A puzzling finding in the recent literature on social policy preferences in Latin America is the relatively weak demand for redistributive policies among the economically vulnerable (Holland Reference Holland2018; Holland and Schneider 2017; Berens Reference Berens2015a, b; Carnes and Mares 2015; Haggard et al. 2013; Blofield and Luna Reference Blofield, Luna and Blofield2011; Dion and Birchfield Reference Dion and Birchfield2010). Even in societies with extreme inequalities, when compared to other income groups, low-income sectors do not appear to be much more demanding of government intervention to provide social policies (Blofield and Luna Reference Blofield, Luna and Blofield2011; Berens Reference Berens2015a, b; Holland Reference Holland2018).

This result goes against the predictions of classic models in political economy, which expect disadvantaged citizens to demand a certain level of redistribution from the state, depending on their position within the income distribution (Meltzer and Richard Reference Meltzer and Richard1981). Recent analyses have started to explore the mechanisms that reduce the demand for social policies in Latin America. So far, extant works have suggested that the dualized structure of the labor market and the exclusionary design of the welfare regimes in the region make it difficult for economically vulnerable citizens (particularly those in the informal sector) to see themselves as beneficiaries of increased spending on social policies, thus driving down pressure for government action (Holland Reference Holland2018; Berens Reference Berens2020). Yet empirical works have failed to identify a clear divide within the labor market (cf. Berens Reference Berens2015a, b; Baker and Velasco-Guachalla 2018). We therefore propose to take a step back and reanalyze previous null results on labor market dualization in Latin America from three angles: measurement, conceptualization, and the supply side.

Due to the concealed nature of informality, measuring outsider status is an obvious challenge. Because available cross-sectional data are imprecise, identifying formal and informal workers has previously been possible only to a limited extent (cf. Carnes and Mares Reference Carnes and Mares2013, 2014, 2015; Berens Reference Berens2015a, b; Altamirano Reference Altamirano2019; Baker and Velasco-Guachalla 2018). Therefore, this study, relies on a specific measure of informality that considers the labor market structure.

To fully understand the labor market divide in this context, we need to expand the notion of labor market vulnerability to consider how household composition and expected job insecurity might enhance or mitigate the divide between insiders and outsiders. To do this, we study the effect of economic vulnerability beyond current labor status. While we explore the role of the type of employment using a direct measure of labor informality, we also consider alternative risk-hedging mechanisms at the household level and expectations regarding transitions in and out of formal work. We expect economic vulnerability to go beyond the individual’s own and current employment sector so that formal workers who anticipate informality in the future might mimic an informal worker’s preferences or those of an informal spouse. We also question the appeal of the social policy supply side for workers on both “sides” of the divide. By definition, informal wage earners do not have access to social security benefits and depend on programs and services provided on a noncontributory basis. It is unclear how far—in a context of weak state institutions—labor market outsiders find the social policy supply for insiders appealing and seek to become beneficiaries of these programs. Therefore, we need to unpack not only “outsiderness” but also social policy supply.

Acknowledging that social policy reforms are usually multidimensional, we analyze individual attitudes toward distinct policy packages, each with varying elements of accessibility and compensation. Using a conjoint analysis, we asked respondents to choose between two options that differed in their scope, level, and financing, which allowed us to identify the contribution of each design element to the preferences of workers with distinct combinations of labor market vulnerability. This research design incorporates the perspective of potential social policy beneficiaries. It allows us to assess the relative importance they assign to certain policy elements, which has implications for reforming fragmented welfare regimes.

The study was conducted in Mexico in the aftermath of the 2018 presidential elections. This setting was particularly suitable for analyzing social policy preferences, for two reasons. First, although the main issues in the election revolved mainly around the need to increase economic growth, reduce violence, and combat prevailing corruption, the state’s role in ameliorating those very problems became recurrent in the political discussion. Second, it is likely that for voters, the prospect for social policy reform was credible in this period. The winning candidate, Andrés Manuel López Obrador (AMLO), from the Morena party, campaigned on a plat-form that promised more encompassing social policy programs to lift a segment of the population out of poverty and to fight corruption and crime in the long term. Moreover, the timing of the survey allowed us to capture citizens’ attitudes before any significant policy changes were implemented.

The findings reveal that varying economic vulnerability levels contribute to shaping preferences when welfare interventions are assessed in terms of overall government spending in certain social policy areas. In our sample, individuals facing labor vulnerability are relatively less supportive of government spending on social insurance, particularly pensions. Crucially, for those in the informal sector, the presence of a household member currently shielded from labor market risks does not seem to mitigate the negative effect of vulnerability on welfare policy support. Also, expected transitions to the informal sector appear to shape insiders’ preferences: insecure formal workers become closer to the preferences of outsiders, thereby showing less support for social policy efforts. Preferences are, however, much less distinct when trade-offs are introduced. Both formal and informal workers are less likely to prioritize social policy reform packages when confronting policy design alternatives (different supply-side options) with specific financing measures and clear winners and losers. This lack of prioritizing suggests reduced expectations about the state’s role and a lack of clarity about the tangible benefits of social policy reform.

This article makes two contributions beyond the Mexican case. It adds to the discussion on dualization and preferences for welfare provision with a better identification of formal and informal sector workers. Drawing on a growing field of research on the impact of labor informality on political attitudes and outcomes (Carnes and Mares 2015; Berens Reference Berens2015a; Holland Reference Holland2016; Baker and Velasco-Guachalla 2018; Altamirano Reference Altamirano2019; Feierherd 2020), it provides a nuanced approach to the formation of social policy preferences in truncated welfare regimes. Furthermore, by studying heterogeneous treatment effects, it explores the formation of the redistributive coalitions needed to pursue substantial social policy reforms.

WELFARE PROVISION IN LATIN AMERICA

Social protection programs in Latin America historically were built to benefit workers in the private formal sector, as well as employees in government institutions and public companies. In this initial phase, social policy was geared toward social insurance rather than social assistance, with a subsequent emphasis on contribution-based rather than universal tax–financed benefits (Perry et al. Reference Perry, Maloney, Arias, Fajnzylber, Mason and Saavedra-Chanduví2007). Dualized labor markets, where “insiders” were highly protected through labor law and “outsiders” lacked access to social insurance, became characteristic in Latin American countries (Collier and Collier Reference Collier and Collier2002; Carnes Reference Carnes2014; Rueda et al. Reference Rueda, Wibbels, Altamirano, Beramendi, Häusermann, Kitschelt and Kriesi2015). Coverage of poverty alleviation programs, such as conditional cash transfers (CCTs), increased considerably in the 2000s. Still, the size and quality of these types of protection have remained insufficient to change economic disparities in the region.

As Holland and Schneider (2017) note, noncontributory programs represent the ceiling of “easy redistribution,” while redistributive policies that would have more substantive effects, such as unemployment insurance, pensions, and universal high-quality health services, need electoral coalitions that are much harder to build. Indeed, many governments in the region have followed a policy “layering” process, creating and implementing noncontributory programs (both means-tested and universal) on top of contributory insurance policies. This process has added substantial complexity to Latin American welfare regimes, making it more difficult for citizens to identify the rules of access to certain programs, the modes of financing, and the expected stability and level of welfare benefits.

Labor market and welfare policies go hand in hand in the region, as both determine individual risk levels. Social policy can be financed through different schemes: via contributions (payroll taxation, applicable only to formal wage earners), general taxes (including the value added tax [VAT]), or through more progressive taxation systems (such as progressive personal income taxes). Noncontributory social policies are usually financed through general taxes, and the size of the benefit is relatively small (Holland and Schneider 2017). The tax mix in many low- and middle-income countries often relies highly on consumption taxes (VAT), which presents a higher tax burden for low-income earners (Wibbels and Arce Reference Wibbels and Arce2003; Goñi et al. Reference Goñi, Humberto López and Servén2011). Therefore, depending on their rules of access and their target population, financing of social policy reforms rests either on an increase of payroll deductions or on general taxes.

At the same time, access to social programs is often conditioned on labor status. A universal system benefits informal sector workers and informal employers (e.g., street vendors, informal microfirms). It comes at the cost of higher general taxes for all (and in a tax system that places a higher burden on consumption tax, this means higher taxes for the poor). In turn, a contribution-based system is more favorable to formal sector workers, as only those who pay in benefit from it. Therefore, risk pooling occurs among a specific group of workers, who probably have lower probabilities of need, and the group itself is small. Also, compared to universal programs, the benefit levels are usually higher in contribution-based options (Carnes and Mares 2014, 705).

Investment and adjustments to social insurance programs do not bear an effect on labor market outsiders. On the other hand, the expansion of noncontributory policies often excludes as beneficiaries those individuals who have formal jobs and are therefore eligible for social insurance. In addition, in some noncontributory programs, targeting criteria imply that not all low-income households or individuals are eligible to become recipients, further fragmenting the groups of beneficiaries, even among the uninsured in the informal sector.

Given the close relationship between dualization and welfare policies, what is the effect of labor market vulnerability on social policy preferences? While the liter ature in the context of industrialized democracies suggests an insider-outsider dynamic with implications for social policy preferences and even electoral outcomes (Rueda Reference Rueda2005; Emmenegger Reference Emmenegger2009; Schwander and Häusermann Reference Schwander and Häusermann2013), such divisions are much less visible in the Latin American context (Berens Reference Berens2015b; Baker and Velasco-Guachalla 2018). This might be due to shortcomings in the conceptual understanding of vulnerability or in the empirical identification of informal sector workers (Baker et al. Reference Baker, Berens, Feierherd and Menéndez González2020), or because of an insufficient understanding of the actual appeal of social policies in truncated welfare states.

LABOR MARKET SEGMENTATION AND SOCIAL POLICY PREFERENCES

We start by considering the insider-outsider divide as a fundamental dimension shaping social policy preferences (Lindbeck and Snower Reference Lindbeck and Snower1986; Rueda Reference Rueda2005). According to the classical political economy argument, labor market insiders should shield their insider status, while outsiders would be more favorably inclined toward labor market liberalization and universal social protection schemes (Rueda Reference Rueda2005; Guillaud and Marx Reference Guillaud and Marx2014). Job insecurity raises the demand for redistribution and the need for protection (Rehm Reference Rehm2009), so that, in principle, labor informality should be associated with increased demands toward the state.

Considering the welfare state’s exclusionary nature, such demands should yield universal or means-tested programs (vs. contributory programs). However, there is also reason to anticipate that labor market outsiders might mimic insiders’ preferences. Demanding a reduction of the welfare state and labor protection presupposes that informal workers do not ever expect to join the lucky group of insiders, which is not an accurate assumption in some contexts (Emmenegger Reference Emmenegger2009). Also, in advanced democracies, researchers have identified a more nuanced divide—the new social risks debate—which considers the transformed nature of the labor market, one that is less easily distinguished into secure and insecure (Schwander Reference Schwander2019).

In the case of labor market outsiders in developing economies pervaded by labor informality, we anticipate opposition to government spending in contributory systems and support for either means-tested or universal programs. However, rules of access and eligibility thresholds of means-tested programs may exclude economically vulnerable households (albeit above the poverty line), making it difficult for some to perceive themselves as potential beneficiaries. Such lack of clarity might weaken support for targeted transfers in general. Therefore, when correctly identified through empirical means, we expect informal sector workers to be more supportive of universal social policies over means-tested and contribution-based benefits. In contrast, in line with existing studies, we expect formal workers to support a closed, contribution-based system, as such a system offers more benefits to them.

H1a. Informal sector workers will be more likely to support a universal social policy than a means-tested or contributory social policy.

H1b. Formal sector workers will be more likely to support an expansion of a contribution-based policy than a universal or means-tested social policy.

Recent works have acknowledged the potential volatility of the labor market divide, highlighting the importance of expanding the notion of “outsiderness” to include different degrees of risk exposure (Walter Reference Walter2010; Schwander and Häusermann Reference Schwander and Häusermann2013; Schwander Reference Schwander2019). Recognizing that the effect of individual labor market status might depend on alternative risk-hedging mechanisms, we consider the individual’s economic situation from a more holistic perspective on economic vulnerability. We consider each individual’s economic context by looking at the composition of their household in terms of access to social insurance by other family members.

While household composition has been analyzed in recent studies for Europe (Emmenegger Reference Emmenegger2010; Häusermann et al. Reference Häusermann, Kurer and Schwander2016), it remains relatively unexplored in the Latin American context. Risk sharing within households might be a crucial component for social policy preference formation, as family members might benefit from social programs whose recipient is the spouse.Footnote 1 Thus, we might expect that individuals in the informal sector who share a household with a formal worker will feel less economically insecure. Consequently, individual living arrangements in “mixed households” might result in preferences that favor contributory insurance instead of universal or means-tested policies. In this scenario, risk sharing at home would have a mitigating effect on the divide between insiders and outsiders, blurring the link between labor market vulnerability and social policy preferences (Häusermann et al. Reference Häusermann, Kurer and Schwander2016, 1046).

Yet it might be the case that individual preferences in mixed households align with those prevalent among informal workers. That is, a formal worker sharing the home with an informal sector worker might judge social policy from the position of a labor market outsider. Individual perceptions of risk may depend more on the vulnerability of uninsured household members than on their formal status. In that case, a reform that eases informal workers’ access (one with a universal design, for instance) might be more popular among individuals in mixed households. Following this logic, members of mixed households might also be less likely to support government spending in contributory systems. Potential household effects are expected when there is a disparity in labor market vulnerability within the family. Therefore, we expect that the preferences of individuals living in households that are purely formal or purely informal will be reinforced by the shared level of labor market vulnerability among family members. We therefore propose the following hypotheses:

H2. In mixed households, an individual’s social policy preferences will be aligned with those of household members who are in the formal (informal) sector and therefore in an economically stronger (vulnerable) position.

H3. In purely formal or informal households, an individual’s preferences will mirror the shared level of labor market vulnerability within the family, reinforcing the relationship between individual economic vulnerability and social policy choices.

While household composition can be understood as a dimension of horizontal vulnerability and must be factored in when deriving expectations on individual redistributive and insurance preferences, time horizons work as a vertical vulnerability mechanism that can have equally decisive implications. That is, individuals will take into account their expectations about their prospective level of risk. In Latin America, labor market analyses have found that transitions into and out of the formal labor force are not uncommon, suggesting that the formal and informal sectors are highly permeable (Maloney Reference Maloney2004; Duryea et al. Reference Duryea, Gustavo Márquez, Scarpetta and Reinhart2006; Vega Núñez 2017). These dynamics also reflect informalization patterns in response to weak welfare states (Berens Reference Berens2020). This significant labor market mobility implies that individuals currently in the formal labor force might perceive their situation as unstable, thus anticipating a likely transition to the informal sector. As Carnes and Mares (2016) note, the benefits formal sector workers derive from contributory policies depend on regular contributions to the social security system (2016, 1650). Therefore, transitions out of the formal labor force can substantially reduce or even endanger access to contributory benefits.

We argue that for workers currently in the formal sector, the perception of prospective labor market risk will contribute to shaping their individual social policy preferences. We theorize that formal workers expecting labor informality in the future will be less likely to support efforts to expand the contributory system. Individuals with this expectation will, in turn, favor an increased provision of universal social policies.Footnote 2 In contrast, a worker who considers it likely to enter or remain in the formal sector in the future might favor a contribution-based system. That is, prospective labor market risk might blur the distinction between current insiders and outsiders, thus aligning vulnerable formal workers’ preferences with those of informal workers. To test the effect of labor mobility expectations on social policy preferences, we present the following hypothesis:

H4. Formal sector workers who expect to lose their jobs or to work in the informal sector in the near future will be more likely to support a universal social policy than one that is contribution-based or means-tested.

Furthermore, although the individual’s risk assessment regarding current labor market status, household composition, and future employment should be influential for the labor divide, such considerations should depend on the nature of welfare policy supply. Social policies are complex constructs and also often compete with each other because the size of the budget “pie” is usually fixed. Spending more on education sometimes means fewer available resources to expand health care. Some programs are financed through general tax money while others rely on payroll taxes. Some are open to all, whereas others are exclusive to contributors. Thus, null results on the divide between labor market insiders and outsiders in Latin America (Berens Reference Berens2015b; Baker and Velasco-Guachalla 2018) might be a result of not adequately considering social policy complexity (see Baker et al. Reference Baker, Berens, Feierherd and Menéndez González2020) and actual supply.

We explore how preferences for redistribution and social policies are linked (if linked at all) to their financing scheme. Specifically, we study whether individuals are generally more favorably inclined toward an expansion of social policy programs if these are financed by placing a higher tax burden on the rich (see Fairfield 2013; Flores-Macías Reference Flores-Macías2014). As Flores-Macías (Reference Flores-Macías2018) reveals for the Mexican case, willingness to accept taxation depends very much on institutional trust and can be facilitated through design features that reduce uncertainty about the misuse of tax money. Considering the preferences of formal and informal sector workers, we expect that both will prefer an increase of social policies (contribution-based in the case of formal workers and universal schemes in the case of informal workers) when the tax burden can be shifted onto someone else. For formal workers, this means financing reforms through increased general taxes (which, in the Mexican context, basically means consumption taxes that place the tax burden on lower-income earners) or raising taxes on the rich. For informal workers, supporting a social policy expansion should hinge on shifting the costs to workers with a written contract and the government, or else by placing the tax burden on the rich.Footnote 3

H5. Informal sector workers are more likely to support an increase of universal social policies if the form of financing relies on government contributions obtained from increasing the taxes of people with higher incomes or of workers with a written contract.

H6. Formal sector workers are more likely to accept an increase of contribution-based social policies if the form of financing is through government contributions obtained from increasing the taxes of people with higher incomes or from an increase of general taxes.

SOCIAL POLICIES IN MEXICO

There are two main social insurance institutions in the country: the Mexican Social Security Institute (IMSS) provides social security and services for private-sector workers, while the State’s Employees’ Social Security and Social Services Institute (ISSSTE) focuses exclusively on national public servants. Through these two institutions, individuals working in formal private enterprises (or government institutions) have access to health insurance, old age pensions, housing credits, and other labor benefits. Only formal workers are eligible for enrollment and labor benefits at IMSS or ISSSTE. By 2015, approximately 47 percent of the national population was entitled to health services at these institutions.Footnote 4 A small share of the population had private health insurance, and state institution coverage for local government employees was also limited.Footnote 5 The informal employment rate in the country was 56 percent in November 2020 (INEGI 2020). This measure includes individuals working in non– formally registered enterprises and workers without access to labor benefits.Footnote 6

The Mexican pension program is regulated by the state and designed as a defined-contribution program, which means that access to a pension is based on prior contributions. Formal sector workers contribute to their pension plans through mandatory payroll deductions and additional voluntary payments.Footnote 7 A further prominent contribution-based system is Mexico’s housing program. It is managed through the Instituto del Fondo Nacional de la Vivienda para los Trabajadores (INFONAVIT), which grants mortgages to Mexican formal sector workers. Employees mandatorily contribute to the program through payroll deductions.

Besides contribution-based institutions, there is a combination of means-tested and universal programs aimed at workers and their dependents in the informal and agricultural sectors. While some informal workers have access to noncontributory programs, none of these provide comprehensive social insurance. In 2018, Prospera was the main conditional cash transfer program (CCT). It provided a monthly transfer to female heads of eligible households, who were required to take their children for regular health check-ups and attend meetings related to the program. Households were selected on the basis of specific criteria according to poverty thresholds. While there was an overlap, the program did not offer complete coverage for the informal sector population. By the end of 2017, approximately 23 percent of the national population had access to Prospera (Yaschine Reference Yaschine2018, 41).Footnote 8 In Puebla and Querétaro, the subnational states where we collected our survey, only 5 percent of respondents claimed to be Prospera beneficiaries.Footnote 9

In 2003, the public health care system was reformed to create Seguro Popular, a noncontributory program for the population without social medical insurance. The program was intended to reach the informal sector population and offered coverage of a set of medical treatments and interventions. Services were funded by the federal government and provided by local health authorities, with outcomes of varying quality (Flamand and Moreno Jaimes Reference Flamand and Moreno Jaimes2014).Footnote 10

To summarize, as in other Latin American welfare regimes, the structure of social security institutions and programs in Mexico is currently a fragmented system combining contributory programs, means-tested programs, and emergent universal policies. Each of these services and programs has specific rules for access, eligibility criteria, and a set of conditions required for continued enrollment in the program or institution. Following the hypotheses above, we expect that different labor market vulnerability configurations will be associated with varying support for these policies, depending on their perceived benefits. At the same time, and recognizing the multidimensional nature of policy packages, we expect that individuals facing varying levels of vulnerability will assign more value to specific components of social policies, such as access or type of financing.

EMPIRICAL SETUP

We collected an original, standardized, face-to-face survey (computer-assisted personal interview, CAPI) with N = 1,400 respondents in Mexico in November 2018. We drew a random sample at the subnational level in the states of Puebla and Querétaro (700 respondents per state).Footnote 11 Querétaro has slightly above the national average (0.16) GDP per capita (0.22, in millions of pesos, INEGI 2018). Puebla’s is below the average, with 0.10 in 2017 (INEGI 2018). Both are equally close to Mexico City and score below the national homicide rate. Selecting two states allowed covering a larger range of production sectors (manufacturing, service, and agriculture) and wealth.

We ran focus group interviews in Mexico City and pretested the questionnaire with a random sample of 60 respondents in both states before the launch of the survey to test the validity of the items and the comprehensiveness of the conjoint experiment in particular.Footnote 12 We employed several quality control mechanisms, such as interviewer training (see Lupu and Michelitch Reference Lupu and Michelitch2018) to reduce possible survey error.Footnote 13

The empirical analysis is twofold. First, we study welfare attitudes with standard questions on social policy preferences and unpack varieties of labor market vulnerability. We estimate an ordered probit regression to analyze the observational social policy preference responses (H1–H4).Footnote 14 Second, we analyze the results from a conjoint experiment, increasing policy choice complexity to tease out how far introducing trade-offs influences preference formation (H5 and H6). Here we use a logistic model, as the dependent variable is the choice between the two policy packages.Footnote 15 We look at the responses for the full sample and subsequently study subgroup effects, as we are interested in policy preferences of formal and informal sector workers.

Dependent Variable: Social Policy Preferences

We are interested in understanding individual support for welfare state expansion. We therefore asked respondents about their support for state-administered social policy expansion in the following fields: public pensions, health care, conditional cash transfers (CCT), and progressive taxation.

We asked how much the respondents agreed or disagreed with the following statement: “The Mexican government should increase spending on [health care services],” varying the respective policy field. We explicitly referred to social policy types rather than concrete programs to avoid loading the question with partisan cues. Also, we reminded the respondents that an increase in spending might come with a rise in taxes and reduced survey satisfying (the respondent provides positive responses to please the interviewer, also known as survey error of acquiescence) by adding, “Consider that this may or may not imply an increase in taxes.” The response scale ranged from 1 (disagree) to 4 (agree).

To assess respondents’ tax preferences, we employed a different scale. We asked how much high-, middle-, and low-income earners should pay in taxes out of 100 pesos (50/30/20, a progressive option; 40/30/30, a moderately progressive option; or a flat tax with 33/33/33).Footnote 16

Figure 1 displays the distribution of the social policy questions. A majority of respondents support an expansion of the welfare state and taxes to be made more progressive.Footnote 17 In line with previous findings from cross-sectional studies in Latin America, support for tax progressivity is widely shared in Mexico (70.8 percent). Yet in regional comparison, Mexico scores only as an average case of tax progressivity demand (see Bogliaccini and Luna 2019; Berens and von Schiller Reference Berens and von Schiller2017). Although overall levels of support for social policy expansion are relatively high, the puzzle that drives our analysis relates to the lack of a significant gap between the preferences of the vulnerable and the nonvulnerable. Indeed, cross-tabulations show that informal workers are no more likely to support social policies than are formal workers, even though they should be in greater need of them (see supplement table L).

Figure 1. Distribution of DV Survey Questions (PQMex Survey 2018)

Independent Variable: Informality

We constructed a set of items that allowed identification of informal and formal sector workers: to determine whether they previously had worked in the formal or informal sector; to indicate the extent to which they expected to stay in the current sector or to work formally or informally in the future (reference category: no anticipated change); and to note if they shared a household with a formal or informal spouse. Informality was identified on the basis of the benefits definition (Baker et al. Reference Baker, Berens, Feierherd and Menéndez González2020). We asked respondents if they had a written working contract and if they were enrolled in a medical insurance plan; the housing credit system, INFONAVIT; and a pension plan through their employer.

Combining information on the possession of a written contract and the three different formal employment-related public benefits gave us a firm measure of formal and informal labor status.Footnote 18 We then inquired, “How likely do you think it is for you to have a job where you won’t get employer-connected benefits in the next five years?” and a separate question, “How likely do you think it is for you to have a job where you will get employer-connected benefits in the next five years?” In addition, we asked respondents, “Are there people living in your household who work for a wage but without a contract or employer-connected benefits?” and also if there were people in the household who worked for a salary, had a contract, and were enrolled in employer-connected benefits.

Figure 2 shows the distribution of formal and informal workers (panel a), the composition of the household (purely informal, formal, or mixed, panel b), the share of formal workers who expected to become informal (panel c), and informal workers who expected to become formalized in the future (panel d). Our estimates of the informal sector’s portion (63.5 percent) of the active working population corresponded with Mexican labor market statistics. Also, our results were comparable to the estimates of informality in LAPOP, which was conducted in Mexico in 2018.Footnote 19 To identify household nature, we built on the information by asking respondents about having a work contract and employer benefits, together with the question about household members’ labor market status, which reduced the sample to 651 respondents (by definition, nonemployed individuals—e.g., homemakers, students, and the retired—could not be categorized by formal or informal labor status). Interestingly, most households in the sample were exclusively informal (59 percent). Only 17.5 percent were mixed households. As controls, we added a battery of standard sociodemographic variables (see Dion and Birchfield Reference Dion and Birchfield2010; Morgan and Kelly Reference Morgan and Kelly2013; Carnes and Mares 2015; Berens Reference Berens2015b).

Figure 2. Distribution of Formal and Informal Workers, Labor Market Prospects, and Household Composition Note: The two bottom panels show reduced sample sizes, since only those respondents identified as formal workers were asked whether they saw themselves moving in the future from formal to informal employment. Accordingly, only informal workers were asked whether they thought they would move from informal to formal employment. The small sample size of 241 in the lower left panel thereby relates to the 36.53 percent formal workers from the panel above. The N = 513 in the fourth panel relates to 63.47 percent of informal workers. Furthermore, these subsamples exclude the cases of respondents who did not express an expectation about their labor status (“do not know” answers). Given the reduced subsample of formal workers, this particular analysis should be taken with caution.

To measure income, we used an asset indicator (AMAI), which ranges from 1 (poor) to 7 (rich). We included information on gender, age, dependents in the household (dichotomous variable), education, and urbanization level. We also controlled for vertical reciprocity (trust in public institutions and government; see Flores-Macías Reference Flores-Macías2014) through an item that asked about corruption in the public system in robustness analyses (see supplement table F; estimation results remain robust). As a further test for robustness, we added information on union membership (only 4 percent of the sample) and job security (Rehm et al. Reference Rehm, Hacker and Schlesinger2012; see supplement table G). Moreover, we controlled for vote choice in the 2018 presidential elections to take into account the possibility that political affinities might be a key driver of social policy preferences (supplement tables I, J, and K).Footnote 20 Our results on the impact of economic vulnerability remain robust to the inclusion of vote choice.

Conjoint Analysis

In order to confront the respondents with the complexity and trade-offs in social policy, we employed a conjoint experiment.Footnote 21 We used a forced-choice conjoint that asked the respondents to choose between different social policy reforms that differed across four policy attributes. We varied the type of policy (old age pensions, health service, housing credits, financial support for low-income households, daycare centers), who should pay for it (only with contributions from workers with written contracts and the government, with contributions from the government with increased taxes, with contributions from the government raising taxes on people with higher incomes), beneficiary (universal—everyone has access, workers with written contracts, only those in need), and what should be done (increase benefits, reduce benefits, keep benefits as they are).Footnote 22 Each respondent received two policy packages for comparison, and we repeated this step three times (N = 1,400 × 2, × 3, thus, 8,400 choices).Footnote 23 In the three attributes, we used three values; only in the first attribute did we employ five values. The possible number of combinations was thus (5 × 3 × 3 × 3) = 135. We asked, “Imagine that you have the opportunity to change some public policies. Below is a table with two public policies for you to choose from. Think about which would bring you the most benefits. For your choice, take into account the four aspects seen in the table. We will show you several tables. If you have to choose one of the policy programs, which one would you prefer?”Footnote 24 The respondents were asked to choose one of the packages.Footnote 25 We deliberately asked for an egotropic evaluation of the policy package to ensure a constant interpretation across respondents. All attribute values within the four attributes had the same probability of being drawn.Footnote 26

The conjoint setup allows comparing the effects between different attributes because all attribute values are placed on the same scale (Hainmueller et al. Reference Hainmueller, Hopkins and Yamamoto2014). Due to random assignment, weights are not necessary. Thus, the only systematic difference between the respondents should be induced through the random display of policy packages.

RESULTS

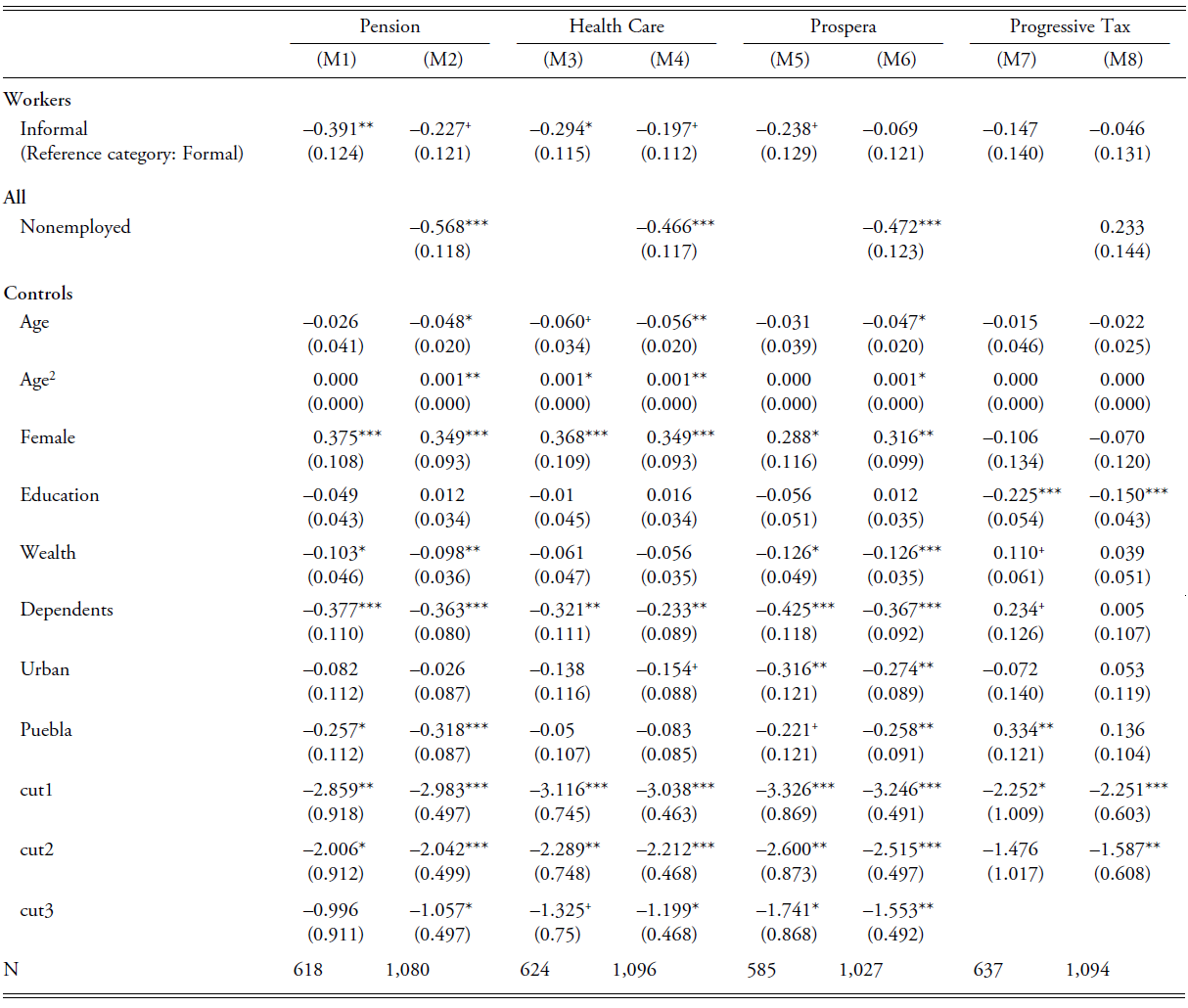

Table 1 shows ordered probit regression results for the impact of formal versus informal labor market status on social policy preferences, analyzing a sample based on workers only (M1, M3, M5, M7), and for the full sample, distinguishing formal, informal, and nonemployed respondents (M2, M4, M6, M8). Figure 3 plots the findings. Informal sector workers, defined by lack of a working contract and access to employer-related benefits, are significantly less supportive of the contributory pension expansion (M1). We also find a negative effect of labor informality on support for investments in public health care, but this effect is less robust than the pension effect.

Figure 3. Social Policy Preferences and Economic Vulnerability Note: Main coefficients from table 1, M1–M8; supplement table B, M9–M12; table C, M1–M4.

Comparing informal worker preferences to those of the nonemployed, we find more discernible differences between formal workers and the nonemployed. The latter group is less supportive of state-administered increases of public pension, health care, and Prospera expenditures than the formally employed.Footnote 27 However, tax preferences—that is, how benefits are financed and who carries the tax burden—are unaffected by the vulnerability measure based on current labor market status (M7– 8). A better identification of formal and informal workers provides support for the labor divide hypothesis H1, regarding how benefits should be distributed.

To test H2 and H3, we analyzed welfare preferences of respondents who work in the informal sector and share a household with one or more informal workers (purely informal household), formal workers who share a household with one or more formal workers (purely formal household), and respondents who are either formal or informal and share a household with someone who is working in the other sector (mixed household). Results from table 1 already anticipate that the group of the nonemployed, who most probably live with someone who is an active labor market participant, hold decisive views on public investments in the welfare state.

Table 1. Ordered Probit Regression: Social Policy Preferences and Labor Market Dualization

+p < 0.10, *p < 0.05, **p < 0.01, ***p < 0.001

Notes: Standard errors in parentheses. All models include survey weights.

Source: PQMex Survey 2018.

Supplement table B and figure 3 display the results comparing informal house-holds and mixed households (distinguished by the respondent’s labor market status) with purely formal income–earner households. Purely informal households are consistently against the public welfare system. Informal households are significantly less supportive of expanding public pensions, health care, and Prospera, supporting H3. Given the low share of respondents that were Prospera recipients in Puebla and Querétaro, lack of support for the program might be associated with perceived access barriers despite fulfilling the eligibility requirements. As a robustness test, we controlled for receiving a cash transfer from the government (see supplement table H). The inclusion of this measure of benefit receipt does not substantively alter the findings and does not affect preferences. Compared to formal households, mixed households are significantly less supportive of investments in public pensions and Prospera. To better capture potential shielding effects, we differentiated between mixed households in which the respondent is either formal or informal. Formal respondents in mixed households have a significant negative preference against the means-tested CCT program Prospera. In contrast, informal respondents in mixed households are significantly less likely to support an increase in the contribution-based pension system.

This last result suggests that sharing the household with someone currently shielded from labor market risks does not systematically cancel the impact of vulnerability on other family members’ social policy preferences. Such a shielding effect might be at work only regarding health care (M2), where the negative effect of purely informal households does not translate to mixed households. Informal house-holds and formal respondents in mixed households are less supportive of progressive taxation compared to purely formal households (M4). The coefficient for informal respondents from mixed households is also negative, but not significant. Against theoretical expectations, vulnerability does not go hand in hand with a desire to shift the tax burden onto the rich. Shared vulnerability seems to manifest withdrawal from redistributive instruments—be they related to benefit distribution or to revenue generation—compared to formal households.

Delving deeper into the different shades of labor market vulnerability, testing H4, we analyzed the welfare preferences of informal respondents who expect to enter the formal sector, thereby gaining labor market security. We also looked at the preferences of those anticipating a change from formal to informal labor in the next five years. It has to be noted that the sample sizes differ as we now focus on the two subgroups. We present those findings in figure 3 (see also supplement table C). Those who anticipate an increase of vulnerability in the future, expecting to lose their formal employment within the next five years, are significantly less supportive of public health care expansion and progressive taxation. But also, those who anticipate more secure employment in the future are less supportive of progressive taxation compared to those who do not expect any change.Footnote 28

Given that we anticipate respondents to associate the health care item with the noncontributory program Seguro Popular rather than the contributory arm (IMSS and ISSSTE), this finding can be interpreted to disconfirm H4. We expected the risk of future insecurity to raise support for universal programs in contrast to contributory or means-tested ones. This may reflect underlying levels of dissatisfaction or low expectations regarding the public health care scheme Seguro Popular, which might drive down public support in this specific social policy field. Expectations of future formal employment do not seem to influence attitudes toward the contributory pension system.

Starting from a dichotomous view of informality, which revealed a lack of support for the public pension system among informal sector workers (H1), we find a more complex preference pattern the more we unpack the different layers of labor market vulnerability. Those who anticipate moving from protected employment to informality in the future are indifferent toward the pension system and appear less supportive of an increase of government expenditures on public health care services. Those who anticipate changes in labor market status in both directions—becoming more or less secure—are more supportive of a flat tax. Purely informal households, which are the predominant household type in our sample, are less favorably inclined to any expansion of public pensions, health care, or Prospera. At the same time, mixed households resemble this pattern. Informal households are less likely to support redistributive fiscal instruments, as can be interpreted from the tax preference question. Shared economic vulnerability seems to reduce support for public social protection programs and redistributive tax instruments. Thus, our analysis shows the need for better measurements to identify informal workers and a divide in the labor market and for a conceptualization of economic vulnerability as a continuum.

Considering sociodemographic controls, we find intuitive age effects in table 1. The young are less supportive of pensions, health care, and Prospera expansion, whereas the old demand an increase in public protection programs. Interestingly, the negative effect among the young is larger than the effect for the old, despite the apparent self-interest for generous social protection. Perry et al. (Reference Perry, Maloney, Arias, Fajnzylber, Mason and Saavedra-Chanduví2007) have uncovered life cycle patterns of informality, in which the young frequently start labor market entry with informal work and possibly find formal employment during middle age before moving into informality again in old age. However, exploring these patterns calls for an analysis of possible interdependencies between labor market vulnerability and age for preference formation, which goes beyond the scope of this study.Footnote 29 Life cycle patterns in the labor market, in which the elderly—classically a major voter group—find themselves in informality and develop skepticism toward the state, might explain why demand among the vulnerable falls short of expectations.

Results: Conjoint Experiment

Moving beyond a one-dimensional inquiry about welfare preferences, we analyzed results from the conjoint experiment, which confronted respondents with a tradeoff situation. Respondents had to choose between social policies (making an egotropic choice) that differed in regard to what would be insured and who would have access to the benefit, how it should be financed, and how far it should be expanded or retrenched. Because our research interest rests on the different labor market subgroups, we show the findings for the same groups as specified above.Footnote 30 Looking at the forced-choice outcome results, we cannot detect any significant differences in any of the attributes for formal and informal sector workers (figure 4). In this first set of analyses, introducing trade-offs and distinguishing program components does not uncover a significant cleavage in preferences between informal and formal sector workers regarding social policy design.

We observe some differentiated patterns between formal and informal workers when interacting policy dimensions; for example, an increase of benefits and higher taxes on the rich (supplement figures C and D). Formal workers are significantly less likely to select policy packages that combine targeted benefits through either an increase in general taxes or taxation of the rich, which corroborates H6. Informal workers are more likely to choose a policy package that offers a universal policy financed through increased general taxes, supporting H5. This result is in apparent contradiction to what we find in the observational analysis, where we see a correlation between vulnerability and support for a flat tax. However, the result is in line with Flores-Macías’s findings on the impact of policy design instruments (2018). When taxes are earmarked, respondents are more willing to accept taxation and engage in the fiscal contract. Tax progressivity tends to be eyed skeptically when the usage of this revenue is not clearly revealed.

Figure 4. Conjoint: Formal and Informal Sector Workers

Secure workers are less likely to select policy packages that offer targeted benefits with increases in taxation or benefit size. These results are in line with our findings in the observational analysis. However, all other interactions between attributes lead to insignificant results, which corroborates the conclusion that introducing program complexity and trade-offs reduces decisionmaking capacity among both types of workers.

Finally, we combined program complexity and disaggregated forms of economic vulnerability as analyzed above. First, we assessed the variance of economic vulnerability in terms of household constellations. Neither purely formal, purely informal, nor mixed households hold systematically different views on policy packages that differ along our set of dimensions (see supplement figures E and F).

Second, we distinguished workers by their expectations regarding future employment prospects. We find differences in attitudes toward social policy expansion and how social policies should be financed. Formal workers who expect to lose their secure job in the next five years are less supportive of policy packages that offer increased benefits (“keep benefits as they are” is the baseline category). In contrast, informal workers who expect to find formal employment shortly are more likely to choose a policy package when it contains an increase of general taxes or shifts the tax burden onto the rich, compared to a rise in payroll taxes (see figure 5). Again, tax preferences seem to be coherent with a self-interest rationale once financing and spending are linked transparently.

Figure 5. Conjoint: Future Employment Expectations

These results suggest that expected labor market transitions shape policy preferences. Formal workers who anticipate losing access to mostly contribution-based welfare policies are less supportive of an expansion of such policies. In contrast, informal workers want to shield formal workers from increased tax contributions when expecting to become one of them. Unpacking program dimensions—that is, the supply side—and economic vulnerability reveals a complex labor market divide: insecure formal workers become closer to outsiders in their lack of support for government strategies to expand welfare policies.

Discussion

The findings from both the observational and the conjoint experiment analyses unravel a social policy preference divide associated with varying levels of economic vulnerability, which so far had been difficult to identify (see Berens Reference Berens2015b; Baker and Velasco-Guachalla 2018). Mexicans in our sample who face higher levels of vulnerability are more skeptical of state-administered welfare provision. A conceptualization of “outsiderness” as a continuum, and a more fine-grained measurement (see Baker et al. Reference Baker, Berens, Feierherd and Menéndez González2020; Schwander and Häusermann Reference Schwander and Häusermann2013), allowed us to identify its effect on social policy demand. For instance, citizens anticipating an increase in vulnerability in the future were more likely to give up public solutions and prefer to opt out (Holland Reference Holland2018; Berens Reference Berens2020).

Our results confirm that in truncated welfare regimes, vulnerable individuals are less likely to base their social policy preferences on a “calculating solidarity” rationale (Berens Reference Berens2015a). In contrast to Carnes and Mares (Reference Carnes and Mares2013, 20, 2015), we do not find generalized support for universal protection programs among the vulnerable (we could not confirm H4, our analysis of support for health care expansion), except for cases in which a universal policy is directly linked with financing through general taxes, as shown in the conjoint analysis. The findings also contribute to the previously identified patterns of informal worker disengagement from the state when forming partisan linkages (Altamirano Reference Altamirano2019), supporting contributory welfare policies (Altamirano Reference Altamirano2015), or in the case of tax morale (see Castañeda et al. Reference Castañeda, Doyle and Schwartz2020).

This study reveals that informal workers are less supportive of progressive taxation (a fiscal tool of revenue generation, rather than benefits distribution). Citizens facing vulnerability seem to prefer a lean or liberal tax state. Thus, vulnerability raises skepticism across the board, regarding not just the distribution of benefits but also revenue generation. Our findings confirm citizen sensitivity—especially for those less secure—to how policies are financed, following recent contributions on tax preferences (Fairfield 2013; Berens and von Schiller Reference Berens and von Schiller2017; Flores-Macías Reference Flores-Macías2018).

In addition, we provide novel evidence on the potential effects of households as risk-hedging mechanisms. Crucially, we find that sharing the home with a formal labor market participant does not seem to mitigate welfare state skepticism among the vulnerable. Similar to patterns identified for the high-income country context, a secure household setting has only limited power to neutralize the impact of vulnerability on policy preferences (Häusermann et al. Reference Häusermann, Kurer and Schwander2016). Instead, vulnerability has a “multiplier effect” within households (Häusermann et al. Reference Häusermann, Kurer and Schwander2016, 1046). But in clear contrast to social policy dynamics in advanced democracies, magnified vulnerability via household composition seems to reduce expected social policy benefits rather than to increase demand for social protection.

CONCLUSIONS

Welfare states in many Latin American countries are in a delicate position: it is precisely those in need that seem less willing to actively demand more from the state regarding social policy provision (Holland Reference Holland2018; Berens Reference Berens2020). However, current scholarship rarely confronts citizens with realistic social policy options, and surveys often lack the required detail to identify those without employment protection. Therefore, we argue, the policy preferences derived from those works often overlook the heterogeneity of economic vulnerability and portray an incomplete picture of social policy reality. That is, we need a continuous concept of “outsiderness,” rather than a dichotomous one, and we need to factor in how attractive citizens find the social policy supply.

To address the challenge of measuring informality, we collected original survey data at the subnational level in Mexico. We empirically identified informal workers through detailed information about access to contribution-based programs and the possession of a working contract, and we found support for a divide within the Mexican labor market. Yet as the dualization debate implies, this divide is not necessarily dichotomous. Instead, differences become more discernible once we unpack different layers of economic vulnerability. Household membership seems to affect individual demand for public solutions, depending on the household’s risk exposure level. Purely informal households, the prevalent type in our sample, seem less favorably inclined toward any expansion of public pensions, health care, and Prospera, while mixed households resemble this pattern. Shared economic vulnerability seems to reduce support for public social protection programs.

Confronting citizens with social policy trade-offs mimics welfare system complexity often found in middle-income countries, in which clear-cut beneficiaries are not easily identified. However, our analysis suggests that coalitions in Mexico are not yet well defined around specific components of social policy reform. Therefore, our findings highlight the lack of strong coalitions of support willing to actively demand and defend social programs and services in Mexico. This is shown by the various null findings from the conjoint experiment. Targeted benefits seem to provoke ambiguous outcomes for formal and informal workers alike. When we combine program complexity and a disaggregation of economic vulnerabilities, we find some evidence of a labor market divide: more secure workers or, more particularly, those who expect secure employment in the future are more supportive of shifting the tax burden from contribution payers to general taxes or the rich, whereas those who anticipate informality are less supportive of social policy expansion across the board. Our results are consistent across different specifications, which substantiates the robustness of our findings.

The findings have important implications for policymakers and voters in emerging economies. First, the results of unpacking economic vulnerabilities stand in contrast to the argument of a general lack of a labor market divide in developing countries (Berens Reference Berens2015b; Baker and Velasco-Guachalla 2018) and confirm the need for better instruments to identify those who are at risk (Baker et al. Reference Baker, Berens, Feierherd and Menéndez González2020). For instance, the higher the level of mixed households in a society, the stronger the position of the informal sector workers, despite a significant share of formal workers in society, and the harder it will be to detect underlying cleavages when household composition is not accounted for. Taking a holistic approach to economic vulnerability is therefore key to addressing people’s needs.

Second, informal sector workers seem to be fundamentally skeptical of the public social protection system and redistributive fiscal instruments, and this applies to mixed households as well. Lack of distributive justice and a reduction of formal sector worker benefits might make it much less appealing for informal sector workers to support public solutions. In our study, for those excluded from employment-related benefits, the grass does not always seem greener on the other side. Instead, against the backdrop of a fragmented welfare state, weak state capacity, and low expectations, Mexicans in Querétaro and Puebla who are economically vulnerable seem to expect less from the state and implicitly to adopt a neoliberal stance. Future work needs to delve deeper into the drivers and mechanisms that perpetuate outsider skepticism.

Our study has evident limitations. We need to be careful in generalizing our findings beyond the Mexican case. As improvements in identification strategies of informal and formal sector workers are on the rise in cross-national-level data (Baker et al. Reference Baker, Berens, Feierherd and Menéndez González2020), future research needs to test the implications of varieties of economic complexity in a broader context.

At the time of our study, our findings and robustness tests suggested an apparent disconnect between social policy preferences and political leanings among Mexican respondents in our sample. Future studies should further investigate the conditions under which social policy offerings become politicized and the extent to which political identities may filter public preferences for policies that are perceived to be aligned with partisan platforms and agendas. Exploring the mechanisms connecting political identities and policy preferences opens new research questions in the study of social policy demand in truncated welfare systems.

SUPPORTING INFORMATION

Additional supporting materials may be found with the online version of this article at the publisher’s website: Supplement. For replication data, see the authors’ file on the Harvard Dataverse website: https://dataverse.harvard.edu/dataverse/laps