Introduction

Nearly all governments regulate the use of money in politics, and many offer millions of dollars in subsidies to campaigns and political parties. Public officials, activists and scholars often claim that subsidies promote representative democracy and good governance (Casas-Zamora Reference Casas-Zamora2005; Council of Europe 2003; Americas’ Accountability Corruption Project 2004). Yet recurring corruption scandals in some of the world's oldest and most generous political finance systems (for example, Costa Rica, Germany, Israel and France) seem to suggest that political finance subsidies have little – or perhaps even a negative – impact (Casas-Zamora Reference Casas-Zamora2005, 39; Pinto-Duschinsky Reference Pinto-Duschinsky2002, 78; Williams Reference Williams2000, 1–8). Skeptics point to the difficulty of implementing political finance reform. Laws on the books are often weakly enforced, and even when they are enforced officials find ways to get around them (Bryan and Baer Reference Bryan and Denise2005, 4; La Raja Reference La Raja2014, 714).

Studies focused on campaign finance and corruption have produced mixed results. Bryan and Baer (Reference Bryan and Denise2005, 4) suggest that political finance subsidies may encourage corruption. Mietzer (Reference Mietzer, Norris and Abel van Es2016, 102) argues that comprehensive but poorly implemented political finance subsidies in Indonesia hide endemic corruption. In South Africa, Calland (Reference Calland, Norris and Abel van Es2016, 152) finds that subsidies put more money in corrupt elites' pockets and do not combat entrenched corruption. Roper (Reference Roper2002, 186) suggests the same in Eastern Europe, with Romania as a case in point. Meanwhile, cross-national regression analyses discern no relationship between political finance subsidies and corruption (Evertsson Reference Evertsson2013, 83; Norris and Abel van Es Reference Norris and Abel van Es2016, 251).

While the case for optimism may be flawed, the case for pessimism also rests on rather weak foundations. Evertsson (Reference Evertsson2013) and Norris and Abel van Es (Reference Norris and Abel van Es2016) rely on cross-sectional analyses of a single year. Other studies focus on individual countries, the experiences of which may or may not be representative.

Despite the importance of the issue and its prominence in popular discourse, the relationship between political finance subsidies and the quality of governance has not been tested in a comprehensive fashion, perhaps because of the absence of suitable data (Butler Reference Butler2010; Hopkin Reference Hopkin2004; Samuels Reference Samuels2001). The causal role of political finance is also undertheorized (Norris and Abel van Es Reference Norris and Abel van Es2016, 5; Scarrow Reference Scarrow2007, 193).

In this study, we offer a straightforward argument for how (and why) political finance subsidies might impact political corruption and what sort of corruption it might affect. We argue that political finance reform reduces opportunities for corruption by mitigating private money's importance in politics and increasing sanctions for political corruption. We illustrate the argument and develop the theoretical mechanisms using a case study of Paraguay's 1996 political finance reform, which draws on original fieldwork, quantitative data, archival documents, and elite interviews with current and former public officials. To test the argument, we construct a new dataset that measures public subsidies for parties and campaigns across most sovereign countries over the past century. This index is analyzed in a panel format using a measure of political corruption drawn from the Varieties of Democracy (V-Dem) project (Coppedge et al. Reference Coppedge2017). Both qualitative and quantitative analyses suggest that political finance subsidies reduce political corruption across a range of government offices.

Comparative Political Finance

Political finance regulations were inaugurated in the United States and the United Kingdom in the late-nineteenth century with the aim of combatting electoral corruption (Fisher Reference Fisher and Williams2000, 16; La Raja Reference La Raja2008, 18–33; Rix Reference Rix2008, 65). Uruguay initiated the first political finance subsidy in 1928, offering reimbursements for campaign expenses. Uruguayan reformers were concerned about the undue influence of donors and argued that subsidies would insulate parties and encourage broader representation and enhanced competition (Casas-Zamora Reference Casas-Zamora2005, 95). Costa Rica introduced post-election reimbursements in 1956, becoming the second country to legislate campaign subsidies. According to Casas-Zamora (Reference Casas-Zamora2005, 73–74, 95–97), these pioneering subsidy schemes were uncontroversial because they regulated practices that citizens viewed with suspicion and introduced a measure of transparency through accounting requirements. When countries in Western Europe began to adopt subsidies, these same arguments were recycled.Footnote 1 Germany introduced funding for political parties in 1959 and political subsidies diffused to most Western democracies in the following decades (Koß Reference Koß2010; Scarrow Reference Scarrow2004, 661).

Countries transitioning to democracy in the 1980s and 1990s often adopted political finance regulations from these early reformers in Latin America and Europe. For example, political finance reforms in Argentina and Mexico were patterned after Spain and Costa Rica, and were seen as a replacement for ad hoc and informal transfers between states and parties (Instituto de Investigaciones Jurídicas 2011).Footnote 2 Post-communist countries modeled their political finance systems on European exemplars (Roper Reference Roper2002, 175). By the 2000s, world powers, especially the United States, and international organizations such as the European Union and the Organization of American States, were pushing comprehensive political finance subsidies and regulations on the developing world (Council of Europe 2003; Koß Reference Koß2010; United States Agency for International Development 2003).

These reform efforts share several features. First, legislation is often introduced in the wake of a major political scandal (Alexander and Shiratori Reference Alexander and Shiratori1994, 3; Carlson Reference Carlson, Norris and Abel van Es2016, 103; Williams Reference Williams2000, 2). For example, after decades of limited and unenforced campaign finance regulations, the United States introduced campaign subsidies and comprehensive regulations in 1974 in response to the Watergate scandal (Briffault Reference Briffault, Norris and Abel van Es2016, 180; La Raja Reference La Raja2008, 18–33; McSweeney Reference McSweeney and Robert2000, 40). Secondly, reformers typically appeal to the importance of curbing special interests, leveling the playing field and fighting corruption (Williams Reference Williams2000). Thirdly, public opinion surveys suggest ambivalence on the part of mass publics, who tend to support political finance regulations like spending limits but are skeptical when politicians legislate subsidies that support their own campaigns (Avkiran, Kanol, and Oliver Reference Avkiran, Kanol and Oliver2016; Bryan and Baer Reference Bryan and Denise2005, 21; Primo and Milyo Reference Primo and Milyo2006).

Most democracies now have political finance laws and our dataset documents that most of those laws include direct subsidies to parties or campaigns. Laws vary considerably and in many instances are quite new, the product of an accelerating pace of reform over the past several decades (Butler Reference Butler2010; International Institute for Democracy and Electoral Assistance 2014). However, there are some common components. Most political finance systems mix public and private money (Williams Reference Williams2000, 8). The only country that insists upon sole reliance on public funding – that is, the total elimination of non-public sources – is Bhutan, though Tunisia also banned private donations in the 2011 election (International Institute for Democracy and Electoral Assistance 2014, 49). A handful of mostly European countries rely primarily on public funding with some private donations (Butler Reference Butler2010, 7). In most countries, however, public subsidies comprise a minority of party and campaign budgets.

Political Finance and Political Corruption

The concept of political finance, as employed here, encompasses three elements: the legal and statutory regulation of money in politics (stipulating what practices are legal or illegal), government subsidies (in kind or monetary) to support political parties and/or candidates for public office, and enforcement mechanisms to ensure that laws regulating behavior and subsidies are adhered to (Gokcekus and Sonan Reference Gokcekus and Sonan2016; Rose-Ackerman Reference Rose-Ackerman1978). In principle, these factors could vary independently: regulatory burdens may be strong, weak or nonexistent; subsidies may be high, low or nonexistent; enforcement may be strong, weak or nonexistent. In practice, they tend to cohere (Evertsson Reference Evertsson2013; Norris and Abel van Es Reference Norris and Abel van Es2016). It is rare to find generous subsidies unaccompanied by extensive regulation, for example. Thus we consider regulation, subsidies and enforcement as components of a compound treatment – ‘reform’ – with multiple levels.

The outcome of interest, political corruption, is commonly defined as the abuse of public office for private gain (Rose-Ackerman Reference Rose-Ackerman1999, 91). Typically, it involves the exchange of money or goods for political influence (Della Porta and Vannucci Reference Della Porta and Vannucci1999; Evertsson Reference Evertsson2013). Sometimes this agreement is explicit – a quid pro quo arrangement (for example, a bribe) whereby a specific amount of money is transferred from a principal, A, to an agent, B, in exchange for B's action on an issue of concern to A (Butler Reference Butler2010, 2; Gokcekus and Sonan Reference Gokcekus and Sonan2016; Williams Reference Williams2000, 1–2, 8). At other times, the exchange is implicit – a general understanding that A would like B to ‘do something about Policy X’. We consider exchanges of this sort to be corrupt in the general sense of the term even if they break no existing laws, as they involve what most would regard as an abuse of public office for private gain (McMenamin Reference McMenamin2012, 5). A public official may also embezzle state resources by illegally redirecting them to a campaign or into their own accounts.

In considering the impact of political finance reform on political corruption, we focus on the incentives facing politicians, that is, those who hold elective office or aspire to do so. We assume that politicians are motivated to win election (Gerber Reference Gerber1998; Green and Krasno Reference Green and Krasno1988). We also assume that money plays an important role in winning elections in a context of multi-party competition, but that its marginal utility declines (Jacobson Reference Jacobson1978; Samuels Reference Samuels2001): a campaign's first dollar is worth much more than its last (Abramowitz Reference Abramowitz1988; Gerber Reference Gerber1998; Green and Krasno Reference Green and Krasno1988; Levitt Reference Levitt1994).

Funding for election campaigns and party activities may be raised privately or publicly. Private money is susceptible to corrupt exchanges of money for influence, as defined above (Evertsson Reference Evertsson2013; Gokcekus and Sonan Reference Gokcekus and Sonan2016). Public money, by contrast, is not. In making this assertion we assume that there are no corrupt bargains between the state, which provides funding, and the recipients of that funding. In other words, we assume that the bureaucrats distributing money do not arrange kickbacks with politicians who receive funds or condition disbursement on other corrupt behavior. Note that in most instances subsidy disbursement formulas are very specific and therefore difficult to manipulate. Occasionally, election observers report that money arrives late or not at all (International Institute for Democracy and Electoral Assistance 2014, 50). According to those same sources, however, delayed or cancelled disbursements are generally a product of bureaucratic ineptitude rather than a calculated attempt to sway behavior. We have not encountered allegations of corrupt bargains between parties or candidates and state agencies around subsidy disbursement.

Thus, where reforms reduce the role of private money in electoral campaigns, incentives for corrupt behavior should decrease. This may be accomplished by regulation, for example, limiting the amount of money that candidates or parties can obtain from private sources, the kinds of donors that can contribute to campaigns, the amounts that each donor can contribute, and the transparency of these transactions (Fisher Reference Fisher and Williams2000, 16; McSweeney Reference McSweeney and Robert2000, 39–40). It may also be accomplished by subsidizing campaigns with publicly provided funds, which may replace or supplement money that officials raise privately. A body of research finds that politicians and donors skirt spending limits and disclosure requirements, and suggests that public subsidies may be a more effective form of campaign finance reform (Butler Reference Butler2010; Hogan Reference Hogan2005; La Raja Reference La Raja2014; Mann Reference Mann2003). If public money is provided on a supplementary basis, private money persists. However, its importance in winning elections is likely to be mitigated because of the declining marginal utility of money in a campaign, as noted.Footnote 3 This, in turn, should reduce candidates' dependence on private donors, making it less likely that they will engage in quid pro quo arrangements.

We must also consider the possibility of legal sanction. All political finance laws are accompanied by an enforcement mechanism designed to punish those who contravene the law (Evertsson Reference Evertsson2013). Sanctions may include loss of office, fines or incarceration. To be sure, enforcement is uncertain, and it is difficult to gauge the strength and independence of a country's enforcement mechanism. The threat of punishment alone may not significantly reduce corruption (Gans-Morse et al. Reference Gans-Morse2018; Pinto-Duschinsky Reference Pinto-Duschinsky2002, 80). Nonetheless, the possibility of legal sanction is present when a political finance regime is in place and absent when it is not. Insofar as corrupt exchanges violate political finance law, politicians who engage in such activities put themselves in legal jeopardy (Hopkin Reference Hopkin2004). There are also secondary effects on a candidate's probability of winning election, given that the suggestion of scandal – even in the absence of a successful prosecution – may harm a candidacy or even end a political career (Balán Reference Balán2011, 459; Basinger Reference Basinger2013, 386; Hopkin Reference Hopkin2004).Footnote 4

The media often play a key role in identifying and publicizing violations of campaign finance law. For our purposes, what is important is that the media's role as a whistle-blower depends on the existence of a public finance regulatory regime. Otherwise – if all actions are legal, or if illegality is ambiguous – there is little to report on. Note that a scandal usually involves a public official who breaks the law, and news reportage is typically drawn from prosecutors' statements, public trials and interviews with those engaged in the purportedly illegal activity. It is difficult to imagine reporters cracking down on politicians engaged in illicit acts if they are not in violation of a statute. The clearer that statute is, and the more actively it is enforced, the greater the role the press is able to play.

For all these reasons, we anticipate that political finance laws may dissuade politicians from engaging in corrupt behavior. The impact of political finance reform should also extend to non-elected officials such as bureaucrats and judges. Note that in many polities, public officials are appointed through patronage networks with the goal of enlisting them in electoral campaigns – to help get out the vote, to advertise the party's message, to distribute funds or to contribute part of their salary to the campaign (Auyero Reference Auyero2001; Casas-Zamora Reference Casas-Zamora2005; Muñoz Reference Muñoz2014; Muñoz Reference Muñoz2018). Where political finance reforms are in place, this sort of patronage system is likely to be disrupted. Politicians are less dependent on privately raised funds and they face a greater threat of discovery (by the press) or prosecution (by the judiciary or a special election board) if they are caught flaunting the law. This, in turn, should reduce the likelihood that appointed public officials such as ministers and judges will accept or solicit bribes, embezzle or improperly use state resources for campaigning.

In summary, political finance reforms attenuate the likelihood that a politician will engage in corrupt activity insofar as they (a) reduce the role of private money in campaign finance, (b) clarify the legal status of campaign finance activity (that is, the line between what is legal and illegal) and (c) enhance the risk of discovery – and hence of negative publicity and possible legal sanction. Knock-on effects should discourage corruption among non-elected officials, as discussed.

To be sure, political finance laws are only one factor influencing political corruption. Natural resources, state monopolies, unstable economies and many other factors can also fuel the abuse of public power for private gain (Gans-Morse Reference Gans-Morse2018; Rose-Ackerman Reference Rose-Ackerman1999; Treisman Reference Treisman2000; Treisman Reference Treisman2007). Nonetheless, political finance may be an important and understudied factor.

Moreover, as a policy tool, political finance reform is easier to implement than many alternative anti-corruption measures. Political parties usually welcome public funding, citizens usually support the attendant regulations, as noted, and the overall costs are fairly minimal if considered in light of the possible returns to improved governance. Hence, our topic has important practical implications.

Measuring Political Finance

A great deal of activity has occurred over the past century in an attempt to reform systems of political finance. To capture this activity in a systematic fashion we construct a dataset that covers the world at annual intervals from 1900 to 2015. This is a considerably longer period of time than existing political finance datasets such as that maintained by the International Institute for Democracy and Electoral Assistance (International IDEA) or the Political Party Database and, unlike the V-Dem measure, is based on a factual coding of laws and reports rather than expert perceptions.

Our effort builds upon the cross-sectional International IDEA database of public finance laws, which tracks answers to a number of questions related to current public campaign finance for most countries that currently hold elections (International Institute for Democracy and Electoral Assistance 2017). Helpfully, International IDEA publishes its sources – primarily, laws that are currently in force. Additional sources used in our coding include supranational reports, election observer reports, non-governmental organization (NGO) reports and academic articles. Of particular note are reports produced by the European Union's Group of States Against Corruption (GRECO), which provide detailed information on the history, provisions, implementation and public–private dimensions of campaign finance for about sixty countries. We also draw on two reports sponsored by the Organization of American States that cover Central and South America and the Caribbean. For African countries, we rely on the NGO Electoral Institute for Sustainable Democracy in Africa (EISA). We enlist election observer reports from the EU, the Commonwealth, the African Union, EISA and the Carter Center. Where laws or implementation were ambiguous, we sought advice from country experts.

We use these sources to code relevant laws establishing different types of political finance regimes in 175 countries that held national elections between 1900 and 2015. Countries that do not hold regular national elections are excluded from the dataset. Further information on coding protocol and sources is provided in Appendix A. Appendix B contains detailed information on each country, including the dates of adoption of major public finance initiatives and country-specific sources.

In selecting variables to code, we lean primarily upon the provision of public subsidies for candidates and parties. Public subsidies are one of the strongest political finance interventions and also serve as a proxy for other regulatory actions that are harder to measure in a systematic fashion like monitoring and enforcement mechanisms (Norris and Abel van Es Reference Norris and Abel van Es2016, 15). We are not aware of any public subsidy that is unaccompanied by additional regulatory measures.

We code five binary variables, as described in Table 1. (Further details are in Appendices A, B and C.) Each is coded across 175 countries and 115 years, generating 12,380 country-year observations.Footnote 5

Table 1. PFSI components

Note: components of the Political Finance Subsidy Index (PFSI), each coded dichotomously (no = 0, yes = 1).

A principal component analysis demonstrates that a single dimension explains 72 per cent of the variance across the five variables. The first component also loads similarly on all five variables. This suggests that these five variables are capturing a single underlying concept that can be meaningfully combined into a unidimensional Political Finance Subsidy Index (PFSI).

We generate an additive index ranging from 0 to 5. We prefer the additive index to one formed from the first component of a principal components analysis because it is easier to interpret and to decompose. Both versions of the index correlate at r = 0.99 and render similar results, as shown in Appendix C.

Using the additive index (PFSI), we are able to visualize changes in political finance subsidies globally over time. Figure 1 graphs the average PFSI score globally from 1900 to 2015. In 1960, 98 per cent of countries in the dataset did not have any political finance subsidies. By 1980, 11 per cent had at least a subsidy provision on the books and by 1990, the number had more than doubled (to 23 per cent). By 2010, 63 per cent of countries had a law on the books establishing subsidies and most distributed those subsidies to candidates and/or parties. In 20 per cent of countries, public funds supplied the majority of the money used for political campaigns.

Figure 1. Average PFSI score, aggregated globally, 1900–2015

Figure 2 graphs the average political finance subsidy index score by region from 1900 to 2015. Latin America led the world in subsidies until it was overtaken by Europe in the 1970s. Other regions followed suit in the 1980s. The drop in Europe's average around 1990 corresponds to the former USSR countries gaining independence; by 2000, most of these countries had added some political finance subsidies and the regional mean recovers. In the twenty-first century, political finance subsidies emerged as a global norm. Although political finance subsidies are now common in all regions, Africa, the Middle East and North Africa, and Asia lag behind.

Figure 2. Average PFSI score, aggregated by region, 1900–2015

Case Study: Paraguay's 1996 Political Finance Reform

In this section we develop a case study to illustrate the argument laid out in the second section and to shed light on the mechanisms (M) that may lie between the apparent cause, X (political finance reform), and the outcome, Y (corruption). To serve this pathway function, we searched for a case that exhibits the relationship of interest without any obvious potential confounders (Z). Assuming for the moment that X causes Y across the population, the pathway case is a country where X co-varies with Y and Z is constant or exhibits a trend that is inconsistent with observed variation in Y (Gerring Reference Gerring2017).

We began by eliminating cases from our global sample with little or no variation in their political finance regimes like Suriname and Bangladesh. We then ran time-series analyses for the remaining countries to see where there was a strongly negative relationship between political finance subsidies and corruption, thus offering a possibility of elucidating the causal pathway of theoretical interest. Looking closely at the details of the countries that passed this test, we determined that Paraguay was the least subject to potential confounders (other events coincident in time with political finance reform that might also have affected political corruption), and therefore an appropriate choice for intensive analysis. While many countries legislate political finance subsidies as part of a large reform package or a constitutional reform during a regime change, Paraguay introduced its political finance reform several years after a new constitution and after its transition to democracy, thus sidelining these factors as potential confounders.

In addition to its pathway role, Paraguay is also arguably a crucial case for our hypothesis. Paraguayan politics are notoriously corrupt: former President Federico Franco remarked to us, ‘Paraguay is known for its triple border, narco-trafficking, car trafficking, wood smuggling, all sorts of illegal money.’Footnote 6 Paraguayan institutions have a legacy of corruption stemming from the Stroessner years, when the dictator openly encouraged public corruption (Hetherington Reference Hetherington2011; Nickson Reference Nickson, Lambert and Nickson1997, 24).

To develop the case study, one co-author spent three months in Asunción, Paraguay, conducting elite interviews. Informants included top political figures who were active when the 1996 reform was debated and adopted, current officials, and NGO workers and academics who focus on political finance and corruption issues. We use the full names of elected officials who spoke with us on the record because they are public figures and thus do not require confidentiality according to Institutional Review Board guidelines. The names of other informants – appointed officials, political operatives, NGO workers and academics – have been replaced with pseudonyms in accordance with Institutional Review Board guidelines on confidentiality. Appendix D contains a protocol of questions and a list of interview dates and names (for elected officials whose anonymity is not protected).

Background

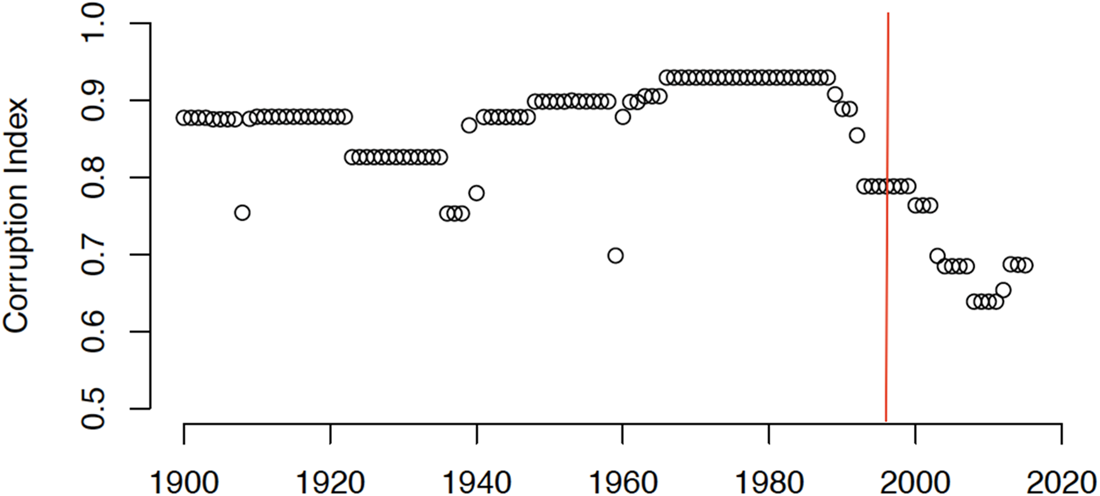

Paraguay experienced institutionalized corruption under the Stroessner dictatorship, from 1954 to 1989. During the authoritarian era, General Stroessner and his Colorado party controlled the state and encouraged corruption as a way to pad salaries (Nickson Reference Nickson, Lambert and Nickson1997, 24). High-level officials were also involved in drug trafficking (Nickson and Lambert Reference Nickson and Lambert2002, 166). Although corruption has declined in recent decades, Paraguay remains the fifth most corrupt country in Latin America, according to the V-Dem corruption index. Bribery is often expected from public officials, embezzlement is commonplace, and few corruption cases make it through the courts (Hetherington Reference Hetherington2011; Lambert and Nickson Reference Nickson and Lambert2002, 166). Figure 3 illustrates Paraguay's decline from extreme corruption during the Stroessner dictatorship to moderate corruption under the current regime, using the V-Dem corruption index. Brief declines in the country's corruption score earlier in the century correspond to reforms that were passed and then rolled back under the Liberal Party (1908), General Rafael Franco (1936–38) and General Stroessner (1959).

Figure 3. Corruption in Paraguay, 1900–2015

Note: the vertical line marks the initiation of political finance reform (1996). Corruption is measured by the V-Dem political corruption index.

Following a coup that returned the country to civilian rule, Paraguay introduced a new constitution (1992) and held its first democratic elections (1993). Colorado politicians, in consultation with representatives from the largest opposition party, the Liberal Party, introduced political finance legislation following the 1993 election. Both parties wanted legitimate state funds for their campaigns and party organizations. Additionally, the Colorados were confident that they could maintain their national majority against a better-funded opposition, particularly since subsidies are allocated based on how many seats each party has in Congress, an arrangement that continues to favor the Colorados. The law explicitly outlawed the use of state resources and government facilities for campaigns and required parties to publish financial accounts. The law also introduced substantial subsidies for campaigns and yearly subsidies for parties; public subsidies now cover roughly half of a campaign's expenses, though the proportion of public to private money is dropping. The Colorados and Liberals fund day-to-day operations with a mix of private and public money, while smaller parties rely almost entirely on public funding. In 1996, eighteen newly appointed electoral judges were charged with enforcing the law, which employs injunctions and confiscation to punish violations.

Subsidies were first distributed to parties in 1997 and to candidates in the 1998 elections. They appear to have had an immediate electoral effect. With a guaranteed funding floor, Liberal politicians were able to run viable campaigns and won additional seats in the 1998 elections, especially at local levels. Still, the Colorados maintained their legislative majority and have held the executive in all but one election.

Potential Confounders

Paraguay's decline in corruption might be credited to the departure of Stroessner and the subsequent transition to democracy. However, this would run against the experience of most countries, where democratic transitions are accompanied by an increase in corruption – especially electoral corruption, spurred by the fact that parties and politicians must now compete in multi-party elections, and often choose to do so with an expenditure of funds to buy votes or influence turnout (Keefer Reference Keefer2007; McMann et al. Reference McMann2017). We see considerable evidence of this in the Paraguayan case, vindicating the widely accepted view that the first-order effects of democratization on corruption are negative rather than positive. In the 1993 election, the Colorados were the only party with a developed party infrastructure and experienced personnel, as well as unrestricted access to state resources (Riquelme and Riquelme Reference Riquelme, Riquelme, Lambert and Nickson1997, 48). The 1993 election was marked by rampant vote buying and embezzlement, and Colorado candidates ran their campaigns out of state offices while using state resources. As a result, the Colorados easily beat the disorganized and underfunded Liberal opposition (Riquelme and Riquelme Reference Riquelme, Riquelme, Lambert and Nickson1997, 48).

To further address potential confounders, we analyze lagged dependent variable models of political finance and corruption in Paraguay in Table 2. These models have three specifications with different sets of controls, including GDP, growth, urbanization, polyarchy and polyarchy squared, as well as regular elections. The data come from a larger dataset described in the following section.

Table 2. PFSI and corruption in Paraguay

Outcome: political corruption (V-Dem), forward lagged by five years. Estimator: ordinary least squares with a lagged dependent variable. *p < 0.1 **p < 0.05 ***p < 0.01 ****p < 0.001.

As Table 2 demonstrates, political finance is a negative predictor of corruption in Paraguay and is statistically significant at the p < 0.05 level in all three models. Even controlling for important potential confounders, political finance retains its significance – indeed, the estimated coefficient is virtually unchanged vis-à-vis the bivariate baseline specification (Model 1) – suggesting that Paraguay functions as a pathway case.

Effects and Mechanisms

Did campaign finance reform reduce corruption in Paraguay? The elites who we interviewed suggest that it did. Former senator Sebastian Acha claims that, ‘The 1996 law has generally prevented this country from turning into a narcocracy, or a kleptocracy.’Footnote 7 We identified two principal causal mechanisms in the theory and illustrate them using this case. First, the law clarified what was legal and illegal in political financing and inaugurated an enforcement regime. Secondly, public funding greatly reduced many of the incentives for corruption in politics.

We begin with the problem of clarity and enforcement. The 1996 law clarified what was legal and illegal in political finance and inaugurated the first campaign finance enforcement regime in Paraguay's history. These measures standardized practices and expectations around political finance. After the law's passage, officials knew that they were expected to keep records of where money came from and how it was spent, and that state resources could not be used for campaigns and party activities. This allowed politicians’ behavior to be judged by clear standards, which meant the law was more likely to be followed – a good instance of statutes paving the way for behavioral change.

Judge Raúl Gonzalez Ruiz, the first electoral judge in Asunción tasked with enforcing the law, remembers that when he first started doing so, embezzlement and the misuse of state resources were endemic. In our data, Paraguay's corruption scored 0.863 in 1996, far above the global average of 0.542 that year. Candidates routinely held campaign events in public buildings and used public resources, and Ruiz recalls evicting a band playing the Colorado Party polka from the Ministry of Public Works.Footnote 8 The judge reported impounding nearly 100 official vehicles and a goat for misuse of public resources in the first municipal campaign cycle after the law passed.

Ruiz and others note that after just one election cycle, misuse of state resources and embezzlement for campaign purposes dropped dramatically. Multiple interviewees noted that this form of corruption was rampant before the reform and is now rare.Footnote 9 The introduction of this law included a relatively weak enforcement regime, which largely eliminated the overt use of public resources in campaigns within a few years.

Prior to the 1996 law, it was hard for the press or the public – or even politicians – to tell when they were on the right side of the law. The establishment and formalization of standards have made voters more willing to punish officials caught engaging in political finance-related corruption. Senator Acha explains, ‘There has been little judicial consequence for cheating the system by the government, but a social consequence has been at play in punishing politicians who sell out. Voters don't tolerate using public party funds and then proving disloyal.’Footnote 10 Thus an important impact of the reform was that it clarified for voters and politicians which campaign finance practices are legal (and illegal). Although Paraguay's political finance law contains weak sanctions and weak monitoring mechanisms, the politicians we interviewed believe that voters will punish politicians caught in scandals, wreaking electoral vengeance upon corrupt politicians.

The law also reduced incentives for corruption during campaigns and in party organizations more generally by introducing public subsidies. According to Congressman Carlos Riveros, ‘Public subsidies are a disincentive to corrupt activities… In terms of incentives for corruption, when one has resources they don't need to resort to extremes and can use these resources’.Footnote 11 In other words, by introducing a guaranteed funding floor, public subsidies reduced pressure to take money from other sources, making it possible for candidates to be discerning about which donations to accept while remaining competitive. A recent mayoral candidate and long-time party operative, Alejandro Armendia, restated this relationship and explicitly tied subsidies to a reduction in corruption:

The greater the influx of state subsidies, the lesser the need for politicians to resort to other types of financing, or [parties] to resort to candidates with their own capital that comes from illicit activities. The more the state is involved in supporting parties, I believe, the more one diminishes corruption.Footnote 12

Campaign subsidies did not eliminate all incentives for illicit campaign activity. Interviewees spoke frequently of subsidies as a floor that allowed parties and candidates to sustain an honest campaign. Interviewees referred to public subsidies as the ‘foundation of the finances’Footnote 13 or ‘a base to at least make the machine work’.Footnote 14 Subsidies offered politicians a legal, state-provided alternative to illegitimate fundraising. Although the challenges of financing campaigns remain, subsidies moderate fundraising pressures. As interviewees stated, subsidies enable parties to be more discerning about their candidates, and candidates to be more discerning about the sources of their campaign contributions.

These statements are consistent with our argument that public subsidies diminish the role of private money in politics, which reduces – but does not eliminate – incentives for corruption. Alejandro Armendia elaborated, ‘Most corruption is for personal gain, but a good deal of it is to finance campaigns. Without a doubt, a larger public role in financing campaigns reduces levels of corruption.’Footnote 15

To conclude, our theory lays out two principal theoretical mechanisms through which political finance reform reduces corruption: reforms clarify legality and introduce the possibility of sanctions, and public subsidies reduce opportunities for corruption by lowering the relative importance of private money.

Additionally, our interviews corroborate the important role played by the media in monitoring officials' behavior, exposing those who violate the law, and giving voters the information they need to punish corrupt politicians at the polls. Former President Franco claims that the media has helped enforce the law and its sanctions, ‘[Politicians] fear that a citizen or journalist might expose them…The media and social media served to make this law applicable’.Footnote 16 Paraguay's experience thus suggests that social sanctions can assist the anti-corruption features of a political finance system. This may be especially important in Paraguay, which has a weak civil society, one of the lowest levels of political participation in Latin America and few NGOs following political finance policy (Hetherington Reference Hetherington2011; Nickson and Lambert Reference Nickson, Lambert and Nickson1997).

Carlos Riveros, a former Liberal Party congressman who was active during the reform, sums up the important role of public subsidies in Paraguayan politics:

Public subsidies are the only way that we can fight corruption. Corruption will always exist, that is without a doubt. But this is a way of moderating its effects and its presence. It is a way of reducing the role of ill-gotten money in politics. That is without question the most important impact of this type of financing.Footnote 17

Panel Analysis

In this section, we evaluate the main hypothesis using a panel analysis incorporating sovereign states observed annually from 1900 to 2015. As a first step, we need to think carefully about the functional form of the relationship between political finance reform and political corruption. We presume that the impact of political finance subsidies accrues over time but with diminishing marginal returns. To operationalize this expectation, we construct a stock variable that adds the political finance subsidy index score registered for a country in each year (starting from 1900) with a 1 per cent depreciation rate (following Gerring et al. Reference Gerring2005). We further presume that the impact of a country's accumulated stock has diminishing marginal returns on corruption. The stock variable is therefore transformed by the natural logarithm. In this fashion, we attempt to track small, long-term effects over time.

To measure corruption, we rely on the corruption index developed by McMann et al. (Reference McMann2017) as part of the Varieties of Democracy (V-Dem) project (Coppedge et al. Reference Coppedge2017). The corruption index aggregates indicators of corruption in different arenas – executive, legislative, public sector and judicial. Underlying data is coded by country experts and integrated into a global dataset with a Bayesian latent variable measurement model (Pemstein et al. Reference Pemstein2015). The indicators measure the latent concepts of executive, legislative, public sector and judicial corruption by aggregating expert perceptions of these types of corruption and expert interpretations of primary and secondary sources from a given country over time. McMann et al. (Reference McMann2017) report that the V-Dem index covers more types of corruption than other corruption datasets and aligns with theoretical definitions of corruption. They also find that the individual indicators load heavily on a single dimension, justifying the construction of an aggregated index (McMann et al. Reference McMann2017, 9–12).

We recognize that all corruption indices are prone to measurement error (Jensen, Li and Rahman Reference Jensen, Li and Rahman2010; Olken and Pande Reference Olken and Pande2012; Sequeira and Djankov Reference Sequeira and Djankov2014). In particular, corruption perception indices are a controversial proxy for the level of corruption in a given country because perceptions and experiences often diverge (Donchev and Ujhelyi Reference Donchev and Ujhelyi2014; Razafindrakoto and Roubaud Reference Razafindrakoto and Roubaud2010). Unfortunately, the only global corruption experience survey, Transparency International's Global Corruption Barometer, offers only nine observations between 2003 and 2017. Likewise, questions about corruption experience do not overcome fundamental measurement problems, namely that respondents have incentives to hide or under-report the corruption that they engage in and may be unaware of what goes on outside their immediate purview (Della Porta and Vannucci Reference Della Porta and Vannucci1999; Olken Reference Olken2009). Thus, while imperfect, corruption perception indices represent our best guess about the level of corruption in different countries over time. Their validity is enhanced when measures of democracy and per capita GDP are included on the right side of a causal model, minimizing potential sources of measurement bias from these background factors.

The V-Dem index offers a substantial improvement in coverage relative to other indices, as yearly estimates extend from the turn of the twentieth century to the present, offering an unparalleled time series. Other cross-national measures such as Transparency International's Perceptions of Corruption index, the World Bank's corruption estimates, or the Political Risk Services Group's International Country Risk Guide, cover only the past several decades. Despite differences in measurement strategy, the Varieties of Democracy corruption index is highly correlated with other indices of corruption, such as the World Bank Corruption control index (Pearson's r = 0.91), Transparency International's Corruption Perceptions Index (0.87) and the International Country Risk Guide's corruption index (0.69). To test the robustness of our benchmark model we include pooled ordinary least squares (OLS) models with Transparency International's Corruption Perceptions Index and the World Bank's Control of Corruption estimates as dependent variables (Appendix Tables C22 and C23), and run our benchmark model using the International Country Risk Guide's corruption index (Appendix Table C26).

Indices based on respondent experiences (as opposed to perceptions) are even more limited in spatial and temporal coverage. Importantly, systematic error in measurement is most likely to be associated with cross-country comparisons insofar as corruption may be understood differently or manifested differently in different contexts, rendering estimates that are not cross-nationally equivalent. The expansive data provided by V-Dem allows for a time-series format (with country fixed effects), in which a country is compared to itself over time. This sort of comparison appears to be less prone to systematic error in measurement that might lead to biased estimates.

Expert perceptions indirectly measure underlying phenomena such as corruption with some level of error. Of particular concern for this project is the possibility that experts might expect political finance reforms to decrease corruption. Observing such reforms in the historical record, they may record a decrease in corruption in the following years. If so, the relationship is subject to circularity. We do not anticipate this to be the case since political finance reforms are often introduced in the wake of a scandal and scandals are likely to increase corruption perceptions (Alexander and Shiratori Reference Alexander and Shiratori1994, 3; Carlson Reference Carlson, Norris and Abel van Es2016, 103; Williams Reference Williams2000, 2). However, to systematically address this issue, we use V-Dem data to ‘clean’ our PFSI estimates in a robustness test explored below (Model 3, Table 5).

Initial Tests

Table 3 presents time-series cross-sectional analyses where corruption is regressed against a political finance subsidy index (PFSI). Model 1 employs OLS along with country and year fixed effects, with errors clustered by country. Right-side variables are lagged five years behind the outcome. (Appendix C contains comprehensive variable definitions, sources and descriptive statistics.) On the right side we include only the variable of theoretical interest, the PFSI, measured as a stock variable and transformed by the natural logarithm, as explained.

Table 3. PFSI and corruption

Outcome: political corruption (V-Dem), forward lagged by five years. For GMM, analysis is conducted across 5-year intervals. Estimators: OLS (ordinary least squares), FE (country fixed effects), RE (random effects), GMM (generalized method of moments). Standard errors clustered by country. **p < 0.1 **p < 0.05 ***p < 0.01 ****p < 0.001.

Model 2 adds several covariates commonly regarded as causes of corruption – and, perhaps, of political finance reform. Democracies regulate political finance more heavily than non-democracies. Additionally, a number of studies have shown that democracy has non-linear effects on corruption (Treisman Reference Treisman2000; Treisman Reference Treisman2007; Rose-Ackerman Reference Rose-Ackerman1999) and perhaps on policy implementation, including political finance (Norris and Abel van Es Reference Norris and Abel van Es2016; Rose-Ackerman Reference Rose-Ackerman1999). We therefore include an index measuring the quality of democracy – the Polyarchy index (Teorell et al. Reference Teorell2016) – and its quadratic. Virtually all studies of corruption regard economic development, measured as per capita GDP (log) with historical data from Fariss et al (Reference Fariss2017), as a background factor (Mauro Reference Mauro1995; Treisman Reference Treisman2000; Treisman Reference Treisman2007). Owing to the ubiquity of these variables in studies of corruption, and their strong performance in our models, we regard the specification in Model 2 as the benchmark model.

In Model 3, we add several additional covariates that are less central in the literature but may nonetheless serve as confounders. These include urban population, GDP growth and regular elections (Fisman and Svenson Reference Fisman and Svensson2007; Mauro Reference Mauro1995; Treisman Reference Treisman2007). Model 4 replicates this model with a random effects estimator.

In Model 5, we enlist a dynamic panel model known as system generalized method of moments (GMM), developed explicitly to study sluggish variables (Blundell and Bond Reference Blundell and Bond1998). The benchmark specification includes a one-period lagged dependent variable along with a time trend (replacing the annual dummies). Data is aggregated at five-year intervals, rather than annually, to mitigate the problem of too many instruments (Roodman Reference Roodman2009). We also restrict the number of lags used for instrumentation to three (third to fifth lag). The model treats PFSI as endogenous, and performs well on all relevant specification tests. The Hansen J-test p-value is 0.92, the Ar(2)- and AR(3)-test p-values are, respectively, 0.46 and 0.39. There are thirty-seven instruments, considerably fewer than the 156 cross-section units. This suggests that Model 5 yields a consistent estimate of the relationship between PFSI and corruption.

Tests in Table 3 demonstrate that the relationship between PFSI and corruption is highly significant and fairly stable across all model specifications. Appendix C contains additional specification tests with covariates that measure other factors sometimes associated with corruption including media censorship, trade and natural resource income.

Figure 4 displays how predicted values for corruption vary with PFSI stock (log) in Model 2, the benchmark model, holding other variables at their means. Note that the confidence intervals increase at higher values of the PFSI because few countries have had subsidies in place for more than thirty years. To gain a more specific understanding of this relationship, let us consider the hypothetical case of a country with no prior political finance experience (PFSI = 0) that adopts a full set of measures (a maximum score on the index) in year 1 and maintains those regulations over the subsequent decade (PFSI = 4.02). Levels of corruption in this country are predicted to fall from 0.49 to 0.42, or 0.37 standard deviations.

Figure 4. Predicted values for corruption as PFSI stock (log) increases

Note: Predicted values calculated holding all other variables in the benchmark specification (Model 2, Table 3) at their means, and surrounded by 95% confidence intervals.

Disaggregated Tests

Corruption takes many different forms, providing an additional point of leverage into the relationship between political finance reform and political behavior. While most corruption measures offer only a single variable, V-Dem offers several.

In the first section of Table 4 we interrogate the components of the V-Dem index of political corruption, which measure corruption in the executive, the legislature, the public sector and the judiciary, respectively. Each forms a dependent variable in subsequent regression tests, based on the benchmark specification (Model 2, Table 3). The estimated coefficient for PFSI is negative in all four models, and statistically significant in three. We suspect that small differences in the estimated coefficient for PFSI are the product of the different levels of year-to-year variability across these four outcomes rather than of differing underlying causal relationships.Footnote 18 In any case, our theoretical presumption that political finance reform has wide-ranging effects across different governmental bodies is confirmed.

Table 4. PFSI and disaggregated corruption measures

Outcome: corruption in different sectors (V-Dem), forward lagged by five years. Estimator: ordinary least squares panel analysis with two-way fixed effects (unit and time) and standard errors clustered by country. *p < 0.1 **p < 0.05 ***p < 0.01 ****p < 0.001.

The final column of Table 4 tests corruption in the media. This variable, also drawn from the V-Dem project, is not included as a component of the public corruption index as the media is not – at least not formally – a part of the state. The V-Dem media corruption variable measures the likelihood that members of the media take money or receive favors in exchange for altering their coverage of political events. We have no reason to suspect that changes in political finance regulations would have any effect on levels of media corruption. This alternative dimension of corruption thus provides an important placebo test.

Note that when countries are on a reform trajectory it is reasonable to expect that lots of good things will happen at the same time, generating a problem of simultaneity between political finance reform and curbs on corruption. For example, leadership or a reform movement could be driving both political subsidy reforms and general improvements in corruption across many sectors of society. Our models attempt to deal with this potential problem by adopting a five-year lag structure, but lags do not necessarily suffice to overcome the problem of holism in politics (good things going together). Here, the placebo is helpful. If the covariation between PFSI and Public Corruption is spurious, we would expect it to have a (spurious) relationship with other variables in the V-Dem dataset that measure similar outcomes, like Media Corruption. Model 5 in Table 4 shows that there is no such relationship. The estimated coefficient for PFSI is positive, and nowhere near statistical significance. We regard this as strong corroborating evidence of a causal interpretation of the main finding.

Robustness

This section addresses several additional concerns about the quality of our data and the robustness of the analyses in previous tables.

In Model 1 of Table 5, we return to the benchmark model (Model 2, Table 3), this time with an alternate measure of political finance reform. This measure is drawn from V-Dem, where coding is performed by multiple country experts, aggregated in a latent-variable measurement model. (It is not logged because the V-Dem measurement model ensures that the underlying data approximate a normal distribution.) The V-Dem measure captures public campaign finance and involves a judgment of how central public finance is to national campaigns. Importantly, the V-Dem measure also includes perceptions of private money's importance in campaigns, which the PFSI does not. Estimates from this model confirm our finding that political finance reform is correlated with lower levels of political corruption. (We have more confidence in the accuracy of our factual coding than in V-Dem's expert coding, which is susceptible to systematic error. Note also that because the outcome variable is also drawn from the V-Dem dataset there is a potential problem of circularity.)

Table 5. Political finance (variously measured) and corruption

Outcome: political corruption (V-Dem). DV is forward lagged by five years except public subsidies in Model 3. Estimator: ordinary least squares panel analysis with two-way fixed effects (unit and time) and standard errors clustered by country. *p < 0.1 **p < 0.05 ***p < 0.01 ****p < 0.001.

Model 2 introduces a measure of political finance disclosure regulations. V-Dem's disclosure variable asks experts to code if a country has political finance disclosure laws and, if so, the extent to which parties and candidates adhere to them. The theory outlined above suggests that disclosure requirements increase the possibility of sanctions and therefore are likely to reduce corruption. In conjunction with our political finance subsidy index, disclosure laws do appear to have a negative and statistically significant relationship with corruption, corroborating our expectation.

In the final model in Table 5 we address an additional problem of measurement. V-Dem experts coding levels of corruption in a country may regard political finance reforms as prima facie evidence that levels of corruption are decreasing in a given year. If so, this expectation should be captured in the V-Dem measure of political finance in that year. By including this covariate in our model – along with the PFSI – we should be able to purge the outcome (corruption) of this anticipatory bias. Model 3 excludes other covariates, which introduce problems of collinearity. (Appendix C, Table C25 contains additional models with more controls.) We find that the PFSI remains a negative and statistically significant predictor of corruption even after cleaning the estimate of potential coder bias. Indeed, the estimate from this model is remarkably close to the benchmark model in Table 3.

Further robustness tests are contained in Appendix C. There, we explore changes in model specification, estimator and sample, for example, alternative dependent variables, lagged dependent variable models, pooled OLS, varying lags of the right-side variables, and split-sample tests that restrict the sample to recent decades or drop influential cases or regions. We also show the results for the PFSI in the benchmark model when varying depreciation rates are used to construct the stock for this index, when the components of the PFSI are aggregated using the first component of a principal components analysis, when the PFSI is measured as a level (rather than stock) variable, and when the stock variable is measured in a linear, rather than logarithmic, form. We include controls for natural resources, imports and exports, and media censorship, all of which have been linked to corruption in the literature. We also evaluate alternative dependent variables using corruption data from Transparency International (1995–2015) and the World Bank (1996–2015) in pooled OLS models, as well as the International Country Risk Guide's corruption data (1984–2003) in the benchmark model with varying lags. In these tests, the PFSI shows a strong, negative and statistically significant relationship with political corruption.

Conclusion

Every year, governments around the world disburse billions of public dollars to political parties and campaigns. Political finance reform has vocal proponents and critics among voters, researchers and policy makers. Proponents claim that political finance regulations and subsidies reduce public corruption, reign in special interests and broaden representation (Casas-Zamora Reference Casas-Zamora2005; Council of Europe 2003; United States Agency for International Development 2003). Critics claim that subsidies channel public money to corrupt politicians and organizations, benefit established parties to the detriment of new or small ones, and waste public money (Calland Reference Calland, Norris and Abel van Es2016; Mietzer Reference Mietzer, Norris and Abel van Es2016; Pinto-Duschinsky Reference Pinto-Duschinsky2002; Roper Reference Roper2002). Despite these established debates, few studies have evaluated the effects of political finance laws or subsidies around the world.

This project uses an original dataset of political party and campaign subsidies in 175 countries over 115 years to evaluate claims about political finance laws and corruption. We argue that subsidies for parties and campaigns reduce corruption by curtailing the role of private money in politics and increasing sanctions for corrupt politicians. With more discretion over where funds come from and under the threat of more serious sanctions for malfeasance, officials prioritize clean money over suspect funds. As a result, subsidies reduce corruption by displacing bribes and embezzlement, and accompanying campaign finance regulation increases the legal and social sanctions for being caught.

Our cross-national panel analyses find that political finance subsidies are negatively associated with political corruption. The relationship remains stable after adjusting for time and country effects, and controlling for the quality of democracy, GDP per capita, GDP growth, urban population and regular elections – along with a series of additional robustness tests carried out in Appendix C. An intensive case study focused on Paraguay's 1996 political finance reform illustrates the process and theoretical mechanisms behind the quantitative results: after the country's 1996 reform, public corruption – particularly embezzlement and the misuse of state resources – decreased even in the face of uneven implementation. Officials attribute the decrease, in part, to political finance regulations and subsidies.

Our results raise further questions. In future research, we hope to be able to disentangle the effects of political subsidies and regulations – here understood as part of an omnibus treatment. This project establishes that political subsidies and regulations appear to incrementally decrease corruption over time, but does not investigate which measures have the biggest impacts, or which mechanism is the most important.

This empirical study contributes to debates on political finance by establishing a strong case for the role of political finance in reducing corruption – even in highly corrupt, poorly institutionalized political contexts. Indeed, Paraguay's experience suggests that reforms may have the greatest impact where corruption is most widespread.

Supplementary material

Data replication sets are available in Harvard Dataverse at: https://doi.org/10.7910/DVN/QBBVOL and online appendices at https://doi.org/10.1017/S0007123419000358.

Acknowledgements

We gratefully acknowledge helpful comments from Hind Arroub, Alejandro Avenburg, Merike Blofield, Ashley Brooks, Kevin Casas-Zamora, Lee Cojocaru, Louise Davidson-Schmich, Peter Esaiasson, Jessica Gottlieb, Adam Harris, Allen Hicken, Jay Kao, Sokol Lleschi, Lindsay Mayka, Daniel Ogbaharya, Susan Scarrow, Iryna Solonenko, Mike Touchton, Agustín Vallejo, Jack Vowles and the Political Science faculty workshop at the University of Miami. This project was previously presented at the Red de Economía Política de América Latina 2019 meeting at Tulane University and the Southern Political Science Association 2019 meeting in Austin. This research project was supported by Riksbankens Jubileumsfond, Grant M13-0559:1, PI: Staffan I. Lindberg, V-Dem Institute, University of Gothenburg, Sweden as well as co-funding from the Vice-Chancellor's office, the Dean of the College of Social Sciences and the Department of Political Science at University of Gothenburg.