Introduction

Population ageing and concerns about the sustainability of social security systems have caused policy-makers globally to reform old-age pension schemes (Hassel, Naczyk, & Wiß, Reference Hassel, Naczyk and Wiß2019; Hofäcker et al., Reference Hofäcker, Schröder, Li and Flynn2016). Besides increasing the significance of occupational and private pension funds (Naczyk & Hassel, Reference Naczyk and Hassel2019; Schelkle, Reference Schelkle2019; Wiß, Reference Wiß2019), measures are introduced that aim to delay work-retirement transitions (Flynn & Schröder, Reference Flynn and Schröder2018). These policies are part of the “active ageing” paradigm and are associated with the advantage that workers collect more public pension benefits as they work longer. While this promises fiscal reliefs, the role of national institutional contexts (and individual sentiments) in supporting active ageing measures determines the strategy’s overall success (Walker & Maltby, Reference Walker and Maltby2012).

Conservative welfare states (see: Esping-Andersen, Reference Esping-Andersen1990) display particular challenges in implementing active ageing measures because they traditionally operate with a higher degree of provision mechanisms than liberal welfare states. Policy changes in line with active ageing have changed this welfare state landscape: employees today are expected to use “employment” as the predominant coverage of provision risk, while their parents could often take advantage of financially attractive early retirement opportunities. We discuss how retirement behaviour has changed following the introduction of employment and pension-related active ageing measures.

We employ a push-and-pull factor framework that allows considering whether retirement transitions are influenced by institutional, organisational and/or individual parameters that either force individuals out of employment or incentivise them to leave employment (Radl, Reference Radl2007). Postponing retirement is therefore, in part, dependent upon the value one assigns to labour versus family and leisure time. However, the ability to exercise rational choice is also shaped by the determining nature of the institutional and organisational context as well as the degree of information transparency, eg. related to anticipated financial provisions post-retirement (Wang & Wanberg, Reference Wang and Wanberg2017). Given that retirement pathways have become more diverse (Kojola & Moen, Reference Kojola and Moen2016), it is relevant to determine how policy changes affect individuals’ retirement decisions. Using this perspective therefore helps us to understand and explain national variations in work–retirement transitions (Van Oorschot & Jensen, Reference Van Oorschot and Jensen2009).

We therefore evaluate whether national policy developments and individual responses follow the prescribed institutional path as outlined by traditional institutional taxonomies or whether countries diverge from the expected institutional path as a result of demographic change. The research question is: “How do changes in labour market and pension measures associated with active ageing affect retirement behaviour in Austria and Germany?” To answer this question, we use a similar-system-design (Anckar, Reference Anckar2008). Austria and Germany are good cases for comparison because they exhibit similar public policy dynamics and belong to the same institutional cluster with similar pressures and processes related to work–retirement transitions (see Trampusch, Reference Trampusch2009; Wiß, Reference Wiß2018).

We first review labour market and retirement institutions and public policy developments before applying the push-and-pull factor perspective to investigate timing and type of work–retirement transitions (Barbosa, Monteiro, & Murta, Reference Barbosa, Monteiro and Murta2016). We use German and Austrian data from the Survey of Health, Ageing and Retirement in Europe (SHARE) and analyse individuals’ work–retirement transitions, and whether the nature of these transitions has changed over time reflecting changes to the public policy context. We then discuss our findings and draw conclusions. Our study contributes to the literature on work and pensions, to country-comparative research as well as to institutional theory and institutional change literature.

German and Austrian old age security compared

Austria and Germany have a welfare state policy focussing on status maintenance (Blossfeld, Buchholz, & Kurz, Reference Blossfeld, Buchholz and Kurz2010), and pension systems are pay-as-you-go-financed (Ebbinghaus, Reference Ebbinghaus2011). This so-called Bismarckian pension system, which both countries ascribe to, is characterised by a strong reliance on basic insurance in the public pillar and earnings-related pension benefits (Ebbinghaus, Reference Ebbinghaus2011). Occupational and private pensions only play a minor role (Esping-Andersen, Reference Esping-Andersen1990; Hassel, Naczyk, & Wiß, Reference Hassel, Naczyk and Wiß2019).

Germany

German old-age security has changed fundamentally since the 1970s: while it supported early retirement until the mid-1990s, it has since shifted to promote “extended working lives” policies. In response to the economic crises of the 1970s, companies downsized and cut costs by offering financially attractive, state-financed early retirement opportunities with comparably small pension reductions (Naumann, Reference Naumann, Kumlin and Stadelmann-Steffen2014). The state supported this to create new jobs and to reduce costs for employers by externalising costly older workers, who had comparatively high wages due to seniority pay schemes (Ebbinghaus, Reference Ebbinghaus2006). Furthermore, there were early retirement options for long-term social security system contributors; the long-term unemployed and those with disabilities, as well as part-time early retirement schemes (Altersteilzeit) (Hess, Reference Hess, Hofäcker, Hess and König2016). Consequently, the employment rate of older workers fell steeply between the 1970s and early 1990s (König, Hess, & Hofäcker, Reference König, Hess, Hofäcker, Hofäcker, Hess and König2016). At this time, German policy-makers acknowledged that early retirement threatened the long-term sustainability of the welfare state and old-age security systems. Hence, policy reforms included: (i) the step-wise increase of the retirement age from 65 to 67, (ii) the abolition of early retirement options and tightening of eligibly criteria, (iii) the introduction of training and life-long learning measures and (iv) the marketisation and privatisation of pensions (Ebbinghaus, Reference Ebbinghaus2015). In response, the actual average retirement age and older workers’ employment rates have been rising (Stiemke, Reference Stiemke, Naegele and Hess2020). Other reasons for this trend are demographic and cohort effects, rising female employment and the positive development of the labour market (Hess, Reference Hess, Hofäcker, Hess and König2016).

Nevertheless, there are concerns regarding a (re-)emergence of social inequalities in late employment careers and the work–retirement transition. While highly skilled experts in privileged jobs with good working conditions and generous pension provisions can and often actively choose to retire later, low-skilled and low-income workers are often forced to extend their working lives for financial reasons but are struggling to do so due to adverse working conditions and high unemployment risks (Buchholz, Rinklake, & Blossfeld, Reference Buchholz, Rinklake and Blossfeld2013; Hess, Reference Hess2018).

Austria

Austrian public policy has also initiated a paradigm shift from early to late retirement. However, early retirement is still common due to the persistence of early retirement pathways related to disability and unemployment (Inderbitzin et al., Reference Inderbitzin, Staubli and Zweimüller2016). In addition, the relatively low femaleFootnote 1 statutory retirement age leads to lower average retirement ages compared to Germany.

Austria has implemented several pension reforms, particularly focussing on improving the labour market integration of older individuals (Zweimüller & Staubli, Reference Zweimüller and Staubli2012). In 2000, the pension system was modified, and the third pension pillar was strengthened, consisting of a state-subsidised private pension (Hofer, Reference Hofer2007). In 2003 a reform then foresaw the step-wise increase of the statutory retirement age to age 65 for men and age 60 for women by 2017 (Zweimüller & Staubli, Reference Zweimüller and Staubli2012). Also, unemployment-related early retirement and part-time early retirement schemes (Gleitpension) were abolished. Furthermore, the pension assessment period was raised from 15 to 40 contribution years by 2028, and the assessment rate per insurance year was incrementally decreased from 2 to 1.78 per cent by 2009 (Zweimüller & Staubli, Reference Zweimüller and Staubli2012). However, the subsequent 2004 pension reform partially mitigated these measures (Zweimüller & Staubli, Reference Zweimüller and Staubli2012, p. 19), eg. the introduction of the so-called corridor pension offers a pathway into early retirement again at the age of 62. Lastly, generous pension provisions for heavy labourers and long-term pension contributors were re-introduced (Zweimüller & Staubli, Reference Zweimüller and Staubli2012).

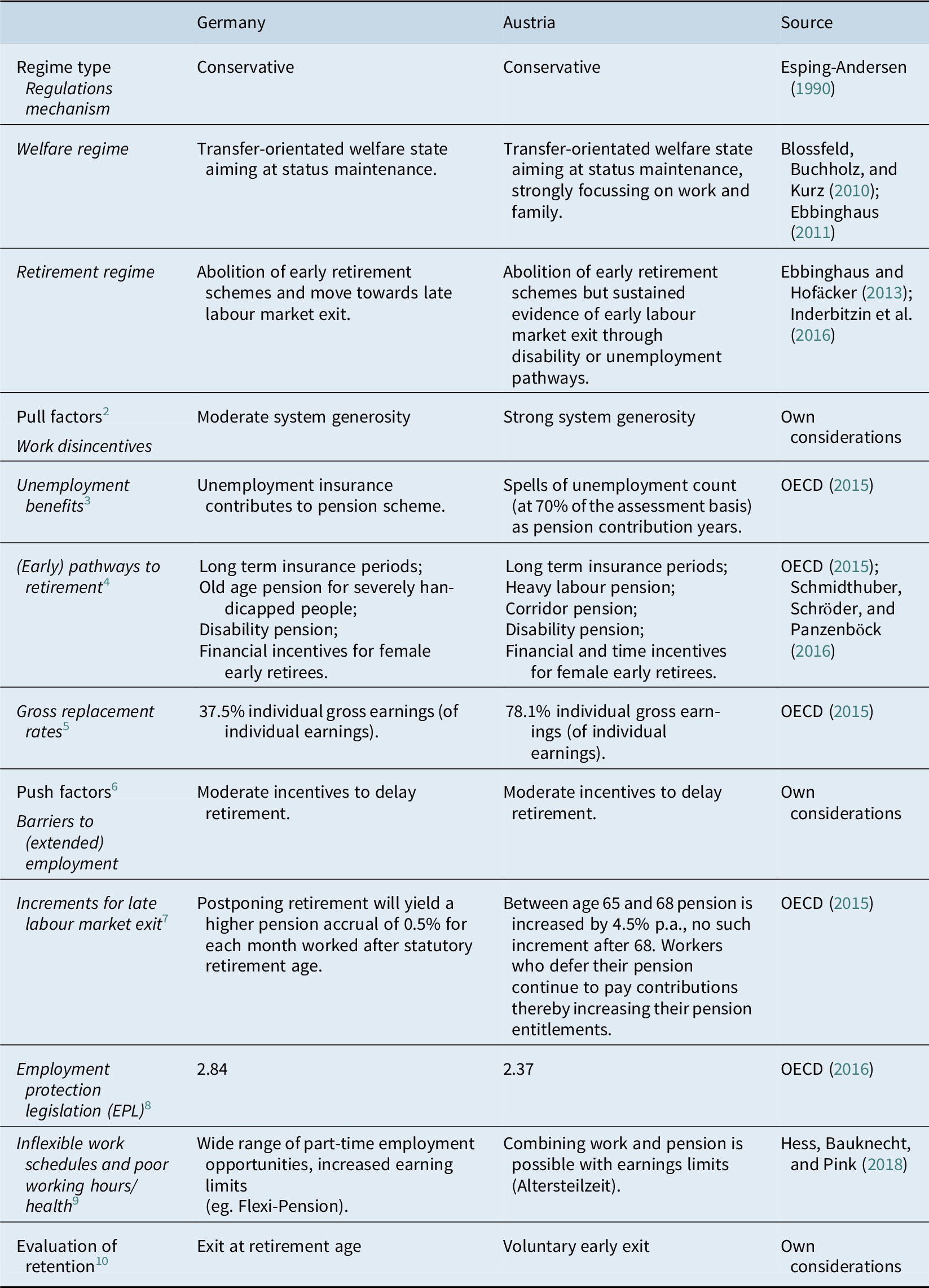

Although Austria has implemented a demand-based tax-financed minimum pension along with the compulsory pension insurance for the self-employed without employees (Blank et al., Reference Blank, Logeay, Türk, Wöss and Zwiener2016), the differences in pension eligibility indicate inequalities in retirement timing across gender and household context (Raab, Reference Raab2008). While in Germany, it seems that the gap between high- and low-income groups is widening (Hess, Reference Hess2018), in Austria, the system supports a gender gap associated with pension entitlements is increasing (Fechter, Reference Fechter2019). For an overview of the institutional determinants of old-age security in Germany and Austria, see Table 1 below.

Table 1. Institutional determinants of the German and Austrian old age security systems.

Source: Fechter & Sesselmeier, Reference Fechter and Sesselmeier2017.

The influence of policy changes on retirement transitions

After having discussed institutional similarities and differences between the German and Austrian welfare and labour market regimes, we now investigate how these regimes and policy changes have affected retirement transitions.

Decisions regarding early or later retirement transitions depend on the institutional context (Hofäcker et al., Reference Hofäcker, Schröder, Li and Flynn2016). However, with “extended working lives” being the new norm, we assume that older adults are potential labour market participants and will be able to turn to the market if their skills and knowledge are in demand and/or if they need to earn (extra) income (Van der Horst et al., Reference Van der Horst, Lain, Vickerstaff, Clark and Baumberg-Geiger2017). Individuals therefore have an increasing amount of different retirement pathways available to them (Fasang, Reference Fasang2012; Phillipson et al., Reference Phillipson, Shepherd, Robinson and Vickerstaff2018). However, whether these options are feasible depends on individuals’ abilities and socioeconomic profiles that either enable or hinder them to extend their careers, leading to labour market inclusion or exclusion (Kojola & Moen, Reference Kojola and Moen2016). This is not necessarily individual-specific. In fact, Calvo, Madero-Cabib, and Staudinger (Reference Calvo, Madero-Cabib and Staudinger2017), using U.S. panel data, indicate that retirement transitions are highly stratified by gender, class and race.

From the national policy contexts and the theoretical background discussed above, we develop two hypotheses. First, we expect that, in line with changes in the institutional architecture, typical challenges of liberal welfare states emerge in Germany but not in Austria, and that these challenges affect retirement timing. Second, we expect to observe changes in retirement behaviour along the lines of gender and educational attainment. This is in line with the U.S. study by Calvo et al. (2018) which finds stratification by gender and social class (operationalised as educational attainment) as well as a study on Dutch retirement behaviour by Riekhoff (Reference Riekhoff2019), which finds that women’s retirement transitions are more heterogeneous than men’s. We therefore assume that the relative system generosity of the Austrian welfare system “pulls” women earlier into retirement than men and that women in Austria retire earlier than women in Germany. We also expect that the level of educational attainment creates either barriers or opportunities for extended working lives in Germany, and that this effect is stronger in Germany than in Austria.

H1: If retirement age varies between Austria and Germany, then these differences are observed by gender and level of educational attainment.

Our second hypothesis concerns the transfer of the old-age-related financial risk from welfare institutions and employers to individuals (Flynn & Schröder, Reference Flynn and Schröder2018). With the introduction of extended working lives, individuals have to work longer to reduce financial risks at old age. We assume that this effect will be stronger in Germany than in Austria because Germany displays more liberal welfare characteristics. This means that pull and push factors were simultaneously reduced to support/enforce longer working lives.

H2: If retirement age rises, then increases are stronger in Germany than in Austria.

Data and method

Data and sample selection

We use data from SHARE,Footnote 11 which provides cross-national and longitudinal panel microdata on the health, economic and social situation of individuals aged 50 and above (Börsch-Supan and Jürgen, Reference Börsch-Supan and Jürges2005; Börsch-Supan et al., Reference Börsch-Supan, Brandt, Hunkler, Kneip, Korbmacher, Malter, Schaan, Stuck and Zuber2013; Malter and Börsch-Supan, Reference Malter and Börsch-Supan2017). SHARE also offers information on employment decisions.

We focus on the retirement decisions of employees in Austria and Germany over time. Consequently, we restrict our analysis to individuals who were retired at the time of data collection. To conduct cross-time analysis, we use two of the seven waves: wave 1 was conducted in 2004/2005 (Börsch-Supan, Reference Börsch-Supan2018), and wave 6 data were collected in 2015 (Börsch-Supan, Reference Börsch-Supan2020). This allows the comparison of two retirement cohorts. Due to possible unequal inclusion probabilities of sample respondents, we have weighted the data. We applied the calibrated weights for individuals provided by SHARE, as the basic sample unit of analysis is the individual.

Dependent variable

The retirement timing is calculated as the difference between the year of retirement [or year of the last job ended (wave 1)] and the respondent’s year of birth. In line with Hofäcker et al. (Reference Hofäcker, Schröder, Li and Flynn2016), we exclude extreme cases of early or late retirement and focus on retirement transitions between ages 50 and 70 (excluding 0.3 per cent of all cases in wave 1 and 0.1 per cent in wave 6). For wave 1, the year of retirement is limited to 1995 and later to allow comparison of push and pull factors (see Table 1). In wave 6, the year of retirement is cut off in 2005 to provide insights into the effect of pension policy on retirement timing. Hence, the compared cohorts have retired between 1995 and 2004, and 2005 and 2015. This sample selection leads to the following birth cohorts: individuals born 1927 and later and individuals born 1940 and later.

Independent variables

Gender is included as a dummy variable, taking female as a reference category. Education attainment is included as a proxy for differences in social capital: lower secondary education or less [International Standard Classification of Education (ISCED 0–2)], upper secondary education (ISCED 3 and 4) and tertiary education (ISCED 5 and 6). Finally, we test country effects by splitting the sample respondents into two groups, Austrian and German retirees.

Control variables

We control for employment as the last job before retirement using dummies: employed; self-employed with low and intermediate educational level; self-employed with high educational level; and whether respondents were civil servants (=1; =0 otherwise) because the retirement of civil servants is governed by different regulations (see Wiß, Schmidthuber, & Bordone, Reference Wiß, Schmidthuber and Bordone2020). Marital status is included using dummies: widowed and currently married individuals, irrespective of living together with or living separately from a partner (reference category); divorced individuals; and others, including individuals in a registered partnership and single. We differentiate between married and cohabitating individuals due to specific pension regulations for married couples in both countries. For the 2005 German sample, we further control for whether respondents have lived in East Germany (=1; =0 otherwise) in November 1989.

Reasons for retirement

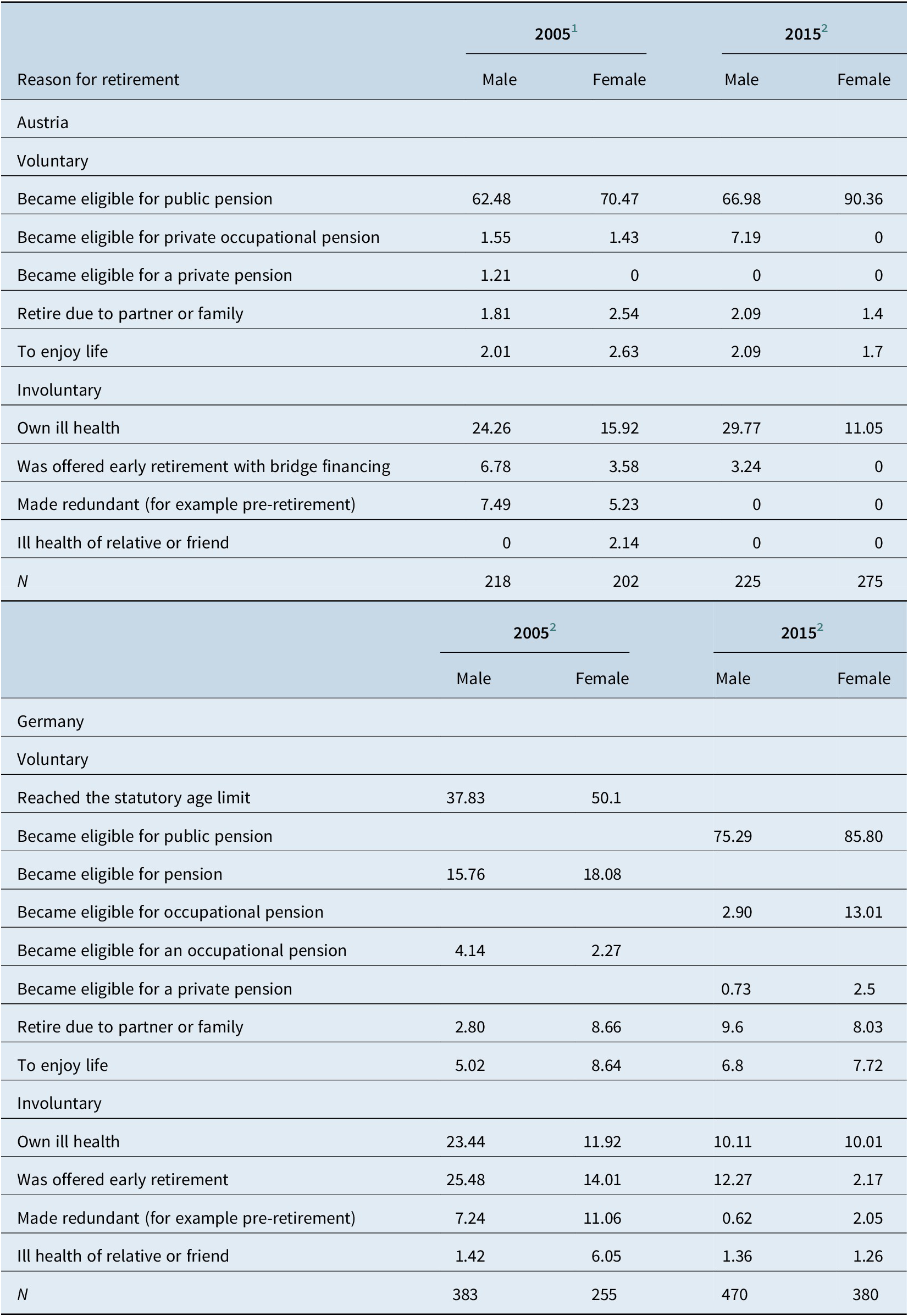

To explore retirement timing in the context of push and pull factors, we analyse why individuals retire. Reasons for retirement are classified into voluntary and involuntary reasons (Table 2). We consider retirement to be voluntary reasons, if this is based on incentives that pull individuals into early retirement. Involuntary reasons are those that push individuals out of the labour market. By aligning institutional factors (Table 1) with voluntary and involuntary retirement reasons (Table 2), we aim to underline our findings further. In line with Hofäcker et al. (Reference Hofäcker, Schröder, Li and Flynn2016), we define a voluntary transition into retirement as having the opportunity to continue working (and choosing not to), whereas involuntary retirement is defined as having no options to stay gainfully employed. Table 2 provides an overview of the reasons for voluntary and involuntary retirement. In the 2005 Austrian sample, respondents were asked to list the main reason for retirement. In the 2015 Austrian sample and in both German samples, respondents could list multiple reasons. Due to country-specific peculiarities in the questionnaire, we differentiate the classification between Austria and Germany.

Table 2. Reasons for retirement: voluntary versus involuntary retirement.

Source: Hofäcker et al. (Reference Hofäcker, Schröder, Li and Flynn2016).

Sample characteristics

Table 3 outlines the sample characteristics. The 2005 Austrian sample consists of about 53 per cent male respondents, more than 57 per cent hold an intermediate educational level, 79 per cent are married, and more than 73 per cent were employed in their last job before retirement. The 2005 German sample consists of 57 per cent male respondents, 74 per cent hold an intermediate educational level, about 85 per cent are married, and 84 per cent were employed. The 2015 Austrian sample consists of 45 per cent male respondents, 45 per cent hold an intermediate educational level, 68 per cent are married, and 60 per cent are employed. The 2015 German sample is comprised of 60 per cent male respondents, 58 per cent hold an intermediate educational level, more than 81 per cent are married, and 59 per cent are employed.

Table 3. Sample descriptives.

Numbers are percentages. Data are weighted.

Source: Survey of Health, Ageing and Retirement in Europe (SHARE) wave 1 and wave 6.

Results

Descriptive results

Table 4 provides an overview of the average retirement age of Austrian and German respondents, and reports the t-test statistics. First, we compare the average retirement ages in the 2005 and 2015 samples. Descriptive findings from the 2005 sample indicate that Austrians retired on average at age 57.67. The average retirement age in Germany was 60.76, more than 3 years later than in Austria. A t-test analysis indicates a significant difference between the Austrian and German retirement age of 3.09 years. Next, findings point to differences concerning gender. In both countries, women retire earlier than men. In Austria, the female retirement age is 56.82, whereas the male one is 58.46, a significant difference of 1.63 years. German men and women retire on average at age 61.14 and 60.76, respectively, indicating a significant difference of 0.97 years.

Table 4. Retirement timing in Austria and Germany and t-test statistics.

Abbreviation: SD, standard deviation; SE, standard error.

Source: Survey of Health, Ageing and Retirement in Europe (SHARE) wave 1 and wave 6.

Note: + p < 0.10; * p < 0.05; ** p < 0.01; *** p < 0.001.

Regarding the 2015 samples, the Austrian average retirement age increased to 60.64, whereas the German one rose to 63.21, resulting in a significant difference of 2.58 years. Austrians therefore retire about 2 years earlier than Germans. Moreover, the 2015 sample re-confirms gender differences in Austria. Women in Austria retire on average 2.73 years earlier than their male counterparts. In Germany, the female retirement age is slightly above the male one and there is a significant difference in the retirement age across genders at the 5 per cent level.

Table 5 outlines the reasons for retirement in Austria and Germany, respectively. For the 2005 sample, descriptive statistics indicate that the majority of Austrians, about 62 per cent of men and 70 per cent of women, retire due to the eligibility for a public pension. 38 per cent of men and 50 per cent of women in Germany retire as soon as they have reached the statutory age limit, and about 16 and 18 per cent, respectively, once they became eligible for a pension.

Table 5. Reasons for retirement in Austria and Germany.

1 only one answer possible.

2 multiple answers possible. Numbers are percentages. Data are weighted.

Source: SHARE Wave 1 and Wave 6

In terms of involuntary retirement, findings indicate that in both countries, a great share of individuals retires due to health reasons, and this retirement reason is more frequent among men than women. About 24 per cent of Austrian men and 23 per cent of German men retire due to health reasons, whereas women mention health as a reason for retirement at half of the male rate. Besides, more than 25 per cent of the male German sample report to have retired early. In Austria, less than 7 per cent of the male sample was offered early retirement with bridge financing.

As far as the 2015 sample is concerned, findings indicate that about 67 per cent of men and 90 per cent of women in Austria retire because they have become eligible for public pension. About 75 per cent of male and 86 per cent of female Germans do so. More than 30 per cent of men and 11 per cent of women in Austria retire due to health reasons (for Germany: 10.01 per cent of women, 10.11 per cent of men). In Austria, eligibility for occupational pension is a retirement reason for about 7 per cent of men. In Germany, this is the case for about 3 per cent of men and 13 per cent of women. About 3 per cent of men in Austria, and 12 per cent of men and 2 per cent of women in Germany was offered early retirement.

Multivariate results: determinants of retirement timing

Multivariate analyses are conducted to examine the determinants of retirement timing. To account for any possible issues with multicollinearity, correlation matrix (Appendices 1–4) and the variance inflation factor (VIF) are assessed for all models to verify the validity and reliability of our empirical approach. Multicollinearity tests dismissed the potential for problems since none of the mean-VIFs exceeds 2.09, which is below the typical cut-off of 10 (see Kutner, Nachtsheim, & Neter, Reference Kutner, Nachtsheim and Neter2004).

Table 6 presents the multivariate findings of the linear regression for the Austrian sample. Results indicate that men retire significantly later than women. Also, education correlates with retirement timing. Accordingly, individuals with low educational level retire later than those with intermediate educational level, and those with high educational level retire later than individuals with low educational level. As far as control variables are concerned, findings show that married individuals retire later than divorcees. Finally, findings indicate that employed respondents retire earlier than self-employed with low and intermediate educational levels and civil servants retire earlier than individuals with other prior employment.

Table 6. Explaining variation in retirement timing.

Linear regression. Regression coefficient and Standard Error. Data are weighted.

Abbreviation: VIF, variance inflation factor.

Note: + p < 0.10; * p < 0.05; ** p < 0.01; *** p < 0.001.

The second column presents the findings on the regression analysis for the 2015 sample. Similar to the first model, men in Austria retire significantly later than women. The regression coefficient is even higher than the 2005 one. The non-linear relationship between education and retirement timing disappears when looking at the 2015 findings. Accordingly, respondents with a low educational level retire earlier than those with higher educational level, pointing to a somewhat linear effect of education on retirement age. In turn, married individuals retire later than divorced ones. Finally, self-employed individuals with high educational level retire significantly later than employed individuals.

Model 3 presents the findings from the 2005 German sample. Similar to the Austrian sample, men retire significantly later than women. However, the regression coefficient is smaller in the German sample, meaning that gender differences are lower and the findings are only significant at the 10 per cent level. Furthermore, low educated individuals retire later than those with intermediate educational level. Whereas divorcees retire more than one year earlier than married individuals, married respondents retire about 1.7 years earlier than singles. Self-employed with low and intermediate educational level retire about 2.4 years later than employed respondents. Finally, respondents having lived in East Germany retire earlier than others.

Model 4 outlines the regression findings of the 2015 sample. Female respondents retire about 1 year later than male respondents. Similar to the 2015 Austrian sample, there is a linear association between education and retirement age in the 2015 German sample. Individuals with high educational level retire later than those with a low educational level. Finally, marriage and employment do not significantly influence retirement timing.

Additional models using interaction terms have explored potential moderating effects of gender and education. Findings indicate that gender does not change the effect of the educational levels on retirement timing, meaning that there are no significant differences between men and women in terms of the effect of education on retirement timing.

To represent retirement timing pictorially, Kaplan–Meier curves are presented in Figure 1 for both countries’ samples. The time to retirement is outlined on the x-axis, and the percentage of the sample on the y-axis. The figure, once more, clearly point to the gender difference in retirement timing in the Austrian samples. A great share of female Austrians retire before the age of 60 in the 2005 sample, whereas a great percentage of men retire at the age of 60. The gender gap is time-displaced in the 2015 sample, illustrated in Figure 1c. Both women and men retire later, however, most female Austrians are already in retirement at the time of male retirement. Considering the 2005 German sample in Figure 1b, there is also a gender gap in retirement timing. However, the gender differences are not comparable to the Austrian samples. Furthermore, gender differences seem to disappear in the 2015 sample. The retirement trajectories of both genders are nearly identical and both groups tend to retire later.

Figure 1. Kaplan–Meier survival graph for men versus women, Austria and Germany compared across two time periods. The x-axis “retirement timing” indicates how many years (x) respondents stay in their jobs after age 50. If a repondents retire at age 70, this would be a value of 20 on the x-axis.

Discussion

We investigated pension reforms in Austria and Germany and their effects on retirement timing. These reforms were more substantial in Germany than in Austria, resulting in a stronger increase of the actual retirement age in Germany. This is also reflected in our empirical findings. Table 4 depicts the reasons for retirement and shows that “being offered early retirement” and “being made redundant” have become less important reasons in 2015 than in 2005 while “working up until the statutory retirement age” or “eligibility for a public pension” are much more common in 2015 than 2005. Furthermore, the regression analysis underlines this development: the actual retirement age has increased in both countries but it is still over 2 years higher in Germany. However, differences in development can be observed. In Germany, the gender gap has decreased: in 2015, women were older at retirement than men, after controlling for confounding variables. In contrast, Austrian women and men seem to still follow the traditional roles in the male breadwinner welfare state. For education, a different development is observed: the effect of educational attainment on retirement timing has become larger in Germany but has remained rather small in Austria. We suggest that patterns in work-retirement transitions have changed in both countries towards later retirement. However, while similar policy measures seem to cause similar developments within countries, we find that the strength of the effect differs between countries. Results therefore point to increasing de-standardisation along educational lines in Germany but to an increasing standardisation of retirement timing by gender. In Austria, existing gender differences remain stable over time and educational differences do not affect retirement timing to the same extent as in Germany. We therefore conclude that retirement de-standardisation trends are stronger in Germany than in Austria but suggest that this is offset by the increasing labour market attachment of German women.

We propose that the two countries respond differently to measures of pension policy-related active ageing measures. Austria shows persistent gender differences, which corresponds with the conservative welfare paradigm (Lewis, Reference Lewis1992) and follows a path-dependent logic. The Austrian welfare state therefore still represents the male-breadwinner/female part-time career model (compare: Berghammer, Reference Berghammer2014; Pfau-Effinger, Reference Pfau-Effinger, Van Ooorschot, Opielka and Pfau-Effinger2008; Sackmann & Wingens, Reference Sackmann, Wingens, Heinz and Marshall2003), preserving gender differences throughout the life course. Germany, in turn, displays increasing similarities with liberal welfare states: ie. fewer gender differences, but stronger inequalities between educational groups.

In Germany, previously labour market-inactive women increasingly enter the labour market using part-time employment models (Möhring & Weiland, Reference Möhring and Weiland2018), in line with the aims of the Hartz reform. Therefore, delaying retirement by reducing pull factors coincides with reducing push factors to extend employment in Germany. Skill shortages as part of the German industrial economic model could also be influential in strengthening those welfare elements that increase the likelihood of labour market retention (Rubery et al., Reference Rubery, Grimshaw, Donnerly, Urwin, Bosch, Lehndorff and Rubery2009). Thus, older individuals are still more competitive than younger ones, but this is mediated by older individuals’ educational background. If push factors dominate the labour market, then labour market integration becomes more difficult even if early retirement incentives are reduced (Fechter, Reference Fechter2019). Therefore, the push and pull design of employment models is consistent with differences in work-retirement transitions between the countries. In contrast to De Preter, Van Looy, and Mortelmans (Reference De Preter, Van Looy and Mortelmans2013), we find that institutional push factors are important for labour retention. Adjustment mechanisms in Germany show a stronger reliance on the use of labour as a risk provision, known from liberal welfare states. In Austria, institutional arrangements seem to produce trade-offs with the new norm of “extended working lives” in line with Austria’s traditional welfare architecture.

We acknowledge several limitations. First, the welfare state regime approach is broad, subsuming all welfare state regulations, ideas, and historical path-dependencies into one cluster. However, such an overarching framework is beneficial here as this study includes all welfare state aspects that influence retirement transitions. Second, the study does not analyse occupational or private pensions, but focusses only on state pensions. However, in particular in Germany there was a policy trend towards strengthening private pensions (Riesterrente) to supplement the public pension. This must be considered when interpreting the results. Furthermore, we do not control for unemployment, although it remains a persistent problem, particularly in Austria. Future research should investigate how the experience of unemployment affects retirement timing. Lastly, the comparison of retirement reasons must be interpreted with caution as they differ between the two countries and at the two measurement points. We therefore did not include retirement reasons in our multivariate models.

Despite these limitations, we make three distinct contributions to the comparative welfare research literature. First, we find that “extended working lives” correspond to the initial welfare structure in Austria, but strengthen the more liberal elements in the German welfare state. Second, we have detected shifts in the outlined similarities and differences between the two countries by incorporating a range of push and pull factors. Third, regarding the findings on skill-levels, social policy demands emerge for a more heterogeneous group.

In conclusion, socio-economic determinants of retirement timing point towards the emergence of country-specific social security gaps: In the German case, considerations of demand-based tax-financed minimum pensions, following the Austrian example, seem adequate as this institutional mechanism appears to counteract the impact of educational differences on retirement. In Austria, inequalities emerge from welfare incentives supporting the labour market discontinuity of women. Here, a stronger focus should be on individual pension entitlements, as seen in the German context.

Acknowledgements

The effort of two anonymous referees is highly appreciated, whose valuable suggestions have helped greatly to improve the paper. This paper was carried out as part of the FACTAGE project. The FACTAGE project was supported by the German Federal Ministry of Education and Research.

Disclosure statement

No potential conflict of interest was reported by the authors.

Notes on contributors

Lisa Schmidthuber is post-doctoral researcher in the Institute for Public Management and Governance, Vienna University of Economics and Business, Austria. Charlotte Fechter is post-doctoral researcher at University of Koblenz-Landau, Germany. Heike Schröder is Lecturer in Human Resource Management at Queen’s University Belfast. Moritz Heß is Professor of Gerontology at Hochschule Niederrhein, Germany.

Appendices

Appendix 1: Correlation matrix, 2005 Austrian sample

+p < 0.10; *p < 0.05; **p < 0.01; ***p < 0.001.

Appendix 2: Correlation matrix, 2005 German sample

+p < 0.10; *p < 0.05; **p < 0.01; ***p < 0.001.

Appendix 3: Correlation matrix, 2015 Austria sample

+p < 0.10; *p < 0.05; **p < 0.01; ***p < 0.001.

Appendix 4: Correlation matrix, 2015 German sample

+p < 0.10; *p < 0.05; **p < 0.01; ***p < 0.001.