INTRODUCTION

In contrast to Motorola's mobile phone business that was sold for US$2.9 billion in 2014, China's smartphone brand, Xiaomi, achieved an initial public offering (IPO) of nearly $50 billion in 2018.[Footnote 1] Motorola's historical significance yet grim prospect in the Chinese mobile phone market and the contrasted rise of Xiaomi reflect the fundamental changes of this industry during the past 30 years. Although it is widely discussed among practitioners that the rise of these Chinese mobile phone vendors can be attributed to an industry-wide ecosystem in China,[Footnote 2] it still remains unclear how such an ecosystem takes form.

The extant studies argue that business ecosystems[Footnote 3] emerge as collaborative arrangements around two major structural components (Jacobides, Cennamo, & Gawer, Reference Jacobides, Cennamo and Gawer2018), that is, value propositions (Adner, Reference Adner2017) and ecosystem actors (Adner & Kapoor, Reference Adner and Kapoor2010). Such inter-firm arrangements require various patterns of coordination and collaboration (Iansiti & Levien, Reference Iansiti and Levien2004a; Moore, Reference Moore1993; Rong & Shi, Reference Rong and Shi2014) from a wide array of actors with heterogeneous yet interdependent product offerings (Hannah & Eisenhardt, Reference Hannah and Eisenhardt2018). It is the modularity, therefore, that enables ecosystem emergence (Jacobides et al., Reference Jacobides, Cennamo and Gawer2018). This structural discourse sheds light on the configurations of an ecosystem (i.e., value propositions and ecosystem actors) but has overlooked how such an ecosystem comes into being in the first place. Specifically, it assumes that value propositions and ecosystem actors are priori. Dattée, Alexy, and Autio (Reference Dattée, Alexy and Autio2018), therefore, further contend that value propositions are not ex ante, rather, they are the ex post outcomes of ecosystem actors’ collective efforts over time. In this sense, they showcase a process of how ecosystems emerge as consensus is reached among various ecosystem actors regarding value propositions. However, it still remains unclear how ecosystem actors – the other priori treatment in the extant literature – come into being. This is the gap we attempt to fill in this article, especially focusing on the emergence of ecosystem actors.

We employ the value chain lens to explore the emergence of ecosystems in relation to ecosystem actors. This is because, similar to business ecosystems that perceive value proposition as a core structural element (Adner, Reference Adner2017; Kapoor, Reference Kapoor2018; Moore, Reference Moore1993), the value chain approach also resembles various activities and actors organized around specific value propositions (Kano, Reference Kano2018; Porter, Reference Porter1985). Therefore, examining how ecosystem actors come into being involves investigations of the collaborative value co-creation arrangements in the ecosystem context, which resonates with the traditional value chain approach (Gereffi, Humphrey, & Sturgeon, Reference Gereffi, Humphrey and Sturgeon2005; Porter, Reference Porter1985). Indeed, as the value chain approach considers ‘the interdependence among activities … such that the firm's competitive advantage stems from how the different activities fit together’ (Kapoor, Reference Kapoor2018: 4), value co-creation arrangements in value chains are similar to the ecosystem treatments (Adner, Reference Adner2017; Kapoor, Reference Kapoor2018). Given such similarities, one might cast doubts on the added value of the concept of business ecosystems. If ecosystems do have wider boundaries than value chains according to the extant literature, how do these similar value co-creation arrangements extend their boundary beyond value chains? While the value chain underpins value creation activities from the focal firm's perspective, the ecosystem may shed light on the dynamic value creation configurations toward shared visions among all ecosystem actors (Parente, Rong, Geleilate, & Misati, Reference Parente, Rong, Geleilate and Misati2019; Rong, Hu, Lin, Shi, & Guo, Reference Rong, Hu, Lin, Shi and Guo2015). In this sense, we set out to answer the following research question: How do business ecosystems emerge from value chains? In other words, we focus on the temporal dimension in terms of the process of ecosystem emergence in relation to ecosystem actors.

This article employs an inductive, qualitative method. The Chinese mobile phone industry is selected as the empirical context. Specifically, we focus on the vertically disintegrated part of this industry. This is because, first, the mobile phone industry, especially the vertically disintegrated part, consists of many co-evolving actors encompassing various industries and sectors (such as hardware production, telecommunication, internet, and distribution), hence featuring fragmented and disintegrated ecosystem resources for us to observe their emergence over time. Second, unlike previous ecosystem emergence research settings (Dattée et al., Reference Dattée, Alexy and Autio2018), the emergence of value propositions is not salient as the Chinese mobile phone industry imitates the existing value propositions of global leading companies such as Motorola, Nokia, and Apple. Instead, the most salient feature for the Chinese mobile phone industry is the emergence of ecosystem actors, which aligns well with our theoretical motivation.

Our findings enable us to develop a three-stage process model of ecosystem emergence from value chains. In particular, our model offers a two-dimensional account of ecosystem emergence: the temporal dimension delineating three processal stages of ecosystem emergence and the spatial dimension highlighting one architectural pattern of reciprocities between value chains and resource pool over time. In particular, our architectural pattern of business ecosystem emergence goes beyond the traditional interlinks between value chain actors in the extant literature (e.g., Adner, Reference Adner2017) to imply the process through which the interlinked structure emerges from the broader resource pool (Fjeldstad, Snow, Miles, & Lettl, Reference Fjeldstad, Snow, Miles and Lettl2012). Following Geels’ (Reference Geels2014) framework, we also offer inter-temporal enabling conditions including socio-political, technological, and industry regime factors, during the coevolution (Lewin & Volberda, Reference Lewin and Volberda1999) between value chains and resource pool.

In this process model, we define ‘resource pool’ as a shared pool consisting of various ecosystem resources. According to our findings, actors refer to business entities in the value creation arrangements of the ecosystem, that is, the value chains, namely those firms and organizations involved in the value creation process. In contrast, resources are nonphysical assets possessed by various entities and/or their employees, within or outside of the value chain, for instance, knowledge and capabilities. Ecosystems may contain resources that are not possessed by value chain actors before these resources are brought to the value creation arrangements. Thus, the relationship between a value chain and an ecosystem is that the latter contains all the (ecosystem) resources needed to constantly (re-)configure a value chain. In this sense, a value chain may be regarded as the main vehicle for value creation in the ecosystem. In other words, within the same temporal stage, ecosystem actors are identical to value chain actors as the main value creation arrangements. However, besides the value chain, the ecosystem contains a resource pool that does not create value directly, but goes beyond what value chain actors in the current stage may possess and could nevertheless be exploited to reconfigure value chains in the next stage. It is, therefore, the resource pool of an ecosystem that continuously provides new resources for the value chain to be able to reconfigure a new arrangement, thereby transiting to the next stage. Hence, the reciprocities between value chain and resource pool constitute a dynamic view of the ecosystem.

This article contributes to both ecosystem and value chain literatures. On the one hand, by revealing how the reciprocity between value chains and ecosystem resources shapes ecosystem emergence over time, our process model offers a dynamic and holistic view of business ecosystems, as a complement to the ex-ante assumption of ecosystem actors in the current literature (e.g., Adner, Reference Adner2017). Adding onto prior studies of ecosystem dynamics (Ansari, Raghu, & Kumaraswamy, Reference Ansari, Raghu and Kumaraswamy2016; Dattée et al., Reference Dattée, Alexy and Autio2018; Liu & Rong, Reference Liu and Rong2015), we also aspire to introduce value chains as the foundation of ecosystems to distil such dynamics. On the other hand, our process model extends the value chain literature by explicating how value chains are dynamically reconfigured and therefore able to evolve from one stable arrangement to another through the reciprocities between value chain and resource pool, as a complement to the perspective of static optimized systems in the extant literature on value chains.

This article is structured as follows: we start by reviewing relevant literatures and introduce our research design; we then present our process model, and conclude with theoretical and practical implications, and some remarks on the transferability of our findings.

THEORETICAL BACKGROUND

In recent decades, scholarly interest on ecosystems has surged dramatically due to increased complexity and uncertainty in firms’ collaboration and competition. The concept of business ecosystems was initially derived from a biological analogy of the phenomenon that industrial, social, economic, and geographical factors are intertwined to form a complex system of interactive community based on a common foundation (Moore, Reference Moore1993). Since Moore's description of the ecosystem as an economic community consisting of interacting organizations, scholars have identified the key ecosystem constituents and interactions between them, highlighting keystones, dominator, niche players, and hub landlords as four types of ecosystem actors (Iansiti & Levien, Reference Iansiti and Levien2002, Reference Iansiti and Levien2004a, Reference Iansiti and Levien2004b).

Early conceptualizations, however, did not clearly identify the boundary of an ecosystem. Enacting an ecosystem-as-structure perspective, Adner (Reference Adner2017: 42) defined an ecosystem as ‘the alignment structure of the multilateral set of partners that need to interact in order for a focal value proposition to materialize’. Based on the input and output flows with respect to a focal firm in the ecosystem, Adner and Kapoor (Reference Adner and Kapoor2010) analyzed how various ecosystem actors, including suppliers and complementors, are structured around a focal value proposition and its implication for focal firm's innovation performance. Following an evolutionary perspective, Rong and Shi (Reference Rong and Shi2014) further deconstructed business ecosystems by lifecycle stages and configuration patterns, demonstrating the coordination and collaboration among various ecosystem actors over time. More recently, an ecosystem is defined as ‘a community of hierarchically independent, yet interdependent heterogeneous participants who collectively generate an ecosystem output’ (Thomas & Autio, Reference Thomas and Autio2020: 38), highlighting the importance of both actors and value propositions in ecosystem emergence.

Although these views differ slightly, a general consensus, synthesizing the above perspectives, is that an ecosystem is consisted of a community of multiple co-evolving actors that organized around specific value propositions/focal offerings/outputs. This is the initial definition of ecosystem we follow to start the enquiry. The value proposition/focal offering/output of a mobile phone ecosystem is, therefore, the mobile phone and its use.

While the above studies offer new insights into how an ecosystem is structured and configured, relatively less is known on how an ecosystem emerges. More specifically, we note that ecosystem actors are assumed as given in previous studies, leaving the emergence of these actors unexplored. For example, Hannah and Eisenhardt (Reference Hannah and Eisenhardt2018) identified three ecosystem strategies – bottleneck, component, and system – that firms could enact to engage with multiple ecosystem actors with given value propositions/focal offerings. In particular, as an emerging ecosystem is constantly changing, its actors and resources are (re-)configured rapidly. It may, therefore, not be feasible to treat actors as given (Hannah & Eisenhardt, Reference Hannah and Eisenhardt2018) unlike in an established ecosystem. Moreover, the emergence of ecosystems, in which actors at various degrees of complementarities (Shipilov & Gawer, Reference Shipilov and Gawer2020) are not controlled in a hierarchical way, may be more complex than value chains (Jacobides et al., Reference Jacobides, Cennamo and Gawer2018).

Furthermore, the mutual dependency between actors and value propositions in value creation makes it more ambiguous to understand how ecosystems came into being (Dattée et al., Reference Dattée, Alexy and Autio2018). In volatile industries such as consumer electronics and portable devices, new value propositions brought by innovative products with the most advanced technologies, like commercial drones, will require combinations of new and existing actors for successful value delivery to customers (Shipilov & Gawer, Reference Shipilov and Gawer2020). It is, therefore, important for firms and governments to gain a comprehensive understanding of ecosystem emergence. In particular, how actors within the ecosystem are cultivated and enriched are critical for their decision-making. Since Dattée et al. (Reference Dattée, Alexy and Autio2018) have explored ecosystem emergence by challenging the assumption that a clear value proposition exists ex ante and shown ecosystem emergence as a process of collective discovery and refinement of value propositions, we would like to take one more step forward by analyzing the emergence of ecosystem actors. The position of this article in relation to Adner (Reference Adner2017) and Dattée et al. (Reference Dattée, Alexy and Autio2018) is illustrated in Figure 1, to highlight our contributions in challenging the ex-ante assumption of ecosystem actors.

Figure 1. Existing literature on the ecosystem (emergence) with regard to our position

We draw on the value chain literature to explore the emergence of an ecosystem, especially how various actors join the value creation arrangements. This is because a value chain is also often organized around a specific value proposition and thus shares similarities with the ecosystem in addressing how firms create value and how other actors contribute to such value creation processes. We start with an initial speculation that value chains may be the underpinning value creation arrangements of ecosystems. To trace how these actors are brought into the value creation process of an ecosystem with a wider boundary compared to a traditional value chain (Kapoor, Reference Kapoor2018), it is essential to turn to the value chain literature to gain insights on how value chains are created by various actors over time.

The value chain approach originates from Porter's (Reference Porter1985) conceptual development. The Global Value Chain (GVC) approach builds upon Porter's work and emphasized the division of labor and geographical spaces. Our use of ‘value chains’ involves both terms as mobile phone production experienced a significant change from vertical integration to specialization with geographical dispersions even within China. Therefore, we follow Porter (Reference Porter1985) and Gereffi et al. (Reference Gereffi, Humphrey and Sturgeon2005), and define a value chain as a sequence or a process of value creation activities to deliver products. As will be shown in our findings, we posit that value chains constitute the foundations of ecosystems: a value chain is the main vehicle for value creation in ecosystems. Besides value chains, an ecosystem includes various resources that have not yet joined the value co-creation process in the value chain.

To summarize, the extant literature focuses more on ecosystems with ex-ante value propositions and ecosystem actors, and significant gaps remain on how such ecosystem components emerge in the first place. Although recent literature has started to pay attention to how firms proactively nurture an ecosystem by manipulating visions/value propositions (Dattée et al., Reference Dattée, Alexy and Autio2018; Rong & Shi, Reference Rong and Shi2014), relatively less is known about how ecosystems emerge in relation to ecosystem actors that are assumed priori. The underlying antecedents, enabling conditions, and outcomes of such emergence also remain unclear (Rong, Ren, & Shi, Reference Rong, Ren and Shi2018; Rong, Shi, & Yu, Reference Rong, Shi and Yu2013). Furthermore, although recent literature sheds light on how ecosystems are structured around particular value propositions (Adner, Reference Adner2017; Adner & Kapoor, Reference Adner and Kapoor2010; Jacobides et al., Reference Jacobides, Cennamo and Gawer2018), it is still unclear how firms adjust their value chains when the ecosystem is evolving, especially when both technology and market uncertainty are high (Dattée et al., Reference Dattée, Alexy and Autio2018). We employ a value chain lens to examine the emergence of ecosystems, with initial speculation that value chains underpin value co-creation activities of ecosystems because they are the main vehicles to deliver outputs described in the extant ecosystem literature. We, therefore, set out to answer the following research question:

-

How do business ecosystems emerge from value chains?

METHODS

Considering the exploratory nature of the research question, a qualitative approach is adopted as rich data and context (Miles & Huberman, Reference Miles and Huberman1994; Yin, Reference Yin2009) can be provided in order to make sense of the process of ecosystem emergence.

Empirical Setting

We select the vertically disintegrated part of the Chinese mobile phone industry as our empirical setting. This is because, first, the mobile phone industry, especially the vertically disintegrated part, comprises many co-evolving actors encompassing various industries (such as hardware production, telecommunication, internet, and distribution), hence featuring fragmented and disintegrated resources for us to observe their emergence over time. Although the mobile phone industry is highly modularized and specialized, there still exists heterogeneity across the industry in terms of vertical integration. For instance, Huawei and Samsung rely significantly less on other actors for components and complements compared to Xiaomi and alike. It is important to focus on the vertically disintegrated part because doing so could maximize the odds of capturing the emergence of these disintegrated resources.

Second, as a complement to Dattée et al. (Reference Dattée, Alexy and Autio2018) who sheds light on the emergence of ecosystem value propositions, we are more concerned with the emergence of ecosystem actors. As the Chinese mobile phone industry imitates the value propositions made by global original equipment manufacturers (OEMs) such as Motorola, Nokia, and Apple over the past 30 years, the more salient feature in this context, instead, is the emergence of numerous actors and the coupled ecosystem resources, to assist in the production of mobile phones (Lee & Hung, Reference Lee and Hung2014) in China. Selecting the Chinese context, hence, enables us to capture how these actors emerge in a consistent and efficient manner.[Footnote 4] Our qualitative approach is also fit for this indigenous setting to reveal novel insights (Li, Leung, Chen, & Luo, Reference Li, Leung, Chen and Luo2012) regarding ecosystem emergence.

We define actors as business entities in value chains, namely those firms and organizations directly involved in the value creation process, while resources are nonphysical assets possessed by various entities and/or their employees, within or outside of the value chain, for instance, knowledge and capabilities. It should also be noted that resources in the focal ecosystem may be actors in other ecosystems, as will be shown later in our findings.

OEM Selection

Although our unit of analysis focuses on the ecosystem, our levers for fulfilling such analysis are mobile phone OEMs. Similar to the automobile industry described in Jacobides, MacDuffie, and Tae (Reference Jacobides, MacDuffie and Tae2016), this is because the Chinese mobile phone industry is primarily driven by OEMs, and their interactions with different types of actors provide a clear picture to aid our understanding of the industrial landscape. We draw on secondary sources to identify the most profound industrial changes and propose a few criteria for screening targeted OEMs: (1) The targeted OEMs should be among the largest OEMs in the Chinese market. (2) The targeted OEMs should fully demonstrate the characteristics (Laamanen & Wallin, Reference Laamanen and Wallin2009; Miles & Huberman, Reference Miles and Huberman1994; Williamson, Reference Williamson2016) of the relevant evolutionary stages of the industry, and they should also cover the whole time span of the mobile phone industry evolution over recent years. (3) The targeted OEMs should reflect our theoretical interests in the vertically disintegrated part of the Chinese mobile phone industry. While the Chinese mobile phone industry demonstrates both vertically integrated and disintegrated patterns of value chain configurations, we are more concerned with the disintegrated part as it may better reflect the disintegrated and fragmented nature of ecosystem resources. For example, we select Xiaomi over Huawei and Samsung because Xiaomi completely disintegrates and outsources almost everything, while Huawei and many others still integrate to some extent. Xiaomi, therefore, acts as a polar case described by Siggelkow (Reference Siggelkow2007) in order to maximize the likelihood of capturing the emergence of ecosystem resources during the smartphone era.

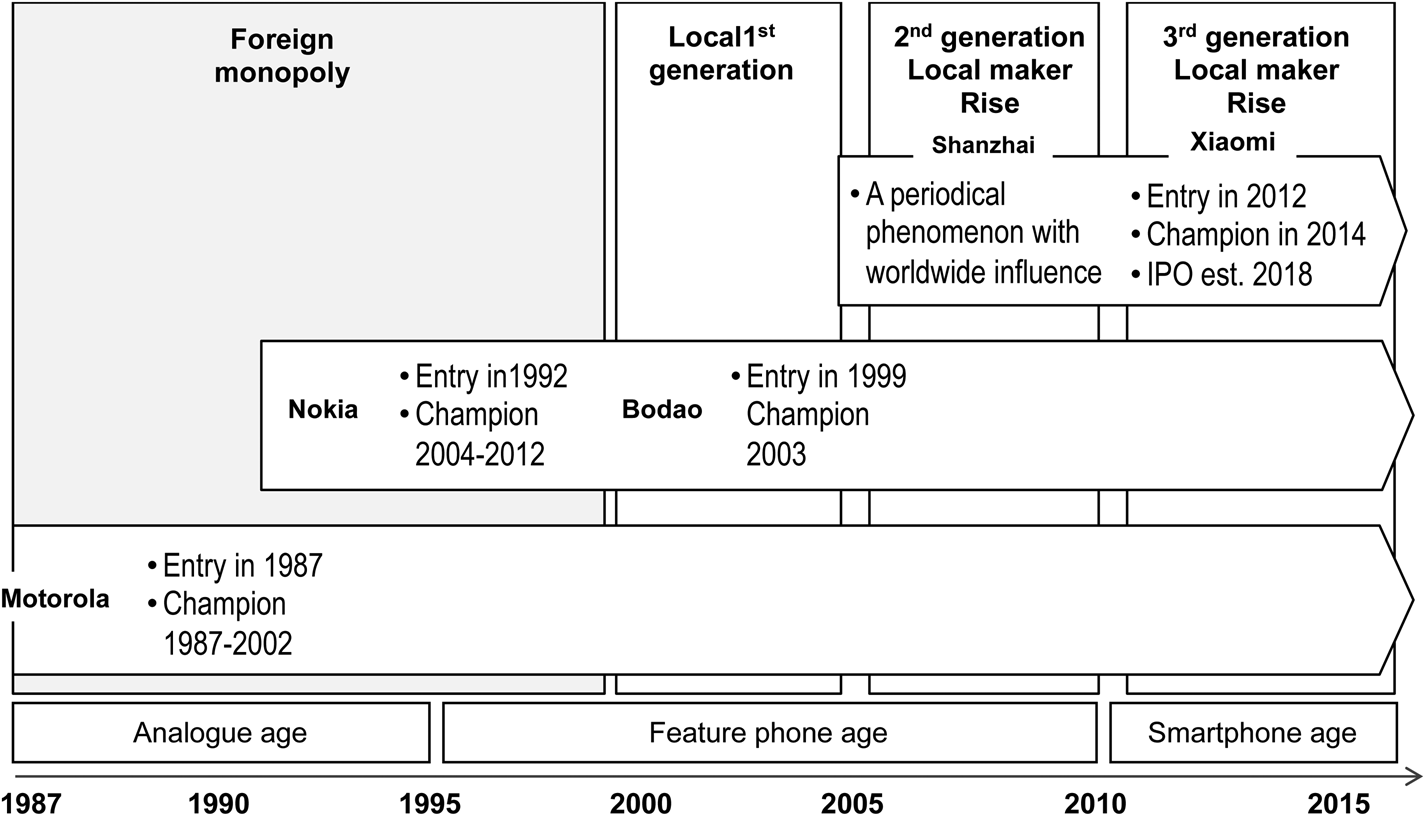

Following the above criteria, we select Motorola, Nokia, Bodao, Shanzhai, and Xiaomi as our targeted OEMs, spanning analog phones, to feature phones and to smartphones (Kenney & Pon, Reference Kenney and Pon2011; Pon, Seppälä, & Kenney, Reference Pon, Seppälä and Kenney2014), as is shown in Figure 2. Different from other OEMs, Shanzhai OEMs are copycats clustered around Shenzhen from the early 2000s to early 2010s (Lee & Hung, Reference Lee and Hung2014). Producing extremely cheap but functionally innovative mobile phones, they are treated as a single set of OEMs in this article because (1) they demonstrate very high homogeneity in their structures and behaviors and (2) they have collectively exerted a huge influence on the mobile phone market.

Figure 2. OEM selection in relation to industrial evolution

Data Collection

Both primary and secondary data are used in order to triangulate and increase the validity of the case studies (Yin, Reference Yin2009). Primary data are mainly from interviewing key employees in the case companies, either through site visits or remote calls. Our interviewees include current and former senior executives, project/product managers, supply chain managers, production operations managers, and public relationship managers for all OEMs. In addition, we interviewed industry analysts for more insight into the whole mobile phone industry. We also included interview excerpts in our analysis from other ecosystem actors, such as service providers, component suppliers, and operators, to provide complement perspectives.

In total, we carried out 85 interviews adding up to 186 hours, as illustrated in Table 1. To ensure data triangulation and constructive validity (Miles & Huberman, Reference Miles and Huberman1994; Yin, Reference Yin2009), we also compared the primary data with secondary data such as media reports and documentaries of the activities of each firm and their partners, as is detailed in Table 1.

Table 1. Data sources

Our interview questions are listed in Table 2. The first set of questions is related to the landscape of the whole industry and how it evolves. The second set addresses the historical development of the OEMs. The third set is on how OEMs (re-)configure their value chains and how they benefit from and are beneficial to the other ecosystem actors.

Table 2. Data collection protocol

Data Analysis

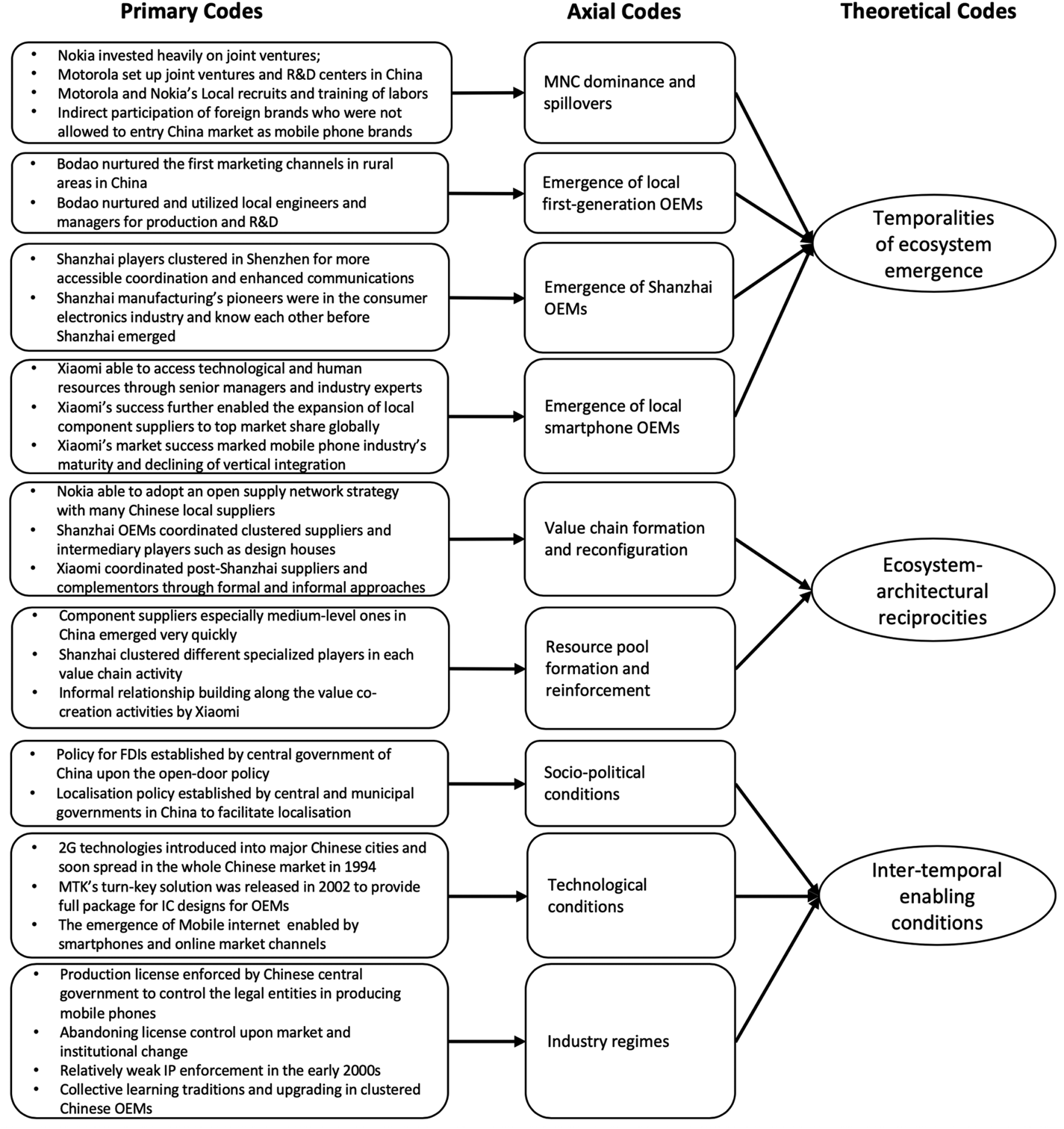

All interview recordings were transcribed immediately after site visits and interviews. Secondary data were also collected before and after the interviews for triangulation. We first conducted open coding (Glaser & Strauss, Reference Glaser and Strauss1967; Miles & Huberman, Reference Miles and Huberman1994) with the primary data. After open coding, we validated all codes using secondary data to reduce biases and ensure reliability and examined if any new open codes emerged. Each author then compiled emerging primary codes based on open codes, providing a basis for the axial coding.

We compared the axial coding developed by each author until an axial coding system emerged that was agreed on by all authors. With these axial codes, it is possible to link the cases with theories. Finally, consistent with Dey (Reference Dey2003), we conducted selective coding and linked axial codes with theoretical terms. Our data structure is illustrated in Figure 3.

Figure 3. Data structure

Inductive coding enables us to identify the architectural pattern of the process model, which is the reciprocity between value chains and the resource pool. In order to further enrich the model, we followed the suggestions made by Langley (Langley, Reference Langley1999; Langley, Smallman, Tsoukas, & Van de Ven, Reference Langley, Smallman, Tsoukas and Van de Ven2013) to examine the ‘continuity’ of process and distil the temporal dimension of the process model. By using a temporal bracketing strategy (Langley, Reference Langley1999), we are able to further delineate the boundaries of temporal stages and, more importantly, the enabling conditions during the transitions between stages (Van de Ven & Poole, Reference Van de Ven and Poole1995). Notably, we follow Geels (Reference Geels2014) in identifying how socio-political, technological, and industrial regime conditions across various temporal and spatial dimensions enable transitions between stages.

RESULTS

Our data show that the emergence of the Chinese mobile phone ecosystem unfolds in three temporal stages, featuring reciprocities between value chains and ecosystem resources that enable ecosystem emergence over time. These stages include multinational corporations’ (MNCs’) dominance and spillover, the emergence of local OEMs, and the emergence of smartphone OEMs. Notably, Stage 2 includes two sub-phases where first-generation local players and Shanzhai OEMs both enabled the dynamics between the resource pool and value chains in a different manner.

Stage 1: MNC Dominance and Spillover

The branches located by MNCs in China laid the foundation for the local resource pool and dynamics between the resource pool and newly formed value chains. We show how the value chain manifests in Stage 1, as shown in Figure 4.

Figure 4. Illustration of key actors and resources in Stage 1

The value chain formed at this stage was highly vertically integrated, controlled by MNCs such as Motorola and Nokia. Although mobile phones at this stage were functional devices with only a few modules, there was a lack of component suppliers in China. Most of the key components and materials for manufacturing were sourced by MNCs from abroad and imported into the mainland through foreign direct investments (FDIs). The FDIs from multinationals such as Nokia played a key role in cultivating local resources during the 1990s. Nokia set up joint ventures in China and collaborated with local universities and telecommunication companies to develop customized technologies and functions for the Chinese market. Nokia has brought not only its own mobile phone plant but also 15 of its international component suppliers to the Star Network Industrial Park in Beijing, which involved an initial investment of approximately US$1.2 billion (Ernst, Reference Ernst, Yusuf, Altaf and Nabeshima2002). During this process, many managers and engineers were trained for mobile phone production and supply chain management. A supply chain manager in one of Nokia's key suppliers in China noted:

One of its [Nokia's] most important investment decisions in China was the establishment of Star Network [Xingwang in Chinese] Industrial Park in 2000 in Beijing, China, which gathered more than 20 supply chain partners from China and beyond until 2005. This park and the supply network within it were operated by its joint venture with Beijing Capitek, a state-owned company, which represented the cutting edge of supply chain management [SCM] techniques. Many Chinese firms [encountered] the idea of SCM for the first time and learned SCM skills by engaging in this project.

These joint ventures thus passed technologies and tacit knowledge such as mobile phone production know-how to indigenous companies and served as a medium for technology and knowledge spillovers for the emergence of local mobile phones. In the meantime, the components manufacturing infrastructure in China was gradually nurtured and Motorola's local procurement rate grew to 65% in 2000. Although most of these components, such as printed circuit boards (PCBs), were at the low end of the mobile phone value chain, the localized chain was gradually accomplished. As a supply chain manager in Motorola noted:

Motorola not only pioneered FDI in China and directly provided manufacturing capacity for the Chinese telecommunication market but also educated and trained a generation of Chinese telecommunication engineers and managers by transferring related manufacturing and supply chain management knowledge to local industries. Perhaps more importantly, Motorola actually nurtured Chinese suppliers in the mobile phone industry, although its spillover capacity was limited compared to supply chain coordinators like Nokia.

In addition to component manufacturing capabilities, both Nokia and Motorola had also rendered local firms to start businesses in the assembly of handsets. Such low value-added and labor-intensive activity has enabled some local firms to scale up based on the relatively cheap labor and high efficiency in China. At this stage, the key new resources introduced in terms of component manufacturers and mobile phone assemblers were initially from other ecosystems (e.g., foreign consumer electronics). During the localization process, they also induced the emergence of their local counterparts. These resources then became actors of the Chinese mobile phone ecosystem, as we illustrate next.

Enabling Conditions for MNC Dominance and Spillover

Socio-political condition: Policy for attracting FDIs

China's economic development since its openness and reform in the late 1970s has gradually induced the emergence of a large population with growing demand and affordability for mobile services. With the growth of per capita income, the purchasing power of domestic customers began to erupt after 1994 and the number of mobile users grew exponentially to 24 million in 1997, indicating that mobile phones were no longer luxury goods but had become commodity goods in China.

Observing the emerging Chinese market based on growing local demand, foreign enterprises were more confident to establish their branches in the mainland. The ‘Law of the People's Republic of China on Chinese-Foreign Equity Joint Ventures’ was launched in July 1979, which legalized the use of foreign capital. Then, the State Council set up the Foreign Investment Commission to deal with issues associated with foreign investments. The establishment of Special Economic Zones (SEZs) in the early 1980s can be seen as experiments in coastal cities for applying foreign capital in the secondary industry. Since 1984, the economic growth in mainland China has mainly been driven by industrial development, particularly non-state-owned and international trade (Fujita & Hu, Reference Fujita and Hu2001). The legal system for introducing and utilizing foreign capital was gradually improved from the mid-1980s onwards, while MNCs used FDIs as a means to organize production processes worldwide through establishing an international intra-firm division of labor (Sit & Yang, Reference Sit and Yang1997). For instance, when Motorola entered China in the late 1980s, its local procurement rate was only 5%, indicating a weak local manufacturing base at that time. Driven by the entry requirements stipulated by the Chinese government and its own intention for reducing costs, Motorola established joint ventures as well as R&D centers in China with heavy investments. As a senior official of Motorola mentioned in a media interview:

Initially the Chinese government [wanted] to set up the semiconductor component industry via introducing Motorola. After careful consideration, our CEO, Mr Galvin, decided to exchange our technologies with China's market opportunities by investing in the Tianjin plant.

Following Motorola's investments, more FDIs from MNCs were injected into China which enabled the embryonic formation of the mobile phone value chain and resource pool.

Technological condition: Introduction of 2G technology

The entry of FDIs in the Chinese market enabled the formation of mobile phone value chains in China, which then induced the formation of a local resource pool. Moreover, the advancement of telecom technology allowed more integrated and miniaturized designs of mobile phones. While the telecommunication service in China was initiated in 1987, the market did not take off until 1994 when the 2G mobile network, that is, the Global System for Mobile Communication (GSM), was rolled out. In the initial seven years, the demand was suppressed by the high price of handsets and telecom services. As the market progressed from the first generation to 2G technology, as well as the coupled network cost reduction per user, the service price was lowered and more market demands were, thus, activated. To satisfy increasing demands, more enterprises entered component manufacturing and handset assembly, thereby enriching the diversity of local resources. A senior telecom engineer who experienced the period recalled:

The first 2G mobile phone sold in China was made by Ericsson, with a slim body and light weight, approximately 200 g, as well as high quality of network connection. It was launched to the market in 1995 with portability and higher reliability but much lower price than a mobile phone based on analogue technology.

Stage 2.1: Emergence of the Local First-Generation OEMs

After the value chain in the stage of MNC dominance was established, and the emergence of supply-side actors such as integrated circuit (IC) companies and hardware component suppliers, together with intermediaries such as open marketing channels, the existing value chain began to disintegrate. In turn, OEMs in this stage were mainly specialized players who outsourced more activities to the above new actors. We illustrate in Figure 5 how the value chain manifests at this stage, highlighting key actors and resources that emerged.

Figure 5. Illustration of key actors and resources in Stage 2.1

In this stage, we observed the availability of disintegrated supply-side resources at the industry level as the result of the emergence of new actors. As shown in Figure 5, IC companies sensed the market opportunity from Motorola and Nokia's dominant success in China, injecting resources of IC design, R&D, and manufacturing into the industry resource pool. Salient cases in this respect include the entry of Siemens’ Infineon Technologies and Philip's NXP as independent players. These IC-related companies were all introduced as new resources from other existing ecosystems and then became key actors for Shanzhai mobile phone manufacturing in the following stage. In addition, the establishment of China Unicom has brought the American IC company Qualcomm into the Chinese market in 2000. As a new stated-owned telecom operator, China Unicom was granted the licence to operate the Code-Division Multiple Access (CDMA) network. A senior supply chain manager of a component provider, Infineon Technologies, proved its ability to survive independently in 2005:

At that time, Siemens’ performance in handset market was inferior. Infineon was in danger, since, despite nominally independent, it heavily relied on Siemens as the single major account. In 2005, by releasing a single-chip solution with a low price of 100 US dollars, it successfully attracted new accounts including Nokia, LG, and rising Chinese brands such as KONKA and ZTE.

Meanwhile, more component suppliers appeared. Previously, Nokia's open supply chain strategy allowed the emergence of independent local component suppliers. In the early 2000s, as many latecomer MNCs had to enter the Chinese market by establishing joint ventures with local players, their supply chain resources were introduced to China. For example, Bodao's first production line and the components were procured from SAGEM, a French telecom giant who later established a joint venture with Bodao in 2002. Later, local suppliers of components such as camera lenses and batteries emerged. An industry analyst told us:

Around 2005, many factories could produce generic components such as electrical inductance and capacitance for both foreign and domestic brands. These generic components did not have a very high knowledge barrier as they were not exclusive to particular handset hardware interfaces. There were a few design houses created by ex-employees from foreign companies. They configured generic components, basic application software and chipset boards to form standard technique designs of handsets and sold them to low-end local handset manufacturers.

At this stage, the enriched resources also include distribution and retailing services mainly as a result of swarming local players. Previously, the national postal system (later the carriers’ retailing networks) was the only available distribution channel. Since the late 1990s, professional national distributors had emerged, procuring handsets from multiple OEMs and then selling to downstream merchants and retailers. However, their coverage had been limited to city markets as foreign brands’ handsets were relatively expensive at that time. The low-tier markets were left untapped for the rise of first-generation local OEMs. To seize this opportunity, local OEMs managed to secure new intermediary and demand-side resources, because national distributors had declined their request of cooperation due to the low margin of doing business with them. This was how new distribution services were activated in the resource pool. For example, Bodao built its own marketing and distribution network, and nurtured the first-generation mobile phone merchants in the fourth- and fifth-tier cities, forming the marketing resources that were essential for later mobile phone vendors to leverage. One former branch head of Bodao said:

We did a lot to exploit the rural market. Before our entry, handsets were treated as luxury goods and people in villages had little knowledge about them. We had more than 50,000 staff at the peak, who were employed and trained by our local branches, dispatched to assist retailing. Unfortunately, when we fell into troubles, most of them, as well as retailers they had assisted, switched to [our] competitors. You may know, at that time, even Nokia was copying our strategy and channel policies.

In the case of Bodao, even after its collapse, many talented employees continued to work in the mobile phone sector. For example, Tecno, the company accounting for a 40% share of the African mobile phone market, was created by Bodao's former sales executive in 2006.

Enabling Conditions for the Emergence of First-Generation Local OEMs

Socio-political condition: China's localization policy

Although the localization strategy by Nokia and Motorola was partly driven by lowering costs, policy intervention to stimulate localization from the government was a key enabler at this stage. Our data show how the reciprocity between actors and resources was accelerated by the localization policy.

From 1984 to 1992, many development zones were established in the coastal cities of mainland China and preferential policies were offered to encourage localization. Initially, foreign enterprises could locate their manufacturing sites in China for cheap land and labor only if they satisfied the requirements set by the local government. For instance, when Motorola came to China in the late 1980s, the company was required to train local employees and suppliers and thereby transfer technology to Chinese workers and local firms. This is known as ‘obligated embeddedness’, which was adopted by the Chinese government to use foreign capital and expertise to build up and develop its industries at the early stage (Liu & Dicken, Reference Liu and Dicken2006). Motorola brought China advanced management and promotion systems, as well as the Six Sigma strategies for process improvement. It became the first localized foreign giant in the mobile phone sector, as the President of Motorola China noted:

China is not just the assembly factory for Motorola. In China, Motorola should act as a Chinese company, even more ‘native’ than local firms.

After Deng Xiaoping's Southern Tour in 1992, government officials and grassroots entrepreneurs were encouraged to undertake further reforms. As a result, development zones and private enterprises mushroomed within mainland cities. Among these new developments, the Beijing Economic and Technological Development Zone was established in 1994, within which Nokia took the leading role in setting up the Xingwang Industrial Park. In contrast to Motorola, Nokia brought many of its foreign suppliers to the Industrial Park and such localized foreign suppliers could help Nokia to meet the ‘sourcing from local suppliers’ requirement set by the local government, as an executive of Nokia noted in an interview:

Nokia has always committed itself to becoming China's best cooperative partner, and, … without the great support and help from governments at all levels and cooperative partners in China, it would not have been able to score such a development as today.

Industrial regime: Production licence

The requirement of obtaining a production licence in the Chinese mobile phone industry has also played an enabling role in the dynamics between the resource pool and value chains. It should be noted that Geels (Reference Geels2014), whose framework we follow to structure the enabling conditions, suggests distinguishing between specific institutions at the industry level (i.e., industry regime) and general institutions at the societal level (i.e., socio-political environments). Accordingly, the policy of production licence falls into the category of industry regime. This policy created an opportunity for the entry of local OEMs and triggered resource replenishment processes.

From 1998 to 2004, all mobile phones manufactured in China were required to obtain a production licence issued by the Chinese government. This left limited space for the rise of first-generation local mobile phone manufacturers whose resources and capabilities were significantly inferior to foreign competitors. Many local start-ups chose to partner with foreign companies that might find it difficult to enter China's market. While these local start-ups joined mobile phone value chains, foreign firms, as their suppliers or partners, gradually injected resources and capabilities into the resource pool so as to grab a share of China's promising market, which in turn contributed to enriching the resource pool. According to a strategy analyst in a major telecommunication operator in China:

There are 49 licences issued in total so far. Among them, GSM licences are issued to 13 Sino-foreign joint-ventures and 17 domestic firms; CDMA licences are issued to Motorola and other 18 domestic firms.

Stage 2.2: Emergence of Shanzhai OEMs

After the MNC dominance and local first-generation OEMs, individual firms could exploit ecosystem resources and coordinate different players to rapidly (re-)configure their distinctive value chains, which also further enriched the resource pool. We illustrate how the value chains manifest at this stage, highlighting key actors and resources in Figure 6.

Figure 6. Illustration of key actors and resources in Stage 2.2

With the rise of Chinese mobile phone OEMs, the value chain at this stage started to modularize. More ecosystem actors joined value co-creation as ecosystem resources were enhanced further, with increased quantity and specialization of suppliers, complementors, and service providers. As can be seen from Figure 6, the most salient feature at this stage is that the traditional norm of integrated chip design was replaced by design houses and contracted manufacturing service providers who design and deliver a total solution to the OEMs, triggered by MTK's (MediaTek) turn-key solution, which will be discussed later as a key enabling condition for the emergence of Shanzhai OEMs.

The reciprocity between value chain and resource pool remains salient as Shanzhai OEMs coordinate new actors in value co-creation. For example, Shanzhai OEMs heavily clustered in the Shenzhen area and these players formed very close relationships with each other. Initially, many of Shanzhai OEMs’ suppliers were producing components for MNCs such as Nokia and Motorola. As their capabilities grew through this collaboration, many managerial level workers and skilled workers gradually gained the know-how of mobile phone manufacturing and started their own companies along the whole value chain and supplied various components to Shanzhai OEMs. In the meantime, some electronics manufacturers clustered in Shenzhen, whose businesses might not have been involved in the mobile phone ecosystem, chose to join the value chain as suppliers, largely as a result of the increasing modularity of handset products. Regardless of their original businesses, their product development was highly collaborative, featuring incredible speed in new product turnarounds, some of them being as fast as one month. The CEO of a Shanzhai OEM noted:

[Y]ou can find almost all of the components of mobile phones in Shenzhen, so, based on MTK's [MediaTek's] total solution chip, we can easily purchase all the components and outsource assembly locally as well … You cannot believe, we can [take] only one month to develop one generation of mobile phone. Because the independent design houses help us design the whole system, casing companies can quickly produce the prototype and real products as well. All of those components are cheap and easy to assemble, so our mobile phone is very cheap.

Along with the process of reconfiguring value chains with new actors, the resource pool had been gradually reinforced since the Shanzhai era. These Shanzhai OEMs entered the market with very weak technological capabilities and needed to source almost everything from external suppliers rather than developing anything themselves. Their presence provoked the triumph of the upstream of value chains – many Chinese local players, especially from Shenzhen, started to supply components for Shanzhai mobile phone OEMs at very cheap prices. More importantly, although Shanzhai declined after 2010, these actors did not just disappear with Shanzhai, but rather remained as resources in the resource pool for further exploitation by OEMs in the smartphone era. After Shanzhai, the Chinese mobile phone industry gradually became mature and highly modular, with each of the value chain activities being performed by a few companies who could provide good enough and affordable components or solutions compared to international brands. The mature resource pool, thus, further afford the emergence of Chinese new-generation brands such as Xiaomi.

Enabling Conditions for Shanzhai Emergence

Technological condition: Leveraging MTK's turn-key solution

Although policy intervention seemed to be particularly effective in the early stage of ecosystem emergence (Augier, Guo, & Rowen, Reference Augier, Guo and Rowen2016), the key enabler for the emergence of Shanzhai OEMs could be attributed to the diffusion of MTK's chipset solutions.

In the early 2000s, although several local makers had achieved high market share in low-tier markets, they suffered from poor R&D capabilities, sloppy supply chain management, and inferior product innovation. These difficulties were rooted in the structural characteristics of the mobile phone industry. Suppliers were bundled into several major players who owned hardware platforms that determined interfaces between components and the core chipset. The development of such platforms was knowledge-intensive, capital-intensive, and time-consuming, which can only be afforded by global leaders. In fact, the mobile phone industry in the early 2000s seemed more akin to the automobile industry (Jacobides et al., Reference Jacobides, MacDuffie and Tae2016) rather than the PC industry. The CEO of a local mobile phone company recalled:

In the early 2000s, the supply was largely dominated by several big brands, such as Motorola and Nokia. It was because most suppliers in most categories of components organised production around these big brands’ platforms, technologies and products. We [local players] were marginal in the suppliers’ eyes.

These platform owners’ dominant position was disrupted by MTK's turn-key solution for mobile phone manufacturers. As a latecomer, MTK initially found it difficult to compete within the existing industrial architecture as a new entrant. After two years’ accumulation of experience, MTK sensed an opportunity – its competitors (e.g., TI, Qualcomm) only provided chipsets to OEMs, leaving many activities for these OEMs to complete by themselves, such as system integration, UI design, and testing. The problem was that not all OEMs had the resources and capabilities to do so. Then, by integrating core and peripheral chips and standardizing the interface between components and the integrated chipset, MTK successfully launched the turn-key solution. A supply chain manager of a Shanzhai OEM told us:

… For example, once MTK provides a total solution, there are so many ID/MD [industrial design/mechanical design] and casing companies, the design house will immediately roll out the whole system of the mobile phone based on that solution. I also employ one person to purchase the component and outsource the assembly work to local EMS [Electronics Manufacturing Services] companies. So, all of them are working together very smoothly ….

There were three consequences following the implementation of MTK's turn-key solution. First, the barrier to entering mobile phone manufacturing was dramatically lowered because it was much easier and more efficient for firms to design a mobile phone based on MTK's solution. Second, small manufacturers were enabled to gain support from established suppliers. Previously, it had been difficult for them to order components from large suppliers, but the MTK solution provided a shared scale economy across them, thereby motivating suppliers to support small players. Third, component suppliers were liberalized from specializing for hardware platforms and became more modularized. These implications of the diffusion of the turn-key solution, thus, enriched the resource pool by bringing new knowledge (turn-key solution) and services (e.g., contracted manufacturing services) for these local companies. From 2005 to 2010, based on the MTK solution, Shanzhai mobile phone OEMs achieved an accumulative global shipment of more than 600 million sets (Zhu & Shi, Reference Zhu and Shi2010). Pressured by MTK's entry, Qualcomm finally launched a similar chipset solution in 2011.

Industry regime: Abandoning licence control and weak intellectual property (IP) enforcement

Interactions between value chains and the emerging resource pool were also precipitated by the change in industry regimes since Shanzhai. The most salient event that enabled such a change is the abandoning of production licence that was once crucial for local players in learning experiences and accumulating knowledge during the resource pool formation stage. In October 2007, the State Council of China removed the government's control over mobile phone licences and such regulatory change contributed to the legitimacy of Shanzhai manufacturing activities and their legal standing (Lee & Hung, Reference Lee and Hung2014). More Shanzhai manufacturers for mobile phones mushroomed in China and without their own R&D, they chose to follow solutions issued by design houses and integrated different components into mobile phones. As noted above, the production-ready solutions by MTK helped in scaling up Shanzhai manufacturing (Lindtner, Greenspan, & Li, Reference Lindtner, Greenspan and Li2015). As a mobile phone component supplier located in the Huaqiangbei electronics market described,

The lifting of the licensing barrier enabled many Shanzhai enterprises to become branded manufacturers … and the majority of them still kept on making their Shanzhai mobile phones.

By the end of 2007, more than 150 million Shanzhai handsets were manufactured in China and 40% of them were exported to Africa and other regions.[Footnote 5] Although Shanzhai OEMs brought new vitality to the mobile phone industry, they raised the concern of weak enforcement of patent legislation in China. Most of Shanzhai OEMs operated on the borderline of or even violated China's IP laws, while the Chinese court was not so capable of dealing with complicated technological issues (Tse, Huang, & Ma, Reference Tse, Huang and Ma2009). The government did not intervene in the regulation of the Shanzhai market directly but, instead, gradually improved the legal system for IP enforcement to protect enterprises with indigenous innovations and own brands. Moreover, the laissez-faire attitude of the municipal government of Shenzhen toward the Shanzhai OEMs left space for them to grow rapidly. The local government neither imposed any restrictions on Shanzhai OEMs nor launched any preferential policies. Since the advancement of telecom technology and proliferation of smartphones in the 2010s, Shanzhai manufacturers have been able to strive for survival only if they invest in R&D and branding. The potential of Shanzhai for wider industrial applications was a key prerequisite for the development of local ‘makers’ (individual component suppliers) in the following years, as noted by a former distributor of Shanzhai:

… Opinions on IP have become stronger … most of entrepreneurs were among those people who made Shanzhai products. In the past, everyone looked down on Shanzhai products … the idea of ‘Maker’ is the same as Shanzhai … is a spirit of the grassroots.

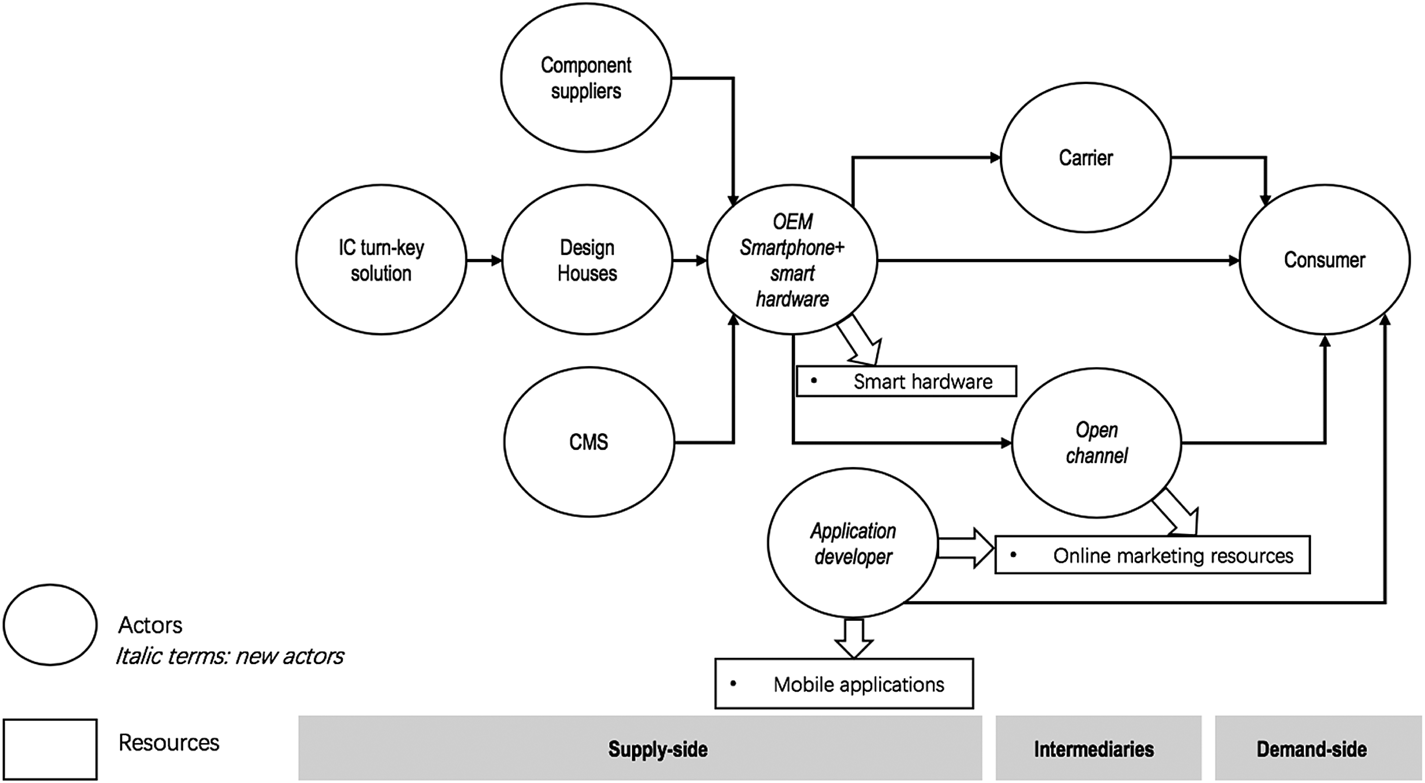

Stage 3: Emergence of Xiaomi

The last stage of development is the emergence of the new generation of Chinese smartphone OEMs such as Xiaomi. We observe that the resource pool embedded within the ecosystem is iteratively reinforced, while resources are exploited to reconfigure the smartphone value chains during value co-creation activities. Such a feedback loop is reflected in three aspects: highly modularized industry, more accessible manufacturing resources, and stronger network ties. We illustrate in Figure 7 how the mature and disintegrated value chain manifests itself at this stage through its most salient feature: the emergence of complementary resources such as smart hardware OEMs and application/service providers.

Figure 7. Illustration of key actors and resources in Stage 3

Xiaomi successfully leveraged new resources from Shanzhai's development such as local manufacturing service providers and design houses for some of their products. In the Shanzhai phase, they produced 2G feature phone components, but in the smartphone phase, they successfully upgraded their production lines and started to supply smartphone components. As noted by an industry analyst specializing in the smartphone market:

Xiaomi's success can be partly attributed to Shanzhai … The reason why I say this is because, by the time Xiaomi came into the market, Shanzhai's value chain [was] very mature … Xiaomi did not have to know how to assemble a smartphone by themselves … Instead it just utilised the existing industrial chain formed in the Shanzhai era … For example, one of the independent design houses that emerged in the Shanzhai trend helped Xiaomi to design its RedMi, one of its most popular smartphones ….

More interestingly, the network ties built up in previous phases helped later smartphone OEMs to realize the coordination of not only supply-side resources but also intermediary resources. For instance, one of Xiaomi's co-founders is a former Motorola China hardware director, whose professional networks in value chains help secure key component providers of, for example, displays and batteries.[Footnote 6] A supply chain manager in Xiaomi noted:

He [Lei Jun] kept a good relationship with Dr Zhou [the former hardware manager of Motorola in China], who later became a key member in the initial founding team of Xiaomi. His joining provided more opportunities for us to source components from top suppliers.

Besides leveraging new resources gained from the emergence of Shanzhai, Xiaomi's contribution to the resource pool followed a similar logic to Shanzhai's. As indigenous OEMs like Xiaomi gradually developed to capture the majority of the Chinese market, their volume of production enhanced the capabilities and technologies of local suppliers and manufacturing service providers. For example, Sunny Optical rose from a low-end local supplier of mobile phone camera modules to a mid-end international supplier with the highest market share globally within just a decade, due to the continuously huge orders from Chinese brands such as Xiaomi and Huawei, as a supply chain manager of Xiaomi described:

It is definitely a win-win situation. Our suppliers are willing to collaborate with us again and again simply because we can guarantee them a huge order … One of the camera lens companies in Shenzhen actually has become the world's largest supplier recently, because of us and some other Chinese smartphone OEMs.

In this sense, if Shanzhai's contribution to the resource pool is to improve local supply-side resources from zero to one, Xiaomi's contribution to the resource pool is to elevate these resources from one to multiple. Besides increasing accessible supply-side resources, Shanzhai developed stronger network ties within the ecosystem. These network ties – either formal relationships between companies in value chains or informal relationships between senior management individuals – made it easier for firms to navigate and coordinate new value chains. A supply chain manager of a Shanzhai mobile phone OEM noted:

After we developed several types of products, we had a very quick-response network. This is a small community in local Shenzhen, and we know each other. If [there are] any new ideas, this network could help you organise the production easily. For example, right now, besides mobile phone, we can also sell netbooks as well. Almost the same groups of people are doing this new business.

In a similar way, another Chinese brand, Smartisan, also leveraged ties that Xiaomi created with the largest manufacturing service provider, Foxconn, to manufacture their smartphones, although in the beginning Smartisan was nobody in terms of its smartphone shipments. This shows how various resources in the resource pool are reinforced as these OEMs constantly organize their value chains, and can be leveraged by subsequent OEMs.

Enabling Conditions for the Emergence of Xiaomi

Technological condition: The rise of mobile internet

Since 3G and the subsequent 4G became prevalent, the transition from feature phones to smartphones triggered the rise of the mobile internet, which has changed the entire ecosystem. Two types of resources are enabled by the mobile internet: on the one hand, supply-side resources such as application/service providers and smart hardware, which are embedded with new actors such as application developers and hardware OEMs; on the other hand, intermediary resources such as online distribution channels borne out by e-commerce platforms.

Around 2008, the shift from Symbian to iOS and Android largely enriched the availability of applications and contents, resulting in the demise of Nokia. Such a shift changed the value propositions of mobile phones fundamentally: prior to the smartphone era, mobile phones were used for calling, texting, and simple information exchange, but the core value propositions of smartphones became the use of various applications such as WeChat and Alipay. The rise of these third-party application providers has particularly enabled the proliferation of local smartphone OEMs because customization for local demands can be made more easily (e.g., instant messaging and mobile payment), which, in turn, fosters the development of indigenous application providers and hence enriches the ecosystem resources available for subsequent OEMs. A strategy analyst in Tencent explained:

The time between 2011 and 2015 is very important for the mobile internet in China …There are mutual benefits: Chinese app developers provide customised contents to the users which help local OEMs gain market; the surge of Chinese smartphone vendors also brings more downloads for the app developers because there are more and more users in third- and fourth-tier and even lower-tier cities. Most of these people could never afford a smartphone before 2011.

It should be noted that not all ecosystem resources can be attributed to the interaction within the handset industry, particularly in the paradigm shift from PC internet to mobile internet. Many mobile application providers, such as Tencent and many others, established their businesses in the PC internet era. Nevertheless, it is the rise of the mobile internet that enables such convergence and enriches the mobile phone ecosystem.

Besides the emergence of application/service providers, smart hardware products interoperable with smartphones are key emerging complementary resources. For example, although an air purifier and mobile phone cannot be integrated in one device, they can be bundled by using the phone as a remote control and display panel for the purifier. This also applies to other smart home appliances including TVs, air-conditioners, and refrigerators. Since 2013, Xiaomi has formed a strong alliance in which many members have received investment from Xiaomi and shared their marketing and supply networks. Many start-ups have grown rapidly, raising concern from established firms in complementary industries, such as Haier, Media, and Gree, who hence keenly developed new products with connectivity. Meanwhile, other smartphone OEMs (such as Huawei) aggressively competed to attract these hardware OEMs, jointly enriching the variety and volume of these supply-side resources.

Online distribution channels were another key intermediary resource to emerge due to the mobile internet. With only 2% of the sales volume of mobile phones from e-channels in 2010, this figure rocketed to 25% in 2015. Besides the rapid penetration of the internet, this boom could be attributed to the entry of Xiaomi, whose products were initially sold online exclusively. Even before the product release, Xiaomi relied heavily on its own online forum to engage with their ‘fans’ (target customers) about the product specifications. The power of this e-channel was proven by the fact that the online orders exceeded 3 million in the first two days after Xiaomi's opening. Xiaomi's success stimulated imitation from 2011 to 2013. Internet companies raced to enter the smartphone market and traditional OEMs launched sub-brands (e.g., the Honor series of Huawei) dedicated to online sales, enriching the e-channel resources. As Xiaomi's founder noted in a product launching event:

Through online sales, we get rid of middlemen and only sell for 1999 Yuan [for the Mi 1 smartphone]… Our products are not only sold on our Xiaomi website but also on Weibo and many other online platforms.

Industry regime: Collective learning and upgrading

Our findings also show that collective learning and upgrading play a key role in further enriching the resource pool. As observed during the development of Shanzhai OEMs, stronger network ties and accessible production resources in Shenzhen could be attributed to the collective legacies that had been developed in the consumer electronic production in Shanzhai's early stage. Although these players competed against each other in domestic and international markets, the collective learning among them incurred considerable knowledge spillovers, and such spillovers augmented the resource pool, as an investor of an intermediary start-up told us:

The key here is that Shanzhai mobile phone players were not forever ‘Shanzhai’. The reason why they could upgrade is that Shanzhai players were highly interactive and information sharing among them is a widespread industry practice – marketing channels, component, equipment … anything you can think of …

Such a sharing tradition carried over to the smartphone period, when the collective upgrading led by Xiaomi, labeled as ‘the New Made in China’, created many new ecosystem actors, including many smart hardware OEMs, such as smart home appliances (TVs, washing machines, etc.). With these continuing dynamics between ecosystem resources and value chains, the transition to the 3G and 4G phases in terms of smartphone components and services was completed, as Xiaomi's founder noted in an interview:

[Our smartphone] has already brought up many local players [in providing smartphone components and services] … In the future, we aspire to build more than 100 ecosystem chain players … They are made in China and also designed in China, sourced in China … This means we could advance the whole value chain of the Chinese smartphone industry …

An Integrated Process Model

To summarize, we illustrate the process of ecosystem emergence in Figure 8. This integrative model consists of two dimensions: the temporal dimension that highlights the evolution of ecosystems and the architectural pattern that features the reciprocities between resource pool and value chains throughout ecosystem emergence. It also delineates the most salient enabling conditions for each temporal stage as the ecosystem unfolds.

Figure 8. Process model of business ecosystem emergence from value chain

We summarize the emergence of key resources and actors, as well as the different roles of actors in each stage in Table 3. In particular, there are three types of roles among these actors: enabling role such as MTK in facilitating the emergence of Shanzhai mobile phones; integrating role such as the mobile phone OEMs (e.g., Bodao, Xiaomi) in integrating different components and complements into mobile phone products; and participating role for other actors such as IC solution providers and EMS providers who are not platform builders or owners but are critical to the delivery of a coherent mobile phone product. Together, the resource pool and value chain, as well as the interactions between them, constitute a dynamic business ecosystem. According to our model, should smartphones cease to be the focal offering in the future, such an ecosystem may well serve as the basis for a substitute offering to emerge. From that end, the ecosystem built around the new offering will unfold in a similar manner.

Table 3. Emergence of new actors and new resources in the ecosystem

DISCUSSION

Contributions to Ecosystem Literature

Our findings shed light on the understanding of ecosystems with a holistic and dynamic model. Our process model delineates two main components of an ecosystem – value chain and resource pool – as well as their cyclic interactions. The extant literature focuses on value co-creation arrangements within ecosystems, for example, the value co-creation logic between focal firms and complementors (Adner, Reference Adner2017; Adner & Kapoor, Reference Adner and Kapoor2010), and how to create competitive advantages by leveraging ecosystem partners (Iansiti & Levien, Reference Iansiti and Levien2004a, Reference Iansiti and Levien2004b; Moore, Reference Moore1993, Reference Moore1996). However, the underlying assumption of these literatures treats ecosystems actors as priori, whereas, for instance, ecosystem actors can be coordinated only when they exist in the ecosystem. This prerequisite is largely taken for granted in the existing literature (Adner, Reference Adner2017; Dattée et al., Reference Dattée, Alexy and Autio2018; Hannah & Eisenhardt, Reference Hannah and Eisenhardt2018). Contrary to this assertion, ecosystem actors do not magically turn up just because focal firms need them. Rather, they emerge and join value co-creation activities through a reciprocal process.

In this sense, our process model reconciles such a ‘chicken and egg’ tension by identifying the process of ecosystem emergence in relation to the reciprocal interactions between resource pool and value chains – revealing the antecedents, enabling conditions, and consequences of value co-creation activities within ecosystems. The antecedent of an ecosystem is the formation of both the resource pool and value chains. A resource pool contains resources such as technologies, manufacturing resources, human resources, and network ties. Only with these resources would focal firms be able to rapidly establish a stable (or unstable, depending on the industry architecture and clock speed) value chain to deliver products that meet the changing demand of consumers. As previously noted, resources can be assets embedded with actors within or outside of the value chains. When the value chain dissolves, the resources coordinated in this instance do not fade away. Instead, they go back to the resource pool once again and are ready for the next round of configuring and transforming. Besides existing resources possessed by value chain actors in the current temporal stage, the ecosystem resource pool attracts and includes resources that go beyond the existing value chain. The consequence of ecosystem emergence, therefore, is the reinforcement of both the resource pool and value chains as the ecosystem progresses to the next stage, which is reminiscent of path dependency for firms and industries (Sydow, Schreyogg, & Koch, Reference Sydow, Schreyogg and Koch2009; Vergne & Durand, Reference Vergne and Durand2010) in a collective manner. Therefore, we challenge the ex-ante assumption of ecosystem actors (Adner, Reference Adner2017; Dattée et al., Reference Dattée, Alexy and Autio2018; Hannah & Eisenhardt, Reference Hannah and Eisenhardt2018) and offer new insights into how these actors emerge and how the ecosystem's resource pool is enriched.

Previous literature on ecosystems also largely focuses on the static structures of value co-creation arrangements (Adner, Reference Adner2017; Iansiti & Levien, Reference Iansiti and Levien2004b), with fewer accounts of how an ecosystem evolves over time. Particularly when firms are faced with high technology and market uncertainties (Dattée et al., Reference Dattée, Alexy and Autio2018), the ecosystem may well be emergent, resulting in a need to constantly (re-)configure the existing value creation arrangements. By providing an account of ex post ecosystem resources, we offer a dynamic view of how ecosystems emerge and are iteratively strengthened over time along with the reciprocal interactions between value chains and ecosystem resources. Our two-dimensional process model, particularly the spatial dimension of an architectural pattern of business ecosystem emergence, goes beyond the traditional structural interlinks between value chain actors in the extant literature (e.g., Adner, Reference Adner2017) to imply the process through which the interlinked structure emerges from the broader resource pool (Fjeldstad et al., Reference Fjeldstad, Snow, Miles and Lettl2012). This dynamic view partly resonates with prior work on ecosystem nurturing (Autio & Thomas, Reference Autio, Thomas, Dodgson, Gann and Phillips2014; Liu & Rong, Reference Liu and Rong2015) and evolutions (Moore, Reference Moore1993; Rong & Shi, Reference Rong and Shi2014), but differs from them in that we show how ecosystems are shaped under multiple conditions. Furthermore, this article streamlines the relations between ‘value chain’ and ‘ecosystem’. While previous research on ecosystems is often challenged as being similar to value chain treatments (Kapoor, Reference Kapoor2018), our research indicates that an ecosystem can be better understood as the dynamic process featuring the coevolution of value chains and resource pool, initiated by players in different lifecycle stages with different path dependencies (Vergne & Durand, Reference Vergne and Durand2010). As value chains act as the main vehicle for value co-creation, we regard firms’ value chains as the foundations of ecosystems.

Enabling Conditions in Ecosystem Emergence

We also contextualize the enabling conditions for ecosystem emergence by delineating the roles of socio-political conditions, technological conditions, and industrial regimes during ecosystem emergence. Our findings offer new insights into the antecedents of ecosystem emergence that previously focused almost exclusively on modularity (Baldwin & Clark, Reference Baldwin and Clark2000; Jacobides et al., Reference Jacobides, MacDuffie and Tae2016, Reference Jacobides, Cennamo and Gawer2018). Such new insights are twofold.

On the one hand, while the extant ecosystem literature mostly focuses on elaborating ecosystem-internal dynamics, our study suggests that ecosystem-external dynamics are also key to shaping the ecosystem. For example, Jacobides et al. (Reference Jacobides, Cennamo and Gawer2018) assert modularity as the antecedent to ecosystem emergence, but where the modularity comes from and how it comes about are still unclear. In our setting, while ecosystem-internal dynamics, particularly the reciprocity between the resource pool and the value chain, explain ecosystem emergence in part, it is exogenous factors, such as socio-political, technological, and industry regime conditions, that set the stage for these ecosystem dynamics to unfold.

On the other hand, our findings show not only how environmental conditions shape ecosystems but also vice versa: the process of ecosystem emergence could also shape environmental factors. As the notion of coevolution (Vergne & Durand, Reference Vergne and Durand2010) suggested, the enabling effects are bidirectional. For example, as noted in our findings, the de facto significance of the Shanzhai in the 2000s had contributed to the abolition of the control of manufacturing policy, which, however, was the very policy that enabled the development of local first-generation mobile phone OEMs. These dynamics imply how ecosystem evolution could be intertwined with broader socio-political, technological, and industrial contexts.

Additionally, our findings of enabling conditions could also contribute to the Triple Embeddedness Framework (Geels, Reference Geels2014) by shedding light on the heterogeneous temporality and combinations of different factors. Like other coevolution literature (Huygens, Baden-Fuller, Van Den Bosch, & Volberda, Reference Huygens, Baden-Fuller, Van Den Bosch and Volberda2001; Lewin & Volberda, Reference Lewin and Volberda1999), Geels (Reference Geels2014) sheds light on how social, institutional, political, and technological factors have collectively shaped industrial development. However, our findings show that these factors do not necessarily take effect altogether at the same time. Instead, there exists heterogeneous temporal combinations across different factors. Specifically, we show how, in the early stage, the combination of socio-political and technological factors is key to enabling ecosystem evolution, while in the late stage, the combination of technological and industrial conditions set the stage.

Contributions to Value Chain Literature

Our findings also shed new light on the value chain literature. The extant studies focus more on value chain coordination, integration, and alignment (Gereffi et al., Reference Gereffi, Humphrey and Sturgeon2005). These studies unveil the characteristics of transactions between actors within a chain (Sturgeon, Van Biesebroeck, & Gereffi, Reference Sturgeon, Van Biesebroeck and Gereffi2008) and the governance by lead firms (Gereffi, Reference Gereffi1999) but overlooked the ‘design’ of value chains in the first place. We argue that to deal with the increasing technology and market uncertainty (Dattée et al., Reference Dattée, Alexy and Autio2018; Rong & Shi, Reference Rong and Shi2014), it is more important to understand how to design, construct, and reconfigure value chains from the ecosystem's resource pool, in light of the architectural pattern of our process model.

The traditional value chain literature tends to treat value chains as a relatively static, optimized configuration where key focuses are on how to maximize the output of such a stable, given system (Gereffi, Reference Gereffi1999; Porter, Reference Porter1985). Ecosystems, however, bring an evolutionary perspective into this static picture (Rong & Shi, Reference Rong and Shi2014). Such an evolutionary view is not symbolic. Rather, in our findings, it is the resource pool of an ecosystem that continuously provides new resources for the value chain to reconfigure a new arrangement, thereby transiting to the next stage of ‘static and optimized’ configuration. In this sense, we argue that our process model contributes to the value chain literature in demonstrating how value chains are reconfigured and are, therefore, able to evolve from one stable arrangement to another, as a complement to the traditional focus of static optimized systems (Autio & Thomas, Reference Autio, Thomas, Dodgson, Gann and Phillips2014).