Multilateralism … is the cornerstone of the post-war GATT trading system, now the WTO trading system.

Director-General Renato Ruggiero, the World Trade Organization, 1995Footnote 1If we want to see trade helping to drive growth and recovery …we need to properly prize and defend the stability that has been the pursuit of the multilateral trading system since World War Two. The system offers a stable and predictable business environment.

Director-General Roberto Azevêdo, the World Trade Organization, 2018Footnote 21. Introduction

Globalization, in the last few decades, has generated an unprecedented increase in international trade flows. Between 1960 and 2015, the average annual growth rate of world exports was 8.9%, compared with a GDP growth of 3.5% (World Bank, 2017). While the advantages to this process are many, the rise in economic openness has also made countries more vulnerable to international economic volatility, and to trade volatility in particular. Many studies have established that trade volatility can harm a country's economic growth. For example, Turnovsky and Chattopadhyay (Reference Turnovsky and Chattopadhyay2003) present a theoretical model and show that terms of trade volatility lowers the equilibrium growth rate. The theoretical findings are also supported by their empirical analysis based on a sample of 61 less-developed countries (LDCs) over the period 1975–1995 (Grimes, Reference Grimes2006; Brueckner and Carneiro, Reference Brueckner and Carneiro2017). Using disaggregated price and trade share data in New Zealand from 1972 to 2004, Grimes (Reference Grimes2006) concludes that low terms of trade volatility statistically explains recent growth outcomes in New Zealand (Razin et al., Reference Razin, Sadka and Coury2003; Blattman et al., Reference Blattman, Hwang and Williamson2007; Iscan, Reference Iscan2011).

We examine the role of the World Trade Organization (WTO) and its predecessor the General Agreement on Tariffs and Trade (GATT) in stabilizing international trade.Footnote 3 This work is motivated by the seminal paper of Rose (Reference Rose2005), who investigates whether GATT/WTO members have lower bilateral trade volatilities when they trade with each other. Rose (Reference Rose2005) finds that membership in the GATT/WTO has no consistent dampening effect on the trade volatility. Mansfield and Reinhardt (Reference Mansfield and Reinhardt2008) revisit this issue and estimate the effect of WTO membership on trade volatility using an ARCH-in-mean model. The authors conclude that the GATT/WTO reduces trade volatility according to the bilateral trade data in 1951–2001. They argue that the trade-stabilizing effect of the WTO possibly comes from constraining members from introducing new trade barriers, diversifying the composition of trade, and increasing transparency of trade standards and policy instruments.

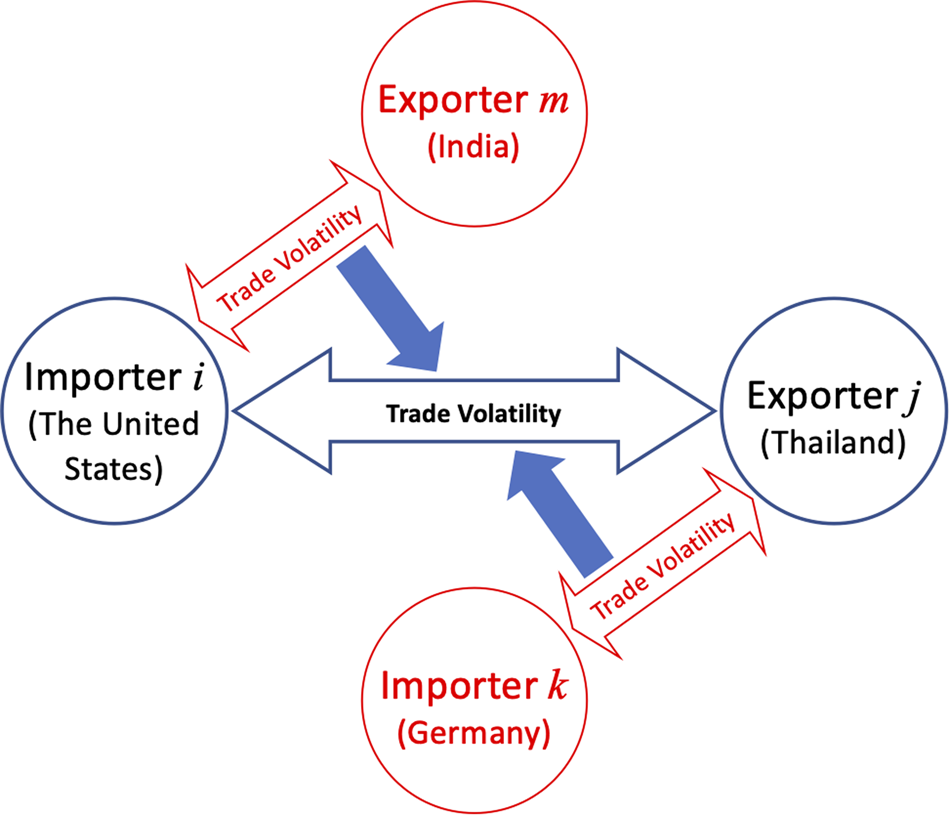

Rose (Reference Rose2005) and Mansfield and Reinhardt (Reference Mansfield and Reinhardt2008) assess the volatility of trade between two countries (the bilateral trade volatility) if one or both trade partners are WTO members, controlling for a set of bilateral country characteristics. We use the trade between the US (importer i) and Thailand (exporter j) as an example. In this case, only bilateral characteristics of the US and Thailand, such as their GDP or whether they share a common language, are considered to affect the volatility of trade between these two countries. Any possible influence on the bilateral US–Thailand trade volatility from the rest of the world is not considered. Without controlling for the ‘third country’ effect, however, this framework leaves out the feature of multilateralism of the WTO –‘the cornerstone of the international trading system’ (WTO News, 1995). As a result, it may not fully capture the effect of WTO membership and does not necessarily investigate why a multilateral platform of international trade (that is, the WTO) should exist.

In this paper, we first explore whether the WTO stabilizes trade globally with both a fixed-effects model and an event-study approach. Next, we set up a spatial framework to explore trade volatility comovement among countries, allowing for multilateral linkages of trade volatilities across trading pairs, as presented in Figure 1. Controlling for bilateral characteristics of countries i and j, we capture the multilateral linkages of trade volatilities by measuring how much trade volatilities between other trading dyads influence the i–j trade volatility. For example, Figure 1 shows that the volatility of trade between the US (i) and Thailand (j) can be influenced by the US–India (i–m) trade volatility as well as by the Germany–Thailand (k–j) trade volatility, where India represents one of the other exporters m trading with the United States (i), and Germany is one of the other importers k trading with Thailand (j). We study the degree to which trade volatilities co-move, depending on trade partners’ WTO membership. If the GATT/WTO's multilateral trade platform creates a more integrated and transparent system and promotes lower trade barriers among members, we would expect to observe a more stable trade and a stronger comovement of trade volatilities among member countries than non-member countries.

Figure 1. Measuring multilateral linkages of trade volatilities.

Controlling for such spatial correlations makes it possible to explore the dependence of international trade volatilities across multiple dyads, which is of policy importance. The effects of other countries’ trade policies or economic policies can be more directly felt through such interdependence among WTO members. From an estimation point of view, a more flexible multilateral framework allowing for inter-dyad dependence better addresses specific econometric concerns. If trade volatility between two countries is indeed affected by trade volatilities of other trading pairs, omitting the spatial dependence measures can lead to biased coefficient estimates and invalid statistical inferences (Anselin, Reference Anselin1988, Reference Anselin and Baltagi2003b).

Drawing on bilateral trade data from 189 countries over 1950–2017, several interesting findings emerge from our empirical investigations. First, we find that trade between a pair of countries is more stable when both partners are WTO members, suggesting the WTO reduces trade volatilities. Second, when controlling for multi-dyad dependence of trade volatilities, the coefficients on our spatial measures of trade volatilities are robustly positive and significant, supporting (1) the necessary inclusion of the multilateral dependence terms in the model, and (2) a comovement of trade volatilities across trading pairs in general. Third, we find that the trade volatility comovement is much stronger among WTO members than between WTO and non-WTO members.

These results have important policy implications. We argue that WTO members share the benefits of a stable and predictable trade environment with more transparent trade rules and regulations. In addition, individual dyad's trade stability might also contribute to further stabilize the global trade due to the feedback mechanism through spatial dependence in the WTO multilateral framework. Our paper offers strong empirical evidence that the intended goal of ‘making the business environment stable and predictable’ by the WTO in a multilateral trading system can be achieved (WTO News, 2018).

Our results are robust to the inclusion of a large set of control variables and an alternative measure of spatial trade volatilities. To ensure that the findings are not caused by dominant traders in the sample, we also estimate regressions without the US, China, or the OPEC countries. Our results are qualitatively unaffected.

The rest of the paper is organized as follows. The literature review and theoretical underpinning of questions considered in this paper are presented in Section 2. The empirical specification is presented in Section 3. We discuss the regression results in Section 4 and present robustness checks in Section 5. The paper concludes in Section 6.

2. The WTO and Multilateral Trade Volatility

It is now generally accepted that the boost in international trade over the last several decades could have also led to more volatility and uncertainty in trade as trade openness naturally makes economies exposed to external shocks. A number of distinct economic mechanisms could be at play in the relationship between openness to trade and trade volatility (Haddad et al., Reference Haddad, Lim, Pancaro and Saborowski2013). For example, the terms of trade and export earnings can directly affect output and growth in a major way. Declining demand overseas not only reduces export shipments and harms producer revenues, but also leads to falling prices and worsening terms of trade.

When the world economy is volatile, the multilateral trading system promoted by the GATT/ WTO could contribute to stability and reduced uncertainty. The primary purpose of the GATT/WTO is to liberalize international trade. Through rounds of trade negotiations, member countries are committed to reducing and binding the tariff rates on imported products and limiting the use of non-tariff trade barriers. Obligating members to extend the most favorable tariff on a product of any one member to all other members, the most-favored-nation (MFN) principle adopted by the GATT/WTO also helps secure fair trade conditions as trading rights are no longer dependent on an individual country's economic power. The GATT/WTO builds a more predictable and transparent trading system by requiring member countries to publish their trade regulations and notify changes, which promotes trade.

As argued by Mansfield and Reinhardt (Reference Mansfield and Reinhardt2008), WTO membership may help to reduce members’ trade volatility through different channels. First, trade agreements reduce future volatility in trade-flows by ‘locking-in’ states’ existing trade commitments and deterring the erection of new protectionist barriers. Second, trade-agreements increase policy transparency and promote policy convergence among member states, which reduces trade volatility by stabilizing the expectations of trade partners. Third, the WTO can signal long-term predictability and low credit-risk environments to international investors. This stable business environment would then reassure investors that governments will not engage in predatory behaviors and, in turn, help diversify export portfolios and encourage foreign direct investment (FDI) flows. The dispute settlement provisions under the GATT/WTO, serving as a commitment device for governments to commit to trade liberalization and policy transparency, also contribute strongly to the global economic stability (Maggi, Reference Maggi1999). By providing means of settling trade disputes, GATT/WTO rules can be enforced effectively, leading to a more secure and stable trading environment. For instance, Hudec (Reference Hudec1993) finds that early GATT panels resolve a majority of the disputes. Tallying dispute outcomes for the first ten years under the WTO, Davey (Reference Davey2009) shows that more than 80% of all disputes settlements rulings have been complied with.

The empirical literature directly addressing the impact of WTO membership on trade volatility, however, remains quite limited, and the results from existing studies are rather mixed. Using bilateral export data from 1951 through 2001, Mansfield and Reinhardt (Reference Mansfield and Reinhardt2008) find that the WTO significantly reduces export volatility. Dreher and Voigt (Reference Dreher and Voigt2011) study the effect of membership in international organizations on member countries’ credibility. They find that membership in the GATT/WTO is strongly linked to better government credibility measured by lower country risk ratings. On the other hand, Rose (Reference Rose2005) examines the hypothesis that membership in the GATT/WTO has increased the stability and predictability of trade flows. With data covering bilateral trade flows between over 175 countries between 1950 and 1999, Rose finds little evidence that membership in the GATT/WTO has a significant dampening effect on trade volatility.

In our paper, we specifically study the dependence of trade volatilities in a multilateral framework using tools of spatial econometrics. When studying trade volatilities, the traditional bilateral framework may have become inadequate because this framework only captures the characteristics of the two trade partners without considering the influence from other countries or other country pairs. As mentioned previously, deepening globalization and opening up to foreign trade and investment could naturally increase a country's exposure to external shocks.

To model the interactions of country pairs better, we adopt a more flexible specification that includes spatial correlations of trade volatilities. Our focal point here is to explore whether the spatial correlation of trade volatilities across dyads is significant and, if so, whether the degree of trade volatilities dependence or comovement varies based on partners’ GATT/WTO membership.

It has been found in many empirical studies that GATT/WTO members enjoy higher trade levels or are more likely to establish new trade relations with each other (Subramanian and Wei, Reference Subramanian and Wei2007; Tomz et al., Reference Tomz, Goldstein and Rivers2007; Liu, Reference Liu2009; Bista, Reference Bista2015).Footnote 4 If trade among WTO members is more integrated than trade between members and non-members or trade among non-members, we would expect to see a stronger comovement of trade volatilities within the WTO. If bilateral trade between WTO member countries becomes more stable given a potential volatility-reducing effect of the GATT/WTO, we should also expect to see a stronger comovement of trade stability among members.

Further, one prominent feature of modern world trade is the growing importance of trade in intermediate goods or outsourcing. With advances in transportation, information, and communication technology, and driven by differences in labor costs across countries, different production stages occur in different countries (Baldwin, Reference Baldwin, Elms and Low2013). The activities comprising a value chain such as the design, the production, and the distribution of a single product are recently carried out in different countries on a global scale. Several sectoral initiatives under the WTO, such as the Information Technology Agreement (ITA) in the late 1990s, help member countries to build stronger ties along global value chains (GVCs) (Baldwin, Reference Baldwin2012). For instance, according to the OECD (2013), ITA members are now significantly more involved in GVCs in the sector than non-signatories compared to the earlier period after the ITA was in force.

Many empirical studies in the macroeconomic literature argue that vertical linkages in trade along GVCs may play a crucial role in explaining the relationship between bilateral trade and business cycle transmission (Di Giovanni and Levchenko, Reference Di Giovanni and Levchenko2010). Countries that trade more with each other often experience higher aggregate business cycle correlation (Frankel and Rose, Reference Frankel and Rose1998; Clark and van Wincoop, Reference Clark and van Wincoop2001, Baxter and Kouparitsas, Reference Baxter and Kouparitsas2005; Wang et al., Reference Wang, Wong and Granato2015). For example, with data from 55 countries over 1970–1999, Di Giovanni and Levchenko (Reference Di Giovanni and Levchenko2010) show that vertical production linkages account for 32% of the total impact of bilateral trade on business cycle comovement in their sample. If the WTO helps to build GVCs among members through vertical integration, this could result in more countries being exposed to similar economic shocks and likely a higher degree of production and business cycle synchronization among members. Similarly, WTO member countries, especially those with stronger trade ties along the same GVCs (e.g., upstream and downstream countries in the automobile industry), would be expected to experience a stronger comovement of their trade volatilities.

3. Empirical Methodology

3.1 Baseline Empirical Specification and Variables

Our empirical analysis adopts a gravity model, widely used to study the magnitude and patterns of bilateral trade activities (Anderson and van Wincoop, Reference Anderson and van Wincoop2003; Rose, Reference Rose2004, Reference Rose2005; Behrens et al., Reference Behrens, Ertur and Koch2012). Following Rose (Reference Rose2005) model for trade volatility, we start with a benchmark specification given by:

where M ijt represents the log value of imports in country i from country j in year t; ![]() $\sigma ({\cdot} ) _\tau $ and

$\sigma ({\cdot} ) _\tau $ and ![]() $\mu ({\cdot} ) _\tau $ are standard deviation and mean operators over a certain time-interval period τ, respectively. For our baseline regression, we look at trade volatility calculated over five-year periods, where τ ∈ {1950 − 1954, 1955 − 1959, ⋅ ⋅ ⋅ }. Robustness checks are provided to also look at trade volatilities constructed over 10- and 15-year periods.

$\mu ({\cdot} ) _\tau $ are standard deviation and mean operators over a certain time-interval period τ, respectively. For our baseline regression, we look at trade volatility calculated over five-year periods, where τ ∈ {1950 − 1954, 1955 − 1959, ⋅ ⋅ ⋅ }. Robustness checks are provided to also look at trade volatilities constructed over 10- and 15-year periods.

Proceeding to controls included in equation (1), the dummy variable BothWTO ijt takes the value of 1 if both importing (i) and exporting (j) countries are WTO members in year t, and 0 otherwise; Z is a vector of other control variables commonly chosen in a gravity model, including log value of real GDP of i and j (lnGDP it and lnGDP jt), log value of real GDP per capita of i and j (lnGDPPC it and lnGDPPC jt), log value of geographical distance between i and j (lnDist ij), whether i and j belong to the same regional trading agreement in year t (RTA ijt) or the same currency union (CU ijt), whether i offered generalized system of preferences (GSP) to j in year t (GSP ijt), whether country i has ever been a colony of j (Colony ij), whether country i has ever been a colonizer of j (Colonizer ij), whether i and j have been colonized by the same colonizer (ComColony ij), whether i was currently a colony of j in year t (CurColony ijt), whether i was currently a colonizer of j in year t (CurColonizer ijt), whether i and j share a common language (ComLang ij), and whether countries i and j share a common religion (ComRelig ij). In bilateral trade analysis, a measure reflecting trade frictions between a specific country pair and all other trade partners in addition to trade frictions between i and j needs to be included, referred to as the ‘multilateral resistance effect’ in Anderson and van Wincoop (Reference Anderson and van Wincoop2003). Therefore, we follow the literature by including the measure of remoteness (Remote ijt) to control for the multilateral resistance (Head, Reference Head2003; Hummels, Reference Hummels2007; Bacchetta et al., Reference Bacchetta, Beverelli, Cadot, Fugazza, Grether, Helble, Nicita and Piermartini2012). A country remoteness is defined as the log distance of country i to the rest of the world weighted by all the other countries’ shares of world GDP in year t (Remote it). The remoteness of a dyad (Remote ijt) is simply the sum of Remote it and Remote jt. We also control for other geographical characteristics for countries i and j in the regressions: whether the pair of countries share a border (Border ij), log value of the geographical area of i and j (ln(Area i) and ln(Area j)), the number of landlocked countries in a pair (Landlock ij = 0, 1, or 2), and the number of island nations in a pair (Island ij = 0, 1, or 2). Similar to the WTO variable, all other controls are also averaged over time period τ.

The data used in our analysis are from the Direction of Trade Statistics by the IMF, the CEPII, and the Penn World Table 9.1. Our sample covers 189 countries over the period 1950–2017. Appendix Table A (see on-line Supplementary material) lists the countries included in our data set, along with the year of each country's GATT/WTO accession when applicable.

3.2. Modeling Multilateralism of the WTO: The Spatial Dependence

It is important to recognize the potential dependence of trade volatilities across various dyads in an integrated global trading system. To account for spatial correlation of trade volatilities, we modify our baseline regression as equation (2) by including spatial lag trade volatility measures (Li and Vashchilko, Reference Li and Vashchilko2010; Neumayer and Plümper, Reference Neumayer and Plümper2010a; Cho et al., Reference Cho, Dreher and Neumayer2014). A brief description of a general spatial lag model is provided in the Appendix (see on-line supplementary material). For ease of illustration, we represent our trade volatility measure from now on as ![]() $Vol( {M_{ijt}} ) _\tau = \sigma ( {M_{ijt}} ) _\tau /\mu ( {M_{ijt}} ) _\tau $:

$Vol( {M_{ijt}} ) _\tau = \sigma ( {M_{ijt}} ) _\tau /\mu ( {M_{ijt}} ) _\tau $:

where ij ≠ km, and ![]() $Z_\tau = \mu ( {Z_t} ) _\tau $. Equation (2) indicates that, in addition to bilateral characteristics, the volatility of trade between two countries i and j also depends on the volatility of trade between country k and country m (i.e.,

$Z_\tau = \mu ( {Z_t} ) _\tau $. Equation (2) indicates that, in addition to bilateral characteristics, the volatility of trade between two countries i and j also depends on the volatility of trade between country k and country m (i.e., ![]() $Vol( {M_{km}} ) _\tau $), weighted by a matrix capturing the connectedness between dyad i–j and dyads k–m (i.e., w ij−km). The sign and strength of the spatial dependence are then reflected by the spatial lag coefficient ρ.

$Vol( {M_{km}} ) _\tau $), weighted by a matrix capturing the connectedness between dyad i–j and dyads k–m (i.e., w ij−km). The sign and strength of the spatial dependence are then reflected by the spatial lag coefficient ρ.

Our sample includes 189 countries, conceptually generating about 35,532 trading dyads annually since the volatility of imports in country i from country j is different from the volatility of imports in country j from country i. In this case, the spatial lag measure in equation (2) implies that trade volatility of a dyad i–j, in theory, would be influenced by trade volatilities of other 35,530 trading pairs each year, which can make the calculation of the spatial volatilities over a long sample span extremely computationally costly.Footnote 5 As a result, we aim to focus on trading pairs that would most likely influence trade volatility between country i and country j and keep the construction of spatial lags computationally practical. We consider four spatial lag volatility measures to reflect trade volatilities of “other dyads” based on WTO membership. These spatial trade volatilities are represented as follows:Footnote 6

For a trading dyad i–j, our first two spatial measures, ![]() $V_{im\tau }^{{\rm WTO}} $ and

$V_{im\tau }^{{\rm WTO}} $ and ![]() $V_{im\tau }^{{\rm NWTO}} $ in equations (3) and (4), are the trade volatilities between the same importing country i and other exporting countries m, where m ≠ j. The connectedness variable

$V_{im\tau }^{{\rm NWTO}} $ in equations (3) and (4), are the trade volatilities between the same importing country i and other exporting countries m, where m ≠ j. The connectedness variable ![]() $w_m^{{\rm WTO}} $ in equation (3) is a dichotomous measure, equal to 1 if exporting country m is a WTO member and 0 otherwise. The connectedness variable

$w_m^{{\rm WTO}} $ in equation (3) is a dichotomous measure, equal to 1 if exporting country m is a WTO member and 0 otherwise. The connectedness variable ![]() $w_m^{{\rm NWTO}} $ in equation (4) takes the value of 1 if exporting country m is not a WTO member, 0 otherwise.

$w_m^{{\rm NWTO}} $ in equation (4) takes the value of 1 if exporting country m is not a WTO member, 0 otherwise.

For example, the volatility of imports in the US (country i) from Thailand (country j) could be correlated with the volatility of imports in the US from India as well as with the volatility of imports in the US from Venus (a hypothetical non-WTO member). In this example, the term ![]() $V_{im\tau }^{{\rm WTO}} $ in equation (3) is the volatility of imports in the US from India (a WTO member), and the term

$V_{im\tau }^{{\rm WTO}} $ in equation (3) is the volatility of imports in the US from India (a WTO member), and the term ![]() $V_{im\tau }^{{\rm NWTO}} $ in equation (4) is the volatility of imports in the US from Venus. The actual

$V_{im\tau }^{{\rm NWTO}} $ in equation (4) is the volatility of imports in the US from Venus. The actual ![]() $V_{im\tau }^{{\rm WTO}} $ and

$V_{im\tau }^{{\rm WTO}} $ and ![]() $V_{im\tau }^{{\rm NWTO}} $ terms we include in our model are calculated based on the import volatilities of all dyads i–m in our sample.

$V_{im\tau }^{{\rm NWTO}} $ terms we include in our model are calculated based on the import volatilities of all dyads i–m in our sample.

Moving on to equations (5) and (6), for a dyad i–j, these spatial measures represent trade volatilities between other importing countries k and the same exporting country j, where k ≠ i. The dichotomous connectedness measure ![]() $w_k^{{\rm WTO}} $ in equation (5) is set to 1 when importing country k is a WTO member and 0 otherwise. The connectedness measure

$w_k^{{\rm WTO}} $ in equation (5) is set to 1 when importing country k is a WTO member and 0 otherwise. The connectedness measure ![]() $w_k^{{\rm NWTO}} $ in equation (6) is 1 when importing country k is not a WTO member and 0 otherwise. These measures suggest, for instance, the volatility of imports in the US from Thailand is influenced by the volatility of imports in Germany from Thailand and also by the volatility of imports in Mars (a hypothetical non-WTO member) from Thailand. In this example, the term

$w_k^{{\rm NWTO}} $ in equation (6) is 1 when importing country k is not a WTO member and 0 otherwise. These measures suggest, for instance, the volatility of imports in the US from Thailand is influenced by the volatility of imports in Germany from Thailand and also by the volatility of imports in Mars (a hypothetical non-WTO member) from Thailand. In this example, the term ![]() $V_{kj\tau }^{{\rm WTO}} $ captures the volatility of imports in Germany (a WTO member) from Thailand, and the term

$V_{kj\tau }^{{\rm WTO}} $ captures the volatility of imports in Germany (a WTO member) from Thailand, and the term ![]() $V_{kj\tau }^{{\rm NWTO}} $ is the volatility of imports in Mars from Thailand.Footnote 7 Again, the actual

$V_{kj\tau }^{{\rm NWTO}} $ is the volatility of imports in Mars from Thailand.Footnote 7 Again, the actual ![]() $V_{kj\tau }^{{\rm WTO}} $ and

$V_{kj\tau }^{{\rm WTO}} $ and ![]() $V_{kj\tau }^{{\rm NWTO}} $ terms in our model are calculated based on the import volatilities of all dyads k–j in our sample. Figure 2 illustrates graphically how we define these four spatial trade volatilities for a dyad i–j and how those spatial measures can affect the trade volatility between countries i and j. Based on the above discussion, we rewrite the panel data model (2) as follows:

$V_{kj\tau }^{{\rm NWTO}} $ terms in our model are calculated based on the import volatilities of all dyads k–j in our sample. Figure 2 illustrates graphically how we define these four spatial trade volatilities for a dyad i–j and how those spatial measures can affect the trade volatility between countries i and j. Based on the above discussion, we rewrite the panel data model (2) as follows:

We present the correlation matrix of variables in our baseline regressions in Table B and the correlation matrix of the bilateral trade volatility and four measures of spatial dyadic trade volatilities in Appendix Table C (see on-line supplementary material).Footnote 8 Summary statistics are provided in Table 1.

Figure 2. An example of spatial measures for dyad i–j, where the US represents importing country i and Thailand exporting country j.

Table 1. Descriptive statistics

4. Empirical Results

4.1. Baseline Regressions without Spatial Dependence

Our baseline regression results regarding the effect of WTO membership on trade volatility without spatial measures are reported in Table 2. The three columns in Table 2 give results from OLS regression, regression with importer and exporter fixed effects (Ctry FE), and regression with dyadic fixed effects (Dyad FE), respectively. We prefer the specification with dyadic fixed effects, which controls for the unobserved heterogeneity in bilateral volatility for each dyad. Time fixed effects are included in all regressions.

Table 2. Results of WTO membership and trade volatility

Notes: All regressions are controlled for geographical factors: ln(Area i), ln(Area j), Border ij, Landlock ij and Island ij. Clustered standard errors by countries i and j are in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1.

The coefficient on BothWTO in Table 2 is consistently negative across all regressions and significant at the 1% level. These results suggest that if both trade partners are WTO members, they have more stable trade. Regression 2.3 indicates that the volatility of trade between two WTO members is, on average, 0.0058 units smaller than other dyads, a reduction equivalent to 8% of the average trade volatility reported in Table 1. The trade-stabilizing effect of the GATT/WTO, as discussed previously, can result from the GATT/WTO's role in creating and promoting a more transparent and predictable global trade system. The negative and significant coefficients on RTA, GSP, and CU suggest dyads participating in regional trading agreements, Generalized System of Preferences program, or currency unions also experience trade that is more stable. These findings on the effects of RTA, GSP, and CU on bilateral trade volatility are consistent with those in Rose (Reference Rose2005). The stabilizing effect of WTO membership appears small relative to the trade-stabilizing effect of RTA or GSP in regressions without dyad fixed effects. When dyad fixed effects are included, only GSP program participation seems to have a stronger negative effect on trade volatility than WTO membership. For instance, regression 2.3 shows that if an importing country offers GSP to its trade partner, trade volatility of this dyad would be on average 0.0073 units lower, approximately 10% of the sample average trade volatility, than a dyad where an importer does not provide GSP treatment to an exporter. These results suggest that, to a large extent, dyadic heterogeneities explain the effect of RTAs and CU on bilateral trade volatilities. In addition, the stronger effect of RTAs or GSP on trade volatilities in some cases might be caused by weak disciplines involved in WTO agreements in certain sectors, as suggested in Cadot et al. (Reference Cadot, Olarreaga and Tschopp2008). Further, many WTO members belong to at least one RTA. RTAs (or GSP) can offer more extensive product coverage and/or further reduction of trade barriers to member countries than to regular MFN countries, which might also explain the different effects of WTO and RTAs (or GSP) on trade volatilities (Crawford and Laird, Reference Crawford and Laird2001).

We also adopt a standard event-study approach to estimate the effect of WTO membership on the trade volatilities.Footnote 9 In particular, we closely follow the event-study methodology suggested by MacKinlay (Reference MacKinlay1997) to compare trade volatilities of a dyad before and after both countries become WTO members. We estimate the following model (see also Head and Mayer, Reference Head, Mayer, Gopinath, Helpman and Rogoff2014; Rose, Reference Rose2019):

where μ i, χ j, and δ t are importer, exporter, and time dummy variables, respectively, and ε ijt represents the stochastic error term. The window of estimation (in years) is represented by s, and T is the year of the event when both countries i and j are members of WTO.

After we obtain coefficient estimates from equation (9), they are used to form trade volatilities around the time of the event (Moser and Rose, Reference Moser and Rose2014). In this case, we calculate trade volatility as the standard deviation of the residuals from equation (9) for any given pair of countries over the nth five-year period since the event in year T, referred to as σ(ε ijt)n. For example, σ(ε ijt)0 represents the initial trade volatilities over the period of T + 1 and T + 5, or over the first five-year period after both countries i and j join the WTO; σ(ε ijt)1 is the trade volatility in the period of T + 6 and T + 10, and so on. Similarly, σ(ε ijt)−1 is the trade volatility over the period T − 4 and T; and σ(ε ijt)−2 denotes the trade volatility over the period of T − 9 and T − 5. We then test if the trade volatility in any period n is significantly different from that in the period right before both countries were WTO members (i.e., n = −1). If WTO membership does reduce trade volatilities, the difference in trade volatilities, ![]() $\tilde{\sigma }_n = \sigma ( {\epsilon_{ijt}} ) _n-\sigma ( {\epsilon_{ijt}} ) _{{-}1}$, should be insignificant when n < 0, and become negative and significant when both countries join the WTO (i.e., n ≥ 0).

$\tilde{\sigma }_n = \sigma ( {\epsilon_{ijt}} ) _n-\sigma ( {\epsilon_{ijt}} ) _{{-}1}$, should be insignificant when n < 0, and become negative and significant when both countries join the WTO (i.e., n ≥ 0).

To ensure that the trade-stabilizing effect of the WTO does not depend on the length of our estimation windows, we estimate the model with 15-year (i.e., s = 15) and 25-year (i.e., s = 25) estimation windows. The results with 15-year and 25-year estimation windows are illustrated in Figures 3a and 3b, respectively. Both figures show that the difference in dyad trade volatilities is not statistically significant before both trade partners are WTO members (i.e., n < 0), and it becomes negative and significant once both countries become WTO members (i.e., n ≥ 0). These results again provide evidence supporting that WTO members tend to experience lower trade volatilities than non-WTO members.

Figure 3. Event study on trade volatility.

We also compare the changes in bilateral trade volatilities after one country joining the WTO and after both countries joining the WTO in an event study setting. The left panel of Figure 4 (4a) shows the change in trade volatility after one country joins the WTO, and the right panel (4b) displays the change in bilateral trade volatility after both countries become WTO members. Figure 4a shows that, in general, the bilateral trade volatility decreases after one country becomes a WTO member. However, the effect is not significant at the 5% level immediately after one partner joins WTO (i.e., n = 0 and 1). The difference in trade volatility becomes significant in n = 2 and 3. On the other hand, Figure 4b shows that, after both countries join the WTO, the bilateral trade volatility drops significantly compared to the case where only one country is a WTO member.

Figure 4. Trade volatilities after one country vs. two countries joining the WTO.

4.2. Regressions with Spatial Dependence

Next, we include in our model the spatial volatility measures defined in equations (3)–(6). To better interpret coefficients on these spatial measures and answer whether the comovement of trade volatility differs based on partners’ WTO membership, we restrict our sample of estimation to dyads within the WTO. Note that we still construct spatial volatilities with all dyads in the sample but run regressions only including trading pairs with both partners being WTO members. In this way, the estimated coefficients on ![]() $V_{im\tau }^{{\rm WTO}} $ and

$V_{im\tau }^{{\rm WTO}} $ and ![]() $V_{kj\tau }^{{\rm WTO}} $ will capture the strength of trade volatility dependence or comovement among WTO trading pairs and the estimated coefficients on

$V_{kj\tau }^{{\rm WTO}} $ will capture the strength of trade volatility dependence or comovement among WTO trading pairs and the estimated coefficients on ![]() $V_{im\tau }^{{\rm NWTO}} $ and

$V_{im\tau }^{{\rm NWTO}} $ and ![]() $V_{kj\tau }^{{\rm NWTO}} $ will show the strength of trade volatility dependence between a dyad within the WTO (i.e., dyad i–j) and dyads with one non-WTO member.Footnote 10

$V_{kj\tau }^{{\rm NWTO}} $ will show the strength of trade volatility dependence between a dyad within the WTO (i.e., dyad i–j) and dyads with one non-WTO member.Footnote 10

As both countries i and j are WTO members in our new regressions, the variable BothWTO is irrelevant and excluded from all regressions. We also construct and include two combined terms ![]() $V_\tau ^{{\rm WTO}} $ and

$V_\tau ^{{\rm WTO}} $ and ![]() $V_\tau ^{{\rm NWTO}} $ for our analysis, where

$V_\tau ^{{\rm NWTO}} $ for our analysis, where ![]() $V_\tau ^{{\rm WTO}} = V_{im\tau }^{{\rm WTO}} + V_{kj\tau }^{{\rm WTO}} $ and

$V_\tau ^{{\rm WTO}} = V_{im\tau }^{{\rm WTO}} + V_{kj\tau }^{{\rm WTO}} $ and ![]() $V_\tau ^{{\rm NWTO}} = V_{im\tau }^{{\rm NWTO}} + V_{kj\tau }^{{\rm NWTO}} $.Footnote 11 To save space, we only report coefficients on our spatial measures. Estimated coefficients on other controls are available upon request.

$V_\tau ^{{\rm NWTO}} = V_{im\tau }^{{\rm NWTO}} + V_{kj\tau }^{{\rm NWTO}} $.Footnote 11 To save space, we only report coefficients on our spatial measures. Estimated coefficients on other controls are available upon request.

The results with spatial measures for WTO pairs are reported in columns 3.1 and 3.2 in Table 3. The estimated coefficients on spatial volatility measures are all positive and significant at the 10% level or better, well supporting the inclusion of spatial terms to control for the inter-dyad trade volatility dependence and an empirical specification allowing for multilateral interactions.

Table 3. Spatial dyadic trade volatility for WTO countries and non-WTO countries

Notes: All regressions are controlled for other control variables presented in regression 2.3 in Table 2. We define: ![]() $V_\tau ^{{\rm WTO}} = V_{im\tau }^{{\rm WTO}} + V_{kj\tau }^{{\rm WTO}} $ and

$V_\tau ^{{\rm WTO}} = V_{im\tau }^{{\rm WTO}} + V_{kj\tau }^{{\rm WTO}} $ and ![]() $V_\tau ^{{\rm NWTO}} = V_{im\tau }^{{\rm NWTO}} + V_{kj\tau }^{{\rm NWTO}} $. Clustered standard errors by countries i and j are in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1.

$V_\tau ^{{\rm NWTO}} = V_{im\tau }^{{\rm NWTO}} + V_{kj\tau }^{{\rm NWTO}} $. Clustered standard errors by countries i and j are in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1.

More importantly, we find a strong comovement of trade volatilities among trading pairs in general. The positive coefficients on spatial terms indicate that trade between two WTO members i and j is more stable if trade between the same country i and other WTO or non-WTO exporters m is more stable. Similarly, trade between countries i and j is more stable if trade between other WTO or non-WTO importers and the same exporting country j becomes more stable.

We then estimate the trade volatility comovements by restricting our sample to dyads outside the WTO (i.e., both countries i and j are non-WTO members) and report the results in columns 3.3 and 3.4 in Table 3. The estimated coefficients on ![]() $V_{im\tau }^{{\rm NWTO}} $ and

$V_{im\tau }^{{\rm NWTO}} $ and ![]() $V_{kj\tau }^{{\rm NWTO}} $ in this regression show the trade volatility comovement among pairs outside the WTO, and those on

$V_{kj\tau }^{{\rm NWTO}} $ in this regression show the trade volatility comovement among pairs outside the WTO, and those on ![]() $V_{im\tau }^{{\rm WTO}} $ and

$V_{im\tau }^{{\rm WTO}} $ and ![]() $V_{kj\tau }^{{\rm WTO}} $ capture volatility comovement between a non-WTO pair (i and j) and pairs with one WTO member.

$V_{kj\tau }^{{\rm WTO}} $ capture volatility comovement between a non-WTO pair (i and j) and pairs with one WTO member.

For ease of discussion, we focus on coefficients on ![]() $V_\tau ^{{\rm WTO}} $ and

$V_\tau ^{{\rm WTO}} $ and ![]() $V_\tau ^{{\rm NWTO}} $ in regressions 3.2 and 3.4. The estimated coefficient on

$V_\tau ^{{\rm NWTO}} $ in regressions 3.2 and 3.4. The estimated coefficient on ![]() $V_\tau ^{{\rm WTO}} $ drops from 0.485 in regression 3.2 to 0.328 in regression 3.4. These numbers show that the trade volatility of a WTO pair goes up by 0.485 units if the trade volatility of other WTO pairs goes up by one unit (regression 3.2). The trade volatility of a non-WTO pair goes up by 0.328 units if the trade volatility of other pairs with a WTO member goes up by one unit (regression 3.4). The estimated coefficient on

$V_\tau ^{{\rm WTO}} $ drops from 0.485 in regression 3.2 to 0.328 in regression 3.4. These numbers show that the trade volatility of a WTO pair goes up by 0.485 units if the trade volatility of other WTO pairs goes up by one unit (regression 3.2). The trade volatility of a non-WTO pair goes up by 0.328 units if the trade volatility of other pairs with a WTO member goes up by one unit (regression 3.4). The estimated coefficient on ![]() $V_\tau ^{{\rm NWTO}} $ rises from 0.018 in regression 3.2 to 0.111 in regression 3.4. These numbers indicate that WTO dyad trade volatility only increases by 0.018 units if the trade volatility of other dyads with a non-WTO member goes up by one unit (regression 3.2). In comparison, the trade volatility of a non-WTO pair increases by 0.111 units if the trade volatility of other non-WTO pairs goes up by one unit (regression 3.4). The results suggest that the comovement of trade volatility appears strongest among WTO members. We also observe that the trade volatility comovement among non-WTO pairs is stronger than that between WTO pairs and pairs including a non-WTO member – we indeed observe the weakest trade volatility interdependence between WTO dyads and dyads with a non-WTO member based on the empirical results on volatility comovement across various groups in Table 3.

$V_\tau ^{{\rm NWTO}} $ rises from 0.018 in regression 3.2 to 0.111 in regression 3.4. These numbers indicate that WTO dyad trade volatility only increases by 0.018 units if the trade volatility of other dyads with a non-WTO member goes up by one unit (regression 3.2). In comparison, the trade volatility of a non-WTO pair increases by 0.111 units if the trade volatility of other non-WTO pairs goes up by one unit (regression 3.4). The results suggest that the comovement of trade volatility appears strongest among WTO members. We also observe that the trade volatility comovement among non-WTO pairs is stronger than that between WTO pairs and pairs including a non-WTO member – we indeed observe the weakest trade volatility interdependence between WTO dyads and dyads with a non-WTO member based on the empirical results on volatility comovement across various groups in Table 3.

Over our sample period, the GATT/WTO has gone through several big formative stages, following rounds of negotiations on tariff- and non-tariff trade barriers reduction. Because lower trade barriers should apply to all GATT/WTO members according to the MFN principle, an effective round of trade negotiations should have made trade among GATT/WTO members more integrated than trade between members and non-members or trade among non-members. Lower trade barriers and more integrated trade among members, in turn, may lead to the comovement of their trade volatilities. This result suggests that the comovement should be stronger in periods with more progress toward reducing trade barriers over our sample time span.

Following Felbermayr and Kohler (Reference Felbermayr and Kohler2010), we look at four subsample periods: pre-Kennedy Round (1948–1967), Kennedy to Tokyo Round (1968–1978), Tokyo to Uruguay Round (1979–1994), and WTO (1995–2017) and report subsample regression results in Table 4. The subsample regressions allow us to tease out whether the spatial correlation of trade volatilities across trading pairs varies over time. In light of our previous findings that the coefficients on ![]() $V_{im\tau }^{{\rm WTO}} $ and

$V_{im\tau }^{{\rm WTO}} $ and ![]() $V_{kj\tau }^{{\rm WTO}} $ are qualitatively similar and the coefficients on

$V_{kj\tau }^{{\rm WTO}} $ are qualitatively similar and the coefficients on ![]() $V_{im\tau }^{{\rm NWTO}} $ and

$V_{im\tau }^{{\rm NWTO}} $ and ![]() $V_{kj\tau }^{{\rm NWTO}} $ are qualitatively similar, we include two combined terms

$V_{kj\tau }^{{\rm NWTO}} $ are qualitatively similar, we include two combined terms ![]() $V_\tau ^{{\rm WTO}} $ and

$V_\tau ^{{\rm WTO}} $ and ![]() $V_\tau ^{{\rm NWTO}} $ in Table 4 for brevity. Similarly to regressions in Table 3, we report results with both countries i and j being WTO members and with both countries i and j being non-WTO members.

$V_\tau ^{{\rm NWTO}} $ in Table 4 for brevity. Similarly to regressions in Table 3, we report results with both countries i and j being WTO members and with both countries i and j being non-WTO members.

Table 4. Subsample regression results, with dyad fixed effects

Notes: All regressions are controlled for other control variables, dyad and time fixed effects similar to regression 2.3 in Table 2. We group our sample period (1948–2003) into four periods based on the GATT rounds and the WTO, following Felbermayr and Kohler (Reference Felbermayr and Kohler2010).

We define: ![]() $V_\tau ^{{\rm WTO}} = V_{im\tau }^{{\rm WTO}} + V_{kj\tau }^{{\rm WTO}} $ and

$V_\tau ^{{\rm WTO}} = V_{im\tau }^{{\rm WTO}} + V_{kj\tau }^{{\rm WTO}} $ and ![]() $V_\tau ^{{\rm NWTO}} = V_{im\tau }^{{\rm NWTO}} + V_{kj\tau }^{{\rm NWTO}} $. Clustered standard errors by countries i and j are in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1.

$V_\tau ^{{\rm NWTO}} = V_{im\tau }^{{\rm NWTO}} + V_{kj\tau }^{{\rm NWTO}} $. Clustered standard errors by countries i and j are in parentheses. ***p < 0.01, **p < 0.05, *p < 0.1.

By and large, the results in Table 4 are qualitatively similar to those in Table 3. In the regressions with both countries i and j being WTO members (regressions 4.1, 4.3, 4.5, and 4.7), six of the eight coefficients on spatial terms are positive and significant at the 5% level or better. In the regressions with both countries i and j being non-WTO members (regressions 4.2, 4.4, 4.6, and 4.8), seven of the eight spatial coefficients are positive, and three are statistically significant. We also observe that the strength of trade volatility comovement changes over time. For example, in the regressions for WTO members, the magnitude of the positive coefficient on ![]() $V_\tau ^{{\rm WTO}} $ is similar in regressions 4.1 and 4.3 over the pre-Kennedy Round (0.329) and the Kennedy to Tokyo Round (0.329). It declines to 0.197 over the Tokyo to Uruguay Round in regression 4.5 and then goes up to 0.487 during the WTO period in regression 4.7. The change in the strength of trade volatility dependence across GATT/WTO member pairs over time is, in general, consistent with our hypothesis related to the relationship between progress in GATT/WTO trade liberalization and trade volatility comovement across trading dyads. For instance, tariff reductions by major industrial countries in the first few rounds of negotiations under the GATT spurred fast growth in international trade in the 1950s and 1960s. However, economic recessions in the 1970s drove governments to devise other forms of protection (non-tariff barriers or NTBs) for sectors facing increased foreign competition, which could undermine the GATT's credibility and effectiveness and reduce the predictability of trade.Footnote 12 These might lead to a decline of trade volatility comovement among WTO trading pairs shown in the subsample results. Over the latter subsample periods, new developments facilitating international trade and a more formal and effective trade dispute settlement mechanism under the WTO could result in more integrated and more stable trade and hence a stronger interdependence of trade volatilities shown in the results. For non-WTO members, the coefficients on both spatial terms,

$V_\tau ^{{\rm WTO}} $ is similar in regressions 4.1 and 4.3 over the pre-Kennedy Round (0.329) and the Kennedy to Tokyo Round (0.329). It declines to 0.197 over the Tokyo to Uruguay Round in regression 4.5 and then goes up to 0.487 during the WTO period in regression 4.7. The change in the strength of trade volatility dependence across GATT/WTO member pairs over time is, in general, consistent with our hypothesis related to the relationship between progress in GATT/WTO trade liberalization and trade volatility comovement across trading dyads. For instance, tariff reductions by major industrial countries in the first few rounds of negotiations under the GATT spurred fast growth in international trade in the 1950s and 1960s. However, economic recessions in the 1970s drove governments to devise other forms of protection (non-tariff barriers or NTBs) for sectors facing increased foreign competition, which could undermine the GATT's credibility and effectiveness and reduce the predictability of trade.Footnote 12 These might lead to a decline of trade volatility comovement among WTO trading pairs shown in the subsample results. Over the latter subsample periods, new developments facilitating international trade and a more formal and effective trade dispute settlement mechanism under the WTO could result in more integrated and more stable trade and hence a stronger interdependence of trade volatilities shown in the results. For non-WTO members, the coefficients on both spatial terms, ![]() $V_\tau ^{{\rm WTO}} $ and

$V_\tau ^{{\rm WTO}} $ and ![]() $V_\tau ^{{\rm NWTO}} $, are insignificant in regression 4.2, suggesting that trade volatility comovement of dyads outside the GATT/WTO with other dyads is rather weak before the Kennedy round. The coefficient on

$V_\tau ^{{\rm NWTO}} $, are insignificant in regression 4.2, suggesting that trade volatility comovement of dyads outside the GATT/WTO with other dyads is rather weak before the Kennedy round. The coefficient on ![]() $V_\tau ^{{\rm WTO}} $ in regression 4.4 is positive and significant, showing a strong comovement of trade volatility between non-WTO dyads and dyads with a WTO member between 1968 and 1978. Interestingly, the coefficient on

$V_\tau ^{{\rm WTO}} $ in regression 4.4 is positive and significant, showing a strong comovement of trade volatility between non-WTO dyads and dyads with a WTO member between 1968 and 1978. Interestingly, the coefficient on ![]() $V_\tau ^{{\rm NWTO}} \;$is positive and significant at the 5% level, while the coefficient on

$V_\tau ^{{\rm NWTO}} \;$is positive and significant at the 5% level, while the coefficient on ![]() $V_\tau ^{{\rm WTO}} $ is not statistically different from 0 in regressions 4.6 and 4.8. These results indicate that since the Tokyo round, trade volatility of dyads outside the GATT/WTO co-moves strongly with that of other dyads outside the GATT/WTO. When there is deeper trade integration among GATT/WTO members, trade patterns of countries outside the system may appear to diverge from member countries. As a result, we could see the volatility of trade of non-members co-move with that of other non-members. These results, however, need to be interpreted with caution given that the sample size of regressions 4.6 and 4.8 is quite small relative to that of regressions 4.5 and 4.7.

$V_\tau ^{{\rm WTO}} $ is not statistically different from 0 in regressions 4.6 and 4.8. These results indicate that since the Tokyo round, trade volatility of dyads outside the GATT/WTO co-moves strongly with that of other dyads outside the GATT/WTO. When there is deeper trade integration among GATT/WTO members, trade patterns of countries outside the system may appear to diverge from member countries. As a result, we could see the volatility of trade of non-members co-move with that of other non-members. These results, however, need to be interpreted with caution given that the sample size of regressions 4.6 and 4.8 is quite small relative to that of regressions 4.5 and 4.7.

In summary, our results in Table 2 and those from the event study suggest that the GATT/WTO reduces members’ trade volatility. Regressions with the spatial correlation of trade volatilities in Table 3 indicate that the comovement of trade volatilities exists in general. There is a stronger interdependence of trade volatilities among WTO trading pairs than among other dyads. Our results imply that the WTO may stabilize bilateral trade even further through the strong comovement of trade volatilities among members. For example, joining WTO directly helps to reduce a dyad's trade volatility. A more stable trade between this dyad likely leads to more stable trade among other dyads due to the positive dependence of trade volatilities among members. In turn, spatial dependence indicates that stable trade among other dyads will further stabilize trade of our dyad of interest. In other words, the trade-stabilizing effect of the WTO is magnified due to spillovers when spatial dependence exists.Footnote 13 Focusing on WTO members, they can benefit from growing international trade with each other and a more transparent and integrated system.

5. Robustness Checks

We also undertake a series of sensitivity analyses to check the robustness of our results. First, we re-estimate Tables 2 and 3 regressions with trade volatilities constructed over 10- and 15-year periods and report results in Appendix Tables D and E (on-line supplementary material). These results are qualitatively similar. We then apply different weights to construct spatial volatilities. We first incorporate geographical distance in the weight matrix. To be specific, we replace the weight ![]() $w_m^{{\rm WTO}} $ in equation (3) for the term

$w_m^{{\rm WTO}} $ in equation (3) for the term ![]() $V_{im\tau }^{{\rm WTO}} $ by

$V_{im\tau }^{{\rm WTO}} $ by ![]() $w_m^{{\rm WTO}} /Dist_{jm}$, with Dist jm representing the geographical distance between country j and country m. For example, this indicates that the influence of the trade volatility between the US and India (country m) on the trade volatility between the US (country i) and Thailand (country j) is now conditioned by both the WTO membership of India and the geographical distance between Thailand and India. An inverse distance weight is used to reflect the first law of geography that ‘near things are more related than distant things’ (Tobler, Reference Tobler1970, 236). With the new weight matrix, the trade volatility between the US and Thailand is more affected by the trade volatility between the US and India than by the trade volatility between the US and the UK since geographically India is closer to Thailand than the UK is to Thailand.

$w_m^{{\rm WTO}} /Dist_{jm}$, with Dist jm representing the geographical distance between country j and country m. For example, this indicates that the influence of the trade volatility between the US and India (country m) on the trade volatility between the US (country i) and Thailand (country j) is now conditioned by both the WTO membership of India and the geographical distance between Thailand and India. An inverse distance weight is used to reflect the first law of geography that ‘near things are more related than distant things’ (Tobler, Reference Tobler1970, 236). With the new weight matrix, the trade volatility between the US and Thailand is more affected by the trade volatility between the US and India than by the trade volatility between the US and the UK since geographically India is closer to Thailand than the UK is to Thailand.

Similarly, for the spatial term ![]() $V_{im\tau }^{{\rm NWTO}} $, the weight

$V_{im\tau }^{{\rm NWTO}} $, the weight ![]() $w_m^{{\rm NWTO}} $ in equation (4) is replaced by

$w_m^{{\rm NWTO}} $ in equation (4) is replaced by ![]() $w_m^{{\rm NWTO}} /Dist_{jm}$. We apply the same technique to generate new weights for spatial volatility terms in equations (5) and (6), now being

$w_m^{{\rm NWTO}} /Dist_{jm}$. We apply the same technique to generate new weights for spatial volatility terms in equations (5) and (6), now being ![]() $w_k^{{\rm WTO}} /Dist_{ik}$ and

$w_k^{{\rm WTO}} /Dist_{ik}$ and ![]() $w_k^{{\rm NWTO}} /Dist_{ik}$, with Dist ik representing the geographical distance between countries i and k. For example, the trade volatility between the US and Thailand should be more correlated with the trade volatility between Canada and Thailand than with the trade volatility between Germany and Thailand as Canada is geographically closer to the US than Germany is to the US

$w_k^{{\rm NWTO}} /Dist_{ik}$, with Dist ik representing the geographical distance between countries i and k. For example, the trade volatility between the US and Thailand should be more correlated with the trade volatility between Canada and Thailand than with the trade volatility between Germany and Thailand as Canada is geographically closer to the US than Germany is to the US

The other alternative weight matrix measures the connectivity among countries based on their ‘economic distance’. Countries can be geographically far apart while sharing a strong economic bond and experiencing strong synchronization of the business cycle (Clark and van Wincoop, Reference Clark and van Wincoop2001; Baxter and Kouparitsas, Reference Baxter and Kouparitsas2005; Wang et al., Reference Wang, Wong and Granato2015). Countries are considered economically closer if they conduct a large volume of trade with each other, ceteris paribus. In particular, we replace ![]() $w_m^{{\rm WTO}} $ in equation (3) and

$w_m^{{\rm WTO}} $ in equation (3) and ![]() $w_m^{{\rm NWTO}} $ in equation (4) by

$w_m^{{\rm NWTO}} $ in equation (4) by ![]() $w_m^{{\rm WTO}} \cdot trade_{jm\tau }$ and

$w_m^{{\rm WTO}} \cdot trade_{jm\tau }$ and ![]() $w_m^{{\rm NWTO}} \cdot trade_{jm\tau }$, respectively. The term trade jmτ is the log value of average total trade between countries j and m over period τ. The weights in equations (5) and (6) are replaced by

$w_m^{{\rm NWTO}} \cdot trade_{jm\tau }$, respectively. The term trade jmτ is the log value of average total trade between countries j and m over period τ. The weights in equations (5) and (6) are replaced by ![]() $w_k^{{\rm WTO}} \cdot trade_{ik\tau }$ and

$w_k^{{\rm WTO}} \cdot trade_{ik\tau }$ and ![]() $w_k^{{\rm NWTO}} \cdot trade_{ik\tau }$, respectively, with trade ikτ being the log value of the average total trade between countries i and k over period τ.

$w_k^{{\rm NWTO}} \cdot trade_{ik\tau }$, respectively, with trade ikτ being the log value of the average total trade between countries i and k over period τ.

Results based on alternative weights are provided in Appendix Table F (on-line supplementary material). These results are consistent with the results in Table 3. Estimated coefficients on spatial terms are positive and significant, suggesting clustering of volatilities among geographical neighbors and among those who have strong economic ties with each other. Trade volatility dependence is stronger among WTO members compared to that between WTO members and non-WTO members.

Finally, to ensure that the comovement of trade volatilities is not driven simply by a dominant trader, we estimate regressions without the US, the world's leading economy, or China, one of the largest trading countries in the world. The OPEC group is also excluded from the sample to alleviate the influence of global oil supply shocks. We exclude these countries from our sample for regressions and from the data we use to reconstruct the spatial lag measures. Results for subsamples are reported in Appendix Table G (on-line supplementary material). The results do not change substantially from those in Table 3.

6. Conclusions

Recent studies in the literature have suggested that exposure to global markets increases trade volatility. Governments try to insulate their economies from such instability through membership in international trade institutions, such as the WTO, and preferential trading arrangements. As the primary purpose of the WTO is to liberalize international trade and to serve as a multilateral institution providing the global framework for peace and stability, this paper investigated the role of multilateralism of the WTO in international trade stability.

Specifically, we studied the comovement of trade volatility across multiple dyads with a unique spatial framework considering interactions among multiple trading pairs. Our paper aimed to shed some light on the WTO trade volatility nexus where previous research has tended to leave out the interdependence of trade volatilities as a determinant of bilateral trade volatility. In fact, the volatility of bilateral trade between a dyad can be affected by trade volatilities between other country pairs. Omitting a measure of the interdependence of trade volatilities can lead to biased estimates and invalid statistical inferences.

Our results show that trading partners who are GATT/WTO members experience more stable trade compared to trading pairs with at least one non-member. More importantly, after controlling for dyadic spatial trade volatilities, we found that trade volatilities co-move among different trading pairs in general. However, such a comovement is more evident between two dyads within the GATT/WTO. We also found that the comovement of trade volatility within the GATT/WTO may be stronger during the GATT rounds with more progress in trade barriers reduction and the WTO period with coverage of more trade-related issues.

Existing empirical research about the impact of international trade organizations highlights the increase in the level of trade and more stable trade without taking interdependence across dyads into account. Once that is done, the beneficial impact of trade organizations and trade agreements becomes clearer. Regarding policy implications, the findings in this paper extend our understanding that the benefits of transparent trade rules and regulations are not merely for individual pairs of trade partners. Due to the strong trade volatility comovement within the GATT/WTO, the trade stabilization in a bilateral setting can also benefit other countries in the multilateral system of the WTO, which fulfills the primary goal of making the global business environment stable and predictable.

Supplementary Materials

To view supplementary material for this article, please visit https://doi.org/10.1017/S1474745621000057.

Acknowledgements

We are grateful to the editor (Alan Winters) and two anonymous referees for providing valuable comments to improve the earlier draft of our paper.