Introduction

The Philippines was characterized as a newly industrialized country due to its “rapid economic growth, dynamic export drives, and prospective industrialization.”Footnote 1 In the past five years, the Philippines was among the fastest-growing economies with its gross domestic product (GDP) averaging within the 6.5 percent growth rate.Footnote 2 One of the bids for achieving the Philippines’ middle income economy status is to develop the country through the Comprehensive National Industrial Strategy that integrates its initial Manufacturing Resurgence Program (MRP) to a more comprehensive approach incorporating stronger linkages with the service and agricultural sectors. The initial key goal of the manufacturing resurgence program is to “enhance the competitiveness of domestic manufacturing industries so they can be integrated in higher value-added, ASEAN-based production networks and global value chains (GVCs)”.Footnote 3

The program objectives sought to build globally competitive industries with strong domestic and international linkages; to address supply chain gaps; and to resolve issues in infrastructure, governance, and regulations that would now cut across all three (industrial, agricultural, and service) sectors.Footnote 4 To achieve its targets, the industrial strategy developed six pillars of action: addressing supply or value chain gaps; expanding the domestic market base; investing in human resource development and skills training; MSME development; investing in innovation or technology, marketing, and promotions; and addressing horizontal issues such as power, shipping, smuggling, and doing business procedures.Footnote 5

The implementation of these economic development plans was halted upon the onslaught of the COVID-19 crisis in 2020 as the Philippines became one of the most affected countries in Southeast Asia by the pandemic. With total cases reaching 511,679 and fatalities totaling 10,190 as of 23 January 2021,Footnote 6 the pandemic brought about a large-scale emergency that overwhelmed the country's health sector and economy. While the healthcare system struggled to cope with the sudden rise of COVID-related cases, the Philippine economy continued to worsen as growth, employment, and overall productivity fell into recession levels as a result of the nationwide lockdown.

As a key driver of the Philippine economy, the private sector shouldered the significant effects of the pandemic and the responsibility to contribute to economic recovery. The private sector was forced to reevaluate the effects of COVID-19 including its threat to business continuity and survival. Corporate strategy pivots became imperative to mitigate the shocks caused by COVID-19 to business industries, partners, stakeholders, and the overall economy. More importantly, coordination and joint efforts with the government on pandemic response were seen as crucial to national recovery.

The article seeks to answer the following questions: How did the private sector view and respond to the implications of the COVID-19 pandemic? What is their assessment of the pandemic effects on the Philippine economy? What strategic pivots were employed by businesses to adjust into the constrained new normal of doing business? To what extent is private-sector participation in the national pandemic response toward economic recovery and growth post-COVID-19?

This article explores the COVID-19 Philippine case from the private sector's perspective and discusses business response to the pandemic. As pandemic response research tends to focus on public sector assessment, this article seeks to contribute to the less exposed but equally important literature on private sector perspectives. Focusing on the economic aspect of the crisis, the article presents the business community's assessment of the pandemic's impact on the economy along with their views on the policies and interventions implemented by government agencies and institutions. It further deals with their observations on the extent of public-private partnerships in stimulating the economy along with their own efforts in addressing challenges to business continuity and job security.

The discussion is framed from a political economic lens examining the pandemic effects on economic and business interests as well as public and private sector dynamics. Literature on political economy and New Institutional Economics consider five theoretical approaches in the study of business and state-business relations. Each theory has its own view of business: (1) as capital, (2) as a sector, (3) as a firm, (4) as a network, and (5) as an association.Footnote 7

The approaches to business as capital, as sector, and as a firm emphasize business influence based on its structural configuration and capacity in facilitating or constraining government policy and economic activity. Viewing business as capital shows how private interests shape government decision making through exerting collective pressure in the policy-making process as well as its investment decisionsFootnote 8 that have underlying implications to economic growth. Scholars point to the gradual integration of financial markets and the rise of global finance as the forces behind freedom from capital mobility constraintsFootnote 9 through state deregulation and economic liberalization especially for developing countries. Business as sector looks at how the economy, divided along sectoral lines, gave rise to sectoral coalitions and interests that shape government policies and plans for economic growth.Footnote 10 Primary debates among scholars using this view revolve around how sectoral interests can lead to collective action and how these interests translate to policy outcomes.Footnote 11 The approach to business as a firm studies firm-level characteristics such as size, multisectoral diversification, financing, and internal organization, including sales and asset growth as factors that affect state-business relations.Footnote 12 Among the various characteristics, financing and diversification are considered as the factors that have the most impact on the economic behavior of firms and carry significant implications on their relations with the government.Footnote 13

The next two theories consider the political organizational aspect of business including the power and influence of business groups to advance business interests. Business as networks see business influence over government decisions as a product of personal relationships and overlapping roles instead of formal institutions and processes. Footnote 14 On one hand, it manifests itself in the form iron triangles and clientelism in states, collusions among politicians and businesses that tend to prioritize particularistic interests over the common good. On the other hand, these informal networks can be utilized as instrumental forms of cooperation to achieve common objectives.Footnote 15 In the business-as-association theory, business groups or associations are seen not only as “institutional vehicles” that articulate and represent business interests in public dialogues with states but also as partners in fostering improvements in economic performance.Footnote 16 While economic development theorists have an adverse view of business associations’ potential behavior such as rent-seeking and state capture, there is growing evidence of businesses pursuing distributive objectives and mutually beneficial outcomes with states that lead to economic growth.Footnote 17

Private sector pandemic response and strategies in this article were examined using the theoretical perspective of business as association. Business groups have a long-standing history of being present in Philippine politics. From financing and supporting electoral candidates to being consulted on political and economic matters, business associations enjoy formal and informal ties with government institutions. Furthermore, business associations actively participate in policy and regulatory dialogues not only concerning corporate governance but also in discussing the national economy and trade policies. These organizations also spearhead initiatives with economic, social, and environmental impact. Business groups have also been vocal about their position and have been very active in efforts to counter the effects of the COVID-19 crisis.

However, in the context of the pandemic, businesses and business associations faced common and unique challenges in dealing with the effects of the health-economic crisis as well as fragile relations with the Duterte administration. In the course of the discussion, private-sector assessment on the economic impacts of COVID-19 will be taken from the viewpoint of business associations. This is followed by the strategic pivots and initiatives employed by businesses to mitigate the shocks caused by the pandemic to their industries, stakeholders, and the economy as well as their collective paradigmatic shift in doing business and cultivating state-business relations in the midst and after the pandemic. The last part of the article tackles their perspectives on the national pandemic response spearheaded by the government and the extent of their partnership and participation in the ongoing efforts.

Key informant interviews were conducted among fifteen corporate board directors and executives belonging to four top Philippine business organizations: Management Association of the Philippines, Makati Business Club, Institute of Corporate Directors, and Philippine Chamber of Commerce and Industry. Table 1 shows the list of interviewees who were selected based on two criteria. The first qualification concerns the business organization to which they belong. Interviewees were sourced from highly influential business organizations that had the following characteristics: (1) widespread membership covering directors and executives from publicly listed companies to private corporations and micro, small, and medium enterprises (MSMEs); (2) their organization's level of influence in policy making as regular participants in dialogues and consultations involving the Philippine legislature, national government agencies such as the Department of Trade and Industry and National Economic Development Authority, and regulators such as the Securities and Exchange Commission and Bangko Sentral ng Pilipinas (BSP); and (3) the diversity of sectors represented. The second criterion involves the profile and expertise of the key informants that serve as indicators of their knowledge and experience on the topics.

Table 1: Respondent profiles.

The data culled from the interviews are supplemented by discussions of other business group leaders and subject-matter experts in business conferences held in 2020. Apart from discussions on the socioeconomic implications of COVID-19 and state-business relations in the context of pandemic response, a thematic discussion of corporate strategy pivots employed by different companies are featured in countering pandemic effects as well as the changing mindset in doing business toward economic recovery and growth post-COVID-19.

The Philippine economy amidst COVID-19

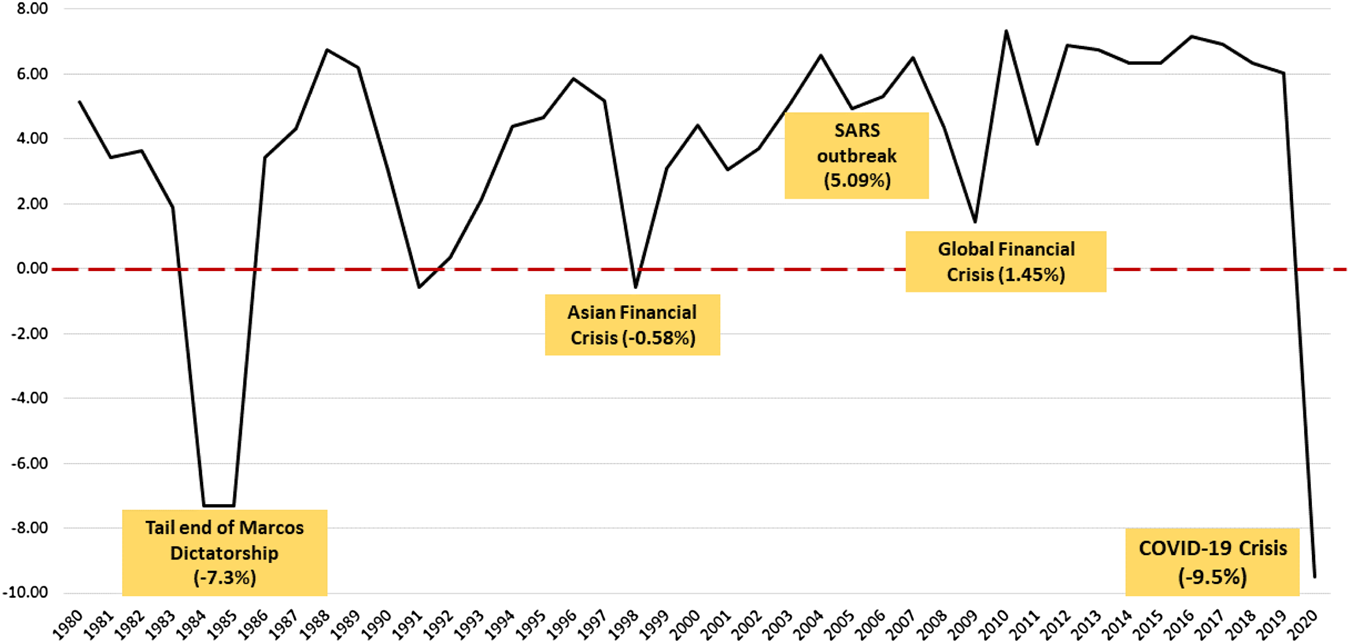

The COVID-19 pandemic brought major disruptions to the Philippine economy rivaling previous crises over the last four decades (figure 1). Compared to previous contractions in GDP, the economic damage from the pandemic surpassed plunges resulting from financial meltdown, disease outbreak, and political instability. As the country was put under lockdown, the recessionary effects were felt through a massive slump in household consumption, a drastic decrease in annual variations of export and investment growth as opposed to the five-year average before COVID-19 struck, and high unemployment rates. In terms of GDP, the Philippines ended up with a 9.5 percent annual contraction for 2020, the lowest recorded since the beginning of economic data collection for the country in 1947.Footnote 18

Figure 1. Philippine GDP year-on-year growth rates (1980–Q2 2020).Footnote 19

Table 2: Engines of growth pre-COVID-19 and the pandemic effects on the Philippine economy.Footnote 20

The economy, as observed by the corporate executive respondents, became largely driven by anxiety and fear. The uncertainty that came with it has resulted in changing patterns of consumer behavior further validated by a significant decline in the household final consumption expenditure for 2020. Consumer optimism in the Philippines dropped to 42 percent in Q3 and Q4 2020 from 57 percent in March before the nationwide lockdown took effect.Footnote 21

From being a consumption-driven economy where people continuously spend on products and services in establishments like malls, the Filipino consumer in the middle of the pandemic would rather stay at home and conserve cash for fear of emergency and other unforeseen expenses. People no longer go to malls for leisure, rather for specific and targeted needs. They also value proximity, safety, and convenience that makes local or community marts with safety measures more appealing.Footnote 22

The Philippines has also suffered decline in engines of growth linked to the global economy such as exports and investments. Disruptions in global trade, supply, and value chains especially affected Philippine exports of agricultural produce, fisheries products, and manufacturing goods. Weakened merchandise exports were down 50.8 percent equivalent to $2.8 billion in April 2020 from $5.6 billion the previous year.Footnote 23 The decline in sales of exports were attributed to year-on-year drops in shipments of seven major export commodities reflective of disruptions in global supply chains and weakened activities in consumption and domestic investment.Footnote 24

Yet despite the BSP's report of a decrease in investment annual percentage variation for 2020, one of the sources of relief came from the country's unchanging credit rating even at the height of the COVID-crisis. Philippine investment grades remained affirmed by three major credit rating agencies with Fitch at BBB, Moody's at Baa2, and S&P at BBB+ rating at Q4 2020 all with a stable outlook.

The business community was largely affected across various sectors with arts and entertainment, tourism, and transportation having the most business closures in a World Bank survey conducted last July 2020 (figure 2). Only 5 percent remained fully open while 40 percent were partially in operation among the 74,031 surveyed firms. The rest have yet to reopen (40 percent) or were permanently closed (15 percent). To avert further business closures, one of the remedies is to increase loans made available to the private sector. However, not all members of the private sector had the capability to avail of those options—small businesses encounter higher hurdles in terms of applying for loans and overall business continuity.

Figure 2. Business operations and top ten affected sectors.Footnote 25

Micro, small, and medium enterprises figure significantly into assessing the impact of the COVID-19 crisis on Philippine businesses and the economy.Footnote 26 MSMEs comprise 99.5 percent of all registered businesses and establishments in the country employing 62.4 percent of the labor force equivalent to 5.5 million generated jobs.Footnote 27 Burdened with limitations in capital funding, cash reserves, credit lines, and even the lack of business continuity plans, small businesses had the lowest survival rates with 70.6 percent temporary closures reported in a study conducted by ADB.Footnote 28

A significant hindrance to small business's survival, recovery, and growth is their lack of access to financing and lack of knowledge in dealing with banks. Given the weak credit and guarantee system in the country, MSMEs experience difficulties in complying with bank lending requirements. The credit share for MSMEs from the total bank credit allocation has been declining to less than 10 percent since 2013.Footnote 29 The decline can be attributed to the growing number of lenders that prefer to just pay for the penalty rather than take the risk associated to lending to small businesses.Footnote 30 Banks started offering more flexible loan opportunities to MSMEs amidst the pandemic, taking a cue from the monetary policies issued by the central bank.

Small business owners, however, were not inclined to avail of the offered loan opportunities due to the inherent constraints and scale of operations. The lockdown took a toll on monthly income that led to cashflow problems. As people were prohibited from going out and directly buying from establishments, their customer base was drastically reduced. The MSME's lack of access to international markets and supply chains also posed a problem as those inside the country were also initially disrupted. Without a concrete and sound business continuity plan, MSMEs are left with no other choice but to either temporarily or permanently close their businesses.Footnote 31

COVID-19 brought a domino effect affecting labor and social indicators. Unemployment rates were at a 17.6 percent all-time high in April 2020 equivalent to 7.2 million jobless Filipinos but eased into 10.3 percent or 4.5 million by the end of 2020.Footnote 32 In addition, the latest SWS survey conducted in September 2020 resulted in a 30.7 percent hunger rate, which is an estimated 7.6 million households that experienced involuntary hunger in the middle of the pandemic.Footnote 33

Private sector assessment: Opportunities and risks

Based on their assessment of the economy and consumer behavior, the private sector identified opportunities to stimulate the economy.Footnote 34 Digital transformation has become a necessity. E-governance portals must be created for government transactions and applications, including the implementation of the national ID system and the registration or renewal of business permits and licenses online. Platforms involving digital payments and transactions for e-commerce also need to be developed and reinforced to withstand the volume of daily transactions. Lastly, the demand for logistics and delivery services has increased with the rise of e-commerce as well as opportunities for local or community retail establishments promising safe and convenient access to products and services.Footnote 35

The continuous flow of information about COVID-19 has been helpful in increasing the awareness as well as easing fears and doubt among Filipinos. The availability and access to digital platforms and online payments boosted consumer spending. These together with the consistent enforcement of safety protocols became the starting point in regaining consumer confidence and spurring economic activity.

While the pandemic brought several opportunities that would steer the economy toward recovery, it also exposed structural risks and vulnerabilities.Footnote 36 A critical issue faced by the private sector is the liquidity problem of enterprises as this could branch out to other problems such as unemployment due to organizational downsizing and supply chain disruption owing to business closures. Another identified risk is the growing digital divide as portions of the population are deprived of access to electronic devices, accounts, and platforms used for digital transactions. Privacy and security risks posed another concern as more personal data are being collected to register and avail of products and services online. With recurring account registrations, fund transfers, and mobile payments come the increasing risk of cybersecurity breaches and crimes. Eventually, as pandemic response primarily revolved around healthcare services of COVID cases, the amassed volume of toxic and nontoxic wastes also signifies potential environmental repercussions.

Pivots in corporate strategy

As the private sector conducted initiatives on pandemic response to restart the economy, companies concurrently launched efforts to adjust to the “new normal.” COVID-19 disrupted business models, operations, supply chains, and other business activities that threatened cashflows and the very existence and continuity of firms. Thus companies from different industries implemented corresponding pivots in corporate strategy to mitigate the risks and ensure business recovery in a post-COVID-19 context.

Based on the interviews with the corporate executives and directors from various industries, the strategic pivots and adjustments to the new setup were done piecemeal and were driven by necessity.Footnote 37 As such, shared experiences across different firms were collated and thematically presented as strategic pivots employed. This section features experiences of firms belonging to the following sectors: retail and e-commerce, banking and finance, food and beverage, logistics, and construction.

Widespread digital transformation

Digitalization efforts in the middle of the pandemic permeated across the different areas of running businesses from upgrading their internal operations suitable for remote work, to developing the necessary infrastructure for fast-paced, convenient, and secure transactions, and to establishing systems for seamless delivery of products and services. Hence within less than a year, the Philippines saw the emergence of digital platforms, remote work arrangements, and the implementation of stricter cybersecurity measures and protocols.

One of the most significant milestones of this accelerated digital transformation is the rise of e-payments and electronic transactions. For several years, financial inclusion in the Philippines has been low with around 52.8 million or 77.4 percent of Filipino adults still do not have bank accounts as of 2017.Footnote 38 From the introduction of the national retail payments to the country in 2017, the volume and value of electronic fund transfer services PESOnet and InstaPay have at least tripled between March to October 2020 at the height of the pandemic. PESONet volume has ballooned to 4.8 million with a total value of ₱292.8 billion in November 2020 compared to a little more than a million and ₱125.4 billion in November 2019.Footnote 39 InstaPay volume grew 5.5 times to more than 26 million with a total value of ₱144.4 billion in November 2020 compared to 4.8 million with a total value of ₱34 billion last 2019.Footnote 40 At this rate, bankers observed that the pandemic accelerated their projection of reduced ATM transactions by two to three years.

While there are still hurdles to be overcome such as the Filipinos’ lack of access to smartphones and delayed full integration of payment and other transactional features in digital banking, the banking and finance industry saw more opportunities for financial inclusion as more Filipinos became adept at using their platforms. In addition, the burgeoning spirit of entrepreneurship from the public who began venturing into businesses of their own and selling products across social media platforms greatly contributed to the rise of digital payments and transactions to popularity. This would further aid MSMEs that no longer have to bear the costs of renting spaces in establishments and instead use their income for their business development and daily sustenance.

The year 2020 was also the banner year for e-commerce as platforms like Lazada heavily benefitted from the lockdown period when people resorted to online shopping. Lazada Philippines reported that transaction volumes grew twice across monthly transactions compared to 2019. Lazada also noted that the platform recorded more than twice the total of daily sales compared to the pre-COVID period. Lazada responded to the crisis primarily by pivoting the platform to cater to evolving customer needs. The e-commerce platform prioritized selling essential goods such as the launch of fresh and frozen goods along with other product essentials such as stocks of hand sanitizers, alcohol, and face masks. It immediately ramped up its efforts of onboarding new sellers and brands while helping other existing sellers who got affected by the crisis to bounce back. Lazada also enhanced its customer experience features by making the platform more interactive through games, livestream programs, and other promotional activities.

Construction solutions giant Holcim Philippines also embraced the digital revolution by applying it to their system operations. One initiative the company started is to develop an online portal for its different projects. Another initiative that was launched involves the company's health and safety audit conducted online with only a few inspectors onsite while streaming a video documentation to other team members through video conferencing tools such as Zoom or Google Meet aided by other applications to ensure the reliability of their data. These innovations that were initially designed to navigate the constraints of site visits and other areas of operations will usher in new practices that will build into the future of construction.

While companies are transitioning to digital operations, privacy and cybersecurity experts are pushing for the inclusion of cybersecurity considerations in their corporate strategies. IBM Philippines reported that there are more than 8.5 million records compromised in 2019 globally, which is double than the previous year. There was also a 2000 percent increase in operational technology targeting incidents with successful data breaches costing an average of $3.85 million in the Southeast Asia up by 8.2 percent from 2018.Footnote 41 The National Privacy Commission urged firms to embed privacy into their organizational and digital design. A proactive and preventive approach to cybersecurity done by securing all systems as early as their development phase ensures full life-cycle protection for the system as well as the users who will be entrusting their personal information as part of the transactions.

As more and more companies are undergoing digital transformation, the Philippines is also projected to shift into a digital economy.Footnote 42 A digital economy would significantly facilitate economic recovery and growth while maintaining health and safety measures through streamlined processes, remote transactions, and off-site service or contactless delivery. Granted that it would take massive investments into building the infrastructure and capabilities to support the volume of transactions across different platforms, a 67 percent internet penetration rate and 73 million internet users in the Philippines further builds the case for this transition.Footnote 43

Repurposing and shifts in distribution channels

As COVID-19 introduced new product demands, other firms repurposed existing equipment and raw materials to manufacture essential products that would prevent the spread of the virus. The EMS group, an electronics company, repurposed its facilities into producing medical grade face masks for general sales and distribution. The country's major liquor producers—Ginebra San Miguel Inc., Alliance Global Group Inc., Asia Brewery Inc., and Tanduay Distillers Inc.—also dedicated a portion of their facilities to continuously supply rubbing alcohol to boost the production of sanitary solutions.

Agricultural and food industries also encountered logistical challenges of delivering their perishable products to consumers because of enforced quarantine protocols preventing regular shipments of produce and onsite dining in restaurants. This prompted a change in distribution channels. Shakey's Philippines and Jollibee are among the fast food restaurants that repackaged their landmark products in ready-to-cook sets to be sold in supermarkets as adjustment measures to temporary branch closures and to hedge against a huge drop in sales. With restaurants closed, supermarkets and the food supply chains disrupted, farm-to-table models have also been on the rise as food suppliers from the agricultural sector started cutting through the middlemen and directly delivering produce to customers. Other produce suppliers also turned to e-commerce platforms to aid in sales and promotions. Zupafresh, a vegetables and fruits supplier in Metro Manila entered Lazada and experienced a 3.2× increase in sales versus its pre-COVID figures in February 2020.

Logistics companies such as Ninja Van began innovating its delivery process to expand across new services that would navigate through the constraints of the current operating conditions. Ninja Van Philippines observed the emergence of demands coming from MSMEs. To help small businesses in sourcing their materials and other needs, Ninja Van served as a bridge connecting them to regional suppliers in Southeast Asia. The logistics company also offered business solutions customized for clients such as e-commerce entrepreneurs and began elevating their operations and delivery safety protocols such as contactless delivery.

As trade in the Philippines took a hit from the pandemic causing supply chain disruptions, businesses have been turning inward to cater to domestic demand and to source materials from local suppliers. This called for further adjustments in operations and distribution. Through the combined use of digital platforms and logistics company partnerships, businesses were slowly able to adjust and close the supply chain gaps.

Future-proofing talent

With the fast-paced transitioning of companies to a digital landscape, the demand for a flexible workforce that can cope with technological processes is becoming greater. Companies are now moving toward a work-from-home setup requiring employees to be familiar with different tools, software, and applications to carry out tasks with the same efficiency as in an office setup. As the nature and process of work is currently evolving, the members of the workforce must engage in the necessary upskilling to meet the demands of their work—to future-proof talent.Footnote 44

The factors governing this process include the socioeconomic forces and industry dynamics that shape the business landscape and corporate objectives and indicate the direction of business. These, in turn, influence individual characteristics from one's traits and attitudes to one's learning preferences and career choices. Human resources thus comes to the fore in preparing human capital through the following technology and employee-centric strategies:

1. Integrating technology in the workforce;

2. Enhancing employee experience;

3. Building an agile and personalized learning culture;

4. Establishing metrics for valuing human capital;

5. Embedding diversity and inclusion; and

6. Honing skills for the digital age.

Apart from the domestic labor force, the Philippine economy benefits from the remittances sent by overseas Filipino workers (OFWs) averaging a 9.5 percent share of the GDP from 2017 to 2019. Since the start of the pandemic, more than 400,000 OFWs were repatriated without any assurance of getting another contract or reemployment once they are permitted to travel back, the Department of Trade and Industry thus urged repatriated OFWs to also build their capacity to familiarize themselves with the latest technologies and programs used to cope with new domestic and overseas employment demands.

Building partnerships for inclusive recovery and growth

One of the primary lessons learned by companies during the COVID-19 crisis is the exploration of potential areas for collaboration either with competitors or firms from other industries. In the case of banks, the Bank of Philippine Islands (BPI) shared that they are looking into tools employed by fintech companies as they also began sharing their technological capabilities. By partnering with pawnshops, retail merchants, and other companies, banks are trying to create value by building a financial ecosystem with stakeholders extending beyond the banking and financial industry.

LafargeHolcim, through LH Startup MAQER, serves as a startup incubator that offers early adoption of business solutions offered by startups. Through establishing partnerships and collaborations, MAQER gains capabilities and business solutions in exchange for granting the startups access to the company's platform, facilities, and equipment. Holcim Philippines believes that digitalization was the primary factor that connected communities to their company as with startups that lend their technology and capabilities to Holcim.

Each of the four initial strategic pivots technically fall under the six pillars of the Comprehensive National Industrial Strategy. Digital transformation covers investing in innovation and technology. It also encourages MSME development and provides more opportunities for marketing and promotion. Future-proofing talent involves human resource development and skills training. Repurposing and shifts in distribution channels address supply or value chain gaps, and with the pivot to building more partnerships, address potential horizontal issues and ultimately expand the domestic market base. Taking the values and impacts of these strategic pivots into account, it appears that while the COVID-19 pandemic has disrupted the implementation of the country's industrialization program, the ensuing measures to counter its effects were not only aligned with the original national strategy but also accelerated the implementation process out of constraint and necessity.

A shift in corporate mindset

The COVID-19 crisis brought a paradigmatic shift in corporate mindset. The pandemic forced the private sector to rethink how it does business, reassess how it reaches their customers, and renew its commitment to the broader community.Footnote 45 Business associations play an important role in facilitating, spreading, and instilling this shift in mindset. Through their wide reach across their membership and the level of influence they command in the business community and in society, business associations can leverage these capabilities in realizing these changes and in urging companies to have a “much more humane and far-sighted approach to management for the next normal.”Footnote 46

1. Sustainability as prime consideration.

As resilience takes priority over efficiency, the private sector tries to strike a balance between economic growth and social responsibility through adjusting business models, launching green initiatives, increasing access to health services, and launching campaigns for productivity through aiding identified industry clusters, also making MSMEs an integral part of the supply and value chain, and taking care of the workers and communities’ welfare.

Environmental, social, and governance (ESG) campaigns, while not entirely new in the business sector, have become more relevant with the impacts of the pandemic. Companies are now doubling down on sustainability programs along with health and safety protocols to preserve the environment as well as to ensure the health and protection of workers and the community. Philippine firms in the shipping industry are also now considering the blue economy pivot taking advantage of the country's archipelagic configuration and biodiversity. Putting together the values of sustainability and cooperation, the blue economy pivot would enforce proper and sustainable ways of harnessing marine resources while increasing interisland trade.

2. Trust as the new currency.

New entrepreneurial ventures emerged with the accelerated digitalization and other opportunities despite the constraints from the nationwide lockdown. And with the increasing number of new businesses competing for the attention of consumers comes the corresponding increase of various risks. As consumers become more informed, discerning, and risk averse in purchasing goods and services from businesses, the value put on trust progressively increases with every transaction. Trust as the new currency is further highlighted with the shift to a digital economy where contactless transactions, payments, and delivery systems are put in place. Even as its definition and scope has evolved along with other changes brought about by the pandemic, trust remains as the foundation of doing business and value creation for customers and other stakeholders.

3. Role of business in society.

Finally the pandemic pushed the private sector into rethinking its role and responsibility to society. COVID-19 revealed the challenges borne out of inequality as the pandemic has shown to compound generational disparities in income, jobs, and opportunities.Footnote 47 The pandemic brought about consciousness across the business community on the economic and social impact of the crisis across the different social classes. This urged industry associations and business organizations to come up with a Shared Prosperity Covenant renewing their commitment to the various stakeholders in the business ecosystem and in society. The covenant pledges just compensation and inclusivity among employees, quality products and services for customers, respectful, fair, and ethical dealing for partners and active involvement with additional assistance for the disadvantaged in communities. The private sector reaffirms its roles in society, prioritizing long-term gains over short-term profits, ultimately fulfilling their part in economic growth and national development for the next generations.

The COVID-19 crisis disrupted the private sector, and with it, drove businesses to adapt and change their corporate mindset. From an “inward-looking” style of operation and thinking, businesses began looking out more for their stakeholders and the community—ensuring survival and inclusive growth or shared prosperity beyond the pandemic. As businesses try to find new ways of delivering value to stakeholders, they collectively realize, and with the help of business associations, adopt the primacy of values such as trust, integrity, and sustainability, all affirming their role and responsibilities not only to the business ecosystem but also in society.

Apart from strategic pivots and corporate paradigm shifts, the business community emphasized the importance of public-private partnerships. By harnessing the capabilities of the public and private sectors, attaining the goals of pandemic response on the health sector and the economy would be accelerated. However, the quality of public-private partnership came into question as there were mixed views on the level of representation and participation of businesses in the critical advisory or decision-making bodies to counter the risks of the COVID-19 crisis.

Private-sector perspectives on government pandemic response

The policy approach to the pandemic was characterized as a “balancing act between lives and livelihood.” The economic aspect of this balance involves a mix of stimulus packages, corporate incentives, and social protection measures under the Duterte administration's PH-PROGRESO program.Footnote 48 Bayanihan 2, CREATE, GUIDE, and FIST comprise the formulated policies aiming at economic and corporate recovery. The Bayanihan to Recover as One Act (Bayanihan 2) primarily contains stimulus packages along with tax breaks for corporate lenders and borrowers with operating losses.Footnote 49 The Corporate Recovery and Tax Incentives for Enterprises (CREATE) bill is a proposed law providing the largest corporate income tax cut in the country's recent history with corporations benefitting from 30 to 25 percent tax reductions and small businesses getting a tax cut of 10 percentage points from 30 to 20 percent.Footnote 50 The proposed Government Financial Institutions Unified Initiatives to Distressed Enterprises for Economic Recovery (GUIDE) bill seeks for a ₱55-billion allocation dedicated to MSME loans from the Philippine Guarantee Corporation (PGC), the Development Bank of the Philippines (DBP), and Landbank of the Philippines (Landbank).Footnote 51 Lastly, the Financial Institutions Strategic Transfer Act (FIST) is a bill allowing banks to dispose of nonperforming assets by selling them to strategic transfer corporations to lend to small businesses.Footnote 52

The Bangko Sentral ng Pilipinas (BSP) also implemented a set of policies to provide more favorable terms for MSMEs that needed to apply for loans from private banks. BSP lowered interest rates signaling banks to lend to businesses “in the red” it also reduced credit risk weights for MSME loans as an alternative compliance for reserve requirements.Footnote 53

The private sector welcomed the efforts of policy makers, economic managers, and the BSP in formulating recovery measures.Footnote 54 Even though the pandemic led to economic contraction, it accelerated the formulation of laws that will level the playing field for businesses and yield long-term benefits. In addition, the BSP was ahead of the curve in pulling its monetary levers while fiscal policies have not yet been fully put in place.

Although there was a generally favorable view of the policiesFootnote 55 and initiatives enforced by the government and the BSP, there were a few criticisms on the overall handling of the pandemic. One of the identified shortcomings involved the delayed and uncoordinated government response on the first sixty days of the pandemic. It was already March 2020 by the time that the government declared a “state of public health emergency” in the country followed by a lockdown, with the total number of COVID-19 cases almost breaching a hundred. Debates surrounding mass testing led to the delay of its administration by April with only a small portion of the population tested. The lack of immediate containment measures accelerated the spread of the virus, which resulted in a prolonged nationwide lockdown and, by extent, the halting of business operations and supply chain disruptions.

Other issues involved the reliance on local government units (LGUs) in implementing testing, contact tracing, and treatment despite the LGUs’ lack of funds, equipment, and facilities dedicated to COVID-19 countermeasures. Stimulus packages for priority sectors and vulnerable groups were also given in piecemeal and were not fully distributed due to issues on outdated lists of beneficiaries and data management. Finally, even with the integration of corporate incentives in proposed policies, doing business in the time of the pandemic has been difficult especially for small businesses as documents required by some government agencies for business permits and license applications have not been adjusted or digitalized. Business associations urged government agencies and institutions to reduce the cost of doing business by enforcing the necessary adjustments to private-to-public transactions and processes.

Private sector participation and state-business relations

The extent of private sector participation in the national pandemic response garnered mixed views from the respondents. Positive views on public-private sector dynamics maintain that the private sector has been well-consulted on policy proposals and COVID-19 measures on public health and the economy. The Test, Trace, Treat (T3) Taskforce is a private sector–led initiative actively working with the Inter-Agency Task Force on Emerging Infectious Diseases (IATF-EID) in creating a strategic plan for vaccine development. The presence of the presidential adviser on entrepreneurship in IATF-EID meetings add representation of private-sector interests in the taskforce. Dialogues were also conducted on the economic recovery bills with the legislature and on the health sector with organizations such as the Healthcare Professionals Alliance Against COVID-19 (HPAAC). These measures show the extent of cooperation between the government and the private sector with disputes solely revolving around the calibration of solutions against otherwise commonly identified challenges.Footnote 56

In contrast, other business organizations observe the government's lack of a whole-of-society approach to dealing with the pandemic. The Philippine Chamber of Commerce and Industry (PCCI), the largest business organization in the country, advocated for more private-sector representation in the IATF-EID and further collaboration with government agencies. As decision making was observed to be largely left to bureaucrats, business associations continuously called for direct involvement in the policy process, particularly those concerning the economy and the workplace. A case raised by PCCI concerns the handling of small businesses.Footnote 57

PCCI stated that while BSP has lowered the interest rate, these measures would still cut down to the bottom line of private banks. It may “look good” on paper but this implies that private-sector banks would be shouldering the risk of small businesses. As depositors start withdrawing cash from their accounts in times of crisis, banks tend to conserve cash to prevent significant liquidity crashes. Add to uncertain levels of market and consumer confidence, this made lending to MSMEs unattractive especially without guarantees.Footnote 58

The private sector through PCCI took action to assist small business owners in reviving their enterprises. PCCI appealed to banks for voluntary and negotiated loan term extension and restructuring. They negotiated with malls and commercial property owners to provide their tenants reprieve through a partnership where rent is based on sales percentage of MSME tenants until the situation normalizes. They also continued to call for the increase in public transportation to make it easier for workers to return to work and to boost public confidence. Finally PCCI continuously advocated to participate in the decision-making process of the interagency taskforce until they were eventually invited by August 2020.

Private-sector representativesFootnote 59 provided the following policy recommendations to ensure sustained recovery classified under three key themes: fiscal policy, monetary policy, and structural reforms.

Fiscal policy

-

The national budget must not be constrained by the considerations of pandemic response rather it must be anchored on a long-term, strategic, incentivizing plan.

-

National strategic investment planning is significantly needed as the benefits from foreign direct investments (FDI) coming in the country needs three to five years before the people could experience its effects.

Monetary policy

-

The Philippine guarantee system must be strengthened to be able to assess and share the risk with businesses, particularly MSMEs, who were affected by the economic crisis.

Structural reforms

-

Better risk management must be implemented and used to guide scenario planning across identified risks.

-

The governance system must be improved and fortified including the ability to effectively harness resources and the absorptive capacity of government agencies.

-

Regulatory adjustments must be enforced to further reduce the cost and difficulties of doing business in the Philippines.

-

Mobility must be increased through reforms and enhanced access to public transportation such as the bus rapid transit system.

A pressing concern to interviewed members of the private sector is the potential politicizing of pandemic response affecting the business community's relationship with the current administration. The country context under the Duterte administration is characterized as a populist regime branded to champion the sentiments of the masses through widespread anticorruption campaigns, counterinsurgency crusades, and war on drugs. As part of its populist character, the Duterte administration embodied an “antielitist” stance targeting corporate elite families. At the height of the COVID-19 crisis, President Duterte launched a tirade against touted oligarchs heading major conglomerates with one corporation threatened with a government takeover due to alleged onerous provisions in water concession contractsFootnote 60 while another family owning the largest, longest-running broadcasting network had its franchise revoked and the channel shut down.Footnote 61 While the company involved in the water concession contracts were able to renegotiate with the government, the broadcasting network company suffered massive losses amounting to a total of ₱3.93 billion from Q1 to Q2 2020.Footnote 62 The network shutdown led to a domino effect adding to existing economic woes in the middle of the COVID-19 crisis with job losses and local supply chain disruptions from the company's reliance on a wide network of suppliers and outsourced services.

Despite having mixed views on the policies and implications of the government's pandemic response, the private sector's perspective points toward a cooperative response with the government and other policy actors. The Philippine private sector in the context of the pandemic is thus aligned with the business-as-association lens wherein businesses and business groups are more inclined toward mutually beneficial outcomes. As the pandemic evolved into an economic crisis, it became clear that the private-sector interests on business recovery were closely tied to public interest of overall health and economic recovery. This entailed that the business community's struggle for representation and participation in the policy process was a move not toward private interest rather toward national interest and recovery.

To ensure a strong partnership, there must be increased cooperation between the government and the private sector. Even as members of the business community remain assured of the private sector's resilience that has withstood different national administrations, what must prevail is the governance mindset of accountability along with a clear, transparent, and consistent policy framework. The national government must remain as an organizing force not only in implementing policies but also in establishing a conducive environment for businesses to keep afloat to accelerate recovery. By steering clear of pandemic politics, the government and private sector could redirect their focus on opportunities for cooperation toward the health and economic crisis resolution.

Lessons learned in the Philippine experience and topics for further study

The Philippine case on pandemic response from the perspective of the private sector shows the stake and untapped potential of businesses in further contributing to public health and economic recovery. By having limited participation in the policy process countering the spread and effects of COVID-19, the private sector was pressed to organize their own activities to aid existing government initiatives and to ensure their own survival. Yet despite the constraints set by the current public-private sector dynamics, the Philippines remains a fertile ground for studying and applying a more collaborative governance approach involving the government, the business community, as well as other sectors in society.

The country cases of Taiwan, Vietnam, Singapore, and South Korea serve as illustrative models of partnerships between the government and private sector in times of health and economic crisis. Recalling their lessons from the SARS epidemic in 2003, these neighboring countries were quick to respond by activating their systems to contain the spread of the virus as soon as possible. Each country exhibited broad private-sector and civil society engagement in assistance to the policies carried out by the national government.

Taiwan's private sector lent their capabilities in technology and manufacturing equipment to assist in the tracking system, quarantine monitoring, and big data processing for immigration and health warning systems.Footnote 63 Vietnam made use of mobile applications such as the Bluezone app for contact tracing that was reportedly installed by 20 percent of the population upon the first four weeks of its release.Footnote 64 Singapore-based biotech firm Proteona is currently leading an international alliance for developing neutralizing antibodies across different coronavirus strains.Footnote 65 South Korea also enlisted the assistance of medical and biotech firms in producing rapid assessment test kits as well as the help of telecommunication and tech companies for contact tracing efforts and information dissemination campaigns.Footnote 66

As for economic recovery policies, South Korea unveiled in July 2020 the Korean New Deal that sought to “transform the economy from a fast follower to a leader, from a carbon-dependent economy to a green economy, with the society going to a more inclusive one.”Footnote 67 The policy package focuses on advancing the digital economy, green-based technology, and social protection measures. Singapore allocated more than $100 billion worth of stimulus packages in support of households and low income to unemployed individuals. The national government also provided wage subsidies, increased contingency funds, and set aside a $20 billion loan capital for businesses with operational losses. Vietnam, however, introduced massive tax cuts, deferred payments of VAT and CIT obligations, and lowered fees in business registration in support of small businesses apart from fiscal packages.Footnote 68 Finally, Taiwan allocated an equivalent of $35 billion stimulus package to encourage consumer spending and to provide industrial relief.Footnote 69

These demonstrations of prompt government response, private sector engagement, and robust public-private partnerships exemplify best practices that can be further researched on and adopted to the Philippine context. The private sector, as a key driver of the Philippine economy, must be tapped as a partner in the governance ecosystem. Its participation would ensure not only a comprehensive view of economic and financial conditions but also a more attuned pandemic response to what is happening on the ground. Exploring areas of collaboration would thus be more advantageous to both government and businesses rather than pursuing separate, uncoordinated initiatives to countering the effects of the pandemic.

Ultimately, the COVID-19 crisis was a disruption that placed the private sector unto an irreversible track of changing demands, values, and ways of doing business. The pandemic paved the way for businesses to be transformed from their digitalization to rethinking their relationships with stakeholders, and finally their responsibilities to society. As the private sector evolves through its pivots in corporate strategy and efforts for greater cooperation with the government, this reimagined Philippine governance and economic landscape may just be the key to achieving national recovery, economic growth, and sustainability in a postpandemic world.