1. Introduction

Jensen and Malesky (Reference Jensen and Malesky2018) demonstrate that politicians can benefit from providing incentives to attract business investment. Voters reward politicians who try to create jobs and offering those incentives signals to voters that they are doing so. We expand on this insight to consider that not all firms' investments are likely to be equally embraced. That heterogeneity is particularly important in a political climate of ascendant “economic nationalism.” In that spirit, this paper explores whether Americans' fondness for business investment is conditional on the investing firm's national origin.

Our core contention is that foreign and, especially, Chinese business investment is viewed more skeptically than the investment of unknown provenance and that this skepticism is shaped by Americans' experiences with trade-related deindustrialization (TRD) and their own cultural nationalism. We expect (and find) that proximity to TRD fuels Americans' eagerness for business investment, but to a substantially greater degree for the investment of unknown provenance (which may read as domestic) than for Chinese investment. In the aggregate (i.e., without accounting for nationalism) we find that attitudes toward Chinese investment are relatively constant across deindustrialized and non-deindustrialized counties. The consequence of a growing enthusiasm for investment, but not Chinese investment, is that the gap between attitudes toward the two grows with TRD.Footnote 1 We also expect (and find) that cultural nationalists are more skeptical of Chinese investment than cultural non-nationalists.Footnote 2

It is less clear a priori how those two factors interact—if, indeed, they do—and we explore the extent to which cultural nationalists and non-nationalists differ in how they translate economic contexts into economic attitudes. It is unclear in the literature whether proximity to TRD heightens or homogenizes the distinctions between nationalists' and non-nationalists' view of foreign investment (and, if it homogenizes them, whether nationalists drop their resistance to foreign business investment when deindustrialization demands it, or whether the trauma of TRD turns even non-nationalists into skeptics of globalization).

We clarify which of these possibilities best fits the data using a survey experiment administered in late 2017 to a representative sample of roughly 1000 Americans. We solicited respondents' attitudes toward “business investment,” but randomly assigned them into treatment groups defined by whether the investing firm is a business, a foreign business, or a Chinese business. Our findings suggest that the weight of TRD falls on the economic attitudes of cultural non-nationalists, who become increasingly skeptical of the benefits of Chinese (and, to a slightly lesser extent, generically foreign) investment as local trade-related job losses mount. In contrast, TRD has no clear effect on cultural nationalists' consistently skeptical view of Chinese investment. Cultural nationalists are more skeptical of Chinese than generic business investment regardless of location.

Relating these findings back to practical politics, they imply that Jensen and Malesky's “incentives to pander” may not apply to Chinese or foreign investment, especially in places afflicted by TRD. The more affected an area is, the more its residents display a preference for investment that is not foreign or Chinese. Moreover, those distinctions are driven by the souring attitudes of non-nationalists, who in other circumstances would have supported foreign business investment.

The remainder of this paper is as follows: Section 2 provides background information on the mass politics of foreign direct investment, FDI in the United States and the economic context behind focusing on Chinese inward investment, Section 3 develops a series of hypotheses relating exposure to deindustrialization, nationalism, and attitudes toward inward FDI. Section 4 describes our research design and results. Section 5 concludes.

2. Background

2.1. Mass politics of FDI

The American public and political elite have often been hostile toward inward FDI,Footnote 3 despite Americans' relative openness to FDI and, more generally, support for business investment (and job creation) (Jensen and Malesky, Reference Jensen and Malesky2018). American skepticism of FDI is well known—and at times a cultural tropeFootnote 4—but little has been written on the sources of popular opposition in mass politics (Pandya, Reference Pandya2016: 458). The work that does exist on the topic tends to focus on its distributional consequences in the labor market (Pinto and Pinto, Reference Pinto and Pinto2008; Pandya, Reference Pandya2010, Reference Pandya2014). Those who are likeliest to benefit from the jobs that FDI promotes—which Pandya identifies as skilled, college-educated workers—are thought likeliest to support it. As Pandya (Reference Pandya2016) notes in her review, the non-material drivers of mass politics toward inwards foreign investment is especially understudied.Footnote 5

That limited knowledge is notable in relation to Americans' attitudes towards Chinese business investment. Partially that is because the coincidence of rising Chinese investment and a broader recognition of the “China Shock's” implications for the American labor market have made this an economically and politically significant topic. Yet it is also notable for the contrastingly large body of scholarly and popular writing on the political determinants of America's current trend towards economic nationalism. That literature is notably split between stressing economic and cultural sources of American economic nationalism. Guisinger (Reference Guisinger2014), Mansfield and Mutz (Reference Mansfield and Mutz2009, Reference Mansfield and Mutz2013), and Sabet (Reference Sabet2016) all find that political reactions to trade and offshoring more closely tie to individuals' nativism and sense of national superiority than they do to their economic circumstances.Footnote 6 Others, including Autor et al. (Reference Autor, Dorn and Hanson2016, Reference Autor, Dorn and Hanson2017), Che et al. (Reference Che, Lu, Pierce, Schott and Tao2016), and Feigenbaum and Hall (Reference Feigenbaum and Hall2015), see in the current political moment a reaction to deindustrialization, and to the uniquely destabilizing role of Chinese trade.

In what follows, we describe the major planks of our theory of contemporary attitudes towards Chinese business investment in the United States, which centrally focuses on the “China Shock” and on Americans' personally held cultural nationalism.

2.2. The China Shock

According to data from the US Bureau of Economic Analysis, Chinese exports into the United States rose from roughly $20 billion in 1991 to $108 billion in 2000, more than doubling its share of American imports (from 3.98 to 8.55 percent) and making it the 4th largest importing nation, behind Canada, Japan, and Mexico. China became the largest importer of goods into the United States in 2007, and by 2016 imported $481 billion worth of goods into the United States, or 21.42 percent of American imports.Footnote 7

China's rise as an American trading partner has been politically salient in the United States, largely for its role in concurrent trends in American deindustrialization. Manufacturing's share of American employment fell by roughly a third between 1990 and 2016. Acemoglu et al. (Reference Acemoglu, Autor, Dorn, Hanson and Price2016) estimate that import penetration from China accounted for 560,000 lost manufacturing jobs between 1999 and 2011, or about 10 percent of the total manufacturing job decline over that period. Including associated job losses along the supply chain increases those estimates to 985,000 lost jobs, and to nearly 2 million jobs across the entire economy.Footnote 8 The American labor market has, by most accounts, failed to fully adjust. There is neither evidence of geographic migration as a consequence of China-related trade displacementFootnote 9 nor of sectoral reallocation of labor within geographic areas.Footnote 10 Losses in manufacturing employment have instead resulted in increases in unemployment.Footnote 11 Those trends, commonly called the “China Shock” have created geographically defined pockets of deindustrialization and associated pathologies.Footnote 12

The China Shock has left a mark on American politics. Consider for illustration then-candidate Trump's 28 June 2016 speech on “how to make America wealthy again.” That speech made 18 references to foreign countries, 12 of which called for trade restrictions with China, and included a characterization of China's entry into the WTO as the “greatest jobs theft in history.”Footnote 13 In the academic literature, Autor et al.'s (Reference Autor, Dorn and Hanson2017) work on vote choice in the 2016 elections, Che et al.'s (Reference Che, Lu, Pierce, Schott and Tao2016) work on voter turnout, Feigenbaum and Hall's (Reference Feigenbaum and Hall2015) work on legislative protectionism, and Autor et al.'s (Reference Autor, Dorn and Hanson2016) work on political polarization all ascribe political consequences to living in areas beset by Chinese trade-related job-losses.

2.3. FDI in the United States

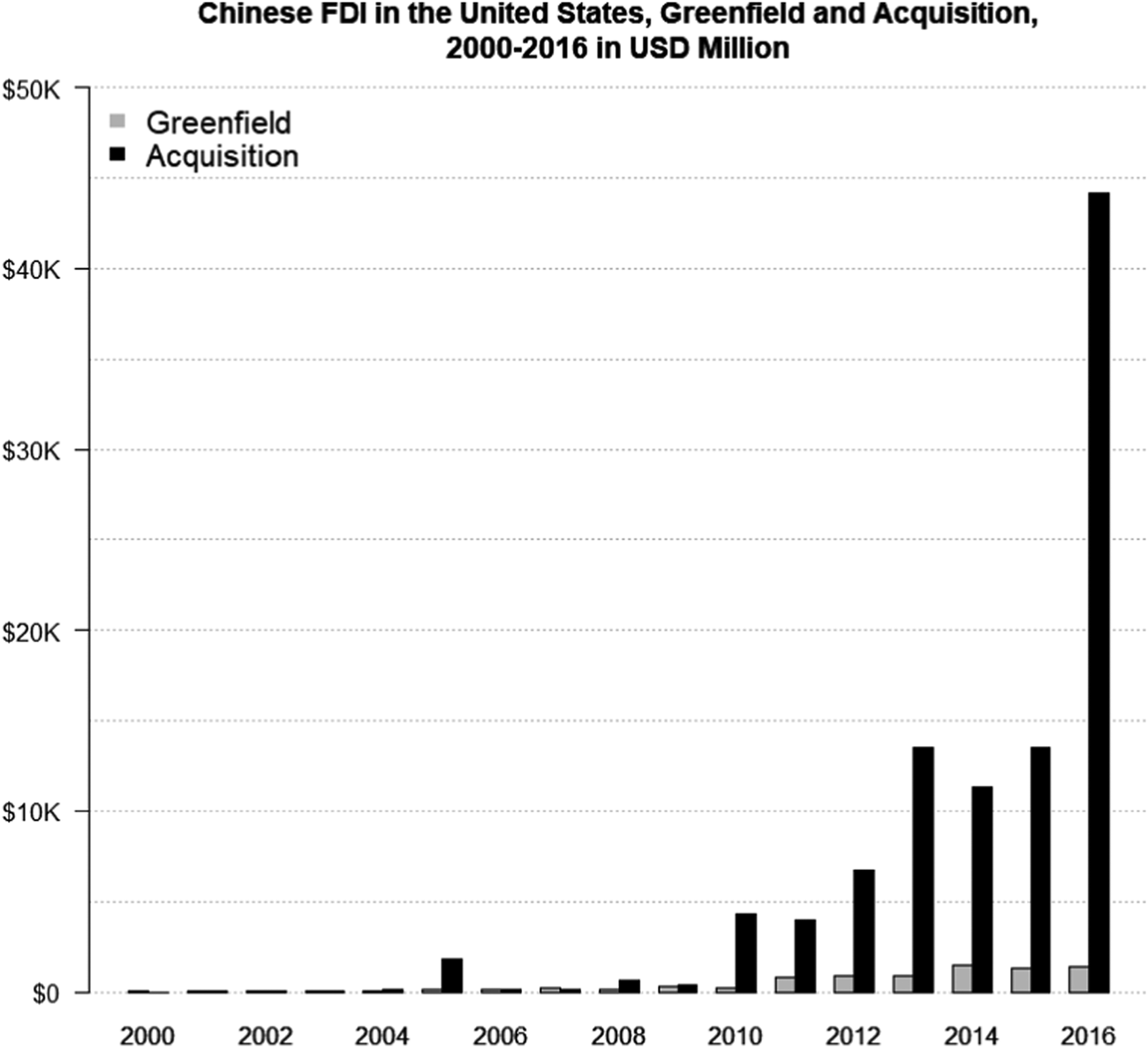

Chinese investment in the United States has also risen. China is now among the United States' most important sources of inward FDI.Footnote 14 The recent surge in Chinese investment (see Figure 1) includes high profile acquisitions—such as Anbang's acquisition of Strategic Hotels, WH Group's purchase of Smithfield Foods and Tesla's sale of a 5 percent stake to TencentFootnote 15—as well as substantial greenfield investments, including major investments in chemicals (Yuhuang Chemical's methanol plant in Louisiana), manufacturing (the Tianjin Pipe Corporation plant in Gregory, Texas, or Fuyao Glass America's facility in Moraine, Ohio) and real estate (Ping An and China Life Insurance Company's investments in developing Boston's Pier 4.)

Figure 1. Chinese foreign direct investment (FDI) in the United States from 2000 to 2016. Numbers include both greenfield investment as well as mergers and acquisitions. Data from: http://cim.rhg.com/.

3. Trade, nationalism, and aversion to FDI

There has not been an FDI-related analog to the China shock in American politics.Footnote 16 FDI does tend to benefit certain kinds of workers and not others, and may in some cases reduce labor security.Footnote 17 Those downsides, even as they relate to Chinese FDI, seem largely un-politicized. Indeed, FDI (including Chinese FDI) is often seen as a salve for the labor market dislocations associated with the US–China trade relationship. Over 140,000 Americans work at firms with at least 10 percent Chinese ownership, of which over 130,000 work at firms with majority Chinese ownership.Footnote 18 To highlight a particularly cinematic example of that substitution, Fuyao Glass America employs over 2000 Ohioans on the site of a shuttered GM plant. Nonetheless, Americans have long been more skeptical of foreign investment than its economic contributions would suggest. As we show below, Americans are (or, at least, were, in August 2017) much more skeptical of foreign than business investment more generically, and even more skeptical still of Chinese investment. Why are some Americans so skeptical of foreign business investment?

We approach that question by adopting premises from the broader debate over the contemporary politics of American attitudes toward globalization. We argue that American attitudes towards FDI are shaped by individuals' underlying sense of nationalism and by their exposure to TRD. Below we explore competing hypotheses concerning these relationships, focusing first on the effect of trade-related job losses, and then separately on the conditioning effect of nationalism.

3.1. Trade-related job loss

Given the China Shock's oft-noted effects on Americans' attitudes toward politics and globalization, it seems entirely straightforward that it should also affect how Americans view foreign investment and Chinese investment in particular. How it does so depends on how Americans see inward FDI. We consider in particular the possibilities that American see FDI as a potential solution to the ill-effects of the China Shock, or, conversely, that they infer from the China Shock that foreign economic influence is best resisted in all of its forms. The former possibility has the benefit of accuracy—FDI is different from trade in its distributional consequences in the labor market—but is also cognitively demanding. Indeed, a recurrent finding in the literature is that in the absence of an explicit cue, American attitudes toward globalization are often unmoored from economic principles (see Rho and Tomz, Reference Rho and Tomz2017).Footnote 19 Rather than considering what makes FDI distinct from trade, Americans exposed to deindustrialization might fall back on a simpler heuristic of judging FDI based on their experiences with globalization more generally.

Which posture best fits the data is a relatively straightforward empirical question. If Americans distinguish between FDI and trade, they should see jobs lost to trade and (the potential of) jobs gained through FDI as substitutes. Americans living in proximity to TRD should be the least likely to express skepticism toward foreign or Chinese investment. Applying a nationalist impulse to the question of investment would be a luxury that residents of deindustrialized areas are unable to afford. That dynamic would be consistent with much of American FDI politics. Consider Governor Scott Walker's efforts to attract Foxconn's $10 billion flat screen factory to Wisconsin. The politics of those efforts centered not just on the jobs, but on restoring a manufacturing base that had eroded in part through trade competition. Walker praised the investment as a “once-in-a-lifetime opportunity that brings high-tech manufacturing back to America, right here in Wisconsin” (Paquette, Reference Paquette2017).Footnote 20 Touting the Foxconn investment like this presumes that losing jobs through trade generates a desire to win them back through FDI, rather than a desire to buck globalized commerce entirely. If so, Southeast Wisconsin would be precisely the right sort of place to gain politically through high profile (and expensive) efforts to attract foreign business.

An alternative hypothesis is that exposure to TRD builds a view of globalization as economically detrimental, leading Americans to treat any form of it skeptically. Americans may not know about FDI's specific distributional consequences or may not care, but, in either case, the economic dislocation associated with TRD should sour them on the prospect of more globalization of any type. This premise has a close relationship with realistic group conflict theory (e.g. Levine and Campbell Reference LeVine and Campbell1972; Bobo Reference Bobo1983; Jackson Reference Jackson1993; Zárate et al., Reference Zárate, Garcia, Garza and Hitlan2004; Brief et al Reference Brief, Umphress, Dietz, Burrows, Butz and Scholten2005).Footnote 21 It suggests that Americans from trade-affected areas should be more likely to perceive foreign firms in nationalist term, as “our companies” versus “their companies” and as “arm[s] of the economic and political power of their parent countries” (Macesich, Reference Macesich1985; Baughn and Yaprak, Reference Baughn and Yaprak1996: 766).Footnote 22 “Losing” in trade should, in this view, breed skepticism of foreign economic influence generally, including ostensibly beneficial forms of it, such as FDI.

3.2. Nationalism and its interaction with trade-related job loss

The second premise of our approach is that nationalism—defined here as a heightened sense of national identity, and a belief in its superiority—affects attitudes towards FDI. We expect that nationalism breeds skepticism of foreign and Chinese investment.Footnote 23 We also expect that nationalism shapes how exposure to TRD translates into attitudes toward FDI. As before, we consider competing explanations for such an interaction.

We first consider the possibility that TRD primarily affects the views of non-nationalists who, in its absence, would be least likely to oppose foreign or Chinese investment. Non-nationalists, in this view, are not inherently acceptant of foreign investment, but rather are the most likely to “learn” from local conditions and adjust their attitudes toward FDI accordingly. Nationalists' attitudes toward foreign ownership are, in contrast, more philosophical than practical. Cultural nationalists are economic nationalists by definition, and equally so across economic contexts. Nationalists living in areas hit hard by TRD will be skeptical of foreign business investment to the same extent as nationalists living in areas that have not been. Notably, this view is not specific to any particular linkage between TRD and hostility to FDI. Whether TRD creates hostility to FDI or an acceptance of it, we expect that the effect of those job losses should be larger among non-nationalists.

Other possible forms of that relationship are plausible, however, and worth considering as alternative hypotheses. First, it could be that non-nationalism implies not the absence of economic nationalism but an active and principled support of foreign investment. Thus, non-nationalists may be as committed to a preference over foreign investment as nationalists are, and equally impervious to updating based on local economic context. If this were the case, non-nationalists should be no more or less affected by local economic conditions than nationalists but should be uniformly more supportive of foreign investment.

An argument can also be made that nationalists' attitudes toward FDI should be more affected by local economic conditions, not less. In one version of this argument, nationalists react to TRD by becoming more antagonistic toward FDI. Perhaps because they do not consider foreign economic influence inevitable, nationalists see in TRD a rationale for rejecting even its ostensibly good parts.Footnote 24 It is also possible that TRD homogenizes attitudes toward FDI on non-nationalists' terms. In this view, non-nationalists maintain their FDI-acceptant views across economic contexts, but nationalists shed their opposition to foreign business investment as local trade-related job losses mount. The translation of cultural nationalism to economic nationalism is, in this view, a luxury only afforded to cultural nationalists living in areas unaffected by TRD. When local economic conditions demand it, even nationalists welcome FDI.

Which of these, if any, best describe Americans' attitudes toward business investment is taken up empirically below.

4. Research design and findings

4.1. Research design

We evaluate these hypotheses using a survey experiment conducted on a demographically representative panel of US residents fielded by Qualtrics. Our study was in the field from 15 to 24 August 2017. Out of 1029 respondents, 855 provided sufficient information about the dependent and independent variables for this analysis.

Participants were randomly assigned into one of the three treatment groups, and therefore asked to respond to one of the three different versions of the following statement: “The last five years have seen significant growth in business investment by companies in the United States.”Footnote 25 The first group receives that statement verbatim, giving no information about the investment's provenance. The second group was told the business investment was “by foreign companies.” The third group was told the business was “by Chinese companies.” Each group was then asked, “Is this [the preceding statement] good for the US, bad for the US, or neither?”

Our interest is in modeling the gap between respondents' enthusiasm for generic, foreign, and Chinese business investment.Footnote 26 Our focus on Chinese exceptionality stems from the exceptional role that China plays in American trade politics, as well as the aforementioned growth in Chinese FDI. China is, by leaps and bound, the most relevant country for our inquiry. It is important to note, however, that the role played by China in these matters is not the sole plausible reason why reactions to “Chinese” investment might be more negative (or conditionally negative) than reactions to investments by “foreign” firms. It could be that China is unpopular for unrelated reasons (see Jensen and Lindstädt, Reference Jensen and Lindstädt2013), or that any specifically named country would elicit a stronger reaction. Our research design is not intended to distinguish between these, and we leave that question to future research.

We measure exposure to TRD by matching the respondent's county of residence to the number of Trade Adjustment Assistance (TAA) claims reported for that county.Footnote 27 More TAA claims suggest greater exposure. This variable has been used previously for identical purposes in Jensen et al. (Reference Jensen, Quinn and Weymouth2017), Kerner et al. (Reference Kerner, Sumner and Richter2017), and Margalit (Reference Margalit2011). Figure 1 shows the distribution of TAA claims per capita in our sample.Footnote 28 We use per capita rather than absolute counts because the population size matters for understanding the practical consequences of job losses: a large number of job losses in a highly-populated county is likely less devastating than a similar number of job losses within a smaller population. Indeed, the counties with the most TAA claims in our sample are also the largest counties. Los Angeles County has the most claims (838) and also the largest population (over 10 million in 2015). By contrast, the county in our sample with the most TAA claims per capita is Torrance County, New Mexico, which had only 42 claims but spread among a population of only about 15,500. That is almost 3 (2.7) claims per 1000 residents. In Los Angeles County, there were only 0.08 TAA claims per 1000 people.

Identifying nationalism is less straightforward, not least of which because TRD could (and likely does) generate attitudes toward economic globalization that might, in other circumstances, be considered nationalism. We want to isolate a less plausibly endogenous form of cultural nationalism rather than economic nationalism and want further to avoid indicators of nationalism that might tap into attitudes toward China specifically. To do so, we asked respondents whether students should be required by law to stand and say the Pledge of Allegiance and whether they agree that American culture is superior to other cultures. We code as “nationalist” anyone who answered both questions affirmatively. Everyone else is coded as non-nationalist. 43.9 percent of our respondents answered that American culture was better, and 48.1 percent thought that students should be required by law to stand and say the Pledge. 26.5 percent of respondents (273 people) said yes to both. In practice, our use of this operationalization of nationalism is not particularly consequential. In unreported models, we re-coded as nationalist anyone who answered at least one of our nationalism questions affirmatively, and our substantive conclusions are unchanged. We also obtained similar results by adding the two indicators to create an index of nationalism running from 0 to 2. Still, nationalism is a difficult concept to measure. Notwithstanding the necessarily modest claims one can make with a measure of nationalism, we think ours captures an important aspect of it and in ways that are more plausibly exogenous.

It is possible that TRD causes cultural nationalism, even on the dimensions in our measure. Yet there is no evidence in these data that it does. We do not find a correlation (causal or not) between proximity to TRD and cultural nationalism (ρ = −0.035), suggesting that TRD might actually decrease cultural nationalism in our sample, if anything.Footnote 29 Nonetheless, were such a relationship to be true it would suggest that we consider nationalism not as a factor that mediates the relationship between TRD and attitudes toward globalization, but as a product of deindustrialization. In such a causal model, proximity to deindustrialization could cause a broad set of nationalist traits that encompass but are not defined by attitudes toward globalization, or it could cause a set of nationalist traits that function as an intermediate step toward globalization-skepticism. Either is a quite different causal model than the one we consider in this paper and while both are conceptually possible and interesting, there is no evidence in the data that TRD and cultural nationalism are related in this way.

Although our experimental treatment is randomized (see online Appendix A), our tests rely upon interactions with observational data on county-level TAA claims, and those measures likely correlate with demographic variables in ways that could confound our regressions unless explicitly modeled. We collected that demographic information through a pre-scenario questionnaire, including age, gender identity, county and state, experience with manufacturing sector employment, and level of education. Our control for college education is particularly notable insofar as it captures Pandya's (Reference Pandya2010) argument that attitudes toward FDI are driven by skilled labor's economic incentive to support it. We also control for the number of unemployed people per capita within a respondent's county (in 2016, using data from the Bureau of Labor Statistics' Local Area Unemployment Statistics, with 2015 Census population estimates) to assure that our TAA variable captures the effect of trade-related job loss, rather than serving as a proxy for unemployment.

We focus our analysis on opposition to the investment, or the probability that a respondent says the investment is bad for the United States. Accordingly, we use a logistic regression model, where the independent variables are the experimental treatments, TAA claims per capita, and the interactions between each treatment and TAA claims (Foreign × TAA and China × TAA). The omitted category is the control group, meaning that both the foreign and China treatments represent the marginal effectFootnote 30 of each as compared with the “no information” treatment. The quantities of interest are the marginal effects of each treatment, which describe the difference between enthusiasm for foreign/Chinese investment and enthusiasm for generic investment (the omitted category), evaluated at different values of trade exposure.

4.2. Findings

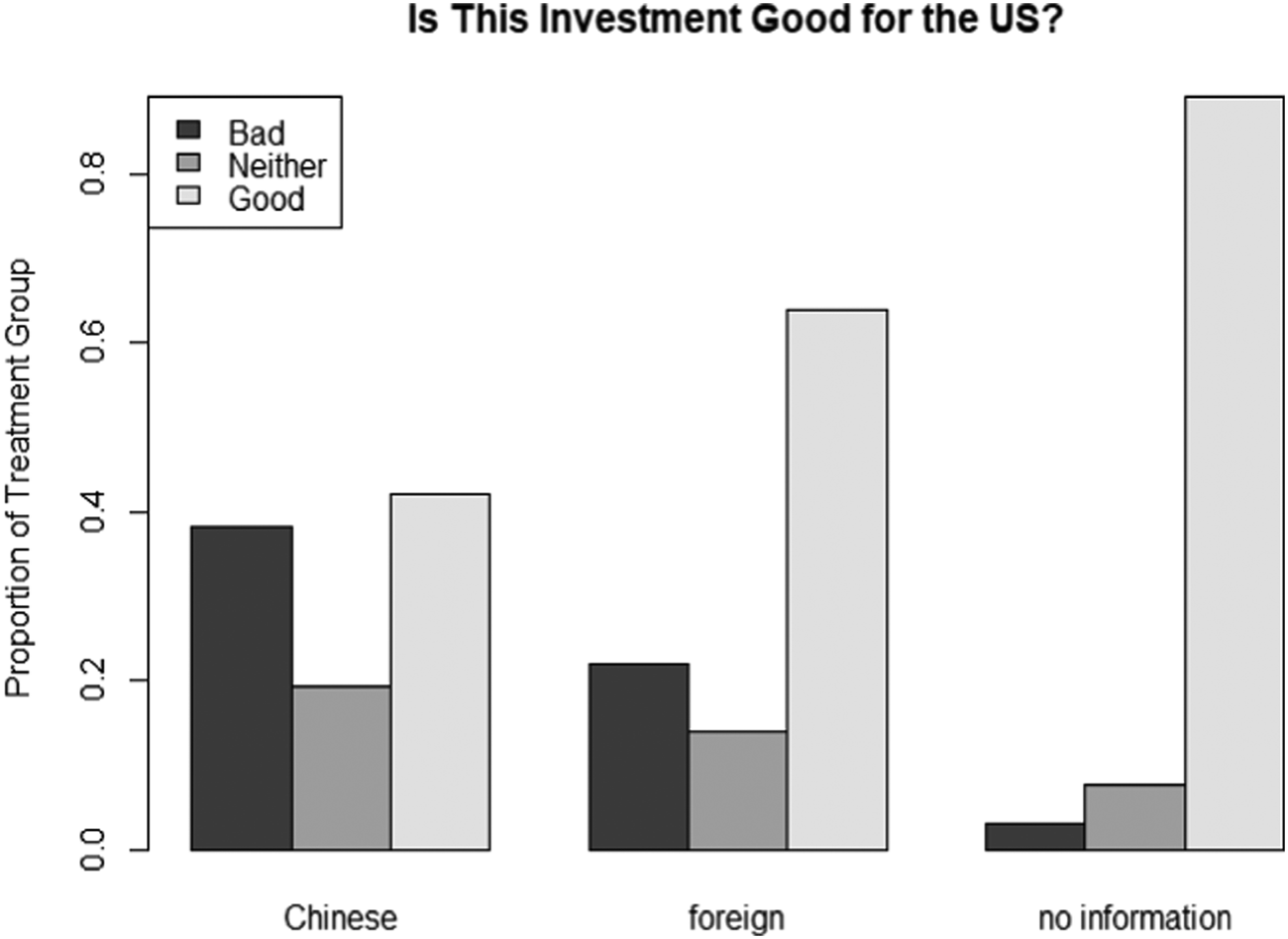

Figure 2 shows the responses from each treatment group when asked “Is [this business investment] good for the United States, bad for the United States, or neither?”Footnote 31 Our respondents were less enthusiastic about business investment if the investing firms are foreign, and especially if the firm is Chinese. The liability of foreignness is not surprising, but its scale in these data is striking. 89.2 percent of respondents who were informed about generic business investment (“no information”) believe that it is good for the United States. Only 63.9 percent say the same about the otherwise-identical “foreign” investment, and only 42.2 percent hold that opinion of Chinese investment.Footnote 32 Conversely, the number of people who believed the investment in question was bad for the United States is negligible (3.1 percent) when the origin of the investment was unknown, increases to 22 percent when the investment is from a generically foreign firm, and increases again to 38.4% when the respondents are told the investment is Chinese.Footnote 33 The only difference between these groups, and thus the only plausible driver of these distinctions, is the presence of the modifier “Chinese” or “foreign.”

Figure 2. Distribution of Trade Adjustment Assistance (TAA) Claims per capita for our sample.

Beyond the dramatic size of the treatment effect, it is notable that Americans' dissatisfaction with foreign investment is visible even in the context of asking whether or not it is beneficial to the United States. Americans do not merely dislike the idea of Chinese investment, they actually believe it is bad for the United States.

4.3. Globalization-related job loss and aversion to FDI

To see if and how that skepticism varies by trade exposure, we use regression analyses. For ease of exposition, we dichotomize our dependent variable into a measure of “aversion to investment,” reducing our three-category variable into a dichotomous variable coded 1 if the respondent says the investment is bad for the United States and 0 otherwise.Footnote 34 Rather than asking “how do people feel about investment?” we are now asking “who thinks investment is bad for the United States?”

We answer that question using the logit model described above, where the key independent variables are the treatment group designation (Chinese or foreign, with the residual category being the “no information” group), the log of TAA claims, and the interaction between the two. We control for local unemployment per capita, whether the respondent identifies as a man, as white, as a Republican, whether they have ever worked in manufacturing, and whether they have a college degree.

The results of these models, one with controls and one without, are displayed in Table 1. The models yield similar findings. Respondents' attitudes towards generic investment are negatively and statistically significantly associated with TAA claims. Because generic investment is the residual category in these regressions, this is captured in our regression by the coefficient on TAA claims. That suggests that trade-related job losses increase the appetite for business investment, at least when that investment is uncomplicated by foreignness. Note that this finding obtains even after controlling for the number of unemployed in the county, suggesting that trade-related job losses in particular spark an enthusiasm for business investment. It holds when controlling for education, suggesting that our measure of local job loss is not simply a proxy for pockets of unskilled labor. More importantly, the coefficients on the foreign and Chinese treatments are both positive and statistically significant. That indicates that the “foreignness” or “Chineseness” of business investment increases the probability that respondents express aversion to it. The Chinese treatment effect is about a third larger than the foreign treatment effect, which corroborates the distinctions evident in Figure 3.

Table 1. Results of logit models

Standard errors are clustered by county (online Appendix B). Bolded terms are statistically significant at conventional levels. The drop in sample size in Model 2 is due to missing data. One respondent did not provide data on gender and three did not provide age. Age and TAA claims are rescaled to have mean 0 and standard deviation 1.

Note: *p < 0.1; > **p < 0.05; > ***p < 0.01

Figure 3. The proportion of respondents in each treatment group that believed the investment was good for the United States, bad for the United States, or neither.

Both of the interaction terms between TAA claims and treatment group designations are positive, indicating that survey takers' aversion to foreign investment increases with exposure to trade-related job loss, though the coefficient is only statistically significant for respondents in the Chinese treatment group and in the model without controls (p = 0.12 with controls). Foreign investment may compensate for TRD in an economic sense, but, as a matter of public sentiment, it seems in these data to compound an aversion to foreign influence. That the effect is stronger and more statistically significant when the investment is specifically identified as Chinese makes sense given the nature of the China shock and the special place that China occupies in political resistance to free-market policies. The marginal effect of each treatment (Figure 4)—its effect on the dependent variable at all levels of TAA claims, conditional on the controls—is increasing in TAA claims, suggesting that respondents become more averse to Chinese or foreign investment (relative to generic investment) as TAA claims in their county increase. This shows an enthusiasm gap for foreign and Chinese business investment that rises with TAA claims but is apparent at all levels of it. The differences in the magnitude and statistical significance between the two treatments' interactions with local TAA claims data are evident but do not fundamentally alter the story these data are telling.

Figure 4. Marginal effect (first partial derivative of the regression equation with respect to each treatment) of the foreign and Chinese treatments on aversion to FDI, both relative to the “no information” treatment. Confidence intervals use analytical standard errors.

A final noteworthy finding from Table 1 is that the negative effect of TAA claims on aversion to business investment (−0.501 in Model 1 and −0.465 in Model 2) is almost perfectly offset by the positive effect of the interaction terms (0.416 and 0.349, respectively, for the “Chinese” interaction; 0.552 and 0.485 for the “Foreign” interaction). Thus, while the enthusiasm gap between generic and foreign investment rises in TAA claims, the actual rates of enthusiasm for foreign investment stay relatively constant and nearly perfectly so in the case of China. The increasing gap described in Figure 4 is, therefore, best understood as an increasing appetite for generic business investment that is not matched for foreign investment. This is easiest to see in the predicted probabilities of believing that investment is bad at every level of TAA claims, separately for respondents in the three treatment groups (Figure 5).

Figure 5. Predicted probabilities of believing that investment is bad at every level of TAA claims. 95 percent confidence intervals formed by non-parametric bootstrap with 1000 iterations. Control variables held at their means.

The predicted probability of reporting that generic investment is bad for the United States is about 10.5 percent in the absence of local TAA claims and decreases as TAA claims increase, eventually approaching zero (0.68 percent) in counties where job losses have been greatest. The dashed line representing the foreign treatment group also slopes downward, but the differences are slightly less pronounced: the least trade-affected have a 28.9 percent probability of reporting that investment is bad, compared with 16.7 percent among the most trade-affected. Thus, the rising gap between generic and foreign investment narrows as TAA claims rise not because foreign investment gets less popular, but because it gets more popular more slowly than generic investment does. In contrast, the solid line representing the Chinese treatment group is almost perfectly flat, increasingly slightly from 38.1 percent at the low end of TAA claims to 41.1 percent at the high end, which can be attributed to statistical noise. In other words, the gap between skepticism for Chinese and generic business investment rises in TAA claims because the generic investment is increasing in popularity while Chinese investment is not increasing as much.

4.4. Nationalism and local material conditions

Finally, we consider the possibility these effects are better understood as aggregates of different effects among nationalists and non-nationalists. We test for that possibility using a similar logit model but splitting the sample into nationalists and non-nationalists (Table 2).Footnote 35

Table 2. Results of logistic regression models in nationalist and non-nationalist subsets

Standard errors clustered by county. Bolded terms are statistically significant at conventional levels.

Note: *p < 0.1, **p < 0.05, ***p < 0.01.

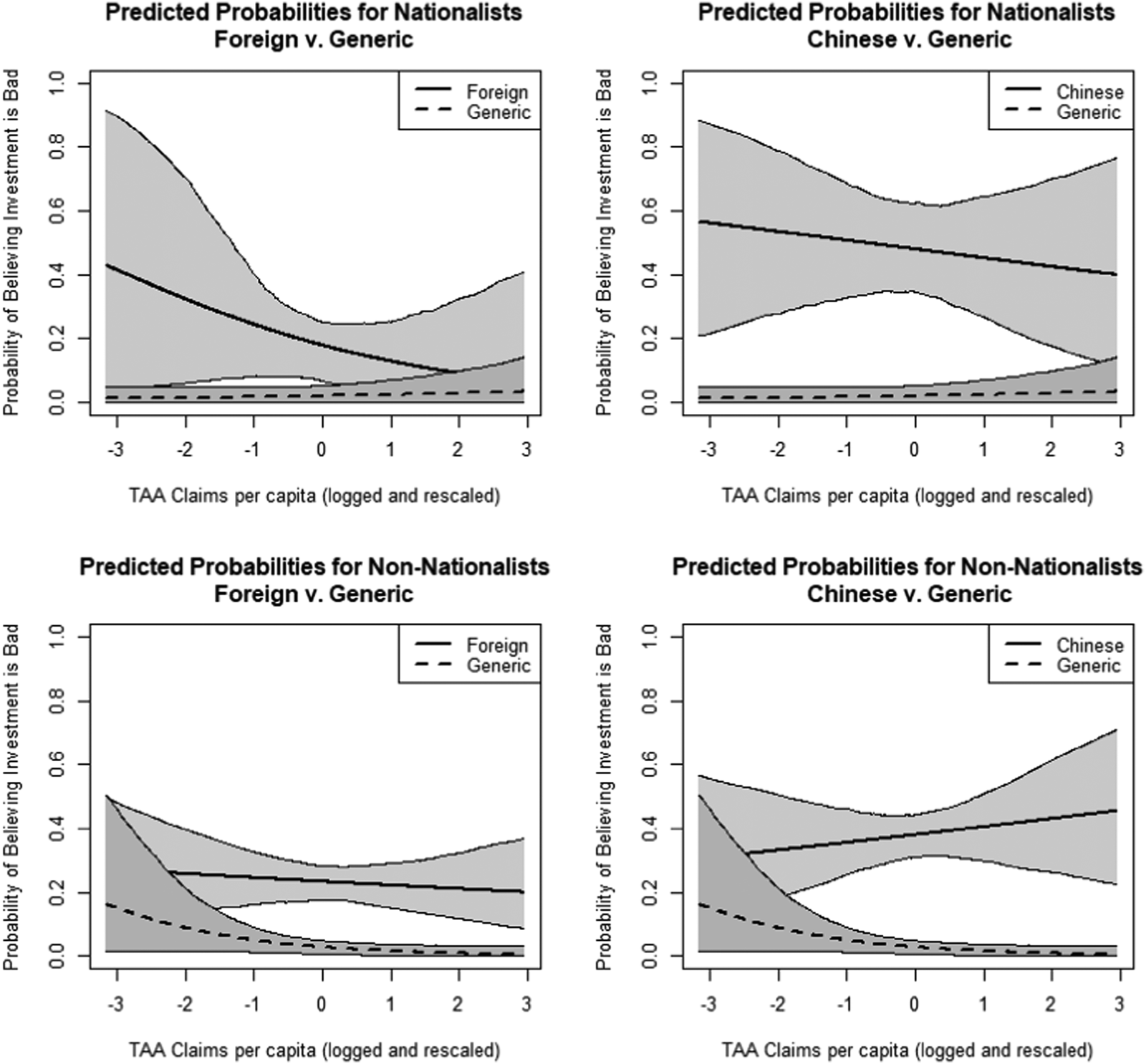

The most notable findings in Model 1 are the statistically significant coefficients on the treatment group variables, and the relatively small and insignificant coefficients on their interaction with TAA claims. This suggests that nationalists are skeptical of foreign and Chinese investment regardless of local TAA claims. Nationalists always resist foreign investment; local economic conditions are largely irrelevant. In Model 2, in contrast, we find that economic conditions do matter for non-nationalists. The coefficients on the treatment group variables are similarly large and statistically significant, but, unlike with the nationalists, their interactions with TAA claims are positive and statistically significant. In other words, nationalists display relatively constant opposition to foreign and Chinese investment relative to generic investment, while non-nationalists become increasingly skeptical of foreign and Chinese investment relative to generic investment as TAA claims mount.

Figure 6 shows the treatment effect—i.e., the extra skepticism applied to foreign or Chinese investment relative to generic investment—as a function of TAA claims, separately for nationalists and non-nationalists. In this figure, non-nationalists are no more skeptical of Chinese or foreign investment when TAA claims are lowFootnote 36, but the gap between their attitudes toward Chinese and generic investment grow as trade-related job losses rise. The more TRD is present in a county, the more skeptical non-nationalists are of Chinese investment. In contrast, the extra skepticism that nationalists have for foreign/Chinese investment stays relatively stable (or perhaps decreases very slightly) across the range of TAA claims. Nationalists are always more skeptical of foreign ownership than of generic investment and are essentially unaffected by local economic conditions. As in prior models, our control for education indicates that our measure of personal nationalism is not a proxy for education or skill level. Further, in neither set of models do we find any evidence that education shapes Americans' attitudes toward foreign business investment.

Figure 6. The marginal effect of each treatment on reporting that investment is bad for the United States as a function of TAA claims for nationalists (top row) and non-nationalists (bottom row). The histogram on the bottom illustrates the distribution of TAA claims per capita among the subgroup.

However, the treatment effects described in Figure 6 represent the skepticism gap between foreign and generic investment. As before, interpretation of that gap is complicated by shifting attitudes toward generic investment. These effects are best characterized through predicted probabilities (Figure 7).Footnote 37 Figure 7 shows that nationalists and non-nationalists both remain generally favorable toward generic business investment as the number of local TAA claims rise. The predicted probability of a nationalist being averse to generic business investment rises almost imperceptibly from the minimum of TAA claims to the maximum (1.05–3.3 percent). For non-nationalists it falls from 16.3 to 0.49 percent. Nationalists' attitudes toward Chinese and foreign investment follow a similar path. The predicted probability of a nationalist being averse to foreign business investment falls from 43.0 to 6.3 percent, moving from the least to the most trade affected counties. The predicted probability of a nationalist being averse to Chinese business investment falls from 56.6 to 39.9 percent over that same range. This supports the findings from the marginal effects plots: although their relative enthusiasm for foreign or Chinese investment over generic investment stays roughly the same or decreases very slightly, this is driven by a drop in opposition to foreign or Chinese investment and a slight increase in opposition to generic investment. In Figure 6, the marginal effect of foreign investment becomes insignificant at high levels of TAA claims because levels of support for foreign and generic investment become statistically indistinguishable.

Figure 7. Predicted probabilities of believing that investment is bad at every level of TAA claim. Shaded areas indicate 95 percent simulated confidence intervals.

Unlike nationalists, non-nationalists do not become more acceptant of foreign or Chinese investment as local economic conditions worsen. Instead, they remain roughly as opposed to foreign investment and become more opposed to Chinese investment, while becoming less averse to generic investment. Again, this helps to interpret the findings in Figure 6: non-nationalists do become slightly more skeptical of Chinese investment (and remain about the same for foreign investment), but the slope is so pronounced because the gap between that skepticism and the skepticism of generic investment is growing. Our results are consistent with offsetting effects, whereby the direct effect of TRD to increase enthusiasm for the business is offset by non-nationalists' increasing skepticism toward Chinese investment. The predicted probability of a non-nationalist reporting skepticism towards Chinese investment in the absence of local TAA claims is 30.5 percent,Footnote 38 which is similar to their attitudes toward foreign business investment (27.2 percent). However, while nationalists become slightly more accepting of Chinese investments as trade-related job losses rise, non-nationalists become more skeptical. Our model predicts a 45.5 percent probability that a non-nationalist respondent living in the most trade-affected counties will report that Chinese investment is bad for the United States. That is about 15 points higher than if they were living in the least trade-affected counties, and almost six points higher than a nationalist neighbor in their highly trade-affected county. They are, however, significantly less opposed to Chinese investment than a nationalist living in a county that has the lowest number of TAA claims (56.6 percent).

Non-nationalists' attitudes toward foreign investment decrease across the range of TAA claims, but at a slower rate than among nationalists. Non-nationalists are far less opposed to foreign investment when TAA claims are low (27.2 percent, as compared with 43.0 percent for nationalists), but are more opposed when TAA claims are high. At the sample maximum, non-nationalists are predicted to oppose foreign investment with a probability of 20.0 percent, as compared with 6.3 percent for nationalists. This means that non-nationalists are more supportive when times are good, but do not change much as they deteriorate, while, on the other hand, nationalists oppose foreign investment on principle when good economic times give them the luxury to do so, but quickly shed it as trade-related job losses mount.

5. Conclusion

Our primary goal in this paper is to marry the question of Americans' attitudes toward foreign investment to contemporary arguments about the roots of American economic nationalism. Doing so not only brings the literature on FDI into that debate but provides a theoretical vehicle for exploring the understudied non-material drivers of FDI politics. It also sheds further light on the conditions under which we might expect politicians to benefit from trying to attract investment, versus where those same attempts to credit claim might backfire.

To answer this question, we proposed two competing theories of how nationalism and deindustrialization interact to shape public opinion toward Chinese investment. To test them, we ran a survey experiment on a representative sample of US residents.

Our experiment yielded four main findings:

(1) Americans are skeptical of foreign and, especially, Chinese business investment. While virtually all respondents were enthusiastic about generic business investment, survey takers in our China treatment group were nearly as likely to say that such investment was “bad” for the United States as they were to say it was “good” (38 versus 42 percent).

(2) Proximity to trade-related job losses increases skepticism towards FDI, suggesting that American see FDI as an indistinguishable part of the broader globalization project. Dissatisfaction with one part of that project creates resistance to the broader project, even its “good” parts.

(3) Nationalism shapes Americans' reactions to TRD. Non-nationalists in counties with few trade-related job losses do not distinguish between foreign, Chinese, and generic investment, but become relatively more skeptical toward Chinese investment as local trade-related job losses rise and only slowly warm toward foreign investment. Nationalists are less enthusiastic about foreign investment relative to more generic investment when economic conditions are good, but shed their nationalist impulses and become more accepting of foreign investment when local economic conditions deteriorate. At high levels of trade-related job losses, nationalists and non-nationalists are almost indistinguishable in their views on Chinese investment, and nationalists are more favorable toward foreign investment than non-nationalists.

This research makes several contributions. First, it clarifies the drivers of American attitudes toward globalization. We find that the drivers of attitudes toward inward investment are substantially non-material. Second, our study suggests that the economic stress identified by Autor et al., homogenizes attitudes across cultural divides. Nationalism is a meaningful indicator of attitudes toward foreign investment only in the absence of local trade-related job loss. Once local job loss is significantly high, nationalists and non-nationalists have similarly negative views of Chinese investment, even if they arrived at those views differently. While our data can only speak to the specific case of FDI attitudes, this finding suggests that we should consider those drivers as interactive in the broader literature.

Second, our focus on the impacts of trade-related job loss and heightened scrutiny of Chinese investment illuminates relationships that are topical to the literature on the “China Shock,” which has been linked to rising polarization, the election of Trump, legislative voting patterns, and political communication strategies. Our findings suggest that the China shock in trade also affects attitudes toward foreign investment. This is notable because Chinese investment in the United States has grown dramatically, and often with accompanying fanfare and credit-taking by American politicians who have used it to demonstrate their ability to “win” a globalization game that many American manufacturing centers appear to be losing. Our findings of the effects of exposure to trade-related job losses on attitudes toward the benefits of inwards investment suggest that those efforts may start at a disadvantage. On average, Americans who “lose” on one dimension of globalization do not want to “win” on another. They prefer to quit the globalization game entirely.

Author ORCIDs

Jane L. Sumner, 0000-0001-6616-2238.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/psrm.2019.30.

Acknowledgements

For their feedback on this paper, the authors would like to thank panel participants at APSA 2017 and 2018, and participants at the Minnesota International Relations Colloquium (MIRC).