No CrossRef data available.

Article contents

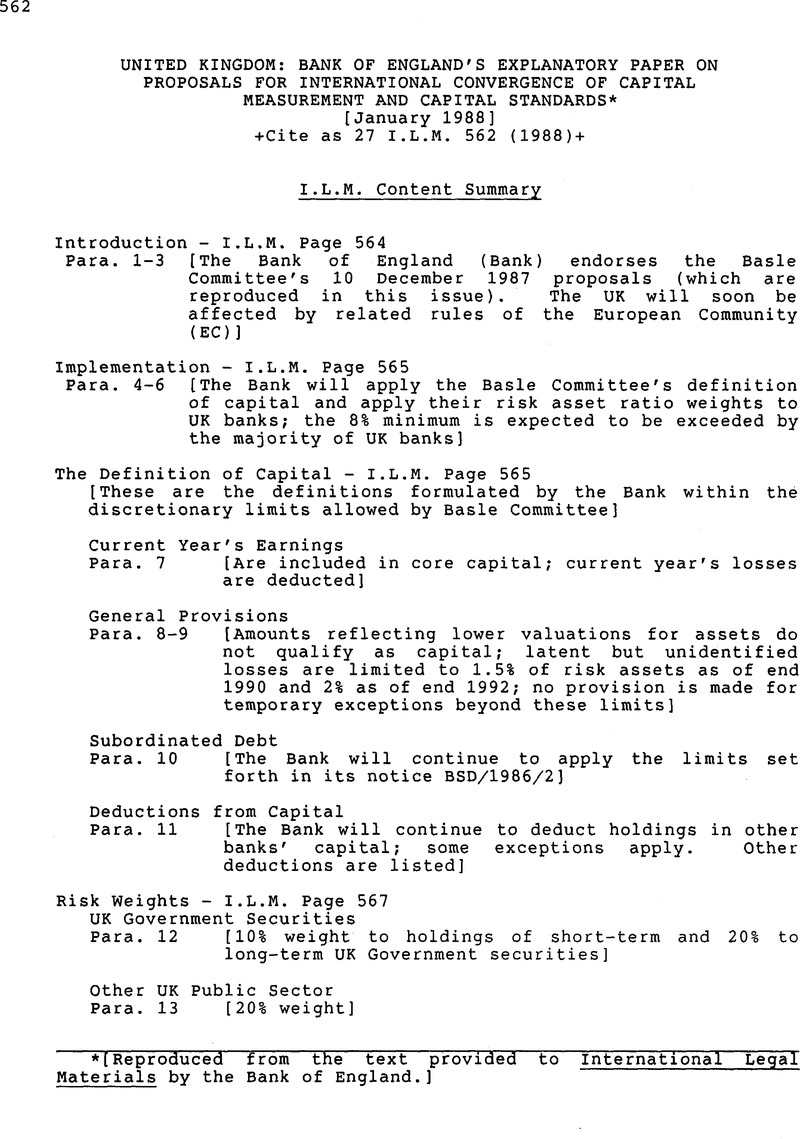

United Kingdom: Bank of England's Explanatory Paper on Proposals for International Convergence of Capital Measurement and Capital Standards

Published online by Cambridge University Press: 27 February 2017

Abstract

- Type

- Other Documents

- Information

- Copyright

- Copyright © American Society of International Law 1988

References

* [Reproduced from the text provided to international Legat Materials by the Bank of England.]

* Except certain specialist institutions such as money funds and discount houses.

* This will include all intangible assets, including for example mortgage servicing rights.

* Agreed Proposal of the United States Federal Banking Supervisory Authorities and the Bank of England on Primary Capital and Capital Adequacy Assessment.

* The Bank believes that the calculation of credit risk under the original exposure method should be based on the original maturity of the contracts, not the residual maturity.