INTRODUCTION

Studies on drivers of emerging economy (EE) firms' internationalization have gained prominence. This is primarily due to the growing share of foreign direct investment (FDI) by emerging economy multinational enterprises (EMNEs) (UNCTAD, 2015). The rise in FDI by EMNEs into developed economies in spite of lack of conventional ownership specific advantages like technological know-how, patents, management skills, brands, etc. (Dunning, Reference Dunning1993; Morck & Yeung, Reference Morck and Yeung1991) is even more intriguing. The internationalization of EMNEs has also been multifaceted in terms of motive, paths, processes, and performance (Gaur & Kumar, Reference Gaur and Kumar2010). EMNEs have not only internationalized into other EEs but have also expanded into developed economies to acquire strategic assets and to exploit niche opportunities (Luo & Tung, Reference Luo and Tung2007; Madhok & Keyhani, Reference Madhok and Keyhani2012; Mathews, Reference Mathews2006). With the rapid increase in internationalization of EE firms in the past two decades, there has been a growing interest among scholars in decoding the different motives of internationalization (Guillén & García-Canal, Reference Guillén and García-Canal2009; Ramamurti, Reference Ramamurti2012) and also the contextual factors that drive EMNE's internationalization (Chittoor, Aulakh, & Ray, Reference Chittoor, Aulakh and Ray2015; Cui, Meyer, & Hu, Reference Cui, Meyer and Hu2014).

The extant literature on drivers of internationalization of EMNEs has focused on home country institutional factors like government policies (Gaur, Ma, & Ding, Reference Gaur, Ma and Ding2018; Popli & Sinha, Reference Popli and Sinha2014), firm's industry specific drivers like competition, technology intensity (Cui et al., Reference Cui, Meyer and Hu2014; Gaur et al., Reference Gaur, Ma and Ding2018), and firm specific characteristics (Cui et al., Reference Cui, Meyer and Hu2014; Guillén & García-Canal, Reference Guillén and García-Canal2009; Ramamurti, Reference Ramamurti2012). The focus of most of these studies has been on drivers of internationalization of EMNEs per se, without differentiating between the motives of internationalization. We argue that each internationalization decision would be driven by an underlying motive. The motive of internationalization in turn would be driven by firm's context. Hence, classification of different motives of internationalization of EMNEs and differentiation between firms’ characteristics that shape up these motives is a gap in literature that we intend to address in this study. Specifically, our research objectives are: (1) to offer a classification of motives of internationalization of EMNEs in knowledge intensive industries, and (2) to identify and differentiate between the firm specific characteristics that drive the different motives of internationalization of EMNEs in these industries. Our study has implications for understanding of FDI strategies of EE firms.

The spring board perspective (Luo & Tung, Reference Luo and Tung2007) and other notable theoretical perspectives on internationalization of EMNEs (Madhok & Keyhani, Reference Madhok and Keyhani2012; Mathews, Reference Mathews2006) highlight various motives of internationalization of EMNEs. These include acquisition of strategic assets and natural resources (e.g., Athreye & Kapur, Reference Athreye and Kapur2009; Gaur & Kumar, Reference Gaur and Kumar2010), exploitation of EMNE's unique characteristics like low cost operating capabilities, and faster technology adoption into international markets (Contractor, Reference Contractor2013; Guillén & García-Canal, Reference Guillén and García-Canal2009). EMNEs have also internationalized to diversify their risk of operation and to escape institutional constraints at home (Gaur & Kumar, Reference Gaur and Kumar2010). In the current study, we consider the internationalization of EMNEs belonging to knowledge intensive industries. Therefore, we focus on specific motives of internationalization pertaining to such industries.[Footnote 1]

We present a framework to classify various motives of internationalization for EMNEs. This classification of motives of internationalization is based on two dimensions – resource based considerations of the internationalizing firm and location advantages of the host country. The motives of internationalization of EMNEs are thus classified into three broad categories. The first is market-seeking, based on the exploitation of conventional firm specific advantages (FSAs) into other EEs or least developed countries. The second is opportunity-seeking (Luo & Tung, Reference Luo and Tung2007; Madhok & Keyhani, Reference Madhok and Keyhani2012), driven by exploitation of firm's unconventional advantages across niche opportunities in developed countries and the third is augmentation of FSAs, termed as strategic asset-seeking (Luo & Tung, Reference Luo and Tung2007).

To identify the unique advantages of EMNEs, we draw upon the recent extension of the spring board perspective (Luo & Tung, Reference Luo and Tung2018). The spring board perspective highlights the unique advantages of EMNEs as amalgamation, ambidexterity, and adaptability (AAA), which they leverage upon internationalization. Besides firm specific characteristics, a firm's motive of internationalization is also influenced by the home country's government policies and the industry in which the firm operates (Lu, Liu, & Wang, Reference Lu, Liu and Wang2011). To control for such country level and industry level contextual variations, we focus on a sample of Indian MNEs belonging to four knowledge-based industries (Automotive, Pharmaceuticals, Chemicals, and IT).[Footnote 2] The research setting offers a unique advantage of having firms with a mix of motives of internationalization. We prepared a propriety dataset of 781 international expansions of 415 firms in our sample, which include Greenfield ventures, acquisitions, alliances, and joint ventures.

Our empirical findings highlight the significance of different firm level characteristics that influence EMNE's unique advantages of amalgamation, ambidexterity, and adaptability. Empirical findings suggest that firms' investments in R&D is a strong determinant of asset exploitative internationalization. Firms' characteristics like family control and ownership structure are key determinants of opportunity-seeking and strategic asset-seeking internationalization.

We contribute to the literature on EMNE internationalization by providing a framework for classifying different motives of internationalization for knowledge based industries. We prepare a proprietary dataset comprising of different modes of internationalization – Greenfield ventures, alliances, joint ventures, and acquisitions to identify the motives of internationalization. Unlike past studies, which have considered either exports or acquisitions, considering all modes of internationalization provides a holistic picture of internationalization of EMNEs for the industries under consideration. To the best of our knowledge, this is also the first study highlighting the antecedents of opportunity-seeking motive of EMNE internationalization.

In the following sections, we provide a brief review of the motives of internationalization, followed by hypotheses development, description of the sample, and methodology. This is followed by the results and the discussion sections. The final section concludes our study.

LITERATURE REVIEW AND THEORY DEVELOPMENT

Internationalization by EMNEs

The two most popular perspectives on internationalization, internalization theory (Buckley & Casson, Reference Buckley and Casson1976) and the eclectic paradigm (Dunning, Reference Dunning1980) explain internationalization as firms search for markets and natural resources to exploit their ownership advantages (Dunning, Reference Dunning1993; Dunning & Lundan, Reference Dunning and Lundan2008). Although popular, these views do not fully explain internationalization of EMNEs as their sources of advantage, motives, and paths of internationalization are different from developed economy MNEs (DMNEs) (Luo & Tung, Reference Luo and Tung2007; Mathews, Reference Mathews2006).

Several perspectives explain the unique characteristics of EMNE's internationalization. The linkage, leverage, and learn (L-L-L) (Mathews, Reference Mathews2006) perspective views EMNEs as late comers in the international arena. It suggests that EMNEs form linkages with global MNEs, leverage their existing capabilities, and learn about new sources of advantage during internationalization. Similarly, Luo and Tung's (Reference Luo and Tung2007) springboard perspective suggests that EMNEs systematically and recursively use international expansion as a springboard to acquire critical resources needed to compete more effectively against rivals, and also to avoid institutional and market constraints at home. In recent works on EMNE internationalization, Madhok and Keyhani (Reference Madhok and Keyhani2012) conceptualize international expansion through acquisitions by EMNEs as an act and form of entrepreneurship. They suggest that EMNEs, owing to the unique institutional environments they operate in, possess unique characteristics (organizational culture, frugal engineering skills, etc.) which these firms leverage in the international markets.

These perspectives on EMNE's internationalization highlight their unique sources of advantages and motives of internationalization. EMNE's sources of advantage are not their technological and marketing competence but characteristics like frugal engineering, technology adaptation (Guillén & García-Canal, Reference Guillén and García-Canal2009), and network resources like diaspora of local nationals in foreign countries, etc. (Contractor, Reference Contractor2013). The spring board perspective further suggests that EMNEs unique advantages lie in amalgamation, ambidexterity, and adaptability (AAA) (Luo & Tung, Reference Luo and Tung2018). We reiterate Luo and Tung's (Reference Luo and Tung2018) definition of adaptability, amalgamation, and ambidexterity in the following paragraph.

Amalgamation implies EMNE's ability to combine acquired technologies to exploit market opportunities by providing superior price value ratios. Ambidexterity implies EMNE's ability to pursue both exploitation and exploration activities together. It also includes EMNEs ability to operate in difficult institutional environment at home and other EEs and at the same time search for better operating conditions in developed economies. Adaptability on the other hand, underscores EMNE's ability to adapt to changing market and environmental changes during their course of internationalization. EMNE's leverage these unique advantages across international markets.

Drivers of EMNE Internationalization

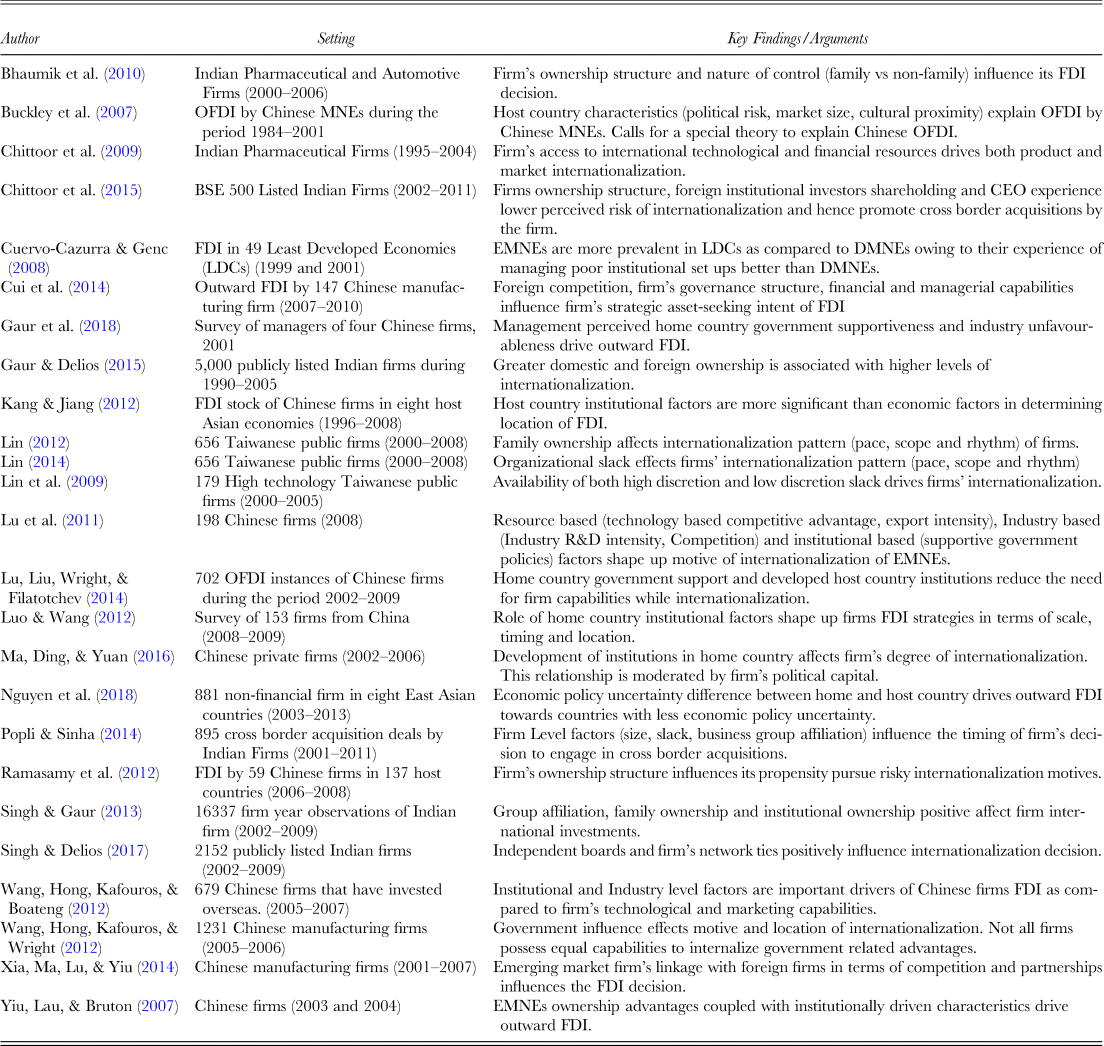

In this section, we briefly review the extant literature on drivers of internationalization of EMNEs. Table 1 presents a summary of some of the recent studies on drivers of internationalization of EMNEs. EMNE's drivers of internationalization have been explained through three different lenses – institution based (Peng, Wang, & Jiang, Reference Peng, Wang and Jiang2008), industry based (Porter, Reference Porter1990), and resource based views (Barney, Reference Barney1991).

Table 1. Summary of recent studies on drivers of emerging economy firm's internationalization

Among the three views, the institution and industry based view explain internationalization of EMNEs at an aggregate level (Duanmu, Reference Duanmu2012). This is evident in the number of studies on drivers of FDI in an EE context (e.g., Buckley, Clegg, Cross, Liu, Voss, & Zheng, Reference Buckley, Clegg, Cross, Liu, Voss and Zheng2007; Kang & Jiang, Reference Kang and Jiang2012). Although, the focus of the majority of the studies has been Chinese FDI, the findings can be extended to other EEs. EMNE's FDI is driven by both home and host country characteristics. Market-seeking FDI by EMNEs is driven by host country market size and geographic proximity to the host country (Buckley et al., Reference Buckley, Clegg, Cross, Liu, Voss and Zheng2007; Kang & Jiang, Reference Kang and Jiang2012). Natural resource seeking and strategic asset-seeking FDI is driven by host countries’ endowment of natural resources and strategic assets (Kang & Jiang, Reference Kang and Jiang2012). FDI by EMNEs is also directed towards countries with high political risk (De Beule & Duanmu, Reference De Beule and Duanmu2012) where the EMNEs can leverage their experience of operating in weak institutional environments (Cuervo-Cazurra, Reference Cuervo-Cazurra2008; Cuervo-Cazurra, Ciravegna, Melgarejo, & Lopez, Reference Cuervo-Cazurra, Ciravegna, Melgarejo and Lopez2018). On the other hand, FDI by EMNEs is also attracted to countries with stable policy regimes where operational risk can be reduced (Nguyen, Kim, & Papanastassiou, Reference Nguyen, Kim and Papanastassiou2018).

Institution based drivers of EMNE internationalization take the form of government policies like tax incentives, protection against political risk, bilateral regional treaties, etc. (Gaur et al., Reference Gaur, Ma and Ding2018; Luo, Xue, & Han, Reference Luo, Xue and Han2010; Pradhan, Reference Pradhan2011). Indian governments also started liberalizing its policies on trade and FDI in 1991. Competitive pressures on Indian firms post liberalization led to increased FDI (Popli, Akbar, Kumar, & Gaur, Reference Popli, Akbar, Kumar and Gaur2017). To promote FDI by domestic firms, Indian governments have relaxed a number of FDI policies (Popli & Sinha, Reference Popli and Sinha2014).

EMNEs also use internationalization as a mode to escape from market constraints at home (Luo & Tung, Reference Luo and Tung2007). These constraints take the form of intense competition both from domestic and foreign firms (Cui et al., Reference Cui, Meyer and Hu2014; Hutzschenreuter & Gröne, Reference Hutzschenreuter and Gröne2009). Expansion into international markets not only provides EMNEs with a larger market but also enables them to augment their asset base so as to be competitive at home (e.g., Gubbi, Aulakh, Ray, Sarkar, & Chittoor, Reference Gubbi, Aulakh, Ray, Sarkar and Chittoor2010; Mathews, Reference Mathews2006).

Even though institutional and industry level factors are essential drivers of FDI, not all firms have the resources and capabilities to leverage these factors (Gaur, Kumar, & Singh, Reference Gaur, Kumar and Singh2014; Wang, Hong, Kafouros, & Wright, Reference Wang, Hong, Kafouros and Wright2012). Firm level factors such as technology and marketing capability, export experience (Gaur et al., Reference Gaur, Kumar and Singh2014; Lu et al., Reference Lu, Liu and Wang2011), and availability of slack resources (Popli & Sinha, Reference Popli and Sinha2014) have been found to influence firms’ decision to internationalize. Firms top management team's experience and orientation (Chittoor et al., Reference Chittoor, Aulakh and Ray2015; George, Wiklund, & Zahra, Reference George, Wiklund and Zahra2005) also influence its decision to pursue risky and costly internationalization modes. A firm's preference to take risky internationalization decisions with a longer term perspective are also determined by its ownership structure, family control (Bhaumik, Driffield, & Pal, Reference Bhaumik, Driffield and Pal2010; Gaur & Delios, Reference Gaur and Delios2015), and business group affiliation (Gaur & Kumar, Reference Gaur and Kumar2009). Although, the above firm level characteristics influence a firm's decision to internationalize, their role in shaping up different motives of internationalization has not been adequately explored in literature.

Motives of Internationalization

In this section, we review the extant literature on motives driving firm internationalization. We first consider studies that have examined these motives from a broad perspective, followed by a survey of studies on motives of firm internationalization from an EE perspective. In the end, we focus on studies in the Indian context, in particular.

Most of the theoretical models of international expansion – the product life cycle (Vernon, Reference Vernon1966), innovation related model (Cavusgil, Reference Cavusgil1980), process model of internationalization (Johanson & Vahlne, Reference Johanson and Vahlne1977), internalization model (Buckley & Casson, Reference Buckley and Casson1976), the OLI framework (Dunning, Reference Dunning1988)–have implicitly assumed the motive of international expansion (Cuervo-Cazurra et al., Reference Cuervo-Cazurra, Narula and Un2015) as market-seeking i.e., firms seek markets to leverage upon their firm specific advantages and resources. There have been a number of classifications of motives of international expansion (Cuervo-Cazurra et al., Reference Cuervo-Cazurra, Narula and Un2015). Amongst them, the motives classification based on the criteria of search suggested by Dunning (Reference Dunning1993) have been the most popular and repeatedly used in literature. Dunning (Reference Dunning1993), based on the OLI framework, suggested motives of internationalization as market-seeking, natural resource seeking, efficiency seeking, and strategic asset-seeking.

The OLI framework explains the internationalization of large and established firms, i.e., firms, that have already developed ownership specific advantages. It does not fully explain the internationalization of EMNEs which are small, resource deficient and do not have ownership advantages of firm specific assets (Luo, Reference Luo2002; Mathews, Reference Mathews2006). Secondly, EE firms learn and gain capabilities during internationalization. The static nature of the OLI framework may not be sufficient to explain the internationalization phenomenon of EE firms (Kedia, Gaffney, & Clampit, Reference Kedia, Gaffney and Clampit2012; Mathews, Reference Mathews2006).

EMNEs internationalize into developed countries to acquire strategic assets that help them overcome their latecomer disadvantage and also compensate for their competitive disadvantage (Luo & Tung, Reference Luo and Tung2007). Further, EMNE's internationalization into developed economies is also characterized by exploitation of their unique sources of advantage in low cost manufacturing (Guillén & García-Canal, Reference Guillén and García-Canal2009; Ramamurti, Reference Ramamurti2012) and relational assets (Madhok & Keyhani, Reference Madhok and Keyhani2012). Consequently, EMNEs look for niche opportunities in international markets to exploit such characteristics (Luo & Tung, Reference Luo and Tung2007). Other motives of internationalization into developed economies include escape from institutional and market constraints at home (Luo & Tung, Reference Luo and Tung2018; Witt & Lewin, Reference Witt and Lewin2007), risk diversification, overcoming negative country of origin labels, and gaining legitimacy (Gaur & Kumar, Reference Gaur and Kumar2010). EMNEs also internationalize into other EEs in search of larger markets to exploit their sources of advantage (Cuervo-Cazurra & Genc, Reference Cuervo-Cazurra and Genc2008).

Indian MNEs have also internationalized to acquire strategic assets such as technologies and brands and to secure a supply of raw materials and natural resources (Athreye & Kapur, Reference Athreye and Kapur2009; Gubbi et al., Reference Gubbi, Aulakh, Ray, Sarkar and Chittoor2010; Gubbi & Elango, Reference Gubbi and Elango2016). Indian IT firms have been most active in internationalization and have entered developed markets to acquire both high end technologies and also to gain proximity to potential clients (Athreye & Kapur, Reference Athreye and Kapur2009; Contractor, Reference Contractor2013). Indian manufacturing firms have internationalized into developed economies to exploit their low cost manufacturing capabilities (Chittoor et al., Reference Chittoor, Aulakh and Ray2015) and have also become preferred partners in the global value chains of large MNEs from developed economies (Giroud & Mirza, Reference Giroud and Mirza2015).

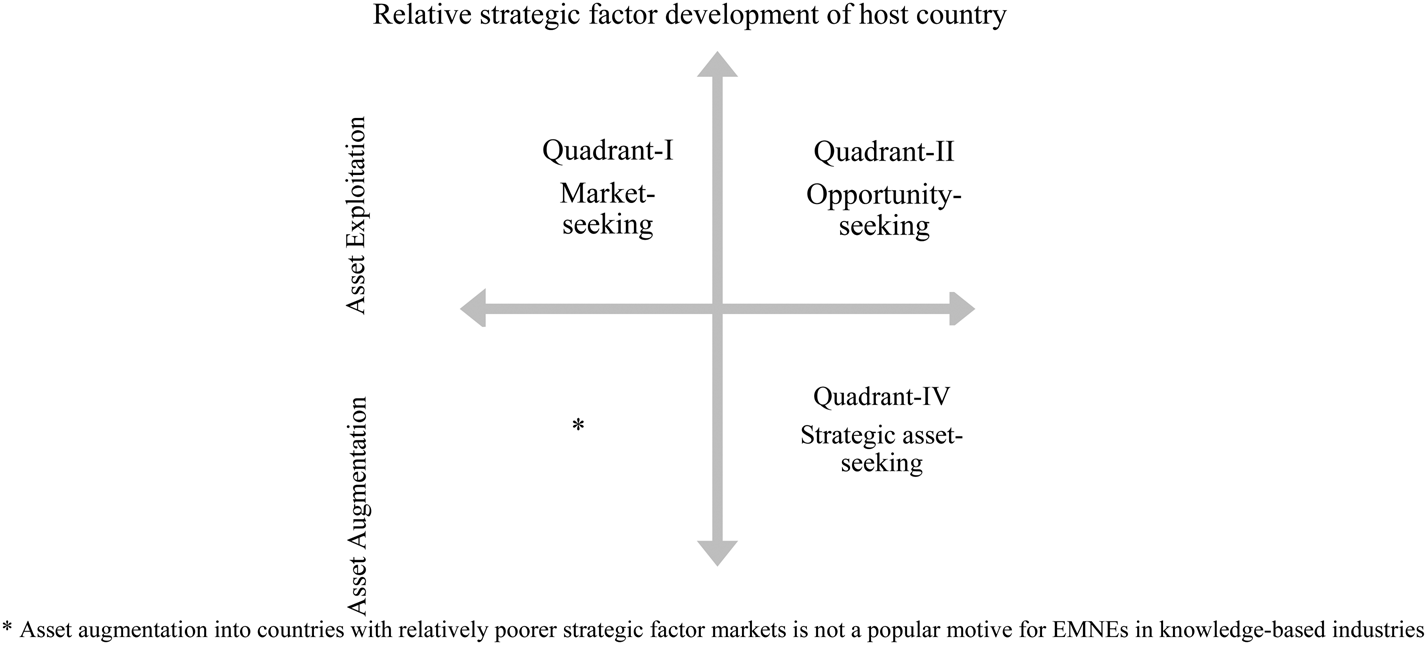

In view of the changing international business landscape due to the emergence of EMNEs in the international business environment, there is a need to reclassify motives of internationalization (Cuervo-Cazurra et al., Reference Cuervo-Cazurra, Narula and Un2015). We respond to the call of Gaur and Kumar (Reference Gaur and Kumar2010) to search for new theoretical approaches to study motivations of internationalization of EMNEs, taking into account their unique aspects. We propose a framework to classify motives of internationalization of EMNEs. We classify the different motives of internationalization based on two criteria. The first is firm's decision to either exploit its sources of advantage or augment its asset base, and the second is locational advantages of the host country (Cuervo-Cazurra & Narula, Reference Cuervo-Cazurra and Narula2015; Makino, Lau, & Yeh, Reference Makino, Lau and Yeh2002; Rugman, Reference Rugman2010). Locational advantages include access to natural resources, important local markets, relatively cheap labor costs, aspects of the infrastructure, the education system, and other aspects of political and government systems (such as investment incentives, intellectual property rights protection and enforcement mechanisms) (Dunning, Reference Dunning1993). Our key premise is that – ‘motives of internationalization of a firm are determined by the interaction of firm's resource based considerations (i.e. exploitation or augmentation of FSAs) and the relative differences in locational advantages of host and home countries’. Based on the two dimensions, we propose a framework to classify the motives of internationalization for EMNEs belonging to knowledge-based industries. The motives are depicted in Figure 1.

Figure 1. Classification of motives for international expansion

Exploitation of FSAs into other emerging or least developed economies

When EMNEs expand into other EEs or least developed economies they are at an advantage as their home grown FSAs are superior to the host country firm's FSAs (Kim, Hoskisson, & Lee, Reference Kim, Hoskisson and Lee2015). EMNEs also possess the experience of operating in an environment with ‘institutional voids' (Cuervo-Cazurra & Genc, Reference Cuervo-Cazurra and Genc2008). EMNEs can exploit both these advantages in such countries. Such host countries are sources of high revenue (Prahalad, Reference Prahalad2004). The internationalizing firm gains from economies of scale as it gets access to a larger market (Buckley et al., Reference Buckley, Clegg, Cross, Liu, Voss and Zheng2007). The firm, thus, complements its home country sales by additional sales from foreign markets. In line with Dunning (Reference Dunning1993), such a motive of internationalization has been termed as market-seeking.[Footnote 3]

Exploitation of FSAs into developed economies

EMNEs have also internationalized into developed countries to exploit their unique advantages. Such an expansion, although similar to market-seeking internationalization, is different in terms of resources exploited. In such an international expansion, the firm is at a disadvantage compared to host country firms, as it does not possess the advantage of ownership specific assets with respect to host country firms. Even though the firm is at a disadvantage, there have been numerous instances where firms, especially EMNEs, have entered developed countries. In such cases, firms primarily compete on the advantages derived from the unique context in which they operate. These advantages take the form of flexibility, speed of operation, ability to operate in difficult institutional and political set ups, flexibility in technology adaptation; low cost operations, etc. (Contractor, Reference Contractor2013; Guillén & García-Canal, Reference Guillén and García-Canal2009; Ramamurti, Reference Ramamurti2012). EMNEs leverage these capabilities across niche opportunities[Footnote 4] in the international markets to compete with global MNEs. Therefore, such an expansion where EMNEs internationalize with an asset exploitation motive without the possession of ownership advantages of assets compared to host country firms has been termed as opportunity-seeking internationalization.

Apart from seeking newer markets to exploit their unique capabilities, EMNEs also undertake opportunity-seeking expansions to by-pass trade barriers imposed by developed economy countries (Luo & Tung, Reference Luo and Tung2007). Further, developed countries also have better supporting institutions associated with them. Operating in countries with better institutional environments provides EMNEs with low risk operating conditions as compared to their home country (Witt & Lewin, Reference Witt and Lewin2007).

Augmentation of FSAs

Internationalization with a motive to augment the firm's asset base helps EMNEs to overcome their latecomer disadvantage and compensates for their asset based disadvantages (Luo & Tung, Reference Luo and Tung2007). EMNEs expand into developed countries to augment their asset-based advantages. Developed countries are characterized by strong regulatory institutions. They also have supporting scientific research institutions, management institutions and basic infrastructure, which are key ingredients for developing upstream and downstream capabilities as both require intensive application of knowledge and creativity (Gaur & Lu, Reference Gaur and Lu2007). In line with past literature, such an international expansion has been termed as strategic asset-seeking [Footnote 5] international expansion (Cui et al., Reference Cui, Meyer and Hu2014; Rui & Yip, Reference Rui and Yip2008). Strategic assets usually take the form of technological knowhow, brands or distribution channels, idiosyncratic assets like manufacturing facilities, managerial skills, etc. (Luo & Tung, Reference Luo and Tung2007; Mathews, Reference Mathews2006).

Although the three motives identified above are distinct, EMNEs may pursue them simultaneously in a particular international expansion. For example, a particular international expansion may provide the firm access to strategic manufacturing facilities (strategic asset-seeking) along with access to newer markets (opportunity-seeking). Thus, opportunity and strategic-asset-seeking motives can also be pursued simultaneously in a single host location. Further, EMNEs, especially in knowledge intensive industries, have limited motivation to pursue internationalization with an efficiency seeking motive. These firms have the benefit of a lower cost of operation in their home market. Further, the natural resource seeking motive is also not popular among MNEs from the knowledge intensive industries. Therefore, the above two motives have not been discussed further in this study.

HYPOTHESES DEVELOPMENT

We distinguish between firm's characteristics that drive different motives of internationalization. Essentially, we draw on the springboard perspective and focus on EMNE's unique advantages of amalgamation, ambidexterity, and adaptability (AAA) to differentiate between firm level drivers of internationalization. These AAA advantages are derived from underlying firm characteristics and vary among firms.

We hypothesize that the capability of amalgamation is reflected by EMNEs’ investment in R&D. EMNEs that invest in R&D are more likely to identify and exploit resource and market opportunities in the international market. Further, we argue that adaptability to the external environment is determined by availability of slack resources with the firm. Ambidexterity in an organization is a result of organization culture, management preferences and its strategic orientation. Therefore, we hold that EMNEs’ ownership structure and nature of control (family vs. non-family) influence organization culture and its orientation. We elaborate upon these ideas in the following sub-sections.

R&D Investments

A firm's investment in R&D is an indicator of its technological capability, i.e., its technological know-how, stock of patents, and research and development ability (Cohen & Levinthal, Reference Cohen and Levinthal1990). In knowledge intensive industries, technological capability is a key source of advantage for firms. EMNEs’ investment in R&D is not an indicator of their possession of cutting edge technologies and original innovations (Guillén & García-Canal, Reference Guillén and García-Canal2009; Ramamurti, Reference Ramamurti2012) but their unique capability in amalgamation (Luo & Tung, Reference Luo and Tung2018). The capability of amalgamation includes EMNEs' unique skills in frugal engineering, flexibility in adapting to new technologies, process innovations, and producing products with suitable price-value ratios (Chittoor, Sarkar, Ray, & Aulakh, Reference Chittoor, Sarkar, Ray and Aulakh2009; Guillén & García-Canal, Reference Guillén and García-Canal2009; Luo & Tung, Reference Luo and Tung2018).

EMNEs that invest in R&D would be more inclined to exploit their unique capabilities into a larger market (Contractor, Kumar, & Kundu, Reference Contractor, Kumar and Kundu2007). Other developing or least developed countries offer a large base of price sensitive customers. EMNEs that invest in R&D are more likely to compete with DMNEs in such markets as their home grown technological capabilities along with experience of operating in weak institutional set up would give them an advantage over DMNEs (Cuervo-Cazurra & Genc, Reference Cuervo-Cazurra and Genc2008). Secondly, the home grown capabilities of EMNEs are superior to those of host country firms owing to relatively better strategic factor markets at home (Kim et al., Reference Kim, Hoskisson and Lee2015). Such firms would be more inclined towards using internationalization to exploit their competitive advantage in other EEs (Luo & Tung, Reference Luo and Tung2007). The firm, thus, complements its home country sales by additional sales from foreign markets. Hence, we hypothesize,

Hypothesis 1a:

A firm's investment in R&D is positively associated with market-seeking internationalization.

While expanding into developed countries with an exploitative motive, EMNEs are at a disadvantage, as they do not possess superior technological capability or global brands compared to host country firms. Even then, there have been a number of instances where firms from EEs have forayed into the world's most developed countries (Child & Rodrigues, Reference Child and Rodrigues2005). In such cases too, EMNEs compete on their ability to amalgamate i.e., identify and combine resources to create products with advantageous price value ratios (Luo & Tung, Reference Luo and Tung2018). Such products can be exploited across niche opportunities in the international markets (Luo & Tung, Reference Luo and Tung2007). Such opportunities, for example, may take the form of generic drug businesses in developed countries for pharmaceutical firms (Chittoor et al., Reference Chittoor, Sarkar, Ray and Aulakh2009), becoming preferred suppliers for GVCs of global MNEs for auto ancillary firms (Giroud & Mirza, Reference Giroud and Mirza2015) or, becoming preferred partners in providing low cost software solutions in the case of IT firms (Athreye, Reference Athreye2005). The potential of such opportunities cannot be attained without requisite resources to realize them. A firm's investment in R&D also adds to its stock of information and help it to identify opportunities in developed markets. Hence, the hypothesis,

Hypothesis 1b:

A firm's investment in R&D is positively associated with opportunity-seeking internationalization.

Spring-boarding helps the amalgamation process by identifying strategic assets in the international markets (Luo & Tung, Reference Luo and Tung2018). The strategic asset-seeking motive is largely driven by firm's strategic orientation, i.e., its global aspirations and external mindset (Cui et al., Reference Cui, Meyer and Hu2014; Kedia et al., Reference Kedia, Gaffney and Clampit2012) and industry related factors like competition in the focal firm's home market (Cui et al., Reference Cui, Meyer and Hu2014; Luo & Tung, Reference Luo and Tung2018).

Compared to market-seeking and opportunity-seeking motive, the role of R&D investments as a driver of strategic asset-seeking motive may be tenuous. In addition to a firm's strategic orientation and industry drivers, it may be necessary to adequately internalize and absorb the knowledge based assets acquired from the developed country markets (Buckley, Munjal, Enderwick, & Forsans, Reference Buckley, Munjal, Enderwick and Forsans2016; Vermeulen & Barkema, Reference Vermeulen and Barkema2001). Such knowledge assets, which usually take the form of patents, propriety assets, etc. can be commercially useful (Cohen & Levinthal, Reference Cohen and Levinthal1990; Zahra & George, Reference Zahra and George2002) only when the firm is aware of their value and has the necessary absorptive capacity (Cohen & Levinthal, Reference Cohen and Levinthal1990). We expect that a firm's R&D investments may have a significant association with the strategic asset-seeking motive. Such a relationship, however, may not be as strong as that of R&D investments and the market-seeking motive or opportunity-seeking motive. Hence, the hypotheses,

Hypothesis 1c:

Firm's investment in R&D is positively associated with strategic asset-seeking internationalization; this positive association shall be weaker in comparison to its association with market-seeking internationalization as well as opportunity-seeking internationalization.

Financial Slack

The business environment that EMNEs face is unique in terms of the institutional setup. It is characterized by weak and under-developed institutions at home and in other EEs. It is also characterized by dynamism in terms of newer market opportunities and strategic assets when they expand into developed countries (Luo & Tung, Reference Luo and Tung2007; Madhok & Keyhani, Reference Madhok and Keyhani2012). A crucial requirement for competing in such environments is the firm's ability to adapt to diverse business environments (Luo & Tung, Reference Luo and Tung2018) which in turn is dictated by the availability of financial slack (Lin, Cheng, & Liu, Reference Lin, Cheng and Liu2009).

In the context of internationalization, financial slack has been found to affect internationalization patterns of the firm (Calof & Beamish, Reference Calof and Beamish1995; Lin, Reference Lin2014). Financial slack has been viewed as a resource that positively affects a firm's internationalization process (Lin et al., Reference Lin, Cheng and Liu2009). We expect that firms with higher levels of financial slack adapt to uncertain business environments more readily as compared to others. Such firms would be in a better position to pursue internationalization motives with higher uncertainty and risk.

Internationalization with a motive to seek strategic assets requires high level of adaptability on the part of the firm. Strategic assets sought by EMNEs in international markets are usually high-end technological capabilities, brands, distribution channels, and managerial capabilities (e.g., Cui et al., Reference Cui, Meyer and Hu2014; Luo & Tung, Reference Luo and Tung2007; Mathews, Reference Mathews2006). These assets, especially in knowledge intensive industries, are intangible in nature. Hence, there is a considerable level of uncertainty in determination of the actual value of such assets (Singla & George, Reference Singla and George2013). Moreover, such assets are acquired through higher order FDI modes like acquisitions and joint ventures (JVs) (Gubbi et al., Reference Gubbi, Aulakh, Ray, Sarkar and Chittoor2010; Reuer, Shenkar, & Ragozzino, Reference Reuer, Shenkar and Ragozzino2004). The success of both acquisitions and JVs is uncertain as failure rates of both of them are high (Lunnan & Haugland, Reference Lunnan and Haugland2008; Ravenscraft & Scherer, Reference Ravenscraft and Scherer1987). Such modes of expansion also require high initial capital (Cui et al., Reference Cui, Meyer and Hu2014). Risk associated with international acquisitions is amplified as EMNEs usually acquire loss-making units (Duysters, Jacob, Lemmens, & Jintian, Reference Duysters, Jacob, Lemmens and Jintian2009), which take time before becoming profitable.

Owing to protectionist policies and the slow pace of liberalization at home, EMNEs have accumulated huge amounts of financial slack by catering to unsaturated domestic markets (Buckley et al., Reference Buckley, Munjal, Enderwick and Forsans2016). EMNEs can leverage this advantage across international markets to adapt to adverse business situations arising out of strategic asset-seeking internationalization. Thus, we hypothesize,

Hypothesis 2a:

Availability of financial slack is positively associated with strategic asset-seeking internationalization.

When EMNEs expand into developed countries to exploit niche market opportunities, they primarily compete on their ability to offer low cost products, speed of internationalization, technology adaptation and ability to adapt to newer and different business environments (e.g., Madhok & Keyhani, Reference Madhok and Keyhani2012). The internationalizing firm has to adapt to developed institutions in host countries along with under developed institutions at home (Luo & Tung, Reference Luo and Tung2018). As opportunities in international markets are exploited, the information diffuses to other competing firms in the host markets. In such a case, the profit accruing to the firm upon exploiting the opportunity may be distributed among other firms as well. Therefore, EMNEs that are able to quickly identify and garner opportunities and adapt to the changing environmental conditions are better placed in the international markets than others. Since, a firm's ability to adapt to the different environmental contexts is determined by the availability of financial slack, we expect firms with an endowment of financial slack to be more active in pursuing opportunity-seeking internationalization. Further, opportunity-seeking internationalization also has certain level of risk and uncertainty associated with it in the form of the costs associated with both liabilities of origin (Ramachandran & Pant, Reference Ramachandran, Pant, Timothy, Torben and Laszlo2010) and liabilities of foreignness (Zaheer, Reference Zaheer1995). Availability of financial slack can help the firm overcome these costs associated with internationalization. Therefore, we hypothesize,

Hypothesis 2b:

Availability of financial slack is positively associated with opportunity-seeking internationalization.

EMNEs also expand into other EEs in search of larger markets. Other EEs are characterized by weaker institutional set ups. Since, EMNEs are accustomed to operating in such environments (Cuervo-Cazurra & Genc, Reference Cuervo-Cazurra and Genc2008), the pressure of adapting to host country environment in such countries for EMNEs shall be lesser as compared to developed economies. Secondly, since EMNEs are better equipped in terms of resources when they enter other emerging or less developed countries (Kim et al., Reference Kim, Hoskisson and Lee2015), it helps them overcome the costs associated with liabilities of foreignness. The liabilities of origin may not be significant as EMNEs enter into other less developed countries. Although, availability of financial slack is beneficial to weather risks of internationalization, it may not be a critical requirement for EMNEs expanding into other emerging or less developed economies. Therefore, we hypothesize

Hypothesis 2c:

Availability of financial slack is positively associated with market-seeking internationalization; this positive association is weaker in comparison to its association with opportunity-seeking internationalization as well as strategic asset-seeking internationalization.

Ownership Structure

The international expansion of EMNEs is characterized by a simultaneous pursuit of divergent goals. Luo and Tung (Reference Luo and Tung2018) highlight such goals as – identification and augmentation of assets from international markets, and at the same time, pursuance of mass production activities at home. Such simultaneous pursuits also include EMNEs’ search for better institutional environment in developed countries as well as exploitation of their experience of operating in weaker institutions in other developing or least developed countries. The above aspects of internationalization of EMNEs underscores their unique capability of ambidexterity (Luo & Tung, Reference Luo and Tung2018). Luo and Tung (Reference Luo and Tung2018) define ambidexterity, as ‘a firm's characteristic property to fulfill two disparate and conflicting goals that are critical to firm's long range success’.

Organization characteristics like a decentralized structure, common culture, vision, shared ambition, supportive leaders and managers are determinants of ambidexterity in an organization (Gibson & Birkinshaw, Reference Gibson and Birkinshaw2004; Tushman & O'Reilly, Reference Tushman and O'Reilly1996). As controlling owners of the firm affect its business development strategies (Connelly, Hoskisson, Tihanyi, & Certo, Reference Connelly, Hoskisson, Tihanyi and Certo2010), we look at firm's ownership structure and nature of control (family vs. non-family) as determinants of its motive of internationalization.

A firm's ownership structure is a key determinant of its strategic orientation (Liu, Li, & Xue, Reference Liu, Li and Xue2011; Zahra, Ireland, & Hitt, Reference Zahra, Ireland and Hitt2000). Strategic orientation is associated with a firm's propensity to take long-term decisions, pursue new market opportunities, innovativeness, managerial vision and proactive competitive posture. Ownership concentration in EE firms is a response to the ‘institutional voids’ (Khanna, Palepu, & Sinha, Reference Khanna, Palepu and Sinha2005) caused by the absence of specialized intermediaries, regulatory systems, and contract-enforcing mechanisms in emerging markets. In EE firms, ownership is concentrated among few shareholders like family owners and financial institutions.

Although limited, few studies (e.g., Bhaumik et al., Reference Bhaumik, Driffield and Pal2010; Gaur & Delios, Reference Gaur and Delios2015) have explored the link between firm's ownership structure and international strategies. Owners in such firms have the ability to monitor and control management as compared to firms with diffused shareholding. Such owners have both incentive and power to pursue risky internationalization opportunities (Gaur & Delios, Reference Gaur and Delios2015; Lien & Filatotchev, Reference Lien and Filatotchev2015; Singh & Gaur, Reference Singh and Gaur2013). On the other hand, Bhaumik et al. (Reference Bhaumik, Driffield and Pal2010) report that firms with concentrated shareholding are less likely to invest overseas as owners wealth may be subjected to risks associated with internationalization. These diverse findings regarding effects of ownership structure on a firm's internationalization preferences can be explained by viewing internationalization from the lens of motives.

Each motive of internationalization necessitates different levels of ambidexterity on the part of the firm. Strategic asset-seeking motive of internationalization requires augmentation of assets acquired from international markets (Luo & Tung, Reference Luo and Tung2018) and simultaneous exploitation of the firm's advantages, like low cost manufacturing capabilities. Such an international expansion requires the firm to forgo short-term gains in view of long-term profitability. Secondly, as strategic asset-seeking investments, especially in knowledge intensive industries, both are costly and risky. Financing of such investments from internal resources may subject the investment of the major shareholders to specific risks of internationalization (Myers, Reference Myers1984). In India, large shareholdings are usually in the hand of family owners and financial institutions. They may not prefer risky internationalization decisions as their wealth may be subjected to specific risks of internationalization. Further, other investors like financial institutions, whose main purpose of association with the firm is for profit making, may discourage strategies that may not be profitable in the short term (Ramaswamy, Li, & Veliyath, Reference Ramaswamy, Li and Veliyath2002). Preference for short term profitability may limit a firm's ambidextrous posture (Gibson & Birkinshaw, Reference Gibson and Birkinshaw2004). Therefore, a firm with concentrated ownership may refrain from strategic asset-seeking internationalization in order to avoid risks associated with it, and focus on short-term profitability. Hence, we hypothesize,

Hypothesis 3a:

Concentration of ownership is negatively associated with strategic asset-seeking internationalization.

Opportunity-seeking internationalization also requires firms to exhibit an ambidextrous posture as firms seek to avoid weaker institutions at home and simultaneously exploit their unique advantages in developed countries (Luo & Tung, Reference Luo and Tung2018). In knowledge intensive industries, EMNEs have to unlearn some of their beliefs and competitive strategies that may have worked in their home country institutional environment (Zahra, Abdelgawad, & Tsang, Reference Zahra, Abdelgawad and Tsang2011), and which may not be required in the newer and more developed institutional set ups (North, Reference North1990). At the same time, EMNEs have to continue their existing strategies of managing institutional constraints in their home markets. Unlearning existing practices and process is both costly and time consuming (Zahra et al., Reference Zahra, Abdelgawad and Tsang2011). Therefore, EE firms with concentrated shareholding, whose main intention is profitability in the short term, may refrain from such strategies.

Although, opportunity-seeking internationalization also has risks associated with it, these risks are lower when compared to strategic asset-seeking internationalization as these strategies are exploitative in nature and initial investment may not be too high as well. Opportunity-seeking internationalization may also act as a mode of reducing risk. Internationalization into countries with better institutional environments lowers the risk of operation (Witt & Lewin, Reference Witt and Lewin2007). It also reduces risk by diversifying the firm's investments (Oesterle, Richta, & Fisch, Reference Oesterle, Richta and Fisch2013). Systematic risks such as political risk, foreign exchange risk and asymmetric information between the MNE and domestic firms are lower in the case of opportunity-seeking internationalization, owing to better institutional setup of the host country. Therefore, we hypothesize,

Hypothesis 3b:

The negative effect of concentrated ownership is weaker on opportunity-seeking internationalization as compared to strategic asset-seeking internationalization.

In comparison to other motives of internationalization, the capability of being ambidextrous may be less needed in the case of market-seeking motive, as EMNEs expand into other EEs and less developed countries. In these countries, EMNEs face familiar environments and also extend their home country practices into the foreign country (Kim et al., Reference Kim, Hoskisson and Lee2015). In such an environment, the EMNE does not face disparate and conflicting goals to the extent faced in the case of expansion into developed countries. In such countries, the systematic risks of internationalization arising out of weaker institutions, political set ups can also be overcome by the EMNEs prior experience of operating in such an environment in their home country (Cuervo-Cazurra et al., Reference Cuervo-Cazurra, Ciravegna, Melgarejo and Lopez2018). Thus, the hypotheses,

Hypothesis 3c:

Ownership concentration is negatively associated with market-seeking internationalization; this negative association is weaker in comparison to its association with strategic asset-seeking internationalization as well as opportunity-seeking internationalization.

Family Control

Family control, which is a feature of many EMNEs, influences the organizational culture, strategic orientation, and decision-making process (Zahra, Hayton, Neubaum, Dibrell, & Craig, Reference Zahra, Hayton, Neubaum, Dibrell and Craig2008). Family members have a strong personal attachment, commitment, and identification with the firm. This manifests itself as a long-term orientation in decision-making, a close-knit community culture in the organization and strong, long-term relationships with stakeholders (Davis, Schoorman, & Donaldson, Reference Davis, Schoorman and Donaldson1997; Miller & Le Breton-Miller, Reference Miller and Le Breton-Miller2006). Family firms usually do not suffer from traditional principal-agent agency costs, as owners themselves are part of the management of the company (Dharwadkar, George, & Brandes, Reference Dharwadkar, George and Brandes2000). This alignment of interests between owners and managers makes the family controlled firms risk neutral, as owners tend to pursue risky strategic decisions if such decisions offer commensurate increase in returns on investment (Carpenter, Pollock, & Leary, Reference Carpenter, Pollock and Leary2003). Family controlled firms also have a longer term horizon as family firms’ main objective is to pass on the business to future generations (Miller & Le Breton-Miller, Reference Miller and Le Breton-Miller2006).

Family firms also tend to be cost effective and avoid risky decisions, as the majority of the family wealth is concentrated in a single business (Anderson & Reeb, Reference Anderson and Reeb2003). Family firms exhibit a centralized organizational control and decision making as owners are reluctant to hire and give control to external managers (Bhaumik et al., Reference Bhaumik, Driffield and Pal2010; Carney, Reference Carney2005). Therefore, we expect family firms to be inherently ambidextrous and hence keen to pursue internationalization as compared to non-family firms (Stubner, Blarr, Brands, & Wulf, Reference Stubner, Blarr, Brands and Wulf2012). Because of the inherently ambidextrous character of family owned firms, the degree to which different motives of internationalization that such a firm exhibits shall vary. We discuss this in detail in the following paragraphs.

With a market-seeking motive of internationalization, EMNEs expand into developing or less developed countries. Family controlled firms would not be averse to expanding in such markets as it promises immediate returns compared to other motives of internationalization. Since the family has been able to negotiate the institutional voids in the home country, they may not need much external support in expanding into other developing or least developed countries. Even if external managers are present, there may not be conflict between owners and managers as both may find entering such markets attractive with a market-seeking motive. Since, market-seeking motive is associated with comparatively lesser risk, the conservative family owned firms might exhibit this motive more prominently compared to non-family firms. Hence, we hypothesize

Hypothesis 4a:

In comparison to non-family firms, family firms are more inclined to pursue market-seeking internationalization.

In comparison to the market-seeking motive of internationalization, the risk associated with opportunity-seeking internationalization is higher. Since the traditional principal-agent agency issues are not prominent in family controlled firms, it is easier to conjure up support for such internationalization strategies, which may be risky, but beneficial in the longer term.

However, the motivation could be diluted by the fact that, at times family members who are also majority shareholders expropriate the firm's resources at the cost of minority shareholders to obtain private benefits (Ashwin, Krishnan, & George, Reference Ashwin, Krishnan and George2015). Such acts go unnoticed in EE firm's home countries where the institutions are weak but are subjected to scrutiny from external regulators, investors, creditors and credit-rating agencies in countries with better institutions (Bhaumik et al., Reference Bhaumik, Driffield and Pal2010).

Additionally, the costly unlearning before beginning to learn and adapt to such environments may be perceived as a constraint to opportunity-seeking internationalization (Kim et al., Reference Kim, Hoskisson and Lee2015; Zahra et al., Reference Zahra, Abdelgawad and Tsang2011). Initial risks associated with cultural and institutional difference may also deter some family owned EMNEs from pursuing internationalization with an opportunity-seeking motive (Zaheer, Reference Zaheer1995).

However, inherently ambidextrous family owned firms would realize that in the longer term, beyond a certain threshold, expansion with an opportunity-seeking motive benefits the internationalizing firm by providing them greater market access (Contractor et al., Reference Contractor, Kumar and Kundu2007). Expansion into countries with better institutions also helps EMNEs alleviate domestic institutional and market constraints (Witt & Lewin, Reference Witt and Lewin2007).

Considering the above, it is likely that the opportunity-seeking motive of internationalization followed by family owned firms will be less intense compared market-seeking motive of internationalization. Therefore, we hypothesize,

Hypothesis 4b:

The positive effect of family control is weaker on opportunity-seeking internationalization as compared to market-seeking internationalization.

Strategic asset-seeking internationalization makes the firm competitive in the longer term (Kedia et al., Reference Kedia, Gaffney and Clampit2012). Family owned firms, which usually have a longer-term horizon, would prefer such strategies as compared to non-family firms.

However, family controlled firms would have to contend with concerns of the family when pursuing the strategic asset-seeking motive of internationalization. The family may be averse to scrutiny that is the norm in countries with better institutions. Various modes of internationalization like M&A, strategic alliances and joint ventures, need not only external capital, but also new routines, practices and systems within the organization (Leonard-Barton, Reference Leonard-Barton1992). Family members may not desire such changes due to social and financial reasons. Socially, such changes may disrupt the close knit social systems built over years and financially, the use of external finance may weaken the control of the family over the firm and simultaneously increase the risk profile of the firm (Dreux, Reference Dreux1990). Further, in knowledge intensive industries, the family may be reluctant to use professional managers, anticipating loss of control in the long run (Bhaumik et al., Reference Bhaumik, Driffield and Pal2010).

Ambidextrous family owned firms may successfully overcome these challenges. However, in view of these concerns, it is expected that strategic asset-seeking motive will be less intensely associated with EMNEs undertaking internationalization, compared to market-seeking and opportunity-seeking motive. Hence, we hypothesize,

Hypothesis 4c:

Family control is positively associated with strategic asset-seeking internationalization; this positive association is weaker compared to its association with market-seeking as well as opportunity-seeking internationalization.

METHODS

The sample for the study comprises of Indian firms belonging to four knowledge intensive industries[Footnote 6] – Pharmaceuticals, Chemicals, Automotive, and Information Technology (IT). Firms in these industries have been the most active in pursuing FDI (Nayyar, Reference Nayyar2008). These industries also give us a set of firms belonging to both service and manufacturing sectors. The Indian context provides us a unique research setting with a mix of market-seeking, opportunity-seeking and strategic asset-seeking international expansions. We focus on firms listed on the BSE (Bombay Stock Exchange) or the NSE (National Stock Exchange) as financial data of listed firms is available from published resources. Since our study is focused on Indian firms, firms that are foreign affiliates of foreign firms have been excluded from the sample. Our data is longitudinal in nature and includes firms that have reported sales in each year of the period of study. The final set is an unbalanced panel data set of 415 firms with 94 firms belonging to the automotive industry, 89 firms belonging to the Chemicals industry, 108 firms belonging to the pharmaceuticals industry and 124 firms belonging to the IT industry. The period of study is 2003 to 2013 as most of the disclosures by Indian firms regarding their ownership structure, foreign expansions like acquisitions, Greenfields, etc. have been post 2001–02. The unit of analysis is firm-year that results in 4565 firm-year observations. The final data set is an unbalanced panel data consisting of 3826 firm year observations for which complete set of financial data was available.

Firm level financial data is collected from Prowess (maintained by Centre for Monitoring Indian Economy (CMIE)). There is no formal database that records all international expansions of Indian firms. Therefore, to identify international expansions (Greenfields, Acquisitions, Alliances and Joint Ventures) of Indian firms we prepared a propriety dataset. We gathered information primarily from annual reports of firms. Annual reports were accessed from Dion Global Solutions – Insight database. We identified a total number of 781 international expansions by the firms in our sample. We excluded expansions that comprised purely special purpose entities (SPEs), or holding companies located in offshore financial centers (OFCs), without any substantive economic and productive substance. The 781 international expansions comprised of 255 acquisitions both full and partial; 290 Greenfields; 114 alliances and joint ventures in a foreign country; 66 alliances and joint ventures in India and 63 instances of technology acquisitions. Both technology acquisitions and alliances/ joint ventures with foreign partners are an important source of acquiring strategic assets from foreign partners and hence they have been included in the sample (Child & Rodrigues, Reference Child and Rodrigues2005).

Dependent Variables

We determine motives based on the two criteria depicted in Figure 1, i.e., asset exploitation vs. asset augmentation, and relative differences in locational advantages of host and home countries. In the first step, the resource based motive, i.e., asset augmentation vs. asset exploitation, was determined by analyzing different international expansions. Consequently, Greenfield ventures and technology acquisitions were classified as purely asset exploitative and asset augmenting respectively. Therefore, green field ventures have been coded as ‘0’ on asset augmentation and ‘1’ on the asset exploitation while technology acquisitions were coded as ‘1’ on asset augmentation and ‘0’ on asset exploitation. The motives for alliances, joint ventures and acquisitions were determined by analyzing the content of ‘management discussion analysis’, ‘director's report’ section of the annual reports using ATLAS/ti, a computer-assisted qualitative data analysis package. In some cases, the information provided in the annual reports was supplemented by news articles. For analyzing the content, we first identified the distinctive lexicon (keywords/phrases) for both asset exploitation and asset augmentation. Key words related to acquiring assets like ‘technology’, ‘brands’, ‘distributional channels’, ‘manufacturing base’, etc. were classified as asset augmentation. Keywords related to ‘faster entry’, ‘gaining a foot hold’, ‘toe hold’, ‘beach heads’, etc. were classified in the asset exploitation category. A complete list of keywords was prepared to be used for software-based content analysis. Next, each text regarding the acquisition, alliance or JV, was classified either as exploitative or augmenting based on the keywords present.

In general, there have been two broad ways of classifying text into different categories. While some scholars have used the frequency with which key words pertaining to a conceptual category occur as an indicator of the concept's importance (Uotila, Maula, Keil, & Zahra, Reference Uotila, Maula, Keil and Zahra2009), others have used the mere presence of a conceptual category as an indication of its significance (Mishina, Pollock, & Porac, Reference Mishina, Pollock and Porac2004). In the current study we use a technique similar to the former wherein based on the occurrence of frequency of keywords pertaining to a specific category implied the importance that category. Hence, if a text contained 7 key words related to asset exploitation category and 3 key words related to asset augmentation category, the text was given a score of 0.7 on asset exploitation and 0.3 on asset augmentation. Since the score on asset exploitation was more than 0.5, the foreign expansion was scored 1 on asset exploitation and 0 on asset augmentation. For cases where the number of key words was same for both categories, the score for both asset exploitation and augmentation was 1. Alternatively, we also did manual coding of the text into asset augmentation and asset exploitation categories.

In the second step, we determined the relative differences in locational advantages of host and home countries. We measured locational advantages in terms of strategic factor markets. We developed a measure similar to the factor market endowment index (FMEI) developed by (Kim et al., Reference Kim, Hoskisson and Lee2015). The index is based upon three broad categories of strategic factors – endowed, advanced and human factors. The index was developed by adding up scores on quality of infrastructure (rail, road, ports, air transport, electricity supply and telephone lines), quality of educational system, quality of scientific research institutions and availability of scientists and engineers. These scores were taken from the World Competitiveness Year Book. Where country scores were not available for a host country, we carefully examined country characteristics such as the legal system, religions, languages, and ethnicity from various sources on the internet and assigned scores using averages of the available scores of countries with similar characteristics. In this manner, we had obtained scores for strategic factors for all countries. Countries which had scores higher than India, were termed as developed countries while countries with lesser scores were termed as developing or under developed countries.

Once the resource based motive and the relative strategic factor market development were determined, we derived the final scores for motives based on the criteria given in Figure 1. All foreign expansions with an asset augmentation motive in countries with relatively better strategic factor markets were classified as strategic asset-seeking. Similarly, exploitative foreign expansion into host countries with relatively better-developed strategic factor markets were classified as opportunity-seeking foreign expansion while those in host countries with relatively poorer strategic factor markets were classified as market-seeking.[Footnote 7] In some cases, keywords related to both asset augmentation and asset exploitation were observed in the available text related to the expansion. Such foreign expansions were classified into both strategic asset-seeking and opportunity-seeking categories.

In this way for each foreign expansion, we were able to assign a score of either 0 or 1 on each category of foreign motive. The yearly score for motive was obtained by summing up scores of different foreign expansions in the given year. The final score for the motive variable was the cumulative sum of yearly expansions with the same motive. We also computed scores for motives based on manual coding of texts describing the intent of acquisitions and alliances. To verify the inter-rater agreement between scores obtained for motives manually and through the content analysis software, we calculated the Cohen's Kappa (Cohen, Reference Cohen1968). The value of Kappa for strategic asset-seeking motive was 0.66, for market-seeking motive, 0.85 and for opportunity-seeking motive, 0.72. Values above 0.60 suggest substantial agreement (Landis & Koch, Reference Landis and Koch1977) between the methods used for determining the motive of internationalization.

Independent Variables

We measured firms’ R&D investments as R&D expenditures as a percentage of net sales. R&D investments is the most widely used measure for firms’ technological capability (e.g., Lu & Beamish, Reference Lu and Beamish2004). Moreover, firms’ investment in R&D is also an indicator of a firm's absorptive capacity (Cohen & Levinthal, Reference Cohen and Levinthal1990). Therefore, using R&D intensity serves the purpose of indicating a firm's level of technological capability as well as absorptive capacity. Financial slack has been measured using a wide range of measures like debt to equity ratio, equity to debt ratio, current ratio, etc. in literature (Daniel, Lohrke, Fornaciari, & Turner Jr., Reference Daniel, Lohrke, Fornaciari and Turner2004; Lin et al., Reference Lin, Cheng and Liu2009). In our study, we require a measure of slack that provides managers high discretion regarding its deployment. Therefore, we use operating cash flows (OCF) available to the firm as a measure of financial slack. Operating cash flow is defined as sales minus the cost of goods sold, sales and general administration expenses and working capital change. We normalized the value of operating cash flows by dividing it by net sales.

For measuring a family's control, an appropriate measure would have been the percentage of voting rights possessed by the family members (Chakrabarty, Reference Chakrabarty2009; Lu et al., Reference Lu, Liu and Wang2011). Due to unavailability of data, we used domestic promoter's share holdings as a proxy for family's shareholding (Ashwin et al., Reference Ashwin, Krishnan and George2015). Family control was operationalized as a dummy variable, which took a value of 1, if the family was the single largest holder in the firm. Domestic promoter's shareholding is a suitable measure as higher promoter's (owners) shareholding would determine the level of owners’ control (Bhaumik et al., Reference Bhaumik, Driffield and Pal2010). We did not use a continuous measure of promoter's shareholding, as family members must have a minimum level of shareholding to exercise control over the firm. To measure level of ownership concentration, we computed the Herfindahl index for all shareholdings of different shareholders. A high value of Herfindahl index would imply concentration of shares among fewer shareholders (Bhaumik et al., Reference Bhaumik, Driffield and Pal2010).

Control Variables

We included controls for firm size and age. Firm's size is measured by the logarithm of net sales while firm's age is measured by the logarithm of the number of years of operation of the firm since inception. Natural logarithm transformation ensured the distribution of data is closer to normality. We controlled for firm's financial leverage, measured as debt-to-equity ratio. Business group affiliation is a predominant characteristic of firms from EEs. We control for business group affiliation by including a dummy variable, which takes a value ‘1’ if a firm is affiliated to a group and ‘0’ otherwise. We also controlled for firm's marketing intensity as it is a key driver of internationalization (Lu & Beamish, Reference Lu and Beamish2004). Marketing intensity was measured as marketing expenses as a percentage of sales. Foreign institutional investors can be a source of information regarding opportunities in foreign markets, hence we controlled for shareholding by non-promoter foreign institutional investors (FII shareholding), measured as a percentage of total shares held by foreign institutions to total outstanding shares. Social networks of EMNEs can also be a source of information of international markets. We control for firm's network ties by including a variable that measures the number of links the focal firm has with other firms. Number of links have been measured in terms of firm degree centrality in its network (Haunschild & Beckman, Reference Haunschild and Beckman1998). Degree centrality reflects the ‘information volume’ available to a focal firm and is the most common measure of firm's position in a network (Ahuja, Reference Ahuja2000). A control for firm's market structure was also included. Market structure measures the level of competition in the firm's industry. Market structure is determined by the Herfindahl index. Herfindahl index is computed using net sales of all companies in the industry. We also controlled for time fixed affects by including dummy variables for each year.

Statistical Analysis

Our sample also comprises firms that have never pursued FDI. Therefore, we followed a two-stage Heckman (Reference Heckman1979) estimation procedure to correct for any sample selection bias. In the first stage, we estimated a probit regression model to predict the propensity of the focal firm to pursue FDI. In this stage, we used a dichotomous dependent variable, FDI, which took a value 1, if the firm pursued FDI during the study period, and 0 otherwise. In this first stage model, we used the firm's international experience and availability of international financial resources as instrument variables to predict the firm's propensity to pursue internationalization. Exports or income from providing services in foreign markets exposes the firm to a host of new challenges, capabilities and customer needs of the host country (Cui et al., Reference Cui, Meyer and Hu2014). Therefore, a firm's international experience may drive FDI decisions. We measure international experience by measuring the contribution of the firm's foreign sales in total sales i.e., foreign sales divided by total sales. Availability of international financial resources also influences the FDI decision (Chittoor et al., Reference Chittoor, Sarkar, Ray and Aulakh2009). Therefore, we include international financial resources in model 1 as an instrumental variable. International financial resources available to the firm were measured as the sum of foreign equity and foreign debt available to the firm. We divide this sum by total liabilities of the firm. The value of inverse-mills ratio generated from the first stage was used in our main regression model. The dependent variable i.e., motive of internationalization in the second stage model is a count variable. The dependent variable is over-dispersed, as there are a number of firms that have not pursued internationalization with a particular motive. To model such over dispersed count data, we use a negative binomial regression technique.

RESULTS

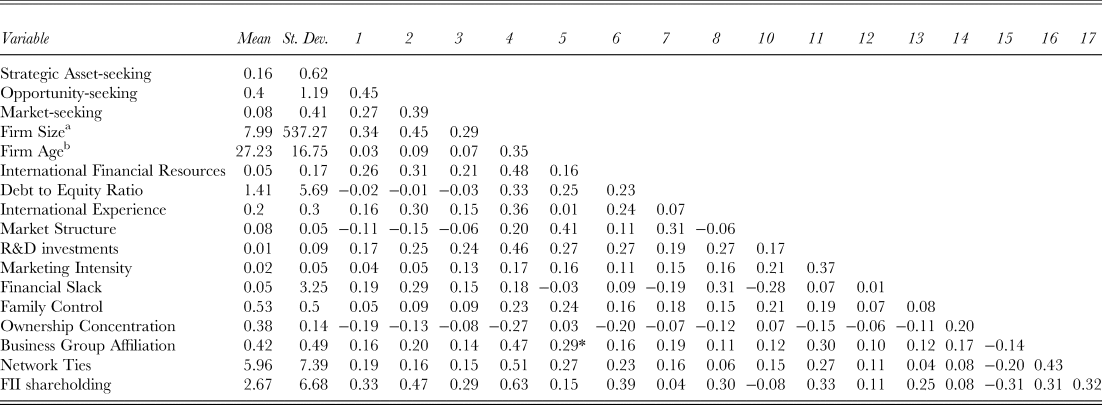

Table 2 shows the correlations between the variables and the descriptive statistics. The total number of pooled firm-year observations is 3826. The mean value of opportunity-seeking motive is highest compared to strategic asset-seeking and market-seeking international expansion. This depicts the general trend of foreign investment by Indian firms led by the IT industry. The mean value of family control and ownership concentration is high; a characteristic of EE firms.

Table 2. Descriptive statistics and correlation table

Note: *Correlations greater than 0.04 are significant at 5% level

a Firm size is measured as net sales in billions of Rs; b Firm age is measured in years

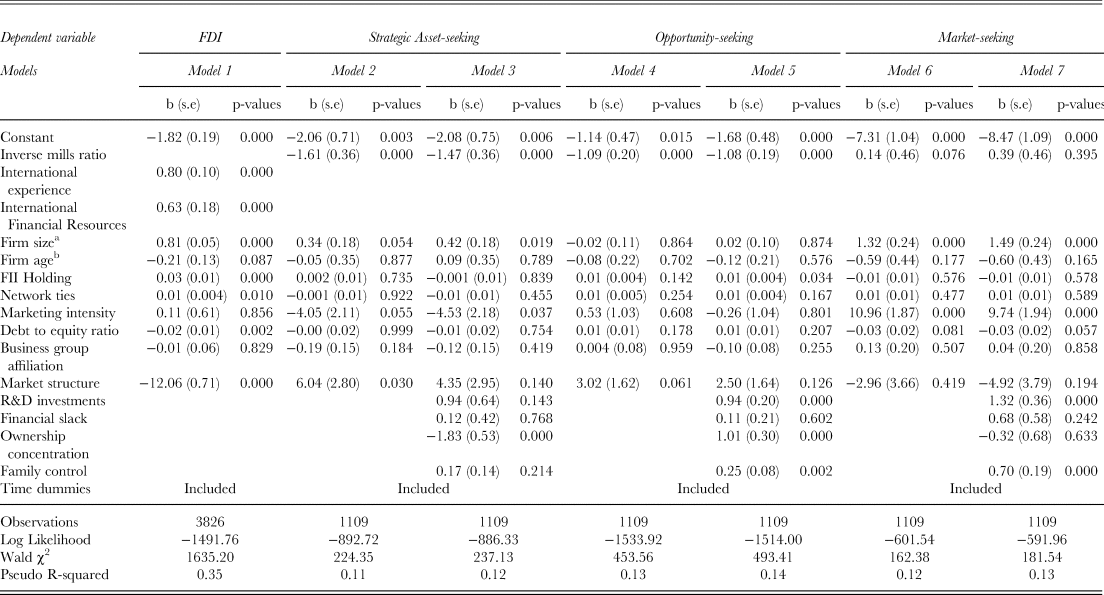

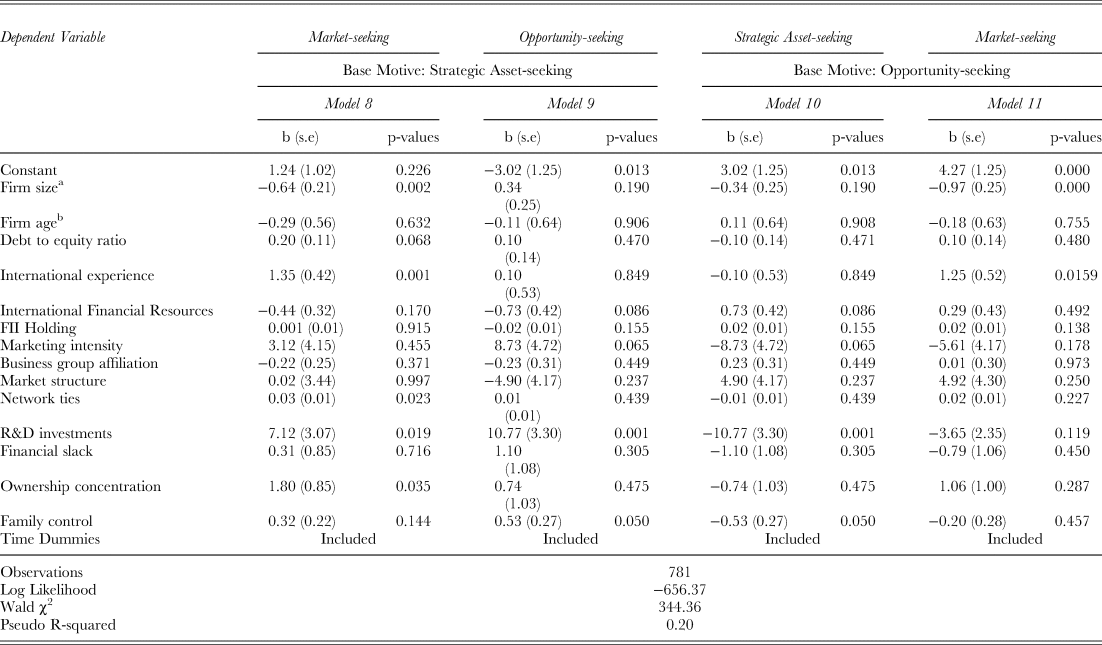

Table 3 shows the results of first stage probit and second stage negative binomial regression. The dependent variable in model 1 is the dichotomous variable FDI. Firm size, network ties, business group affiliation, international experience, FII shareholding and availability of international financial resources are significant drivers of the FDI decision. Models 2 to 7 depict our second stage negative binomial regression results. In models 2 to 7, the dependent variables are the different motives of internationalization. To test the relative effect of each of the firm level variables on the motive of internationalization we created a dataset of all foreign expansions. We used a multinomial logit (M-Logit) regression model that estimates the effect of the independent variables (firm level variables) on the probability that one of the motives is chosen. The regression results of the M-logit model are presented in Table 4. In models 8 to 11, one motive of internationalization has been kept as base motive and the marginal impact of firm level variables with respect to the base motive are shown. The base motive in models 8 and 9 is strategic asset-seeking, while in models 10 and 11 the base motive is opportunity-seeking.

Table 3. Results of negative binomial regression

Notes: a logarithm of sales; b logarithm of years since inception; values in brackets are standard errors; Wald χ2 values are significant with p values = 0.000

Table 4. Results of multinomial logit regression

Notes: a: logarithm of sales; b: logarithm of years since inception; Wald χ2 values are significant with p values = 0.000

Models 2, 4, and 6 depict the effect of control variables on strategic asset-seeking, opportunity-seeking and market-seeking motive of internationalization respectively. Models 3, 5, and 7 are full models. In models 5 and 7 the coefficient of technological capability is positive and significant. The positive coefficient of R&D investments in models 5 (β = 0.94, p = 0.000) and 7 (β = 1.32, p = 0.000) lends support to hypothesis 1a and 1b.[Footnote 8] In models 8 and 9, the coefficient of R&D investments is positive and significant (β = 7.12, p = 0.019 and β = 10.77, p = 0.000, respectively), suggesting that firms with higher investments in R&D are likely to opt for market-seeking and opportunity-seeking internationalization as compared to strategic asset-seeking internationalization. Thus, hypothesis 1c is partially supported, as the direct effect of R&D investments on strategic asset-seeking is not significant. Since, negative binomial models are non-linear; it is difficult to interpret the effect size from the coefficients of the covariates in the regression output. Hence, we use the delta-method (Kotha, Zheng, & George, Reference Kotha, Zheng and George2011) to compute the marginal effect of covariates. The marginal effect of R&D investments on opportunity-seeking and market-seeking motive is 0.82 and 0.17 both significant at p value = 0.000. The marginal effects imply that a one-unit change in R&D investments results in 82% and 17% change in the number of opportunity-seeking and market-seeking investments respectively.

The coefficient of financial slack in all full models 3, 5, and 7 was not significant. Hence, financial slack is not a significant determinant of motive of internationalization. Hence, hypothesis 2a and 2b were not supported. Hypothesis 2c regarding stronger effect of financial slack on strategic asset-seeking internationalization as compared to opportunity-seeking and market-seeking internationalization was also not supported by results in model 8 and 9.

The coefficient of ownership concentration in model 3 was negative and significant (β = −1.83, p = 0.000), suggesting a negative impact of ownership concentration on strategic asset-seeking internationalization (hypothesis 3a). The coefficient of ownership concentration in model 5 (β = 1.01, p = 0.000) suggests that firms with concentrated ownership prefer opportunity-seeking internationalization. This also lends support to hypothesis 3b. Hypothesis 3c, regarding weaker negative impact of concentrated ownership on market-seeking internationalization as compared to strategic asset-seeking was also partially supported (Model 8, β = 1.80, p = 0.035) as the direct effect of ownership concentration on market-seeking internationalization was not significant. The marginal impact of ownership concentration on strategic asset-seeking internationalization and opportunity-seeking internationalization is −0.52 and 0.89 both significant at p = 0.000. This suggests that a 1-unit increase in ownership concentration leads to 52% reduction in strategic asset-seeking internationalization and 89% increase in opportunity-seeking internationalization.

The coefficient of family control was positive and significant in model 7 (β = 0.70, p = 0.000), suggesting a positive impact of family control on market-seeking (Hypothesis 4a). The coefficient of family control in model 5 (β = 0.25, p = 0.002) was also significant, suggesting a positive impact of family control on opportunity-seeking as well. Though the relative impact with respect to market-seeking motive was not significant, hence hypothesis 4b was partially supported. The marginal impacts of family control on market-seeking and opportunity-seeking was 0.21 (p = 0.001) and 0.10 (p = 0.000) respectively, suggesting that family firm are 21% and 10% more likely to pursue opportunity-seeking and market-seeking internationalization respectively when compared to non-family firms. The coefficient of family ownership in models 8 and 9 were both positive and significant, suggesting that family owned firms prefer market-seeking and opportunity-seeking internationalization as compared to strategic asset-seeking internationalization, thereby partially supporting hypothesis 4c as direct effect of family control on strategic asset-seeking was not significant.

Overall, the regression models exhibit a significant model fit with Wald χ2 statistic significant at p = 0.000 for all models. The unexplained variance in these models can be attributed to top management team characteristics and preferences that play a significant role in a firm's perception of opportunities and risks in the international markets (e.g., Nielsen, Reference Nielsen2010). Another factor contributing to the unexplained variance is the role firm's formal and informal networks. Both, formal and informal networks are sources of information about opportunities in international markets (e.g., Haunschild & Beckman, Reference Haunschild and Beckman1998). Hence, these may also influence firm's motive of internationalization. We discuss the implications of these results in detail in the next section.

Robustness Checks