Introduction

At the core of the current debates on privatisation is the question of whether the unpopularity of privatisation and its failures, especially in Latin America, are manifestations of problems with the implementation of a fundamentally sound policy, or whether privatisation as a reform policy was itself seriously flawed. The orthodox defence of privatisation tends to blame poor implementation. At the political or strategic level, it is suggested that the policy environments within which privatisation programmes were implemented did not control rent-seeking and political interference, thereby dampening investor interest. Policymakers are condemned for not being committed to privatisation and for abandoning it as soon as they obtained some fiscal manoeuvring space. They are also criticised for being timid and deserting reforms in the face of opposition from bureaucrats and the public. Although orthodox analyses sometimes acknowledge that privatisation is poorly equipped to deal with the distributive conflicts which lead to public protest, more often they claim: (a) that such conflicts may be more a result of politicking than actual conflict; and (b) that the benefits of privatisation are still substantial and conflict could be avoided if the gains were better distributed through superior implementation.Footnote 1 At the tactical level, the orthodoxy blames governments for instituting inadequate or flawed regulatory and market frameworks, and insists that better designed policies would have averted privatisation failures.Footnote 2 A common conclusion of these literatures and approaches is that privatisation programmes fell victim not so much as to strategic flaws but rather to the fact that insufficient attention was paid to preparation and implementation, especially in their institutional aspects. Consequently, analysts argue that privatisation should neither be abandoned nor reversed; instead, efforts to privatise correctly should be strengthened.Footnote 3 In recognising the ‘orthodox paradox’, this literature argues for building up state capacity, but only to the extent that it supports privatisation. It does not even consider how devoting similar amounts of financial and/or political resources to reforming and strengthening public sector institutions and practices might improve the performance of publicly owned utilities without privatisation.Footnote 4

This article argues against the orthodox position in the specific case of the privatisation of public utilities. It does not intend to claim that the efficiency benefits claimed by privatisation advocates did not occur, but rather to explain that efficiency gains are only one of a complex set of factors that determine the overall impact of the privatisation of public utilities. It will build on the finding that privatisation often accompanies economic stabilisation programmes to show that high financial costs are involved in keeping privatisation attractive to private, especially foreign, investors and that these costs may be so high that privatisation ceases to be a sustainable reform. The macroeconomic concerns underpinning most large-scale infrastructure privatisation programmes inevitably subordinate sectoral concerns and create tensions between citizens and investors that are difficult for policymakers. The analysis suggests that from a broader politico-economic perspective the alternative means of reform under continued state ownership may be no more costly than privatisation.

The article is based on an empirical investigation of a ‘critical case’ where the causal chains predicted by the orthodox theories underlying privatisation programmes could not sustain themselves.Footnote 5 The example of the Brazilian electric power reforms largely satisfies the criteria demanded of a critical case. Among the Latin American countries, Brazil was one of the best placed to benefit from orthodox reforms. First, many Brazilian electricity companies, especially the generating companies, were technically well managed even under state ownership.Footnote 6 By enabling more supportive economic and commercial environments, orthodox reforms should have facilitated even more efficiency and investment. Second, electricity tariffs in Brazil were never populist in the traditional sense. Cross-subsidies in the sector favoured large industrial consumers at the expense of domestic ones. Populist political resistance to price rationalisation, which has been one of the key barriers to implementing orthodox reform, was therefore unlikely. Third, the Brazilian federal government had already completed the basic and politically difficult reforms before initiating privatisation. Electricity charges had been raised and many of the state-owned electricity companies had begun streamlining their workforces, forcing thousands of employees into early retirement. Fourth, as Latin America's biggest economy, Brazil enjoyed the investor interest which should have helped cement the orthodox reforms. Finally, the Brazilians had access to a wide range of experiences of energy reforms implemented elsewhere from which to learn.

Given these favourable factors, electric power privatisation should have delivered immediate and self-reinforcing benefits in Brazil. Instead, the programme was in a shambles within five years. First, the privatisation of electricity generating companies stalled. Then, the electricity distribution companies which had been privatised began to haemorrhage money following the devaluation of the Brazilian real because they had accumulated high levels of debt denominated in foreign currency. Finally, the government's attempts to induce private investment through independent power projects (IPPs) also failed. The lack of investment in building generating capacity led to a crippling energy crisis in 2001, and forced the nation into rationing electricity. By the following year privatisation was politically dead. None of the major candidates in Brazil's 2002 presidential elections, not even the incumbent administration's nominee, favoured continuing the process.

If the failure of energy reform in Brazil had been an isolated disappointment among a series of successful privatisation initiatives in the region, it would still have been useful to study the experience, given that the country's electricity industry is the largest and most sophisticated in the region. However, the Brazilian experience is not unique. Public utility privatisation, along with the orthodox economic reforms with which it was associated, has become deeply unpopular throughout Latin America.Footnote 7 Given that Brazil was more favourably placed to benefit from privatisation, understanding why the power reforms failed in Brazil can provide important insights into the general weaknesses in privatisation practice.

Electricity Privatisation in Brazil

The Brazilian energy privatisation programme, like the other infrastructure privatisations in Latin America, was conducted against a backdrop of macroeconomic instability. Such policies were championed by reformist administrations that promised an end to inflation and economic stagnation.Footnote 8 In Brazil, Fernando Collor de Mello was elected as president in 1990 on a platform promising economic stability, modernism and growth. He initiated an ambitious national privatisation programme, but was impeached on charges of corruption within two years of the elections. His vice-president and successor, Itamar Franco, was not of the neo-liberal mould and resisted privatisation, especially of public services.Footnote 9 Nevertheless, he did promote public sector reform. Under his presidency the Brazilian congress passed critical pieces of legislation that paved the way for the institutional reform and financial recovery of the publicly owned power industry.Footnote 10 Franco was, however, not successful in defeating inflation until the end of his mandate, when the last in a series of his finance ministers introduced a currency peg similar to the Argentine Law of Convertibility, and arrested inflation. The success of the Finance Minister, Senator Fernando Henrique Cardoso, propelled him to the presidency. Having defeated inflation, established a strong currency, and won the presidency largely due to his personal popularity, Cardoso was able to push through the Concessions Law (Law 8987/95), which amended Brazil's 1988 Constitution to allow private investors to provide public services and to purchase public utility companies.

Energy privatisations quickly followed. They adhered to the standard norms, with some adjustments that took into account the predominance of hydroelectric power in the Brazilian system. Unbundling vertically integrated power companies was one of the standard prescriptions of the time, though this did not require much restructuring in Brazil because its electricity industry was for the most part already vertically separated, except that transmission was generally bundled with generation. Distribution companies (DISCOS) were privatised in the first phase, and this was to be followed by the generating and transmission companies (GENCOS) in the second phase.

DISCOS were auctioned on the basis of a 30-year concession, and their regulation followed the established British model of price caps. This regulation was applied to costs directly under the control of the DISCO; other costs such as wholesale power purchases and taxes and surcharges were to be passed through automatically to retail tariffs. The wholesale power purchases were subject to a pass-through price ceiling called the valor normativo (VN), which was essentially the maximum price at which DISCOS could acquire power. The concessions contracts also allowed DISCOS to generate up to 35 per cent of their total wholesale power requirements themselves. This was done partly to make the concessions more attractive to investors. More importantly, since power supplies were already stretched thin and GENCO privatisation would take time, the administration wanted to create space for immediate private investment in generating capacity. At this stage a competitive wholesale energy market had not yet been established, and GENCOS supplied power to DISCOS at prices administered by the federal government.

In its initial years the Brazilian power privatisation programme was a resounding success. By late 1997 the major DISCOS had been privatised, with most of them fetching handsome premiums over their minimum reserve prices (see Table 1). In fact, on a per-megawatt basis Brazilian DISCOS generally commanded a much higher price than DISCOS in other Latin American countries. As a result of this frenetic pace of selling, Brazil – which before 1995 had privatised little – quickly became the largest recipient of privatisation revenues in Latin America. As expected, efficiencies in the power sector also increased in terms of increased employee productivity and lower technical losses.Footnote 11

Table 1. Privatisation Prices and Premiums Paid for Brazilian DISCOS

Source: BNDES.

By the time the administration had prepared GENCOS for privatisation, the Asian and Russian financial crises had derailed Brazil's Plano Real.Footnote 12 The currency peg was abandoned in January 1999, and the real's value quickly dropped by half, so that it was trading at over R$ 2 to the US dollar. The privatised DISCOS began to suffer large losses because of their high levels of hard-currency debt and they clamoured for rate relief. Although the regulatory agency, the Agência Nacional de Energia Elétrica (ANEEL), subsequently allowed the increase in electricity tariffs to outpace inflation, investors claimed that this was not sufficient to compensate them for the losses they suffered in the currency markets. In this economically chaotic environment the privatisation of GENCOS stalled. Not only were investors disinterested – when the federal government put the smallest of its GENCOS, Eletrosul, up for sale it received only one bid at the minimum reserve price – but in addition opposition to privatisation solidified in both the political and bureaucratic arenas.

With privatisation stalled and public investment not forthcoming, the system quickly lost reliability. In May 2001, following a drought, the Operador Nacional do Sistema Elétrico (ONS) warned that the hydroelectric reservoirs in most of the country were practically depleted, and President Cardoso was forced to declare emergency electricity rationing. All except the smallest residential customers were instructed to reduce their consumption by at least 20 per cent, failing which they would be fined or even disconnected. The rationing lasted ten months, and cost the industry at least US$ 5 billion in lost revenue.Footnote 13 Estimates of the loss in GDP caused by electricity rationing vary between 1.5 and 2 per cent, which indicates a further loss of about US$ 10 billion to the Brazilian economy.

The Surprise of Rationing

In the wake of electricity rationing blame was hurled in all directions. Some blamed the neoliberal reforms for going too far.Footnote 14 Others complained that they had not gone far enough.Footnote 15 Some accused foreign investors of being overly speculative, while others criticised corporatist bureaucrats for resisting privatisation and liberalisation.Footnote 16 Many faulted political impasses for stalling privatisation and investment.Footnote 17 The more fatalist blamed the drought for drying up Brazil's hydroelectric reservoirs.

Three of the claims that the Brazilian power crisis was caused by circumstances unrelated to the content of the reforms can be eliminated at the outset. The first is that an unforeseeable drought pushed the country towards rationing. While it is true that Brazil's power supply is predominantly hydroelectric and thus threatened by drought, it is not true that the rationing was an unfortunate surprise. Brazil's reservoirs are fed by seasonal rainfall, becoming depleted during the summer and being recharged during the winter. Rainfall in Brazil is quite erratic and it is not uncommon to have several consecutive years of below-average rainfall. These facts were well-known and consequently Brazilian electricity planners deliberately constructed large reservoirs so that there would be enough water stored to carry the system through the dry years. Charts prepared by Eletrobrás indicate that after 1996 these reservoirs were progressively depleted of their reserve storage capacities. While it was not a simple task to determine what level of reserve storage was adequate, given that predicting rainfall years in advance is impossible, Eletrobrás's research laboratory had overcome this problem by developing a sophisticated probabilistic stochastic computational programme called NEWAVE to determine whether existing reservoir capacities were adequate or if new power generation facilities were needed. NEWAVE calculates the possible electricity production capabilities under 2,000 different rainfall scenarios; installed capacity is considered inadequate if expected demand would not be satisfied in more than 5 per cent of the scenarios. After 1995 this threshold safety margin of 5 per cent began to be breached, and the number of scenarios predicting a risk of rationing began to approach 20 per cent. The figures on the risk of rationing were published by various sources including Eletrobrás, and were widely available. As early as 1996, a study by the national development bank Banco Nacional de Desenvolvimento Econômico e Social (BNDES), indicated that Brazil faced a higher risk of rationing after 2000.Footnote 18 Even the consultants contracted by the Ministry of Mines and Energy (MME) to advise on the privatisation and the restructuring of the industry warned that Brazil would face an elevated higher risk of rationing if investment in generating capacity suffered any delays.Footnote 19 Moreover, given the steep drop in energy investments after the mid-1980s, and the fact that the government's inability to invest in expanding infrastructures was the main argument proffered for privatisation, it must have been recognised by even lay people that the electricity supply situation was already critical when power privatisation began in late 1995.

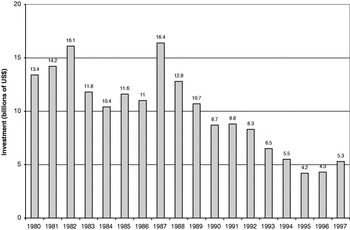

The second claim is that once privatisation stalled, rationing was inevitable because the government was too credit-constrained to raise the money required to invest in the power sector. This claim has two flaws. First, it assumes that privatisation was improving the power supply situation. The evidence indicates the contrary. Instead of improving, the power supply situation deteriorated with privatisation. It was rendered even more critical by that fact that electricity demand accelerated after the Plano Real because monetary stability had stimulated consumer demand and industrial production. In the three years after privatisation, which began when the power supply situation was already grave, electricity consumption increased by over 15 per cent but increases in installed capacity trailed behind at 10 per cent (see Figure 1). The consequent deterioration in the security of supply was evidenced by the fact that in each year after 1996 the levels of the hydroelectric reservoirs were always less than in the corresponding period in the preceding year (see Figure 2). In other words, the reserve stock of water, which was necessary to guarantee the security of supply in an industry in which hydroelectric power supplied over 90 per cent of electricity requirements, was steadily being depleted. Indeed, even as the Brazilian electric power privatisation programme seemed to be showing signs of initial success, the security of supply in Brazil was being steadily compromised.

Fig. 1. Electricity Consumption and Installed Capacity Changes (1981–2000). Source: Author elaboration based on Eletrobrás, Plano Decenal de Expansão, 1997/2006 and 1998/2007.

Fig. 2. Systems Centralwest/Southeast Reservoir Levels 1997–2001. Source: The reservoir levels are available on the website of ONS: http://www.ons.org.br/historico/energia_armazenada.aspx; accessed November 2006.

The main reason for the deterioration was that shortly after initiating the privatisation of the distribution companies, the Cardoso administration began to include the Eletrobrás generating companies in the national privatisation programme, drastically curtailing their investment programmes and rescinding many of the concessions that these companies had been awarded to develop new hydroelectric sites. This leads to the second flaw in the assumptions which is that the government was unable to raise the funds to invest in the industry. While it is a fact that public investment in energy was frozen, it was not, as is commonly believed and as the Cardoso administration repeatedly tried to point out, because of a lack of financial resources.Footnote 20 Several pieces of evidence illustrate this. Despite an outward determination to withdraw the state from the energy sector, the Cardoso administration actively employed public resources to ensure high levels of ‘private’ investment. Almost throughout the privatisation process, BNDES made low-interest loans available to potential (mostly foreign) investors for up to 50 per cent of the reserve price. In some cases BNDES even took equity positions in the privatised enterprises. Initially BNDES had intended to finance the privatisation of only those firms which were in relatively unattractive markets, such as in the smaller states in Brazil's poorer northeast. In the end, under pressure from the Cardoso administration, these loans were extended for the privatisation of all power companies. BNDES was not the only source of public money being provided to private investors in the power industry. In several subsequent sales, funds originating from other federal entities such as Previ (the workers' pension fund of the Banco do Brasil, which is one of the largest in the country), figured prominently in the investor consortia. For example, a consortium headed by Spain's Iberdrola bought Coelba, Bahia's distribution company, but the shares of the Banco do Brasil and Previ in this consortium were almost equivalent to Iberdrola's.Footnote 21 In all of these cases the administration applied pressure on government-owned financial institutions to invest in privatisation and the objective was to increase the sales prices of these firms. This view is supported by public statements made by senior BNDES executives where they confirmed that BNDES funding was vital to ensure that the privatisation of energy companies fetched high prices.Footnote 22

Moreover, the initial power industry reforms of 1993 had set the stage for the recuperation of the financial health of the generating companies (see Figure 3). Given that the hydroelectric system could be stretched for a few years because of the reservoir balances which had been maintained, the administration applied the GENCOS' increasing revenues to paying off their debts instead of amplifying their investment programmes. Between 1995 and 1997, the debt of Furnas was more than halved, from R$ 5.65 billion to R$ 2.72 billion. Eletrosul's debt reduction was even more dramatic: in two years it slashed its debt by 80 per cent, from R$ 1.45 billion to R$ 300 million.Footnote 23 The downside of this strategy was that the excessive depletion of reservoirs, and the postponement of investments in order to improve the GENCOS' balance sheets, was running down the capacity of the system to deal with extended dry weather periods.

Fig. 3. Brazilian Generation Company Profits (1994–1998).

The third claim, that the government abandoned privatisation prematurely, is contradicted by empirical research that goes beyond merely checking whether privatisation was continued or not. The fact that the Brazilian government did not renege on their contractual obligations until after the rationing, and insisted on ploughing public financial resources into private firms in order to stimulate private investment in the power industry, indicates that the administration was not arbitrarily confiscating private investors' returns but rather trying to make a difficult policy work.Footnote 24

With ample indications that a power crisis was looming and that the government was using its considerable financial resources to promote privatisation of existing power companies and infrastructure rather than to invest directly in new infrastructure, the surprise related to power rationing in Brazil was not that the drought suddenly dried up Brazil's hydroelectric power reservoirs, but that rationing happened in spite of the government's commitment to privatisation.

Policy Symbiosis: The Self-Reinforcing Virtuous Cycle of Stabilisation and Privatisation

If the need for investment was the publicly stated reason for privatisation, then why did the Cardoso administration use BNDES and other funds controlled by the state to promote privatisation rather than to invest in new electric power infrastructure?Footnote 25 One could argue that the main purpose of extending BNDES loans was that it would lower the cost of capital for investors and provide incentives for larger investments in new infrastructure. However, if the process of purchasing energy companies is competitive, then any lowering of the cost of capital in this way would automatically translate into a higher willingness to pay for the firm. An analogous situation is how changes in mortgage interest rates affect real estate prices. Here, purchase decisions are not normally based on the nominal price of the house but on expected monthly mortgage payments. If interest rates are lowered, then home buyers are likely to bid higher for the property and vice versa as long as their monthly payments remain within their target range. Similarly, as BNDES financing implicitly reduced the buyer's cost of capital, it inflated the nominal value of the firm. If privatisation was intended to bring in foreign and private investment, then BNDES financing was counter-productive in that it had a substitutive rather than complementary effect.

From the administration's point of view, the desire to focus on privatisation, especially through the application of federally controlled financial resources, has to be understood by examining the political and economic context within which privatisation was being conducted. As Finance Minister, Cardoso's principal preoccupation had been to deal with hyperinflation, which he had defeated. As President, Cardoso inherited a massive debt burden which continued to threaten the precarious stability established by the Plano Real, the preservation of which was the basis of his administration's economic programme.

Brazil's fundamental economic problem, as diagnosed by the Cardoso administration along the then popular orthodox lines, was that the economic policies of the entrepreneurial state had led to a massive increase in public sector debt, which in turn had led to high rates of inflation, exchange rate instability, and, ultimately, low economic growth. Furthermore, given the government's debt problems, state ownership in critical sectors such as electric power and telecommunications had led to insufficient public investment and precluded private investment. As a result of insufficient investment in public services they were inadequately and inefficiently provided, thereby further dampening economic growth. The orthodox solution, as shown by the causal-chain analysis depicted in the top half of Figure 4, was privatisation. It would establish a virtuous self-reinforcing cycle of efficiency and growth by reducing the public debt, thereby contributing to monetary and exchange rate stability which, in turn, would attract investment.

Fig. 4. The Virtuous and the Vicious Cycle in Brazilian Power Reforms.

Defeating inflation was a necessary first step. Brazil's own experience, as well as those of other countries, had shown that a degree of economic stability was a prerequisite to attracting investor interest. Brazil's first attempts at undertaking large-scale privatisation under Collor had not been clearly articulated with a macroeconomic stabilisation policy; at most, his administration had linked privatisation to debt reduction, and his privatisation programme had limited the scope of foreign investment. In reality, given the economic instability, foreign interest in acquiring Brazilian assets was low and foreign investors purchased only 5 per cent of the assets sold under Collor's privatisation programme.Footnote 26

Foreign investment was, however, essential to promoting stability because it was needed to prop up the value of the domestic currency. In order to attract this stability-inducing investment, a stabilisation plan, such as the Plano Real, would first have to be introduced in order to break the cycle of inflation and exchange rate volatility. This would, in turn, attract foreign investment, which was essential for the longer term sustenance of the stabilisation plan. Thus, in contrast to Collor's privatisation plans, Cardoso's privatisation strategy placed much fewer restrictions on foreign capital, and it wanted foreign investors to take majority positions in the privatised companies. Not surprisingly, Brazilian-led investor groups rarely won the auctions for the large DISCOS that were initially privatised (see Table 1).

In order for this strategy to work, it was essential to maintain the monetary stability of the Plano Real until such time as economic growth became consolidated in Brazil. Privatisation served to enhance stability in three ways. First, the administration expected Brazil's massive infrastructure firms, primarily in electric power and telecommunications, to fetch tens of billions of dollars. This influx of foreign exchange would increase demand for the real and keep its value stable vis-à-vis the dollar. The resulting monetary stability would itself reinforce investor confidence, thereby pushing privatisation prices even higher. Second, privatisation would provide immediate funds to help pay for a large one-time reduction in the federal debt. Third, it would discipline the federal and, more importantly, the state governments by selling the institutions – such as state-owned banks and power companies – that had facilitated fiscal indiscipline. Removal of investment responsibility in these sectors from the state would also lower the public sector borrowing requirement (PSBR), to further increase investor confidence. Privatisation and the Plano Real were thus symbiotic.

Edmund Amann and Werner Baer have shown that the stability provided by this approach was bought at the cost of an overvalued real, which was the main instrument used to control inflation. This had several negative repercussions on the Brazilian economy. To maintain an overvalued real the government had to offer extremely high interest rates. This worsened the fiscal situation as it pushed up debt service payments, which rose to 13 per cent of GDP or about 40 per cent of total tax revenues. Exports also suffered as the overvalued real made domestic producers less competitive and, for the first time in several decades, Brazil became a net importer.Footnote 27

Since many of these negative effects became apparent fairly immediately, the only assumption that could justify the costs of maintaining this stability was that these initial costs would be rewarded by higher growth rates which would eventually reduce fiscal deficits by increasing tax revenues and lowering public expenditures. A dynamic and growing economy would in turn provide more profit-making opportunities to foreign investors, thereby reducing over time the risk premium that they were demanding.

Given this symbiosis, the use of state-controlled resources such as BNDES funds to help promote privatisation was logical from the macroeconomic perspective. Its revenues were required to help pay for the economic stability which would buy credibility for the government's reform plans. While the Cardoso administration did prioritise macroeconomic imperatives over electricity sector needs, they did not view the two as necessarily antagonistic. They expected that as a result of macroeconomic stability the privatisation of DISCOS and then GENCOS would proceed smoothly, that the newly established electric power regulatory body would be able to control excessive profit-seeking yet allow sufficient returns for the private investors to bring in new investment, technologies and efficiencies, and consequently, that consumers would enjoy good service at appropriate prices. In short, they expected privatisation to initiate a virtuous circle of investment, good service, profit and reinvestment (see Figure 4).Footnote 28 The following section analyses why this virtuous cycle was not sustainable.

From the Virtuous to the Vicious Cycle

On theoretical grounds, it did not appear that the Cardoso administration's reasoning or strategy was flawed. Agency, property rights and public choice theories all predicted that privatisation should lead to increased efficiency. Moreover, elements of competition were introduced into the privatisation process. Although DISCOS were privatised as monopolies, and there would be little competition in retail markets, competition was introduced to the market by auctioning them through sealed-bid first-price processes. This should have led to the maximisation of efficiency gains because such auctions assume that the most efficient investors win, since they are the ones who stand to make the largest operational profits at any given level of regulated rates and would therefore attribute the highest possible value to the firm.Footnote 29 It logically followed that both governments and consumers should benefit from such transactions: the former should be able to capture the full value for their assets (and apply it towards debt reduction), whereas the latter should continually benefit because real rates should progressively fall in response to the regulators' judicious setting of X factors under price-cap regulation.Footnote 30

The first indications that the electric power reforms in Brazil were diverging from the expected virtuous causal chain were provided by post-privatisation trends in electricity rates. We can assume, given the frenetic competition and the premiums paid by investors to acquire DISCOS, that electricity rates at the time of privatisation were more than just sufficient to attract private investment in the sector. In hindsight the fact that investors bid so high might be considered curious or surprising, especially if we consider that in the initial stages an independent regulatory agency that would protect investor interests did not exist. DISCOS were sold with only their concessions contracts. These were not comprehensive and left many critical issues, such as the basis for the periodic rate revisions, unaddressed. In addition, significant risks, such as those related to exchange rates, remained with the investors. Other than vague government commitments to further privatisation and liberalisation, there were not even any clear policy directives on the future industrial structure.

The willingness to pay high prices for Brazilian electric power companies can be attributed to a generalised enthusiasm about the prospects for the high levels of profits to be made from international infrastructure investments. While the lack of institutional clarity and maturity in the re-organised infrastructure sectors did increase uncertainty for investors, this was adequately compensated by the potentially high levels of returns that the developing country governments were at that time willing to allow investors. In Brazil, the Cardoso administration's underlying assumption, which was borne out by the high privatisation prices, was that investor interest in the initial stages of privatisation had little to do with the state of the institutional infrastructure in the sector but much to do with perceptions of the government's policy orientation. This was created through the initial concessions contracts and pricing policies that were very advantageous to private investors. Distribution margins, which are generally to the order of 40 per cent of final tariffs, were increased in Brazil so that they ended up representing 60 per cent of the final tariffs.Footnote 31 Retail electricity prices rose substantially straightaway, but wholesale (in other words, generating) prices, which accrued to federal GENCOS that were not yet slated for privatisation, lagged behind.

As a result of favourable policies, in the first two years after privatisation DISCO profits rose from about US$ 100 million to about US$ 2 billion. This increased profitability cannot be attributed to increasing efficiencies resulting from privatisation, because by 1996 only three DISCOS had been privatised and their combined profits added up to only US$ 115 million.Footnote 32 DISCO profitability was thus increased before privatisation. In addition, several potential profit-making opportunities were built into the concessions contracts: DISCOS were allowed to generate up to 35 per cent of their power requirements themselves; they were allowed to explore related commercial opportunities, such as in internet and telecommunications, which would be outside the regulatory purview of the concessions contracts; almost no minimum investment or service expansion conditions were imposed upon them; and despite being regulated by the RPI-X model, the X factor was set at zero for the first five years, thereby allowing them to appropriate all benefits arising from efficiency improvements.

Despite the high tariffs that resulted initially from privatisation, retail electricity rates – given that price-cap regulation was in force – should at least have fallen in real terms over the years. However, a study of Brazilian retail electricity rates reveals that they have been increasing since 1995 (see Figure 5). Between 1995 and 2001, average electricity rates increased by 106.2 per cent while the IGP-M price index that was being used to correct electricity prices for inflation increased by only 66.8 per cent.Footnote 33 If privatised power companies are supposed to become continually more efficient, then it appears contradictory that real distribution rates should increase.

Fig. 5. Retail Electricity Prices. Source: Author elabration based on ANEEL. The tariffs are available on the website of ANEEL: http://www.aneel.gov.br/98.htm accessed November, 2006.

Potential explanations for these unexpected results are indicated by empirical investigations of investor behaviour, which reveal many deviations from the (virtuous) chain of causality which theory predicted would accrue to privatisation. It has been observed that firms which win auctions are not necessarily the most efficient, just the most optimistic.Footnote 34 To some extent this optimism may stem from investor beliefs that they are more efficient than they really are, but to a larger extent a different dynamic prevails in the case of developing countries. Here governments and regulation are viewed as more malleable to foreign investor pressure. Investors may bid high just to make sure they win the auction because they expect to be able to renegotiate better contract terms in the immediate future. This dynamic is borne out by empirical studies which show that almost half of all infrastructure concessions contracts are renegotiated within the first two years, almost always in favour of the investors.Footnote 35

Where competitive forces are minimal or absent, this dynamic may have severe repercussions. In competitive industries, even if investors overspend on acquiring an asset, consumers may not suffer because prevailing market prices would prevent one firm from passing on the costs of its mistake, thereby exposing investors to the ‘winner's curse’.Footnote 36 In regulated industries, prices are established administratively and are based on an implicit or explicit guarantee to provide investors with an adequate rate of return on capital. This causes a moral hazard and a circularity problem whereby the more an investor pays for an asset, the more the pressure will be on regulators to allow higher rates, especially in developing countries where regulatory institutions are nascent and weak, and where governments are keen to attract further investment.Footnote 37 Moreover, with auction prices not correlating well with the actual values of firms acquired, the process of adjudicating investor claims becomes methodologically, and politically, difficult. Consequently, contrary to the assumptions of privatisation policy, in most regulated infrastructures where there is limited competition, prices did not go through a one-time correction at the moment of privatisation, but have displayed a consistent upward trend.

The second and more serious indication that power reforms had deviated from the virtuous causal chain came from trends in investment in electric power. Although investment had picked up after 1995, by 1998 it was still below the pre-reform levels of 1993 (see Figure 6). Why did the reforms not lead to the expected spurt in investment? The previous section explained why public investment in the industry was curtailed. The issue addressed here is that of inadequate private investment.

Fig. 6. Investment in the Brazilian Electric Power Industry (1980–1997). Source: Author elaboration based on Eletrobrás, Plano Decenal de Expansão, 1997/2006 & 1998/2007.

Private investment was limited partly because the sums being invested in the Brazilian power sector were being used to purchase existing assets rather than create new ones. More importantly, however, private investment was restricted because serious distortions were appearing in the financial dynamics of the energy sector. Viewed in isolation, the Cardoso administration's decision to increase distribution margins and retail tariffs was undesirable, but not sufficient to cause a general crisis in the industry. In combination with the macroeconomic constraints then prevailing, however, it was unworkable. The Cardoso administration could allow electricity tariffs to rise up to a point, gambling that – as in the case of the Plano Real – economic growth would bring the sector back into equilibrium. It was, however, a risky venture. Since electricity is a basic input into most economic activities, the administration could not raise energy tariffs beyond a certain point without creating inflationary pressures, defeating the objective of its economic policies.

Given the immediate need to allow investors high returns while at the same time not allowing retail tariffs to increase even more dramatically, the government squeezed generating margins. Since the GENCOS were still federally owned, the government was able to suppress wholesale rates to around US$ 30 per megawatt-hour (MWh), which was significantly below the system's long-term marginal expansion cost (around US$ 36–40 per MWh), or in other words below rates which would make new investments in power generation financially viable.Footnote 38 The fact that the government squeezed generating margins was not immediately obvious because GENCOS appeared to be making healthy profits, even with low wholesale rates (see Figure 3, earlier). While it could logically have been assumed from this that generating margins were more or less healthy, in reality GENCOS in Brazil benefited from the fact that much of their power was generated by hydroelectric plants whose capital costs had already been amortised, thus enabling them to operate profitably because of the low operating costs associated with hydroelectricity (around US$ 5 per MWh). New investment in generating capacity, whether in hydroelectric or thermal power plants, would require much higher levels of remuneration and result in a much higher wholesale and retail price for electricity.

A secondary effect of increasing distribution margins and the pressures that it created on electricity prices was that the government was reluctant to adopt measures which would have increased security of power supply because such measures would have increased average prices even further. Capacity payments, for example, which remunerate investors for making stand-by generating plants available, would have helped to back up hydroelectric power during times of water scarcity. However, capacity payments were not implemented because they would have had to be tacked on to energy tariffs as surcharges, which would have raised average rates even more.Footnote 39

Orthodox proponents of privatisation and liberalisation argue that the government's reluctance to allow prices to rise to what a liberalised market would have established, is one important reason why electricity privatisation failed, thus blaming the incompleteness of the Cardoso administration's policy reforms for the eventual rationing.Footnote 40 The Brazilian case thus appears to provide an empirical confirmation of Vernon's concept of the obsolescing bargain wherein the government, once investors are committed with heavy sunk costs, proceeds to expropriate their earnings by restraining the prices that the firms are allowed to charge.Footnote 41 This argument is factually plausible, but it ignores the economic backdrop to electricity sector reforms in Brazil. Higher electricity tariffs would feed right back into the macroeconomic problem of inflation, which was the focus of the economic stabilisation plans. It was not so much that rampant rate increases would create a populist backlash that deterred the administration from allowing larger increases in electricity tariffs. Rather, it was that the electricity price increases and the government's economic policies were having a severe negative impact on economic growth and forcing an adverse reaction from the very policy constituencies within the administration that were pushing for privatisation and liberalisation.

The disagreements over how to limit the electricity price increases also weakened some of the critical institutions and policy constituencies associated with the privatisation of the power sector. In response to the unfolding economic crisis, a faction from Cardoso's own party even tried to have the Finance Minister and the president of the Central Bank replaced, and did, in fact, succeed in removing the latter.Footnote 42 As electricity tariffs rose, the Treasury, which was still pushing privatisation, began to pressure ANEEL to find ways to control the increase in electricity rates. ANEEL, in turn, began to lose credibility because it was unable to find appropriate solutions to maintaining the regulatory contract and facilitating private investment while keeping electricity rates in check. The internal discord within the administration became so strong – at one point Cardoso wanted to fire the president of ANEEL – that ANEEL complained that its activities should be restricted solely to regulation, and that it should not be responsible for developing energy policies or issuing licences for new plants.Footnote 43

In the end, government efforts to control electricity rates increased perceptions of policy risk of earnings appropriation. This translated into lower levels of private investment in generating capacity as investors waited to see how the administration intended to resolve the internal contradiction in its reform plans of trying to control prices while increasing investment.Footnote 44 The lower levels of private investment combined with the curtailing of federal GENCO investments made power supply markets tighter, with the resultant scarcity itself creating additional pressures on wholesale electricity rates. Rather than the expected virtuous cycle, Brazil's reforms became trapped in a vicious cycle (see Figure 4, earlier).

Let us now turn our attention to one of the main orthodox criticisms of the Brazilian electrical power reforms, which is that liberalisation was not carried far enough. A more sophisticated approach to privatisation argues that efficiency gains and corresponding benefits for consumers accrue not so much from privatisation as from accompanying market liberalisation and competition.Footnote 45 However, wholesale energy market liberalisation and the putative efficiency gains ascribed to it would not have improved the fragile equation according to which the industry was being privatised. Wholesale prices in Brazil could be controlled to some extent without bankrupting the energy companies, because a large proportion of the power was being produced by hydroelectric plants whose capital costs had already been amortised. By mixing the amortised and other energy, average electricity prices were lower than the market-clearing rates. The market liberalisation that was being proposed, which was based on the model operational in Great Britain, would mean that the average prices earned by all power plants would automatically gravitate towards the much higher market-clearing prices that are determined by the marginal costs of new generating plants. A federal commission later estimated (after the rationing) that liberalising the market would lead to a doubling of wholesale power rates, from about R$ 40.7 per MWh to R$ 92.1 per MWh and, as a consequence, average retail prices would increase from R$ 124 per MWh to R$ 170 per MWh over the same period.Footnote 46 Given the enormous difference in the costs of the amortised hydroelectric plants and the proposed new sources of electricity, any static efficiency gains that market liberalisation would bring would be too low to compensate for this windfall profit and price increase. Any potential dynamic efficiency gains, which might or might not push market-clearing prices to such low levels, would in any case be realised much too far in the future to have compensatory effects within the time-frame required by the Plano Real.

Although the presence of cheap energy from amortised hydroelectric plants did complicate the liberalisation of the wholesale market in Brazil, studies from other countries have shown that even in the absence of such sui generis circumstances, power market privatisation and liberalisation tend not to promote price reductions and security of supply simultaneously. In some cases, such as in California, the problem with power markets was driven by a dynamic opposite to that in Brazil: stranded assets in the form of relatively expensive power plants built under regulatory regimes which guaranteed them a specified rate of return were then required to compete in a deregulated market.Footnote 47

Lost in Translation: The Fragility of the Brazilian Privatisation Strategy

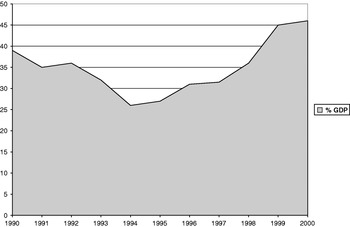

The Brazilian power reforms were essentially fragile and, like the country's Plano Real, based on the gamble that assuming certain costs and risks in the short term would provide the economic stability and growth which would carry the industry to a stable equilibrium. However, the stability-based growth cycle that both plans anticipated was not sustainable, to a large extent because it was too expensive in terms of both the interest payments required to maintain the value of the real and the high post-privatisation utility tariffs. After several years, these high costs were not rewarded with increased credibility because investors withdrew massively in the wake of the Asian and Russian financial crises. The government was no longer able to maintain the currency peg which was, in effect, covering up the fact that utility rates had been pushed to very high levels. The subsequent and inevitable devaluation ensured that such high utility tariffs could not be maintained and the privatisation programme collapsed under the weight of its own revenue-generation needs. The idea that the stability of the Plano Real would help to pay the debt also failed in a similar manner. The interest rates necessary to maintain the currency peg became so expensive, sometimes exceeding 50 per cent for some short-term debt, that in the end the Plano Real resulted in a net outflow of resources from the Treasury and a 77 per cent increase in the national debt (see Figure 7).

Fig. 7. Brazil Net Debt. Source: Author elaboration based on data available on Banco do Brasil website: http://www.bcb.gov.br/?SERIETEMP; accessed November 2006.

In this chaotic economic situation, issues that were identified as implementation problems were really symptoms of a combination of policies intended to promote privatisation and of coping mechanisms in the face of a privatisation policy that was tenuous and towards the end, failing rapidly. Policies that were meant to facilitate and consolidate privatisation became lost in translation. Supporting the Plano Real required large inflows of foreign exchange, which the administration tried to ensure by raising the potential profits of investors. This facilitated DISCO privatisation, but at the same time it made investment in generating capacity unattractive because it forced the government to squeeze generating margins in order to prevent electricity rates from climbing too high. The withdrawal of federal investment was expected to signal that the government was serious about privatisation, and to bolster investor confidence. Instead, the curtailing of public investments at a critical juncture translated into tighter markets that lessened the government's space for manoeuvre to adopt more strategic power sector policies. Since what would be classified as implementation failures were actually coping mechanisms intended to deal with distortions generated by policies that were failing their own logic, better implementation of the same policies would have done little to lessen the magnitude of the failure and the resultant losses to the Brazilian power industry and the general economy.

Table 2 summarises a series of policy initiatives in the Brazilian electric power reforms which were criticised as implementation problems. It shows first the underlying assumptions and intended effects of the policies and then it shows why and how in their application these assumptions did not hold up, thereby identifying how these policy initiatives became mistranslated and resulted in perverse outcomes quite different from what the administration had intended.

Table 2. Policy Mistranslations in the Brazilian Power Sector

Source: Author elaboration.

Conclusions

The analysis presented in this paper arbitrates between the hypotheses of strategy failure and implementation failure and concludes that, while elements of both strategy and implementation failure were present in the case of Brazilian electric power privatisation, the effect of the former dominated. Brazilian power reforms failed because they were fragile and their success relied greatly on a number of favourable assumptions which were in reality quite uncertain. The first assumption was that the initial economic stability provided by the Plano Real could be sustained (partly by the country's privatisation programme), providing the economic growth which would over time compensate for the high costs that the country was incurring to ensure that stability. In the initial stages privatisation worked because both the government and investors underestimated potential risks and overestimated potential profitability and efficiency gains. This strategy fell apart when the delicate balance upon which they operated was upset by the financial crises that spread from Asia and Russia to Latin America. The second assumption was that there was a treasure trove of efficiency waiting to accrue to privatisation, and that this would ameliorate the distortions that the stability-focussed privatisation programmes were creating. In reality, the efficiency gains from privatisation were substantial, but insufficient to compensate for the costs imposed by the stability-promoting strategies within which it was embedded.

These findings indicate the priority areas for further research, especially in the translation of theoretical models to their empirical settings, in the context of privatisation policies. This will require more case-based research. Some social scientists consider it problematic to generalise findings from even careful case-based empirical research, arguing that single case studies are uncontrollable and idiosyncratic.Footnote 48 For this reason, this paper deliberately provides a detailed narrative in order to identify clearly the rationales of policymakers and the points of departure from the expected causal chain, and to provide sufficient detail to allow scholars to compare this with other cases. By careful deductive reasoning, the case study presented in this paper intends to contribute to what Brent Flyvjberg characterises as the ‘collective process of knowledge accumulation’ in this field.Footnote 49

Moreover, the failures of Brazilian power privatisation are not idiosyncratic. On the contrary, the dynamics of the failure of stability-based privatisation programmes that have been described in this article appear to have been repeated in many other contexts in Latin America, most notably Argentina, where the implementation of reforms in the energy sector was quite different and, in fact, for a long time considered optimal. For example, Argentina privatised power generation first and ensured adequate competition by restricting the size of the companies. Nevertheless, electricity prices rose and the system collapsed after the devaluation of the Argentine peso. While the stage at which privatisation failure becomes evident, and the extent to which privatisation was conducted before its collapse, have varied across countries, there are certain trends which are consistent. First, post-privatisation prices in developing countries have risen consistently.Footnote 50 If private operators are supposed continually to improve efficiencies, post-privatisation prices for public services should show a falling trend (after adjusting for inflation). In most sectors other than in telecommunications they do not. Many studies point to cases in which privatisation resulted in reduced prices,Footnote 51 but careful analysis of these cases, for example electricity privatisation in the United Kingdom and Argentina, and water privatisation in Buenos Aires, reveals that prices were increased substantially just before privatisation and this indicates that many of the frequently cited claims about price reductions through privatisations are spurious.Footnote 52

Second, privatisation was supposed to unlock global private capital flows into developing country infrastructures. These flows, though indeed substantial, were still a small fraction of public investment in the same period. Moreover, the increase in private sector investments was not even adequate to compensate for the decrease in infrastructure financing being provided by aid agencies and development assistance programmes.Footnote 53 Worse, not all of what is counted as private investment represents new sources of finance. In reality, post-privatisation investments have often used many of the same sources of funds as state-led investments, such as multilateral aid agencies and even public funds. For example, about half of ‘private’ investment in Brazilian electric power between 1995 and 2000 actually came from BNDES loans channelled through private companies.Footnote 54

Third, and most critically, in developing countries privatisation in combination with other reforms was supposed to deliver strong and sustained economic growth. Indeed, the pragmatic privatisation thesis was that developing countries were privatising at one level to deal with immediate fiscal problems, but more critical to the enthusiasm for privatisation was the belief that, together with associated reforms, it would lead to higher rates of growth.Footnote 55 Privatisation appears to have largely delivered on efficiency and productivity at the firm level in absolute terms.Footnote 56 However, the more substantial claims of diffuse benefits to governments and customers have not been realised.Footnote 57 Privatisation also appears to have been particularly weak in overcoming the heavy financial burdens imposed by broad structural reform initiatives.

All of these problems have contributed to privatisation's current unpopularity despite its initial promise and favourability. It was not only in Brazil that privatisation initially enjoyed substantial and broad political support and where policy inconsistencies and opposition followed – rather than preceded – privatisation failures. The wider empirical research suggests a more generalised pattern where policy-related troubles followed rather than instigated privatisation failures.Footnote 58 What the Brazilian electric power case has demonstrated, and what other privatisation cases appear to indicate, is that the theorising that favours privatisation is often bolstered by untenable assumptions about implementation dynamics, and that much has been lost in the translation from theory to application.