INTRODUCTION

In the face of a dynamic and increasingly complex market environment, subsidiaries are no longer just passive performers of parent company's strategy but are active participants in the formulation of parent companies’ strategy and relatively independent autonomous actors (Manev, Reference Manev2003; Rugman & Verbeke, Reference Rugman and Verbeke2001). The changes of role, free allocation of resources, and double pressure of efficiency and adaptability brought by market and technology have promoted the independent innovation of subsidiaries. The high risk and uncertainty of innovative behaviors increases the company's dependence on the decision-making ability of top management team (TMT) (Daellenbach, McCarthy, & Schoenecker, Reference Daellenbach, McCarthy and Schoenecker1999). In the decision-making process, due to the limitation of information processing capabilities, TMT cannot pay attention to all information, and can only selectively filter, screen, and interpret some information according to their concerns (Simon, Reference Simon1947). This leads to attention allocation bias (Chen, Bu, Wu, & Liang, Reference Chen, Bu, Wu and Liang2015) and affects resource acquisition, which will ultimately affect company innovation. Therefore, how to allocate the limited attention of subsidiary TMT to promote the effective development of subsidiary innovation activities has become a key issue in practice.

Existing literature has explored the relationship between TMT and corporate innovation for a long time and mostly focused on the demographic characteristics of team members. It was not until the attention-based view was proposed (Ocasio, Reference Ocasio1997) that the role of TMT attention in corporate innovation was explored based on cognitive models. However, reviewing existing literature, it is not difficult to find that most related studies are confined to the theoretical framework of how TMT attention is restrained or restricted. They have recognized that TMT attention is an important resource, and emphasized its impact on corporate innovation, but failed to take TMT attention as a channel for specific resource acquisition and explore how to dynamically allocate TMT attention to promote corporate innovation. In terms of research objects, relevant studies only focus on unitary standalone company or parent company TMT attention's impact on corporate behaviors, and rarely consider the role of subsidiary TMT attention. This situation directly leads to insufficient exploration on the refinement, coverage, and integration of key constraints of subsidiary innovation, making it difficult to explain underlying motivations and mechanisms that drive innovation in subsidiaries. As research object of this article, group subsidiaries are different from unitary standalone companies. They are embedded not only in external business networks but also in their group's networks (Meyer, Mudambi, & Narula, Reference Meyer, Mudambi and Narula2011). The dual network embedding gives subsidiaries a natural innovation advantage because they enjoy both the convenience to use resources within the group, and possibility of obtaining external resources. Embedding in external networks provides subsidiaries with forward-looking regional market resources and information that are closely related to industry development. Compared with external networks, embedding in group networks enables subsidiaries to not only obtain shared information and high-quality resources within the group, but also enjoy the convenience of financing or lending through the internal capital market, which, to some extent, can make up for shortcomings of external network environment, such as imperfect system, poor information transparency, and high transaction costs. It can be seen that the different characteristics of external network and group network could bring differentiated resources to subsidiaries embedded in them.

In view of the above, this article takes group subsidiaries as the research subject, divides subsidiary TMT attention into group network attention and external network attention based on the dual network embedding characteristics of subsidiaries, and explores the impact of subsidiary autonomy (which is an important guarantee for subsidiary initiative), on the relationship between subsidiary TMT attention and subsidiary innovation. The research makes up for the lack of theoretical exploration on the relationship between the attention of subsidiary TMT and company innovation, and recognition of TMT attention at different network levels helps to present the internal mechanism of subsidiary TMT attention's impact on subsidiary innovation from different perspectives. In particular, exploration of the moderating effect of subsidiary autonomy is a concern for the initiative role of subsidiary that has long been neglected by the group governance research. It helps to clarify the boundary conditions of the impact of TMT attention on subsidiary innovation and provides targeted guidance on how TMT could allocate and use their limited attention to ensure the innovation behavior of subsidiaries.

LITERATURE REVIEW

Since Simon (Reference Simon1947) introduced the concept of attention into the field of management, the impact of attention on decision-making has been a key issue in management research. Ocasio (Reference Ocasio1997) clearly states that the key to organizational decision-making is how to effectively allocate the limited attention of decision-makers, and considers that attention is the process by which decision-makers allocate their limited information processing capabilities to decision-making-related stimulus factors, encompass the noticing, encoding, interpreting, and focusing of time and effort by organizational decision-makers on both (1) issues: the available repertoire of categories for making sense of the environment, such as problems, opportunities, and threats; and (2) answers: the available repertoire of action alternatives, such as proposals, routines, projects, programs, and procedures. Based on this cognition, the attention effect has been developed accordingly, especially attention of TMT on corporate innovation.

In the relationship between TMT attention and corporate innovation, attention is often viewed as a scarce resource in the decision-making activities and process. To a large extent, corporate behavior depends on where TMT focus their attention on. In his research, Levinthal (Reference Levinthal1997) finds that TMT focus on the smooth operation of the company's existing business due to the combination of heavy work pressure and dynamic changes in the external environment, paying less attention to innovation activities with high risks and even if TMT allocate part of their attention on innovation, they would be insensitive to innovation opportunities due to vested interests or deep-seated mentality, thus losing the opportunity for innovation (Tripsas & Gavetti, Reference Tripsas and Gavetti2000). Recent research by Kleinknecht, Haq, Muller, and Kraan (Reference Kleinknecht, Haq, Muller and Kraan2020) supports this view. Their results show that the increase of company operate scale, hierarchical structure, bureaucracy, and labor flexibility not only reduces the level of idle resources available to TMT but also increases the complexity to obtain the information needed for operations. This undoubtedly weakens the sense of control of TMT for long-term development and tends to shift attention to more understandable short-term pressure. Although it does not directly clarify the effect of TMT attention on company innovation, it does indicate that focusing on short-term goals is not conducive to long-term development-oriented innovation. Opposite to the idea that TMT attention has a negative influence on corporate innovation, Barker and Mueller (Reference Barker and Mueller2002) hold that TMT attention will give companies more opportunities to perceive the emergence of new markets and drive internal employees to implement innovative activities to adapt to new needs, meanwhile the TMT can also implement targeted participation and supervision to ensure and promote the smooth progress of innovative projects. Unlike the above, Burgelman's (Reference Burgelman1994) study shows that there is no correlation between TMT attention and corporate innovation. The main reason is that the influence of TMT attention is generally limited to the project level through support for individuals and teams, but the occurrence and implementation of innovative behavior is mostly achieved through operation of the middle management team.

As can be seen from the above, although the discussion of the relationship between TMT attention and corporate innovation has attracted much attention in the existing literature, no consensus has been reached. As research progresses, the refinement of attention construct broadens the cognition of the problem. Levy (Reference Levy2005) divides TMT attention into internal attention and external attention and explores its effect on the implementation of corporate decision-making. He finds that external attention can quickly and accurately perceive changes in the environment and market due to global focus, and have a positive role in promoting the innovation of corporate globalization strategies; while internal attention focuses on the standardization of business management and smooth operation, but due to too much focus on corporate internal affairs, it is difficult for TMT to cultivate globalization vision and perspective, thus internal attention works against the development of globalization strategic innovation activities. Based on this division, Yadav, Prabhu, and Chandy (Reference Yadav, Prabhu and Chandy2007) find that TMT internal attention is only related to innovation in technology, and external attention is applied to both technology and market. In recent years, as the research focus has been transferred from decision-making implementation to the expectation and assessment of decision-making, the significance of TMT time perception has attracted many researchers’ attention. Nadkarni and Chen (Reference Nadkarni and Chen2014) point out that the difference in top management time perception leads to different decision-making, divides the attention into past attention, current attention, and future attention according to the time dimension, and explores the influence of different attention allocation modes on innovation. Their study shows that under steady environment, the allocation mode of TMT attention with high past attention, high current attention, and low future attention can accelerate the speed of new product introduction; while the low past attention, high current attention, and high future attention allocation mode in a turbulent environment is conductive to the introduction of new product. In addition to the influence of time, strategies and behaviors are also subject to the influence of space. In other words, the TMT needs more space to operate and innovate. Compared with the fleeting of time, space is more flexible and durable. TMT choice of market space and behavior space will affect company behavior (Joseph & Wilson, Reference Joseph and Wilson2017). Wang, Chen, and Nguyen (Reference Wang, Chen and Nguyen2018) discuss the relationship between TMT spatial attention and corporate innovation investment and provide support for the idea of Joseph and Wilson (Reference Joseph and Wilson2017). Their results show that when the executive team's spatial attention level is high, they tend to invest more in innovation.

In terms of research object, most studies regarding the relationship between TMT attention and corporate innovation mainly focus on unitary standalone companies. With the in-depth study, the focus gradually shifted to the enterprise group, mainly around the group's parent attention. Initial research began with a discussion of how subsidiaries acquire the attention of parent company, noting that the market environment in which the subsidiary operate affects parental attention allocation (Bouquet & Birkinshaw, Reference Bouquet and Birkinshaw2008), and the allocation of attention is dynamically changeable among subsidiaries (Laamanen, Reference Laamanen2019). The role of parent company attention on subsidiaries is to promote the performance of subsidiaries (Ambos & Birkinshaw, Reference Ambos and Birkinshaw2010) and to support the legitimacy and identity of subsidiaries in regional markets (Conroy & Collings, Reference Conroy and Collings2016). In addition, previous studies have demonstrated the relationship between parent company attention and subsidiaries’ feedback behavior (Haq, Drogendijk, & Holm, Reference Haq, Drogendijk and Holm2017). However, no matter whether it is about the impact on subsidiaries or feedback effect on parent company, most related research focuses on the parent company attention, and even the few that have mentioned subsidiary attention are mainly based on parent company attention, exploring the impact of the asymmetry between subsidiary TMT attention and parent company TMT attention on strategic cooperation between the two (Temmes & Välikangas, Reference Temmes and Välikangas2019). No targeted exploration has focused on subsidiary TMT attention.

In summary, the relationship between TMT attention and corporate innovation has received more and more attention, and the results have become more abundant, but the following deficiencies still exist. First, little research has taken TMT attention as a resource acquisition channel. Most related studies stress the limitedness and restriction of attention. They have recognized that TMT attention is an important scarce resource, and explored its impact on corporate innovation, but neglected its impact on resource acquisition. Second, scan research has considered the company's subjective initiative. Current research on TMT attention and corporate innovation mainly focuses on the direct effect between the two but fails to explore the potential influence of corporate initiative on their relationship. Third, little attention has been paid to subsidiary TMT attention. Existing studies have mostly focused on unitary standalone companies, and a few of the discussions on the operating entities in enterprise groups have also focused on parent company, demonstrating the impact of parent company TMT attention on subsidiary performance and behavior, but neglecting the impact of subsidiary TMT attention on subsidiary behaviors. Fourth, the division of attention does not take into account the network embeddedness of companies. Existing studies have divided TMT attention into temporal attention, spatial attention, and target attention, but neglected the network situation that the company is embedded in. In particular, for companies that have dual network embedding qualities within an enterprise group, differences in resources obtained at different network levels will affect company behavior. In light of the above, this article is based on resource dependence theory and takes into account the dual embedded nature of subsidiary network, exploring the relationship between group network attention, external network attention, and subsidiary innovation, which could make up the insufficiency in studies concerning TMT attention and corporate behavior, and worth to in-depth exploration.

THEORETICAL ANALYSIS AND HYPOTHESES

Main Effects of Subsidiary TMT Attention on Subsidiary Innovation

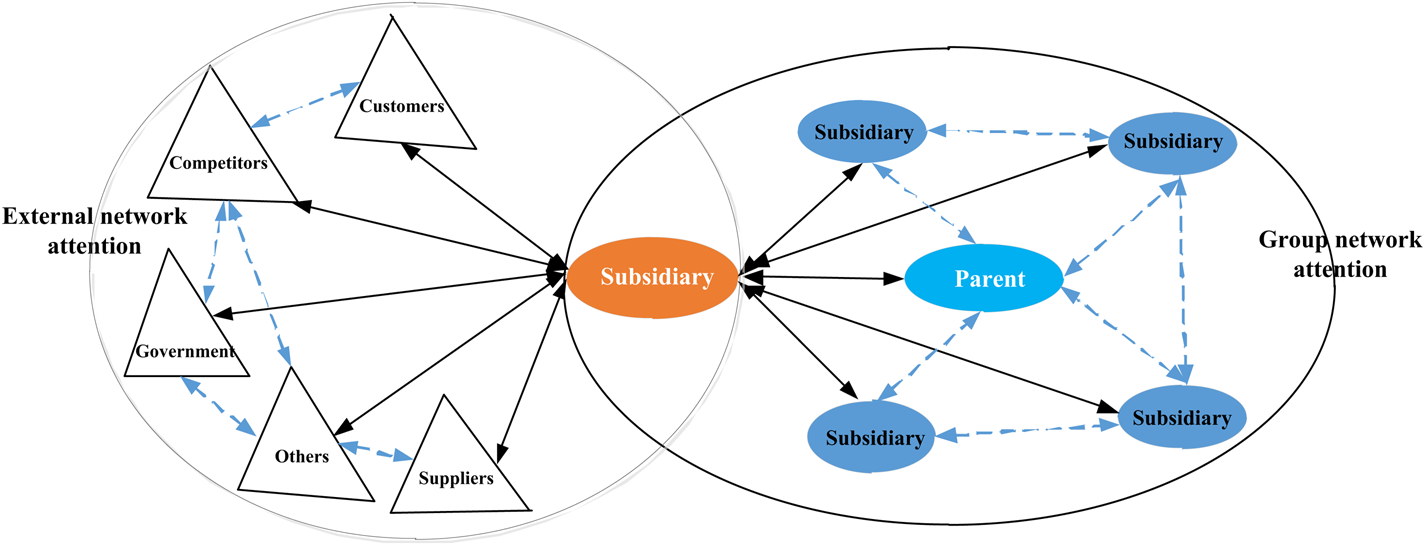

Different TMT attention allocation modes will lead to heterogeneous strategic decisions of the company (Ocasio, Reference Ocasio2011). When TMT focuses on profit growth, it will achieve the goal through development of new products or introduction of new technologies. When the focus is on obtaining competitive advantages in the industry, it will strengthen the maintenance of embedded network relationships of the company to occupy a dominant position and obtain superior resources (Royer, Reference Royer2003). As for group subsidiaries, their own resources are difficult to meet all the needs of operation, so they depend on obtaining resources from other organizations. In practice, subsidiaries are not only embedded in the external network of suppliers and customers but also in the group's relationship network. Differences in the concerns and resource acquisition in different networks embedded will affect behaviors of subsidiaries. On such basis, this article divides the subsidiary TMT attention into group network attention and external network attention. Among them, group network attention indicates concern about the factors within the group (such as parent company's support for subsidiaries and the use of group advantages); external network attention emphasizes attention to external environmental factors (such as market demand and market competition). TMT dual network attention of subsidiary is shown in Figure 1.

Figure 1. TMT dual network attention of subsidiary

The impact of subsidiary TMT group network attention on subsidiary innovation

Within a group, the success of a subsidiary depends, to some extent, on its continued access to organizational resources such as capital, assets, products, and information which are provided by the parent company (Yiu, Bruton, & Lu, Reference Yiu, Bruton and Lu2005). For example, Gonenc and Hermes (Reference Gonenc and Hermes2008) use parent companies and subsidiaries in Turkey from 1991 to 2003 as a research sample and confirm the existence of the parent company's support for subsidiary during the ‘low negative growth’ period from 1991 to 1999, and support enabled subsidiaries survived in a difficult business period. When subsidiary TMT group network attention focuses on the support of parent company, the subsidiary is manifested by planning their own behavior to affect the parent company's perception of them. Generally speaking, a subsidiary adjusts its behavior to match the strategy of the parent company. While effectively reducing the conflict of interest with the parent company and promoting formation of a harmonious atmosphere between them, it is conducive to fostering common cognition and ideas, increasing parent company recognition, obtaining favorable resource support, and ensuring operation and development of subsidiary. However, the strategic adjustment around the parent company can easily lead to strong dependence on resources of the parent company and cause subsidiary TMT to underestimate the strategic position of subsidiary. They believe that subsidiary is a subordinate of parent company and cannot afford to bear more risks, thus would deliberately avoid innovative ideas. It's not conducive to the development of innovative behaviors with high risks and uncertainties. At the same time, concentration of attention within the group will limit the vision of subsidiary TMT, making it difficult to form an overall view, and it is difficult to quickly capture new opportunities and challenges brought by technological development and changes in market demand (Huemer, Boström, & Felzensztein, Reference Huemer, Boström and Felzensztein2009). This will also lead to short-sighted views and behaviors of subsidiaries, such as an unclear grasp of industry development trends, insensitivity to changes in the market environment, susceptibility to inherent thinking patterns, over-protection of vested interests, and focus on the company's short-term financial performance improvement. All of these will suppress the occurrence of innovative behaviors for long-term development-oriented subsidiaries.

As a joint organization form, enterprise group is widely adopted because it can reduce transaction costs between members and realize the complementary advantages and integration of internal resources (Chang, Gong, & Peng, Reference Chang, Gong and Peng2012; George & Kabir, Reference George and Kabir2008). Subsidiaries’ use of advantages of enterprise groups is implicit in transactions and cooperation with other subsidiaries and parent companies in the group. The attention of subsidiary TMT group network attention on the use of advantages of group is manifested in actively promoting transactions and cooperation between the entities to avoid the uncertainty in the external environment. Cooperation and interaction can also increase opportunities of being guaranteed from the group network. Reciprocal guarantees are considered as the basis of internal capital markets (Luciano & Nicodano, Reference Luciano and Nicodano2008), and it's a sign of the holding capacity of member companies’ cash flows. Not only that, but the natural trust relationship also inherent in the group network will further strengthen the closeness between subsidiaries and related entities (Khanna & Yafeh, Reference Khanna and Yafeh2007), especially for hidden resources such as highly professional skills and knowledge. The close relationship provides an effective interaction platform for the transfer of resources between the sender and the receiver and helps the low-cost and efficient transfer of hidden skills and knowledge to subsidiary. Although the advantages of enterprise group can provide the above-mentioned resources guaranteed for the embedded subsidiaries, limited attention determines that when subsidiaries allocate TMT attention to the group network level, they will reduce attention on the external network. Although it is possible to achieve low-cost access to resources in the network, due to high homogeneity of resource and information updates in the group network, it is difficult for subsidiaries to obtain forward-looking information that matches the latest developments in the industry, which is not conducive to subsidiaries to capture new opportunities and hinders the identification of innovation and entrepreneurial opportunities for subsidiaries. In addition, homogeneous resources deposited in the network limit the acquisition of diversified resources by subsidiaries, making it difficult for subsidiaries to withstand new challenges and environmental shocks based on the resources obtained (Gulati, Nohria, & Zaheer, Reference Gulati, Nohria and Zaheer2000). Weaker risk tolerance restrains subsidiaries from trying creative new ideas with higher risk (Marchica & Mura, Reference Marchica and Mura2010), especially when faced with innovation opportunities outside the existing business in the environment, it is easy to miss opportunities. In summary, Hypothesis 1 is put forward as follows:

Hypothesis 1: Subsidiary TMT group network attention is negatively related to subsidiary innovation.

The impact of subsidiary TMT external network attention on subsidiary innovation

External network attention makes subsidiary TMT more sensitive to the uncertainty of market demand and complexity of technology replacement in the embedded network (Yadav et al., Reference Yadav, Prabhu and Chandy2007). The attention of external network enables subsidiary TMT to take the lead in focusing on market demand and market competition, when screening, filtering, and interpreting information, and use this to evaluate their overall level.

In the external network environment, changes in market demand are personalized, complex, and dynamic. Tracking searches for market demand (connections with externally associated entities) can not only bring forward-looking information on industry development to subsidiaries, but also improve the recognition of subsidiaries in external network relationships, strengthen their influence and reputation in the field, and influence the acquisition of information and resources of subsidiaries in external networks (Schmid & Schurig, Reference Schmid and Schurig2003). Market demand is the goal of companies unremitting efforts. Matching production with demand is key to sustainable development of subsidiaries. The focus on market demand enables subsidiaries to understand the industry development trends more clearly and comprehensively (D'Aveni, Reference D'Aveni1998), affecting the innovative efforts of subsidiaries to pursue profitability. On the one hand, the acquisition of market demand information and resources will directly encourage subsidiaries to increase innovation investment and develop new products that match the needs; on the other hand, sufficient information and resources can relax corporate internal control and allow subsidiaries to pursue more innovation and entrepreneurship projects. Furthermore, sufficient information and resources can also buffer the company from uncertainty and high risk of these projects help to cultivate an experimental culture (Bourgeois, Reference Bourgeois1981), and promote the company to actively implement new strategies.

The focus on market competition is reflected in the search for relevant information about competitiveness, competitors, imitators, and new entrants. Subsidiary TMT that focuses their attention on competitive environment of market will feel the dynamics and complexity of the competitive environment more deeply, strengthen the sense of crisis and comprehensive cognitive level, accurately grasp the competitive pressures they face, and directly affect TMT's efforts in pursuing a strategic advantage. On the one hand, intensified competition, increased new entrants, and the emergence of substitute products will increase sales management costs, and reduce the profit space of company's products. In order to make up for the loss caused by competition, reducing costs (low cost) and developing new products (differentiation) have become the coping strategies that managers tend to choose. Among them, innovation as an effective way to relieve external pressure has become an important strategic decision for companies (Harmancioglu, Grinstein, & Goldman, Reference Harmancioglu, Grinstein and Goldman2010), in other words, attention in market competition has a positive impact on company innovation. On the other hand, TMT's acquisition of resources that are closely related to market competition could bring subsidiaries closer to information about market conditions and regulatory changes (Asmussen, Pedersen, & Dhanaraj, Reference Asmussen, Pedersen and Dhanaraj2009), and help subsidiaries to occupy comparative advantages when making innovation decisions. Moreover, such information could also provide precise guidance for whole process of innovative activities from conceptualization, identification, and strategy formation to concrete implementation, enabling subsidiaries to have the ability and motivation to take risks in order to obtain long-term benefits, and have demand to carry out high-risk innovative activities (Marchica & Mura, Reference Marchica and Mura2010). As mentioned above, the external network attention of subsidiary TMT on market competition allows subsidiaries to grasp the forward-looking information on the development of industry, effectively predict the change trend of industry, and efficiently identify new opportunities suitable for their long-term sustainable development. Based on this, Hypothesis 2 is proposed as follows:

Hypothesis 2: Subsidiary TMT external network attention is positively related to subsidiary innovation.

Moderating Effect of Subsidiary Autonomy

Subsidiary autonomy refers to the power given by parent company to subsidiary to make strategic decisions independently (Schmid & Schurig, Reference Schmid and Schurig2003). It is an important reflection of the degree to which a subsidiary control its own affairs and influences a subsidiary's resource acquisition and utilization. Subsidiaries with lower autonomy in the group network are more limited by parent company in terms of quality and quantity of resources acquired. Parent company selective resource supply around the group's interests and overall strategic planning severely limits subsidiaries’ taking advantage of group advantages and affects their resource integration and utilization of efficiency in group network. In addition, low autonomy makes subsidiary operating strategies under the control of group headquarters, and subsidiaries may have to match the overall strategic layout of the group. To a certain extent, this restricts the possible strategic choices and operational flexibility of subsidiary (Bouquet, Morrison, & Birkinshaw, Reference Bouquet, Morrison and Birkinshaw2009). It hinders the creation of a constructive relationship between subsidiary and the main body in the group network according to its own needs (Chini, Ambos, & Wehle, Reference Chini, Ambos and Wehle2005), and reduces full utilization of the group's advantage by subsidiary. At the same time, subsidiaries with low autonomy are mostly positioned as tools for maximizing the overall interest of the group, and the role of affiliates inhibits the initiative of subsidiary TMT. The negative inaction of TMT not only hinders the subsidiary's accurate assessment of its own strategic position, but also it's not conducive to the improvement of the subsidiary's comprehensive capabilities and expansion of managers’ horizons. The vicious circle formed in this way will affect parent company's support to subsidiary and affect subsidiary's resource acquisition from parent company. Conversely, if subsidiary has a higher level of autonomy, it will be difficult for parent company to monitor subsidiary. While weakening parent company's administrative intervention, it can also promote subsidiary to build a cooperative relationship within the group network with itself as the core. The acquisition and integration of resources on the interest-centric of subsidiary, not only enables subsidiaries to make full use of the advantages of group, but also strengthens the confidence of subsidiaries’ managers, improves the subsidiaries’ overall evaluation level of themselves, and promotes the willingness of subsidiaries to improve their capabilities. The improvement of subsidiary's status within group network brought by the capability enhancement can further strengthen the parent company's resource support for subsidiary. To sum up, it can be seen that with the increase of subsidiary autonomy, its impact on subsidiaries making full use of the group's advantages and the parent company's support for subsidiary will inhibit the negative impact of subsidiary TMT group network attention on subsidiary innovation, that is, subsidiary autonomy has a negative moderating effect in the relationship between the two. Based on this, Hypothesis 3 is proposed as follows:

Hypothesis 3: Subsidiary autonomy has a negative moderating effect on the relationship between subsidiary TMT group network attention and subsidiary innovation.

Subsidiary TMT external network attention is manifested by the attention to the information of demanders and competitors in the external network. The degree of information acquisition and utilization efficiency is subject to the level of subsidiary autonomy. Subsidiaries with a lower level of autonomy are the implementer of parent companies’ strategy. Their overall operating activities are under parent companies’ arrangement and monitoring, so they have less independent decision-making power (Foss & Pedersen, Reference Foss and Pedersen2002). Subsidiaries cannot easily get rid of the intervention of the parent company. Restricted by the overall strategic planning of the parent company, it is difficult for subsidiaries to obtain resources completely according to their own interests, even if the subsidiary TMT external network attention can obtain resources required for the development of innovative behaviors from the environment by paying attention to market demand and competitors. But due to low autonomy, it is difficult to make full use of resources according to their own wishes, and limited exert space can easily lead to negative emotions of subsidiary TMT and inhibit their motivation to integrate and allocate resources, leading to their inaction or non-cooperative behavior. Moreover, this kind of negative inaction caused by low autonomy make subsidiaries seldom lay out network relationships for their own actions, even if they are embedded in resource-rich external network (Ambos & Birkinshaw, Reference Ambos and Birkinshaw2010). At this time, for the subsidiary, the advantage of external network embedding is lost, which can obtain timely and efficient access to forward-looking resources and information closely related to demanders and competitors. Conversely, if subsidiary has a higher level of autonomy, it can not only weaken the parent company's supervision and control, but also enhance the enthusiasm and initiative of subsidiary TMT (Kawai & Strange, Reference Kawai and Strange2014). The mobilization of subsidiary TMT initiative can optimize the allocation of resources, improve the efficiency of resource utilization, and promote the subsidiary's precise positioning of itself according to market needs and competition. At the same time, high level of autonomy allows subsidiaries to have more space to carry out behaviors that are beneficial to themselves, which can promote them to actively capture information on demanders and competitors in external networks that are closely related to improvement of the overall benefit of subsidiary, and they have more motivation to develop, integrate, and utilize the obtained resources, in order to ensure the strategic actions are carried out smoothly. It can be seen that with the increase of subsidiary autonomy, its impact on the initiative of subsidiary's external network resource acquisition and resource utilization efficiency will strengthen the positive relationship between subsidiary TMT external network attention and subsidiary innovation, that is, it has a positive moderating effect in the relationship. Therefore, Hypothesis 4 is proposed:

Hypothesis 4: Subsidiary autonomy has a positive moderating effect on the relationship between subsidiary TMT external network attention and subsidiary innovation.

Theoretical Model

According to above analysis, a theoretical model can be constructed in which the subsidiary TMT attention affects subsidiary innovation. The model consists of categories of subsidiary TMT attention (group network attention and external network attention), subsidiary autonomy and subsidiary innovation, and the corresponding path relationship, as shown in Figure 2.

Figure 2. Theoretical model for the impact of subsidiary TMT attention on subsidiary innovation

METHODS

Samples and Data

This article uses 2012–2017[Footnote 1] A-share listed subsidiaries in Shanghai and Shenzhen Stock Exchanges of China as a sample. To ensure the validity of the data collection, sample data were screened through the following steps: First, identify the sample subsidiaries. ‘List of Large Chinese Groups’ was obtained by consulting the ‘Annual Development Report of the Large Chinese Groups’ issued by the National Bureau of Statistics; listed subsidiaries were obtained through websites of these groups. Controlling shareholder chain from the ‘property right and control diagram’ disclosed in the annual report of the listed subsidiaries was obtained; then the controlling shareholder in the shareholder chain was compared with the group list. If the match is successful, it will be determined as the research sample. Second, data collect. Financial data of the sample subsidiaries were queried through the Wind database, texts of the board reports (business discussion and analysis) were extracted from the annual reports of listed subsidiaries, and the patent data were obtained from the SIPO patent database of the China Intellectual Property Office. Finally, samples elimination. ST and *ST companies[Footnote 2] (these companies have abnormal financial situation and stock trading), companies operating in the financial and insurance industries (these companies have abnormal business and accounting calculations), and some companies with missing data were excluded from the sample. (Specifically, the excluded companies are those with missing variable indicator values in a certain year, because some companies may have missing year data, can no longer be tracked, or no longer have data when the conditions are not met. Of course, some companies have been added, because they meet the sample conditions in a certain year. Accordingly, the unbalanced panel data were obtained. Although the sample is different every year, each indicator itself has no missing data.) At the same time, in order to overcome the possible influence of extreme values on the regression results, a 1% Winsorize was performed on continuous variables. Finally, 726 listed subsidiaries were obtained, with a total of 3,654 observation samples.

Variables

Dependent variable

Referring to the existing measurement of company innovation (Jia, Tian, & Zhang, Reference Jia, Tian and Zhang2016), this article uses the number of invention patent applications to measure the innovation level of subsidiaries. The reasons are as follows: (1) Patent applications can reflect the true level of innovation more than grant. Patent grants require testing and payment of annual fees. There is more uncertainty and instability, and they are more susceptible to political factors. Comparatively speaking, patent applications are more stable, reliable, and timely. (2) Determination of patent application for invention. According to the provisions of the Patent Law of the People's Republic of China, patented inventions creation can be divided into three types: invention, utility model, and design. Among them, the invention patent refers to patents awarded to new technical solutions proposed for products, methods, or improvements thereof. The utility model patent is a patent awarded to a new technical solution suitable for practical use that is proposed for the shape, structure, or combination of products. Appearance design patent refers to patent awarded to a new design that is esthetically pleasing and suitable for industrial applications on the shape, pattern, or combination of products and the combination of color, shape, and pattern. It can be seen that the technical content of utility model and design patents is relatively low, while invention patents have higher technical requirements and greater difficulty in obtaining, which can better represent the company's ability to innovate (Tong, He, He, & Lu, Reference Tong, He, He and Lu2014). (3) The invention patent application is based on the performance of new technologies, which can effectively capture the technological value of innovation, which is consistent with the common understanding of innovation in the literature (Lin, Lee, & Hung, Reference Lin, Lee and Hung2006; Shen & Zhang, Reference Shen and Zhang2013). In summary, the number of invention patent applications is used to measure the innovation level of subsidiaries.

Independent variable

Text analysis method[Footnote 3] was used to measure subsidiary TMT attention (Cho & Hambrick, Reference Cho and Hambrick2006). In terms of text selection, it is different from the use of ‘Letter to shareholders’ in most foreign countries. ‘Letter to shareholders’ is not common in the annual reports of listed companies in China. Instead, board reports (business discussion and analysis) are often used as the original material for attention measurement (Wu & Guan, Reference Wu and Guan2015). The main basis is as follows: This part of the content is a fixed chapter that every listed company must disclose in the annual report. The content involves the company's senior management's interpretation of the main operating conditions during the reporting period, industry development and policy analysis, reflecting the thinking and judgment of company's operating environment and direction. Therefore, using the board report (business discussion and analysis) in the subsidiary's annual report to measure the attention of subsidiary TMT can ensure the validity of the measurement results.

Firstly, board reports (business discussion and analysis) in the annual reports of the sample subsidiaries between 2012 and 2017 were converted into a text format, and imported into ROSTCM6 software, by which Chinese word segmentation was conducted (removing empty words and connective words), and high-frequency words were screened out. Subsequently, referring to the keyword list proposed by Yadav et al. (Reference Yadav, Prabhu and Chandy2007), combining the operating characteristics of the subsidiaries in Chinese context and the focus of thematic argumentation, a preliminary keyword list of subsidiary TMT group network attention and external network attention was established. In the list, group network attention mainly focuses on the content related to the parent companies and other subsidiaries, while the external network attention focuses on the interaction with customers and competitors in the external market. This is consistent with the focus of subsidiary TMT group network level (parent company support and group advantage utilization) and external network level (market demand and market competition) in the hypothesis reasoning of this article, so it can better reflect the group network attention and external network attention. At the same time, in order to ensure the validity of keyword classification, a rating scale was designed. The matching degree of the corresponding keywords with the group network attention and external network attention of subsidiary TMT was measured (on a 1–5 score basis ranging from 1 ‘completely inconsistent’ to 5 ‘completely consistent’, with 3 denoting ‘unsure’). Specifically, the designed scale was distributed to experts in the field. Experts scored the representativeness of keywords according to their theoretical and practical knowledge (discussion was not allowed to ensure the independence of the process). According to this, the words with lower scores (below the average score) were eliminated, and text search terms (i.e., seed words) were finally determined, as shown in Table 1.

Table 1. List of search terms for subsidiary TMT attention

Then, Nvivo software was used to text analysis of the board reports (business discussion and analysis) and get the frequency of search terms. In order to ensure reliability and accuracy of the measurement results, the research identified sentences containing search terms, and adjusted the category or deleted the non-conforming content accordingly. In the specific operation, three master students in the team (whose research direction is group governance) were trained, asked them to read the sentences containing the search terms in the board reports (business discussion and analysis) of all the sample subsidiaries, and make judgments, respectively. After summarizing the results, in order to ensure the objectivity, consistency, and accuracy of the text determination, doctoral students responsible for the project coordination organized a discussion meeting (participants of the meeting consisted of a mentor, two doctoral students, and three master students responsible for text analysis) to discuss the controversial or uncertain place in sentence identification, and make a corresponding judgment after finding an accurate and reliable basis. On such basis, sentences that are inconsistent with the attention to be expressed were adjusted to the appropriate attention category or deleted from the database (with nonappropriate). Finally, the number of sentences that contain the search terms was calculated (Levy, Reference Levy2005) and the attention level of subsidiary TMT was hereby obtained.

Moderating variable

The measurement of subsidiary autonomy mostly takes foreign subsidiaries as the target, and the data are obtained by constructing an indicator system and issuing questionnaires (Vachani, Reference Vachani1999). Tong, Wang, and Kwok (Reference Tong, Wang and Kwok2012) have developed measurement indicators for the autonomy of subsidiaries applicable to the Chinese context. However, determination of the indicators is still based on the background of multinational companies, and these indicators not only contain the internal power allocation indicators, but also include many macro-factor indicators such as the level of the rule of law and governance culture of the host country. The context thereto is different from the situation of the subsidiaries in the enterprise group under study in this article. The direct use of these indicators may lead to variable measurement errors and affect the validity and robustness of the research conclusions. This article considers the essence of the parent–subsidiary company relationship on the basis of existing research, combines the subsidiary autonomy representation in the hypothesis reasoning, and selects proxy variables to measure the subsidiary autonomy. Subsidiary autonomy is the power of a subsidiary to make strategic decisions independently. It is affected by the strength of parent company control and the bargaining power of subsidiary (Manolopoulos, Reference Manolopoulos2006). However, the measurement of subsidiary autonomy emphasizes parent company control, ignores the degree of perfection of subsidiary governance mechanism and the role of subsidiary characteristics, the variable measurement deviation is very easy to cause endogenous problems. To circumvent this shortcoming, this study determined the selection criteria for the proxy variables of subsidiary autonomy as variables that were both exogenous to the control intensity of parent company and related to the subsidiary's governance mechanism or characteristics.

The parent–subsidiary company is essentially a principal–agent relationship. The traditional property rights theory assumes that the owner will ultimately bear the losses caused by agency costs, so is motivated to reduce agency costs (Chernenko, Foley, & Greenwood, Reference Chernenko, Foley and Greenwood2012). However, due to the inevitability of incomplete contracts (uncertainty in the external environment and opportunism on both sides of the contract), agency costs are difficult to eliminate. For the owner's parent company, while enjoying the second type of agency cost ‘control right benefit’, it also needs to bear the efficiency damage caused by the first type of agency cost. The first type of agency cost is exogenously controlled by the parent company (although the parent company knows that the agency cost exists, but it cannot eliminate the agency cost, and can only weaken the loss caused by the agency cost through other measures), and closely related with subsidiary governance mechanism and the characteristics of subsidiaries, therefore, it could meet the selection criteria of the proxy variable of subsidiary autonomy in this article.

Thus, this article chooses the first type of agency cost as a proxy variable for subsidiary autonomy to show that subsidiaries have autonomous decision-making power independent from parent companies. For the first type of agency cost measurement, Ang, Cole, and Lin (Reference Ang, Cole and Lin2000) gave two measurement methods, namely the operating expense ratio (operating expense ratio = operating expenses/annual sales) and asset utilization ratio (asset utilization ratio = annual sales/total assets), to explain management's operating cost control and asset allocation. To a certain extent, these two proxies could characterize management's due diligence. However, it should be pointed out that the research of Ang et al. (Reference Ang, Cole and Lin2000) focused on the principal–agent problem between company owners and managers. The objective of this article is principal–agent between parent and subsidiary companies, so there is a difference in measurement between the two. Subsidiary is an independent legal person, which is different from the branches and functional departments of parent company. Operating cost control and asset allocation efficiency improvement are spontaneous actions of subsidiaries centered on their own interests. The specific efficiency is restricted by the subsidiaries’ own capabilities, so the operating expense ratio and asset utilization rate are not suitable proxies for the research object of this article. Accordingly, considering the particularity of the principal–agent relationship between parent and subsidiary companies, research selected the management expense ratio (management expense ratio = management expense/operating income) to measure the agency cost between parent and subsidiary companies. The reason is that the management expense ratio emphasizes how much income is consumed by management expenses[Footnote 4] (subsidiary's exclusive benefits), and the ultimate beneficiary of subsidiary income is the major shareholder, that is, the parent company, so the management expense ratio can be clearer in presenting the agency problem between the parent and subsidiary companies. Generally speaking, relatively high level of the first type of agency cost indicates that the subsidiary has a greater power to control management expenses in daily operations, which can effectively mobilize the subjective initiative of subsidiary, that is, subsidiary has the ability and motivation to efficiently integrate and allocate resources. This is consistent with the perception of the hypothetical argumentation in this article and supports the validity of the first type of agency cost as a proxy variable for subsidiary autonomy.

In the measurement process, considering the degree of parent company's control over subsidiaries (restrictions on the autonomy of subsidiaries) varies due to the different industries the subsidiary belongs to, that is, industry factors have an impact on the proportion of subsidiary management expenses. Therefore, this article makes industry adjustments to the subsidiary autonomy indicator (management expense ratio). First, the median of each subsidiary's autonomy indicator by industry and year was calculated. Then, the corresponding median was subtracted from the original value (Cang, Chu, & Fan, Reference Cang, Chu and Fan2020). Based on this, the industry-adjusted subsidiary autonomy level was obtained.

Control variables

With reference to the relevant literature regarding company innovation, this article controls the variables such as subsidiary size, subsidiary age, profitability, growth capability, and risk appetite. Specifically, the natural logarithm of the total assets of subsidiary at the end of the year is used to control the effect of the size of subsidiary (Ahuja, Reference Ahuja2000), and return on assets (ROA), and revenue growth rate (Growth) are used to control the subsidiary's profitability and development capabilities. The subsidiary's asset-liability ratio (Lev) can reflect the company's risk appetite and may also have an effect on organizational innovation (Blair, Reference Blair2010). It is measured by dividing liabilities by total assets. Ownership attributes reflect the flexibility of the subsidiary system and will affect subsidiary resource acquisition (generally speaking, SOEs have more advantages in resource acquisition), influence subsidiary innovation (Chernenko et al., Reference Chernenko, Foley and Greenwood2012). Therefore, the nature of property rights (SOE) is selected as a control variable. When the property nature is 1, it represents state-owned enterprises. Other enterprises that are non-state-owned enterprises are represented by 0. Not only that, but the company's industry also is usually closely related to the degree of innovation. In order to control the impact of industry, this study used the industry classification of listed companies by the Securities Regulatory Commission as the standard.[Footnote 5] After excluding the financial industry and the industries without sample, 14 dummy variables were selected for 15 industries (Industry). Other control variables also include annual dummy variables, 6 fiscal years, with a total of 5 dummy variables generated (Year). In summary, the variables in the study are integrated into Table 2.

Table 2. Variable measurement

RESULTS

Descriptive Statistics and Analysis

Statistical analysis of the variables involved in the study was performed using STATA 15 to obtain the statistical results of Table 3. The analysis shows that the correlation coefficients of all variables are between 0 and 0.108 and far less than 0.8, so the probability of multicolinearity between variables is preliminarily determined to be small. From the perspective of specific correlation coefficient values and significance level, TMT group network attention and subsidiary innovation (r = −0.029, p < 0.1), TMT external network attention and subsidiary innovation (r = 0.052, p < 0.01), the correlation between these variables is good overall, which preliminarily shows the existence of the relationship in theoretical models.

Table 3. Mean, standard deviation, and Pearson correlation coefficient of the main variables

Notes: t statistics in parentheses, *p < 0.1, **p < 0.05, ***p < 0.01.

Regression Results and Analysis

Main effect test

In Table 4, Column (1) contains only the control variable results. Column (2) reports the main effect regression results of TMT attention and subsidiary innovation. The Atten1 regression coefficient is −0.0097 and is significantly negative at the 5% level, which means that with the group network attention increases, the innovation level of subsidiaries will be reduced, thus Hypothesis 1 is supported. Atten2 regression coefficient is 0.0224 and is significantly positive at the 1% level, indicating that as the external network attention increases, the innovation level of subsidiaries will be increased, thus Hypothesis 2 is supported.

Table 4. Regression results about subsidiary TMT attention impact on subsidiary innovation

Notes: t statistics in parentheses, *p < 0.1, **p < 0.05, ***p < 0.01.

In addition, from the perspective of control variables, the relationship between subsidiary age and subsidiary innovation is not significant, and the possible reason is that although subsidiaries with a short time of establishment have more innovation opportunities, their limited resources are difficult to support the effective development of innovative activities. On the other hand, although subsidiaries which have been established for a long time have the capital to carry out innovative research and development, they are not sensitive to the identification of innovation opportunities due to influence of vested interests and inherent thinking. The size coefficient is positive and reaches a significance level of 10%, indicating that larger companies have stronger innovation capabilities; the asset-liability ratio (Lev) coefficient is significantly negative at the level of 1%, which proves that the in-debt operation is not beneficial to subsidiary innovation; the property right (SOE) coefficient is significantly positive, indicating that the state-owned subsidiaries are more conducive to resource acquisition due to the availability of policy support and can effectively guarantee the development of innovation. At the same time, the relationship between other control variables and subsidiary innovations has also reached theoretical expectations, which is basically consistent with previous research conclusions, indicating that the theoretical model construction, variable selection and estimation results in this article have strong reliability.

Moderating effect test

In order to eliminate the possible multicollinearity and before the regression of moderating effect, this research used the standardized subsidiary TMT attention and subsidiary autonomy to construct the interaction term of moderating effect. At the same time, the variance inflation factor (VIF) of each variable was tested, and it was between 1.01 and 1.04, which was far less than the empirical threshold of 10 (Gao, Gao, Zhou, & Huang, Reference Gao, Gao, Zhou and Huang2015), and basically ruled out the multicollinearity problem of the regression model.

Columns (4) and (5) in Table 4 are the results of the moderating effect test. Among them, the Atten1 coefficient in column (4) is significantly negative (−0.0108), and the coefficient of interaction term Atten1 × Aut is significantly positive (0.0718), indicating that subsidiary autonomy will inhibit the effect of subsidiary TMT group network attention. The higher the degree of subsidiary autonomy, the weaker the negative correlation between subsidiary TMT group network attention and subsidiary innovation, that is, subsidiary autonomy plays a negative moderating role in the relationship between subsidiary TMT group network attention and subsidiary innovation. Therefore, Hypothesis 3 is supported.

In order to further confirm and clearly present the moderating effect of subsidiary autonomy in the relationship between subsidiary TMT group network attention and subsidiary innovation, research following the approach of Aiken and West (Reference Aiken and West1991), respectively, imported the value that adding and subtracting one standard deviation from subsidiary autonomy into the regression model, and drawn the moderating effect graph accordingly. As shown in Figure 3, when subsidiary autonomy is high, the slope of TMT group network attention is positive (β = 0.027, p < 0.01). At this time, TMT group network attention can promote the innovation of the subsidiaries. When subsidiary autonomy is low, the slope of TMT group network attention is negative (β = −0.229, p < 0.01), indicating that under the background of low subsidiary autonomy, high (low) TMT group network attention corresponds to the low (high) subsidiary innovation. In other words, when subsidiary has a higher level of autonomy, TMT group network attention has a significant positive effect on subsidiary innovation, but when the subsidiary autonomy level is low, the subsidiary TMT group network attention has a negative impact on subsidiary innovation.

Figure 3. Moderating effect in the relationship between group network attention and subsidiary innovation

From the test results in Column (5), it can be found that Atten2 (0.0238) and interaction term Atten2 × Aut (0.1182) coefficients are all significantly positive, indicating that subsidiary autonomy has a moderating effect on the relationship between external network attention and subsidiary innovation. When subsidiary autonomy is high, the positive influence of TMT external network attention on subsidiary innovation is more significant. That is, the subsidiary's autonomy can positively moderate the relationship between external network attention and subsidiary innovation, thus Hypothesis 4 is supported.

According to the same rules, the moderating effect graph of subsidiary autonomy on the relationship between TMT external network attention and subsidiary innovation was drawn. It is used to analyze the impact of subsidiary TMT external network attention on subsidiary innovation under different levels of subsidiary autonomy. As shown in Figure 4, the slopes for both high-level subsidiary autonomy line and low-level subsidiary autonomy line are positive, coefficients are (β = 0.233, p < 0.01) and (β = 0.085, p < 0.01) respectively, but compared with the low-level subsidiary autonomy line, the high-level autonomy line is steeper. In other words, when the level of subsidiary autonomy is high, the positive effect of subsidiary TMT external network attention on subsidiary innovation is relatively strong. When the level of subsidiary autonomy is low, the positive effect of subsidiary TMT external network attention on subsidiary innovation is relatively gentle.

Figure 4. Moderating effect in the relationship between external network attention and subsidiary innovation

Industry-based group test

There are differences in resources required for innovation in different types of industries, and attributes of a company's industry are often closely related to innovation output. For companies with comparable resources, age, and scale, the difference in innovation output can be analyzed at the level of the company's industry category (Huang, Lü, & Zhu, Reference Huang, Lü and Zhu2018). Thus, according to the 2012 industry classification standards of the China Securities Regulatory Commission, this article classifies all sample industries according to the intensity of production factors (Lu & Dang, Reference Lu and Dang2014). The classification indicators are as follows:

First, the fixed asset ratio and R&D expenditure salary ratio of each industry was calculated separately, and then the sum of squares of deviation method in cluster analysis was used to process. This method can minimize the sample difference within the group after classification. When the number of groups is fixed, the sum of squared deviations within the whole group can be minimized, and difference between the groups can be maximized, which is the best classification. Second, it is classified according to the proportion of fixed assets. A larger proportion indicates a higher importance of capital and is classified as a capital-intensive industry. Finally, it is classified according to the salary ratio of R&D expenditure. A higher proportion means that technological research and development are more important to enterprises than labor factors, and belong to technology-intensive industries, while the rest are labor-intensive industries. Based on this, the study classified the 67 industries involved in the sample, and the results are shown in Table 5.

Table 5. Production factor-based industry classification

Notes: The industry codes come from the ‘2012 China Securities Regulatory Commission's Industry Classification Guidelines for Listed Companies’, and the classification results are obtained through cluster analysis.

Judging from the classification results, there are more labor-intensive sub-industry codes in the sample companies, and the number of technology-intensive industries is equivalent to that of capital-intensive industries. This is basically consistent with the classification results of Lu and Dang (Reference Lu and Dang2014) and Yin, Sheng, and Li (Reference Yin, Sheng and Li2018), which proves the reliability of the industry classification in this article. On top of this, the research examines the relationship between different network levels of attention and subsidiary innovation by the industry. The regression results are shown in Table 6.

Table 6. Regression result of subsidiary TMT attention impact on subsidiary innovation by the industry

Notes: t statistics in parentheses, *p < 0.1, **p < 0.05, ***p < 0.01.

In technology-intensive industries, group network attention is negatively correlated with subsidiary innovation (β = −0.0168, p < 0.05), and interaction coefficient of subsidiary autonomy moderating effect is significantly positive (β = 0.0674, p < 0.1); external network attention is positively correlated with subsidiary innovation (β = 0.0321, p < 0.01), and interaction coefficient is significant (β = 0.1445, p < 0.1). The test results are consistent with the resource characteristics required for innovation in technology-intensive industries. Innovations in technology-intensive industries are mostly based on advanced science and technology, in which scientific and technical personnel play a core role and new products are characterized by technical complexity and rapid updating (Carlucci, Marr, & Schiuma, Reference Carlucci, Marr and Schiuma2004), thus the acquisition of a company's competitive advantage depends on accurate and rapid response to the external market environment. At this time, the forward-looking resources closely related to the development of industry brought by subsidiary TMT's external network attention ensure the smooth progress of subsidiary innovation. In contrast, the slow update speed and high homogeneity of internal resources provided by group network attention is obviously not conducive to technology-intensive industry innovation characterized by high precision. Judging from the test results of the moderating effect of subsidiary autonomy, fierce competition within technology-intensive industries has placed subsidiaries in a more complex and uncertain environment, highlighting the importance of independent decision-making by subsidiaries. When facing the dynamic and changing opportunities in the environment, high level of subsidiary autonomy can allocate and utilize resources in a timely and efficient manner to avoid missing opportunities for innovation.

In capital-intensive industries, group network attention is positively correlated with subsidiary innovation (β = 0.0203, p < 0.1), and the interaction coefficient of the moderating effect of subsidiary autonomy is significantly positive (β = 0.1844, p < 0.05); the relationship between external network attention and subsidiary innovation is not significant (β = 0.0077), but the interaction coefficient is still significant (β = −0.3107, p < 0.05). This is consistent with the characteristics of resources required for innovation in capital-intensive industries. Production and operation of capital-intensive industries mostly relies on fixed assets such as large-scale machinery and equipment. Innovations in these industries almost focus on technological process improvements which can increase the efficiency of equipment operation, thereby reducing unit product costs and gaining competitive advantages (Lu & Yun, Reference Lu and Yun2010). In terms of corporate innovation, the harmonious atmosphere within the group promoted by subsidiary group network attention to the inter-subject relationship is conducive to the transfer of high-tech hidden resources (skills, knowledge, and experience) to the target subsidiary, and helps the subsidiary better overcome technical drawbacks and achieve innovative development. Compared with tacit knowledge provided by internal network that matches the technological process improvement, industry development trend information brought by the external network has no obvious effect on the innovation of capital-intensive industries. Another notable feature of capital-intensive industries is that they are mostly monopolistic enterprise groups. This reduces the external competition pressure of subsidiaries to a certain extent and makes it easier for subsidiaries to generate innovation inertia, and a higher level of autonomy can effectively mobilize subsidiaries’ subjective initiative, promote more consideration for their own long-term development, activate subsidiaries’ willingness to innovate, improve resource integration and utilization efficiency, and carry out innovation activities.

In labor-intensive industries, group network attention is negatively correlated with subsidiary innovation, but not significant (β = 0.0106), and the interaction coefficient of subsidiary autonomy moderating effect is significantly positive (β = 0.0858, p < 0.1); external network attention is positively correlated with subsidiary innovation (β = 0.0110, p < 0.1), and the interaction coefficient is also significant (β = −0.0947, p < 0.01). This is in line with the characteristics of resources required for innovation in labor-intensive industries. The production and operation of labor-intensive industries mostly rely on a large amount of labor input. These industries do not require high levels of knowledge and technical operation of employees, has low entry barriers, and relatively low-quality employees (Lu & Yun, Reference Lu and Yun2010), thus they generally do not have background knowledge and experience to carry out innovative activities. However, when the subsidiary TMT allocates its attention to external network, the influx of a large number of latest market demand and competitive information closely related to industry development has strengthened subsidiary's crisis awareness and stimulated its willingness to innovate and promote innovative development. However, when subsidiary TMT attention is allocated to the group network level, because of the lack of external information stimulation, the subsidiary is easier to be satisfied with the status quo, and acquisition of tacit knowledge and skills within the group, which can improve labor efficiency to a certain extent, is mostly considered to be welfare brought about by technology spillovers. Although it has increased the company's value but failed to enhance the company's awareness of innovation.

It can be seen that the relationship between subsidiary TMT network-level attention and subsidiary innovation varies from industry to industry, which indicates that industries with different proportions of production factors have different resources required for innovation. The results are shown in Table 6.

Robustness test

(1) Robustness test by replacing the variable measurement method.

In order to further verify the reliability of the research and applicability of the theoretical model, a robustness test was performed by replacing the dependent variable measurement method. Specifically, the subsidiary innovation measurement in the main test is replaced by the number that the listed subsidiary patents were cited. The number of invention patents cited can objectively reflect the effective innovation of the company and is an important manifestation of the quality of patent output (Zhong, Reference Zhong2018). The number of invention patents cited in the study comes from the GOOGLE patent citation database. To be specific, the public number of patents obtained by subsidiary is used as the identification code for searching, and then according to the invention patent application list of subsidiaries from 2012 to 2017, calculated the cited number of invention patents. In consideration of the time lag from application to approval of patents, the statistics on the number of invention patents cited are up to the end of 2020. From the results of robustness test in Table 7 (column (1)–column (4)), the conclusions obtained are basically consistent with the previous ones, which prove that the overall robustness of the study is good.

(2) Robustness test by changing the estimation method.

Table 7. Robustness test result of replacing the variable measurement method and changing the estimation method

The number of invention patent applications is a non-negative integer value, and the result after logarithm was used above. For non-negative integer values, Poisson Regression can also be used. The estimated results are shown in Table 7 (column (5)–column (7)). From the estimation results in Table 7, the estimated coefficient of subsidiary TMT group network attention (Atten1) is negative, and it is significant at the level of 1%. The estimated coefficient of subsidiary TMT external network attention (Atten2) is positive at the level of 1%, indicating that the effect of subsidiary TMT attention on the invention patent application is not affected by changes in the estimation method. At the same time, the coefficients of each interaction term are also significant, indicating that the moderating effect of subsidiary autonomy still exists after changing the estimation method.

Endogeneity test

The endogeneity problems that may exist in the research come from two aspects: one is the reverse causal relationship between subsidiary TMT network attention and subsidiary innovation, that is, in order to innovation subsidiaries may have a conscious choice to allocate subsidiary TMT attention at different network levels; second, there may be missing variables in the model design. The study solves above problems jointly by lag period test and panel data fixed effect. The test results are shown in Table 8.

(1) Endogeneity test by the independent variable lag test.

Table 8. Independent variable lag and fixed effect regression results

Notes: t statistics in parentheses, *p < 0.1, **p < 0.05, ***p < 0.01.

The independent variable lag test in Table 8, the coefficients of lag period about subsidiary TMT group network attention and subsidiary TMT external network attention (column (1)) are both significant, and the moderating effects in columns (2) and (3) are also significant, and the overall results are basically the same as the main test.

(2) Robustness test by the fixed effect test.

In the panel data fixed effect regression results, Atten1 is significantly negative at the 5% level (column (4)), Atten2 is significantly positive at the 1% level (column (4)), basically consistent with the main test results.

DISCUSSION

Subsidiary TMT group network attention is negatively correlated with subsidiary innovation, and it is significant at a 1% significance level (β = −0.0097, p < 0.05). The research supports the conclusion put forward by Tripsas and Gavetti (Reference Tripsas and Gavetti2000) and Kleinknecht et al. (Reference Kleinknecht, Haq, Muller and Kraan2020) that TMT attention has a negative impact on subsidiary innovation. Subsidiary TMT external network attention is positively correlated with subsidiary innovation, and it is significant at a 1% significance level (β = 0.0224, p < 0.01). This is consistent with the conclusion of Barker and Mueller (Reference Barker and Mueller2002) that TMT attention could ensure and promote the smooth progress of innovation projects. It also responds to the positive effects of external attention on subsidiary innovation emphasized by Levy (Reference Levy2005) and Yadav et al. (Reference Yadav, Prabhu and Chandy2007). Although the research results of this article support the existing research conclusions, the argumentation perspectives are quite different. It is different from the existing research that regards TMT attention as a limited and scarce resource of the company and explores its impact on company innovation. This article focuses on how the subsidiary TMT allocates limited attention, and specifically regards TMT attention as a resource acquisition channel, to discuss its relationship with subsidiary innovation. The above-mentioned main effect hypothesis is supported by empirical testing, which proves that TMT attention plays an important role in resource acquisition. By comparing regression coefficients of the impact of subsidiary TMT group network attention and external network attention on subsidiary innovation (|−0.0097| < |0.0224|), the negative effect of subsidiary TMT group network attention on subsidiary innovation is less than the positive effect of subsidiary TMT external attention on subsidiary innovation. It can also be said that at the same level, compared with the inhibition of group network attention on subsidiary innovation, external network attention has a more obvious promotion effect on subsidiary innovation.

The interaction term coefficient of moderating effect about subsidiary autonomy on the relationship between subsidiary TMT group network attention and subsidiary innovation is positive and significant (β = 0.0718, p < 0.05), indicating that autonomy can negative moderate the relationship between TMT group network attention and subsidiary innovation. It can be seen from the moderating effect diagram that in the high subsidiary autonomy scenario, the subsidiary group network attention is positively correlated with subsidiary innovation, and in the low subsidiary autonomy scenario, the relationship is negatively correlated. This shows that subsidiary autonomy can not only affect the size of the relationship between subsidiary TMT group network attention and subsidiary innovation, but when a certain threshold is reached, the relationship will change, that is, from negative to positive. The possible reason is that the continuous increase in subsidiary autonomy will activate the subjective initiative of subsidiary to a certain extent. For the long-term sustainable development, subsidiary will be active in improving the efficiency of resource utilization and its own capabilities. Moreover, under the predicament of homogeneity of resources in the group network, and in order to achieve its own operational goals, subsidiaries with high autonomy will actively build relationships with entities outside the group network to obtain heterogeneous resources that are complementary to the group's internal resources, and low parent company monitoring ensures the success rate of these resources acquisition. The improved efficiency in complementary resource acquisition and utilization brought by a gradual increase in the level of subsidiary autonomy, promoted the influence of TMT group network attention on subsidiary innovation changing from negative to positive.

The interaction term coefficient of moderating effect about subsidiary autonomy on the relationship between external network attention and subsidiary innovation is positive and significant (β = 0.1182, p < 0.1). It shows that subsidiary autonomy can positive moderate the relationship between TMT external network attention and subsidiary innovation. It can be seen from the moderating effect graph that whether it's in the context of high subsidiary autonomy or low, influence of subsidiary TMT external network attention on subsidiary innovation is always positive, and the high-level subsidiary autonomy line has always been above the low-level subsidiary autonomy line, indicating that compared with the low-level subsidiary autonomy, the high-level subsidiary autonomy has a more obvious moderating effect on the relationship between subsidiary TMT external network attention and subsidiary innovation.

In summary, the moderating effect of subsidiary autonomy reflects the influence of autonomy on the efficiency of resource acquisition and utilization, that subsidiary with high autonomy can fully obtain and use regional market information and resources to provide resource support for the identification of strategic opportunities for subsidiary. And it's also in line with principle of Ambos and Birkinshaw (Reference Ambos and Birkinshaw2010), pointed out that even if subsidiaries with low autonomy can obtain abundant resources from parent company, they seldom analysis, process, and utilize the resources for the benefit of their own behaviors. The identification of the moderating role of subsidiary autonomy shows the importance of subjective initiative to inter organizational relations and behavior.