1. Introduction

Over-extraction of oil and gas resources can cause many problems, from reservoir damageFootnote 1 to the socially inefficient time path of benefits. Over-extraction by private firms is made possible if the economic incentives are misaligned. This is the essence of the concern raised by Solow (Reference Solow1974: 8). By referring to the Hotelling (Reference Hotelling1931) model, he writes: ‘If it is true that the market rate of interest exceeds the social rate of time preference, then scarcity rents and market prices will rise faster than they “ought to” and production will have to fall correspondingly faster along the demand curve. Thus the resource will be exploited too fast and exhausted too soon’. One of the most discussed reasons for over-extraction by private firms is uncertainty of the ownership of the extracted resource due to the form of oil governance. Oil firms which face uncertainty due to ownership issues, such as expropriation risk, may incorporate this uncertainty into their decisions by raising their risk-adjusted discount rate.

This problem is more complicated because, in more recent theoretical models, the impact of ownership uncertainty on the extraction path (see Lasserre, Reference Lasserre1982; Neher, Reference Neher1982; Farzin, Reference Farzin1984; Olsen, Reference Olsen1987; and Bohn and Deacon, Reference Bohn and Deacon2000) depends on the capital intensity of the extraction process and the size of the resource stock. If one knew whether the resource stock size was ‘high’ or ‘low’, the impact of ownership uncertainty on extraction could be signed. In practice, it is difficult to know the size of the resource stock. Therefore, an effort to alter oil governance can also cause a higher extraction rate and lead to faster depletion. This issue is of particular concern in countries which are endowed with few natural resources (Farzin, Reference Farzin1984). Since the impact of ownership uncertainty on the extraction path is theoretically ambiguous, this paper empirically investigates the impact of a change in institutional design of oil governance on the extraction path.

In our setting, a regulatory agency is created to manage the resource stock instead of a national oil company (NOC). As the regulatory agency does not possess the inputs necessary to extract oil and gas, the shift in ownership rights to a regulatory agency lowers the risk of expropriation and changes the level of ownership uncertainty. The creation of BPMIGAS in Indonesia as a regulatory agency made Pertamina, the Indonesian NOC, a purely business entity. We use this change in oil governance as a proxy for a change in ownership uncertainty for private firms operating in Indonesia. This proxy is different from those used in the literature, such as Bohn and Deacon (Reference Bohn and Deacon2000) or Stroebel and van Benthem (Reference Stroebel and van Benthem2013) who use measures of institutional quality to proxy for expropriation risk or other ownership uncertainty issues. Fundamentally, all analyses use a proxy for ownership uncertainty as it is not clearly defined and measured.Footnote 2 This analysis uses the change in ownership rights for oil and gas in Indonesia in a difference-in-difference framework to show that the creation of a regulatory entity for oil and gas development slows the rate of extraction from oil and gas fields. Results show that the change in oil governance leads to a roughly 40 per cent reduction in the extraction rate. The magnitude of the reduction is greatest for small fields and the effect wanes as the field size increases. These results are robust to numerous econometric specifications and alternative definitions of control variables.

Bohn and Deacon (Reference Bohn and Deacon2000) and Olsen (Reference Olsen2013) conducted empirical studies of the impact of expropriation risk on the extraction path of the non-renewable resource.Footnote 3 They investigate capital intensity as a source of ambiguity of the impact of expropriation risk on the natural resource extraction path. However, to our knowledge, there has been no study investigating resource stock size as a source of ambiguity, although this has been shown theoretically as a plausible source. Therefore, we also aim to answer the question: what is the impact of a change in oil governance on the extraction path for different sizes of resource stocks?

This paper makes two primary contributions. First, it provides empirical evidence of how a change in oil governance affects extraction paths. By employing a difference-in-difference econometric model, we can make an inference that the change in oil governance reduces ownership uncertainty and leads oil companies to choose a slower extraction path. Second, it contributes to the non-renewable resource extraction literature by providing empirical evidence of resource stock size on the impact of a change in oil governance on the oil extraction path. Regression results show that the impacts of the change in oil governance are different for different sizes of resource stocks. Specifically, the creation of a regulatory entity to manage oil and gas reserves leads oil companies to choose a slower extraction path for smaller-sized resource stocks. Our results reiterate the importance of strengthening institutions to influence the extraction path such that over-extraction can be avoided and a more sustainable extraction path can be achieved.

To answer the research question posed above, the remainder of this paper is structured as follows. In section 2, we provide a discussion of how the change in institutional design of oil governance can reduce expropriation risk and affect the extraction path. In section 3, we discuss our econometric model. In section 4, we identify potential problems that might affect our results, which are described in section 5. Concluding remarks are provided in section 6.

2. Change in oil governance, risk of expropriation and extraction path

In order to extract oil and gas, governments of oil-producing countries typically work with oil and gas companies which have the technological, labor and capital capabilities to explore and to produce oil and gas. Depending on the institutional design, the government appoints the NOC or a regulatory entity to host bidding, to award an oil and gas contract, and then to monitor and regulate the contract. Ownership uncertainty can be defined broadly as any act of government that can curtail private firms' claim to their income from an investment project, including capital levies, taxes or even nationalization.

In 1971, Indonesia created a NOC named Pertamina.Footnote 4 As the NOC, Pertamina not only explored and produced from its own oil and gas fields but also was appointed to act as the regulator for the access of international oil companies (IOCs) to oil and gas reserves. Since the creation of Pertamina, oil companies that wanted to work in Indonesia had to enter into an oil and gas contract, called a Production Sharing Contract (PSC), with Pertamina. Driven by worldwide trends in economic globalization, Indonesia changed its institutional design of oil governance in 2002, creating a separate regulatory entity called BPMIGAS. The task of BPMIGAS was to replace Pertamina in managing and regulating PSCs, such that Pertamina had to act only as a business entity which explores and produces from its own fields, similar to other IOCs. With the creation of BPMIGAS, all oil companies (including Pertamina) enter into PSCs with it. The creation of BPMIGAS as a separate regulatory entity could alter how IOCs negotiated their PSCs, and potentially their extraction rates, for many reasons. As The Economist (2012) pointed out, having Pertamina negotiate PSCs leads to conflicts of interest that are of concern to IOCs. BPMIGAS may have had a more efficient negotiating process for transactions or the IOCs may have provided information in a more transparent manner, but these are unlikely to have changed the extraction rate and more likely altered the amount of drilling.

This switch of the contracting party in the PSC from Pertamina, which possesses the technological, labor and capital capability to explore and produce an oil field, to BPMIGAS, a separate administrative regulatory entity, increases the cost of expropriation and potentially reduces the ownership uncertainty for IOCs. This logic follows from Stroebel and van Benthem (Reference Stroebel and van Benthem2013), who argue that expropriation is dependent on the expropriator's costs and benefits. We argue that the switch to BPMIGAS as the contracting party increased the cost of expropriation. Unlike Pertamina, BPMIGAS does not have the technological, labor and capital capability to take over the operation of an oil well if it were expropriated. While it is true that BPMIGAS could expropriate an oil well and appoint Pertamina (or another oil company) to take over the operation, there would be a time gap to transfer knowledge and assets, which incurs an opportunity cost to the government. Additionally, BPMIGAS would be unlikely to expropriate an asset and transfer it to Pertamina given the political strife between the two entities.

The transfer of the regulatory function of oil contracts from Pertamina to BPMIGAS was a real transfer of political power that led to political conflicts between the two entities.Footnote 5 It was ‘former Pertamina power-holders’ (Carswell et al., Reference Carswell2015) which led the court case that invalidated parts of the law which created BPMIGAS on constitutional grounds in 2012. Immediately after the court case, the executive branch created SKKMIGAS to undertake the functions of BPMIGAS. SKKMIGAS has continued to be the regulatory agency for oil and gas and Pertamina continues to be a business entity.

Stroebel and van Benthem (Reference Stroebel and van Benthem2013) argue that due to incomplete information about the cost of expropriation, even in an optimal contract, expropriation is a possible event with positive probability. The probability is even higher when the benefit of expropriation to the government exceeds the cost of expropriations. Therefore, the occurrence of expropriation is more likely when oil prices are high or in countries with low cost of expropriation. Hence, oil governance arrangements in which oil companies make contracts with the NOC rather than with a separate regulatory entity potentially have a higher expropriation risk because the cost to expropriate is lower. However, the impact of the change in oil governance on the extraction path is ambiguous because, in theory, the impact of reducing uncertainty on the extraction path is unclear when the ‘size’ of the resource stock is unknown.

The impact of ownership uncertainty on the oil extraction path was formalized by van Long (Reference van Long1975) and can be explained with simplicity using the Hotelling (Reference Hotelling1931) model. If oil firms face ownership uncertainty, they may incorporate it by raising their risk-adjusted discount rate. A higher discount rate causes oil extraction to be tilted to the present and eventually causes faster depletion. However, these models do not include capital, which is an important characteristic in oil and gas extraction.Footnote 6

Oil and gas extraction is a capital-intensive sector. Prior to extraction, capital is required to find reserves (exploration drilling, seismic, geological and geophysical study, etc.) and to develop them (production facility, pipeline, development drilling, etc.). When capital is introduced into the theoretical model, the impact of ownership uncertainty on extraction path can become ambiguous (see Lasserre, Reference Lasserre1982; Neher, Reference Neher1982; Farzin, Reference Farzin1984; Olsen, Reference Olsen1987; and Bohn and Deacon, Reference Bohn and Deacon2000). Intuitively, a higher risk-adjusted discount rate reduces the value of the resource stock in the ground, which causes faster extraction. However, it also increases the cost of capital, which causes slower extraction due to under-investment. Therefore, the oil extraction path is affected by two opposing forces of ownership uncertainty. It can follow the standard Hotelling rule or the inverse Hotelling rule. If the direct effect of ownership risk dominates the indirect effect through investment, it will follow the standard Hotelling rule (i.e., a higher discount rate will cause firms to choose a higher extraction rate). If the indirect effect of ownership uncertainty dominates the direct effect, it will follow the inverse Hotelling rule (i.e., a higher discount rate will cause firms to choose a slower extraction rate).

Lasserre (Reference Lasserre1982); Neher (Reference Neher1982); Farzin (Reference Farzin1984) and Olsen (Reference Olsen1987) show that the ambiguity of the impact of ownership uncertainty on the extraction path depends on capital intensity and the size of the resource stock. They basically show that, for a large enough resource stock, the capital intensity term will dominate the size of the resource stocks term such that a reduction in ownership uncertainty leads to a faster extraction path (inverse Hotelling rule). The reverse is true for small enough resource stocks: the size of the resource stocks term will dominate the capital intensity term such that a reduction in ownership uncertainty leads to slower extraction (standard Hotelling rule). Since the impact of reduction in expropriation risk on the extraction path is theoretically ambiguous, the problem is empirical.

3. Econometric model

To empirically study the impact of a change in the institutional design of oil governance on the extraction path, we observe producing oil and gas fields in the South East Asia region during the period from 1996 to 2012.Footnote 7 We source the dataset from IHS which consists of 5,632 observations of field-level oil and gas production, recoverable and in-place reserves (proven and probable), number of development drilling projects, production start year and some other field characteristics from 596 fields, 53 basins and 9 countries.Footnote 8 Observations start in 1996 mainly because data on the number of development drilling projects, which is an important control variable, is not reliable prior to that year. Summary statistics are available in table 1.

Table 1. Summary statistics

Notes: **p < 0.05

In estimating the relationship between how the change in oil governance impacts the extraction path, we use a difference-in-difference methodology. This method is powerful in estimating the impact of a policy provided that it is possible to observe some fields' characteristics prior to and after implementation of the policy for groups that are affected by the policy (treatment group) and are not affected by the policy (control group). In this paper, our treatment group is all producing oil and gas fields in Indonesia after 2002. The control group is other fields in the South East Asia region. While the data is sub-national, our treatment is at the national level as oil governance decisions are often, though not always, made at a national level and we are unaware of any sub-national oil governance changes during the period of study.

Our difference-in-difference model is:

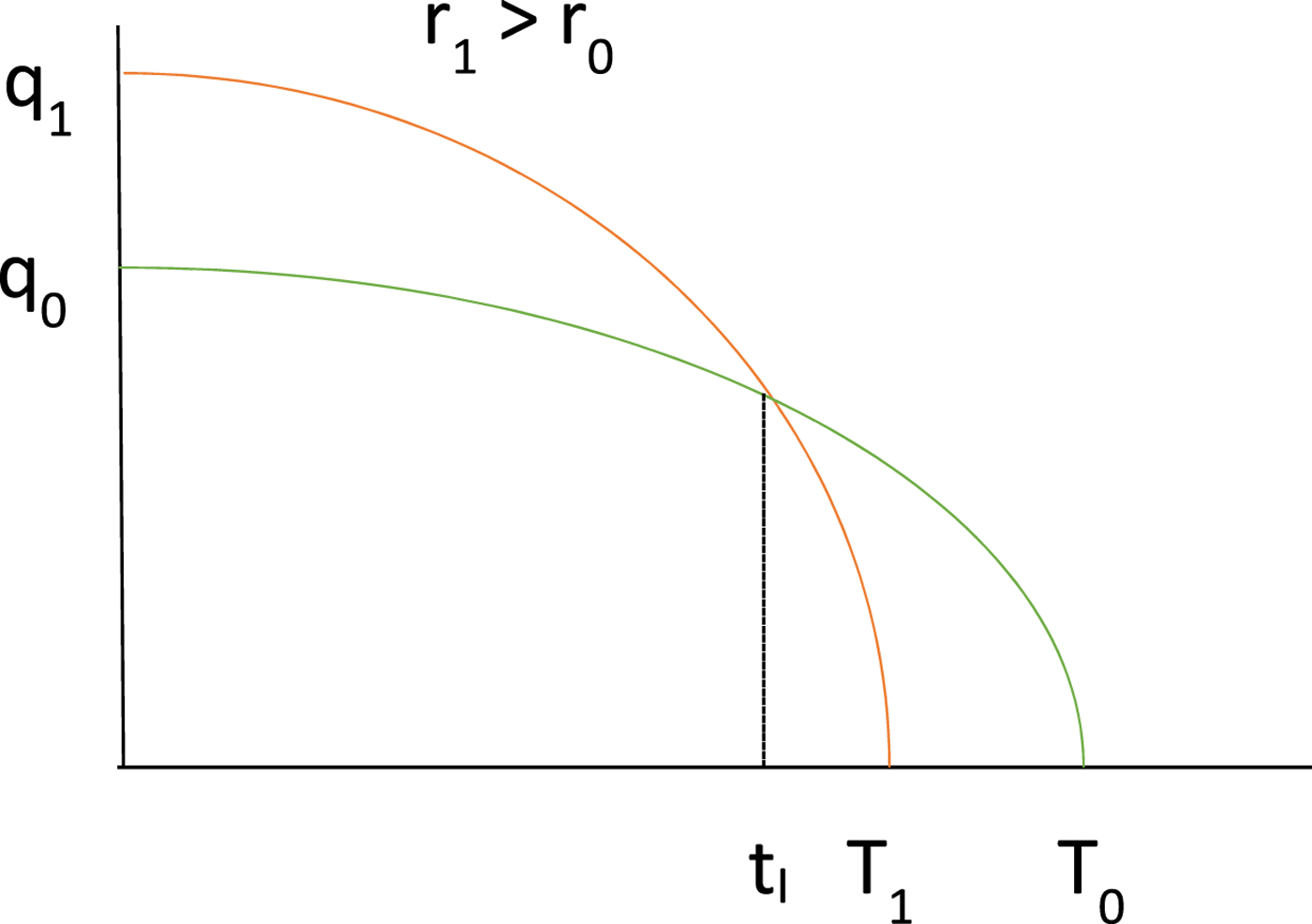

The dependent variable, Y ict, is oil and gas extraction rate in field i, of country c, at year t, defined as the log of production to reserve ratio (log(q ict/R ict)). This variable definition has been used previously in Bohn and Deacon (Reference Bohn and Deacon2000) and Olsen (Reference Olsen2013). Olsen (Reference Olsen2013) points out that since higher and lower oil and gas extraction rates will intersect at some point in time t (as shown in figure 1), then the relative speed of extraction will depend on the time t when the observation is made. After the intersection time t I in figure 1, a relatively faster extraction path will become slower and vice versa. Therefore, using oil and gas production by itself as a proxy for extraction rate is not appropriate. Using a formal proof, Olsen (Reference Olsen2013) shows that using the production-to-reserve ratio will solve this problem (i.e., faster/slower extraction path will be independent of time).

Figure 1. Extraction path under expropriation risk.

Since the number of development drilling projects, which is an important control variable, cannot be differentiated between oil and gas wells, we sum oil and gas production as the numerator in the extraction rate variable. To do that, we convert gas production from million standard cubic feet (mscf) of gas to barrel of oil equivalence (BOE) using a conversion factor (6 mscf = 1 BOE). For the denominator in the extraction rate, we calculate the reserve in field i of country c in year t using recoverable reserve and in-place reserve data.Footnote 9 Since the reserves data from producing fields are generally fixed, a new commercial discovery will be developed under a new field, then oil and gas reserve at year t (R ict) is calculated as the initial recoverable or in-place reserve (R ic0) minus cumulative production before year ![]() $t( {R_{ict} = R_{ic0} - \sum\nolimits_0^{t - 1} {q_{ict}} })$.Footnote 10

$t( {R_{ict} = R_{ic0} - \sum\nolimits_0^{t - 1} {q_{ict}} })$.Footnote 10

Independent variables consist of an oil governance dummy (D ict) and time varying control variables (X′ict). Time varying control variables are proxies for the depletion effect and the log capital-to-reserve ratio. We also include year (γt) and field (αi) fixed effects to capture unobserved variables which vary by year (price, technology, etc.) and time-invariant unobserved variables which vary by fields (geological condition, geographical condition, etc.), respectively.

The oil governance dummy variable captures the impact of the change in oil governance; it is equal to 1 for all oil and gas producing fields in Indonesia each year after 2002 and equal to 0 otherwise. This form is due to the fact that Indonesia moved from ownership rights with Pertamina to ownership rights with BPIMGAS in 2002, and all other countries in South East Asia kept the ownership rights with their NOC during the sample. While this treatment is not a measure of institutional quality, such as the Polity IV or Freedom House data, it has the advantage of being relatively uncorrelated with impacts on the larger economy to ensure that we do not conflate other changes in the economy with our treatment (such as those that would occur after a coup). Further, searches for changes in the institutional design of control countries related to oil and gas did not reveal reasons for concern. Changes in oil prices or other events that impact all countries in our sample will be netted out in the difference-in-difference methodology.

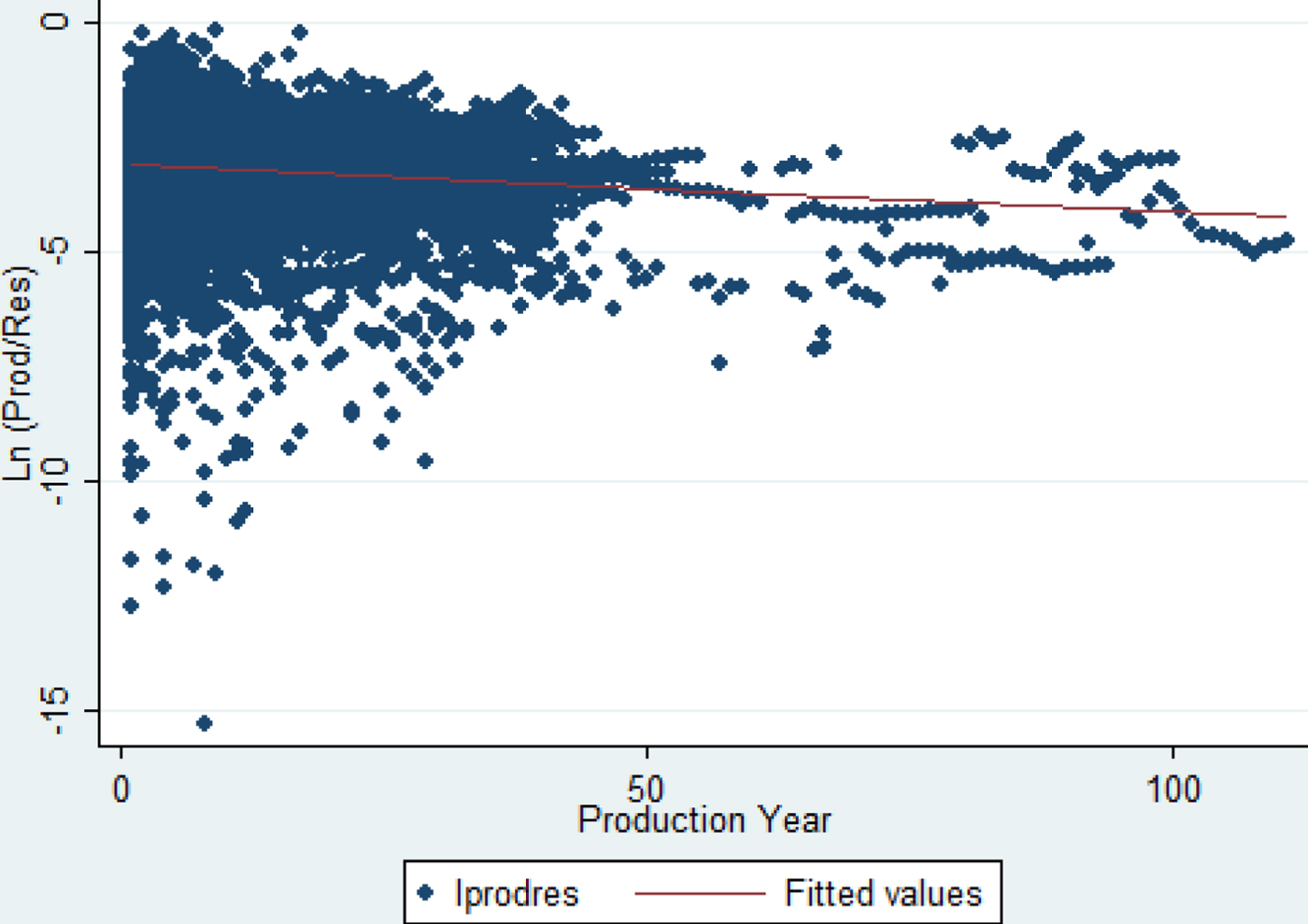

Oil and gas wells follow a decline curve where the early years of production are naturally greater than later years of production. The depletion effect is often due to changes in reservoir pressure as production occurs. As a proxy for the depletion effect, we use the number of years in production because number of years in production is not affected by treatment and is correlated with the extraction path as shown in figure 2 and figure A1 (available in the online appendix).Footnote 11 The depletion effect variable attempts to control for changes in extraction that are caused by reservoir characteristics and may not be fully controllable by the operator of the well.

Figure 2. Scatter plot extraction rate versus year in production for all fields.

As a proxy for the flow of capital, we use the number of development drilling projects, which is preferred to other types of capital such as production facilities for two main reasons. First, a production facility is typically built before the start of production (i.e., up-front capital) unless there is a modification or the field is developed in phases, whereas development drilling is spread out across production years as shown in figure 3. Therefore, development drilling is more suitable to be used in a panel setting. Second, using a physical measure (number of drilling projects) rather than cost is less prone to measurement error. To avoid taking the log of zero which will result in missing observations, we scale up the number of development drilling projects by adding one to all development drilling observations. Using drilling projects as a control variable is not without concerns as Cust and Harding (Reference Cust and Harding2014) show that the relative (to neighboring countries) institutional quality will impact the amount of drilling done in areas close to the borders. We are less concerned about the use of drilling as a control variable in this setting as the underlying geology can be quite different across our geographic sample and thus it is not possible to move drilling across the border for most of the deposits. Additionally, the panel difference-in-difference methodology would control for time-invariant differences in drilling preferences of oil firms and the slow depreciating capital investments that service a field like pipelines (Makholm, Reference Makholm2012).

Figure 3. Scatter plot number of development drilling projects versus year in production.

Our baseline estimation will cluster the standard errors at the field level. This will control for correlation amongst oil wells with similar geological characteristics, which is a potentially important source of correlation given the outcome is rate of extraction. The seminal work of Bertrand et al. (Reference Bertrand, Duflo and Mullainathan2004) argues that difference-in-difference estimations should cluster the errors at the level of the treatment, which is country in this case. It is not clear what the correct level of clustering is, so we also show results from clustering at the field, basin, and country levels. Cameron and Miller (Reference Cameron and Miller2015) argue that there is no minimum number of clusters required, just that more clusters are better. Our country level clustering specification has 9 clusters; while this is small, there is evidence from Brewer et al. (Reference Brewer, Crossley and Joyce2013) that correct inference can be made even with this number of clusters.

Summary statistics can be found in table 1. Given that the treatment period (2002–2012) corresponds to higher oil prices than the control period (1996–2001), it is not surprising that both the treatment and control groups increased their extraction rate from the control to treatment periods, not controlling for other factors. As Stroebel and van Benthem (Reference Stroebel and van Benthem2013) point out, higher oil prices lead to higher benefits of expropriation and thus a higher expropriation risk. The fact that the increase in extraction rate for fields in Indonesia is more modest is consistent with the possibility that change in oil governance may have altered ownership uncertainty.

4. Identification

The reliability of the difference-in-difference estimate depends on two important assumptions. First, the difference between the treatment and control groups does not change in the absence of treatment. Unfortunately, this is an untestable assumption. Instead, we follow the literature by testing whether both groups were trending together prior to treatment. Second, the treatment is exogenous.

We test the first assumption by determining if, prior to treatment, the treatment and control groups have the same trend. This assumption is tested by employing a model:

$$Y_{ict} = \alpha _i + \gamma _t + {X}^{\prime}_{ict}\beta + \sum\limits_{\delta = 0}^q {\tau _{ - \delta }} D_{ict - \delta } + \sum\limits_{\delta = 1}^r {\tau _\delta } D_{ict + \delta } + \varepsilon _{it}.$$

$$Y_{ict} = \alpha _i + \gamma _t + {X}^{\prime}_{ict}\beta + \sum\limits_{\delta = 0}^q {\tau _{ - \delta }} D_{ict - \delta } + \sum\limits_{\delta = 1}^r {\tau _\delta } D_{ict + \delta } + \varepsilon _{it}.$$This model can capture the differences in extraction rate between the treatment and control groups in the pre-treatment period (parameter τ −δ) and post-treatment period (parameter τ +δ). The differences (shown in figure 4) confirm, that prior to treatment, there are no statistically significant differences between the treatment and control groups, and a statistically significant break exists after treatment.

Figure 4. The differences in extraction paths between treatment and control groups in pre-treatment and post-treatment periods.

This time-varying treatment test shown in figure 4 also confirms that any placebo treatment year chosen prior to the actual treatment year is not statistically different from the other pre-treatment years. For example, Indonesia altered the split between central and local governments for natural resource revenues through Law 22 and 25 in 1999 (Rusli and Duek Reference Rusli and Duek2010). The results in figure 4 and that of a placebo treatment test (not shown here but available from the authors) reveal that Indonesian extraction rates did not differ statistically from the control group.

With regard to the second assumption, the main driver of the change in oil governance in Indonesia was economic globalization which was trending worldwide. Discussion about the oil and gas law in Indonesia was only triggered after Indonesia hosted the Asian Pacific Economic Cooperation in 1994. The discussion was halted several times, but after working with the IMF, Indonesia finally enacted the Oil and Gas Law in 2002. Given that the political process was started and stopped a couple of times before enactment of the law, it is unlikely that firms would have changed their behavior in expectation of the law passing.Footnote 12 Furthermore, figure 5 provides data on proven reserves in Indonesia and some control countries over this time period. There are no large changes in the amount of reserves for Indonesia around the time of the treatment, providing support for the argument that the treatment was not initiated due to large oil reserve finds in Indonesia.Footnote 13 As a result, we believe the treatment is exogenous.

Figure 5. Proven reserves of selected countries.

An improvement which this analysis has over previous literature is the use of field level data. Previous work, such as that of Bohn and Deacon (Reference Bohn and Deacon2000), uses data aggregated at the country level. The aggregation problem might bias the result of an empirical model analyzing the supply behavior of non-renewable resources.Footnote 14 Fields are different in their reserve size and, as discussed above, it is theoretically predicted that field size would have an impact on how the extraction rate changes when oil governance is changed. Moreover, by using producing field-level data, we can isolate the impact of oil governance changes on exploration since new commercial discoveries will be developed under new fields. Hence, we can also overcome the interdependency problem between exploration and production, another criticism which is pointed out by Bohi and Toman (Reference Bohi and Toman1984).

5. Results

The main regression results from the difference-in-difference method are shown in table 2. The coefficient of the oil governance dummy variable in specifications 1 and 2 is negative and statistically significant, even after controlling for the depletion effect (number of years in production). From these two specifications, it is clear that the change in oil governance causes oil companies to choose a slower extraction path. In specifications 3 to 8, we attempt to control for the indirect effects of a change in oil governance by controlling for capital, although using capital as a control potentially leads to ‘bad control’ concerns discussed in Angrist and Pischke (Reference Angrist and Pischke2009). We control not just for the current flow of capital but also for the lagged effect of flow of capital (in an effort to account for installation lag). We also try to control for stock of capital by using the cumulative number of development drilling projects in the past three years.Footnote 15 By controlling for this indirect effect, the coefficient for the oil governance dummy should only capture the direct effect of the change in oil governance. The coefficient on the treatment is negative and statistically significant after adding these controls, which lends support to the notion that a change in oil governance which creates a separate regulatory agency leads oil firms to choose a slower extraction path. Thus, from the results of specifications 1 and 2, we can also make an inference that the change in oil governance decreases the extraction rate by roughly 40 per cent or decreases the production-to-reserve ratio from 6 per cent to 3.6 per cent which significantly increases the production life of the fields.

Table 2. Main regression results

Notes: Standard errors are clustered for 596 fields in parentheses. Each column includes field and year fixed effects.

a Proxy by number of years in production.

b Proxy by number of development drilling/reserve.

c Proxy by number of development drilling projects in the past 3 years/reserve.

**p < 0.05, ***p < 0.01.

All results are consistent with the theory which shows that for small enough resource stocks, the impact of the change in oil governance will follow the standard Hotelling rule (i.e., direct effect dominates indirect effect such that there is a slower extraction path). We will further confirm this result later in this section by employing another econometric model which includes an interaction term between the oil governance dummy and the size of reserve dummy, but first we are going to explain some interesting results for the control variables.

The coefficients of the control variables for flow of capital, lag of flow of capital and stock of capital are positive and statistically significant. These results show that an increase in flow (current or lag) or stock of capital leads to an increase in extraction rates. These results make intuitive sense as the more wells are drilled, the higher the extraction rate of the field.

The coefficient for the depletion effect in all specifications except specification 6 is positive and statistically significant at the 99 per cent confidence level, which shows that as the number of years in production increases, the higher the extraction rate of the field. These results seem counterintuitive because the extraction rate is supposed to be declining over years of production. This intuition can also be confirmed from a scatter plot of extraction rates from all fields (shown in figure 2). However, by plotting the extraction rate from a random selection of fields shown in figure A1 (online appendix), the extraction path in an individual field is not just declining over time but has a bell shape. Therefore, as a robustness check, we include the square function of the depletion effect in the model in table A1. The coefficient is negative and statistically significant for the quadratic term and is positive and statistically significant for the linear term, which confirms the bell shape of the individual field extraction paths.

Campbell (Reference Campbell1980) shows that under certainty it is optimal to invest at time t = 0. However, in practice there are many sources of uncertainty. In the oil and gas industry, it is almost impossible to know for certain about subsurface conditions. Oil companies build their knowledge or learn about subsurface conditions through drilling. Thus, drilling activities, which set the maximum production capacity, are more spread out through time depending on learning results and cause non-linear or bell-shaped depletion. More importantly, the coefficients for the oil governance change dummy are still robust.

To further investigate the impact of the change in oil governance at different reserve sizes, we employ another econometric model which includes an interaction term between the oil governance dummy and the size of reserve dummy:

We define fields whose reserve in 2001Footnote 16 was below the 25th percentile as small reserve fields, those between the 25th and 75th percentile as medium reserve fields and those above the 75th percentile as large reserve fields.Footnote 17 With this model, we can estimate the impact of the change in oil governance for small, medium and large reserve fields. The marginal effect for a small reserve field is τ1, for a medium reserve field is τ 1 + τ 2 and for a large reserve field is τ 1 + τ 3. We will also generate the joint hypothesis standard error (τ 1 + τ 2 and τ 1 + τ 3) to test the significance of the result.

The regression results for this model are shown in table 3. In table 3, the coefficient for the interaction term between the oil governance dummy and small reserve fields is negative and statistically significant, whereas the coefficient for the interaction term between the oil governance dummy and medium reserve fields is positive and statistically significant. It is even more positive and again statistically significant for the interaction term between the oil governance dummy and large reserve fields. These results show that the extraction rate for large reserve fields is faster than for medium reserve fields, and the extraction rate for medium reserve fields is faster than for small reserve fields. The marginal effects are a 34 per cent reduction in the extraction rate for medium sized fields that is statistically different from zero and a 22 per cent reduction in the extraction rate for large fields that is not statistically different from zero.

Table 3. Regression results from model with an interaction term between oil governance change dummy and size of reserve fields

Notes: Standard errors are clustered for 596 fields in parentheses. Each column includes field and year fixed effects.

a Proxy by number of years in production.

*p < 0.10, **p < 0.05, ***p < 0.01.

These results show that the change in oil governance causes oil companies to choose a slower extraction path for medium reserve fields but not as slow as for small reserve fields. More importantly, the impact of the change in oil governance on extraction path is statistically unchanged for large reserve fields as theory would predict. Though it is not shown in our empirical results, for a large enough reserve, a change in oil governance can cause oil firms to choose a faster extraction path (i.e., the coefficient flips to positive). To summarize the results from the model with interaction terms between the oil governance change dummy and the size of reserve dummy, the impact of the change in oil governance is different for different sizes of reserve. Specifically, the extraction path slows the most for smaller reserve fields.

To test the robustness of the main regression results, we provide some alternative specifications to the econometric model. First, we clustered standard errors at each of the basin and country levels separately to tackle possible alternative group-wise correlation. As shown in tables A2 and A3, the results are robust to these different ways of standard error clustering. Not surprisingly given the small number of countries in the sample, the country level clustered standard errors are the smallest. The standard errors are hardly changed with basin versus field clustering.

Second, one might be concerned that the results are driven by new fields whose production started after the change in oil governance in 2002. Since new fields might have a low production-to-reserve ratio, they might drive the regression results to show a slower extraction path. Therefore, as a further robustness check, we dropped fields whose production started after 2002. The results are still robust (see table A4). All the coefficients have the same sign and statistical significance as the main regression results. A final robustness check shown here is to utilize basin fixed effects instead of field fixed effects. Table A5 shows that the oil governance coefficient remains negative and statistically significant.

We then checked two issues around the use of reserves. First, Olsen (Reference Olsen2013) points out that using recoverable reserve data might be problematic because the data might be affected by ownership uncertainty. By definition, recoverable reserve is the part of a physical reserve which is economically viable to extract. Therefore, the change in oil governance can theoretically influence the incentives to look for more oil which might affect recoverable reserve data. As a further robustness check we use in-place reserve, which is a more physical measure of reserve than recoverable reserve. The results show that all the coefficients are larger but keep the same sign and statistical significance (results available upon request).

Second, the reserve calculation might introduce endogeneity into the model. As mentioned above, the dependent variable (Y ict) is log of production-to-reserve ratio (log(q ict/R ict)), which is equal to log of production (log(q ict)) minus log of reserve ![]() $( {{\rm log}( {R_{ict}} ) = {\rm log}( {R_{ic0} - \sum\nolimits_0^{t - 1} {q_{ict}} } )} )$. If the log of the reserves is moved to the right-hand side of the main econometric model (equation (1)), the model might contain a lag effect of the dependent variable which might be correlated with the error term. Hence, as a final robustness check, we follow Olsen (Reference Olsen2013) in using the log of production-to-fixed-reserve (measure at some year t) ratio. He shows that by using the fixed reserve, the behavior of the relative speed of extraction does not change (i.e., it is still independent of the time of observation) as long as the fixed reserve observation is made after the production observations. Fortunately, in our model, the fixed reserve will be controlled automatically through the field fixed effect so that our model will only include the log of production as a dependent variable. Results, available upon request, show that the coefficient of the oil governance change dummy is still negative and statistically significant, which confirms the robustness of the results.

$( {{\rm log}( {R_{ict}} ) = {\rm log}( {R_{ic0} - \sum\nolimits_0^{t - 1} {q_{ict}} } )} )$. If the log of the reserves is moved to the right-hand side of the main econometric model (equation (1)), the model might contain a lag effect of the dependent variable which might be correlated with the error term. Hence, as a final robustness check, we follow Olsen (Reference Olsen2013) in using the log of production-to-fixed-reserve (measure at some year t) ratio. He shows that by using the fixed reserve, the behavior of the relative speed of extraction does not change (i.e., it is still independent of the time of observation) as long as the fixed reserve observation is made after the production observations. Fortunately, in our model, the fixed reserve will be controlled automatically through the field fixed effect so that our model will only include the log of production as a dependent variable. Results, available upon request, show that the coefficient of the oil governance change dummy is still negative and statistically significant, which confirms the robustness of the results.

6. Conclusion

Changes in the institutional design of oil governance, such as creating a separate regulatory entity to negotiate access rights to resource stocks compared to the NOC, can have large impacts on firm behavior. Whether a change in oil governance increases or decreases the extraction path of a resource depends on the capital intensity of the extraction process and the size of the resource stock, We analyze the creation of a regulatory agency to write contracts with oil companies in Indonesia in a difference-in-difference framework to understand how changes in oil governance alter extraction paths.

By controlling for capital, the regression results show that the effect of a change in oil governance leads oil firms to choose a slower extraction path. The impact of the reduction in extraction path is different for different sizes of reserves in that the extraction path slows the most for smaller reserve fields. These results are robust to alternative specifications and different ways of standard error clustering. They confirm the theory that if the resource stock is small enough, the extraction path will follow a standard Hotelling model rule (i.e., a change in oil governance results in a slower extraction path). Thus, the results reiterate the importance of strengthening institutions to influence the extraction path even in a country endowed with small resource stocks such that over-extraction can be avoided and a more sustainable extraction path can be achieved.

Supplementary material

The supplementary material for this article can be found at https://doi.org/10.1017/S1355770X18000207.

Acknowledgements

The authors wish to thank Ben Gilbert, Yuzran Bustamar, Harrison Fell, Pete Maniloff, Wendy Davis, two anonymous referees, and seminar participants at the Colorado School of Mines for their helpful suggestions. The views which are presented in this paper are the authors' and do not represent those of SKKMIGAS.