INTRODUCTION

Due to the accelerated economic development in countries such as China and India in past decades, the catch-up experience of large emerging economies has attracted great attention in the extant literature (Chatterjee & Sahasranamam, Reference Chatterjee and Sahasranamam2018; Guo & Zheng, Reference Guo and Zheng2019; Lee, Park, & Krishnan, Reference Lee, Park and Krishnan2014; Xiao, Tylecote, & Liu, Reference Xiao, Tylecote and Liu2013). One primary stream of research highlighted the role of technological learning in the catch-up of latecomers and demonstrated that effective technological learning processes facilitate latecomers in accumulating innovative capability and achieving technological catch-up (Chung & Lee, Reference Chung and Lee2015; Figueiredo & Cohen, Reference Figueiredo and Cohen2019).

Despite considerable focus on latecomer technological learning in the literature, several issues remain unsettled. First, substantial catch-up studies have exclusively emphasized that latecomers largely rely on external knowledge acquisition from foreign firms (Chen, Reference Chen2009; Ray, Ray, & Kumar, Reference Ray, Ray and Kumar2017; Tzeng, Reference Tzeng2018), while little is known about the underlying learning-related mechanisms that could clarify how these latecomers absorb acquired knowledge and create new knowledge (Figueiredo & Cohen, Reference Figueiredo and Cohen2019; Lewin, Massini, & Peeters, Reference Lewin, Massini and Peeters2011). However, reality has shown that not every latecomer that began learning from foreign firms successfully achieved industrial catch-up (Vind, Reference Vind2008; Yap & Truffer, Reference Yap and Truffer2019). Therefore, to better understand industrial catch-up, it is essential to analyze the underlying learning-related mechanisms that allow industries to absorb knowledge and learn quickly (Chatterjee & Sahasranamam, Reference Chatterjee and Sahasranamam2018; Liefner, Si, & Schafer, Reference Liefner, Si and Schafer2019). Absorptive capacity, which goes beyond knowledge acquisition and has been refined as a multidimensional construct involving knowledge acquisition, assimilation, transformation, and exploitation, offers a useful lens to deconstruct the technological learning process and address this gap (Lane, Koka, & Pathak, Reference Lane, Koka and Pathak2006; Zahra & George, Reference Zahra and George2002).

Second, the technological learning process is highly context-dependent (Figueiredo & Cohen, Reference Figueiredo and Cohen2019; Lee & Malerba, Reference Lee and Malerba2017). In this regard, the unique contexts of large emerging economies cannot be ignored because these significantly shape the effectiveness of technological learning. Previous studies have investigated technology-related contexts, such as technological regimes (Lee, Gao, & Li, Reference Lee, Gao and Li2017; Li, Capone, & Malerba, Reference Li, Capone and Malerba2019), and market-related contexts, such as market size and market segmentation, for catch-up success (e.g., Mu & Lee, Reference Mu and Lee2005; Wei, Wang, & Liu, Reference Wei, Wang and Liu2018). However, we argue that systematic discussions of large emerging economies’ structural aspects are still nascent (Brandt & Thun, Reference Brandt and Thun2016; Thun, Reference Thun2018). This is important because large emerging economies normally have a ‘ladder-like’ context: a highly segmented market structure on the demand side (i.e., from price-sensitive and good-enough markets to price-tolerant and high-quality markets) (Buckley & Hashai, Reference Buckley and Hashai2014; Li et al., Reference Li, Capone and Malerba2019) and diverse levels of technologies on the supply side (i.e., from low-end technologies to high-end advanced technologies). Specifically, each market segment is a crucial rung on the market ladder, and each technology building block is a rung on the technology ladder (Brandt & Thun, Reference Brandt and Thun2016). We contend that applying the notion of a ladder to both the technology and the market contexts demonstrates the multilevel nature of the catch-up contexts of large emerging economies (Brandt & Thun, Reference Brandt and Thun2016; Thun, Reference Thun2018), and such concepts are key to understanding how large emerging economies adopt learning processes to reduce technological gaps and compete with leading foreign firms (Brandt & Thun, Reference Brandt and Thun2016).

To address the aforementioned gaps, this study first deconstructs the technological learning process into technology decomposition and technology recombination. We then discuss how the unique catch-up context in terms of the technology ladder and market ladder shapes the impact of technological learning on industrial catch-up performance. More specifically, our destruction of technological learning is theoretically related to the absorptive capacity perspective, which emphasizes four main aspects of the learning process: knowledge acquisition, assimilation, transformation, and exploitation (Zahra & George, Reference Zahra and George2002). We deconstruct the technological learning process into technology decomposition and technology recombination. Technology decomposition corresponds to knowledge acquisition and assimilation, especially in terms of decomposing advanced technologies acquired externally into pieces, parts, or modules. Technology recombination corresponds to knowledge transformation and exploitation, aiming to capture market opportunities by recombining technologies and knowledge acquired from diverse sources into commercial products with localized innovations and adaptations (Guo & Chen, Reference Guo and Chen2013; Guo & Zheng, Reference Guo and Zheng2019). We argue that both technology decomposition and technology recombination are crucial learning mechanisms for latecomers to catch up with industrial leadership because they leverage limited knowledge and resources to create something from nothing (Liu, Ying, & Wu, Reference Liu, Ying and Wu2017). We believe this deconstruction of the technological learning process illustrates how latecomers with limited resources can progress from low-tier (or productive) skills to high-tier innovation (Miao, Song, Lee, & Jin, Reference Miao, Song, Lee and Jin2018).

We further introduce the concepts of the industry-level technology ladder and market ladder to capture the unique structural features of large emerging economies engaged in catch-up. The technology ladder refers to the degree of technological continuity among different levels of a given industry and its constituent firms. The market ladder refers to the degree of continuity of market segments for all firms in a given industry. A more seamless technology ladder or market ladder enables latecomers to make full and efficient use of their capabilities and greatly reduce the technological threshold requirements when engaging in catch-up (Li et al., Reference Li, Capone and Malerba2019; Wei et al., Reference Wei, Wang and Liu2018). Specifically, a continuous technology ladder increases the availability of knowledge and may serve as a substitute for technology decomposition. A continuous market ladder gives latecomers specializing in technology recombination more opportunities to capture market share and profit through localized innovations. We argue that the technology ladder weakens the positive impact of technology decomposition on industrial catch-up performance, while the market ladder strengthens the positive impact of technology recombination on industrial catch-up performance.

Using an industry-level sample of Chinese manufacturing industries during the period of 2001 to 2007, we conducted a panel data analysis to validate our research hypotheses. The choice of Chinese manufacturing industries is justified for two reasons. First, as a large emerging economy, China has made great achievements in terms of industrial catch-up and has enjoyed significant growth in the manufacturing sector over four decades (Brandt, Biesebroeck, & Zhang, Reference Brandt, Biesebroeck and Zhang2012; Brandt and Thun, Reference Brandt and Thun2016). Second, even in the present China still faces a lack of core technologies as a whole and the challenge of catching up with foreign industry leaders (Wei et al., Reference Wei, Wang and Liu2018). According to an evaluation of China's technological development level by the Ministry of Science and Technology of China in 2016, among the 1,350 technologies in 13 important technical fields, 52% were still lagging behind, relative to international levels (Minister of S&T of People's Republic of China, 2016). Therefore, it is necessary to examine the unique learning-related mechanisms underlying technological learning processes to understand why some industries have become globally competitive, while others have not.

This study contributes to the latecomer technological learning and catch-up literature in the following ways. First, through the lens of the absorptive capacity perspective, we unpack the underlying technological learning process by deconstructing it into technology decomposition and technology recombination. Based on this, our study empirically confirms that only technology recombination significantly affects industry-level catch-up performance. Second, going beyond prior studies that mainly emphasize the generic characteristics of the catch-up context in the developing countries, the notion of the technology ladder and market ladder in our study systematically illustrates the structural traits of catch-up contexts in large emerging economies. Furthermore, the joint effects of technology decomposition, technology recombination, and catch-up context enriches our understanding of why different industries have heterogeneous catch-up performance under similar catch-up contexts (e.g., technology gap and speed of technology development).

THEORETICAL BACKGROUND AND HYPOTHESES

Technology Decomposition and Technology Recombination

Technology decomposition and technology recombination are based on the absorptive capacity perspective. The absorptive capacity literature has acknowledged that technological learning processes consist of four dimensions: knowledge acquisition, assimilation, transformation, and exploitation (Cohen & Levinthal, Reference Cohen and Levinthal1990; Lane et al., Reference Lane, Koka and Pathak2006). However, the existing literature on latecomer technological learning pays significant attention to how latecomers acquire external advanced knowledge (Bell & Figueiredo, Reference Bell, Figueiredo, Amann and Cantwell2012; Lee & Malerba, Reference Lee and Malerba2017; Zahra & George, Reference Zahra and George2002) while neglecting the learning mechanisms pertinent to other dimensions. Although external advanced technologies can provide opportunities for catching up, the extent to which such opportunities are used depends greatly on the learning strategy the latecomer adopts (Kim, Reference Kim1998; Tzeng, Reference Tzeng2018). In addressing this issue, we propose an analytical framework of latecomer technological learning processes to reveal how latecomers in the catch-up process absorb external knowledge and use knowledge.

The technological learning process in this study is divided into two mechanisms: technology decomposition and technology recombination. As different actors in a given industry collaborate, technology decomposition and technology recombination may intertwine and relate to each other (Carlile & Rebentisch, Reference Carlile and Rebentisch2003). In addition, these two mechanisms are not necessarily sequential because defining where one begins or ends is difficult in practice (Carlile & Rebentisch, Reference Carlile and Rebentisch2003). For example, when acquired technical knowledge is relatively simple and therefore can be smoothly assimilated, technology decomposition may be unnecessary, and only recombination may occur.

Technology decomposition entails comprehensively understanding the architecture and principles embodied by a given technological component and its modules (Chen & Liu, Reference Chen and Liu2005; Guo & Chen, Reference Guo and Chen2013; Henderson & Clark, Reference Henderson and Clark1990; Ulrich, Reference Ulrich1995). The existing literature generally emphasizes that knowledge acquisition is distinct from knowledge assimilation (Kim, Reference Kim1997; Zahra & George, Reference Zahra and George2002). However, the technology gap between latecomers and industry forerunners may impede knowledge assimilation, and previous studies have failed to demonstrate how latecomers should adapt their learning processes in response. To address this problem, this study introduces the concept of technology decomposition based on the absorptive capacity perspective, which can clarify the methods by which latecomers decode the architecture and design principles embodied in external technologies. Through technology decomposition, latecomers can overcome obstacles to knowledge assimilation. Technology decomposition typically entails (but should not be limited to) gradual participation in collaborative product development among system vendors and suppliers of materials, components, and equipment; gradual extension from peripheral to core subsystems or from parts to product modules and system products; and adaptive and/or localized technology improvement (Choung, Hwang, & Song, Reference Choung, Hwang and Song2014; Guo & Chen, Reference Guo and Chen2013).

The tension between the resource-consuming feature of catching up and the severe resource deficiencies faced by latecomers makes efficient and effective knowledge transformation and exploitation processes critical. An effective way for latecomers to address such constraints is technology recombination. Extending the conceptualization of knowledge transformation and knowledge exploitation based on the absorptive capacity perspective, technology recombination refers to the process through which latecomers in large emerging economies fully capture the business opportunities in domestic markets. Through this process, technology recombination effectively facilitates the accumulation of financial resources from market returns to sustain long-term efforts to catch up. Specifically, the characteristics of domestic demands in large emerging economies are different from those in developed markets. For example, some market segments in large emerging economies do not necessarily require the most sophisticated technology and may value the price–value ratio highly (Brandt & Thun, Reference Brandt and Thun2016; Thun, Reference Thun2018). With a more intuitive understanding of the domestic market than foreign firms, latecomers can effectively recombine knowledge to satisfy particular domestic market segments, such as the more price-sensitive low-end segments at the initial catch-up stage or the growing middle segments that require ‘good-enough’ products and innovation (Brandt & Thun, Reference Brandt and Thun2016; Gadiesh, Leung, & Vestring, Reference Gadiesh, Leung and Vestring2007; Thun, Reference Thun2018). In contrast, knowledge transformation denotes the combining of existing knowledge with newly acquired and assimilated knowledge, and knowledge exploitation denotes the new application of knowledge (Zahra & George, Reference Zahra and George2002), setting aside the distinctive activities of technology recombination for targeting particular market segments to formulate differentiated competitive advantage in large emerging economies. Technology recombination typically entails (but should not be limited to) the integration of local and hyperlocal technologies and expertise from diverse sources, the collaborative development of product designs and manufacturing processes, the fusion of different technical routines and standards, the exploitative reconfiguration of local technological expertise, and the recombination of familiar components in new ways (Arts & Veugelers, Reference Arts and Veugelers2014; Guan & Yan, Reference Guan and Yan2016; Guo & Chen, Reference Guo and Chen2013).

In addition, we note that some concepts in existing studies share a similar focus on recombination: for example, combinative capability proposed by Kogut and Zander (Reference Kogut and Zander1992) and the composition-based view (CBV) proposed by Luo and Child (Reference Luo and Child2015). Given this shared focus, we believe technology recombination can be regarded as a specific extension of the combinative capability proposed by Kogut and Zander (Reference Kogut and Zander1992). The concept of combinative capability is a more generic concept that emphasizes the intersection of the capability to synthesize and apply current and acquired knowledge in a competitive environment (Kogut & Zander, Reference Kogut and Zander1992). Technology recombination is useful in the context of large emerging economies because latecomers can recombine domestic knowledge inputs to provide the exact level of quality products and innovations required by the domestic market and further build differentiated competitive advantage (Brandt & Thun, Reference Brandt and Thun2016; Thun, Reference Thun2018).

The CBV attributes firms’ competitive advantage to being able to ‘identify a set of resources available in the market that they can purchase and to combine them in a way that is creatively and speedily adaptive to market requirements’ (Luo & Child, Reference Luo and Child2015: 379). However, the CBV does not treat the possession of knowledge as a superior resource, and it exclusively emphasizes the creative use of resources available for sale in the open market (e.g., technology, brand, services, channels) to satisfy mass consumption (Luo & Child, Reference Luo and Child2015). By contrast, our study of technology recombination highlights knowledge as a special resource – some knowledge cannot be purchased in the market, such as tacit knowledge about certain products and technologies. To further support and clarify our position, in Appendix I, we summarize the key theoretical arguments in the existing literature on concepts related to technology decomposition and technology recombination.

Technology Decomposition, Technology Recombination, and Catch-up Performance

Technology decomposition can mitigate or overcome the potential negative influence of a large technology gap between foreign forerunners and latecomers, thus facilitating the catch-up process (Lee, Cho, & Jin, Reference Lee, Cho and Jin2009). The technological gap represents great promise because it provides latecomers with the opportunity to imitate and use more advanced technology elsewhere (Fagerberg, Srholec, & Knell, Reference Fagerberg, Srholec and Knell2007). To take advantage of this learning opportunity, latecomers must overcome obstacles in the path of assimilating external technology – specifically, a knowledge threshold in certain sectors or technology fields must be crossed (Jang, Lo, & Chang, Reference Jang, Lo and Chang2009). Otherwise, large technology gaps can frustrate attempts to catch up (Haddad & Harrison, Reference Haddad and Harrison1993). As such, technology decomposition is helpful in dividing advanced technologies into knowledge subsets that are much easier to learn and understand as well as in accelerating assimilation of external knowledge through better use of externally accessible expertise (Chen & Liu, Reference Chen and Liu2005). Technology decomposition is therefore crucial for lowering the learning threshold for latecomers aspiring toward a higher rung on the technology ladder and improved mass production (Mathews & Cho, Reference Mathews and Cho1999). Moreover, technology decomposition can help latecomers greatly reduce the cost and time associated with understanding information obtained from external sources, thus accelerating capability-building during the catch-up process. Thus, we propose the following:

Hypothesis 1: Technology decomposition is positively related to catch-up performance.

On the one hand, in the process of technology recombination, latecomers can recombine technologies and expertise from a wide variety of external sources or recombine these technologies with existing expertise into new technology and product developments (Keupp & Gassmann, Reference Keupp and Gassmann2013). On the other hand, they can localize or adapt technologies acquired to meet specific demands in the highly segmented domestic market and new market segments created by technological changes, or they can transplant the technical expertise arising from technology decomposition into new market segmentations or applications (Li et al., Reference Li, Capone and Malerba2019; Thun, Reference Thun2018; Wei et al., Reference Wei, Wang and Liu2018). Hence, technology recombination is not only a learning and knowledge-creation process in which latecomers’ technological capability is built and enhanced but also a moderator for latecomers to take advantage of market opportunities to increase the possibility of and efficiency in obtaining market returns (Guo & Chen, Reference Guo and Chen2013). These market returns allow latecomers to accumulate sufficient capital for further investments in research and development (R&D) – the key to being capable of upgrading their technological capabilities (Wei et al., Reference Wei, Wang and Liu2018). By upgrading their technological capabilities, latecomers are more likely to achieve sustainable catch-up (Li et al., Reference Li, Capone and Malerba2019). Therefore, we propose the following:

Hypothesis 2: Technology recombination is positively related to catch-up performance.

Large Emerging Market Contexts: Technology Ladder and Market Ladder

The contexts of large emerging economies, especially Brazil, Russia, India, and China (the BRICs), may differ from those in newly industrialized economies (such as Singapore, Korea, and Taiwan) or other developing countries with relatively small populations and domestic markets (Brandt & Thun, Reference Brandt and Thun2016; Wei et al., Reference Wei, Wang and Liu2018). The empirical studies on emerging market contexts are summarized in Appendix II.

A highly segmented technology and market structure implies that latecomers in large emerging economies must select an appropriate entry point in the range from low-end to high-end technology and market segments according to their existing learning processes and mechanisms and then keep moving up the ladder. Nonetheless, the empirical evidence remains scant on how latecomers implement learning-related mechanisms in different technology- and market-related contexts for industrial catch-up in large emerging economies[Footnote 1] For this reason, a more systematic and empirically grounded understanding of the conditions under which latecomers with different learning mechanisms achieve catch-up is still needed (Miao et al., Reference Miao, Song, Lee and Jin2018). Specifically, this study introduces the concepts of the technology ladder and market ladder to capture the unique structural features of catch-up contexts in large emerging economies. An industry's technology ladder reflects the degree of continuity of technology-level distribution in that industry, and its market ladder reflects the degree of continuity of market segments in that industry. Heeding the call by Miao et al. (Reference Miao, Song, Lee and Jin2018), we argue that the ladder-like contexts serve as contingencies in the relationships between technological decomposition, recombination, and industrial catch-up performance. Specifically, we postulate that the technology ladder may serve as a substitute for technology decomposition in improving industrial catch-up performance, while the market ladder may serve as a complement for technology recombination in improving industrial catch-up performance.[Footnote 2]

The moderating effect of the technology ladder

In a given industry, the level of continuity in the technology ladder greatly affects the quantity of available knowledge and the difficulty involved with knowledge acquisition. The higher the level of continuity of the technology ladder is, the greater the availability of knowledge, which may induce a substitute for the impact of technology decomposition on catch-up performance. Within such industries, no matter which technology tiers the latecomers are in (even for local latecomers with relatively weak capabilities), it is easy for them to meet many other firms from adjacently higher technology tiers, and they have many opportunities to benefit from the foreign advanced technology imported by the top rungs in the ladder, especially in the context of large emerging economies (Brandt & Thun, Reference Brandt and Thun2016).

In China, the presence of a large number of firms ensures continuity in the distribution of technology and capability levels across firms within a given industry. Due to the technological superiority of foreign firms relative to domestic firms, foreign firms often occupy the top end of the technology ladder in China (Zhang, Li, Li, & Zhou, Reference Zhang, Li, Li and Zhou2010). As a typical case, Mu and Lee (Reference Mu and Lee2005) illustrated how knowledge was acquired from the Bell Telephone Manufacturing Company by Shanghai Bell (a Sino–foreign joint venture), then by domestic firms, such as Huawei. As an analogy between technology development and ladder climbing, the more rungs domestic latecomers face and the more consecutive the rungs are, the more easily the latecomers can climb the ladder (Brandt & Thun, Reference Brandt and Thun2016). Missing rungs at any point can impede the development process for climbers at low levels. As a consequence, the difficulty and cost involved in absorbing external knowledge tend to decrease, and such a favorable knowledge environment may weaken the facilitating role of technology decomposition by reducing the learning threshold for catching up. Even latecomers with a relatively weak level of technology decomposition can acquire external knowledge because they can easily find learning targets and establish linkages with advanced targets. Such a continuous technology ladder allows domestic firms to gradually assimilate advanced technology through using spillovers from a set of actors in the catch-up process, and it ensures the continuity of the capability-building process at the industry level (Lee & Ki, Reference Lee and Ki2017; Li et al., Reference Li, Capone and Malerba2019).

Moreover, the high continuity of a technology ladder may greatly reduce the need for local latecomers to develop and innovate technologies internally (Awate, Larsen, & Mudambi, Reference Awate, Larsen and Mudambi2012; Xiao et al., Reference Xiao, Tylecote and Liu2013). Internal development is often perceived as riskier or more uncertain than acquiring technology from elsewhere. Therefore, we propose the following substitute effect hypothesis:

Hypothesis 3: The more continuous the technology ladder is at the industry level, the weaker the positive impact of technology decomposition on catch-up performance.

The moderating effect of the market ladder

Previous studies revealed that large emerging economies often have several typical economic features, such as a large potential domestic market (Guennif & Ramani, Reference Guennif and Ramani2012; Mu & Lee, Reference Mu and Lee2005; Wei et al., Reference Wei, Wang and Liu2018) and a highly segmented market structure (Buckley & Hashai, Reference Buckley and Hashai2014; Gadiesh et al., Reference Gadiesh, Leung and Vestring2007; Li et al., Reference Li, Capone and Malerba2019). A highly segmented market comprises a market ladder from the low-end to the high-end segments, in which the technology and capability requirements are different across different segments. This is especially important for latecomers in manufacturing sectors because the large domestic market in large emerging economies is more likely to make each market segment large enough to provide economies of scale. Each market segment in the domestic market serves as a rung on the developmental ladder. Specifically, demand in the low-end – the first rung on the ladder – provides latecomers with an ‘incubation space’ in which they can start with low-level capabilities. In addition, demand in medium- and higher-end market segments enables latecomers to learn about consumers’ preferences in these segments and to justify the sizable investments in R&D, personnel, and equipment that upgrading entails (Brandt & Thun, Reference Brandt and Thun2016; Li et al., Reference Li, Capone and Malerba2019).

In a market ladder with a high level of continuity, local latecomers specialized in technology recombination, on the one hand, may have a greater chance of capturing market opportunity through localized innovations. Notably, products designed domestically are most often introduced first in the domestic market rather than in global markets (Butollo & Ten Brink, Reference Butollo and Ten Brink2018; Mu & Lee, Reference Mu and Lee2005). Latecomers widely employ the market strategy of targeting lower-end markets or niche markets, especially in their early stages of development (Lee, Lim, & Song, Reference Lee, Lim and Song2005). With a continuous market ladder, an industry specialized in technology recombination can easily find market segment targets matching the existing technology and capability levels. This provides a space to survive and develop (Wei et al., Reference Wei, Wang and Liu2018; Zeschky, Widenmayer, & Gassmann, Reference Zeschky, Widenmayer and Gassmann2011). As capability develops, latecomers can continuously use recombination strategies to seize market opportunities with local requirements and become strikingly innovative in manufacturing and product designs (Butollo & Ten Brink, Reference Butollo and Ten Brink2018).

On the other hand, for latecomers specialized in technology recombination, a market ladder with a high level of continuity facilitates profiting from local markets. For example, latecomers can offer ‘good-enough’ quality at lower costs to meet the demands of price-sensitive market segments (Thun, Reference Thun2018; Wei et al., Reference Wei, Wang and Liu2018). A continuous market ladder can provide more opportunities to adopt the above development strategy and keep improving, which is likely a necessary condition for latecomers to climb the market ladder. In addition, a continuous market ladder can help latecomers with strong recombination capabilities anticipate new technological developments and capabilities, which in turn incentivize them to invest more profit into capability improvement. Consequently, latecomers with strong recombination capabilities benefit from the learning curve and thus achieve higher levels of catch-up performance.

Hypothesis 4: The more continuous the market ladder is, the stronger the positive impact of technology recombination on catch-up performance.

METHODS

Data and Sample

We created an industry–year dataset. It covers all two-digit Standard Industrial Code (SIC) manufacturing industries in China for the period between 2001 and 2007.[Footnote 3] This was a period when China was transitioning from a central planning system to a market-oriented system, and the country made numerous national policies to promote technological upgrades.[Footnote 4] During this period, the Chinese government was quite open to bottom-up experimentation and learning (Heilmann, Reference Heilmann2018), and such an embrace of local experimentation stimulated diverse trial-and-error experiments among different industries. Our data show that for most industries, the productivity gap between local firms and foreign firms hosted in China persisted during the period.[Footnote 5]

Our dataset combines five different secondary data sources. Four were compiled by China's National Bureau of Statistics (CNBS): the Annual Industrial Survey Database (AISD), the Industrial Product Production Capacity Database (IPPCD), the China Statistical Yearbook, and the China Statistical Yearbook on Science and Technology (S&T Yearbook). The AISD and IPPCD provide detailed firm-level financial and operational information for all state-owned and nonstate-owned industrial enterprises above the designated size of five million RMB in revenue, foreign firms included. These firm-level data are aggregated to measure the two industry-level variables – the technology ladder and the market ladder. The China Statistical Yearbook and S&T Yearbook provide aggregated data at the industry level for most other variables.[Footnote 6] The fifth source is the marketization index compiled yearly by the National Economic Research Institute in China (Fan, Wang, & Zhu, Reference Fan, Wang and Zhu2010). Due to the limitation of the IPPCD, this study set up seven-year panel data, with a one-year lag between the independent variables (from 2000 to 2006) and the dependent variables (from 2001 to 2007). All monetary variables are deflated by taking 2000 as the base year, with the producer price index for manufactured goods taken from the China Statistical Yearbook.

The AISD is recognized as the most comprehensive firm-level dataset, accounting for approximately 90% of the total output in most Chinese industries (Wang & Li, Reference Wang and Li2014); it has become an important and accurate source for academic research because it has achieved a level of consistency in data collection across time, industries, and regions (e.g., Park, Li, & Tse, Reference Park, Li and Tse2006; Zhou, Gao, & Zhao, Reference Zhou, Gao and Zhao2017). Its sample size was more than 120,000 in 2000 and increased to nearly 280,000 in 2006. It contains firm-level statistical indicators such as industrial output, value-added, employment, subsidy, and industry code (at the four-digit level). Each firm is identified by an invariant code in the dataset, based on which the AISD and IPPCD are combined. The IPPCD includes production capacity data by product code. The data collected from the China Statistical Yearbook include the following: number of firms, number of employees, original value of microelectronics-controlled equipment, sales revenue from the principal business, profit, fixed-asset investment, and industrial value-added of both all firms and foreign firms in each industry.

Variable Measurements

Dependent variable: Catch-up performance

Catch-up performance is shown in terms of increasing labor productivity when industry firms climbed the ladder of value chains toward higher value-added activities (Lee, Reference Lee2013). Excluding foreign firms in the industry, we used domestic firms’ labor productivity difference between the prior year and the focal year to reflect an industry's catch-up performance (Jung & Lee, Reference Jung and Lee2010; Lyu, Lin, Ho, & Yang, Reference Lyu, Lin, Ho and Yang2019). Labor productivity was calculated by value-added per capita. Because the amount variable is highly skewed, we computed the natural logarithm.

Independent variables: Technology decomposition and technology recombination

According to our theory, technology decomposition involves dividing advanced technologies into knowledge subsets, which facilitates the assimilation of advanced knowledge. Therefore, expenditure on technology absorption of the acquired technology is a good indicator available in the CNBS dataset at the aggregate level to reflect firms’ efforts in technology decomposition activities.[Footnote 7] Specifically, we measured technology decomposition using the following: (a) absolute assimilation intensity, the ratio of expenditure on technology absorption to sales revenue from the principal business, and (b) relative assimilation intensity, the ratio of expenditure on technology absorption to the total expenditure on S&T activities.[Footnote 8]

Following our theory of technology recombination, domestic firms usually recombine diverse technologies and knowledge to yield products quite different from those of foreign firms to capture market opportunities (Guo & Chen, Reference Guo and Chen2013). R&D allows firms to generate new ideas, blueprints, and models, part of which will eventually facilitate knowledge recombination and application (Hagedoorn & Cloodt, Reference Hagedoorn and Cloodt2003). Latecomer firms usually have to conduct more R&D to support recombination activities because they can no longer use reengineering as a strategy to catch up as market-oriented reforms progress (Guennif & Ramani, Reference Guennif and Ramani2012).[Footnote 9] Therefore, we adopted data on new product development and internal technology development to measure technology recombination (Liu & White, Reference Liu and White1997). Patent application was used as a supplemental indicator since it can reflect firms’ accumulation of economically valuable knowledge to prepare for potential market opportunities. Specifically, we calculated (a) output intensity on new product: the ratio of new product sales to sales revenue in the principal business, (b) output intensity on patent: the ratio of invention-type patent application count to sales revenue from the principal business, and (c) input intensity on S&T activities: the ratio of intramural expenditure on S&T activities to sales revenue from the principal business.

To assess the convergent and discriminant validity of our measures, we conducted an exploratory factor analysis (EFA). We included the two technology decomposition items and three technology recombination items. Our EFA indicated a distinct two-factor solution (see Table 1). Each factor had an eigenvalue above 1.0 (2.426 and 1.498, respectively). The two factors explained 78.48% of the variance. This pattern of results confirmed both the convergent and discriminant validity of our indicators. Therefore, the first three indicators were used to generate technology recombination, and the last two were used for technology decomposition. Owing to the difference in scale among indicators, the indicators were first transferred proportionally into a value range [0, 5], and then their arithmetic means were calculated as the variable scores.

Table 1. Factor analysis of technology decomposition and technology recombination

Moderators: Technology ladder and market ladder

The technology ladder of an industry reflects the degree of continuity of technology-level distribution for all the firms in that industry. The calculation procedure for a given industry was as follows: (1) each firm's labor productivity (value-added per capita) was calculated as the proxy for the technology level; (2) based on the values of technology level for all firms in the industry, a value range [min, max] was set up and divided into k intervals with the same length;[Footnote 10] (3) all firms in the industry were classified into one of the k intervals according to their technology level; (4) the number of firms in each interval (Ni) was then counted, and the ratio of each interval (as one group) to all the k intervals (the whole industry) in the firm number was calculated: Ri =${\boldsymbol N}_{\boldsymbol i}/\mathop \sum \limits_1^{\boldsymbol K} {\boldsymbol N}_{\boldsymbol j}$![]() ; and (5) based on a widely used measure of concentration, the Herfindahl–Hirschman Index (Acar & Sankaran, Reference Acar and Sankaran1999), the technology ladder was measured by$\;1-\mathop \sum \limits_1^{\boldsymbol k} {\boldsymbol R}_{\boldsymbol i}^2$

; and (5) based on a widely used measure of concentration, the Herfindahl–Hirschman Index (Acar & Sankaran, Reference Acar and Sankaran1999), the technology ladder was measured by$\;1-\mathop \sum \limits_1^{\boldsymbol k} {\boldsymbol R}_{\boldsymbol i}^2$![]() . The higher the value was, the more continuous the technology ladder. To avoid the potential effect of outliers and save more samples, firms with labor productivity lower than the 5th percentile or higher than the 95th percentile were dropped in measuring the technology ladder (similar treatment was adopted in [Balasubramanian & Lieberman, Reference Balasubramanian and Lieberman2010]). The measurements based on samples across the range [1st percentile, 99th percentile] were used as alternatives in the robustness tests.

. The higher the value was, the more continuous the technology ladder. To avoid the potential effect of outliers and save more samples, firms with labor productivity lower than the 5th percentile or higher than the 95th percentile were dropped in measuring the technology ladder (similar treatment was adopted in [Balasubramanian & Lieberman, Reference Balasubramanian and Lieberman2010]). The measurements based on samples across the range [1st percentile, 99th percentile] were used as alternatives in the robustness tests.

The market ladder of an industry reflects the degree of continuity of market segments (i.e., the so-called quality level distribution) for all the firms in that industry. We first calculated each firm's product price as a proxy for the quality level,[Footnote 11] which was measured as industrial output value divided by production capacity. Similar to the technology ladder, the market ladder was calculated by replacing the value of the technology level with the quality level. When firms in one industry had two or more measurement units (e.g., Yuan per ton, Yuan per meter), we calculated the values of the market ladder separately based on the subsamples that contained the most firms and the second-most firms according to their measurement units. When two values of the market ladder based on different subsamples occurred in an industry, we chose the larger value or the value calculated based on many more subsamples (e.g., with a sample size more than 10 times that of the other group). The average value of the two values of the market ladder was also calculated and used as an alternative in the robustness tests.

Control variables

Sectoral factors. (1) Foreign direct investment (FDI) spillover. We used the ratio of foreign firms’ value-added to the total value-added in an industry. Previous literature has argued that FDI investment can create positive or negative externalities on domestic firms through knowledge diffusion, provision of public goods, or a crowding-out effect (Spencer, Reference Spencer2008). (2) Public research institution competence. Universities and public research laboratories have been important agents of the innovation systems supporting economic catch-up (Fischer et al., Reference Fischer, Schaeffer and Vonortas2019; Mazzoleni & Nelson, Reference Mazzoleni and Nelson2007). They play the role of technology gatekeepers and enablers in the catch-up process of domestic firms and the development of domestic capabilities by helping collect foreign information on advanced technology, promoting technology transfer, solving related problems in external knowledge absorption and application, and making R&D project evaluations (Chen, Reference Chen2009; Mazzoleni & Nelson, Reference Mazzoleni and Nelson2007). Five indicators were used: (a) the ratio of the number of employees in public research institutions to the number of firm employees; (b) the ratio of the number of S&T personnel in public research institutions to the number of firm employees; (c) the ratio of the number of scientists and engineers in public research institutions to the number of firm employees; (d) the ratio of intramural expenditure on S&T activities in public research institutions to that in firms; and (e) the ratio of intramural expenditure on S&T activities in public research institutions to firms’ sales revenue from the principal business. An orthogonal factor analysis (with varimax rotation) of these five indicators yielded one significant factor (with an eigenvalue above 4 and all factor loadings over 0.8). Thus, these five indicators were first transformed proportionally into scores within a value range [0, 5], and then their arithmetic means were calculated. (3) Technological complexity. The complexity of technological knowledge can affect the ease of learning and act as a distinct barrier to imitation (Cohen & Levinthal, Reference Cohen and Levinthal1990; Ryall, Reference Ryall2009) and thus to catch-up performance. It was measured as the original value of microelectronics-controlled equipment divided by sales revenue from the principal business. (4) Industry competition. It was measured as the natural logarithm of the total number of firms in a given industry.

Industry-average firm features: (1) Firm size. It was measured as the total number of employee in a given industry divided by the total firm number (Lee, Reference Lee2013; Park et al., Reference Park, Li and Tse2006). (2) Investment intensity. Given the potential influence of fixed-asset investment on economic growth and productivity, fixed-asset investment per capita at the industry level was included (Park et al., Reference Park, Li and Tse2006). (3) Fund source diversity. Firms obtain funds for innovation activities from different sources, including self-raised funds, bank loans, government funds, foreign funds, and others. We first calculated the source concentration by using the Herfindahl–Hirschman Index; we then used one minus that value to reflect the fund source diversity. (4) Profitability. It was measured as the total profits divided by the sales revenue from the principal business.

Institutional factors: (1) Institutional development. Previous studies have extensively used the marketization index to measure institutional development in different regions in China (Fan et al., Reference Fan, Wang and Zhu2010, Zhou et al., Reference Zhou, Gao and Zhao2017). Because this study is at the industry level, the exposure to different marketization environments of each industry-year observation was measured as the sum of marketization scores across all provinces in the given year, weighted by the percentage of industry output reported in a given province over the total industry output for the focal year. (2) State ownership. The resources, objectives, and governance of state-affiliated firms differ significantly from those of private firms (Cui & Jiang, Reference Cui and Jiang2012). We used the ratio of state-affiliated firms to the total number of firms for each industry to control for the role of state capitalism in China. (3) Subsidy. We used the average subsidy amount per firm in an industry to control for the role of government support. Governments in emerging economies have a significant influence on regulatory policies and control key resources in the restructuring of the economy, and subsidies are a typical type of government sponsorship (Du & Mickiewicz, Reference Du and Mickiewicz2016).

Estimation Method

We adopted the Breusch-Pagan Lagrange multiplier test to decide whether the pooled ordinary least squares approach or the panel data method was more appropriate (Breusch & Pagan, Reference Breusch and Pagan1980). The results of the test show that the latter is better since there were unobserved individual effects in the data. Next, the Hausman test was used to choose between fixed-effect and random-effect models for the panel data method. The results suggest that fixed-effect panel models were more appropriate (see results in Table 3). Heteroskedasticity, autocorrelation, and cross-sectional dependence of panel data were tested for every regression model, and the results (in Tables 3 and 4) showed that there were heteroskedasticity and autocorrelation for many models. Regressions with Driscoll-Kraay standard errors were implemented to cope with these problems (Driscoll & Kraay, Reference Driscoll and Kraay1998). To reduce the potential multicollinearity due to interaction terms, these independent variables were centered before calculating the product terms. All independent variables were lagged one year to mitigate potential endogeneity problems in the models. In addition, we examined the variance inflation factor (VIF) in the models. The maximum VIF was 4.83, and the mean VIF was 2.40, which is substantially less than the standard rule of 10, indicating that multicollinearity was not a significant concern.

RESULTS

Descriptive Statistics and Regression Analysis

Table 2 reports descriptive statistics and correlation coefficients for all variables. As shown in Table 2, labor productivity declines in a few cases (i.e., catch-up performance is negative), which indicates that labor productivity does not always improve for every industry. The market ladder has a wider variation than the technology ladder among different industries. Regarding the correlation matrix of the main variables, the correlation between technology decomposition and technology recombination is significant and positive (β = 0.38, p = 0.00). Technology decomposition, technology ladder, and market ladder are all significantly positively correlated with catch-up performance. Because the state-owned ratio is highly related to institutional development (β = -0.71, p = 0.00), a robustness test was done by deleting the state-owned ratio.

Table 2. Descriptive statistics and correlation coefficients (N = 182)

Notes: * p < 0.05; ** p < 0.01; *** p < 0.001.

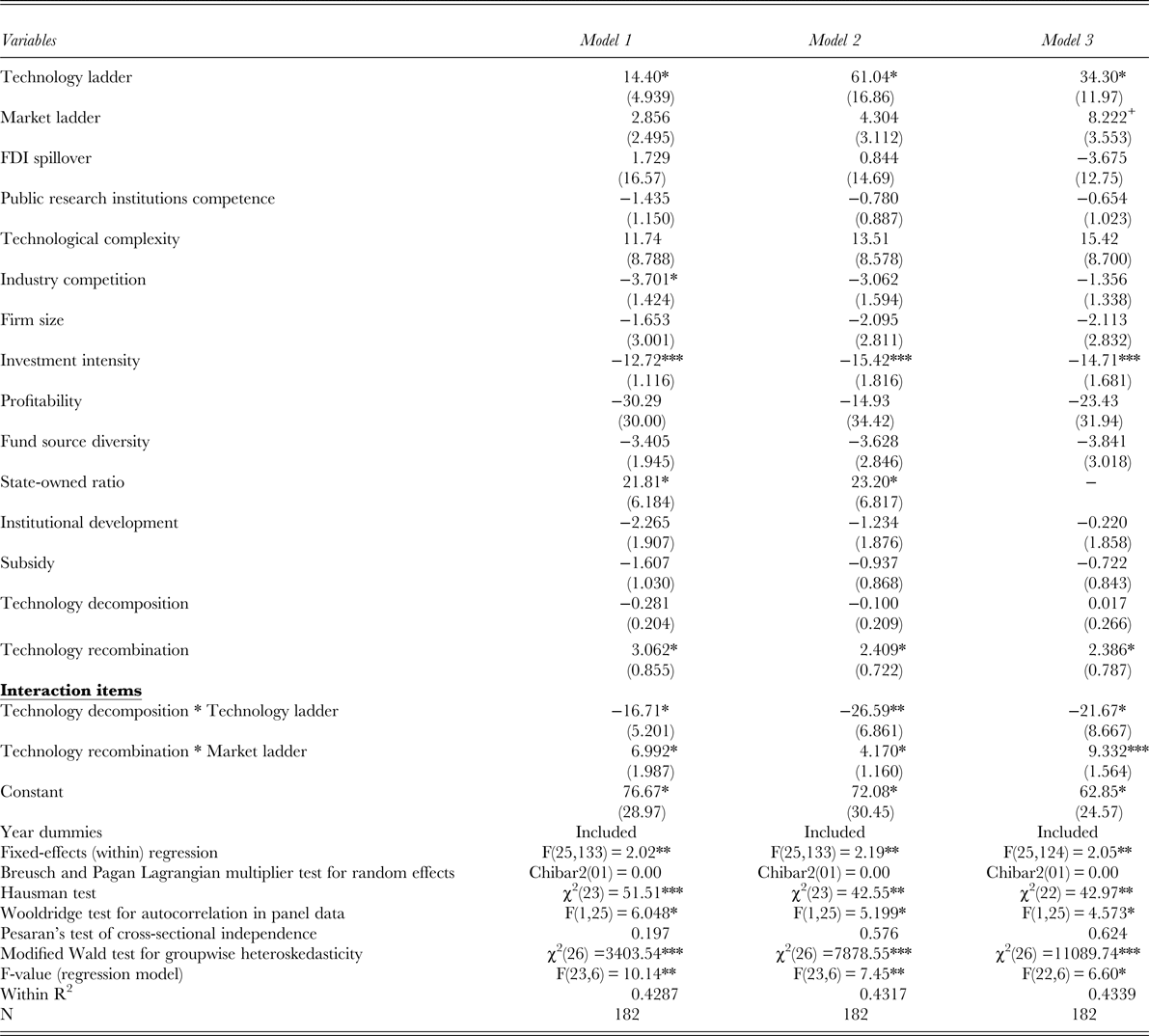

Table 3 reports the regression results. Model 2 includes all variables, excluding two interaction terms, and Models 3 and 4 add one interaction separately. The results indicate that technology recombination has a positive and significant effect on catch-up performance (β = 2.65, p = 0.02, in Model 5), but the direct effect of technology decomposition is not statistically significant. Thus, Hypothesis 2 is supported, while Hypothesis 1 is not. In terms of effect size, holding all other factors constant, a 1% increase in technology recombination increases catch-up performance by 1.85%.

Table 3. Regression models

Notes: The t-statistics based on Driscoll-Kraay standard errors in parentheses. + p < 0.1, * p < 0.05, ** p < 0.01, *** p < 0.001. The preferred model by the test statistics: Fixed-effects regression models. For the fixed effects estimates: within R2. Here, only the results of FE regressions are reported due to limited space.

Regarding the interaction effects, the interaction of technology recombination and the market ladder is positive and significant (β = 8.48, p = 0.00, in Model 5), while the interaction of technology decomposition and the technology ladder is negative and significant (β = -24.64, p = 0.02, in Model 5). Hence, Hypotheses 3 and 4 receive support. In terms of effect size, holding all others at their means, when the technology ladder is at the high level (i.e., the mean plus one standard deviation), a 1% increase in technology decomposition decreases catch-up performance by 0.73%. However, when the technology ladder is at a low level (i.e., the mean minus one standard deviation), a 1% increase in technology decomposition increases catch-up performance by 0.74%. When the market ladder is set at the low level (i.e., the mean minus one standard deviation) and the high level (i.e., the mean plus one standard deviation), a 1% increase in technology recombination increases catch-up performance by 1.57% and 3.82%, respectively.

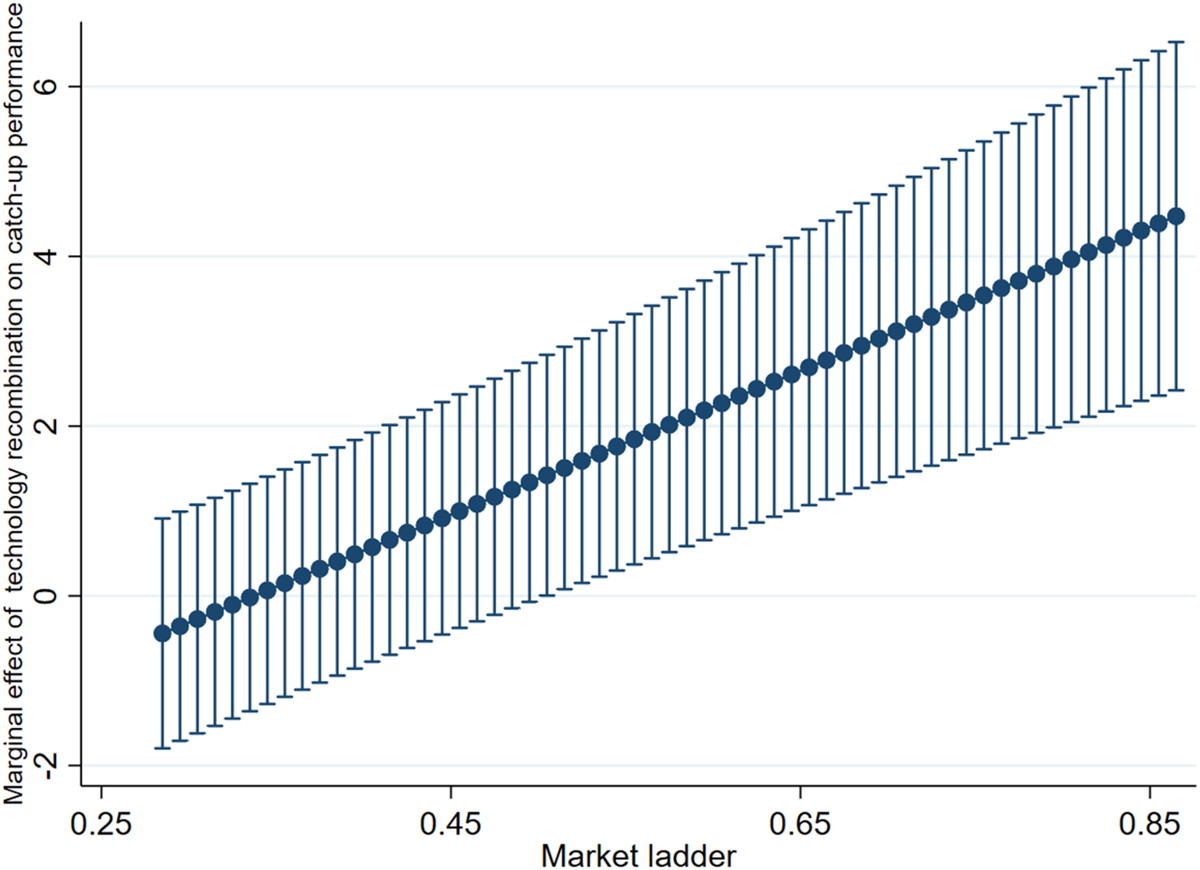

To better understand the moderation results, we plotted the moderation effects following Meyer, van Witteloostuijn, and Beugelsdijk (Reference Meyer, van Witteloostuijn and Beugelsdijk2017). Figure 1 (Figure 2) gives the 95% confidence interval for the moderating effect, which shows the marginal effect of technology decomposition (technology recombination) on catch-up performance for the full range values of the technology ladder (market ladder). Figure 1 shows that although the average moderating effect is significantly negative in the regression model, there is a middle range (approximately from 0.754 to 0.807) for the technology ladder for which the effect is insignificant, and the effect of technology decomposition on catch-up performance is positive for low values of the technology ladder and negative for high values of the technology ladder. Figure 2 illustrates that the positive moderating effect, i.e., the marginal effect of technology recombination on catch-up performance, is significant only after the value of the market ladder is approximately 0.508.

Figure 1. The marginal effect of technology decomposition on catch-up performance (technology ladder as a moderator).

Figure 2. The marginal effect of technology recombination on catch-up performance (market ladder as a moderator).

Robustness Tests

We ran a set of robustness tests. Their estimates all showed that our results are robust when using a variety of alternative measurements of the key variables (i.e., technology ladder and market ladder) in the estimating equation (Model 1 and 2 of Table 4) and when the state-owned ratio was deleted because of its highly correlated relationship with institutional development (Model 3 of Table 4). As discussed in the Variable Measurements section, we adopted alternative measurements of the technology ladder and market ladder. First, the range (i.e., [5th percentile, 95th percentile]) of firm-level data used in calculating the technology or market ladder can be widened to increase the sample size by deleting fewer outliers. In Model 1 of Table 4, the technology ladder and market ladder were calculated with the firm-level data included in the range [1st percentile, 99th percentile]. Second, the market ladder was calculated with the average of the market ladder values based on two separate subsamples (firm groups with different measurement units) in one industry, and the corresponding robustness test results are reported in Model 2 of Table 4.

Table 4. Robustness tests

Notes: The t-statistics based on Driscoll-Kraay standard errors in parentheses. + p < 0.1, * p < 0.05, ** p < 0.01, *** p < 0.001. The preferred model by the test statistics: Fixed-effects regression models. For the fixed effects estimates: within R2. Here, only the results of FE regressions are reported due to limited space. In Model 1, the technology ladder and market ladder were calculated with the data in the range [1st percentile, 99th percentile]. In Model 2, the market ladder was calculated with the average of the market ladder values based on two separate subsamples (firm groups with different measurement units) in one industry. In Model 3, the state-owned ratio was deleted because of its highly correlated relationship with institutional development.

DISCUSSION

In this study, we examined how technological learning (in terms of technology decomposition and technology recombination) and catch-up context (in terms of the market ladder and technology ladder) jointly determine industrial catch-up performance. With industry-level data on a sample of Chinese manufacturing industries, we find that technology recombination increases industry-level catch-up performance, while the empirical results do not confirm the existence of a direct effect of technology decomposition on industry-level catch-up performance. Moreover, we find that continuity in the market ladder strengthens the positive influence of technology recombination on industry-level catch-up performance, while continuity in the technology ladder weakens the positive influence of technology decomposition on industry-level catch-up performance.

This study contributes to the literature on latecomer technological learning in the following aspects. First, few analytical frameworks explore how latecomers absorb acquired external knowledge and create new knowledge to achieve industrial catch-up (Figueiredo & Cohen, Reference Figueiredo and Cohen2019). Latecomers are normally dislocated from the technological frontier, and they must implement unique technological learning mechanisms to build their own capabilities (Chung & Lee, Reference Chung and Lee2015; Figueiredo, Reference Figueiredo2003; Figueiredo & Cohen, Reference Figueiredo and Cohen2019). This study divides technological learning into two mechanisms, technology decomposition and technology recombination, as derived from the absorptive capacity perspective, to explain how technological learning processes lead to cross-industry variation in industry-level catch-up performance. Despite the potential catch-up opportunities offered by advanced foreign technologies, latecomers still face a large technology gap in the technology ladder, and technology decomposition may help mitigate this gap and accelerate the assimilation of external knowledge by dividing external technologies into knowledge subsets. In addition, technology recombination helps latecomers conduct architectural innovation to capture the demand characteristics of diverse domestic market segments in large emerging economies and balance products’ cost–quality ratio (Thun, Reference Thun2018), achieve competitive advantage, and sustain technological catch-up through continuously profiting from localized innovations (Guo & Chen, Reference Guo and Chen2013). The empirical results indicate that technology recombination has a significantly positive relationship with industry-level catch-up performance. The results are in line with previous research that emphasizes how technological learning processes facilitate catch-up in latecomers (Figueiredo, Reference Figueiredo2003; Figueiredo & Cohen, Reference Figueiredo and Cohen2019), and the results offer further insight into direct assessments of learning-related mechanisms constituting absorptive capacity (Lewin et al., Reference Lewin, Massini and Peeters2011). However, the proposed relationship between technology decomposition and industry-level catch-up performance is not significant. A possible explanation is that the decomposed knowledge may not be used or may be stored for later use (rather than used immediately) due to a lack of markets or complementary technologies (Garud & Nayyar, Reference Garud and Nayyar1994). In this regard, technology decomposition may not necessarily influence the next year's industry-level catch-up performance. In addition, technology decomposition may frustrate latecomers to some degree when conducting domestic innovation. As stated, technology decomposition is likely to lower the learning threshold for latecomers to assimilate the acquired knowledge. When technology decomposition is at a high level, even latecomers with weak technological capability may be reluctant to pursue production and process innovation internally. Consequently, technology decomposition may not significantly affect industry-level catch-up performance in large emerging economies.

Second, our study confirms that both the technology ladder and market ladder play important contingent roles in shaping the relationship between technological learning and industry-level catch-up performance. Unlike previous catch-up studies that mainly emphasize the role of generic characteristics of the catch-up context for developing countries (e.g., technology gap, technology life cycle, and technology complexity and uncertainty) (Park et al., Reference Park, Li and Tse2006; Wang et al., Reference Wang, Roijakkers and Vanhaverbeke2014), we purposely focus on the structural featured traits of catch-up contexts in large emerging economies (i.e., the technology ladder and market ladder). The technology ladder indicates the extent to which latecomers can leverage technological opportunities and resources, thereby reducing the technology gap (Brandt & Thun, Reference Brandt and Thun2016; Jefferson & Rawski, Reference Jefferson and Rawski1994; Thun, Reference Thun2018); the market ladder enables latecomers to effectively satisfy diverse market demands and further facilitate the upgrading process (Brandt & Thun, Reference Brandt and Thun2016; Wei et al., Reference Wei, Wang and Liu2018). This study captures a better understanding of the unique characteristics of catch-up contexts, which reflect the structural nature of the technology level and the quality/price level at the industry level in large emerging economies. Such findings can help better understand the catch-up context differences between large emerging economies and other emerging countries.

Third, the present study empirically validates how the interactions between technology decomposition, technology recombination, and catch-up context affect industry-level catch-up performance. The existing literature has paid significant attention to the direct effects of both technological learning and catch-up contexts on catch-up performance. However, less empirical validation has been made concerning the interactive effects of technological learning and the catch-up context on industrial catch-up performance. The technology ladder and market ladder, as unique features of the catch-up contexts in large emerging economies, signify the extent to which technological and market opportunities and resources can be leveraged at the industry level, and recent studies have demonstrated that industry-level catch-up performance depends on the interactions between technological learning processes and available opportunities and resources (Figueiredo & Cohen, Reference Figueiredo and Cohen2019; Jung & Lee, Reference Jung and Lee2010). To advance this line of inquiry, the empirical evidence from our study reveals that technological decomposition, technology recombination, and catch-up context jointly and distinctively affect industry-level catch-up performance. Specifically, a substitute effect is found between technology decomposition and the technology ladder, while a complementary effect is found between technology recombination and the market ladder. The results extend the work of Figueiredo and Cohen (Reference Figueiredo and Cohen2019) and Lee and Lim (Reference Lee and Lim2001) and provide a new research angle for us to understand the inter-industry differences in catch-up performance in the context of large emerging economies.

Our findings provide new insights for policymakers in large emerging economies. First, policymakers must understand the positive effects of technological recombination on industry-level catch-up performance. Industrial policies should be made to improve domestic technological capabilities and to encourage latecomers to be more open and collaborative for innovation; this would further enable latecomers to recombine knowledge from diverse sources into commercial products with localized innovations. Second, policymakers should identify the level of continuity in the technology ladder and market ladder of a given industry and carry out relevant policy initiatives to facilitate appropriate technological learning processes to improve catch-up performance. Specifically, an industry with a high market ladder level should conduct more technology recombination, whereas an industry with a low technology ladder level should carry out more technology decomposition. Third, this study's findings demonstrate the importance of market ladder continuity in improving catch-up performance. A demand-side policy, such as public procurement, should be given more attention during industrial policymaking. By doing so, a more continuous market segment structure can be formulated for latecomers in a given industry.

Several limitations also exist in this study. First, this study used industry-level Chinese manufacturing industries as the research sample. Although China is a typical large emerging economy, future studies are needed to examine whether the findings in this study can be generalized to broader contexts (e.g., Brazil and India). Second, given that this study purposefully focuses on industry-level analysis, further research based on case studies and regional-level or firm-level empirical studies (when conditions permit) can explore whether similar, identical, or different results might be found. Researching antecedents of catch-up performance at different levels will definitely garner new insights into Chinese manufacturing industries. Third, we did not directly observe and thus measure technology decomposition and technology recombination based on firm-level data. Instead, we used archival data regarding the input or output highly related to these technology learning activities as proxy measurements. Future studies could comprehensively measure technology decomposition and technology recombination using available microlevel data. Finally, additional research would shed more light on catch-up theory by investigating whether institutional contexts change the moderating effect of the technology ladder and market ladder on the relationship between technology decomposition, technology recombination, and industrial catch-up performance in large emerging economies.

APPENDIX I Summary of Key Studies on Concepts Related to Technology Decomposition and Technology Recombination