1. Introduction

Coal has been an energy mainstay of Europe for millennia. Early Greek accounts mention coal extraction taking place in third century BC Liguria, and by the second century AD, Romans were mining coal at multiple locations in Britain, mainly in small, bell-shaped pits or from exposed seams. Underground mining of hard coal had become established in most European countries by the second half of the eighteenth century. By the nineteenth century, coal had become a vital input for the industrial revolution, and as a heating fuel for tens of millions of homes (Ponting, Reference Ponting1992: 283).

Following the 1957 Suez crisis, however, fuel oil became progressively cheaper as a source of energy, threatening coal's dominance as a fuel for electric power generation. The discovery and subsequent development of natural gas, particularly in the Netherlands and in the North Sea, and the extension of piped natural gas, first from the former Soviet Union and then from North Africa, further threatened coal's centuries-old primacy.

Because of the nature of coal production, involving large numbers of specially trained and usually highly unionized miners, often concentrated in particular regions, there was considerable political resistance to the abandonment of coal, particularly hard coal (bituminous coal and anthracite) mined in countries with large domestic industries: Belgium, France, Germany, Spain, and the United Kingdom. Through various policies, these industries were protected from competition from imported coal and often from competing sources of energy.

This paper explains the interaction between subsidies and other policies that protected the coal market in Western Europe, and trade in coal between Europe and the rest of the world. What it suggests is that this relationship was a complex one, as the dismantling of coal-industry protection, especially in the larger EU Member States, occurred contemporaneous with other developments in the energy market that substantially changed the consumption side of the equation as well. Chief among these were actions taken to privatize the electricity industry and more generally to open it up to competition; the active promotion by states of alternative forms of electric power generation, particularly nuclear power and renewable energy; and policies to limit air pollution and ultimately emissions of carbon dioxide (CO2).

The paper is structured as follows. It starts by tracing the re-emergence of the Western European hard-coal industry after the deprivations of the Second World War (1939–1945), and the policies that were put in place after the initial rationalization of the industry within the European Coal and Steel Community. It then traces the major periods of senescence, resuscitation, and eventual terminal decline of the industry and the responses taken at both the national and supra-national (EU level) during these periods. Thereafter follows observations on how trade in coal developed in response to these developments. A few policy recommendations conclude the paper.

2. The Western European Coal Industry, 1945–2019

The coal industry in Western and Central Europe, including the Balkans, has had five separate historical paths and experiences with coal subsidies since the Second World War. One dividing line is between the hard-coal industry, which in Europe traces back centuries and involves extraction mainly from underground pits, and the production of lower-grade solid fossil fuels (lignite and peat), which are accessed principally by large machines operating on the surface. The other division has been between mining operations based in countries on opposite sides of the former Iron Curtain – i.e., to the west those countries that would eventually become the EU-15 and the associated non-EU members of the European Economic Area (Iceland, Norway, and Switzerland), and to the east those that would join the EU much later (starting in 2004), or are not yet members.Footnote 1 The fifth category is those countries that have no recent history of domestic coal production, namely Denmark, Iceland, Luxembourg, Sweden, and Switzerland.

This paper focusses on subsidized hard-coal mining in Western Europe and Norway from the end of the Second World War to the present. Mining of hard coal in this group has struggled over most of the past 60 years, and was typically put under the control of state-owned or state-created enterprises. Subsidies were designed to keep these industries afloat, both for local employment reasons and energy security.

2.1 The Immediate Post-War Years and the Marshall Plan

Before the war, the European economies depended heavily on coal. It was the main fuel for powering steam-driven electric power plants, heavy industry, railroad engines, inland and coastal ships, and even some tractors and trucks that were equipped with engines that could operate on gas generated from coal (Bizzozero, Reference Bizzozero2003: 55). Millions of homes also were heated by coal, and coal-based plants produced a significant share of Europe's nitrogenous fertilizers.

A continuous supply of hard coal – anthracite and especially bituminous coal – had been vital to the war effort of European countries, but production had been damaged both by the drafting of miners into the armed forces, and by physical destruction to mines and transport infrastructure wrought by aerial bombing. Shortages of materials and skilled manpower also hampered the development of new mines and the maintenance of existing ones (Thompson, Reference Thompson1952).

Thus, in the years immediately following the war, Western European coal production struggled to recover to its pre-war (1938) annual output level of around 500 million tonnes, and had to be supplemented by imports, largely from the United States (United States, 1947: 177, 180). In order ‘to prevent the extremes of misery which might have resulted from a ruthless struggle’ among the nations of Western Europe for the limited amounts of coal available on the international market, ‘a struggle which in particular might have meant disaster to the countries without coal mines’, the United States and most of the Western European countries, apart from Spain, established the European Coal Organization (ECO). Until its authority was transferred to the Economic Commission for Europe at the end of 1947, little of Europe's internal coal trade took place that was not under the organization's purview (A.S.A., 1948: 111).

By the end of 1946, the economies of Europe began to stall, and there was fear of an economic collapse (Jackson, Reference Jackson1979: Reference Jackson1046).Footnote 2 In response, the United States, under the stewardship of US Secretary of State George Marshall, proposed a major package of economic aid at an unprecedented scale (Payne and Thakkar, Reference Payne, Thakkar and Cuadra-Montiel2012). The European Cooperation Act, which would become more popularly referred to as the Marshall Plan, was signed on 3 April 1948, disbursing a total of US$13.3 billion in aid to 16 European countries over the next three fiscal years (equivalent to around US$200 billion in dollars in 2019), of which 89% was in the form of grants and 11% in the form of loans.Footnote 3

The over-riding aim of the Marshall Plan was ‘to once more make Europe a viable economic entity’, which in turn would ‘restore stability in Europe and establish her as a market for goods [other than coal] from the United States’ (Bizzozero, Reference Bizzozero2003: 56, 73). Many involved in developing the plan felt that the shortage of coal was a major impediment to the region's recovery. German mines, under the control of the occupying forces, Britain (Ruhr) and France (Saar), were still exporting – reducing supplies to Germany itself – but Britain, which had been an important supplier of coal to neighbouring European countries, was having trouble meeting even its own requirements; and Poland's coal was now mainly being shipped eastward (United States, 1947: 180–184). The United States was capable of exporting more than 45 million tonnes a year to EuropeFootnote 4, and had increased shipments considerably as soon as hostilities ceased, but transport charges made it expensive (Thompson, Reference Thompson1952).

Among the conditions placed on the United States’ aid was that trade between the recipient countries become less restricted, and that the cartel arrangements that had been a major feature of German industry before the war, including coal, would not be allowed to return (Wells, Reference Wells2002: 203). The State Department's Policy Planning Staff thus devised a ‘Coal for Europe’ programme, focussed on the restoration of hard-coal production in the Rhine valley (Keenan, Reference Keenan1947).

Much of the aid provided under the Marshall Plan was expected to be used for the purchase of goods from the United States, including coal. Earlier assistance had raised US coal exports to Europe to a peak of 36 million tonnes in 1947 (Arkes, Reference Arkes2015: 264). But just as the Marshall plan went into high gear, US coal exports began to slow. For one, the Economic Cooperation Administration (ECA), the organization established to administer the Marshall Plan, had levied export quotas of 1 million short tons a month, which the United States’ Coal Exporters’ Association argued was half of what it should have been (Arkes, Reference Arkes2015: 264). US coal exports to Europe had already fallen to US$276 million by the first quarter of 1949. By the third quarter of that year, their value had dropped to a mere US$2.9 million, and thereafter the ECA financed no imports of US coal at all (Arkes, Reference Arkes2015: 265).

Meanwhile, several European countries were using Marshall Plan funds to invest in rebuilding their coal industries. These ‘counterpart funds’ accounted for 40% of the investment in the West German coal industry in 1949–1950, for instance (Crafts and Toniolo, Reference Crafts and Toniolo1996, cited in Barlow Reference Barlow2018). Despite that, the German Government, responding to inadequate investment in coal and steel mining, enacted the Investment Aid Act of 1951, which imposed a levy on other German industries in order to raise funds to support investments in coal and steel production, electricity generation, and transport infrastructure (Eichengreen and Ritschl, 2008: 29–30). Belgium, for its part, designated 30% of the direct aid it requested through the Marshall Plan for its coal industry; in the event, according to Cassiers et al. (1996: 181), ‘[t]he aid they did receive went almost entirely down the mines’. These investments had the desired effect, and by the end of the Marshall Plan, in 1951, the Western European coal industry had largely recovered and was experiencing rapid domestic demand, both from its metallurgical industry and for power generation.Footnote 5

2.2 1953–1958 – The European Coal and Steel Community, from Formation to First Crisis

Even from before the start of the Marshall Plan, European politicians had been discussing ways to create a more economically integrated Europe and avoid future wars, particularly between France and Germany. An initial major hurdle to the achievement of that goal had been resistance from the French Gaullists, whose policies aimed at developing France's own coal and steel industries and maintaining control over Germany's western borderlands in order to support its own industries in the east and slow its recent adversary's economic recovery (Reischer, Reference Reischer1949: 64). The French Plan de Modernisation et d’Équippement (the ‘Monnet Plan’), announced in January 1946, assumed continued French control of the Saar industries and access to coal through the Allies’ International Ruhr Authority. Around 30% of the funds disbursed under the Monnet Plan went into modernizing France's coal and steel industries (Lee, Reference Lee2004: 110, n.8).

Germany became increasingly resentful over the controls put on their economy, and London and Washington favoured relaxing those controls sooner than did Paris. The French eventually conceded that a new approach was needed (Lee, Reference Lee2004). Following many months of secret discussions, on 9 May 1950 French foreign minister Robert Schuman unveiled a grand plan that envisaged placing ‘Franco-German production of coal and steel as a whole … under a common High Authority, within the framework of an organization open to the participation of the other countries of Europe’ (Schuman, Reference Schuman1950). After less than a year of negotiations among the potential participants, this bold initiative led to the crafting of the Treaty constituting the European Coal and Steel Community (ECSC), which was signed in Paris on 18 April 1951 and came into force on 25 July 1952 (European Commission, 2002: 1).

Originally encompassing six European countries (Belgium, France, Italy, Luxembourg, the Netherlands, and West Germany), the initial idea behind the ECSC was that the rules governing investment in these countries’ coal and steel industries would be placed under a centralized authority, and that a common market would be created for their output. Notably, the United Kingdom decided not to join in this arrangement.

Article 4 of the ECSC (CVCE, 2015: 5) set out unusually restrictive rules for providing subsidies – or, in the language of the ECSC, ‘state assistance’ (later, ‘state aid’) – to ECSC coal and steel producers:

The following are recognized to be incompatible with the common market for coal and steel, and are, therefore, abolished and prohibited within the Community in the manner set forth in the present Treaty:

a) import and export duties, or charges with an equivalent effect, and quantitative restrictions on the movement of coal and steel;

b) measures or practices discriminating among producers, among buyers or among consumers, specifically as concerns prices, delivery terms and transportation rates, as well as measures or practices which hamper the buyer in the free choice of his supplier;

c) subsidies or state assistance, or special charges imposed by the state, in any form whatsoever;

d) restrictive practices tending towards the division of markets or the exploitation of the consumer.

The common market for coal, iron-ore, and scrap went into effect on 10 February 1953, and for steel 80 days later. Tariffs and quotas on coal imported from other member states were eliminated. From the beginning, however, ECSC member states often thwarted efforts by the Commission's High Authority to fully dismantle all barriers to trade, and sometimes supported domestic production by indirect means, such as low-interest loans or discriminatory rates for rail transport. As Alter and Steinberg (Reference Alter, Steinberg, Meunier and McNamara2007: 93) write, ‘[a]s long as national policies did not create negative externalities that flowed across borders, member states saw no role for the ECSC institutions in facilitating market adjustments’.

In late 1958, the ECSC faced its first major test. During the four years prior to the crisis, when demand for coal was booming, ECSC members had entered into long-term import contracts from third (i.e., non-ECSC) countries, mainly the United States, for deliveries up to three years ahead, often at high prices (Economic Weekly, 1959: 481). When demand softened, it was therefore Community-mined coal that had to absorb the necessary cutbacks in sales. Stockpiles grew, prices fell, and a number of mines ceased producing, precipitating widespread miners’ strikes (CVCE, 2016: 2). As the crisis reached its climax, ECSC governments forbade new import contracts and raised sharply the duty on imports in excess of specified quotas. Belgium even went so far as to impose a complete embargo on all imports of coal, including from the member countries of the ECSC, in clear violation of the ECSC Treaty (Economic Weekly, 1959: 482).

The nine-member independent High Authority sought to declare a state of ‘manifest crisis’ for coal, which would have allowed it to set production quotas and restrict third-country imports. But to take these actions it needed the approval of the Special Council of Ministers, who in the event refused to give their assent, arguing instead for allowing state aid to the coal mines (European Commission, 2002). Unable to impose any Community-wide measures on the sector, the High Authority was constrained to case-by-case interventions (CVCE, 2016: 3). It did, nonetheless, create an adaptation fund to help redundant minders, and authorized Belgium to grant subsidies so its coal companies could lower their sales prices. It also created a stabilization programme to help Belgium close its least profitable pits, and provided individual grants to France and the Netherlands (CVCE, 2016: 3).

2.3 1959–1972 – Coal's Senescence

The ensuing years witnessed the slow contraction of the Western European hard-coal industry, as new power plants began to be built to take advantage of relatively inexpensive residual (heavy) fuel oil, and old, inefficient coal-fired power plants were retired. German hard-coal production peaked in 1957 but remained at 1958 levels through the next six years, and then declined by 25% between 1964 and 1972 (Brecht et al., Reference Brecht, Goethe, Krämer, Reintges and Willing1983: 855). Output from hard-coal mines in the UK, not an ESCS member, similarly peaked in 1957, but had declined by 44% by 1972 (DBEIS, 2019).

Basically, although bituminous coal suitable for coking was still in demand by the metallurgical industry, expensive, subsidized European bituminous coal for heat or steam electric power generation became less and less competitive with other energy sources, the result of its own rising costs and the falling costs of alternatives – and as Söderholm (2002: 205) notes, the main criterion governing fuel choice in Western Europe during this period was cost. In mountainous areas, hydroelectric power was developed aggressively. Many countries with flatter terrain, particularly Belgium, France, Germany, Spain, Sweden, and the United Kingdom, embarked on ambitious programmes to develop nuclear power. Throughout Western Europe, except in places where relatively inexpensive, surface-mined sub-bituminous coal or lignite could be extracted and burned locally, the bulk industrial fuels of choice became fuel oil or natural gas.

In the early 1960s, several decisions by the European Court of First Instance affirmed the authority of the European Commission to allow derogations from the prohibition against state aid to the coal and steel sectors, as set out in Article 4(c) of the ECSC Treaty (Podsiadło, 2015: 4). Thereafter followed a succession of Commission decisions, the first of which, Decision No. 3/65/ECSC (European Commission, 1965), permitted members of the ECSC to grant state aid to coal enterprises in order to help partly finance activities such as recruitment, training, and mine closures (including early retirement benefits). But it also allowed ‘exceptional expenditure contributing to the increase of profitability’ by what it called ‘positive rationalization’. Allowable expenditures included:

• expenditure resulting from the concentration of mining operations;

• capital expenditure to increase the mechanization of operations;

• capital investment to improve the value of coal (e.g., washing facilities); and

• capital investment to improve mine safety.

The aid could be granted only if the companies in receipt of such aid could provide proof they had overdrafts corresponding to at least three years of normal operation and coal reserves for at least 20 years of operation, and that the implementation of the investment programmes for which state aid was requested would lead to a substantial reduction in production costs or to a substantial increase in the value of coal products.

During this period, some ESCS member states nonetheless continued to pursue a policy of facilitating a gradual contraction of their hard-coal industries, and a reduction in subsidies (Fosty, 1966: 2–3). Italy's once giant Serbariu colliery, on Sardinia, ceased mining in 1964 (ERIH, n.d.). On 17 December 1965, just two years after production of natural gas commenced from the country's massive Groningen field, the Netherlands’ Minister for Economic Affairs announced that all the country's remaining coal mines – both the state-owned and private mines, all located in the Province of Limburg – would be shut down within ten years (Messing, 1988: 98). In 1967, Belgium's Government called for a managed, but rapid closing down of its remaining collieries (Adelman, Reference Adelman1972: 240). In other countries, heavily subsidized coal mines were closed, but the remaining ones were modernized where it made economic sense to do so (Steenblik, Reference Steenblik2020).

At the end of 1970, the European Commission issued another Decision (No. 3/71/ESC), in which it asserted that ‘despite all that has been done’, many of the ECSC states’ ‘collieries would not be viable without aid’, adding ‘there is no prospect of the energy market developing in such a way as would allow the Community coal industry as a whole to achieve financial equilibrium’ (European Commission, 1971: 10). As always, its concern was that if aid to the industry were to be suddenly withdrawn, there would be a serious risk of ‘disturbances in economic and social conditions in certain mining regions in the Community’. It then authorized Member States to provide state aid for another five years, particularly related to closures, and subject to pre-approval by the Commission.

2.4 1973–1985 – Coal's Resuscitation

In March 1972, the Club of Rome, a self-described ‘organization of individuals who share a common concern for the future of humanity and strive to make a difference’,Footnote 6 published a small book with a big impact. The Limits to Growth (Meadows et al., Reference Meadows, Meadows, Randers and WW Behrens1972), a non-technical version of the first Report to the Club of Rome, summarized the findings of a two-year research project into the viability of continued economic growth and its consequent environmental footprint. Using a global computerized model, the team fed in data on the five variables that, in their view, determined and, through their interactions, ultimately limited population increase: the number of people alive at any given moment, food production, industrial output, pollution, and the consumption of non-renewable natural resources. The authors’ basic finding was stark:

The earth's interlocking resources – the global system of nature in which we all live – probably cannot support present rates of economic and population growth much beyond the year 2100, if that long, even with advanced technology.Footnote 7

The impact of the book, which was ultimately translated into over 30 languages, was enormous. And its message, coming in the wake of nationalization of South American mines and successful efforts by Middle Eastern and North African oil producers to raise prices for their crude oil, added to the growing fear that the world was quickly depleting its stock of non-renewable natural resources.

When, in October 1973, members of the Organization of Arab Petroleum Exporting Countries proclaimed an oil embargo against nations it perceived to be supporting Israel during the Yom Kippur War (Canada, Japan, the Netherlands, the United Kingdom, and the United States, later extended to Portugal, Rhodesia, and South Africa), panic in the market took hold. By the end of the embargo, in March 1974, the international price of crude oil had risen four-fold, from US$3 to US$12 per barrel (around US$50 in US dollars of 2019). Prices for products, such as residual fuel oil for power generation, and ultimately natural gas, also rose.

The ‘first oil shock’, as it would later be called, convinced European policy makers of the need to make the security of its energy supplies a top priority (European Commission, 1975). For countries with their own energy resources, domestic producers ensured that ‘energy security’ would be regarded as best served through energy self-sufficiency, to the extent possible. For electric utilities, however, it meant substituting other energy sources for heavy fuel oil. That might have meant much more natural gas, but gas was now seen as a noble fuel that was better kept for higher-value uses, such as home heating and cooking. Consequently, a European Community Directive was issued in 1975 that restricted the use of natural gas in existing electric-power plants and the construction of new gas-fired power plants (Council of the European Communities, 1975: 24–25).

Two years later, the Governing Board of the International Energy Agency (IEA), which had been created in 1975 in response to the oil shock, adopted a set of guiding principles for energy policy (Scott, 1994: 381–384). Significantly, paragraphs 5 and 6 of the principles spelled out specific recommendations regarding the use of particular fossil fuels for power generation by, among other actions, the ‘[p]rogressive replacement of oil in electricity generation, district heating, industries and other sectors by discouraging the construction of new, exclusively oil-fired power stations; [and] encouraging the conversion of existing oil-fired capacity to more plentiful fuels in electricity, industrial and other sectors’ (IEA, 1977: 382, italics not in the original). The principles also called for a rapid phasing in of steam-coal in the electrical power generation and industrial sectors, and active promotion of an expanded and reliable international trade in steam coal.

The principles also envisaged a ‘steady expansion of nuclear generating capacity as a main and indispensable element in attaining the group objectives’. To the extent that renewable energy was mentioned, the stress was on research into ‘technologies for broadly applicable renewable energy sources’, and the development of ‘policies which facilitate the transition of new energy technologies from the research and development phase to the point of utilization.’

The 1977 IEA Principles are notable, not so much as any kind of binding obligation on its members (which included all the Western European countries except for France and Iceland), but a reflection of policy priorities at the time. Basically, these were: substitute coal for oil and gas in existing power plants and heavy industrial plants, expand coal-fired and nuclear-fuelled power plant capacity,Footnote 8 and support research into renewable energy.

On coal, however, there was a sharp divide between the countries with an extensive history of coal mining, namely Belgium, France, Germany, Spain, and the UK, and countries with limited or no domestic resources. The former saw the new energy politique as justifying new (government-supported) investment in their energy industries, whereas the latter planned on turning to imports from Poland, the United States, or emerging overseas exporters, such as Australia and South Africa. The Netherlands was still a coal producer, but it decided to continue implementing its plan to close down its industry; its last coal was hauled out of the ground in December 1974 (Jongde, 2004: 232).

Some users of heavy fuel oil could switch to using coal fairly quickly, and many did, especially in Austria and Belgium, often supported in these efforts by subsidies (see, e.g., Wagner, 1981). But the lag time in commissioning new coal-fired plants meant that substantial growth in coal demand and imports would take several years to manifest itself. Indeed, thanks to the economic slump precipitated by the oil shock, US exports of coal, one-third of which were shipped to Western Europe, having risen in 1974 and 1975, fell sharply during the next three years (EIA, 2012: 207).

Between 1975 and 1988, more than 115 new power-plant units designed to burn hard coal were added to the electricity generating fleet in Western Europe, including in countries with no previous history of large-scale use of coal for power generation, such as Denmark and Finland (Table 1). Altogether, between 1975 and 1988, eight Western European countries that were not among the leading coal or lignite producers added more than 12,650 MW of coal-fired power plant capacity designed to use hard coal imported from outside the EU. During the early part of that period, some plants that had been designed to use fuel oil were made coal-capable before construction was completed. But most of this capacity came on-line after 1980, due to the lead time required to site, design, and construct the plants and associated infrastructure. In these countries, net coal imports grew rapidly, peaking in 1985 and then fluctuating at a slightly lower average level for the next five years (Figure 1).

Figure 1. Non-coal producing EU-15 coal countries: evolution of production and trade

Table 1. Additions of power plant capacity in selected Western European countries that were commissioned between 1975 and 1988 and designed to use imported hard coal (gross MW)

Source: Based on data contained in ‘Europe Beyond Coal: European Coal Plant Database’, v. 22 June 2018. https://d3ihh3ce7usp68.cloudfront.net/wp-content/uploads/2020/04/2020-04-21_Europe_Beyond_Coal-European_Coal_Database_hc.xlsx

New coal-fired power plants were also ordered in the leading coal-producing countries of Germany, Greece, Spain, and the United Kingdom, but these were primarily built to use domestically produced coal, either expensive local hard coal or less expensive lignite (brown coal). In addition, some 27 lignite-fired power plant units came online, mainly in Germany (including the eastern Länder, then part of the German Democratic Republic) and Greece, all built as mine-mouth plants. Belgium, by contrast, commissioned its last hard-coal-fired power plant in 1975.

Hard-coal production in the main producing countries of Western Europe at the time (Belgium, France, Germany, Norway, Spain, and the United Kingdom) did expand slightly between 1974 and 1981, but then continued the pre-oil-crisis decline thereafter. Coal imports increased during this period, and for 15 years thereafter, but did not fully replace the lost domestic production (Figure 2). The total energy equivalent supply of hard coal in these countries thus declined as well.

Figure 2. Coal-producing EU-15 and EFTA countries: evolution of production and trade

One major reason for the slow contraction of the domestic coal industries in the traditional coal-producing countries were the various government-brokered arrangements between the domestic coal industries and the government-owned or at least heavily regulated electric utilities (Steenblik, Reference Steenblik2020). By the mid-1980s, however – shortly before the sudden collapse of international oil prices – these arrangements began to come under stress.

2.5 1986–2010 – The Writing on the Coal Face

In 1981, in the midst of what has often been called ‘the second oil shock’, the spot price of Brent crude oil, an international reference price, reached US$35 per barrel (equivalent to over US$100 per barrel in dollars of 2019), a level that would not be seen again in real terms for another 27 years. Over the next half-decade, the price gradually slid downwards, owing to slow economic growth in industrial countries and new petroleum supplies coming on stream. By the beginning of 1986, the price of Brent crude stood at US$27, but after production-limiting talks by OPEC failed in June of that year, it then plunged to below US$9 (or around US$21 in dollars of 2019). Prices for natural gas sold in Europe soon followed suit, but with a lag (Yijun and Li, Reference Yijun and Li2016: Reference Yijun and Li500).

Coal-fired power, the answer to the relatively high prices of oil witnessed over the previous 12 years, suddenly looked less competitive. As well, the bottlenecks that had afflicted non-European coal exporters during the early part of the decade had largely been resolved. The future viability of subsidized hard-coal production in Western Europe started to be questioned more and more seriously. If the low oil prices during the second half of the 1980s had been troublesome for European coal producers, they were even more of a problem for coal exporters, who had expanded their export capacity in anticipation of ever-increasing shipments. Instead, they found their export markets stagnating, as European power plants and steel mills continued to give preference to coal produced domestically.

In 1989, following a report by the International Energy Agency (IEA, 1988) that quantified coal production subsidies in the EU and Japan, Australia began pressing the European Community on its Member States’ coal producer subsidies, which Australia alleged were hurting its own coal producers’ export revenues (GATT, 1991). Ultimately, the two economies settled out of court, and on 15 December 1993 they signed the bilateral European Community–Australia Coal Agreement. Among other concessions, the European Community agreed to a standstill in subsidized coal production, and Australia committed to not challenge the Community's coal subsidy scheme (Steenblik et al., Reference Steenblik, Sauvage, Timiliotis, Van Asselt and Skovgaard2018: 127).

This standstill largely reflected a reality already evident in most of the coal mining countries of the EU at the time: that subsidized coal production had no long-term future. Ireland had already shut its last hard-coal mine in 1990. Belgium closed its mines in Waterschei, Winterslag, and Eisden in 1987, and soon thereafter in Beringen; the country's last hard-coal mine, Zolder, ceased production in 1992 (Anonymous, 2019a). Portugal similarly stopped mining hard coal in 1994 (Ribeiro et al., Reference Ribeiro, Ferreira da Silva and Flores2010: 359).

In 1990, these coal producers were accounting for only around 1% of EU production and had little effect on international trade in coal. By contrast, the coal industries of France, Germany, Spain, and the UK continued to hold on, hoping that the decline in oil and gas prices would be short-lived. Even Norway's state-owned coal company decided to invest in a major expansion of its coal mining operations on the Svalbard archipelago at around this time, with the intention of selling most of the mines’ output into the export market (Steenblik, Reference Steenblik2020).

In December 1993, the European Commission issued new rules for aid to the coal industry (Decision No. 3632/93/EC), the last within the framework of the ECSC. Among other changes, it set out a definition of ‘aid’ that was closer to the one that would soon be adopted by the WTO (European Commission, 1993: 14). Importantly, an ‘indirect measure’, even if it did not place a burden on the public budget, was considered as conferring aid if it gave an economic advantage to a coal undertaking. Moreover, existing aid linked to agreements between producers and consumers had to be modified before the end of 1996 to bring it into line with the provisions of the decision.

Significant for trade, Decision No. 3632/93/ECSC acknowledged that ‘the world market in coal is stable, with abundant supplies from a wide variety of geographical sources, with the result that, even in the long term and with increased demand for coal, the risk of persistent interruption of supply, although it cannot be ruled out totally, is nevertheless minimal’. In other words, domestic production was no longer vital for the security of Europe's energy supplies; what still needed addressing, nonetheless, was the ‘precarious social situation of mining regions’ (European Commission, 1993: 12–13).

The Government of France let its coal industry continue to wither, as the monopoly electricity supplier, EdF, turned to nuclear power as its energy of the future. In 1994, it decided to close down all of its remaining coal and lignite mines, a feat that was symbolically concluded ten years later, on 23 April 2004 (Lichfield, Reference Lichfield2004). The British coal industry, emerging from a bitter confrontation in the mid-1980s between the National Union of Mineworkers and the Thatcher Government, now faced the prospect of privatization and the ending of its brokered contracts with the state-owned Central Electricity Generating Board (also slated for privatization).

Germany, meanwhile, had already by the late 1980s anticipated the continued, albeit gradual, downsizing of the sector. Following the unification of East and West Germany in 1990, however, coal subsidies resurfaced as an issue due to the public financing pressures created by the integration of the eastern part of the country with its much wealthier western Lander. In 1991, another round of discussions took place, resulting in a plan through 2005 for phasing-out subsidies to the mining sector and achieving further capacity adjustments.

With the expiry of the ECSC Treaty on 23 July 2002, the Council of the European Union had to establish new rules for state aid to the coal industry, which it finally issued on the ECSC's very last day. By then, ‘the world political situation’ (e.g., Middle East terrorism), per the Regulation (No. 1407/2002), had brought ‘an entirely new dimension to the assessment of geopolitical risks and security risks in the energy sector and gives a wider meaning to the concept of security of supplies’ (Council of the European Union, 2002: 1). It called for maintaining ‘a minimum level of coal production’, complemented by measures to promote renewable energy. Aid became more restricted, confined to coal used for the production of electricity, combined heat and power, or metallurgical uses (Article 3). Moreover, the aid granted by EU Member States had to follow a downward trend and, after 2003, should never again exceed what was authorized for the year 2001 (Article 6).

2.6 2010–2018: The Lamps Go Out

By 2005, the EU fuel market, especially for coal and natural gas, had changed dramatically. The prices of internationally traded oil and coal were rising quickly, giving some hope to the remaining mines. But natural gas prices were paralleling the price of coal imports, and were stabilizing. Perhaps far more importantly, however, the EU had in 2003 agreed to establish an Emissions Trading System (EU ETS), which would set a cap on total allowable greenhouse gas emissions for each Member State. Phase 1, its initial three-year trial period, went into effect in 2005. The first EU ETS covered only CO2 emissions from power generators and energy-intensive industries, and almost all allowances were given to businesses for free. In the end, those allowances were over-generous and their price fell to zero (Skjærseth and Wettestad, Reference Skjærseth and Wettestad2009: 114). But the signalling was clear: it was unlikely that coal-fired electric power had a long-term future in Western Europe.

Both the EU and its Member States were, accordingly, by the mid-2000s putting much more stress on renewable energy and cutting carbon emissions. In 2010, the EU (via Council Decision 2010/787/EU) had set out new state-aid rules for the coal sector, allowing Member States to cover production losses and certain exceptional costs arising from the closure of uncompetitive coal mines, in order to alleviate the social impacts and protect the environment (Council of the European Union, 2010). The rules required in particular that mines receiving such aid must be wound down by the end of 2018 at the latest. Financial support to workers who lost their jobs due to mine closures was approved, by funding severance payments and social security benefits. It would also finance the safety and remediation works necessary after the mines closed. However, part of the aid was also allowed to be used to cover the production losses of the mines during the transition.

Over the next eight years, almost all the remaining hard-coal mines in Western Europe closed down. In Italy, the cessation of underground coal mining on its island of Sardinia essentially occurred at the end of 2012. In the UK, the last operating underground coal pit, Kellingley, shut its gates on 18 December 2015 (Macalister et al., Reference Macalister, Duncan, Levett, Sheehy, Scruton and Swann2015). In Norway (not subject to the EU Council Directive), the state wound down its two largest, and newest, underground coalmines, on Svalbard, in 2017 (Anonymous, 2019b). And the two biggest Western European coal producers, Germany and Spain, both oversaw the closure of their last subsidized, hard-coal mines in December 2018 – just in time to meet the EU's deadline (Steenblik, Reference Steenblik2020).

2.7 The Situation as of the end of 2019

As of the end of 2019, hard-coal mining had all but disappeared in Western Europe. Only around 0.5 million tonnes of coal were still being produced in the UK annually, all from small surface mines (DBEIS, 2019).Footnote 9 Norway had shut down all of its Svalbard coal mines except for one. And only one hard-coal mine remained in operation in Spain. In all the other EU-15 Member States, hard-coal production had ended definitively.

What additional solid fossil-fuel production does remain within the EU-15 area is a small amount of peat harvesting in IrelandFootnote 10 and Finland (each around 3 million tonnes in 2016), and Sweden (0.4 million tonnes in 2016, much of which is not combusted), declining production of lignite in Greece (from 63 million tonnes in 2012 to 35 million tonnes in 2018), and a slowly falling level of lignite output in Germany, the world's leading producer of brown coal, at 166 million tonnes in 2018 (BP, 2019: 44; Kaltenbach and Maaßen, Reference Kaltenbach and Maaßen2019: 1). Even this latter amount is half the quantity produced in 1990, when the former GDR was re-united with the Federal Republic.Footnote 11

In addition, by the close of 2019, most Western European countries – apart from Norway, and SpainFootnote 12 – had become members of the Powering Past Coal Alliance, thereby committing to phase out unabated coal use within their jurisdictions at the latest by 2030, and to a moratorium on approving any new coal power stations unless they were equipped with operational carbon capture and storage facilities.Footnote 13 Within this group, France and Sweden plan to close down their last coal-fired plants by 2022; Austria, Ireland, Italy, and the UK by 2025; and the rest by 2029 or 2030 (Galgóczi, Reference Galgóczi2019: 21). Already, during the second quarter of 2019, the UK electricity grid experienced 18 days in which its coal-fired power plants sat idle (Staffell et al., Reference Staffell, Green, Gross and Green2019: 5). Germany has targeted 2038 as the latest date for its complete phase out of coal-fired power (Eriksen, 2019).

One additional harbinger of the end of hard-coal production and consumption in Western Europe was the auction price of a carbon credit on the European Energy Exchange, which trebled over the course of 2018, ending at €23.40 (US$ 26.70) per tonne of CO2 (European Energy Exchange, 2018). Despite this sharp rise, the price of imported steam coal itself only slumped by around 10% over the year, stabilizing at around US$100 per tonne (Hodges, Reference Hodges2018).Footnote 14

3. Trade Effects

What the foregoing historical narrative shows is that the relationship between government support, and changes in the nature of that support, to coal production and trade is a complex one, at least in the specific case of hard coal in Western Europe. That is because hard coal is just one of a number of intermediate inputs to the production of iron and steel, and even more so of electric power. Through time, with the advent of electric arc furnaces (which require no coal for coking) and new technologies for generating electricity, the choice of substitute inputs has only increased.

Other policies, most notably those related to the environment, have also worked against coal over time. Since coal combustion releases more pollutants than any other fossil fuel, and much more than most non-fossil forms of generating electricity, regulations limiting air pollutants have changed the relative attractiveness of coal over time. These regulations first targeted particulate matter (soot), then emissions of nitrous oxides and sulphur dioxide, and most recently carbon dioxide, through the Emissions Trading Scheme. These regulations have both increased the relative cost of coal-fired electricity generation, favouring cleaner fossil-fuel alternatives such as natural gas, and stimulated the uptake of renewable energy, particularly solar and wind power.

3.1 Import Responsiveness Differed between Producers and Non-Producers

Looking back across the past three-quarters of a century since the end of the Second World War, one can witness different degrees of import response to changes in domestic coal-industry protection over the five main periods. In the early years, when demand for coal outstripped the ability of Western European mines to supply it, and protection against imports was relatively low, supply shortfalls were easily and quickly met by imports, generally from other European countries or the United States.

After residual fuel oil emerged as a cheaper alternative to coal, however, beginning around the end of the 1950s, domestic hard-coal production stopped expanding and went into slow decline, which hit coal imports particularly hard. Employment in mining communities was a greater concern for policymakers than the contribution that domestic coal might make to energy self-sufficiency, as the advent of civilian nuclear power plants and the rapid expansion of European natural gas deposits seemed to promise ample supplies of energy long into the future. This decline in Western European hard-coal production mainly benefited trade in petroleum products and natural gas, however, and had little stimulating effect on imports of coal.

The oil-price shock of 1973–1974 caused a major reversal of European policies towards coal, but with very different consequences for coal imports depending on whether the country was a coal producer or not. In countries that were major producers of hard coal, domestic producers (most of which by then were state-owned) were hugely influential in discussions over energy policy, and naturally lobbied for the expansion of their operations. Generally, they were successful in attracting new investment, but because they were state-owned, the amount of financial assistance that could be mobilized during the recession years that followed the oil-price crisis was limited. Coal imports increased modestly, but at a slightly slower rate over the decade than domestic production contracted.

By contrast, countries without a major tradition of coal mining showed a quicker and larger responsiveness to new market conditions, increasing their coal-fired power-plant capacity aggressively in response to the changing relative price of imported coal. Net coal imports to those Western European countries thus increased sharply between the mid-1970s and the mid-1980s, but then levelled off as the world price of oil, and then the European prices of natural gas, fell. From 1975 onwards, in any case, these countries were afforded few options for adding large amounts of power capacity quickly other than those based on coal, as renewable energy sources were still expensive and immature, and nuclear power plants took too long to build. Moreover, until 1991, when the European Community repealed its 1975 Directive that prohibited the use of gas in power stations, new oil or natural-gas fired power plants had been prohibited.

3.2 Competing Technologies and Environmental Regulations Have also Affected Trade

At the dawn of the high-oil-price period, in both the Western European countries that produced coal and those that did not, coal was not the first choice of policy makers as the secure source of electrical energy, however: nuclear power was. For example, the European Commission's ‘New Energy Policy Strategy for the Community’, prepared in June 1974, envisaged nuclear power ensuring at least 50% of total Community energy requirements – not just that of electricity – by the year 2000 (Hassel, Reference Hassel2017: 25–26). Plans were made initially for far more nuclear power plants to be built around the coastlines or along the major waterways of Belgium, Britain, France, Germany, Italy, Netherlands, and Sweden than would actually eventually be built.Footnote 15 This uncertainty about the future dominant electrical power source in Western Europe may have contributed to delays in orders for new coal-fired power plants in several countries.

For the next two decades after 1986, for every tonne by which production in these countries declined, imports of coal increased by only a half a tonne. Part of the loss of coal's market share in the coal-producing countries may have been a result of the earlier local-content requirements imposed on electric utilities. These created an incentive to keep older (and less energy-efficient) coal-fired plants operating for longer than would have otherwise been the case just to ensure that the coal would get consumed; as the electricity sector began to get more liberalized, these aging plants were shut down and replaced often by other types of plants (Steenblik and Coroyannakis, Reference Steenblik and Coroyannakis1995). The UK power industry's ‘dash for gas’ during the 1990s was perhaps the most dramatic example. In 1991, the European Community repealed its 1975 Directive that prohibited the use of gas in power stations, and in the years that followed, the newly privatized British electricity producers based most of their capacity expansion on highly efficient combined-cycle power plants, using natural gas from the North Sea (Bocse and Gegenbauer, Reference Bocse and Gegenbauer2017: 9).

The decline in coal imports and use in Western Europe since 2006 (Figure 3), when the international price of crude oil also peaked, can be attributed to many factors: the capping of CO2 emissions; the 2008–2013 economic recession; stagnant growth in the consumption of electricity; strong government support for renewable energy (including biomass, often co-fired with coal) and, related to that, the increasing cost competitiveness of wind and solar power. What have increased in coal's place have been imports of renewable-energy equipment, particularly solar panels; woody biomass; and natural gas. In the United Kingdom, for example, as coal consumption was reduced, the use of ‘solid biomass’ for electric power generation increased more than ten-fold between 2004 and 2017.Footnote 16 Most of this biomass was imported from outside the EU.

Figure 3. Government support to current coal production provided by EU Member States and Norway, 2008–2017

Statistics on imports of renewable energy equipment are imprecise owing to the non-specificity of the Harmonized System sub-headings that are used, but Pepermans (Reference Pepermans2017: 1404–1405) reports that, even in 2010 (i.e., before the European Commission agreed a so-called price undertaking with China that effectively curbed imports of solar photovoltaic (PV) panels from that country), imports of solar cells and modules to the EU were running at close to US$25 billion a year. At an average spot coal price of US$110 per tonne for coal delivered to ARA portsFootnote 17 in 2010, those PV-panel imports were equivalent in value to around 225 million tonnes of coal – far more than the amount of coal imported into Western Europe during the peak year of 2006. According to the IEA's World Energy Outlook 2018 (‘WEO-2018’) wind turbines, followed by solar PV installations, will contribute the largest increments of new power-generation capacity in the EU between 2018 and 2025, and even more so out to the year 2040 (IEA, 2018a: 369). The extent to which the demand for renewable energy equipment is met by European factories as opposed to imports from abroad remains to be seen.

The other traded good that has benefitted from Western Europe's long retreat from hard coal has been natural gas. Once natural-gas-fired power plants were allowed to be built again, in 1991, use of ‘the noble fuel’ for electricity generation rose rapidly in the EU-15 plus Norway, from producing 149,000 GWh in 1991 to 748,000 GWh in 2008 – a five-fold increase.Footnote 18 Natural-gas-based power generation declined for several years after that, dipping to 432,000 GWh in 2014, but climbed back up to 622,000 GWh in 2017. By contrast with the change in imports of coal between the two groups of countries, those that had been coal producers in 1991 saw a much greater percentage and absolute increase in electric power generated by natural gas than those that were producing little or no coal at the beginning of the 1990s. This growth in natural gas consumption was met to a small extent by increases in European production, but in recent years largely by imports – of pipeline gas from Russia (66% of total EU imports in 2017, not counting from Norway), Algeria (16%), and Azerbaijan, and in liquified form from Qatar (8%), Nigeria, Peru, and a few minor suppliers.

In total, the three top suppliers accounted for 90% of EU imports of natural gas from outside of Western and Central Europe in 2017. The total between dependency of the EU on natural gas in that year (counting Norwegian gas) was 73%, and under the WEO-2018's ‘New Policies Scenario’ (IEA, 2018a: 182) is expected to reach 89% by 2040. The WEO-2018 also projects that the EU will continue to add new natural-gas-fired power generation capacity through 2040, for a net addition between 2018 and 2025 of about 30 GW, and around 70 MW by 2040 (IEA, 2018a: 369). If this scenario comes to pass, Western Europe's net imports of natural gas are unlikely to decline any time soon.

4. Subsidies and Coal Trade in the Rest of the World

With the closing of the last subsidized hard-coal mines in Western Europe at the end of 2018, the amount of solid fossil-fuel production in the world that is dependent on subsidies for its continued survival is rapidly diminishing. Some of that production remains in the EU, in the form of subsidies that support production of peat or lignite, but also through capacity payments for coal-fired power plants in Poland, the EU's main remaining producer of hard coal.

To the east and southeast of the EU, however – i.e., the nine Contracting Parties of the Energy Community,Footnote 19 plus Turkey, which is an official observer to the group – coal mining and coal-fired power generation continues to be supported. A recent preliminary assessment by the Energy Community (Miljević et al., Reference Miljević, Mumović and Kopač2019) showed that coal-fired electric power, mainly based on domestically sourced coal, was being subsidized at annual rates of EUR 40 million or more in Bosnia and Herzegovina, Serbia, and Ukraine, at least through 2017. In Ukraine, however, hostilities in the vicinity of the main producing area of Donets have effectively dried up support for domestic coal (OECD, 2018). Turkey, which mines mainly low-cost lignite, and has plans to expand that fuel's production to 100 million tonnes in 2019 (Reuters, 2018), still produces around 2.5 million tonnes a year of heavily subsidized hard coal to feed a nearby thermal power plant (IEA, 2018b: III.249).

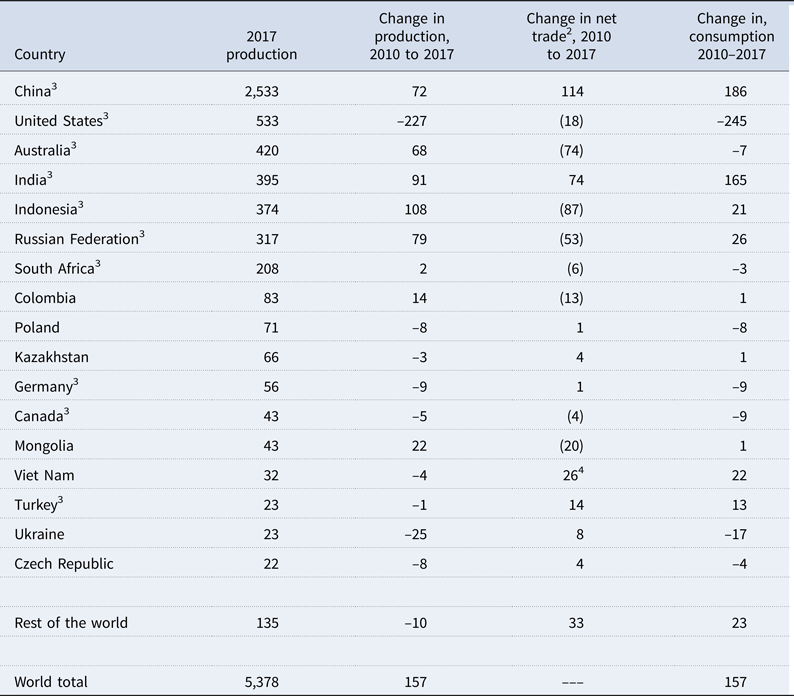

Outside of Europe, information on production subsidies is still incomplete. China accounts for about half of world coal output (2,533 million tonnes of coal equivalent in 2017), followed far behind by its fellow G20 members the United States, Australia, India, Indonesia, the Russian Federation, and South Africa (Table 2). If one adds to that list Germany, Canada, and Turkey, the G20 members alone account for more than 90% of world coal production on a thermal-equivalent basis.

Table 2. Production of coal by the leading 17 producing economies in 2017, and changes in production, consumption, and net trade between 2010 and 2017 (million metric tonnes of coal equivalent1)

1. A tonne of coal equivalent equals 7 giga-calories, or (29.3076 gigajoules). Values refer to the sum of hard coal (anthracite and bituminous coal) and brown coal (sub-bituminous coal and lignite, but not peat). The IEA (2018b: I.4–I.5) defines the dividing line as 5.732 giga-calories (24 gigajoules) per tonne, with hard coal at or above that value and brown coal below. All values are standardized to measurements made on an ash-free but moist basis.

2. Numbers in brackets indicate an increase in net exports.

3. G20 member.

4. Value indicates absolute value of change from net exports to net imports.

Data source: IEA (2018b, II.9–10 and II.14–16).

All the coal industries in the G20 countries receive some assistance from their federal governments, and in some cases from sub-national governments, but such assistance is unlikely to be anywhere near as heavy as had been provided to the high-cost underground hard-coal mines in the EU.Footnote 20 Estimating the full amount of assistance to G20 coal producers has proved challenging, however, because of the heavy involvement of state-owned enterprises (in coal mining, electric power generation, or both) in many; the use of long-term contracts between producers and electric utilities, in some cases in ways designed to protect domestic mines; and difficulties in obtaining data on government-backed credit extended to the industry of the kind that would be needed to estimate the grant equivalent of concessional loans and loan guarantees (Bast et al., Reference Bast, Doukas, Pickard, van der Burg and Whitley2015). Quantification of the support provided through these instruments, adding to the already existing information collected by the OECD on budgetary subsidies and tax expenditures (OECD, n.d.), is necessary before a detailed analysis can be undertaken of the trade effects of reducing or eliminating these types of state aid.

Nonetheless, some insights can be gleaned from changes in production and net trade in coal among the 17 top producers who accounted for 97.5% of global production in 2017. The countries can be grouped into whether their domestic demand for coal grew over the 2010–2017 period, and whether they were net exporters or net importers of coal at the end of the period.Footnote 21 The resulting four categories can be further differentiated, yielding eight sub-categories:

Countries that experienced a decline in consumption of coal between 2010 and 2017:

1. Net coal-exporting countries for which the increase in coal exports did not fully offset the decline in consumption (Canada, United States).

2. Net coal-exporting countries for which coal exports increased by more than the decline in consumption (Australia, South Africa).

3. Net coal-importing countries for which the increase in coal imports did not fully offset the decline in production (Czech Republic, Germany, Poland, Ukraine).

Countries that experienced an increase in domestic consumption of coal between 2010 and 2017:

4. Net coal-exporting countries for which coal exports increased by more than consumption increased (Colombia, Indonesia, Mongolia, Russian Federation).

5. Net coal-exporting countries for which coal exports declined by more than consumption increased (Kazakhstan).

6. Net coal-importing countries for which the increase in domestic coal production exceeded the increase in coal imports (India).

7. Net coal-importing countries for which the increase in coal imports exceeded the increase in domestic coal production (China).

8. Net coal-importing countries that witnessed a slight decline in domestic coal production, but strong growth in coal consumption met by coal imports (Turkey, Viet Nam).

What this categorization shows is that coal production among the more mature economies of the world has been stagnating or contracting in response to declining consumption, and only low-cost producers such as Australia and South Africa have been able to expand coal exports – mainly to southern, eastern, and south-eastern Asia (IEA, 2018b: III.50–51 and IV.38) – by more than they lost in domestic sales. Meanwhile, emerging economies, such as Colombia, Indonesia, and Mongolia, have continued to experience growth in coal exports, even while meeting growth in domestic consumption.Footnote 22 India has favoured domestic production over imports to meet its fast-growing needs, while China, Turkey, and Viet Nam have done the reverse.

The variation in outcomes since 2010 reflects diverse influences, and not just or even mainly changes in subsidies or in environmental policies that discourage coal for power generation, except in the case of EU Member States. Competition from lower-cost natural gas has been the main reason for contraction of coal production in North America, for example. More and more, both natural gas and renewable energy are likely to constrain growth in international coal trade, which was already flattened since it peaked in 2013 (IEA, 2018b: II.24).

If there were to be a coordinated phase out or halt to all government assistance to coal production at the multilateral level it would affect mainly trade in southeast Asia, though to what extent has not been determined. Everywhere, it would probably also result in more electricity generated from natural gas and renewable energy, boosting trade in both categories of goods (see, e.g., Holz et al., Reference Holz, Kafemann, Sartor, Scherwath and Spencer2018). A plurilateral phase-out – for example, by members of the G20 – would have a similar effect, particularly if it were to be combined with a commitment not to support (e.g., through export credits or other investment assistance) new coal projects elsewhere, such as in Africa. These are all hypotheticals that merit deeper, quantitative analysis.

5. Conclusions and Policy Recommendations

The phasing out of government support for domestic coal mining in Western Europe, a process that started sooner and progressed more quickly in some countries than in others, was expected to lead to a surge in coal imports from lower-cost producers, such as Australia, Colombia, South Africa, and the United States. While net imports of coal to Western Europe did increase from the mid-1990s onward, by the mid 2000s they started to reach a plateau, and looked likely to decline, along with demand for coal in general.

For policy makers whose main interest in coal-subsidy reform is trading opportunities, the main lessons are that the phasing out of production subsidies in other countries does not necessarily translate into increased coal exports to those countries. Countries that are still subsidizing their coal industries are largely doing so to avoid a sudden collapse of a high-cost industry and the associated effects on local labour markets. Indeed, because they often fear the potential disruptive power of organized miners, they have little interest in expanding coal-consuming capacity (particularly in the power-generating sector), because of the temptation of the domestic coal industry's political allies to impose local-content requirements on such plants. That logic does not always apply, however, if the decision-making body is a local or regional government; in the past, some (e.g., the regional government in Sardinia) have responded by promoting new coal-fired power plants that would have used local coal to power an advanced coal-fired technology. In any case, with increased pressure on countries to reduce their carbon emissions, coal-fired electric power is falling out of favour: the days of rapidly expanding coal trade are now history. The only major market for which the IEA projects growth in coal imports over the next 20 years is India (IEA, 2018a: 49).

Producers of other forms of energy, or of technologies for generating electricity, can expect to benefit, depending on growth in the country's electricity market, and domestic capacity for meeting that demand. If Western Europe provides a model, a considerable amount of the replacement power in the future will be provided by renewable energy. That is an outcome of subsidy reform that should also cheer policy makers more interested in the reform's environmental effects.

For both kinds of policy makers, help given to countries undergoing or contemplating their reform can speed the transition and make it less traumatic. There are certainly lessons – both good and bad – to be learned and shared from examining the different approaches used by Western European countries as they wound down their coal industries. Some phased out coal production quickly, others, especially those that had allowed coal mining to take root as a major regional employer, took decades. In the context of plurilateral or multilateral rulemaking on subsidies, these experiences also suggest that allowances may need to be made for government financial support to the coal mines, and miners, to facilitate their transition.

Acknowledgements

The authors would like to express their gratitude for the very helpful comments and suggestions provided by participants in the workshop on ‘Trade Impacts of Fossil Fuel Subsidies’ (Geneva, 5 October 2018), jointly organized by the Global Subsidies Initiative (GSI) of the International Institute for Sustainable Development (IISD) and the Centre for Trade and Economic Integration (CTEI) of the Graduate Institute for International and Development Studies (IHEID); by an anonymous reviewer; and by the special-issue editor, Tom Moerenhout. Any remaining errors are the fault of the authors. The views contained herein also do not necessarily reflect those of the IISD (Ronald Steenblik), or of the Organisation for Economic Development and Co-operation (OECD) or of its member countries (Mark Mateo).