Introduction

Several recent studies indicate that the structural characteristics of interorganizational networks influence firms’ behavior and outcomes (e.g., Chen & Wang, Reference Chen and Wang2008; Stam & Elfring, Reference Stam and Elfring2008; Shipilov, Reference Shipilov2009; Shipilov, Greve, & Rowley, Reference Shipilov, Greve and Rowley2010; Zheng, Liu, & George, Reference Zheng, Liu and George2010). Network structures have even been described as network resources because of their facilitative role in various interorganizational activities (Gulati, Dialdin, & Wang, Reference Gulati, Dialdin and Wang2002). In spite of the growing consensus that network structures do matter, the specific effects of the content that is exchanged between firms on innovative performance remain unclear. In the literature on social networks, a debate has arisen over the content of interorganizational relationships that can appropriately be regarded as comprising beneficial activities (Gulati, Dialdin, & Wang, Reference Gulati, Dialdin and Wang2002; Hoang & Antoncic, Reference Hoang and Antoncic2003; Kilduff & Brass, Reference Kilduff and Brass2010; Wincent, Anokhin, Ortqvist, & Autio, Reference Wincent, Anokhin, Ortqvist and Autio2010). With regard to network content, interorganizational relationships are viewed as strategic decisions by which firms coordinate their exchange activities to both create value and access various resources that are held by other firms (Hoang & Antoncic, Reference Hoang and Antoncic2003; Wincent et al., Reference Wincent, Anokhin, Ortqvist and Autio2010; Lo & Hung, Reference Lo and Hung2015; Murray & Fu, Reference Murray and Fu2016). From Rodan and Galunic’s (Reference Rodan and Galunic2004) viewpoint, more than the value of a network structure rich with structural holes, political advantages could be explored by examining the value of maintaining a network rich in heterogeneous knowledge. According to another view, a firm is a repository of knowledge that brings about structural opportunities through the use of interfirm networks. This has a powerful effect on determining paths of knowledge acquisition and accumulation (Kogut, Reference Kogut2000). Using the notion of a firm as a knowledge reservoir (Argote & Ingram, Reference Argote and Ingram2000; Kogut, Reference Kogut2000), a firm should consider not only how to occupy a critical position in interfirm networks, but should also consider why it should cooperate with other firms and what to exchange in these relationships (Ibarra, Kilduff, & Tsai, Reference Ibarra, Kilduff and Tsai2005; de Carolis, Litzky, & Eddleston, Reference de Carolis, Litzky and Eddleston2009).

First, this study addresses an important question concerning the relationship between the structure and content of the network in which a firm cooperates with others for reserving knowledge and exchanging resources to in turn acquire heterogeneous knowledge. While prior network studies point to the importance of the structure of interfirm networks, the characteristics (often referred to as the content of the network) of the firm in industrial networks have been underexplored (Podolny, Reference Podolny2001; Wincent et al., Reference Wincent, Anokhin, Ortqvist and Autio2010; Wang, Rodan, Fruin, & Xu, Reference Wang, Rodan, Fruin and Xu2014). Traditionally, the configuration of a firm’s network has been associated with two structural strategies: network centrality and structural holes. Network centrality lends itself to the diversity of available information acquired from the redundancy of links held constant. An alternative structural strategy is required if there is a structural hole in the network. Such structural holes provide different perspectives on the diversity of available information. More structural holes in a firm’s network enhance the firm’s performance (Reagans & Zuckerman, Reference Reagans and Zuckerman2001; Yang, Sun, Lin, & Peng, Reference Yang, Sun, Lin and Peng2011). Given the likely association between the structural strategies of networks and network content with regard to the cooperative purpose among firms and the diversity of their knowledge, alternative implications and a discussion of previous findings relating network structure to performance rests in the potential to facilitate and catalyze organizational innovations. These causal factors, however, have not been disentangled, either theoretically or empirically.

Second, it is critical to explore the role of knowledge in relation to how firms cooperate and exchange knowledge in the conventional sense (Kogut, Reference Kogut2000; Lee & Yang, Reference Lee and Yang2014; Wang et al., Reference Wang, Rodan, Fruin and Xu2014). Recent comprehensive reviews of the social network literature reveal a dearth of studies on this topic, with little attention focused on the effects of the structural characteristics of networks (e.g., Bell & Zaheer, Reference Bell and Zaheer2007; Kilduff & Brass, Reference Kilduff and Brass2010). The considerable literature on knowledge management related to organizational innovation has yet to consider innovation through the channel of social networks (Hansen, Reference Hansen2002; Rodan & Galunic, Reference Rodan and Galunic2004; Williams & Lee, Reference Williams and Lee2009; Ozer & Zhang, Reference Ozer and Zhang2015). The knowledge-based view of the firm suggests that knowledge is the most strategically significant resource of a firm, and its generative mechanism consists of both static knowledge capital and dynamic knowledge flow (e.g., Kogut & Zander, Reference Kogut and Zander1992; Rodan & Galunic, Reference Rodan and Galunic2004; O’Shannassy, Reference O’Shannassy2015). Connecting with partners can provide channels to deliver knowledge (Bell & Zaheer, Reference Bell and Zaheer2007), opportunities to store knowledge (Wu & Shanley, Reference Wu and Shanley2009), and the means to maintain innovative momentum such that a firm is able to compete with others (Rodan & Galunic, Reference Rodan and Galunic2004). A social networking approach to organizational innovation, which takes into consideration factors related to knowledge flow in network content, along the lines suggested by Gulati, Dialdin, and Wang (Reference Gulati, Dialdin and Wang2002), is lacking. Including network content in the pursuit of social network research (Zaheer & Bell, Reference Zaheer and Bell2005; Bell & Zaheer, Reference Bell and Zaheer2007; Wang et al., Reference Wang, Rodan, Fruin and Xu2014) suggests that integrating insights from work on the knowledge-based viewpoint with social network theory is worthwhile. Furthering our understanding of knowledge in the network context may also help to shed light on key factors in social networks.

This research integrates network structure and network content with social network theory and a knowledge-based view regarding organizational innovation. For the purposes of this research, the concept of a knowledge network includes both the network structure and content by which a firm increases its knowledge cognition. This involves understanding and recognizing what to exchange with partners who hold heterogeneous knowledge and how to deliver knowledge from its position in their interactions (Kogut & Zander, Reference Kogut and Zander1992; Gulati, Dialdin, & Wang, Reference Gulati, Dialdin and Wang2002; Rodan & Galunic, Reference Rodan and Galunic2004; Bell & Zaheer, Reference Bell and Zaheer2007; Wincent et al., Reference Wincent, Anokhin, Ortqvist and Autio2010). Therefore, we develop hypotheses, describe the empirical setting, and, finally, discuss our results, giving an understanding of network structures and the critical role that network content plays in innovative performance.

Network Content and Structure as Managerial Purposes and Resources

A network is a structure that explains the ongoing exchange in relationships. Within a firm, a network can be a source of potential value and capital accumulated over time (Nahapiet & Ghoshal, Reference Nahapiet and Ghoshal1998; Adler & Kwon, Reference Adler and Kwon2002). However, this source does not originate from the qualities of the firm, as understood in terms of abilities (know-how, technologies, intelligence), but is rather a function of the social network within which a firm is embedded (Granovetter, Reference Granovetter1985). There are two main approaches in social network theory (Nahapiet & Ghoshal, Reference Nahapiet and Ghoshal1998) by means of which the whole configuration of a social network can be understood and clarified. One approach focuses on the structural characteristics of the network. Previous studies of network structures focus on the degree of interorganizational relationships (Uzzi, Reference Uzzi1996), direct and indirect connections with partners (Ahuja, Reference Ahuja2000), closure relationships in the community (Coleman, Reference Coleman1990), the firm’s centrality position in the network (Shipilov, Reference Shipilov2009), and the social gap (or structural holes) between contacts (Burt, Reference Burt1992). The other, less explored, approach considers the content of the relationships among firms; that is, the characteristics of the actors and the qualitative nature of the relationships (Uzzi, Reference Uzzi1996; Wincent et al., Reference Wincent, Anokhin, Ortqvist and Autio2010). Research tends to focus on either one or the other of these approaches and there have been few empirical attempts at integrating the two. Further, there has been little discussion about the flow of knowledge as a purpose of network content (Rodan & Galunic, Reference Rodan and Galunic2004).

However, the resources available to a firm via its relationships with partners and the content of these interactions may be just as important as network structures in explaining the benefit of social networks (Nahapiet & Ghoshal, Reference Nahapiet and Ghoshal1998; Hoang & Antoncic, Reference Hoang and Antoncic2003). While not denying its power and effectiveness, a purely structural perspective of networks leaves considerable variance unexplained. Where interactions have to do with the exchange of knowledge (Tsai & Ghoshal, Reference Tsai and Ghoshal1998; Yli-Renko, Autio, & Sapienza, Reference Yli-Renko, Autio and Sapienza2001; Arikan, Reference Arikan2009), a consideration of the network structure of such exchanges needs to be augmented by a discussion of the knowledge held by firms in their respective relationships (Kogut & Zander, Reference Kogut and Zander1992; Kogut, Reference Kogut2000; Rodan & Galunic, Reference Rodan and Galunic2004). In addition, previous studies on network structure and knowledge heterogeneity provide evidence that firms in networks composed of partners with heterogeneous experiences benefit from the experiences and knowledge of a variety of partners (Beckman & Haunschild, Reference Beckman and Haunschild2002; Rodan & Galunic, Reference Rodan and Galunic2004; Sammarra & Biggiero, Reference Sammarra and Biggiero2008). Sammarra and Biggiero (Reference Sammarra and Biggiero2008) suggest that a focal firm, together with other firms, exchanges technological, market, and managerial knowledge with its partners, emphasizing the complex nature of the innovation process, which requires access to and a recombination of heterogeneous knowledge. By acquiring heterogeneous knowledge from its partners, by occupying a key position in the network, a firm is able to foster innovation and creativity. Although knowledge heterogeneity is critical for firms to access from their partners or coordinators when considering network structure, there should be more attention paid to how to explore the mechanism of knowledge flow in the network context (Podolny, Reference Podolny2001; Rodan & Galunic, Reference Rodan and Galunic2004).

Considering the importance of network strategies attached to knowledge and its flow among firms’ relationships, it would seem appropriate to consider network content: why firms cooperate (knowledge cognition) and what knowledge is exchanged (knowledge heterogeneity). Adding this information to a knowledge-based view and existing research on network structure will give us a fuller account of how firms circulate knowledge in line with social network theory. It would be valuable to display the configuration of the social network (Nahapiet & Ghoshal, Reference Nahapiet and Ghoshal1998; Gulati, Dialdin, & Wang, Reference Gulati, Dialdin and Wang2002) and also to reveal the importance of knowledge in the network (Kogut & Zander, Reference Kogut and Zander1992; Kogut, Reference Kogut2000; Wang et al., Reference Wang, Rodan, Fruin and Xu2014).

Network structure: How firms channel structural characteristics

The structural characteristics of networks emphasize the strategic benefits and advantages that firms are able to derive from their relationships. This perspective considers the consequences of variation in the relationship between a firm’s industrial position (Nahapiet & Ghoshal, Reference Nahapiet and Ghoshal1998; Tsai & Ghoshal, Reference Tsai and Ghoshal1998; Owen-Smith & Powell, Reference Owen-Smith and Powell2004; Shipilov, Reference Shipilov2009) and the effect of disconnected contacts, which is most systematically explained by Burt’s (Reference Burt1992) research on structural holes (Ahuja, Reference Ahuja2000; Zaheer & Bell, Reference Zaheer and Bell2005). However, a firm’s skills base and knowledge are implicit elements of the network structure that are seldom directly measured by either perspective in a network. Burt’s (Reference Burt1992) theory of structural holes and Freeman’s (Reference Freeman1979) view on network centrality feature different perspectives on obtaining information and, implicitly, knowledge. The popularity of these two views of network structure have much to do with their robustness (Lechner, Frankenberger, & Floyd, Reference Lechner, Frankenberger and Floyd2010; Paruchuri, Reference Paruchuri2010) in providing different mechanisms associated with social networks.

Occupying a central location in an industrial network (Wasserman & Faust, Reference Wasserman and Faust1994) gives a firm a competitive advantage for resources and power. Greater centrality, which is defined most broadly by the number of direct ties a firm has with others (Freeman, Reference Freeman1979), allows a firm to access more knowledge and increases the knowledge available from diverse connections. Central firms are likely to both access knowledge and be exposed to critical new developments sooner than less central firms (Salman & Saives, Reference Salman and Saives2005). Moreover, the globally central firm can reach any firm in the network much faster than others. Therefore, firms that are centrally situated have both the status and the power necessary to access knowledge and, moreover, control the flow of knowledge in the network (Shipilov, Greve, & Rowley, Reference Shipilov, Greve and Rowley2010). The advantage of network centrality, then, is that, by connecting with diverse partners, knowledge perception is broadened and knowledge cognition is facilitated. When a certain threshold has been reached, further increases in centrality are more likely to create links with other firms, which in turn will increase a firm’s knowledge cognition, which is defined as the firm’s understanding and recognition of knowledge domains that have been acquired from others and which serve to increase the firm’s knowledge capital.

The other structural characteristic, structural holes, refers to how a particular firm is able to span boundaries to perform a critical role in restructuring and acquisitions. A structural hole between two firms increases the likelihood of diverse views and an increase in the number of gaps in a firm’s network means that the knowledge available to the firm increases (Burt, Reference Burt1992; Zaheer & Bell, Reference Zaheer and Bell2005; Tiwana, Reference Tiwana2008). Broadly speaking, structural holes are important to a firm’s innovative outcomes because they execute the knowledge flow between various alters linked to the same ego but not linked to each other. Structural holes, then, represent an opportunity for knowledge brokers or boundary spanners to bring together different knowledge streams, leading to richer content (Shipilov, Reference Shipilov2009). The firm that spans structural holes is likely to understand and store knowledge from a broader range of fields. Therefore, such a firm not only economizes on the scope of its interactions with others in gathering knowledge but also possesses greater knowledge that is also richer in content. The extent of the connections requires that firms that value richness in their search of knowledge channel their search efforts through a focal firm (Burt, Reference Burt1997). This pushes the firm to understand the different knowledge and experience gained from its partners and increases the knowledge base and cognition of the firm. It is clear that the advantage gained from structural holes is that firms have access to diverse sources of knowledge and can increase their knowledge cognition. Consequently, we can consider that:

Hypothesis 1: The position a firm occupies in the network will correlate positively with its level of knowledge cognition in terms of searching for and learning such knowledge.

Moreover, network structure also provides opportunities for the firm to access heterogeneous knowledge from network members. Burt (Reference Burt1992, Reference Burt1997) suggests that structural holes are the gaps between nonredundant contacts to access different knowledge from other networks, because actors in the two networks are unaware of one another. It directs that the actors who span the structural hole, by having contact with the other side of the hole, have access to both knowledge and resources and so benefit from the network (Shipilov, Reference Shipilov2009; Ozer & Zhang, Reference Ozer and Zhang2015). Zaheer and Bell (Reference Zaheer and Bell2005) consider that a firm in a network rich in structural holes will be able to acquire novel and heterogeneous knowledge from unique parts of the network since it occupies the gap among different networks and so can be exposed to a greater heterogeneity of nonoverlapping and nonredundant knowledge flows by interacting with disconnected partners (Burt, Reference Burt1992). Structural holes, that is, allow a firm the advantage of absorbing different and heterogeneous knowledge from partners not directly connected to each other.

In addition, firms in central positions in the network have better opportunities to acquire heterogeneous knowledge. Shipilov (Reference Shipilov2009) considers a central firm to be better informed about diverse and heterogeneous knowledge in the network. It increases possibilities for the central firm to absorb critical and different knowledge from the network. The firm in the central network position has great scope to collect and utilize different knowledge because many direct and indirect ties among partners connect with the central firm (Polidoro, Ahuja, & Mitchell, Reference Polidoro, Ahuja and Mitchell2011). The benefits of network centrality are relevant when a firm is searching for heterogeneous knowledge because it offers access to nonredundant sources of different and heterogeneous knowledge. Following this, we expect that the central firm benefits and has more chances to further its advantage by obtaining different and heterogeneous knowledge from other members of its network. Consequently, we anticipate that the network centrality and structural holes of a firm, the manifestations of network structure, have a positive effect on heterogeneous knowledge acquisition obtained from network members.

Hypothesis 2: The position a firm occupies in the network will correlate positively with the level of heterogeneous knowledge that a firm accesses from different partners.

Network content from the perspective of a knowledge-based view of the firm

It is the persistence in the organizing of social relationships in which knowledge is embedded (Kogut & Zander, Reference Kogut and Zander1992). A firm may increase its innovative capacity and enhance its competitive advantage by accessing knowledge across organizational boundaries from a variety of both close and distant partners through interactive channels. From the perspective of a knowledge-based view of the firm, the structure is composed of static knowledge capital and dynamic knowledge flow (e.g., Kogut & Zander, Reference Kogut and Zander1992; Rodan & Galunic, Reference Rodan and Galunic2004). Network structures create the channels by which knowledge can be exchanged and delivered, allowing a firm to increase its knowledge base. The firm does so by accessing knowledge through relationships with partners. Owen-Smith and Powell (Reference Owen-Smith and Powell2004) suggest that network channels, information exchange and knowledge flow from actor to actor within the status of the social structure constitutes the framework of the firm’s capabilities in terms of understanding and storing knowledge in a competitive environment. Williams and Lee (Reference Williams and Lee2009) consider that knowledge and external opportunities for gaining a competitive advantage are more likely to be developed and utilized using a social network. There is also evidence that the structural characteristics of a network explain the path of exchange regarding how knowledge flows in firms’ relationships (Bell & Zaheer, Reference Bell and Zaheer2007; Sammarra & Biggiero, Reference Sammarra and Biggiero2008). The mechanisms of knowledge capital and how a firm is able to utilize it are unexplored from the perspective of network content.

There is considerable evidence to suggest that firms’ interactive relationships can signal which firms are likely to cooperate and what firms are likely to seek (Hoang & Antoncic, Reference Hoang and Antoncic2003; Lee & Yang, Reference Lee and Yang2014). Research on cooperative relationships shows that the aims of networking are often decided by the reasons for cooperating and with whom to collaborate (Reagans & McEvily, Reference Reagans and McEvily2003; Wincent et al., Reference Wincent, Anokhin, Ortqvist and Autio2010). Network content, discussed from a knowledge-based view, explains the purpose of a firm’s cooperation; to increase its knowledge cognition and to acquire knowledge from its partners who have different expertise. We will begin with a careful explanation of the concept and then identify network content from the knowledge perspective for the purpose of networking and what to access: knowledge cognition, increasing firms’ knowledge capital, and heterogeneous knowledge for acquiring partners’ specific knowledge.

Knowledge heterogeneity: Network content and what firms choose to exchange

In this research, knowledge heterogeneity is defined as the different knowledge, expertise, skills, and experiences of partners in network relationships. It refers to the degree of diversity in technology, knowledge, product, or skill between the focal firm and its partners. Rodan and Galunic (Reference Rodan and Galunic2004) suggest that a firm can access heterogeneous knowledge, which is a variety of knowledge, know-how, and expertise gained through network structure, to improve its creativity and ability to invent ideas. The firm is thus enriched through knowledge cognition and is able to discern and utilize stored knowledge. In other words, knowledge heterogeneity allows for the acquisition of knowledge from different sources and may increase a firm’s knowledge cognition at a deeper level than that of its contacts.

From the knowledge-based view of the firm, competitive advantages are likely to arise from the knowledge which it utilizes to add value to product outcomes and development. In order to enhance and increase a competitive advantage, a firm begins to acquire knowledge from the external environment. By acquiring knowledge from partners, a firm can leverage its R&D expenditure, not only to improve product development (Rindfleisch & Moorman, Reference Rindfleisch and Moorman2001), but also to obtain a greater understanding of its technology and knowledge (Spencer, Reference Spencer2003). The firm can add heterogeneous knowledge to its existing knowledge and increase its understanding by gaining access to different technological and knowledge fields from diverse partners (Wu & Shanley, Reference Wu and Shanley2009). The firm can develop its understanding of knowledge, know-how, and skills as a result of accessing heterogeneous knowledge from its partners in the network. Heterogeneous knowledge meets the resource needs of a firm and also provides opportunities for understanding different information, which can be added to the firm’s knowledge base (Rodan & Galunic, Reference Rodan and Galunic2004). In a cooperative network, by exchanging heterogeneous knowledge with diverse partners, a firm is likely to develop and expand its own knowledge, which means increasing its knowledge base. Thus, we should explore the relationship between the heterogeneous knowledge to which the firm has access though interacting with its partners and its knowledge cognition for understanding and storing knowledge. This suggests the following:

Hypothesis 3: A high level of heterogeneous knowledge that a firm accesses from different partners will correlate positively with the level of its knowledge cognition and how it searches for and acquires new knowledge.

Knowledge cognition: Factors influencing why firms cooperate in a network

Knowledge cognition refers to the recognition and understanding of knowledge, skills, and know-how, which a firm acquires from others in order to increase its own knowledge capital. A critical motive behind a firm’s choice to collaborate with other firms is gaining access to these partners’ knowledge bases (Kogut, Reference Kogut2000; Owen-Smith & Powell, Reference Owen-Smith and Powell2004; Galvin & Arndt, Reference Galvin and Arndt2014) and then converting this received knowledge into its own knowledge base. The greater the knowledge acquired in cooperative relationships, the greater the knowledge cognition that can be accessed from the firm’s knowledge capital. Therefore, a firm will cooperate with other firms in order to enrich its knowledge cognition by increasing its knowledge capital.

According to Borgatti and Cross’s (Reference Borgatti and Cross2003) study, organizational learning can be seen as the part of the cognitive process which is the mechanism by which a firm understands and stores partners’ knowledge and expertise. The study indicates that a firm’s knowledge accumulation is the stock of the firm’s expertise and the understanding of this knowledge, which is originally gained from the firm’s learning from others (Bierly & Chakrabarti, Reference Bierly and Chakrabarti1996). The storage and understanding of knowledge is developed through associative learning in which activities are recognized into the firm’s knowledge capital by establishing links with pre-existing concepts (Cohen & Levinthal, Reference Cohen and Levinthal1990). Therefore, knowledge cognition, which is the firm’s understanding and recognition of knowledge, is constructed through the firm’s learning.

In addition, Fiet, Norton, and Clouse (Reference Fiet, Norton and Clouse2007) suggest that the firm learns of technology and knowledge development companies while seeking different domain knowledge from its partners. The firm, that is, will seek knowledge that it considers lacking and will learn what it can in terms of furthering its abilities and technology development or increasing its knowledge assets (Shenkar & Li, Reference Shenkar and Li1999). In particular, this searching behavior is one aspect of the organizational learning process (Katila, Reference Katila2002). On the other hand, when the firm learns how to create, retain, and transfer knowledge thereby developing a procedural understanding of its knowledge base, it will search for further novel knowledge with which to replenish its domain knowledge (Kogut & Zander, Reference Kogut and Zander1996; Greve, Reference Greve2007). The function of organizational searching is to improve firms’ existing knowledge and to enable firms to learn new skills from the external environment. As well as increasing the firm’s knowledge cognition, another advantage of searching behavior is that firms are alerted to new ideas for wealth creation in its stores and utilities (Patel & Fiet, Reference Patel and Fiet2009). In general, organizational discovery, however, relies on a fit between the new knowledge and a firm’s prior, specific knowledge and experience, which can be discovered through searching behavior.

Encouraging knowledge cognition will improve not only the attainment of knowledge, and is thus associated with an increase in organizational learning (Gavetti & Levinthal, Reference Gavetti and Levinthal2000) and searching behavior (Patel & Fiet, Reference Patel and Fiet2009), but could also increase the knowledge capital of the firm (Wu & Shanley, Reference Wu and Shanley2009). This view, then, presents the advantage of organizational searching, which, it shows, can have a positive effect on organizational innovativeness (Katila & Ahuja, Reference Katila and Ahuja2002) in at least two ways. First, organizational searching increases the number of a firm’s new technologies or products. Increasing a firm’s knowledge searching capacity adds knowledge cognition to the firm’s knowledge capital, facilitating the possibility of combining a new useful product or technology with greater innovative performance. Second, the searching behaviors of a firm enrich its knowledge capital with regard to understanding and recognizing knowledge by adding distinctive new variations. By understanding these new variations, the firm is likely to also understand how to utilize them in its own development process and therefore how to use it as a source of knowledge capital.

Moreover, Cohen and Levinthal (Reference Cohen and Levinthal1990) suggest that a firm’s ability (e.g., absorptive capacity, organizational learning) to recognize the value of new, different knowledge, and to apply it to its own development is important in relation to its innovative capabilities. Learning is a system of knowledge accumulation and flows across the organizational structure (Bontis, Crossan, & Hulland, Reference Bontis, Crossan and Hulland2002). The firm can strengthen its learning capabilities by acquiring diverse knowledge from the external environment and storing this new knowledge in its knowledge base. Given this, a firm is able to develop new products or technology from its reserves of knowledge capital with regard to knowledge cognition and thereby increase its innovative performance. Consequently, in our final hypothesis, we propose the following:

Hypothesis 4: A high level of knowledge cognition, accessed by searching behavior and knowledge learned from the network, will show a positive correlation with a firm’s high level of innovative performance.

Methodology

Research setting

We chose to conduct our research in Taiwan’s high-tech industry for several reasons. First, Taiwan’s technology and innovation industry is well developed (Dodgson, Mathews, Kastelle, & Hu, Reference Dodgson, Mathews, Kastelle and Hu2008; Yang, Motohashi, & Chen, Reference Yang, Motohashi and Chen2009). Taiwan’s IT industry (e.g., semiconductors, IC design, and liquid crystal displays) has become a critical player in the global market (Chu, Reference Chu2009). Second, the high-tech industry has been driven by innovative activities because the surest path to successful commercialization has been to develop new technologies (Stuart & Podolny, Reference Stuart and Podolny1996; Stuart, Reference Stuart2000). Innovation in technology is viewed as a critical activity by most of the firms in the high-tech industry. For this reason, the industry is considered to be an appropriate context in which to investigate the role of cooperation (Muthusamy and White, Reference Muthusamy and White2005; Wu & Cavusgil, Reference Wu and Cavusgil2006) and stockholding (Mudambi & Navarra, Reference Mudambi and Navarra2004; Gomes-Casseres, Hagedoorn, & Jaffe, Reference Gomes-Casseres, Hagedoorn and Jaffe2006) as a strategy for searching, learning, and acquiring technological capabilities from partners, cooperators, joint ventures, etc.

Data

Both primary and secondary data were gathered for the analysis. In order to gather our secondary data, the sample that we analyzed included Taiwan’s high-tech firms that were incorporated into the Association of Industries in Science Parks and the Taiwan Stock Exchange Corporation (TWSE) in 2009. Science parks have increasingly been promoted in order to facilitate technology transfer because they often result in fast-growing, highly technological, geographically clustered firms within an industry (Tan, Reference Tan2006). The phenomenon of clustered firms defines network boundaries by gathering in the same geographic area. The TWSE is the Taiwanese governing body under the Ministry of Economic Affairs, ROC (Taiwan). It has compiled complete data of company profiles, financial data, and the private data of shareholders for firms that are listed in Taiwan.

Using these two valuable sources for data collection (from Association of Industries in Science Parks and TWSE), we established knowledge network data, which were defined as the relationships between the focal firm and its shareholders; linkage boundaries were identified using four main steps. First, based on the cluster of science parks, we collected 750 high-tech firms in science parks from the Taiwan Science Park Business Directory (Association of Industries in Science Parks, 2009). Second, after investigating the TWSE database to access the complete data of company portfolios, finances, and their shareholders’ linkage, 164 high-tech firms were identified in the TWSE database from these 750 high-tech firms. Third, we collected information about each firm’s shareholders, which were identified in the TWSE database. In order to prevent missing data from occurring and increase congruity for the whole knowledge network, shareholders who cooperate with the focal firm had to be both listed in the TWSE database and related to the high-tech industry. There were 108 shareholders who were satisfied both of these criteria. Linkages between the focal firm and its shareholders were used to establish and represent the knowledge network boundary. As the focal firm coordinates with its shareholders efficient knowledge flow and exchange may occur (Gomes-Casseres, Hagedoorn, & Jaffe, Reference Gomes-Casseres, Hagedoorn and Jaffe2006). When knowledge flows across network boundaries, which are established using the relationships between the focal firm and its shareholders, this illustrates the concept of the knowledge network. Finally, based on these 108 shareholders, who were identified in the third step described above, a snowball method was used to follow leads to further build the knowledge network boundaries (Wasserman & Faust, Reference Wasserman and Faust1994). A single snowball-round of the sample investigation was collected from shareholders connected to high-tech firms within science parks in the initial round; an additional 164 firms in total were identified. After five rounds, the snowball method generated 180 additional firms. In total, we acquired 344 firms for primary data mailing and network data construction. Consequently, a 344×344 matrix of organizational interaction proximity was generated, where the value of cell ij is 1 if the shareholder has stocks in the focal firm, and 0 otherwise. This network matrix was used to calculate network variables (e.g., structural holes, degree centrality, betweenness centrality, and closeness centrality).

The design of the questionnaire involved three steps: initial questionnaire development, questionnaire pretesting, and mailing of the final questionnaire. First, using the network and knowledge management literature, the questionnaire items were generated to demonstrate and test previous studies. Second, in order to fit the real environment, we used early pretests with 10 of the high-tech firms’ top management team members to verify and clarify the questionnaire items. This resulted in a slight modification of the wording of a few items, which further strengthened the content validity of the questionnaire. Finally, we sent a covering letter and the questionnaire to the Chief Executive Officer (CEO) or top management team of each firm in the sample, asking them to respond. Each high-tech firm only received one questionnaire to complete. In order to improve our response rate, we employed techniques recommended by Dillman (Reference Dillman2000), which included follow-up phone calls and mailing or faxing duplicate copies of the survey. Responses were received from 144 of the 344 firms we surveyed (41.86% response rate).

Nonresponse bias effect

In order to confirm that the participating firms were representative of the general population, the t-test and analysis of variance analyses were employed to check for differences between early and late wave-mailing respondents (Armstrong & Overton, Reference Armstrong and Overton1977). Using t-test analysis, we checked the potential for nonresponse bias by comparing key attributes of respondent firms to those of the targeted population sample (nonrespondent). The results of the t-tests for structural holes (p=.756), network centrality (degree: p=.729; closeness: p=.667; betweenness: p=.751), knowledge cognition (knowledge search: p=.429; organizational learning: p=.311), knowledge heterogeneity (p=.621), and innovative performance (p=.562) revealed no significant differences between respondent and nonrespondent groups. We also examined the difference between different wave returns in order to estimate nonresponse bias (Mishra, Heide, & Cort, Reference Mishra, Heide and Cort1998). To compare first-, second-, and third-wave respondents, the analysis of variance analysis was performed against the null hypothesis that the structural holes (p=.677), network centrality (degree: p=.652; closeness: p=.828; betweenness: p=.364), knowledge cognition (knowledge search: p=.409; organizational learning: p=.883), knowledge heterogeneity (p=.077), and innovative performance (p=.281) do not differ among these different waves of respondent groups.

Dependent variable

In line with previous studies, we measure innovative performance in terms of patent creation, that is, as the average number of patents granted annually to a firm’s employees (e.g., Stuart & Podolny, Reference Stuart and Podolny1996; Ahuja, Reference Ahuja2000; Stuart, Reference Stuart2000; Owen-Smith & Powell, Reference Owen-Smith and Powell2004). The average number of patents granted is 0.162 for each firm in this research. Patents are a critical measure of innovative performance because they are directly related to inventiveness (Ahuja, Reference Ahuja2000); they are considered to describe the technological position of a firm (Stuart & Podolny, Reference Stuart and Podolny1996), characterize the innovative activities of a firm (Stuart, Reference Stuart2000), and confer intellectual capital (Phene, Fladmoe-Lindquist, & Marsh, Reference Phene, Fladmoe-Lindquist and Marsh2006).

Independent variables

Network structure: Network centrality and structural holes

Network structure is measured as a formative construct encompassing the following components: network centrality and structural holes. Network centrality and structural holes are calculated using a full structural adjacency matrix, constructed by combining ego network archival data and information from cited contacts. Adopting archival sources in order to construct network data provides one with an advantage when it comes to conducting network research (Marsden, Reference Marsden1990) because questionnaire items may be able to draw forth negative interactions with sensitivity or ego problems on the part of respondents (Scott, Reference Scott2013) and the specializations of these respondents within the organization can give rise to lock-in directions where only one informant responds concerning the organization’s interactions with all other organizations (Borgatti & Cross, Reference Borgatti and Cross2003; Kijkuit & Van den Ende, Reference Kijkuit and Van den Ende2007). Moreover, Borgatti, Everett, and Johnson (Reference Borgatti, Everett and Johnson2013) consider the claim that network data gathered from archival documents have the power to predict comprehensive interactive relationships between organizations, because they are able to provide complete and detailed information about relevant organizational resources and interorganizational relationships (Hoang & Antoncic, Reference Hoang and Antoncic2003). The UCINET v6.221 program serves to identify the structure matrix made by the network data (Borgatti, Everett, & Freeman, Reference Borgatti, Everett and Freeman2002). The simplest definition of centrality is therefore that central firms are those that are most active given that they have the most ties to other firms in the network. Based on Freeman’s work (Reference Freeman1979), we calculated degree centrality for each firm using the following formula:

where C D (n i ) is the firm i’s degree of centrality index, d(n i ) the degree of the firm i, X i+ refers to the matrix of firm i’s business network data, X ij the business network data between firm i and j.

Betweenness centrality refers to the location of the firm on the shortest path (i.e., geodesic) between any two organizations in its business network. Formally, betweenness centrality for firm i is calculated as

where g jk (n i ) refers to the number (n) of geodesics (i.e., shortest paths) linking firms j and k that contain focal firm i. The term g jk (n i )/g jk captures the probability that firm i is involved in the shortest path between j and k. Betweenness centrality is the sum of these estimated probabilities over all pairs of firms (excluding the ith firm) in the network.

The last variable of network centrality, closeness centrality, focuses on how close the firm is to all the other firms in the network. We adopted Freeman’s (Reference Freeman1979) formula to calculate closeness centrality:

where d(n

i

, n

j

) is the number of lines in the geodesic linking firm i and j.

![]() $\mathop{\sum}\limits_{j{\equals}1}^g {d(n_{i} ,\,n_{j} )} $

is the total distance that firm i is from all other firms, where the sum is taken over all j≠i.

$\mathop{\sum}\limits_{j{\equals}1}^g {d(n_{i} ,\,n_{j} )} $

is the total distance that firm i is from all other firms, where the sum is taken over all j≠i.

We also assessed the presence or absence of structural holes in the overall network of ties among firms because we wanted to measure the extent to which firms access structural holes in the total network structure. Based on Burt (Reference Burt1992), network constraint effectively measures a firm’s lack of access to structural holes. The formula we use for constraint is as follows:

$${{\left[ {\mathop{\sum}\limits_j {\left( {1{\minus}\mathop{\sum}\limits_q {P_{{iq{\rm }}}{\!}\, m_{{jq}} {\rm }} } \right)} } \right]} \over {Cj}}$$

$${{\left[ {\mathop{\sum}\limits_j {\left( {1{\minus}\mathop{\sum}\limits_q {P_{{iq{\rm }}}{\!}\, m_{{jq}} {\rm }} } \right)} } \right]} \over {Cj}}$$

(Borgatti, Everett, & Freeman, Reference Borgatti, Everett and Freeman2002; Burt, Reference Burt1992), where P iq is the proportion of firm i’s ties invested in connection with contact q, m jq the marginal strength of the relationship between contact j and contact q, and C j the total number of contacts for firm i. This measure captures the extent of nonredundancy in a firm’s network, where higher values of efficiency (which ranges from 0 to 1) signify a network high in structural holes (Burt, Reference Burt1992), that is, the firms’ partners are not connected to each other. The value of 1 indicates that none of the firm’s contacts are redundant if all of the firm’s partners are unconnected to each other.

Knowledge heterogeneity

Knowledge heterogeneity is measured using Cummings and Teng’s (Reference Cummings and Teng2003) 2-item scale. Knowledge heterogeneity is defined as the degree of heterogeneous knowledge held by the focal firm, compared with its partners. Therefore, we asked each firm whether (1) their partners had the knowledge base necessary for the basic understanding and implementation of know-how transferred from us (the focal firm) and (2) whether we (the focal firm) had the knowledge base necessary to understand how their partners planned to use this transferred know-how (Cronbach’s α=0.710). Moreover, the Spearman–Brown reliability is the most appropriate reliability coefficient for estimating 2-item measures, because this reliability is less biased than other indicators of scale reliability (Eisinga, te Grotenhuis, & Pelzer, Reference Eisinga, te Grotenhuis and Pelzer2013; Kooij & Zacher, Reference Kooij and Zacher2016; Lombardi, Danielson, & Young, Reference Lombardi, Danielson and Young2016). The Spearman–Brown reliability coefficient of knowledge heterogeneity was 0.73, which indicates good reliability (Nunnally, Reference Nunnally1978).

Knowledge cognition: Knowledge searching and organizational learning

Knowledge cognition refers to how technology and knowledge are understood and comprehended by a firm in order to recognize and increase its understanding of various knowledge domains. We conceptualize knowledge cognition as a higher order construct that increases in magnitude as each of the two knowledge cognition components increases, meaning that knowledge cognition is a composite that requires a formative measure (Diamantopoulos & Winkelhofer, Reference Diamantopoulos and Winkelhofer2001; Diamantopoulos & Siguaw, Reference Diamantopoulos and Siguaw2006). The process of knowledge searching and organizational learning assists a firm in increasing its knowledge capital and in extending the scope of its knowledge domains: that is, how to recognize what they are and how to utilize them. Knowledge searching has to do with the systematic search undergone by a firm to identify new ideas and skills for increasing its perception of knowledge and technology (Patel & Fiet, Reference Patel and Fiet2009). Therefore, a firm can increase its knowledge cognition by discovering specific (the recollection of particular information) or general knowledge (information that can be codified into rules or procedures) through systematic search activities (Fiet, Piskounov, & Patel, Reference Fiet, Piskounov and Patel2005; Patel & Fiet, Reference Patel and Fiet2009). Adapting from Patel and Fiet (Reference Patel and Fiet2009), three items are used to measure knowledge searching in this study: (1) we have engaged in deliberate systematic search, (2) for us, identifying business opportunities has involved several learning steps over time rather than a once-off process, and (3) best business ideas just come (reversed) (Cronbach’s α=0.706).

The other component of knowledge cognition, the behavior of organizational learning, specifies that a firm can absorb specific knowledge, technology, and skills both from network partners (interorganization) and from employees (intraorganization). Muthusamy and White (Reference Muthusamy and White2005) argue that the organization gains knowledge and resources from partners by inter-learning. On the other hand, intraorganizational learning (within a firm) indicates the extent to which the firm values learning processes. According to these arguments of inter- and intraorganizational learning, derived from Wu and Cavusgil (Reference Wu and Cavusgil2006), Chen, Duan, Edwards, and Lehaney (Reference Chen, Duan, Edwards and Lehaney2006), and Huber (Reference Huber1991), there are five items that can be used to measure organizational learning: (1) learning in the firm is viewed as key to organizational survival, (2) the sense around here is that employee learning is an investment, not an expense, (3) we strongly encourage the incorporation of fresh ideas and knowledge into the workplace, (4) we send employees to relevant exhibitions/congresses, and (5) we use information from competitors to improve our processes of production (Cronbach’s α=0.838).

Control variables

Firm size and firm age

We use the measures of firm size and firm age as control variables, since larger (Wu, Wang, Chen, & Pan Reference Wu, Wang, Chen and Pan2008) and older firms (Zaheer & Bell, Reference Zaheer and Bell2005) may have greater capacity for innovation and creation (which require more resources and capital) than newer or smaller firms. We therefore controlled for firm size by calculating the logarithm of the firm’s total number of employees, and we controlled for firm age by calculating the logarithm of the years since the firm was founded.

Foreign patenting experiences and R&D expenditure

Stam and Elfring (Reference Stam and Elfring2008) consider that the extent to which firms possess patents reflects their experience in applying for patents, and may also reflect their innovative capabilities. Moreover, if a firm has patents in a foreign market, then it is able to access a broader market with more advanced technological abilities. Hence, for dummy variables, we controlled for a firm with foreign patents issued from foreign countries. In addition, we also controlled for a firm’s R&D expenditure by calculating the logarithm of the firm’s R&D expenditure in the focal year, because an appropriate control would be to include R&D expenditures for reducing the consideration of innovative output and process (Ahuja, Reference Ahuja2000).

Financial performance

Some studies demonstrate that innovative activities are closely related to financial performance because managers have the resources to explore new products or ideas (Shipilov, Reference Shipilov2009). Therefore, we include a firm’s performance measure, earnings per share, in order to control for the possibility that financial performance affects innovation.

Knowledge complexity and knowledge tacitness

Simonin (Reference Simonin1999) considers that more complex technological systems or knowledge maps produce higher levels of ambiguity and, therefore, restrain knowledge transfer between a firm and its partners. According to the definition of complexity, we therefore adapted three items from Simonin (Reference Simonin1999) and Kogut and Zander (Reference Kogut and Zander1992) in order to measure knowledge complexity: (1) technology/process know-how from partners is the product of many routines and resources, (2) many options and alternatives need to be considered, and (3) requires a lot of time to be understood before it can be used (Cronbach’s α=0.744).

Simonin (Reference Simonin1999) suggests that causal ambiguity can be a barrier to imitation as well as that complexity and tacitness can lead to ambiguity. Therefore, we also controlled for knowledge tacitness, adapted from Simonin (Reference Simonin1999) and Kogut and Zander (Reference Kogut and Zander1992) by asking each firm whether (1) technology/process know-how from partners can be easily codified (in blueprints, instructions, formulas, etc.), (2) is more explicit than tacit, (3) in the company, and (4) does not need several experts to explain it (Cronbach’s α=0.882).

Network relationships and network density

We use five items to measure the strength of the ties between a firm and its partners because a firm benefits from the exchange of information or the transfer of knowledge when strong network relationships are fostered (Yli-Renko, Autio, & Sapienza, Reference Yli-Renko, Autio and Sapienza2001; Chen & Wang, Reference Chen and Wang2008). Therefore, we asked each firm whether (1) we interact well with our partners that cooperate with us to enhance the business-related exchange of information, (2) we will take the relationship of key customers to the broader marketplace and access information of other firms from key customers, (3) we often seek to establish links with other firms in order to enhance our reputation and image, (4) we, in our position in the industry network, are able to provide powerful marketplace information to firms that interact with us, and (5) the position we occupy in the industry structure is a key role in this network (Cronbach’s α=0.844).

Furthermore, we also controlled for the overall density of the network using the variable network density, calculated for each firm’s network. Some scholars suggest that the rate and extent to which knowledge diffuses increases with density (Shipilov, Reference Shipilov2009; Zheng, Liu, & George, Reference Zheng, Liu and George2010), and, therefore, could have an impact on new product development and innovation.

Results

Measure validity and reliability

The measures were validated by confirmatory factor analysis (CFA) using AMOS 16.0 for Windows. Measures were subjected to a purification process in order to assess their reliability, convergent validity, and discriminant validity (Byrne, Reference Byrne2010; Hair, Black, Babin, & Anderson, Reference Hair, Black, Babin and Anderson2010). Formative constructs, which measured secondary data, do not require inclusion in the analysis and, moreover, the construct was not under any dimensions when conducting CFA (Diamantopoulos & Winkelhofer, Reference Diamantopoulos and Winkelhofer2001; Diamantopoulos & Siguaw, Reference Diamantopoulos and Siguaw2006). Network structure is modeled as a formative construct with network centrality and structural holes, which are calculated from a full structural adjacency matrix using network data (Borgatti, Everett, & Freeman, Reference Borgatti, Everett and Freeman2002). Network structure is not incorporated into the CFA process. However, knowledge cognition is modeled to be a formative construct using knowledge searching and organizational learning as manifest variables in a questionnaire scored on a Likert scale. These two constructs, knowledge searching and organizational learning, are incorporated into the CFA in order to measure validity. The CFA results for the measurement model, including the measurement items, standardized factor loadings, standard error of regression weight, critical ratio for regression weight, etc., are presented in Table 1. The overall disposition of the CFA model fit index χ2-value is 41.70 (with a df=32) and the p-value is .11. The goodness-of-fit index (GFI) is 0.93, adjusted GFI is 0.88, root mean square error of approximation is 0.05, normed fit index is 0.92, Tucker–Lewis index is 0.97, and comparative fit index is 0.98. These indicators suggest that the overall disposition of the model fit indexes is reasonably goodFootnote 1 .

Table 1 Results of confirmatory factor analysis

Note.

a Composite reliability (CR)=(∑X i )2/(∑X i )2+∑Var(E i ); where X i is the standardized factor loadings and Var(E i ) is the error variance associated with the individual indicator variables.

b Average variance extracted (AVE)=∑(X i 2)/∑(X i 2)+∑Var(E i ); where X i is the standardized factor loadings and Var(E i ) is the error variance associated with the individual indicator variables.

C.R.=critical ratio for regression weight; SE=standard error of regression weight; SFL=standardized factor loading.

*p<.05, **p<.01, ***p<.001.

The average variance extracted values, shown in Table 1, all exceed 50%, indicating that the measurement error variance is less than the variance captured by the latent variable and that measurement error is therefore not influencing our results. The other reliability estimates, including coefficient αs and AMOS-based composite reliabilities, are well beyond the threshold levels suggested by Byrne (Reference Byrne2010). These results demonstrate reliability.

Anderson (Reference Anderson1987) defines convergent validity as the existence of a latent trait or construct underlying a set of measures. The convergent validity of a construct is demonstrated by showing that each indicator is strongly related to its theoretical construct. In Table 1, the standardized factor loadings of items on their given constructs are statistically significant (p<.05) and all exceed .5, which demonstrates convergent validity. Moreover, the degree to which measures of distinct constructs differ indicates discriminant validity (Byrne, Reference Byrne2010; Hair et al., Reference Hair, Black, Babin and Anderson2010). These constructs demonstrate discriminant validity as the average variance extracted for each pair of constructs is found to be greater than their squared correlations (Hair et al., Reference Hair, Black, Babin and Anderson2010). The average variance extracted exceeds the level of 0.5 suggesting discriminant validity (Hair et al., Reference Hair, Black, Babin and Anderson2010). Table 2 summarizes the descriptive statistics and correlations among the constructs used for testing the hypotheses.

Finally, in order to assess the suitability of the two knowledge cognition components, an overall knowledge cognition measurement item external to the knowledge cognition index was correlated with the following variables: knowledge searching and organizational learning. We tested these constructs for multicollinearity by calculating variance inflation factors at the item level (Diamantopoulos & Winkelhofer, Reference Diamantopoulos and Winkelhofer2001; Diamantopoulos & Siguaw, Reference Diamantopoulos and Siguaw2006) and condition indices at the construct level (Belsley, Kuh, & Welsch, Reference Belsley, Kuh and Welsch1980). The correlations (Pearson) range from 0.195 to 0.604 at p<.001. Among the two knowledge cognition variables, the correlations (range from 0.195 to 0.604 at p<.001), variance inflations factors (maximum variance inflation factor=2.299), and condition indices (maximum condition indices=25.658) indicate that collinearity does not seem to pose a problem. Typically, correlations over 0.70, variance inflation factors over 10, and condition indices over 30 indicate serious multicollinearity problems (Belsley, Kuh, & Welsch, Reference Belsley, Kuh and Welsch1980; Diamantopoulos & Winkelhofer, Reference Diamantopoulos and Winkelhofer2001) (Table 3).

Table 3 Detailed information on formative constructsFootnote a

a The possible range for all measures is from 1 to 5 (1=‘strongly disagree,’ to 5=‘strongly agree’).

VIF=variance inflation factor.

*p<.05, **p<.01, ***p<.001.

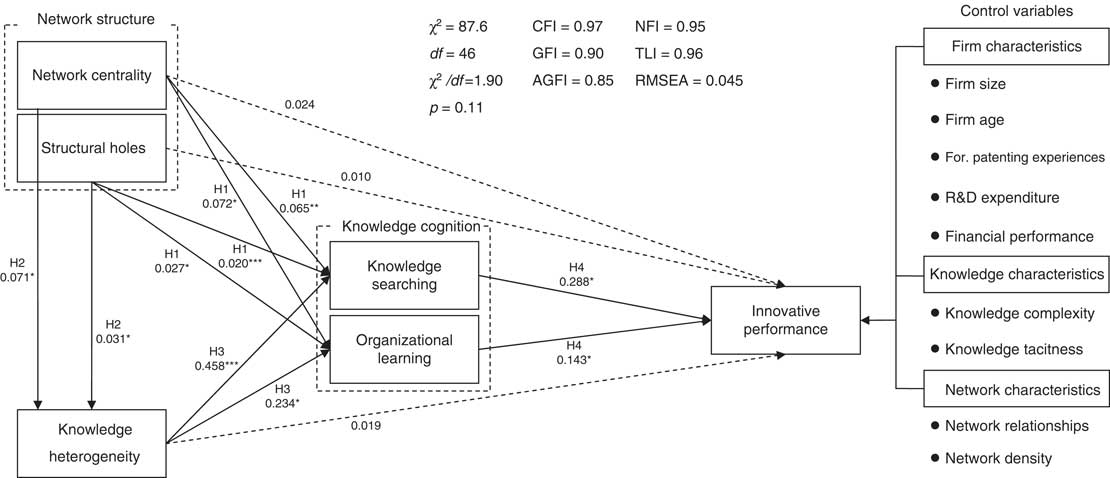

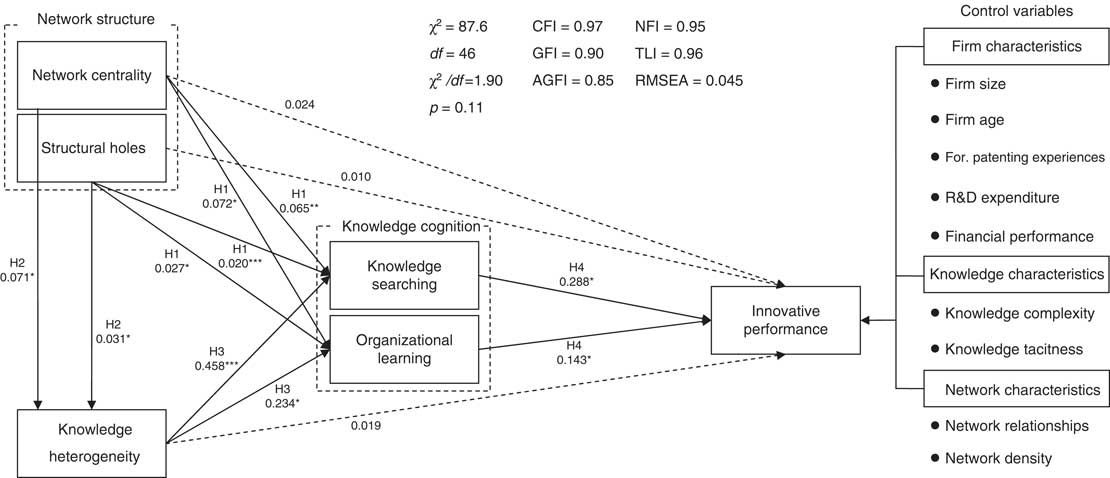

Hypothesis testing

Using the covariance matrix resulting from the CFA of the measurement model as input, the hypotheses were assessed via SEM. The test results are presented in Table 4. The results show that the overall disposition of the model fit index χ2-value was 87.6 (df =46), with a p-value of .11. The GFI was 0.90, adjusted GFI was 0.85, root mean square error of approximation was 0.045, normed fit index was 0.95, Tucker–Lewis index was 0.96, and comparative fit index was 0.97. These indicators showed that the model fit indexes had an excellent overall disposition.

Table 4 Results of hypotheses testingFootnote a , Footnote b

a N=144 firms.

b Path coefficients are standardized.

*p<.05; **p<.01; ***p<.001.

The analytical results showed support for all hypotheses. Network centrality, one aspect of network structure, had a significantly positive influence on knowledge heterogeneity (β=0.071, t=2.019, p<.05). It also had a significantly positive effect on knowledge searching (β=0.065, t=3.115, p<.01) and organizational learning (β=0.072, t=2.114, p<.05), which are the two elements of knowledge cognition. Furthermore, structural holes, the other aspect of network structure, showed a positively significant, direct effect on knowledge heterogeneity (β=0.031, t=2.227, p<.05). It also has a positively significant, direct effect on the searching for knowledge (β=0.020, t=3.264, p<.001) and organizational learning (β=0.027, t=1.958, p<.05). Therefore, Hypotheses 1 and 2 were supported.

In support of Hypothesis 3, evidence showed a positively significant and direct effect of knowledge heterogeneity on knowledge searching (β=0.458, t=3.716, p<.001) and organizational learning (β=0.234, t=2.077, p<.05). Finally, Hypothesis 4 was supported. Knowledge searching (β=0.288, t=2.312, p<.05) and organizational learning (β=0.143, t=2.140, p<.05) allowed for the absorbing and storage of knowledge which the firm could recognize and understand and as such had a significant, positive effect on innovative performance (see Figure 1).

Figure 1 Results of structural equation model of knowledge network and innovative performance.

NOTES: Solid lines indicate significant paths. Dashed lines indicate nonsignificant paths. *p<.05, **p<.01, ***p<.001

Discussion

The aim of this research is to develop an understanding of the influence of knowledge networks on innovative performance. Using two social network approaches and building on social network theory from a knowledge-based view, we assess how both the structural characteristics and the content of a network, within which the flow of knowledge is embedded, contribute to a firm’s performance. We aim to provide different network approaches, using social network theory and the knowledge-based view, and then evaluate the channeling, exchange, and circulation of knowledge within a firm’s relationships. In other words, we explore the question: how much does the knowledge network, giving particular consideration to network structure and network content, really matter?

Our findings are consistent with those of previous studies on network structure, which indicate that it performs a critical role in organizational management (Burt, Reference Burt1997; Ahuja, Reference Ahuja2000; Zaheer & Bell, Reference Zaheer and Bell2005; Tiwana, Reference Tiwana2008; Wincent et al., Reference Wincent, Anokhin, Ortqvist and Autio2010). A firm embedded in a network is likely to benefit according to the position it occupies in the industrial network, specifically network centrality and structural holes; a central position (network centrality) and a bridging position (structural holes) are associated with high levels of knowledge heterogeneity and with the acquisition of different and heterogeneous knowledge from network members (Hypothesis 1). They are also associated with high level of knowledge cognition and with the understanding and storing of knowledge (Hypothesis 2). However, our results reflect that a previously established concept, network content, also matters. Drawing on network content and exploring the concept from the knowledge-based view, the heterogeneous knowledge to which firms are exposed is a critical element in increasing a firm’s knowledge cognition (Hypothesis 3). Knowledge cognition and the process whereby firms understand and store knowledge in their knowledge base are important components in innovative performance (Hypothesis 4).

The impact of these findings is particularly noteworthy. Given that the creation of knowledge is of fundamental importance, exploring the network and the mechanisms of knowledge flow within this network serves to justify the importance that social network theory places on the channeling of knowledge (Ahuja, Reference Ahuja2000; Owen-Smith & Powell, Reference Owen-Smith and Powell2004; Zaheer & Bell, Reference Zaheer and Bell2005; Zheng, Liu, & George, Reference Zheng, Liu and George2010). The exchange of knowledge and increasing knowledge capital are important from the knowledge-based perspective (Kogut & Zander, Reference Kogut and Zander1992; Kogut, Reference Kogut2000; Gulati, Dialdin, & Wang, Reference Gulati, Dialdin and Wang2002; Ibarra, Kilduff, & Tsai, Reference Ibarra, Kilduff and Tsai2005; Wu & Shanley, Reference Wu and Shanley2009). It is evident that knowledge circulates in the network and that, in light of this, the question of how to manage it becomes very important to firms. However, previous research does not provide empirical insight and discussion into how knowledge flow in a network actually matters to the firms in that network.

This does not negate the contribution of the structural characteristics of networks to a firm’s relationships. Impacting on innovative performance, network structures, and content provide mechanisms for knowledge flow in the network. Thus, it is not only the network structure that is important in relation to delivering knowledge in the network; knowledge heterogeneity and knowledge cognition, which are manifestations of network content, are also critical for the exchange of diverse knowledge and for cooperation with partners. If network structure is the only aspect to be considered when investigating the flow of knowledge and how it is channeled, then the contributions made by this research will be sparse. Because including network content considers the reasons why firms cooperate as well as the nature of what is exchanged between them, it is essential that this aspect also be considered as part of the mechanisms for delivering knowledge. When both network approaches: network structure and network content, are considered it can be established that they complement each other and also are able to have independent effects. Network structure may facilitate innovation even when there is no knowledge flow in terms of network content, while knowledge flow in network content may help even when there are no structural characteristics of the network to be posited and bridged. This mechanism is consistent with the work of previous scholars on the advantaged position in a competitive network (Tsai & Ghoshal, Reference Tsai and Ghoshal1998; Zaheer & Bell, Reference Zaheer and Bell2005), knowledge recognition and capital (Kogut, Reference Kogut2000; Owen-Smith & Powell, Reference Owen-Smith and Powell2004), and the acquisition of heterogeneous knowledge (Burt, Reference Burt1992; Rodan & Galunic, Reference Rodan and Galunic2004).

Moreover, our findings caution us to consider the critical nature of knowledge cognition in network content. Network structure can provide us with significant insight about the circulation of knowledge within a firm’s relationships if we also disclose the content of the network. This refers to the mechanism of knowledge flow in the network regarding with whom the firm will cooperate and what the firm chooses to exchange. While network content explores the reason and purpose of firms’ cooperative activities in the network, it does not identify the abilities of a firm or the quality of knowledge being shared. In other words, there is no guarantee that a firm can increase opportunities for its survival.

This is a critical insight, given the tendency of the relevant literature concerning networks and the knowledge-based view to presume that network structure and content are a panacea for survival. This point is highlighted by our discussion that network structure and content provide the channel for and the exchange and circulation of knowledge, which is the mechanism of knowledge flow in networking. In short, while knowledge flow within a firm’s relationships are discussed with regard to network structure and content, the ability of a firm to manage and benefit from this knowledge becomes a critical issue in network research.

Managerial implications

Our study has critical implications for how knowledge in networks can be translated into performance outcomes from the perspective of network structure and network content, which constitute the core configuration of networking. Drawing on network structure and network content from a social network theory and knowledge-based view, it is shown that it is important that managers understand and act on these differences. Given the complimentary role of network structure and network content on innovation, managers need to focus on increasing and storing knowledge by understanding knowledge gained from the external environment rather than just expecting to acquire resources from their firm’s critical position or heterogeneous knowledge in the industrial network. It is particularly important for managers to understand that an advantage which the firm may hold in terms of network structure does not necessarily lead to an advantage in relation to network content; that is, knowledge heterogeneity and knowledge cognition. Recognizing that network structure alone does not guarantee performance outcomes, managers should consider the content of networking, why to cooperate and what to exchange, as well as the advantages provided. Although managers do not put more effort into occupying a critical position in the network, they cannot ignore the advantages of network position in terms of obtaining novel and heterogeneous knowledge from network partners. Because network position provides opportunities for firms to access nonredundant and heterogeneous knowledge by occupying a central position and positing the gap among networks, managers should still work to maintain relationships with their network partners and should try to possess network advantages for ensuring that they catch the flow of heterogeneous knowledge and resources.

The importance of considering network content is particularly salient if we consider the costs of knowledge flow in networking. Knowledge cannot always be accurately assessed by a firm, since the characteristics of knowledge are difficult to imitate. As our results show, the benefits of leveraging knowledge in network relationships can improve innovative outcomes by acquiring knowledge from structural relationships and exchanging heterogeneous knowledge with partners and by cooperating with partners to store knowledge and increase its knowledge base. However, it is not always easy to translate this flow of knowledge into innovation within the firm. While managers may understand the importance of knowledge to a firm, they may find it difficult to measure and work out how invest in it to the advantage of the firm.

The implication of this for managers is that any research conducted on network content, which considers knowledge flow in networking, will need to incorporate those organizational abilities and skills by which knowledge is identified. Such research should also evaluate the potential value of external interactions in order to avoid overestimating the benefits accruing to such resources and thereby overstating the perceived abilities of the organizations.

Limitations and directions for future research

The research framework of this study represents a particular way of examining the impact of network structure and network content on the innovative performance of firms from a social network theory and knowledge-based view. The study generates several exciting possibilities for future research. First, both academic researchers and managers may benefit from a more comprehensive outlook stemming from the conceptual framework of this study; this can be obtained by considering the contexts of different countries. While Taiwan plays a critical role in high-technology industries (e.g., semiconductors and liquid crystal displays), Western countries differ from Eastern countries in regard to culture, strategic alliance activities, or partner selection criteria. Moreover, an analysis of different industries has the potential to offer valuable perspectives on the relationships between the relevant variables. Therefore, readers should be cautious about generalizing the results of this study to different national contexts.

Second, while we assessed knowledge heterogeneity using a 5-point Likert scale, future studies could consider developing a more reliable measure of knowledge heterogeneity. Respondents were asked to consider the difference in knowledge, which was assessed and compared with the knowledge heterogeneity of their relationships. However, a broad range of knowledge, or the characteristic of tacit knowledge, made it difficult for respondents to pinpoint these differences with any great degree of accuracy. Establishing objective measures of knowledge heterogeneity, such as assessing well-established heterogeneity with a Herfindahl index of difference in types of partners (Zheng, Liu, & George, Reference Zheng, Liu and George2010), a knowledge heterogeneity matrix (Rodan & Galunic, Reference Rodan and Galunic2004), or technological distance calculations (Nooteboom, van Haverbeke, Duysters, Gilsing, & Van de Oord, Reference Nooteboom, van Haverbeke, Duysters, Gilsing and Van de Oord2007) could be used in the future as another means of evaluating the knowledge heterogeneity between firms. Moreover, knowledge cognition could be examined by considering the quality of knowledge searching. Drawing on different knowledge searching types in innovation, local and distant searches (March, Reference March1991), search depth and scope (Katila, Reference Katila2002; Katila & Ahuja, Reference Katila and Ahuja2002), or knowledge exploration and exploitation (Ichijo, Reference Ichijo2002) could have an impact in the future in terms of varied ways to store knowledge. Studies can be conducted to assess how additional searching behavior affects knowledge cognition and the quality of knowledge searching.

Finally, future studies could refine the measurement of this research’s key constructs and possibly include others. Further work could discuss other indicators (e.g., R&D inputs and patent citations) to measure a firm’s innovative outcomes since average number of patents was used as a single indicator of a firm’s innovative performance. Clearly, future studies might also try to adopt individually or combine in a multiple setting in order to measure innovative outcomes in the broader sense.

Acknowledgements

The authors acknowledge the financial support for this research from the Ministry of Science and Technology, Taiwan, R.O.C. (MOST-105-2410-H-155-042). The authors are also indebted to two anonymous reviewers and Associate Editor Timothy O’Shannassy whose comments greatly improved the paper.