1 Introduction

There are many decisions in life that people may not be able to make with full confidence. These decisions often involve difficult trade-offs among conflicting objectives, such as price vs. quality when buying goods, risk vs. return when investing, and efficiency vs. equality when making policy decisions. As more studies suggest that decision confidence has the potential to explain a wide range of behavioral anomalies, there is growing interest in eliciting and accounting for decision confidence when studying people’s choices.Footnote 1

Past studies so far have mostly relied on non-incentivized self-reports to elicit decision confidence. For example, some studies (Cohen et al., Reference Cohen, Jaffray and Said1987; Dubourg et al., Reference Dubourg, Jones-Lee and Loomes1994, Reference Dubourg, Jones-Lee and Loomes1997; Cubitt et al., Reference Cubitt, Navarro-Martinez and Starmer2015) allowed subjects to indicate whether they were unsure of their choices. Butler and Loomes (Reference Butler and Loomes2007, Reference Butler and Loomes2011) had subjects indicate their decision confidence using the ordinal terms “definitely” and “probably.” More quantitatively, Enke and Graeber (Reference Enke and Graeber2021, Reference Enke and Graeber2023) had subjects rate how certain (from 0% to 100% in increments of 5%) they were that their actual valuation of an option was within the interval obtained from the choices they made earlier in a price list.

While asking people explicitly about how confident they are about their decisions directly elicits decision confidence, incentivized behavioral measures that elicit decision confidence without referring to confidence may encourage people to contemplate their decisions carefully and thereby reduce behavioral biases such as priming effects and experimenter demand effects (Camerer and Hogarth, Reference Camerer and Hogarth1999). Yet, finding behavioral measures of decision confidence “in a form simple and transparent enough to work without creating additional uncertainty” is not trivial (Butler and Loomes, Reference Butler and Loomes2011, p. 516).

Building on earlier studies, we propose to use the randomization probability assigned to an option in a choice pair as a behavioral measure of decision confidence, and test its validity in two experiments. For each pair of options (a lottery x and a sure payment y), we obtained subjects’ binary choice, self-reported decision confidence, and randomization probabilities. Self-reported decision confidence was elicited by having subjects select a confidence statement from “Surely x,” “Probably x,” “Unsure,” “Probably y,” “Surely y,” after they chose an option and by having them report how confident they were in choosing either options as a probabilistic confidence of p% x and 100-p% y, where p ranged from 0 to 40 and 60 to 100 in increments of 10. Separately, subjects chose a randomization probability

![]() with which they would receive x (and with probability

with which they would receive x (and with probability

![]() receive y) for each pair of options (Miao and Zhong, Reference Miao and Zhong2018; Agranov and Ortoleva, Reference Agranov and Ortoleva2023; Feldman and Rehbeck, Reference Feldman and Rehbeck2022; Ong and Qiu, Reference Ong and Qiu2023). Unlike the two self-reported confidence measures, the elicitation of randomization probabilities made no reference to decision confidence.

receive y) for each pair of options (Miao and Zhong, Reference Miao and Zhong2018; Agranov and Ortoleva, Reference Agranov and Ortoleva2023; Feldman and Rehbeck, Reference Feldman and Rehbeck2022; Ong and Qiu, Reference Ong and Qiu2023). Unlike the two self-reported confidence measures, the elicitation of randomization probabilities made no reference to decision confidence.

We exogenously manipulated decision confidence by a) having a simple lottery with two outcomes and a complex lottery with the same expected value but with more payoff outcomes over a wider range of possible values (Fudenberg and Puri, Reference Fudenberg and Puri2021), and by b) increasing subjects’ experience with the lottery by allowing them to either observe the outcome draws of the lottery or to make hypothetical choices and observe the payoffs of their choices and the counterfactual (Myagkov and Plott, Reference Myagkov and Plott1997; Plott and Zeiler, Reference Plott and Zeiler2005; van de Kuilen and Wakker, Reference van de Kuilen and Wakker2006; van de Kuilen, Reference van de Kuilen2009).

To ensure that experimenter demand effects and order effects were not driving our results, in one of our experiments, we elicited the three measures separately over three sessions (at least seven days apart). Subjects were randomly assigned to one of the three decision orders, which differed by whether the confidence statements, the probabilistic confidence, or the randomization probabilities were elicited in the first session.

We structure the analyses of our experiments through two theoretical frameworks, one based on Klibanoff et al. (Reference Klibanoff, Marinacci and Mukerji2005) and Cerreia-Vioglio et al. (Reference Cerreia-Vioglio, Dillenberger and Ortoleva2015) and the other based on Fudenberg et al. (Reference Fudenberg, Iijima and Strzalecki2015). We illustrate how randomization emerges from the optimization behavior of an individual who faces uncertainty regarding her preference between the two options. Based on our expectations that randomization probabilities serve as a good proxy for decision confidence, and that complexity increases preference uncertainty while experience decreases it, we have four hypotheses. First, randomization probabilities correlate positively with both self-reported measures; second, subjects choose randomization probabilities around 0.5 for choice pairs in which the sure payment has a similar decision utility as the lottery (and one does not dominate the other); third, subjects randomize over a wider range of sure payments and choose randomization probabilities closer to 0.5 for the complex lottery than for the simple lottery; finally, subjects randomize over a smaller range of sure payments and choose randomization probabilities further away from 0.5 in the experience treatments.

Our experimental results support all four hypotheses. Subjects’ randomization probabilities were strongly and positively correlated with both confidence statements and probabilistic confidence (median Spearman correlation between 0.86 to 0.89). In line with our expectations, the two exogenous manipulations affected self-reported decision confidence. Increasing the complexity of the lottery led to a decrease in self-reported decision confidence, while increasing experience with lotteries led to an increase in self-reported decision confidence. These exogenous changes in self-reported decision confidence were met with corresponding changes in randomization probabilities: subjects randomized over a larger range of sure payments and the randomization probabilities were closer to 0.5 for the complex lottery than for the simple lottery, while the opposite occurred when subjects had more experience. As a result, the correlations between randomization probabilities and self-reported decision confidence measures were robust to the exogenous manipulations of decision confidence.

Our study builds on the growing literature on preferences for randomization, implying preference functionals that are convex with respect to probabilistic mixing, which is a violation of the betweenness axiom (Chew, Reference Chew1983; Dekel, Reference Dekel1986; Chew, Reference Chew1989). Preferences for randomization have been documented over wide ranges, across different domains, in experimental settings as well as in real life decisions. In a multiple-decision setting, Rubinstein (Reference Rubinstein2002) suggested that randomization (diversification in his term) by choosing differently across five independent and identical decisions is “an expression of a more general phenomenon in which people tend to diversify their choices when they face a sequence of similar decision problems and are uncertain about the right action” (Rubinstein, Reference Rubinstein2002, p. 1370). Dwenger et al. (Reference Dwenger, Kübler and Weizsäcker2018) found that their experimental subjects preferred to randomize via an external randomization device rather than making choices themselves, and the authors reported similar behavior among German university applicants. Miao and Zhong (Reference Miao and Zhong2018) showed that randomization could be used to balance ex-ante and ex-post social preferences. Feldman and Rehbeck (Reference Feldman and Rehbeck2022) elicited individuals’ attitudes toward reduced mixtures over two lotteries in the space of three-outcome lotteries (the Marschak-Machina triangle) and found pervasive evidence of a preference for non-degenerate mixing over lotteries. The studies closest to ours are Agranov and Ortoleva (Reference Agranov and Ortoleva2023) and Ong and Qiu (Reference Ong and Qiu2023), who also allowed subjects to choose randomization probabilities when deciding between two options. Both studies found that subjects often randomized and did so over large ranges. Ong and Qiu (Reference Ong and Qiu2023) further found that subjects were willing to pay to randomize, suggesting that randomization was deliberate and not merely a result of indifference. Popular explanations for convex preferences include hedging in the face of preference uncertainty (Cerreia-Vioglio et al., Reference Cerreia-Vioglio, Dillenberger and Ortoleva2015; Fudenberg et al., Reference Fudenberg, Iijima and Strzalecki2015; Cerreia-Vioglio et al., Reference Cerreia-Vioglio, Dillenberger, Ortoleva and Riella2019), non-linear probability weighting (Kahneman and Tversky, Reference Kahneman and Tversky1979; Quiggin, Reference Quiggin1982; Tversky and Kahneman, Reference Tversky and Kahneman1992), and responsibility aversion (Dwenger et al., Reference Dwenger, Kübler and Weizsäcker2014). Our study is the first to provide experimental evidence linking preference uncertainty and randomization behavior.Footnote 2

We also contribute to the literature on stochastic choice, which examines why individuals change their decisions when they face the same decision situation repeatedly. The relationship we found between randomization probabilities and sure payments bears a remarkable resemblance to results reported in studies on stochastic choice, for example, Mosteller and Nogee (Reference Mosteller and Nogee1951, Fig. 2) and Loomes and Pogrebna (Reference Loomes and Pogrebna2017, Table 1).Footnote 3 The similarity between the choice proportion in repeated choices and the randomization probability in a one-shot decision suggests that decision confidence may have the potential to explain stochastic choices. Consistent with this interpretation, we find that, across subjects and decisions, higher decision confidence in an option corresponded to choosing that option more frequently (but not always) in binary choices. Meanwhile, random (expected) utility models (see, e.g., Eliashberg and Hauser, Reference Eliashberg and Hauser1985; Loomes and Sugden, Reference Loomes and Sugden1995; Gul and Pesendorfer, Reference Gul and Pesendorfer2006; Apesteguia and Ballester, Reference Apesteguia and Ballester2018), which are the standard explanations for stochastic choices, do not predict randomization in a one-shot decision as observed in our experiment. This is because, while individuals may be considered to have a set of utility functions in this literature, at the moment of decision-making, they rely on one utility function randomly realized from the set.

Overall, our study provides direct evidence to the connections between some important concepts in the literature, such as decision confidence, cognitive uncertainty, preference uncertainty/imprecision, incomplete preference, preference for randomization, and stochastic choice. While there have been notable theoretical advancements and accumulating empirical evidence in this field, the precise interplay and relationships between these concepts as well as how they are connected to choices remain ambiguous. Our finding of a systematic relationship between the randomization, alternative measures of decision confidence, and stochastic choice suggests that there may exist a common psychological underpinning for these various concepts.

The rest of the paper proceeds as follows. Section 2 describes the experimental procedure. Section 3 provides the theoretical basis for how randomization probabilities may be linked to decision confidence. The results are reported in Sect. 4. Finally, Sect. 5 concludes the paper.

2 Experimental design

We had two experiments. We first describe the general structure of the experiments before detailing the differences.

2.1 General structure of the experiments

In each decision, subjects faced a pair of options: a lottery x and a sure payment y. The lottery was paired with 13 values of sure payments (0, 2, 3, 3.5, 4, 4.5, 5, 5.5, 6, 6.5, 7, 8, and 10 euros). For each type of decisions that we will describe below, subjects faced these pairs in a random sequence. Each decision was made on a separate screen, and subjects were not allowed to review or change their decisions once they were made. Each subject made three types of decisions: binary choices, self-reported decision confidence, and randomized choices.

2.1.1 Binary choices

The binary choices required subjects to choose either x or y. If x was chosen, the computer would draw a random number to determine x’s outcome. For example, for x that has a 50% chance of paying 9 euro and a 50% chance of paying 1 euro, if the randomly drawn number falls between 1 and 50, the subject would receive 1 euro, and if the randomly drawn number falls between 51 and 100, the subject would receive 9 euros.

2.1.2 Two measures of self-reported decision confidence

After making the binary choices, we asked subjects how confident they felt about their choices. The confidence statements they could choose were “Surely x,” “Probably x,” “Unsure,” “Probably y,” or “Surely y.” Similar statements were used in Dubourg et al. (Reference Dubourg, Jones-Lee and Loomes1994), Butler and Loomes (Reference Butler and Loomes2007), and Butler and Loomes (Reference Butler and Loomes2011). Confidence statements were not incentivized and could not affect payoffs.

In addition to the confidence statements, subjects in Experiment 2 also had to report their probabilistic confidence in a separate experimental decision. Instead of making a direct binary choice, subjects had to choose how confident they felt about choosing x versus y. They had to choose between ten levels of probabilistic confidence: “100% x, 0% y,” “90% x, 10% y,” ... “60% x, 40% y,” “40% x, 60% y,” ..., “0% x, 100% y.” Subjects were considered to have chosen the option for which they indicated more than 50% probabilistic confidence. For example, if a subject chose “60% x, 40% y,” she was considered to have chosen x over y in that decision. To use the probabilistic confidence as a measure of decision confidence as well as an indicator of a subject’s choice between x and y, we omitted the option “50% x, 50% y”.

Fig. 1 An example of the randomized choice decision screen, where option x is a lottery with a 50% chance of gaining 9 euro and a 50% chance of gaining 1 euro. Option y is a sure payment and varies across choices

2.1.3 Randomized choices

The randomized choices required subjects to choose a randomization probability

![]() , based on which they would receive x (and hence with a probability

, based on which they would receive x (and hence with a probability

![]() of receiving y). For example, choosing

of receiving y). For example, choosing

![]() means the subject would receive x with a chance of 40% and y with a chance of 60%. The subjects used a slider from 0% to 100% with increments of 1% to choose the randomization probability in each choice. In experiment 1, the slider was set in the middle at the start. To reduce anchoring bias, in experiment 2, the slider had no initial position, and subjects needed to click on the slider and move the bar to determine the randomization probability. If the randomized choice was chosen for payment, the computer would draw a random number between 1 and 100. If the drawn number was between 1 and

means the subject would receive x with a chance of 40% and y with a chance of 60%. The subjects used a slider from 0% to 100% with increments of 1% to choose the randomization probability in each choice. In experiment 1, the slider was set in the middle at the start. To reduce anchoring bias, in experiment 2, the slider had no initial position, and subjects needed to click on the slider and move the bar to determine the randomization probability. If the randomized choice was chosen for payment, the computer would draw a random number between 1 and 100. If the drawn number was between 1 and

![]() , x would be chosen over y in that decision. If x was chosen for payment, a second random draw determined the outcome of the lottery. Figure 1 shows the decision screen for the randomized choice. To ensure that subjects understand the payoff structure of randomized choices, we provided two examples as well as reminders in the lower part of the decision screens on how randomized choices affect payment (see Figs. C.4 and C.5 in Appendix C).

, x would be chosen over y in that decision. If x was chosen for payment, a second random draw determined the outcome of the lottery. Figure 1 shows the decision screen for the randomized choice. To ensure that subjects understand the payoff structure of randomized choices, we provided two examples as well as reminders in the lower part of the decision screens on how randomized choices affect payment (see Figs. C.4 and C.5 in Appendix C).

2.2 Manipulating decision confidence

In the baseline treatment, the subjects faced a simple lottery with two outcomes (a 50% chance of 9 euro and a 50% chance of 1 euro). They received a complete description of the lottery before making their decisions.

2.2.1 Varying the complexity of the lottery

We manipulated, within subject, the complexity of the lottery by asking all subjects to make decisions involving a complex lottery with four outcomes in addition to decisions involving the simple lottery. The complex lottery has the same expected value as the simple lottery. It offers 9.75 euros with a chance of 20%, 7.50 euros with a chance of 30%, 2.50 euros with a chance of 30%, and 0.25 euros with a chance of 20%. The order of the lotteries was randomized at individual subject level: some subjects proceeded from the simple lottery to the complex lottery, while others completed the decisions in the reverse order.Footnote 4

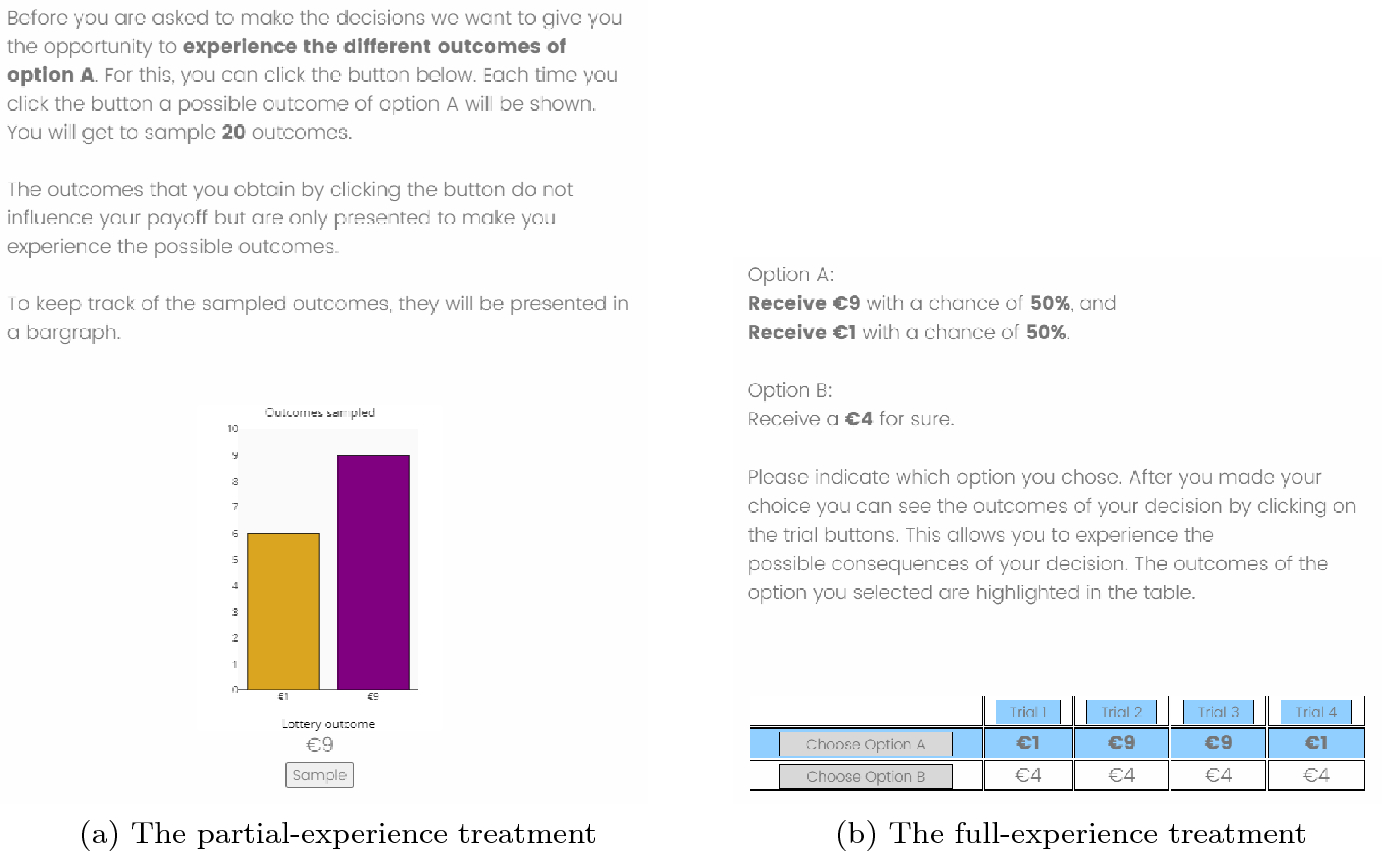

Fig. 2 Panel a illustrates what subjects in the partial-experience treatment saw when they generated the outcomes of the lottery. Panel b illustrates what subjects saw in the full-experience treatment. The numbers highlighted in blue in the table show a subject’s hypothetical decision and her four potential payoffs, and the not highlighted numbers show the counterfactuals

2.2.2 Varying subjects’ experience with the lottery

For this manipulation, we adopted a between-subject design, where subjects were randomly assigned to either the baseline treatment or the experience treatment. In Experiment 1, after learning the probability distribution of the lottery and prior to making actual decisions, subjects in the partial-experience treatment had to click and view 20 draws of the lottery. As the subjects viewed each lottery draw, an accompanying bar chart which recorded each lottery outcome was updated. By the 20th draw, the bar chart reflected the probability distribution of the lottery. Figure 2a shows an example of the partial-experience treatment.

In Experiment 2, subjects in the full-experience treatment had to make five hypothetical decisions per lottery, with each decision involving a different sure payment (3, 4, 5, 6 or 7 euros in a random sequence). For each decision, they observed four potential realizations of the payoff of their choice as well as the counterfactual in a payoff table. Figure 2b shows the decision screen and the payoff table viewed by a subject who chose the lottery over the sure payment of 4 euros in the hypothetical decision.

2.3 Design considerations

A few design features deserve some discussion. First, our within-subject design of eliciting self-reported confidence measures and randomization probabilities for each subject raises the concern that experimenter demand effects or order effects may unintentionally influence subjects to give similar responses, resulting in a systematic relationship between them. We took several measures in Experiment 2 to make it more obscure and costly for subjects to connect self-reported confidence measures and randomization probabilities (Zizzo, Reference Zizzo2010), such as spreading the decisions over three sessions (at least seven days apart), including a cost for randomizing, and randomly assigning subjects to one of the three different orders. The key features of the two experiments are summarized in Figure 3.

Second, varying the complexity of the lottery could induce changes in behavior through channels other than decision confidence. For example, subjects may valuate the two lotteries differently, as found in studies documenting complexity seeking and complexity averse behaviors (see e.g. Abdellaoui et al., Reference Abdellaoui, Li, Wakker and Wu2020, and the references therein). This difference is less relevant for our purpose because our focus is on decision confidence (e.g., the range of sure payments that subjects do not have full confidence) rather than the average valuation of the lotteries. Another concern is that varying the complexity of the lottery induces different randomization behavior. While this may occur in some non-EUT models (Machina, Reference Machina1985; Kahneman and Tversky, Reference Kahneman and Tversky1979; Tversky and Kahneman, Reference Tversky and Kahneman1992; Quiggin, Reference Quiggin1982), they do not predict a close relationship between randomization probability and self-reported decision confidence, or how this relationship changes with the complexity of the lottery. We will return to this point in subsection 4.4 to discuss other interpretations of randomization probabilities that could predict different randomization behavior between the two lotteries.

Fig. 3 Summary of the treatments and experimental procedure in Experiment 1 and 2. The dotted rectangle highlights the types of decisions that subjects in each experiment made for both lotteries. The sequence of the simple lottery and the complex lottery in each type of decision was randomized at individual subject level

A final concern is the choice of the experience treatments. The description-experience gap literature suggests that description and experience may induce different risk preferences (see e.g., Hertwig et al., Reference Hertwig, Barron, Weber and Erev2004; Wulff et al., Reference Wulff, Mergenthaler-Canseco and Hertwig2018), which could reduce decision confidence. Our partial experience design is unlikely to have this issue because subjects’ experience of the lottery realizations were equivalent to its description. Recent studies by Aydogan and Gao (Reference Aydogan and Gao2020) and Cubitt et al. (Reference Cubitt, Kopsacheilis and Starmer2022) show that the description-experience gap should be small in this case. Examining more closely, our experience treatments differ from the standard design in the Description-Experience gap literature as we provided subjects with the full description of the lottery’s probability distribution in addition to the opportunity to experience the realizations of the lottery. In this sense, our experience treatments are closer to studies showing that experience in addition to a full description of the lottery could help subjects develop a better understanding about their preference (e.g., van de Kuilen and Wakker, Reference van de Kuilen and Wakker2006; van de Kuilen, Reference van de Kuilen2009).

2.4 Sample and procedure

The data were collected from a sample of 498 subjects of the ID lab at Radboud University. A total of 205 subjects participated in Experiment 1 and 293 in Experiment 2. Invitations were sent in batches via ORSEE (Greiner, Reference Greiner2015). The experiment was conducted using Qualtrics and lasted approximately 20 min for Experiment 1 and about 30 min in total for Experiment 2. In Experiment 2, subjects were also asked to answer a post-experiment questionnaire at the end of each of the three sessions based on the type of decision confidence they reported in that session. Appendix C contains the experimental instructions and decision screens. Each subject received a participation fee of 1 euro and an additional payment based on one of the decisions they made in the experiment. In Experiment 1, the additional monetary compensation was based on a decision randomly selected from their binary choices or randomized choices. In Experiment 2, it was based on a decision randomly selected from their binary choices, randomized choices, or probabilistic confidence decisions. The average additional payment was 6.28 euros. We made the payment via bank transfers.

3 Theoretical analysis

Under expected utility theory (EUT) which ignores decision confidence and assumes that a unique utility function (subject to positive affine transformation) captures an individual’s preference, it is straightforward to show that the individual chooses

![]() for at most one value of the sure payment in the 13 choice pairs. Thus, under EUT, strict randomization (

for at most one value of the sure payment in the 13 choice pairs. Thus, under EUT, strict randomization (

![]() ) rarely occurs, and randomization probabilities do not contain additional information beyond indifference.

) rarely occurs, and randomization probabilities do not contain additional information beyond indifference.

We present two theoretical analyses of our experiments that provide an explicit link between randomization probabilities and decision confidence. Both analyses assume that the individual is uncertain about her preference. Appendix A.1 presents a theoretical framework based on Klibanoff et al. (Reference Klibanoff, Marinacci and Mukerji2005) and Cerreia-Vioglio et al. (Reference Cerreia-Vioglio, Dillenberger and Ortoleva2015). In this framework, the individual has multiple utility functions that we call multiple selves. She is not fully confident about her choice when some selves prefer one option while others prefer the other. In such instances, the individual prefers randomization over selecting a particular option because it offers a ”fair” way to resolve internal conflicts among her different selves. This approach of capturing the lack of decision confidence from unsureness about preferences is closely related but is different from models of ambiguity (e.g., Gilboa and Schmeidler, Reference Gilboa and Schmeidler1989; Klibanoff et al., Reference Klibanoff, Marinacci and Mukerji2005), which focus on unsureness about beliefs (e.g., Halevy, Reference Halevy2007; Chew et al., Reference Chew, Miao and Zhong2017; Cubitt et al., Reference Cubitt, van de Kuilen and Mukerji2020, and the references therein).

Appendix A.2 presents the extension of Fudenberg et al.’s (Reference Fudenberg, Iijima and Strzalecki2015) model. Fudenberg et al. (Reference Fudenberg, Iijima and Strzalecki2015) axiomatized a choice rule of deliberate randomization called additive perturbed utility (APU). Their representation corresponds to a form of ambiguity-averse preferences for an individual who is uncertain about her true utility function. The individual randomizes to balance the probability of errors due to preference uncertainty against the cost of avoiding them (Fudenberg et al., Reference Fudenberg, Iijima and Strzalecki2015, p. 2373).

Both analyses suggest that the preference for randomization is motivated by the hedging of preference uncertainty. In particular, randomization probabilities are affected by the perceived preference uncertainty of the options, attitudes towards preference uncertainty, as well as the utility difference between the options. The two theoretical analyses suggest that our proposed link between randomization probabilities and decision confidence could hold under a broad class of decision models that incorporate preference uncertainty.

We expect that subjects perceive more preference uncertainty with the complex lottery than with the simple lottery, and experience with the lottery reduces preference uncertainty regarding the lottery. With these expectations, our theoretical analyses show that randomization probabilities share three important properties of decision confidence: a) subjects choose randomization probabilities close to 0.5 when the sure payment has a similar decision utility to the lottery; b) they randomize over a wider range of sure payments, with randomization probabilities closer to 0.5, when they face the complex lottery compared to the simple lottery; and c) with experience and less preference uncertainty about the lottery, subjects’ randomization probabilities may be stretched away from 0.5 as they randomize over a smaller range of sure payments. If randomization probabilities and the two self-report measures both capture decision confidence, we expect the following:

Hypotheses

1. Randomization probabilities are positively correlated with the self-reported confidence measures.

2. When two choice options are more similar, for example, around the switching choices where subjects switch between the lottery and the sure payment, the subjects have lower decision confidence, a higher likelihood of randomizing, and randomization probabilities closer to 0.5.

3. Compared to the decisions about the simple lottery, the decisions about the complex lottery exhibit lower decision confidence, as measured by the self-reported confidence measures, and randomization probabilities are affected in the same direction, maintaining a strong association between them.

4. Compared to the decisions in the no-experience treatment, the decisions in the experience treatments exhibit higher decision confidence, as measured by the self-reported confidence measures, and randomization probabilities are affected in the same direction, maintaining a strong association between them.

4 Experimental results

We report the results in two steps. We begin by showing the systematic link between randomization probabilities and the two measures of self-reported confidence in the baseline no-experience treatment for decisions about the simple lottery (Hypotheses 1 and 2). We then show that decision confidence responded to our treatment manipulations in the expected direction by comparing the two measures of self-reported decision confidence across treatments. We demonstrate that exogenous shifts in self-reported decision confidence are paired with corresponding shifts in randomization probabilities, maintaining their systematic link (hypotheses 3 and 4). We pool subjects in different orders in our main analyses and discuss order effects in subsection 4.3.

4.1 Randomization probabilities and self-reported confidence

Below, we report two empirical observations that are consistent with Hypothesis 1 and 2.

Result 1

In the baseline no-experience-simple-lottery treatment, randomization probabilities were significantly and positively correlated with confidence statements and probabilistic confidence among the large majority of subjects. Further, on average, randomization probabilities corresponded to probabilistic confidence in absolute levels.

Fig. 4 a Cumulative distributions of subjects’ Spearman correlations between randomization probabilities and confidence statements or probabilistic confidence in the baseline no-experience treatment for decisions about the simple lottery. E1 and E2 refer to data from Experiment 1 and 2 respectively. b Scatter plot of randomization probabilities, with the mean randomization probability (in solid line) at each probabilistic confidence level in Experiment 2 in the baseline no-experience treatment for decisions about the simple lottery. The dashed line is a 45-degree line

To obtain the correlation between randomization probabilities and confidence statements, we transformed the confidence statements to a scale of 1 to 5, with “Surely y” taking the value of 1 and “Surely x” taking the value of 5 to represent one’s decision confidence in choosing x. We computed for each subject the nonparametric Spearman correlation between confidence statements and randomization probabilities in Experiment 1 and 2, and between probabilistic confidence and randomization probabilities in Experiment 2. The results for the baseline treatment are illustrated in Figure 4, Panel (a). Table B.1 in Appendix B summarizes the cross-measure correlations across treatments. Consistent with Hypothesis 1, confidence statements and randomization probabilities have a high and positive correlation. Moderate to strong correlations of 0.60 in Experiment 1 and 0.71 in Experiment 2 were found at the 10th percentile level, which increased to 0.91 in Experiment 1 and 0.89 in Experiment 2 at the median level. Since the subjects in Experiment 2 reported confidence statements and randomization probabilities in different sessions separated by at least seven days and in different orders, the similarities between the correlations found in Experiments 1 and 2 suggest that confidence statements and randomization probabilities are associated in ways beyond experimenter demand effects and order effects. In Experiment 2, we also found high correlation between self-reported probabilistic confidence and randomization probabilities: the correlation is 0.73 at the 10th percentile and 0.90 at the median.

As correlations do not describe the correspondence between randomization probabilities and self-reported decision confidence in absolute levels, we also computed the mean randomization probability at each level of probabilistic confidence for each subject and took the mean across subjects. This is shown in Panel (b) of Fig. 4. Overall, the mean randomization probability for x is close to the probabilistic confidence of choosing x: subjects who chose a randomization probability of, for example, 0.7 would report probabilistic confidence of 70% on average. Examining the absolute correspondence between randomization probabilities and confidence statements gives a similar result, as summarized in Fig. B.1 and Table B.2 in Appendix B. These results suggest randomization probabilities can be used as a direct proxy for probabilistic confidence.

Next, we turn to Hypothesis 2 and examine the randomization probabilities around the switching choices. Intuitively, x and y are harder to compare around the switching choices. Reflecting this, subjects reported lower decision confidence and chose randomization probabilities close to 0.5 around the switching choices, as indicated in Result Footnote 2.

Result 2

On average, the subjects reported lower decision confidence around the switching choices based on the self-reported confidence measures and were more likely to randomize and chose randomization probabilities close to 0.5 around the switching choices.

We study the switching choice of each subject by considering two levels of sure payments:

![]() and

and

![]() . We let

. We let

![]() denote the highest sure payment at and below which the subject always preferred x over y, and

denote the highest sure payment at and below which the subject always preferred x over y, and

![]() denote the lowest sure payment amount at and above which the subject always chose y over x in the binary choices. We henceforth refer to the values of y between

denote the lowest sure payment amount at and above which the subject always chose y over x in the binary choices. We henceforth refer to the values of y between

![]() and

and

![]() as the subject’s switching range. This approach allows us to accommodate subjects who switched once as well as those who switched multiple times between lottery x and the sure payments (for the simple and complex lotteries, respectively, 19% and 25% in Experiment 1 and 14% and 23% in Experiment 2).Footnote 5

as the subject’s switching range. This approach allows us to accommodate subjects who switched once as well as those who switched multiple times between lottery x and the sure payments (for the simple and complex lotteries, respectively, 19% and 25% in Experiment 1 and 14% and 23% in Experiment 2).Footnote 5

As expected, decision confidence was lower within the switching range than outside it. In Experiment 2 (Experiment 1), 88% (85%) of the confidence statements within the switching range were “Probably x,” “Unsure,” or “Probably y,” compared to 41% (40%) outside the switching range. In Experiment 2, “60% x, 40% y” and “40% x, 60% y” were selected for 53% of the values within the switching range, compared to 13% outside the switching range. Table 1 shows the median randomization probabilities, probabilistic confidence, and confidence statements around the switching range. The median responses to the self-reported confidence measures indicate a lack of confidence around the switching range.

The randomization probabilities within the switching range resemble the two self-reported confidence measures. In Experiment 2 (Experiment 1), 67% (85%) of randomization probabilities reported for values of y within the switching range fell between 0.1 and 0.9, whereas this only holds for 33% (47%) outside the switching range. Further, in Experiment 2 (Experiment 1), the subjects assigned a median randomization probability of 0.65 (0.67) to x at

![]() , and a median randomization probability of 0.45 (0.46) to x at

, and a median randomization probability of 0.45 (0.46) to x at

![]() . The median randomization probability for all the choices that fell within the switching range is 0.5. These results are consistent with Hypothesis 2: subjects were more likely to choose randomization probabilities close to 0.5 for choices that they found difficult to compare.

. The median randomization probability for all the choices that fell within the switching range is 0.5. These results are consistent with Hypothesis 2: subjects were more likely to choose randomization probabilities close to 0.5 for choices that they found difficult to compare.

Table 1 Median behavior around the switching choices in the baseline no-experience treatment for decisions about the simple lottery

|

Median behavior around the switching range |

||||||

|---|---|---|---|---|---|---|

|

Experiment |

Confidence statements |

Probabilistic confidence |

Randomization probabilities |

|||

|

|

|

|

|

|

|

|

|

Experiment 1 (

|

Probably x |

Probably y |

– |

– |

0.67 |

0.46 |

|

Experiment 2 (

|

Probably x |

Probably y |

60% x |

40% x |

0.65 |

0.45 |

4.2 Manipulating decision confidence

In this section, we examine whether our exogenous manipulations of the decision situation affected self-reported decision confidence in the expected direction and whether randomization probabilities were affected in similar ways to maintain a systematic relationship with the self-reported confidence measures.

4.2.1 The complex lottery versus the simple lottery

Consistent with Hypothesis 3, we find that subjects had lower decision confidence when making decisions about the complex lottery compared to the simple lottery. Result Footnote 3 summarizes our finding.

Result 3

Compared to decisions about the simple lottery, the subjects revealed less than full decision confidence over a wider range of sure payments for decisions about the complex lottery, and their reported decision confidence were more compressed toward “Unsure” or (50% x, 50% y). Likewise, the subjects randomized over a wider range of sure payments and chose randomization probabilities closer to 0.5 for decisions about the complex lottery.

We find that the range of sure payments over which the subjects chose confidence statements “Unsure” or “Probably” is larger for decisions about the complex lottery than for decisions about the simple lottery in both Experiment 1 and 2, and it is statistically significant in Experiment 2 (Experiment 1: 3.62 vs 3.36, Wilcoxon signed-rank test

![]() ; Experiment 2: 3.58 vs 3.15, Wilcoxon signed-rank test

; Experiment 2: 3.58 vs 3.15, Wilcoxon signed-rank test

![]() ). Comparing the range of sure payments for which subjects did not indicate probabilistic confidence of (100% x, 0% y) or (0% x, 100% y) gives similar results: the subjects were not fully confident over a wider range of sure payments for decisions about the complex lottery than decisions about the simple lottery (4.63 vs. 4.37, Wilcoxon signed-rank test

). Comparing the range of sure payments for which subjects did not indicate probabilistic confidence of (100% x, 0% y) or (0% x, 100% y) gives similar results: the subjects were not fully confident over a wider range of sure payments for decisions about the complex lottery than decisions about the simple lottery (4.63 vs. 4.37, Wilcoxon signed-rank test

![]() ).

).

Panel (a) and Panel (b) of Fig. 5 illustrate how confidence statements and probabilistic confidence varied with different sure payment amounts across the two lotteries in Experiment 2. Compared to the simple lottery, self-reported decision confidence measures were more compressed towards “Unsure” or (50% x, 50% y) when the subjects faced the complex lottery. The difference in decision confidence across the two lotteries is statistically significant between sure payments of 5 and 8 euros, and is less often statistically significant for lower sure payment amounts. The results for Experiment 1 are similar, albeit weaker, and can be found in Fig. B.2 of Appendix B.

Fig. 5 The mean self-reported decision confidence and randomization probabilities for each value of y for the simple lottery (solid line) and complex lottery (dashed line). Wilcoxon signed-rank tests were performed to test the treatment difference for each value of y: *

![]() , **

, **

![]() , ***

, ***

![]()

We proceed to examine the randomization probabilities chosen for each lottery. As we can see from Table B.3 in Appendix B, in both experiments, the range of sure payments over which subjects chose a randomization probability between 0.1 and 0.9 was significantly larger for decisions about the complex lottery than for decisions about the simple lottery (Experiment 1: 4.06 vs. 3.63, Wilcoxon signed-rank test

![]() ; Experiment 2: 3.19 vs. 3.03, Wilcoxon signed-rank test

; Experiment 2: 3.19 vs. 3.03, Wilcoxon signed-rank test

![]() ). This is consistent with the findings from self-reported decision confidence reported above.

). This is consistent with the findings from self-reported decision confidence reported above.

Further, the randomization probabilities were also more compressed towards 0.5 when the subjects faced the complex lottery compared to the simple lottery, as shown in Panel (c) of Fig. 5. The difference in randomization probabilities across the two lotteries is statistically significant between sure payments of 5 and 7 euros, coinciding with the range obtained from probabilistic confidence. Panel (c) of Figure 5 also shows asymmetric treatment effects on randomization probabilities for sure payments above 5 euros and sure payments below 5 euros. We show in Appendix A.3 that this asymmetric treatment effect can be consistent with the theoretical analysis when the treatment manipulation affects both preference uncertainty and the average valuation of the lotteries.

Despite our manipulation, the correlations between the two decision confidence measures and randomization probabilities remain similar. Comparing decisions about the simple lottery with those about the complex lottery, the median correlations between randomization probabilities and confidence statements are 0.86 versus 0.82 in Experiment 1 and 0.89 versus 0.88 in Experiment 2. The median correlations between randomization probabilities and probabilistic confidence are 0.90 versus 0.89 in Experiment 2. More results can be found in Table B.1, B.2, and B.4 in Appendix B.

4.2.2 Experience and no experience

Hypothesis 4 states that, compared to the baseline no-experience treatment, gaining experience with the lotteries increases decision confidence. The results about Hypothesis 4 are summarized in Result Footnote 4.

Result 4

Decisions in the partial-experience treatment and decisions about the simple lottery in the full-experience treatment did not exhibit significant treatment effects. Comparing decisions about the complex lottery in the full-experience treatment and the no-experience treatment, the subjects (1) revealed less than full decision confidence over a narrower range of sure payments, and their self-reported decision confidence were stretched further away from “Unsure” or (50% x, 50% y); and (2) they randomized over a narrower range of sure payments and chose randomization probabilities further away from 0.5.

We report the results about the partial-experience treatment and the simple lottery in Figs. B.3, B.4, and Table B.5 in Appendix B, and report the comparison between the full-experience treatment and the no-experience treatment about the complex lottery here. We find that the range of sure payments over which subjects reported confidence statements of “Probably” or “Unsure” is significantly narrower (3.16 vs. 3.58, Wilcoxon rank-sum test

![]() ). The range of sure payments over which subjects chose probabilistic confidence between 0.1 and 0.9 did not differ significantly between the full-experience treatment and the no-experience treatment (4.58 vs. 4.63, Wilcoxon rank-sum test

). The range of sure payments over which subjects chose probabilistic confidence between 0.1 and 0.9 did not differ significantly between the full-experience treatment and the no-experience treatment (4.58 vs. 4.63, Wilcoxon rank-sum test

![]() ).

).

Panels (a) and (b) of Fig. 6 show how self-reported decision confidence differs between the full-experience and the no-experience treatment. Compared to the no-experience treatment, self-reported decision confidence was stretched further away from “Unsure” or (50% x, 50% y) for the subjects in the full-experience treatment and these differences in decision confidence were significantly different for sure payments between 2 and 4.5 euros. This implies that the subjects in the full-experience treatment were more confident about which option they preferred than subjects in the no-experience treatment.

Fig. 6 The mean self-reported decision confidence and randomization probabilities for each value of y for the complex lottery in Experiment 2. The graphs show the baseline no-experience treatment (solid line) compared to the full-experience treatment (dashed line). Wilcoxon rank-sum tests were performed to test the treatment difference for each value of y: *

![]() , **

, **

![]() , ***

, ***

![]()

Next, we examine these treatment effects on randomization probabilities. Like decision confidence, we find that the range of sure payments over which subjects chose randomization probabilities between 0.1 and 0.9 was significantly narrower in the full-experience treatment than in the no-experience treatment for decisions about the complex lottery (2.67 vs. 3.19, Wilcoxon rank-sum test

![]() ). Panel (c) of Fig. 6 shows that the difference in mean randomization probabilities across sure payments between the full-experience treatment and the no-experience treatment resembles that shown in Panel (a) and Panel (b). Compared to the no-experience treatment, randomization probabilities were also stretched further away from 0.5 among the subjects in the full-experience treatment. Significant differences in the randomization probabilities between subjects in the full-experience treatment and the no-experience treatment were also observed between 2 euros to 4.5 euros. Asymmetric treatment effects on randomization probabilities could also be observed here for sure payments above 5 compared to those below 5, which we discuss further in the theoretical models in Appendix A.3.

). Panel (c) of Fig. 6 shows that the difference in mean randomization probabilities across sure payments between the full-experience treatment and the no-experience treatment resembles that shown in Panel (a) and Panel (b). Compared to the no-experience treatment, randomization probabilities were also stretched further away from 0.5 among the subjects in the full-experience treatment. Significant differences in the randomization probabilities between subjects in the full-experience treatment and the no-experience treatment were also observed between 2 euros to 4.5 euros. Asymmetric treatment effects on randomization probabilities could also be observed here for sure payments above 5 compared to those below 5, which we discuss further in the theoretical models in Appendix A.3.

The increase in decision confidence from subjects’ experience with the lotteries did not affect the high correlation between self-reported decision confidence and randomization probabilities. The median correlation between self-reported decision confidence and randomization probabilities was broadly similar in the two treatments. More details can be found in Table B.1, B.2, and B.4 in Appendix B.

4.3 Order effects

An important concern of the within-subject design is order effects: subjects’ earlier decisions may affect their subsequent decisions. We are especially concerned with the order effects arising from priming: when randomization probabilities were elicited after self-reported confidence measures, subjects could be primed to link randomization probabilities to decision confidence and consequently reported randomization probabilities that cohered with self-reported decision confidence measures. Below we highlight the key findings about order effects and leave the details to Appendix B.1.

We find some order effects, suggesting that priming effects on randomized choices could be present. For example, subjects randomized strictly (

![]() randomization probability

randomization probability

![]() ) in fewer choices when randomized choices were presented first (Order 2) compared to later (Order 1 and 3) in all treatments: averaging across treatments, 34% in Order 2 compared to 41% and 45% in Order 1 and 3 respectively (see Table B.6 and Fig. B.5 in Appendix B.1 for details). Also, the cumulative distributions of the correlations in Order 2 tend to be lower (on the left of the other two orders), with a larger difference at the lower percentiles and in the complex lottery treatments.

) in fewer choices when randomized choices were presented first (Order 2) compared to later (Order 1 and 3) in all treatments: averaging across treatments, 34% in Order 2 compared to 41% and 45% in Order 1 and 3 respectively (see Table B.6 and Fig. B.5 in Appendix B.1 for details). Also, the cumulative distributions of the correlations in Order 2 tend to be lower (on the left of the other two orders), with a larger difference at the lower percentiles and in the complex lottery treatments.

Despite these differences, we find support for our hypotheses among the subjects in Order 2 where the aforementioned priming effects were absent, although the support is sometimes weaker than in the full sample, possibly due to the reduction of sample size. Figure B.6 in Appendix B.1 shows that across treatments, the median cross-measure correlations in Order 2 are high, consistent with H1. Subjects reported low decision around the switching choices and chose randomization probabilities around 0.5 in these choices, supporting H2 (see Table B.7). Table B.8 suggests that subjects in Order 2 had lower decision confidence in decisions involving the complex lottery compared to the simple lottery, consistent with H3. In Order 2, similar to the other two orders, decisions involving the complex lottery showed higher confidence in the full experience treatment than in the non-experience treatment, consistent with H4, although the treatment effect is not statistically significant in any individual order. This high level of consistency between randomization probabilities and self-reported confidence measures as well as their similar reactions to exogenous change of decision confidence suggest that these measures likely share common psychological foundations, even if not identical.

Finally, it is worth noting that the order effects discussed above do not necessarily suggest that randomization probabilities are a poorer proxy for decision confidence than the self-reported confidence measures. Confidence statements and probabilistic confidence are also noisy proxies of decision confidence, and it is not obvious what the “right” amount of strict randomization is. When we assess the value of decision confidence based on its correspondence with actual choices (when subjects report lower confidence in choosing an option, they should be less likely to choose that option), we find both randomization probabilities and probabilistic confidence corresponded to actual choices. Importantly, randomization probabilities exhibited a closer correspondence to binary choices than probabilistic confidence, especially in Order 2. See Appendix B.1 for more details.

4.4 Alternative interpretations of randomization probabilities

We have interpreted randomization behavior as a lack of decision confidence in the face of preference uncertainty. This is consistent with the findings from our post-experiment questionnaire as well as findings in Agranov and Ortoleva (Reference Agranov and Ortoleva2023) where many subjects explicitly mentioned unsureness, complexity, difficulty, and hedging as reasons for randomization (see Appendix B.3 for details). However, subjects may have other reasons for randomization. While it is not possible to eliminate all alternative interpretations, we show that indifference, random errors, or utility difference alone cannot be the driving force behind subjects’ randomization behavior and the treatment effects.

First, indifference is not the driving reason for randomization because the majority of the subjects randomized at least twice (see Table B.9 in Appendix B.2), while randomization from indifference should occur for at most one value of sure payments. Second, randomization was unlikely a result of random errors because subjects’ randomization probabilities of choosing x decreased monotonically with the value of y, even though they faced a random sequence of y (see e.g., Panel (c) in Fig. 5). Further, the treatment effects on randomization probabilities in the expected directions suggest that subjects’ randomization was likely a deliberate choice. Third, if randomization probabilities were due to utility differences alone, randomization probabilities should increase for each value of sure payments when the utility over the lottery increases (e.g., moving from the simple lottery to the complex lottery or the no-experience treatment to the full-experience treatment), which increases the lower bound and the upper bound of randomization as well. Our results clearly reject these predictions. Randomization probabilities were compressed toward 0.5 rather than increased monotonically, and the two bounds often moved in opposite directions. We elaborate on this in Appendix B.2.

5 Conclusion

We propose that letting individuals assign randomization probabilities according to which they receive options can be an incentivized way to elicit decision confidence. In two experiments, we elicited randomization probabilities as well as two self-reported confidence measures and further manipulated decision confidence exogenously.

We find that most subjects randomized frequently, and their randomization probabilities and self-reported confidence measures were linked in ways that are consistent with the hypotheses derived from two theoretical analyses. While there were some order effects depending on whether randomization probabilities were elicited before or after the self-reported confidence, cross-measure correlations were high, and randomization probabilities corresponded closely to probabilistic confidence in absolute levels, with a high randomization probability assigned to an option associated with high self-reported probabilistic confidence. Our further examination suggests that alternative interpretations of randomization such as indifference, random errors, or differences in utility alone are unlikely to be the driving factors. Overall, our results suggest that decision confidence can be meaningfully and accurately inferred from randomization probabilities.

Supplementary Information

The online version contains supplementary material available at https://doi.org/10.1007/s10683-024-09837-x.

p<0.10

p<0.10 p<0.05

p<0.05 p<0.01

p<0.01

p<0.10

p<0.10 p<0.05

p<0.05 p<0.01

p<0.01