This article investigates the impact of Australian government action and legislation, specifically the carbon tax, on Australian businesses which feature in the country's top 300 emitters list. Based on a qualitative study, it presents insights of business responses in preparing for and managing the carbon tax in Australia introduced in 2012 and subsequently repealed in 2014. Specifically, this article clarifies how these businesses responded to government actions. This focus is important because business and climate change (hereinafter referred to as B&CC) literature leans heavily towards market-based responses to clarify how businesses respond to climate change – however, more recently, business responses have been spurred by international and national politics (Engau & Hoffmann, Reference Engau and Hoffmann2011; Nyberg, Spicer, & Wright, Reference Nyberg, Spicer and Wright2013; Rice & Martin, Reference Rice and Martin2016). As such, understanding how businesses respond to carbon tax can inform legislation that promotes carbon neutrality.

The questions addressed in this article are:

1. How did Australian high-emission businesses respond to government's climate change-related action and legislation?

2. How can this knowledge assist in delineating future carbon legislation?

Uniquely positioned to reflect the views of Australian high-emission businesses during the implementation of the Carbon tax, it is envisaged that the findings of this study will assist in delineating future climate legislation. The article is structured as follows: the first part presents a background of climate change governance development in the global and Australian contexts; the second, a literature review of key works in the field of B&CC; the third details the research design; the fourth presents the results of the study and the fifth discusses the results highlighting the contributions made, the limitations of the study and future research directions.

Climate change governance

The United Nations (UN) has designated Climate action as Sustainability Development Goal 13 urging action to combat climate change and its impacts (UN, 2015). Although relegated to number 13, climate action has the potential to impact several other SDGs including goals that address hunger, poverty, health and well-being, clean water and sanitation, life below water, as well as life on land. Towards this aspiration, the UN proposed ‘Integrat[ing]… climate change measures into national policies, strategies and planning’ (p.14).

Australian climate policy, however, has been heavily impacted by the frequent leadership changes in Australia resulting in the introduction and subsequent repeal of several climate change-related policies (Talberg, Hui, & Loynes, Reference Talberg, Hui and Loynes2016). Since 2010, the country has seen government control pass through the hands of seven prime ministers, following Prime Minister Howard's attempts to ratify the Kyoto protocol in 2007 with climate change featuring as a key factor in the debates between the political parties. The Carbon Pollution Reduction Scheme (CPRS) introduced in 2010, the Clean Energy Future (CEF) plan introduced in 2011, and the Carbon Farming Initiative have all seen premature deaths (Department of Climate Change, 2012) as a result of changing governments. The carbon tax came into effect in July 2012 in Australia with a plan of moving to an emission trading scheme by 2015. The tax required liable emitters to pay a carbon tax of $23 per tonne of their carbon dioxide (or equivalent) emissions (Clean Energy Regulator, 2016). This added an economic imperative for businesses to reduce emissions. However, a change in government in September 2013 when Tony Abbott took over as Prime Minister, saw the repeal of the Clean Energy legislation and the carbon tax in 2014 (Department of the Environment and Energy, 2017).

Around the world, climate legislation is increasingly being introduced with variations in the formats used, such as legislated acts of parliament (e.g., Mexico, the UK), executive orders (e.g., Indonesia, Russia) or strategic policy documents (e.g., South Africa). Countries categorised as least developed and particularly vulnerable to the impacts of climate change (e.g., Zambia) are increasingly active on climate change legislation since the Paris agreement (Nachmany, Fankhauser, Setzer, & Averchenkova, Reference Nachmany, Fankhauser, Setzer and Averchenkova2017). As of 2019, 59 countries have implemented carbon pricing initiatives around the world (World Bank, 2019).

Australia's immediate neighbour New Zealand has embarked on a Zero Carbon initiative in 2019, to reduce net emissions of all greenhouse gases (except biogenic methane)Footnote 1 to zero by 2050. Besides ensuring a climate-resilient future for New Zealanders, this move is motivated by a focus on national and international leadership. An independent Climate change commission was established in December 2019 to advise the Government on climate change mitigation and adaptation, and to monitor progress (Ministry for the Environment, 2020).

Under the UN Framework Convention on Climate Change (UNFCCC) Paris agreement (UNFCCC, 2015), Australia has committed to reducing national emissions by 26–28% from the 2005 levels by 2030 (Department of the Environment and Energy, 2015). Despite a 12.4% reduction between 2005 and 2016, the bulk of the emissions reductions is attributed to changes in land use and forestry while emissions from the energy and industrial processes sectors increased 9 and 5.7%, respectively (Department of the Environment and Energy, 2017). This emphasises the importance of this study of Australian high-emission business responses to Australian government action and climate change legislation.

At the time of writing, Australia's central climate change policy tool is the Emissions Reduction Fund (ERF) established in 2014 and administered by the Clean Energy regulator (Power, Reference Power2018). The ERF, which is a voluntary emissions offset scheme to credit and/or purchase emissions reductions has been criticised in the media as deeply flawed (Baxter, Reference Baxter2019), needs a radical rethink (MacKenzie, Reference MacKenzie2018) and as a discredited scheme (Hannam, Reference Hannam2017). This reveals the complexities in the delineation of carbon policy and this article presents the views of high-emission businesses on the same.

Literature review

Climate change has aptly been described as a ‘super wicked problem’ as we are running out of time and the solution is unfortunately dependent on the same entities which cause the issue (Lazarus, Reference Lazarus2010). A variety of perspectives regarding the efforts required to mitigate emissions are evident in the literature. One view considers self-regulating market mechanisms – macro-economic instruments focusing on pricing carbon as in emissions trading, and micro-economic techniques which encourage consumers to make environmentally-friendly choices – as key approaches for the self-regulating nature of the market to transition to a low carbon society (Webb, Reference Webb2012).

In contrast, a second school of thought which criticised the inadequacy of self-regulating mechanisms proposed that change can only be effected by a top-down approach by enforcing stringent regulations. This school recognised the importance of the role of climate policy in attempting to change the behaviours, attitudes and beliefs of individuals and the society at large towards the science and the mitigation of climate change (Wittneben, Okereke, Banerjee, & Levy, Reference Wittneben, Okereke, Banerjee and Levy2012). The high dependency of the world's economy on fossil fuels has generated a sympathetic view towards the inability of organisations to tackle the issue of climate change effectively (Wittneben & Kiyar, Reference Wittneben and Kiyar2009) making it unreasonable to expect individual businesses to take full responsibility for mitigating climate change. This situation is compounded by the fact that there is no central authority and that policy makers all over the world are dominated by a short-term focus (Lazarus, Reference Lazarus2010).

Kolk (Reference Kolk and Hansjurgens2008) contended that businesses have collectively developed different climate change strategies over the years, responding to developments in the business environment. Correspondingly, their actions have evolved from being initially resistive or inactive (taking a ‘wait and see’ approach), to taking positive steps to address climate change. The factors that encourage resistance include a weak policy framework, uncertainty about government actions and uncertainty about the market place (Okereke, Reference Okereke2007). Businesses can be reluctant to invest in emission reduction initiatives when policy directives are unclear, or perceived as such (Sullivan, Reference Sullivan2009). With increasing evidence that global warming causes natural devastation (IPCC, 2014), corporate attitudes have shifted from initial antagonism to acceptance. When businesses employ reactive strategies, they ‘just do what is legally obliged’ (Kolk, Reference Kolk and Hansjurgens2008, p. 9). When enforcement is stringent and noncompliance penalised, businesses use this strategy and demonstrate the minimum necessary compliance as required by the authorities (Kolk & Pinkse, Reference Kolk and Pinkse2007). Banerjee (Reference Banerjee2001) investigating corporate environmental strategies concluded that business responses are reactive when faced with environmental regulations or can move into proactive strategies when organisations see them as a source of competitive advantage. Cooperative strategies are also found in response to climate change. Cooperative action can help to optimise efficiencies through resource efficiencies, economies of scale, knowledge and skills transfer, risk sharing and other means (Baranchenko & Oglethorpe, 2012).

There is a common acknowledgement that government actions and regulations represent a major influence on business responses to climate change, driving them to reduce emissions (Bradford & Fraser, Reference Bradford and Fraser2008; Brouhle & Harrington, Reference Brouhle and Harrington2009; Delmas & Toffel, Reference Delmas and Toffel2004; Etzion, Reference Etzion2007; Hoffman & Georg, Reference Hoffman, Georg, Georg and Hoffman2012; Kolk & Pinkse, Reference Kolk and Pinkse2007; Okereke, Reference Okereke2007; Sangle, Reference Sangle2011). Regulatory authorities assist organisations by sharing R&D costs and providing technical assistance (Delmas & Toffel, Reference Delmas and Toffel2004). Government authorities, however, do not typically interfere with value chain activities, which are left under the influence of market forces and management actions (Griffiths, Haigh, & Rassias, Reference Griffiths, Haigh and Rassias2007). This can explain the phenomenon that though regulatory pressures are uniformly applied to all members in an industry, uniform responses and performance are not necessarily apparent (Etzion, Reference Etzion2007).

Government policies typically avoid the tensions between environmental protection, consumerism and economic growth (Webb, Reference Webb2012). For instance, the US government policy that prevented the ratification of the Kyoto protocol was attributed by Greenpeace to powerful conglomerates such as Exxon-Mobil (Mackay & Munro, Reference Mackay and Munro2012). Policy-making, whether at a global or national level, is influenced by the bargaining between policymakers, activist organisations and businesses (Fremeth & Richter, Reference Fremeth and Richter2011). The key terms of debate in the political scene in Australia emerged between emissions management and national economic risks with no major political party receiving broad-based support for their climate policies (Pearse, Reference Pearse2017).

A common theme in the literature related to factors impacting on business responses to climate change is the high levels of uncertainty and lack of clarity present in the business environment. Depending on any historical experience for contemporary responses to climate change is futile. Climate change is characterised by ‘uncertainty, randomness and unprecedented scales’, which challenges mainstream theories in conceptualising environmental problems (Kavalski, Reference Kavalski2011, p. 5). New government regulations at the country level that disrupt traditional practices pose risks for businesses and these risks are compounded by uncertainty in the regulatory regime (Kolk, Reference Kolk and Hansjurgens2008). Policy-making is linked to national politics (Millán, Reference Millán2010) and where there is no consensus between all parties on climate change actions, future legislation becomes circumspect and tied to future politics as seen in Australia. Ill-defined policy frameworks and weak incentives can prevent firms from emission mitigation activities (Jones & Levy, Reference Jones and Levy2007; Okereke, Reference Okereke2007; Pinkse & Kolk, Reference Pinkse and Kolk2010; Sangle, Reference Sangle2011). Carbon markets and carbon taxes pose a risk of loss of competitiveness for businesses increasing vulnerability to external competitors (Bebbington & Larrinaga-Gonzalez, Reference Bebbington and Larrinaga-Gonzalez2008). However, while uncertainty in the business environment is generally considered risky for businesses, when coupled with internal capabilities, these forces can be used beneficially by proactive firms which seek opportunities (Sangle, Reference Sangle2011).

B&CC literature predominantly explores the market responses of businesses. There is, however, an increasing focus in recent literature on business actions specifically in response to the political arena spurred by later developments in the political regime both at global and national levels. Examples of this genre include Levy & Rothenberg (Reference Levy, Rothenberg and Ventresca2002), Levy and Egan (Reference Levy and Egan2003), Northrop (Reference Northrop2004), Kolk & Pinkse (Reference Kolk and Pinkse2007), Engau and Hoffmann (Reference Engau and Hoffmann2011), Nyberg, Spicer, & Wright (Reference Nyberg, Spicer and Wright2013), Rice and Martin (Reference Rice and Martin2016). With reference to Australian policy impacts, specifically the carbon tax, Xynas (Reference Xynas2011) favourably reviews from an economic perspective the carbon tax prior to its introduction and the emission trading scheme which was never introduced. There is however limited evidence of real-time studies on Australian business responses when being subjected to carbon legislation and this article attempts to fill this gap. Knowing how businesses responded to carbon legislation can potentially help future regulatory regime to drive business efforts to reduce their carbon footprint. The details of the research design of this study are explained in the next section.

Research design

The results presented in this article are part of a larger study on corporate strategies in response to climate change taking into consideration all the complexities of the varied forces in the macro-environment (Sree Kumar, Reference Sree Kumar2019). This article focuses specifically on the impact of Government actions and legislation related to climate change on the Australian high-emission businesses under study. Exploratory qualitative research was utilised to study business responses to climate change. The interpretation of qualitative data was appropriate ‘to generate new insights on a phenomenon for which there is not a great deal of information’ (Duarte, Reference Duarte2015, p. 428).

Purposive sampling was used by selecting participants according to predefined criteria which included (a) membership of high-emission industries, (b) liable to pay the carbon tax and (c) market capitalisation. This helped to ensure they represented the population studied. The sampling procedure involved two steps. First, high-emission industries were identified using the Australian government report on industry emissions (Department of Climate Change and Energy Efficiency, 2011). The industries selected were coal, oil and gas, electricity, metals and minerals and chemicals. Second, businesses from the selected industries were identified from the Australian Government's National Greenhouse and Energy Reporting (NGER) (Clean Energy Regulator, 2013) high emitters list which included the businesses liable to pay the carbon tax. All the businesses selected featured in the top hundred listed by the Australian Stock Exchange (ASX) in terms of market capitalisation within each industry (ASX, 2011) to ensure that the financial status of the businesses was at par. The 17 businesses selected for the study were three from the coal industry (mining), three from the oil and gas industry (exploration), four from the electricity industry (generator, transmitter, distributor and retailer), four from metals and mining industry (exploration) and three from the chemicals industry (fertilisers, chemicals and polymers).

Primary data was collected via 17 semi-structured interviews with key personnel who were nominated by the businesses selected for the study as officers who had climate change-related decision-making authority (see Table 1). Additionally, two interviews were conducted with personnel from Industry associations (IA1 and IA2) bringing the total number of interviews to 19. Semi-structured interviews facilitated coverage of specific themes that helped answer the research questions. They also provided the flexibility to change the formats and the sequence of the questions to allow the interviewee to explore their experiences, observations and opinions (Kvale, Reference Kvale1996). The interviews were conducted between 2012 and 2013 in the lead up to and during the implementation of the carbon tax. The interviews lasted approximately 1 h each and the participants (with the exception of one) allowed the audio recording of the interview for ease of transcription. Codes were assigned to maintain the anonymity of the participating organisations (Coal – C, electricity – E, Oil and gas – O, metals and minerals – M and Chemicals – CH). Questions related to business responses to government action and climate change legislation were designed as both closed and open ended to elicit factual information as well as opinions (see Table 2).

Table 1. Designations of interviewees

Table 2. Sample questions used in the interviews related to Government

Secondary data supplemented the information collected in the interviews and were key sources of information on business responses to climate change. These included published documents and websites of the businesses which were made available to current and potential investors and to the general public. Additionally, statements made by business leaders served as an important second voice of the business facilitating assessment of the importance of climate change to the organisation. The secondary data used included webpages related to climate change; annual reports from 2010 and 2011; sustainability reports from 2010–2011 and 2012; and CEOFootnote 2 statements from 2010–2011 and 2012 for each of the 17 businesses. Published documents of three industry associations were also studied. Annual reports provided general business information on the business and sustainability reports were key sources of information on climate-related aspects of the businesses. A total of 621 pages from 34 sustainability reports of the 17 businesses were examined. Published documents of three industry associations were also examined.

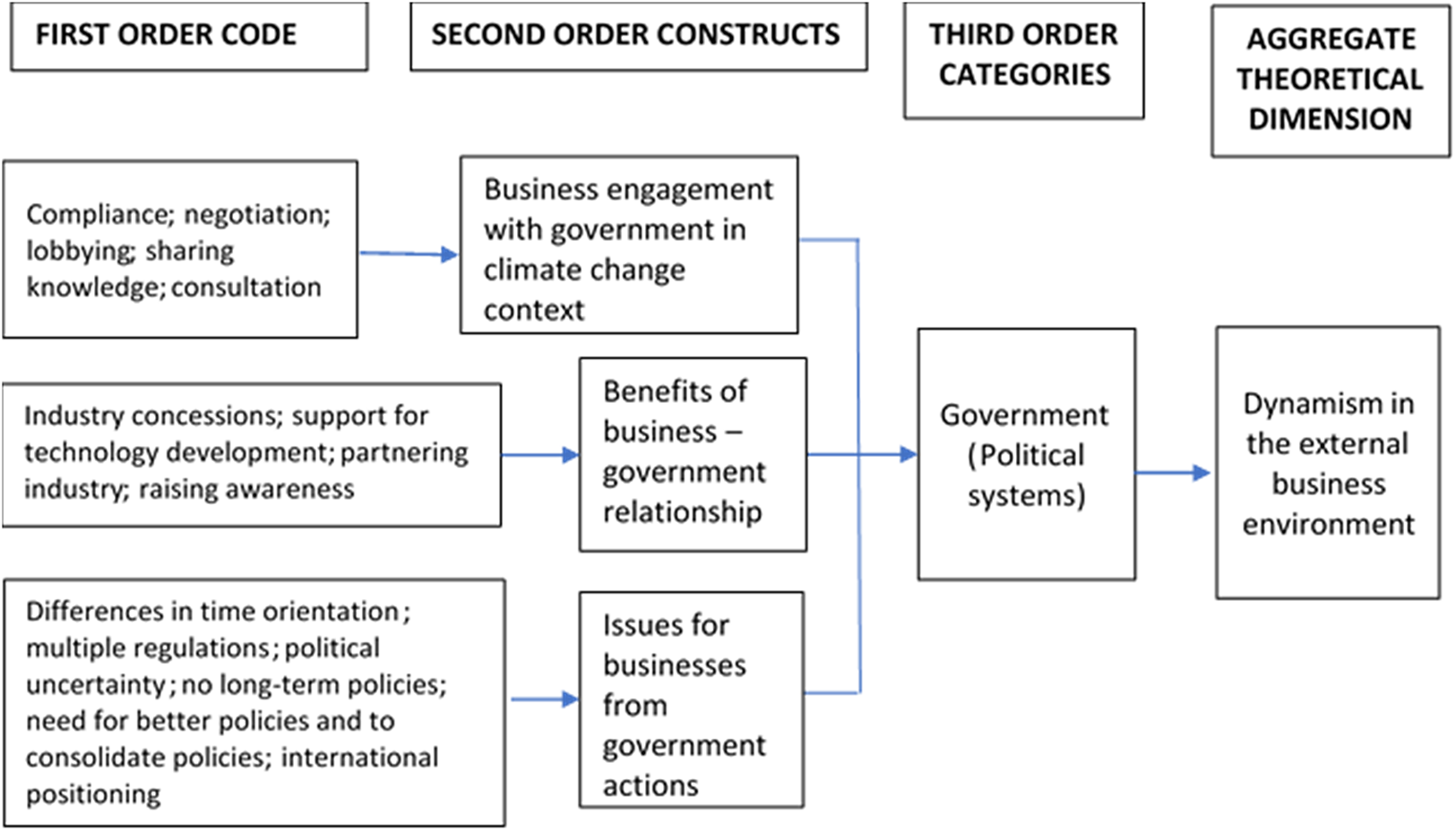

NVivo software was used for the qualitative analysis to identify codes and themes leading to the findings. Themes or categories are ‘broad units of information that consist of several codes aggregated to form a common idea’ (Creswell, Reference Creswell2013 p.186). In the first step of the analysis, business annual reports and webpages were studied to establish the background of each business included in the study. In the second step, preliminary coding of all the data sources to nodes was carried out (see Figure 1) (e.g., compliance, negotiation, lobbying, sharing knowledge, consultation). The third step was the examination of the codes to sort them into second-order constructs (e.g., business engagement with government in climate change context) and third-order categories (or themes) (e.g., government (political systems)) feeding into an aggregate theoretical dimension (e.g., dynamism in the external environment) for further analysis of the data. Thematic analysis of the data examined as presented in this article is an analysis of business responses to government actions and legislation incorporating the forces which drive these responses and the differences in the responses of businesses from the five industries. Additionally, the issues perceived by businesses in relation to government actions and legislation were also analysed.

Figure 1. Code development example: Political systems – Government.

Results

This results section presents the findings related to the business–government exchanges as seen in the study. The importance of government intervention was universally acknowledged by all the businesses studied, contrary to literary claims regarding the ability of market forces and the ‘invisible hand’ to drive emissions reduction. The importance of government climate legislation was highlighted by a senior official from a chemicals business as follows:

I think most Australian businesses would've … their first preferred position would've been, ‘Don't do anything. You're getting in the way of doing our business. Our business is to make product and make money. We've reduced our emissions so what are you worried about,’ type of thing. So the governments do need to regulate it. If it's left to industry to self-regulate on this issue they won't do anything (CH3, Interview).

The findings presented in this section build upon the premise that businesses found government intervention necessary to drive business efforts to reduce their emissions. There was however a variety of perspectives on the methods that the government needed to follow to delineate and implement climate legislation. The remainder of the results section explores the different stances of the businesses in their responses to government action and legislation, and the issues they perceived in the same. Tables are included in each section illustrating the first-order codes and second-order themes identified along with select quotes for a few of the first-order codes.

Business responses to government actions and legislation

All types of business responses were analysed, and three key types of strategies used by businesses in response to government action and legislation were identified. They were resistive strategy, reactive strategy and cooperative strategy. The actions undertaken by the businesses relating to each of the strategy types along with the forces which facilitated these strategies, and the differences between industries within these strategies are discussed in the sections below.

Resistive strategy

Businesses chose a resistive strategy to prevent changes to their operational methods. They could choose to remain inactive if the external forces permitted or alternatively resist the external forces which required them to make changes to their current operations. Inaction was not deemed as an option by the businesses at the time this study was rolled out due to the need for the Australian high-emission businesses to comply with legislation. Thwarting policy and influencing public opinion were seen as key strategies used by the businesses in their attempts to prevent change (see Table 3).

Table 3. Resistive Strategy Analysis – Response to Government Actions and Legislation

Thwarting policy was done by a variety of methods which included lobbying, influencing and advocating and financing the opposition. Lobbying government was evident both as direct business action and through the industry associations: ‘We are part of the ACA which is the Australian Coal Association so we lobby the government through that association primarily because that sort of represents the industry's views’ (C1, Interview). The need for businesses to share their expertise and industry knowledge with the government and highlight their issues helped to influence the regulators, while giving the businesses an opportunity to establish themselves as opinion leaders: ‘We do have a role to educate policy makers about our industry and the complexities’ (C3, Interview). An electricity business had a unique approach to influencing government by sharing knowledge first established in the academic field to free the information from vested business interests (E1, Interview). While no business admitted to financing opposition, a coal business emphatically stated their principles of ‘prohibition of political donations’ (C3, Sustainability Report 2010), leaving one to surmise that the practice existed.

Additionally, businesses engaged in influencing public opinion against carbon policy in public forums, advertising campaigns and sharing information with the media. Businesses were seen taking a strong public position and making public statements about the endangering of their investments and the risk to jobs, to indirectly recruit the support and sympathy of employees, society and media. The fossil fuel businesses which include the coal and oil and gas industries are subject to high levels of both scope 1 and scope 2 emissions which jeopardise their very existence. This made the coal businesses with substantial fugitive emissions the most vociferous in protecting their businesses. The Australian Coal association very famously launched a nationwide advertising campaign in 2009 ‘Let's cut emissions, not jobs’ on behalf of its members seeking to get the support of society by referring to possible job losses if carbon legislation as planned were to go ahead.

Key government-related forces which drove resistive strategies were the uncertainty in global regulatory developments, inconsistency of Australian climate policies and related competitive threats (see Table 4). The need for all countries to move simultaneously is needed to prevent countries like Australia from being disadvantaged when trying to be a first mover in introducing carbon legislation. This sentiment was evidenced throughout the study with participants making statements such as ‘…international negotiations I think that's fine, we should be a part of the conversation, but we should realise that we're not the conversation, we're not the only players in there. I mean look at China, Russia, India and the rest of it’ (C3, Interview). The high volatility of Australian politics was reflected in the lack of commitment to the emission-reducing initiatives of the businesses (M2, Interview). Businesses exposed to international competition were the most affected by this aspect and consequently quite strong in their disapproval of Australia imposing a tax ahead of other countries. ‘Carbon cost comes on Australian business, ie us, and the competitors don't have an equivalent cost then pretty much putting through the … it's a recipe to put us out of business’ (CH3, Interview).

Table 4. Negative Forces – Government Actions and Legislation

Chief differences in resistive strategies between businesses in the five industries were the types and levels of resistance exhibited to government policies and their responses to the carbon tax. The fossil fuel industries (coal, oil and gas) by the very nature of their energy-intensive exploratory operations, the fugitive emissions released and the scope 2 emissions from the burning of their products were the businesses which exhibited maximum resistance to government action and restrictive legislation. The coal-based electricity generators which operated their own coal mines did not have the same clout as the coal industry though they were subjected to similar pressures.

In contrast, the manufacturing and production sectors (metals, chemicals) and the electricity retailers capitalised on the opportunities arising from the carbon legislation to move into reactive strategies.

Reactive strategy

The second identified strategy in relation to government actions and legislation was reactive strategy which compelled businesses to prepare for changes, protect business interests and generate profits in win-win solutions (see Table 5).

Table 5. Reactive Strategy Analysis – Response to Government Actions and Legislation

Preparation for changes in response to legislation saw a flurry of business activities. These included initiatives to put in place systems to cope with the changes. Coupled with a constant need to monitor the environment for emerging changes, businesses were also required to develop skills to track, measure, report and audit emissions. Of these, the first three were done in-house with businesses citing the complexities involved in their respective businesses, the time and cost involved and the need for personnel to develop new skills on the go. Auditing was done by external consultants as per mandatory regulations. Financial modelling to assess the impacts of the carbon pricing featured as a high priority activity. Compliance was mentioned frequently regarding legislation such as the carbon tax and energy efficiency opportunities (EEO) initiatives. There was considerable interaction between businesses and government, whether for simple compliance-related issues or for major policy discussions.

While moving out of the comfort zone as necessitated by forces, businesses were also seen to put in place measures to protect their businesses. These included measures to manage risks such as climate-related insurances and preparation for worst-case scenarios such as investing in other countries, closing operations and increasing prices to cope with the additional burden of carbon taxes. Many businesses acknowledged direct negotiations with government officials to benefit their individual business. The main reasons cited for this was the unique circumstances of each business. They preferred to deal with government directly than through industry associations to protect the details of their business operations. While most of the responses related to the administration of the legislation, the responses such as appraising customers and increasing prices to accommodate costs of the carbon price were also discussed.

All efforts taken by businesses in relation to emissions in the reactive strategy mode neatly fit into the ‘win-win’ rhetoric aimed at generating profits. Having anticipated the carbon tax, businesses claimed to ramp up efforts towards energy efficiencies and emission reductions in anticipation of the carbon tax legislation. The major response to climate change and the associated regulatory impacts focused on the direct monetary benefits to the business. Energy efficiencies led to decreased energy consumption and hence saving on energy costs. Decreasing emissions also helped to alleviate the burden of the carbon tax.

Businesses adopting a reactive strategy were impacted simultaneously by both negative forces which prevented them from taking major steps in reducing emissions while positive forces such as their relationship with other agents such as customers and industry associations, government actions and policy, and the resulting need to advance research and development compelled them to do what was needed at the bare minimum levels (see Table 6).

Table 6. Positive Forces – Government Actions and Legislation

Reactive strategies related to compliance were similar across the board with all businesses in all industries putting in place measures to comply with the legislation, reduce energy consumption and reduce emissions within their capacities to do so. Domestic businesses though concerned about the increased financial burden of the tax, supported the move because it levelled the playing field for all members in the industry, incentivised energy efficiencies, emission reductions, technological innovation, renewables development and set the path for achieving Australia's emission reduction targets. Businesses with limited international presence were not in favour of emission trading claiming they did not have the expertise while a transnational electricity business which strongly supported carbon legislation preferred emissions trading to a carbon tax.

The transnational businesses studied fell into two categories namely Australian businesses with international operations and international businesses with operations in Australia, with a marked difference between the two. The Australian businesses evinced more concern and integration with the developments in the climate change legislative scenario in Australia while the internationals had a more ‘fight or flight’ attitude emphasising their options to move to other countries if Australia becomes uncompetitive: ‘So why should you put your money in Australia when you can go to Africa and basically you have much greater flexibility in operating freedom’ (C1, Interview). They cited the potential for carbon leakage as a reason for the nonviability of the Australian carbon tax introduced ahead of other countries: ‘It would be counterproductive if carbon pricing drove Australian business offshore to countries with little or no carbon price, as this simply shifts emissions to another part of the world rather than reduce global emissions’ (M1, Website).

In terms of impact on customers, the key difference was between businesses which could pass on the additional costs due to carbon tax to the customers versus those businesses which could not, restricted by the fear of losing customers to international competitors or by internationally fixed commodity prices. The electricity retailers saw an opportunity in the impact of the tax on their customers – increasing energy costs which had the potential to make many business customers unviable and individual customers face increased living expenses. Some of the customer-focused solutions they proposed included energy-efficient products, solar installations, co-generation facilities and electric transport solutions.

The oil and gas businesses saw an opportunity to push liquid natural gas (LNG) as the best alternative to coal with lower emissions as an interim measure to renewables. The electricity retailers whose main sources of emission were from their energy consumptions for their operations stood apart with their presence along the value chain and their ability to vertically integrate. They were seen actively moving into commercial production of renewable energy with wind farms and solar projects and consequently actively supported carbon legislation and renewable targets.

The metals and mining, and the chemicals industries which were predominantly consumers of energy, dabbled in small-scale renewable energy projects for their own consumption and were receptive to the drive to reduce dependency on fossil fuels and increase renewable energy production, provided alternative energy could replace fossil fuels in terms of affordability, availability, suitability and dependability. A chemicals business personnel expressed support for the carbon tax as a key motivator for the drive towards renewable energy but qualified it with the need for the tax revenue to be channelled into developing renewable energy solutions.

Cooperative strategy

Cooperative strategy here refers to business responses to climate change working with other agents in the business environment in developing policy, developing partnerships and developing research. Cooperative strategies were evidenced in all the businesses examined. Cooperative responses are seen in both positive efforts to address climate change, reduce emissions and consequently reduce their liabilities due to legislation; and in negative efforts to resist changes due to impending policies (see Table 7).

Table 7. Cooperative Strategy Analysis – Response to Government Actions and Legislation

Cooperative efforts with the government were evidenced in a range of circumstances from policy development to technology development. Businesses claim to work with government agencies on a cooperative basis sharing knowledge and information about their business and their industry. The identified first-order codes are consultation process, sharing knowledge and partnering government initiatives. Business relationships with government extended to providing consultation and partnering research projects.

Developing partnerships appear to be commonly used in the advancement of research in technological solutions to climate change. The range of agents with whom they form these alliances includes government, industrial associations (and through them their competitors and other businesses in the same industry) customers, employees, businesses from other industries, research institutions and universities and there are also a few evidences of multi-agent groups. Industry-wide negotiation processes to improve outcomes for the industry were also evident.

Developing research on behalf of entire industries was initiated by industry associations on behalf of member companies to aid in emissions reduction. The COAL 21 fund to which black coal mining companies contribute for the purpose of R&D of low emission technologies is a prime example of one such venture. In the investigation of cooperative ventures with research organisations, reference to the Commonwealth Scientific and Industrial Research Organisation (CSIRO) which is the Federal government agency for scientific research in Australia came up very often.

Collaborative efforts between businesses and other agents assisted in the pooling of skills, knowledge and resources in the research ventures, sharing costs and sharing risks. Homogenous industries such as the coal industry were seen to participate in cooperative action with other members of the industry to promote research and also to lobby the government. In diverse industries like chemicals, the businesses were reluctant to work with their competitors or through industry associations for fear of leakage of crucial business information.

Issues perceived by businesses in government action and legislation

Data analysis revealed the key issues related to government actions and climate legislation as the short-term and fragmented policy regime, the uncertainty surrounding policy and international positioning (see Table 8).

Table 8. Issues for Businesses from Government Actions

Businesses opined that the government's limited conviction on the impact of climate change facilitated economic imperatives taking a front seat in government decision-making. An insightful statement by an interviewee compared the longevity of businesses to the short-term focus of governments with limited terms of administration (C3, Interview). The carbon tax was seen as a revenue-generating instrument for the government and not really meant for driving reduction in emissions or renewable energy production. A long-term view was aired by an interviewee (E1) who cited the examples of legislation banning smoking in public areas and drink driving to protect the health and welfare of citizens to emphasise that governments cannot ‘swim against the tide’ forever ignoring the ill effects related to climate change. Additionally, the dissatisfaction of the businesses in being subjected to multiple regulations with no consistency between state and federal policies and the political uncertainty impacting on carbon legislation drew some very intense responses.

The uncertainty surrounding the carbon tax was of major concern to the businesses. Political uncertainty led to businesses anticipating the revoking of the carbon pricing legislation which reflected in the lack of commitment to their emission reduction initiatives. Businesses that had begun to implement the carbon tax had a few practical issues in terms of the complexities and costs involved in the administration of the carbon tax. Some referred to the need for continued consultations with the government to sort specific issues affecting their business/industry. Businesses claimed that though they were prepared to start complying with the carbon tax, the Government was not ready to administer it, citing documentation and processing issues. This implied the premature introduction of the tax without ironing out the potential issues related to the administration of the new legislation.

The design of the carbon tax to transition from a fixed price after 3 years to emission trading was welcomed by some who said that it gave them time to get prepared for trading. Opinions that emission trading was a better option than a fixed price was seen to come mostly from transnational organisations with exposure to international practices while domestic operators did not believe in the efficacy of emission trading nor were they interested in developing new skills to participate in trading. The main negative effects of the carbon tax were identified as monetary related and risk related. Monetary issues included financial outlays required for compliance, increase in the costs of administration related to carbon accounting, auditing and reporting and increase in energy costs. The risks identified related to the carbon tax were risk of losing market share to overseas competitors, risk of carbon leakage, risk to Australian economy and risk to jobs.

The Australian government's actions related to Australia's international positioning brought forth negative views. While acknowledging the science of climate change, Australia's move ahead of other countries to introduce carbon tax as perceived by the businesses was seen to jeopardise business competitivity in the international market. A transnational coal business representative (C2) stated in the interview that Australia's aspirations to be a global leader in introducing climate legislation ahead of other countries attracted ridicule in the global arena.

Following the presentation of the research findings, the next section reengages with extant literature to demonstrate how this article contributes to and extends B&CC scholarship related to the impact of government actions and legislation on business responses to climate change and the associated issues as perceived by the businesses.

Discussion

While the global endeavours have progressed with the Paris agreement (effective 2016) and the corresponding undertaking of Australia's endeavours to reduce emissions by 2030, it is envisaged that some form of new carbon legislation needs to emerge in the political/legal system in Australia in the near future. It is believed that the findings of this research with regard to how Australian high-emission businesses responded to government action and climate change-related legislation and the associated issues perceived by the businesses will assist regulatory authorities in the formulation and implementation of new legislation.

The importance of the role of the government and legislation to address climate change has been emphasised in literature and reiterated by the findings of this research in the Australian context. Reducing emissions needs reduction in demand for energy which is however in direct correlation to lowering economic growth is driven by consumer demand. This results in direct contradictions between climate change policies, consumerism and growth, with governments placed in a controversial position needing to boost consumerism and consequently economic growth on the one hand, while trying to effect the reduction of carbon emissions on the other as reiterated by Webb (Reference Webb2012). This has translated into the frequent changes that Australia has experienced in the political regime related to climate change policies.

Business responses to climate change as examined in this research are hugely dependent on the developments in the macro environment as all the agents in all the systems evolve in the context of climate change. To achieve substantial reductions in emissions, solutions need to factor in holistic efforts fuelled by a universal acknowledgement of an urgent need to reduce emissions. Echoing the words of Teece, Peteraf, and Leih (Reference Teece, Peteraf and Leih2016), the invisible hand of the market is not sufficient to deal with the uncertainties inherent in climate change. Notwithstanding the issues in the details of the legislation and the absence of equivalent legislation in the rest of the world, the need for some type of a national legislation to drive emission reductions if Australia is to meet its 2030 target was evident in the findings as perceived by businesses.

Despite intense lobbying and attempts to influence policy in the lead up to the carbon tax, as discussed in the resistive strategy of businesses, this research revealed that once the law was passed, all the businesses were seen to be reactively making a range of efforts to comply to the legislation, getting their carbon accounting and reporting systems in order and making additional efforts to reduce emissions and reduce energy consumption to lower their carbon tax liabilities. Top down carbon legislative directives such as the carbon tax which levelled the playing field in the industry were seen by the businesses which were predominantly consumers of energy as effective instruments to drive change and innovation in the direction of renewable energy in response to climate change. Cooperative ventures give businesses the security in numbers, sharing risks and costs as they venture into the unknown responding to climate change.

Understanding the forces which result in resistive, reactive and cooperative strategies will assist in government efforts to diminish the negative factors such as no long-term policy, lack of clear price signal, risk of becoming uncompetitive and lack of government support to enable businesses to make efforts to reduce their carbon footprint. Additionally, reinforcing the positive forces such as industry-wide regulations and concessions, stability in carbon pricing and government support for technology in general and renewable energy projects in particular will assist businesses in moving beyond reactive strategies into proactive and innovative stances. Facilitating cooperation within industry and between industries with government support will pave the path for forays into technological innovation.

Major criticisms about the delineation of government policy by many of the businesses were (1) the Australian carbon tax was not in line with international developments; (2) the businesses were better prepared for the tax but the government did not seem to have the administration system for the tax fully sorted out and that they were improvising on the go; (3) there were multiple regulations and policies which was a big burden on their administration systems resulting in a need for a consolidated national policy; (4) the carbon tax was only a revenue-generating instrument for the government and not really meant for driving reduction in emissions; and (5) the lack of expertise of auditors and the costs of external auditing which was a mandatory requirement of the government. This brings to the fore Levy's (Reference Levy, Rabin, Miller and Hildreth2000) remark that ill framed and formed regulations can set back the efforts of businesses to mitigate emissions.

The key factors which provided dissonance in the efforts of businesses in implementing the tax included the uncertainty of the future of the tax, the high price set ($23 per tonne of emissions) in comparison to the rest of the world, the complexities and lack of standardised procedures for carbon accounting and the repercussions on passing on the cost of the tax to customers. Political uncertainty fuelled by the dissonance between the political parties seemed the biggest concern for the businesses who were putting in considerable efforts to develop systems and processes to report emissions.

The political and legislative developments in Australia in the context of climate change recall the findings of Lazarus (Reference Lazarus2010) who highlights the issues the world faces in handling the super wicked problem of climate change. Restraining the present is needed to liberate the future. But restraining the present translates to short-term costs which inevitably meet with resistance from powerful players in the political and economic arenas. The success of environmental laws will depend on strategies which make it hard for future powers to undo legislation; on the ability of the legislation to simultaneously exhibit certainty to withstand pressures over the long-term while being flexible to adapt to the uncertain and changing conditions.

The impact of the climate change debate in making and breaking governments in the past two decades in Australia reaffirms the necessity for long-term governance of climate change issues to be free from the politics of the country. The climate change phenomenon is new with no past experiences to assist in decision-making. Elected representatives are torn between the need to ensure the economic growth of the country and consequently promote consumerism on the one hand, while attempting to address climate change on the other. This suggests the potential value of an independent body comprised of experts from different fields who are appointed for periods that exceed election cycles and who have the authority to enact strategies to address climate change, or at least, advise policymakers. One such example is the independent commission in New Zealand (Ministry for the Environment, 2020).

In summary, new carbon legislation is needed to incentivise businesses to move towards carbon neutrality. The conditions that need to be taken care of in designing a carbon price include the following:

• The pricing needs to be in line with international developments. Australia should drive international efforts to bring in a global carbon price.

• Australian economy should not be put at risk; industries which are at risk of losing competitiveness to international competitors need to be supported.

• All details of the policy and administration of the policy need to be fully developed and then rolled out.

• All varied carbon regulations at national and state levels should be brought under one carbon policy.

• The life of the policy should be longer than the term of the government and should be delinked from changes in the government.

• Auditing emission reports needs to be a government function with costs built into the carbon price and the onus of enhancing the skills of the auditors whether in-house or outsourced would be with the government.

• Transparency in the use of the revenue generated by the carbon pricing is needed with the funds invested in advancing low-emission technology, in renewable energy projects and in other projects aimed at reducing dependence on fossil fuels.

• There is an urgent need for definitive carbon legislation to drive businesses to reduce emissions before businesses abandoned all the developed systems and processes to implement the carbon tax.

The findings from this study make important contributions to B&CC scholarship and relatedly, the development and implementation of policies that aim to promote carbon neutrality. Specifically, the findings extend scholarship by clarifying: the key role played by government actions and legislation in the climate change context as perceived by Australian businesses from the high-emission industries; the need for climate legislation for businesses to reduce emissions and move towards a carbon-neutral path; the negative and positive impacts of government actions and climate change legislation on the responses of Australian high-emission businesses to climate change; how these businesses resisted, reacted to or cooperatively engaged with government actions; and the concerns of business representatives with government actions and climate legislation.

Following from these contributions, findings from this study can inform the development and implementation of future climate change policies. This is because they clarify what might help (or hinder) the effectiveness of these policies, as perceived by business representatives. For instance, with reference to the carbon tax, they were concerned by: its limited alignment with international policies; limited consistency between national and state-wide regulations; the associated costs; limited government capacity to readily manage its administration or address implementation issues; and limited government commitment to carbon neutrality, given the changing imperatives, which in turn, heightened cynicism about the rationale for the carbon tax. Collectively, these concerns suggest a need for greater transparency in government decisions to reinforce the policymakers' commitment to environmental sustainability.

Despite the aforesaid contributions of this article, several methodological limitations warrant mention. First, given the study focus and relatedly, the sampling method, participants from small and medium businesses were not included. As such, the relevance of the findings to these businesses is yet to be determined. Second, given the study timeframe, there was no opportunity to gauge the effects of the repeal of the carbon tax. Longitudinal research would help to clarify the short and long term implications associated with such change, particularly those that are industry- or business-specific. Third, although different types of qualitative data from different sources were analysed, its use limits the lifespan of the associated findings, particularly given the cross-sectional design of this study.

This study provides a platform for future research. Specifically, longitudinal research is required to clarify the short and long term implications associated with legislation. With the subsequent repealing of the carbon tax, the changes in the global arena with the Paris agreement, and the continued uncertainty in the national climate policies, it will be enlightening to follow-up on the same businesses to assess their current practices. Longitudinal studies linking business actions to changes in the environment will provide valuable insights both to strategy theories and to business practice in the context of climate change. Additionally, further research on the views of the government and other key agents such as customers and NGOs in the climate change scenario besides businesses is required to develop agendas for action.

This article clarifies how Australian businesses from high-emission industries responded to Australian government actions and carbon legislation. It highlights the forces that impacted their responses and the perceived issues with government actions. These findings can inform legislation that aims to promote carbon neutrality, and serve as a platform for future research.

Acknowledgements

This article draws insights from the PhD research of the first author Sheela Sree Kumar, which was a part of the ARC Discovery Research project ‘Corporate and Institutional Strategies for Climate change- An International Comparative study'. The article builds upon the paper presented by the first author at the Australia New Zealand Academy of Management (ANZAM) 2019 conference ‘Wicked Solutions to Wicked Problems: The Challenges facing Management Research and Practice’.

Dr. Sheela Sree Kumar is an academic with the School of Business, Western Sydney University (WSU) since 2011 teaching in the Management and Human Resources disciplines. She has varied academic experience having taught in private business colleges, TAFE, UTS and has conducted corporate training. She currently teaches management and human resources units at WSU. She completed her PhD at the Western Sydney University in 2019 and her thesis is titled: Corporate strategies in response to climate change – A complexity based study of Australian businesses from the high-emission industries. She obtained her MBA from the Australian Graduate School of Management (AGSM) and has an undergraduate degree in Architecture. Her research interests include corporate strategy, climate change and complexity theory.

Prof. Bobby Banerjee is Professor of Management and Associate Dean of Research & Enterprise at Cass Business School, City University of London. His research interests include sustainability, climate change, corporate social irresponsibility, Indigenous ecology and resistance movements. He has published widely in international scholarly journals and his work has appeared in Academy of Management Learning & Education, Business Ethics Quarterly, Human Relations, Organization Studies, Journal of Management Studies, Journal of Business Research and Journal of Marketing among others. He is the author of two books: Corporate Social Responsibility: The Good, The Bad and The Ugly and the coedited volume Organizations, Markets and Imperial Formations: Towards an Anthropology of Globalization. Bobby was a Senior Editor of Organization Studies during 2007–2019.

Assoc. Prof. Dr Fernanda P. Duarte has a PhD in Sociology from the University of New South Wales. Between 2002 and 2016 she was an Associate Professor at the School of Business, Western Sydney University. She taught, conducted research and supervised PhD candidates on the topics of CSR, sustainability, business ethics, organisational learning and the Scholarship of Teaching and Learning. During her active years, she participated in a number of research projects - including two financed by the Australian Research Council (ARC). She also received awards for her teaching contribution, including one from the Australian Learning and Teaching Council (ALTC). Dr Duarte has published many peer reviewed articles on her topics of interest.

Assoc. Prof. Dr. Ann Dadich is an Associate Professor within the Western Sydney University School of Business. She is also a registered psychologist, a full member of the Australian Psychological Society, and a Justice of the Peace in New South Wales. A/Prof. Dadich has accumulated considerable expertise in health service management, notably knowledge translation. This encompasses scholarship on the processes through which different knowledges coalesce to promote quality care. This is demonstrated by her publishing record, which includes over 150 refereed publications; the research grants she has secured; and the awards she has received. A/Prof. Dadich holds editorial appointments with several academic journals, including the Australian Health Review; and BMC Health Services Research. She is also the Deputy Director of the Sydney Partnership for Health, Education, Research and Enterprise (SPHERE) Knowledge Translation Strategic Platform; she chairs the Australian and New Zealand Academy of Management (ANZAM) Health Management and Organisation (HMO) Conference Stream; and she convenes the ANZAM HMO Special Interest Group. Additionally, A/Prof. Dadich supervises doctoral candidates and teaches undergraduate units on change management, innovation, creativity and organisational behaviour.