1. Introduction

Evolutionary economics and institutional economics need one another (Hodgson and Stoelhorst, Reference Hodgson and Stoelhorst2014; Nelson, Reference Nelson2005). Combining these perspectives makes it possible to study the realm of mesoeconomics, which posits the existence of an intermediate level between the microeconomic and macroeconomic levels (Dopfer et al., Reference Dopfer, Foster and Potts2004), while taking into account the interactions between actors and technological as well as institutional change (Ménard, Reference Ménard2014). By employing the theory of the collaborative innovation bloc (CIB), an emergent system of innovation within which activity takes place over time, we try to do just that. While its roots can be traced to the studies of earlier Swedish economists (Erixon, Reference Erixon2011), Elert and Henrekson's (Reference Elert and Henrekson2019a) reintroduction of the CIB perspective ushered in a debate involving several entrepreneurship scholars (Bylund, Reference Bylund2019; Elert and Henrekson, Reference Elert and Henrekson2019b; Foss et al., Reference Foss, Klein and McCaffrey2019; Lucas, Reference Lucas2019).Footnote 1 Focusing on Sweden, we show how the CIB perspective can help make institutional and evolutionary economics more concrete and relevant, especially regarding policy prescriptions, which, we contend, should strive for antifragility (Taleb, Reference Taleb2012).

The CIB perspective offers a concrete way of thinking about coordination and economic change, treating economic evolution as a knowledge process. The perspective places innovative entrepreneurship at the core of new business development and long-term wealth creation. Although entrepreneurship can be about many things (Foss et al., Reference Foss, Klein and McCaffrey2019), the CIB's innovative focus is highly relevant given that more than nine-tenths of the rise in gross domestic product (GDP) per capita since 1870 can be attributed to innovation (Baumol, Reference Baumol2010). Furthermore, ‘the independent innovator and the independent entrepreneur have tended to account for most of the true, fundamentally novel innovations’ (Baumol, Reference Baumol2005: 36).

To some extent, however, the adjective independent is misleading; at every turn, these entrepreneurs and innovators were, after all, dependent on gathering and mobilizing crucial skills that others possessed. The CIB perspective acknowledges this by treating the entrepreneur as a collaborator. Whereas Lachmann's (Reference Lachmann1956) entrepreneur is seen as a socially embedded creature engaged in team-based agency to be juxtaposed against the more independent-minded Schumpeterian entrepreneur (Endres and Harper, Reference Endres and Harper2013), the fact is that Schumpeter (Reference Schumpeter and Clemence1989 [1949]: 261) argued that the entrepreneurial function ‘may be and is often filled cooperatively’ (cf. Harper, Reference Harper2008; McCloskey and Klamer, Reference McCloskey and Klamer1995; Sarasvathy, Reference Sarasvathy2008). The crucial question is how entrepreneurs find and engage with their collaborators, and this is where the CIB comes in: such a bloc consists of several (stylized) pools of economic skills, encompassing entrepreneurs, inventors, key personnel, early-stage financiers, later-stage financiers, and customers. People are recruited from these pools to form part of an entrepreneur's collaborative team, which is necessary if innovation-based venturing is to flourish.

The CIB perspective offers a path to concerted and logically consistent policy action. Preferably, such action should strive to improve the antifragility of CIBs and the broader economic system. Since Taleb (Reference Taleb2012) coined this term, antifragility has been studied within such varied fields as physics (Naji et al., Reference Naji, Ghodrat, Komaie-Moghaddam and Podgornik2014), computer science (Lichtman, Reference Lichtman2016), and economics (Markey-Towler, Reference Markey-Towler2018). The core distinction between antifragility and seemingly similar terms such as robustness or resilience is that an antifragile object, firm or economy not only endures a shock (robustness) or bounces back from it (resilience) but is strengthened by and thrives from the shock. As an example, consider hormesis, which is a favorable biological response to low exposure to toxins and other stressors.

Applied to an organization, hormesis describes its adaptation to the challenges brought about by a changing environment, making it fitter and better able to survive (Derbyshire and Wright, Reference Derbyshire and Wright2014; Pech and Oakley, Reference Pech and Oakley2005). Optionality, i.e. a payoff structure with large, open-ended upside and limited, known downside, appears crucial to any antifragile strategy. This trait characterizes innovation, which is what drives improvements in human material wellbeing. Antifragility is also a desirable property of an economic system.Footnote 2

Macroeconomic stability (antifragility) implies microeconomic instability or turbulence in the sense that many firms are born, compete, and die or, at least, that many economic ideas and economic experiments are tested, developed, and phased out if they do not prove valuable (e.g. Brown et al., Reference Brown, Haltiwanger and Lane2008). A desirable property for CIBs is to be less fragile than the individual firms and organizations that operate within them, but all healthy economies will see a blend of fragile, robust, and antifragile CIBs and a continuous movement across these three categories.

A newly formed CIB will be fragile before developing a sufficient depth and width, i.e. before it has attracted enough competent actors. Conversely, a CIB that was once antifragile may gradually lose essential actors to other CIBs, until it is merely robust/resilient or even fragile – two examples are the US railroad industry (Boissoneault, Reference Boissoneault2015) and the Swedish shipping industry (Olsson, Reference Olsson1995). In a well-functioning institutional setting, the renewal of the CIB population should be less volatile and smoother than micro-level processes. Policy should aim to remove institutional hurdles and bottlenecks that impede the self-organizing ability of CIBs to become antifragile. Not even in countries with high-quality institutions is this a modest undertaking. We make use of the Swedish reform experience since the 1970s to identify seven institutional reform areas that are key to protecting or enabling well-functioning CIBs.

We organize the remainder of this paper as follows. First, we present the CIB perspective in detail, highlighting the relevant actor categories and relationships and arguing what is needed for a CIB to achieve its antifragile potential. We then analyze seven institutional areas that can enable CIBs to achieve antifragility, using Sweden's institutional and economic development since the 1970s as an illustrative case. The last section discusses core takeaways and limitations of the perspective before highlighting fruitful avenues for future research.

2. The collaborative innovation bloc

The CIB perspective outlined

A CIB is a complex system. This complexity makes the system unpredictable, but is also necessary for a CIB to be adaptive, resilient, and even antifragile (cf. Dekker, Reference Dekker2012). All actors, organizations, and teams in a CIB struggle to survive in an environment characterized by real constraints, such as the amount of capital available, the number of customers they can reach, and the qualifications of available employees. Entrepreneurial success and failure are both emergent phenomena, and a thin line often separates these outcomes.

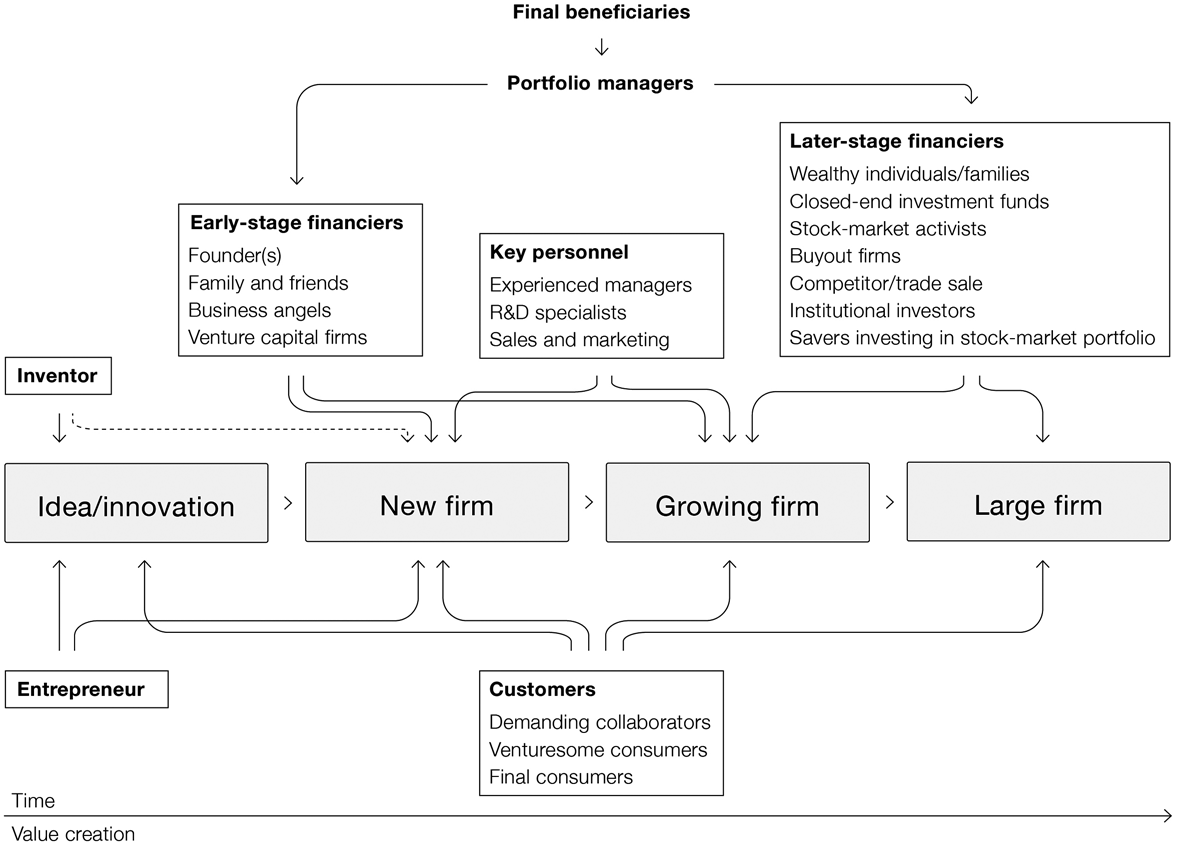

Figure 1 provides a schematic overview of the structure of skills that, according to the CIB perspective, are required for a new idea to transform into a growing firm that eventually reaches maturity (e.g. Fenn et al., Reference Fenn, Liang and Prowse1995; Gompers and Lerner, Reference Gompers and Lerner2001). Because the many simultaneous, non-linear interactions make it impossible to keep track of causal relationships (cf. McKelvey, Reference McKelvey2004b), the figure's purpose is simply to get a sense of the system's structure, embodied in the patterns of interactions (Cilliers, Reference Cilliers2000).

Figure 1. The collaborative innovation bloc – an overview.

The skills and resources required to take an idea from inception to commercial use must be mobilized by drawing upon several skill pools. For analytical purposes, we focus on six sufficiently distinct skills (for a more extensive treatment, see Elert and Henrekson, Reference Elert and Henrekson2019a) – entrepreneurs, inventors, key personnel, early-stage financiers, later-stage financiers, and customers – noting that the actors are themselves less important than the myriad of non-linear interactions between them (Cilliers, Reference Cilliers2000; Heylighen et al., Reference Heylighen, Cilliers and Gershenson2006).

Moreover, most CIBs are subject to an entanglement between the economic and political realms. In some instances, political appointees and state-owned firms are big players in a CIB (though they exert influence rather than control; Wagner, Reference Wagner2016), e.g. as important customers or financiers. The political sphere also has an indirect yet crucial effect on CIBs, in that politically instituted rules and regulations affect the strength of interactions between the different actor categories, their incentives to acquire and use skills, and ultimately the quality of the collaborations that come about.Footnote 3

Some phenomena within CIBs are sufficiently common to qualify as regularities. Entrepreneurs are regularly the prime movers: most ideas and inventions originate with them or with inventors (Baumol, Reference Baumol2005). To commercialize the ideas, they usually create new collaborative teams, searching for and attracting the skills they perceive to be necessary to realize their projects. In this role, entrepreneurs benefit from the skill pools in existing CIBs but also create new blocs and help existing CIBs evolve when necessary. If their innovations are sufficiently disruptive, they can also help cause the demise of existing CIBs (Beltagui et al., Reference Beltagui, Rosli and Candi2020).

The innovative process frequently begins when an entrepreneur identifies and attempts to develop a potential opportunity into a successfully commercialized innovation together with an inventor and a small number of key personnel.Footnote 4 Financing is critical in this uncertain, experimental stage. Early-stage financiers usually propel the project into a scale-up phase, during which the conjectured entrepreneurial profits can be realized (assuming the project reaches this point). Venture capital (VC) firms can, at least partly, transform non-calculable uncertainty into risk-taking by concurrently investing in a large number of young firms. By contrast, entrepreneurs typically invest all their human capital and most, if not all, of their financial assets in their venture, thus being unable to mitigate any uncertainty through diversification (Knight, Reference Knight1921).

To scale up the business to a full-grown firm, the entrepreneur also requires more key personnel that are permitted to act upon the knowledge only they possess to promote intra-firm discoveries (Foss, Reference Foss1997), allowing the firm to adapt in a hormesis-like manner, react quickly to change, and encourage innovation. Eventually, later-stage financiers assume responsibility for financing, which may be substantial. At this point, the innovation may have resulted in adaptive tensions (creative destruction) that drive the emergence of new firms (McKelvey, Reference McKelvey2004a) as perceptive competitors begin to imitate the innovation. The market grows through the operational scaling-up of activities resulting from differential growth and selection (Metcalfe, Reference Metcalfe1998). Ultimately, this may result in the emergence of a new industry (Chiles et al., Reference Chiles, Meyer and Hench2004).

Most ideas do not get this far – most business ideas and businesses fail (Hall and Woodward, Reference Hall and Woodward2010). While Taleb (Reference Taleb2012) views innovation as inherently antifragile, he also sees the vulnerability of every startup as necessary for the economy to be antifragile. A CIB will likely remain antifragile as long as most failures occur early, which has ramifications for what type of financing is required. In addition to financing, business angels and VC firms perform important screening functions and contribute management and market expertise. Such non-financial value appears to a be a main driver of the better performance of firms backed by early-stage financiers (Croce et al., Reference Croce, Martí and Murtinu2013; Landström and Mason, Reference Landström and Mason2016). Evidence suggests that buyout firms and other later-stage financiers provide similar skill-transfers at later stages (Bloom et al., Reference Bloom, Sadun, Van Reenen, Gurung and Lerner2009; Tåg, Reference Tåg and Cumming2012).

Moreover, the ideas that are eventually commercialized may differ substantially from the idea that provided the igniting spark. Because innovations drift, one needs flaneur-like abilities to keep capturing the opportunities that arise (Taleb, Reference Taleb2012). Especially in the early stages, customers acting as demanding collaborators may be essential sources of information and offer critical inputs and feedback that shape emerging innovations (Bhidé, Reference Bhidé2008; von Hippel et al., Reference von Hippel, Ogawa and de Jong2011). Errors are ubiquitous in this process, but so are plan and error corrections, as actors find ways to cross technological, economic, social, and institutional hurdles through trial and error and learning by doing, guided throughout this search by markets and prices.

When are CIBs antifragile?

Whereas a robust economy is simply able to endure a macroeconomic shock, an antifragile economy becomes stronger. If the economy harbors multiple CIBs, many of which are robust or antifragile, this supersystem will likely be antifragile. Although some CIBs will inevitably suffer or fail, the overall system of CIBs should be strengthened. While an antifragile CIB permits plenty of trial and error and constant bottom-up tinkering, its aggregate result involves the joint mitigation of two errors (Eliasson, Reference Eliasson2000): allowing failed projects to survive for too long and rejecting winners.

Taken together, a number of heuristics make it possible to assess whether a CIB is antifragile. First, a core diagnostic to determine whether a CIB or a sector is fragile is the way it is financed. Taleb (Reference Taleb2012: 235) views debt as fragile and equity as robust and VC as antifragile because it spreads ‘attempts in as large a number of trials as possible’. This is consistent with the view that ‘skin in the game’ is necessary if a CIB is to have the potential of being antifragile – actors who benefit from the upside of success and suffer the downside of failure have sound incentives. Incentives will be even more conducive to antifragility if they are structured in an optionality manner, offering a payoff structure with large, open-ended upside and limited, known downside.

Collaboration can, in and of itself, become an antifragile phenomenon because it has an ‘explosive upside, what is mathematically called a superadditive function’ (Taleb, Reference Taleb2012: 238; cf. Baumol, Reference Baumol2005). Whether these effects will materialize in a CIB depends on who is collaborating and to what degree, but diversity in skill pools increases the likelihood that entrepreneurs can find the skills they are looking for or replace a skill that turned out to be erroneous (Dekker, Reference Dekker2012).

Moreover, the organization of an antifragile CIB is not fixed but flexible and adaptive (Heylighen et al., Reference Heylighen, Cilliers and Gershenson2006). This flexibility is, in part, a function of a CIB's degree of centralization. A CIB with sufficient depth and breadth and a skill pool that encompasses a host of competent players will be decentralized by necessity. This adds antifragility because individual failures become less likely to propagate through the system, and may instead convey valuable lessons to actors that survive.

3. Institutions for antifragility: the Swedish case

CIBs are path dependent and sensitive to initial conditions. While entrepreneurs are prime movers who may contribute to the emergence of new CIBs, neither they nor policymakers can foresee the full consequences of a particular action or policy.Footnote 5 Nevertheless, policymakers are critical for the creation of an institutional environment that facilitates beneficial collaborations, thereby laying the foundation for antifragility.

Institutions attune human interaction, reduce uncertainty, and prevent free-riding and conflict (North, Reference North1990). It is noteworthy, therefore, that Taleb (Reference Taleb2012) considers many institutions to be inherently fragile. The fact that institutions constrain behavior to an accepted set of norms may be beneficial in 99 out of 100 instances, but the removal of free-thinkers and non-conformers may ultimately be what causes their undoing in the face of that rare shock. Here, it is essential to distinguish between designed and evolving institutional systems; top-down designs are inherently fragile, whereas bottom-up processes thrive under the right amount of stress and disorder.

In this section, we will use the Swedish reform experience since the 1970 to highlight a set of institutional preconditions that are necessary if an individual CIB, and indeed the economy as a whole, is to have a reasonable likelihood of achieving antifragility. While Sweden is a country with which we are highly familiar, it is also an interesting case as it has gone from being a paragon of socialist policies in the 1970s to becoming a leader in terms of privatization and deregulation in the modern era. Highlighting some of these key developments and their effects for the development of CIBs and economic progress more generally is thus worthwhile.

An early study shows that 80 of 100 significant Swedish innovations emanated from large firms (Granstrand and Alänge, Reference Granstrand and Alänge1995), but more recent results from Sandström (Reference Sandström2014) show that while 45% of the most important innovations came from incumbent firms, as many as 35% originated from individual inventor-entrepreneurs who started firms. Moreover, Sweden in the late 2010s was second only to Silicon Valley in terms of unicorns (multi-billion dollar tech companies) per capita (Lindmark Frier, Reference Lindmark Frier2018). This shift away from the historical large/old-firm dominance in Swedish innovation can be better understood by focusing on the development of the institutional conditions shaping Swedish CIBs.

Private–public entanglement

CIB activity does not take place in a political vacuum; rather, rules and regulations are of paramount importance, as is the presence of CIB actors who may, in one way or another, be considered ‘public’. Acknowledging this fact is crucial, given that a central segment of many advanced economies is heavily regulated or even monopolized by the public sector, namely the provision of private good social services such as healthcare, care of children and the elderly, and education (Andersen, Reference Andersen2008; Henrekson and Johansson, Reference Henrekson and Johansson2009). The extent and nature of government involvement can differ substantially, but if the government monopolizes both production and financing, the room for any of the CIB actors/skills to play a role will be severely curtailed. As a result, CIBs with the requisite breadth and width to become antifragile cannot emerge. The same is effectively the case when the government ‘only’ monopolizes production.

As shown in Section 2, thriving CIBs need to be characterized by a variety of actors with requisite skills and skin in the game. In practice, this entails free private provision of goods and services and private financing. Only then can the incentives be harmonized for all CIB actors. Thus, even when private production is allowed but the government remains the sole buyer of goods and services, CIB development may suffer for two core reasons.

First, because it makes the government a monopsonist on behalf of the taxpayer/citizen, which hampers the crucial function of (large and small) consumers in the CIB. When a certain service or good that is free of charge can only be offered by the provider commissioned by the government, the consumer's opportunities to act in a competent manner is severely limited. Conversely, the service provider typically has a limited scope for acting entrepreneurially by offering and charging for additional services on top of what is granted through the tax-financed system.

Second, a common pattern is that the government rather than prohibiting private provision of services simply crowds out private producers by failing to level the playing field in markets such as healthcare and non-mandatory schooling. This usually occurs because the public sector offers the service free of charge, financed through taxes combined with the barring of any subsidies to customers when buying from a private provider.

In summary, a mix of public financing and private provision does not preclude CIBs, but they are likely to be insufficiently coalesced to become antifragile. Still, permitting private provision is better than not doing so. Indeed, it has been shown that opening previously monopolized markets to private providers has led to impressive performance of high-growth firms suggesting that there is a large untapped potential for this in sectors such as healthcare, education, and care of children and the elderly (Andersson et al., Reference Andersson, Jordahl and Josephson2019). Sweden offers several illustrative examples in this respect. One example is the voucher system for school choice that was introduced in Sweden in the early 1990s, which paved the way for several high-growth firms in the area. At about the same time, local and regional governments began to outsource healthcare, spawning a number of high-growth firms, some of which have become multinational (Blix and Jordahl, Reference Blix and Jordahl2020).

Rule of law and protection of private property

The rule of law and property rights protection are fundamental institutions to achieve an economic system that safeguards the accomplishments of the past (limited downside) while keeping the door open for beneficial change (unlimited upside). Conversely, deficient rule of law and weak property rights protection within a country cause more uncertainty than necessary, discouraging entrepreneurs and jeopardizing the very collaborations that compose a CIB. Flaws in these fundamental institutions explain why many countries lack all but the most fragile of CIBs.Footnote 6 Nevertheless, economic history shows that private property is in many ways a function of technology and norms (Christiansen and Gothberg, Reference Christiansen, Gothberg, Anderson and Hill2001; Pagano, Reference Pagano2011). As Wagner (Reference Wagner2016: 48) puts it, property rights are just settled quarrels, ‘settled for now anyway’. There may even be a value to property rights continually being challenged and renegotiated – such stressors can improve the property system as a whole.

Today, Sweden ranks in the top among advanced countries where the protection of private property is concerned (Levy-Carciente, Reference Levy-Carciente2019) but the situation could have been very different. During the 1970s, Sweden's blue-collar workers' trade union, LO, pushed the government to take legislative measures aimed at giving labor direct influence on corporate decision making, including explicit demands for increased collective ownership. LO presented a plan for an inexorable gradual transfer of ownership from private hands to collective ‘wage-earner funds’ of all firms with more than 50 employees to wage earners as a collective group (Meidner, Reference Meidner1978). Firms should be obligated to issue new shares to the wage-earner funds corresponding to a value of 20% of the profits. Eventually, voting rights should reside in bodies controlled by the national unions but including representatives of other interests in society (Henrekson and Jakobsson, Reference Henrekson and Jakobsson2001).

The wage-earner fund proposals met unprecedented opposition from firm owners, and the original proposal never gained full acceptance within the Social Democratic Party. The funds eventually introduced in 1984 were a considerably diluted version of the original proposal (Henrekson and Jakobsson, Reference Henrekson and Jakobsson2001: 352–354; Lindbeck, Reference Lindbeck1997). The actual funds were financed by a 0.2% pay-roll tax and a tax on real profits, which added approximately five percentage points to the formal tax rate (Agell et al., Reference Agell, Englund and Södersten1998), and the build-up of the funds was restricted to 7 years. The funds were abolished in 1992 by the then non-socialist government. The ramifications for Sweden's CIBs from the introduction of a fundamental bottleneck as the more stringent version of the funds likely would have been vast. While the wage-earners funds are unique to the Swedish experience, threats to private property and the dissolution of the profit motive are a core reason why many countries or sectors fail to see the emergence of CIBs with antifragile potential.

Taxation

An antifragile tax system should acknowledge the fact that the future is radically uncertain by promoting a level playing field that does not steer the flow of labor, capital, and knowledge away from innovative ventures, capping their upside. However, tax structures almost invariably favor debt over equity financing (de Mooij and Devereux, Reference de Mooij and Devereux2016), a fact that (unintentionally) biases the flow of financial resources away from innovative entrepreneurial firms and impedes the workings of CIBs. In addition to neutrality vis-à-vis owner categories, sources of finance, and types of economic activities, the system should be simple, transparent, and characterized by as few exceptions and loopholes as possible to limit the scope for unproductive or destructive activities (Baumol, Reference Baumol1990).

Sweden stands out as one of the countries in the OECD with the highest tax pressure. While we touch upon some important developments in this area when discussing savings and finance below (Section ‘Savings and financing’), we focus on a single, but very important area of the tax code here, namely the fiscal treatment of stock options. Options and optionality are, after all, quintessential to most antifragile strategies. As a promise of a future ownership stake, employee stock options can be used to give key personnel a convex payoff structure, encouraging them to supply key competencies to a young firm short on cash. However, the value of options – and their effectiveness as an incentive mechanism – greatly depends on the option tax code, notably on whether employees can defer the tax liability until they sell the stocks and whether they are taxed at a low capital gains tax rate at this point (Gilson and Schizer, Reference Gilson and Schizer2003). A low effective taxation of gains on employee stock options appears to be necessary to develop a large VC sector, with this crucial early financing sector remaining small in most countries where the tax rate on stock options is high (Henrekson and Sanandaji, Reference Henrekson and Sanandaji2018a).

In Sweden, the use of stock options is highly penalized by the tax system, since gains on options are taxed as wage income when the stock options are tied to employment in the firm (Henrekson, Reference Henrekson2005). This amounts to a marginal tax of some 65% of the gain, and many companies have therefore avoided options (Sandström et al., Reference Sandström, Wennberg and Karlson2019). Following several investigations and referrals, the Swedish tax rate was recently reduced for up to four people in young companies with less than 50 employees. It is too early to evaluate the effects of this reform. While the size of Sweden's VC industry relative to GDP compares fairly well to other countries in the European Union, it is still far smaller than in countries such as the United States and Hong Kong (Armour and Cumming, Reference Armour and Cumming2006; Lerner and Tåg, Reference Lerner and Tåg2013). Possibly as a consequence, US firms grow faster than their European counterparts, which are more likely to remain small (Henrekson and Sanandaji, Reference Henrekson and Sanandaji2018b; Scarpetta et al., Reference Scarpetta, Hemmings, Tressel and Woo2002). Sweden's reduction in the tax on stock options may prove to be an important first step to remove an arguably important bottleneck presently hampering the workings of Swedish CIBs.

Savings and financing

Neutrality is also a core aspect of an antifragile savings policy, which, to be sure, is entangled with taxation. Here, the volume is generally not the problem. Europe, for example, has no shortage of savings (OECD, 2019) – the allocation rather than the volume of savings is what matters for entrepreneurial activity. In fact, the tax system's tendency to bias financing toward debt is exacerbated by strong legal creditor protection that reduces risks for creditors, as such risks would otherwise justify a higher risk premium on debt financing. This puts entrepreneurs at a disadvantage when competing for debt financing relative to homeowners, large multinationals, governments, and real-estate investors.

In addition to reducing the fiscal advantages enjoyed by debt over equity financing, many countries must address the fact that most financial resources are intermediated through universal banks and institutional investors who prefer large, low-risk, debt-based assets and blue-chip stock over small, risky equity-based investments (Westerhuis, Reference Westerhuis, Cassis, Schenk and Grossman2016). While one can only speculate as to the number of fundamentally sound entrepreneurial projects that never got off the ground because the financial playing field was tilted against them, Sweden's post-war experience in this respect is illuminating. Notably, the supply of later-stage financiers was stymied by economic policy until the 1980s. Real effective taxation on individual ownership of financial assets typically exceeded 100%, and corporate taxation strongly favored debt financing and financing through retained earnings (Du Rietz et al., Reference Du Rietz, Johansson, Stenkula, Henrekson and Stenkula2015). Moreover, the system strictly rationed bank lending to the corporate sector, obliged financial institutions to invest most of their assets in bonds and largely barred foreign investors from investing in Swedish stocks (Jonung, Reference Jonung, Bordo and Capie1994). Exit markets effectively disappeared, and thus, there were virtually no new initial public offerings or new equity issues by existing firms (Althaimer, Reference Althaimer and Hägg1988). This resulted in a low rate of new firm formation and very few new firms that grew large. By contrast, big corporations' share of the business sector grew exceptionally large compared to other countries, and the bulk of innovations emanated from large firms (Granstrand and Alänge, Reference Granstrand and Alänge1995).

Prompted by sluggish economic performance compared to most other industrialized countries (Lindbeck, Reference Lindbeck1997), Swedish policymakers gradually dismantled the rules and regulations that had hampered later-stage financing. Financial markets were deregulated, and foreign exchange controls and restrictions on foreign ownership were lifted. Pension funds, including the large government pension funds, were allowed to invest as much as they wanted in the public stock market. A major tax reform more than halved the personal tax rate on capital income, and the new corporate tax code only marginally favored retained earnings. The effects were dramatic. Stock market capitalization skyrocketed, there was a record number of newly listed firms (Holmén and Högfeldt, Reference Holmén and Högfeldt2005), many new firms grew from small to large (Heyman et al., Reference Heyman, Norbäck, Persson and Andersson2019), and Sweden came to have one of Europe's largest buyout sectors, enabling successful spinouts of numerous divisions from old incumbents (Tåg, Reference Tåg and Cumming2012). This increased diversity in the economy has had large ramifications for Swedish CIBs, likely ushering in more short-term turbulence but a greater long-term antifragility.

Contestable markets

CIBs are experimental at their core, which makes frequent failure inevitable and sometimes even desirable. Unsuccessful projects are not necessarily a waste of resources; instead, firm failure provides economic agents valuable information on a business model's viability. This ‘process of learning by trial and error … must involve a constant disappointment of some expectations’ (Hayek, Reference Hayek1976: 124). As a stressor enabling improvement, learning by failure is thus of paramount importance for both the entrepreneur and society (Harford, Reference Harford2011). An antifragile institutional system is one where entry and exit are easy and where ‘fear of failure’ does not prevent new entrants from challenging the status quo.

Indeed, empirical research shows that a higher turnover of companies leads to a more competitive economy both nationally and regionally, boosting the number of high-growth firms (Bartelsman et al., Reference Bartelsman, Scarpetta and Schivardi2005; Brown et al., Reference Brown, Haltiwanger and Lane2008; Caballero, Reference Caballero2007). This regularity appears to be true for Sweden as well (Heyman et al., Reference Heyman, Norbäck, Persson and Andersson2019; Nyström, Reference Nyström2009). A prerequisite is that entry and expansion as well as contraction and exit are facilitated, so that new and expanding firms can attract resources from inefficient firms in CIBs.

Regulations that raise entry barriers are an important bottleneck for CIBs in many parts of the world. Nonetheless, in recent decades, developed countries have implemented extensive deregulations of product markets aimed at increasing contestability and providing more opportunities for private entrepreneurship, e.g. in telecommunications, transportation, and financial services. Sweden has been at the forefront of many of these processes of deregulation, in no small measure because of entrepreneurial initiative. This is true for the abolishment of the telecom, television, and stock market monopolies (Jörnmark, Reference Jörnmark2013). In the past decade, however, Sweden has seen little additional deregulation of product markets (Heyman et al., Reference Heyman, Norbäck, Persson and Andersson2019). The Swedish Federation of Business Owners (Företagarna, 2017) report that their members spend 1 day a week on government-mandated tasks, and the work environment area encompasses 2,000 rules that entrepreneurs need to obey. Because such rules have a disproportionate effect on small businesses, they likely reduce the supply of entrepreneurs in CIBs.

The other side of the turbulence coin is also important. Business failures can stimulate firm founding by opening new opportunities, enabling knowledge spillovers, and making additional resources available (Hiatt et al., Reference Hiatt, Sine and Tolbert2009; Hoetker and Agarwal, Reference Hoetker and Agarwal2007). Moreover, a restructured venture with new management or a different firm can often recycle and improve upon the knowledge and ideas from failed projects, laying the foundation for future success. Indeed, more lenient bankruptcy laws are associated with higher rates of venture formation (Fan and White, Reference Fan and White2003; Peng et al., Reference Peng, Yamakawa and Lee2009). In a longitudinal study of the connectedness of barriers to failure, venture growth, and elite entrepreneurs, Eberhardt et al. (Reference Eberhart, Eesley and Eisenhardt2017: 93) even find that ‘lowering barriers to failure via lenient bankruptcy laws encourages more capable – and not just more – entrepreneurs to start firms’. Of course, failure also implies that people suffer, psychologically and financially, and such damage should be minimized. Thus, it is reasonable to institute relatively generous bankruptcy laws and insolvency regulations with provision for discharge clauses, the postponement of debt service and repayment, and the possibility of restructuring.

The labor market and social security

Faced with radical uncertainty, an antifragile institutional system should not steer the flow of labor, capital, and knowledge away from innovative, entrepreneurial ventures, but this is what social security systems and labor market regulations in many countries do. While new ventures are free to offer jobs and recruit workers as they see fit, they do not compete for the talent they need on a level playing field with large firms. This occurs because employing labor typically comes with responsibilities that go beyond paying a competitive wage – responsibilities that may be particularly hard for new ventures to shoulder. Access to key personnel then becomes more constrained, to the detriment of the workings of CIBs.

The labor market has been identified as an area where Sweden has great potential for improvement (World Bank, 2009). In fact, Sweden stands out for its substantial liberalization of temporary employment contracts over the past 20 years, and the fact that Sweden is a top-performing EU-country in terms of employment arguably has to do with the high share of temporary employment (OECD, 2016). Nonetheless, a large wedge between the strictness of temporary and permanent contracts has given rise to dual labor markets, which, however unintentionally, tilt the playing field against entrepreneurial ventures. The greater the disparity between temporary and permanent contracts, the greater the opportunity cost for an employee on a permanent contract of accepting a job in a high-risk firm (Elert et al., Reference Elert, Henrekson and Sanders2019).

As for social security, the incentives encouraging activation, mobility, and risk-taking are best served by universal insurance systems that disregard labor market status, employment history, or attachment. These institutions should ensure portability of tenure rights and pension plans as well as a full decoupling of health insurance from current employers. Such measures would avoid punishing individuals who leave secure, tenured employment positions and pursue entrepreneurial projects, whether as entrepreneurs or as employees in entrepreneurial startups. This would give these people a limited and calculable downside from leaving their tenured position, and the resulting increase in labor mobility would likely make affected CIBs more antifragile.

A role model here is Denmark, whose flexicurity system combines generous welfare protection and opportunities for retraining with weak job security mandates (Andersen, Reference Andersen and Werding2005). Danish employees lose little when they switch employers or labor market status, making Danish talent available on more equal terms for entrepreneurial firms (Bredgaard, Reference Bredgaard, Stone and Arthurs2013). By contrast, a Swedish employee who voluntarily gives up a tenured position for self-employment typically has no more security than what is provided by (means-tested) social welfare, and this presupposes that the individual depletes all her own assets. The construction of the public income insurance systems in combination with labor security legislation tend to penalize individuals who assume entrepreneurial risk. Thus, the opportunity cost of giving up a tenured position in Sweden is substantially higher than in Denmark (Elert et al., Reference Elert, Henrekson and Sanders2019). Lowering it would foster the supply of entrepreneurs and key personnel in Swedish CIBs, and likely make them more antifragile.

Human capital

The absence of skilled employees is a common bottleneck in CIBs. In Sweden, a lack of employees with relevant skills has been identified as a growth obstacle for rapidly growing firms (Demir et al., Reference Demir, Wennberg and McKelvie2017; Wennberg et al., Reference Wennberg, Lindberg and Fergin2013), and the problem seems to accrue to firms in the metal and engineering industries (World Bank, 2014), as well as in the IT and telecom industries (Confederation of Swedish Enterprise, 2016). Matching of labor demand and labor supply has also deteriorated for several years, with fewer and fewer employees having jobs that correspond to their educational competence (Le Grand et al., Reference Le Grand, Szulkin, Tibajev and Tåhlin2013). These shortcomings hamper the workings of Swedish CIBs, making them less antifragile. While aforementioned factors such as labor market rigidities help explain the presence of this institutional bottleneck, the quality, efficiency, and relevance of education emerge as a core institutional factor to address this.

As measured in internationally comparable tests of pupils' abilities and skills, human capital is of crucial importance for economic growth (Hanushek and Woessmann, Reference Hanushek and Woessmann2015). Combining a carefully sequenced curriculum organized around subject disciplines with external exit exams (Hirsch, Reference Hirsch2016; Woessmann, Reference Woessmann2018) is probably a good way to standardize a body of knowledge that everyone, including the craziest freethinker, can benefit from without becoming too neutered. Beyond that, however, the radical uncertainty of the future means that we cannot predict what skills and knowledge future generations require to thrive.

As a case in point: while the performance of American pupils on internationally comparable tests is inferior to that of many European and Asian countries, the USA is universally considered the superior venue for Ph.D. training. This ‘paradox’ may occur because ‘the educational approaches that are most effective in providing mastery of the already extant body of intellectual materials actually tend to handicap a student's ability to “think outside the box” and thus discourage unorthodox ideas and breakthrough approaches and results’ (Baumol, Reference Baumol2005: 7). Fortunato (Reference Fortunato2017: 184) raises the point that standardized practices at every educational level risk yielding fragility. In his view, value differences and knowledge diversity are desirable in education precisely because they introduce instability; this helps the educational system become increasingly antifragile and able to cope with systemic shocks. While he considers imposing standards to bring up the bottom end ‘a noble goal’, he is wary of isolating and eschewing ‘those productive rebels who might simply see the world differently, question the current paradigm, and create situations that are, let's face it, very hard to measure indeed’. Nonetheless, Swedish empirical evidence suggests that it is possible to educate and train successful entrepreneurs when that education and training is practically oriented and centered on experiencing every stage of the entrepreneurial process, from birth to death (see, e.g. Elert et al., Reference Elert, Andersson and Wennberg2015). This rhymes well with Lerner's (Reference Lerner2012: 12) assessment that ‘ensuring that business and technology students are exposed to entrepreneurship classes will allow them to make more informed decisions; and creating training opportunities in entrepreneurship for midcareer professionals is also likely to pay dividends’.

Summary and conclusions

Swedish CIBs are in better shape now than they were in the 1970s, and the economy has seen a number of reforms that has made it more antifragile. As our account suggests, firms and entrepreneurs sometimes led the way in establishing what essentially became new CIBs. This highlights the fact that institutional change need not be top-down. Moreover, whether institutions evolve and become flexible depends to a large extent on entrepreneurs and the presence of entrepreneurially minded rule-breakers. Such individuals are less constrained by the institutional status quo than others and affect this status quo in a host of ways (Elert and Henrekson, Reference Elert and Henrekson2017) – in Taleb's parlance, such persons are stressors that can help purge the system of obsolete rules and enable the evolution of more appropriate rules. As such, they are likely critical to overcoming institutional lock-in – the stifling of new ideas beyond the realm of current institutional constructions (Liebowitz and Margolis, Reference Liebowitz and Margolis1995).

4. Discussion and conclusions

Antifragility is a desirable property of an economic system. By tracing the outlines of the CIB perspective, we have tried to assess under what conditions such meso-level phenomena are antifragile and how a healthy population of CIBs can help create antifragile conditions at the macro level. Policies that enable the emergence of such a beneficial situation are generally indirect, targeting the institutional underpinnings of CIBs rather than attempting to create CIBs and clusters from the top down. Drawing on the Swedish experience, we highlighted seven institutional areas of particular importance for antifragility.

First, though all industries are subject to politically determined institutions, the direct involvement of public actors and private–public entanglement should be limited due to its distortive impacts on CIB activity. Second, the rule of law and property rights protection should be sufficiently stable to protect people's expectations but permit innovation and be sufficiently flexible to evolve when challenged by stressors. Third, the tax system should avoid artificially skewing resources in a particular direction and be characterized by neutrality vis-à-vis owner categories, sources of finance, and types of economic activities. Fourth, the savings system should not only channel available savings into the reproduction and growth of the existing capital stock but also make funds available to new, innovative ventures. Fifth, markets should be contestable, with low entry and exit barriers making it possible for newcomers to challenge the status quo in a stressor-like manner. Sixth, the labor market and social security system should be characterized by flexicurity and avoid punishing individuals who leave secure, tenured employment positions to pursue entrepreneurial projects. Finally, the educational system should provide everyone with a robust and stable knowledge base without isolating or eschewing free-thinkers, rebels, and other people of an entrepreneurial mindset.

To be sure, complete and pervasive antifragility on all societal levels is neither possible nor desirable. At the micro level, most business ideas will continue to fail, and at the meso level, CIBs will always move along the fragile-antifragile continuum, with new CIBs emerging and failing or emerging and becoming antifragile, whereas others go from being antifragile to becoming robust or fragile. This continuous process produces antifragility at the macro level.

Future studies could move in several directions. Importantly, while it is elucidating to examine thriving CIB ecologies as Silicon Valley, it is also helpful to identify CIBs that had the potential to become antifragile but never did so. Why was that? Which actors were missing? What facets of the institutional setup prevented the emergence of an antifragile CIB? And in instances when a CIB went from being antifragile to fragile, what were the reasons for this development? Such questions are probably best answered by conducting case studies or comparative studies focusing on different industries within a country or similar industries in different countries. As a next step, researchers should ask whether and to what extent findings related to successful CIBs embedded in a specific context can be used to guide policy in other contexts. Taking institutional arguments seriously means acknowledging that institutional complementarities exist and that more than one institutional constellation can enable entrepreneurship and antifragility.

Acknowledgements

We are grateful for useful comments and suggestions from Kurt Dopfer. Financial support from the Jan Wallander and Tom Hedelius Research Foundation and the Marianne and Marcus Wallenberg Foundation is gratefully acknowledged.