1. Introduction

It has been argued that inequality distorts democracy by providing a false sense of the very idea at the heart of America: If you work hard and you really try, you can make something of yourself (Wehner & Beschel, Reference Wehner and Beschel2012). Inequality presents a choice to society: restore an economy where everyone gets a fair shot, does a fair share, and plays by the same set of rules, or else settle for a country where a smaller number of people do really well and a growing number of people barely make ends meet. However, while this discussion refers to the pitfalls of income inequality, income mobility is truly at the center of the issue.

Income inequality only provides an idea of how stratified one country is based on income. It might be true that a country has a large degree of income inequality, but this does not mean that the individuals in the lowest income brackets are not becoming better off. Former president John F. Kennedy once said, ‘A rising tide lifts all boats but some are raised higher than others’. This adage suggests income inequality is not the real problem. If economic growth raises income inequality but raises some more than others, then inequality should be of virtually little importance unless individuals express concerns of equity itself. However, this is not to say that societies do not benefit from a more equitable income distribution; citizens may value equality of individuals and not just the well-being of all individuals. Rawls’ theory of principle of difference captures this sentiment. According to his theory, individuals behind a veil of ignorance will choose societal rules that will provide equal opportunity and maximize the utility of the worst individual (Rawls, Reference Rawls1971). However, any policy recommendation short of raising substantial marginal tax rates on individuals with higher income would not make the poor in a society better off, but instead make the rich worse off. This accomplishes little to help a society. On the other hand, policies that allow the poor to become better off should not only reduce income inequality but also increase the well-being of the poorest individuals (Wehner & Beschel, Reference Wehner and Beschel2012). Stated alternatively, changing the rules of the game (North, Reference North1991) to permit the poorest in society equal opportunity to improve their situation is the best policy a society can consider. Buchanan and Tullock (Reference Buchanan and Tullock1962) suggest economists have two choices: they can analyze either a change in outcomes within a set of narrowly defined rules (Hayek, Reference Hayek1960), or a change in the rules themselves.

Cross-country studies have provided some evidence of association between inequality and corruption (Gupta et al., Reference Gupta, Davoodi and Alonso-Terme2002), economic freedom (Berggren, Reference Berggren1999), per capita income (Ku & Salmon, Reference Ku and Salmon2012), and many others. Even if there turns out to be no relationship between income inequality and per capita income (Barro, Reference Barro2000), income inequality remains an important launching pad for the institution of income mobility.

Income mobility addresses this idea of the possibility or the potential of an individual to move from one income bracket to another. Typically, individuals are grouped into five brackets known as quintiles. The idea of income mobility then can be analyzed by looking at the likelihood of an individual of moving from one income bracket to another. While individuals can move between any income bracket, the interesting case is how likely an individual is to move out of a lower quintile and into a higher one during his lifetime. This idea can be measured two ways: the first method is to look at the income of an individual when he is young and then look at that same individual's income later on in life when he is older. Then one can compare to see if his income has increased and more importantly if he has changed income quintiles. This is known as intragenerational mobility. The alternative is to compare the income information for an individual and his parent.

The idea behind this method is that parents who are better off economically will invest more in their children's futures. Parents who derive more utility from raising successful offspring tend to endow their children with a greater variety of investment and consumption opportunities. As a consequence, children whose parents invest more in their future will be better off economically. As Becker and Tomes (Reference Becker and Tomes1979) point out, the endowment of children's attributes, ‘are determined by the reputation and connections of their families, and the learning, skills, goals, and other family commodities acquired through belonging to a particular family culture’. This latter measure is known as intergenerational mobility or the ‘rise and fall of families’ (Becker & Tomes, Reference Becker and Tomes1986). This method is much more commonly used for research. Empirical estimates of intergenerational mobility are known as intergenerational earnings elasticities and these are measured as follows:

where Yi,t is the logarithmic income of a descendent, Yi,s is the log wage of the parents, and εi,t is a white-noise error term. The coefficient β is the measure of the intergenerational income elasticity (Schnetzer & Altzinger, Reference Schnetzer and Altzinger2013; Solon, Reference Solon1992; Zimmerman, Reference Zimmerman1992).

Andrews and Leigh (Reference Andrews and Leigh2009) specify criteria for which good measures can be taken for income mobility. Ideally, they claim this data should come from comparable sources to capture cross-country differences. This way one would receive meaningful results and not just results stemming from the differences in the data construction. Also, they mention that the data should come from estimates based on fathers and sons during economically active ages. Therefore, the first strategy in this article will be to analyze the sub-sample of intergenerational elasticity estimates from Corak (Reference Corak and Rycroft2013a). These estimates possess the smallest measurement error since they are derived from fathers and sons in a comparable manner. Analyzing these cross-country observations provides the best chance that differences in outcomes are not due to differences in data construction. First, qualitative results are drawn from scatter plots using the smaller sub-sample. Second, quantitative results are derived from ordinary least squares (OLS) using the entire sample of cross-country observations sample of intergenerational elasticity estimates from Corak (Reference Corak and Rycroft2013a).

The paper will proceed in the following manner: Section 2 is a review of the literature. Section 3 discusses the data and methodology. Section 4 discusses the quantitative and qualitative strategies involved in analyzing the relationship between institutions that facilitate entrepreneurship and income mobility. Section 5 discusses the results while section 6 closes with concluding remarks.

2. Literature review

Corak (Reference Corak and Rycroft2013a) looks at the intergenerational earnings elasticity between the United States and 24 other countries, and he uses the most common method of analyzing the intergenerational earnings elasticity between fathers and sons. For a recent review of the literature on intergenerational income mobility see Corak (Reference Corak2013b). Sometimes data is drawn from mothers and sons, fathers and daughters, mothers and daughters, and some combination of parents and children (Schnetzer & Altzinger, Reference Schnetzer and Altzinger2013). Schnetzer and Altzinger (Reference Schnetzer and Altzinger2013) only refer to their estimate of the intergenerational earnings elasticity for Austria as parents to children. Furthermore, concerns might arise due to different studies using data from different years of cohorts. Data for intergenerational income mobility are derived from two surveys for the United States: the Panel Study of Income Dynamics (PSID) and the National Longitudinal Surveys (NLS) of labor market experience (Solon, Reference Solon2002).

Andrews and Leigh (Reference Andrews and Leigh2009) examine the relationship between income inequality and mobility. They find evidence to suggest that there is indeed a negative association between inequality and mobility, that is, more income inequality is correlated with less income mobility; sons who grew up in countries that were more unequal in the 1970s had a worse chance for increased social mobility in the late 1990s.

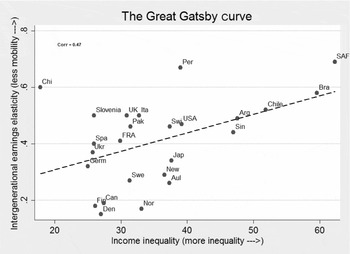

Corak (Reference Corak and Rycroft2013a) analyzes the relationship between income inequality and mobility. Alan Krueger calls this relationship the ‘Great Gatsby curve’. Income inequality is captured by the Gini coefficient and is measured on the horizontal axis. Income mobility is captured by the intergenerational income elasticity measures and is displayed on the vertical axis. Gini coefficients are measured between 0 and 100 where zero means complete income equality and 100 means complete income inequality. The intergenerational income elasticity, β, measures the persistence of income from one generation to the next. That is, it measures how likely one individual is to follow in a parent's footsteps in relation to the income distribution. Thus, a lower β means an individual has lower earnings persistence and therefore higher income mobility. The positive trend line on the Great Gatsby curve illustrates an inverse relationship between income inequality and income mobility; countries with more income inequality have greater earnings persistence between generations and less income mobility.

The Great Gatsby curve has certain policy recommendations. If the relationship is such that the higher inequality in a country, the lower the mobility, then policies for higher social mobility are recommended to be accompanied by policies for more equal societies. In a policy recommendation, OECD (Organization for Economic Co-operation and Development; 2010) suggests that progressive tax systems and social transfer programs should not only make a society more equal but also strengthen the chances for individual social and economic advancement. Alternatively, economic regulations and ineffective government may explain declines in income mobility.

Policies consistent with improvements in economic institutions are hypothesized to allow for greater income mobility. If citizens are free to engage in commerce with others and if they do not fear their property will be stolen from them, then they should face better opportunities to experience the American Dream through income mobility. Specifically, regulatory constraints should have a large impact on income mobility. Indeed, this has been offered as an explanation of why income mobility (inequality) has decreased (increased) in the United States in the past few decades (Clark & Lawson, Reference Clark and Lawson2008).

In his inquiry on the mystery of capital, De Soto (Reference De Soto2000) finds that capitalism succeeds in the west and fails everywhere else. One contributing factor is that the barriers to entrepreneurship and acquiring private property are so tedious that citizens cannot improve their economic well-being. It took De Soto's team of researchers 289 days to register a legal business enterprise in Peru while working at it for six hours a day, filling out forms, standing in lines, and acquiring certifications necessary to operate. In total, the cost of legal registration was $1,231, which was 31 times the monthly minimum wage. Similarly, in the Philippines, the process to registering private property required 168 steps, involving 53 private and public agencies, and taking anywhere from 13 to 25 years. They also found it would take someone 5 to 14 years in Egypt and two years in Haiti (De Soto, Reference De Soto2000: 20–21). Therefore, it follows that sound economic institutions for commerce and entrepreneurship matter; sound rules allow individuals to prosper, and this is hypothesized to be reflected in greater income mobility.

3. Data and methodology

Data on political and economic institutions are available to test the hypothesis that fewer burdens and regulations allow for more income mobility. There are six World Wide Governance Indicators (WGI) described by Kaufmann et al. (Reference Kaufmann, Kraay and Mastruzzi2011): government effectiveness, control of corruption, voice and accountability, regulatory environment, rule of law, political stability, and absence of violence and terrorism. Since entrepreneurship is hypothesized to influence income mobility, only three of these variables are used to ascertain whether burdens and regulations stymie income mobility: (i) government effectiveness, (ii) regulatory quality, and (iii) the rule of law. According to the WGI, government effectiveness ‘reflects perceptions of the quality of public services, the quality of the civil service, and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government's commitment to such policies’. Regulatory quality ‘reflects perceptions of the ability of the government to formulate and implement sound policies and regulations that permit and promote private sector development’. Rule of law ‘reflects perceptions of the extent to which agents have confidence in and abide by the rules of society, and in particular the quality of contract enforcement, property rights, the police, and the courts, as well as the likelihood of crime and violence’ (Kaufmann et al., Reference Kaufmann, Kraay and Mastruzzi2011). All three of these explanatory variables range from –2.5 to 2.5 where 2.5 indicates a country has a more productive regulatory environment, an effective quality of government, and a judicial and legal system that protects property rights. These three measures are then interpreted as follows: higher political, economic, and judicial quality of institutions as measured by the WGI is associated with higher numbers on the scale of –2.5 to 2.5.

Transparency International collects annual data on corruption known as the corruption perceptions index (CPI). It measures the perceived levels of public sector corruption in 176 countries and territories around the world by utilizing surveys from multiple, comparable sources, and it aggregates the results to construct the CPI index. The data are measured on a scale of 1 to 10 where 1 means very little corruption and 10 is the most corrupt. The CPI index by Transparency International was chosen for the analysis rather than the World Bank's control of corruption measure because the latter is another measure under the World Governance Indicator similar to government effectiveness and regulatory quality. Multiple sources and alternative institutional measures will do a better job of ascertaining the effects of institutional quality on income mobility.

To the best of my knowledge, there are currently 32 countries with an available β coefficient, the measure of intergenerational earnings elasticity derived from equation (1). Twenty-five of these estimates are available from Corak (Reference Corak and Rycroft2013a). The other seven come from other studies. In total there are 15 studies with at least one estimate of the intergenerational earnings elasticity for a country. These studies and their β coefficients are listed in Table 1. While there are some countries with only one β coefficient from one study, there are also quite a few countries with multiple β coefficients from multiple studies. For the empirical estimates derived in this study, intergenerational earnings elasticity estimates are taken from Corak (Reference Corak and Rycroft2013a) which provides β coefficients for 25 countries. The other studies have been listed in Table 1 in hopes that the data from these studies are useful to other researchers, but their estimates are not included in the scatter plots, correlation coefficients, and OLS regressions. The other intergenerational earnings elasticity estimates are not included in an attempt to minimize measurement error because they may use other combinations of cohorts, such as fathers and daughters, mothers and sons, and different time spans of study. Thus, empirical estimates derived from sources other than Corak (Reference Corak and Rycroft2013a) may actually capture differences in data collection rather than cross-country differences in income mobility. A more concerning issue is with the accuracy of the parental income. Zimmerman (Reference Zimmerman1992) has critiqued the increase in income mobility as a result of measurement error arising from attenuation bias. The results here are reported using income data from Corak (Reference Corak and Rycroft2013a) and it cannot be ruled out that attenuation bias is not present. However, Blanden et al. (Reference Blanden, Gregg and Macmillan2013), using National Child Development Survey (NCDS) income data, argue that their findings run counter to these claims because their data stem from observable characteristics, which are free from the influence of attenuation bias. While it should be noted that the data in this paper are gathered from Corak (Reference Corak and Rycroft2013a), this provides some evidence that increases in income mobility may arise for reasons other than attenuation bias.

Table 1. β coefficients from Corak (Reference Corak and Rycroft2013a) and other studies on intergenerational mobility

The Gini coefficient is another explanatory variable used to capture the Great Gatsby effect, and it is taken from Deininger and Squire (Reference Deininger and Squire1996). This Gini is subject to a couple of criticisms (Atkinson & Brandolini, Reference Atkinson and Brandolini2001; Galbraith & Kum, Reference Galbraith and Kum2005). Most notably, the Gini for China is lower than in Europe, which is a striking result. However, the results presented here are robust to the substitution of the Gini measure used by the World Bank.Footnote 1 The distance to the equator is also included as an additional measure of economic institutional quality (Hall & Jones, Reference Hall and Jones1999). It is hypothesized that countries located farther away from the equator set up better economic institutions.Footnote 2

The Great Gatsby curve and the relationship between institutional measures and income mobility are depicted in Figure 1 below. The correlation coefficient of income inequality and the intergenerational earnings elasticity is 0.47, which is the lowest correlation coefficient among all five measures. In addition, there are four institutional measures hypothesized to be associated with income mobility: (i) government effectiveness, (ii) regulatory quality, (iii) rule of law, and (iv) corruption.

Figure 1. Great Gatsby curve.

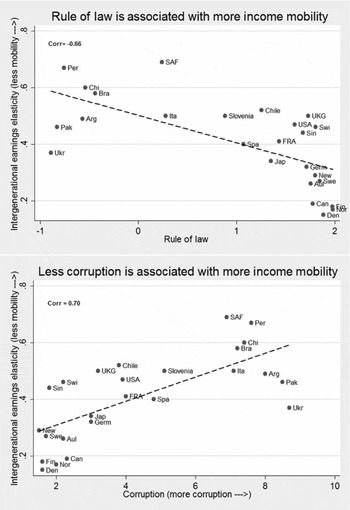

Rule of law facilitates entrepreneurship through the channel of the protection of property rights and an equal enforcement of contracts. When property is better protected under the law and there is legal remediation for contract violation, entrepreneurs have a greater incentive to start their own business; Coase (Reference Coase1937) suggests that individuals join firms in order to reduce transactions costs. However, if transactions costs associated with contract enforcement are reduced and property is more secure, then individuals have a greater incentive to work for themselves. Similarly, the Kirznerian entrepreneur is more likely to possess a desire to discover profitable opportunities when he may reap the benefits from his alertness. Rule of law is located at the top of Figure 2, and it has a correlation coefficient of –0.66. This suggests that the security of property rights is positively correlated with income mobility as measured by intergenerational earnings elasticity. The relationship between corruption and income mobility is depicted at the bottom of Figure 2. Méon and Sekkat (Reference Méon and Sekkat2005) suggest that corruption can either sand or grease the wheels for economic development, depending on the institutional structure of the economy. In countries with strong economic institutions, corruption is expected to stymie entrepreneurship because bribes and additional bureaucratic payments increase the cost and time of entrepreneurship. This relationship boasts the highest correlation coefficient of 0.70; more corruption is associated with higher earnings persistence and lower income mobility.

Figure 2. Rule of law, corruption, and intergenerational mobility.

Countries with a superior regulatory quality are expected to facilitate entrepreneurship through the promotion of private sector development. Regulatory quality is depicted at the top of Figure 3. The correlation coefficient is –0.52, which suggests a lower regulatory burden is associated with lower earnings persistence and higher income mobility. Finally, government effectiveness is located at the bottom of Figure 3. Similar to the regulatory quality, an effective government is expected to promote entrepreneurship by supporting good economic policies and independence from the political process. Its correlation coefficient with income mobility is –0.62; an effective government is associated with less income persistence and higher income mobility. All five of these measures and the correlation coefficients are illustrated in Figure 4 below.

Figure 3. Regulatory quality, government efficacy, and intergenerational mobility.

Figure 4. Correlation coefficients of income inequality, institutions, and income mobility. Note: The correlation coefficients are calculated as the correlation between intergenerational earnings elasticity and five measures: income inequality, regulatory quality, government effectiveness, rule of law, and corruption.

Table 2 illustrates the descriptive statistics for the variables used in this study. The dependent variable is a measure of income mobility using collected data on intergenerational income elasticity measures. The values for the intergenerational earnings elasticity range from –0.15 to –0.69 corresponding to Denmark and South Africa, respectively. Typically, these values are positive as shown in Table 1 and Figure 1, but in order to make the results easier to interpret, the signs have been flipped for the intergenerational earnings elasticity measure in the regression output. The way to interpret the income mobility measure is simple; it measures the degree of earnings persistence from one generation to the next. Higher values for the intergenerational income elasticity translate into more persistence in earnings and consequently less income mobility. Since smaller values mean more income mobility, it makes more sense to make them negative. This would allow larger numbers to express more income mobility as it is easier to interpret. Thus, income mobility measures are multiplied by negative unity.

Table 2. Descriptive statistics

GDP = gross domestic product; PISA = Programme for International Student Assessment.

The Gini coefficient is measured on a scale of 0 to 100 where 0 means completely equal wealth and 100 means one person owns all of the wealth. The minimum in the 25 country data is 17.8 and the maximum is 62.3 with a mean Gini coefficient of 35.428. The largest Gini coefficient corresponds to South Africa and the smallest Gini coefficient corresponds to China. Gini data is taken from Deininger and Squire (Reference Deininger and Squire1996) with data observed around 1990 and gathered as personal income. However, the results in all tables and specifications are robust to the World Bank's Gini measure in 2006. These results are reported in Appendix Table 2. Data on per capita income and the growth of per capita income are taken from the Penn World Tables (Heston et al., Reference Heston, Summers and Aten2012). Data on the growth of per capita income are for the 10 years from 1996 to 2006. Data on the level of per capita income are gathered in 2006. Growth rates and levels are included for the convergence of incomes to steady-states (Barro & Sala-i-Martin, Reference Barro and Sala-i-Martin1992; Barro et al., Reference Barro, Mankiw and Sala-i-Martin1995; Sokoloff & Engerman, Reference Sokoloff and Engerman2000).

Kirzner (Reference Kirzner1979) argues that private property rights, free enterprise, and sound money foster an environment where subconscious learning can occur and the alert entrepreneur discovers these profitable opportunities. Excessive regulations which curtail business activity and consequently make it harder for poorer people to become entrepreneurs are barriers to increasing income mobility. If this is true, removing some of these barriers, regulations, and red tape are posited to improve income mobility. This leads to the first hypothesis.

Proposition 1: Institutional quality that allows entrepreneurs the chance to flourish is associated with greater income mobility.

Another alternative has been suggested by OECD (2010). The idea captures the Great Gatsby relationship. Subsequently, they suggest a policy recommendation of increasing social transfers which should reduce income inequality and increase income mobility. These social transfers can be thought of as increased government spending on education and healthcare. It is hypothesized that education expenditures by the government allows economically disadvantaged groups the opportunity to increase their earnings capacity by receiving an education. In a study of US states, Mayer and Lopoo (Reference Mayer and Lopoo2008) find that high spending states possess greater income mobility than low spending states. Similarly, healthcare expenditures help to ensure that citizens in society are healthy, and facilitate movement between income brackets for economically disadvantaged citizens. Several studies support this claim. Case et al. (Reference Case, Angela and Paxson2005) suggest that a large share of the intergenerational transmission of socioeconomic status works through the channel of parents’ income to their children's health. Eriksson et al. (Reference Eriksson, Bratsberg and Raaum2005) report that the intergenerational earnings elasticity in Denmark falls by 25%–28% when controlling for their parental health status. Hertz (Reference Hertz2007) finds that the relationship between parental income and health status explains 8% of intergenerational correlation of income in the United States. Similarly, poor health explains 5%–10% of the variation in an offspring's income mobility (Esping-Anderson & Wagner, Reference Esping-Andersen and Wagner2010). For a larger review of the literature, see Nolan et al. (Reference Nolan, Esping-Andersen, Whelan, Maitre and Wagner2010).

Proposition 2: Countries with greater spending on education and healthcare should be associated with greater income mobility.

In order to test these two hypotheses, an empirical specification using OLS is employed, and the form of the equations estimated is specified as follows:

where the dependent variable, Income Mobility, refers to the intergenerational income elasticity; X′ is a vector of institutional variables that are of interest in explaining the variation in income mobility, and it includes rule of law, corruption, regulatory quality, and government effectiveness; δ′ is a vector of control variables that may be important in analyzing the relationship between institutional quality and income mobility. Included in this control vector are the growth of per capita income, the level of GDP per capita, the Gini coefficient, distance to the equator, government expenditures on education, and government expenditures on healthcare. Government expenditures on education and healthcare are taken from the World Bank in 2006 and are measured as a percentage of Gross Domestic Product (GDP). In addition, I have used the internationally comparable Programme for International Student Assessment (PISA) data as an alternative measure of education. This specification does not change any of the effects of institutions on income mobility and it is reported in Appendix Table 3.

Table 3. Effect of institutions on income mobility

Note: |t| statistics in parentheses.

Degree of freedom corresponds to the critical value, α = 0.05 of 2.11.

† denotes thousands of miles.

*p < 0.10, **p < 0.05, ***p < 0.01.

4. Results

The first relationship to empirically measure is the association between income inequality and intergenerational earnings elasticity in Table 3. The measure of income inequality, Gini coefficient, is statistically significant in all five specifications under OLS, but it is only marginally significant (p < 0.10). Analyzing the marginal effects suggests that increasing a country's income inequality by 10 points on the Gini coefficient is associated with a 0.07 increase in intergenerational elasticity, which is an increase (decrease) in income persistence (income mobility). These specifications capture both the effect of Gini coefficient on intergenerational earnings elasticity without institutional controls in column (1) and with alternative institutional controls in columns (2) through (5). Note that the t-statistics are above the common critical value in large sample studies. However, due to the small sample size, the critical value has increased from 1.96 to 2.11. Thus, one can only discern a marginally statistically significant relationship illustrating the Great Gatsby effect.

The first institutional measure, corruption, is the only measure that exhibits a statistically significant relationship (p < 0.05) with intergenerational earnings elasticity; the results suggest that corruption is inversely related to income mobility. Analyzing the marginal effect suggests that a one-point increase in corruption as measured by Transparency International's CPI is associated with a 0.04 increase in earnings persistence, which is a decrease in income mobility. Further, the greatest proportion of the variation in income mobility is explained by the specification that includes both the Gini coefficient and corruption in column (2) with an adjusted R 2 of 0.53.

Column (3) is the only other alternative specification that exhibits a statistically significant influence on intergenerational earnings elasticity, but the positive relationship between rule of law and intergenerational earnings elasticity is only marginally significant with a t-statistic of 1.95. The results suggest that for every one-point increase in rule of law there is an associated 0.086 decrease in income persistence or increase in income mobility.

The remaining two institutional measures exhibit very little statistical influence on intergenerational earnings elasticity. Further, the social transfer variables such as government spending on education and healthcare are never statistically significant in any empirical specification. In addition, there is scant evidence that variations in income alone have any statistical influence on income mobility. The one exception is in column (1), which excludes any controls for institutional measures. Income information on the levels of GDP per capita and growth rates of GDP per capita are generally statistically insignificant. The level of GDP per capita in the first and last specification of Table 3 does possess a positive and statistically significant relationship with income mobility. The marginal effects suggest that a 1% increase in per capita GDP is associated with a 0.17–0.19 decrease in the intergenerational elasticity, which is an increase in income mobility. However, these results are fragile to the specifications (2) through (5). Finally, distance to the equator (Hall & Jones, Reference Hall and Jones1999) exhibits no statistical influence on income mobility.

Baumol (Reference Baumol1990) discusses how individuals can either be productive or destructive as entrepreneurs, contingent on the institutional environment; market institutions that promote commerce will experience productive environment, and institutions that promote government intervention and favoritism will largely be destructive. Sobel (Reference Sobel2008) finds evidence to support this theory. Following this work, Table 4 analyzes the same relationship between institutions and income mobility, but it also considers a more direct link of entrepreneurship using a measure of new business density (NBD) taken from the World Bank's Doing Business project. While this is not a perfect measure of entrepreneurship, it serves as a proxy to the extent that individuals can start their own businesses and ventures. A greater number of new businesses suggest that the market environment is conducive to entrepreneurship. The positive relationship between NBD and income mobility in Table 4 confirms the a priori expectations; countries that have a greater number of new businesses tend to also have higher income mobility and lower earnings persistence, but this relationship erodes when controlling for the institutional framework and healthcare and education expenditures per person. One interpretation is that institutions matter for entrepreneurship; it is not the density of new business startups that affect income mobility. Rather, it is the environment that allows or prohibits entrepreneurship that matters. Another explanation is that healthcare and education expenditures allow for individuals to start new business.

Table 4. The effect of new business density on intergenerational mobility

Note: |t| statistics in parentheses.

Only 22 countries had available data for new business density. Degree of freedom corresponds to the critical value, α = 0.05 of 2.13.

† denotes thousands of miles.*p < 0.10, **p < 0.05, ***p < 0.01.

The Great Gatsby effect is stronger under the specifications in Table 4 than in the previous table. While the magnitudes of the coefficient are slightly larger, the real change is that all specifications exhibit a statistically significant p value (p < 0.05) and inverse relationship between income inequality and income mobility. The relationship between the institutional measures and income mobility remains largely unchanged in Table 4 from the previous table. Corruption exhibits an inverse and statistically significant relationship with income mobility, and the rule of law exhibits a positive association with income mobility. However, the rule of law measure fails to meet the 5% rejection threshold, which is the same result from Table 3. However, the rule of law possesses a t-statistic that is very close to rejection at the 5% threshold, and this relationship deserves a closer examination.

Table 5 looks closer at the relationship between institutions and income mobility using the composite index of economic freedom, and its individual component areas using the Economic Freedom of the World Index (EFW) updated annually by Gwartney and Lawson (Reference Gwartney and Lawson2012). The EFW index provides a robustness check, as it is a frequently used measure of the quality of economic institutions. The EFW index is designed to measure the degree of economic freedom that exists in a country and to leave out measures of political freedom, such as civil liberties or democratic government. The EFW index measures economic freedom by grouping 42 components into five areas: (1) size of government, (2) legal structure and security of property rights, (3) access to sound money, (4) freedom to trade internationally, and (5) freedom from regulation. Refer to Berggren (Reference Berggren2003) and Faria and Montesinos (Reference Faria and Montesinos2009) for literature reviews of the EFW index.

Table 5. Does economic freedom affect intergenerational mobility?

Note: |t| statistics in parentheses.

Degree of freedom corresponds to the critical value, α = 0.05 of 2.11.

† denotes thousands of miles.

*p < 0.10, **p < 0.05, ***p < 0.01.

Analyzing the individual component areas suggests that the rule of law is positively associated with income mobility and it is statistically significant at conventional levels (p < 0.05). The marginal effects suggest that an increase of one in area 2 of the EFW index is correlated with a 0.028 decrease in income persistence, which is an increase in income mobility. Notice that the magnitude is smaller using area 2 of the EFW index than the rule of law (WGI). This is because EFW is measured on a scale of 1 to 10, and the WGI's rule of law is scaled from –2.5 to 2.5. The composite EFW index is used under the sixth specification, and the results suggest a positive relationship between institutional quality and income mobility. However, this effect is statistically insignificant at conventional levels (p < 0.05), and it has a t-statistic of 2.05, which is just over the threshold. One explanation is that the rule of law, equality under governance, and the protection of property rights affect income mobility, but the remaining individual component areas exhibit little to no influence on income mobility. Finally, notice that income information has been omitted in the first six specifications and it is included in the last specification. It has been purposely omitted in order to avoid the multicollinearity present between economic freedom, income levels, and income growth. The last specification includes the composite economic freedom measure, the level of GDP per capita, and the growth of GDP per capita. As expected, economic freedom exhibits very little influence on income mobility under this specification.

5. Conclusion

This article has provided evidence to suggest improvements in institutional quality can increase income mobility. Economic theory supports these findings because improvements in regulations and a less burdensome economy facilitate income mobility. The empirical estimates in this study suggest that lack of corruption and secure property rights are associated with reductions in intergenerational earnings persistence, which leads to greater income mobility. In addition, empirical support is found for the Great Gatsby effect in the data. However, independent of this effect, the results suggest that the dream of income mobility can be supported through high quality institutions that facilitate entrepreneurship and the protection of property rights.

The other hypothesis, that social transfer programs such as government spending on education and healthcare will increase income mobility for a society finds little support, although other studies do find a relationship between healthcare spending and income mobility (see Nolan et al., (Reference Nolan, Esping-Andersen, Whelan, Maitre and Wagner2010) for a review of this literature). This finding in conjunction with the first suggests that institutions matter (North, Reference North1991) for income mobility by facilitating the entrepreneurial process. In order to allow everyone the opportunity to realize the dream of income mobility, countries must allow sound institutions to foster entrepreneurship. Only then will income mobility persist as a reality and not merely a dream.

Table 1. Correlation coefficients for institutional measures

Table 2. Effect of institutions on income mobility (world bank Gini)

Table 3. Effect of institutions on income mobility (PISA science replaces education expenditures)