INTRODUCTION

Cognitive psychology has established that individual knowledge structures can be presented graphically (Ferreira, Jalali, & Ferreira, Reference Ferreira, Jalali and Ferreira2016). Strategic schemas (also called dominant logics, belief structures, cognitive maps, and strategy frames) are the ‘mental template that individuals impose on an information environment to give it form and meaning’ (Walsh, Reference Walsh1995: 281), allowing firms and strategists to reduce their extremely complex real-world problems to more manageable ‘small world’ problems (Levinthal, Reference Levinthal2011). These are lenses through which strategic decision makers interpret information and translate it into organizational action (Menon, Reference Menon2018). Scholars in strategic management have discussed the close association between managerial cognition and strategy formulation and implementation (Barr, Stimpert, & Huff, Reference Barr, Stimpert and Huff1992; Nadkarni & Barr, Reference Nadkarni and Barr2008), particularly for small, entrepreneurial firms whose founders retain control and whose top management teams (TMTs) are relatively small, with high levels of discretion (Powell, Lovallo, & Fox, Reference Powell, Lovallo and Fox2011).

Strategic schemas are composed of cognitive content and cognitive structures (Narayanan, Zane, & Kemmerer, Reference Narayanan, Zane and Kemmerer2011; Walsh, Reference Walsh1995; Wilms, Winnen, & Lanwehr, Reference Wilms, Winnen and Lanwehr2019). The structural attributes reflect the way environmental, strategic, and organizational constructs (Nadkarni & Narayanan, Reference Nadkarni and Narayanan2007) embedded in strategic schemas are organized, linked, or assessed (Finkelstein & Hambrick, Reference Finkelstein and Hambrick1990), whereas content-based orientations refer to which aspect or domain top managers’ subjective representations of their external environment are dominated (Nadkarni & Barr, Reference Nadkarni and Barr2008). Strategic schemas influence firm performance (FP) by promoting effective strategic actions (Weick, Reference Weick1995). However, only a few quantitative papers discuss the direct effects but have not arrived at a consensus. And empirical studies examining the influence of managerial cognition on FP show how different types of strategic schemas could positively influence organizational performance (Al-Ansaari, Bederr, & Chen, Reference Al-Ansaari, Bederr and Chen2015; Gröschl, Gabaldón, & Hahn, Reference Gröschl, Gabaldón and Hahn2019; Lau, Reference Lau2011; Nadkarni & Narayanan, Reference Nadkarni and Narayanan2005). Additionally, although the content and structure of strategic schemas are theoretically interwoven (Hahn, Preuss, Pinkse, & Figge, Reference Hahn, Preuss, Pinkse and Figge2014; Walsh, Reference Walsh1995), few papers have considered them simultaneously. In response to the call from Cheng and Chang (Reference Cheng and Chang2009), this exploratory study aims to contribute to the understanding of how firms realize high performance with various strategic schemas by integrating the structural attributes and content-based orientation of managerial cognition, to enrich understanding of cognitive characteristics and its performance implications.

In a bid to move manufacturing up the value chain, the central government of China released the ten-year action plan, ‘Made in China 2025’, on May 19, 2015, designed to transform China from a manufacturing giant that relies on low-cost labor into a world manufacturing power. It articulated a goal of ‘develop[ing] a number of specialized medium-size enterprises that are prominent in niche markets’, modeled after, as a large number of world leaders in very specific markets called, ‘hidden champions’ (Simon, Reference Simon1996), which constitute the backbone of the German economy. Simon (Reference Simon1996) highlighted that ‘narrow market focus’ is one of the nine qualitative lessons of hidden champions,[Footnote 1] guided by strategic schemas of being a ‘single-minded specialist’ (Simon, Reference Simon1996: 4). However, given perpetually fluctuating information in the modern world, especially under the context of transitional economies, incremental and discontinuous changes in markets and technology require a cognitive structure with deep and rich connections (Shepherd, McMullen, & Ocasio, Reference Shepherd, McMullen and Ocasio2017) in order to sense and act on continuous environmental changes. Therefore, strategic schema profiles for high FP may have multiple explanations. Using fuzzy-set qualitative comparative analysis (fsQCA), this research identifies the configurations of strategic schemas that lead to high FP, involving a sample of 25 manufacturers in China identified by the Zhejiang Province government as ‘hidden champions’ or ‘near-champions’.

The remainder of this article is organized as follows. The theoretical background develops the theoretical base on dimensions of strategic schemas and their correlation to FP. Methods describes the research method, sampling rules, data collection process, and analysis. Results presents the empirical results, followed by the discussion which generates configurations of strategic schemas for high FP and offer conclusions and contributions to the existed literatures.

THEORETICAL BACKGROUND

Although cognitive science initially seems to be far removed from strategy (Stubbart, Reference Stubbart1989), since the 1980s a number of scholars have pioneered a cognitive perspective on strategy as a complement to rational analytical models, for exploring the links between cognition and strategic diagnosis (Dutton, Fahey, & Narayanan, Reference Dutton, Fahey and Narayanan1983) and strategic decision-making (Hambrick & Mason, Reference Hambrick and Mason1984). The literature on managerial cognition argues that ‘bounded rationality’ constrains top managers from developing an optimal understanding of the environment in which their firms operate (Bogner & Barr, Reference Bogner and Barr2000; Daft & Weick, Reference Daft and Weick1984). Instead, top managers are assumed to develop subjective representations of the environment that drive their strategic decisions and subsequent firm actions (Nadkarni & Barr, Reference Nadkarni and Barr2008). Strategy formulation is described as a complex process consisting of scanning, interpreting, and responding (Daft & Weick, Reference Daft and Weick1984; Narayanan et al., Reference Narayanan, Zane and Kemmerer2011). Given the call proposed by Wilms et al. (Reference Wilms, Winnen and Lanwehr2019), further research should investigate how strategic schemas and cognitive processes differently or interactively (Lei, Wu, & Tan, Reference Lei, Wu and Tan2020) affect strategy formulation and implementation. The process begins by scanning, from which the structural attributes referring to how the strategic schemas are organized determine how much information could be gathered from both external (Kiesler & Sproull, Reference Kiesler and Sproull1982; Shepherd et al., Reference Shepherd, McMullen and Ocasio2017) and internal environment (Cowan, Reference Cowan1986). Interpretation refers to the ways of comprehending the meaning of incoming information, thus cognitive content ‘consists of the things [an agent] knows, assumes and believes’ (Finkelstein & Hambrick, Reference Finkelstein and Hambrick1990: 57), and determines which domains the information could be internalized into the organization. Therefore, further theoretical explanations of managerial cognition are needed.

Structural Attributes of Strategic Schemas

Several structural attributes of strategic schemas are identified in the literature at the individual, group, and firm levels. Research on whether strategic schemas are simple or complex, centralized or decentralized, focuses on the structural attributes of complexity (Calori, Johnson, & Sarnin, Reference Calori, Johnson and Sarnin1994) and centrality (Eden, Ackermann, & Cropper, Reference Eden, Ackermann and Cropper1992) as their key characteristics. The growth of hidden champions, even during the economic crisis, inspired the assumption that ‘the single-minded specialist usually beats the generalist’ (Simon, Reference Simon1996). From the view of cognitive structure, thinking like a specialist is supported by a centralized strategic schema that compels strategic decision makers to direct their attention toward a narrow set of core strategy concepts (Eden et al., Reference Eden, Ackermann and Cropper1992); conversely, thinking like a generalist brings more external information to firms through a complex strategic schema (Shepherd et al., Reference Shepherd, McMullen and Ocasio2017).

Centrality refers to the extent to which strategic schemas are centralized around a few core constructs (Eden et al., Reference Eden, Ackermann and Cropper1992; Nadkarni & Narayanan, Reference Nadkarni and Narayanan2005). As with network centrality, which captures the degree to which a small number of firms or individuals serve as the nexus of relationships between other members of the network, the centrality of strategic schemas reflects the degree to which constructs in the cognitive structure are causally connected, directly or indirectly, to a few focal concepts (Nadkarni & Narayanan, Reference Nadkarni and Narayanan2005). In strategic schemas with a high level of centrality, managers tend to pay attention to core constructs and clearly distinguish between core and peripheral groups of constructs (Eden et al., Reference Eden, Ackermann and Cropper1992). And the level of centrality promotes path-dependent sense making in which decision makers attempt to fit new stimuli into their existing mindset (Kiesler & Sproull, Reference Kiesler and Sproull1982).

Complexity captures the differentiation and integration of information embedded in strategic schemas (Calori et al., Reference Calori, Johnson and Sarnin1994; Nadkarni & Narayanan, Reference Nadkarni and Narayanan2005). Differentiation refers to the breadth and variety of constructs embedded in a strategic schema, whereas integration emphasizes the degree of connectedness among these constructs (Walsh, Reference Walsh1995). Managers with more complex cognitive structures may use more dimensions to understand and differentiate competitors’ behaviors. Thus, greater complexity provides more stimuli and information for managers to perceive environmental change (Shepherd et al., Reference Shepherd, McMullen and Ocasio2017), thereby increasing a firm's ability to adapt to the environment.

Content Orientations of Strategic Schemas

Schema theory also suggests that individuals act on schemas or cognitive models that represent their general knowledge about a given construct or stimulus domain (Fiske & Taylor, Reference Fiske and Taylor1991). Distinct typologies and constructs for strategic orientations have developed across different literature streams. In line with the cognitive stream, we adopted the construct ‘strategic orientation’ to describe the direction of a cognitive structure concerning a specific information domain (Voss & Voss, Reference Voss and Voss2000).

Strategic orientations include technology orientation (Gatignon & Xuereb, Reference Gatignon and Xuereb1997), market orientation (Tyler & Gnyawali, Reference Tyler and Gnyawali2002), competitor orientation (Armstrong & Collopy, Reference Armstrong and Collopy1996), and alliance orientation (Kandemir, Yaprak, & Cavusgil, Reference Kandemir, Yaprak and Cavusgil2006). Considering Simon's (Reference Simon1996) work on the lessons of hidden champions, their ‘continuous innovation’ and ‘closeness to customer[s]’ reflect their concerns in technology and market domains. Thus, we mainly discuss technology orientation and market orientation in this study, both of which are regarded as valuable resource for enhancing performance (Al-Ansaari et al., Reference Al-Ansaari, Bederr and Chen2015; Chen, Tang, Jin, Xie, & Li, Reference Chen, Tang, Jin, Xie and Li2014).

Technology orientation describes a firm's attitude toward engaging in technological research and development (R&D), analyzing the technology potential, and forecasting technology trends (Gatignon & Xuereb, Reference Gatignon and Xuereb1997). Market orientation is underpinned by the ‘consumer pull’ philosophy, which places the highest priority on the profitable creation and maintenance of superior customer value (Kirca, Jayachandran, & Bearden, Reference Kirca, Jayachandran and Bearden2005; Narver & Slater, Reference Narver and Slater1990). Typically, scholars examine technology orientation and market orientation separately (Hakala, Reference Hakala2011). But McTavish (Reference McTavish1967), who proposed a complementary view of technology orientation and market orientation, contended that market orientation must be considered from long- and short-term perspectives; specifically, the key short-term objective is to satisfy consumer demand through proper product quality, product design, and pricing, whereas firms should consider whether strategic actions and continuous demand are compatible in the long term. This approach inspired the notion that the market orientation requires support from the technology orientation.

Strategic Schemas and FP

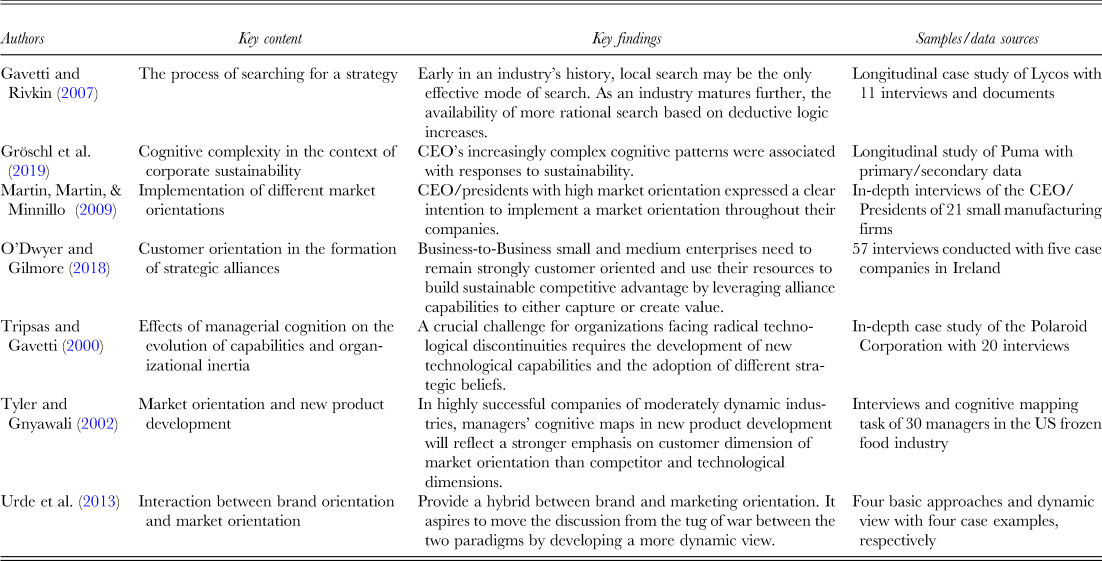

Strategic schemas influence FP by promoting effective strategic actions (Weick, Reference Weick1995); however, little empirical research examines direct links between strategic schemas and FP, especially regarding the structural attributes of managerial cognitive structures (McNamara, Luce, & Tompson, Reference McNamara, Luce and Tompson2002). Tables 1 and 2 summarize related empirical quantitative and qualitative studies. The tables show the variety of scholarly perspectives regarding the role that structural attributes of strategic schemas play in FP. One explanation for the relationship between the complexity of cognitive structures and performance is that managers with more complex strategic schemas have more pre-existing dimensions about their environment through which to assess competitors’ behavior, which helps managers deal with ambiguous and inconsistent information (Schneier, Reference Schneier1979). This explanation is further supported by empirical evidence from Chen and Liang (Reference Chen and Liang2016) and Cheng and Chang (Reference Cheng and Chang2009). However, the role of complexity is not always positive. For example, McNamara et al. (Reference McNamara, Luce and Tompson2002) examined three measures of complexity (number of strategies, number of competitors, and the size of groups identified by top managers) of top managers’ knowledge structures and performance with a sample of 76 TMTs from banks in three US cities. Using hierarchical regression, in linear and curvilinear analyses, the results indicate a positive relationship between the last two complexity variables and a negative relationship between the first ones. In the work of Gary and Wood (Reference Gary and Wood2011), the relationship between the complexity of mental models as a control variable and FP is not significant. Therefore, current empirical research on the relationship between complexity and performance has not reached a consensus. Additionally, studies on the association between centrality and FP are limited, and some scholars consider complexity and centrality as opposite ends of a continuum on the same facet (Eden et al., Reference Eden, Ackermann and Cropper1992).

Table 1. Summary of key quantitative studies on strategic schema

Notes: †Knowledge complexity as a mediator; ‡Complexity as a control variable; §Analysis at the levels of TMT and CEO, and three different measures of performance are conducted; ||Conducted via two-way and three-way interactions of different orientations; ¶0.66 is the value of coverage in fsQCA; ††Based on different measures

Table 2. Summary of key qualitative studies on strategic schema

In terms of the relationship between content-based orientations and FP, we find that most relevant studies focus on the relationship between market orientation and performance. Studies predict a positive correlation between market orientation and performance (Al-Ansaari et al., Reference Al-Ansaari, Bederr and Chen2015; Frambach et al., Reference Frambach, Fiss and Ingenbleek2016; Voss & Voss, Reference Voss and Voss2000; Zhou et al., Reference Zhou, Gao, Yang and Zhou2005) on the assumption that market orientation provides firms with a better understanding of their environment and customers, ultimately leading to enhanced customer satisfaction. Kirca et al. (Reference Kirca, Jayachandran and Bearden2005) conducted a meta-analysis that aggregates empirical findings in the market orientation literature. They find that the relationship between market orientation and performance is stronger in samples of manufacturing firms, in low-power-distance and uncertainty-avoidance cultures. Yet the positive effects could become negative during an economic crisis (Grewal & Tansuhaj, Reference Grewal and Tansuhaj2001), because a highly attuned market orientation causes firms to become locked into a standard mode of cognition and response, thereby creating inertia, instead of the creative thinking needed to manage crises.

The majority of prior literature focuses on a particular strategic orientation and its effect on FP, and research analyzing more than one strategic orientation is comparatively limited (Hakala, Reference Hakala2011). Adams et al. (Reference Adams, Freitas and Fontana2019) and Deutscher et al. (Reference Deutscher, Zapkau, Schwens, Baum and Kabst2016) introduce the notion of combined orientations. Based on a sample of 1,603 French manufacturing firms, Adams et al. (Reference Adams, Freitas and Fontana2019) show that organizations with combined customer/technology-orientations outperform those with a customer or technology orientation alone. However, given resource limitation when adopting multiple orientations simultaneously, they call for further research to explore the trade-offs between different combinations of various orientations.

This overview of the literature leads us to conclude that only a few empirical studies assess the influence of managerial cognition on FP (Menon, Reference Menon2018) and the extant literature has not arrived at a consensus. Moreover, only a few quantitative papers report and discuss the effect size in their research (Adams et al., Reference Adams, Freitas and Fontana2019; Deutscher et al., Reference Deutscher, Zapkau, Schwens, Baum and Kabst2016; McNamara et al., Reference McNamara, Luce and Tompson2002), and the variance in R 2 explained by the structural attributes and content of strategic schemas was relatively small. We are responding to the call by Cheng and Chang ( Reference Cheng and Chang2009) for further empirical research to enrich understanding of cognitive characteristics and its performance implications. Although cognitive structure consists of different combinations of underlying constructs – that is, structural attributes and content (Hahn et al., Reference Hahn, Preuss, Pinkse and Figge2014) – few studies integrate them into one research design in a systematic analysis. Based on a content analysis of articles on entrepreneurship cognition published between 1976 and 2008, Grégoire, Corbett, and McMullen (Reference Grégoire, Corbett and McMullen2011) also encouraged future research to consider simultaneously the roles and interactions of different variables of cognitive interest. Therefore, this study incorporates structural attributes and content-based orientations into our analysis of FP, exploring which configurations of strategic schemas lead to high-level performance.

METHODS

fsQCA Method

Our literature review reveals that, from the managerial cognition perspective, variance in strategic schemas could lead to similar or equifinal outcomes in FP. To address multiple or competing explanations, we examine whether FP is the collective result of content orientations and structural attributes of strategic schemas. QCA offers an innovative approach, widely adopted to attain understanding on how different combinations of causal factors can have equivalent results (Fiss, Reference Fiss2011; Ragin, Reference Ragin, Benoit and Ragin2008; Woodside, Reference Woodside2013). For example, Judge, Fainshmidt, and Brown (Reference Judge, Fainshmidt and Brown2014) examine how national institutional dimensions, in concert and in equifinality, relate to equitable wealth creation through a fuzzy-set study of 48 developed and developing economies. Based on a survey of high-tech firms in China, Xie, Fang, and Zeng (Reference Xie, Fang and Zeng2016) use fsQCA to explore whether network size, network tie strength, and network centrality determine the level of knowledge transfer. Through a fsQCA-based study of 50 nascent entrepreneurs, Stroe, Parida, and Wincent (Reference Stroe, Parida and Wincent2018) explore the effect of passion, entrepreneurial self-efficacy, and risk perception on cause-and-effect decision-making. Based on the types of variables in this study, we also adopted fsQCA to avoid the limitation of using only dichotomous variables while maintaining the advantages of simplified configurations (Greckhamer, Furnari, Fiss, & Aguilera, Reference Greckhamer, Furnari, Fiss and Aguilera2018).

Sampling

The context for this study is the national initiative to exploit the availability of a seemingly unlimited supply of low-cost labor to build a huge export manufacturing engine as a means of boosting living standards by doubling the country's GDP per capita over the last decade. China overtook the United States in 2011 in gross production to become the world's largest producer of manufactured goods. In 2016, the China Ministry of Industry and Information Technology initiated a program to achieve the goal of promoting high-performing, high value-adding enterprises in manufacturing, as part of reinforcing the country's position as a global manufacturing power. Guided by the central government, several provinces in China organized large-scale experiments to select and cultivate champion firms in manufacturing within provinces. The provincial government of Zhejiang is the pioneer who has conducted an annual review of firms within the province to identify hidden champions beginning in 2016, providing a rich population sample and data accessibility for research on champion firms in Zhejiang province. The details of the Zhejiang province for identifying hidden champions are in presented in Appendix I. According to the application requirements from Zhejiang Provincial Government for selecting ‘hidden champions’, the industry of applicant firms should be included as the heavily promoted manufacturing in ‘Made in China 2025’, and their sales should be less than 2 billion yuan for identifying the ‘midsized giants’ (Simon, Reference Simon1992). Then based on Nadkarni and Barr (Reference Nadkarni and Barr2008), firms that are at least 10 years old are adequately mature and have well-developed cognition (Barr, Reference Barr1998), so we also considered the firm age of at least 10 years old in the sample selection. We sent invitations for interviews with founders, presidents, or CEOs of 43 firms that were identified as champions through this process. The response rate was 39.53%. To enhance sample variation, we also included firms identified as near-champions as part of the Zhejiang hidden champion process. The final dataset consisted of 25 firms in manufacturing sectors of general equipment, specialized equipment, and rubber and plastic, of which 17 were identified as hidden champions and 8 as near-champions. Given the four causal conditions in this study, namely ‘centrality’, ‘complexity’, ‘technology orientation’, and ‘market orientation’, the sample size exceeds the number of potential configurations for causal conditions, effectively avoiding the problem of limited diversification (Rihoux & Ragin, Reference Rihoux and Ragin2009).

Data Collection

Data were derived from several sources. First, we conducted in-depth interviews with the founders, presidents, or CEOs of each firm in 2016–2018. The interviews included an opening statement from one of the interviewers and a set of open-ended questions. Depending on the interviewee's response, each interview developed its own characteristics. Two researchers attended each interview for observer triangulation (Stake, Reference Stake1995) and to monitor one another's interaction with the interviewee. Finally, we conducted 41 semi-structured interviews, and some sample firms were visited more than once to obtain supplementary information or because not all interviewees were available during the initial round of interviews. The interviews totaled 2,517 min (41.95 h) of recordings, and the transcriptions totaled 579,603 words.

Second, we got access to the application forms for hidden champions in Zhejiang Province that were submitted by each firm to the Zhejiang Provincial Government, including its basic information, honors, patents, R&D investment, and financial data from the previous three years, which enabled us to develop an initial understanding prior to the interviews. They also provided objective information that informed supplemental material for interview data.

Third, we gathered secondary data from company websites, news, and journal articles, which enabled triangulation of data sources, increasing the validity of the study (Guion, Diehl, & McDonald, Reference Guion, Diehl and McDonald2011).

Calibration and Variables

Following the calibration procedure, the antecedents included a series of characteristics of the strategic schemas (SS): ‘centrality’ (SS-CE), ‘complexity’ (SS-CP), ‘technology orientation’ (CO-TO), and ‘market orientation’ (CO-MO). To emphasize a sustainable competitive advantage, we evaluated FP from static and dynamic perspectives: operating capacity and growth capacity. Firm development occurs in two main ways: (1) developing and commercializing new products or services and (2) entering new markets (Naldi & Davidsson, Reference Naldi and Davidsson2014). Hence, we applied content analysis to capture FP in terms of new product development, entering new markets, and prospects for future growth by considering the endogenous issue between managerial cognition and FP (Chakravarthy, Reference Chakravarthy1982; Nadkarni & Narayanan, Reference Nadkarni and Narayanan2007; Weick, Reference Weick1995). Taking the longitudinal view, especially the development of sample firms in the year 2019 was also considered in the measurement of FP for excluding the situation of reverse explanation on the managerial cognition in 2016–2018.

According to Eden et al. (Reference Eden, Ackermann and Cropper1992) and Nadkarni and Narayanan (Reference Nadkarni and Narayanan2007), centrality is measured by the degree to which knowledge or information about the environment revolves around one or more core constructs or is organized hierarchically. As indicated by Ozgen and Baron (Reference Ozgen and Baron2007) and Fernandez-Perez et al. (Reference Fernandez-Perez, Garcia-Morales and Cabeza Pulles2016), complexity is measured with two items: a broad range of industry-related knowledge and information and high connectedness among industry-related concepts. To evaluate strategic orientation, we followed Gatignon and Xuereb (Reference Gatignon and Xuereb1997) and Chen et al. (Reference Chen, Tang, Jin, Xie and Li2014), in using four items to measure technology orientation:

• the use of sophisticated technologies in new product development,

• new products that include state-of-the-art technology,

• active solicitation and development of technologically advanced new products, and

• technical innovation, based on research results, is readily accepted at the firm.

The measure of market orientation comprises six items:

• business objectives that are driven primarily by customer satisfaction,

• constantly monitoring by the firm to ensure its level of commitment and orientation serve customer needs,

• rapid response to competitive actions that threaten the firm,

• firm targets customers that offer opportunities for competitive advantages,

• firm communication about positive and negative customer experiences across all business functions, and

• business functions that are all focused on serving the needs of the firm's target markets.

The aim of fsQCA is to calibrate set membership such that levels of membership represent meaningful groupings (Ragin, Reference Ragin, Benoit and Ragin2008). Levels can be 0, 0.33, 0.67, or 1, where 0 represents non-membership, 1 represents full membership, and 0.33 and 0.67 each represent intermediate membership levels: a value of 0.33 implies that a case is more outside, rather than within the set, and a value of 0.67 implies that the case is more within, rather than outside the set. Levels can be based on theoretical evidence or in-depth knowledge of cases (Rihoux & Ragin, Reference Rihoux and Ragin2009). In this study, we used measures reported in the literature to set the criteria for different levels.

The scoring criteria here were explained by taking technology orientation as an example. The scoring criteria were set based on the four items of technology orientation, and membership for the set of firms who show a high degree in all the four items was evaluated as fully in for a value of ‘1’. For example, firm SXG, a pharmaceutical manufacturer, attached great importance to developing technologically advanced new products. In order to develop a new product, firm SXG has conducted more than 1,000 experiments in one year, and it was the first firm to adopt the advanced extraction-separation technologies for new product development in its industry. Similarly, firms who show a relatively low degree of four items were classified as more out than in this set (0.33). For example, technological innovation based on basic research was relatively difficult to be accepted in firm XZB, an engine valve producer. It was mainly engaged in process innovation and OEM was the dominant model. Compared with foreign products, there were still significant distances in technological know-how and quality control of equipment. Although it had a basic research laboratory, technologies were difficult to be applied in new product development.

Two coders of the research team evaluated each construct for all the samples independently, the inter-rater reliability here is 0.936 following the Holsti method, which represents good agreement between the two coders. Table 3 displays the fuzzy-set membership distribution as well as descriptive statistics of sample firms.

Table 3. Fuzzy-set membership distribution and measure descriptive statistics

Data Analysis

After collecting data and confirming the scoring criteria, data processing and analysis entailed the following steps:

1. We inserted all related contents of each sample firm into an Excel spreadsheet.

2. A two-person coding team conducted preliminary verification and summarization.

3. Coding team members extracted core content for each construct from the original document independently.

4. Coders crosschecked extracted content.

5. Data were compared with scoring criteria to confirm specific scores for fuzzy-set assessment.

6. Data were analyzed using fsQCA 2.5 software to obtain results.

RESULTS

The first step of fsQCA was taken to examine whether causal conditions in this study were required for the identified outcome (Stroe et al., Reference Stroe, Parida and Wincent2018). Our research indicated that no causal condition is necessary when the consistency score fails to exceed the threshold of 0.9 (Ragin, Reference Ragin, Benoit and Ragin2008; Schneider, Schulze-Bentrop, & Paunescu, Reference Schneider, Schulze-Bentrop and Paunescu2010). Table 4 presents the results of the necessary analysis. It shows that each causal condition explained only part of the variation in outcome, and thus none were omitted as causal conditions. Next, we constructed a truth table for the Quine-McCluskey algorithm.

Table 4. Analysis of necessary conditions

Notes: FP = firm performance; SO-TO = technology orientation; SO-MO = market orientation; SS-CE = centrality; SS-CP = complexity

We then identified configurations of causal conditions deemed causally sufficient for the outcomes. We assessed causal sufficiency using a frequency threshold of 1 and a consistency threshold of 0.75 (Stroe et al., Reference Stroe, Parida and Wincent2018). Table 5 displays three configurations we identified with a strategic orientation and cognitive structural attributes that can lead to high FP. Coverage, ranging from 0 to 1, captures the extent to which the solutions explain all cases of the outcome, with a higher coverage score reflecting a better empirical explanation of the results (Ragin, Reference Ragin, Benoit and Ragin2008). The solution coverage indicates that the set of sufficient antecedent combinations explained 84.48% of the results of the model at a consistency level of 0.8953.

Table 5. Configurations of strategic orientation and cognitive structural attributes for high FP

Notes: ● = core causal condition present; • = peripheral causal condition present; ○ = peripheral causal condition absent

In these configurations, * denotes the logical operator AND, and ~ reflects the absence of the condition. Configuration 1 (SO-TO*~SO-MO*SS-CE) means that a firm whose decision-making uses technology-oriented strategic schemas, especially when market information garners little attention, could achieve high-level performance in a centralized managerial cognition structure. Configuration 2 (SO-TO*SO-MO*SS-CP) means that a firm whose decision-making is greatly concerned with technology and the market could attain high-level performance in a complex managerial cognition structure. Configuration 3 (SO-MO*SS-CE*SS-CP) reveals a cognitive structure that is complex but centralized to some extent, whose market orientation could promote FP. The core causal conditions in this study are technology orientation and the centrality of strategic schemas with a parsimonious solution.

Consistent with the findings of Simon (Reference Simon1992, Reference Simon1996), hidden champions in the Zhejiang sample pay close attention to technology and market. The key point to recognize here is that we must consider both the content and structure of strategic schemas, which is consistent with Hayes-Roth's (Reference Hayes-Roth1977) theory of knowledge assembly, depicting a schema as both the components and the linkages among those components. Additionally, the four causal conditions, complexity, centrality, technology, and market orientations, are identified to be related to promoting firm growth, within multiple configurations of strategic schemas. In this section, we discuss the three configurations (Figure 1) in terms of the extent to which they are technology-oriented or market-oriented.

Figure 1. Strategic schema profiles for high FP

We explore the mechanisms by looking into the interaction between the content and structure of strategic schemas in the process of organizational adaptation, as a deeper understanding of this class of mechanisms can also serve as a powerful source of competitive advantage (Menon, Reference Menon2018) calling for further research. Researchers have developed a number of models to describe the process of how managers or organizations deal with potentially significant information (Dutton & Duncan, Reference Dutton and Duncan1987; Kiesler & Sproull, Reference Kiesler and Sproull1982). Daft and Weick (Reference Daft and Weick1984) proposed that organizational adaptation entails three key processes-scanning, interpreting, and responding, which are all important aspects of the more general notion of sense making.

Configuration 1: Centralized Technology Orientation

Configuration 1 shows how a firm with a technology orientation can attain high FP when the causal condition of market orientation is absent. In the stage of scanning, managers in a highly centralized strategic schema tend to focus on a narrow set of core strategy constructs and have a more thorough understanding of them through interpretation, which mainly promotes a narrow set of tried-and-true strategic actions (Nadkarni & Narayanan, Reference Nadkarni and Narayanan2007). In this case, centrality may support a technology-oriented cognitive structure by encouraging detailed research regarding specific technological fields (Zhou & Li, Reference Zhou and Li2010). Here the market orientation as the causal condition is absent, and firms can conduct R&D activities on the essence of technology and products. Then customer value is created through new solutions based on technological advancements rather than on customer inputs. Gatignon and Xuereb (Reference Gatignon and Xuereb1997) and Voss and Voss (Reference Voss and Voss2000) found that the greater a firm's technology orientation, the more innovative the firm is; thus, the organization can gain a competitive advantage by launching a series of technologically advanced products. With accumulated experience exploitation, active R&D promotes the application of technology to product design, manufacturing, and general operations to advance the firm's overall development (Gatignon & Xuereb, Reference Gatignon and Xuereb1997; Lin & Li, Reference Lin and Li2017; Voss & Voss, Reference Voss and Voss2000) for realizing high firm performance.

Among our samples, the strategic schema of Firm XZB, an engine valve system producer, revolved around the construct of ‘core technology’. Their interpretation process of external information also shows significant emphasizing on this construct, ‘when we consider our future product development, the key issue is whether the product could be developed based on our core technology. If one potential product could not rely on current core technology, or our core technology in the future, it would be excluded in our list of new product list’. Given their market leadership, products are mainly developed with the technology developing. By primarily searching for familiar information, the centralized strategic schemas support firm XZB transfer familiar information into efficient implementation in ‘conducting some R&D activities for technology exploration only for the core principles of products rather than for any consumer’. Then the knowledge will accumulate in their database, which could be extracted and exploited when we conduct new product development in the future. Particularly for hidden champions, most of whom are from industries with a long-life cycle, iterations of different technological paradigms do not emerge in the short-term; hence, technological accumulation or reserves can help firms gain a competitive advantage via the interaction of a technology orientation and centrality in strategic schema.

Configuration 2: Complementary of Centrality and Complexity

Scholars hold different views on the relationship between the complexity and centrality of strategic schemas. Pioneering authors such as Eden et al. (Reference Eden, Ackermann and Cropper1992) argued that causal maps generally have either a flat shape with a range of choices or a thin, tall shape that encompasses detailed arguments without considering alternative definitions. From this perspective, centrality and complexity are opposite poles of a continuous variable, in which an increase in complexity leads to a reduction in centrality. However, social network theory frames complexity and centrality as distinct facets of cognitive structure (Carley & Palmquist, Reference Carley and Palmquist1992). Nadkarni and Narayanan (Reference Nadkarni and Narayanan2007) provided empirical evidence to support this assertion, calling for further exploration of the distinctiveness of each facet in various contexts. Given the limited nature of cognitive capacity (Eden et al., Reference Eden, Ackermann and Cropper1992), complexity and centrality have also been regarded as a competing pair that can play complementary roles in the depth and breadth of information. The complexity of strategic schema provides broader and more diverse information for organizations (Calori et al., Reference Calori, Johnson and Sarnin1994), whereas centrality elicits more specific and focused information (Kiesler & Sproull, Reference Kiesler and Sproull1982). Unlike prior papers suggesting that the two structural attributes of strategic schemas either concern the same facet (Eden et al., Reference Eden, Ackermann and Cropper1992) or are independent (Nadkarni & Narayanan, Reference Nadkarni and Narayanan2007), configuration 2 indicates that the centrality and complexity of strategic schemas can play complementary roles in promoting firm development when the market orientation is high, which suggests a way for further exploring the ambidexterity in managerial cognition.

At Firm CC, product layout and new product development of the integrated circuit equipment producer are based on market demand as part of its high market orientation, in which ‘customer demand’ is the core construct in its centralized strategic schema. Yet the core construct has also evolved along with the firm, shifting from current demand to current and future demand. The decision maker at Firm CC shared that, in the long term, ‘It is relatively easy for us to think from the customers’ point of view because we are very clear [about] what the customer really wants, which is one of our advantages’. The complexity of strategic schema in this context has helped Firm CC access and utilize new information in a timely and accurate manner. As stated by the interviewee, ‘Currently the integrated circuit market keeps changing every year, with the emergence of new market applications and new developing trends. We are constantly on the lookout for new application fields to see whether they are related to the development of our firm’.

Most hidden champions have management modes that are not as complex as those at diversified firms for their single business. Since decision makers, at most hidden champions, are also the firm founders or part of the founding team, they can better utilize their historical transactive memory (Ren & Argote, Reference Ren and Argote2011) to make decisions rapidly in the face of uncertain and shifting market environments based on prior success with activities in a familiar value chain. However, market-oriented firms nevertheless must develop a comprehensive understanding of the environment, through which they can devise strategies based on their forecasts on where the industry is heading (e.g., what the next paradigm of their industry will be); accordingly, the complementarity of strategic schemas’ complexity and centrality promotes FP.

Configuration 3: Adopting Multiple Orientations

Unlike configuration 1, configuration 3 has a cognitive structure for attaining high FP when both the market orientation and technology orientation are high. From our results, a technology orientation, especially with synergy between market orientation and complexity as a peripheral causal condition, may help firms attain high-level performance. When developing new products, technology-oriented firms must collect, transform, disseminate, and apply various forms of market information (Brown & Eisenhardt, Reference Brown and Eisenhardt1995) to enhance the market competitiveness. The stages of information processing are described below.

First, in the stage of scanning, the complexity of strategic schema helps firms establish a clear understanding of users’ demands and preferences. Additionally, market-oriented firms are encouraged to conduct market research to learn about customers and competitors, thus constructing strategic schemas with as much market information as possible (Scott-Kennel & Giroud, Reference Scott-Kennel and Giroud2015). An interviewee from Firm TR explained, ‘We visit customers' project sites to see whether there is any problem when our equipment is used with their mold and what improvements we need to make. During the visit, we also try to obtain some market information’. Complex strategic schemas and a relatively high market orientation can collectively guarantee sufficient information input for new product development.

Second, in the stage of interpretation, the complex strategic schemas provide linkages among different domains when pursuing market- and technology-orientations simultaneously. Scholars have identified a problem across firms in which market information is considered the ‘private property’ of sales departments (Clark & Fujimoto, Reference Clark and Fujimoto1991) – that is, sales departments do not share market information with other departments. An interviewee from Firm BD stated, ‘We require the technology staff and employees from the sales department to go to exhibitions together. Doing this makes it easier for them to find agreement when discussing which product has high demand or which product has strong operability’. The complexity of strategic schema requires the connectedness of constructs in different domains, thus providing channels to absorb new information more effectively. And a market orientation calls for different business departments to communicate freely about customer experience (Narver & Slater, Reference Narver and Slater1990).

Finally, the application of information in the stage of action, decision makers with complex strategic schemas are more likely to engage in a dynamic learning process, adapting to frequent changes as they seek the best position for the firm (Miller, Lant, Milliken, & Korn, Reference Miller, Lant, Milliken and Korn1996). In the context of dumping investigations in Europe and North America, as well as a dilemma caused by long-term original equipment manufacturing, firm NL combined information from leading firms’ product layouts and the developing institutional environment in China. Then, guided by managerial cognition along with the technology orientation, market orientation, and complexity in strategic schema, firm NL has made a lot of effort in dynamic learning and adaptation but focused its R&D on all-electric products to secure an industry-leading advantage.

Thus, when the technology orientation is high, firms can attain high performance through centralized strategic schemas when the causal condition of market orientation is absent (configuration 1). Firms can also promote performance development via the interaction of market orientation and complex strategic schemas (configuration 3). The first configuration accounts for the conclusion ‘Single-minded specialist usually beats generalist’ (Simon, Reference Simon1996: 4) when describing hidden champions. While configuration 3 provides the insight that a ‘generalist’ could also be a hidden champion with high FP. Specifically, the marketing management emerged as the critical complementary asset for firms with a technology orientation, which aligns conforming technology-based intelligence and the market environment.

Unique Attributes of Hidden Champions

When the causal condition of market orientation is absent, configuration 1 emphasizes the interaction between technology orientation and centrality. Our results from an analysis of cases with the membership greater than 0.5 in configuration 1 indicate that, compared with near-champions, hidden champions demonstrated significant performance differences across the same level of technology orientation. Table 6 reveals that all hidden champions in our sample attained relatively high FP based on their long-term accumulation of technological advantage. The founder of firm KT also founded the optical thin-film research field in China. In contrast to its domestic competitors, firm KT had a better starting point in the technology, and its technological advantage continued to be strengthened under guidance from centralized strategic schema. It supports the firm to apply emerging technology to new products. Additionally, firm KT also applied new technology to its process optimization, noting that ‘our advantage comes from making process improvements, as we know what kinds of optimization improve production efficiency even though they do not influence product quality. Competitors whose technical capacity is not great enough dare not make such adjustments’. Based on product and process innovation, firm KT has achieved leading product advancement and precision in its industry.

Table 6. FP in Configuration 1

Notes: Cases shown have more than 0.5 membership in configuration 1. H = high; RH = relatively high; L = low; RL = relatively low

However, under the same configuration, near-champions had relatively low FP (Table 6). Although these firms paid great attention to R&D for new products and technologies, their technological superiority was insufficient to enable them to attain industrial leadership. The absence of a market orientation might also contribute to a challenging position after their industries fell into a period of bottleneck or recession. According to the interviewee from firm XG, the firm emphasizes technological innovation but invests ‘neither high nor low’ in R&D in their industry. Moreover, firm XG has yet to investigate other application fields for its product, which limits the firm's development opportunities. Thus, configuration 1 is more descriptive of hidden champions with sizable technological advantages, based on which these firms may lead their industries in technology or product development through explorative innovation.

In configurations 2 and 3, hidden champions and near-champions showed no significant differences in FP. Therefore, the interactions of causal conditions in all three configurations could enable hidden champions to achieve high-level performance, whereas the performance of near-champion firms in configurations 2 and 3 was more typical – that is, the interaction of either ‘technology orientation–market orientation’ or ‘centrality–complexity’ can enable firm evolution into industry champions.

DISCUSSION

Assuming an integrated view of the cognitive content and structure of strategic schemas, this article develops architecture types for realizing equifinal outcomes of high FP. The fsQCA of 25 hidden champions or near-champions identified by the Zhejiang Provincial Government process revealed that, for manufacturers that focus on specialized fields in the long-term, three configurations of content and structure in managerial cognition can account for high-level performance. Configuration 1 shows that firms whose decision makers have technology-oriented strategic schemas, especially when market information is of negligible importance, can attain high-level performance in a centralized managerial cognition structure. Configuration 2 indicates that a cognitive structure may be complex but centralized to some extent, and a market orientation promotes FP. Configuration 3 illustrates that firms whose decision makers are more concerned with technology and the market can achieve high-level performance in a complex managerial cognition structure. A comparison of hidden champions and near-champions reveals that configuration 1 was suitable only for firms with notable technological advantages. This conclusion highlights the important roles of the centrality and complexity of strategic schemas in the development of hidden champions and underscores that the mechanisms of different structural attributes in FP are based on cognitive content.

Contributions

First, our findings, which take an integrated view of structure and content in managerial cognition, enrich the managerial cognition literature by constructing configurations of strategic schemas that facilitate high-level FP. Decision makers’ strategic schemas rely simultaneously on constructs (nodes) and the relationships between them (links) (Tyler & Gnyawali, Reference Tyler and Gnyawali2002). Although strategic orientations and structural attributes are antecedents that influence FP, few studies have examined both simultaneously. This study explores the characteristics of managerial cognition of hidden champions in terms of behaviors such as continuous innovation, closeness to customers, and specialization to provide a structured understanding of how the combination of content and structure in strategic schemas leads to similar results in FP. Thus, this research goes beyond an analysis of demographic characteristics (Li, Reference Li2016) from an upper-echelon perspective to describe decision makers’ cognitive characteristics with an integrated lens of structural attributes and content orientation in strategic schemas.

Second, this research extends and supplements studies on hidden champions based on the highly dynamic growth of such firms in emerging economies. Scholarship on hidden champions to date focuses on questions such as ‘What kinds of firms are hidden champions’? and ‘What are their characteristics’? (Kriz, Sonntag, & Kriz, Reference Kriz, Sonntag and Kriz2015; McKiernan & Purg, Reference McKiernan and Purg2013) without exploring longitudinal considerations, including ‘How can firms become hidden champions’? and ‘How can hidden champions achieve sustainable growth’? Apart from longitudinal considerations, this study offers a fresh perspective on the development of Chinese hidden champions that started out as latecomers, challenging the consensus that hidden champions are similar across countries (even developed countries). The changing market and institutional environment in China since the reform and opening-up policy over 40 years ago engendered stricter requirements for managerial cognition in the interest of proactive organizational adaptation; thus, by using managerial cognition analysis, this study expands the body of literature on hidden champions.

Limitations and Future Research Directions

This article has certain limitations. First, based on managerial cognition theory, the study examines the interactive influence on FP of structural attributes and content orientation in strategic schemas. However, we do not explore how strategic schemas transfer related information or data to the information input of strategic actions. As Shepherd et al. (Reference Shepherd, McMullen and Ocasio2017) point out, theoretical and empirical work on this topic is an important avenue for further research. Second, studies on cognitive structure have been based mainly on content analysis using secondary sources (Auh & Menguc, Reference Auh and Menguc2005; Nadkarni & Barr, Reference Nadkarni and Barr2008). However, because most hidden champions are not publicly listed, using annual reports for content analysis poses a challenge. The data in this study came from interviews as the content source to evaluate strategic schema and thus could not necessarily eliminate subjective influence during data collection and analysis. In subsequent studies, widely available materials, such as speeches by CEOs, could be included as objective supplements to managerial cognition measures. Third, our sampling as one exploratory study is based on hidden champions identified by the Zhejiang Provincial Government, process, and the samples may not satisfy requirements for statistical representative samples. A rigorous mathematical analytical way (e.g., data envelope analysis) for ranking the firms is needed in the future (Day, Lewin, & Li, Reference Day, Lewin and Li1995; Serrano-Cinca, Fuertes-Callén, & Mar-Molinero, Reference Serrano-Cinca, Fuertes-Callén and Mar-Molinero2005). Also considering the environmental constraints, further configurations of strategic schemas for firm growth are still under exploration, beyond these identified from hidden champions in China who are located in relatively long-life cycles but transition economy. Fourth, future studies could consider the connection between managerial cognition and Chinese cultural values (Wei, Bilimoria, & Li, Reference Wei, Bilimoria and Li2017), considering that Chinese business and management draw on indigenous philosophical and cultural values like Zhong Yong thinking (Pan & Sun, Reference Pan and Sun2018) and Yin-Yang balancing (Li, Reference Li2014) that date back thousands of years.

APPENDIX I

The Zhejiang Provincial Government's Process for Selecting ‘Hidden Champions’

The Committee on Economics and Information Technology of Zhejiang Province selects ‘hidden champions’ based on certain requirements, such as specialization, quality/technology leadership, and continuous innovation, as summarized in Table A1; Figure A1 illustrates the full process. Firms proactively submit the applications, and industry associations at the provincial level also invite leading firms in their industries to submit the applications. Then the city government in which the firm is located in reviews the firm's eligibility. Applicants are divided up by geographic location, and the Zhejiang Provincial Government creates a review panel whose members include industrial experts and other reviewers from consultancies, universities, and government. The review includes a field visit to each company to conduct a thorough evaluation. Finally, all the firms that have applied are discussed in an extensive roundtable process to determine the final list of hidden champions or ‘near-champion’ companies every year. In 2016–2017, of 149 candidates for selection as hidden champions and 567 applicants for selection as ‘near-champion’ firms, 43 firms were identified through this process as champions and 368 as near-champions with the potential to become champions in the near future (Table A2). And the basic information of the sample firms are shown in Table A3.

Figure A1. Zhejiang Provincial Government review process.

Table A1. Zhejiang Provincial Government requirements for selection as hidden champion firms

Table A2. Number of sample firms

Table A3. Basic information of sample firms