Do economic motives always dominate, as many economists believe, or do they sometimes take second place to other motives, including a perception of the common good? The campaigns in the United States to sell government bonds during World War I provide a unique opportunity to test the primacy of economic motives. If there is any time when people are willing to make personal sacrifices for the common good, it is during a major war. It is therefore worth knowing how effective the bond campaigns really were. What price, to put it somewhat differently, were investors willing to pay to help make the ‘world safe for democracy’? Historians have generally viewed the campaigns as successful. Indeed, the apparent success of emotional appeals during the war convinced many observers, such as the influential columnist Walter Lippmann, of the basic irrationality of the public (Vaughn Reference Vaughn1980, p. 191). Historians also see the effort to sell bonds to the middle and working classes as a uniquely successful effort that, unfortunately, helped prepare the way for the stock market boom and crash of the 1920s by teaching people how to invest in stocks and bonds. In short, the campaign to sell the Liberty bonds provides a unique natural experiment in which to examine the possibilities and the limits of non-pecuniary social pressures.

I

When World War I began the Secretary of the Treasury, William Gibbs McAdoo, turned to the record of Lincoln's Secretary of the Treasury, Samuel Chase, for lessons on how to finance a major war.Footnote 1 In the end, however, McAdoo partially rejected Chase's methods. McAdoo believed that Chase had made a major error in turning over the marketing of the government's securities to a private firm, Jay Cooke and Company. McAdoo would make no such mistake. He expected bankers, insurance executives, and ordinary citizens to donate their services to the government. Moreover, while he acknowledged that Jay Cooke and Company had succeeded to some degree in marketing bonds to middle-class Americans, McAdoo thought that he could push Cooke's policy much further. Britain and Germany had already undertaken noisy ‘drives’ aimed at selling bonds, especially to middle-class and working-class investors (Noyes Reference Noyes1926, pp. 181-2). And McAdoo enthusiastically adopted the same strategy.

McAdoo crisscrossed the country on an exhausting speaking tour urging the public to express its support for the war by buying bonds, and he arranged rallies at which movie stars such as Douglas Fairbanks, Mary Pickford and Charlie Chaplin exhorted the crowd to buy bonds (Kennedy Reference Kennedy2004, p. 105). The campaign for the first Liberty bond had to be put together quickly; it nevertheless included many of the elements that would characterize later campaigns including the famous histrionic posters. One of the first (a million were printed) showed the Goddess of Liberty pointing at a passerby and saying ‘You buy a Liberty Bond, lest I perish’ (St Clair Reference St Clair1919, p. 42). The machinery for marketing the bonds, however, improved from campaign to campaign. The campaign for the second Liberty bond made a more determined effort to market the bonds in small towns throughout the country, rather than in the big cities of the East Coast, the focus of the first campaign. During the third Liberty loan campaign some new tactics were employed. For example, stars were awarded to towns that doubled their bond quota. Carthage Ohio was the leader with 47 stars (St Clair Reference St Clair1919, p. 61).

The campaign for the fourth Liberty bond was more subdued in tone, perhaps because the flu epidemic had begun and the German peace overtures suggested that the war would soon be over. But the showmanship was still there. In the closing week of the campaign for the fourth loan $4,800,000 was raised from an audience at Carnegie Hall who heard Enzo Caruso and other stars perform (Noyes Reference Noyes1926, p. 185). The campaign for the postwar Victory loan had to be different. The message was now money was needed to ‘finish the job’.

It wasn't just stars. Everyone who was able was asked to sell bonds. The Boy Scouts were enlisted under the slogan ‘Every Scout to Save a Soldier’. The Scouts went from door to door soliciting promises to buy bonds. War savings stamps costing $.25 and War Savings Certificates worth $5.00 at maturity were created to provide a way for people with low incomes to participate. (More on this in Section v.) And the Scouts distributed red cards on which people could offer to buy the savings certificates.

Even the names of the bonds were chosen to emphasize patriotism. While one of the most popular Civil War issues was known prosaically as the 5-20 (callable after 5 years, redeemed at 20), the World War I debt consisted of four ‘Liberty loans’, and a final ‘Victory loan’ after the armistice. The point of the campaigns was to create strong social pressures to buy bonds. When the Comptroller of the Currency learned that a national bank charter had been granted to six applicants from a ‘certain western state’ who had between them bought only $200 worth of Liberty bonds, the charter was revoked (Whittlesey Reference Whittlesey1950, p.175). There also were a few cases in which German Americans who did not wish to buy bonds were coerced into doing so.

Much of the campaign to sell the Liberty bonds was developed by the government's Committee on Public Information created on 13 April 1917. Its Division of Pictorial Publicity, created on 22 April, produced many of the famous Liberty bond posters. The division was headed by Charles Dana Gibson whose ‘Gibson's Girls’ had become American icons. Gibson explicitly rejected an appeal to the material side of American life and believed that ‘war art “must appeal to the heart”’ (Vaughn Reference Vaughn1980, p. 150).

As the war wore on the emphasis in the posters shifted toward negative appeals. The campaign to sell the Fourth Liberty loan, although making some appeals to financial self-interest, explicitly emphasized the bestiality of the Germans. It is not always clear which posters were put out by official government agencies. But one poster issued by the Division of Advertising of the Committee for Public Information for the Fourth loan showed German soldiers abusing women and children in Belgium and argued that ‘Such a civilization is not fit to live’ (Vaughn Reference Vaughn1980, p. 165). Another official poster for the Fourth loan, ‘Remember Belgium’, showed a German soldier bayoneting a defenceless woman. The caption explained that ‘You can floor an Uhlan [German and Austrian cavalry] with lead, but only gold can floor Berlin’ and that ‘You can overwhelm the mad Wolf of Wilhelmstrasse with the crushing wrath of billions’ (Vaughn Reference Vaughn1980, p. 166).

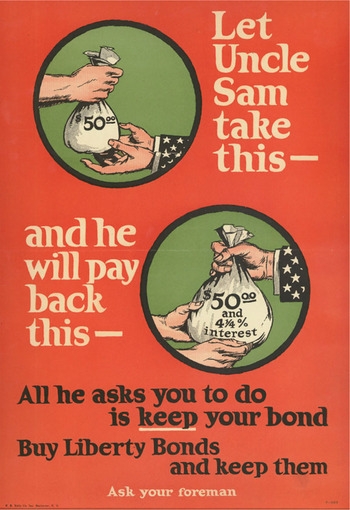

Four examples of the famous Liberty loan posters are reproduced as Figures 1–4. The first three rely on emotional appeals. Perhaps it was anti-German posters that Senator Harding had in mind when he criticized the Liberty loan campaign as ‘hysterical and unseemly’.Footnote 2 The fourth poster, on the other hand, shows an appeal to self-interest.

Figure 1. Louis Raemaekers, ‘After a Zeppelin raid in London: “But Mother Had Done Nothing Wrong, Had She, Daddy?” Prevent this in New York: Invest in Liberty Bonds’, 19” × 12”. From the Rutgers University Library Collection of Liberty Bond Posters, accessed 5 October 2005

Figure 2. Louis Raemaekers, ‘Will you be ready to-morrow to make munitions for Germany? If not: invest in Liberty bonds to-day’ [1917?], 19” × 12”. From the Rutgers University collection of Liberty Bond Posters, accessed 5 October 2005

Figure 3. F. Strathmann, ‘Beat back the Hun with Liberty Bonds’. Maurice F.V. Doll, ‘The Poster War: Allied Propaganda of the First World War’. The Provincial Museum of Alberta, www.royalalbertamuseum.ca/vexhibit/warpost/english/home.htm, accessed 5 October 2005

Figure 4. Anonymous, ‘Let Uncle Sam take this – and he will pay back this – All he asks you to do is keep your bond: buy Liberty bonds and keep them: ask your foreman’ [1918], 17 ⅝” × 11 ¾”. From the Rutgers University Library Collection of Liberty Bond Posters

We are unlikely to witness anything like the Liberty bonds again. True, there was a brief flurry of interest in issuing war bonds after the 9/11 attacks. Both houses of Congress passed legislation that would have created ‘Freedom bonds’. The administration, however, although sympathetic with the sentiment behind the legislation, was opposed to issuing Freedom bonds because the United States was in a recession. Encouraging saving, the administration believed, would be counterproductive. The Treasury did inscribe a variation of its standard EE Savings Bonds as ‘Patriot bonds’.Footnote 3 But interest in Freedom bonds or Patriot bonds faded quickly.

II

To put the Liberty bonds and the campaigns to sell them in perspective, it is useful to recount the debate among economists and policy makers over how to finance the war. There were, as economists always say, three ways to finance the war – taxes, borrowing from the public and printing money.Footnote 4 There was agreement that printing money was wrong because it would produce inflation.Footnote 5 Printing money was at best a stopgap to be used until an appropriate means of finance could be put in place. But the choice between taxes and borrowing was far from obvious.

In 1917 economists were acutely aware that they were the heirs to a tradition, the ‘classical’ or ‘English’ tradition, which favored taxes over borrowing. As set out by David Hume (Reference Hume and Rotwein1970, pp. 91-2)Footnote 6 and Adam Smith (Reference Smith, Campbell and Skinner1979, pp. 919-20), the case for taxes was political rather than economic. Smith's splendid statement of the case against borrowing, in particular, is worth quoting:

The ordinary expense of the greater part of modern governments in time of peace being equal or nearly equal to their ordinary revenue, when war comes they are both unwilling and unable to increase their revenue in proportion to the increase of their expense. They are unwilling for fear of offending the people, who, by so great and so sudden an increase of taxes, would soon be disgusted with the war; and they are unable from not well knowing what taxes would be sufficient to produce the revenue wanted. The facility of borrowing delivers them from the embarrassment which this fear and inability would otherwise occasion. By means of borrowing they are enabled, with a very moderate increase of taxes, to raise, from year to year, money sufficient for carrying on the war, and by the practice of perpetually funding they are enabled, with the smallest possible increase of taxes, to raise annually the largest possible sum of money.

Smith then goes on to explain how bond-finance encourages war by hiding the true costs of war:

In great empires the people who live in the capital, and in the provinces remote from the scene of action, feel, many of them, scarce any inconveniency from the war; but enjoy, at their ease, the amusement of reading in the newspapers the exploits of their own fleets and armies. To them this amusement compensates the small difference between the taxes which they pay on account of the war, and those which they had been accustomed to pay in time of peace. They are commonly dissatisfied with the return of peace, which puts an end to their amusement, and to a thousand visionary hopes of conquest and national glory from a longer continuance of the war.

Subsequent economists in the classical school maintained the antipathy toward borrowing, although John Stuart Mill took a more moderate stance. Mill emphasized the dangers of borrowing, but thought that some borrowing would be acceptable. The interest rate would show whether borrowing had been held to a prudent level: an increase would be the sign that borrowing had reached an excessive level (Mill Reference Mill and Ashley1940, pp. 873-6).

On the eve of American entry into the war, Oliver M. W. Sprague – a professor at Harvard and one of America's leading monetary economists – was given the task of discussing the optimal means of financing a major war at the annual meetings of the American Economic Association. Sprague, following the classical tradition, made a strong case for taxation, although his arguments were ethical and economic rather than political. Borrowing, according to Sprague, was unjust:

The injustice of treating those who provide the funds for war more generously than those who risk life itself will not be questioned. Consider for a moment the contrast under the borrowing method of war finance of a soldier in receipt of an income of $2500 before a war and his neighbor who remains at home in continued receipt of a similar amount. The civilian reduces his expenditures in every possible way and subcribes a total of $4000 to war loans. He is rewarded with a high rate of interest to which his soldier neighbor must contribute his quota in higher taxes if he is fortunate enough to return from the front. (Sprague Reference Sprague1917, p. 204)

Would high taxes reduce output?

Taxation on this onerous scale [sufficient to finance a major war] would virtually eliminate the ordinary economic motives for effort and sacrifice. What would be the effect on production? There is no experience whatever on which to base a judgment. I venture to think, however, that no serious difficulties would be encountered when millions of men were fighting in the trenches in a great war in which a people believed that its vital interests were at stake. (Sprague Reference Sprague1917, p. 208)

In other words, Sprague recognized that high taxes might discourage effort, but thought that this effect could be offset during a war by patriotism. Four leading economists commented on Sprague's paper (Miller, Lutz, Lincoln, Urdahl and Sprague Reference Miller, Lutz, Lincoln, Urdahl and Sprague1917). In general, Sprague's discussants agreed that tax-finance was best. Miller, however, worried that relying entirely on taxes would weaken the ‘motive to industry’.Footnote 7

At an important conference held a few months later (and after the declaration of war and the passage of the War Revenue Act) one can find greater acceptance of borrowing. Edwin R. A. Seligman (Reference Seligman1918) thought that taxes should be raised, but that possible adverse effects on consumption and investment should be kept in mind. For Seligman financing 25 or 35 percent through taxes was about right. Even Sprague (Reference Sprague1918) recognized that the war was going to be financed mainly (perhaps 75 percent) by debt whatever he or other economists might say. But he still believed that it would have been better to finance it 75 percent by taxes. Greater reliance on taxes would have reduced consumption and speeded conversion.Footnote 8

The debates among the economists were echoed in other quarters. The socialists thought that all of the war could be financed by the appropriation of all incomes over $10,000 per year. The Wall Street Journal, on the other hand, advocated reducing the income tax exemption from $4,000 to $1,000. The Journal, moreover, thought that considerable reliance should be placed on borrowing. It was a matter of equity, but of a different sort from that invoked by Sprague: ‘It is not right that the present generation should bear the whole burden of a conflict fought for the freedom of our children's children.’Footnote 9

McAdoo rejected the extreme view that all of the war should be financed by taxes. He saw a tradeoff between taxes and bonds: excessive reliance on taxation would frighten the wealthy and reduce support for the war; excessive reliance on bonds would be inflationary. Given this tradeoff, the practical matter became one of naming the optimal percentage to be financed by each method. McAdoo, according to his Memoirs, initially thought that a 50–50 split was about right. J. P. Morgan, America's leading investment banker, when questioned by McAdoo, advised financing 20 percent through taxes. Later McAdoo thought that financing only 33 percent through taxes would do (McAdoo 1931).

Davis Rich Dewey (Reference Dewey1931, 506-7), an astute financial historian who experienced the debate at first hand, summed up the outcome this way:

Some indeed advocated a policy of ‘pay as you go’ and even proposed a conscription of wealth, if necessary to meet the war costs. Others favored a more equal division between taxes and loans. These views, however, did not prevail. There was fear of ‘frightening capital’ and arousing popular discontent which would retard the progress of military and naval plans. Although no exact ratio was formally adopted, there slowly developed an accepted conviction that taxation should provide at least one-third of the costs of the war.

As it turned out, about 25 percent of the war was financed through taxation.

When it came to practical details about what instruments to market and how to market them, the economists were less helpful, although they did offer some advice. Irving Fisher was perhaps the leading American economist of the day, certainly the best known today. Fisher (Reference Fisher1918) accepted the need for issuing bonds, and made three points about how patriotic citizens should respond to them. (1) People should buy them by reducing their own consumption, not by borrowing from banks. (2) People should hold them, and not resell them unless the need was strong. (3) It was important that poor people invest in bonds so that after the war we wouldn't be in the position of taxing the poor in order to pay the interest and principal on bonds owned by the rich. All of these points were stressed in the Liberty bond campaigns.

Arthur Cecil Pigou, who had succeeded Alfred Marshall at Cambridge, could be considered Britain's leading economist. After the war Pigou (1941 [Reference Pigou1921], 92-4) offered what he considered to be three decisive objections to allowing interest rates to increase in wartime. (1) Higher rates, in particular rates that rose above rates in enemy countries, might be seen as a sign of weakness. (2) Higher rates might not stimulate much additional savings, and in any case would store up problems for future finance ministers. (3) Higher rates, like loans themselves, might be viewed as inequitable, allowing the rich to ‘make a good thing out of war’. It seems likely that these concerns, although not derived from economists, explain the determined effort made in the United States and in Britain to keep rates low during the war.

IIIFootnote 10

There were four issues of Liberty bonds during the war and one issue of Victory bonds afterwards. Table 1 shows the amounts offered, the amounts purchased, the terms to maturity, the coupons on the bonds and other details. The Treasury specified amount to be offered to the public, the terms and the fixed price at which they would be offered. Then, on the particular day that had been set, the subscription books were opened and offers to purchase were taken. All of the issues were ‘oversubscribed’. That is, the public offered to buy more bonds than the Treasury had placed on sale.

Table 1. The properties of the Liberty bonds and the results of the campaigns

Sources: Dewey (Reference Dewey1931, pp. 502-10); Schultz and Caine (Reference Schultz and Caine1937, pp. 533-41); Gilbert (Reference Gilbert1970, passim); Garbade (Reference Garbade2012, p. 70); and New York Times, passim.

For the First Liberty loan the Treasury only filled orders up to the amount announced before the sale. In the sales of the second, third and fourth Liberty bonds, the Treasury filled part of the oversubscription as shown in Table 1. In the case of the Victory loan, the Treasury again only sold the amount set in advance.

This system allowed the Treasury to create public drives and use patriotism to whip up enthusiasm. Would the American people show their support for the war by buying all of the bonds offered and offering to buy even more? Each region of the country, to give a more specific example, was given a quota to purchase, creating a basis for regional competition. Which region would be the most patriotic and exceed its quota by the widest margin? A possible alternative was to sell bonds continuously. In other words, McAdoo could have opened the bond-selling window of the Treasury and urged the public to buy bonds and then kept the window open for the remainder of the war. This was the practice followed for short-term instruments in the United States, and for longer-term instruments in France. But continuous sales would have made it harder to get the public excited about buying the bonds.

The most controversial feature of the bonds was their exemption from income taxes. The first issue was exempt from both normal (peacetime) income taxes and from a wartime ‘surtax’ which had been added and would be, presumably, temporary. The exemption drew considerable criticism: the Wilson administration, nominally a progressive democratic administration, was raising taxes on the wealthy with one hand, and then creating a huge loophole for them with the other. The surtax exemption for the second and third bonds was therefore limited to the interest on the first $5,000.00 worth of bonds at face value. When it came to planning the fourth issue, however, concerns about finding a market led to backtracking. The limit to the exemption from the surtax was raised to $30,000.00, and provision was made to extend the surtax exemption to interest on the second and third issues, provided specified amounts of the fourth issue were purchased. The history of the surtax exemption is telling when it comes to evaluating the role of patriotism; evidently, McAdoo, despite his efforts to capitalize patriotism, thought that he also needed to rely on old-fashioned tax avoidance by the rich to help market the bonds.

The coupons were chosen by McAdoo in conjunction with his advisors. They represented the yield that McAdoo thought was consistent with the sale of the bonds at par. Figure 5 shows these coupons, and the market rates on AAA corporate bonds (Moody's highest-rated bonds) and on municipal bonds, which were relatively safe and tax exempt.Footnote 11 The first Liberty loan was priced a bit below the municipals, which makes sense for an asset that was similar to a municipal in terms of tax exemption, but less risky. When the third Liberty loan was issued, however, it was priced within a few basis points of the municipals. It is evident that McAdoo priced the Liberty bonds to sell as purely financial investments.Footnote 12 His faith in his ability to capitalize patriotism was qualified by the belief that the market would be interested first and foremost in financial returns.Footnote 13

Figure 5. Coupons on the Liberty bonds, and Alternative yields, June 1917 – December 1921

IV

The yields on the Liberty bonds can reveal a good deal more about the effectiveness of the bond-selling campaigns, but it is important to keep in mind that yields by themselves just tell us about the marginal holder. In equilibrium, to put the point formally, the net advantages of holding government bonds must be equal at the margin to the net advantages of holding other securities. Thus, we can write the following equation:

I1 is the yield of the Liberty bonds. U(P) is the marginal value to a bond holder of the satisfaction from contributing to the war effort; in other words the utility from being patriotic. U(S) is the value to the bond holder of other advantages of holding government bonds – their greater security, liquidity, tax advantages, and eligibility as security for loans from the Federal Reserve, and so on – net of similar advantages from holding alternative assets. And Ia is the yield on an alternative such as corporates or municipals. Thus, the spread between various alternatives and Liberties will tell us something about the sacrifice that the marginal investor was willing to make for the sake of patriotism.

The government, of course, can exploit the patriotic motive for buying Liberty bonds by increasing the amount offered for sale and driving U(P) towards zero. So a finding that I1 – Ia was small may mean simply that the government fully exploited the potential of patriotism. For this reason the war period itself does not provide a good natural experiment with which to test the role played by patriotism. This is illustrated in Figure 6. In the absence of a patriotic demand, the Treasury could sell the ‘initial amount’ of bonds (each bearing a coupon of, say, 3.5 percent) at price A. A surge of patriotism, other things equal, would increase demand for these bonds and lift the price to B. But if the Treasury fully exploits this surge in demand by increasing supply accordingly, the price will remain at A. This is the policy it would follow if it was trying to raise as much money as possible while preventing an increase in interest rates, to avoid the suggestion, as Pigou put it, ‘that the rich were making a good thing out of the war’.

Figure 6. The supply and demand for liberty bonds

The end of the war, however, does provide a natural experiment. Now patriotism collapses and the demand curve shifts back to the initial level. But the amount of bonds outstanding is not reduced and their price falls to C. History, of course, is not as neat as these supply and demand curves suggest. There will be additional issues of bonds once the war ends, the patriotic motive for holding bonds will not completely disappear immediately, and other events, such as changes in tax rates, will affect returns in the bond market. Nevertheless, the response of the bond market to the end of World War I will, we believe, yield some important information about the role of patriotism.

The main reason that the end of World War I works well as a natural experiment is that it marked an abrupt change in economics, politics and public opinion. Until a few months prior to the Armistice the German army was fighting hard and successfully in France, and the issue was in doubt.Footnote 14 In the Civil War or World War II, by way of contrast, enemy forces were in retreat long before the end of the war. The transition from uncertainty to certainty about victory, in other words, occurred suddenly in World War I.Footnote 15 When it came time after the Armistice to issue the Victory bonds, according to Gilbert (Reference Gilbert1970, p. 136), ‘the Treasury was told by Wall Street that there could be no further appeals to patriotism and that the problem must be approached in a distinctly cold-blooded fashion’. It is true that some of the old hoopla was rolled out to help sell the Victory bonds, but the Victory bonds did not have the Committee on Public Information behind them. According to the Chair of the Committee, George Creel (Reference Creel1972 [1920], p. 150), ‘Within twenty-four hours from the signing of the armistice orders were issued for the immediate cessation of every domestic activity of the Committee on Public Information.’ The Committee, moreover, was not an outlier. Virtually the entire bureaucracy that had been assembled to run the war economy was scrapped the moment the war ended, reflecting the public's desire to get the whole experience over with (Lauterbach Reference Lauterbach1942).

The Republicans made strong gains in the fall 1919 Congressional elections, winning majorities in both the House and Senate. The issues separating the parties were complex, including differences on trade, agriculture and the proposed League of Nations. Nevertheless, it is clear that there was also a general turn away from wartime demands for patriotic sacrifice. In November 1920 Republican Warren G. Harding was elected President in a landslide over Democrat James M. Cox. Harding's victory reiterated the move away from wartime Progressivism presaged by the Congressional elections, as suggested by Harding's famous call for ‘a return to normalcy’. Harding, as we noted above, had complained during the war that the campaign for the first Liberty loan was ‘hysterical and unseemly’. The days when people bought bonds for patriotic reasons at the urging of their government were over.

The Republican ascendancy must have strengthened confidence that in the future there would be a balanced federal budget, price stability and adherence to the gold standard, although there was considerable support for these orthodoxies among Democrats. And this confidence would have meant lower yields on the Liberty bonds. On the other hand, the Republican ascendancy increased the likelihood that high wartime taxes would be cut. This is what in fact was done under Treasury Secretary Andrew Mellon in the early 1920s.Footnote 16 Lower taxes would mean higher yields on Liberty bonds. Republican electoral success, to sum up, clearly meant an end to patriotic appeals to hold bonds, while other aspects of the Republican agenda carried a mixed message for bond holders.

The Federal Reserve might have entered the bond market and purchased bonds that people no longer wanted because the patriotic motive for holding them had disappeared. But this does not seem to have happened. Federal Reserve holdings of US Securities, never large, increased by a smaller amount in 1919 than in 1918. Commercial banks, benefitting from an inflow of cash from the public, maintained the pace at which they added to their holdings of US securities. Therefore, continued monetary expansion may have obscured, to some degree, the decline in patriotic holdings.Footnote 17 The War Finance Corporation, however, did purchase bonds for the Treasury in an effort to smooth their price during the transition to peace (Nash Reference Nash1959, p. 457; Butkiewicz and Solcan Reference Butkiewicz and Solcan2012). The estimates of the latter, however, suggest that the effect was rather small and short-lived.

Figure 7 plots the yield on the four Liberty bonds before and after the Armistice, along with the municipal bond rate. The lowest line plots the yield to maturity on the first Liberty bonds. The first Liberty bonds fell below par, although only a bit, shortly after they were issued (the period in the chart where the yield rises above 3.50). The fall may have been due in part to the inherent limits of social pressure. When the bonds were offered people could display their patriotism by announcing their purchase and by pointedly asking others how many Liberty bonds they had bought. After the initial offering, it was hard to prevent people from selling bonds and readjusting their portfolio. Few people were likely to go around asking their neighbors how many bonds they had sold. Note our fourth poster which calls on workers to ‘Buy Liberty Bonds and Keep Them’ (our italics). Mainly, however, the fall in the price of Liberty bonds was probably due to the general rise in rates that can be seen also in the municipal bond rates. The major difference that tax exemption could make is shown by the large spreads between the yields on the first Liberty bonds, which were fully tax exempt, and on the second, third and fourth Liberty bonds, which were partly subject to taxation.

Figure 7. The yields on the liberty loans, June 1917 – December 1919

The clearest test of patriotism, as argued above, is what happened after the Armistice. If people were holding government bonds mainly for patriotic reasons, we would expect them to begin selling them and adjusting their portfolios. If this process was anticipated, then prices would adjust quickly. The Armistice, however, had little effect on the yields of the Liberty bonds. Figure 7, in other words reveals a calm market; a market that took the end of the war in its stride. As noted above, the turn toward the Republicans in 1918 might have created expectations of a reduction in the high wartime progressivity of the income tax. On these grounds one would expect a narrowing of the spread between the yields on the first Liberty bonds, which were fully tax exempt, and the yields on subsequent issues which were only partly exempt. But this didn't happen, suggesting that the likelihood of sharp cuts still appeared low.

Figure 8 takes a longer view. It plots the yields of the first Liberty bond, the fourth Liberty bond (the yields on second and third Liberty bonds were similar to those on the fourth), municipal bonds and the Federal Reserve discount rate. The rates on the first three remained stable until the first postwar recession when, as can be seen in Figure 8, the Federal Reserve raised its discount rate substantially in order to force prices down to the prewar level, an action that intensified the recession. Indeed, the increase in January, from 4.75 to 6 percent, was unprecedented (Friedman and Schwartz Reference Friedman and Schwartz1963, pp. 230-1). The response of the bond market to the Federal Reserve rate hike shows that market rates, including those on the Liberty bonds, were not sluggish in the face of changes in economic conditions. The yield on the Liberty bonds varied little after this recession, returning to about the level at issue. Again, there seems to be little evidence that a vast reservoir of patriotism was drained during the ‘return to normalcy’.

Figure 8. Selected yields, 1917–25

Our conclusions about the effectiveness of the Liberty bond campaigns based on the charts can be tested formally. Tables 2a and 2b show regressions for the first and fourth Liberty bonds.Footnote 18 The regressions include three variables that measure conditions in financial markets. (1) The AAA corporate rate was included to measure general market conditions, including the impact of changes in fundamentals such as the Federal budget, recessions and expansions in economic activity, and so on. (2) The municipal rate was included to measure the effect of the postwar reductions in tax rates. (3) The Federal Reserve discount rate was included to measure the effect of monetary policy. To measure the impact of the Armistice we tried two variables. (1) ‘Rapid adjustment’ takes the value zero before November 1918 and the value one from November 1918 forward. This models the case where bondholders immediately attempted to readjust their portfolios. (2) ‘Gradual adjustment’ starts at .001 in November 1918 and rises at a constant rate until it reaches 1.00 in December 1929.Footnote 19 This would be the relevant variable if investors gradually awakened to the possibility of readjusting their portfolios.

Table 2a. Determinants of the yield on the First Liberty loan, September 1917 – December 1929

Sources: see data appendix.

On economic grounds one would not expect there to be a unit root in the yields. There is a zero lower bound on interest rates, and the gold standard, which the United States maintained throughout, set a limit on the inflation premium.Footnote 20 The Augmented Dickey Fuller tests, however, perhaps because of their weak power, generally failed to reject the hypothesis of a unit root. For that reason we estimated the basic equation over a number of samples and in a number of ways to account for the possibility of a unit root, or autocorrelation in the residuals: in levels, first differences, levels with a lagged dependent variable, and in levels with an AR(1) adjustment for autocorrelation.Footnote 21

Table 2a shows the results for the yield on the first Liberty loan for the full sample (the results for shorter samples were similar) and for the four estimation methods. There is some evidence from the regressions in levels that the Armistice may have had an impact: ‘rapid adjustment’ is significant when the regression is estimated in levels without any adjustment for auto-correlation and when an auto-correlation adjustment is included, although not when the dependent variable is lagged one period. Gradual adjustment also turns out to be significant when the equation is estimated in levels and an auto-correlation adjustment is included. The coefficients, however, are small. The largest estimate is only about 15 basis points. First differencing the data produces more plausible coefficients on the fundamentals: the coefficient on the AAA rate is positive.Footnote 22 When the equation is estimated in first differences, however, the coefficients on both rapid adjustment and gradual adjustment are small and not significantly different from zero.

Table 2b shows the results of similar regressions for the fourth Liberty loan. Rapid adjustment is significant when the equation in levels is estimated with an AR(1) adjustment and when the equation is estimated in first differences. Gradual adjustment is significant when the equation is estimated in levels without an adjustment for auto-correlation and when it is estimated in levels and a lagged dependent variable is included. But the coefficient is small in all of the equations. The largest estimate, when gradual adjustment is included in the simple OLS equation in levels, is 23 basis points. The other estimates are smaller.

Table 2b. Determinants of the yield on the Fourth Liberty loan, September 1917 – December 1929

Sources: see data appendix.

We can also ask whether the volume of sales of Liberty bonds changed dramatically with the Armistice. Suppose some investors decided to sell their Liberty bonds because they no longer had a patriotic reason to hold them, but others decided to buy them, because, to give a plausible example, they thought that highly liquid investments made sense until more was known about the shape of the postwar economy. Under these assumptions one would see little movement in the price of bonds, but lots of movement in the volume of sales.

Figure 9 shows the volume of sales for the first and fourth Liberty bonds from 1917 through 1923. Evidently, the Armistice did not produce a sharp realignment in the holding of Liberty bonds. Instead, monthly sales of Liberty bonds settled down to a mostly stable rate in the postwar era. The one exception was in December 1920, when there was a sharp spike in sales. The New York Times attributed this spike to concerns about the revival of the War Finance Corporation (its debt might compete with the Liberty bonds) and to income tax considerations (losses had to be realized to count against income). The Times thought that many of the income tax sales were being matched with purchases.Footnote 23 If the Times' interpretation is right it suggests that the volume of sales would respond quickly when financial reasons for holding bonds changed. The Armistice and the concurrent reduction in the patriotic motive for holding bonds, evidently did not have a similar effect. The spike, moreover, tells against the argument that many of the bonds were in the hands of low-income purchasers who would have found it difficult to sell them.

Figure 9. Volume of sales on the New York Stock Exchange, June 1917 – December 1923

V

Table 3 shows a snapshot of the denominational structure of the bonds outstanding on 30 June 1920. The modal bond was the $1,000 bond, which was close to a $50,000 bond in today's money: Possible for a middle class family, but one would think not in large amounts. The smallest denominations, $50 and $100, seem more plausible for middle class investors although still a stretch, and constituted about 20 percent of the outstanding debt. This does not mean, however, that all of these bonds were held by middle-class investors. A number of large corporations bought these denominations so that they could make dividend payments with them, Gilbert (Reference Gilbert1970, p. 128). Nevertheless, the denominational structure suggests that McAdoo's attempt to market the Liberty bonds to middle-class investors enjoyed a modest success

Table 3. Denominations of the Liberty bonds outstanding on 30 June 1920

a We used per capita real GDP, available at www.eh.net, as the inflator, to convey how hard it would be for the average person to buy one of the bonds.

Source: Gilbert (Reference Gilbert1970, p. 141).

Another attempt to sell war bonds in small denominations to the young and poor was modeled on a British program. ‘War Savings Certificates’, were first issued in January 1918. They sold for $4.12 (about $60 in today's money using the CPI) and were worth $5.00 at maturity in January 1923. The price increased one cent per month until sales were stopped in December 1918. The annual rate works out to about 4.5 percent. For those who could not afford a War Savings Certificate, savings stamps costing $.25 could be purchased. Each stamp was pasted on a special board, and when the buyer had enough it could be exchanged for a Savings Certificate. The War Savings Certificate was continued after the war, used in World War II, and continued in various guises ever since.

The purpose of the War Savings Certificates was to provide a vehicle for people of limited means, especially young people, to express their patriotism and at the same time to teach them the value of thrift. In American high schools young women were encouraged to knit for the war effort, and young men to buy savings stamps. The program contributed a modest amount to the actual financing of the war. At the end of August 1919, the total amount of debt issued to finance the war amounted to $26.4 billion. Of this amount $0.93 billion consisted of War Savings Certificates, about 3.5 percent of the total (Schultz and Caine Reference Schultz and Caine1937, p. 540). It could be argued, moreover, that the War Savings Certificates represented additional real savings, as opposed to other issues that were partly monetized, and these were real savings that might not otherwise have been available.

We can get an idea of how the portion of bonds purchased by individuals was distributed from a government survey of nearly 13,000 urban working households, undertaken due to concerns about how working families were being affected by wartime inflation. The survey was coded by Martha Olney (Reference Olney1995) and provides a remarkably detailed account of how a sample of urban households spent their money during the war years. Figure 10 plots the percentage of income spent on war loans (net of sales) against household income. We plotted a 51-household moving average in order to smooth out some of the variance so that it would be easier to read the figure.Footnote 24 A linear tread is also included. The figure shows that war loan expenditures rose with income, as might be expected. At the high end the savings rate was quite respectable by modern standards. But Figure 10 also shows, somewhat surprisingly, that some households with very low incomes did spend part of their income on war loans, as McAdoo had hoped. There were 1,065 households in the sample with incomes less than or equal to $1,000. On average they earned $896 ($13,800.00 in 2015 $s using the Consumer Price Index to inflate).Footnote 25 On average they spent $18 on Liberty loans, about 2.00 percent of their income. Much of these savings was likely to have been in the form of War Savings Stamps or War Savings Certificates, or instalment purchases of Liberty bonds. The lowest denomination of the fourth Liberty bond, $50, could be purchased by making a down payment of $4.00 and then paying $2.00 per week for 23 weeks.

Figure 10. Household income and the percentage spent on Liberty loans

This was a respectable showing for McAdoo's effort to use the Liberty loan campaigns to improve morale. Working-class families, however, at most provided only a part of total war finance as the following calculation shows. The 12,596 households in Olney's sample spent a total of $901,615 on war loans. When this is blown up by the total number of households one gets a figure of $1,669,200,257. This was a substantial amount, but still only about 16.8 percent of the Federal deficits in 1917-18. This calculation tells us that most of the debt was purchased by institutions and rich households rather than working-class households. To be sure, some working-class households held government bonds indirectly through their deposits in banks and other intermediaries. But it seems unlikely that taking these indirect holdings into account, would alter the picture of a notable but secondary contribution from working-class households. Working-class households may have found it difficult when the war was over to liquidate their holdings. But this consideration affected only a small part of the total bond holdings.

Showing that many poor households invested in war loans, however, does not prove that patriotism was the overriding motive. It was a good time to save. Jobs were plentiful, wages were up, but all that might end when the war was over. And the Liberty loans offered a good return compared with deposits in banks, as some of the propaganda aimed at workers claimed.

VI

If patriotism played a small role in increasing the demand for bonds, then why did nominal rates remain so low during the war, given the huge increase in the supply of bonds, and the rapid inflation? It is not possible to give a definitive answer. We can, however, identify some of the main forces at work. We list them in order starting with what appears to us to be the most important factor.

(1) The Federal Reserve directly or indirectly monetized a good portion of the new debt. Milton Friedman and Anna J. Schwartz (1963, p. 216) put it this way:

The Federal Reserve became to all intents and purposes the bond-selling window of the Treasury, using its monetary powers almost exclusively to that end. Although no ‘greenbacks’ were printed, the same result was achieved by more indirect methods using Federal Reserve notes and Federal Reserve deposits.

The mechanics have been described in detail by Garbade (Reference Garbade2012, pp. 136-42). The Federal Reserve did not rely mainly on buying bonds for its own portfolio. Instead, it set attractive rates on loans to commercial banks secured with Liberty bonds, a policy that was frequently and accurately described simply as ‘borrow and buy’. It's clear, to return to our central theme, that officials at the Federal Reserve and the Treasury who cooperated in establishing lending rates did not think that patriotism was enough to ensure purchase of the bonds at high prices.

How much was involved? Between June 1916 and June 1919, the Federal debt increased by $24.3 billion (from $1.2 billion to $25.5 billion). High-powered money (which includes mainly Federal Reserve notes and deposits) increased by $2.1 billion, according to Friedman and Schwartz (Reference Friedman and Schwartz1963, pp. 801-2). So the increase in high-powered money could directly purchase only about 10 percent of the increase in the Federal debt. But commercial banks also created new money as their reserves increased and so were able to monetize part of the debt. They did so by purchasing bonds for their own portfolios and by lending money that was then used to purchase bonds. Generally, the banks lent at the coupon rate or at a slight advance over the coupon rate. The Liberty bonds were essentially the collateral for the loans. Since the amount of bonds purchased with newly created money was not matched one for one by bonds held by banks, we cannot produce an exact estimate of how much of the debt was monetized by examining the balance sheets of the banks. All commercial banks, for example, increased their holdings of US government securities by 4.1$ billion between 1916 and 1919, but their loan portfolio increased by 6.7$ billion over the same period (Carter et al. Reference Carter, Gartner, Haines, Olmstead, Sutch and Wright2006, series Cj257 and Cj253).

We can get an upper bound for the contribution of monetization, however, by looking at the increase in the total stock of money and assuming that all of the money that was created was backed directly or indirectly by government bonds. The increases for M1, M2, M3 and M4, from June 1917 to June 1919, were $7.03 billion, $10.02 billion, $10.68 billion and $11.46 billion respectively (Friedman and Schwartz Reference Friedman and Schwartz1970, pp. 15-17). These figures imply estimates of the share of the increase in the debt that was monetized ranging from 29 percent (M1) through 41 percent (M2), and 44 percent (M3) to 47 percent (M4). Roughly speaking M1 includes demand deposits in commercial banks, M2 adds time deposits in commercial banks, M3 adds postal savings deposits and mutual savings bank deposits, and M4 adds savings and loan shares. It would appear, therefore, that as much as 40 percent of the debt was monetized. For the first year of US involvement in the war (June 1917 to June 1918) the estimates of the share of the debt monetized range from 35 percent (M1) through 49 percent (M2), and 52 percent (M3) to 64 percent (M4).

(2) The savings ratio (the ratio of savings to GDP) rose.Footnote 26 The most likely explanation in our view is that the increases in income after 1914 were regarded as temporary. According to Friedman's permanent income hypothesis a high proportion of the temporary increase in income would be saved because consumption would be determined by permanent income. Friedman (Reference Friedman1957, pp. 151-2) drew attention specifically to the World War I years and argued that measured consumption was lower (and measured savings therefore higher) than would have been predicted on the basis of peacetime relationships. Robert Barro's model of Ricardian equivalence provides another rationale for high wartime savings: savings may have risen in anticipation of future taxes. Paul Evans (Reference Evans1986) drew attention to the stability of interest rates in World War I, and other American wars, and suggested, tentatively, that the explanation would need to make use Ricardian equivalence.

(3) As we have already noted, the bonds were exempt from state and local taxes and were exempt or partially exempt from Federal taxes. Investors in high tax brackets had a strong financial incentive to buy them. During the early 1920s Treasury Secretary Andrew Mellon argued that holding tax-exempt bonds by wealthy individuals was a major source of tax avoidance, and he argued for cuts in marginal federal tax rates to reduce this and other forms of tax avoidance. Work by Smiley and Keehn (Reference Smiley and Keehn1995) supports Mellon's argument.

(4) The issue of new private bonds was curtailed during the war. A government agency, The Capital Issues Committee, was given the authority to prohibit issues that it considered inappropriate. But chances are that a considerable amount of private investment would have been deferred until after the war in any case because of the uncertainties created by the war.

(5) As Allan H. Meltzer (Reference Meltzer2003, pp. 88-9) has noted, many bond holders probably expected the price level to return to its prewar level after the war. The bonds contained a gold clause, and it might have been assumed that after the war the world would return to the international gold standard that had prevailed before the war and that wartime inflation would be wrung from the system as it was after the Civil War. In other words, investors in Liberty bonds might reasonably have expected to gain from postwar deflation. Investors who bought bonds on this expectation were only partly right. The price level rose every year from 1914 to 1920. The price level then fell during the 1920-21 recession, but the price level never returned to the 1914 level. Investors who bought Liberty bonds in 1918 and held them until 1929 experienced a loss from price changes (-2.37 percent per year); investors who bought in 1919 and held until 1929 experienced a small gain from price changes (+0.27 percent per year).Footnote 27

Secretary McAdoo argued that his policies, including capitalizing patriotism, had saved taxpayers millions compared with allowing interest rates to rise to market clearing levels (McAdoo Reference Mcadoo1931, p. 381). But as we have seen, capitalizing patriotism probably contributed only a small amount to keeping interest rates low. More important was the decision to make the bonds exempt from federal taxes, a decision that undermined Progressive hopes to use the income tax to redistribute income. For taxpayers in very high tax brackets the gains from tax exemption could be substantial. An example will make this clear. In January 1920 AAA corporate bonds were yielding 5.55 percent, and the first Liberty bonds were yielding 3.60 percent. Therefore, someone in a 35 percent bracket would have been indifferent between the securities as far as after-tax yield was concerned (5.55*[1-.35] ≈3.60). The highest bracket in 1920, however, was 73 percent for taxpayers earning more than one million. For them, first Liberty bonds were equivalent to taxable bonds yielding 13.33 percent, higher than the yield on many junk bonds (13.33*[1-.73] ≈ 3.60).Footnote 28 To be sure, there already existed a fairly safe tax-exempt alternative to Liberty bonds: municipal bonds. The municipals might have gained more from the imposition of very high tax rates during the war if the Liberty bonds had been taxable. Taking the sting out of very high tax brackets and punishing municipalities were not, one would think, major Progressive priorities.

VII

Appeals to patriotism, we have argued, had a small effect on the financing of the war, and the attempt to conceal the limited effect of patriotism led to the adoption of tax exemptions that undermined Progressive redistributive priorities. Then why do it? Why enlist everyone from actress Mary Pickford to evangelist Billy Sunday to sell bonds? There appear to have been several of reasons. We list them from those that seem to us least important to those that seem most important.

(1) ‘Everyone else was doing it.’ Germany had been the first, it appears, to use a massive public drive to help sell bonds. In Britain the Treasury mocked the first German drive – it showed how desperate the German's were – but later adopted similar tactics. Eventually, the German Treasury returned the favor and mocked the circus atmosphere in which bonds were being sold in Britain (Noyes Reference Noyes1926, pp. 181-2). Following suit made sense. The United States had a larger population and a larger economy than the Germans or the Austrians, following the same policies minimized the chance that mistakes would offset these clear-cut advantages.

(2) It might have worked. This was a Progressive Democratic administration going to war in an era when the belief in the primacy of market forces was under attack. It is hardly surprising that Wilson, McAdoo and their associates would have believed that patriotism could move mountains. The contrast between the Civil War and World War I is particularly telling on this point. The Republican Secretary of the Treasury Salmon Chase believed passionately in the cause of the Union, but he assumed that to sell bonds he would have to appeal mainly to the self-interest of the buyers.

(3) It cost little to stir up patriotism and every little bit of extra savings it brought in was a plus. The Boy Scouts and other sellers and purchasers of small certificates are a good example. They didn't contribute much to the overall financing of the war. Still, every little bit helped.

(4) There was that important but mysterious factor that goes under the name of ‘morale’. Buying bonds, and urging others to buy them, allowed people to feel that they were participating in the war effort. The bond buying campaigns also allowed racial and ethnic minorities to reveal their patriotism, which may have helped ease inter-group tensions both during and after the war. The bond rallies and similar forms of support, moreover, were a visible sign to the armed forces, and to our enemies, of the public's support for the war. Less specific rallies in support of the war might have had similar effects, but rallies at which people pledged to buy bonds may have carried more weight. Morale was also important for parents: giving young people a way to feel that they were helping relieved anxieties stoked by the war.

The structure of the bond issues, a series of five highly publicized sales of specific amounts, introduced a discontinuity in the significance of the amount sold. If the government offers to sell $1000 worth of bonds, it would seem to matter little from a purely financial point of view whether the public offers to buy $999 or $1001. But in the first case the issue is a failure and in the second case a success. The first case shows a lack of public support for the war, and the second enthusiasm – the issue has been ‘oversubscribed’. Patriotic rallies that raise demand ‘only’ from $999 to $1001 therefore could have a large influence on the how the issue was perceived both domestically and abroad by our soldiers, our allies and our enemies. The investment banker Thomas W. Lamont made this point when he addressed a bond rally:

Germany is watching to see whether we are going to make a mighty effort on the very first step of the war. She is going to gauge our ability to fight in the trenches by the way we take hold of this loan. (New York Times, 2 June 1917, p. 3)

This aspect of the problem was also on McAdoo's mind. As he noted in his Memoirs when recalling his thinking prior to the issue of the first Liberty loan:

Suppose hundreds of millions of the bonds were left on our hands? The moral effect of such a failure would be equal to a crushing military disaster. It would not only dishearten our own people, but also the nations across the sea whose fortunes were joined to ours; and it would give our enemies new confidence and courage. (McAdoo Reference Mcadoo1931, p. 380)

Although McAdoo professed to fear a shortfall of hundreds of millions, it is obvious that any shortfall would have produced a public relations problem.

Economists and economic historians are often reproached, with some justification, for putting too much weight on pecuniary motives. Deirdre McCloskey (Reference Mccloskey1998), for one, has provided a long list of economic activities that she believes cannot be understood without bringing in concepts such as shame and social solidarity. Major wars provide natural laboratories in which to test the primacy of financial incentives because major wars inevitably bring a chorus of demands for personal sacrifices to ensure victory. A close look at the Liberty bonds, however, suggests that in the field of war finance the economist's confidence in the primacy of financial incentives is well taken.

DATA APPENDIX

The Aaa bond rate is the yield on high-grade industrial bonds, NBER series m13026. The Municipal bond rate is the Index of Yields of High Grade Municipal Bonds, series m13023. The Federal Reserve discount rate is the Federal Reserve Bank of New York Discount Rate, series m13009. These series are available at www.nber.org. The yields and sales volumes for the Liberty bonds were compiled from the Commercial and Financial Chronicle. To compute the yields we used end of month prices and the Excel yield to maturity function. The yields for the First and Fourth Liberty Loans, which are used in the reported regressions, are given in the following table.