INTRODUCTION

This study will address the transformation of the Philippine currency system during the American colonial period (1898–1945). For this subject Edwin W. Kemmerer's Modern Currency Reform (1916) and George F. Luthringer's The Gold-Exchange Standard in the Philippines (1934) are essential sources. The value of these two books might almost be compared to that of John Maynard Keynes's classic Indian Currency and Finance (1924), which so clearly illuminated the gold exchange standard system of British India from the end of the nineteenth century to World War I. Yet Kemmerer's and Luthringer's works leave one area untouched: they say nothing of the interrelationship between the currency system and the trade and investment patterns in the Philippines. Given that the currency system was a key component of the financial sector, and served as a superstructure to the country's economy, it is also important for us to consider its linkages with the production structure.

It is well known that the Philippine trade structure became dependent upon the US under special tariff treaties between the two countries from the late 1910s. By the 1920s the United States took in 80 to 90 percent of total exports from the Philippines, while supplying nearly 60 percent of Philippine imports. This heavy reliance on the US market might be interpreted as a typical example of the universal phenomenon of colonial economies during the first half of the twentieth century, with trade structures closely bound to their colonial masters. However, in some respects the Philippines during the American colonial period was unique in terms of its investment structure. In industrial investment in some primary commodities such as coconut and Manila hemp, American investors did acquire majority ownership. In the sugar industry, however, Filipino entrepreneurs held a majority share of the investment, and the Spanish firm Tabacalera dominated the tobacco industry from the late nineteenth century onwards. In the agricultural production of primary commodities, it was generally Filipino landowners who held majority ownership; American investors never penetrated deeply into this sector. The paramount position of Filipino landowners in agricultural production and Filipino entrepreneurs in the sugar industry was a distinctive feature of the production structure of the Philippine export economy. But how did the US-dependent trade structure and the production structure of primary commodities relate to the changing structure of the currency system in the Philippines during the American colonial period?

In order to explore this question, this study will first outline the introduction of the gold exchange standard in the Philippines. Second, the transformation of the gold exchange standard into the dollar exchange standard in the 1920s will be considered. Third, the introduction of the dollar exchange standard during the Great Depression of the 1930s will be traced. Then, in conclusion, the Philippine currency system during the American colonial period will be compared to the gold exchange standard in British India.

ADOPTION OF THE GOLD EXCHANGE STANDARD

According to Kemmerer's Modern Currency Reform (Reference Kemmerer1916), five different currencies were in circulation at the outset of the US occupation of the Philippines: (1) Mexican pesos, mostly smuggled into the Philippines, that contained 377 grains of pure silver; (2) Alfonsino pesos, commonly known as Alfonsinos, that were minted in Spain as Philippines currency under a Royal Decree of 1897; (3) silver coins of 50, 20, and 10 centavos with silver content 11.2 percent less than that of the Mexican pesos; (4) various coins including Spanish pesos, silver coins from Spanish America (in addition to the abovementioned Mexican pesos), and copper coins from Spain and other countries; and (5) bank notes issued by the Banco Español Filipino (later renamed the Bank of the Philippine Islands) in Manila, under authority granted by a Spanish decree of 1896. At the end of the nineteenth century the supply of currency was so limited that all of the above currencies circulated in the Philippines at a value substantially higher than that of the peso in Mexico.Footnote 1 As Kemmerer observed: “Strictly speaking, the Philippines were not upon the silver standard from the time that gold disappeared from circulation in the early eighties to the time of the American occupation in 1898. They were upon a fiduciary coin standard… .”Footnote 2

The US War Department estimated that the United States spent 177 million dollars in total from 1 May 1898 to 30 June 1902 for the pacification of the Philippine Islands.Footnote 3 One primary policy of American rule in the Philippines was the establishment of a colonial government with political and administrative autonomy; another was the maintenance of a self-reliant financial system. As will be described below, the US government continually disbursed military funding for stationing its army and navy in the Philippines; yet, the US Congress never approved any funding assistance for the Philippine government throughout the period of colonial rule.Footnote 4

To run the colonial government under such budgetary constraints, the initial task of the United States was the stabilization of the exchange rate between the US dollar and the various monies circulating in the Philippines.Footnote 5 The Philippine government first attempted to maintain a rate of two Mexican pesos to one dollar in American gold.Footnote 6 However, when the Boxer Rebellion broke out in China, the exchange rate of the Mexican peso rose sharply in 1900 owing to the strong demand for silver currency, only to fall back again after the Rebellion was over in 1901. During the two-year period between 1902 and 1903 the Philippine government was forced to change the official exchange rate several times.Footnote 7 The instability of the exchange rate of the Mexican peso not only had a negative impact on foreign trade, but also brought financial losses and considerable complexity in budgetary accounting for the Philippine government.Footnote 8 Many heated debates on the long-lasting reform of the currency system were held in the Philippines during the early years of the twentieth century.

In 1901 three different plans were proposed for currency reform: (1) to continue the silver standard, by re-coining the Mexican and Spanish-Filipino coins into American ones;Footnote 9 (2) to establish a gold standard by adopting the US dollar; (3) to adopt the gold standard with a new peso equivalent to half the US dollar.Footnote 10

The first plan had the support of overseas Chinese and European exporters and British bankers in the Philippines. They did business with the neighboring countries of China and the Straits Settlements, which ran currency systems based on a silver standard within the British economic sphere. These businessmen preferred to maintain a silver standard in the Philippines similar to that of other Asian countries. By contrast, American and European importers incurred enormous losses from the silver devaluations, and this deterred the Philippine government from maintaining a silver standard. The plan for a silver standard was unanimously opposed not only by the members of the Philippine Commission who dominated the legislative and administrative power in the Philippines at that time, but also by a majority in the US House of Representatives, though it was once approved by the US Senate.Footnote 11

On the second plan, to introduce a US dollar-based gold standard, there were various opinions in the United States. Supporters offered three reasons: (1) it was the simplest way to introduce a gold standard; (2) it would encourage closer relations with the United States; and (3) by introducing the American currency system, the United States would show its prestige to the Filipino people. Opponents argued that: (1) the Filipino people were accustomed to silver coins, so the introduction of American money would cause confusion among them; (2) the American dollar was too large to be the unit of Philippine money; (3) there was the danger that the American dollar might be counterfeited in the Philippines; and (4) maintaining the American currency system in the Philippines would necessitate a substantial gold reserve and gold coin in circulation, and this gold would drain away to other countries in Asia. The plan was adopted by the US House of Representatives in January 1903, but rejected by the Senate and later abandoned by the House.Footnote 12

The Philippine Commission in Manila regarded the third plan, a new gold-based peso, as the most suitable for the Philippines. Upon the transition to civilian rule in July 1901, the US Secretary of War Elihu Root sent Charles A. Conant to the Philippines to prepare a reform plan for a new currency and banking system.Footnote 13 At that time Conant was already widely recognized as a leading financial and banking expert by American government officials and bankers.Footnote 14 Conant conducted his investigations in the Philippines in the summer of 1901 as special commissioner of the US War Department, and upon submission of his report in November the same year, he proposed a new coinage and banking system in the Philippines in accordance with that favored by the Philippine Commission.Footnote 15 In January 1902, a bill for Philippine currency reform was submitted to both the US House of Representatives and Senate, but was withdrawn when it failed to secure approval.Footnote 16 Hence the basic plan for the currency system had still not been decided when the Philippine Organic Act of July 1902 was enacted, by which the general guidelines for Philippine colonial rule under a civil government were formulated.Footnote 17 However, with the strong recommendation of the Philippine Commission, the same currency reform bill was introduced once again to the US Congress in 1903 and this time approved by both House and Senate, being finally enacted as the Philippine Coinage Act of March 1903.Footnote 18

The Philippine Coinage Act had thirteen sections, and its main provisions were as follows:Footnote 19 (1) the legal currency of the Philippine Islands would be the gold peso at the rate in gold coin of one US dollar for two Philippine pesos (Section 1); (2) the Philippine government was authorized to mint currency not exceeding 75 million pesos (Section 2), and to mint silver coins of 50 centavos, 20 centavos and 10 centavos (Section 4); (3) to maintain the value of the silver peso at the rate of one gold peso, the Philippine government was authorized to issue a temporary certificate of indebtedness not to exceed 10 million dollars (Section 6); (4) the Insular Treasurer was authorized to issue silver certificates and to retain the reserves to back them (Section 8).

Under these provisions, a new currency system was introduced in the Philippines, in the form of silver coins based on gold coin whose denomination was a peso pegged to the US dollar. As a result, Charles Conant, who had been instrumental in the introduction of the new system, was called “Father of the Philippine currency system”, and the silver coin first issued in the Philippines in 1903 was named the “Conant”. After his death in 1915, his half-length portrait was printed on the one-peso bill issued by the Philippine government.Footnote 20 This was the gold exchange standard that was introduced by the United States in the Philippines. It was usual for a gold exchange standard to be the currency system of choice for colonies or dependencies, where a silver standard pegged to the gold coin of the colonial masters under a gold standard system was maintained.Footnote 21 Thus, the adoption of the gold exchange standard meant that the Philippines would be in a subordinate position to the United States in terms of the currency system.

While the Philippine Coinage Act of 1903 reflects the general outline of the Philippine currency system as laid down by the US Congress, the Philippine Gold Standard Act (Act No. 938) enacted by the Philippine Commission in 1903 established various detailed regulations for the government institutions to implement the Coinage Act and the establishment of the currency reserve.

The Philippine Gold Standard Act had fourteen sections and its main provisions may be summarized as follows.Footnote 22 (1) The Gold Standard Fund was established as a separate trust fund under the Bureau of Treasury of the Philippine government to be used for the purpose of maintaining the parity of the silver Philippine peso with the gold standard peso. This fund was established from various sources: the proceeds of certificates of indebtedness; all profits of seigniorage made by the Philippine government in the purchase of bullion and minting coinage, and in the issue of the Philippine pesos and the subsidiary and minor coins; all profits made by the Philippine government from the sale of exchange between the Philippines and the United States; and all other receipts taken by the Insular Treasury (Section 1). (2) A Division of Currency under the Bureau of Treasury was created for the purpose of facilitating the circulation of the currency and maintaining parity with the dollar (Section 2).Footnote 23 (3) To maintain the parity of the Philippine currency with the dollar, the Insular Treasurer was authorized to deploy three conversion systems: (a) to sell on demand drafts on the Gold Standard Fund both in the Philippines and the United States; (b) to exchange US bank notes or treasury notes for Philippine currency; and (c) to exchange US gold coin or gold bars for Philippine currency (Section 7). (4) Detailed regulations were prepared for the printing and issuance of the silver certificates and the reserve vault for the certificates (Section 10).

Thus, a Division of Currency was created under the Bureau of Treasury in the Philippine government and the Gold Standard Fund was deposited both in the Philippines (Manila) and the United States (New York). For currency conversion the above three methods for maintaining parity with the dollar were stipulated, but it was in reality the sale of drafts on the Gold Standard Fund in the Philippines and the United States that put the Philippine currency system onto a gold exchange standard.Footnote 24 In short, the gold exchange standard functioned in the Philippines, while the Gold Standard Fund was deposited both in Manila and New York and the drafts sold at a fixed rate on the fund, thereby maintaining the parity of the currency by government regulation of foreign exchange without the circulation of gold coin. Nevertheless, the Philippine government in Manila and the US War Department faced various difficulties in maintaining the gold exchange standard right from the time of its introduction – for example the problems with the issuance of new currencies in 1903, or the sharp increase in the silver price between 1905 and 1907 – yet these difficulties were not serious enough to lead to drastic currency reform in the Philippines. A more severe problem that the Philippine government and the US War Department were to encounter later was a shortfall in the Gold Standard Fund caused by a change in the function of silver certificates.

THE TRANSFORMATION OF THE GOLD EXCHANGE STANDARD

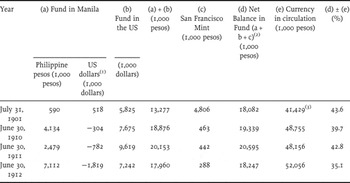

As a general rule, to sustain the gold exchange standard in the colonies, it was important that the currency system of the colonial masters be stabilized under a gold standard, at the same time as the colonies maintained an export surplus. However, as George F. Luthringer correctly pointed out, the gold exchange standard was stabilized in the Philippines under quite particular circumstances: the United States was remitting military expenses to the Philippines every year to maintain its army and navy there. US military expenditures for the Philippines were first transferred in dollars to US banks as its government depositories, and then, as the dollars were deposited into the Gold Standard Fund, silver certificates (in pesos) were issued accordingly. It was due to the constant flow of US military expenditures that the US dollar balance in the Gold Standard Fund continually increased in spite of the trade deficit before World War I. The amount of the transfer of US army and navy expenditures in the Philippines varied year by year; between 1912 and 1921, the annual average of military expenditure transfers is recorded as 11,635,000 dollars, with a low of 5 million dollars in 1919, and a high of 23 million dollars in 1918.Footnote 25 This was a substantial amount when compared to the size of the overall Philippine economy before World War I – by comparison, total exports and imports in the Philippines averaged roughly 50 million dollars annually between 1911 and 1915. As a result, by the early 1910s the Philippine government secured an amount in the Gold Standard Fund equivalent to approximately 40 percent of the total amount of currency in circulation (see Table 1).

Table 1. Status of the Gold Standard Fund (1909–1912)

Source: Philippine Islands, Bureau of the Treasury, Annual Report of the Treasurer of the Philippine Islands, various years.

Notes: (1) A minus sign indicates an overdraft.

(2) Excluding the amount in the hands of the disbursing agent.

(3) As of June 30, 1909.

With the Gold Standard Fund maintained at a sufficient level, certain of the provisions regarding the fund and the method of deposit were revised several times.

First, in January 1908, a portion of the Gold Standard Fund was allowed to be deposited in commercial banks in Manila. Under this new regulation, 800,000 pesos of the Gold Standard Fund were deposited at the Manila branch of the Hongkong Shanghai Banking Corporation. The Manila branch of the Chartered Bank of India, Australia and China and the Bank of the Philippine Islands also received deposits from the Fund. Total deposits from the Fund at these three banks reached 1,702,000 pesos, which meant that 41 percent of the Gold Standard Fund of 4,134,000 pesos was held in Manila at that time.Footnote 26

Second, by Act No. 2067 of July 1911, a portion of the Gold Standard Fund could be lent to local governments (provinces or municipalities) for a period of up to five years. This act also permitted the use of the Fund to purchase interest-bearing first mortgage bonds of sugar mills, when those mills were established by sugar-cane landowners as their stockholders, on the condition that: (1) the bonds purchased could not exceed 70 percent of the value of the property offered as security; (2) the sugar mill was required to have contracts with landowners (or stockholders) owning 3,000 hectares or more; (3) the sugar mills had to maintain a sinking fund for the redemption of the bonds and the debt repaid within thirty years.Footnote 27

Third, in December 1912, the following regulations were introduced by Act No. 2083: (1) the total amount of the Gold Standard Fund was fixed at a sum equal to 35 percent of Philippine government money in circulation; (2) all the monies in the Gold Standard Fund in excess of the above provision were to be deposited to the credit of a general fund in the Bureau of Treasury in the Philippines; (3) less than 50 percent of the Gold Standard Fund could be invested for periods not exceeding ten years in loans to provinces and municipalities, though up to half of this 50 percent could be invested as a construction fund for the Manila Railroad Company with the prior approval of the Governor-General of the Philippines.Footnote 28

As a result, as shown in Table 2, loans and investments allocated from the Gold Standard Fund increased year by year, until they reached nearly 80 percent of the total Fund in 1916/1917. Utilizing the Gold Standard Fund in such a manner was a deviation from the original purpose of maintaining the parity of Philippine currency against fluctuations in the value of silver. This should have brought about a shortage in the currency reserve. Why then did the Philippine government take such a risk?

Table 2. Loans and Investments of the Gold Standard Fund (1912–1918)

Source: Philippine Islands, Bureau of Treasury, Annual Report of the Treasurer of the Philippine Islands, various years.

The Philippines needed to promote the export of primary commodities in order to relieve its trade deficit, and for this purpose it took measures to vitalize agricultural investment for export. The currency system in the Philippines before World War I faced a dilemma. After the occupation of the Philippines, American businessmen came to the Philippines seeking new investment opportunities in various areas; however, until the mid-1910s, the Philippines could not export sufficient commodities to maintain a favorable balance of trade. Under such economic conditions, the Philippine government promoted investment not only in the construction of infrastructure, such as railroads, by American enterprises, but also in the processing industries of primary commodities, such as sugar mills, run by Filipino entrepreneurs. Under the self-supporting budgetary system, the Philippine government had to procure for itself all the funds needed for its expenditures. This was the colonial foundation of the Philippines under which a majority of the Gold Standard Fund was appropriated for investments in public utilities and the processing industries for primary commodities.

The role of the Silver Certificate Reserve also changed during this period. With the establishment of the civil government in July 1901 and its announcement of the end of pacification one year later, the domestic economy in the Philippines gradually recovered. The expansion of the economy was accompanied by growth of money in circulation, including silver certificates. However, such a situation made it unfavorable for the Philippine government to maintain a balance in the Silver Certificate Reserve equal to the issue of silver certificates, as required both by the Philippine Coinage Act and by the Philippine Gold Standard Act. Thus, in June 1906 new provisions were made: a maximum of 60 percent of the total amount of silver certificates outstanding could be held in American gold coin, while silver certificates would be redeemable either in silver pesos or gold coin.Footnote 29 Under these provisions the government was not necessarily obliged to redeem silver certificates in silver coins. The silver certificates were thus transformed from the original “coin certificates” into “currency notes” by this measure.Footnote 30 In February 1916 the Philippine government made another provision that the Silver Certificate Reserve could be deposited in US dollars in the United States commercial banks as the designated depositories of the Philippine government.Footnote 31 This measure came to create a new relation between the Silver Certificate Reserve and the Gold Standard Fund, as George Luthringer explained:

[W]hen the major part of the Silver Certificate Reserve became deposits in United States banks, held in exactly the same manner as the balance of the Gold Standard Fund maintained in that country, the Silver Certificate Reserve began to be used in such a way that it assumed in part the function of the Gold Standard Fund. Namely, instead of being used merely as a reserve for the maintenance of the parity of the silver certificates with the coined silver pesos which they represented, the Silver Certificate Reserve began to be used as a regulator fund for maintaining the parity of the silver certificates with the theoretical gold peso. Thus, silver certificates were issued directly against deposits in banks in the United States and were redeemed in drafts drawn on these deposits.Footnote 32

Interestingly enough, Luthringer suggested the possibility that “the US army and navy transfers must have been affected by the direct issue of silver certificates in the Philippines against deposits in banks in the United States to the credit of the Silver Certificate Reserve.”Footnote 33 Here we can see how important the role played by the transfer of US army and navy expenditures must have been in maintaining the parity of the Philippine peso against the US dollar.

In light of the fact that a majority of the Gold Standard Fund was already being appropriated for domestic investments with the transformation of the role of the Silver Certificate Reserve, the Philippine Legislature revised the currency law by Act No. 2776 in May 1918. This revision was made with the strong recommendation of the Bureau of Insular Affairs (BIA), which had conceived the reform of the Philippine currency system in the face of the shortfall in the Gold Standard Fund from the early 1910s.Footnote 34 Act No. 2776 revised some of the regulations on the currency system in the Administrative Code of 1917 (Act No. 2711), which reorganized the administrative system of the Philippine government under the Jones Law of 1916. Major revised provisions for the currency system in Act No. 2776 were as follows (all the section numbers below are from the original Act No. 2711):Footnote 35

(1) The designation “silver certificate” was changed to “Treasury certificate” (Section 1610).

(2) The basic currency unit in the Philippines Islands was established as the gold peso, and two gold pesos would be equal to one gold United States dollar (Section 1611).

(3) The Governor-General was authorized to order a reduction in the weight and fineness of the Philippine coins, subject to the consent of the presiding officers of both Houses of the Philippine Legislature (Section 1612).

(4) The parity between the Philippine silver peso and the legal gold coins of the United States would be kept at the rate of one dollar for two pesos as before (Section 1613).

(5) The Insular Treasurer was authorized to deposit silver pesos or gold coin of the United States in the Bureau of Treasury and to issue treasury certificates (Section 1622).Footnote 36

(6) The Gold Standard Fund and the Silver Certificate Reserve were combined, to form a new Currency Reserve Fund. The Currency Reserve Fund would be deposited at member banks of the Federal Reserve System in the United States designated by the Governor-General of the Philippines. However, not more than 25 percent of the Currency Reserve Fund could be deposited with any single branch depository in the United States, except at branches of the Philippine National Bank in the United States (Section 1624).

(7) The Currency Reserve Fund could not be less than the amount of Treasury certificates in circulation, plus 15 percent of the total money of the Philippine government in circulation, exclusive of the silver certificates protected by a gold reserve (Section 1624).

Three conditions were necessary to sustain the new currency system. First, the Bureau of Treasury in the Philippines had to be responsible for maintaining the credibility of Treasury certificates in the same way as silver certificates. Second, the US government would have to keep its legal tender at par with the gold dollar. Third, the US depository banks would have to remain solvent to redeem the deposit in gold coins.Footnote 37

However, the Philippine currency system under the revised law of 1918 was still not stable. After the consolidation of the two previously separate currency reserves, the newly created Currency Reserve Fund was appropriated for other purposes with even less restraint than the previous Gold Standard Fund had been, and this precipitated the grave financial crisis of 1919–1922 in the Philippines.

FROM 1919–1922 FINANCIAL CRISIS TO MID-1930S INTRODUCTION OF DOLLAR EXCHANGE STANDARD

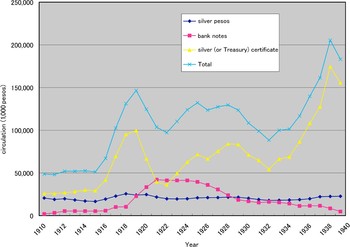

Figure 1 shows the amount of the Philippine currencies in circulation, including silver pesos, silver certificates (Treasury certificates after 1918) and bank notes, between 1910 and 1940. The total amount of Philippine currency in circulation stood at only 50 million pesos until the mid-1910s; however, it increased sharply to 100 million pesos from 1916 onwards as a result of the economic boom during World War I. In 1919 it swelled even further to 150 million pesos; this was the outcome of serious currency and credit inflation that brought about a shortage in the currency reserves. Under measures to stabilize the currency system imposed in 1922, the currency in circulation in the Philippines fluctuated at around 120 to 130 million pesos during the 1920s, and then dropped to less than 100 million pesos in the early 1930s due to the effects of the world depression. However, during the late 1930s it again increased sharply under yet another reform of the currency system.

Figure 1. Philippine Currencies in Circulation (1910–1940)

It should also be noted that the composition of the Philippine currencies in circulation changed drastically between the 1910s and the 1930s. As shown in Figure 1, silver pesos made up over 30 percent of the total during the first half of the 1910s, and then fell to 20 percent or even less in the late 1910s. At the same time, the percentage of silver certificates and Treasury certificates increased sharply from approximately 50 percent in the first half of the 1910s to between 60 and 70 percent in the late 1910s. In the 1920s the percentage of Treasury certificates declined, while the number of bank notes rose dramatically; however, it was still Treasury certificates that made up the greater part of currencies circulated in the Philippines. Thus, in Figure 1 we can also trace the process of how silver certificates or Treasury certificates became the major currency issued in the Philippine economy from the 1910s.

What was the main cause of the serious currency and credit inflation after World War I? It was in fact very closely related to the drain in the Currency Reserve deposited in the New York agency of the Philippine National Bank.

The Philippine National Bank was established in 1916 as a semi-governmental bank. This was a multipurpose bank, with three major functions: (1) a loan business mainly for agriculture and the processing industries of agricultural commodities; (2) financing for the commercial sector; and (3) issuing bank notes.Footnote 38 From the time of its establishment, the Philippine National Bank sought to maintain links with the Federal Reserve System in the United States.

The Federal Reserve System was a central bank system unique to the United States, established in December 1913 by the Federal Reserve Act. Under the system administered by the Federal Reserve Board in Washington DC, Federal Reserve Banks were established in twelve districts of the United States to supervise and regulate the banking and financial activities of its member banks, including national and state banks.Footnote 39 However, under the Federal Reserve System, a bank based in the Philippines was deemed a foreign bank, not eligible for qualification under the Federal Reserve Bank. Therefore, according to the provisions of Section 14 of the Federal Reserve Act, the Federal Reserve Board authorized the designation of the Philippine National Bank as a foreign correspondent or agent, and a Federal Reserve Bank designated it as its representative in the Philippines.Footnote 40

Until the Philippine National Bank was established, the Philippine government had deposited the Gold Standard Fund and the Silver Certificate Reserve in United States commercial banks designated as depositories of the Philippine government. However, after its New York agency was opened in 1917, the Philippine government transferred these two funds to this agency. By the end of December 1916, the Philippine government had deposited 12 million dollars of the Silver Certificate Reserve and 4 million dollars of the Gold Standard Fund (16 million dollars in total) in US banks. Out of the 16 million dollars, 7 million dollars (44 percent) were deposited at the Irving National Bank in New York City as the agent for the Philippine National Bank. Then, at the end of 1917, the deposited amount of the Gold Standard Fund and the Silver Certificate Reserve in the United States shot up to 30 million dollars in total, two-thirds of which was held by the New York agent of the Philippine National Bank.Footnote 41

After the consolidation of the two reserve funds, the amount of the Currency Reserve Fund deposited in the New York agency of the Philippine National Bank reached 38 million dollars in 1918–1919, consisting of 84 percent of the total amount of the fund deposited in the United States. However, the Currency Reserve Fund was mismanaged during this period. First, a large proportion of the Currency Reserve Fund was transferred from New York to Manila by the sale of drafts on Liberty Loan purchases that the United States sold after its declaration of war against Germany in April 1917 (resulting in the issue of more Treasury certificates in Manila).Footnote 42 Second, another proportion of the Currency Reserve Fund was used by the National Bank for its loan business. The National Bank appropriated both the funds transferred from the US and the loan business funds to provide extravagant loans or credits to landowners, entrepreneurs and exporters for the purpose of promoting export agriculture to take advantage of price hikes in primary commodities during World War I. The haphazard sale of drafts and currency mismanagement in wartime precipitated currency and credit inflation on the enormous scale shown in Figure 1, making the Currency Reserve Fund essentially non-functional.Footnote 43

Luthringer estimated that by 1919 the transfer of the Currency Reserve Fund from New York to Manila reached more than 41 million dollars.Footnote 44 In April 1919 the Philippine government issued bonds worth 10 million dollars to raise funds to purchase drafts in the United States, but it continually faced a serious shortage in its currency reserves.Footnote 45 In 1920, when the price of primary commodities declined sharply, currency and credit inflation resulting from the wartime economic boom led the Philippines into severe monetary crisis. The Philippine government tried hard to remove Treasury certificates from circulation by selling drafts from 1920 onwards, but the Philippine National Bank could not reclaim bank notes issued erroneously by the appropriation of the Currency Reserve Fund. To demand full repayment of loans from landowners, entrepreneurs and exporters would have meant the collapse of the Philippine economy, at a time when a deflation policy was needed to combat the depreciation of the peso due to the decline in prices for export commodities.

In January 1921, responding to serious shortages in the currency reserves, the Philippine government implemented Act No. 2939 to revise some of the provisions in Section 1624 governing the Currency Reserve Fund in Act No. 2776 of 1918. First, the Currency Reserve Fund had to be maintained at a minimum of 60 percent of the nominal value of Treasury certificates in circulation up to a total circulation of 120 million pesos, and 100 percent of pesos in excess of 120 million. Second, any surplus in the Currency Reserve Fund, and all its investments, was transferred to the general fund in the Bureau of Treasury, and any future surplus accumulated in excess of 25 percent of the minimum established could be transferred to the general fund entirely or in part.Footnote 46

As shown in Figure 1, the amount of the Treasury certificates in circulation in the early 1920s was well below 120 million pesos, which meant that the minimum level of the Currency Reserve Fund was set at 60 percent of certificates in circulation. This minimum requirement under Act No. 2939 was far lower than that of Act No. 2776. Therefore, already in 1922, with the limited currency reserve, the Philippine government faced the difficulty of not being able to cope with the increased demand for drafts on New York, and was forced to suspend the sale of exchange until the end of that year.Footnote 47

In this situation the Philippine government enacted Act No. 3058 in June 1922 to revise yet again the regulations on the currency reserve, as follows:Footnote 48

(1) A Gold Standard Fund and a Treasury Certificate Fund were established as separate currency funds, by the abolition of the Currency Reserve Fund (Sections 1622 and 1626).

(2) The Gold Standard Fund was to be maintained at a level not less than 15 percent of the Treasury certificates and silver pesos in circulation (Section 1622).

(3) The Gold Standard Fund would be deposited in Federal Reserve Banks or members of the Federal Reserve System in the United States, to be designated by the Governor-General of the Philippines as the depositories of the Philippine government. No proportion of the fund could be deposited in any domestic banks or any branch or agency of foreign banks doing business in the Philippines. No more than 20 percent of the fund could be deposited with any single depository in the United States, except with the bank where the Insular Treasurer kept his deposits in a current account in connection with his exchange operations (Section 1623).

(4) The Treasury Certificate Fund had to be equivalent to 100 percent of all Treasury certificates in circulation (Section 1626).

In addition, this Act also provided the issuance of additional bonds of 23.5 million dollars under the guarantee of the US government.Footnote 49 These measures to reform the currency reserve system were implemented in January 1923, after government bonds were issued with the guarantee of sufficient funding to do so.Footnote 50 Thus, the Philippine currency system reverted to the original gold exchange standard after five years' confusion resulting from the revision of the Act in 1918. However, under the reconstructed gold standard system, the role of the Gold Standard Fund was never again as large as it had previously been for the maintenance of the parity of pesos. With the enlargement of the circulation of the Treasury certificates, the importance of the Treasury Certificate Fund increased in comparison to the Gold Standard Fund.

Table 3 shows the amount of the Gold Standard Fund and the Treasury Certificate Fund in the 1920s and early 1930s. From 1923 to 1925 the annual average amount of the Treasury Certificate Fund was 77 million pesos, five times larger than that of the Gold Standard Fund. During the period between 1931 and 1934, the annual average amount of the Gold Standard Fund grew to 43 million pesos, yet still was smaller than the Treasury Certificate Fund of 88 million pesos. As has been discussed earlier, the Treasury certificates (or silver certificates before 1918) became the major currency from the late 1910s, and acquired the status of “currency note”, a change from the original status of “coin certificate”. Reflecting the transformation in the nature of the Treasury certificate, the Treasury Certificate Fund came to play a role much more significant than that of the Gold Standard Fund in the structure of the currency reserve system.

Table 3. The Annual Average Amount of the Gold Standard Fund and the Treasury Certificate Fund (1923–1934)

Source: Philippine Islands, Bureau of the Treasury, Annual Report of the Treasurer of the Philippine Islands, various years.

Thus, by establishing the Treasury certificate as the major currency in circulation, the currency system in the Philippines was no longer maintained by the stabilization of foreign exchange through the operation of the Gold Standard Fund, but rather through the maintenance of the parity of the peso against the US dollar by the regulation of the currency supply under the control of the Treasury Certificate Fund. This was a system fundamentally different from the gold exchange standard. Under the gold exchange standard, it had been the Gold Standard Fund that regulated the foreign exchange and currency system. However, in the 1920s, it was the Treasury Certificate Fund that played the major role as the currency reserve of the Philippines. The larger part of the Treasury Certificate Fund was deposited in the United States banks, such that the stabilization of Philippine currency was now closely linked to the monetary and credit system of the United States.Footnote 51 In this context, we can see that the reconstructed gold exchange standard in 1923 was heavily dependent on the strength of the US dollar in international exchange markets, and came close to being a dollar exchange standard. As a result, the Philippines had a relatively smooth path following the reform of the US currency system during the world depression.

In April 1933 the United States withdrew from the gold standard by suspending the convertibility of paper currency, and in January 1934 it enacted the Gold Reserve Act. By this Act, the United States was able to set a new parity for the dollar, and implemented a devaluation of 40 percent. This was the beginning of the managed currency system in the United States. Following these US measures, the Philippine government also lowered the nominal value of the peso by about 40 percent, maintaining the official rate of one dollar for two pesos as before.Footnote 52 Then in March 1935, before the establishment of the Philippine Commonwealth, Act No. 4199 was implemented to reform the regulations of the currency system under Act No. 3058. The major changes were as follows:Footnote 53

(1) The unit of monetary value in the Philippines would be the peso, and two pesos would be equal in value to one dollar, the dollar being defined as that used as legal tender in the United States (Section 1611).

(2) For the purpose of maintaining the parity of the Philippine peso with the legal tender currency in the United States, a new Exchange Standard Fund was established (Section 1621).

(3) The Exchange Standard Fund would be maintained at a level to comprise not less than 15 percent of all Treasury certificates and coins (Section 1622).

(4) The Exchange Standard Fund would be held in the vaults of the Bureau of Treasury in Manila, or a portion could be held in the US Department of Treasury and/or with Federal Reserve Banks or member banks of the Federal Reserve System in the United States (Section 1623).

(5) The Treasury Certificate Fund had at all times to be equivalent to 100 percent of Treasury certificates in circulation and had to be constituted entirely of silver coins. It was to be held in the vaults of the Bureau of Treasury in Manila (Section 1626).

As is clear from the above, the new currency regulations did not set the value of the Philippine peso directly against gold. In order to exchange Philippine pesos with gold, they had first to be exchanged for US dollars. For this purpose the new Exchange Standard Fund was established, which was actually deposited mostly with the US Department of the Treasury.Footnote 54 The Philippine peso had become a currency whose unit of value was determined according to the US dollar, and its relation with gold was sustained only through the medium of the US dollar. By the mid-1930s, the Philippine currency system had lost all vestiges of its original gold exchange standard, having gone over entirely to a dollar exchange standard.

CONCLUSION: COMPARISON WITH BRITISH INDIA

This study will conclude by offering a brief comparison of the Philippine currency system during the American colonial period and the currency system of British India, a comparison that highlights the distinctive features of the former.

First, under the gold exchange standard in the Philippines, the majority of the currency reserve had been deposited in the form of US dollars in the United States by the middle of the 1920s. In British India, by contrast, the majority of the gold standard reserve was deposited in Britain in the form of sterling certificates as well as gold; one-half of its currency reserve was held in silver coins and the remaining part was in various other forms, such as gold coins, rupee certificates and silver bullion.Footnote 55 This sharp contrast between the Philippines and British India shows that the gold exchange standard in the Philippines was much more like the typical “colonial master's currency exchange standard” than that of British India in the 1920s.

Second, in the Philippines the Gold Standard Fund (renamed the Currency Reserve Fund between 1918 and 1922) was reallocated in various ways as a domestic investment fund, resulting in serious financial crisis after World War I. The appropriation of the Gold Standard Fund was promoted by the Philippine government under the emergent need to develop industrial capacity for processing primary commodities for export. In British India, the Gold Standard Fund was also utilized for purposes other than the regulation of exchange fluctuations, but it was mostly used in the financial markets in Britain.Footnote 56 This was the reason why the greater part of the Gold Standard Fund in British India was held in the form of sterling certificates. Britain appropriated the Gold Standard Fund in India for the economic interests of the home country, but in the Philippines it was utilized mostly for domestic landowners, entrepreneurs and exporters.

Third, the Philippines adopted the dollar exchange standard in 1935, abandoning the already much-transformed gold exchange standard. The Philippines adopted the US-dependent currency system to protect the economic interests of the export sector, particularly domestic landowners and entrepreneurs engaging in primary commodity production for export. However, it should also be noted that there were some moves in the Philippines to explore the possibility of establishing a self-reliant currency system, and a bill for this purpose was submitted to the National Assembly under the Commonwealth government in 1937. This bill, to establish a Reserve Bank, was passed as Commonwealth Act No. 458 in June 1939; however, it was not approved by US President Franklin Roosevelt. In the Philippines a central bank was established after independence, with the recommendation of the Joint Philippine American Finance Commission.Footnote 57

In the case of India, from the early twentieth century the Indian economy was absorbed into the British multilateral settlement system by which Britain balanced its trade deficits with European countries using its trade surplus with India.Footnote 58 The Indian currency system functioned as a pillar to support the higher trade structures of the British Empire. Thus, when the currency system was transformed into the gold bullion standard in 1927, the Congress in India expressed its opposition, demanding the introduction of the gold standard precisely because it was so favorable for Britain to manipulate the Indian currency system.Footnote 59 This is one example of the constant demands made in India to constitute an autonomous, self-reliant foreign exchange control system.

The currency systems introduced into various colonies during the early twentieth century were conditioned by a variety of factors, such as the trade structures between colonial masters and colonies; capital investments in these colonies from their masters; the economic interests of domestic landowners, entrepreneurs or exporters; and the development of banking systems. These factors were in turn also influenced by the currency systems in the colonies. The Philippine currency system during the American colonial period adjusted itself almost constantly to maintain a good fit with its US-dependent trade structure and the prominence of domestic capital in major export industries. In such a context, the gold exchange standard that evolved into the dollar exchange standard could be considered as representative of the evolving export economy of the Philippines under American rule.