It has been argued that financial revolutions – the emergence of modern financial systems – underpinned and even preceded the emergence of modern high growth rates. Sylla considers the rise of the modern financial system as synonymous with well-managed public finances, stable money, a central bank, a banking system, securities markets and a sound insurance system.Footnote 2 This emphasises the manifold character of the financial revolution. Ögren further stresses that synergies between parts of the system were important, and so was the improved quality of financial services as changing roles for the financial organisations that evolved during the nineteenth century.Footnote 3

According to Ögren, stable currency is evident in Sweden from 1834 and was associated with the Riksbank, which due to its leading position developed into a proper central bank.Footnote 4 Furthermore, from the late 1850s, the National Debt Office came to play an important role in managing public finances. In the 1860s, the establishment of the Swedish Mortgage Bank along with the growing commercial banks enabled a rapid monetisation through liquidating fixed assets.

Insurance was certainly part of the evolving financial system and underwent qualitative changes in interplay with other institutions. Indeed, the growth of insurance activities was related to economic growth. Historical literature consistently suggests that insurance assisted economic development in the early years of industrialisation by, amongst other things, mobilising savings, mitigating risk and uncertainty, encouraging entrepreneurship, accumulating productive capital, and fostering the development of the national financial and legal infrastructure.Footnote 5 Furthermore, it may be assumed that fire insurance promoted economic growth as a result of its risk transfer, indemnification and financial intermediation functions. For similar reasons, a strong linkage between banking, insurance and economic growth in today's emerging economies is likely.Footnote 6 By offering risk transfer and indemnification for unexpectedly large losses, insurance companies most likely aided investment in productive assets. By providing surety to investors and other contractual claimants, such as banks, the insured investment became protected against unanticipated severe losses, for instance, through fire damage.Footnote 7

The causality may, however, have been the opposite, as exemplified by King and Levine, who suggest that economic development may have stimulated the demand for ancillary financial services such as banking and insurance.Footnote 8 Furthermore, the expectation that the demand for insurance will increase in approximate proportion to income growth implies more accumulated real capital assets to insure. Therefore, it is equally plausible that the growth of banking and insurance services was prompted by the increasing levels of per capita income generated by national economic growth during the period of our analysis.

This article contributes to the existing historical literature by providing empirical testing of factors that previous studies have put forward in order to explain the growth of insurance demand and supply. Firstly, we notice that income growth itself due to a relatively high income elasticity of demand has been addressed as an important determinant for growing insurance markets. The demand and supply of insurance is, in other words, likely to depend upon economic development.Footnote 9

It is not, however, known how important income growth was in relation to other factors, such as urbanisation, which, due to differences in demand for insurance between rural and urban areas, may have contributed to an increased demand for fire insurance. Indeed, Pearson notes that contemporary income elasticity of demand (based on cross-section regression analysis) gives a poor proxy for the historical relation between income growth and premiums.Footnote 10 Additionally, the price and risk elasticity respectively, defined as the response of insurance demanders due to changes in price, at a given risk, and the response of insurance demanders due to changes in risk, at a given price, need to be investigated. Finally, we will investigate the development of fire insurance as an integrated part of the monetisation of the Swedish economy.

Sweden is deemed to be a particularly apt jurisdiction in which to conduct our research because of its rich insurance industry archives and the important role fire insurance played in promoting economic growth during the nineteenth and twentieth centuries.Footnote 11 Therefore, focusing our study on Sweden also enables us to test the determinants of fire insurance growth during a period covering the transition from an agricultural economy, the early years of domestic mass industrialisation to World War II.

The remainder of this article is organised as follows. Section I provides an outline of the historical development and characteristics of the Swedish fire insurance market. Section II provides the methodology for the empirical investigation, while Section III describes our sources of data, econometric specifications used and measurement of the variables. Section V elaborates empirical results, while section VI concludes the investigation by linking the findings to the financial revolution and the industrial breakthrough in Sweden.

I

Fire insurance in Sweden first appeared in the form of the rural compulsory fire-support institution known as brandstod, funded through a cooperative system of ‘deposit and call’.Footnote 12 This institution is first mentioned in medieval county laws. During the seventeenth and eighteenth centuries the fire insurance institution was strengthened through attempts to create national insurance companies through royal initiative, of which the first was the Allmänna brandförsäkringsfonden (General fire insurance fund) of 1782.Footnote 13 However, discontent arose when it became clear that the risks were higher in cities than in the countryside; the fund was therefore divided into an urban and a rural branch in 1808. In the same period investor-owned insurance organisations, such as Stockholms stad brandförsäkringskontor (Stockholm city fire-support fund), founded in 1746, were located in the major cities and towns. The Stockholm fund was especially successful and became involved in various precautionary measures concerning fire safety, most notably the establishment of a fire brigade in Stockholm. Another example was the nationwide mutual fire-support fund Städernas allmänna brandstodsbolag (General fire-support company for cities) established for Swedish towns and cities in 1827/8. It turned out that the success of these initiatives was limited, probably due to difficulties associated with risk management. The period therefore saw the rise and fall of several town-based fire-support funds, such as the Borås brandfösäkringskassa, which soon became insolvent due to poor underwriting and inadequate management.Footnote 14 From around 1830 county fire-support funds were organised in a more systematic way compared to their medieval forerunners. These companies limited the insurance sums, which is why they mainly insured small and middle-sized farms. Larger estates, industrial and public facilities were instead insured by the Allmänna brandförsäkringsverket (General fire insurance agency), the continuation of the Allmänna brandförsäkringsfonden.

It is worth pointing out that fire insurance, either through local fire-support funds or through any of the major organisations, was compulsory. This obligation was, however, cancelled through a royal decree in 1853 and gained legal force a few years later. The Stock Corporation Act of 1848, along with nationalistic concern over increased foreign presence by companies such as Phoenix, Alliance and the Magdeburg Fire Insurance Company, contributed to the establishment of the first national stock company insurance carrier in Sweden, Skandia, in 1855. Skandia was a composite which combined life and fire insurance. It was also a very large company by the standards of the day, and the organisation as a stock company was a novelty in Sweden. From the outset Skandia used a national network of brokers and tied agents, although the bulk of its business was located in Stockholm. Another novelty was the use of reinsurance. Despite the competitive power Skandia represented, it turned out that many of the older organisations survived as they underwent major restructuring and improved business organisation, particularly after the major city fires of 1888.

The next wave of companies to be established, apart from the Gothenburg-based composite Svea in 1866, mainly took place in the 1880s. This wave included the Malmö-based composite Skåne in 1884 and a few other stock companies in fire insurance, including Sverige (1873), renamed Fenix after a reconstruction in 1889, Norrland (1890) and Victoria-brand (1899).

Mutual companies were also established during the period, such Svenska Järnvägsmännens in 1884, Järnvägsassuransföreningen (later renamed Svecia) in 1885, the former intended for railway employees and the latter insuring warehouses and other installations associated with railways. Other mutual companies intended to compete with the joint-stock companies included Tor, established in 1888, the short-lived Svenska brand of 1890, Samarbete of 1908, Egna Hem of 1913 and Svitjod of 1914.

Concerning overall market structure, it is clear that mutuality was the sole form of association prior to 1855, but that their role rapidly decreased during the latter half of the nineteenth century. Still, there were very few existing during the investigated period, with the only liquidations in Svenska brand in 1892, Svenska Lloyds in 1923 and Norra Sveriges varuförsäkringsbolag in 1927. A few more companies left fire insurance during the period and instead took up other lines of insurance business.

Throughout this period there were also the mainly rural fire-support associations, including 24 county companies and some 400 small local (parish) fire-support funds in the countryside. Especially the latter saw a loss of market shares and a decline in numbers along with the urbanisation process. However, a surprisingly high number survived throughout the investigated period. Foreign companies were active in the Swedish market throughout the nineteenth and first half of the twentieth century. In the mid nineteenth century some 16 companies, of which Phoenix was the most prominent, held together a market share of approximately 11 per cent. The market share declined somewhat during the twentieth century. An overview of the market structure between 1855 and 1950 is given in Table 1.

Table 1. Fire insurance companies in Sweden, 1855, 1912 and 1950

Note: The premium income of mutual parish companies and foreign companies is estimated in the year 1855. Only registered companies are included. Compulsory registration of parish companies was introduced in 1887, which partly explains the increase in the number of parish companies between 1855 and 1912.

Source: B. Bergander, Försäkringsväsendet i Sverige 1814–1914 (Lund, 1967); Eget förlag. Sveriges Officiella Statistik, Enskilda försäkringsanstalter [Official Statistics of Sweden, Private insurance companies] 1912, 1950.

The rapid development of the Swedish fire insurance market created a growing demand for reinsurance.Footnote 15 At times it was, however, difficult to obtain the needed reinsurance abroad. The reinsurance company Freja, for instance, was founded in 1870; and when Svea was turned down by reinsurance companies in both Germany and the UK, a reinsurance subsidiary company, Astrea, was established in 1871. Vidar, another reinsurance company, was established in 1873 by persons involved in Skandia. Even Skåne started two subsidiary reinsurance companies, Aurora in 1896 and Malmö in 1902. Adding Aurora (1896), Göta and Hermes (both established in 1887) and Niord (established in 1898) completes the list of Swedish companies that provided fire reinsurance during the latter part of the nineteenth century. It is worth noting that reinsurance could have enabled foremost joint-stock companies to increase their capacity to underwrite new business in uncertain economic times.Footnote 16

It is tempting to see the joint-stock company organisational form as crucial in itself. From a supply-side perspective, a more efficient organisational form could compete by offering more insurance at a lower price, which in turn would find its demand, just as Say's law would predict. Looking at the average nationwide company's size, measured as premium incomes per company, we may derive from Table 1 that the mutuals were slightly larger in the mid 1850s compared to the recently formed Skandia. However, by 1912 the average stock company was 10 times as large as the average mutual company. The mutuals were, however, not helpless victims in the fire insurance market. In 1950 had they had gained in relative size and were now on average half the size of the average stock company. Among the five leading mutual associations we find Städernas allmänna, Allmänna brand, Svecia, Samarbete and Svitjod, of which two were companies established in the first part of the eighteenth century. This suggests that the new organisational form as represented by the joint-stock company is not a single-bullet explanation for the rapidly expanding fire insurance market during the period. However, Pearson has indeed pointed out that joint-stock companies had an advantage over mutual forms in raising capital during periods of rapid growth.Footnote 17 The bottom line of his argument is that stock companies were in a better to position to capture a growing market, not that stock companies drove the market growth through a supply-oriented process, an argument that indirectly points to the importance of investigating insurance demand.

II

In order to examine the demand side we will first estimate the income elasticity of demand for fire insurance. This is done on the basis of data collected from twentieth-century household budget surveys (HBS). This provides an estimate of income elasticity and the impact of some additional control variables on what could be reckoned as a mature fire insurance market. Secondly, we estimate how fire insurance demand would have developed during the investigated period given elasticities of the twentieth-century data. Here we use aggregated time series data for the period as a whole in order to arrive at what is perceived as a counterfactual model of total fire insurance premiums between 1830 and 1950. Finally, the estimated premiums in the counterfactual model are compared with actual fire insurance premiums. Deviations between counterfactual and actual demand indicate that additional forces apart from those identified in the micro-based investigation were at play. These deviations are analysed by quantitative measures of price and risk as well as qualitative explanation derived from economic historical literature. In the closing part the deviations are analysed against the backdrop of the monetisation of the economy, generally speaking an exponent of the financial revolution itself.

The data set is based on six household budget surveys from the period 1913–51. In order to avoid problems pertaining to deflation of consumption baskets with changing composition, the operational model utilises consumption shares of food and insurance respectively. We notice research that shows that income elasticity of foodstuffs is particularly stable over time, which is why the consumption share of foodstuffs is a reliable indicator of real incomes.Footnote 18 Accordingly we estimate:

where P S is the expenditure share of fire insurance premiums (of total expenditure), FS is the expenditure share of foodstuffs. D R is a dummy for rural population (1 for rural and 0 for urban population) and D T is a time dummy.

Given that the estimates in model (1) are significant at the 1 per cent level for the food share and the rural share, they are multiplied with time series data of actual food share and the actual rural population share on the national aggregated level:

where CP S is the counterfactual share of premiums expenditure share in time t, AFS is the actual national food share and ARS is the actual share of rural population in the country. The counterfactual model covers the period 1830–1950 and, as previously stated, the food share and rural population share are national aggregates. First, we calculate the food expenditure share (AFS) in year (T) as:

where C L is the aggregated private consumption foodstuffs expenditure in current prices, and C is the aggregated private consumption. ![]() is calculated as:

is calculated as:

where C A is the private consumption of agricultural output, inclusive of hunting and fishing and horticulture, but exclusive of forestry products, C I is the private consumption of foodstuff industries output, C M,I is the private consumption of imported foodstuff industries products and C M,A is the private consumption of imported agricultural products, exclusive of forestry products.

In addition, the demand for fire insurance may be different depending on the proportion of people living in cities and in rural areas. To account for changes in this proportion, i.e. urbanisation, the share of people living in rural areas (of total population) is measured. Based on the actual rural population share and the actual food share inserted in equation 2, we finally arrive at the counterfactual insurance premiums (CP) in time (t) as:

where CP t is compared with the actual fire insurance premiums over the period 1830–1950.

Insurance prices in this investigation are measured as the load, corresponding to the percentage increase in an actuarially fair premium that is included to pay for administrative and other overhead expenses.Footnote 19 The load at time t (L t) is measured as

where E t is overhead expenses and P t is premium incomes. E is the sum of wages, commissions, profits, taxes and other administrative expenses.

III

The data used for estimating (1) are, as previously mentioned, constructed from a series of household budget surveys (HBS), which in turn were based on records of expenditure (kassaböcker) distributed to a sample of households. The households accordingly reported all consumption of goods and services, including consumption of stored foodstuffs. Since social objectives were important in the early investigations, there were no ambitions to cover a representative population sample. Instead of using a sampling method that allowed such generalisations, the investigations were aimed at certain social groups, such as working-class households in cities or poorer households on the countryside. The highest-income classes were not included during the period of study. The HBS do, however, provide a fairly robust and detailed picture of spending decisions among the majority of the population.

All HBS present data on consumption divided into aggregated income classes or (HBS 1920) types of employment. This means that for each HBS there are between four and nine observations readily available. It is worth noting that actual household-level data are, apart from 1913, not available in any other form than a vast number of individual books of records of expenditure, even in the national archives. We are therefore forced to use the income classes that were employed in the printed reports. It is important to note that since we organise the data on basis of the consumption share of foodstuffs, we may still ensure consistency even though the span of aggregated income classes and their number vary between the investigations.

This investigation is based on the HBS of 1913, 1920, 1923, 1933, 1948 and 1951.Footnote 20 Of these, HBS in 1920 and 1951 covered the countryside, a circumstance that is taken advantage of in this investigation by introducing the rural dummy in (1). As for other theoretically potential control variables, the HBS themselves set important limits and so does the availability of corresponding time series, with which such control variables, if significant, must work in tandem. Based on these HBS, the variables are defined in Table 2.

Table 2. Descriptive statistics of variables derived from household budget surveys

Note: Number of observations = 33, household budget data 1913–51.

Source: Swedish Official Statistics, Household budget surveys, for 1913, 1920, 1923, 1933, 1948 and 1951.

Table 2 shows that the expenditure share of fire insurance is small and that the expenditure share of foodstuffs is about one-third of total consumption, although the deviations from the mean are quite large.

Consumption of foodstuffs was directly obtained from the Swedish Historical National Accounts (SHNA) as the sum of direct domestic consumption with origins in agriculture, horticulture and foodstuff industries.Footnote 21 Missing in SHNA is use of imports for final consumption, which is necessary for estimating the foodstuff consumption share. The problem was addressed by using Schön's unpublished series from 1984, which covers imports with both agriculture and foodstuff industries as foreign sectors of origin during the period 1830–71.Footnote 22 Schön's series are directly followed by corresponding series according to Johansson's Historical National Accounts.Footnote 23

For estimating the shares of imports for final consumption we used the 1920 foreign trade statistics and divided imported agricultural goods and foodstuffs on final and intermediate consumption. Using import statistics from 1924, we have divided the agricultural goods and foodstuffs between investments, intermediate consumption and final consumption. The share of final consumption is 24 per cent for agricultural goods and 54 per cent for foodstuffs. We assume that the share of final consumption is constant during the period 1830–1950. In line with these considerations, we arrive at the descriptive statistics presented in Table 3.

Table 3. Descriptive statistics of variables derived from historical national accounts

Note: N = 120, Historical National Accounts data 1830–1950.

Source: Krantz and Schön, Swedish Historical National Accounts (2007); ‘Historiska nationalräkenskaper för Sverige: Utrikeshandel’ (unpublished mimeo, University of Lund, 1984); Johansson, The Gross Domestic Product of Sweden and its Composition 1861–1955 (Stockholm, 1967).

Concerning fire insurance premiums it is worth noting that it became compulsory for all insurance companies to report detailed economic data to the authorities from 1903. From this year a full coverage of insurance business in Sweden is readily available. However, following the UK example of volunteer reporting, several major Swedish companies had already in the 1870s begun to report financial data in the insurance industry journal Svensk försäkringstidskrift. This practice was strengthened in 1887, when also minor mutual fire support funds started to report full economic information. Most of this information has been collected by Bengt Bergander and is used for our estimates.Footnote 24

We have, however, been forced to make some additional estimates for obtaining total series. Data on foreign companies operating in Sweden are not accessible before 1887. The market share held by foreign companies was, however, comparatively small in the mid nineteenth century, according to Bergander. For the 1890s we know that foreign insurers earned approximately 10 per cent of the total insurance premiums generated in the Swedish market. On the basis of Bergander's conclusion that foreign insurance businesses were limited in size as late as in the 1850s, and that market shares were modest some 40 years later, we can assume that the foreign companies roughly followed the development of Swedish companies, but at a slightly lower rate.

We therefore assumed that the development of the foreign companies in the Swedish market resembled the development of the old Swedish mutual companies, of which Stockholms Stads Brandkontor was one of the most important fire insurance companies for which long time series are readily available.Footnote 25

One more methodological issue must, however, be addressed. The HBS only include fire insurance consumed by households. Insurance underwritten for the manufacturing industry therefore needs to be accounted for. This is dealt with by using the insurance as it appears as intermediate consumption in the manufacturing industry according to the HNA input–output tables. The counterfactual insurance premium is simply adjusted by including this intermediate consumption, which turns the counterfactual series into a series showing the demand for fire insurance after actual industrial fire insurance has been accounted for.

Data on premium are based on large mutual and stock companies up till 1912 were collected from Bergander and thereafter data for all companies operating in Sweden were collected from the official statistics.Footnote 26

IV

The relationship between budget shares for foodstuffs and insurance is shown in Table 4. Expected negative signs are reported for the foodstuff share in all models, showing positive income elasticity of insurance demand. The explanatory power is ![]() .

.

Table 4. Coefficient estimate household budget surveys, 1913–51

The rural dummy is insignificant, hence it may be concluded that demand for fire insurance is not correlated with the rural dummy. The time dummy is significant at the 1 per cent level. However, as the value is zero, the economic relevance of this variable is missing.

Based on the result in Table 4 and data on food share, we have compiled a series of counterfactual insurance premiums for the period 1830 to 1950 (see equation 2). The rural dummy as well as the time dummy is excluded as they are not significant at the 1 per cent level. The time dummy for fire is excluded as the value is zero.

In Figure 1 the estimated fire insurance premiums are compared with the actual development of fire insurance premiums. The figure shows that the estimated premiums exceeded the actual premiums in the period 1830–1900. During the period 1840–1900 the actual premiums grew faster than the estimated premiums, resulting in a phase of convergence. Actual and estimated premiums follow a similar path after 1890.

Figure 1. Premium incomes and estimated premium incomes (thousand SEK current prices) in Swedish fire insurance, 1830–1950

The estimated income elasticity of demand gives a fair approximation of the development of premium incomes during the first half of the twentieth century. Demand was to a high extent income driven from the 1890s to the 1950s.

However, the counterfactual demand (based on twentieth-century estimates of income elasticity of demand) is much higher than actual premiums during the nineteenth century. This shows that the growth of fire insurance was not solely caused by income growth and urbanisation.

The phase of convergence during the period 1840–1900 was, among other things, characterised by a rapid transformation of the insurance business; a transition from cooperative fire pools into a business managed by joint-stock and mutual companies.

Insurance premium growth rates also became much higher from the 1850s and clearly surpass that of the counterfactual insurance demand until the 1900s. From the perspective of insurance supply, this coincides with the establishment of the first national composites and also the second phase of the establishment of companies during the 1870s and 1880s. These companies clearly operated according to different principles as compared to the early nineteenth-century mutual companies.

From the perspective of insurance demand there were clearly other factors apart from income growth that affected the market between the 1850s and 1900s. Furthermore, due to the very close resemblance between actual insurance premium growth and estimated premium growth after 1890s, these, so far in the investigation, unidentified factors must have played an important role in the development of the insurance market.

In previous research, factors such as price, risk and actuarial principles have been suggested to play an important part in the growth of insurance. Indeed, Pearson states that the growth of the insurance industry was preceded by a general reduced risk in different areas.Footnote 27 Insurance growth could also be attributed to prices, as indicated in a study of American health insurance.Footnote 28 Based on these findings, the following section will address the convergence between actual and counterfactual premiums by analysing developments of price and risk of insurance.

V

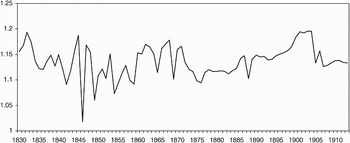

The price of insurance is generally measured as the load, i.e. the cost of administration and commission in relation to premium incomes, according to equation 6. Figure 2 shows the load in six fire insurance companies during the period 1830–1913. As can be seen from the figure, the load is very similar at the beginning and at the end of the period. It is also evident that the load fluctuates between 1.10 and 1.20, while there is no evidence for any negative trend. Based on these findings, it is hard to argue that falling insurance prices are in a good position to explain a boosted insurance demand during the period 1840–1900.

Figure 2. The development of load in Swedish fire insurance companies 1830–1913

One additional finding in relation to Figure 2 is that the load is substantially lower as compared to figures for the cost of administration and commission in relation to premium incomes, as reported by Kenely for Australia during the early twentieth century.Footnote 29 In her case the load was approximately 1.44. Furthermore, Supple reports that the costs in Britain rose from 28 per cent in 1870 to 38 per cent in 1907.Footnote 30 We cannot explain this difference, but its existence would strongly suggest future comparative research.

Another important aspect of the insurance market is the development of risk, as it affects both the demand and supply of insurance. In Figure 3 risk in fire insurance is indicated by the five-year standard deviation of claims of fire events during the period 1834–1913. As seen in the figure, risk in terms of volatility was clearly reduced during the period. The figure reports in detail a reduction of risk from 1.8 in 1840 to 0.14 in 1913. Indeed, the management of risk in fire insurance seems to have been less distressing in 1913 than in 1840.

Figure 3. Volatility in claims of fire events 1834–1910

The reduction of risk in fire insurance may be explained through a number of factors. The entry of nationwide insurance companies like Skandia could have facilitated the implementation of risk management based on actuarial principles. Secondly, there was also a reduction in the probability of fire incidents, which in turn was related to actions taken to prevent city fires. Stricter building regulations were passed in 1884, and it is furthermore likely that improved heating and lighting techniques reduced the risk of fire. Iron stoves and tile stoves replaced open stoves during the nineteenth century, while kerosene lamps were replacing candles.

Despite the reduced risks there is no indication that this translated into reduced prices.Footnote 31 The lack of correspondence between risk and prices may, possibly, be explained by collusion, which was common among insurance companies during parts of the period. The prime example is the Svenska brandtarifföreningen (Swedish fire insurance tariff association), formed 1873 with the main purpose of coordinating premiums and other conditions for fire insurance.Footnote 32 Baranoff points out that the need to minimise each firm's exposure to risk and to diversify its overall risks led to a cartelisation of the US fire insurance industry from the 1870s, characterised by cooperative sales, with agents selling policies for several companies, and the sharing of fire incident data.Footnote 33 Furthermore, Baranoff states that individual insurers could not set high enough long-term prices, since low barriers to entry made it possible for competitors to undercut them for short-term gains. As a parallel to the US case, where the activities of the National Board of Fire Underwriters experienced an upheaval after the major city fires of Chicago and Boston, it was the city fires of 1888 that triggered increased activity in the tariff association.Footnote 34

In Sweden, the turbulence associated with city fires is exemplified by the Skutskär fire of 1874, which led to the near bankruptcy of Sverige and to the bankruptcy of the Hungarian reinsurance company Hunnia. In 1888 Sverige was again severely hit, which required the reconstruction of the company as Fenix in the subsequent year. These events of 1888 also caused the near liquidation of the old mutual Städernas Allmänna. Through the fire tariff association, reinsurance companies proclaimed that only companies using the pro-rata principle were accepted to reinsure.Footnote 35 Changes in company statutes stating the pro-rata principle were required in several mutual companies such as Städernas Allmänna in order to be accepted as a member of the tariff association. Interestingly enough, the tariff association comprised not only Swedish but also several foreign companies. Collusion cannot, however, be the main explanation for the deviation between actual and counterfactual premiums, since the tariff association was only effectively in operation until the late 1880s. By that time, the convergence between actual and counterfactual premiums had already been under way for several decades, as seen in Figure 1.

Although previous research has suggested that price and risk have played important roles in the development of insurance, we cannot find strong evidence for this in the Swedish case. The development of price in fire insurance (measured as load) during the period 1840 to 1900 indicates only minor and temporary changes, and the development of risk in the fire insurance market (measured as volatility in fire events) shows that the risk of fire was generally reduced after the 1840s. The risk in life insurance (measured as volatility in mortality) was also reduced during the second half of the nineteenth century. Although this reduction of risk may have facilitated the operation of the insurance business, it can hardly explain the rapid growth of insurance premiums during second half of the nineteenth century, since it did not translate into falling prices.

VI

The very concept of the financial revolution, and especially Ögren's important point that synergies between parts of the system were important, makes it relevant to address the growth of fire insurance in the light of monetisation of the economy. Figure 4 shows the fire insurance premiums plotted against the stock of notes in circulation, i.e. the M1 money supply. As compared to previous plots, Figure 4 also includes industrial fire insurance and not only household insurance.

Figure 4. Money supply (M1) and fire insurance premiums in million kronor (SEK), 1834–1913

The striking similarity between insurance premiums and M1, especially from the early 1860s and onwards, shows that the development of fire insurance was indeed an integrated part of the financial revolution. We have previously argued that fire insurance contributed to the monetisation of fixed assets by working in tandem with, for example, mortgage banks. Fire insurance assisted in mortgaging fixed assets, such as houses, through guaranteeing them as collateral. This, in turn, made it possible to leverage fixed assets to produce growth. Furthermore, monetisation would have been crucial both for conducting business and for the ordinary customer to pay the premiums.

This finally closes the circle. It was not growth or urbanisation per se that caused fire insurance to expand, but the financial revolution itself, of which fire insurance was certainly an integrated component.

Whether these developments preceded or coincided with the industrialisation of Sweden depends on how industrialisation is understood. Lennart Jörberg, for instance, states that the Swedish manufacturing industry had made little advance by 1870.Footnote 36 Its structure was one-sided and it concerned itself but little with the working up of raw-materials. It was only in the 1890s, when the obstacles due to poor communications had been overcome, that the industry reached what he called ‘its self-generating stage’ characterised by increasing demand from Swedish industry for Swedish industrial products.Footnote 37 In this respect, the financial revolution certainly preceded industrialisation.

Still, and of importance for this study, the period prior to the breakthrough of the 1890s was not static from the perspective of the manufacturing industry. For instance, Walt Rostow suggests, tentatively, and in his well-known terminology, that the Swedish take-off date occurred between 1868 and 1890, while the turning point into maturity is found in the early 1890s.Footnote 38 Rostow certainly based his conclusions on the works of Swedish economic historians such as Eli F. Heckscher, who indeed emphasised economic progress prior to the 1890s, most noticeably developments in the saw-mill industry.Footnote 39 Among contemporary scholars, Lennart Schön argues that the first wave of industrialisation is detectable already in the 1850s, an argument supported by various institutional reforms, a rising investment-to-GDP ratio and the developments in certain manufacturing industries such as textiles and saw-mills.Footnote 40 In this respect it rather seems that the financial revolution occurred simultaneously with industrialisation. These changes were, however, hardly discernible at the aggregated economy level, which is why Schön, despite being an advocate for early economic dynamics, supports the notion of a definitive industrial break-through in the 1890s.Footnote 41 This is also confirmed if productivity is taken into account. Prior to the onset of the long depression, the modest aggregated productivity growth was mainly driven by agriculture, while the contributions of both agriculture and manufacturing industry were approximately equivalent in magnitude throughout the long depression.Footnote 42 It was only in the early 1890s that the manufacturing industry could surpass agriculture as the main contributor to productivity growth. This means that income-driven fire insurance growth coincides with the definitive industrial breakthrough, while the financial revolution was probably related to developments in agriculture and early dynamics in the manufacturing industries.