Introduction

By dragging the world's two largest economies into a costly battle of tariffs, the US–China Trade War transformed a traditional ballast of the bilateral relationship into a maelstrom of instability. Historically. US businesses have staunchly advocated for free trade with China. They ranked among the biggest beneficiaries of China's market opening and risk becoming the greatest casualties of the present conflict as tariffs erode their profits and tensions disrupt their operations. So how united have US businesses been in opposing the US–China Trade War?

Existing theories of trade politics suggest that larger multinational corporations (MNCs) benefit much more from trade liberalization and more actively lobby and advocate for free trade.Footnote 1 One might expect US firms doing business in China to have even stronger incentives to voice opposition to the tariffs compared to their domestic counterparts that merely source from China. Indeed, of the 4,000 companies that submitted public comments to the United States Trade Representative (USTR) on the first three lists of section 301 tariffs, nearly 86 percent are opposed tariffs and 88 percent say that tariffs would disrupt their supply chains.Footnote 2 Yet, even though the US–China Trade War is widely recognized as bad for business, most of these new tariffs still remain in place after the Phase One Trade Deal signed on January 15, 2021.Footnote 3 As of 2021, a surprisingly small number (less than 2 percent) of large and very large US firms have openly voiced opposition to tariffs.Footnote 4 Which factors make some MNCs take political action in response to the trade war and cause others to stay on the sidelines?

To answer this question, we link China-based subsidiaries of US firms to their political behavior in the United States to examine the effects of firm-heterogeneity on how US MNCs respond to the trade war. We leverage two new datasets in the analysis. The first dataset uses annual registration records filed with the Chinese Ministry of Commerce to identify the universe of foreign-invested enterprises in China from 2014 to 2019. The second dataset consists of the observed political behaviors of all US firms that responded to section 301 tariffs by submitting a comment, testifying in a hearing, filing a tariff exclusion request, or lobbying the USTR in 2018 and 2019. We take a representative random sample of 500 American MNCs from the first dataset and match these to the political behavior of their parent companies in the United States in the second dataset. Using the exit, voice, and loyalty (EVL) frameworkFootnote 5, we analyze how these MNCs choose between different strategies in response to US tariffs. We pair this quantitative analysis with four case studies of MNCs to identify greater sources of firm heterogeneity in response to the trade war. This mixed-methods approach provides a unique picture of the correlates of firm actions in a time of increased political risk and economic costs.

Our results highlight that firm behavior in politically advocating for market access, traditionally characterized by successful collective action, varies significantly when existing market access is threatened by new trade barriers. Advocating for trade liberalization—market opening—is different from speaking up against protectionism—lowering tariff barriers—after MNCs are already operating in the foreign market. Some factors are undoubtedly unique to the US–China case. The Trump White House, citing national security concerns with China, openly embraced protectionism and dared interest groups and Congress to challenge them on tariffs. This security framing resonated with the “tough on China” mood on Capitol Hill and increased the political cost for opposing tariffs (Zhang Reference Zhang, Zeng and Liang2022b). But we identify significant firm-level heterogeneity that explains which MNCs are willing to speak out against new trade barriers. The level of embeddedness in the foreign market divides MNCs and erodes their willingness to engage in politically costly collective action. We show in our case study that every company brought up China and the risk of policy instability arising from the trade war in their annual financial report to shareholders, but none directly challenged policymakers over tariffs. Our results have implications for how we understand the relationship between the political behavior of firms, free trade, and threats to the liberal economic order.

US–China Trade War and Ambivalent Politics of US MNCs

Average US tariff levels on Chinese exports increased from 3 percent to 21 percent since 2018.Footnote 6 The escalation of tariffs accompanied a slew of other policy measures designed to curb Chinese competitiveness in emerging technologies—the so-called tech war—and to heighten ideological competition between the two systems of government—the so-called new cold war. These developments dramatically increased operational costs and political risks for US MNCs doing business with China. The Eurasia Group, a leading political risk consultancy, identified the “broken” US–China relationship as a top risk for its clients in 2019.Footnote 7

Both governments appear intent on rallying MNCs to advance their national political interests, putting businesses in a difficult position. US policy in the trade war seems to be motivated by the belief that tariffs would be the wake-up call American MNCs needed to abandon China and reshore supply chains to the United States. Chinese policy, particularly in the early stages of the trade war, seems to have been guided by the perceived leverage differences in Trump's and the US business community's goals on trade were expected to generate in US–China trade negotiations.Footnote 8 Chinese scholars saw little risk of a full-scale trade war between the United States and China because they expected that influential special interest groups in the United States would make it difficult for the Trump administration to start a trade war with China, despite his bombastic rhetoric.Footnote 9

Yet, US MNCs responded to the trade war neither by divesting en masse from China (exit), as the US side hoped, nor by vocally opposing Trump administration tariffs in the United States, as the Chinese side expected. The modal strategy for MNCs is to neither exit nor voice, but to be apolitical and adjust to the increased political risks by altering their business model. Even though more than 63 percent of MNCs in our sample were adversely impacted by tariffs, only 22 percent chose voice and 7 percent chose exit in response. We believe this apolitical response of US MNCs is puzzling from the perspective of interest group politics. The remainder of the article addresses why the interest group with the most invested in the US–China relationship did not coalesce into an effective coalition in opposition to the trade war.

“Normal” Trade Politics

The US–China Trade War appears at first to contradict established theories that predict a leading role of interest groups in championing free trade and a highly constrained White House.

Firms that export or produce abroad tend to be larger and more productive.Footnote 10 This is because exporting or producing abroad using foreign direct investment (FDI) involves high, nonrecoverable fixed costs. Only more productive and larger firms can afford the upfront fixed costs of doing business in foreign markets because they are able to charge higher markups and thus are more profitable. Lowering tariffs also means that firms face increasing competition from imports. Yet, larger and more productive firms are less concerned about intensified global competition resulting from trade liberalization for at least two reasons. First, high productivity enables them to sustain competition with foreign firms. Second, accessing better and cheaper inputs using global sourcing further bolsters their competitiveness.Footnote 11 With the emergence of complex global production and investment networks, these MNCs, with their ability to coordinate networks of foreign affiliates, have emerged as influential political actors.

MNCs can wield enormous political influence with both their home and host governments to protect their business interests. They lobby individually and through peak associations such as the American Chamber of Commerce (AmCham) for favorable policies.Footnote 12 China consistently ranks as one of the most popular investment destinations for American MNCs. In the 1990s, Congress voted every year to end China's most-favored-nation (MFN) status, which guaranteed low tariff rates for Chinese goods. During this period, US MNCs worked closely with the Bush and Clinton administrations to lobby Congress for MFN renewal. These US firms organized to support trade with China, both with new organizations and with what became known as the annual “door knock,” where American business groups from throughout the United States visited Washington to lobby Capitol Hill, paving the way for China's accession to the World Trade Organization (WTO) in 2001.Footnote 13

Traditional trade politics involves coalitions of exporting and import-competing interest groups competing to influence Congress and the president over the optimal level of trade liberalization. Milner and Tingley (Reference Milner and Tingley2015) explain presidential strength across foreign policy instruments as a function of two factors: distributive politics and ideological divisions. In “normal” trade politics, interests group lobbying and political pressure constrains the president because distributive politics around trade policy are high. Additionally, because ideological divisions across the two political parties around free trade were historically high, the president was further constrained on using trade as an instrument of policy.

Distributive politics between interest groups constrain the White House's ability to set trade policy. However, over the past half century, the exporting interests of large MNCs enjoyed the upper hand over import competing industries in these domestic fights and contributed to the lowering of trade barriers globally.Footnote 14 Export dependence and multinationality historically made firms more likely to oppose protectionism in their home market.Footnote 15 These firms typically source intermediate inputs globally including their home countries to produce final products in foreign markets. As such, they are concerned about potential retaliation by the host country if their home country moves toward protectionism.

Historically, the concentrated interests of large, export-intensive MNCs were instrumental in trade liberalization because they outspent the diffuse interests of smaller, import-competing rivals in lobbying and campaign contributions.Footnote 16 Their contributions created the public good of a more open market between the United States and China, enabling firms that did not lobby to gain access to the vast new markets. Thus, collective action against tariffs should still be possible today if these same large MNCs that enjoy concentrated benefits from trade liberalization were equally willing to shoulder the costs of fighting against new trade barriers.

Trade War Politics

The US–China Trade War seems to turn all of these expectations about the leading role of MNCs as champions of free trade on their heads. President Trump appeared unconstrained by either interest groups or by Congress in raising tariffs.

Some share of MNC reticence to participate in politics can be explained by their growing frustration with discriminatory Chinese policies. The record of public testimonies held by the USTR reveal that some US firms saw the trade war as a window of opportunity to address their grievances with Chinese industrial policies that limit market access for foreign MNCs. Most of these firms are either import-competing or no longer invested in China. But the US–China Business Council (USCBC), which represents more than 200 prominent MNCs that do business in China, also took an ambivalent stance in the USTR hearings, supporting the damning section 301 report findings but opposing the unilateral use of tariffs. This highlights the dilemma for US MNCs that may support some of the goals of trade war but nevertheless oppose tariffs as a means because they are unwilling to shoulder higher costs.

Some share of MNC reticence is due to the fact that the traditional ideological division between Republicans and Democrats over trade does not apply to the China trade war. The Trump White House, citing national security concerns, initiated trade wars on multiple fronts, and dared interest groups and Congress to challenge them. Congressional Democrats and industry groups were notably much more vocal in their opposition to the section 232 tariffsFootnote 17, which affected US allies in Europe and North America as well as China, than to the section 301 tariffs. Since assuming office, the Biden administration removed section 232 tariffs on allies such as the Europe Union, United Kingdom, and Japan but have kept both section 232 and section 301 tariffs against China in place.

Republican and Democratic legislators have instead embraced a bipartisan consensus that views tariffs as one front in a broader rivalry between the United States and China. Since 2010, attack ads featuring China have surged, particularly in competitive districts, and incumbents who were attacked took tougher positions on China after reelection.Footnote 18 The annual number of “tough on China” bills introduced in Congress would quintuple between 2016 and 2020.Footnote 19 These bills often had bipartisan sponsorship and were just as likely introduced by Republicans like Marco Rubio (R-FL) as Democrats like Robert Menendez (D-NJ). As Amy Celico, a former China director at the USTR and principal at Albright Stonebridge Group, observed, Congress has been taking the lead on placing stricter export controls and screening investments from China under the Trump administration.

This lack of ideological division on the China trade war in Congress undoubtedly increased the political cost of opposing the section 301 tariffs among American businesses.

The few MNCs that publicly opposed the trade war such as Apple and GM struggled to find allies in Congress because of the bipartisan consensus around getting tough China. Most firms used the USTR testimony and comments process to lobby for individual tariff exclusions while doing little to oppose the trade war as a whole.

However, bipartisan hostility toward China was a major obstacle faced by all MNCs suffering from the section 301 tariffs. To understand why some MNCs voiced opposition while others remained silent we must examine distributive politics. We argue that heterogeneity of interests among US MNCs also explain why the trade war was largely unopposed. US MNCs in China differ greatly in terms of their level of embeddedness in the Chinese economy, which is in turn driven by date of establishment, size of registered capital, and whether they operate as a joint venture (JV) or as a wholly foreign-owned enterprise.

Building on a wave of new research on MNCs behavior in ChinaFootnote 20 and in the United StatesFootnote 21, the subsequent sections analyze the political behavior of American MNCs in reaction to the US tariffs to unpack the ambiguous role they play in US–China strategic competition. We show that US MNCs were not unequivocal champions of free trade with China in the immediate years following the initiation of the trade war, even though they are among free trade's largest beneficiaries. Businesses facing tariffs were, surprisingly, not more likely to speak out against the trade war but neither were they likely to divest from China.

Exit, Voice, Loyalty Framework

MNCs faced with rising tariffs must weigh cost of political inaction (loyalty) against the costs of political (voice) and economic (exit) action. We adopt the EVL framework pioneered by Hirschman (Reference Hirschman1970) and formalized by Clark et al. (Reference Clark, Golder and Golder2017) to classify MNC responses. When faced with a negative change in the policy environment, citizens in the EVL framework have a choice to take three types of actions: (1) exit or forgo the existing benefits and seek the best possible alternative, (2) voice or make an active effort to pressure the government to change the new policy by showing their dissatisfaction, or (3) loyalty, meaning putting up with the policy and not alter their behavior. As Clark et al. (Reference Clark, Golder and Golder2017) show the EVL game is solved differently depending on the relative cost of exit and voice.

This study builds on these earlier works by introducing novel data on EVL for a sample of 500 US MNCs in China.Footnote 22 Previous research show that US MNCs are resilient to all but the most intense and persistent conflicts after the costs of entry have been sunk and rarely exit in the face of mounting political risksFootnote 23. Another study using the EVL framework found that American MNCs that have verticalized their production have even stronger incentives to engage in lobbying activities and voice their policy preferences due to their greater “sunk costs” and hence the “higher cost of exit”.Footnote 24 We strive to show how MNCs choose from the full menu of political and economic strategies available to them in responding to tariffs.

MNCs operate and have interests in both the United States and China. They could voice their dissatisfaction to both governments or exit from either market. The irony is that most US MNCs cannot credibly threaten to exit the United States because they have likely already outsourced production overseas and keep only essential headquarters functions in the United States. So, we will only consider MNC exit from China in response to tariffs in this article. This decision to leave or partially leave China through shutting subsidiaries still remains a difficult choice for many MNCs. A vice president of government affairs for GM China put it this way: “If an American company is not in China, it cannot be a global leader and cannot benefit from economy of scale.” So, while tariffs of 25 percent or more pose a significant challenge for some China-based exporters, others are loathed to abandon the China market to their global competitors.

Another possible action of firms is voice in China. Firms do negotiate at the local level in China on some policies, but the Chinese state is notoriously autonomous and unresponsive to foreign MNCs on the scale of national economic policy. In fact, the lack of responsiveness to MNC grievances over technology transfer, intellectual property protection, and regulatory uncertainty feature prominently in the section 301 investigation and played an important role in the onset of trade hostilities. No systematic data was available on which MNCs lobbied the Chinese government. By contrast, we were able to identify multiple channels through which MNCs could voice opposition to the trade war in the United States. Thus, when we examine voice, we mean MNCs exercising voice in the United States and when we examine exit, we mean MNCs closing down their operations in China.

Measuring Exit, Voice, and Loyalty

Our outcome variable of interest is MNCs’ strategy, covering three possible responses: exit, voice, or loyalty.

Exit: MNCs in China are required to report annually to the Ministry of Commerce. An MNC is defined as exiting if they report in one year but do not report in the subsequent year. Across all foreign MNCs in China, between 2018 and 2019, just more than 32,000 foreign firms (11.42 percent) exited the dataset.Footnote 25 In the same period, 1,893 US firms (11.45 percent) exited China. We draw our sample of 500 firms from 2018, a firm in our sample is defined as existing if it did not report in 2019. In this sample, thirty-four MNCs (6.8 percent) are coded as exiting.Footnote 26 Exit measured in this way is exit of a subsidiary, not necessarily of the parent company; it could reflect corporate restructuring, a new name, or simply failure to report. Because we are working with a sample, we were able to evaluate every identified exit to ensure it measured subsidiary closure rather than restructuring, name changes, or delinquent reporting.

Voice: In the main analysis, we define voice as engaging in any political voice activity in Washington, D.C. including USTR lobbying, USTR testifying, submitting public comments, and requesting tariff exclusion. We define a company as voicing if the MNC belongs to the US–China Business Council (USCBC) and this peak association engaged in voice activities on behalf of their members. We found that 115 MNCs (23 percent) engaged in voice. The USCBC participated in the testimony, submitted public comment, and lobbied the USTR. Forty-seven MNCs in our sample were identified as USCBC members. Another sixty-eight MNCs individually engaged in some form of voice.

Some voice activities are financially costlier than others. Comments and testifying are nearly cost-less: Anyone can submit an online comment on behalf of a firm and be invited to testify by the USTR. Eighty-nine MNCs participated in public comments or testimonies in our sample. Tariff exclusion requests are somewhat costlier, there is no filing fee but many MNCs retained the services of specialist law firms to submit the requisite documentation. Fifty-six MNCs submitted tariff exclusion requests. Individual lobbying is costlier still because a firm would need to retain a registered lobbyist. Eighteen MNCs lobbied the USTR independently. Lobbying through the USCBC is the costliest option financially because this option is only available to prominent businesses and annual membership fees are $30,000. Twelve MNCs lobbied passively through USCBC and thirty-five lobbied both through USCBC and individually. These are fixed costs of entry and tend to be available for larger MNCs but not to smaller ones, once you pay for a lobbyist or join the USCBC, the marginal cost of lobbying on tariffs become marginal.

The political costs associated with voice activities are inverse to financial costs. Testimony is the costliest because it might generate unwanted press and public attention. Public comments carry similar risks but are less prominent. Zhu et al. (Reference Zhu, Waddick and Villegas-Cruz2021) posit that MNCs were muted in their public opposition to the trade war because they were weary of upsetting Trump and his allies in Congress. Tariff exclusion requests are less politically confrontational but require the disclosure of commercially sensitive information that firms might not want to make public. Lobbying the USTR is even less costly because it occurs behind closed doors, the records are obscure, and it is rarely covered by the press. Also, the lobbying disclosure records do not reveal whether the firm is for or against the trade war, only that China or tariffs were discussed. Lobbying through the USCBC gives even greater plausible deniability to the firm because it offers both privacy and anonymity, big reasons MNCs are attracted to these associations.

Larger MNCs are likely to be more sensitive to political costs and less sensitive to financial costs. Bipartisan hostility toward China might mean that those with greater means to voice are also the most reluctant to publicly oppose the trade war. Thus, we distinguish between more public (comments and testimonies) and more private (exclusions and lobbying) forms of voice in our subsequent analysis. We include a breakdown of the voice measure by MNC size in the appendix.

Loyalty: Finally, a firm expresses loyalty when they neither exit nor participate in any voice activities. Loyalty is overwhelmingly the modal response for MNCs, it was adopted by 351 MNCs (70 percent) in our sample. Loyalty is the baseline category for the quantitative analysis but we engage it further in the process tracing case studies. This too is a heterogeneous category. Large MNCs with extensive global networks may prefer loyalty because of the availability of apolitical tariff avoidance schemes such as foreign trade zones, country of origin adjustments, or value reduction through using the first-sale rule.Footnote 27 Small MNCs may not have the resources or capacity to engage in voice and default to paying the cost of tariffs or passing them along the supply chain to customers.Footnote 28

Taken together, EVL shows the primary actions MNCs can take in reaction to increasing costs of the trade war. Table 1 presents the distribution of firms in our sample across EVL outcomes.

Table 1: Summary of the exit, voice, loyalty outcome variable.

A Theory of Firm (In)Action

US MNCs differ in their degree of embeddedness in the China market, which in turn, determines which strategy—exit, voice, or loyalty—they adopt in response to the onset of tariffs and the elevation of political risk in their China operations. Embeddedness in China is a function of the size of the firm's relationship-specific sunk costs and the firm's access to risk-mitigating political resources. US MNCs also differ in their degree of exposure to US and Chinese tariffs. Those firms that do not source products from the United States or export to the United States do not face tariffs directly.

Accounting for the Heterogeneity of MNC Interests in China

US MNCs were instrumental in paving the way for the wave of trade liberalization that followed China's WTO membership. Even before China's WTO accession in 2001, US MNCs like Boeing, General Motors (GM), General Electric (GE), and American International Group (AIG), were critical in reducing trade barriers with China as Congress and the Bush and Clinton administrations battled over China's MFN status (Davis & Wei, Reference Davis and Wei2020). US firms received the reward of the opening of the China market to American trade and investment for their troubles of political voice.

Jiang era China (1989–2003) saw an alliance of big foreign capital and state-owned capital, both of which received preferential policy treatment at the expense of domestic private firms (Huang, Reference Huang2003). China actively courted large MNCs to set up JVs with state-owned enterprises. In 1995, foreign-invested enterprises accounted for 47 percent of China's manufacturing exports and these MNCs also dominated domestic sales in industries such as chemicals and electronics. Huang (Reference Huang2003) argues that China's financial and legal institutions, under Jiang Zemin and Zhu Rongji, reduced the ability of domestic private firms to provide the same benefits brought about by FDI.

The neoliberal economic policies of the Jiang era produced a bonanza for the foreign investors and large state-owned enterprises but faced mounting criticism in China. Most of these MNCs engaged in little truly cutting-edge research and design in China. For example, Shanghai-Volkswagen produced the Santana sedan in China for nearly thirty years with minor upgrades, two decades after Volkswagen stopped manufacturing of the same model in Europe. Strong criticism of the “exchanging market for technology” strategy emerged in policy and academic circles during the debate about WTO accession and coalesced into a call for “indigenous innovation” in the mid-2000s (Chen, Reference Chen2018).

The Hu-Wen leadership (2004–12) that succeeded Jiang made promoting indige nous innovation a national policy priority. These policies would ultimately split the coalition of US MNCs who advocated in favor of engagement with China. While many US MNCs continued to reap massive profits in China, others began to chafe at the increasingly techno-nationalist policies of the state. The implementation of indigenous innovation policies also varied across regions, depending on how local governments forged alliances with different types of foreign firms and how these coalitional politics subsequently shaped government policies.Footnote 29 Support for indigenous innovation is lowest in municipalities where the export share of foreign firms is high and concentrated in large firms because the government is more reliant on FDI for revenue.

At the same time, as China became the fastest-growing consumer market in the world with the largest middle class in the 2010s. Many US MNCs have moved toward a business model of “In China, For China” to produce for local consumption rather than export and to invest in local research and development. The pace of this trend was uneven and, as the case studies show, the same MNC can produce goods for foreign export as well as local consumption. Since 2008, many US MNCs also accelerated their efforts at management localization to reduce management cost, develop and retain local talent with more local competencies, and maintain good relations with local governments.Footnote 30 This trend toward localization includes the hiring of former Chinese policy makers and regulators as managers who can help mitigate political risks through their political connections.

Degrees of Embeddedness in China

This history is important because it highlights the fact that US MNCs that entered China at different times differ in the amount of registered capital they brought to China and had different relationships with JVs and local governments. All these factors—age, size, JV status, and business model—determine the degree to which US MNCs are embedded in China. This in turn shapes how these firms perceive political risk and the menu of options they have to dealing with the trade war.

The more deeply the MNC is embedded in China, the costlier is it to exit and the better connected it becomes. These two mechanisms are not easy to disentangle. Older, larger MNCs and those with local JV partners have greater relationship-specific sunk costs in China. The higher these sunk costs, the more likely the firm is to prefer voice to exit. At the same time, more experienced, well-resourced, and locally connected MNCs have more options available when dealing with the trade war. The greater these available resources, the more likely the firm is to prefer voice to loyalty. In any case, if the cost of exit (from China) or the cost of voice (in the United States) are greater than the cost of tariffs, that MNC is likely to put up with the policy and not alter their behavior (loyalty). Thus, the business model and exposure to tariffs of the MNC will also determine the cost of tariffs and the relative appeal of exit and loyalty.

We anticipate that older firms, especially those that entered China before 2004 under the Jiang administration, are likely to have more experience weathering political risks in China with more time to develop political connections are also less likely to exit. These firms have a deeper pool of local talent to draw from. They are also more likely to have experienced favorable treatment from the Chinese government. All this should decrease the likelihood of exit and increase the likelihood of voice in response to tariffs.

H1a: US MNCs with older subsidiaries should be less likely to exit China during the trade war.

H1b: US MNCs with older subsidiaries should be more likely to voice opposition to tariffs in the United States.

We anticipate that large MNCs in China, measured by amount of registered capital, have greater relationship-specific sunk costs. They are more likely to be engaging in intrafirm trade but also more likely to have greater amounts of resources at their disposal to mitigate political risk. Larger MNCs are much more likely to have government relations teams in both the United States and China and to cultivate political connections with local officials and are thus less likely to exit. These firms have more at stake financially and more resources with which to face the elevated political risks of the trade war. They should also be more likely to voice opposition to tariffs because their parent companies are more likely to have the resources to do so.

H2a: US MNCs with larger investments in China should be less likely to exit China during the trade war.

H2b: US MNCs with larger investments in China should be more likely to voice opposition to tariffs in the United States.

We anticipate that US MNCs that are in JVs with a Chinese company have the highest relationship-specific sunk costs in China and thus should be the least likely to exit China in response to tariffs. They are also more likely to be producing for the Chinese market and receive more preferential treatment from the Chinese government. Both these factors should mitigate the cost of tariffs and reduce the likelihood that they will need to exercise their political voice in the United States. They are likely to have Chinese nationals as managers and behave as native Chinese firms in response to the trade war and their political behavior should diverge from other US MNCs.

H3a: US MNCs with JVs in China should be less likely to exit China during the trade war.

H3b: US MNCs with JVs in China should be less likely to voice opposition to tariffs in the United States.

Finally, we anticipate that US MNCs that are engaged in international trade are more exposed to both US tariffs and Chinese retaliatory tariffs. These firms will have greater incentive to voice opposition in the United States to the trade war or, failing that, to cut their losses and exit China. By comparison, MNCs that have successfully implemented the “In China, For China” business model and produce goods for the Chinese market should be relatively unfazed by rising tariffs.

H4a: US MNCs with import-export as a business model should be more likely to voice opposition to tariffs in the United States.

H4b: US MNCs with import-export as a business model should be more likely to exit China during the trade war.

Research Design

The analysis relies on a mixed methods research design, drawing on a wide array of data, including a new dataset of Foreign-Invested Enterprises in China (FIEC). Vortherms and Zhang (Reference Vortherms and Zhang2021) construct this dataset of China-based foreign-invested enterprises (FIEs) using registration data from the Ministry of Commerce. This dataset includes more than one million registered firms with relevant operating information from 2014 to 2019, of which about 16,000 are registered to the United States.

We first draw a stratified sample of 500 subsidiaries of US MNCs in China from FIEC based on their registered capital size and the date of their establishment. The FIEC data allows us to measure exit among US MNC subsidiaries before and after the onset of the trade war. These data are paired with data on the political behaviors of the subsidiaries’ parent companies in the US to measure voice using various public sources. Political behaviors include whether they lobby the USTR, submit public comments, participate in public testimony, or file tariff exclusion requests. This article is the first to study the full menu of economic and political behaviors of US MNCs in the United States and their subsidiaries’ exit decisions in the host country, in response to elevated political risks. We supplement the quantitative analysis with process-tracing case studies of four US MNCs.

Data and Measurement

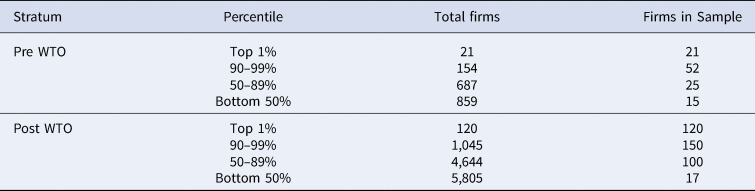

We use a stratified random sample of 500 foreign-invested enterprises in China whose investment comes from firms and individuals in the United States. We constructed strata based on firm size (defined by registered capital percentile) and time of registration (defined by establishment before and after WTO ascension).Footnote 31 The sampling frame has a clear skew with small, individually invested firms. Stratification allows us to select a sample with greater representation of capital investments. Size and registration date were chosen as stratification variables to reduce sampling variance based on findings from Vortherms and Zhang (Reference Vortherms and Zhang2021). The result is a representative sample of 500 firms (Table A1). All results are run on the unweighted sample and using design weights. The inclusion of design weights do not significantly alter the results.

Our final sample of firms includes firms from all three economic sectors, with 7 firms in the primary (extractive) sector, 265 firms in the secondary (manufacturing) sector, and 228 in the tertiary (services) sector. Of the sample firms, 221, or just under half, explicitly mention “import and export” (jìn chū kǒu) in their business description. We identify these firms as “exporters” because they are most likely to be affected by trade war tariffs.

The other key source of data captures US MNCs’ voice behaviors, including lobbying USTR, submitting comments, requesting tariff exclusion, and testifying in section 301 hearings. We collect USTR lobbying activities related to Chinese trade of the US companies in our sample in 2018 and 2019 from the Center for Responsive Politics (OpenSecrets.org). To mitigate the negative impact of trade war on US firms, USTR launched a tariff exclusion project, in which US companies could submit requests to have certain goods excluded from the imposed tariffs. List 1-3 tariff exclusion requests data were compiled from the Mercatus Center. We also collected comments submitted to the USTR concerning the section 301 case against China from regulations.gov website for List 1-3 tariffs. Finally, we collected data on which firms appeared in USTR testimonies for all tariff lists. While previous effortsFootnote 32 focus on lobbying, our measure of voice includes the full range of political behaviors to “voice” opposition to tariffs.

Firms vary in how they lobby. Many large MNCs are coded as testifying to the USTR and lobbying through the USCBC, the industry association representing more than 200 of the largest MNCs that do business with China. Overall, USCBC member firms are more active than nonmember firms in participating in these activities. We find that some of the USCBC member firms in our sample also individually participated in activities with lower political costs such as lobbying USTR and requesting for tariff exclusion. But fewer member firms engaged in activities with higher political costs such as commenting and none testified independently. A summary of the different voice strategies by firm size can be found in the appendix (Figure A1).

Dependent Variable: Firm Actions

For the quantitative analysis, we use EVL as a categorical variable. For the quantitative analysis, we define the three strategies as mutually exclusive. In the sample, there are six MNCs that could be coded as both exit and voice categories. We coded these MNCs as voice rather than exit because we find that although these MNCs closed their subsidiary in our sample, all six corporate parents continued to operate in China through other subsidiaries.

Explanatory Variables

The explanatory variables include MNCs’ tariff intensity, investment size in China, date of establishment, JV status, location, and whether or not their registered business practices include imports or exports.

Tariff intensity is our primary indicator for the probable costs facing each MNC as a result of the trade war. Vortherms and Zhang (Reference Vortherms and Zhang2021) constructed this variable to capture the intensity of both American tariffs and Chinese tariffs. Tariff intensity takes the count of products subject to tariffs in the firm's industry class divided by the number of industries to account for variation in industry size. The US tariff intensity ranges from 0 to 894 (pharmaceuticals) whereas the PRC tariff intensity measure ranges from 0 to 225 (textiles manufacturing). We include variables for both US and Chinese tariffs because tariffs from either side could be affecting business costs. As a robustness check, we simplify the tariff intensity measure to an indicator variable to see if any tariff exposure, defined as any tariff intensity above zero, affects outcomes. These results are consistent with the main models and available in the appendix (Tables A3-A6).

These are admittedly rough measures of the targeted effects of tariffs because we are inferring tariff impact from the firm's industry. But they provide a proxy for potential exposure. Ideally, we would match the tariff intensity with specific products of firms involved in imports and exports. Because this data is not available, we include an indicator variable, exporter, to identify firms that mention “imports-exports” in the description of their business practices. Together, our sample has 211 MNCs that mention import-export in their business description submitted to the Ministry of Commerce. If tariffs induce exit, these firms should show the largest impact. We include the exporter variable in the aggregate analysis and run a subsample analysis that includes only exporters.

There are three firm-specific variables of interest that proxy for degree of embeddedness in China. First, we measure firm size as the amount of registered capital reported in the FIEC dataset. Registered capital ranges from $45,000 to $1,378,440,000, with a median of $14,900,000 in this sample. While we cannot observe each firm's investment in fixed assets—the best measure of concrete sunk costs—registered capital captures the financial commitment of an FIE.

Second, we use establishment year (age) to proxy for the soft sunk costs such as relationships and local experience. The longer a firms operates in China, the more they have developed networks and working relationships both with other firms and government officials. Exiting would mean abandoning these relationships. Establishment year ranges from 1989 to 2018 (age ranges from 1 to 29 years old), with the average year 2007 (average age 12 years old).

Finally, we include an indicator variable for JVs. JVs operate with investment from at least one investor from mainland China. JV status is a specialized indicator of sunk costs, as JVs have a clearly established business relationship that would have to be abandoned if the FIE exits.

To control for industry-level variation and province-level variation, we also include subsidiary's location and its industry as controls. Location is measured by region, comparing FIEs in eastern coastal provinces versus other inland provinces. We also control for whether the MNC is in the manufacturing sector because this sector is most directly impacted by tariffs.

Empirical Strategies

To understand the effects of firm-heterogeneity on MNCs’ responses to trade war, we first use multinomial logit models to test the hypotheses. The outcome variable of MNCs’ response includes three mutually exclusive categories: exit, voice, and loyalty. Multinomial logit model assumes the independence of irrelevant alternatives (IIA) property where the relative odds of selecting between any two strategies is independent of the number of alternatives. In this study, we assume that the probability of MNCs choosing one strategy is not affected by the presence of additional options. The probabilities of choosing different strategies should depend on the characteristics of the MNCs making the choices, not subtle characteristics of the choices. As Dow and Endersby (Reference Dow and Endersby2004) argue, multinomial logit can provide reliable estimates in the aggregate even if individual choices are not IIA. As a robustness check, we performed a Hausman test for IIA assumption violation, which failed to reject the null hypothesis, providing evidence that multinomial logit is appropriate. Additionally, we reran our models using multinomial probit, a model that allows the relaxation of the IIA assumption. The results do not change.

Quantitative analysis provides an aggregate picture of firm choices, but the limitations imposed by data availability for all firms meant glossing over significant details about individual firm experiences. To provide a fuller picture, we also use process-tracing case studies of MNCs subsidiaries in China to better capture nuances behind their responses. The business and production activities of individual MNCs can vary greatly even among those in the same industry. For example, our large-n data fails to consider alternate strategies firms can use to mitigate tariffs, and how firm-heterogeneity impacts a company's ability to adopt these strategies. Larger firms may have greater resources with which to implement tariff-evasion strategies such as utilizing a foreign trade zone, or other legal strategies that may be cost prohibitive for smaller firms. They could also not close their operations in China but expand their operations in other countries—the China Plus strategy. By narrowing the scope of examination to specific firms, this case study will allow us to identify the firm-specific factors (e.g., share of firm profits from China) underlying intra-industry fragmentation. In sum, case studies of individual firms can account for differences between individual firms, allowing us to examine the effects of firm-heterogeneity on the strategy firms adopt to respond to trade war.

Results: The Determinants of Firm Behavior

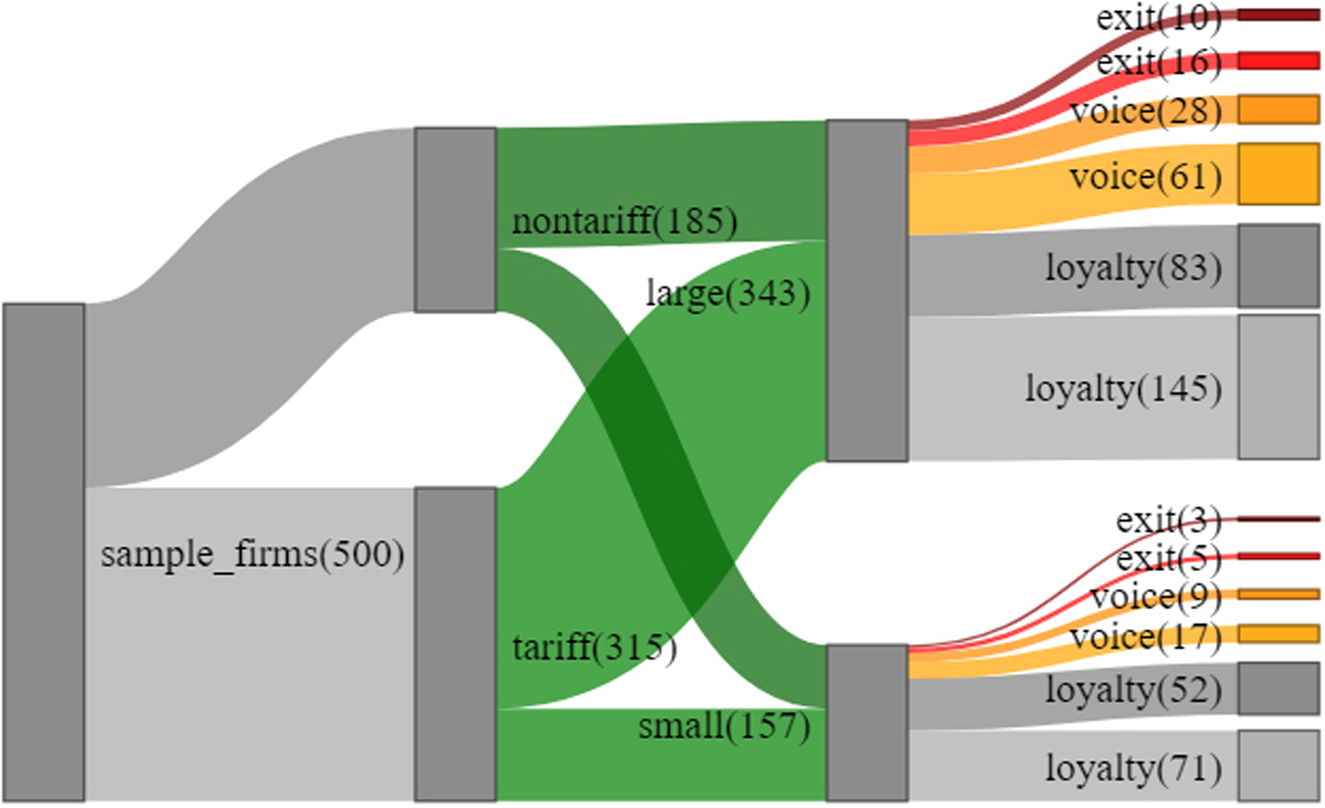

Figure 1 shows a Sankey diagram for the number of firms in our sample categorized by size and whether they were affected by tariffs and their behavior. The modal response among the MNCs observed is loyalty; this holds true for firms in tariff-impacted industries as well as those in non-tariff impacted industries regardless of size.

Figure 1: Exit, voice, loyalty in response to tariffs.

This pattern of more loyalty than exit or voice is replicated across different sectors, as well (Table 2). Firms in the tertiary sector have both the highest relative rate of exit at nearly 8 percent and voice at 25 percent. But the distribution across these categories is not statistically distinct (p = 0.415). Very few firms in our sample fall into the primary sector, meaning we cannot evaluate the relative distribution. The three outcomes are therefore consistently distributed across the secondary and tertiary industries. Based on a Chi-squared test, tariffed and non-tariffed firms do not have different distributions across the three possible outcomes. Large and small firms do have a slightly different distribution, with small firms more likely to express loyalty than large firms (p = 0.03). Large MNCs, defined as those in the top 10 percent by capital make up approximately 77 percent of all firms that voice. They were also more likely to be in the room for the signing of the Phase One Trade Deal. MNCs with more registered capital in China are more likely to choose voice, and small firms are more likely to choose loyalty than other strategies. Finally, JVs and non-JVs have distinctly different patterns across the three outcomes. Nearly one-third of MNCs in our sample were registered as JVs in China, but these JVs only account for 20 percent voice and 11.76 percent exit. Thus, size and JV status will be important variables for the multivariate analysis.

Table 2: MNCs’ responses by tariff-impact/size/joint venture.

* p < 0.05; ** p < 0.01; *** p < 0.001.

Multivariate Analysis: Determinants of MNCs’ strategy

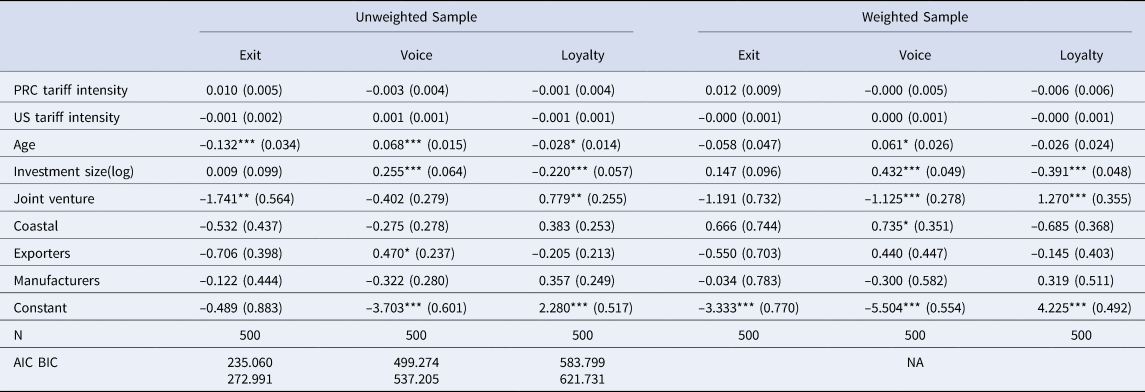

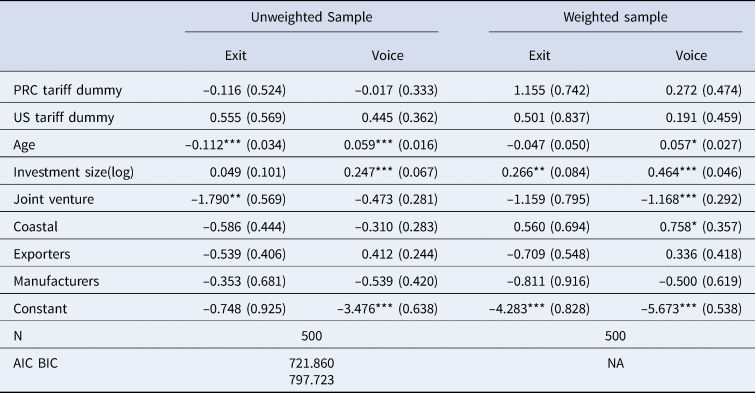

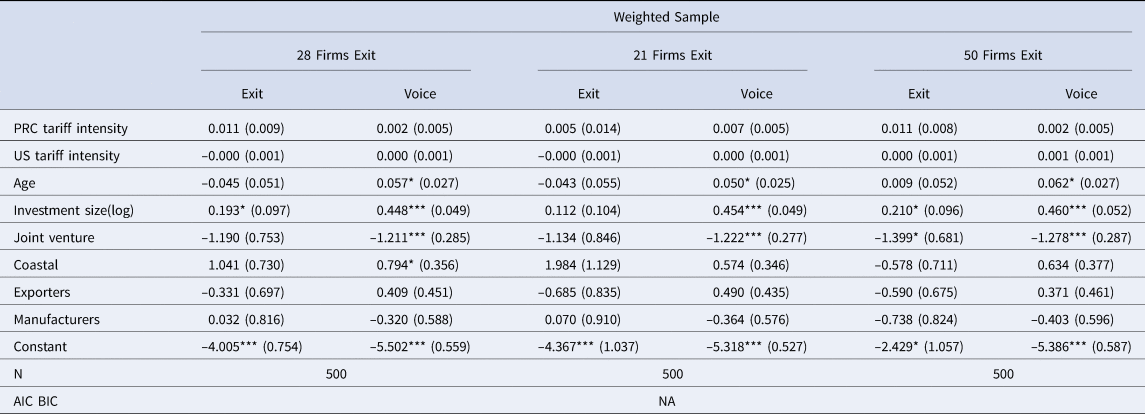

Because the sample of 500 US firms was constructed using a weighted sampling approach, we present results for both unweighted sample (columns 1 and 2) and with survey design weights (columns 3 and 4) in Table 3. Additionally, we include results for a subsample of firms self-identified as engaging in the import-export industries (columns 5 and 6).

Table 3: Multinominal logit analysis of determinants of MNCs’ strategy.

Standard error in the parentheses.

* p < 0.05; ** p < 0.01; *** p < 0.001.

Exposure to PRC tariffs have no impact in any of the models, either full sample or restricted to exporters only. Exposure to US tariffs is not statistically significant in the full sample models but is positive and significant in the exporter sample for voice. Firms exposed to US tariffs are more likely to voice than express loyalty but are no more likely to exit than have an outcome of loyalty. This finding supports Vortherms and Zhang (Reference Vortherms and Zhang2021), which finds a minimal impact of tariffs on firm exit.

Age increases likelihood of voice and decreases the likelihood of exit, lending support to H1. Size is positively correlated with voice but does not consistently explain exit, lending partial support to H2. Finally, being in a JV with a Chinese firm presents mixed results across the different models. In the unweighted sample, JV status is negatively correlated with exit whereas in the weighted and exporter-only samples, JV status is negatively correlated with voice. These results taken together suggest JV status increases the probability of loyalty, with mixed results on exit and voice, lending support to H3.

Across all models, manufacturers are no more or less likely to voice or exit than nonmanufacturers. Similarly, in the aggregate models (columns 1 through 4), exporters are no more or less likely to exit or voice than non-exporters, contrary to H4. Similarly, the exporters subsample follows the same patterns as the weighted sample results, with the exception of US tariff intensity increasing voice. Thus, exporters, the firms most likely directly affected by tariffs, follow similar patterns of EVL as the average firm. Older exporters are less likely to exit and more likely to voice and larger exporters are more likely to voice. The degree of MNC embeddedness offers at least a partial explanation for how firms respond to the trade war. The lack of a stronger collective response by MNCs to tariffs, whether through voice or exit, combined with government autonomy from MNCs in both the United States and China is a major factor in the persistence of tariffs and the “forever trade war.”

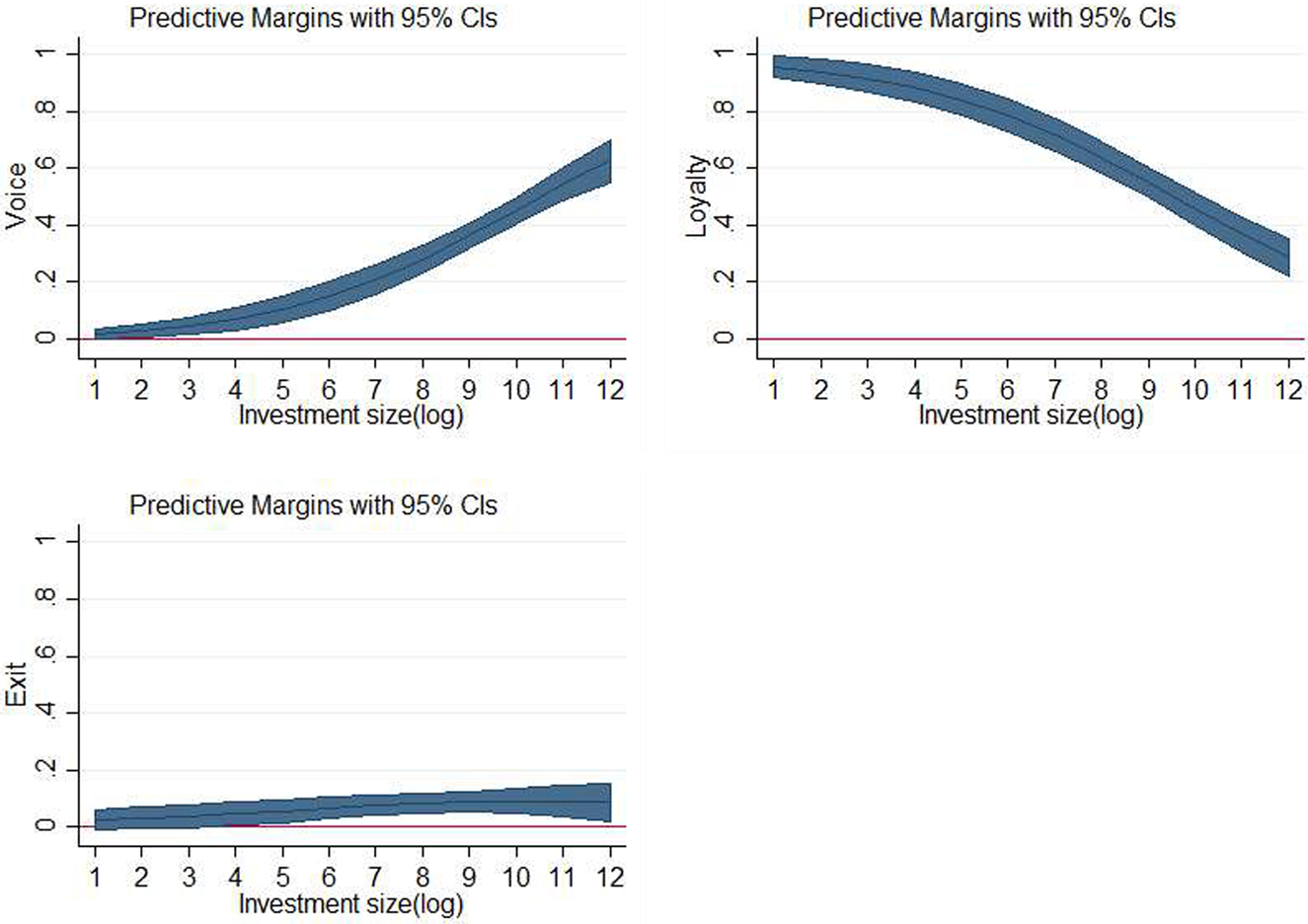

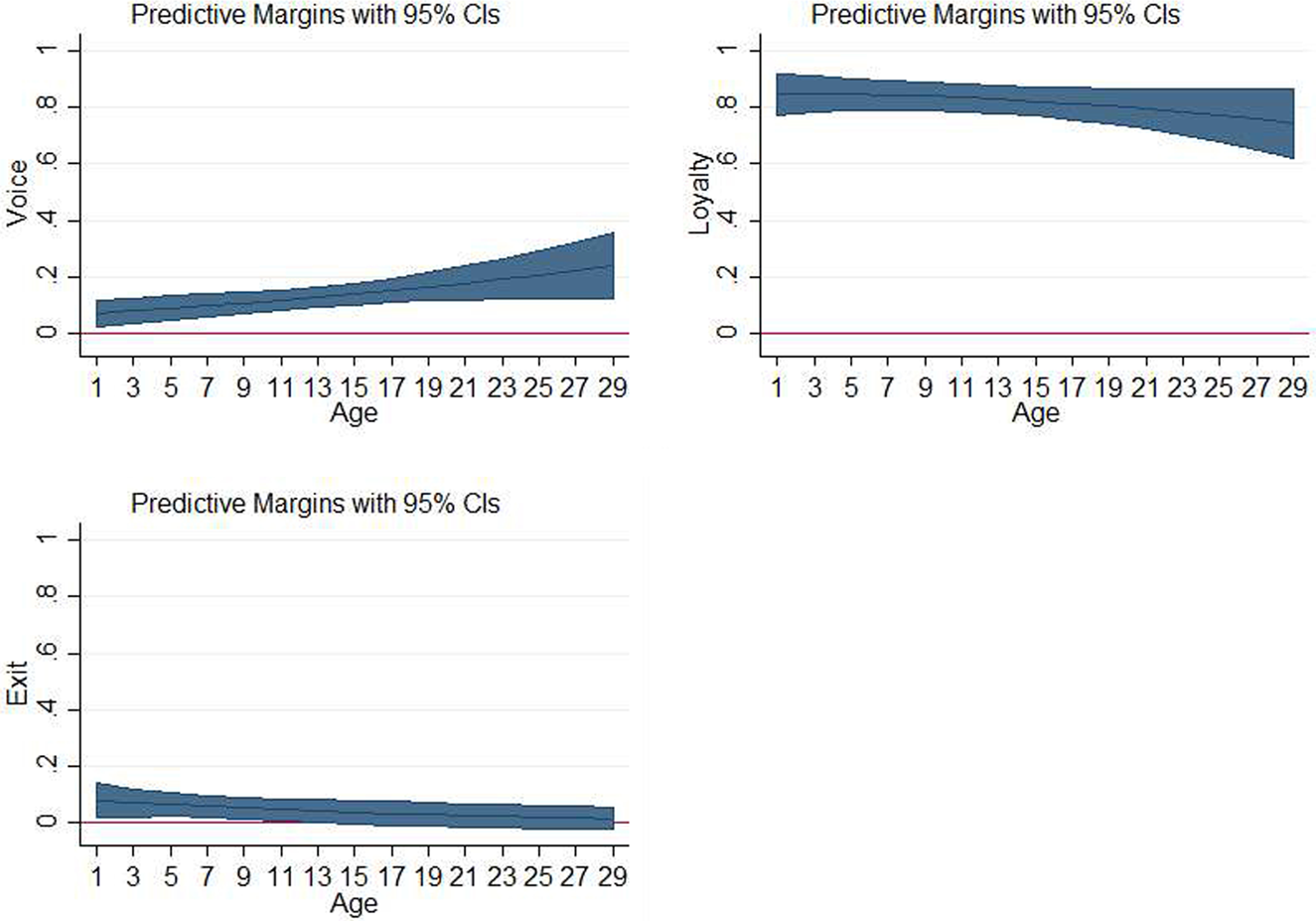

Figures 2 and 3 present the predicted probabilities of EVL across our two key firm variables, size and age, respectively. As the predicted probabilities show, the probability of loyalty declines with investment size. As loyalty declines, voice rises. By age, voice increases with age whereas exit decreases with age.

Figure 2: Predicted probability of response by investment size.

Note: Predicted probabilities estimated from the second model in table 3 columns 3 and 4 with sample design weights.

Figure 3: Predicted probability of response by firm age.

Note: Predicted probabilities estimated from the second model in table 3 columns 3 and 4 with sample design weights.

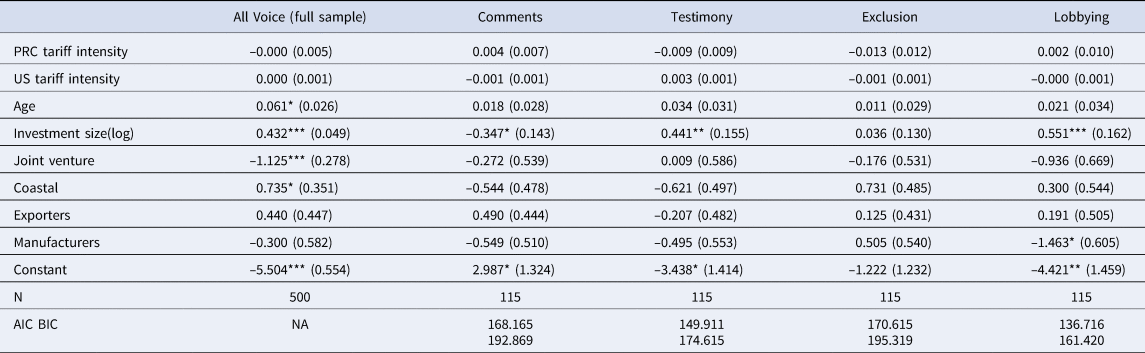

As discussed in the preceding text, voice strategies vary by firm. Descriptively, US MNCs with larger investments in China are more likely to participate in USTR lobbying and tariff exclusion requests, but the correlation between size and tariff exclusion requests is not statistically significant once other controls are included. Only 15 percent of large firms lobbied USTR and 13 percent large firms requested tariff exclusion, suggesting heterogeneous preferences among large MNCs regarding voice options. Similarly, none of the small firms in our sample engaged in lobbying and only 4 percent small firms requested tariff exclusion.

Among firms that voice, larger firms are more likely to participate in lobbying activities than smaller firms, aligning with the descriptive analysis mentioned previously (Table 3). Surprisingly, neither US or PRC tariff intensity increases the probability for affected MNCs to engage in any of the voice activities. Manufacturing firms are less likely to provide comments or testimony or participate in lobbying activities than nonmanufacturing firms. In our sample, none of our observed firm characteristics correlated with requesting tariff exclusions.

Case Studies

Multivariate analysis relies on rough measures of MNC characteristics and behaviors to provide average trends in our sample population. To identify greater detail in firm experiences, we conducted four case studies using process tracing to further unpack how different firms adjusted to tariffs both economically and politically. These case studies also allow us to extend the time frame of analysis from 2019 into 2021 to observe not only the short-term but also medium-term effects of the trade war.

We selected four subsidiaries from the existing dataset on the following basis to cover firm size—large and small—and experience with tariffs—subject to tariffs and no subject to tariffs. Firms were selected on the independent variables of firm size—measured by registered capital in China—and tariff intensity. The purpose of these criteria is to avoid selecting based on the dependent variable (i.e., whether the firm used EVL in response to the trade war), and because it allows for tariff severity to be controlled and its effect on firm response to be measured. The case studies investigate the behavior of the US-based parent company of these four firms. Because subsidiaries owned by the same parent company differed in terms of their JV status and import-export profile, we did not select cases based on these variables but address these in the analysis.

The firms selected for this case study are Deere & Company, Twin City Fans, Abbott Laboratories, and Sorrento Therapeutics. We queried SEC filings, firm databases, and firm websites to determine selected firms’ share of employees in China, number of subsidiaries in China, and amount of capital in China. The 2021 annual reports of all selected firms specifically cite the US–China Trade War as posing risks to their business operations and profitability. Table 4 provides relevant information gathered on the selected firms.

Table 4: Case study of four US multinationals in China.

Large and Tariff Impacted: Deere & Company

Deere & Company (Deere) is a Fortune 500 American corporation that manufactures agricultural, construction, and forestry machinery, diesel engines, drive trains used in heavy equipment, and lawn care equipment. The company also provides financial services and other related activities. Deere had seven subsidiaries in China with a total registered capital of $420,519,906 a total of 2,577 employees in 2020. These subsidiaries include three production sites at Ningbo (wholly owned), Jiamusi (wholly owned), and Tianjin (JV).

Deere entered the China market directly in 1995 and established its first JV in the country in 1997. Over the next decade, Deere established more JVs, which gradually increased its market share of small horsepower tractors and helped the firm improve access to the agricultural machinery market in China.Footnote 33 Deere's subsidiaries in China both manufacture and sell agricultural tractors, combines, and engines for the domestic Chinese market, and export final products as well. Its Chinese subsidiaries accounts for 7.5 percent of Deere's global presence and 3.7 percent of its workforce. Deere is a member of both AmCham China and USCBC.

Deere operates in an industry class—agricultural machinery—that is heavily impacted by both US and PRC tariffs, meaning that both its import and export costs likely increased as a result of the trade war. For example, single-axle tractors and track-laying tractors are among the products targeted by the section 301 tariffs. According to Deere's 2020 10-K filing reports, “changing US export controls and sanctions on China, as well as other restrictions affecting transactions involving China and Chinese parties, could affect John Deere's ability to collect receivables, provide aftermarket and warranty support for John Deere equipment, sell products, and otherwise impact Deere's reputation and business.” Chinese retaliatory tariffs on US agricultural exports such as soybeans also took a heavy toll on Deere by driving down demand for its equipment. It laid off hundreds of workers in Iowa and Illinois as demand for its machines dried up when agricultural exports to China plummeted. Deere's annual revenue grew rapidly before the trade war, earning $37.358B in 2018, a 25.62 percent increase from 2017. However, the onset of tariffs and retaliatory tariffs slowed revenue growth to 5.09 percent in 2019 ($39.258B) and to a 9.47 percent decline in 2020 ($35.54B) with the onset of the COVID-19 pandemic.

Despite these headwinds, Deere executives rarely spoke out publicly against tariffs. We code them as engaging in voice because they are a member of peak associations (USCBC and AmCham China) that testified to the USTR and because a member of Congress, Bill Huizenga, submitted a comment to the USTR on behalf of John Deere and explicitly mentioned how it would be harmed by tariffs. Deere's USTR lobbying expenditure did not increase significantly from 2017 to 2018 and fell by 32 percent in 2019 (from $1,590,000 to $1,080,000). Notably, Deere also did not file for any tariff exclusion requests. It did, however, have access to Foreign Trade Zones as a means to evade tariffs: “Whole tractors can be imported duty-free, but some tractor parts do have tariffs. By bringing the parts into a zone, building the tractor in the zone and only then importing the product, John Deere can pay the tractor tariffs, which amount to zero, instead of the taxes on its parts, which could be higher.”Footnote 34

As a well-entrenched business with a valuable brand in China, Deere did not exit the China market in 2019 or close any of its seven subsidiaries. However, our research found that it temporarily closed its tractor manufacturing facilities early in the COVID-19 pandemic and subsequently closed its Ningbo factory at the end of 2020. The now-closed Ningbo factory produced agricultural machines for export. The factory manufactured some products covered by PRC tariffs—such as sugarcane harvesters—and US tariffs—including parts for harvesting or threshing machinery and hydraulic cylinders. Approximately 63 percent of shipments from the Ningbo factory went to the United States with the rest to South Korea, India, and Germany. These shipments consisted of machine parts (HTS 8433.90) covered by US tariffs. Deere did not open a new factory elsewhere in the world in 2020 to replace the Ningbo facility but did announce plans to expand operations in Australia and Brazil in 2021.

This Ningbo plant closure should not be interpreted as a withdrawal from China but as a reorientation in its corporate strategy. The director of John Deere's Ningbo Factory, Sun Baolin, was promoted to become president of John Deere China in 2020. Deere also replaced its CEO with John C. May who previously served as managing director of Deere's China operations in November 2019 and promoted Jahmy Hindman, who was previously general manager and engineering manager at Deere's construction-equipment factory in Tianjin to CTO in July 2020. The elevation of China hands to the leadership team of

Deere reflects the continued importance of managing this market. Rather than exiting

China, Deere appears poised to reap short-term windfalls from the Phase One Trade Deal, which increased Chinese agricultural purchases, and ironically, from proposed US sanctions on Xinjiang. Deere has a sales office in Urumqi, which saw a massive increase in demand for its high-end cotton-picking machines, the sales of which increase by more than 4,000 percent in 2020 to $117.8 million. Its four other manufacturing facilities in China, which produce mostly for the Chinese domestic market, remain operational along with the Beijing headquarters. Moving forward, Deere is expected to place a greater emphasis on new technology. This strategy was echoed by Sun Baolin, who said the company planned to “develop new [artificial] intelligence capabilities” beginning in 2021.

In sum, over the medium term, Deere adopted a mixed strategy of EVL. It took a nuanced political position, making few public statements on section 301 tariffs or Chinese retaliatory tariffs while exerting pressure through its registered lobbyists and government relations staff. It closed one out of its seven subsidiaries in China, due likely in part to persisting tariffs because it was one of only two factories in a port city and exported tariffed products to the United States. But it did not exit China all together, rather it reaped higher than normal sales in cotton-picking machines in 2020. Despite a decline in revenue in 2020, Deere share prices soared after the Phase One Trade Deal and the COVID-19 pandemic boosted demand for agricultural products. More than 60 percent of Deere's revenue come from its United States and Canada region. So, while China remains an important overseas market, it only accounts for a comparatively small portion of Deere's global presence and workforce. Deere will not likely cede ground in China, the world's fastest-growing market for agricultural equipment, but it does appear to be hedging its bets with announced plans to expand in Australia and Brazil.

Small and Tariff Impacted: Twin City Fan Company

The Twin City Fan Company (Twin City), founded in 1973, is a family-owned business that claims to be an industry-leading designer and manufacturer commercial and industrial fans. Since its founding, Twin City expanded manufacturing and service operations located in the United States, South America, Europe, India, China, and Singapore. Twin City followed some of its US customers, such as 3M Co. and General Motors Corp. (GM), to China and built a plant in Shanghai in 2006—Twin City Fan (Shanghai) Co. Ltd.— which was set up as a wholly foreign-owned enterprise with the registered capital of $20 million. It employs ninety workers in China in 2020, accounting for about one-fifth of its global workforce.

Twin City–China serves the automotive and petroleum industry in China, supplying the China operations of BMW, Volkswagen AG, and General Motors. Twin City imports to and exports from China. It sources parts from China each year for placement in its US-made fans. It exported some custom-designed and high-end premium fans to China. The major custom fans built in China are sold to Chinese and Western companies in China, though some high-end premium fans for China are made in the United States. The net sale revenues and net profits of Twin City–China have been growing from 2016 to 2019.

As a general equipment manufacturer both importing to and exporting from China, Twin City was affected by US–China Trade War. In 2019, Twin City requested tariff exclusion for six products including AC motors for fans and other component parts for fans on List 3 tariffs. These products were all components of industrial fans such as fan blades, hubs, guards, and AC motors that the firm imported from China. As of 2020, all Twin City's tariff exclusion requests were listed as pending, meaning the firm had to pay tariffs since the start of List 3 in September 2018. In contrast to Deere, whose top import partners are Germany and Japan, Twin City imports more than half its products from its sole subsidiary in China and is thus much more directly exposed to tariffs. Unsurprisingly, the number of Twin City shipments from China to the United States declined sharply after 2018 according to importgenius.com data.

Despite its high tariff exposure, we found no evidence that Twin City engaged in public lobbying on the trade war. It did not participate in USTR testimony, submit public comments, issue press releases, or enlist a registered lobbyist. This is in line with recent research explaining the barriers to political action: Only 1.73 percent of large US firms openly voice opposition to tariffs (Zhu et al. Reference Zhu, Waddick and Villegas-Cruz2021). We also found no evidence that Twin City exited China; it remains registered in 2019 and had an active job advertisement as late as 2021. Twin City is not a publicly listed company so we could not find information about whether it adjusted business strategy during this period. We cannot confirm whether Twin City was able to replace the parts and components that it sourced from China before the onset of the trade war. We also do not know the change in annual revenue between 2018 and 2020. Dun & Bradstreet estimates Twin City annual revenue at $316 million, about one hundred times smaller than that of Deere Company. We can only assume that Twin City adopted strategies to pass on increased costs to customers because it did not exit and voiced opposition in a very limited way.

Large and Not Tariff Impacted: Abbott Labs

Abbott Laboratories (Abbott) is a Fortune 500 multinational medical devices and healthcare company. Abbott entered the China market in 1995. It owned eleven subsidiaries with a total registered capital of $286,861,413 and 3,639 total employees in China in 2020 according to our dataset. According to Abbott's website, it operated twenty-three offices, four factories, three research and design centers, two training centers, and one customer experience center in China. This suggests that the FIEC data likely undercounts smaller offices that may not require FDI to open. Its subsidiaries in China discover, develop, manufacture, and sell a diverse line of healthcare products, including pharmaceuticals, diagnostics systems, cardiovascular and neuromodulation products, and nutritional products such as infant formula. Sales outside of the United States made up 64 percent of Abbott's 2019 sales according to its 10-K filing and China is its second-largest market, accounting for 7.6 percent of net sales.

The subsidiary in our sample, Abbott Laboratories Trading (Shanghai) Co., Ltd, was established in 2001 and is registered as a warehousing industry. Its business practices involved sales and storage of medical devices, medicine, nutritional products, food, and dairy products including infant formula milk powder. It is also allowed to have import and export and related supporting services. Because warehousing is not an industry-class subject to tariffs, the tariff intensity measure is zero. Again, this reflects the conservative nature of our tariff intensity measures.

Even though the subsidiary in our sample focuses on sale and storage of Abbot's products and is not directly affected by the section 301 tariffs, Abbott does import to and export from China. Those subsidiaries focusing on pharmaceutical preparation manufacturing and surgical and medical instrument manufacturing may be affected by the US–China Trade War as they export to the United States. The Shanghai subsidiary can be indirectly impacted by tariffs if products imported from the United States are covered by Chinese tariffs, which mostly targeted agricultural and transportation products but did include some medical equipment. Without knowing more about the operations of Abbot's China subsidiaries and where the products each one imports and exports come from and go to, it is hard to calculate the exact impact of tariffs. But Abbott was among 3,500 US companies that filed lawsuits with the International Trade Court against the USTR over section 301 tariffs in October 2020. This action suggests that it suffered some material harm from tariffs. Its 10-K filing in 2017 and 2018 does not mention tariffs but its 2019 and 2020 filing notes “trade protection measures, including tariffs” as a business risk that may harm revenue. It did not, however, file for any tariff exclusion requests.

Abbott had the resources to respond to tariffs with voice, though it did so privately. Abbott is a member of both the USCBC and AmCham China. We coded it as testifying and commenting to the USTR through its involvement in these peak associations. But it is important to note that Abbott did not make any public comments or issue press releases on the trade war. Abbott also retains dozens of lobbyists and increased its total lobbying expenditure from 2018 to 2020. Its lobbying disclosures show that in 2018 it lobbied on the “Foreign Investment Risk Review Modernization Act,” which tightened investment screening of Chinese firms. In 2019, the company lobbied on “Proposals regarding US–China trade negotiations” and in 2020 on “Proposals related to the China Phase One Trade Agreement.”

Even though it may have faced some headwinds from tariffs, Abbott saw increasing net sales in China during the trade war going from $2,146 million in 2017 to $2,311 million in 2018 (up 7.6 percent) to $2,346 million in 2019 (up 1.5 percent). It acknowledged “challenging conditions in the Greater China market” for its nutritional products in its 2019 10-K but still reported 3.4 percent growth, compared to double digit growth in this segment prior to the trade war, and saw healthy 7.4 percent sales growth in its pharmaceutical products, driven by “double digit growth in India and China.” It did not close any of its registered subsidiaries in China or pull back from the Chinese market. Neither did it make any significant global expansions in 2018–20, including in China. In fact, Abbott CFO Brian Yoor said at the J. P. Morgan Healthcare Conference “Health care is a very sticky, very good place to be” when asked to compare Abbott's performance to Apple's poor financial performance in 2019.

It should also be noted that in July 2019, Abbott Laboratories applied for an expansion of its foreign trade zone in Elk Grove, Illinois. In December 2020, Abbott applied for an expansion of its foreign trade subzone in Itasca, Illinois. These foreign-trade zones are well-known means for duty avoidance, allowing firms to avoid paying tariffs as long as the good is eventually reexported. They are an option not available to smaller firms that lack Abbott's network of global subsidiaries. We note also that while Abbott's trade war exposure is likely lower than that of TCF, its ability to conduct trade through foreign trade zones meant that it did not need to apply for tariff exclusions like TCF. The fact that it did not use its own name in either comment or testify but spoke through the USCBC is all the more telling. Abbott did lobby the USTR independently of the USCBC. But given the global nature of its business and the fact that it spent more on lobbying the USTR in 2016 and 2017, before the trade war, than in 2018 and 2019 indicates that it has a trade lobbyist on retainer and that its agenda with the USTR is broader than the Trump-era tariffs.

Small and Not Tariff Impacted: Sorrento Therapeutics

Sorrento Therapeutics (Sorrento) is a publicly traded biopharmaceutical company founded in 2009. Sorrento entered the China market in 2013. It had five subsidiaries with a total registered capital of $14,561,692 and ninety-three employees in China in 2020 (18 percent of its global workforce).

Sorrento's subsidiaries in China focus on research and development of biopharmaceuticals and not engaged in import-export. The subsidiary in our sample, Zhejiang Zova Biotherapeutics, Inc. is a JV with Concortis Biosystem, which was acquired by Sorrento in 2013. By introducing advanced antibody-drug conjugates technology from Concortis, Zhejiang Zova Biotherapeutics engages in the research and development of new antibody-drug conjugates biopharmaceuticals in China.Footnote 35

Because Sorrento's subsidiaries in China focus on research and development of biopharmaceuticals, they were not affected by the section 301 tariffs. We did not find any of its shipment data from China to the United States in 2018. Sorrento represents the 37 percent of US firms in our sample that were most likely not affected by tariffs.

Nevertheless it's 2019 10-K filing notes the rising trade war, stating,

“Any further changes in US trade policy could trigger retaliatory actions by affected countries, including China, resulting in trade wars and in increased costs for goods imported into the United States and our ability to sell goods and services in the affected countries. Such an outcome may reduce customer demand for our products and services, especially if parties required to pay those tariffs increase their prices, or if trading partners limit their trade with the United States” as a risk.

This risk does not appear to have decreased Sorrento's appetite for expansion in China. In 2021, Sorrento expanded its China presence further by paying $488 million to acquire ACEA Therapeutics, another San Diego–based pharmaceutical company with a manufacturing facility in China.

Sorrento is not a member of either the USCBC or AmCham China. It made no public comments on the trade war. It did engage in registered lobbying but did not lobby issues related to China. It spent only a fraction of what Abbott, the much larger healthcare company, spent on lobbying. Sorrento's strategy in China during the trade war is best characterized by loyalty, it engaged in neither exit nor voice.

Table 5 summarizes the ways these four MNCs in this paired case study reacted to the onset of tariffs. Two of these firms were equipment manufactures with very high tariff exposure and two were in the healthcare sector and are less directly exposed to tariffs (though both noting the deleterious effects of the trade war for their business). None of these firms exited China in 2019, though Deere did eventually close one of its Chinese factories in late 2020. All remain committed to the Chinese market but only Sorrento expanded its China presence after the trade war began. Their size determines whether and how they chose to voice opposition to tariffs or influence Phase One Trade Deal. The Fortune 500 firms had access to peak associations such as the USCBC and AmCham China to advocate on their behalf and spent considerably more on lobbyists. The cases reveal that our industry based quantitative measure of tariff exposure almost certainly underestimate firm-level exposure to tariffs. But all four firms were reluctant to individually or publicly voice opposition to tariffs even though all acknowledged the risks the trade war poses to their profitability. All, with the possible exception of the unlisted Twin City Fans, saw revenue growth despite the trade war. They adapted to changing conditions of the Chinese market and relied on sales in their subsidiaries around the globe to offset challenges they face in China.

Table 5: Summary of different firm strategies for dealing with tariffs.

Discussion

We argue that firm-level variation among MNCs in their embeddedness in China and collective action failure due to the availability of tariff mitigation strategies for some firms explains the persistence of the trade war.

This article unpacks the ambiguous role of American MNCs in the US–China Trade War enhance the IPE community's understanding of transnational trade and investment politics. The modal response of US MNCs to the trade war is loyalty because both exit from China and voice in the United States present fixed costs that can be greater than adjusting to the cost of tariffs. Smaller firms lack resources to voice, larger firms (sometimes) lack incentives. We find that larger, more experienced MNCs are resilient to both tariffs and to political pressure to decouple from China due to privileged access to various regulatory loopholes as well as greater market power. Contrary to our expectations, exporters are no more or less likely to exit or voice than non-exporters.

The case studies also reveal a number of factors not previously considered in the trade politics literature such as tariff avoidance or recovery strategies available to MNCs such as use of Foreign Trade Zones and the ability of subsidiaries around the globe to offset challenges they face in China. All these result point to the fact that the politics of deglobalization are not a mirror image of the politics of globalization, the fact that MNCs effectively lobbied for trade liberalization in the past does not mean they will be successful in rolling back tariffs in the trade war.

The trade war interest group politics of EVL differ from the established theories explaining trade liberalizationFootnote 36 and interest-group–based theories of protectionism.Footnote 37 US MNCs behave in accordance with their economic interests as determined by the degree of relationship-specific sunk costs and political resources in China. Therefore, it is not surprising that MNCs, whose subsidiaries in China differed terms of the age, size, and JV status, responded in different ways in their willingness to voice opposition to section 301 tariffs. Large US MNCs have access to a larger range of tariff mitigation measures and are more embedded in China, they are far more ambivalent when lobbying against protectionism than for trade liberalization.

Both Deere and Abbott entered the China market earlier and invested more compared to TCF and Sorrento. Three of the four companies investigated in the case studies were involved in some way with import-export through a China-based subsidiary. Of these TCF was the most export intensive while Deere and Abbott both were largely “In China, For China” and producing for local consumption. Sorrento was primarily involved in research and development rather than trade. Unsurprisingly, TCF reacted to the trade war by (unsuccessfully) seeking tariff exclusion. We anticipate that if it had the means to do so, it would have voiced through other channels. By contrast, Abbott and Sorrento lobbied the USTR in 2019 and indicated concern over the trade war in investor reports but they were less tariff-exposed and did not file for tariff exclusions. Deere and Abbott executives were careful not to take a public stance on the trade war but worked through industry associations like the USCBC. Three of the four firms had a JV with a Chinese company but also had wholly owned production facilities; the exception was the wholly owned TCF subsidiary. It is also noteworthy that Deere eventually did close its wholly owned and export-oriented factory in Ningbo but kept its JV factory in Tianjin and its wholly owned but landlocked (domestically oriented) factory in Jiamusi open while pivoting toward importing foreign-made cotton-picking machines in Urumqi. The case studies reveal that US MNCs were sensitive to the effects of the trade war but adopted a range of mitigation strategies. Their actions resulted in limited political pressure in the United States, particularly when we unpack different voice behaviors, and no-exits China.

The arguments presented here focus on the subsidiary exits and parent company actions in the United States. The patterns found here open the door for important further research in two key areas. First, a remaining question is how firms engage in a “China plus one” strategy of diversity in investments. According to a recent AmCham Shanghai report, approximately 13 percent of surveyed firms said they were considering shifting production outside of China.Footnote 38 Future research should evaluate the effect of rising costs in China with MNC expansion in non–China markets. Second, beyond the heterogeneity presented here, firms vary in their local bargaining power and their ability to both lobby and evade the costs of the trade war in China. Future research should consider how these foreign firms operate in China to navigate the trade war.