1. Objective of this paper

The market-consistent valuation (MCV) approach has become one of the standard measures for the valuation of life insurance business during the last ten years.

The recent financial crisis (in particular the period since September 2008) has led to some interesting MCV results. Some companies have published MCV results showing negative investment variances or negative new business profits, greater than they would have been under non-MCV measures. Other companies have delayed the external reporting of MCV information, highlighting as a reason the sudden wide diversion in methodologies employed under the MCV reporting banner.

Meanwhile, insurance accounting and regulatory standard setters have continued to move towards MCV approaches, and will be making decisions during 2010 and 2011 on main technical aspects.

Given this background, I believe that this is a good time to review:

– the development of MCV in recent years.

– what business issues MCV can and can not address.

– which additional metrics can help in addressing companies’ business issues.

– what technical aspects of MCV require revisiting in light of the financial crisis.

The main objective of this paper is to contribute ideas for the future development of MCVs that are aimed at meeting the insurance industry's needs in all economic conditions.

The paper is written from a life insurance perspective, although many of the recommendations are also relevant to non-life insurance.

2. Summary of conclusions

This Section provides a summary of the conclusions of this paper.

2.1 The recent dislocation of the financial markets has raised challenges to market-consistent valuation, both in its implementation and application. These include both commercial and technical challenges. The whole concept of mark-to-market accounting has been questioned in some quarters.

2.2 However, market-consistent valuation techniques have been at the forefront of insurer accounting and regulatory developments during the 21st Century. Their use is likely to grow going forward as Solvency II and IASB/FASB Phase II take effect.

2.3 Designing and applying a fuller financial reporting information pack can help address any limitations in focusing solely on the MCV result.

2.4 Components of an MCV information pack include the balance sheet (including segmented results and breakdown into components of value), the analysis of movement (including the separate analysis of new business sales and in-force variances) and the sensitivities (both economic and non-economic).

2.5 Other financial reporting metrics should be monitored as well, to aid strategic decision making and ensure that decisions made during financial crises achieve both the short-term and long-term objectives.

2.6 The recent financial crisis has, in particular, highlighted the need for capital-based metrics, such as projections of cash flows, return on capital and internal rates of return.

2.7 The financial crisis has led to a number of difficult technical challenges and to companies adopting a broader range of methodologies and assumptions under the ‘market-consistent’ banner.

2.8 Some of the solutions to these technical challenges should be revisited by reconsidering the overall measurement objective. Accounting and regulatory bodies have historically proposed a market-consistent current exit value approach, separately valuing the assets and liabilities. I recommend a market-consistent fulfilment value approach to achieve a more realistic valuation, where the allowance for risk is calibrated by:

– considering the business on a going concern basis

– assessing the risks arising from blocks of business rather than assets and liabilities separately.

I believe this works better because it reflects how insurers manage their businesses and how they assess prices in M&A activity.

2.9 In addition the paper recommends more flexibility than is evident either from recent observations of industry practice or the methods/principles allowed by FASB/IASB and CEIOPS proposals. The increase in flexibility covers the following areas:

– the valuation of financial instruments within the assets, where in disorderly markets a mark-to-model approach is recommended and more generally a mid-price calibration is recommended for assets held to match liabilities.

– the reference rate, where subject to certain conditions I recommend applying a ‘minimum cost’ liability valuation premise to permit calibration to either government bonds or swaps in the valuation of non-option business. This results in a small amount of credit risk in the liability valuation, unrelated to the insurer's own credit risk.

– the allowance for non-hedgeable risks, where a critical aspect is the robustness of the best estimate assumption setting process and ensuring that residual risks are allowed for. Where all residual risks are allowed for separately, a small charge for uncertainty can be justified.

2.10 The paper recommends a liquidity premium in an MCV with suitable restrictions, reflecting the restrictions that companies would face in practice in trying to capture a liquidity premium in ALM strategies.

2.11 The paper recommends a calibration to market prices of traded options where relevant options exist and markets remain deep and liquid.

2.12 I believe the implementation of these recommendations would lead to a more useful internal financial management framework and a better link to ALM and investment strategies than approaches proposed recently within accounting and regulatory developments.

2.13 Whilst Solvency II and IASB/FASB Phase II head towards a market-consistent framework, a number of restrictions may remain compared to a “purer” economic value-based approach. Going forwards, insurers will face a challenge in explaining clearly and reconciling alternative market-consistent valuation reporting measures, including both the balance sheet and analysis of movement. This paper provides a recommended way forward.

2.14 One macroeconomic concern with a market-consistent reporting framework is the risk that it leads to procyclicality. This paper provides some options for regulators and other stakeholders to consider in mitigating procyclicality.

3. Background: historical MCV developments

3.1 A brief history of life insurance valuation: multiple reporting measures and valuation approaches

Many life insurance companies produce three forms of published accounts, unusually among industries:

1. returns to regulators, designed to demonstrate the ability of companies to maintain solvency and meet claims to policyholders;

2. statutory accounts under local Generally Accepted Accounting Principles (GAAP), which for many countries has recently been under the International Financial Reporting Standards (IFRS) banner, and

3. embedded values (EVs), produced voluntarily for external publication, internal financial management or both.

Regulatory rules have traditionally differed from region to region. Historically, these rules specified formulaic approaches to valuation (for example, the net premium valuation approach), although more recently discounted cash flow (DCF) techniques have become more common. Assumptions underlying the regulatory valuation have typically been set by an actuary, often with discretion. Assets and liabilities have been measured on either a book or market basis or a hybrid approach.

Primary financial statements have historically been based on local GAAP. For life insurance the local GAAP accounts have often been largely based on the regulatory balance sheets (calculated according to local regulatory rules) with certain adjustments. Assets and liabilities have been measured on either a book or market basis or a hybrid approach.

The origins of EV techniques can be traced back to Anderson (Reference Anderson1959). At a time when regulatory rules specified formulaic approaches to valuation, this paper argued for a valuation and pricing method based on projecting future cash flows using best estimate assumptions and discounting the emerging surpluses using a risk discount rate reflecting the shareholders’ required rate of return and the degree of risk in the blocks of business being valued. EV techniques were therefore an early application of the DCF approach to insurance valuation and were designed to give shareholders more meaningful information than the regulatory or GAAP approaches.

In the 50 years that followed, the main developments in these areas have been:

– Wide acceptance of the DCF approach as the most realistic measure of reporting for life insurance businesses.

– The improvement in computer power and construction of complex computer models, allowing companies to value huge portfolios of business using the DCF approach within a relatively short timeframe.

– The development of analytical tools to determine an analysis of the change in values over time.

– The widespread use of DCF techniques and EVs by company management to aid in making business decisions, measure performance and as a basis of remuneration.

– The increasing acceptance of DCF techniques within regulatory reporting and primary accounts.

– The increasing acceptance of MCV techniques within DCF approaches.

3.2 More MCV within regulatory reporting

In certain countries, companies have recently been required to produce regulatory returns with certain elements valued using market-consistent techniques. For examples, see ASSA (2008), Swiss FOPI (2004) and Swiss FOPI (2006); and for UK with-profits business Hare et al. (Reference Hare, Craske, Crispin, Desai, Dullaway, Earnshaw, Frankland, Jordan, Kerr, Manley, McKenzie, Rae and Saker2004) and Dullaway & Needleman (2004).

For companies in the European Union, the adoption of Solvency II will lead to a market-consistent approach being required for the insurance company balance sheet. Solvency II is led by the European Commission with the objective of improving the protection for policyholders by requiring a more dynamic risk-based approach to setting regulatory reserves and required capital than has been the case under existing Solvency I regulations.

The European Council and Parliament agreed and adopted a final text of the Solvency II Directive dated 10 November 2009, referred to later in this paper as “Solvency II Directive” or European Commission (2009a). The Directive is based on a market-consistent valuation of assets and liabilities.

However, most of the specific requirements within this market-consistent framework will only be agreed as part of the Level 2 implementing measures and Level 3 guidance, where the European Commission is being assisted by CEIOPS and other European bodies such as the CEA, CFO Forum, CRO Forum and Groupe Consultatif. Regulators in countries outside the European Commission are following developments with interest, with some planning to adopt similar measures. Ultimately the European Commission, Council and Parliament are expected to decide on the exact Level 2 implementing measures for Solvency II, during 2010 and 2011. During 2009, the Committee of European Insurance and Occupational Pensions Supervisors (CEIOPS) published a series of consultation papers and “final advice” on various aspects of the Level 2 implementing measures. The European Commission is not bound to accept the recommendations within CEIOPS’ final advice. See European Commission (2009b) for a request for CEIOPS to revisit certain elements of its final advice.

CEIOPS published a final specification for the fifth Quantitative Impact Study (QIS5) in July 2010, broadly consistent with CEIOPS’ final advice in many areas but departing in certain aspects, generally reflecting feedback from the European insurance industry and the European Commission.

3.3 More MCV within primary accounts

Historically, the International Accounting Standards Board (IASB) has, in some areas, been quick to adopt market-consistent valuation techniques within elements of IFRS, although this has generally not been extended to the accounting for insurance contracts. In particular:

– In 2001, the IASB published a Draft Statement of Principles (IASB, 2001) setting out a set of principles for insurance contract valuation which would in practice require market-consistent valuation techniques. There were, however, a number of restrictions in the application compared to an approach more closely aligned with economic value, for example the treatment of renewal premiums and market value margins, Dullaway & Foroughi (Reference Dullaway and Foroughi2002).

– the IASB then published a series of IFRSs (IASB, 2004-5) which were adopted by members of the European Union and many other countries. IAS 39 defines the classification and measurement of financial instruments. IFRS 4 governs the accounting for insurance contracts but was designed as an interim standard, allowing grandfathering of existing local GAAP approaches for the measurement of insurance contract liabilities, subject to a number of minimum standards. A market-consistent approach was permitted within IFRS 4 but not encouraged or required, Lloyds TSB (2006) describes how Scottish Widows’ embedded value was restated on to a market-consistent EEV basis and for the “insurance business” carried into the primary accounts under IFRS 4.

– The IASB published the Discussion Paper “Preliminary Views on Insurance Contracts” on 3 May 2007, setting out a building block approach for measuring the insurance contract technical provision underpinned by market-consistent valuation techniques. However there were a number of important differences compared to a more realistic approach; see Dullaway et al. (Reference Dullaway, Foroughi and Wright2007) for a description.

The IASB's Insurance Contracts project has since become a joint project with the United States’ Financial Accounting Standards Board (FASB).

The IASB published its exposure draft on the Insurance Contracts project on 30 July 2010 (IASB, 2010), requesting comments from the insurance industry by 30 November 2010. The final insurance contracts standard is expected to be published by the summer of 2011.

The IASB exposure draft broadly follows the IASB (2007) approach to construct an insurance contract measurement model using a market-consistent building block approach, stating in paragraph IN13:

“The exposure draft proposes a comprehensive measurement approach for all types of insurance contracts issued by entities (and reinsurance contracts held by entities), with a modified approach for some short-duration contracts. The approach is based on the principle that insurance contracts create a bundle of rights and obligations that work together to generate a package of cash inflows (premiums) and outflows (benefits and claims). An insurer would apply to that package of cash flows a measurement approach that uses the following building blocks:

(a) a current estimate of the future cash flows

(b) a discount rate that adjusts those cash flows for the time value of money

(c) an explicit risk adjustment

(d) a residual margin…”

Paragraph 17 defines the residual margin as an amount that

“eliminates any gain at inception of the contract. A residual margin arises when … the expected present value of the future cash outflows plus the risk adjustment is less than the expected present value of the future cash inflows”.

This decision on the residual margin leads to restrictions placed on the timing of profit recognition and so moves the valuation model away from an economic value approach.

The IASB exposure draft describes differences with the FASB approach. One main difference is the desire of the FASB to combine the explicit risk adjustment and the residual margin building blocks.

3.4 More MCV within embedded values

The use of MCV techniques has perhaps been most widespread in recent years among companies publishing embedded values, where the term market-consistent embedded value (MCEV) has become commonly accepted. The first MCEVs were published by AMP (2003) and Royal & Sun Alliance (2003).

This was closely followed by the CFO Forum publishing the European Embedded Value Principles (“EEV Principles”) in May 2004, which set out an external financial reporting framework with extensive disclosure requirements. The EEV Principles permitted, but did not require, a market-consistent approach to be used to set the overall allowance for risk. The use of the market-consistent approach within EEV was advocated by True et al. (Reference True, Taylor-Gooby, Whitlock, Byrne, Hoffmann, Milton, Jones, Hales, Kalberer and Melody2004), Dullaway & Whitlock (Reference Dullaway and Whitlock2005) and O’ Keeffe et al. (Reference O’ Keeffe, Desai, Foroughi, Hibbett, Maxwell, Sharp, Taverner, Ward and Willis2005).

The first companies adopting the EEV Principles at year-end 2004 generally adopted a “top-down” approach to allow for risk in the risk discount rate, similar to that advocated in Anderson (Reference Anderson1959) and historical traditional embedded value (TEV) practice. Companies adopting in later years tended to use the MCV approach to allow for risk. This trend is shown in Table 1. Up to year-end 2007 there was broad consistency but some differences in approaches used under the “MCV banner” (Foroughi et al., Reference Foroughi, Alargé Salvans, Bause, Cartier, Creedon, Gose, Hugmark, Harewood, Kapel, Lebel, Milton, Mirani and Whitlock2008a). This led to calls in the industry for the CFO Forum to prescribe and standardise an MCV approach within the EEV Principles.

Table 1 Approaches to allow for risk within EEV/MCEV Principles publications, year-end 2004–2009

On 4 June 2008, the CFO Forum published the original MCEV PrinciplesFootnote 1, (Copyright Stichting CFO Forum Foundation 2008), which prescribed a market-consistent approach to the allowance for risk within embedded values. Upon publication, all members of the CFO Forum pledged a compulsory adoption of the MCEV Principles from year-end 2009. This CFO Forum publication is summarised in Coughlan et al. (Reference Coughlan, Demerle, McGuffie, Paton, Purves and Sanner2008a) and Foroughi et al. (Reference Foroughi, Alargé Salvans, Bause, Cartier, Creedon, Gose, Hugmark, Harewood, Kapel, Lebel, Milton, Mirani and Whitlock2008b).

The evolution of companies adopting market-consistent valuation techniques to allow for risk within published embedded values under either the EEV Principles or MCEV Principles is shown in Table 1.

The financial crisis, in particular following Lehman Brothers’ collapse in September 2008, led to a number of MCV technical decisions being revisited. The CFO Forum announced on 19 December 2008 that:

“The CFO Forum remains committed to MCEV and the Principles published in July [sic] 2008. However, the MCEV Principles were designed during a period of relatively stable market conditions and their application could, in turbulent markets, lead to misleading results. The CFO Forum has therefore agreed to conduct a review of the impact of turbulent market conditions on the MCEV Principles, the result of which may lead to changes to the published MCEV Principles or the issuance of guidance. The particular areas under review include implied volatilities, the cost of non-hedgeable risks, the use of swap rates as a proxy for risk-free rates and the effect of liquidity premia.”

At year-end 2008, following the onset of the recent financial crisis a proliferation of “MCV” approaches arose under ‘market-consistent’ EEV Principles or the MCEV Principles (with areas of material non-compliance), described in detail in Foroughi et al. (Reference Foroughi, Alargé Salvans, Bause, Cartier, Creedon, Gose, Hugmark, Harewood, Kapel, Lebel, Milton, Mirani and Whitlock2009a).

Consequently, in an announcement dated 22 May 2009, the date for compulsory adoption of the MCEV Principles was postponed from 2009 to 2011. The June 2008 MCEV Principles were revised on 20 October 2009 (CFO Forum, 2009), with the main revision being the potential inclusion of a liquidity premium above the swap yield curve. The October 2009 MCEV Principles are summarised in Foroughi et al. (Reference Foroughi, Alargé Salvans, Bause, Cartier, Creedon, Gose, Hugmark, Harewood, Kapel, Lebel, Milton, Mirani and Whitlock2009b).

4. The case for MCV

4.1 The “market-consistent valuation” concept

The “market-consistent valuation” concept aims to ensure that the allowance for risk within a valuation is calibrated to market prices of risk where relevant and reliable.

In a market-consistent valuation framework, assets and liabilities are valued in line with market prices and so consistently with each other. In principle, each projected cash flow is valued in line with the prices of similar cash flows that are traded on the open market. For example, the cash flows arising from an equity are valued in line with the market price of the equity, the cash flows from a bond in line with the price of that bond, and so on. Furthermore, liability cash flows (which are not usually traded) are valued in line with the traded assets they most closely resemble. A fixed liability due in ten years would be valued in line with a 10-year zero coupon bond and an embedded financial option in line with the market price of a similar option.

In practice, a number of short cuts and alternative approaches (for example certainty equivalent valuation and risk-neutral stochastic valuation) are used. These make the valuation process easier whilst achieving the objective set out in the preceding paragraph.

The market-consistent valuation concept and the description and application of these short cuts are described in more detail in Dullaway (Reference Dullaway2001), Dullaway & Foroughi (Reference Dullaway and Foroughi2002), Blight, Kapel & Bice (Reference Blight, Kapel and Bice2003), Exley & Smith (Reference Exley and Smith2003), Foroughi et al. (Reference Foroughi, Jones and Dardis2003), Tillinghast (2003), Sheldon & Smith (Reference Sheldon and Smith2004), Dullaway & Whitlock (Reference Dullaway and Whitlock2005), O’ Keeffe et al. (Reference O’ Keeffe, Desai, Foroughi, Hibbett, Maxwell, Sharp, Taverner, Ward and Willis2005), CFO Forum (2008, 2009), IAA (2009), Foroughi (2009) and Varnell (Reference Varnell2009).

4.2 The case for MCV

As well as having to satisfy external demands for MCV information, companies have increasingly used MCV techniques in setting ALM and investment strategies, monitoring performance against planned activities, negotiating M&A transaction prices and pricing new business.

Reasons for these developments include the following:

– It offers decision makers the ability to meaningfully compare the relative value of alternative courses of action.

– The allowance for risk within the MCV approach is more objective than under alternative approaches, creating greater confidence in the results among stakeholders.

– The allowance for risk is more granular, giving more meaningful information about segmental results.

– It is easier to achieve consistency between the asset and liability valuation, helping to ensure that variances in the profit and loss account/analysis of movement result from asset liability mismatches and not accounting mismatches.

– By valuing liabilities with reference to the market price of a closely matching asset, the MCV information is of relevance from a solvency perspective and helps a company make Asset Liability Management (ALM) and risk management decisions.

– The MCV analysis of movement, variances and sensitivities give an insight into the sources of value creation and can feed into the business control cycle decision-making process and risk management. (See Section 6 for a further description of the analysis of movement and sensitivities.)

5. Some MCV commercial challenges

5.1 Some MCV commercial challenges

Recent MCV developments have led to a number of commercial challenges:

1. An MCV measure may lead to much greater volatility of balance sheet and earnings than non-MCV measures.

In principle, the MCV approach should lead to volatility arising due to real asset liability mismatches, not accounting mismatches. Therefore, the MCV approach should exhibit lower volatility if assets and liabilities are well matched.

2. It is not clear how to price new business in markets where other market participants base prices on non-MCV measures.

Where other market participants base prices on non-MCV measures, particularly where expected investment spreads are allowed for in the valuation, companies face a strategic challenge in deciding whether to follow such prices (potentially writing the new business at an MCV loss) or reduce market share.

In the short term, a company may wish to continue selling in the market to maintain its franchise value, particularly if it believes that it will be able to achieve expected investment spreads and other metrics (such as those set out in Section 6) support the new business strategy.

However in the long run, a company may wish to consider whether to raise prices. One point of view is that there is a disconnect if policyholders are receiving the benefit of expected investment spreads (via the pricing of the business), whereas shareholders are bearing the risk associated with achieving these spreads, and yet are not being compensated for taking this risk. A harder pricing market may result.

3. In extreme financial conditions, the MCV approach can lead to a procyclical effect on the values of financial assets, potentially leading to adverse effects on otherwise sound insurance companies and industries.

This is addressed in section 15.

4. The points above can discourage insurance companies from investing more in credit risky assets that are otherwise a good match for the liabilities, leading to knock on macroeconomic effects such as higher prices for policyholders and reduced availability of credit.

This is not specifically addressed further in this paper.

5. The MCV does not provide information on the capital requirements and capital generation characteristics of the business.

This is addressed in section 6.

5.2 Addressing these challenges – an overview of the rest of this paper

The rest of this paper addresses these MCV challenges as follows:

– Section 6 describes a recommended financial reporting information pack.

– Sections 7 to 14 describe the technical challenges underlying the MCV calculation and recommend some enhancements in light of the recent financial crisis. Some of these dampen the procyclicality effect.

– Section 15 describes the procyclical effect in more detail recognising it as an important political concern, and describes some methods which can be applied in mitigation.

– Section 16 then provides a final thought on the subject of MCV.

6. A wider reporting pack

6.1 Introduction

This section describes a recommended financial reporting information pack consisting of an MCV disclosure pack and additional information for users to consider. This combination of financial reporting information helps stakeholders to assess business strategies.

The recommended MCV disclosure pack includes:

– the balance sheet.

– the analysis of movement (including a separate identification of the value added by new business).

– the sensitivities of the balance sheet and value of new business to risks.

– disclosure of the methodology and assumptions used in the MCV calculations.

– explanation of the results.

The items above are similar to the disclosure requirements of CFO Forum (2008, 2009).

The recommended additional information includes:

– the primary accounting and regulatory balance sheet and earnings, together with a reconciliation with the MCV balance sheet and movement analysis.

– analysis of movement in levels of assets

– projected “real world” distributable earnings.

– implied risk discount rates.

– new business information including sales volumes, new business strains, internal rates of return and payback periods.

6.2. Analysis of movement of MCV

The analysis of movement in market-consistent valuations during a reporting period is a useful tool to indicate the performance of a block of business or company. One such approach is that mandated for companies publishing under the MCEV Principles and is reproduced in Table 2 below. This approach originates from insurance company practice and a rationale is set out in Collins & Keeler (Reference Collins and Keeler1993).

Table 2 Movement analysis (Source: CFO Forum MCEV Principles Appendix A)

(1)This represents the following two components:

▪ Expected earnings on free surplus and required capital; and

▪ Expected change in VIF

(2)The earnings assuming assets earn the beginning of period reference rate

(3)The earnings is the component in excess of the reference rate reflecting the additional return consistent with the expectation of management for the business.

The analysis is on a net of taxation basis with movements disclosed on a line-by-line basis.

The MCEV Principles provide a glossary of terms used in this table (including the MCEV components free surplus, required capital and VIF) and guidance in calculating and allocating sources of surplus to the various elements of the analysis.

This analysis is useful in managing business from a number of perspectives:

– The analysis of MCEV movement is often used as a measure of performance and as a basis of remuneration.

– Different areas of the business can take responsibility for the business performance shown in different elements of the analysis.

– The separate identification of the value of new business within this analysis, including a product breakdown, provides a useful input into decisions on new business pricing and product strategies.

– A split of this analysis into the relevant components of MCEV (free surplus, required capital and value of in force) helps to assess any implications for dividend paying capacity. In particular, the capital generation of in-force business can be compared with the capital strain of writing new business. This helps address point 5 in section 5.1 above.

– The analysis of variances broken down by source of risk is useful information for those responsible for setting best estimate assumptions.

6.3 MCV sensitivities

The sensitivity of the market-consistent value to risks helps in risk management, risk quantification and in highlighting the materiality of specific assumptions.

The MCEV Principles mandate publication of economic and non-economic sensitivities.

Economic sensitivities include change in the interest rate environment, change in equity/property capital values, changes in equity/property implied volatilities and changes in swaption implied volatilities.

Non-economic sensitivities include changes in maintenance expenses, lapse rates, mortality and morbidity rates.

The MCEV Principles mandate specific quantums of sensitivities. Users are often interested in other quantums as well.

The MCEV Principles generally mandate pessimistic economic scenario sensitivities. Users are often interested in optimistic economic scenario sensitivities as well, particularly in times of financial crisis.

Additional sensitivities not mandated by the MCEV Principles but which are of interest to users of the information include:

– a credit spread sensitivity (which affects the assumed market value of corporate bonds and other credit-risky assets, with consequential impact on those liabilities affected by credit risk).

– a liquidity premium sensitivity (see Section 10 for a description of the liquidity premium).

Interestingly, a number of European-headquartered companies are providing MCEV sensitivities within the primary accounts under the section on risk disclosures (as required by IFRS 7 Financial Instruments: Disclosures), using the supplementary embedded value reporting calculations instead of, or in addition to, the sensitivities of the IFRS equity.

6.4 Primary account and regulatory account information

While primary and regulatory balance sheets are constructed in a different manner to the market-consistent approach, companies have to calculate these balance sheets as well, and users will be interested in the results.

Insurance companies will then face a challenge in communicating the differences in balance sheets and earnings analysis between the various reporting metrics, particularly as these explanations are likely to involve the differences in the technical aspects of the underlying calculations.

This challenge is discussed in more depth in Foroughi (Reference Foroughi2010b), with Table 3 proposed as a possible solution. The article includes a detailed explanation of the rationale, structure and contents of the table. The main elements are as follows:

Table 3 A proposed analysis/reconciliation of earnings across reporting measures

– The analysis follows a similar structure to the MCEV Principles Appendix A.

– The possible asset adjustments incorporate the revaluation to fair value of those financial instrument assets not measured at fair value in the primary accounts.

– The liability adjustments include setting the residual margin to nil for insurance contracts, and revaluing those contracts classified as “investment contracts.

– “Economic equity” is a realistic measure of MCV.

– The Solvency Capital is the Solvency Capital Requirement under Solvency II.

– The Free Surplus is defined such that the Solvency Capital and Free Surplus is the available capital under Solvency II, adjusted to allow for any margins within the Solvency II valuation of assets and liabilities other than Technical Provisions.

– The Value of In Force is the margins within the Technical Provisions measurement.

6.5. Analysis of the movement in the levels of assets

For savings products where the earnings by the insurer are related to the levels of assets, users of the information are interested in an analysis of the movement in the levels of assets, indicating how much the levels of assets have moved over a period due to for example new business sales, investment performance and decrements such as lapses. Such analysis is also referred to as “analysis of net fund flows”.

6.6 Projected “real world” distributable earnings

Users of the information are also interested in projected distributable earnings calculated on a “real world” economic best estimate basis, i.e. including expected asset risk premia. This information helps the user assess the expected timing of return of capital, as well as providing information on the expected reward for the company given the risks taken on.

DCF applications in TEV and other industries are often calculated on a similar basis as well. This information helps to relate the valuation of a block of insurance business with information available in other industries. A number of metrics can be calculated from the projected real world distributable earning (and underlying cash flow projections), described below.

6.7 Implied risk discount rates

Once projected real world cash flows are calculated, implied risk discount rates (“IDRs”) can be calculated showing what aggregate discount rate should be used to convert the projected real world cash flows into the market-consistent value at the valuation date. IDRs are therefore a measure of the theoretical minimum required return to capital providers given the risks inherent in a block of business.

6.8 New business information

Clear and complete new business information can help provide users of the information with insights into the new business strategy and the capital that is being used to write new business. In addition to market-consistent new business values (identified within Table 2), useful information includes:

6.8.1 New business volumes

This information is often provided split by product. This typically shows single premiums and annualised regular premiums separately, and hence Annualised Premium Equivalent (APE, equals RP + SP/10). The Present Value of New Business Premiums is also typically published (PVNBP = SP + AP * capitalisation factor).

6.8.2 New business strain

The new business strain is the amount of capital required to be employed by an insurance company in the sale of new business. A strain arises because the outgo (in particular acquisition expenses and commissions, as well as the need to set up regulatory reserves and additional capital requirements) generally exceeds the income (typically the initial premium). The new business strain can be identified in Table 2 – it is the free surplus column in the new business value row.

6.8.3 Internal rates of return

The internal rate of return (IRR) is the discount rate applied to the projected real world distributable earnings (including the new business strain) to produce a nil present value at the point of sale. It gives the user an indication of the expected reward given the capital invested.

This can be compared with the new business IDR as an alternative method of assessing the profitability of new business written.

6.8.4 Payback period

The payback period is the length of time required before the sum of projected real world cash flows on a block of new business is greater than nil. It helps stakeholders understand how long it takes before capital employed is expected to be returned. The payback period is generally calculated using undiscounted projected real world cash flows.

7. Calibration of the overall allowance for risk

7.1 Introduction

Based on the learnings from the recent financial crisis, I believe there is a need to improve aspects of the MCV allowance for risk calibration. In the following sections, I set out my thoughts on how this could be done, with the objective of maintaining the advantages of the MCV approach set out in Section 4.2.

Three specific aspects are considered in this section:

– whether the calibration should be on a current exit value or fulfilment value basis.

– how to ensure consistency in the overall allowance for risk.

– clarity over areas of judgement.

Sections 8 to 14 then go on to consider individual aspects of the allowance for risk.

7.2 Current exit value or fulfilment value

Practitioners are faced with two general approaches to the calibration of the allowance for risk:

– a “current exit value”, that is the value a third party would pay to purchase an asset or the consideration required for a third party to accept a liability obligation, also known as transfer value.

– a “fulfilment value”, that is the “in-use”Footnote 2 market value of the asset or the cost to the insurer of fulfilling the obligation, sometimes referred to as going concern value or settlement value.

The Solvency II Directive contains elements of a current exit value approach to valuation. Article 75 (1) of the final text of the Solvency II Directive states “assets shall be valued at the amount for which they could be exchanged between knowledgeable willing parties in an arm's length transaction” and separately states “liabilities shall be valued at the amount for which they could be transferred, or settled, between knowledgeable willing parties in an arm's length transaction”.

IASB (2007) puts forward a current exit value approach to setting insurance contract liabilities, stating:

“An informative and concise name for a measurement that uses the three building blocks is ‘current exit value’. This paper defines current exit value as the amount the insurer would expect to pay at the reporting date to transfer its remaining contractual rights and obligations immediately to another entity.”

Interestingly, IASB (2010) makes no overall mention of a current exit value concept, instead stating in paragraph 17

“An insurer shall measure an insurance contract initially at … the expected present value of the future cash outflows less future cash inflows that will arise as the insurer fulfils the insurance contract, adjusted for the effects of uncertainty about the amount and timing of those future cash flows …”

However, paragraph 35 of IASB (2010) describes the risk adjustment as

“the maximum amount the insurer would rationally pay to be relieved of the risk that the ultimate fulfilment cash flows exceed those expected”.

This appears to introduce some aspects of a current exit value, albeit based on the insurer's own perspective rather than that of a market participant.

No focus is given to a current exit value by the EEV and MCEV Principles when calibrating the allowance for risk. Principle 3 of both publications states the

“…. embedded value represents the present value of shareholders’ interests in the earnings distributable from assets allocated to the covered business after sufficient allowance for the aggregate risks in the covered business”

The practical difficulty with the current exit value concept is that it does not reflect how insurers generally manage their business. Transfers of business between one insurer and another do not happen frequently and hence no reliable market price exists for calibration. In addition, transfers generally occur due to merger and acquisition activity, and are usually on the basis that one insurer transfers a block of business containing both assets and liabilities to another insurer. The consideration paid in respect of the transfer of the assets and liabilities often depends on many qualitative factors influencing both buyer and seller.

The MCEV Principles recognise these complications when stating “the allowance for risk should be calibrated to match the market price for risk where reliably observable.” In addition G.3.3 states “the concept of mark to market is to value insurance liabilities and therefore the shareholders’ interest in the earnings distributable from assets allocated to the covered business as if they are traded assets with equivalent cash flows. However, most insurance liabilities are not traded. As assets are generally traded with an observable market price, asset cash flows that most closely resemble the insurance cash flows (from the shareholders’ perspective) are used.”

Interestingly the IAIS also recognises that the concept of a “current exit value” is somewhat theoretical and is, in practice, related to the fulfilment concept. IAIS (2007) states “the IAIS believe that any transfer notion would be strongly influenced by the settlement [fulfilment] obligations that the transferee would undertake”.

I recommend the fulfilment value approach to calibrating the allowance for risk.

Practitioners that have to perform a current exit value allowance for risk calibration (for example to follow prescribed rules) should also pay close regard to the fulfilment value approach in order to avoid the potential for an unreliable calibration.

7.3 Consistency in the overall allowance for risk

When considering the overall allowance for risk, it is important to ensure consistency between the valuation of assets and liabilities. Consistency is easier to achieve if the allowance for risk is considered across both assets and liabilities together.

The developments within Solvency II, IASB and FASB (see quotes in section 7.2 above) mean that assets and liabilities are calibrated and valued separately, increasing the risk of inconsistency in the overall calibration.

In contrast, the EEV and MCEV Principles’ philosophy of calibrating the allowance for risk to blocks of business (containing both assets and liabilities) helps to ensure consistency in the overall valuation.

This concept of consistency influences a number of recommendations made in later sections.

7.4 Clarity over areas of judgement

The remainder of this paper illustrates the challenges with calibrating a robust MCV at times of financial crisis. Calibration is often much easier in more benign financial market conditions.

I recommend ensuring the disclosure accompanying MCV makes clear the extent to which judgement is required. An approach set out in FAS 157 Fair Value Measurement (FASB, 2006) and followed in recent IFRS disclosure requirements is to require a Three Level Hierarchy:

Level 1: unadjusted quoted prices in active markets for identical assets or liabilities that the reporting entity has the ability to access at the measurement date.

Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. Examples include quoted prices for similar assets or liabilities in active markets.

Level 3: unobservable inputs for the asset or liability.

Disclosure regarding the fair value of assets under each level of hierarchy can help the reader assess the areas of judgement with financial instrument valuation.

Similar information can be provided for the valuation of insurance liabilities, by considering the equivalent calibration asset. A number of companies publishing market-consistent EEVs or MCEVs have provided some related information in the disclosures, for example indicating where extrapolation is required and the materiality on the result.

8. The valuation of financial instruments

8.1 Background and recent developments

Historically, the MCV approach sets the valuation of financial instruments to market value. However the recent financial crisis has led to much greater illiquidity in a number of asset classes with subsequent concerns about the reliability of quoted market prices. This has led to the question of how to assess whether markets are “deep and liquid” and the related question of what is the market-consistent value of illiquid assets.

Recent developments in this area have been led by both the FASB and the IASB.

In April 2009, the US accounting regulator FASB published Staff Position Paper FAS 157-4 (FASB, 2009) addressing how to determine fair value in illiquid markets.

The IASB announced in April 2009 a comprehensive and urgent review of both IAS 39 Financial Instruments: Recognition and Measurement, and the more general concept of “fair value”.

The IAS 39 review led to the publication of IASB (2009b), then to the publication of the financial asset classification and measurement standard IFRS 9 (IASB, 2009c) which comes into effect in 2013 with early adoption permitted. IFRS 9 requires companies to classify and measure financial assets as either “amortised cost” or “fair value”, with the company's business model and the characteristics of the asset influencing the classification. IFRS 9 does not yet cover the impairment model for assets measured at amortised cost and hedge accounting and in these areas the IAS 39 review is ongoing.

The IASB's Fair Value Measurement Exposure Draft (IASB, 2009a) proposes that the core principle of the fair value of assets is to determine “the price that would be received to sell an asset … in an orderly transaction between market participants at the measurement date”.

Both FAS 157-4 and IASB (2009a) recommend using a mark-to-model approach when markets are no longer orderly. The aim of such a mark-to-model approach is to estimate what the market price would be in an orderly market, taking into account all available information.

These publications provide guidance in what constitutes a disorderly market, much of which relates to the depth and liquidity of the market. Examples are set out in IASB (2009a) Appendix B5 and are extracted below:

“The presence of the following factors may indicate that a market is not active:

(a) there has been a significant decrease in the volume and level of activity for the asset or liability when compared with normal market activity for the asset or liability (or similar assets or liabilities).

(b) there are few recent transactions.

(c) price quotations are not based on current information.

(d) price quotations vary substantially over time or among market-makers (eg some brokered markets).

(e) indices that previously were highly correlated with the fair values of the asset or liability are demonstrably uncorrelated with recent indications of fair value for that asset or liability.

(f) there is a significant increase in implied liquidity risk premiums, yields or performance indicators (such as delinquency rates or loss severities) for observed transactions or quoted prices when compared with the entity's estimate of expected cash flows, considering all available market data about credit and other non-performance risk for the asset or liability.

(g) there is a wide bid-ask spread or significant increase in the bid-ask spread.

(h) there is a significant decline or absence of a market for new issues (ie primary market) for the asset or liability (or similar assets or liabilities).

(i) little information is released publicly (eg a principal-to-principal market).

(j) An entity evaluates the significance and relevance of the factors (together with other pertinent factors) to determine whether, on the basis of the evidence available, a market is not active.”

A similar list can be found in FAS 157-4.

When valuing financial instrument assets within markets judged to be orderly, IASB (2009a) requires companies to use observed market prices.

When valuing financial instrument assets where that asset's market price is not observable, IASB (2009a) requires companies to use a mark-to-model approach.

Judgement is required for financial instruments where market prices are observable, but the presence of a number of the other conditions described above suggest disorderly markets. An illustrative example may be the corporate bond markets in late 2008, where observed yields rose significantly over a short time period. However, companies found that volumes of trades fell significantly over the same period, with both buyers and sellers unable to transact meaningful sized trades at observed market prices. The implementation of IASB (2009a) would require companies in such circumstances to judge whether the fair value core principle would lead to a different price than the observed market price.

However, a fair value standard has not yet been published and is not expected to come into effect until around 2012.

The Solvency II QIS5 specification makes no explicit reference to this type of situation when describing the valuation of the assets. There is a general reference to IASB fair value but no further consideration or discussion about how to determine fair value in inactive markets or consider whether markets are active or inactive.

In the context of valuing the technical provisions, QIS5 specification TP.2.98. states:

“In principle, the calibration process should use market prices only from financial markets that are deep, liquid and transparent. If the derivation of a parameter is not possible by means of prices from deep, liquid and transparent markets, other market prices may be used. In this case, particular attention should be paid to any distortions of the market prices. Corrections for the distortions should be made in a deliberate, objective and reliable manner.”

In this context, QIS5 specification TP.4.4. goes on to define the required financial market conditions as follows:

“(a) a large number of assets can be transacted without significantly affecting the price of the financial instruments used in the replications (deep),

(b) assets can be easily bought and sold without causing a significant movement in the price (liquid),

(c) current trade and price information are normally readily available to the public, in particular to the undertakings (transparent).”

8.2 Valuation of financial instrument asset recommendations

8.2.1 Classification of financial instruments

IFRS 9 permits companies to classify financial instruments as amortised cost or fair value. The combination of an amortised cost asset measurement and a market-based liability discount rate arising from the tentative FASB/IASB decisions set out in section 3.3 may lead to significant mismatches in the measurement of assets and liabilities and an inability to compare results across the insurance industry. Within primary accounting, insurers may consider applying the fair value option described in IFRS 9 to avoid such accounting mismatches.

Notwithstanding the above uncertainty within the primary accounts, I recommend valuing all financial assets at fair value within the MCV, noting the other recommendations in this section.

8.2.2 When to use market prices or a mark-to-model approach

Until a new fair value standard is required to be followed, insurance companies may be reluctant to depart too much from observed market prices (even in dislocated financial markets similar to those at year-end 2008) for a number of reasons:

– it is an easier process to value assets using observed market prices than estimate a fair value using a mark-to-model approach.

– companies may be wary of having to disclose a mark-to-model value much different from an observed market value, particularly if other companies are not doing so as well.

– companies may prefer to make an equivalent adjustment elsewhere in the balance sheet. For example, at year-end 2008 companies typically adjusted upwards the reference rate used, to allow for the “liquidity premium”, part of which was perceived to be related to unreliable market prices of assets.

Nevertheless, the insurance industry will in the longer term need to develop processes to demonstrate they are following the relevant FASB and IASB fair value standards and are able to recognise where judgement is required in the valuation and apply that judgement.

Given that a large proportion of the assets held by insurance companies are financial instruments, it would be very helpful for the insurance industry to develop common approaches for assessing whether markets are judged to be disorderly (permitting a potential move away from observed market prices) and, if so, how fair value would be determined. Disclosure regarding the judgement applied in this process is critical.

8.2.3 Bid or mid prices

IAS 39 prescribes the use of bid prices of assets when calibrating fair value of assets, with one exception discussed below. Interestingly, such prescription is not found in FAS 157, FAS 157-4 or IASB (2009a). However it is in line with the fair value objective described above, in particular “the price received to sell an asset”.

Solvency II QIS5 generally follows the relevant IFRS, so this aspect would be followed as well.

Whether or not this is a desirable calibration depends on one's views of the overall allowance for risk.

In my view, provided the recommendations set out in section 7are accepted, then the calibration should depend in part on how the assets are managed. For blocks of business where assets are held to maturity to match long-term liabilities, a calibration at mid price can be justified and helps to ensure consistency with the liability valuation (where mid prices of more liquid instruments are generally used for calibration).

This is because insurers’ going concern business models are not exposed to fluctuations in bid ask spreads, provided assets can be held to maturity. In addition, from a current exit value point of view, transfers usually involve both the assets and liabilities so the transferee should consider bid mid spreads when negotiating the price.

It is noted that there currently exists an exception to the IAS 39 requirement that bid prices of assets are used. When assets are held to match liabilities and the market and credit risks substantially offset, mid prices can be used provided both the assets and the liabilities are measured using fair value. This means that insurance companies cannot generally use a mid price when measuring assets, as the backing liabilities are measured using the insurance contracts standard. The IASB has provided mixed messages on whether this restriction may be lifted in the future.

9. The reference rate

9.1 Background

The reference rate is the yield curve used, in a market-consistent valuation framework, to discount cash flows which are not affected by investment market movements. It is also the yield curve used to project and discount cash flows which vary linearly with investment market movements (the “certainty equivalent” approach) and the yield curve used within stochastic models designed to determine a market-consistent value of embedded financial options and guarantees.

This section focuses on items to consider when selecting the reference rate with the exception of the liquidity premium. Section 10 discusses items to consider when deciding whether to also apply a liquidity premium, and if so how to calibrate the liquidity premium. It is noted that the phrase “reference rate” is generally defined to include any liquidity premium included in its calibration.

For a number of years up to end 2007, companies using the market-consistent approach within regulatory returns, primary accounts or embedded values tended to use a government bond or swap based calibration of the reference rate, with no additional adjustment. However, at year-end 2008 many companies departed from this practice.

Reasons provided for changes in the calibration of reference rates included reference to the illiquidity premium of assets and/or liabilities, and the higher yields on government bonds relative to swaps.

Table 4 summarises practice among CFO Forum companies at year-end 2008 in this area. Similar inconsistency can be observed in some companies’ year-end 2008 IFRS and regulatory disclosures.

Table 4 Reference rates within year-end 2008 ‘market-consistent’ EEV or MCEV Principles publications

A similar table found in Aaron et al. (Reference Aaron, Bause, Buck, Cartier, Creedon, Escudero, Foroughi, Gose, Guiry, Harrison, Hugmark, Milton, Pater and Vandenbosch2010) shows that practice became more standardised at year-end 2009. This may have been driven more by reductions in liquidity premia observed in the market from year-end 2008 to year-end 2009 than increased standardisation of practice in setting the reference rate.

CEIOPS (2009a, 2009c) sets out and describes a number of criteria used to assess possible reference rate calibrations, including: no credit risk, realism, reliability, highly liquid for all maturities, no technical biases, available for all relevant currencies, and proportionate.

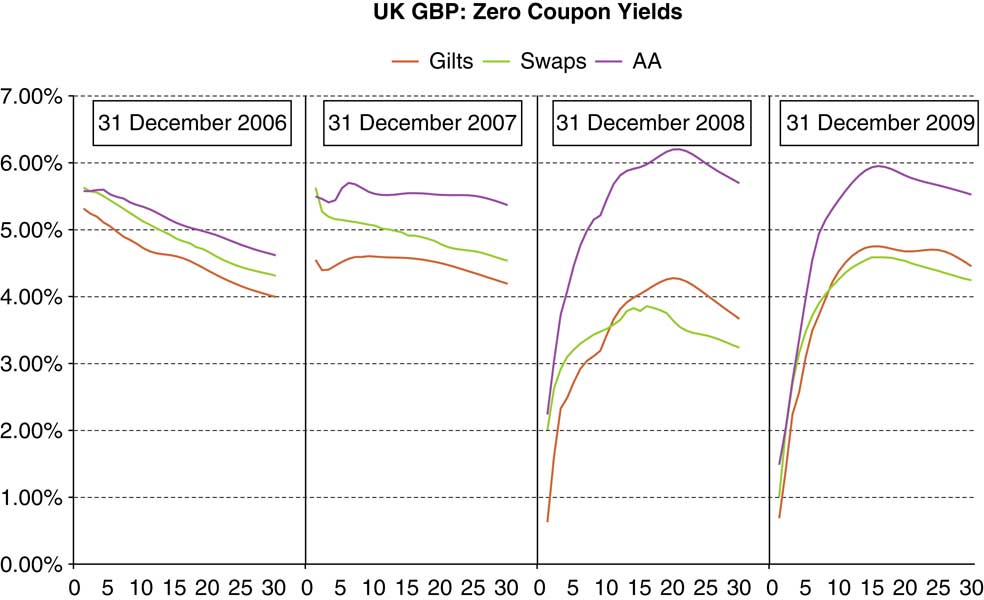

CEIOPS (2009a, 2009c) generally proposed a AAA government bond based calibration, and rules out the use of swap yield curves given the perceived credit risk inherent within these instruments. However, this is one of the tentative decisions that European Commission (2009b) recommended be revisited, and it is noted that in many currencies for periods from year-end 2008 swap yields at medium to longer durations are lower than equivalent government bond yields (see Figure 1).

Figure 1 Government bond, swap and AA corporate debt spot yields, 2006–2009

Source: Towers Watson analysis of Bloomberg data

CFO Forum (2008, 2009) requires a swap based calibration where swap yields are available, although CFO Forum (2009) permits an adjustment to swap rates to allow for a liquidity premium under certain circumstances.

For QIS5 (2010) reference rates are provided for standard currencies. They are based on swap yields (where these are available), with a 10 bps reduction to allow for the perceived level of credit risk in the swap yield and a liquidity premium addition which varies by the nature of the liabilities (details provided in section 10).

Neither CEIOPS (2009a, 2009c), nor QIS5 (2010), nor CFO Forum (2008, 2009) advocate an upwards adjustment to the calibration asset to allow for additional own credit risk.

IASB (2007) describes the following in calibrating the reference rate:

“… the objective of the discount rate is to adjust estimated future cash flows for the time value of money in a way that captures the characteristics of the liability, not the characteristics of the assets viewed as backing those liabilities. Therefore, the discount rate should be consistent with observable current market prices for cash flows whose characteristics match those of the insurance liability, in terms of, for example, timing, currency and liquidity. It should exclude any factors that influence the observed rate but are not relevant to the liability (for example, risks not present in the liability but present in the instrument for which the market prices are observed).”

IASB (2010) describes the following in calibrating the reference rate (referred to in the exposure draft as the “discount rate”), in paragraphs 30 and 31:

“30 An insurer shall adjust the future cash flows for the time value of money, using discount rates that:

(a) are consistent with observable current market prices for instruments with cash flows whose characteristics reflect those of the insurance contract liability, in terms of, for example, timing, currency and liquidity.

(b) exclude any factors that influence the observed rates but are not relevant to the insurance contract liability (eg risks not present in the liability but present in the instrument for which the market prices are observed).

31 As a result of the principle in paragraph 30, if the cash flows of an insurance contract do not depend on the performance of specific assets, the discount rate shall reflect the yield curve in the appropriate currency for instruments that expose the holder to no or negligible credit risk, with an adjustment for illiquidity (see paragraph 34)..”

Paragraph 34 of IASB (2010) covering the liquidity premium is quoted in ¶10.2.3.

9.2 Recommendations

I recommend that reference rates (before considering the liquidity premium) are calibrated using similar principles to CEIOPS (2009a, 2009c) except for the following:

9.2.1 Suitably low credit risk instead of no credit risk

There is a natural trade-off between a) realism/reliability and b) no credit risk in the calibration, with two options available to practitioners:

(1) construct a hypothetical reference rate curve which is deemed to be 100%-credit-risk-free, based on all available market information available at the date of calibration, as well as models estimating the extent of credit risk in specific instruments, or

(2) apply a “suitably low credit risk” criteria instead of “no credit risk” feature, and calibrate to an actual market instrument without amendment.

I recommend Option (2), i.e. to permit suitably low credit risk within a calibration instrument that actually exists and is credible and not require any adjustment to this actual market instrument to remove the credit risk present within the instrument.

Reasons for this recommendation include the following:

– it reflects the price of a viable low risk ALM strategy. This is of interest to insurers when assessing performance against the ALM strategy they have actually undertaken. This should also be of interest to regulators in a run off context.

– it is more realistic and reliable than a hypothetical reference rate.

– it is easier for practitioners to calibrate to.

– the residual credit risks can be allowed for within additional capital requirements instead of the market-consistent liability.

In terms of applications of this option, I believe that both government bond markets (where countries have control of their own money supply) and swap markets are generally of sufficiently low credit risk to be suitable as calibration instruments.

Neither government nor swap asset markets should be considered 100%-credit-risk-free; default in either market is possible if unlikely. Bootle (Reference Bootle2010) describes how in recent years there have been government bond defaults in Russia (1998), Ecuador (1999), Argentina (2001) and Uruguay (2003). Reinhart & Rogoff (Reference Reinhart and Rogoff2009) provides a table of examples of government defaults or restructurings dating back several centuries.

Reinhart & Rogoff (Reference Reinhart and Rogoff2009) includes in the table of government defaults a UK example – from 1932 in the context of undated War Loan government bonds where the coupon payments reduced from 5% pa to 3.5% pa to reduce the cost of borrowing. However, Weale (Reference Weale2010) states that

“The pre-1932 stock, 5 per cent war loan was repayable at three months’ notice between 1929 and 1947. In late 1931 market interest rates had fallen, so that it was in the taxpayers’ interest for the government to redeem the debt and to issue new stock at a lower interest rate. This became ![]() per cent war loan repayable in 1952 or afterwards. This was in no sense a default or a unilateral rescheduling but was entirely in accordance with the prospectus of the 5 per cent stock, as the chancellor of the time explained to the House of Commons.”

per cent war loan repayable in 1952 or afterwards. This was in no sense a default or a unilateral rescheduling but was entirely in accordance with the prospectus of the 5 per cent stock, as the chancellor of the time explained to the House of Commons.”

For those countries which have control of their own money supply, there is a factor reducing the likelihood of default of government bonds. Such countries can always print money to meet nominal liabilities expressed in their own currency instead of triggering a default.

For Eurozone countries, the position is not so clear cut. The absence of full control of monetary policy could cause a country to be forced to abandon the single currency. Indeed, spreads on some Eurozone government bonds indicate that the market is pricing in this possible event. However, as abandonment of the Euro by a country was never envisaged, there are no rules as to what would happen in these circumstances.

More generally, in the context of valuing an insurance liability that is also not 100%-credit-risk-free, both government bond markets (where countries have control of their own money supply) and swap markets are in my view generally sufficiently credible as the basis for the reference rate, in currencies where both calibration instruments are deep and liquid and form a good match for the liabilities. This relies on the assumption that the credit risk within insurance liabilities is at least as great as the higher yielding of government bonds and swaps. The concept of own credit risk in an insurance liability valuation is discussed further in Section 11.

9.2.2 The ‘minimum cost’ valuation premise

The ‘minimum cost’ valuation premise is one where alternative calibration assets that provide a good match to the insurance liabilities are identified, and the calibration assets chosen are those which result in the more favourable result (i.e. lowest liability value or highest MCEV). It is discussed further in Byrne & Dullaway (Reference Byrne and Dullaway2009), Dullaway (Reference Dullaway2009) and Foroughi et al. (Reference Foroughi, Alargé Salvans, Bause, Cartier, Creedon, Gose, Hugmark, Harewood, Kapel, Lebel, Milton, Mirani and Whitlock2009a).

A criterion to apply this premise (related to the recommendations set out in section 7) is to restrict the calibration assets to those which represent viable ALM strategies to match the liabilities and where the insurer is able to implement these strategies at short notice.

This principle is much harder to apply to option cash flows (where typically only one credible calibration asset exists) than non-option cash flows.

In currencies where both government bond and swap asset classes are deep and liquid and form a good match for the liabilities, I recommend the application of the ‘minimum cost’ valuation premise to permit insurance companies to choose the calibration asset(s) leading to the more favourable result.

The ‘minimum cost’ valuation premise is not restricted to just government bonds or swaps. Other asset classes or combinations of asset classes may exist to match the insurance liabilities, although any increased complexity in construction may require more restrictions in their use, in particular regarding achievability and being a good match for the liabilities. I discuss one such approach in depth in Section 10below, in the context of calibrating the liquidity premium.

Advantages of applying the ‘minimum cost’ valuation premise over not applying it include the following:

– markets are not perfectly efficient hence similar matching portfolios may at times have different prices and the relationships of these prices may quickly fluctuate. Such inefficiencies have become particularly noticeable since the onset of the recent financial crisis.

– this approach enables insurance companies to reassess their investment strategies in the light of the market dislocation and encourages insurers to take advantage of any arbitrage opportunities that may exist in inefficient markets.

– this valuation premise is similar to the ‘highest-and-best-use’ asset valuation premise described in IASB (2009a), ensuring consistency between asset and liability valuations.

– this reduces the risk of any one calibration instrument being subject to high demand simply because of the market-consistent calibration. In most markets insurance companies are a large proportion of the overall purchasers of assets and calibration to only one instrument may lead to its yield reducing much more than if alternative low risk calibration instruments were available and encouraged by the valuation framework.

– this reduces the significance of extrapolation. In many currencies one of the government bond or swap asset classes is readily available at much longer durations than the other. The durations for which there is a reliable market price of a reference rate calibration asset is therefore increased.

I note that this recommendation is not without potential disadvantages, in particular:

– different reference rates can arise for the valuation of different blocks of business or different companies. Certain assets may need to be held by the insurer to classify as “achievable”, particularly at times of financial crisis.

– different calibration instruments can apply over different durations at one valuation date.

– different calibration instruments can apply at different valuation dates.

In mitigation, I believe that this reflects different prices available to insurers (both across the industry and over time) when implementing possible low risk ALM strategies. This highlights the judgement required in calibrating an appropriate reference rate.

9.3 Comparison of recent government bond and swap yield curves

When assessing the ‘minimum cost’ valuation premise, it is useful to note that the relationship between government bond and swap yields can vary quickly over time. Figure 1 compares government bond, swap and AA corporate debt spot yields, within the UK at year-end 2006, year-end 2007, year-end 2008 and year-end 2009.

Some observations from Figure 1:

– AA corporate bond yields widened significantly compared to both gilts and swaps from year-end 2006 to year-end 2007 and from year-end 2007 to year-end 2008. Although AA corporate bond spreads have narrowed during 2009, this may in part be due to downgrades within the corporate bond sector.

– Swap spreads (over UK government bonds or gilts) were around 20–40bp at most durations at 31 December 2006.

– At 31 December 2007, swap spreads had widened to 80-100bp at durations 1 and 2 and 30–60bp at most other durations.

– At 31 December 2008, the feature of negative swap spreads was apparent, with a crossover between 10 and 11 years. At most long durations swap spreads were lower than gilts by around 30–70 bp.

– At 31 December 2009 the crossover point had shortened to between 8 and 9 years. However negative swap spreads reduced compared to 31 December 2008. At most long durations swap rates were lower than gilts by around 10–30bp.

There are a number of possible explanations for the recent development of negative swap spreads at medium to long durations:

– swap contracts offer a rolling credit check on the security of the counterparty, a feature not found within government bond contracts.

– government bonds require purchase with 100% cash, whereas swap contracts can be purchased with margin and hence there is a much smaller initial cash outlay. Swaps may therefore be more attractive at medium to long durations.

– the supply of government bonds has increased since the onset of the recent financial crisis in many markets, and this is expected to continue for several years; although in certain markets this may be offset by quantitative easing policies.

– arbitrageurs are less active than in the period prior to the recent financial crisis, and hence are less likely to interact between the government bond and swap markets to take advantage of negative swap spreads.

In my opinion these reasons add to the advantages of applying the ‘minimum cost’ valuation premise set out in Section 9.2.2.

10. The liquidity premium within MCV

10.1 Introduction

Section 9 describes how up to year-end 2007 market practice within MCVs was not to adjust the reference rate for a liquidity premium, but that this practice changed by year-end 2008 (see Table 4) as a result of the financial crisis. The allowance for a liquidity premium can be considered an offset against the increase in corporate bond spreads observed during 2008, shown in Figure 1. This section considers the liquidity premium within an MCV.

Recently consensus has been building (post-financial crisis) that some form of a liquidity premium should be allowed for within an MCV. For examples, see Buck & Bochanski (Reference Buck and Bochanski2009), Byrne & Dullaway (Reference Byrne and Dullaway2009), CEIOPS (2010), Dullaway (Reference Dullaway2009), European Commission (2010), Foroughi et al. (Reference Foroughi, Alargé Salvans, Bause, Cartier, Creedon, Gose, Hugmark, Harewood, Kapel, Lebel, Milton, Mirani and Whitlock2009a, Reference Foroughi, Alargé Salvans, Bause, Cartier, Creedon, Gose, Hugmark, Harewood, Kapel, Lebel, Milton, Mirani and Whitlockb), Foroughi et al. (Reference Foroughi, Alargé Salvans, Bause, Cartier, Creedon, Gose, Hugmark, Harewood, Kapel, Lebel, Milton, Mirani and Whitlock2009b), IASB (2010) and Pritchard & Turnbull (Reference Pritchard and Turnbull2009). The debate is now shifting to what restrictions should be placed on its use within an MCV.

Interestingly, the debate around restrictions in applying a liquidity premium to an MCV has always been present, for example, Dullaway & Foroughi (Reference Dullaway and Foroughi2002, Foroughi et al. (Reference Foroughi, Jones and Dardis2003) and O'Keeffe et al. (Reference O’ Keeffe, Desai, Foroughi, Hibbett, Maxwell, Sharp, Taverner, Ward and Willis2005), all note the following in a pre-financial crisis environment:

(1) “ Very few, if any, liability cash flows are so certain that they could be matched by a perfectly illiquid asset. As a result, insurers would still be required to account for some liquidity in the matching asset.

(2) Insurers make up a significant component of the holders of corporate bonds, so market yields may already reflect their own assessment of the cost of risks of corporate bonds.”

10.2 Liquidity premium developments within Solvency II and Phase II

There have been two significant liquidity premium developments within Solvency II during 2010, set out below.

10.2.1 March 2010 CIEOPS-led Illiquidity Premium Taskforce report

On 17 November 2009, CEIOPS was asked by the European Commission to set up a task force to develop technical solutions to the illiquidity premium, as well as the potential use of swaps as the base risk free rate, and the method for the extrapolation of the yield curve at long durations. In addition to CEIOPS members, the task force included representatives from the Groupe Consultatif, CFO Forum, CRO Forum, CEA, AMICE and the European Commission.

On 3 March 2010, the CEIOPS-led task force published its report concentrating on the potential use of an illiquidity premium in Solvency II, and also covering the choice of risk-free rate and extrapolation. This was accompanied by a cover letter from CEIOPS to the European Commission.

The aspects of the report concentrating on the illiquidity premium are summarised in Towers Watson (2010) as follows:

“The report recommends the following, if an illiquidity premium is to be used:

The report recognises the possibility that in future some illiquidity premium adjustment may be made to the Solvency II valuation of assets, reflecting possible FASB/IASB fair value accounting developments. The phrase “consistent with solvency valuation methods” in principle 6 avoids the risk of double counting.

10.2.2 European Commission (2010) QIS5 specification

The QIS5 specification published in July 2010 allows a liquidity premium with certain conditions. The full liquidity premium is defined for each standard currency at 31 December 2009 using the methodology described in the CRO Forum/CFO Forum calibration paper on the risk free interest rates, which was based on long term illiquid financial assets maturing in that currency.

The QIS5 specification (when published in draft form in April 2010) was accompanied by a CFO Forum/CRO Forum calibration paper entitled “QIS5 Technical Specification Risk-free interest rates”. That paper sets out the following formula, which was originally set out in the task force report, to calculate the liquidity premium for major currencies:

The “Spread” used above is based on corporate bond indices relative to swaps.

For non-standard currencies, no liquidity premium can be used if it is not possible to follow the CRO Forum/ CFO Forum methodology in a robust manner (e.g. due to the lack of appropriate or adequate long-termed illiquid assets, or lack of reliable prices or data, or the principles aforementioned on the illiquidity premium are not met).

QIS5 requires a proportion of this full liquidity premium to be added as an adjustment to the reference rate depending on the nature of the liabilities, following Principle 4 of CEIOPS (2010). The proportion does not depend on the assets held, following Principle 2 of CEIOPS (2010).