The pursuit of corporate social responsibility (CSR) can benefit a firm in different ways, such as an improved reputation (Brammer & Pavelin, Reference Brammer and Pavelin2006), better risk management (Godfrey, Reference Godfrey2005), more motivated employees (Wood, Reference Wood2010), and superior financial performance (for reviews, see Margolis, Elfenbein, & Walsh, Reference Margolis, Elfenbein and Walsh2007; Orlitzky, Schmidt, & Rynes, Reference Orlitzky, Schmidt and Rynes2003; Wang, Dou, & Jia, Reference Wang, Dou and Jia2016). However, recent studies have highlighted that firms are likely to be involved in corporate social irresponsibility (CSI) events even if they have otherwise done much to demonstrate CSR (Kang, Germann, & Grewal, Reference Kang, Germann and Grewal2016; Lenz, Wetzel, & Hammerschmidt, Reference Lenz, Wetzel and Hammerschmidt2017; Oikonomou, Brooks, & Pavelin, Reference Oikonomou, Brooks and Pavelin2014). The inconsistency implied by the coexistence of CSR and CSI can lead to perceptions of corporate hypocrisy, commonly defined as “a belief that a firm claims to be something that it is not” (Wagner, Lutz, & Weitz, Reference Wagner, Lutz and Weitz2009: 79). Corporate hypocrisy can have various detrimental impacts, such as leading stakeholders to judge a firm negatively (Wagner et al., Reference Wagner, Lutz and Weitz2009), lowering customer satisfaction (Ioannou, Kassinis, & Papagiannakis, Reference Ioannou, Kassinis and Papagiannakis2018), damaging corporate reputation (Arli, Grace, Palmer, & Pham, Reference Arli, Grace, Palmer and Pham2017), increasing staff turnover (Scheidler, Edinger-Schons, Spanjol, & Wieseke, Reference Scheidler, Edinger-Schons, Spanjol and Wieseke2019), and inducing harsh market sanctions (Janney & Gove, Reference Janney and Gove2011). As a result, firms may use euphemisms (La Cour & Kromann, Reference La Cour and Kromann2011) or withhold their membership status of the Dow Jones Sustainability Index (a prominent environmental certification) (Carlos & Lewis, Reference Carlos and Lewis2018) to avoid being considered hypocritical.

It remains unclear how a firm’s prior CSR activities can reduce perceived corporate hypocrisy in the wake of a CSI event. Godfrey (Reference Godfrey2005) suggested that a prior CSR record can help a firm accrue goodwill among its stakeholders, encouraging them to give the firm the benefit of the doubt about its wrongdoings. Similarly, moral licensing theory argues that past good deeds can “make morally questionable deeds seem as if they were not transgressions at all” (Miller & Effron, Reference Miller and Effron2010: 128). While these theories suggest that prior CSR activities can reduce perceived corporate hypocrisy in the wake of a CSI event, this notion lacks empirical support. Shim and Yang (Reference Shim and Yang2016) found CSR history to have no impact on perceived corporate hypocrisy. Moreover, Wagner et al. (Reference Wagner, Lutz and Weitz2009) found that, compared with reactive CSR (i.e., CSR engagement after a CSI event), a prior record of CSR activities increases (rather than decreases) perceived corporate hypocrisy.

Such mixed results are perhaps a result of the following limitations in the extant corporate hypocrisy literature. First, corporate hypocrisy is commonly defined as the inconsistency between a firm’s actions and what it preaches (Wagner et al., Reference Wagner, Lutz and Weitz2009). However, this definition fails to adequately differentiate corporate hypocrisy from inconsistency that arises because of a lack of ability and/or resources (Monin & Merritt, Reference Monin, Merritt, Mikulincer and Shaver2011). In this article, we define perceived hypocrisy as inferences by individual stakeholders (hereafter individuals) that an inconsistency occurs because a firm lacks a genuine CSR motive and uses its CSR engagement to claim undeserved moral benefit(s) (Effron, O’Connor, Leroy, & Lucas, Reference Effron, O’Connor, Leroy and Lucas2018; Monin & Merritt, Reference Monin, Merritt, Mikulincer and Shaver2011). Consistent with this, Effron et al. (Reference Effron, O’Connor, Leroy and Lucas2018) suggested that inconsistency can lead to both positive and negative outcomes, and that negative judgments arise when individuals infer that a firm has acted in bad faith. However, previous research provides few insights about how individuals differentiate hypocrisy, thus defined, from inconsistency that arises for other reasons.

Second, Effron, and Monin (Reference Effron and Monin2010) demonstrated that hypocrisy is more evident when good and bad deeds are in the same (vs. different) domains, i.e., are associated with the same, or relatively highly related, social issues. In this regard, it is worth noting that social and environmental issues are arrayed across a host of disparate domains (i.e., from habitat degradation to employee health), and thus a firm’s CSR and CSI events may pertain to the same domain or different ones. Janney and Gove (Reference Janney and Gove2011) found the market tended to punish firms more harshly when CSR and CSI were in the same domain (vs. different domains). This is perhaps because when CSR and CSI are in the same domain (vs. different domains) what a firm does more directly contradicts what it says, which strengthens perceptions of hypocrisy. However, no research has investigated how the relatedness of CSR and CSI domains influences individuals’ perceptions of corporate hypocrisy.

Thus, this article aims to examine how a firm’s prior record on CSR influences individuals’ perceptions of corporate hypocrisy in the wake of a CSI event. In doing so, we will accommodate the possibility that this effect is moderated by the domains (same vs. different) in which the CSR and CSI reside. By taking an individual-level perspective, we address the criticism of Aguinis and Glavas (Reference Aguinis and Glavas2012: 955) that CSR-related “fields of study focusing on macro-level issues have developed without giving a prominent role to their micro-foundations—which are the foundations of a field that are based on individual action and interactions.”

Because judgments of corporate CSR motives underlie judgments of corporate hypocrisy, an understanding of corporate hypocrisy requires an understanding of how individuals perceive the motives underlying CSR initiatives. To achieve this, we use the stereotype content model (SCM), which suggests that stakeholders judge firms in the same way as other social targets—namely, on warmth and competence (Aaker, Vohs, & Mogilner, Reference Aaker, Vohs and Mogilner2010; Bolton & Mattila, Reference Bolton and Mattila2015; Cuddy, Fiske, & Glick, Reference Cuddy, Fiske and Glick2008; Fiske, Cuddy, Glick, & Xu, Reference Fiske, Cuddy, Glick and Xu2002; Kervyn, Fiske, & Malone, Reference Kervyn, Fiske and Malone2012). We argue that a firm’s perceived warmth increases with the strength of its prior record of CSR. Furthermore, we argue that when a subsequent CSI event occurs, this warmth can mitigate the perception that the firm lacks a genuine CSR motive, and thereby lessen perceptions of corporate hypocrisy. In addition, reflecting arguments that hypocrisy is most evident if CSR and CSI lie in the same domain (Effron & Monin, Reference Effron and Monin2010), we propose a moderating effect for the relatedness of CSR and CSI domains.

In doing so, we contribute to the literatures on corporate hypocrisy and CSR. With regard to the corporate hypocrisy literature, our experiments demonstrate that individuals’ perceptions of corporate hypocrisy are mediated by their perceptions that a firm’s CSR initiatives are genuinely motivated. We thereby highlight the role of individuals’ inferences about a genuine CSR motive in their judgments of corporate hypocrisy. Our research further suggests that such inferences of a genuine CSR motive derive from the perception of firm warmth generated by a firm’s prior record of CSR. Thus, our research not only highlights the importance of a firm’s CSR being perceived as genuinely motivated but also identifies a source for such a perception. Furthermore, we highlight the impact of the CSR–CSI domain on individuals’ perceptions of corporate hypocrisy. We find that hypocrisy is more likely to be perceived when CSR and CSI are in the same domain (vs. different domains). Thus, our research complements the extant literature by providing direct evidence that helps to explain why markets react differently when CSR and CSI occur in the same domain (vs. different ones) (Carlos & Lewis, Reference Carlos and Lewis2018; Janney & Gove, Reference Janney and Gove2011).

With regard to the CSR literature, our results suggest that a strong prior record of CSR can reduce perceptions of corporate hypocrisy. This is redolent of Godfrey’s (Reference Godfrey2005) arguments that prior CSR can function as an insurance mechanism, preserving a firm’s value in the wake of negative events. Our article not only supports Godfrey (Reference Godfrey2005) but also provides unique insights into why superior prior CSR can protect firms from negative judgments in the wake of a CSI event. In addition, by sampling respondents from the general public, we address criticism of the extant CSR-related literature with its narrow focus on a subset of primary stakeholders, i.e., investors and consumers (Barnett, Reference Barnett2016). A broader purview enables exploration of the relationship between the interests of business and those of broader society.

THEORETICAL BACKGROUND AND HYPOTHESES DEVELOPMENT

Corporate Hypocrisy

Wagner et al. (Reference Wagner, Lutz and Weitz2009) proposed that when a firm’s CSR engagement is contrary to its stated standards of social responsibility, this can give rise to perceptions of corporate hypocrisy and negative attitudes toward the firm. In a similar vein, Scheidler et al. (Reference Scheidler, Edinger-Schons, Spanjol and Wieseke2019) reported a tendency for corporate hypocrisy to be perceived when firms’ CSR engagement implies an inconsistency between treatment of external and internal stakeholders. Indeed, reinforcing the connection to negative attitudes, their findings associate employees’ perceptions of corporate hypocrisy with emotional exhaustion and higher staff turnover.

However, building on the concept of organized hypocrisy (Brunsson, Reference Brunsson2002), Christensen, Morsing, and Thyssen (Reference Christensen L, Morsing and Thyssen2013) and Cho, Laine, Roberts, and Rodrigue (Reference Cho, Laine, Roberts and Rodrigue2015) challenged the notion that corporate hypocrisy is always detrimental. For example, Christensen et al. (Reference Christensen L, Morsing and Thyssen2013) argued that CSR communication can be performative, announcing firms’ ideals and aspirations. Thus, it does not have to be a neutral tool to describe or report a firm’s CSR practice. Given that CSR standards and goals are continuously expanding and evolving, aspirational CSR communication can be “an important resource for social change, even when organizations do not fully live up to their aspirations” (Christensen et al., Reference Christensen L, Morsing and Thyssen2013: 372). Cho et al. (Reference Cho, Laine, Roberts and Rodrigue2015) pointed out that organizations often face irreconcilable societal and institutional demands. Thus, corporate hypocrisy is needed to establish and maintain legitimacy. As a result, firms’ sustainability reports tend to be symbolic rather than substantive (Cho et al., Reference Cho, Laine, Roberts and Rodrigue2015). These studies suggest that corporate hypocrisy can benefit firms.

As discussed above, such mixed results arise partly because the extant literature fails to differentiate between inconsistency that arises from a firm lacking a genuine CSR motive and using its CSR engagement to claim undeserved moral benefit(s) and inconsistency performed as a result of lack of ability and/or resources. Building on the SCM (Cuddy et al., Reference Cuddy, Fiske and Glick2008; Fiske et al., Reference Fiske, Cuddy, Glick and Xu2002), this article argues that individuals judge firms in the same way they judge other social targets, namely, on perceived warmth and competence (Aaker et al., Reference Aaker, Vohs and Mogilner2010; Bolton & Mattila, Reference Bolton and Mattila2015; Cuddy et al., Reference Cuddy, Fiske and Glick2008; Kervyn et al., Reference Kervyn, Fiske and Malone2012). We further argue that warmth underlies individuals’ judgments of whether a firm’s CSR initiatives are driven by genuine motives. The next section discusses this in detail.

Prior CSR, Firm Warmth, and CSR Motives

The SCM identifies warmth and competence as the two universal dimensions underlying perceptions of different social targets, such as different groups of people (Cuddy et al., Reference Cuddy, Fiske and Glick2008). The warmth dimension comprises traits such as trustworthiness, kindness, and sincerity. It “represents an accommodating orientation that profits others more than the self” (Cuddy et al., Reference Cuddy, Fiske and Glick2008; 63). The competence dimension captures the efficacy of relevant social targets in executing on their intentions, with those targets that are able to carry out their intentions being considered as capable, intelligent, and skillful (Cuddy et al., Reference Cuddy, Fiske and Glick2008). Firms are often anthropomorphized into human beings possessing thoughts, desires, intentions (Knobe & Prinz, Reference Knobe and Prinz2008), character (Godfrey, Reference Godfrey2005), goals, and identities (Pfeffer, Reference Pfeffer, Cummings and Staw1981). Consistent with this, the SCM has been used to explain perceptions of nonhuman entities such as firms (Aaker et al., Reference Aaker, Vohs and Mogilner2010; Bolton & Mattila, Reference Bolton and Mattila2015; Shea & Hawn, Reference Shea and Hawn2019). For example, Aaker et al. (Reference Aaker, Vohs and Mogilner2010) found that not-for-profit firms were considered as warmer but less competent. In contrast, profit-driven firms were considered more competent but less warm.

Relating to our research, Carroll (Reference Carroll1991) argued that CSR is a morally colored concept, reflecting a firm’s concern for its stakeholders’ moral rights that goes beyond legal requirements. In other words, CSR initiatives can reflect a firm’s moral value in accommodating stakeholders’ welfare that is beyond the economic interests of the firm and what is required by law (Carroll, Reference Carroll1991). Therefore, such activities can be considered caring and trustworthy (Aaker et al., Reference Aaker, Vohs and Mogilner2010; Bolton & Mattila, Reference Bolton and Mattila2015). Of course, firms differ in their commitment to CSR initiatives. Some firms show a great and consistent commitment of resources to their CSR initiatives—a strong prior record of CSR. In contrast, other firms show a commitment to CSR that is relatively insubstantial and/or inconsistent over time, depending on a variety of factors such as their profits—a weak prior record of CSR.

Given that CSR activities tend to direct the firm’s resources to the improvement of social welfare by addressing social and/or environmental issues, they are well-suited to promote inferences of firm warmth. As Cuddy, Glick, and Beninger (Reference Cuddy, Glick and Beninger2011) pointed out, “warmth is inferred from actions that appear to serve self-interest versus others’ interests” (Cuddy et al., Reference Cuddy, Glick and Beninger2011: 76), such that a strong record of contributions to the welfare of others tends to promote warmth. Thus, applied to evaluations of firms, SCM predicts greater warmth is inferred for firms with a strong prior record of CSR. Indeed, Shea and Hawn (Reference Shea and Hawn2019) demonstrated that individuals perceive firms engaging in CSR as warm, which in turn influences their purchase intentions and/or reputational judgments toward the firms. This is supported by Gao and Mattila (Reference Gao and Mattila2014). Their research suggested that consumers are more likely to express satisfaction towards green (vs. non-green) hotels, partly because green hotels are perceived to be warmer.

We now turn to individuals’ perceptions of the motives that underlie a firm’s CSR activities and the tendencies for these to be influenced by the strength of a firm’s prior record of CSR and firm warmth. With regard to the connection between warmth and inferred motives, Cuddy et al. (Reference Cuddy, Glick and Beninger2011: 74) argued that “warmth judgments affect how much we trust versus doubt others’ motives.” This reflects a broader tendency for warmth to have a primary role in evaluations, such that “warmth judgments are made more quickly than competence judgments and have a greater impact on overall attitudes toward others” (Cuddy et al., Reference Cuddy, Glick and Beninger2011: 76). This point has received empirical support in the context of the evaluations of firms, as Gao and Mattila (Reference Gao and Mattila2014) and Shea and Hawn (Reference Shea and Hawn2019) demonstrated that perceptions of firm warmth mediate individuals’ judgments of, and behavioral intentions toward, the evaluated firms. Such primacy for warmth in the SCM, such that it forms a basis from which other evaluations of the target are made, predicts that firm warmth influences perceptions of corporate motives. In particular, a perception of greater warmth is expected to increase the likelihood that an individual infers that a firm is motivated to undertake CSR activities by a genuine regard for social welfare.

Thus, alongside the prediction that a strong record of CSR promotes perceptions of firm warmth, this effect of warmth on perceived motive implies that a firm’s prior record of CSR affects individuals’ inferences of firm’s motives. Specifically, a stronger prior record of CSR promotes perceptions that the firm is motivated by a genuine regard for social welfare. Moreover, this effect is mediated by firm warmth. In making this argument, we echo a prominent theme in the extant literature: that individuals’ corporate evaluations depend on the strength of a firm’s prior record of CSR (Luo & Bhattacharya, Reference Luo and Bhattacharya2009). Indeed, this notion has received some empirical support. For example, Du, Bhattacharya, and Sen (Reference Du, Bhattacharya and Sen2010) argued that individuals’ inferences about the motives underlying a firm’s CSR initiatives depend on its perceived commitment to those initiatives. Specifically, a greater and more consistent commitment promotes the inference that CSR activities are motivated by a genuine regard for social welfare. In addition, Skarmeas and Leonidou (Reference Skarmeas and Leonidou2013) found that an inconsistent commitment to CSR leads individuals to suspect that a firm is motivated by a desire to manipulate perceptions through window-dressing.

Hypothesis 1 (direct effect): Individuals perceive greater firm warmth for a firm with strong prior CSR than a firm with weak or no prior CSR.

Hypothesis 2 (mediation): Firm warmth mediates the effect of prior CSR on the degree to which a genuine CSR motive is perceived.

Prior CSR, CSR Motives, and Corporate Hypocrisy

We now turn to perceptions of hypocrisy that can arise in the wake of a CSI event, and apply the notion of moral licensing for this purpose. The moral licensing theory considers the tendency for observers to license transgressions (i.e., “reduce their condemnation of morally dubious behavior or the actor who committed it in light of the actor’s prior good deeds” [Effron & Monin, Reference Effron and Monin2010: 1618]). Within this view, licensing can arise for two reasons: moral credits and moral credentials. For our purposes, the first of these implies that a strong prior record of CSR would provide a firm moral credits in the eyes of individuals, whereas a CSI event would bring moral debits (Ormiston & Wong, Reference Ormiston and Wong2013). Thus, a firm would expectably avoid negative assessments in the wake of a CSI event as long as any moral debits are more than balanced by the moral credits it has previously accumulated through its prior record of CSR. The second reason for licensing—moral credentials—implies that a firm’s prior CSR might change the way individuals construe a CSI event. That is, a firm’s strong prior CSR record can license a CSI event by causing individuals to differently construe the firm’s role in that event, such that the firm is judged to be less culpable. Effron and Monin (Reference Effron and Monin2010) summarized these two reasons for licensing as follows: “If moral credits are like a deposit that allows one to ‘purchase’ the right to transgress, moral credentials provide a lens through which subsequent behavior is construed more favorably” (Effron & Monin, Reference Effron and Monin2010: 1619).

In this way, the moral licensing theory helps us to understand how past good deeds can mitigate perceptions of hypocrisy by providing context for the interpretation of subsequent bad deeds (Effron & Monin, Reference Effron and Monin2010). Transgression may cause individuals to infer that past good deeds were intended to claim underserved moral benefits—leading to perceptions of hypocrisy. Alternatively, past good deeds may cause individuals to interpret transgression as unintentional (e.g., an accident)—thereby mitigating perceptions of hypocrisy (Effron & Monin, Reference Effron and Monin2010). The former tendency reflects a lack of moral license, as a relatively great transgression is perceived to outweigh (the moral credits or credentials accrued from) prior good behavior. In this case, the motives for past good deeds are reinterpreted in light of bad deeds, and the firm is judged to have behaved hypocritically. The latter tendency is redolent of licensing a la moral credentials, as an impressive prior record of good behavior influences individuals to interpret morally dubious behavior more favorably. This lessens the degree to which the transgression undermines positive evaluations of the firm’s motives.

Furthermore, the tendency for transgression to be viewed as unintentional in light of past good deeds echoes a notable contribution to the CSR literature from Godfrey (Reference Godfrey2005), who argued that a firm’s prior record of CSR can influence individuals’ judgments of its culpability in a socially harmful event. This is because a strong prior record of CSR can act as evidence of good corporate character, mitigating individuals’ negative assessments regarding the firm’s intention of wrongdoing (Godfrey, Hatch, & Hansen, Reference Godfrey, Hatch and Hansen2010). In the wake of a potential transgression, a positive evaluation of a firm’s prior CSR activities “encourages stakeholders to give the firm the benefit of the doubt regarding intentionality, knowledge, negligence, or recklessness” (Godfrey, Reference Godfrey2005: 788).

In a similar vein, Lange and Washburn (Reference Lange and Washburn2012) proposed that a firm’s prior record of CSR can serve “as a cognitive anchor, biasing the observer as he or she makes adjustments from the anchor to reach an interpretation of the meaning of a new firm action” (Lange & Washburn, Reference Lange and Washburn2012: 312). Indeed, the extant CSR literature has repeatedly demonstrated that individuals tend to reward firms perceived to have a genuine CSR motive, but respond negatively toward firms perceived to have a profit-driven motive for its CSR activities (e.g., Brunk & de Boer, Reference Brunk and de Boer2020; Gao & Mattila, Reference Gao and Mattila2014; Kim & Choi, Reference Kim and Choi2018). For example, Gao and Mattila (Reference Gao and Mattila2014) demonstrated that consumers were more satisfied when they perceived a hotel’s CSR to be driven by a genuine motive. Recently, Kim and Choi (Reference Kim and Choi2018) documented that individuals responded more positively toward a firm’s post-crisis CSR communication if they considered the communication was driven by a genuine CSR motive. Consistent with these findings, and reflecting arguments drawn from the moral licensing theory above, we propose the following hypotheses:

Hypothesis 3 (direct effect): A strong prior record of CSR lessens individuals’ perceptions of corporate hypocrisy compared to weak or no prior CSR.

Hypothesis 4 (mediation): Perception of a genuine CSR motive mediates the effect of prior CSR on perceived corporate hypocrisy.

Taken together, the arguments presented above imply a double mediation—by both firm warmth and a genuine CSR motive—of the impact of prior CSR on corporate hypocrisy. If the impact of prior CSR on CSR motive is mediated by firm warmth (H2), and the impact of prior CSR on corporate hypocrisy is mediated by CSR motive (H4), this implies that the impact of prior CSR on corporate hypocrisy is mediated by a genuine CSR motive, which in turn is mediated by firm warmth. To reflect this double mediation, we present the following hypothesis:

Hypothesis 5 (double mediation): Perceptions of firm warmth and a genuine CSR motive mediate the effect of prior CSR on perceived corporate hypocrisy.

The Moderating Role of CSR–CSI Domain

As mentioned above, moral licensing is understood to arise from prior good deeds for two reasons: moral credits and moral credentials. The former requires moral credits (accrued from prior good deeds) to outweigh moral debits (from any subsequent transgression); the latter relies upon a tendency for moral credentials earned from prior good deeds to cause observers to positively construe subsequent morally dubious behavior. However, for Effron and Monin (Reference Effron and Monin2010), some transgressions are unlikely to be licensed in these ways. This is because the nature of such transgressions undermines the positive evaluations of prior behavior, thereby undermining the basis for moral credits and credentials. Moreover, these transgressions are relatively likely to bring perceptions of hypocrisy, because they tend to be viewed as more directly contradictory to prior good deeds.

Effron and Monin (Reference Effron and Monin2010) made this argument with reference to the distinction between different-domain transgressions (i.e., prior good deeds and transgression are associated with different, relatively unrelated social issues) and same-domain transgressions (i.e., prior good deeds and transgression are associated with the same or highly related social issues). The latter are expected to be more strongly associated with perceived hypocrisy. Crucially, they argue that transgressions “in the same domain as prior moral behavior can . . . create the appearance of making, and then contradicting, a claim about one’s values” (Effron & Monin, Reference Effron and Monin2010: 1620). In contrast, “transgressions in a different domain should likely not appear hypocritical, because they are not directly inconsistent with prior good deeds” (1620). In the context of individuals’ evaluations of a person, rather than a firm, Effron and Monin (Reference Effron and Monin2010) provided empirical support for this by demonstrating a tendency for moral licensing to be present for different-domain transgressions but absent for same-domain transgressions.

We apply this argument to the evaluation of firms by first recalling the previously discussed tendency for individuals to make anthropomorphic judgments of firms (Godfrey, Reference Godfrey2005). It is well-documented that individuals are willing to ascribe character attributes (e.g., selfishness, trustworthiness) and motives to firms (e.g., Davies, Chun, da Silva, & Roper, Reference Davies, Chun, Silva and Roper2001). Consistent with this, the notion of moral licensing has been used to explain a link between CSR and CSI, wherein CEOs may be willing to run greater risk of CSI if they believe their firm has accumulated sufficient moral credits from its prior CSR record (Ormiston & Wong, Reference Ormiston and Wong2013). Second, we note that CSR is a multidimensional concept that spans the plurality of social and environmental issues. These issues are in turn arrayed across a host of disparate domains, e.g., from habitat degradation to community cohesion, from climate change to employee health, and so forth (Mattingly & Berman, Reference Mattingly and Berman2006). Therefore, a firm’s CSR activities and CSI events may pertain to the same domain or different ones. Indeed, empirical evidence points to a common tendency for firms to exhibit a mix of positive and negative indicators not only across domains, but also within each domain of CSR (Oikonomou et al., Reference Oikonomou, Brooks and Pavelin2014).

When applied to this context, Effron and Monin’s (Reference Effron and Monin2010) argument implies that the effect of a firm’s prior record of CSR affects perceptions of hypocrisy is moderated by the domain(s) of CSR and CSI. Specifically, a firm’s prior record of CSR mitigates perceptions of hypocrisy more strongly if CSR and CSI are in different domains (vs. the same domain). When a CSI event does not relate to the same domain as a firm’s prior record of CSR, that event is less likely to be perceived as a direct contradiction of a firm’s prior CSR. For example, when faced with an apparent corporate misdeed that has brought damage to wildlife, individuals may consider that such a CSI event does not contradict a firm’s prior CSR contributions to employee welfare. That is, the revelation of poor environmental stewardship does not undermine the notion that the firm acts with due regard for employee welfare.

This argument is somewhat supported by previous empirical findings. Janney and Gove (Reference Janney and Gove2011) found that when CSR and CSI were in the same domain (vs. different domains) firms tended to be punished more harshly by the market. In a similar vein, Carlos and Lewis (Reference Carlos and Lewis2018: 130) found that, with respect to membership of the Dow Jones Sustainability Index, “the threat of hypocrisy is amplified for firms with stronger reputations in the same domain as the certification.” However, it is worth noting that both studies (Carlos & Lewis, Reference Carlos and Lewis2018; Janney & Gove, Reference Janney and Gove2011) mainly adopt a firm-level perspective in documenting how the domains of CSR and CSI can influence market reactions and firm strategy without direct evidence regarding individuals’ judgments of corporate hypocrisy. To reflect the arguments presented above and complement these studies by providing more direct evidence of hypocrisy judgments, we predict:

Hypothesis 6 (moderation): CSR–CSI domain moderates the impact of prior CSR on corporate hypocrisy (H3), such that the effect is stronger if CSR and CSI are in different domains rather than the same domain.

OVERVIEW OF STUDIES

We carried out four experiments to test our theoretical framework described above (Figure 1). Study 1 was undertaken to investigate the effect of a firm’s prior record of CSR on the perception of a firm’s warmth, and also the degree to which perceived firm warmth mediated the perception of a genuine CSR motive (H1 and H2). Building on Study 1, Study 2 was undertaken to investigate not only the effect of prior CSR on the perception of corporate hypocrisy but also the degree to which this effect was mediated by the perception of a genuine CSR motive (H1 to H5). To test the robustness of our framework, Studies 3 and 4 replicated Study 2 with different experimental stimuli. In addition, they explored the moderating effect of CSR–CSI domain (H6). The results were consistent with Studies 1 and 2. Taken together, our four studies provided evidence convergent with our framework.

Figure 1: Conceptual Model

STUDY 1

Sample

Using age and gender as criteria for stratified sampling, 181 participants were recruited for Study 1 via one of the biggest online panels—Amazon Mechanical Turk (MTurk).Footnote 1 We recruited participants from MTurk because online participants show similar characteristics to our target population—the general public. In addition, the recruitment of participants online is cheaper than paper-and-pencil methods (Berinsk, Huber, & Lanz, Reference Berinsk, Huber and Lanz2012; Buhrmester, Kwang, & Gosling, Reference Buhrmester, Kwang and Gosling2011). As MTurk’s participants are mainly in the United States (Berinsk et al., Reference Berinsk, Huber and Lanz2012; Buhrmester et al., Reference Buhrmester, Kwang and Gosling2011), Study 1 recruited American residents as participants. However, among the 181 participants, 81 failed our attention-check questions, leaving a reduced, yet sufficient, and effective sample size of 100. It is worth noting that this failure rate for our attention check was consistent with Oppenheimer, Meyvis, and Davidenko (Reference Oppenheimer, Meyvis and Davidenko2009), who suggested 30 to 40 percent of online participants may fail to read instructions carefully. Following Zhou and Fishbach (Reference Zhou and Fishbach2016), we compared the demographic characteristics (age and gender) of participants that failed the attention-check questions with those that did not. The results showed no statistically significant difference. We further compared the sample attrition rate across conditions. The results again showed no statistically significant difference. Thus, our results were not likely to be biased by sample attrition.

We used the United States Census Bureau (2017) as a guide to check that our sample’s age and gender—our stratified sampling criteria—matched the current American population. According to United States Census Bureau (2017) data, 50.8 percent of the US population is female and 15.2 percent of the population are aged 65 or over. A one-sample binomial test indicated that our sample’s gender distribution did not differ significantly from the general population (p = 0.24), with 51 percent of participants in our sample being female. In addition, our sample’s age distribution did not differ significantly from the general population (p = 0.86), with 15 percent of participants in our sample aged 65 or over. Thus, our sample matched the current US population in age and gender.

Design and Procedure

The experiment was a one-factor (prior CSR: strong vs. weak) between-subject design. Participants’ perceptions of firm warmth and CSR motive were collected as mediator and dependent variable. In order to avoid demand artifacts (Sawyer, Reference Sawyer1975), participants were told that the purpose of Study 1 was to investigate how people attribute human traits, emotions, or intentions to nonhuman entities such as firms. After the collection of their demographic information, each participant was invited to read one of the prior-CSR scenarios documented below. Following Goodman and Paolacci (Reference Goodman and Paolacci2017) and Wessling, Huber, and Netzer (Reference Wessling, Huber and Netzer2017), participants were asked to answer the focal firm’s name and industry as an attention check. This was to ensure that participants’ responses were not based on guessing (i.e., without reading the scenarios). Only participants that correctly answered the attention-check questions could proceed. Next, participants answered manipulation check questions, and then their perceptions of firm warmth and CSR motive were collected, together with control variables.

Prior-CSR Manipulation

Consistent with Bolton and Mattila (Reference Bolton and Mattila2015), a fake retailer was chosen as the focal firm to avoid the potential biases associated with participants’ pre-existing knowledge of and attitudes toward existing retailers. In order to increase the external validity of the study, we developed CSR scenarios by drawing upon items within the MSCI ESG—formerly Kinder, Lydenburg & Domini (KLD) —ratings database and an analysis of news media content, via the LexisNexis database. As a result, rural youth unemployment was chosen as the focal issue for CSR, because community CSR is a key index in the MSCI/KLD ratings and the issue has been consistently featured in news coverage of corporate behavior. Furthermore, many key retailers emphasize their commitment to such community-related issues in their annual reports of CSR engagement (e.g., Marks & Spencer, 2016).

Participants were randomly assigned to read either a strong or weak prior-CSR scenario. For strong prior CSR, participants were told that the focal firm was a leader in the retail industry in reducing rural youth unemployment. In addition, participants were told that between 2006 and 2015 the focal firm donated 80 percent more than the industry average and donated £2 million every year regardless of its profitability. Furthermore, in 2015, the focal firm encouraged its employees to spend 240,000 paid work hours (equivalent to a monetary value of £1.1 million) to help various charities reduce rural youth unemployment. As a result, the focal firm had been consistently ranked in the top three of the “50 best retailers for youth.”

In contrast, for weak prior CSR, participants were told that the focal firm played an active role in the retail industry in reducing rural youth unemployment, but that between 2006 and 2015 it donated only 30 percent of the industry average and every year its donation depended on its profitability (failing to contribute in some years because of low profitability). As a result, the focal firm had never been ranked among the “50 best retailers for youth.” All other information was identical across the two conditions.Footnote 2

Measures

Firm Warmth

After reading one of the prior-CSR scenarios, each participant was asked to rate the focal firm on its generosity, kindness and warmth on a seven-point scale (1 = extremely, 7 = not at all, α = 0.98). These items were based on Aaker et al. (Reference Aaker, Vohs and Mogilner2010).

CSR Motives

Participants’ perceptions of a genuine CSR motive were gathered via a four-item scale used in Bolton and Mattila (Reference Bolton and Mattila2015). Sample items in the scale were “The focal firm participates in charitable donations because it genuinely cares about the well-being of others,” and “The focal firm’s commitment to charitable donations is genuine” (1 = strongly disagree, 7 = strongly agree, α = 0.86).

Manipulation Checks

In order to check whether our manipulation was successful, we measured participants’ perceptions of the focal firm’s prior CSR via a three-item scale used in Wagner et al. (Reference Wagner, Lutz and Weitz2009). Sample items in the scale were “The focal firm is a socially responsible company,” and “The focal firm follows high ethical standards” (1 = strongly disagree, 7 = strongly agree, α = 0.92).

Controls

Both Gao and Mattila (Reference Gao and Mattila2014) and Shea and Hawn (Reference Shea and Hawn2019) suggested that CSR engagement increases individuals’ perceptions of a firm’s warmth and competence. In order to see whether firm competence also mediated the effect of prior CSR on perceptions of a genuine CSR motive, each participant was asked to rate the focal firm on its competence, effectiveness, and efficiency on a seven-point scale (1 = extremely, 7 = not at all, α = 0.97). These items were based on Aaker et al. (Reference Aaker, Vohs and Mogilner2010). In order to rule out that the different prior-CSR scenarios also differed in believability, participants were asked to judge CSR scenarios’ believability, following Mariconda and Lurati (Reference Mariconda and Lurati2015). Sample items in the scale were “How believable is the article you just read?” and “How believable is the evidence presented in the text?” (1 = not at all believable, 7 = extremely believable, α = 0.91). In order to support the cover story of Study 1, participants were also asked whether they thought the focal firm behaved like a human with intentions via a four-item scale used in Aaker et al. (Reference Aaker, Vohs and Mogilner2010). Sample items in the scale were “The focal firm appears to be capable of making plans and working towards goals,” and “The focal firm appears to be capable of conveying thoughts and feelings to others.” (1 = strongly disagree, 7 = strongly agree, α = 0.92)

Results

Manipulation Check and Descriptive Statistics

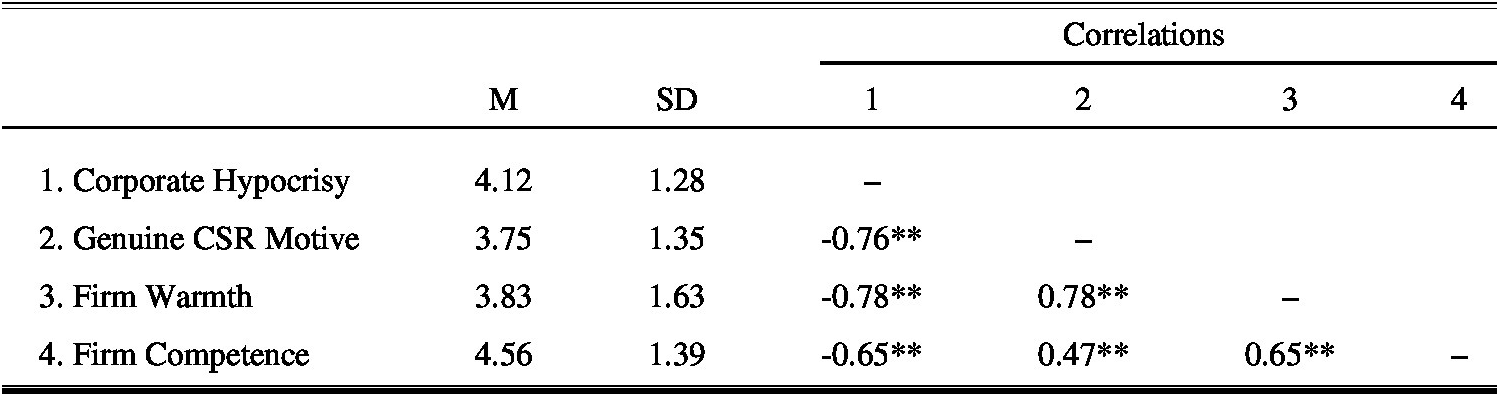

Descriptive statistics can be found in Table 1. Participants considered the focal firm in the strong prior-CSR condition to have stronger CSR (M = 5.63, SD = 1.24) than the focal firm in the weak prior-CSR condition (M = 4.04, SD = 1.23; t (98) = 6.42, p < .0001). In addition, their perceptions of article believability did not differ across conditions (p > 0.05). Taken together, these results suggested our manipulation was successful.

Table 1: Study 1 Descriptive Statistics and Correlations

Note. M = mean. SD = standard deviation. ** p < .01 (two-tailed).

Prior CSR on Firm Warmth (Hypothesis 1)

An independent t-test suggested that strong prior CSR (M = 3.35, SD = 2.31) led to higher perceptions of firm warmth than weak prior CSR (M = 4.47, SD = 1.66; t (98) = 2.81, p < 0.01), supporting H1.Footnote 3 In addition, strong (vs. weak) prior CSR did not affect perceptions of firm competence or firm intentions (p > 0.05 in both cases).

Firm Warmth Mediating Prior CSR on a Genuine CSR Motive (Hypothesis 2)

In order to test H2, we used the bootstrapping-based method and the statistical software of Hayes (Reference Hayes2018) to test the indirect effect of perceived firm warmth on perceptions of a genuine CSR motive (with 5,000 resamples). We found the indirect effect (coefficient = -0.18, SE = 0.32, 95% CI = -0.38, -0.04), the total effect (coefficient = 2.04, p < 0.001), and the direct effect (coefficient = 2.21, p < 0.001) to be significant.Footnote 4 Thus, perceived firm warmth mediated the effect of prior CSR on the perception of a genuine CSR motive. We also found the indirect effect of perceived firm competence on perceptions of a genuine CSR motive to be insignificant (coefficient = -0.10, SE = 0.08, 95% CI = -0.28, 0.06). Thus, perceived firm competence was not a mediator in this context.Footnote 5

Study 1 Discussion

Study 1 provides evidence that strong (vs. weak) prior CSR increases perceptions of a genuine CSR motive. Furthermore, it demonstrates that this effect is partly mediated by perceived firm warmth. Building on Study 1, Studies 2, 3, and 4 address how prior CSR, perceived firm warmth and a genuine CSR motive influence perceptions of corporate hypocrisy.

STUDY 2

We undertook Study 2 for two key purposes: first, to better understand the relationships between prior CSR, perceptions of firm warmth, a genuine CSR motive and corporate hypocrisy; second, to test the robustness of Study 1 by sampling from a different population (the UK general public).

Sample

We recruited 300 participants for Study 2 from the British general public via Qualtrics. As in Study 1, stratified sampling was used to ensure that the sample reflected the demographic characteristics (age and gender) of the British general public, as reported in the most recent census data (Office for National Statistics, 2011). However, 110 participants failed our attention check questions, leaving a reduced, yet sufficient, sample size of 190.Footnote 6 As in Study 1, and following Zhou and Fishbach (Reference Zhou and Fishbach2016), we compared the demographic characteristics of participants who failed the attention-check questions with those who did not. The results showed no statistically significant difference. We further compared the sample attrition rate across conditions. The results again showed no statistically significant difference. Thus, our results were not biased by sample attrition.

The Office for National Statistics (2011) suggests that currently 50 percent of the UK population is female. In terms of age, 15 percent of the UK population is aged 16 to 24, 22 percent is aged 25 to 34, 22 percent is aged 35 to 44, 22 percent is aged 45 to 54, and 19 percent is aged 55 to 64 (Office for National Statistics, 2011). A one-sample binomial test indicated that our sample’s gender distribution did not differ significantly from the general population (p = 0.28), with 54 percent of participants in our sample being female. Similarly, a chi-square goodness-of-fit test indicated that our sample’s age distribution did not differ significantly from the general UK population (χ 2 (4) = 0.47, p = 0.79). Overall, 10 percent of our sample were aged 16 to 24, 22 percent were aged 25 to 34, 21 percent were aged 35 to 44, 23 percent were aged 45 to 54, and 24 percent were aged 55 to 64. Thus, our sample matched the British general public in age and gender.

Design and Procedure

Participants were randomly assigned to one of the prior-CSR conditions: strong vs. weak vs. control. Participants’ perceptions of firm hypocrisy, firm warmth, and a genuine CSR motive were collected as key mediators and dependent variables. In order to avoid demand artifacts (Sawyer, Reference Sawyer1975), participants were told that the purpose of the research was to examine how multitasking and single tasking differently impacted on people’s memory and thoughts. Participants were also told that the research contained different and unrelated sections. After collecting their demographic information, participants in the strong and weak prior-CSR conditions were asked to read one of the prior-CSR scenarios reported in Study 1. Participants in the control group were exposed to the same firm profile without any prior-CSR information. Then participants were asked to answer attention check questions and manipulation check questions as in Study 1.

Participants were then invited to undertake twenty simple mathematical calculations as a distraction task. This was intended to reduce the likelihood of subjects guessing the true purpose of the research project and, by implication, to avoid demand artifacts (Sawyer, Reference Sawyer1975). Following this, all participants were asked to read a CSI-event scenario on bird population decline, described below. While reading, they were required to click the dollar signs ($) embedded in the article and remember the total number of such signs found (as they would need to report it later). This supported the cover story that this project was intended to examine how multitasking and single tasking differently impacted people’s memory and thoughts. After reading the scenario, participants were asked to answer manipulation check questions relating to the CSI event, and provide their views of corporate hypocrisy, a genuine CSR motive, firm warmth, and control variables. Finally, participants were invited to report the number of dollar signs ($) found in the CSI scenario, after which they were thanked and debriefed.

Manipulation and Measures

CSI Manipulation

Lange and Washburn (Reference Lange and Washburn2012) suggested that stakeholders use effect desirability, corporate culpability, and affected-party noncomplicity to assess a CSI event. With regards to effect desirability and corporate culpability, respectively, the CSI scenario employed in our research indicated: that the observed social outcomes were undesirable by informing participants that a wetlands bird population had dropped by 55 percent; and that the focal firm might be responsible for the negative events by citing research from a local university, which concluded that the new retail store had had a significant and irreversible negative impact on the local natural environment.Footnote 7 Finally, affected-party noncomplicity (the affected parties’ lack of power or foresight to prevent the undesirable effect on them, Lange & Washburn, Reference Lange and Washburn2012) was also reflected in our CSI scenario, because birds (the affected party) could not be expected to marshal the resources required to stop the focal firm opening a retail store on the wetlands.

Corporate Hypocrisy

Participants’ perceptions of corporate hypocrisy were gathered via a six-item scale used in Wagner et al. (Reference Wagner, Lutz and Weitz2009). The full set of items in the scale were: “The focal firm acts hypocritically”; “The focal firm pretends to be something that it is not”; “The focal firm does exactly what it says”; “The focal firm keeps its promises”; “The focal firm puts its words into action”; “The focal firm says and does two different things” (1 = strongly disagree, 7 = strongly agree, α = 0.91).

Firm Warmth and CSR Motive

We measured perceived firm warmth (three items; α = 0.88) and a genuine CSR motive (four items; α = 0.84) with the same measures used in Study 1.

Manipulation Checks

In order to check whether our CSI manipulation was successful, following Klein and Dawar (Reference Klein and Dawar2004), participants were asked to indicate whether they thought the CSI event was good or bad. Then, they were asked to rate the degree of goodness/badness of the event on a single-item scale (1 = not at all good/not at all bad, 7 = extremely good/extremely bad).

Controls

To investigate whether perceived firm competence mediated the effect of prior CSR on a genuine CSR motive, we measured perceived firm competence with the same three-item measure as in Study 1 (α = 0.92). To rule out different prior-CSR scenarios having differing levels of believability, the same two items used in Study 1 were used to measure article believability (α = 0.89).

Results

Manipulation Check and Descriptive Statistics

Descriptive statistics are presented in Table 2. In the strong prior-CSR condition, participants judged the focal firm to be showing stronger CSR (M = 5.67, SD = 1.42) than in the weak prior-CSR condition (M = 4.60, SD = 1.13) or the control (M = 4.03, SD = 1.52; F (2, 187) = 22.86, p < 0.001). In addition, all participants viewed our CSI event as negative, with moderate strength (M = 3.73, SD = 2.68). Furthermore, article believability and participants’ perceptions of the CSI event did not differ across conditions (p > 0.05 in all cases). Taken together, these results suggested that our manipulations were successful.

Table 2: Study 2 Descriptive Statistics and Correlations

Note. M = mean. SD = standard deviation. ** p < .01 (two-tailed).

Prior CSR on Firm Warmth (Hypothesis 1)

In order to test Hypothesis 1, we undertook an ANOVA with perceived firm warmth as the dependent variable and prior CSR as the independent variable. A Turkey post-hoc test revealed that strong prior CSR (M = 4.61, SD = 1.49) led to higher firm warmth perceptions than weak prior CSR (M = 3.55, SD = 1.50) or the control (M = 3.34, SD = 1.65; F (2, 185) = 11.99, p < 0.001). Thus, H1 was supported.

Firm Warmth Mediating Prior CSR on a Genuine CSR motive (Hypothesis 2)

Using a bootstrapping-based method (with 5,000 resamples) and the statistical software of Hayes (Reference Hayes2018), we found that firm warmth had a significant indirect effect on the perception of a genuine CSR motive (coefficient = .066, SE = 0.17, 95% CI = 0.34, 0.10). In addition, while we found the total effect to be significant (coefficient = 0.77, p < 0.001), we found no significant direct effect (p > 0.05). Thus, perception of firm warmth mediated the effect of prior CSR on the perception of a genuine CSR motive. We also found the indirect effect of perceived firm competence on the perception of a genuine CSR motive was not significant (coefficient = -0.10, SE = 0.11, 95% CI = -.032, 0.10), Thus, perceived firm competence was not a mediator.

Prior CSR on Corporate Hypocrisy (Hypothesis 3)

In order to test H3, we carried out an ANOVA with perceived corporate hypocrisy as the dependent variable and prior CSR as the independent variable. A Turkey post-hoc test revealed that strong prior CSR (M = 3.76, SD = 1.22) weakened perceptions of corporate hypocrisy compared to weak prior CSR (M = 4.50, SD = 1.34) or the control (M = 4.13, SD = 1.21; F [2, 185] = 5.22, p < 0.01). Thus, H3 was also supported.

A Genuine CSR Motive Mediating Prior CSR on Corporate Hypocrisy (Hypothesis 4)

Using a bootstrapping-based method (with 5,000 resamples) and the statistical software of Hayes (Reference Hayes2018), we found the perception of a genuine CSR motive to have a significant indirect effect on perceived corporate hypocrisy (coefficient = -0.56, SE = 0.17, 95% CI = -0.89, -0.26). In addition, we found that the total effect was significant (coefficient = -0.37, p = 0.09), but the direct effect was not (p > 0.05). Thus, perceptions of a genuine CSR motive mediated the effect of prior CSR on perceived corporate hypocrisy, providing support for H4.

Double Mediation of Firm Warmth and a Genuine CSR Motive (Hypothesis 5)

In order to test H5, we used the bootstrapping-based method (with 5,000 resamples) and model 6 (double mediation) in the statistical software of Hayes (Reference Hayes2018) to test the indirect effect of perceived firm warmth and a genuine CSR motive on perceived corporate hypocrisy. The results suggested that the indirect effect was significant (coefficient = -0.25, SE = 0.08, 95% CI = -0.43, -0.11). In addition, both the total effect (coefficient = -0.37, p = 0.09) and the direct effect were also significant (coefficient = 0.33, p < 0.05). Thus, we found that perceptions of a genuine CSR motive and firm warmth mediated the effect of prior CSR on perceived corporate hypocrisy.

Study 2 Discussion

Study 2 extends Study 1 by providing further support for our hypotheses. The results of Study 2 indicate that firms with a strong prior record of CSR are more likely to be perceived as genuinely motivated in their CSR activities. This, in turn, lessens perceptions of corporate hypocrisy. Furthermore, perceived firm warmth mediates the effect of prior CSR on the perception of a genuine CSR motive, which in turn mediates the effect of prior CSR on perceived corporate hypocrisy. However, to address Hypothesis 6, we must next ask: Does CSR–CSI domain moderate the impact of prior CSR on the perception of corporate hypocrisy?

STUDY 3

Sample

Using the same sampling method as Study 2, 515 participants were recruited for Study 3 from the UK public via Qualtrics. However, 190 failed the attention-check questions, leaving an effective sample size of 325.Footnote 8 The same as in the previous two studies, and following Zhou and Fishbach (Reference Zhou and Fishbach2016), we compared the demographic characteristics of participants who failed the attention-check questions against those who did not. The results showed no statistically significant difference. We further compared the sample attrition rate across conditions. The results again showed no statistically significant difference. Thus, our results were less likely to be biased by this sample attrition.

As Study 3 recruited participants from the British general public, we again used data from the Office for National Statistics (2011) to guide stratification on age and gender. According to a one-sample binomial test, our sample’s gender distribution did not differ significantly from the general population (p = 0.65), with 51 percent of participants in our sample being female. According to a chi-square goodness-of-fit test, our sample did not significantly differ from the general population with respect to age distribution (χ 2[4] = 1.21, p = 0.55). Overall, 10 percent of our sample were aged 16 to 24, 21 percent were aged 25 to 34, 23 percent were aged 35 to 44, 22 percent were aged 45 to 54, and 24 percent were aged 55 to 64. This suggested our sample matched the UK general public in age and gender.

Design, Procedure, and Measurement

Study 3 was a three-by-two (Prior CSR: strong vs. weak vs. control) * (CSR–CSI domains: same vs. different) between-subject design. Just as in Study 2, participants’ perceptions of corporate hypocrisy, firm warmth, and a genuine CSR motive were collected as key mediators and dependent variables. In terms of procedure, Study 3 differed from Study 2 in two respects: first, in Study 3, the CSI event always related to rural youth unemployment; second, in Study 3, the focal firm’s prior CSR either prevented bird population decline or reduced rural youth employment. Thereby, for some participants, the firm’s prior CSR and the CSI event were in the same domain (i.e., rural youth unemployment), and for other participants, they were in different domains (i.e., bird population decline and rural youth unemployment, respectively). The rest of Study 3’s experimental procedure and measurement were identical to Study 2.

Manipulation

Prior-CSR Dimension Manipulation

In order to generate a common (vs. different) domain between the CSR and CSI, we developed prior-CSR scenarios in the environmental domain. Aside from the difference in the focal issue (bird population decline vs. rural youth unemployment), the manipulation of environmental prior CSR closely matched the community prior-CSR manipulation reported in Studies 1 and 2. For example, for strong prior environmental CSR, participants were told that the focal firm was a leader in the retailing industry to preventing bird population decline. In addition, participants were told that between 2006 and 2015 the focal firm donated 80 percent more than the industry average and donated £2 million every year regardless of its profitability. Furthermore, in 2015 the focal firm encouraged its employees to spend 240,000 paid work hours (equivalent to a monetary value of £1.1 million) to help various charities to protect bird populations from decline. As a result, the focal firm had been consistently ranked in the top three of the “50 best green retailers.”

A separate test with 130 participants from the same sample pool as those in Study 1 confirmed that, with respect to the perceived strength of CSR, strong community prior CSR did not differ from strong environmental prior CSR, and weak community prior CSR did not differ from weak environmental prior CSR (p > 0.05 in all cases). In addition, there was no significant difference in participants’ perceptions of firm warmth, competence and perceptions of a genuine CSR motive (p > 0.05 in all cases) among different prior-CSR domains.

Community CSI Manipulation

The community-related CSI event was focused upon rural youth unemployment. Specifically, participants were told that the focal retailer had closed one of its stores due to low profitability, and had blamed the lack of profitability on high rents and extra training costs for young workers. As a result, local youth unemployment rose rapidly in 2015, to more than double the national average. Furthermore, while the focal retailer helped the majority of its middle- to high-level staff secure jobs in its other stores, no such help was offered to its younger workers. A separate test confirmed that participants considered this community-related CSI event to be negative with moderate strength (M = 3.57, SD =1.28).

Results

Manipulation Check and Descriptive Statistics

Table 3 presents descriptive statistics for Study 3. In the strong prior-CSR condition, participants perceived the focal firm to have stronger CSR (M = 5.75, SD = 1.21) than in the weak prior-CSR condition (M = 4.23, SD = 1.20) or the control (M = 4.10, SD = 1.60; F [2, 322] = 54.25, p < 0.001). With regard to perceived strength of the firm’s CSR, strong prior environmental CSR (M = 5.79, SD = 1.06) did not differ from strong prior community CSR (M = 5.71, SD = 1.35; p > 0.05), and weak prior environmental CSR (M = 3.94, SD = 1.46) did not differ from weak prior community CSR (M = 4.08, SD = 1.66; p > 0.05). Furthermore, our manipulation checks confirmed that participants judged the community CSI event to be negative with moderate strength (M = 4.75, SD = 2.97). Finally, article believability did not differ across conditions (p > 0.05). Thus, our manipulation was successful.

Table 3: Study 3 Descriptive Statistics and Correlations

Note. M = mean. SD = standard deviation. ** p < .01 (two-tailed).

Prior CSR on Firm Warmth (Hypothesis 1)

As the assumption of equal variance was violated, one-way ANOVA with the Games-Howell post-hoc test was used to test H1. The results indicate that strong prior CSR (M = 4.49, SD = 1.52) led to higher firm warmth perceptions than weak prior CSR (M = 3.53, SD = 1.63) or the control (M = 2.94, SD =1.19; F [2, 322] = 27.24; p < 0.001). Thus, H1 was supported.

Firm Warmth Mediating Prior CSR on a Genuine CSR Motive (Hypothesis 2)

Using a bootstrapping-based method (with 5,000 resamples) and the statistical software of Hayes (Reference Hayes2018), we found the indirect effect of perceived firm warmth on perception of a genuine CSR motive to be significant (coefficient = 0.98, SE = 0.14, 95% CI = 0.71, 1.26). In addition, while the total effect was significant (coefficient = 0.95, p < 0.001), the direct effect was not (p > 0.05). Thus, perceived firm warmth mediated the effect of prior CSR on the perception of a genuine CSR motive. We also found no significant indirect effect of perceived firm competence on perception of a genuine CSR motive (coefficient = -0.06, SE = 0.07, 95% CI = -0.19, 0.07). Thus, perceived firm competence was not a mediator.

Prior CSR on Corporate Hypocrisy (Hypothesis 3)

From an ANOVA with perceived corporate hypocrisy as the dependent variable and prior CSR as the independent variable, we found that strong prior CSR (M = 3.75, SD = 1.31) lessened perceptions of corporate hypocrisy compared to weak prior CSR (M = 4.42, SD = 1.38) or the control (M = 4.50, SD = 1.17; F ([2, 320] = 11.17, p < 0.001). This supported H3.

A Genuine CSR Motive Mediating Prior CSR on Corporate Hypocrisy (Hypothesis 4)

We used a bootstrapping-based method (with 5,000 resamples) and the statistical software of Hayes (Reference Hayes2018) to test the indirect effect of perceptions of a genuine CSR motive on perceived corporate hypocrisy. The results indicated that the indirect effect was significant (coefficient = -0.68, SE = 0.13, 95% CI = -0.93, -0.44). In addition, we found the total effect to be significant (coefficient = -0.75, p < 0.001) but the direct effect to be insignificant (p > 0.05). Thus, perceptions of a genuine CSR motive mediated the effect of prior CSR on perceived corporate hypocrisy, providing support for H4.

Double Mediation of Firm Warmth and a Genuine CSR Motive (Hypothesis 5)

In order to test H5, we used the bootstrapping-based method (with 5,000 resamples) and model 6 (double mediation) in the statistical software of Hayes (Reference Hayes2018) to test the indirect effect of perceived firm warmth and a genuine CSR motive on perceived corporate hypocrisy. The results suggested the indirect effect was significant (coefficient = -0.39, SE = 0.09, 95% CI = - 0.58, -0.23). In addition, while the total effect was significant (coefficient = -0.75, p < 0.01), the direct effect was not (p > 0.05). This, therefore, suggested that perceptions of a genuine CSR motive and firm warmth mediated the effect of prior CSR on perceived corporate hypocrisy.

The Moderating Role of CSR–CSI Domain (Hypothesis 6)

With CSR and CSI in different domains, strong prior CSR (M = 3.74, SD = 1.46) lessened perceived corporate hypocrisy compared to weak prior CSR (M = 5.79, SD = 1.06; F [2, 120] = 8.71; p < 0.01). With CSR and CSI in the same domain, strong prior CSR (M = 4.38, SD = 1.66) also lessened perceived corporate hypocrisy compared to weak prior CSR (M = 5.71, SD = 1.35; F [2, 134] = 5.15; p < 0.01). More importantly, the two-way interaction between CSR–CSI domain and prior CSR was also significant (F [2, 324] = 4.24, p < 0.05). This provided support for H6 (see Figure 2).

Figure 2: The Interactive Effect between CSR–CSI Domain and Prior CSR on Perceived Corporate Hypocrisy (Study 3)

Study 3 Discussion

Study 3 provides further evidence in support of our framework. It demonstrates that firms with a strong prior record of CSR can lessen perceptions of corporate hypocrisy because stakeholders are more likely to infer a genuine motive in their CSR activities. More importantly, Study 3 suggests that the CSR–CSI domain moderates the impact of prior CSR on perceived corporate hypocrisy such that the moderating effect is stronger when CSR and CSI are in different domains, rather than the same one.

STUDY 4

Study 4 had two key purposes: first, we sought to demonstrate the robustness of our findings by manipulating prior CSR via scorecards, as in Elliott, Jackson, Peecher, and White (Reference Elliott, Jackson, Peecher and White2014). This was to rule out the alternative explanation that our results were a consequence of the different narrative tones in our previous CSR scenarios. Second, Study 4 used an alternative method—structural equation modeling (SEM)—to analyze our data.

Sample

Using the same sampling method as Study 1, we recruited 800 participants for Study 4 from MTurk. However, 224 of these failed our attention-check questions, leaving an effective but sufficient sample size of 576.Footnote 9 The same as in the previous two studies, and following Zhou and Fishbach (Reference Zhou and Fishbach2016), we compared the demographic characteristics of participants who failed the attention-check questions against those who did not. The results showed no statistically significant difference. We further compared the sample attrition rate across conditions. The results again showed no statistically significant difference. Thus, our results were less likely to be biased by this sample attrition.

As per Study 1, we used the United States Census Bureau (2017) as a guide to our sample’s age and gender—our stratified sampling criteria—and sought to match the current American population. Currently, according to United States Census Bureau (2017) data, 50.8 percent of the US population is female and 15.2 percent of the population are aged 65 or over. A one-sample binomial test indicated that our sample’s gender distribution did not differ significantly from the general population (p = 0.17), with 51 percent of participants in our sample being female. In addition, our sample’s age distribution did not differ significantly from the general population (p = 0.73), with 15.4 percent of participants in our sample aged 65 or over. Thus, our sample matched the current American population in age and gender.

Design, Procedure and Measurement

Study 4 had the same design as Study 3: a 3 (prior CSR: strong vs. weak vs. control) X 2 (CSR–CSI domains: same vs. different) between-subject design. Participants’ perceptions of firm warmth, a genuine CSR motive and firm hypocrisy were collected as key mediators and dependent variables. In terms of procedure and measurement, Study 4 made the following changes to Study 3: first, unlike Study 3 where all participants were exposed to the same CSI event, in Study 4 participants were randomly exposed to either an environmental CSI event or a community CSI event, as described below. Second, in Study 4, all participants were exposed to prior CSR activity in the same domain—environment. Thereby, for some participants, the firm’s prior CSR activity and the CSI event were in the same domain (environment) and, for other participants, the firm’s prior CSR activity and the CSI event were in different domains (environment and community, respectively). Third, unlike Study 3, where we measured perceptions of firm warmth and a genuine CSR motive after a CSI event, in Study 4 both variables were measured before a CSI event. Finally, in order to increase scale sensitivity, all constructs were measured on eleven-point scales (rather than the seven-point scales used in the preceding studies). The rest of Study 4’s experimental procedure and measurement were identical to the earlier studies.

Manipulation

Prior-CSR Manipulation

We manipulated prior CSR via the focal firm’s industry ranking and its green score (see the Appendix). For example, for strong prior CSR, the focal firm was ranked second (out of 56 companies) for its environmental CSR. Its overall green score was 86.73 while the industry average was 56.23. For weak prior CSR, the focal firm was ranked 26th (out of 56 companies) for its environmental CSR. Its overall green score was 58.73, while the industry average was again 56.23. A separate test with 119 participants from the same sample pool as those in Study 4 confirmed the focal firm in the strong prior-CSR condition (M = 9.52, SD = 1.46) generated higher CSR perceptions than that in the weak prior-CSR condition (M = 7.68, SD = 1.88; t(117) = 5.75, p < 0.001).

CSI Dimension Manipulation

In order to create CSR–CSI domain, in Study 4 participants were randomly exposed to either an environmental or a community CSI event. In both CSI events, the focal firm opened a store in their local area. The only difference between them was that in the environmental CSI event, participants were told that the bird population had dropped by 55 percent because the focal firm had opened a new store on the local wetlands (the same scenario used in Study 2), and in the community CSI event, participants were told that 55 percent of local residents felt they had lost a strong sense of community because the focal firm had opened a new store in a local nature reserve that had hitherto been a popular social-gathering place for local residents. A separate test with 119 participants from the same sample pool as those in Study 4 confirmed that perceptions of the strength of environmental CSI (M = 5.40, SD = 3.21) did not differ significantly from those of the community CSI (M = 5.08, SD = 2.97; p > 0.05). Another separate test with 32 participants suggested difference CSI events did not differ significantly on the perceptions of corporate culpability and affected-party non-complicity (p > 0.05).

Results

Manipulation Check and Descriptive Statistics

Table 4 presents descriptive statistics for Study 4. In the strong prior CSR condition, participants perceived the focal firm to have stronger CSR (M = 9.44, SD = 1.69) than in the weak prior-CSR condition (M = 7.34, SD = 1.80) and the control (M = 4.66, SD = 3.26; F [2, 573] = 200.69, p < 0.001). Furthermore, our manipulation checks confirmed that participants judged both CSI events to be negative with moderate strength, with no significant difference between environmental CSI (M = 4.48, SD = 3.10) and community CSI (M = 4.73, SD = 2.97: p > 0.05). Finally, article believability did not differ across conditions (p > 0.05). Thus, our manipulation was successful.

Table 4: Study 4 Descriptive Statistics and Correlations

Note. M = mean. SD = standard deviation. * p < .05. ** p < .01 (two-tailed).

Analytical Approach

In order to demonstrate the robustness of our results, in Study 4 we employed partial least squares (PLS-)SEM to analyze the relationships among prior CSR, CSR–CSI domain, perceptions of firm warmth, a genuine CSR motive and firm hypocrisy (Hair, Hult, Ringle, & Sarstedt, Reference Hair, Hult, Ringle and Sarstedt2017). We chose PLS-SEM in preference to covariance-based (CB-)SEM for the following reasons: first, one of the key goals of this article is to identify perceptions of firm warmth and a genuine CSR motive as key driver constructs in predicting stakeholders’ perceptions of corporate hypocrisy. Thus, PLS-SEM is an appropriate method because it aims to maximize the variance of the endogenous variables explained by the exogenous variables (Hair et al., Reference Hair, Hult, Ringle and Sarstedt2017). Second, given the complexity of our conceptual framework, PLS-SEM is preferred over CB-SEM because one of the key strengths of PLS-SEM is complex model estimation (Hair et al., Reference Hair, Hult, Ringle and Sarstedt2017). Third, while PLS-SEM may offer a conservative test of hypotheses by underestimating path coefficients and R-squares, it has the advantage of accommodating both normally and non-normally distributed data (Hair et al., Reference Hair, Hult, Ringle and Sarstedt2017). In contrast, CB-SEM may inflate goodness-of-fit measures when data are not normally distributed (Lei & Lomax, Reference Lei and Lomax2005). This advantage of PLS-SEM is particularly relevant here in Study 4 because perceived firm warmth was not normally distributed. We used SmartPLS 3.2 (Ringle, Wende, & Becker, Reference Ringle, Wende and Becker2015) to analyze our measurement model and our structural model, and to test our hypotheses.

Measurement Model

For each measured latent construct, we assessed its reliability, convergent validity, and discriminant validity. In terms of reliability, the Cronbach’s alphas and composite reliability coefficients of all constructs were above the recommended cutoff of 0.7 (see Table 5), exhibiting high internal consistency. As for convergent validity, none of the constructs’ average variance extracted (AVE) were below the 0.5 threshold (see Table 5), with items’ standardized factor loadings significantly higher than the required minimum of 0.7 (see Table 6). In terms of discriminant validity, based on the Fornell-Larcker criterion, the square root of AVE for each construct exceeded the correlations with other constructs in the model (see Table 7). In addition, all constructs’ heterotrait-monotrait (HTMT) ratios of correlations were below the threshold of 0.85 (values ranged from 0.49 to 0.80), indicating discriminant validity (Hair et al., Reference Hair, Hult, Ringle and Sarstedt2017).

Table 5: Study 4 Latent Constructs’ Cronbach’s Alphas and AVEs

Note. AVE = average variance extracted.

Table 6: Study 4 Items’ Standardized Factor Loadings

Table 7: Discriminant Validity by Fornell–Larcker Criterion (Study 4)

Structural Model

Overall, the estimations fit the data well. The explained variance (adjusted R 2) for perceived firm warmth was 0.74, followed by perceptions of a genuine CSR motive at 0.64 and corporate hypocrisy at 0.43; all larger than the 0.1 suggested by Falk and Miller (Reference Falk and Miller1992). The results of the blindfolding procedure in SmartPLS indicated the values of Stone–Geisser’s Q 2 test were all greater than 0 (values ranged from 0.36 to 0.62), providing strong evidence of the model’s predictive power (Tenenhaus, Vinzi, Chatelin, & Lauro, Reference Tenenhaus, Vinzi, Chatelin and Lauro2005). Our model’s standardized root mean square residual (SRMR) was 0.03, below the acceptable threshold of 0.08. The normed-fit index (NFI) had a value of 0.97, above the required threshold of 0.95, indicating a good fit (Hair et al., Reference Hair, Hult, Ringle and Sarstedt2017). In addition, none of the constructs’ variance inflation factors (VIFs) were larger than 5 (values ranged from 3.10 to 3.29), indicating that multicollinearity was not an issue at the structural model level.

Prior CSR on Firm Warmth (Hypothesis 1)

Based on our model, we found a significant, positive effect of prior CSR on perceived firm warmth (β = 0.86, p < 0.001). In particular, the focal firm in the strong prior-CSR condition (M = 8.67, SD = 1.97) generated higher firm warmth perceptions than its counterparts in the weak prior-CSR condition (M = 7.08, SD = 2.26) and the control (M = 4.92, SD = 3.21). Thus, H1 was supported.

Firm Warmth Mediating Prior CSR on a Genuine CSR Motive (Hypothesis 2)

To test this mediation, we followed the procedure suggested by Hair et al. (Reference Hair, Hult, Ringle and Sarstedt2017). In a first step, we tested whether the direct effect of prior CSR on perception of a genuine CSR motive was significant when the mediator (perceived firm warmth) was not included. We found a significant positive effect of prior CSR on perceptions of a genuine CSR motive (β = 0.82, p < 0.001). In a second step, we included perceived firm warmth as a mediator variable in the model. We found that prior CSR had a significant positive impact on perceived firm warmth, and perceived firm warmth had a significant, positive impact on perceptions of a genuine CSR motive (β = 0.36, p < 0.001). We also found that the direct effect of prior CSR on perceptions of a genuine CSR motive was also significant (β = 0.52, p < 0.001). To test the significance of the mediation, we bootstrapped the sampling distribution of the indirect effect (Preacher & Hayes, Reference Preacher and Hayes2008) and found that the effect of prior CSR on perceptions of a genuine CSR motive through perceived firm warmth was significant (β = 0.31, p < 0.001). The variance accounted for (VAF) was 37.8 percent, indicating partial mediation (Hair et al., Reference Hair, Hult, Ringle and Sarstedt2017). Taken together, H2 was supported.

Prior CSR on Corporate Hypocrisy (Hypothesis 3)

Based on our model, we found a significant, negative effect of prior CSR on perception of corporate hypocrisy (β = -0.28, p < 0.01). In particular, we found that strong prior CSR (M = 5.57, SD = 2.68) lessened perceptions of corporate hypocrisy when compared to weak prior CSR (M = 7.49, SD = 1.87) or the control (M = 7.65, SD = 2.12). This supported H3.

A Genuine CSR Motive Mediating Prior CSR on Corporate Hypocrisy (Hypothesis 4)

In similar fashion to H2, we followed the procedure suggested by Hair et al. (Reference Hair, Hult, Ringle and Sarstedt2017) to test H4. In a first step, we tested whether the direct effect of prior CSR on perceived corporate hypocrisy was significant when the mediator (perception of a genuine CSR motive) was not included. We found a significant negative effect of prior CSR on perceived corporate hypocrisy (β = -0.50, p < 0.01). In a second step, we included a mediator variable (perception of a genuine CSR motive) in the model. We found that prior CSR had a significant positive impact on perception of a genuine CSR motive (β = 0.82, p < 0.001), and perception of a genuine CSR motive had a significant negative impact on perceived firm hypocrisy (β = -0.26, p < 0.01). We also found the direct effect of prior CSR on perception of corporate hypocrisy was also significant (β = -0.28, p < 0.01). To test the significance of the mediation, we bootstrapped the sampling distribution of the indirect effect (Preacher & Hayes, Reference Preacher and Hayes2008) and found that the effect of prior CSR on perceived corporate hypocrisy through perception of a genuine CSR motive was significant (β = -0.21, p < 0.01). The variance accounted for (VAF) was 42 percent, indicating partial mediation (Hair et al., Reference Hair, Hult, Ringle and Sarstedt2017). Taken together, H4 was supported.

Double Mediation of Firm Warmth and a Genuine CSR Motive (Hypothesis 5)