p > 0.1); this is not consistent with our expectation that the media attention to IPO firms influence its stock performance (Pollock & Rindova, Reference Pollock and Rindova2003). Among five industries, the coefficient manufacturing is negative and significant (−0.073, p < 0.1), which indicates that the particularities of firms in manufacturing industry may potentially impact underpricing.

We regressed the main effects of being known for quality and generalized favorability on the underpricing to test Hypotheses 1 and 2. Model 2 shows that being known for quality is significantly and negatively associated with underpricing (−0.015, p < 0.1), thereby supporting Hypothesis 1. We used the unstandardized regression coefficient for being known for quality to calculate the effect of increasing being known for quality by mean value decomposition. The average value of being known for quality has a 0.09% effect on the average underpricing. As predicted in Hypothesis 2, generalized favorability is significantly and negatively associated with underpricing (0.08, p < 0.05), thereby supporting Hypothesis 2. The average value of generalized favorability has a 4.57% effect on the average underpricing. We also observed that the adjusted R2 values for the models were low; thus, our results need to be evaluated with caution. While low R2 values clearly present limitations, this level of explanatory power is not special or unusual in organization management and strategy research (see e.g., Muller & Kräussl, Reference Muller and Kräussl2011 for a recent example).

Mediation Test

To test the mediation hypothesis, we followed the multistep approach suggested by Baron and Kenny (Reference Baron and Kenny1986). At the first stage, this research established regression models to examine the relationship between the independent variables (being known for quality and generalized favorability) and the mediator (investor attention). We then regressed being known for quality and generalized favorability against the dependent variable (underpricing). Finally, we regressed both dimensions and investor attention against underpricing. To indicate significant mediation, all these effects must be significantly related to the association between predictors and dependent variables reduced by the addition of the mediator. To confirm and formally test this mediation effect, we conducted a set of Sobel mediation tests.

As Table 4 suggests, being known for quality is significantly negatively related to underpricing (−0.015, p < 0.10) and investor attention (−0.037, p < 0.01). When we included the mediator as a predictor variable in the model, investor attention became significantly associated with underpricing (0.208, p < 0.01) and the relationship between being known for quality and underpricing was reduced and became nonsignificant (0.008, p > 0.10). The Sobel test confirmed that investor attention mediates the relationship between being known for quality and underpricing at the 0.05 level (two-tailed significance test, Sobel z = −3.162, p < 0.05). Together, these results strongly support H3a.

Table 4. Regression results of the mediating role of investor attention

Notes: n = 463, *p < 0.10; **p < 0.05, ***p < 0.01

As Table 4 also suggests, generalized favorability is significantly negatively related to underpricing (−0.074, p < 0.05) and investor attention (−0.068, p < 0.01). When we included the mediator as a predictor variable in the model, investor attention became significantly associated with underpricing (0.208, p < 0.01) and the relationship between generalized favorability and underpricing decreased and became less significant than it was without the mediator (0.060, p < 0.10). The Sobel test did not confirm the results (two-tailed significance test, Sobel z = −1.861, p > 0.05).

Robustness Check

Endogeneity may have affected our analyses because firm-specific factors other than those covered by this research and unobserved capabilities may underlie investors’ choices about a firm. The result of the analyses that used corporate reputation to predict investor decision may be biased because of the unlikeliness that all firms have an equivalent probability of receiving media coverage. Therefore, we used two-stage Heckman correction models to correct selection bias (Heckman, Reference Heckman1979). In the first stage of the Heckman estimation, we formulated a probit regression to predict the probability that an organization would receive media coverage. In the second stage, we corrected self-selection by incorporating a transformation of these predicted probabilities as an additional explanatory variable in the OLS regression analyses. Moreover, we included the firm age, underwriter reputation, and industry dummy variables in the probit model. These factors may affect the probability that an organization receives media coverage. The inverse Mills ratio was not significant, and our results remain substantively unchanged.

DISCUSSION

Information asymmetry between owners and IPO investors has elicited the concern of researchers in the organizational reputation management literature (Carter & Manaster, Reference Carter and Manaster1990; Pollock & Rindova, Reference Pollock and Rindova2003). However, the different dimensions of reputation in affecting how potential investors react to their IPOs have not been investigated. We analyzed 463 initial public offerings in China from the period of 2010 to 2016 to test the relationships between the two dimensions of organizational reputation, investor attention, and stock market reactions to firms’ IPO. Although the literature has provided certain evidence for the existence of a relationship between organizational reputation and financial performance (e.g., Deephouse, Reference Deephouse2000; Pfarrer, Pollock, & Rindova, Reference Pfarrer, Pollock and Rindova2010; Wei et al., Reference Wei, Ouyang and Chen2017), our theory and empirical results suggest that different dimensions of reputation are important in the IPO process. We determined that the generalized favorability and being known for quality dimensions of corporate reputation are associated with underpricing. From a signaling perspective, corporate reputations that contain different stakeholders’ perceptions affect investor choices of IPO firms in various manners. We argued that the generalized favorability and being known for quality dimensions of corporate reputation affect investors’ evaluation and understanding of an IPO firm.

In response to the call for additional research on the relationship between owner and investor in the context of IPOs (Cohen & Dean, Reference Cohen and Dean2005), we suggest that corporations’ being known for quality and generalized favorability can send positive signals of firm value to potential investors. Our finding suggests the roles of being known for quality and generalized favorability in signaling firm value, which reduce information asymmetry between firms and investors. Cohen and Dean (Reference Cohen and Dean2005: 688) argued that ‘In the uncertain context of an IPO, information asymmetry between current owners and potential investors creates the potential for owner opportunism and the need for convincing signals of firm value’. The ‘being known for quality’ and ‘generalized favorability’ dimensions of reputation can serve as important signals because investors perceive corporate overall favorability as a reliable indicator of firm value. Our results suggest that the generalized favorability dimension of corporate reputation has a negative relationship with underpricing. Thus, our study also contributes to recent research that has examined the influence of different dimensions of reputation on firm-level outcomes.

In addition, the signaling theory perspective on organizational reputation holds that organizational reputation may benefit listed firms financially because investors may have high expectations of reputable firms. This research explores a previously unexplored premise of this argument – that the signal role of organizational reputation should only be expected to accrue to the extent that investors pay attention to them. In this case, the power of organizational reputation in explaining underpricing is due to the extent that these reputation signals attract stakeholder attention. Our analysis supports this view and thereby demonstrates that investor attention mediates the relationship between being known for quality and IPO underpricing.

Several limitations of the present study provide additional opportunities for developing future research. First, we analyzed only investor choices in the aggregate (i.e., individual investors notice similar types of information and react in a similar manner toward such information, thereby arriving at a similar conclusion.). Thus, we restricted our theorizing to individual socio-cognitive processes and did not study the different types of investors’ choices and behaviors (e.g., private individuals versus institutional investors). Given the difference in the relative levels of expertise and risk preference, various types of individuals or organizations may interpret corporate reputation in various ways. Future research can systematically investigate this issue to identify the role that investor characteristics or attributes play in the IPO market. Second, we selected the first trading day to limit the possibility that exogenous or endogenous events with effective signal potential change the investors’ attention and evaluation. However, a different pattern of results may occur under different post-IPO period lengths. We call for a systematic investigation of the relative influence of corporate reputation over considerably long periods in future research. Finally, although we attempted to control a large number of contextual and firm-level variables, other factors that influence the link between corporate reputation and underpricing may emerge.