I

As a result of the 2008 crisis, most recent research on bank lending has focused on risk, leverage and the creation of asset bubbles. It is from this perspective that the use of collateral, and especially the rise of mortgage lending, has been analysed (Jordà et al. Reference Jordà, Schularick and Taylor2014). In this article we look at how the formalisation of lending through the use of more standardised and transferable collateral took place in Sweden, and how this led to the potential for banks to provide credit on a longer-term basis. Before this formalisation lending was usually based on names as collateral, which meant that the screening process was costly, as banks had to have personal knowledge of the people involved. Loans that were not based on name security were mainly short term, through the use of discounted bills of exchange. This means that the banks’ ability to create long-term credit with lesser risk should have increased with the use of more formal collateral that could be more easily valued and monitored, and that was transferable on a secondary market. The formalisation of lending can thus be assumed to have been positive for banks’ credit creation without increasing the disruptive effects which in turn should have been positive for the financing of entrepreneurs and economic growth. The argument presented here regarding the formalisation of bank credit also supports recent literature on the modernisation of credit markets. Earlier studies have shown that informal credit markets, those outside the banking system, continued to be important during the era of industrialisation throughout Europe (Lindgren Reference Lindgren2002; Dermineur Reference Dermineur2018).

Research in economic history, as well as in economics, acknowledges the importance of financial development for economic growth. The causality implicit in finance-led economic growth is more significant for emerging economies (Rousseau and Sylla Reference Rousseau, Sylla, Bordo, Taylor and Williamson2003, Reference Rousseau and Sylla2005). Research also shows Sweden's economic growth to have been finance-led in the period prior to World War I (Hansson and Jonung Reference Hansson and Jonung1997; Ögren Reference Ögren2009). This was also a period under which bank lending to the GDP grew significantly; see Figure 1.

Figure 1. Total commercial bank lending as a percentage of GDP, 1868–1938

Financial development is, however, far from always beneficial for economic growth (Wachtel Reference Wachtel2001). There are certain requirements for the financial system to have a positive impact on growth. The financial system is usually analysed in the growth and finance literature in the sense of solely functioning as a financial intermediary. Its role is thus to allocate resources from savers and distribute these to investors as efficiently as possible (Levine Reference Levine1997; Wachtel Reference Wachtel2001). A survey of the literature in the field of financial systems begins with the sentence: ‘The purpose of a financial system is to channel funds from agents with surpluses to agents with deficits’ (Allen and Gale Reference Allen and Gale2001, p. 1).

In our view, this conception how a financial system works is too shallow, as it overlooks one of a financial system's most important tasks and characteristics: the ability to create capital through credit creation, often called capital formation. This credit creation process takes many forms, but Schumpeter emphasises the pivotal role played by commercial banks because their position enables them to establish claims against themselves which are injected into the payment system (Schumpeter Reference Schumpeter1961; Wray Reference Wray1990; Bell Reference Bell2001). Central banks have also recently started to embrace this more post-Keynesian view of credit creation where agents create credit after demand (McLeay et al. Reference Mcleay, Radia and Thomas2014). The credit creation process (or credit multiplier) means that when faced with a demand for a loan a bank has the ability to create the necessary credit by altering its portfolio. Basically the bank writes up the loan on the asset side of the balance sheet and issues deposits (or notes or other kinds of public liabilities) on the liability side: the bank issues bank money (Diamond Reference Diamond1997; Diamond and Rajan Reference Diamond and Rajan2001). As is well known, banks are the main supplier of money in the economy through the use of this credit (and money) multiplier.

To acknowledge the ability of banks to create credit also means an acknowledgment of the inherent instability of the banking system (Minsky Reference Minsky1982; Kindleberger Reference Kindleberger2001). If one of the fundamental tasks of a well-functioning financial system is credit creation, the question is how this provision of credit can be created in a manner that does not lead to increased instability in the financial system. One such process should be the development of more lending against formalised collateral which can be sold on a secondary market. This requires two things: (1) that there is in fact what can be regarded as formal collateral, i.e. collateral that can be transferred on a secondary market and that can be submitted to a more standardised valuation process; and (2) that there is a secondary market for such collateral, where the more liquid it is the greater the ability to exit at will.

As described in this article, commercial banks in Sweden changed their asset portfolios in the late nineteenth and early twentieth century. The direction of change can be summarised as a process of formalisation – and, as seen above, this process is defined as a move towards more standardised valuation procedures and securities that can be monitored easily and with a higher degree or transferability. The aim of the article is to describe and analyse the formalisation of Swedish commercial bank lending, in 1870–1938. This ambition requires statistics from the Banking Inspection and an analysis of how this data relates to macro-economic and institutional factors. It all boils down to four questions: (1) Did the lending pattern change over the period in a manner that would mean the overall increased formalisation of the commercial banks’ credit creation processes? (2) To what extent did the industrial breakthrough in Sweden relate to this formalisation (a) directly through the creation of assets to be used as collateral, i.e. shares, or (b) indirectly through the increased use of mortgage lending as a result of urbanisation? (3) What other economic and institutional factors can explain the process of formalisation over time? (4) Was the development evenly distributed over time or were there any specific discontinuities?

The formalisation of bank credit has been touched upon before by Swedish scholars, although it has not been made a research issue in its own right. Sjögren (Reference Sjögren1991) and Hellgren (Reference Hellgren2003) are two exceptions. Sjögren analyses the long-term relationship between the industrial sector and the commercial banks in the period 1916–47. We argue, however, that the importance of the banks’ collateral needs to be studied within a time-frame which also encompasses the dynamic decades before and after 1900, in order to capture its relationship to processes of structural transformation. Hellgren's study concerns a local savings bank between 1860 and 1910. It gives insights into local dynamics, but it does not give an overarching picture of the formalisation process and the role played by the use of different types of collateral (Hellgren Reference Hellgren2003; Sjögren Reference Sjögren1991).

The article is divided into five sections. In Section ii, we estimate the total formalisation of commercial bank lending for the period 1870–1938. Data from the official bank statistics are used to show a time-series of the commercial banks’ portfolios of collateral. In Section iii, we deepen the analysis to investigate the causes and results of formalisation. We focus on three main factors: the incorporation process, which provided the banks with an increased ability to use shares as collateral and, thus, directly feed industrialisation with capital; mortgage lending and its interdependence with the industrialisation process and demographic changes; and the structural transformation of the financial markets and the ability to transfer formal collateral. In Section iv, we statistically assess what factors contributed to this formalisation of commercial bank lending. Finally, in Section v, we offer conclusions.

II

Banks will not create credit if projects are deemed too risky, which means that collateral is key in the credit creation process. Empirical evidence tells us that in practice anything that has a value could work as collateral – this could be goods, mortgages, financial instruments or a good reputation. In other words, depending on the kind of collateral that exists banks can be more or less active in the credit creation process. There are two problems with collateral that need to be solved in order to decrease risk: (1) the fact that the asset behind the collateral may fall in value, and (2) the difficulty of monitoring collateral.

The first issue involves the ability of collateral to store value, as well as the potential for the bank to evaluate its market value. One way of dealing with the risk of the valuation of the collateral was by lending on short term. In this way the quality of the collateral could be constantly re-evaluated, or the collateral could be renewed. This explains why lending on short term against bills of exchange was one of the most important lending forms in the nineteenth century. Lending on short term, however, had higher transaction costs for the lender as well as for the borrower compared to more long-term lending. Lending on longer term is important for economic development as the borrower can invest the capital in the longer term without having to fear that the loan will not be renewed every three to six months; something that is important for economic development.

The second issue refers to the fact that collateral can be fraudulent, or rather that the underlying asset that is used as collateral may be. The most obvious example is when the person who signs the loan using their name as collateral decides not to pay it back, and even leaves the country. Collateral such as goods and financial assets can be physically held by the bank, which means that the risk of the borrower leaving with the collateral is quite small. The same is true if a building or land is used as collateral for mortgage loans. Financial assets and real estate have other advantages, making them less costly than goods as collateral: first, they are less bulky and thus less costly to keep as collateral; second, they are easier to evaluate than goods, as goods can deteriorate with time and their quality is difficult to estimate. Financial assets are also easier to sell as financial markets develop.

In this section we look specifically at the formalisation of lending, the extent to which Swedish commercial banks based their lending on formal collateral. Our definition of formalisation is, as stated in the introduction, the relative increase in the use of standardised and transferable collateral in long-term lending. This should be beneficial for the banks, since it is assumed to both lower the cost of estimating the value of collateral and to decrease the risks involved by providing the ability to sell this collateral on a secondary market, if needed. Thus, we regard non-formalised lending as lending with a private person's wealth as collateral on name.

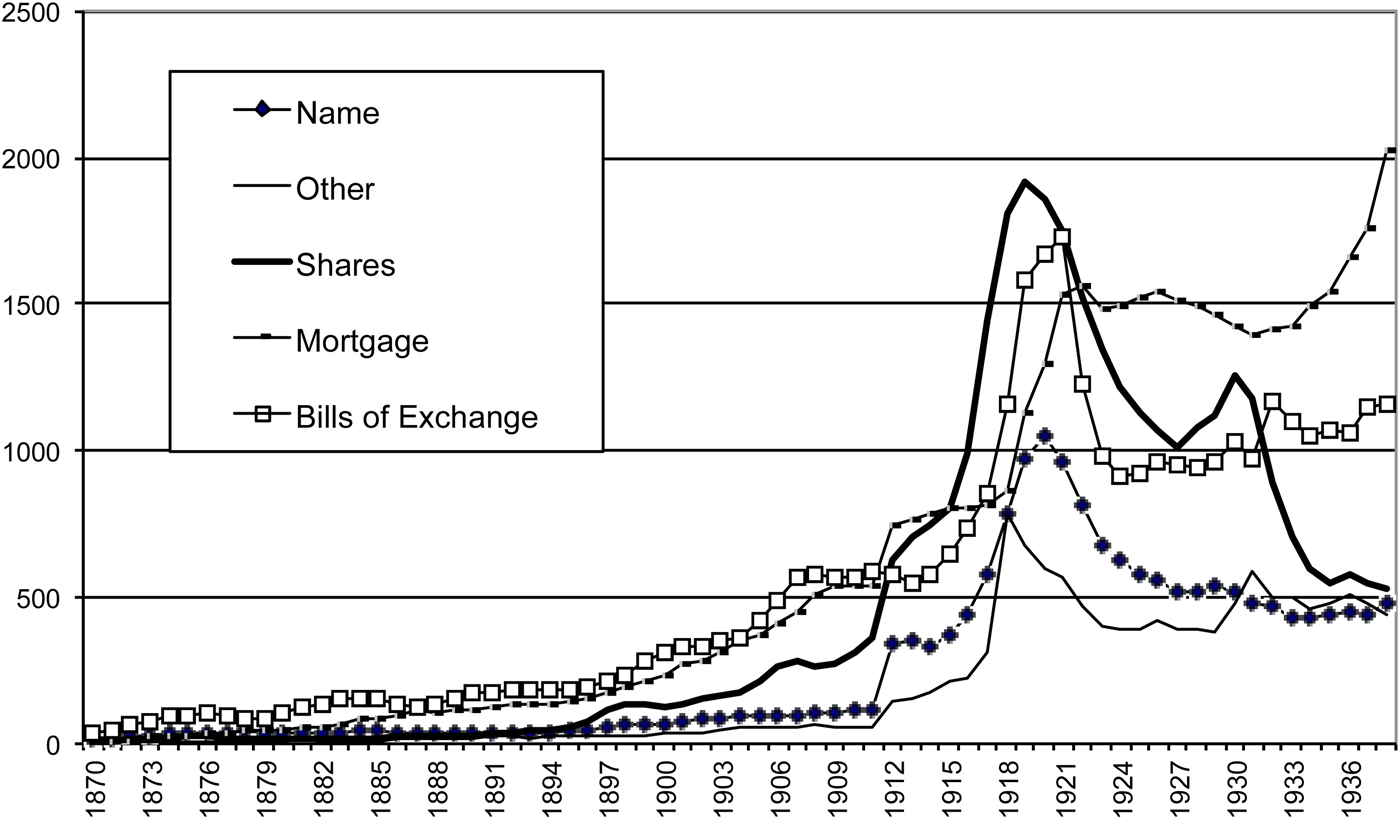

In order to assess the formalisation of commercial bank lending in Sweden, we compiled the Swedish bank statistics according to the distribution of collateral for the years 1870 to 1938. The result is presented in Figures 2 and 3, but the data are also available in the Appendix, Table A1. Commercial bank lending of all types increased in absolute values over the period (Figure 2). We can roughly divide the development into three periods. First there was a period of steady growth until the mid 1890s. Secondly, there was a rapid increase in lending, especially with formal collateral such as shares, mortgages and bills of exchange, until the outbreak of World War I. Thirdly, the period of World War I and afterwards reflects a booming economy, and the decline thereafter when lending decreased significantly - only mortgage lending maintained the levels reached during World War I.

Figure 2. Lending per collateral in millions of SEK, 1870–1938 (MSEK)

Figure 3. Distribution of collateral in Swedish commercial banks, 1870–1938 (%)

It also important to note that up until World War I Sweden had experienced low rates of inflation, but this rose to high levels during the war boom of 1915–18. This boom was highly debt-driven and the commercial banks’ use of share-backed lending was a salient feature of the boom. In the following deflation crisis (1920–2) the conditions were turned around and the commercial banking system did its best to dismantle risky positions and non-performing credit. The structural re-orientation of the banks’ collateral needs to be seen in this light, and that the relative increase in mortgage debt during the 1920s was part of the crisis management and its ‘flight to quality’ (Östlind Reference Östlind1945).

Figure 3 shows that there was indeed a formalisation of commercial bank lending over the period. In the 1870s lending with name as collateral, or non-formalised lending, was the largest proportion of lending, but its share was falling and continued to decrease until 1911, falling from more than 50 per cent to just above 10 per cent. The jump in the data series in 1911/12 is due to a statistical redefinition, when overdrafts were included. Shares and names mainly backed this type of credit; see Appendix, Table A1. This explains the relative increase in these categories and the relative decline in mortgage lending. Without the change in statistics, the secular downward trend of name security would thus have been even more pronounced.

Lending backed by shares was originally of minor importance, but it quickly increased during the economic boom and peaked just before the crisis in 1878/9. Lending stagnated until the late 1880s when it once again started to increase. This pattern of rising relative figures in times of economic booms continued, with peaks in 1897–8, 1906–7, 1917–18 and 1929–30. The severe financial crisis of the 1920s became a watershed, which was followed by a secular downward trend. In 1938 lending backed by shares was down to 15 per cent, but the trend actually continued all the way to 1980, when lending backed by shares only amounted to 3 per cent. There are two general observations to be made from lending with shares as collateral: first, it seems to have followed the pattern of industrialisation; second, it was clearly positively linked to economic trends in terms of booms and busts.

There are some caveats about the figures concerning shares. Shares as collateral were categorised with the use of goods until 1877, after which goods were put in a separate category. Thus, it is possible that the decline in the use of shares as collateral from 1877 was due to this administrative change, but it is more likely that it is a result of the economic downturn that began in 1875, since shares and goods started to decline during that year. It should also be noted that shares were already almost six times as important as goods for collateral in 1877.

Another form of formalised lending that had been part of the commercial banks’ portfolios from the start was mortgage lending; however, the latter part of the nineteenth century saw a dramatic increase in such lending. Unlike lending against shares mortgage lending actually moved in a contra-cyclical manner, falling during booms and picking up again during recessions or more normal periods. The fact that the value of real estate was less volatile than shares made mortgage lending the prime force in formalisation over the long run, and the use of real estate as collateral increased credit creation on a formal basis. It is likely that this phenomenon was based on industrialisation and the demographic changes to which it led, primarily increased urbanisation.

When shares as collateral outgrew mortgage lending it was either in relation to economic booms bordering on what Kindleberger would label ‘manias’ – the 1870s and during World War I – or in relation to a rapid increase in the number of corporations in the 1890s (see below). The latter observation suggests that commercial banks’ credit creation was indeed positively related to the quick formation of companies and the second industrial wave in the 1890s. Thus the breakthrough for the joint-stock company went hand-in-hand with the modernisation of the Swedish financial system.

Finally the ‘other’ category actually includes a formal long-term financial asset; that is bonds. From 1877 it also included goods. The lending part of this collateral is both stable and comparably small over time.

By studying the lending categorised according to different collateral we immediately see two factors that should be important in the formalisation of commercial bank lending: the increased use of shares as collateral, made possible by the emergence and expansion of joint-stock companies; and the increased use of mortgages as collateral that may be explained by demographic factors which were a result of industrialisation, since more and more businesses moved into cities and thus increased urbanisation. As we argued in the introduction, a secondary market is important as it provides the ability to exit at will, and in order to do so liquidity and capital must be at hand. A third factor should thus be the modernisation of the financial system itself and its ability to provide capital and liquidity.

III

Around 1850, the Swedish economy entered a high-growth trajectory that continued for more than a century. During this industrial breakthrough – the decades before and after 1900 – the yearly GDP growth was 2.4 per cent per capita. In the early phases of industrialisation, the export of iron, agricultural products, and timber was important, but by the early twentieth century the balance of the Swedish economy had shifted substantially; exports contained more processed goods and at the same time the demand from the domestic market became more important as an engine of growth (Schön Reference Schön2010). In order to realise this growth it had been necessary to establish economic institutions that could accommodate the forces exerted by the shifts in relative prices on labour, land and energy. In the following, we look into several of these changes and how they were related to the formalisation of the Swedish financial market.

Incorporation

The rise of the corporate form and its importance for economic development from the late nineteenth century onwards has attracted renewed interest in recent years (Rousseau and Sylla Reference Rousseau, Sylla, Bordo, Taylor and Williamson2003; Pearson et al. Reference Pearson, Taylor and Freeman2006; Lipartito and Sicilia Reference Lipartito and Sicilia2004; Guinnane et al. Reference Guinnane, Harris, Lamoreaux and Rosenthal2007). While authors differ in details, they share two characteristics: they stress the importance of incorporation, and none mentions how shares were used as a basis for extending bank credit. In their study of financing of small- and medium-size enterprises during the industrial breakthrough, Cull et al. give several examples of how local credit markets found their own solution to the challenge of capital procurement; however, the fact that shares could be used as collateral to facilitate an expansion of bank credit is not mentioned (Cull et al. Reference Cull, Davis, Lamoreaux and Rosenthal2006). Along the same line of thought, Stefano Battilossi discusses international banking and financial innovation in the period 1890–1931 (Battilossi Reference Battilossi2000). In this context, the use of shares as collateral for credit expansion has mostly been referred to in negative terms, because it has been related to speculative booms and fraudulent behaviour (Baskin and Miranti Reference Baskin and Miranti1997; Sjögren Reference Sjögren1991; Larsson Reference Larsson1998).

At the same time, the use of shares as collateral is a recurrent theme in several monographs on the history of Swedish banks (Gasslander Reference Gasslander1962; Söderlund Reference Söderlund1964; Hildebrand Reference Hildebrand1971). Especially during the late nineteenth and early twentieth century, banks used the possibility of granting credit on the basis of shares as a way of participating in industrial restructuring, but still keeping within the limits of the bank law. Furthermore, when proper balance sheets had to be constructed, hidden assets soon caught the attention of speculators. This enabled a new generation of financial agents to channel resources through credit creation, into the expanding sectors of the newly industrialised economy – amplifying a process of creative destruction. The incorporation process thus transformed the capital stock and altered the relationship between the financial and the industrial sectors of the economy (Schön Reference Schön2010). The role played by the banks in this process could arguably be strengthened when more standardised valuation procedures of firms and transferable shares could be used as collateral for long-term lending.

In Sweden the incorporation process stretched from the breakthrough for liberal ideas in the 1840s to the 1920s, when corporations had become a widely accepted form of economic organisation. In 1848 a new company law was passed, which made the principle of limited liability accessible in Sweden. The number of incorporations remained low during its first two decades, but from the late 1860s large firms – predominantly in heavy industry and in the transport sector – started to adopt the new corporate form on a wider scale (see Figure 4). The period from the 1840s to the 1890s was characterised by institutional formation; LLC legislation was debated and the attitudes of business owners towards incorporation were slowly changing in favour of the joint-stock company. The formative years resulted in the modern company law of 1895, which was followed by a surge in company formations. By the 1920s the number had levelled out, as incorporation now had spread to all sectors of the economy and to all sizes of companies (Broberg Reference Broberg2006).

Figure 4. Number of joint-stock companies founded each year in Sweden, 1850–1938

It is clear that the pattern in Figure 4 resembles the pattern of the share-backed lending; there is a rising secular trend until 1920 and the peaks coincide with the booms of the Swedish economy.

Urbanisation and the emergence of a real estate market

Part of the explanation for the increasing ability of commercial banks to formalise loans probably lay in the changing structure of society due to industrialisation. The population was growing rapidly, and urbanisation rates also increased. Industry and business followed similar patterns to those of population growth, both increasing in number and located predominantly in cities, which made it easy for banks to use both commercial and residential real estate as collateral on loans (SIGAB 1919). Between 1870 and 1910 the total amount of mortgages rose from 768 million to 4,591 million SEK. The largest part of this increase came from cities; mortgages from urban real estate grew from 193 million to 2,235 million SEK. A sizeable proportion of the new mortgages were held by corporations: in 1885 real estate to a value of 237 million SEK was registered on joint-stock companies and in 1910 this figure had risen to 1,443 million SEK (SCB 1917, p. 68–71). Furthermore, it has been shown that the growth in industrial real estate was even stronger than the growth of industrial machinery during the period 1879–1913 (Holmqvist Reference Holmquist2003). This quantitative growth was accommodated by institutional changes, which liberalised the real estate market – such as the Building Statute (1875) and the Law on Parcelling-out (1895) (Fälting Reference Fälting2001; Bladh Reference Bladh and Sjögren2002).

As seen in Figure 5, there was a steady process of migration to the cities from the beginning of the period in 1868 until its end in 1938. While the population grew by 50 per cent (from less than 4.2 million to more than 6.3), urbanisation tripled. The latter meant that from the original half a million inhabitants living in cities, the number increased gradually to around 700,000 in 1880, 1.1 million in 1900, 1.7 million in 1920, and finally 2.3 million in 1938 – an increase of more than 6 per cent annually during the whole period.

Figure 5. Population in millions (right scale) and degree of urbanisation (town population as a percentage of total population (left scale)), 1868–1938

Given this development, it is not surprising that mortgage lending increased. This increase in real estate capital was also connected to the modernisation of the financial market. In the 1870s there were only a handful of real estate companies and they were all focused on administering individual estates. Around the turn of the century this changed, when almost 1,000 real estate corporations were founded and more than 50 per cent of these had ‘trading in estates’ written in their articles. Sixty-four of these companies were also trading in shares and other financial securities. In other words, the most important feature of the transformation of the real estate sector was the massive transformation of real estate property into transferable share capital (Broberg Reference Broberg2006).

Institutional changes

During the latter half of the nineteenth century Sweden experienced what can be considered a financial revolution, with commercial banks at the centre of development (Ögren Reference Ögren2009). Vital institutional and organisational changes spurred rapid financial development, and this in turn encouraged overall economic growth and, not least, industrial transformation (Söderlund Reference Söderlund1964; Fritz Reference Fritz1990; Ögren Reference Ögren2006; Broberg Reference Broberg2006; Larsson Reference Larsson and Ögren2010). This development can be seen in the growth of commercial banks’ balance sheets. The balance sheets of the banks are compared to GDP in the far right column of Table 1. Despite the rapid concurrent GDP growth, the banks’ balance sheets rose from 12 per cent of GDP in 1860, to 75 per cent in 1910.

Table 1. The development of the commercial banks in Sweden, 1860–1938

Sources: Brisman (Reference Brisman1931); Ögren (Reference Ögren2003); Sammandrag af Bankernas Uppgifter, Sveriges Riksbank (1931), Uppgifter om Bankbolagen 1912–1938 [Summary of Bank Reports, Official Statistics].

Of particular importance for this article are the changes which could alter the type of collateral that would be accepted by the commercial banks or affect the commercial banks' potential for credit creation.

The law that guided the business of the Enskilda banks was the Act of 1864. It was an important part of the financial revolution since it meant increased possibilities to establish Enskilda banks as well as to renew their charters (Ögren Reference Ögren2009). When the gold standard was adopted changes were made to the basis of the note issuance from these banks, which have been described as restricting the ability of the Enskilda banks to issue bank notes in the banking law of 1874 – which is within the time scope of this study (Söderlund Reference Söderlund1964). Limited-liability banks without the right to issue notes – Aktiebanker, literally meaning limited-liability joint-stock banks – started to appear in the major cities from the middle of the 1860s. The expansion of the commercial banking system around the turn of the century took place within limited-liability banks – either newly founded or already established Enskilda banks transformed into Aktiebanker. So did several savings banks that transformed into small local limited-liability banks after the German model, the so-called Folkbanker (literally meaning ‘people's banks’), as the Saving Banks law of 1892 limited the ability of savings banks to lend to local businesses (Larsson Reference Larsson and Ögren2010). The number of commercial banks peaked at 82 in 1908, after which a concentration process started. By the 1920s there were about 30 banks left, but the market was in practice dominated by four banks with a total market share of 60 per cent (Jungerhem and Larsson Reference Jungerhem, Larsson, Andersson, Havila and Nilsson2013). With the Bank of Sweden Act of 1897, the Enskilda banks effectively lost their right to issue notes after 1903, and consequently the peak in private bank notes in circulation was reached in the year 1900 (Ögren Reference Ögren2003). Sweden was not unique in this sense, as banking concentration occurred simultaneously also in several other European countries (Cottrell Reference Cottrell1993).

The modern company law of 1895 (implemented 1897) standardised the corporate form and made it accessible for a wider set of businessmen. The corporate form also became more transparent as new rules on information disclosure were instigated and formal accountants became mandatory. This company law also coincided with the above-mentioned law banning commercial banks from issuing notes in 1897.

The new company law of 1910 and the new bank law of 1911 were important institutional changes. The new company law formalised the information duties and the valuation procedures of a company's assets. The new bank law extended, for the first time, the right of the commercial banks to own and trade with shares, and not only to hold them as collateral. The law marked the end of a long political debate about the role of commercial banks in industrial finance. The result was a law that, with certain restrictions, made it easier for commercial banks to enrol in share-backed lending (Fritz Reference Fritz1990).

In the wake of the deflation crisis, a law was passed in 1921 (implemented 1922), which limited banks’ rights to own shares. The boom of the late 1910s was partly blamed on the speculative activity of commercial banks and, in order to secure the stability of the financial system, bank entitlements to owning shares in financial companies were removed by the new law – unless granted special permission.

A new bank law was passed in 1933 (implemented 1934). This time it was another crisis – caused by the 1932 Kreuger crash – which shook the regulative framework of the Swedish financial system and united the legislators through the fear of a breakdown. The banks’ right to own shares was revoked and for the first time the use of shares as collateral was regulated by law. It was specified that banks had to ensure that their lending was covered by the market value of underlying shares, and the shares of financial corporations were not permitted to be used as collateral.

All in all, five important institutional changes have been identified. The Banking Act in 1874 may have dampened the commercial banks' possibility to create credit. The following two (1895/7 and 1910/11) accommodated the shift towards more formalised lending and the use of shares as collateral. The law of 1897 ended the right of the Enskilda banks to issue notes, which could have dampened their credit creation possibilities. The other two changes (1921/2 and 1933/4) went in the opposite direction and limited the scope for credit creation based on shares.

IV

In this section we statistically test which parameters affected the formalisation of the commercial banks’ lending and in what way. Since we define the formalisation of lending as lending with standardised and transferable collateral, our dependent variables are: loans with shares as collateral (SHARES); mortgage loans (MORTGAGE); and finally, as a measure of formalisation, we add the two together so that we have loans based on shares plus loans based on real estates (FORMAL). We run two different tests, one based on the absolute values of the dependent variables and one with their relative size; the percentage of total commercial bank lending.

We hope not only to capture the formalisation in general, with this division, but also its dynamics over time, given that the commercial banks altered their lending portfolios during different economic trends and political regimes.

We chose independent variables that could affect the ability of commercial banks to formalise their business. We divide these into three types: (1) macro-variables that concern macroeconomic (including monetary and financial) as well as overall societal changes over the period; (2) institutional variables that concern changing legal frameworks regulating the business of the banks, or corporations; and (3) banking and financial variables, which means the effects of increased liquidity and financial wealth and the commercial banks’ choices to alter their portfolios, their consolidation etc.

Macro-variables

The most basic macroeconomic variable is overall economic growth (GDP). This is the crudest test of the interdependence between the formalisation of the financial market and economic performance. As prior research has found that growth during the investigated period was finance-led, we are not sure how GDP relates to the formalisation of lending (Hansson and Jonung Reference Hansson and Jonung1997; Ögren Reference Ögren2009).

Growth in the industrial sector (INDUSTRY) is also included as a macro-variable. We refer to the Schumpeterian process of creative destruction in our argument about why commercial bank credit creation was of utmost importance for economic growth, and so we assume that growth in the industrial sector should be positively related to the formalisation of lending, and not least lending with shares as collateral.

As a measure of financial deepening and of broad money supply we use the public's holdings of liquidity plus the public's holdings in commercial and savings banks (M3). This measure should be positively linked to formalisation.

The formation of limited liability joint-stock corporations should also be positively linked to formalisation, especially the use of share-backed lending. We use two measures, the annual number of corporations formed (CORPEST) and the annual amount of subscribed shares (CORPCAP) in newly formed corporations.

Finally, we also assume that growth in population (POPULATION), and especially the degree of urbanisation (URBAN), was positively associated with the formalisation of commercial bank lending, and especially in the case of mortgage lending. Urbanisation is measured as the percentage of the total population living in towns.

Since the relationship we are testing is long term we are lagging the independent macro-variables up to five years. We assume that the macro-variables such as formed corporations (CORPEST), annual amount of subscribed shares (CORPCAP) in newly formed corporations, population growth (POPULATION) and urbanisation (URBAN) require more than one year before a related change in lending can occur. We do the same for economic growth (GDP) and growth in the industrial sector (INDUSTRY), but we are aware that prior research has shown the opposite causality (from credit growth to economic growth).

Institutional variables

Institutional changes are incorporated in the regressions as dummy variables. The important Banking Act of 1864 is outside the scope of this article but it was this Banking Act that paved the way for the growth in commercial banking that occurred thereafter. The first change of the 1864 banking law occurred in 1874 and was a response to the adoption of the gold standard (D1874). The changes mainly concerned the possibility of note issuance in relation to the adoption of the gold standard. The law was implemented gradually between 1874 and 1878, coming into effect for individual banks when their charters expired. It may have had some restrictive effects on the credit creation of these banks.

Modern company law and the ending of the commercial banks right to issue notes were both implemented in 1897 (D1897). The company law was renewed in 1910. In relation to this renewal a new Banking Act was also launched in 1911. These two important institutional changes are not possible to separate, so we treat them as one integral change (D1911). The new company law should have been positive for formalisation as it meant increased transparency and standardisation. The Banking Act 1911 permitted banks to trade in shares but also implemented capital requirements that may have had a negative effect on credit creation.

The bank law of 1921, which was implemented as a result of the deflation crisis, limited the rights of commercial banks to own and trade with shares. This law was implemented in 1922 (D1922). Following the Kreuger crash another suppressive bank law was implemented in 1934 (D1934). This law was directly aimed at the use of shares as collateral. The effects of these laws should, unlike the previous laws, have been negative, since they were directly aimed at limiting the use of shares.

Banking and financial variables

For banking variables we look to other forms of lending in absolute terms, such as bills of exchange (BOE), name security (NAME), shares (SHARES), mortgages (MORTGAGE) and other collateral (OTHER). Including different forms of lending in absolute terms makes it possible to investigate the extent to which one form of lending crowded out another, or whether banks really did have the ability to create credit on demand by increasing all forms of lending in harmony.

In relation to the banks’ ability to create money and credit we are also including a measure of the broad money supply (M3), defined as base money issued by the central bank plus the monetary liabilities (notes and deposits) issued by commercial and savings banks, as a measure of overall financial wealth and liquidity. We assume that this should be possible for formalisation as it increases the potential to sell collateral on a secondary market.

What caused formalisation: absolute values

As seen in Figure 2 above, the size of lending in absolute values at the end of the period is of such magnitude that it makes the prior periods almost insignificant in size; however, using a semi-logarithmic scale, the development is somewhat clearer (Figure 6). First, we can clearly see the increase in lending with shares and bills of exchange in relation to the boom in the 1870s and the fall in relation to the bust. Second, we can see the increase with the use of shares in relation to the increased establishment of joint stock corporations in the mid 1890s. Third, we can see a shift upwards in mortgage lending in 1873, which was the peak of the boom in Sweden, as well as the continuing relatively steady increase in this type of lending. Fourth, we can see that the growth in lending in relation to the booms, and especially the World War I boom, took place across all forms of lending. Fifth, short-term lending on bills of exchange and long-term lending on shares seem to share the same characteristics, by both positively following the economic trend.

Figure 6. Lending per collateral in millions of SEK, 1870–1938 (semi-logarithmic scale)

We used differenced logarithmic values when we tested the statistical relationship between the variables. The series have been differenced since we otherwise encounter problems of non-stationarity. The use of logarithmic values converts the coefficients into percentage values, increasing ease of interpretation. Our independent variables are lending with shares as collateral, mortgage, and the two added together as a measure of overall formalisation. We thus have the following OLS-regressions:

$$\eqalign{ dln\beta \lpar {SHARES} \rpar _t =& \,c + dln\beta \lpar {GDP} \rpar _t + dln\beta \lpar {INDUSTRY} \rpar _t + dln\beta \lpar {CORPEST} \rpar _t \cr & + dln\beta \lpar {CORPCAP} \rpar _t + dln\beta \lpar {POPULATION} \rpar _t \cr & + dln\beta \lpar {URBAN} \rpar _t + dln\beta \lpar {M3} \rpar _t + dln\beta \lpar {BOE} \rpar _t \cr & + dln\beta \lpar {NAME} \rpar _t + dln\beta \lpar {MORTGAGE} \rpar _t \cr & + dln\beta \lpar {OTHER} \rpar _t + \beta \lpar {D1874} \rpar _t + \beta \lpar {D1897} \rpar _t \cr & + \beta \lpar {D1911} \rpar _t + \beta \lpar {D1922} \rpar _t + \beta \lpar {D1934} \rpar _t + \varepsilon _t} $$

$$\eqalign{ dln\beta \lpar {SHARES} \rpar _t =& \,c + dln\beta \lpar {GDP} \rpar _t + dln\beta \lpar {INDUSTRY} \rpar _t + dln\beta \lpar {CORPEST} \rpar _t \cr & + dln\beta \lpar {CORPCAP} \rpar _t + dln\beta \lpar {POPULATION} \rpar _t \cr & + dln\beta \lpar {URBAN} \rpar _t + dln\beta \lpar {M3} \rpar _t + dln\beta \lpar {BOE} \rpar _t \cr & + dln\beta \lpar {NAME} \rpar _t + dln\beta \lpar {MORTGAGE} \rpar _t \cr & + dln\beta \lpar {OTHER} \rpar _t + \beta \lpar {D1874} \rpar _t + \beta \lpar {D1897} \rpar _t \cr & + \beta \lpar {D1911} \rpar _t + \beta \lpar {D1922} \rpar _t + \beta \lpar {D1934} \rpar _t + \varepsilon _t} $$ $$\eqalign{dln\beta \lpar {MORTGAGE} \rpar _t = & \,c + dln\beta \lpar {GDP} \rpar _t + dln\beta \lpar {INDUSTRY} \rpar _t + dln\beta \lpar {CORPEST} \rpar _t \cr & + dln\beta \lpar {CORPCAP} \rpar _t + dln\beta \lpar {POPULATION} \rpar _t \cr & + dln\beta \lpar {URBAN} \rpar _t + dln\beta \lpar {M3} \rpar _t + dln\beta \lpar {BOE} \rpar _t \cr & + dln\beta \lpar {NAME} \rpar _t + dln\beta \lpar {SHARES} \rpar _t \cr & + dln\beta \lpar {OTHER} \rpar _t + \beta \lpar {D1874} \rpar _t + \beta \lpar {D1897} \rpar _t \cr & + \beta \lpar {D1911} \rpar _t + \beta \lpar {D1922} \rpar _t + \beta \lpar {D1934} \rpar _t + \varepsilon_t}$$

$$\eqalign{dln\beta \lpar {MORTGAGE} \rpar _t = & \,c + dln\beta \lpar {GDP} \rpar _t + dln\beta \lpar {INDUSTRY} \rpar _t + dln\beta \lpar {CORPEST} \rpar _t \cr & + dln\beta \lpar {CORPCAP} \rpar _t + dln\beta \lpar {POPULATION} \rpar _t \cr & + dln\beta \lpar {URBAN} \rpar _t + dln\beta \lpar {M3} \rpar _t + dln\beta \lpar {BOE} \rpar _t \cr & + dln\beta \lpar {NAME} \rpar _t + dln\beta \lpar {SHARES} \rpar _t \cr & + dln\beta \lpar {OTHER} \rpar _t + \beta \lpar {D1874} \rpar _t + \beta \lpar {D1897} \rpar _t \cr & + \beta \lpar {D1911} \rpar _t + \beta \lpar {D1922} \rpar _t + \beta \lpar {D1934} \rpar _t + \varepsilon_t}$$ $$\eqalign{ dln\beta \lpar {FORMAL} \rpar _t = & \,c + dln\beta \lpar {GDP} \rpar _t + dln\beta \lpar {INDUSTRY} \rpar _t + dln\beta \lpar {CORPEST} \rpar _t \cr & + dln\beta \lpar {CORPCAP} \rpar _t + dln\beta \lpar {POPULATION} \rpar _t \cr & + dln\beta \lpar {URBAN} \rpar _t + dln\beta \lpar {M3} \rpar _t + dln\beta \lpar {BOE} \rpar _t \cr & + dln\beta \lpar {NAME} \rpar _t + dln\beta \lpar {OTHER} \rpar _t + \beta \lpar {D1874} \rpar _t \cr & + \beta \lpar {D1897} \rpar _t + \beta \lpar {D1911} \rpar _t + \beta \lpar {D1922} \rpar _t + \beta \lpar {D1934} \rpar _t + \varepsilon _t} $$

$$\eqalign{ dln\beta \lpar {FORMAL} \rpar _t = & \,c + dln\beta \lpar {GDP} \rpar _t + dln\beta \lpar {INDUSTRY} \rpar _t + dln\beta \lpar {CORPEST} \rpar _t \cr & + dln\beta \lpar {CORPCAP} \rpar _t + dln\beta \lpar {POPULATION} \rpar _t \cr & + dln\beta \lpar {URBAN} \rpar _t + dln\beta \lpar {M3} \rpar _t + dln\beta \lpar {BOE} \rpar _t \cr & + dln\beta \lpar {NAME} \rpar _t + dln\beta \lpar {OTHER} \rpar _t + \beta \lpar {D1874} \rpar _t \cr & + \beta \lpar {D1897} \rpar _t + \beta \lpar {D1911} \rpar _t + \beta \lpar {D1922} \rpar _t + \beta \lpar {D1934} \rpar _t + \varepsilon _t} $$The results are displayed in Table 2. We have chosen to display only those independent variables with significant results. We have also, given the assumed long-term relationship between the macro-variables and the dependent variables, run the regressions with lags up to five years for those variables, as well as for the variable for financial wealth and market liquidity (M3).

Table 2. OLS-regressions on the causes of formalisation, 1870–1938 (absolute values)

We can first conclude that lending with shares as collateral (first column in Table 2) was mainly driven by urbanisation (URBAN). The creation of financial wealth represented by the broad money supply was also of importance (M3). This signals the need for a liquid secondary market, as well as the relationship to the economic trend that might be captured by the broad money supply. Growth in the industrial sector affected the use of lending on shares positively (INDUSTRY). We can also see that as lending on shares increased, it did so in harmony with non-formalised lending on name (NAME). The establishment of new limited liability corporations measured as newly subscribed share capital (CORPCAP) was also positively related to the use of shares as collateral, but to a lesser extent than expected. The repressive law of 1934 was, as expected, negatively related to lending against shares (D1934). A puzzling outcome is that changes in the growth of GDP were negatively related to shares as collateral, which we think may be because growth was finance-led. The explanatory value for this model, adjusted R2, is quite high, at 68 per cent.

Mortgage lending (second column in Table 2) was clearly driven by the growth in population and urbanisation. An interesting observation here is that the use of mortgage lending lagged three years behind urbanisation, which means that people moved first and the mortgage lending increase followed. The second most important factor was again the growth of financial wealth represented by the broad money supply (M3), but this also affected mortgage lending with a time lag. The broad money supply of the same year was negatively related to mortgage lending, probably because the money supply was more related to the current economic trend. Both non-formalised lending on name and short-term lending on bills of exchange followed the pattern of mortgage lending, and thus mortgage lending increased when these forms of lending did as well. The number of limited liability corporations established (CORPEST) was significantly related to mortgage lending, but not to the amount of shares subscribed (CORPCAP). The explanatory value for this model was 64 per cent.

Formalised lending (third column in Table 2), that is lending using shares and real estate as collateral, was not surprisingly also driven mostly by urbanisation. Formalised lending was done in harmony with non-formalised lending on name. Again, growth in the broad money supply was important, this time with a one-year lag. Finally, the laws of both 1874 and 1911 were negative for formalisation. This may be because of the respective banking Acts of these years: the 1874 law included some restrictions on commercial bank note issuance and the Banking Act of 1911, among other things, implemented capital requirements which may have been negative for the banks’ possibility to create credit in general; however, as credit growth continued until the end of World War I, it may be a foregone conclusion to view the Banking Act of 1911 as restraining for the banks from a longer perspective. The explanatory value was again quite high: 73 per cent.

There are some conclusions to be drawn from the tests in absolute values. The harmony in the growth of different kinds of lending underscores the commercial banks’ ability to create credit on demand. Thus if banks or other financial agents find investment opportunities of interest they will use them to create credit, which is in line with one of the basic assumptions of this article. Urbanisation was of utmost importance for formalisation, both through creating the basis for mortgage lending and as a reflection of the process of industrialisation and formation of limited liability corporations, which positively affected the use of shares as collateral. Economic growth was surprisingly not visible in promoting formalisation; perhaps it was instead a result of this formalisation, as it has been found that growth in Sweden was finance-led. Liquidity and the public's financial wealth, represented by the public's holdings of liquidity and deposits in the banking system, were of importance for growth in formalised lending.

What caused formalisation: relative values

Analysing relative values illustrates the banks’ propensity for asset management as it shows the extent to which commercial banks chose to increase or decrease one kind of lending in relation to their total lending portfolios. We can thus see which variables affected the choices of commercial banks to alter their portfolios towards more formal lending. In Figure 7 we can see that formalised lending started to increase in the mid 1870s and continued to climb steadily to a level of 40 per cent of total lending in the mid 1880s, where it remained until the next shift upwards in the mid 1890s. From the late 1890s it reached 50 per cent and remained above this level with the exception of the boom in relation to World War I, during which formal lending temporarily decreased to below 50 per cent.

Figure 7. Formal long-term lending as a percentage of total lending, 1870–1938

This shows that during booms and manias commercial banks utilised less formal collateral so as to be able to meet the demand for credit, as postulated by Kindleberger (Reference Kindleberger2001) and Minsky (Reference Minsky1982). We can also see that lending with shares as collateral followed the economic trend more than mortgage lending. This is a result of the fact that shares are more liquid and it is possible to create them on shorter notice than physical real estate, and so shares are faster to use in the credit creation process when demand is soaring, as is the case during manias.

For the same reasons as above, we use differenced logarithmic values. The dependent variables are, respectively, lending with shares as collateral (SHARES), mortgage lending (MORTGAGE) and the two added together (FORMAL) as a percentage of total commercial bank lending. We use the same independent variables as for absolute variables except for the lending variables. This gives us the following OLS-regressions:

$$\eqalign{ dln\beta \lpar {SHARES} \rpar _t = & \,c + dln\beta \lpar {GDP} \rpar _t + dln\beta \lpar {INDUSTRY} \rpar _t + dln\beta \lpar {CORPEST} \rpar _t \cr & + dln\beta \lpar {CORPCAP} \rpar _t + dln\beta \lpar {POPULATION} \rpar _t \cr & + dln\beta \lpar {URBAN} \rpar _t + dln\beta \lpar {M3} \rpar _t + \beta \lpar {D1874} \rpar _t \cr & + \beta \lpar {D1897} \rpar _t + \beta \lpar {D1911} \rpar _t + \beta \lpar {D1922} \rpar _t + \beta \lpar {D1934} \rpar _t + \varepsilon _t} $$

$$\eqalign{ dln\beta \lpar {SHARES} \rpar _t = & \,c + dln\beta \lpar {GDP} \rpar _t + dln\beta \lpar {INDUSTRY} \rpar _t + dln\beta \lpar {CORPEST} \rpar _t \cr & + dln\beta \lpar {CORPCAP} \rpar _t + dln\beta \lpar {POPULATION} \rpar _t \cr & + dln\beta \lpar {URBAN} \rpar _t + dln\beta \lpar {M3} \rpar _t + \beta \lpar {D1874} \rpar _t \cr & + \beta \lpar {D1897} \rpar _t + \beta \lpar {D1911} \rpar _t + \beta \lpar {D1922} \rpar _t + \beta \lpar {D1934} \rpar _t + \varepsilon _t} $$ $$\eqalign{ dln\beta \lpar {MORTGAGE} \rpar _t = & \,c + dln\beta \lpar {GDP} \rpar _t + dln\beta \lpar {INDUSTRY} \rpar _t + dln\beta \lpar {CORPEST} \rpar _t \cr & + dln\beta \lpar {CORPCAP} \rpar _t + dln\beta \lpar {POPULATION} \rpar _t \cr & + dln\beta \lpar {URBAN} \rpar _t + dln\beta \lpar {M3} \rpar _t + \beta \lpar {D1874} \rpar _t + \beta \lpar {D1897} \rpar _t \cr & + \beta \lpar {D1911} \rpar _t + \beta \lpar {D1922} \rpar _t + \beta \lpar {D1934} \rpar _t + \varepsilon _t} $$

$$\eqalign{ dln\beta \lpar {MORTGAGE} \rpar _t = & \,c + dln\beta \lpar {GDP} \rpar _t + dln\beta \lpar {INDUSTRY} \rpar _t + dln\beta \lpar {CORPEST} \rpar _t \cr & + dln\beta \lpar {CORPCAP} \rpar _t + dln\beta \lpar {POPULATION} \rpar _t \cr & + dln\beta \lpar {URBAN} \rpar _t + dln\beta \lpar {M3} \rpar _t + \beta \lpar {D1874} \rpar _t + \beta \lpar {D1897} \rpar _t \cr & + \beta \lpar {D1911} \rpar _t + \beta \lpar {D1922} \rpar _t + \beta \lpar {D1934} \rpar _t + \varepsilon _t} $$ $$\eqalign{ dln\beta \lpar {FORMAL} \rpar _t = & \,c + dln\beta \lpar {GDP} \rpar _t + dln\beta \lpar {INDUSTRY} \rpar _t + dln\beta \lpar {CORPEST} \rpar _t \cr & + dln\beta \lpar {CORPCAP} \rpar _t + dln\beta \lpar {POPULATION} \rpar _t \cr & + dln\beta \lpar {URBAN} \rpar _t + dln\beta \lpar {M3} \rpar _t + \beta \lpar {D1874} \rpar _t \cr & + \beta \lpar {D1897} \rpar _t + \beta \lpar {D1911} \rpar _t + \beta \lpar {D1922} \rpar _t + \beta \lpar {D1934} \rpar _t + \varepsilon _t} $$

$$\eqalign{ dln\beta \lpar {FORMAL} \rpar _t = & \,c + dln\beta \lpar {GDP} \rpar _t + dln\beta \lpar {INDUSTRY} \rpar _t + dln\beta \lpar {CORPEST} \rpar _t \cr & + dln\beta \lpar {CORPCAP} \rpar _t + dln\beta \lpar {POPULATION} \rpar _t \cr & + dln\beta \lpar {URBAN} \rpar _t + dln\beta \lpar {M3} \rpar _t + \beta \lpar {D1874} \rpar _t \cr & + \beta \lpar {D1897} \rpar _t + \beta \lpar {D1911} \rpar _t + \beta \lpar {D1922} \rpar _t + \beta \lpar {D1934} \rpar _t + \varepsilon _t} $$We are also testing the macro-variables in this case, and the liquidity and financial wealth variable (M3) with up to five-year lags. The significant results of the OLS-regressions are illustrated in Table 3.

Table 3. OLS-regressions on the causes of formalisation, 1870–1938 (relative values)

Beginning again with shares as collateral (first column in Table 3), the pattern is similar to the results for absolute values. The difference is that urbanisation did not drive the decision to use shares as collateral relative to other forms of collateral. Instead, liquidity and industrial growth are positively connected to the use of shares; however, changes in GDP growth were again negatively related to the use of shares, which we again attribute to the fact that growth was finance-led. The law of 1934 repressed the use of shares as collateral in the banks’ lending portfolios. The explanatory value of the factors explaining the relative choice of shares as collateral is 29 per cent.

Mortgage lending (second column in Table 3), on the other hand, was still highly dependent on urbanisation in prior periods. Here we find the same peculiarity with the broad money supply as with absolute values: a negative relationship to mortgage lending in the same period but a positive relationship with a lag. The explanatory value is still a high 69 per cent.

Total formalisation, the overall choice to lend in the long term with shares or real estate as collateral in relation to all lending (column 3 in Table 3), again stressed the importance of urbanisation and population growth; the coefficient values are high, showing the large impact of these variables on formalisation. The impacts of the economic variables were again somewhat more complex, with industrial growth promoting formalisation but being negatively connected to GDP growth overall. The latter was also the case for the broad money supply. The Banking Act 1874, which was made in relation to the adoption of the gold standard, seems positively related to formalisation. The reason for this is probably that as credit creation becomes somewhat restricted, demand for formal collateral rises. The overall explanatory value is 38 per cent.

V

Research in both economic history and economics acknowledges the importance of financial development for economic growth; however, this importance is not self-evident and certain requirements are needed for the financial system to have a positive impact on growth. In this article, we stress the importance of the process of financial market formalisation due to the ability of financial agents to create credit on demand, and their engagement in long-term financing.

More specifically, we studied how Swedish commercial banks transformed their lending in the late nineteenth and early twentieth century. In the 1860s discounting bills of exchange and lending on name security dominated, but by the late nineteenth century lending backed by mortgages and shares had taken over as the primary forms of credit. We interpret this change as part of a formalisation process, because mortgages and shares could be submitted to a more standardised valuation process and because of the potential to resell on a secondary market.

While both mortgages and shares were part of the formalisation process, they filled partly different roles. Lending backed by shares followed the pattern of industrialisation and it was clearly positively linked to economic trends; in the five biggest booms the share of share-backed lending peaked relative to other forms of collateral. Prior to 1911, Swedish banks were prohibited from owning shares, but used share-backed lending as a way to get around this limitation. Thus, the data support the Schumpeterian notion of the banks’ pivotal role in entrepreneurial finance. Unlike lending against shares, mortgage lending followed a more steady growth path and moved in a contra-cyclical manner relative to other forms of collateral. The increased use of mortgages could be ascribed to two main shifts. The number of mortgages linked to companies rose sharply. Furthermore, the demographic transition combined with heavy urbanisation changed conditions for Swedish real estate. The large building projects in the cities required a lot of capital, but were also part of the capital formation process.

We find evidence from the preliminary statistical tests that the broad money supply (M3) – as a proxy for financial system development – and demographic factors such as population growth and urbanisation were the most important variables with which to explain the formalisation of lending in general. The use of shares was more closely linked to the industrial sector and to the establishment of limited liability joint-stock corporations. It is also clear that the commercial banking system could indeed provide credit when demanded, and this explains why all types of lending in absolute terms grew together. It also explains the different roles played by lending against shares and mortgages in this process. Institutional variables, laws and regulations, played some role, especially the oppressive law against the use of shares as collateral in 1934, and it is possible that this law can partly explain why the market for shares was more or less asleep until late in the twentieth century.

A note of caution is required: the process of formalisation and its contribution to growth is complex and, as the literature reminds us, such study focuses on one part of ‘formalisation’; a complete study also has to take into account the fact that informal credit markets continued to be important well into the twentieth century (Lindgren Reference Lindgren2002). Since we have used aggregated data, the article raises several issues for further research using bank-level data. The question also remains as to whether the Swedish case is representative in an international context or if the rise in share-backed lending is one example of what Cull et al. discussed as the multiplicity of financing solutions (Cull et al Reference Cull, Davis, Lamoreaux and Rosenthal2006). This comparative work remains to be done, but given the limited attention hitherto paid by scholars we believe it could provide financial history with a fruitful path for further research.

APPENDIX

Table A1. Swedish commercial bank lending, 1870–1938, distributed by type of collateral