1. Introduction

Does pure theory have any role in economics, or is it too abstract to be useful? When addressing practical problems, do economists have to rely on the insights of pure theory, or can they proceed on a case-by-case basis? Economists have always differed in their answers to these questions. In Risk, Uncertainty, and Profit, Frank Knight advocated a ‘middle way’ between theoretical and historicist approaches to economics. Importantly, he argued that the relative role of pure theory depends on the nature of the subject matter: economic phenomena involve both general and specific aspects and so economics needs to combine theory with institutional details. Knight argued for using ‘successive approximations’, in which pure theory is augmented by adding specific factors that allow the economist to thereby better explain specific phenomena. For each phenomenon, therefore, there is, depending on its idiosyncrasies, a ‘correct “middle way”’ (1921: 6) between deductive theory and inductive empirical study.

Knight's methodological views have been found appealing to a variety of approaches within economics, including institutional economics (Hodgson, Reference Hodgson2001, Reference Hodgson2004), Austrian economics (Selgin, Reference Selgin1988; von Mises, Reference von Mises1949), and the Chicago School (Emmett, Reference Emmett2009; Reder, Reference Reder1982). However, these approaches usually highlight Knight's appreciation of either general principles or historical specificity, rather than the balance that Knight struck between the two. In this paper, we emphasize this balance, characteristic for both the theory and practice of the modern institutional approaches, in making a case for ‘Frank's way’ of combining, and thereby seeking a golden middle between, theory and history. We illustrate this perspective using the study of entrepreneurship, the field that Knight pioneered.

In the century following Risk, Uncertainty, and Profit, economics has increasingly moved toward studying the general aspects of phenomena and patterns in aggregate data (e.g. Blaug, Reference Blaug2003; Hodgson, Reference Hodgson2001; Weintraub, Reference Weintraub2002) using mathematic and econometric techniques. However, these techniques are less useful in addressing specific problems. Consequently, phenomena where idiosyncratic elements dominate have been largely neglected. A diversity of habits, norms, or routines that could not be explained by the differences in costs and benefits have remained understudied (e.g. Hudik and Fang, Reference Hudik and Fang2020; Spong, Reference Spong2019). This is also an important part of the critique of mainstream economic analysis from heterodox schools such as institutional economics (e.g. Hodgson, Reference Hodgson1998) and behavioral economics (e.g. Davis, Reference Davis2018).

The study of entrepreneurship, in particular, has suffered from this development: entrepreneurial activity pursues creation and novelty, and therefore, the idiosyncratic factors, such as the uniqueness of a situation, or subjective perceptions and preferences, are pivotal. As a result, economic research has either ignored, or even excluded, entrepreneurship (Baumol, Reference Baumol1968; Schumpeter, Reference Schumpeter1947) or focused on those aspects that were amenable to standard economic techniques, such as occupational choice, market entry, or human capital investments (Bianchi and Henrekson, Reference Bianchi and Henrekson2005; Casson, Reference Casson1982).

Using entrepreneurship research as an example, we suggest that economics would benefit from acknowledging that idiosyncratic elements also determine social outcomes. We aid this development by introducing a framework, building on Knight's discussion, for determining when the analysis using standard techniques would be augmented by inclusion and consideration of idiosyncratic elements. Consequently, our argument entails that economics should become more open to those methodologies that are most suitable for the subject matter, including narratives, case studies, process tracing, and other ‘soft’ approaches (e.g. Akerlof, Reference Akerlof2020; McCloskey, Reference McCloskey, Lanteri and Vromen2014; Skarbek, Reference Skarbek2020; Wadhwani et al., Reference Wadhwani, Kirsch, Welter, Gartner and Jones2020). It can draw inspiration from other fields, where individual or historical specificity is essential, such as psychiatry, anthropology, law, management, or history (Morgan, Reference Morgan2019). It can also draw inspiration from methods and approaches used in its own history but since discarded (e.g. Menger, Reference Menger2009; Schmoller, Reference Schmoller1883; Smith, Reference Smith1965).

The importance of the individual and historical specificity has been traditionally emphasized by historical schools and institutionalists (e.g. Hodgson, Reference Hodgson2001). Our contribution to this literature is twofold: first, following Knight (Reference Knight1921), we argue that the usefulness of general theory differs depending on the nature of the studied phenomenon and, therefore, also across fields of study. Specifically, we claim that general theory is more useful in situations where agents face ‘tight constraints’ as opposed to situations where they face ‘loose constraints’ (Koppl and Whitman, Reference Koppl and Whitman2004). Second, we apply this insight regarding individual specificity onto entrepreneurship, which typically, and notably in Knight (Reference Knight1921), takes place beyond simple allocation and thus in ‘pricelessness’ (Bylund, Reference Bylund2016). This example well illustrates our point because entrepreneurs face constraints that are neither completely loose, as entrepreneurs act in and related to existing markets and economize on scarce resources, nor completely tight, as their actions are based on imagining new goods and services and exercising entrepreneurial judgments. We argue that the conventional price-theoretic method is fruitful in the former as the constraints are tight, and the general factors are essential. In the latter, the price-theoretic approach is less useful, as idiosyncratic factors dominate.

2. Knight's ‘middle way’

Knight (Reference Knight1921: 5–6) identifies two positions among economists: those who champion pure abstract theory and those who denounce the role of abstract principles altogether (historicists). Knight recognized shortcomings of both positions and instead advocated a ‘middle way’ drawing from the strengths of both. He argued that the value of theory lies in identifying those few important elements that are common to a large group of situations while neglecting those elements that are specific to each situation. Theorizing is a deductive endeavor that explains phenomena approximately; theory identifies general tendencies that, due to the idiosyncratic or unique elements that are always present in real phenomena, do not hold exactly in any particular case. If the common elements cannot be found or if their effect on the outcomes is small, then, according to Knight, it is not useful to pursue theory as a separate branch of knowledge.

In Figure 1, we represent Knight's views with a simple diagram. On the horizontal axis, we measure the ‘degree of uniqueness’ (Knight, Reference Knight1921: 247) of studied phenomena, s. If s = 0, then all phenomena are governed entirely by the same general principles, and there is no uniqueness or specificity. As s increases, general principles are less dominant, and individual specificity gains importance. The value of pure theory, vT(s), decreases with s, while the value of historicist approaches, vH(s), increases with s. vM(s) represents Knight's ‘middle way’ that combines the theoretical and historicist approaches by augmenting theory with added factors observed in the specific cases. For simplicity, we assume that vM(s) is constant in s. If the specificity of phenomena is below s 1,Footnote 1 it is optimal to focus only on the theory; if the specificity of phenomena is above s 2, historicist approaches are most valuable. If the specificity is between s 1 and s 2, neither of the ‘extreme views’, pure theory and induction, is appropriate. Here, Knight suggests finding a ‘correct “middle way”’, ‘doing justice to both’, is the optimal approach (1921: 6).

Figure 1. Uniqueness of phenomena and the value of various approaches.

To Knight, the appropriate ‘middle way’ is ‘not hard to find’ (1921: 6). Theory represents only a first step toward analyzing economic phenomena. To address concrete issues, individual- and situation-specific elements have to be included. Knight (Reference Knight1921: 8) proposes the method of ‘successive approximations’, according to which we start with the ‘most general aspects of the subject matter, and proceed downward through a succession of principles applicable to more and more restricted classes of phenomena’. To expand theory beyond what can be immediately derived from the general principles requires adding non-general factors, which add detail and thereby improve explanatory accuracy beyond the approximate trends uncovered by pure theory. By including more and more specific aspects, generality is increasingly sacrificed in favor of applicability and practical usefulness.Footnote 2 As summarized by Knight (Reference Knight1921: xxviii),

relevance in economics depends on its being integrally tied up with the fundamentals of institutional history. The heart of this subject, again, from the economic standpoint, is the relation between the roles of conscious and unconscious, and rational and emotional factors, in continuity and change.

The general theory that Knight has in mind in Risk, Uncertainty, and Profit is price theory, or more specifically, the theory of perfect competition. This theory explains the tendency of profits to zero, but it does not explain the existence of profits in actual markets. Knight famously argues that profit is the consequence of uncertainty faced by entrepreneurs. The main source of uncertainty is unanticipated change, which emanates from the uniqueness of situations that entrepreneurs deal with. Since entrepreneurship is closely related to situation-specificity, price theory, which focuses only on the general aspects of phenomena, cannot fully account for entrepreneurship.

Price-theoretic analysis – indeed, theory in general – addresses the problem of specificity by identifying general patterns in phenomena that initially appeared to be unique. Thus, in Figure 1, price-theoretic analysis uncovers that a phenomenon with seeming specificity higher than s 1 is, in fact, smaller than s 1. But when some aspects of phenomena cannot be explained as special instances of general principles, these aspects tend to be neglected or even excluded from the analysis. This occurred also in the case of entrepreneurship studies. Since aspects of entrepreneurship, such as innovativeness (Schumpeter, Reference Schumpeter1934), alertness to opportunities (Kirzner, Reference Kirzner1973), or entrepreneurial judgment (Foss and Klein, Reference Foss and Klein2012), could not be easily incorporated into the pure price-theoretic analysis, they remained outside its scope.

3. Price theory and entrepreneurship

To Knight (Reference Knight1924), the principles concerning the allocation of resources are general and can be applied to any phenomenon (see also Hodgson, Reference Hodgson2001; Leigh, Reference Leigh1974). Conventional Marshallian–Walrasian price theory (cf. Boettke and Candela, Reference Boettke and Candela2017) puts a high value on generality and, therefore, has focused primarily on problems that can be formulated as the allocation of resources among competitive uses (Becker, Reference Becker1978; Robbins, Reference Robbins1932). Recently, Weyl (Reference Weyl2019: 329) has defined the price-theoretic approach as an ‘analysis that reduces rich and often incompletely specified models into “prices” (approximately) sufficient to characterize solutions to simple allocative problems’. The price-theoretic analysis then shows how the allocation of resources responds to changes in exogenous parameters (‘prices’, broadly defined), assuming, typically, zero transaction costs. The responses to parameters are then described with supply and demand functions.

Price-theoretic models consider two categories of exogenous parameters that could be labeled as ‘constraints’ and ‘tastes’. Constraints represent general parameters that are assumed to affect all allocative problems of a given type. Tastes represent all idiosyncratic elements involved in the allocation problem. Given their ambition to be generally applicable, price-theoretic models attempt to identify how the allocation of resources responds to changes in constraints rather than tastes (Stigler and Becker, Reference Stigler and Becker1977). To eliminate the idiosyncrasies in individual behavior, these models focus on the aggregate level (Hudik, Reference Hudik2019; Weyl, Reference Weyl2019). Econometric techniques then attempt to isolate the general causal effects from specific factors. Hence, although there may be no necessary connection between economics and statistics in general (Leeson, Reference Leeson2020), there is a strong complementarity between the two fields in the case of conventional allocative models.

In sum, price-theoretic models aim to explain either the changes in the behavior of many people or persistent differences across various groups of people. Individual behavior and issues other than comparative statics are beyond their scope. To the degree these models are used in entrepreneurship research, they focus on quantitative analyses or simple causalities between resources/inputs and wealth effects but avoid addressing the entrepreneurial action as such or its motivation and aim (e.g. Lerner, Reference Lerner2012). The entrepreneurship function and its non-allocative aspects remain out of reach.

Early attempts to incorporate the entrepreneurship function in price-theoretic models represented the entrepreneur either as exogenous shocks to parameters that disturbed the original equilibrium (Schumpeter, Reference Schumpeter1934) or as the agency that brought parameters closer to their equilibrium values (Kirzner, Reference Kirzner1973). In one way or another, entrepreneurs in these approaches are unexplained shifters of supply and demand curves – the unobservable causes of observed changes. Entrepreneurship is here a disequilibrium phenomenon: entrepreneurs either disturb or restore the supply-demand equilibrium, but in equilibrium, there is no entrepreneurial activity (Packard and Bylund, Reference Packard and Bylund2018). In these approaches, entrepreneurship affects the allocation of goods and services in markets, but it is not itself modeled as an allocative problem.

Other approaches attempt to derive the supply of entrepreneurship and its determinants. Knight's (Reference Knight1921) theory partly belongs to this category. He argued that the supply of entrepreneurship depends on the individual ability, the resource endowment (‘power to give satisfactory guarantees’), tastes (‘willingness’), and the coincidence of the three factors in one individual. For Knight, allocation of entrepreneurial talent was ‘the single most important problem of economic organization’ (1921: 283). Still, he understood that entrepreneurship, as such, cannot be reduced to the problem of resource allocation. In contrast, modern economic theories of entrepreneurship, equipped with, if not made to comply with, the tools of price-theoretic analysis, focus exclusively on allocative problems (e.g. Kihlstrom and Laffont, Reference Kihlstrom and Laffont1979; Lazear, Reference Lazear2004). In doing so, they attempt to identify general factors affecting allocation embodied in constraints of an optimization problem with the aim to explain aggregate data. We review this literature in the following section.

4. Entrepreneurship as allocation of resources

The study of entrepreneurs and entrepreneurship, both from the perspectives of economics and policy, has a centuries-old history (e.g. Cantillon, Reference Cantillon1931; Say, Reference Say1836). Klein (Reference Klein2008) categorizes this body of research as structural, occupational, and functional. The first two approaches define entrepreneurship in terms of outcomes observable in statistical data. Occupational research focuses on whether actors are self-employed (entrepreneurs) or employed in a firm (non-entrepreneurs); structural research contrasts industries with competition between many comparatively small firms (entrepreneurial) with industries where one or several firms have significant market power (non-entrepreneurial). In contrast, the classical study of the entrepreneur (e.g. Hébert and Link, Reference Hébert and Link1988), as well as theory development in the recently established academic field of entrepreneurship, is functional, meaning it focuses on the function of entrepreneurship in the market economy. Each of these three perspectives focuses on a different allocative problem.

4.1 Occupational theories

A vast literature models entrepreneurship as occupational choice and assumes that individuals differ in the characteristics that are relevant to perform the entrepreneurial function. These characteristics include the ability to respond to opportunities to innovate (Holmes and Schmitz, Reference Holmes and Schmitz1990), the ability to recognize and combine talents of others (Lazear, Reference Lazear2005), risk aversion and initial wealth (Kihlstrom and Laffont, Reference Kihlstrom and Laffont1979), age (Levesque and Minniti, Reference Levesque and Minniti2006), or unspecified entrepreneurial talent (Lucas, Reference Lucas1978). Individuals may adopt the role of an employee and a manager or an entrepreneur (e.g. Gifford, Reference Gifford1993; Holmes and Schmitz, Reference Holmes and Schmitz1990); sometimes, entrepreneurs and managers constitute a single category (e.g. Lucas, Reference Lucas1978). The general factors affecting the allocation of individuals to the entrepreneurial role include real wage (e.g. Gifford, Reference Gifford1993; Lucas, Reference Lucas1978), the character of the production processes (Lazear, Reference Lazear2005), or access to capital (Evans and Jovanovic, Reference Evans and Jovanovic1989).

Although these models consider entrepreneurial characteristics as exogenous, another branch of the literature assumes that entrepreneurial characteristics can be, at least to some extent, acquired by education and training. This approach, which derives from Schultz (Reference Schultz1980), thus explicitly links entrepreneurship with human capital theory (Klein and Cook, Reference Klein and Cook2006). The analyzed problem consists of the allocation of resources to acquire skills to become either entrepreneur or wage worker. For example, Lazear (Reference Lazear2005) assumes that entrepreneurs are generalists, while employees are specialists. In another model, Otani (Reference Otani1996) argues that entrepreneurs possess firm-specific human capital, whereas employees have transferable skills. These models complement the previous types of models: they highlight the fact that changes in various exogenous parameters may affect not only the allocation of individuals in the entrepreneurial role but also the acquisition of entrepreneurial characteristics.

4.2 Structural theories

Similar to occupational theories, structural theories also study the allocation of entrepreneurial talent. However, they are less concerned with the individual characteristics of entrepreneurs and more with the environmental factors. In these theories, the issue is whether this talent is more efficiently channeled through existing/new or large/small firms and how this allocation is affected by the market structure. The unit of analysis for structural theories is not an individual but a firm or industry, which are more or less entrepreneurial and can be compared on those grounds. These theories focus on industry dynamics, firm growth, networks, etc. For example, Audretsch et al. (Reference Audretsch, Keilbach and Lehmann2006) assume that entrepreneurs exploit the profit opportunities created by new knowledge. They study how the allocation of entrepreneurship is affected by the size of knowledge spillovers and organizational constraints on knowledge transmission. Entrepreneurial orientation is another example of firm-level analysis where the inclusion of entrepreneurship in a firm's strategy is assumed to contribute positively to the firm's performance (Lumpkin and Dess, Reference Lumpkin and Dess1996; Wales et al., Reference Wales, Covin and Monsen2020; Wiklund, Reference Wiklund1999).

4.3 Functional theories

Several functional models focus on entrepreneurial behavior as allocation. One such approach argues that the entrepreneurial function is small-business management (see Foss and Klein, Reference Foss and Klein2012, Reference Foss and Klein2014). From this perspective, entrepreneurial decisions include the choice of technology and the amounts of inputs, setting the quantity and quality of output, make-or-buy decisions (Masten, Reference Masten1986), governance choices (Williamson, Reference Williamson1990), or strategic decisions to deter competitors. The entrepreneur therefore relies on the firm to conduct controlled experiments to figure out the proper (or most effective) allocation and combination of resources (Foss and Klein, Reference Foss and Klein2012; cf. Lachmann, Reference Lachmann1956). These entrepreneurial decisions represent allocative problems, and they can be addressed with standard optimization methods.

A different approach is adopted by Gifford (Reference Gifford1992, Reference Gifford1993), who argues that if the role of the entrepreneur is to be alert to opportunities (Kirzner, Reference Kirzner1973), then the relevant resource to be allocated is attention. She introduces models where an individual allocates her attention between routine and innovative activities. Specifically, Gifford (Reference Gifford1992) considers an entrepreneur someone who chooses between introducing new products or maintaining and improving the current ones. These decisions are analyzed with standard optimization methods.

Baumol (Reference Baumol1990) similarly adopts a functional approach by asserting entrepreneurship as the value-creative cause of economic growth. He then hypothesizes that the outcome of entrepreneurship, from the point of view of society, differs depending on its type: productive, unproductive, and destructive, which respectively contribute, have zero net effect, and withdraw from the value in society. The outcome of an economy's entrepreneurial undertakings is mediated by the relative allocative effect of institutions (Foss et al., Reference Foss, Klein and Bjørnskov2019; Lucas and Fuller, Reference Lucas and Fuller2017), which determines the relative allocation of entrepreneurial effort between these types.

Although these models provide valuable insights, we argue that the area of entrepreneurial behavior is where allocative models are the least useful. In entrepreneurial decisions, individual- and situation-specific aspects dominate, and therefore, general models have limited applicability. Another problem is that the allocative models typically do not analyze the function of the entrepreneur in the economy in detail; the function is simply assumed from the outset for the sake of analyzing its outcome. For example, Baumol (Reference Baumol1990, Reference Baumol2002) assumes that entrepreneurship is a precursor, if not cause, of economic growth. Entrepreneurship, in other words, is studied because it is assumed to explain economic growth and, consequently, the frequency of entrepreneurship is a determinant of the rate of growth (Audretsch et al., Reference Audretsch, Keilbach and Lehmann2006; Wennekers and Thurik, Reference Wennekers and Thurik1999). Although this assertion facilitates quantitative empirical research, it does little to explain entrepreneurial action or the (causal) link between entrepreneurship and economic growth.

4.4 Allocative models and efficiency

Occupational choice models focus on individuals and their characteristics, whether given exogenously or endogenously. The structural approach adopts a higher level of aggregation by highlighting environmental factors. We find this distinction to be similar in concept, but not in content, to Farrell's (Reference Farrell1957) efficiency concepts, which also apply on different levels. Farrell (Reference Farrell1957) argues that there are two types of efficiencies, which need to be jointly maximized to create overall efficiency: allocative efficiency relates to ‘choosing an optimal set of inputs’ (Farrell, Reference Farrell1957: 259) such that the attempted production contributes to efficient use of scarce resources; technical efficiency relates to the management of existing production such that waste is minimized and, therefore, the output-to-input ratio is maximized.

Seeing entrepreneurship as an allocation problem, Farrell's analysis seems to apply. This, then, allows us to tie an efficiency notion to the allocation of entrepreneurship. The occupational analysis, which applies on the level of individuals, treats entrepreneurship as an input to market structure. Adopting a market-level perspective, it is similar to Farrell's allocative efficiency because for a market to be (allocatively) efficient, the optimal set of people needs to be selected to be entrepreneurs. The structural analysis, which applies on the aggregate level, looks at the output in terms of the market's efficiency given the choice of inputs – Farrell's technical efficiency. From a Farrellian point of view, then, we find support for the assumption implied in the aforementioned models that the allocation of entrepreneurship is directly linked with the efficient functioning of the market. But, as Baumol (Reference Baumol1990) showed, the link between entrepreneurial inputs and market-level output is not simple but mediated by the institutional setting within which entrepreneurship takes place. Thus, more entrepreneurship as input can have both efficiency-enhancing and -reducing effects depending on the present institutions. This raises questions regarding the occupational and structural models' allocative approaches as they typically assume a linear (non-mediated) relationship between technical and allocative efficiency.

In contrast to the assumptions behind these models, recent research has shown that the relationship between entrepreneurship and the institutional setting is not unidirectional (Henrekson and Johansson, Reference Henrekson and Johansson1999; Henrekson and Sanandaji, Reference Henrekson and Sanandaji2011). Although institutions affect entrepreneurs and entrepreneurial decision-making, the latter also affect the former. Specifically, entrepreneurs can take abiding, evasive (Elert and Henrekson, Reference Elert and Henrekson2016), and altering action with respect to the institutional setting that respectively strengthen, undermine, and attempt to change it. The institutional setting can also, depending on its structure, cause uncertainty that further burden entrepreneurs and may force them to exit (Bylund and McCaffrey, Reference Bylund and McCaffrey2017). Similarly, institutions can have the opposite effect by facilitating entrepreneurship (Boudreaux, Reference Boudreaux2014). As a result, the relationship between entrepreneurship and the institutional setting is a complex interaction rather than a relationship, whether uni- or bidirectional. The complexity increases exponentially if we further, with Williamson (Reference Williamson2000) and Bylund and McCaffrey (Reference Bylund and McCaffrey2017), observe that institutions are interrelated, interdependent, and exist and interact on levels within an institutional hierarchy, which in turn imposes constraints on and is affected by entrepreneurial action, which also takes place on different levels.

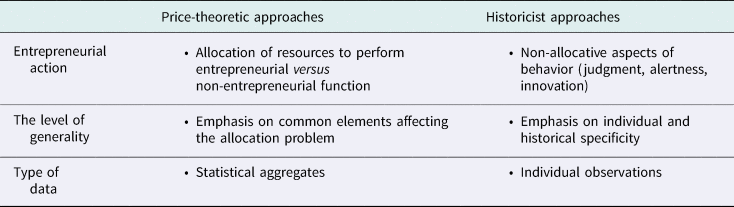

Table 1 summarizes and highlights that dominant occupational, structural, and functional models of entrepreneurship use the price-theoretic approach that focuses on the allocation of resources.

Table 1. Price-theoretic approaches to entrepreneurship

5. Non-allocative functional approaches to entrepreneurship

The distinction between occupational, structural, and functional models was introduced to emphasize the distinct nature and importance of functional theories (Casson, Reference Casson1982; Klein, Reference Klein2008). We agree with this emphasis, but develop the argument further. Certain aspects of entrepreneurial action cannot be reduced to the analysis of general factors affecting the allocation of resources. We, therefore, add another dimension along which the entrepreneurship theories can be classified: price-theoretic versus historicist approaches. This distinction reflects the focus on the general (price-theoretic) and specific (historicist) aspects of entrepreneurship. Although we agree that occupational and structural theories can be adequately modeled as allocations of scarce resources, at least where there are no significant mediating institutional effects, we argue that functional theories have to incorporate non-allocative elements and therefore, they should make use of methods traditionally emphasized by historicist approaches. We, therefore, highlight the importance of non-allocative functional approaches to entrepreneurship as a complement to price-theoretic approaches.

Our point is illustrated in Table 2. Price-theoretic functional theories focus on allocation problems, common factors affecting the allocations, and aggregate data. By contrast, historicist functional theories incorporate non-allocative aspects of behavior. There are two closely related reasons to go beyond allocative models: first, the allocation problem is sometimes difficult to define because entrepreneurs face radical uncertainty (Foss and Klein, Reference Foss and Klein2012; Kirzner, Reference Kirzner and Kirzner1982; Knight, Reference Knight1921), and possible outcomes of their actions are not known in advance. Second, even if the allocation problem can be defined, the allocation is affected by idiosyncratic factors because entrepreneurs deal with unique situations (Baumol, Reference Baumol2000; Bylund, Reference Bylund2016; Knight, Reference Knight1921) and they interpret these situations differently from other individuals (e.g. Foss et al., Reference Foss, Klein and Bjørnskov2019; Tarko, Reference Tarko2013). As a result, the entrepreneurial act cannot be routinized or mechanized (Baumol, Reference Baumol2000) and attention must be given to individual observations.

Table 2. Functional theories of entrepreneurship

Hébert and Link (Reference Hébert and Link1988) illustrate that the study of the entrepreneur historically focused on the functional and non-allocative aspects and highlighted the idiosyncratic factors affecting the function of entrepreneurs. The entrepreneur was typically understood as a risk-taker, an adventurer, and someone causing change and thereby directing the economy's future path and progression (Bylund, Reference Bylund2020). Embedded in specific economic situations, the exact outcome of entrepreneurial action is contingent on the nature of the situation and the entrepreneur's abilities. Although this role has no clear boundaries and is often more easily identifiable ex post facto through the change effected, Hébert and Link (Reference Hébert and Link1988: 12) find that ‘[e]ntrepreneurial talent … has always been closely aligned with the quality of leadership’. As leaders of processes that effect change in the economy, they can be effective at attaining their stated end (such as producing a type of good) without therefore being successful (earning a profit). As such, the entrepreneur is an elusive character whose actions are not conducive to quantitative analysis because the frequency of entrepreneurial action is unrelated to entrepreneurial success, and even successful entrepreneurship need not be productive (Baumol, Reference Baumol1990).

The modern study of entrepreneurship as a non-allocative market function goes back at least to Cantillon's (Reference Cantillon1931) conception of the entrepreneur as uncertainty-bearer, Smith's (Reference Smith1965) undertaker, and Say's ([1803] Reference Say1836) entrepreneur. Within this tradition, entrepreneurship is of central importance for understanding the progression of the market but ultimately lies beyond optimization emphasized by the price-theoretic approaches. von Mises (Reference von Mises1949), for example, defined entrepreneurship, a catallactic function (cf. Packard, Reference Packard2020), as the bearing of uncertainty, and thus the speculative part of all action. To von Mises, the entrepreneur as the ‘driving force’ of the market is captured in the subset of promoters that evades theoretical study (cf. Bylund, Reference Bylund2020). To Knight (Reference Knight1921), the entrepreneur's main quality is economic judgment under uncertainty, a quality that cannot earn a market wage and therefore requires that the entrepreneur organizes a firm to capture the potential profits.

In recent entrepreneurship theory, these and other functional approaches have been rediscovered, revived, and further developed. The concept of the entrepreneurial opportunity was based in Schumpeter and Kirzner (Shane, Reference Shane2003), which then evolved from exogenous and discovered to instead being ‘enacted’ by entrepreneurial foresight and action (Alvarez and Barney, Reference Alvarez and Barney2007). The opportunity construct has thereafter been challenged by theories based on imagination and leadership (Witt, Reference Witt1998), judgment (Foss and Klein, Reference Foss and Klein2012; McMullen, Reference McMullen2015), and interpretivism (Packard, Reference Packard2017). What these recent attempts at theorizing on entrepreneurship have in common, with each other as well as with the historicist approaches, is their explicit focus on attempting to uncover the function or nature of entrepreneurship as distinct from other types of economic action. More importantly, for our purposes, is their focus on entrepreneurship as open-ended creative acts for which the outcome, at least in terms of value, cannot be known a priori. The entrepreneurial function in the market, as has been suggested by, among others, Wiklund et al. (Reference Wiklund, Davidsson, Audretsch and Karlsson2011), is the creation of new economic value, a highly elusive project as novelty by definition defies standardized explanations. Our interest here is in this traditional and revived approach to the entrepreneurship function, and to entrepreneurial action, rather than the asserted relationships between measurable occupational or structural measures and economic growth.

Although we emphasize the non-allocative aspects of entrepreneurship, we do not deny that entrepreneurial acts can often be modeled as the allocation of resources. We argue that the usefulness of these models does not go much beyond providing a unified conceptual framework and cannot offer empirical predictions about how entrepreneurs will respond to changes in constraints. Entrepreneurs allocate resources from production in the market, where their value in terms of produced outcomes is known to projects with uncertain value, many of which will fail (Gage, Reference Gage2012). These entrepreneurial acts often go against established opinions, are atypical responses to incentives, and even meet resistance (Schumpeter, Reference Schumpeter1934). Only when entrepreneurs succeed and the new economic value is created, the standard allocation problem with known parameters emerges, and what used to be an entrepreneurial problem becomes a management problem (Bylund, Reference Bylund and McCaffrey2018).

To clarify our point, we refer to the distinction between ‘loose’ and ‘tight’ constraints (Koppl and Whitman, Reference Koppl and Whitman2004). In the case of loose constraints, idiosyncratic elements dominate; in the case of tight constraints, factors that are common to a large group of situations dominate. As an illustration of the issues involved, consider a demand for a good as a function of prices, income, and tastes. If the prices and income explain relatively little and the tastes explain a lot, then consumers face loose constraints, and general demand theory is of little use. One way to proceed is to ‘tighten’ the constraints by including more variables, such as search cost or advertising (Stigler and Becker, Reference Stigler and Becker1977). If no common factors could be identified, then demand would have to be studied on a case-by-case basis. In Figure 1, the variable s, the ‘degree of uniqueness’, can be related to the tightness of constraints: tight constraints correspond to the low level of s, while loose constraints reflect its high level.

Koppl and Whitman (Reference Koppl and Whitman2004) illustrate the distinction with the theory of Big Players (Koppl, Reference Koppl2002). Big Players' behavior is characterized by discretion rather than rules, i.e. they face loose constraints. Examples of Big Players include political leaders, central banks, or monopolies. General theories, such as rational choice theory, are of limited use in accounting for the behavior of these Big Players because individual- and situation-specific factors dominate in their decisions. Therefore, these players' behavior is typically studied through concrete examples and individual observations (Butos and Koppl, Reference Butos and Koppl1993).

We argue that entrepreneurs are examples of Big Players in Koppl's sense. They make judgmental decisions that are not routine or typical, and therefore, cannot be predicted from the analysis of data sets. In fact, these decisions often go against the established knowledge, and from the perspective of the received view, they may seem wrong or even foolish. Indeed, entrepreneurship research tends to identify entrepreneurs as ‘thinking differently’ than non-entrepreneurs (Baron, Reference Baron1998, Reference Baron2006). Knight (Reference Knight1921: 227) noted that the entrepreneurial logic under uncertainty is ‘obscure, a part of the scientifically unfathomable mystery of life and mind’. Many of the decisions built on these deliberations may turn out to be wrong, but some of them succeed in ways that cannot be predicted from general models based on patterns identified in historical data.

6. Toward a Knightian synthesis

Our central point is that in cases where idiosyncratic factors dominate, general theories are of limited use. What approaches are useful in such cases? Knight's ‘middle way’ characterized by the method of ‘successive approximations’, offers a general guidance on direction: the adding of specific factors to the general principles of pure theory in order to increase precision. But Knight's discussion does not provide detailed guidance for how far researchers can or should go, other than stating that the ‘correct ‘middle way’’ is ‘not hard to find’ (1921: 6). Perhaps not, but we find that there are additional dimensions to the complexity of finding the appropriate level of theory and added factors as there are various ways how individual- and situation-specific factors can be combined with general theory. For example, Koppl and Whitman (Reference Koppl and Whitman2004) consider hermeneutical understanding (Verstehen) as a complementary approach to the abstract rational choice theory. Similar approaches to combining the general and the specific aspects of phenomena have been suggested by, e.g. Schutz (Reference Schutz1932), von Mises (Reference von Mises1949), Lavoie (Reference Lavoie1991), and Boettke (Reference Boettke1995). In entrepreneurship research, Selgin (Reference Selgin1988), Foss and Klein (Reference Foss and Klein2015), Lachmann (Reference Lachmann1956; see also Endres and Harper, Reference Endres and Harper2013), and Packard (Reference Packard2017) highlight the link between Verstehen and entrepreneurship.

One specific example of such an approach combines the economic theory of entrepreneurial judgment with the idea of empathic accuracy (McMullen, Reference McMullen2015). At one extreme, there is a general model, which assumes an individual with given resources, choice alternatives, preferences, and beliefs (e.g. Kihlstrom and Laffont, Reference Kihlstrom and Laffont1979). This approach does not inquire where alternatives or beliefs come from, nor does it analyze the decision process (Hastie, Reference Hastie2001). Baumol's (Reference Baumol1990) institutional determination of the value (positive, neutral, or negative) as well as quantity of entrepreneurship can be construed as an example of how entrepreneurship, including the presumed judgment of entrepreneurs, is itself caused by other (non-individual) factors. However, since an entrepreneur's judgment is individual-specific and situation-contingent, the models can be sufficiently general only by abstracting from (i.e. excluding) the entrepreneur's judgment and decision-making.

Closer to the opposite extreme is the view of entrepreneurial action as effectuation, in which the entrepreneur does not plan their entrepreneurial undertaking but instead ‘embraces’ the uncertainty of the process (Sarasvathy, Reference Sarasvathy2001). The effectuation process stresses open-endedness and highlights the process of stakeholder negotiations (Sarasvathy and Dew, Reference Sarasvathy and Dew2013). Although these processes are characterized by some common elements, they will generally differ case by case. McMullen (Reference McMullen2015) notes that for the processes of negotiations to succeed, empathic accuracy, a specific manifestation of Knightian judgment, is required. But, he points out, the allocation of resources is still present in entrepreneurial action: entrepreneurs cause change to the allocation of resources in the economy. Therefore, both the general economic allocation-based approach and the more specific effectuation-based approach are relevant and complementary to each other.

Complementarity between the general and specific aspects of entrepreneurship can also be identified in the research on innovative entrepreneurship. For example, Langlois (Reference Langlois2018) considers several types of innovations, such as recombination, differentiation, and fine-tuning. Although he does not discuss the abstract theory of innovation in detail, such theory has been elaborated elsewhere (Lancaster, Reference Lancaster1966; Saviotti and Metcalfe, Reference Saviotti and Metcalfe1984). This theory can be used to construct measures of technology output on the aggregate level or estimate the prices of new goods. However, it does not provide insights regarding the process of innovative activity.

Langlois illustrates this process with a historical case study that highlights that while defining types of innovations in general terms is relatively straightforward, in practice, the situation- and individual-specific aspects are crucial. In the late 19th century, the opportunity to create intra-urban railways by recombining electric motors with elements of steam railroads ‘was clear to everyone’; however, the ‘hard part was getting all the elements of that recombination to work and ironing out the kinks: the recombination presented a complex set of bottleneck problems and reverse salients’ (Langlois, Reference Langlois2018: 1061). These bottleneck problems and reverse salients will differ case by case, yet they are crucial in determining whether an innovation is successful (cf. Ridley, Reference Ridley2020). Therefore, ignoring these specific factors by focusing exclusively on the general aspects of innovations provides a highly incomplete picture of innovative entrepreneurship.

Similarly, and further illustrating our point of the limited usefulness of abstract models, McKelvie et al. (Reference McKelvie, Wiklund, McMullen and Palubinskas2020) introduce a dynamic temporal perspective to explain how entrepreneurs' opportunity beliefs change over time. Through two case studies, the authors show the importance of the passing of time, and its implied changes to the discovered opportunity, for entrepreneurial action and, consequently, success. An implication of their findings is that even if an opportunity could be discovered, or even determined formally, its nature changes over time. In other words, even models able to capture the nature of opportunity as perceived by entrepreneurs ex ante will be mismatched with the ex post outcome of exploiting the opportunity, since the entrepreneurial journey (McMullen and Dimov, Reference McMullen and Dimov2013) includes numerous reimaginations, reconceptualizations, and pivots that, other than in the entrepreneur's mind, separates the ex ante opportunity discovery from the ex post outcome. Consequently, allocating resources toward opportunity discovery may not lead to greater or more frequent successful opportunity exploitation.

We find another example of the Knightian approach in the emerging field ‘new entrepreneurial history’ (Wadhwani and Lubinski, Reference Wadhwani and Lubinski2017). Rather than focus on structural determinants of entrepreneurship and optimizing behavior under technological and institutional constraints, as the earlier approaches business history and new institutionalism, new entrepreneurial history emphasizes entrepreneurial processes, including envisioning and valuing opportunities, allocating and reconfiguring resources, and legitimizing novelty. It employs historical narratives as a method to incorporate the perspective of actors in their historical situation without overemphasizing the role of individuals in entrepreneurial processes. By organically combining historical specificity with theory, its approach to entrepreneurship embodies the ‘middle-way’ method envisioned by Knight.

7. Conclusion

Following Knight (Reference Knight1921), we have attempted to show the value, scope, and limits of abstract theories in economics and entrepreneurship. To summarize our point, abstract economic models identify common factors affecting the phenomenon in question. Econometric studies test these models by attempting to explain variability in data by these common factors. If the unexplained variability is small, general theory is highly useful. When the unexplained variability is large, the analysis has to proceed at a lower level of generality, and an analysis of individual cases is often required. This is where methods such as Verstehen, historical narratives, and case studies come into play.

The importance of the Knight's insight, highlighted in this paper, is that the usefulness of abstract and historical approaches depends on the character of studied phenomena. Therefore, our argument is not merely that both general theory and approaches focusing on individual specificity are important; that is, our argument is not primarily about methodological tolerance. Instead, we attempted to show that whether a phenomenon should be approached in an abstract or a concrete way depends on the relative importance of the common or specific factors governing this phenomenon. That is, we take sides with Knight (Reference Knight1921) in arguing that the formal study of economic and social phenomena requires a balance – a ‘middle way’ – between theoretical and historical approaches. In our vernacular, the study of a phenomenon requires the finding of the appropriate balance between theory and history, the aim for universal truth versus the particulars of the specific case, for that phenomenon.

Specifically, there is a difference between the correct middle way studying commodity prices and what is appropriate for entrepreneurship. Economics has, over the course of the century since the publication of Knight's Risk, Uncertainty, and Profit, increasingly adopted a highly theory-dominated approach relying on mathematical theorizing and statistical analyses suitable for analyzing allocative problems. Perhaps as a result, contemporary economics and economists have very little to say about entrepreneurship and, therefore, the change processes in markets. Our discussion suggests that economics has wandered too far to one extreme – theory – and thereby all but excluded specific phenomena from their purview. As a result, economic analysis is applicable to much narrower range of phenomena than economists recognize.

Entrepreneurship research incorporates both general theory and specificity. Although influential theories of entrepreneurship emerged in economics long ago, economic theory has been able to absorb only their general aspects. Simply put, the occupational and structural approaches have successfully been absorbed, but the functional approach much less so due to its focus on the universal but continent and institutionally embedded function to the economic system. Full integration of entrepreneurship in economic analysis requires acknowledging the importance of historical specificity and adopting methodologies appropriate for the nature of the studied phenomena. This requires, in turn, and especially for new scholarly fields such as entrepreneurship, an openness to deviate from the particular balances inherited from other fields. But it also requires an openness within established fields to consider alternative balance configurations, especially when expanding the study to include new and different phenomena.

Another implication of our argument, which is also implied in Knight's study, is the importance of incorporating institutional analysis to provide common structure and framework to the study and thereby also a bridge between the study of singular cases and the highly formalized models. In both polar cases, institutional effects are assumed to be captured through the means of the particular method: in case studies and narratives, institutional impact is but another idiosyncratic variable, and in formalized models, institutional effects are included to the extent they are general enough to be variables in their own right. But the institutional perspective should provide a bridge by bringing the polar opposites closer together. For the former, it suggests cases take place within a dynamic but structuring framework that ultimately may exclude or limit the possibility of certain idiosyncratic phenomena and may also act coalescingly with respect to already existing cases. Both of these effects or tendencies explain why the ‘loose constraints’ still have a constraining or limiting effect. For the latter, the changing and emergent properties of institutions suggest there is dynamism and adaptability also to the highly formalizable, which in turn suggest that the ‘tight constraints’ limit but do not entirely exclude change. We therefore conclude that economics can only be relevant if it manages to incorporate both general and relatively stable aspects of phenomena, and their specific and fickle aspects. That is, if it adopts ‘Frank's way’.