I. Introduction

Despite the significant role of shadow banking in the Global Financial Crisis (GFC),Footnote 1 and heavy involvement by regulators to curb its risks, the concept of shadow banking remains imprecise and elusive. The lack of a precise definition is a potential source of a whole host of problems, including imprecise measurement of shadow banking in different jurisdictions.Footnote 2 For practical purposes, in this paper we define shadow banking by its function, ie the role it plays in the economy and the risks it poses to the financial system. In this view, shadow banking can best be understood as undertaking financial intermediation (credit, maturity and liquidity transformation) outside the banking regulatory perimeter and without access to government safety nets (eg deposit insurance, lender of last resort). Shadow banking activities can be undertaken either by banking institutions that engage in shadow banking activities or by any other institutions (non-banks) that engage in financial intermediation often using financial instruments lying outside the scope of government safety nets (eg repos and certain derivatives).Footnote 3

In this view, shadow banking is a whole that is greater than the sum of its parts. It is a combination of activities, instruments and entities that would collectively pose greater risks than they each would in isolation. But the paradox is that the whole, as an elusive and slippery concept, does not lend itself to the governance of legal rules, and it is only the constituent parts of the whole that can be captured by legal provisions. This is why we rarely see any reference to shadow banking in laws and regulations. Instead, the references to each segment of the shadow banking sector abound in legal and statutory texts. By the same token, instead of focusing on the macro-level analysis of the shadow banking sector, this article studies the micro-level distinctions in the structure and legal treatment of shadow banking in the US and the EU.

The overarching rationale for regulating shadow banking is the concerns about systemic risk.Footnote 4 Systemic risk in the shadow banking sector can materialise either directly or indirectly. Directly, systemic risk originates from credit intermediation (maturity and liquidity transformation), leverage and imperfect credit risk transfer,Footnote 5 and indirectly through the interconnectedness of the shadow banking system with the traditional banking system.Footnote 6 Following the systemic risk logic for regulating the shadow banking system, this study focuses on the parts of the shadow banking sector that are likely to create or contribute to systemic risk.

In exploring the specificities of the shadow banking in the EU compared to its US counterpart, we first focus on the securities financing markets and underline the features distinguishing the European repo markets from their US counterparts. Second, we focus on shadow banking entities and in particular on money market funds (MMFs) and analyse the structure of such funds and highlight their differences and the implications of such distinctive features to MMF regulatory regime in Europe. Due to limitations of time and space, securitisation, derivatives markets and other non-banks engaging in shadow banking activities will remain outside the scope of this paper.

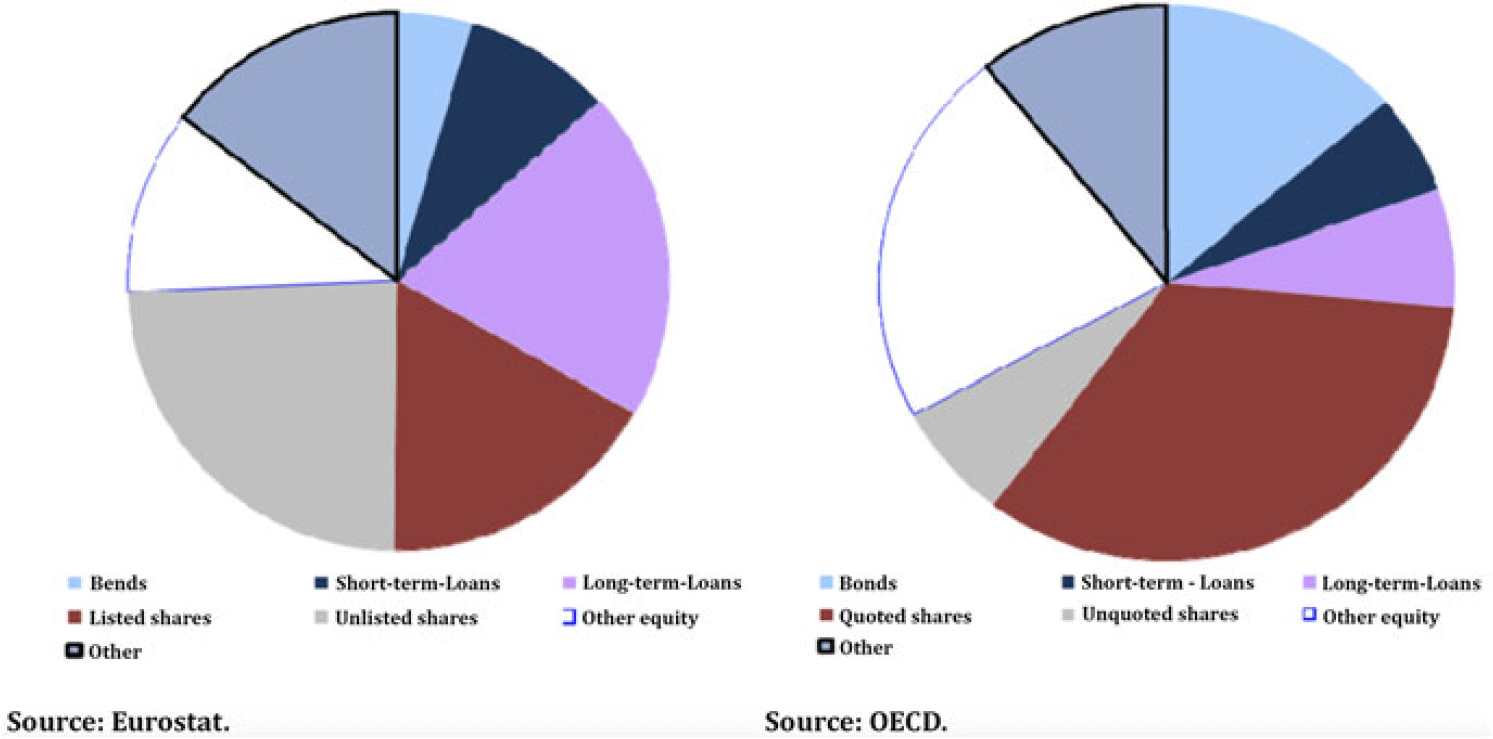

Figure 1: Liabilities of EU (left) and US (right) corporate sectors

Figure 2: Number of funds receiving support: 1980–2011. Data sources are Brady, Anadu and Cooper (2012)

II. International initiatives to regulate shadow banking

The shadow banking system, as part of the broader financial ecosystem, has evolved differently in different jurisdictions. For example, in developing countries shadow banking has emerged significantly differently from the shadow banking system in developed countries.Footnote 7 The main contention of this paper is that idiosyncrasies in the development of the shadow banking system exist in various jurisdictions in the western hemisphere as well. This has been the case despite international efforts to harmonise shadow banking instruments such as repos. Therefore, this paper aims at underlining such differences that require a differential regulatory treatment in the two main shadow banking jurisdictions, ie the EU and the US.Footnote 8

The focus of international efforts and transatlantic regulatory reforms has been on addressing the fragility of the shadow banking system by regulating the liquidity and leverage and incentivising financial institutions to reduce their leverage, improve their liquidity conditions, and specifically reduce their reliance on short-term wholesale funding. At the international level, the main regulatory initiatives on the reforms of the shadow banking sector are carried out by the Financial Stability Board (FSB). In 2011, the FSB put forward five overarching principles and work streams to identify and regulate the key risks in the shadow banking system.Footnote 9 These work streams include:

1. indirect regulation or regulating banks’ interactions with shadow banking entities to limit spillovers between regulated banks and shadow banks;

2. regulatory reform of MMFs to reduce the risk of runs on MMFs;Footnote 10

3. regulation of other shadow banking entities to identify the potential systemic risks of the new shadow banking entities;

4. regulation of securitisation to align the incentives in securitisation transactions;

5. regulation of securities lending and repos – and addressing the risks and procyclicality of such activities and instruments.Footnote 11

The FSB and other international fora have been criticised for imposing their policy priorities on all jurisdictions without due regard to the idiosyncrasies of different markets around the globe. In particular, Chinese legal scholars have been critical of the international initiatives for the regulation of the shadow banking sector and have claimed that the FSB and the Basel Committee on Banking Supervision (BCBS), as global standard-setters, have ignored the nuances of local markets.Footnote 12 In this paper, we highlight significant differences, both regarding market structure and regulatory regime, in the seemingly similar EU and US shadow banking sector to put a spotlight on such differences and attract international standard-setters’ attention to such idiosyncrasies. A close examination of the existing recommendations, preparatory works and decision-making mechanisms within such international fora suggests that international financial fora are largely cognisant of such differences and in many instances take such specificities into account. However, highlighting these idiosyncrasies would benefit not only international standard-setters, but also the national regulators responsible for implementing such guidelines and recommendations in their specific jurisdictions. Therefore, there is still a need for a nuanced tone for international for a, as their recommendations set standards towards which almost all national regulators anchor, particularly those regulators with limited regulatory resources.

For example, in 2012, the International Organization of Securities Commissions (IOSCO) recommended the conversion of Constant Net Asset Value Money Market Funds (CNAV MMFs) to Variable Net Asset Value Money Market Funds (VNAV MMFs).Footnote 13 It further recommended that if such a conversion proved to be impossible, safeguards should be in place to reinforce CNAV MMFs’ resilience in the event of significant redemptions. The FSB also joined forces with the IOSCO in supporting the idea that in the event of the impossibility of the conversion of CNAV to VNAV funds, requirements that are functionally equivalent to capital, liquidity, and other prudential requirements that protect banks against depositor runs should be in place for CNAV MMFs.Footnote 14 These two international fora also supported imposing reserve requirements on MMFs and risk-retention requirements for the suppliers of securitisation (eg originator, sponsors).Footnote 15 As we shall see in this paper, the majority of such proposals were wanting in their theoretical substance as well as empirical evidence.

The proposal for conversion of CNAV funds to VNAV funds received a lukewarm support from the very first day and eventually neither jurisdiction adopted it. The proposal for imposing reserve requirements (so called ‘NAV buffer’) faced strong resistance from the industry and was eventually dropped. However, the policy diverged in the case of sponsor support. In the EU, the European regulators preferred to put a ban on sponsor support, while the US regulator opted for a more nuanced approach, allowing such support but imposing transparency requirements. The proposals put forward on securitisation, which are mainly about retention requirements, despite being adopted in the EU and the US, perhaps was not necessary as many originators have already had retained more than the required risks in the securitisation positions.Footnote 16

In addition to the efforts of the international fora, self-regulatory organisations as well as industry associations have played a significant role in the legal treatment of the shadow banking instruments and activities. These players have a rather different approach compared to international fora. Unlike the international fora, which focus on the mitigating risk to the financial system in the aggregate and at macro-level, these associations focus on the harmonisation of shadow banking instruments at the micro-level (eg contract design, bankruptcy protections, etc) inspired by the commercial and financial customs and practices already in place. For example, efforts to standardise and harmonise the transactions largely used in the shadow banking sector were underway well before the GFC. Industry initiatives through self-regulatory organisations, such as International Capital Market Association (ICMA), Securities Industry and Financial Markets Association (SIFMA), and International Swaps and Derivatives Association (ISDA) have been relatively successful in achieving certain degrees of standardisation in the design, governance, and regulation of such transactions. The ICMA (and its predecessor institutions) played a significant role in pushing governments to pass laws that grant bankruptcy safe harbours to repos and certain types of derivatives with certain counterparties. However, despite such efforts toward standardisation, many transactions used in the shadow banking system remain subject to local rules and regulations of specific jurisdictions. This is the case especially in Europe, where those transactions are still governed and regulated by Member State laws, subject to varying degrees of harmonisation. In the next section, we present the root causes of such subtle idiosyncrasies that drive the divergence in the shadow banking systems of Europe and the US.

III. Specificities of the shadow banking in the EU: a long divergence

At the roots of the differences in the EU and US shadow banking system lies deeper structural differences in the financial market within these two jurisdictions.Footnote 17 There are at least two significant contributing factors to the divergent paths of the evolution of shadow banking on either side of the Atlantic. The first is related to the fact that, roughly speaking, Europe has a bank-based financial systemFootnote 18 and the US has a market-based one.Footnote 19 The second concerns the banking business models on both sides of the Atlantic. Namely, European financial markets are dominated by universal banks, while the modern US banking has been characterised by the separation of investment banking from the commercial banking model, which largely emerged after the Great Depression by the enactment of the Glass-Steagall Act.Footnote 20

To highlight the role of bank-based versus market-based financial systems, the data on the liabilities side of the EU and US corporate sector’s balance sheet is very revealing. In the bank-based financial markets of Europe, data from 2013 suggest that 14% of the total liabilities of European companies is made up of bank loans. In contrast, in the US the share of bank loans in total liabilities of companies stands at 3%. Equally importantly, 11% of the total liabilities of US companies are in the form of corporate bonds, compared to 4% in European companies (see Figure 1).Footnote 21

Against this background, in the European setting, one of the objectives of regulating shadow banking as part of the broader Action Plan on Building a Capital Markets UnionFootnote 22 is to promote market finance and reduce the real economy’s reliance on the banking sector, which is traditionally the dominant and primary medium of channelling funds from surplus spending units to deficit spending ones. In this context, shadow banking is viewed as a market-based finance and is often encouraged, as it provides alternative sources of finance to the real economy and exerts a competitive pressure on the banking sector.Footnote 23

The second important factor that plays a major role in distinguishing European shadow banking from US shadow banking is rooted in the structure of the banking industry or banking business models, which is embodied in the dichotomy of universal banking versus separation of commercial and investment banking models in these two jurisdictions. If we define shadow banking as non-bank financial intermediation,Footnote 24 in a universal banking model there is a wider scope for banks to engage in shadow banking activities. This means that in those jurisdictions where the dominant banking business model is universal banking, one would expect greater interconnectedness between banks and shadow banks. For example, in the universal banking model, since many financial activities can be performed under a single entity, it is more likely for the banking industry to engage in shadow banking operations through sponsoring MMFs, offering prime brokerages services, or through undertaking broker-dealer functions.Footnote 25

This problem is especially acute in the bank sponsorship of MMFs in the EU, giving rise to higher levels of interconnectedness of the European MMFs to banks.Footnote 26 Typically, MMFs are managed by asset management companies. Asset management companies are either sponsored by banks or run MMFs independently. In the Euro area, more than 50% of large asset management companies are owned by banks or bank holding companies.Footnote 27 Although roughly the same figures apply for the US MMFs,Footnote 28 it is estimated that 9 out of 10 biggest EU MMF managers are sponsored by commercial banks.Footnote 29 Evidence suggests that funds sponsored by banks with more MMFs under their sponsorship tend to take on more risk.Footnote 30 This would result in a direct contagion channel between MMFs and sponsoring banks in the event of stress in the MMF industry.

1. Shadow banking activities

The specificities of the shadow banking system in the EU are also present in the financial activities typically associated with shadow banking. The differences are present in securities financing transactions (including repos (bilateral and tri-party repo) and securities lendingFootnote 31), securitisation, and derivatives markets.Footnote 32 One of the targets of regulation therefore was repo transactions, and the FSB, which champions the international initiatives for regulating shadow banking, issued recommendations regarding such transactions. A careful examination of the market structure and legal structure of the repo markets in the EU and the US reveals their fundamental differences and raises doubts about whether a one-size-fits-all approach is the right path to take in regulating securities financing transactions.Footnote 33 We will discuss this issue in the next section.

2. Securities financing transactions: what is special about the European markets?

The largest European banks obtain collateral using Securities Financing Transactions (SFTs) rather than using derivatives.Footnote 34 Repo transactions constitute the main type of SFTs in the EU, which makes it the main mechanism through which banks acquire short-term wholesale funding.Footnote 35 The vulnerabilities in the wholesale funding and in particular short-term (overnight) repo markets were a significant source of systemic risk in the GFC.Footnote 36 In addition to maturity and liquidity transformation, repo transactions allow for financial leverage with varying degrees depending on the level of haircut or initial margin.Footnote 37 Since credit intermediation using repos is outside the government safety net, repos are vulnerable to runs and hence they lie at the heart of the fragility of the shadow banking system.Footnote 38 The excessive dependence on short-term wholesale funding contributed to the spectacular collapse of some of the largest investment and commercial banks, such as Bear Stearns Companies Inc, Lehman Brothers Holdings Inc, and the UK’s Northern Rock.Footnote 39 Given the importance of repos in the shadow banking system, it is of special importance to carefully examine the market structure as well as the legal structure of the repo markets on both sides of the Atlantic, to highlight their fundamental differences and to bring such differences to the attention of the international regulatory fora.

In the wake of the GFC, the EU repo markets have undergone substantive transformation. For example, generally there has been a shift from unsecured funding to secured funding, with the concomitant result of increasing the importance of collateral in financial markets.Footnote 40 According to the recent data by the FSB, the reliance of banks on short-term funding has increased on average in 16 jurisdictions.Footnote 41 Bank assets funded by long-term wholesale assets decreased from 24% in 2011 to 23% in 2015. This pattern has been steeper among the Other Financial Institutions (OFIs), whose reliance on long-term wholesale funding decreased from 28% of total assets to 22%.Footnote 42 In the same vein, the net repo positions of banks and OFIs have witnessed a spike. This means that the OFIs are net providers of cash to the financial system using repos.Footnote 43 It seems that the reliance of financial institutions on non-bank repos is higher in the US. The FSB suggests that from among the 15 reporting jurisdictions, about 59% of non-bank repos were concentrated in the US in late 2015.Footnote 44 However, similar trends have been observed in the reliance of dealers on repo financing. Dealers’ repo financing was at its peak in 2007, and constituted 32% of their total liabilities. Since 2007, this figure has declined and at the first quarter of 2015, it reached a low level of 13% of total liabilities.Footnote 45 This decrease cannot be interpreted as the decreasing role of repo, but is due to the fact that most repo transactions are increasingly netted off the balance sheet. Dealers have also extended the maturity of their repo financing.

Despite serious efforts from the industry and self-regulatory organisations such as ICMA and SIFMA for standardisation of repo transactions and harmonisation of the applicable regime for repos, cross-jurisdictional differences remain in place.Footnote 46 There are at least three differences in the respective repo markets on both sides of the Atlantic. First, in Europe, a repurchase agreement transfers legal title to collateral from the seller to the buyer. In other words, a repo in Europe is a true sale; hence the name ‘title transfer (financial) collateral arrangements’ (TTCA).Footnote 47 Whereas, in the US, under New York law, since transferring title to collateral is difficult, the collateral is pledged, however, it is exempt from certain provisions of the US Bankruptcy Code that apply to pledges (ie automatic stay). In this system, however, the pledgee or the buyer is given a general right of use of collateral, which is also known as rehypothecation.Footnote 48 In spite of this legal nuance, this arrangement is effectively – and in economic terms – equivalent to an outright sale. One important cross-jurisdictional distinction is that under the New York law, repos include a fall-back provision. Namely, if the buyer’s right to collateral proves to be unenforceable, the repo will be recharacterised as secured lending. However, English law does not include such a provision.

Therefore, in the EU, in certain settings, it seems that there has been no need for bankruptcy safe harbours for repo transaction, because the right of reuse is inherent in the TTCA,Footnote 49 and such transactions were already concluded as a true sale transaction (title transfer) rather than a secured one. However, it seems that due to the differential treatments of such transactions in different Member States and potential conflicts stemming from such frictions, bankruptcy safe harbours are already included in the Settlement Finality Directive (SFD)Footnote 50 and the Financial Collateral Arrangements Directive.Footnote 51

The second important difference in the repo markets on the two sides of the Atlantic is that the US market is dominated by tri-party repo the maturity of which is often overnight.Footnote 52 In a tri-party repo market a third party (a repo agent) facilitates the repo settlement, whereas a bilateral repo is directly settled between the two parties to the transactions (collateral and cash provider) without the interposition of a third party.Footnote 53 The estimates reveal that two-thirds of the US repos are in the form of tri-party repos. In the EU, however, only 10% of the repos are tri-party.Footnote 54 One possible explanation for increased use of tri-party repos in the US is the use of treasuries as a funding tool by corporate entities, while in the EU, in particular in the emerging Europe, the repo may often be used for shorting or leveraging.

The third difference manifests itself in the maturity of repo instruments in the EU and the US. The average maturity of US repo transactions is shorter than the maturity of such transactions in the EU.Footnote 55 In June 2007, according to an ICMA survey, only 18.3% of the outstanding repos were overnight in Europe. As of June and December 2017, this figure stood at 18.4% and 16.9% respectively.Footnote 56 However, the US repo market is largely overnight.Footnote 57 This means that the maturity transformation happening through repo transactions in the US is higher than in the EU. Hence, ceteris paribus, the US repo markets are more likely to be prone to runs and are overall riskier than the EU repo markets.Footnote 58 Despite the fact that shorter maturity makes the repo contract itself a safer lending instrument for lenders, on aggregate it increases the fragility of funding of the repo borrowers (eg banks) as it increases maturity transformation in the banking industry if banks rely on such short-term funding to lend long.

The fourth, and perhaps one of the most important, difference concerns the composition of the collateral used in the European repo markets. It is estimated that around 80% of the collateral used in the European repo markets is government securities. Structured securities used as collateral in the EU markets are a small portion of the overall collateral backing repo transactions, and where they are used, they are often used in tri-party repo markets. As stated above, tri-party repos amount to 10% of the European repo markets, and the use of structured securities as collateral amount to about 10% of the European tri-party repos.Footnote 59

In general, jurisdictions where government bonds are prevalent as the collateral in repo are more likely to weather the times of repo market distress.Footnote 60 Given that one of the reasons for the predominance of repo transactions is the supply of highly-demanded safe assets,Footnote 61 the use of government securities as collateral in the EU repo markets is of special importance for financial stability, because these securities have proven to be resilient to runs in times of crises. As the study by Gorton and Metrick on runs on repo backed by Asset-Backed Commercial Paper (ABCP) shows, during the financial crisis, the major repo runs occurred on the commercial paper used as collateral.Footnote 62 Other studies on repos backed by government bonds as collateral show that they were not subject to runs.Footnote 63 Therefore, in the absence of sovereign default risk, the risk of a run on the European repo markets cannot be deemed significant. As the GFC also demonstrated, the EU repo markets weathered the crisis much better than the US markets, perhaps because of the reliance of the EU markets on repos collateralised by government bonds.

3. Regulatory reforms of repo markets

Regulatory reforms affecting the securities financing transactions – especially the collateral used in such transactions – span across a whole host of regulations having direct or indirect impact on such transactions. Rather counterintuitively, instead of the European regulation on transparency of securities financing transactions and of reuse (the SFTR regime),Footnote 64 Basel III and its implementation in the EU by the Capital Requirements Directive (CRD IV)Footnote 65 and the Capital Requirements Regulation (CRR)Footnote 66 (jointly referred to as the CRD IV Package) have perhaps had the most dramatic impact on repo markets.Footnote 67 Risk-based capital requirements, leverage ratio, Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) all have a potential impact on repo markets in terms of increased cost of capital and liquidity for engaging in repo transactions.Footnote 68 The impact is more dramatic in case of leverage ratio and LCR.Footnote 69 For example, the LCR of Basel III makes it costlier for Bank Holding Companies (BHCs) and their subsidiaries to rely on short-term repo funding with low-quality collateral. Basel III NSFR is also adopted to encourage banks and their subsidiaries to rely more on longer-term liabilities and reduce their reliance on short-term wholesale funding.Footnote 70 The bank balance sheet regulation stings in particular where there is no netting opportunity for repo transactions.

Recent studies have found that pursuant to the introduction of the supplementary leverage ratio (SLR) in 2012 in the US, repo borrowings by broker-dealer affiliates of BHCsFootnote 71 has decreased, but the use of repo backed by more volatile collateral has increased.Footnote 72 However, the evidence on this is far from conclusive. Some studies suggest risk shifting from broker-dealer affiliates of banks to those affiliated with non-banks and heightened amounts of risk due to the use of repos backed by more volatile collateral.Footnote 73 In addition, there is evidence that broker-dealer affiliates of BHCs were discouraged from borrowing in tri-party repo markets pursuant to the introduction of the leverage ratio. This development was concomitant with an increase in the activity of active non-bank-affiliated dealers in certain asset classes entering tri-party repo markets, suggesting a risk-shifting behaviour from the banking sector to non-bank sector.Footnote 74 This increase in the importance of non-bank-affiliated broker-dealers in tri-party repo markets has been due to the more stringent capital requirements imposed on BHCs at a consolidated level.Footnote 75 The relative decline in the use of tri-party repos is probably due to the increased use of central clearing in US treasury repos through the use of the so-called sponsored repos, than any other regulatory intervention in the aftermath of the GFC.

Although the size of repo markets remains substantial, overall the maturity of repo funding has been extended, especially for the repos with low-quality collateral. There has also been a move toward diversification of funding sources among dealers.Footnote 76 Although US dealers and banks have decreased their reliance on repo, for US-based foreign bank offices, repo remains a substantial source of funding. This is mainly because of differences in regulations as well as the fact that those banks have a limited access to US retail deposits.Footnote 77

In 2011, the Federal Deposit Insurance Corporation (FDIC) expanded the deposit insurance assessment base from deposits to all of bank liabilities (including repos). This is expected to make it more expensive for insured banks to fund their assets in the repo markets.Footnote 78 In addition, sections 165 and 166 of the Dodd-Frank Act (enhancing prudential standards for US BHCs) encourage the dealer subsidiaries of BHCs to shift more toward longer-term financing. Furthermore, the reforms of the market infrastructure for repo and derivatives transactions will also affect the repo markets. This is expected to strengthen the risk management by tri-party repo cash investors by incentivising them to accept more liquid and high-quality collateral, hence decreasing the counterparty risk. A trend towards more conservatively collateralised tri-party repo markets is expected, which could lead to a more conservative pricing of credit intermediation by repo markets.Footnote 79

4. The case of rehypothecation

One of the most controversial aspects of repo transactions is rehypothecation, or reuse of collateral.Footnote 80 Rehypothecation occurs when an intermediary holding securities on behalf of investors grants a security interest or encumbers those securities to obtain financing for itself.Footnote 81 Rehypothecation is often practiced in the relationship between broker-dealers and their clients (risk portfolio managers or cash portfolio managers) and it provides an inexpensive source of financing for financial institutions, especially broker-dealers.Footnote 82 For example, in repo financing, the broker-dealer often hypothecates the collateral provided by the risk portfolio manager (PM) so that it can procure financing for the risk PM from a cash PM in a matched-book method.Footnote 83 Rehypothecation plays an important role in providing liquidity to markets. However, reuse of collateral is believed to pose risks to financial stability, particularly if one looks at how the global financial crisis manifested itself; namely, as withdrawals of collateral from investment banks such as Lehman Brothers.Footnote 84

The systemic risk concern originates from the uncertainty stemming from a decline in collateral prices and potential runs on the counterparties by the firms whose collateral is being rehypothecated.Footnote 85 For example, the counterparty credit risk of prime brokers has always been a concern for hedge funds. At the centre of such a concern is the reuse of collateral that hedge funds post to secure the funds they borrow from their prime brokers. Reusing collateral can increase the counterparty risk in times of financial distress, during which uncertainty about the counterparty credit risks is at its highest.Footnote 86 It is long established that aggregate uncertainty can impair the ability of the private sector to provide liquidity because this sector cannot be fully insured against the aggregate shocks.Footnote 87 Given that rehypothecation of assets can amplify uncertainty in financial markets, reuse of collateral may play a role in a liquidity crisis.

Rehypothecation of collateral is subject to regulation on both sides of the Atlantic. In the US, according to section 724 of the Dodd-Frank Act,Footnote 88 parties accepting money, securities or property to margin, guarantee, or secure a swap cleared by a derivatives clearing organisation should register as Futures Commission Merchants (FCMs). The FCMs should treat all money, securities, and property of any swaps customer as belonging to the swap customer. They are also required to separately account for and not comingle the customer’s funds with the funds of the FCM. In addition, section 724 requires segregation of assets for uncleared swaps. According to this requirement, a swap dealer or a Major Swap Participant (MSP) should notify the party wishing to enter a swap transaction at the beginning of the swap transaction that it has “the right to require the segregation of the funds or other property supplied to margin, guarantee, or secure the obligations of the counterparty”. The aim of this provision is to prevent the swap dealer or an MSP from using customers’ assets posted with them as collateral to be used as margin, guarantee, or as a security for any of its trades.Footnote 89

In addition, in the US the rehypothecation or the reuse of collateral by the custodian or prime broker is capped at the 140% of the amount of debt of the client. In other words, the amount of a client’s assets that can be rehypothecated by a prime broker or a broker dealer is capped to the equivalent of 140% of the client’s liability to the prime broker or dealer,Footnote 90 but such a cap might not be needed under the UK securities financing transactions, as discussed below.Footnote 91

Financial collateral arrangements in Europe are governed mainly by Directive 2002/47/EC on financial collateral arrangements, as amended (Financial Collateral Directive or FCD).Footnote 92 The main aim of the FCD is to harmonise the regime applicable to financial collateral arrangements. The FCD governs the collateral provided using title transfer or the grant of a security interest.Footnote 93 The main provisions include the prohibition of the recharacterisation of title transfer as grant of security interests,Footnote 94 right of use for collateral taker,Footnote 95 a mechanism for rapid enforcements, including close-out netting,Footnote 96 and protections in insolvency (ie bankruptcy safe harbour).Footnote 97 The FCD generally strengthens the position of collateral takers vis-à-vis collateral providers and creditors. Taking such a stance is based on the ground that providing such special treatment would improve market liquidity, lead to inexpensive credit and contribute to financial stability by preventing ripple effects originating from individual insolvencies.

At the EU level, on 23 December 2015, the European regulation on transparency of securities financing transactions and of reuse (SFTR) was published.Footnote 98 This regulation contains measures aimed at increasing the transparency of the securities lending and repurchase agreements by mandating firms to report all such transactions to trade repositories. The SFTR is mainly concerned with the transparency of the SFTs, and reuse. Since it is believed that transparency helps increase market discipline and the effectiveness of supervision,Footnote 99 the SFTR strives to enhance the transparency of the SFTs through the following three mechanisms.

1. the transactions should be reported to a central database (except where one of the parties to the transaction is a central bank). This will help the supervisor to better identify the interconnectedness of banks and shadow banks;

2. the transparency on the practices of investment funds engaged in the SFTs and total return swaps will be improved by imposing reporting requirements on those operations;

3. the transparency of the reuse of collateral will be improved by imposing minimum conditions to be met for reuse, such as written agreement and prior consent.Footnote 100

According to these provisions, the SFTR requires prior consent for reuse of collateral, and disclosure of risks and consequences of reuses to the parties posting the collateral. It subjects the right to reuse of collateral to the notice and consent requirements.Footnote 101 In other words, the collateral taker should inform the collateral provider in writing of the risks involved in consent to a right of reuses of collateral and in concluding a title transfer collateral arrangement, and the collateral provider should grant its express consent to reuse. The establishment of reporting obligation to trade repositories, the new disclosure requirements for investment funds and reuse enhance the transparency of securities financing markets and will make detailed data available to regulators to monitor the risks of shadow banking activities.

One of the significant differences in the regulatory treatment of the securities financing transactions in the EU and the US is the limit or cap on the rehypothecation of collateral in the US as opposed to many other markets, including the EU markets. At the EU level, there is no cap on reuse, as opposed to the 140% cap in the US.Footnote 102 However, individual Member States such as France have similar limitations (140% cap) in place. Although in the UK there is no 140% cap on rehypothecation, it seems that the percentage used in the US has created an anchoring effect and in fact many hedge funds are using 140% cap as a benchmark in negotiating prime brokerage agreements with their banks.Footnote 103 As this has become a standard practice, for all practical purposes, there is nearly no difference between the US and the UK in terms of cap on collateral reuse.

5. Bankruptcy safe harbours for repo

Another way to regulate repo is through the bankruptcy law applicable to the collateral used in repo, which turns out to be another controversial aspect of securities financing transactions and in particular repo. The run on repo, as one of the main contagion channels in the GFC, thrust the preferential treatment of repo collateral in bankruptcy into the spotlight once again.Footnote 104 In the US, the collateral of repos and derivatives transactions (so-called Qualified Financial Contracts) is exempted from the automatic stay on the borrower’s assets in case of bankruptcy. The Bankruptcy Code affords special treatment to derivatives contracts by exempting them from the “automatic stay” and allowing counterparties to terminate these contracts (by closing out, netting or setting off their derivatives positions) and to seize the underlying collateral.Footnote 105 The repo transactions also enjoy equivalent protections.

Similar provisions exist in the EU. To mitigate the risk of a run on repo, the counterparties to a financial collateral arrangement (eg repos) are permitted to terminate the existing positions in the event of default. Such protection is intended to act as a “firebreak” to contagion in the event of the failure of a large financial institution.Footnote 106 Therefore, the underlying rationale for this safe harbour for derivatives and repos was that such markets can be a source of systemic risk and this exemption would be necessary to prevent the risks of contagion and financial crisis.Footnote 107

Bankruptcy safe harbours for repos played an important role in the growth of shadow banking.Footnote 108 However, after the GFC, these safe harbours have become highly controversial. It is argued that such protections fuel fire sales and collateral crises.Footnote 109 In addition, the role of closeout and netting in reducing systemic risk is far from straightforward.Footnote 110 In other words, although this exemption produces numerous benefits and is necessary for the good functioning of financial markets,Footnote 111 it facilitates or encourages the run on financial institutions by incentivising counterparties of the banking entities to close-out or net derivatives contracts at the first signals of insolvency of a financial firm. Therefore, this safe harbour does not reduce systemic contagion, because it overlooks some intricate incentives lying in the interconnectedness of financial institutions. The safe harbours are also considered responsible for the failure of Lehman Brothers, especially accounting for the fact that the exemptions from the automatic stay failed to prevent a run on Lehman.Footnote 112 For example, just before the collapse of Lehman Brothers, JP Morgan seized $17 billion in Lehman’s collateral and demanded an additional $5 billion payment.Footnote 113

As is clear, scholars are divided on a wide spectrum on this contested issue. Some believe that the safe harbours should be totally repealed.Footnote 114 Others believe that they should be maintained in their entirety.Footnote 115 And a third group believes in narrowing down the scope of such safe harbours.Footnote 116 In general, removing the automatic stay exception would act as a curb on repos by reducing the liquidity of the collateral, particularly in tri-party markets.Footnote 117 This could be a sensible regulatory measure to reduce reliance on lower-quality collateral, akin to setting minimum haircuts. However, it would be probably unwarranted for higher-quality collateral, such as most government-guaranteed securities.Footnote 118

There are various more nuanced policy proposals for amending bankruptcy law as related to repo transactions. Some proposals recommend the removal of the exemption from automatic stay for repos backed by risky or illiquid collateral.Footnote 119 Others suggest making repos backed by risky or illiquid collateral subject to tax as a macroprudential tool, instead of removing the safe harbour.Footnote 120 A rather distinct proposal comes from Acharya and Öncü who propose creating a special resolution authority called ‘Repo Resolution Authority’ (RRA) for addressing the potential systemic risks of repo collateral fire sales during a financial crisis.Footnote 121 They advocate the removal of the bankruptcy safe harbour, except for high quality government bonds. However, in the event of default by a counterparty on a repo, lenders should be able to sell the collateral to the RRA at market price less a predefined haircut specified by asset class by the RRA. The RRA would then make a liquidity payment to repo lenders and then would try to liquidate the collateral in an orderly manner. In this case, an ex-ante fee should be charged on repo lenders. Furthermore, there should also be certain eligibility criteria on repo lenders.Footnote 122 Other proposals put forward a recommendation to impose a temporary stay on close-out netting for a short period of time. Such a temporary stay would allow for benefiting from the risk-mitigation advantage of close-out netting while preventing fire sales. However, any modification beyond that has not gained considerable traction.Footnote 123

Recently, the Bank Recovery and Resolution Directive (BRRD)Footnote 124 revised the regulatory treatment of repo transactions and limited the exemption. As explained above, under the EU law of financial collateral arrangements, holders of instruments involving financial institutions whereby cash or securities are transferred by way of security are protected from the application of the insolvency laws or other measures that could hinder the enforcement of their close-out netting.Footnote 125 Since such protections result in the erosion of the financial institutions goodwill, they were viewed as posing major challenges to insolvency procedures and successful resolutions. To address this problem, the FCD was revised by the BRRD to allow for a stay on close-out netting and enforcement provision until midnight at the end of the next business day.Footnote 126 This new 48-hour rule is intended to afford resolution authorities adequate time for an orderly resolution. As of this writing, despite heated discussions and new proposals in the US,Footnote 127 there has been no equivalent change in the bankruptcy framework of repos.

In the US, as a response to the concerns of a run on repo giving rise to disorderly resolution of banks, the exemption from automatic stay no longer entirely applies to banks being taken over by the Federal Deposit Insurance Corporation (FDIC).Footnote 128 Similarly, under the Dodd-Frank Act, counterparties to a “covered financial company”Footnote 129 may not be able to terminate contracts after the institution is put under the FDIC’s receivership.Footnote 130 To address the issue of moral hazard, Dodd-Frank Act’s section 214 further stipulates that taxpayers’ funds cannot be used to prevent financial companies from liquidation, nor should they bear any losses in the liquidation process led by the authorities.Footnote 131

IV. Shadow banking entities

Shadow banking entities are composed of a complex web of financial entities, conduits, vehicles, and structures in different jurisdictions and are often masqueraded as a whole host of otherwise well-known institutions. Such institutions include MMFs, financial vehicle corporations (FVC; ie financial vehicles mainly engaged in securitisation), and other intermediaries such as securities dealers (and to a lesser degree hedge funds and venture capital funds), leasing and factoring companies and financial holding companies. Due to limitations of space, in this paper we only focus on MMFs as one of the most important components of the shadow banking system.

1. MMFs in the EU

MMFs are financial intermediaries that connect short-term debt issuers with providers of funds who need daily liquidity. In doing so, MMFs can become subject to runs due to their engagement in the liquidity transformation without access to government safety nets. In some European jurisdictions, investment funds can even originate loans that would entail credit intermediation risk. Bond funds investing in fixed income securities are potentially indirectly engaging in indirect credit intermediation and undertaking maturity and liquidity transformation.Footnote 132 Therefore, as far as a fund engages in leveraged credit intermediation (liquidity and maturity transformation), it can impose externalities on other parts of the financial system.Footnote 133 In addition, the risk of financial leverage exists in certain types of funds such as hedge funds.Footnote 134 However, this paper only studies MMFs.

Unlike international initiatives, which propose certain policy objectives and regulatory approaches to addressing the potential systemic risks of the shadow banking sector, a closer examination of European MMFs shows that they display specific features that distinguish them from the US MMFs, and accordingly call for a rather nuanced regulatory approach. According to recent estimates by the European Systemic Risk Board (ESRB) and under the broad measure, which is based on the investment funds and OFIs, in the fourth quarter of 2015, the size of the shadow banking in the EU was around €37 trillion, which amounted to 36% of the EU financial sector.Footnote 135 This estimate stands at around €28 trillion for the Euro area. Between late 2012 and late 2015, the shadow banking system in the EU grew by 22%. This is in sharp contrast to the size of the EU banking sector, which declined by 5% over the same period. As for the OFI sector, the Euro area had the largest share of the total OFIs by the end-2015 with assets amounting to $30 trillion. The US and the UK are the second and third largest jurisdictions with assets of $26 trillion and $8 trillion respectively.Footnote 136

According to the ESRB’s broad measure, the largest segment of the shadow banking system in the Euro area is the investment fund sector. MMFs in the EU amount to €1.1 trillion and non-MMFs amount to €10.3 trillion. Financial vehicle corporations (FVCs) also stand at €1.8 trillion of the broad measure and non-securitisation Special Purpose Entities (SPEs) amount to €3.7 trillion. 39% of the broad measure is categorised as other OFIs that constitute €10.8 trillion composed of heterogeneous entities not covered by regular data collection.Footnote 137 OFIs engaging in shadow banking activities display a significant heterogeneityFootnote 138 and the data about them are largely lacking. This particularly applies to non-securitisation SPEs and holding companies, financial corporations engaged in lending, and securities and derivative dealers.Footnote 139

The most significant difference between US and EU MMFs is in the market structure and composition of the MMFs. First, the EU has a very small MMF sector that belongs to a heavily regulated investment fund industry. The total assets under management (AUM) of the EU MMFs roughly amount to €1 trillion, standing at around 15% of the European fund industry.Footnote 140 In the Euro area, the balance sheets of the MMFs only represent 4% of the MFIs’ balance sheets; credit institutions (banks) constitute 96% of the balance sheets of the MFIs.Footnote 141 Therefore, EU MMFs do not appear to be systemic because of their size.

Second, in most European jurisdictions, such as in Belgium, France, Germany, Italy, the Netherlands, Switzerland, and the UK, Variable Net Asset Value (VNAV) structures are prevalent.Footnote 142 Therefore, the majority of EU MMFs are VNAV funds that form one of the most striking differences between the EU MMFs and their US counterparts. It is estimated that 60% of the EU MMFs are VNAV funds and only 40% are in the form of CNAV model.Footnote 143 As a VNAV MMF is not a suitable substitute to a bank deposit and as it is not subject to maturity mismatch and liquidity risks, it cannot even be considered a part of the shadow banking system. Overall, this marks a major distinction between the EU and US MMFs in the sense that the EU MMFs are less likely to engage in liquidity and maturity transformation, and even if they are exposed to maturity and liquidity mismatch risk, it is less likely for them to become systemically relevant due to their size. The relative resilience of the European MMFs during the crisis confirms this proposition.

An additional problem in the MMF sector relates to sponsor support, which raises concerns about interconnectedness. The main problem in the interconnectedness of MMFs and banks is associated with CNAV funds. The promise of on-demand redemption at a stable share price (ie on-demand par-value redemption promise) bears a substantial resemblance to the promise made by banks in taking deposits. Indeed, a CNAV MMF can functionally be an alternative to a bank deposit, especially for investment funds and corporate treasurers with sizable amounts of cash under their management. To sustain the promise of on-demand par-value redemption, CNAV MMFs have traditionally relied on their sponsor (often a bank) for discretionary capital.

Sponsor rescue may take many forms, such as capital support agreements, letters of credit (guarantees), management fee waivers or distressed asset purchases at amortised costs. The sponsor support is often purely discretionary, ie there is no legal obligation on the side of the sponsor to allocate certain levels of funds or liquidity for stabilising the sponsored MMF under liquidity stress.Footnote 144 However, to avoid potential reputational risks of the failure of the sponsored fund, the sponsoring bank often supports the ailing sponsored fund by extending credit lines, liquidity support or indemnification in times of crisis.Footnote 145

Studies suggest that during the GFC, at least 21 MMFs would have broken the buck had there been no sponsor support.Footnote 146 Indeed, between 2007 and 2011, in 123 instances, out of a total of 341 MMFs, 78 funds received sponsor support amounting to at least $4.4 billion (see Figure 2).Footnote 147 In Europe, during the GFC, the prominent examples of sponsor support were the asset purchase by Société Générale and Credit Suisse from their MMFs, and Barclays’ extension of guarantees costing £276 million.Footnote 148 As the below figure suggests, such discretionary sponsor support is not a phenomenon of the crisis, but it was prevalent even before the GFC.Footnote 149 Although since the adoption of Securities and Exchange Commission (SEC) rules on MMFs in 1983 there have been only two instances of MMFs breaking the buck (the Community Bankers US government Fund in 1994, and the Reserve Primary Fund in 2008), in the absence of sponsor support, there would have been many MMFs breaking the buck.Footnote 150

The liquidity support by the sponsor to the distressed MMF can expose the sponsoring bank to liquidity risks. This increases the probability of the failure of the sponsoring bank. To counter this problem the EU MMF regulationFootnote 151 prohibits sponsor support altogether.Footnote 152 The US regulator, however, has taken a different approach, as it allows discretionary support, but imposes transparency requirements for such support. The outright prohibition on discretionary sponsor support is criticised on the grounds that without such a support the par-value on-demand redemption promise would be nearly impossible, making the CNAV fund model unsuitable for liquidity management for institutional investors.Footnote 153 On the contrary, such critics argue for the formalisation of sponsor support; a form of transparent mandatory sponsor support rather than a discretionary one.Footnote 154

In addition to the sponsor support, to address the liquidity issues of MMFs, the EU proposal for the regulation of MMFs required the CNAV MMFs (and not the sponsoring bank) to maintain a cash reserve (the so-called ‘NAV Buffer’) of 3% of the fund’s assets under management (AUM).Footnote 155 This was expected to reduce the likelihood of the liquidity crisis in a CNAV fund and hence of the actual liquidity support by the sponsoring bank. However, after staunch resistance from the industry and market participants, this proposal was withdrawn. Eventually, instead of cash reserve requirement,Footnote 156 the EU MMF regulation tilted towards imposing portfolio restrictions on the CNAV funds.

The interconnectedness of banks to MMFs is not a one-sided phenomenon. In addition to banks’ investment in MMFs,Footnote 157 MMFs are a source of short-term financing for financial institutions. It is estimated that around 40% of short-term debt issued by the banking sector is held by MMFs.Footnote 158 Moreover, there is an additional international aspect to the interconnectedness of banks and MMFs. Estimates show that US MMFs supply sizable funding to EU banks, making them vulnerable to the shocks originating from US MMFs.Footnote 159

Another source of systemic risk that might arise from the MMFs is the level of concentration in the asset management industry. Data show that as of Q3 2015, 84.9% of all assets were managed by 10% of the asset management companies in the Euro area.Footnote 160 In addition, 90% of all AUM was managed by the 130 largest asset management companies. The 25 largest asset managers, many of whom are owned by banking groups, represent 53% of total net assets and 33% of funds.Footnote 161 There is an additional concern about geographic concentration in Europe. More than 90% of the AUM is managed from a few countries such as Luxembourg, Germany, Ireland, the UK, France and the Netherlands.Footnote 162 By the same token, there is a significant disparity across the Euro area countries in terms of their contribution to financial intermediation. For example, in Luxembourg, the MMFs represent 27% of the total balance sheet of MFIs. This number stands at 24% in Ireland.Footnote 163

Even inside the EU, there is a significant level of heterogeneity in shadow banking entities.Footnote 164 This diversity is especially pronounced in the investment fund sector to which the MMFs belong, and it is to such a degree that it is difficult to include substantial portions of this sector in shadow banking without further painstakingly elaborate classifications. Studies by the ESRB show substantial heterogeneity in how differently banks and the investment fund sector engage in credit intermediation, and liquidity and maturity transformation. For example, a majority of hedge funds acquire leverage using derivatives (ie synthetic leverage) and their reliance on unsecured debt is minimal. Leverage in investment funds is either on an overnight basis or is withdrawable on demand, making them subject to runs. According to the ESRB, the existing measures of leverage do not capture the synthetic leverage.Footnote 165 Overall, the main criterion for considering investment funds as shadow banks lies in their vulnerability to runs originating from maturity and liquidity mismatch and the lack of official safety nets.Footnote 166 Regulating shadow banking entities as regards the investment fund sector mainly targets MMFs and OFIs. In what follows we study the regulatory regime for MMFs.

2. MMF regulation in the EU

In 2013, the European Commission presented its proposal for a new MMF regulation, which was adopted in 2017 by the Parliament and the Council.Footnote 167 Contrary to the early suggestions, the regulation does not ban the CNAV model. However, the treatment of CNAV MMFs has been proved to be the most contentious issue in the proposal. The proposal contained other controversial issues, such as limits on external support and the admissibility of investment in other MMFs. In brief, the most important difference between the proposal and the regulation is that the final regulation does not contain any reserve requirement for the MMFs.

The EU MMF Regulation recognises three different types of MMFs: VNAV MMFs; public debt CNAV MMFs; and low volatility NAV MMFs (LVNAV MMFs).Footnote 168 This regulation imposes certain levels of daily/weekly liquidity (portfolio rules) on both short-term MMFsFootnote 169 and standard MMFs.Footnote 170 The LNAV and public debt CNAV funds are required to hold at least 10% of their assets in instruments that mature on a daily basisFootnote 171 and an additional 30% of their assets maturing in a week.Footnote 172 These liquidity requirements are imposed to ensure that investor redemption could be satisfied in a timely fashion.

The regulation further imposes a requirement, which has come to be known as “clear labelling” on whether the fund is a short-term MMF (holding assets with residual maturity not exceeding 397 days) or a standard MMF (holding assets with residual maturity not exceeding two years).Footnote 173 The regulation further requires MMFs to use customer profiling policies or the so-called “know your customer policies” in order to help the fund to anticipate large redemptions.Footnote 174 The regulation also requires MMFs to use certain internal credit risk assessment by the MMF managers,Footnote 175 which is devised to discourage MMF to over-rely on external ratings. In addition, the regulation imposes certain limitations on exposures to a single counterparty and it introduces diversification requirements,Footnote 176 concentration limits,Footnote 177 stress testing requirements,Footnote 178 and more importantly it prohibits CNAVs funds from receiving any other external form of support.Footnote 179

The proposal for EU regulation contained a cash reserve cushion of 3% for CNAV funds (the so-called “NAV buffer”).Footnote 180 This buffer could be activated to address the redemptions in times of stress. It could operate in a similar manner to a buffer to enable the fund to adjust the difference between the CNAV of €1 and the price fluctuations of the underlying portfolio.Footnote 181 This requirement turned out to be the most contentious aspect of the proposal. As mentioned earlier, however, it was dropped in the legislative process and did not see the light of day.

3. MMF regulation in the US

Starting from the 1970s, in the US, financial products developed by the MMFs, called NOW accounts (Negotiable Order of Withdrawal), were widely accepted as a direct substitute for bank deposits. These were the early examples of shadow banking instruments disintermediating the banking entities.Footnote 182 As of now, US MMFs represent more than 50% of global MMFs.Footnote 183 The US CNAV MMFs are effective substitutes for insured deposits and provide continuous liquidity for those institutional investors that have surplus funds and that need daily liquidity. However, the involvement of the MMFs, specifically the Reserve Primary in the GFC, which resulted in its liquidation, was one of the factors that drew attention to the risks of runs on MMFs and triggered their regulatory reform proposals.

The SEC and the Office of the Comptroller of the Currency (OCC) have adopted measures on the reform of the MMFs and short-term investment funds (STIFs) to address risk of runs. SEC’s 2014 revisions to the regime governing MMFsFootnote 184 have so far focused on reducing risks on the asset side of MMFs’ balance sheets. These reforms require a minimum percentage of assets to be held in highly liquid securities (daily and weekly requirements); they further impose restrictions on the purchase of lower quality securities by MMFs.

According to the SEC rules, there will be three different categories of MMFs: retail (prime/municipal) MMFs; institutional (prime/municipal) MMFs; and government MMFs. Retail (prime/municipal) MMFs will be priced daily at CNAV of $1.00, and they will be available to natural persons only. Institutions, businesses, and other organisations are not eligible to invest in these types of funds.Footnote 185 They are required to impose liquidity fees and/or redemption gates. Institutional (prime/municipal) MMFs will be priced daily at VNAV. All categories of investors are eligible to invest in these types of funds. They are required to impose liquidity fees or redemption gates. And finally, government MMFs will be priced daily at CNAV, and there will be no restrictions on eligible investors. These MMFs can impose redemption or liquidity fees and/or they can suspend redemption through establishing redemption gates.Footnote 186 Although these reforms may protect investors, they are assessed as unlikely to address the risk of runs on MMFs.Footnote 187

In addition, the SEC rules treat government MMFs (that invest at least 80% of their assets in US government debt) and prime MMFs (that invest in corporate debt) differently. According to these rules, government MMFs can maintain stable price per share (CNAV), but the prime MMFs should adopt the VNAV pricing model. Therefore, the US does not report the MMFs based on CNAV and VNAV classification. In other words, in the US, there are two types of major MMFs: government-only MMFs and prime MMFs.Footnote 188 Government-only MMFs primarily invest in government securities, tax-exempt municipal securities, or corporate debt securities, while prime MMFs invest both in government securities and in corporate securities.Footnote 189

Due to the differences in the market structure, there are differences in the regulation of the MMFs in the EU and the US. As mentioned before, in Europe, there was no regulatory or statutory classification of funds based on the portfolio of their investments (government versus prime funds). Instead, the classification relied on whether MMFs were short-term MMFs or standard MMFs. In other words, the US regulation differs from the EU regulation in that it differentiates between government MMFs (with investment of at least 80% of their assets in US government debt) and prime MMFs that primarily invest in corporate debt. MMFs investing primarily in the US government debt can maintain CNAV model and prime MMFs should adopt VNAV pricing model.Footnote 190

The EU largely follows the same classification, though introducing a new classification of LVNAV funds. In the EU, Euro or sterling denominated government MMFs are very small (approximately 3% of assets managed in the CNAV model).Footnote 191 Putting this next to the fact that the VNAV model is prevalent in the EU, one would conclude that the likelihood of runs on EU MMFs is lower as they do not promise at-par on-demand redemptions. Despite this, the EU regulation is very similar to the US rules governing the MMFs (SEC Rule 2a-7) on liquidity rules, issuer diversification and customer profiling. Such similarity may come as a surprise, as EU MMFs historically have developed as VNAV funds that do not pose financial stability risks. In the regulatory framework of MMFs, however, the main point of divergence remains the regime applicable to the external sponsor support. In the EU, such a support is completely banned, while in the US it is allowed, subject to certain regulatory requirement such as transparency rules.

V. Summary and conclusion

In this article, we have highlighted the idiosyncrasies of two components of the shadow banking entities and activities on both sides of the Atlantic and argued against one-size-fits-all policy prescriptions for addressing the risks of the shadow banking system. Focusing primarily on the EU shadow banking system and contrasting it with that of the US, we have demonstrated that not only has shadow banking evolved very differently worldwide, but also it substantially differs across jurisdictions in the developed world. A closer examination of the financial instruments, activities and entities of shadow banking reveals that deeper structural differences between EU and US banking and shadow banking systems are at the root of the differences in development of the shadow banking sectors in the two regions. The traditional bank-based financial system in Europe and its reliance on the universal-banking business model have engendered idiosyncratic shadow banking structures in the EU, which is significantly different from the US model of shadow banking.

Regarding securities financing transactions, as a major segment of shadow banking activities, despite international efforts to harmonise such transactions at the micro level (eg contract design and bankruptcy protections), at the macro level, the markets for securities financing transactions remain fragmented on both sides of the Atlantic. First, while in the US the main mechanism used for securities financing transactions is the security financial collateral arrangement, in the EU it is more likely that a title transfer financial collateral arrangement (TTCA) would be used. This would effectively eliminate the need for the extension of bankruptcy safe harbours for such transactions. Second, overnight tri-party repos dominate the US repo markets, whereas tri-party repos only constitute a small fraction of the EU repo markets. Third, the average maturity of US repos is shorter than that of EU repos. Fourth, the EU repo markets are dominated by government-backed repos, ie the collateral used to secure the repo is government securities. Fifth, although there is no considerable difference in the regulations governing rehypothecation of collateral on the two sides of the Atlantic, in Europe there is no harmonised limit on rehypothecation. In contrast, in the US such rehypothecation is capped at 140% of the liabilities of the client to the broker-dealer. However, for all practical purposes, there is almost no difference between the US and the UK in terms of cap on collateral reuse, due to the customary adoption of the US cap in the EU markets as a matter of practice. The rest of the regulatory treatment of rehypothecation in the EU zone and the US remains virtually uniform. Finally, regarding bankruptcy safe harbours, by revising the FCD, the BRRD allows for a stay on close-out netting and enforcement provision for up to 48 hours,Footnote 192 which is intended to afford resolution authorities with adequate time for an orderly resolution. As of this writing, despite heated discussions and new proposals in the US,Footnote 193 there has been no equivalent change in the bankruptcy framework of repos in the US.

With respect to the MMFs, first, the EU has a very small MMF sector. Second, within this small MMF sector, the VNAV structure is prevalent. Third, the investor base of MMFs in the EU is predominantly composed of institutional investors. Fourth, there is a geographic disparity in the distribution of the MMFs in the EU, and it is likely that in certain jurisdictions the MMFs are more systemic than others. Fifth, a significant difference in the structure of the MMF industry in the EU and the US relates to the distinction between the government MMFs and prime MMFs in the US. Such a distinctive category does not exist in the EU and hence the regulatory framework does not treat them differently. Given the small size of government CNAV funds in the EU, there has been no need for the introduction of a similar legislative categorisation to that of the US for such funds in the EU. However, the EU regulation introduces such categorisation with distinctive rules for funds falling under those newly-created categories, perhaps in anticipation of the proliferation of such funds in the future.

Based on our findings, we conclude that distinctive features of the EU shadow banking require a differentiated and tailor-made approach to regulating shadow banking. We specifically analysed financial instruments, such as repos, which are predominantly associated with the shadow banking, and entities typically considered to be at the heart of the shadow banking system such as MMFs, and underlined their distinctive features. Given that relatively divergent paths in the post-GFC regulation of repo and MMFs have emerged on different sides of the Atlantic, we conclude that international standard-setters should be attentive to these differences and avoid a one-size-fits-all regulatory approach toward shadow banking. In particular, the international initiatives put forward by the FSB and the IOSCO should take note of the subtleties in the structure of the shadow banking sector and its regulatory frameworks in different jurisdictions before attempting to shape global regulatory initiatives.