1 Introduction

Economic decisions often involve choosing between uncertain options,Footnote 1 where the probability distributions of the outcomes are unknown and generated by different contexts. Examples include a recruiter selecting between candidates with different profiles, a firm deciding which market to enter or which technology to adopt, a patient choosing between different treatments, or an investor considering several stocks. In such cases, in addition to beliefs about possible outcomes, the context itself, the “source of uncertainty”, may impact preferences. For instance, an investor may choose to bet on the rise of a domestic stock over the rise of a foreign stock. This choice can be explained by the belief that the domestic stock price is more likely to rise. However, the same investor may also prefer to bet on the fall of the domestic stock over the fall of the foreign stock. These two choices cannot be explained by beliefs alone (as the investor cannot believe that the domestic stock is more likely to rise and fall than the foreign stock), risk attitudes, or even ambiguity attitudes (preference for known over unknown probabilities). These choices reveal a preference for betting on one source of uncertainty (domestic stock) over another (foreign stock).

This example illustrates a pattern called source dependence, which refers to the fact that decisions depend not only on the decision maker’s beliefs about events, which can vary between sources, but also on their attitude toward the source of uncertainty.Footnote 2 A growing body of literature shows that attitudes differ across sources depending on factors such as perceived expertise (de Lara Resende & Wu, Reference de Lara Resende and Wu2010), emotions (Li et al., Reference Li, Müller, Wakker and Wang2017), familiarity (Chew et al., Reference Chew, Ebstein and Zhong2012), or the distinction between epistemic and aleatory uncertainty (Fox & Ülkümen, Reference Fox, Ülkümen, Brun, Keren, Kirkebøen and Montgomery2011). Source-specific attitudes have been observed in a variety of contexts, such as investment decisions (Kilka & Weber, Reference Kilka and Weber2001), strategic interactions (Bruttel et al., Reference Bruttel, Bulutay, Cornand, Heinemann and Zylbersztejn2022; Li et al., Reference Li, Turmunkh and Wakker2020), and self-evaluation (Abdellaoui et al., Reference Abdellaoui, Bleichrodt and Gutierrez2023). The domain of uncertainty is rich (Li et al., Reference Li, Müller, Wakker and Wang2017), and understanding how attitudes vary across situations and individuals is essential (Baillon et al., Reference Baillon, Huang, Selim and Wakker2018). While several methods have been proposed to define and measure ambiguity attitudes toward a given source, there is currently no way to interpret differences in attitudes across sources in terms of source dependence. This paper introduces a tractable definition of source dependence—the preference between different sources with unknown probabilities—and proposes methods to measure it, enabling comparisons of attitudes across sources and individuals.

Prior studies have investigated source dependence by comparing ambiguity attitudes across different sources of uncertainty (e.g., Baillon & Bleichrodt, Reference Baillon and Bleichrodt2015; de Lara Resende & Wu, Reference de Lara Resende and Wu2010; Li et al., Reference Li, Müller, Wakker and Wang2017). Converting ambiguity attitudes toward different sources into source dependence is not straightforward for two reasons. First, ambiguity attitudes are measured on scales that are not independent of risk preferences or are not directly interpretable, making it difficult to compare attitudes across individuals. Methods using certainty equivalents (Fox & Tversky, Reference Fox and Tversky1995) or matching probabilities (Baillon et al., Reference Baillon, Huang, Selim and Wakker2018; Dimmock et al., Reference Dimmock, Kouwenberg and Wakker2016b) measure ambiguity premia in terms of money and willingness to bet, which do not have the same values for individuals with different risk attitudes. Approaches that use weighting functions, like in Abdellaoui et al. (Reference Abdellaoui, Baillon, Placido and Wakker2011), define source dependence as differences in weights that are not easily interpretable. Therefore, these approaches preclude the direct comparison of source dependence across individuals or (pairs of) sources. Second, when attitudes are modeled using non-linear parametric specifications (e.g., Abdellaoui et al., Reference Abdellaoui, Bleichrodt, Kemel and L’Haridon2021; Li et al., Reference Li, Turmunkh and Wakker2019), differences in parameters across sources are also hardly interpretable because of non-linearity. In Sect. 2.3, we present three detailed scenarios illustrating these difficulties quantitatively.

To overcome these difficulties, we introduce a function

![]() that characterizes source preference between natural sources of uncertainty, independently of risk and ambiguity attitudes. The function

that characterizes source preference between natural sources of uncertainty, independently of risk and ambiguity attitudes. The function

![]() is a transformation function that maps beliefs about one source of uncertainty to beliefs about another source.Footnote 3 Deviations from identity of the function

is a transformation function that maps beliefs about one source of uncertainty to beliefs about another source.Footnote 3 Deviations from identity of the function

![]() are directly interpreted as source premia and characterize source preferences. Our approach provides an easy way to quantify and interpret source dependence. It is expressed on the probability scale and allows for a direct comparison of source dependence between individuals without the confound of risk attitudes (utility or probability weighting). Unlike existing methods that compare (the parameters of) ambiguity attitudes toward different sources, the function

are directly interpreted as source premia and characterize source preferences. Our approach provides an easy way to quantify and interpret source dependence. It is expressed on the probability scale and allows for a direct comparison of source dependence between individuals without the confound of risk attitudes (utility or probability weighting). Unlike existing methods that compare (the parameters of) ambiguity attitudes toward different sources, the function

![]() directly captures the degree of relative preference and relative sensitivity (Tversky & Fox, Reference Tversky and Fox1995) between two sources. In subsequent work, Baillon et al. (Reference Baillon, Bleichrodt, Li and Wakker2023) present theoretical arguments on the relevance of our approach to using transformation functions to directly characterize source dependence, and refer to the transformation function we introduce in this paper as a p(robability)matcher.

directly captures the degree of relative preference and relative sensitivity (Tversky & Fox, Reference Tversky and Fox1995) between two sources. In subsequent work, Baillon et al. (Reference Baillon, Bleichrodt, Li and Wakker2023) present theoretical arguments on the relevance of our approach to using transformation functions to directly characterize source dependence, and refer to the transformation function we introduce in this paper as a p(robability)matcher.

Our definition and measurement of source dependence can be applied to a wide range of fields involving multiple sources of ambiguity, such as consumer behavior (Muthukrishnan et al., Reference Muthukrishnan, Wathieu and Xu2009), technology adoption (Barham et al., Reference Barham, Chavas, Fitz, Salas and Schechter2014), climate change (Millner et al., Reference Millner, Dietz and Heal2013), health (Berger et al., Reference Berger, Bleichrodt and Eeckhoudt2013; Hoy et al., Reference Hoy, Peter and Richter2014), finance (Dimmock et al., Reference Dimmock, Kouwenberg, Mitchell and Peijnenburg2016a; Easley & O’Hara, Reference Easley and O’Hara2009), and regulatory policies (Viscusi & Zeckhauser, Reference Viscusi and Zeckhauser2015). Empirical evidence in this literature typically relies on measuring ambiguity attitudes using Ellsberg urns (Anantanasuwong et al., Reference Anantanasuwong, Kouwenberg, Mitchell and Peijnenberg2019; Barham et al., Reference Barham, Chavas, Fitz, Salas and Schechter2014; Dimmock et al., Reference Dimmock, Kouwenberg, Mitchell and Peijnenburg2016a; Muthukrishnan et al., Reference Muthukrishnan, Wathieu and Xu2009), while more recent applied work has started incorporating attitudes toward natural sources of uncertainty (Attema et al., Reference Attema, Bleichrodt and L’Haridon2018; Li et al., Reference Li, Turmunkh and Wakker2019; Gaudecker et al., Reference Gaudecker, Wogrolly and Zimpelmann2022). Studying natural sources requires disentangling beliefs from attitudes. This can be achieved by the exchangeable-events method (Abdellaoui et al., Reference Abdellaoui, Baillon, Placido and Wakker2011; Baillon, Reference Baillon2008), which measures beliefs separately from attitudes, or the belief-hedging method (Baillon et al., Reference Baillon, Huang, Selim and Wakker2018), which allows controlling for beliefs when measuring attitudes.Footnote 4

In this paper, we show how these two approaches can be adapted in order to directly quantify source dependence. Our definition of source dependence is tractable, and the method we propose can be used by researchers who study attitudes toward several sources (using one of the previously mentioned methods) and want to compare them. For instance, Barham et al. (Reference Barham, Chavas, Fitz, Salas and Schechter2014) found that ambiguity aversion (for an Ellsberg-urn task) plays an important role in technology adoption, but only for certain technologies. However, the authors argue that “the impact of ambiguity aversion may have more to do with the underlying characteristics of the new technology,” which cannot be captured using Ellsberg urns and may vary across countries (p. 216). Our method can address this question by directly quantifying source dependence between different types of technologies and enabling cross-country comparisons. We further discuss possible applications of the method in the discussion.

To demonstrate the tractability of our approach, we estimated our transformation function (pmatcher), on three datasets, including one existing dataset and two original experiments. We deliberately chose these datasets to represent the diversity of treatments of beliefs, which were either measured with the exchangeable-events method or neutralized with the belief-hedging method, as well as measurement methods, which were either certainty equivalents or matching probabilities. In all three datasets, we considered one local and one foreign source of uncertainty.

Rather than introducing a new method to differentiate attitudes from beliefs, our contribution is to introduce a tractable definition of source dependence and demonstrate how existing approaches (exchangeable-events and belief-hedging) can be adapted to measure source dependence directly. Furthermore, we show that source dependence can be measured using either certainty equivalents or matching probabilities. When using certainty equivalents, our method does not require the measurement of utility or source (or probability-weighting) functions, which reduces error propagation and the number of required choices compared to indirect methods.

Our empirical analyses employ structural-equation econometrics, which allows us to account for stochastic choices (e.g., Gaudecker et al., Reference Gaudecker, Wogrolly and Zimpelmann2022). To account for heterogeneity in preferences, we estimated the sample distributions of parameters using a random-coefficient model (e.g., Abdellaoui et al., Reference Abdellaoui, Bleichrodt, Kemel and L’Haridon2021). This demonstrates that the methods we propose for estimating pmatchers are compatible with modern econometric techniques (Train, Reference Train2009). In the discussion, we show that under the assumption of deterministic choices and neo-additive preferences, it is possible to compute the parameters of pmatchers without relying on econometrics.

Overall, we found evidence of source dependence in our experimental studies. We also observed that source dependence must be described by two dimensions that capture the relative preference and relative sensitivity between two sources. Finally, our analyses revealed very heterogeneous patterns of source dependence in our samples. On average, individuals in our datasets showed a preference for the “familiar” source. However, a substantial proportion of the subjects exhibited the opposite pattern of preferences.

2 Beliefs and ambiguity attitudes toward sources of uncertainty

In this section, we introduce the theoretical framework to define attitudes toward a given source. We then present the two common choice-based methods to separate ambiguity attitudes from beliefs, a necessary step to estimate attitudes toward natural sources. Using three scenarios, we illustrate the challenges of accurately measuring source dependence through the comparison of attitudes toward multiple sources.

2.1 Source attitudes defined

Expected utility (EU) is the benchmark model of rational choice for decisions under uncertainty (Savage, Reference Savage1954). Under this model, preferences are captured by two components: a utility function U and a probability distribution

![]() over events. The value assigned to a binary prospect (x, E, y), with

over events. The value assigned to a binary prospect (x, E, y), with

![]() , the object of choice studied in this paper, that yields x if event E occurs and y otherwise, is

, the object of choice studied in this paper, that yields x if event E occurs and y otherwise, is

We assume non-negative monetary outcomes and strictly increasing utility throughout. In the case of risk, objective probabilities are available, and the value of a (risky) prospect (x, p, y), which gives x with probability p and y otherwise, is

Despite its normative appeal, this model does not capture two major psychological aspects of decision-making under uncertainty: probability weighting and (non-neutral) ambiguity attitudes. Probability weighting refers to the observation that decision makers do not treat probabilities linearly (Kahneman & Tversky, Reference Kahneman and Tversky1979). Under risk, this bias can be accommodated by a strictly increasing probability-weighting function w mapping [0, 1] to [0, 1] and by assuming that a prospect (x, p, y) is evaluated by

Non-neutral ambiguity attitudes, the other well-documented deviation from EU, refers to the observation that decision makers may exhibit a preference between known and unknown probability distributions over events; in other words, they behave as if they treat known and unknown probabilities differently. In a famous illustration of this behavior, Ellsberg (Reference Ellsberg1961) intuited that people would prefer to bet on an urn with known composition (i.e., risky) rather than on an urn with unknown composition (i.e., ambiguous), even if there were no reason to believe that one composition would be more favorable than the other. Under Eq. 3, such preference entails sub-additive probabilities, which violates probabilistic sophistication (the assumption that beliefs can be represented by a single probability distribution). It is possible to reconcile probabilistic sophistication (at least locally, i.e. within a given source) and ambiguity attitudes by the introduction of a specific weighting function

![]() and by assuming that an ambiguous prospect (x, E, y) is evaluated by

and by assuming that an ambiguous prospect (x, E, y) is evaluated by

Local (or within-source) probabilistic sophistication assumes that probabilistic sophistication holds within source, i.e., for choices between prospects involving the same source.Footnote 5 Ambiguity attitudes in this model are captured by the difference between the weighting functions

![]() , when probability distributions over events are unknown, and w, when probability distributions over events are known. This model allows us to account for ambiguity aversion while assuming the existence of a unique distribution of probabilities

, when probability distributions over events are unknown, and w, when probability distributions over events are known. This model allows us to account for ambiguity aversion while assuming the existence of a unique distribution of probabilities

![]() . This probability is called a-neutral, as it corresponds to the willingness to bet that would be observed for an ambiguity-neutral decision maker. In this paper, unknown probabilities are considered a-neutral and are referred to as probabilities for the sake of simplicity.Footnote 6 Abdellaoui et al. (Reference Abdellaoui, Baillon, Placido and Wakker2011) developed an approach assuming that the weighting function can be different for each source, calling this function a source function. Using the source function

. This probability is called a-neutral, as it corresponds to the willingness to bet that would be observed for an ambiguity-neutral decision maker. In this paper, unknown probabilities are considered a-neutral and are referred to as probabilities for the sake of simplicity.Footnote 6 Abdellaoui et al. (Reference Abdellaoui, Baillon, Placido and Wakker2011) developed an approach assuming that the weighting function can be different for each source, calling this function a source function. Using the source function

![]() , an ambiguous prospect (x, E, y) with event E generated by a source S is evaluated by

, an ambiguous prospect (x, E, y) with event E generated by a source S is evaluated by

Comparing

![]() to w characterizes the ambiguity attitude toward a given source S. The difference between source functions

to w characterizes the ambiguity attitude toward a given source S. The difference between source functions

![]() and

and

![]() of two distinct sources A and B characterizes source dependence, i.e., the fact that ambiguity attitudes differ across sources.Footnote 7

of two distinct sources A and B characterizes source dependence, i.e., the fact that ambiguity attitudes differ across sources.Footnote 7

Most empirical studies on ambiguity attitudes have focused on the unknown “Ellsberg” urn as a source of uncertainty (for a review, see Trautmann & van de Kuilen, Reference Trautmann and van de Kuilen2015). This source offers the advantage that probability distributions

![]() can be inferred from symmetry arguments and consequently do not need to be measured. Fewer studies have measured attitudes toward one or several natural sources of uncertainty. Most of these studies compare attitudes toward a given source to attitudes toward risk (i.e.,

can be inferred from symmetry arguments and consequently do not need to be measured. Fewer studies have measured attitudes toward one or several natural sources of uncertainty. Most of these studies compare attitudes toward a given source to attitudes toward risk (i.e.,

![]() vs. w), revealing ambiguity attitudes (van de Kuilen & Wakker, Reference van de Kuilen and Wakker2011). In the present paper, we compare behavior toward natural sources A and B and, hence, assess source dependence.

vs. w), revealing ambiguity attitudes (van de Kuilen & Wakker, Reference van de Kuilen and Wakker2011). In the present paper, we compare behavior toward natural sources A and B and, hence, assess source dependence.

2.2 Separating attitudes from beliefs

Assessing source dependence requires measuring attitudes toward different sources of uncertainty, for which the decision maker can hold different beliefs. It is thus necessary to control for decision makers’ beliefs about each source. This paper does not introduce a new method to separate attitudes from beliefs. Instead, we propose a method to directly estimate source dependence using existing methods to measure attitudes toward natural sources of uncertainty.

Early studies on source dependence controlled for beliefs by directly asking subjects to state their beliefs about a series of events generated by a given source (e.g., Fox & Tversky, Reference Fox and Tversky1995). However, this approach has several limitations. For instance, these measures are often not choice-based or incentivized, and judged probabilities may be non-additive, which could reflect attitudes toward ambiguity (Wakker, Reference Wakker2004). Scoring rules are popular choice-based methods for measuring beliefs, but they generally rely on the assumptions of risk and ambiguity neutrality, making them inconsistent for analyzing source preferences (for a discussion on biases introduced by scoring rules, see Armantier & Treich, Reference Armantier and Treich2013). To overcome these limitations, two popular choice-based methods have been introduced to distinguish ambiguity attitudes from beliefs: the exchangeable-events method and the belief-hedging method. We briefly introduce these methods before showing in Sect. 3 how they can be adapted to directly estimate source dependence.

2.2.1 Measuring beliefs separately from attitudes using the exchangeable-events method

One method for measuring beliefs without making restrictive assumptions about risk or ambiguity attitudes is the exchangeable-events method proposed by Baillon (Reference Baillon2008). This choice-based method uses the concept of exchangeability of events to construct a series of events

![]() with a known a-neutral probability

with a known a-neutral probability

![]() . Two events

. Two events

![]() and

and

![]() are exchangeable if

are exchangeable if

![]() , which implies that

, which implies that

![]()

To apply the method, the researchers first split the universal event

![]() into two exchangeable events,

into two exchangeable events,

![]() and

and

![]() , such that

, such that

![]() . They then proceed iteratively by splitting

. They then proceed iteratively by splitting

![]() and

and

![]() into exchangeable events until a given level of precision in beliefs is attained. Abdellaoui et al. (Reference Abdellaoui, Baillon, Placido and Wakker2011) applied this method to several sources, and a non-chained version of the method was developed and implemented by Abdellaoui et al. (Reference Abdellaoui, Bleichrodt, Kemel and L’Haridon2021).

into exchangeable events until a given level of precision in beliefs is attained. Abdellaoui et al. (Reference Abdellaoui, Baillon, Placido and Wakker2011) applied this method to several sources, and a non-chained version of the method was developed and implemented by Abdellaoui et al. (Reference Abdellaoui, Bleichrodt, Kemel and L’Haridon2021).

2.2.2 Measuring beliefs jointly with attitudes using the belief-hedging method

Baillon et al. (Reference Baillon, Huang, Selim and Wakker2018) proposed a different approach to separate beliefs from attitudes under ambiguity. Their method, called the belief-hedging method, is based on bets on events and their complementary events. This enables the separate identification of beliefs and ambiguity attitudes toward a given source without the need to dedicate specific tasks to the measurement of beliefs (see also Baillon et al., Reference Baillon, Bleichrodt, Li and Wakker2021 for the theoretical foundations).

The researcher first splits the universal event

![]() into three mutually exclusive and exhaustive events, denoted as

into three mutually exclusive and exhaustive events, denoted as

![]() ,

,

![]() , and

, and

![]() . For each event, the complementary event is defined as the union of the other two events, for example,

. For each event, the complementary event is defined as the union of the other two events, for example,

![]()

![]() . The researchers then measure the matching probabilities of six events, namely,

. The researchers then measure the matching probabilities of six events, namely,

![]() ,

,

![]() ,

,

![]() ,

,

![]() ,

,

![]() , and

, and

![]() . Baillon et al. (Reference Baillon, Huang, Selim and Wakker2018) showed that these six matching probabilities could be easily combined to compute two indexes that capture ambiguity aversion and a(mbiguity-generated)-insensitivity. Gaudecker et al. (Reference Gaudecker, Wogrolly and Zimpelmann2022) implemented structural econometric estimations on these six matching probabilities in order to jointly estimate beliefs and attitudes. Using certainty equivalents and additional tasks to measure the utility function, Baillon et al. (Reference Baillon, Bleichrodt, Keskin, L’Haridon and Li2017) structurally estimated beliefs and attitudes.

. Baillon et al. (Reference Baillon, Huang, Selim and Wakker2018) showed that these six matching probabilities could be easily combined to compute two indexes that capture ambiguity aversion and a(mbiguity-generated)-insensitivity. Gaudecker et al. (Reference Gaudecker, Wogrolly and Zimpelmann2022) implemented structural econometric estimations on these six matching probabilities in order to jointly estimate beliefs and attitudes. Using certainty equivalents and additional tasks to measure the utility function, Baillon et al. (Reference Baillon, Bleichrodt, Keskin, L’Haridon and Li2017) structurally estimated beliefs and attitudes.

Overall, studying natural sources requires separating beliefs and attitudes. Beliefs can be controlled for using either the exchangeable-events or belief-hedging methods. Meanwhile, attitudes can be studied either through ambiguity functions,

![]() (Baillon & Bleichrodt, Reference Baillon and Bleichrodt2015; Baillon et al., Reference Baillon, Huang, Selim and Wakker2018; Li, Reference Li2017; Li et al., Reference Li, Müller, Wakker and Wang2017) or through source functions

(Baillon & Bleichrodt, Reference Baillon and Bleichrodt2015; Baillon et al., Reference Baillon, Huang, Selim and Wakker2018; Li, Reference Li2017; Li et al., Reference Li, Müller, Wakker and Wang2017) or through source functions

![]() (Abdellaoui et al., Reference Abdellaoui, Baillon, Placido and Wakker2011; Abdellaoui et al., Reference Abdellaoui, Bleichrodt, Kemel and L’Haridon2021; Baillon et al., Reference Baillon, Bleichrodt, Keskin, L’Haridon and Li2017). One advantage of ambiguity functions is that they can be estimated using matching probabilities, which avoids the need to measure utility.

(Abdellaoui et al., Reference Abdellaoui, Baillon, Placido and Wakker2011; Abdellaoui et al., Reference Abdellaoui, Bleichrodt, Kemel and L’Haridon2021; Baillon et al., Reference Baillon, Bleichrodt, Keskin, L’Haridon and Li2017). One advantage of ambiguity functions is that they can be estimated using matching probabilities, which avoids the need to measure utility.

2.3 From ambiguity attitudes to source dependence

The previous section highlighted that methods exist for measuring attitudes toward a given source. Analysts can thus measure attitudes toward a series of sources with the objective of comparing them. This section provides detailed examples that illustrate the difficulties in interpreting differences in source attitudes as source dependence. The examples demonstrate that these difficulties apply to both the comparison of ambiguity functions and the comparison of source functions.

Consider two American investors, one with expertise in the telecommunications industry and the other in the food industry, who are considering investing in the stocks of AT&T and British Telecom. Each stock represents a source of uncertainty. According to the home bias (Lau et al., Reference Lau, Ng and Zhang2010)—the tendency to favor domestic stocks—both investors may prefer AT&T over British Telecom. However, it is unclear whether the preference for the domestic stock is weaker for the first investor due to their expertise in the telecommunications industry. Answering this question requires comparing the magnitude of source dependence between individuals.

Furthermore, the magnitude of source dependence may also vary between sources for the same individual. Suppose the investors are also considering investing in Coca-Cola and Danone. For the investor with expertise in telecommunications, would the home bias be stronger between AT&T and British Telecom or between Coca-Cola and Danone? In other words, does expertise mitigate or amplify the home bias? Answering this question requires comparing differences between sources within an individual.

Despite the availability of methods to measure attitudes for each source and investor separately, there is currently no method to accurately answer these questions. We propose three simple scenarios that illustrate that source dependence cannot be derived from comparisons of ambiguity attitudes. We base our examples on the two-parameter Prelec specification for the probability weighting, ambiguity and source functions. One parameter governs the elevation of the function and captures pessimism, the other parameter governs the curvature and captures sensitivity to changes in probabilities. This specification has convenient properties for the illustration, because the inverse of a Prelec function is a Prelec function, and the composition of two Prelec functions is also a Prelec function. For simplicity, we refer to the four stocks by their first letter: A (AT&T), B (British Telecom), C (Coca-Cola), and D (Danone).

2.3.1 Scenario 1: Differences in ambiguity functions between individuals

The scenario considers that two investors, I and II, have the same source functions for stock A (

![]() and B (

and B (

![]() , and both exhibit a preference for A over B. However, investor I does not distort objective probabilities, while investor II exhibits an inverse S-shaped probability weighting.

, and both exhibit a preference for A over B. However, investor I does not distort objective probabilities, while investor II exhibits an inverse S-shaped probability weighting.

Suppose that a researcher estimates the ambiguity attitudes of investors I and II toward stocks A and B using matching probabilities. The values of the pessimism and sensitivity parameters of these functions are reported in Table 1. The higher pessimism for stock B than for stock A for both investors indicates a preference for A over B, which is consistent with the home bias. The analyst wants to understand if expertise mitigates or amplifies the home bias. To do so, one needs to compare the magnitude of source dependence for investor I to the magnitude of source dependence for investor II.

Table 1 Scenario 1. Differences in ambiguity functions between individuals

|

Investor I |

Investor II |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Risk |

Source fn |

Ambiguity fn |

Risk |

Source fn |

Ambiguity fn |

|||||

|

A |

B |

A |

B |

A |

B |

A |

B |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Pessimism |

1 |

1.2 |

1.4 |

1.2 |

1.4 |

1.1 |

1.2 |

1.4 |

1.16 |

1.49 |

|

Sensitivity |

1 |

0.5 |

0.5 |

0.5 |

0.5 |

0.6 |

0.5 |

0.5 |

0.83 |

0.83 |

The difference in the pessimism parameters of the ambiguity function between A and B is 0.2 for investor I and 0.33 for investor II. It might be tempting to conclude that investor II exhibits more source dependence than investor I, but this is not the case. The source functions for A and B are the same for the two investors. This case illustrates that differences in the parameters of ambiguity functions cannot be compared across individuals with different probability weighting functions for risk. The reason is that ambiguity functions are measured on the scale of known probabilities (willingness to bet), and this scale is different for two individuals who weigh risk differently.

2.3.2 Scenario 2: Differences in source functions between sources for a given individual

In this scenario, we examine investor II, who is an expert in the food industry. The researcher has elicited the investor’s source functions, as shown in Table 2. The parameters for sources A and B are the same as in the previous scenario. For sources C and D, the investor also exhibits a home bias, with a preference for C over D, but exhibits more sensitivity toward these sources than toward A and B, possibly due to their expertise in the food industry. The analyst questions whether the magnitude of the home bias is the same between A and B as between C and D. The difference in the pessimism parameters is the same (0.2) between A and B as between C and D. The difference in the sensitivity parameters is also the same (0) between A and B as between C and D. Thus, looking at “differences of differences” leads to the conclusion that the magnitude of the home bias is the same between A and B as between C and D.

Table 2 Scenario 2. Differences in source functions within individual

|

Source functions |

||||

|---|---|---|---|---|

|

A |

B |

C |

D |

|

|

|

|

|

|

|

|

Pessimism |

1.2 |

1.4 |

1.2 |

1.4 |

|

Insensitivity |

0.5 |

0.5 |

0.7 |

0.7 |

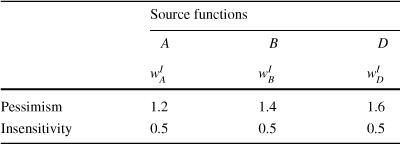

However, investor II is willing to give up on more gain probabilities for betting on A rather than B than for betting on C rather than D (see Fig. 1 in Sect. 3.2). In other words, the source premium is larger between A and B than between C and D. This is because the investor is less sensitive to probability changes for A than for C, thus requiring a larger ambiguity premium to compensate for the same difference in weight. This example illustrates that differences in source function parameters cannot be compared across pairs of sources, even within an individual, since differences in source functions correspond to differences in “weight,” which have different values depending on the sensitivity toward the sources being considered.

2.3.3 Scenario 3: Comparing differences in parameters of non-linear specifications

We now focus on investor I and consider sources A, B, and D (see Table 3). The analyst wants to compare the preference between A and B (local vs. foreign in the investor’s domain of expertise) to the difference between B and D (expertise vs. non-expertise for foreign sources). In this case, the differences in the pessimism parameters between A and B and between B and D are the same (0.2). Here again, one should not conclude that the source premium that investor II is willing to pay for betting on A rather than B is the same as the premium that the investor is willing to pay for betting on B rather than D. In fact, the premium is larger for the former than for the latter. The reason for this is the nonlinearity of the source functions. A difference in the pessimism parameters of 0.2 does not have the same effect between 1.2 and 1.4 as it does between 1.4 and 1.6. This scenario illustrates how difference-in-differences in parameters of non-linear specifications cannot be easily used to analyze differences in source dependence.

Table 3 Scenario 3. Differences in parameters of non-linear specifications

|

Source functions |

|||

|---|---|---|---|

|

A |

B |

D |

|

|

|

|

|

|

|

Pessimism |

1.2 |

1.4 |

1.6 |

|

Insensitivity |

0.5 |

0.5 |

0.5 |

3 A function for measuring source dependence

In this section, we introduce a function

![]() , referred to as a p(robability)matcher, which enables direct measurement of the source dependence of preferences between two natural sources. We then show that such functions can be estimated using either matching probabilities (MP), which assess attitudes toward a source on the scale of probabilities, or certainty equivalents (CE), which assess attitudes toward a source on the scale of outcomes.

, referred to as a p(robability)matcher, which enables direct measurement of the source dependence of preferences between two natural sources. We then show that such functions can be estimated using either matching probabilities (MP), which assess attitudes toward a source on the scale of probabilities, or certainty equivalents (CE), which assess attitudes toward a source on the scale of outcomes.

3.1 A direct measure of source dependence

We introduce a function

![]() that enables the quantification of source dependence and allows for comparisons between individuals and (pairs of) sources. We consider two natural sources, A and B, and their functions

that enables the quantification of source dependence and allows for comparisons between individuals and (pairs of) sources. We consider two natural sources, A and B, and their functions

![]() and

and

![]() . The function

. The function

![]() is defined such that

is defined such that

![]() (i.e.,

(i.e.,

![]() It is strictly increasing, satisfies

It is strictly increasing, satisfies

![]() and

and

![]() , and maps probabilities

, and maps probabilities

![]() of events

of events

![]() generated by the source B to probabilities

generated by the source B to probabilities

![]() of events

of events

![]() generated by the source A as follows: for any event

generated by the source A as follows: for any event

![]() generated by source B with a subjective probability

generated by source B with a subjective probability

![]() , all the events

, all the events

![]() generated by source A with a subjective probability

generated by source A with a subjective probability

![]() are such that the decision maker is indifferent between betting on

are such that the decision maker is indifferent between betting on

![]() and

and

![]() .

.

The comparison of

![]() and

and

![]() characterizes source preference between the two sources. Deviations of

characterizes source preference between the two sources. Deviations of

![]() from identity directly characterize source dependence: A is strictly preferred to B if

from identity directly characterize source dependence: A is strictly preferred to B if

![]() In turn,

In turn,

![]() represents the source premium of source A over source B, i.e., the decrease in likelihood the decision maker is willing to accept in order to bet on source A instead of source B. Because the source premium is measured on the scale of “a-neutral” probabilities, it is independent of risk and ambiguity attitudes. Therefore, the transformation function

represents the source premium of source A over source B, i.e., the decrease in likelihood the decision maker is willing to accept in order to bet on source A instead of source B. Because the source premium is measured on the scale of “a-neutral” probabilities, it is independent of risk and ambiguity attitudes. Therefore, the transformation function

![]() offers a direct measure of source preference for A over B that can be compared across individuals and (pairs of) sources. Inversely, the source preference for B over A is captured by

offers a direct measure of source preference for A over B that can be compared across individuals and (pairs of) sources. Inversely, the source preference for B over A is captured by

![]() .

.

We now illustrate how the shape of the function

![]() relates to choice patterns revealing source dependence. We call A-event an event generated by source A and B-event an event generated by source B. Suppose there exists a probability

relates to choice patterns revealing source dependence. We call A-event an event generated by source A and B-event an event generated by source B. Suppose there exists a probability

![]() such that

such that

![]() and

and

![]() . Then, for all events

. Then, for all events

![]() with a subjective probability

with a subjective probability

![]() such that

such that

![]() , we will observe that

, we will observe that

![]() . This is because

. This is because

![]() implies that

implies that

![]() . Moreover, we will also observe that

. Moreover, we will also observe that

![]() , since

, since

![]() implies that

implies that

![]() In other words, it is possible to find A-events such that, for all B-events with probability

In other words, it is possible to find A-events such that, for all B-events with probability

![]() , the decision maker prefers to bet on A-events instead of B-events and also prefers to bet against A-events instead of against B-events.

, the decision maker prefers to bet on A-events instead of B-events and also prefers to bet against A-events instead of against B-events.

Another key dimension of source preference is comparative sensitivity (Tversky & Fox, Reference Tversky and Fox1995), which can be illustrated by the following example. Suppose there are two disjoint events

![]() and

and

![]() generated by A, and two disjoint events

generated by A, and two disjoint events

![]() and

and

![]() generated by B such that

generated by B such that

![]() and

and

![]() for all

for all

![]() . If we also observe that

. If we also observe that

![]() , then the decision maker is less sensitive to probability changes for B than for A. We say the decision maker exhibits less relative sensitivity (or equivalently, more relative insensitivity) toward B than toward A. This pattern is captured by the curvature of the function

, then the decision maker is less sensitive to probability changes for B than for A. We say the decision maker exhibits less relative sensitivity (or equivalently, more relative insensitivity) toward B than toward A. This pattern is captured by the curvature of the function

![]() . Indeed,

. Indeed,

![]() and

and

![]() imply that

imply that

![]() and

and

![]() , respectively. Thus,

, respectively. Thus,

![]() implies that

implies that

![]() . The function exhibits subadditivity for some probabilities.

. The function exhibits subadditivity for some probabilities.

Overall, the two dimensions of the function

![]() can be interpreted as follows: the elevation captures relative preference (“more or less preference for B than for A”), and the slope captures relative (in)sensitivity (“more or less insensitivity for B than for A”). For example, an inverse S-shaped

can be interpreted as follows: the elevation captures relative preference (“more or less preference for B than for A”), and the slope captures relative (in)sensitivity (“more or less insensitivity for B than for A”). For example, an inverse S-shaped

![]() function can generate both a relative preference for A and a relative insensitivity toward B.

function can generate both a relative preference for A and a relative insensitivity toward B.

3.2 Comparing attitudes across sources and individuals using

We illustrate the pmatcher

![]() using the three scenarios described in Sect. 2.3.

using the three scenarios described in Sect. 2.3.

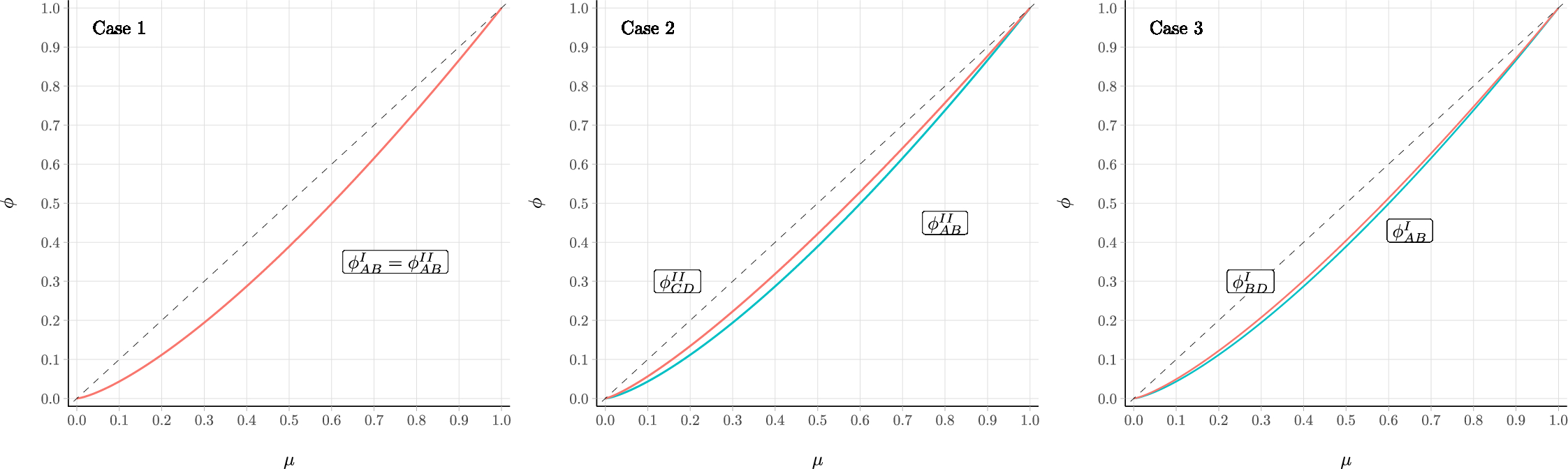

In the first scenario, the two investors have the same source functions for stocks A and B, and both exhibit a preference for A over B. The pmatchers

![]() of the two investors are shown on the left panel of Fig. 1. When

of the two investors are shown on the left panel of Fig. 1. When

![]() , the decision maker exhibits a preference for source A over source B and is willing to accept a reduction in the winning probability

, the decision maker exhibits a preference for source A over source B and is willing to accept a reduction in the winning probability

![]() to bet on the event generated by source A instead of the one generated by source B with probability

to bet on the event generated by source A instead of the one generated by source B with probability

![]() .Footnote 8 For both investors,

.Footnote 8 For both investors,

![]() for all values of x, indicating a preference for source A over source B. Moreover, the magnitude of the source dependence between A and B, capturing the home bias, is the same for the two investors. The pmatcher enables a direct comparison between individuals. Although the two investors have different risk attitudes (investor I does not distort objective probabilities, while investor II exhibits an inverse S-shaped probability weighting), the figure correctly reports that they have the same function

for all values of x, indicating a preference for source A over source B. Moreover, the magnitude of the source dependence between A and B, capturing the home bias, is the same for the two investors. The pmatcher enables a direct comparison between individuals. Although the two investors have different risk attitudes (investor I does not distort objective probabilities, while investor II exhibits an inverse S-shaped probability weighting), the figure correctly reports that they have the same function

![]() .

.

The second scenario, shown in the middle panel of Fig. 1, displays a stronger deviation from linearity for

![]() than for

than for

![]() , indicating a stronger source dependence for A over B than for C over D. The pmatcher captures this larger magnitude of source dependence, which was not detected by comparing the (differences in) source functions, as seen in Sect. 2.3.

, indicating a stronger source dependence for A over B than for C over D. The pmatcher captures this larger magnitude of source dependence, which was not detected by comparing the (differences in) source functions, as seen in Sect. 2.3.

In the third scenario, the deviation from linearity is stronger for

![]() than for

than for

![]() , indicating a stronger source preference for A over B than for B over D. As we saw in Sect. 2.3, comparisons of (differences in) parameters between sources would fail to capture this effect due to the nonlinearity of the source function specification.

, indicating a stronger source preference for A over B than for B over D. As we saw in Sect. 2.3, comparisons of (differences in) parameters between sources would fail to capture this effect due to the nonlinearity of the source function specification.

These scenarios illustrate how the pmatcher helps overcome the difficulties faced when comparing ambiguity attitudes toward different sources, allowing for comparison across individuals and sources.

Fig. 1 Illustration of the pmatchers for the three scenarios of Sect. 2.3

3.3 Estimating

from matching probabilities

from matching probabilities

As introduced earlier, the method developed by Dimmock et al. (Reference Dimmock, Kouwenberg and Wakker2016b) consists of fixing an outcome

![]() and measuring a series of matching probabilities

and measuring a series of matching probabilities

![]() such that

such that

![]() , where

, where

![]() are events generated by S for which the a-neutral probabilities

are events generated by S for which the a-neutral probabilities

![]() are known. The analysis then consists of eliciting an ambiguity function

are known. The analysis then consists of eliciting an ambiguity function

![]() that maps the probabilities

that maps the probabilities

![]() onto the matching probabilities

onto the matching probabilities

![]() :

:

Under standard assumptions of monotonicity and continuity, the ambiguity function

![]() is strictly increasing and satisfies

is strictly increasing and satisfies

![]() and

and

![]() . According to Eq. (5),

. According to Eq. (5),

![]() . The function

. The function

![]() between two sources A and B, with ambiguity functions

between two sources A and B, with ambiguity functions

![]() and

and

![]() , can be obtained as follows:

, can be obtained as follows:

hence,

The function

![]() relies on a direct comparison of ambiguity functions

relies on a direct comparison of ambiguity functions

![]() and

and

![]() , with no need to measure the weighting function for risk w or the source functions

, with no need to measure the weighting function for risk w or the source functions

![]() and

and

![]() .

.

3.4 Estimating

from certainty equivalents

from certainty equivalents

Suppose that we fix an outcome

![]() and measure, for each source S, a series of certainty equivalents

and measure, for each source S, a series of certainty equivalents

![]() such that

such that

![]() , where

, where

![]() are events generated by S, for which the a-neutral probabilities

are events generated by S, for which the a-neutral probabilities

![]() are known. The method then consists of estimating a function

are known. The method then consists of estimating a function

![]() that maps these probabilities

that maps these probabilities

![]() to the normalized certainty equivalents

to the normalized certainty equivalents

![]() :

:

For parallelism with the ambiguity function, we refer to

![]() as an uncertainty function. Under standard assumptions of monotonicity and continuity, the uncertainty function

as an uncertainty function. Under standard assumptions of monotonicity and continuity, the uncertainty function

![]() is strictly increasing and satisfies

is strictly increasing and satisfies

![]() and

and

![]() . According to Eq. (5), and after rescaling the utility such that

. According to Eq. (5), and after rescaling the utility such that

![]() and

and

![]() ,

,

![]() . Assuming that utility is source-independent (an assumption generally made in applications of the source model and empirically supported by Abdellaoui et al., Reference Abdellaoui, Baillon, Placido and Wakker2011), differences in uncertainty functions

. Assuming that utility is source-independent (an assumption generally made in applications of the source model and empirically supported by Abdellaoui et al., Reference Abdellaoui, Baillon, Placido and Wakker2011), differences in uncertainty functions

![]() across sources reveal differences in source functions. The function

across sources reveal differences in source functions. The function

![]() between two sources A and B, with uncertainty functions

between two sources A and B, with uncertainty functions

![]() and

and

![]() , can be obtained as follows:

, can be obtained as follows:

hence,

Therefore, it is possible to estimate

![]() from certainty equivalents with no need to control for the utility function. In this paper, we do not interpret the uncertainty functions on their own. We instead use them as a measurement tool for assessing source dependence.

from certainty equivalents with no need to control for the utility function. In this paper, we do not interpret the uncertainty functions on their own. We instead use them as a measurement tool for assessing source dependence.

3.5 Comments on

Overall,

![]() can be estimated simply from either matching probabilities or certainty equivalents. It does not require measuring or controlling for the utility, the weighting function for risk, or even the source functions. Therefore, it can be estimated from a smaller number of choices and avoid error propagation due to the measurement of utility and source (or risk) weighting functions.

can be estimated simply from either matching probabilities or certainty equivalents. It does not require measuring or controlling for the utility, the weighting function for risk, or even the source functions. Therefore, it can be estimated from a smaller number of choices and avoid error propagation due to the measurement of utility and source (or risk) weighting functions.

The characterization of source dependence is independent of risk attitudes (related to

![]() and

and

![]() ) and ambiguity attitudes (related to the difference between

) and ambiguity attitudes (related to the difference between

![]() and

and

![]() or between

or between

![]() and

and

![]() ). Instead, it relates to the differences in attitudes across sources. A linear

). Instead, it relates to the differences in attitudes across sources. A linear

![]() does not necessarily mean that decision makers are risk neutral or ambiguity neutral for the two sources, only that they exhibit the same attitude for the two sources. Conversely, there may be source dependence even if decision makers are risk neutral or ambiguity neutral for one of the two sources. Therefore, the introduction of source dependence, as measured by the function

does not necessarily mean that decision makers are risk neutral or ambiguity neutral for the two sources, only that they exhibit the same attitude for the two sources. Conversely, there may be source dependence even if decision makers are risk neutral or ambiguity neutral for one of the two sources. Therefore, the introduction of source dependence, as measured by the function

![]() , enlarges the scope of analysis of attitudes toward natural sources of uncertainty beyond the concept of risk and ambiguity attitudes.

, enlarges the scope of analysis of attitudes toward natural sources of uncertainty beyond the concept of risk and ambiguity attitudes.

Eventually, when A is a risky source (R),

![]() and

and

![]() . In this case, the transformation function

. In this case, the transformation function

![]() corresponds to the ambiguity function proposed by Dimmock et al. (Reference Dimmock, Kouwenberg and Wakker2016b) for capturing ambiguity attitudes. To summarize, the function

corresponds to the ambiguity function proposed by Dimmock et al. (Reference Dimmock, Kouwenberg and Wakker2016b) for capturing ambiguity attitudes. To summarize, the function

![]() generalizes the approach of Dimmock et al. (Reference Dimmock, Kouwenberg, Mitchell and Peijnenburg2016a) in two ways: it extends the approach for capturing source dependence between natural sources, and it allows measurement using not only matching probabilities but also certainty equivalents.

generalizes the approach of Dimmock et al. (Reference Dimmock, Kouwenberg, Mitchell and Peijnenburg2016a) in two ways: it extends the approach for capturing source dependence between natural sources, and it allows measurement using not only matching probabilities but also certainty equivalents.

4 Empirical implementation

4.1 Data

We conducted three studies to empirically test our method, including one that used an existing dataset (Study A) and two original experiments (Studies B and C). To test the generality of our method, we selected experimental designs that employed various approaches to evaluating prospects (certainty equivalents vs. matching probabilities) and identifying beliefs. As discussed in Sect. 2, studying attitudes toward natural sources requires accounting for beliefs that are not necessarily uniform. We demonstrate that our method can be applied with two commonly used choice-based methods to disentangle ambiguity attitudes and beliefs: the exchangeable-events method (Studies A and B) and the belief-hedging method (Study C).

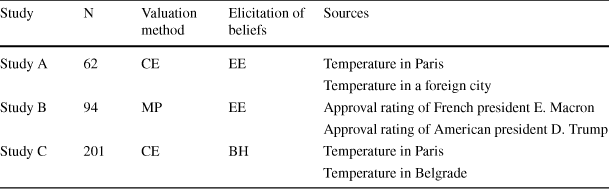

The studies used different experimental procedures, with individual interviews and random incentives used in Studies A and B and an online experiment with hypothetical choices used in Study C. In each study, one source was local and arguably more familiar to the subjects than the other. We used this local source as the reference source. We summarize the characteristics of each dataset in Table 4 and provide details for all three studies below. Instructions for experiments B and C are included in Online Appendix D.

Table 4 Summary of the three datasets

|

Study |

N |

Valuation method |

Elicitation of beliefs |

Sources |

|---|---|---|---|---|

|

Study A |

62 |

CE |

EE |

Temperature in Paris |

|

Temperature in a foreign city |

||||

|

Study B |

94 |

MP |

EE |

Approval rating of French president E. Macron |

|

Approval rating of American president D. Trump |

||||

|

Study C |

201 |

CE |

BH |

Temperature in Paris |

|

Temperature in Belgrade |

EE stands for exchangeable events and BH for belief hedging

4.1.1 Study A

For this study, we used data from Abdellaoui et al. (Reference Abdellaoui, Baillon, Placido and Wakker2011) on two natural sources S, the temperature in Paris (

![]() ) and the temperature in a foreign city (

) and the temperature in a foreign city (

![]() ). For each source, participants’ beliefs were measured prior to eliciting their attitudes toward ambiguity.

). For each source, participants’ beliefs were measured prior to eliciting their attitudes toward ambiguity.

Measurement of beliefs: Participants’ beliefs about the sources were measured using the approach developed by Baillon (Reference Baillon2008) based on exchangeable events (see Sect. 2). For each source S, a sequential process was used to build a series of five events

![]() with probabilities

with probabilities

![]() . Abdellaoui et al. (Reference Abdellaoui, Baillon, Placido and Wakker2011) provide more details about the procedure.

. Abdellaoui et al. (Reference Abdellaoui, Baillon, Placido and Wakker2011) provide more details about the procedure.

Evaluation of prospects: With these events (for which the researchers knew the a-neutral probability) at hand, the certainty equivalents

![]() of five prospects

of five prospects

![]() were measured for each source. These CEs allowed us to assess the uncertainty function

were measured for each source. These CEs allowed us to assess the uncertainty function

![]() since

since

![]() .Footnote 9

.Footnote 9

Procedure: 62 participants participated in individual computer-based interviews. Random incentives were implemented for half of the participants (real-incentive treatment), whereas the other half made hypothetical choices (hypothetical treatment). For the real-incentive treatment, one of the 31 participants was randomly selected at the end of the experiment, and one of their choices was randomly selected to determine their monetary gain. The payment was made three months after the experiment, once the uncertainty was resolved (Abdellaoui et al., Reference Abdellaoui, Baillon, Placido and Wakker2011 provide more details).Footnote 10

4.1.2 Study B

For this study, we followed a similar design to Study A, but with different sources and a distinct valuation approach of ambiguous prospects. In contrast to Study A, we evaluated ambiguous prospects using matching probabilities (MPs) instead of certainty equivalents (CEs). We used two sources S, the approval ratings of French President Emmanuel Macron (

![]() ) and US President Donald Trump (

) and US President Donald Trump (

![]() ).Footnote 11 Each of these variables ranged between 0 and 100 percent and was revealed one month after the experiment.Footnote 12

).Footnote 11 Each of these variables ranged between 0 and 100 percent and was revealed one month after the experiment.Footnote 12

Measurement of beliefs: We used the exchangeable-events method, as in Abdellaoui et al. (Reference Abdellaoui, Baillon, Placido and Wakker2011) and Study A, to elicit a series of events

![]() generated by sources S, with a-neutral probabilities

generated by sources S, with a-neutral probabilities

![]() . Values

. Values

![]() represented the percentages of approval ratings and were measured with a precision of one percentage point.

represented the percentages of approval ratings and were measured with a precision of one percentage point.

Evaluation of prospects: We measured ambiguity attitudes using matching probabilities. For each source, we measured the matching probabilities

![]() of prospects

of prospects

![]() with a precision of 0.01. This allowed us to assess the ambiguity function

with a precision of 0.01. This allowed us to assess the ambiguity function

![]() because

because

![]() .

.

Both beliefs and attitudes rely on the measurement of indifference values, which we elicited using choice lists. We used a bisection procedure to complete these lists (see Abdellaoui et al., Reference Abdellaoui, Kemel, Panin and Vieider2019). When a list was completed, the participants reviewed all the choices from the list and were able to make changes if desired. Participants then had to confirm the whole list for the software to move to the next choice list.

Procedure: We recruited 94 participants to take part in a 1-h individual computer-based interview for a compensation of €10. Participants started by watching a 10-min video describing the experiment. Then they completed a survey with comprehension questions to identify those who required additional clarifications from the research assistants. The experiment started with several practice questions to familiarize participants with the software. Participants then completed the belief task and the ambiguity task for one of the two sources before moving on to the second source. For each source, the belief task always preceded the ambiguity task. The order of the questions in the ambiguity task was randomized.

Real incentives were used, and the procedure was explained in the instructions (see Online Appendix D). Each participant received an envelope and was informed that each envelope had a 10% chance of containing a winning ticket. At the end of the session, participants opened the envelopes to see if they had received the winning ticket, which would allow one of their choices to be played for real. A computer program randomly selected one of the choices made by the selected participants. During the instructions, participants were informed that all of their choices could be selected and played for real. The selected participants could gain up to €100 extra. Eight participants were randomly selected for one of their choices to be played out for real. Three of them earned €100 extra, while the others did not earn an extra bonus. Overall, the average payment was €13.2 per hour.

4.1.3 Study C

In this study, we measured beliefs and attitudes jointly using certainty equivalents and the belief-hedging method (Baillon et al., Reference Baillon, Bleichrodt, Keskin, L’Haridon and Li2017; Li et al., Reference Li, Turmunkh and Wakker2019).

Evaluation of prospects: We considered two sources S, the temperature, in celsius degrees, in a local city, Paris, France (source

![]() ), and a foreign city, Belgrade, Serbia (source

), and a foreign city, Belgrade, Serbia (source

![]() ). For each source S, we created an exhaustive partition of mutually exclusive events

). For each source S, we created an exhaustive partition of mutually exclusive events

![]() and measured CEs for all prospects

and measured CEs for all prospects

![]() , where

, where

![]() . The three events were

. The three events were

![]() ,

,

![]() , and

, and

![]() and their complementary events

and their complementary events

![]()

![]() , and

, and

![]() . We elicited CEs using a bisection method with a precision of €1.

. We elicited CEs using a bisection method with a precision of €1.

Procedure: We recruited a sample of 201 participants from the INSEAD Behavioral Lab subject pool and conducted the experiment online using hypothetical choices. To improve the quality of the data despite the absence of incentives and online data collection, we used an application designed specifically for this purpose. The app detected the size of the user’s screen to prevent completion of the study on smartphones and froze the choice buttons for 2 s for each question to prevent rushing completion.

4.2 Estimation strategy

4.2.1 Errors specification and likelihood function

We used a unified statistical approach to measure source dependence between two sources

![]() in the available datasets. In the three experiments, our measurement followed an equation of type

in the available datasets. In the three experiments, our measurement followed an equation of type

where

![]() is the valuation (either a MP or a CE) by subject i of a prospect k involving event

is the valuation (either a MP or a CE) by subject i of a prospect k involving event

![]() with probability

with probability

![]() , f is either an ambiguity or uncertainty function, and

, f is either an ambiguity or uncertainty function, and

![]() is a pmatcher.

is a pmatcher.

We assumed that subjects made decision errors, such that the measured indifference

![]() followed

followed

![]() where

where

![]() ). Hence, we accounted for heteroscedasticity across sources and individuals. Indifferences were measured with a precision

). Hence, we accounted for heteroscedasticity across sources and individuals. Indifferences were measured with a precision

![]() such that the likelihood of each observation followed

such that the likelihood of each observation followed

where

![]() is the vector of function parameters

is the vector of function parameters

![]() and

and

![]() (the parameters of

(the parameters of

![]() for the domestic source, taken as the reference source),

for the domestic source, taken as the reference source),

![]() and

and

![]() (the parameters of the function

(the parameters of the function

![]() ), and

), and

![]() (the beliefs). The cumulative function of the normal distribution is denoted

(the beliefs). The cumulative function of the normal distribution is denoted

![]() . In Studies A and B, beliefs were measured separately from (and before) attitudes. In contrast, Study C utilized belief hedging, where beliefs were estimated jointly with other parameters (see the details in Online Appendix B).

. In Studies A and B, beliefs were measured separately from (and before) attitudes. In contrast, Study C utilized belief hedging, where beliefs were estimated jointly with other parameters (see the details in Online Appendix B).

The likelihood for a given individual i is

This likelihood specification aims to elicit the parameters of the function f that captures attitudes toward one of the two sources (taken as the reference) and, more importantly, the parameters of the transformation function

![]() that captures source dependence.

that captures source dependence.

4.2.2 Parametric specifications

In our analyses, we used parametric specifications for the functions f and

![]() . We considered two popular, non-linear, two-parameter specifications for the function f (see Table 5): the Goldstein Einhorn (Reference Goldstein and Einhorn1987, hereafter GE) and the Prelec (Reference Prelec1998). Parametric specifications have been commonly used to model probability-weighting functions (Bruhin et al., Reference Bruhin, Fehr-Duda and Epper2010), ambiguity functions (Li et al., Reference Li, Müller, Wakker and Wang2017), and even uncertainty functions (l’Haridon & Vieider, Reference L’Haridon and Vieider2019). In all these applications, the two parameters, relating respectively to elevation and curvature, have behavioral interpretations. The parameter capturing the global elevation of the function (denoted

. We considered two popular, non-linear, two-parameter specifications for the function f (see Table 5): the Goldstein Einhorn (Reference Goldstein and Einhorn1987, hereafter GE) and the Prelec (Reference Prelec1998). Parametric specifications have been commonly used to model probability-weighting functions (Bruhin et al., Reference Bruhin, Fehr-Duda and Epper2010), ambiguity functions (Li et al., Reference Li, Müller, Wakker and Wang2017), and even uncertainty functions (l’Haridon & Vieider, Reference L’Haridon and Vieider2019). In all these applications, the two parameters, relating respectively to elevation and curvature, have behavioral interpretations. The parameter capturing the global elevation of the function (denoted

![]() ) is interpreted in terms of optimism, and the one measuring the curvature of the function (denoted

) is interpreted in terms of optimism, and the one measuring the curvature of the function (denoted

![]() ) is interpreted in terms of sensitivity toward changes in probabilities. These non-linear specifications usually offer a better goodness of fit than the neo-additive specification (Li et al., Reference Li, Müller, Wakker and Wang2017). However, there are limitations to their use. First, the interpretation of the parameters is different for each specification. For example, Li et al. (Reference Li, Müller, Wakker and Wang2017, p. 10) have noted that “in Prelec’s family, the insensitivity parameter

) is interpreted in terms of sensitivity toward changes in probabilities. These non-linear specifications usually offer a better goodness of fit than the neo-additive specification (Li et al., Reference Li, Müller, Wakker and Wang2017). However, there are limitations to their use. First, the interpretation of the parameters is different for each specification. For example, Li et al. (Reference Li, Müller, Wakker and Wang2017, p. 10) have noted that “in Prelec’s family, the insensitivity parameter

![]() overlaps partly with the aversion parameter

overlaps partly with the aversion parameter

![]() , also capturing some aversion.” Second, the interpretation of differences in parameters varies across specifications. For example, the parameter

, also capturing some aversion.” Second, the interpretation of differences in parameters varies across specifications. For example, the parameter

![]() decreases with increasing elevation in the case of the Prelec specification, but it increases with increasing elevation in the case of the GE specification. Third, the parameters of these specifications take non-negative values. When random coefficient estimation methods are used, these parameters are generally assumed to be log-normally distributed, which requires cumbersome transformations for reporting their estimates and inferences on their mean and variance in a sample.

decreases with increasing elevation in the case of the Prelec specification, but it increases with increasing elevation in the case of the GE specification. Third, the parameters of these specifications take non-negative values. When random coefficient estimation methods are used, these parameters are generally assumed to be log-normally distributed, which requires cumbersome transformations for reporting their estimates and inferences on their mean and variance in a sample.

Expressing these two specifications with parameters that have the same range and interpretation and can take both positive and negative values is therefore desirable. We propose such a reparametrization of the GE and the Prelec specifications using two parameters

![]() and

and

![]() . We use

. We use

![]() to denote the global elevation parameter, which captures the overall elevation of the plot, and

to denote the global elevation parameter, which captures the overall elevation of the plot, and

![]() to denote the global sensitivity parameter, which governs curvature (e.g., the inverse-S shape of the plot). Importantly, while simplifying the interpretation of the results, this reparametrization does not create any loss of generality.

to denote the global sensitivity parameter, which governs curvature (e.g., the inverse-S shape of the plot). Importantly, while simplifying the interpretation of the results, this reparametrization does not create any loss of generality.

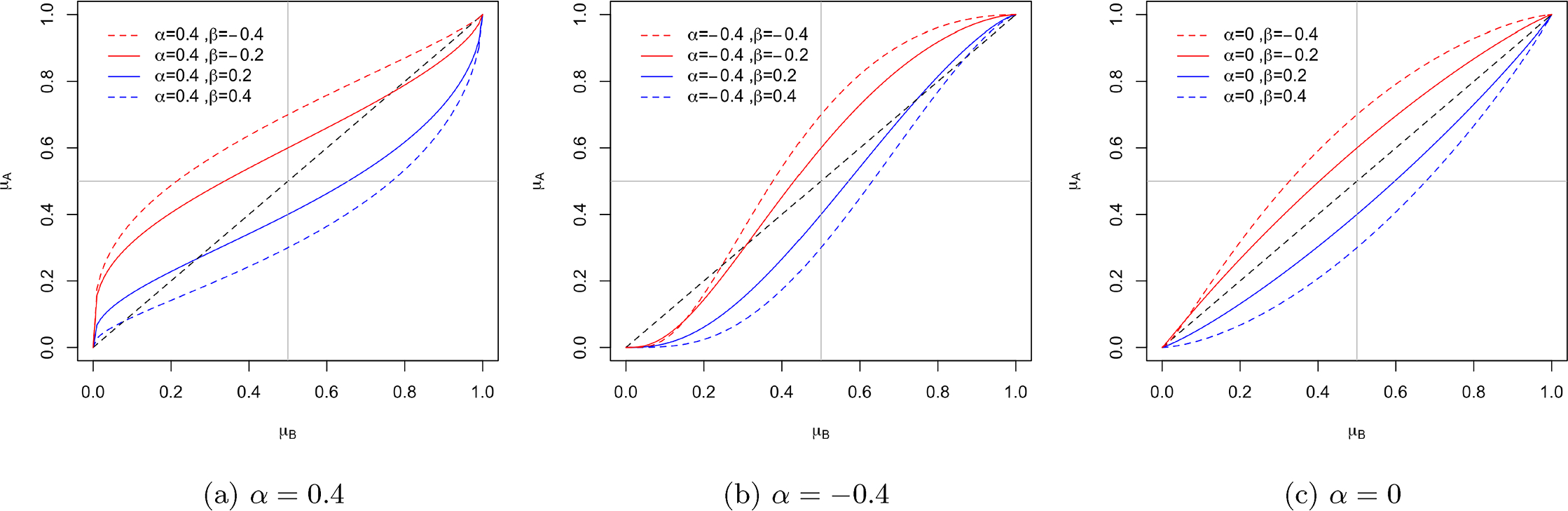

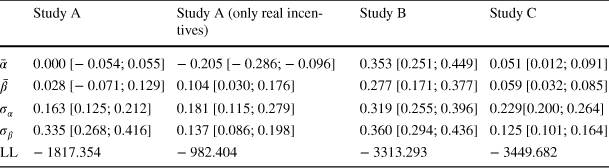

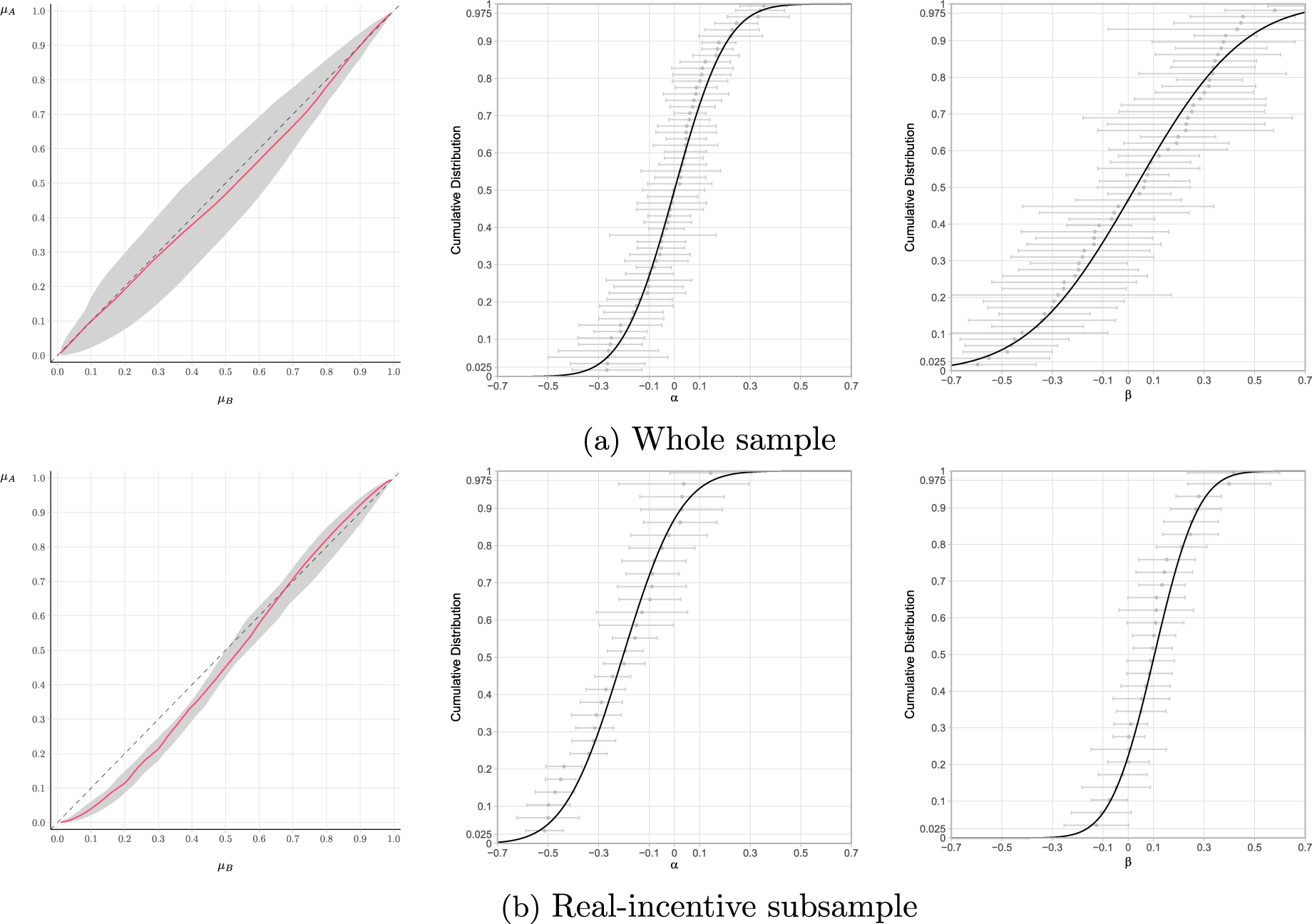

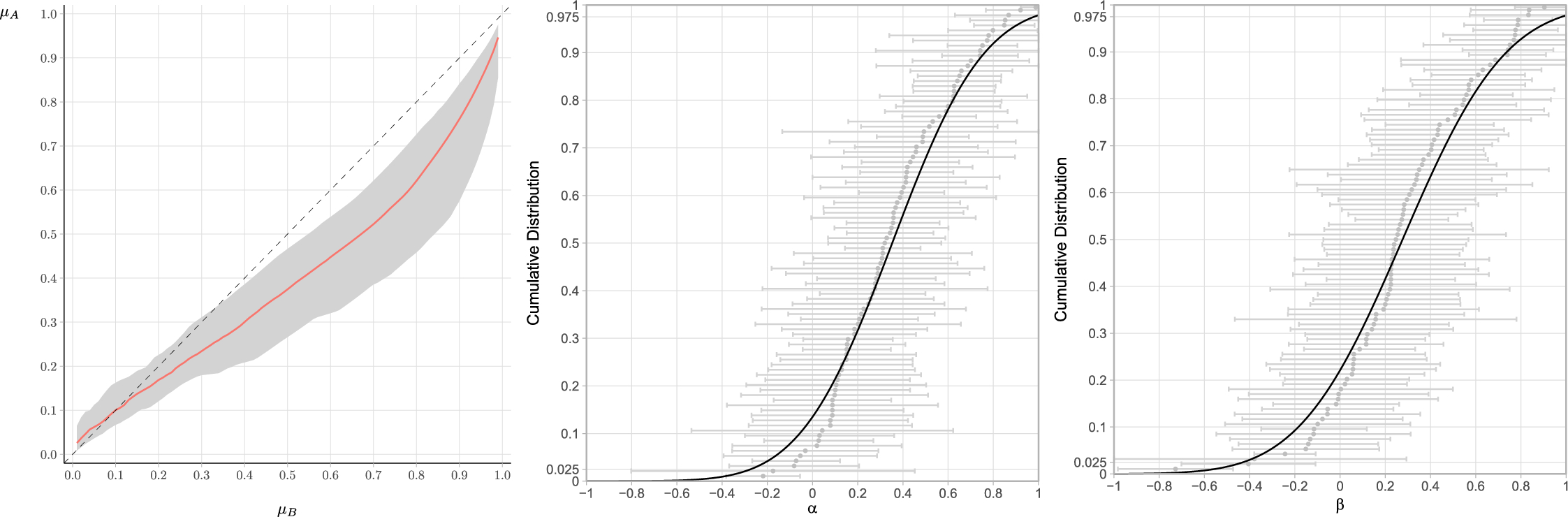

Applying this reparametrization to pmatchers, the first parameter

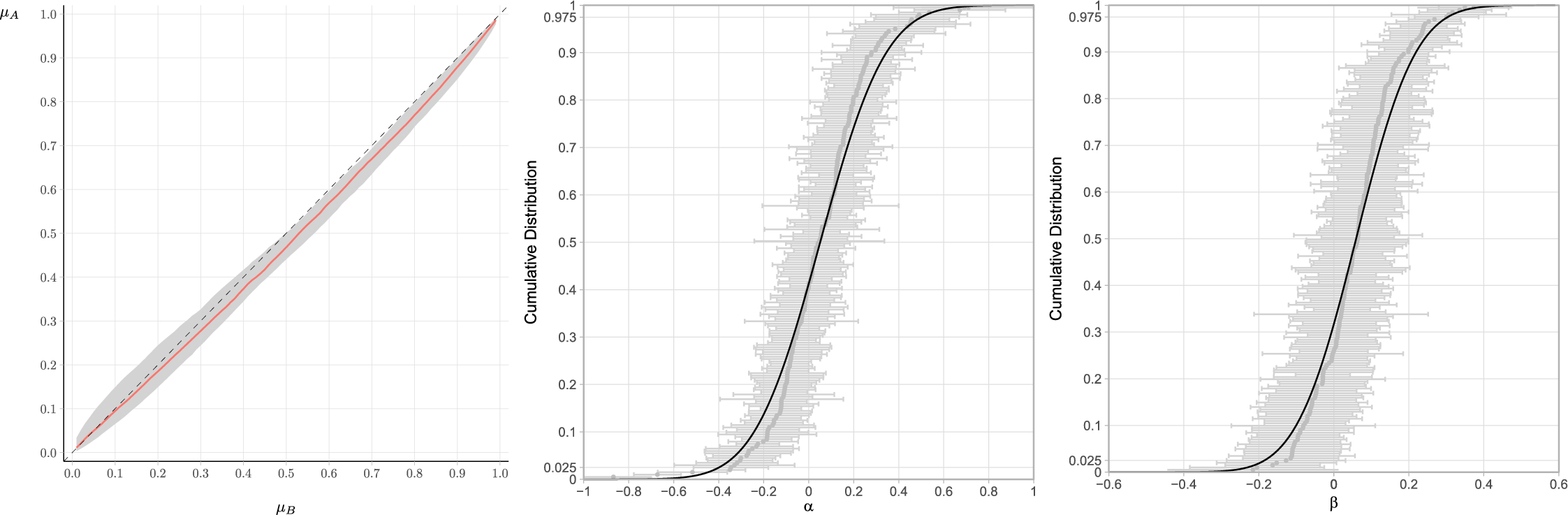

![]() captures the relative preference for source A over source B. As shown in Fig. 2, when

captures the relative preference for source A over source B. As shown in Fig. 2, when

![]() (blue curves), the subject exhibits a preference for source A over source B, whereas when

(blue curves), the subject exhibits a preference for source A over source B, whereas when

![]() (red curves), the subject exhibits a preference for source B over source A. In addition, the value

(red curves), the subject exhibits a preference for source B over source A. In addition, the value

![]() represents the source premium of source A over source B in the middle of the probability interval. It reflects the decrease in likelihood the decision maker is willing to accept to bet on source A instead of source B. When

represents the source premium of source A over source B in the middle of the probability interval. It reflects the decrease in likelihood the decision maker is willing to accept to bet on source A instead of source B. When

![]() ,

,

![]() , which indicates no source premium. Regardless of the underlying reason for the preference, it can be interpreted as a higher level of optimism toward one source compared to the other. We will use the terms relative optimism and relative preference interchangeably: when

, which indicates no source premium. Regardless of the underlying reason for the preference, it can be interpreted as a higher level of optimism toward one source compared to the other. We will use the terms relative optimism and relative preference interchangeably: when

![]() (resp.

(resp.

![]() ), we say that there is a relative preference, or relative optimism, toward A (resp. B).Footnote 13

), we say that there is a relative preference, or relative optimism, toward A (resp. B).Footnote 13

The second parameter

![]() relates to the slope (i.e., the derivative) of the function

relates to the slope (i.e., the derivative) of the function

![]() at probability 0.5. It captures the rate of substitution between the probabilities generated by A and the probabilities generated by B. Starting from 0.5, an increase of

at probability 0.5. It captures the rate of substitution between the probabilities generated by A and the probabilities generated by B. Starting from 0.5, an increase of

![]() in probability generated by B has the same effect as an increase of

in probability generated by B has the same effect as an increase of

![]() in probability generated by A. Therefore, the parameter

in probability generated by A. Therefore, the parameter

![]() can be interpreted in terms of relative insensitivity. When

can be interpreted in terms of relative insensitivity. When

![]() , there is more insensitivity toward B than toward A, and we say that there is relative insensitivity toward B. When

, there is more insensitivity toward B than toward A, and we say that there is relative insensitivity toward B. When

![]() , there is more sensitivity toward B than toward A, and we say that there is relative insensitivity toward A.

, there is more sensitivity toward B than toward A, and we say that there is relative insensitivity toward A.

An interesting and convenient property is that these parameters can be directly computed from the original parameters of the two non-linear specifications considered in this paper (see Table 5 for the mapping between these parameters and the original ones). Importantly, while the parameters can be interpreted with reference to the value of the function or its derivative for probability 0.5, they are not estimated from the behavior of the function in the middle of the probability interval alone. Instead, they depend on the behavior of the function over the whole interval, like any other parametric specification. In this regard, the function estimated using our parameters is one-to-one related to the function estimated using the original parameters. However, the re-parametrization allows for an easier interpretation of the function parameters and their heterogeneity. In particular, the parameters have the same interpretation (regarding the elevation and the slope of the function), regardless of the chosen specification.Footnote 14

Fig. 2 Illustration of the function

![]()

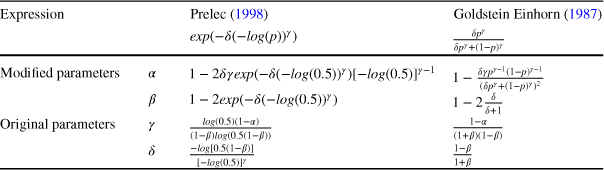

Table 5 Specifications and their re-parametrization

|

Expression |

Prelec (Reference Prelec1998) |

Goldstein Einhorn (Reference Goldstein and Einhorn1987) |

|

|---|---|---|---|

|

|

|

||

|

Modified parameters |

|

|

|

|

|

|

|

|

|

Original parameters |

|

|

|

|

|

|

|

|

4.2.3 Accounting for preference heterogeneity

At the aggregate level, all the subjects are assumed to have the same preferences, i.e.,