1. Introduction

The Dutch and the Danish pension systems are frequently referred to as “the best in the world” (Mercer, 2018). This is due to both the size of pension savings in Denmark and The Netherlands, corporate governance of pension providers, robustness of pension systems, etc. Measured in relation to gross domestic product (GDP), the private pension savings in The Netherlands and Denmark are the largest in the world. In spite of large pension savings, the Danish and the Dutch pension systems also face challenges. These challenges are not least due to the current low-interest-rate environment coupled with increasing life expectancy which makes it challenging for pension providers to honour promised (or guaranteed) pensions. As a consequence, the Dutch and Danish pension sectors have undergone and are undergoing considerable changes.

In The Netherlands, most private pensions are defined benefits (DB).Footnote 1 Although the percentage of pure defined contributions (DC) plans in The Netherlands is low, DC-plan design is highly discussed in The Netherlands as part of the discussions of larger pension-system reforms.Footnote 2 We focus on the law implemented in 2016 that allows for risk-taking in DC plans by investing in risky assets as opposed to only risk-free exposures. Therefore, risk exposure is now possible not only during the accumulation phase but also during the decumulation phase, in the hope of harvesting risk premiums. These are so-called variable, i.e., risky annuities. Previously, pension wealth at retirement had to be converted into a fixed annuity that would no longer be exposed to the risky financial market. In Denmark, in contrast to The Netherlands, most private pensions are DC. Typically, in Denmark, pensions savings were historically in guaranteed products, i.e., the capital in the DC account, both in the accumulation and decumulation phases, was guaranteed to increase by a certain minimum return.Footnote 3 In Denmark, pension holders have shifted from guaranteed pension savings to non-guaranteed savings during the mid-2000s. The main driving forces behind the shift have been the increased capital requirements from Solvency II, unexpected increases in life expectancy, as well as the fundamental idea that allowing for more risk will increase expected returns, too.

When interest rates are low, pension guarantees cause pension providers to invest in safe assets mainly, in order to fulfil guarantees in DC schemes and honour promised benefits in DB schemes. Safe investments secure that pension payments will be known, but also that returns to investment will be low, causing pensions to be low too. In non-guaranteed pension schemes and variable annuities, pension providers can invest more in risky assets, harvesting the risk premium on risky assets, and generate higher expected returns as a result. The cost, of course, is that pensions become more risky.

These developments imply that pension holders are allowed to shift from relatively safe products to risky products, or, at least, move to a situation in which the risks are made explicit, both in the sense of who bears the risks (employees versus employers) as well as the increased potential for extra returns. The recent changes in both countries and the potential of larger reforms call for a comparison of the systems. Perhaps The Netherlands can benefit from some of the learnings of the Danish transition? On the other hand, in The Netherlands, pension projections have been surrounded by confidence bounds, something that pension projections have not been in Denmark. Perhaps Denmark can learn something from The Netherlands here? The scope of this paper is to compare pension systems and products in Denmark and The Netherlands, focusing on the shifts from safe products to more risky products that took place in both countries. The insights on how to structure risk-taking or guarantees in the decumulation phase of DC plans, which are summarised in this paper, are likely to be relevant for the currently discussed Dutch pension reform. Given the well-developed nature of the pension systems in Denmark and The Netherlands, these learnings should also be relevant for other countries considering how to design their pension systems.

In order to understand the situation of both an individual (who has to decide which pension product to acquire with his pension wealth) and the regulatory viewpoint on how the pension system transition took and takes place, we describe the general pension sectors and the design of the products in The Netherlands and Denmark first. We find that on the macro dimensions, the Dutch and the Danish pension systems share many similarities. For instance, the pension sectors are large in international comparisons, both countries face increasing life expectancy, and old-age dependency ratios are expected to increase in both countries.

The main part of this paper focuses on pension products. Here, there are some important differences between Denmark and The Netherlands. As mentioned, the most important difference between the Dutch and the Danish pension sector is the widespread use of DB plans in The Netherlands and the almost non-existence of DB plans in Denmark.Footnote 4 Another interesting dimension is that it seems that different dimensions of pension savings are discussed in Denmark and The Netherlands. In The Netherlands, the 2016 law focuses on risks in the decumulation phase in DC plans, though the ongoing discussion implies a total reform that yields a shift from “DB” to DC. In the Danish case, the discussion focuses on risks in the accumulation phase, i.e., in Denmark there was and will continue to be a DC framework, but the return guarantees are altered. In DB plans, the issue is how the benefits are formed, and thus the uncertainty surrounding these. In DC plans, the issue is regarding the return the contributions can generate.

We note that when this paper discusses “risky pension products”, it is implicitly understood as referring to risks for the customer. A shift from a guaranteed pension product to a non-guaranteed product typically lowers the risk of insolvency of the pension provider, but then as a consequence increases the risk for the customer with respect to returns to pension savings. It is the latter effect we refer to when discussing “increases in risk”.

In this paper, we compare the changes in Denmark and The Netherlands in more detail and we draw some lessons regarding communication about risks and returns, rules and regulations, and supervision. We organise the paper as follows. In section 3, we describe the pillars of the Dutch and the Danish pension systems. In section 4, we discuss and describe the introduction of variable annuities in The Netherlands. This is followed in section 5 by a description of the transition from guaranteed to non-guaranteed pensions in Denmark. In section 6, we discuss the learnings, and the final section concludes.

2. International Movement to Variable Annuities

Transitions similar to those in Denmark and The Netherlands, from guarantees or fixed annuities to non-guarantees in the form of variable annuities, are taking place in a number of countries. The global trend of low-interest rates and low mortality rates has put many large pension systems under pressure and caused discussions and reforms. Variable annuities, i.e., non-guaranteed unit-linked products, and DC-style plans seem to be popular tendencies following the recent global financial crisis.

In Belgium, the average guaranteed rate of 3.5% has been transformed into variable rates that are tied to current yields in order to increase the sustainability of the Belgium pension system (Devolder and de Valeriola, Reference Devolder and de Valeriola2017). In Switzerland, interest rate guarantees date back to 1985; however, the minimum return guaranteed has decreased from 4% to 1.25% during the last decades. In Latin America (Pennacchi, Reference Pennacchi1999), relative rate of return guarantees has become standard products since the major transform from a DB to a DC system in the late 1980s. Garcia Huitron and Rodriguez-Montemayor (Reference Garcia Huitron and Rodriguez-Montemayor2017) discuss the debate for a reform of the current DC setting to more target-based investments. Variable annuities are rarely available (yet) in Latin America, though in Chile variable annuities in combination with a minimum pension guarantee have been allowed since 2004 (Rocha et al., Reference Rocha, Vittas and Rudolph2011). Japan followed the evolution of the US concerning the different guarantees embedded in the variable annuity from the financial deregulation in 1999 onwards (Zhang, Reference Zhang2006). Also in China, variable annuities regained interest after 2008. This caused the Chinese policymakers to proceed the development of regulations on these products. See Matterson (2017) for more information on retirement in the Asian market. In the US, fund-linked annuities were introduced in the 1970s, and in the 1990s, a wide variety of guarantees were added to these variable annuities. The recent financial crisis caused solvency issues for some of the providers (Forsyth and Vetzal, Reference Forsyth and Vetzal2014). In combination with inefficient hedging strategies, these losses were largely due to the high option values. Japan, Canada, and The Netherlands only have 4.2%, 4.6%, and 5.8%, respectively, in DC assets in 2016 (see Global Pension Assets Study 2017, Willis Towers Watson). In Canada, regulations on annuities within DB plans or regulations on the conversion to a larger reform are currently being developed (Warshawsky, Reference Warshawsky2013). In Sweden, DC plans have covered the vast majority of the pension schemes since 2007 (after 12 years of negotiation), similar to the current situation in Denmark. At retirement, pension holders have the choice whether they convert the pension into a fixed annuity to avoid investment risk or a variable annuity. The variable annuity reflects the same mechanism as the Dutch product described in this paper, implying that the customer can opt for the annuity in which the fund continues risky investments. These annuities do not have a guaranteed value (OECD, 2015). Variable annuities were introduced in the UK in 2006, including additional minimum growth rate guarantees on the payout (Rivera-Rozo, Reference Rivera-Rozo2009). The recent crisis set providers under pressure due to these additional guarantees.

3. Pension Savings and Pension Systems in The Netherlands and Denmark

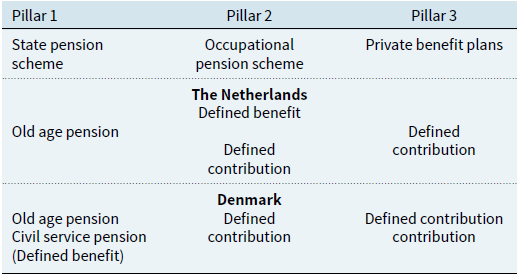

Bovenberg (Reference Bovenberg2012) compares the general Dutch and the Danish pension system. Our focus is more specific on the move from fixed, guaranteed products to risky, unguaranteed products in The Netherland and Denmark. Thus, as an introduction, we give a brief overview. The pension system in The Netherlands and Denmark consists of three pillars, see Table 1. The first pillar accounts for 54% of the Dutch pension entitlements, the second pillar consists of 40%, and the third pillar consists of 6% at the end of 2013 (Bruil et al., Reference Bruil, Schmitz, Gebraad and Bhageloe-Datadin2015).

Table 1. Overview of pillars in the Dutch and Danish pension systems.

The first pillar provides pension irrespective of the labour history. The full right to state pension is conditioned on the requirement that the individual has lived or worked for at least 50 years in The Netherlands. In Denmark, the full right to state pension is obtained after 40 years of residence. This “full right” in Denmark is the right to a basic amount plus a mean tested supplement. The Dutch old age pension (OAP) is not mean tested and is based on the PAYGO system. In The Netherlands as well as in Denmark, state pension contributions depend on income levels through tax payments, but these contributions are not added to an individual account.Footnote 5

The second pillar consists of labour-related pension plans. It is funded by both the employees and employers. About one-third is paid by the employee and two-thirds by the employer in both The Netherlands and Denmark. In The Netherlands, the pension premium with respect to the second pillar is about 20% of the gross pensionable income minus the state pension offset, implying a contribution of about 10% of gross income. In Denmark, the premium depends on whether you are publically or privately employed, though the contribution rate is generally higher for publically employed (18% versus 12%). Privately employed individuals started contributing later than publically employed in Denmark. The pension premium is not allowed to depend on age or sex in neither Denmark nor The Netherlands. This is known as a uniform contribution system.

Pension premiums are tax deductible, and no tax has to be paid on the pension wealth. However, pension payments are taxed. Moreover, the government/labour market partners facilitate a large second pillar by mandatory agreements for many industries. Therefore, the participation level is very high. More than 90% of the employees are affiliated with a pension fund in both countries.

The third pillar consists of voluntary individual pension plans. These are fiscally attractive relative to saving products which are not retirement related. To be fiscally attractive, pensions have to be lifelong in The NetherlandsFootnote 6, whereas in Denmark one can decide to take out a part of pension savings as a lump sum and use the remaining to finance a lifelong annuity.

3.1. Defined benefits and defined contributions

One motivation for this paper is the introduction of The Improved Defined Contribution Scheme Act in The Netherlands. This applies to the DC plans in the second and third pillar. In The Netherlands, 5.8% of the entitlements were in the form of DC, while 94.2% were in the form of DB in 2016, see Global Pension Assets Study 2017 (Willis Towers Watson). Hence, the new law only applies directly to a small fraction of the pension plans. However, there is a transition going on towards more DC plans in The Netherlands. In addition, relaxation of guarantees is currently discussed for the DB plans as part of a reform of the pension system. The other motivation for this paper is the recent developments from guarantees to non-guarantees Denmark went through.

3.2. Defined benefits

In its abstract definition, a DB plan defines the benefits to be received. In The Netherlands, upfront the future pension payments were promised (conditionally on the life expectancies and financial situation of the pension fund), and contributions have been defined too, resulting in a combination of DB and DC characteristics. Nevertheless, it is categorised under the label of “DB” officially. In 2008, 88% of the active employees had a “Dutch DB” plan, and 5% had a DC plan. The remaining 7% consist of a mixture of the regulations and plans (Statistics Netherlands). Note that DB contracts in The Netherlands are de facto collective defined contribution (CDC) contracts. If a pension fund lacks capital (i.e. the asset value of the fund cannot meet the liabilities), then, in a strict DB plan, it is the employers who bear the risk, i.e., have to provide funding for the DB plans. However, the premiums in The Netherlands stay mainly constant in such a situation, and the pension payments and entitlements are reduced according to a supervised recovery plan. This means that the risk is carried by the employees. The CDC plan thus combines the (conditional) guarantee of the pension payments with fixed premium payments. This means that it shares characteristics with both the DB and DC plans. If the premium turns out not to be sufficient, then the future pension rights linked to the premium will be decreased. Therefore, a pure DB plan does not describe the current Dutch system accurately, though the design and non-existence of hard guarantees only came to the surface when several pension funds had to cut the benefits in April 2013 (Bovenberg et al. (Reference Bovenberg, Mehlkopf and Nijman2015). The benefits are indexed or cut based on the funding ratio of the pension fund. It is the funding ratio that is influenced by changes in life expectancies and interest rates. Defined benefit (DB) schemes only contribute to about 5% of the Danish pension products.Footnote 7

3.3. Defined contributions

A defined contribution plan specifies how much money will go into a retirement plan today. The amount is typically defined as a percentage of an employee’s salary. The level to which the pension wealth has accrued at retirement depends on the premium payment of the employee and employer and the returns of the investment plan. At retirement, the wealth can either be allocated to a fixed annuity with guarantees or a variable annuity without guarantees.

In Denmark, pillar two consists completely of DC schemes. At retirement, one can decide to take out a part of pension savings as a lump sum and use the remaining to finance a lifelong annuity, whereas partial lump sums are not allowed without a heavy tax levy in The Netherlands. The DC products in Denmark have traditionally included an interest guarantee. These guarantees have gradually been decreased for new entrants due to the low interest rates. This development serves as a motivation for investigating the transition from guarantees to non-guarantees.

At retirement age, the accumulated pension wealth has to be converted into an annuity. Therefore, there is conversion risk, meaning that if interest rates are low at conversion, an annuity is relatively expensive. Thus, with a given pension wealth, the annual pension payments will be lower than when interest rates are high at conversion. This is independent of whether one buys a fixed or variable annuity.Footnote 8 In The Netherlands, the AFM protects pension holders against conversion risk by imposing interest rate hedges.Footnote 9 If one holds bonds with long maturities, these bonds will have a high value when interest rates are low and thus compensate the loss on the annuity and vice versa. Conversion risk is also present in Denmark. Since the pension providers decide on the exact investment strategies, they are responsible for taking care of conversion risk. It is not clear whether customers are made sufficiently aware of this mechanism.

In Denmark, no big distinctions are made between pension funds and insurance companies as the majority of pension funds also provide life insurance to the pension holders. In The Netherlands, on the other hand, there is a distinction. In particular, since this paper discusses transitions within DC products, we focus on insurance companies as they are the main DC plans providers. The difference is that when a pension fund cannot fulfill its obligations, the employer and employees bear the loss by a recovery plan. In an insurance company, equity holders are also present, and they would have to pay extra since there are no recovery plans for insurance companies. However, equity holders have limited liability, and thus insurance companies are regulated to hold large capital buffers. Pension funds need to measure their funding ratio. The funding ratio determines the indexation level or decrease in pension payments in case of too low ratios. For lateral pension funds in Denmark, the pension holder is also the equity holder and thus shares the insurance characteristics more closely. For company pension funds, the company is legally liable, but these funds are practically not existing in the Danish system. More details and statistics on the macroeconomic dimensions of Dutch and Danish pension systems are provided as additional background information in the Appendix.

4. Variable Annuities in The Netherlands

Since the recent financial crisis, the funding ratios of several Dutch pension funds dropped below 100% due to the low interest rates and the increasing life expectancies. The combined effect of these phenomena is that pension payments cannot keep up with inflation. Moreover, regulation enforces pension funds in a DB scheme that are underfunded for several years to present a recovery plan. Such a plan can entail a cut in pension payments. These developments among many others have triggered a debate about the need for a renewal of the pension system in The Netherlands. The recent agreed pension deal (June 2019) proposes to convert the CDC plan in (deferred) variable annuities with risk sharing and mandatory participation. We, however, concentrate on the individual DC-plan contracts defined by the law that allows for variable annuities and compare this with the change in Danish DC contracts.

A new law for DC schemes has been in place since September 1, 2016, giving the possibility to turn accrued premiums into a variable annuity instead of a fixed annuity. The law Improved Defined Contribution Scheme Act (“Wet Verbeterde Premieregeling” in Dutch, abbreviated as WVP) serves as a pioneer in the movement towards a more flexible pension system. In Balter and Werker (Reference Balter and Werker2019), the technical impact of the assumed interest rate and of smoothing financial shocks on the expected pension payments is analysed. The remainder of the paper focusses on the DC plans.

4.1. Variable annuities

The WVP enables pensioners, who accrued their premium in the second and third pillar, to invest their pension wealth into a variable annuity. This gives them the option to keep investing in risky assets after retirement. Before the introduction of the WVP, it was compulsory to convert the pension wealth into a fixed annuity whenever the pensioner wanted to benefit from tax deductibility. The new option leads to uncertain pension payments. This explains the name variable annuity. Another choice pension providers now have is that they can choose the assumed interest rates (AIR).Footnote 10 The AIR determines how the total pension wealth is allocated across the future pension payments. Thus, it divides the “pot” of money over the remaining lifetime of the retiree. This implies that pension providers can, for instance, offer an initial low expected pension in return for higher payments at older ages.

If financial shocks are immediately absorbed, pension payments become volatile. This is undesirable since individuals prefer to smooth changes to keep a stable standard of living. Therefore, institutions can smooth shocks over several years. To ensure that the variable payments do not decrease too much, it is also possible to adjust the AIR such that it generates constant expected pension payments. In this case, the AIR becomes horizon dependent. Especially in collective systems, smoothing financial shocks can cause redistributions between generations. This raises issues of fairness. We do not discuss such issues here (see Bonekamp et al. Reference Bonekamp, Bovenberg, Nijman and Werker2016 for a discussion).

Other factors, such as how pension funds and insurance companies deal with sharing longevity risk and smoothing financial shocks, are under regulation by the Dutch Central Bank. The Authorities for Financial Markets focusses on communication. Pension product providers are obligated to share micro longevity risk of the individuals. Macro longevity risk can be transferred from the provider to the pension holder when the fixed annuity is changed into a variable annuity. Until the change in the law, a fixed annuity was the only product that a retiree with a DC capital could purchase. Since the fixed annuity does not contain risk, the pension payments are known from the moment of retirement onwards and thus the macro longevity risk is at the account of the provider.

4.1.1. Illustrating pension accumulation in The Netherlands

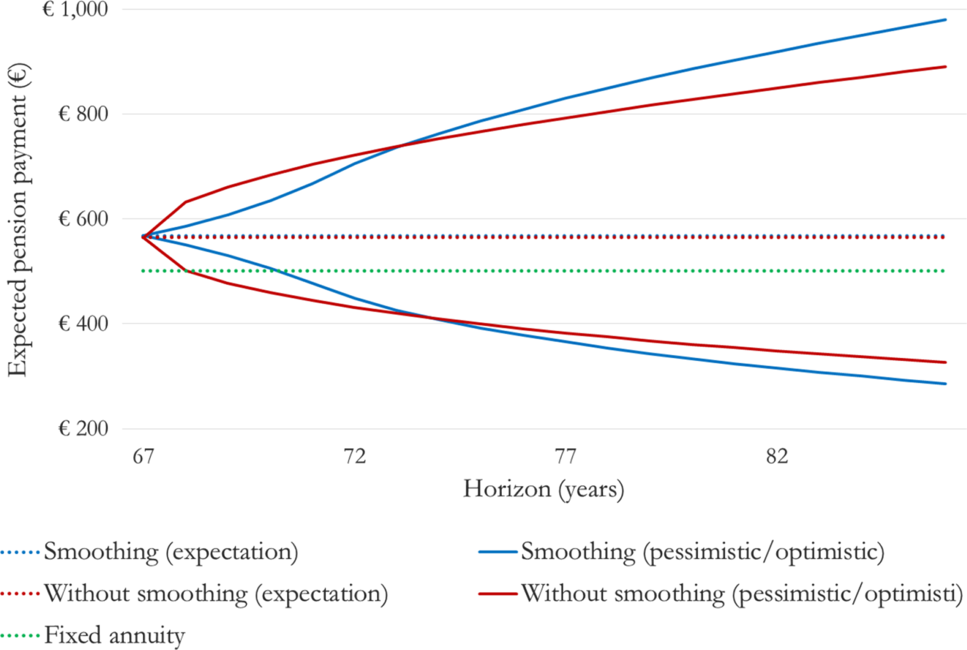

In Figure 1, the expected pension payments for an individual who currently attains the pension age of 67 is depicted. The calculations underlying the figure are based on the Black-Scholes/Merton model and described in Balter and Werker (Reference Balter and Werker2019).

The green dotted line in Figure 1 shows the pension holders monthly pension payment if he chooses a fixed annuity. His accumulated pension wealth has attained a certain value, with which he has to buy a lifelong annuity. Since he buys a fixed annuity, he attains the risk-free rate, and his future payments are known ahead. Note that, for simplicity, a fixed horizon is used. However, macro longevity risk is borne by the provider and thus will not change the level of fixed payments. Until September 2016, this was the only product available for pensioners within a DC scheme in The Netherlands.

Now it is allowed to include risky investment in the decumulation phase, i.e., individuals can choose between fixed and variable annuities. By investing part of the accumulated pension wealth in risky assets, returns become uncertain and so do pensions as a consequence. Note that macro longevity risk can now also cause fluctuations in pensions since providers are allowed to pass on investment risk and/or macro longevity risk. Based on a risk-return trade-off argument, the potential gain of the risky investment is the risk premium, and, therefore, the expected pension payments are higher than the fixed payments that do not include a premium on top of the risk-free rate. This is shown by the red dotted line. The red solid lines show the 95% confidence interval reflecting the extra risk entailed by the risky investments.

It is also possible to smooth financial shocks, as described earlier. This option ceteris paribus will lead to lower risk in the near future at the cost of extra uncertainty later. This is depicted in Figure 1 by the blue lines.Footnote 11 Less overall risk could compensate this at the cost of lower expected returns.

All expected payments are constant in Figure 1. The AIR, which is the parameter that distributes the proportion of total wealth, determines the shape of the expectation. WVP legislation specifies the following rules; the maximum allowance on the assumed interest rate equals the proportion of wealth that is invested in risky assets multiplied by the risk premium, with a maximum of 35% of the risk premium. This rule ensures non-decreasing expected nominal pension payments. In the next subsection, we discuss the products that recently entered the market in response to the new law.

4.2. Regulation and products

Optionality in product choice and design increases the complexity for the participants. Variable annuities increase the nominal risk but potentially increase the expected return as well. Both the pension providers and the participants have several choice variables, which are summarised below:

Pension providers can choose the number of options given to the participants. Overall, regulation states that the investment mix should fit the risk profile of the participant. It is also stated by the Dutch law that micro longevity risk is shared among pools of participants and thus carried by the provider. Variable annuities potentially move the macro longevity risk from the provider to the participant, increasing uncertainty about pensions. The provider can choose whether he or the participant bears the macro risk.

Hybrid structures are combinations of fixed and variable annuities, providing a lower bound that reflects a minimum pension contrary to the theoretical possibility of receiving no pension due to continuous rebalancing. Some providers facilitate these combinations, or make it possible to invest part of the pension wealth in the variable annuity product and the remainder in the fixed annuity.

The question of which product the participant wants to buy at retirement is asked before as well as at retirement. The choice made at retirement is definite. Before retirement, the option to change from a fixed to a variable annuity has to take place at the point when the life cycle investment strategy that leads towards a smooth transition of a fixed annuity differs from the strategy that moves towards a variable annuity. The risk exposure depends on age, thus if a retiree chooses a fixed annuity, the exposure at retirement is zero, and a gradual decline in exposure deviates from a gradual convergence to the exposure that is inherent to the variable contract.

The pension provider has the option to include a partner pension in the variable annuity product. Subsequently, the pension holder can choose this or not. In case an individual dies and opted for this, the partner receives variable or fixed payments depending on the agreement, though lowered by a pre-specified factor.

Participants are thus given the opportunity to choose whether they want known payments from their retirement age onwards or whether they want to make use of the risk-return trade-off. Since the option is given before retirement, pension holders have several stages at which they can decide. The investment mix in the accumulation phase will be adapted to the desired investment mix in the decumulation phase, though. Therefore, a smooth transition is more likely when the decision is consistent.

Moreover, participants have a shopping right, meaning that if their current pension fund does not give both options then they might switch to another provider, while one can always switch among insurance companies.

5. Pension Guarantees and Non-Guarantees in Denmark

5.1. Annuity pension in Denmark

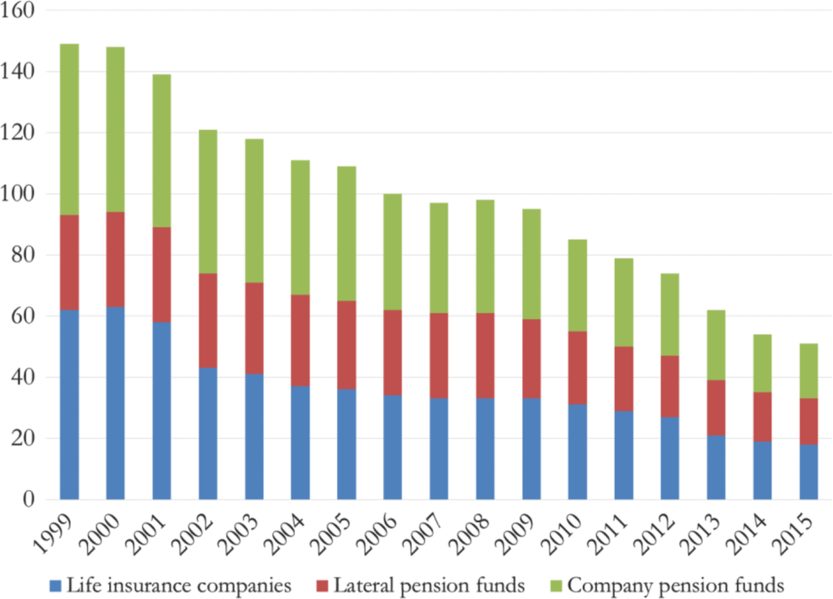

Labour market pension schemes in Denmark are composed of different elements in relation to type of product, premiums, fees, asset allocation, pension benefits, and insurance cover, and thus the composition varies across pension funds. Besides Life Insurance companies, there are two types of pension funds with very similar legislation, company pension funds, and lateral pension funds. The development in the number of Danish pension funds is shown in Figure 2.Footnote 12 Lateral pension funds are organised on the basis of sectors/type of labour and are non-profit organisations owned by both the employer organisations and the unions. This means that in reality every decision including decisions on investment is the result of a collaborative process. The funds manage contributions, investments, and out-payments. The activities of the funds are regulated by law. Pension assets may be used to cover actual pensions or insurance products linked to the pension scheme (disability pensions, spouse/children pensions).

In general, pension products can be divided into three general categories with different pay-out patterns, see Danish FSA (2017):

1. Annuities (57%): Lifelong pension payments.

2. Fixed Period Annuities (28%): Payments in at least 10 years up to 25–30 years depending on the contract. Pension payments will continue to the relatives if the insured person dies.

3. Age Pension (15%): Paid as a lump sum or in multiple instalments.

Most lifelong annuities have a variable element in them, which is explained in greater detail in section 5.2. The last two schemes can be categorised as saving based, while the annuity scheme is insurance based, where the longevity risk until recently for the majority of the contracts was shared between the members. In all three schemes, contributions plus the market return on their investments determine the pension benefits the individual is entitled to at retirement. Thus, any interruptions of the work career due to maternity leave, sickness, and unemployment as well as wage variations will be reflected in the pension payments. Finally, payments are tax deductible when made and taxed as income when they are paid out again which is similar to the Dutch system.

The focus of this paper is on lifelong annuity schemes; however, within this category, different pension saving products exist. Overall, the distinction is made between traditional participating contracts, so-called with-profits, and unit-linked contracts. A number of contracts which can be seen as a mix or extended version of the two also exist, where “Time pension”, a smoothed investment-linked annuity scheme, is the most popular. “Time pension” combines the principle of individuality and transparency regarding market returns from the unit-linked products with the smoothing of returns from the traditional with-profit products, see Jørgensen and Linnemann (Reference Jørgensen and Linnemann2012) and Jakobsen (Reference Jakobsen2003). The majority of arrangements are set up as with-profit deferred annuity contracts; however, unit-linked products have become a growing part of the total market. Figure 3 shows the share of unit-linked insurance premiums as a fraction of total gross premiums in Denmark.

Figure 3. The share of unit-linked insurance premiums as a fraction of total gross premiums in Denmark.

The majority of products have historically included a guaranteed annual return based on a minimum guaranteed interest rate. In pension schemes established before January 1996, the interest rate was usually between 3.7% and 4.5%, and for schemes established between 1997 and July 2005, the interest rates were between 2% and 3%. Hereafter, the guaranteed interest level has been between 1.25% and 0.00%. The guaranteed average interest products have ensured the pension holder a minimum annual return throughout the life of the contract, thus both in the accumulation and the decumulation phases. This nominal guarantee was issued at the start of the contract. For instance, within the unit-linked framework, the guarantee can be viewed as a simple European put option. If the fund value at maturity (retirement) is less than the guaranteed payoff, then the put option is “in the money”, seen from the point of view of the pension holder. Thus, if disappointing returns in the accumulation phase imply that the retirement account delivers less than the guaranteed level at retirement, then the pension fund is obligated to pay out the guaranteed amount. Bruhn and Steffensen (Reference Bruhn and Steffensen2013) derive preferences for which the Danish interest rate guarantee is the optimal product design.

The potential unsustainability of these products in the long run helped trigger the Danish transition to non-guarantees. There has been a debate whether the annual guarantee should be understood as a minimum return every single year or as an average annual return during the accumulation phase. A court ruling from the Supreme Court of Denmark in 2016 has made clear that these are guaranteed average annual minimum returns. In recent years, contracts have been issued with conditional guarantees indicating that the pension fund will only be unable to honour the guarantee if certain events occur, e.g., if unexpected increases in life expectancy are observed.

For unit-linked contracts, the amount of pension savings is directly linked to the market value of the units that the individual’s portfolio is invested in. Pension holders can freely choose between units and can thus influence the riskiness of the investment profile. However, the interest rate guarantees imply incentives to increase riskiness of investments. Pension funds have imposed restrictions on investment rules for unit-linked contracts with guarantees in terms of the mix of financial assets and type of investment funds.

The traditional participating contracts with-profits are slightly more complicated and opaque as the typical profit sharing contract can be decomposed into a risk-free bond element, a bonus option, and a surrender option, see Grossen and Jørgensen (2000, 2002). The majority of the contracts are issued without an option for the pension holder to sell back the policy at face value before maturity: Surrender option. The pension holder participates in an investment community together with the other pension holders and the owners of the pension fund. This joint ownership of the portfolio makes it challenging to identify which assets belong to the individual pension holder and thus the amount by which the individual pension account should be increased each year. The distribution of surplus between pension holders is required to be fair in the sense that the surplus should be redistributed to those who earned it. The individual pension fund determines the annual rate of interest on pension holder’s savings according to a wide ray of factors, such as actual investment returns, the size of the company’s free buffers/bonus reserves, the level of guarantees provided, outlook, and competition, see Jørgensen and Linnemann (Reference Jørgensen and Linnemann2012). Part of the surplus is deposited in an “undistributed” reserve to smooth fluctuations in investment return over different calendar years. The pension fund is not allowed to grow “large” undistributed reserves as they could systematically redistribute surplus from the past and present pension holders to the future pension holders. The undistributed reserve is divided into a buffer belonging to a group of pension holders with the same investment profile and the size is determined according to the risk profile of the investments within that group. In these types of contracts, the pension funds carry both the investment risk and longevity risk. The distributed part is allocated to the pension holder as a percentage of the surplus according to the relative weight of the contributions. Thus, the Dutch “DB” plans’ indexation work similar to the Danish with-profit plans.

During the past 10 years, the majority of the pension industry has moved the annuity contracts specified as guaranteed average interest products to unguaranteed market return products. With market return products without guarantees, the pension funds transfer the annual returns from the pension holder’s pension assets to the pension holder’s pension depot. Thus, in years with poor performance in the financial market, pension payments will potentially be reduced accordingly. Moreover, increases in life expectancy will also imply reductions in benefits in the decumulation phase. Thus, the pension holder carries both the financial risk and the longevity risk. However, the larger degree of freedom in relation to the investment strategy combined with lower levels of solvency capital requirements (as the pension funds no longer have to honour the interest rate guarantees) enables more risky investments and thus higher expected returns. On the investment side, the market interest return products follow a life-cycle strategy.

Depending on the type of contract, the fund value (or the guaranteed value) is converted into either a fixed annuity or a variable annuity (after 2011). In theory, the fixed annuity can be variable if the pension holder has with-profit contracts as the annuity payments can be increased by bonus payments if the actual investment performance exceeds the guaranteed return (thus only exposed to the upside). A number of pension funds allow for flexibility in the decumulation phase. It is possible to receive higher pension benefits in the earlier years of retirement at the cost of lower pension benefits in later years and vice versa. The rules regarding the regulation of the size of the benefits vary significantly between funds. Finally, some providers combine the market return products with a smoothing mechanism in the decumulation phase meaning that they withhold part of the pension holders’ pension assets at retirement. This buffer is used to smooth pension payments across time. However, if the market performs poorly for a longer period, it will be necessary to reduce pension payments accordingly.

5.2. From guaranteed annuities to unguaranteed annuities

In May 2010, the sixth biggest pension fund, Sampension, decided in cooperation with central labour market parties behind the collective pension schemes to discontinue the guaranteed benefits effective January 1, 2011. The argument presented was that the fund was struggling to meet the new Solvency II rules, which would result in significantly stricter capital requirements applicable to pension products with guaranteed benefits.Footnote 13 This inspired the majority of the pension funds in Denmark to make a similar change for their pension holders. In some cases, the pension funds made a collective decision to transfer all pension holders to zero interest guarantees, whereas some funds (Danica, PFA, JøP, and others) offered the pension holder the option to decide for themselves whether they wanted to give up their interest guarantees. Moreover, it implied that the pension holders would now carry both the financial risk and the longevity risk as the pension benefits were made variable in the decumulation phase based on market performance and developments in life expectancy. Prior to these events in 2010/11, there had been some cases where pension funds had offered their pension holder to relinquish their interest rate guarantees. In 2007, JøP made such an offer.

5.2.1. Illustrating pension accumulation in Denmark

For the purpose of illustration, Figures 4 and 5 show how the guaranteed (interest guarantee greater than zero) and unguaranteed (interest guarantee equal to zero) products for lifelong annuities in with-profit contracts differ in both the accumulation phase and the decumulation phase. The calculations underlying the figures are described in Balter, Kallestrup-Lamb and Rangvid (Reference Balter, Kallestrup-Lamb and Rangvid2019). The figures are constructed assuming two identical individuals that only differ in terms of whether the pension product is guaranteed or unguaranteed.

Figure 4. Pension wealth during the accumulation phase.

Figure 5. Expected pension wealth during the decumulation phase.

In Figure 4, we show how the two individuals’ pension wealth evolves throughout the accumulation phase. The black line shows how both types of individuals’ pension wealth grow throughout their work life as they continue to pay contributions. The “guaranteed” individual accumulates higher expected pension wealth as shown by the red line. This is due to the fact that a guaranteed average annual minimum return is added to the individuals’ accounts on top of the pension contributions. The uncertainty related to the “guaranteed” individuals account is depicted by the green dashed lines. If the pension fund performs well in the financial market, it has the option to distribute a bonus on top of honouring the guarantee. The interest guarantee ensures that the policyholder’s accumulated pension wealth is bounded from below indicated by the dark green dashed line (overlapping with the red line: accumulated pension wealth plus the added guaranteed return). Thus, the “guaranteed” individual only takes part in the upside indicating that the value of the policy balance can only increase.

The “unguaranteed” individual with a zero percent interest guarantee is only guaranteed the value of his or her accumulated pension wealth. However, as the pension fund is able to invest in more risky products for this type of policyholder, a higher return is expected, as illustrated by the dashed light blue line, even higher than the combined value of the interest guarantee and bonus distributions (based on realisations of the last 5 years). Due to the 0% guarantee, a minimum wealth equal to the nominal contributions forms the lower bound which is illustrated by the dark blue dashed line.

In Figure 5, we show the expected pension payments for the two types of individuals who at retirement have accumulated an identical amount of pension wealth. At retirement, total accumulated wealth is converted into an annuity, as indicated by the black line. The “guaranteed” individual can with certainty expect a higher pension payment than the black line as the interest guarantee holds throughout the life of the annuity as well, thereby increasing the base amount from the black to the red line. Similar to the accumulation phase, the uncertainty regarding the size of the pension payments in the decumulation phase only arises from potential bonus distributions (light green dashed line) and is bounded from below by the positive interest guarantee (the dark green dashed line).

The “unguaranteed” individual can on average expect higher returns due to more risky investments depicted by the purple line. The uncertainty regarding the expected payments is greater, thus the upside from unguaranteed marked interest pension products is potentially higher (light blue dashed line). The expected pension payments are bounded from below by the zero percent guarantee (Turkish blue line) equivalent to the black line for the base amount of the converted annuity. However, as the zero percent guarantee is a conditional guarantee pension payments can be reduced if the pension fund consistently performs poorly on the financial market or if macro longevity increases more than initially anticipated (dark blue dashed line). This makes the annuity variable in both upward and downward directions. As of January 1st 2019, the largest pension fund in Denmark, PFA, will reduce pension payments between 3% and 10% for the retired policyholders due to increases in longevity. Thus, the variability of the annuity is no longer just a theoretical possibility but applied in practice.

6. Learnings

There are two main differences between the Danish and the Dutch case. First of all, the majority of private (in pillar two) pension products in The Netherlands are DB, whereas in Denmark they are DC. Second, Denmark started the transition towards more risky pension products during the mid-2000s, whereas The Netherlands has allowed for variability only since 2016. This gives rise to some learnings, or perhaps rather areas where inspiration can be drawn, from the Danish case that could be relevant for the Dutch case, and vice versa.

First, the shifts in Denmark started before the regulation was really in place. The Danish FSA has been heavily involved in the supervision of the discontinuity of the interest guarantees and the following lawsuits against pension funds put forward by pension holders. It has raised a number of – very important – questions; did the pension holder receive sufficient information regarding the financial implications, how do you price the value of the interest rate guarantee, to which extent should the pension holders’ individual accounts be increased to give up this guarantee, how much of the undistributed bonus reserved for the participating contract with profit sharing was the pension holder entitled to, how to take risk of changes in life expectancy into account, etc. Thus, in 2014, the Danish Financial Business Act was changed, and in particular, a §60a was added that contains guidelines on how to determine the financial value of pension holders’ accounts when giving up the interest rate guarantees. Moreover, it was specified how much of the undistributed reserve should be allocated to each individual, how much the pension fund can charge regarding administration costs for transferring the policyholder, requirements regarding documentation to ensure that no redistribution between policyholders take place, and the amount that can be withheld by the pension fund as a buffer for unforeseen events. Therefore, a clear learning from the Danish case is that it would be preferable to consider how to regulate these transitions before they take place.

Denmark has been inspired by, among others, The Netherlands in terms of how to inform pension holders about the risk they face. A good feature of the way Danish and Dutch pension projections are made is that pension projections are based on common assumptions about expected returns on different asset classes, i.e., pension providers cannot compete on what they individually anticipate expected returns to be. A challenge with the way pension projections have traditionally been presented in Denmark is that they only show expected pensions, i.e., pension holders are not told about the uncertainly surrounding expected pensions. In The Netherlands, pension holders in DC plans are informed, during their working life, about their first expected pension when they will retire and 10 years after, in a good and a bad scenario (the 5% and 95% quantile), i.e., a low and a high bound on expected pensions. Given the shift from guaranteed to unguaranteed pension in Denmark, this is obviously important information to share with the policy holders. As of January 1st, 2020, pension holders in Denmark will also be informed about their expected pension in a good and a bad scenario.

In The Netherlands, the central bank is influential when it comes to pension regulation. Technical details are provided by the Dutch central bank. No such role exists for the Danish central bank. In Denmark, it is solely the FSA (which is equivalent to the Dutch AFM) that investigates the movements that have taken place in the pension design and sets additional rules to protect pension holders and improve communication. Furthermore, in The Netherlands, it is the central bank who provides the scenarios used to calculate riskiness of pension pay-outs. In Denmark, an industry agreement governs this. It is a positive development, though, that as of 2019, an independent committee determines expected returns, risks, and correlations in Denmark. This improves arms-length and credibility. Another difference is that it is the central bank and the government that guide a reform of the pension system in The Netherlands. In Denmark, the market initiated the process. In other words, there is a trade-off between speed and supervision. The top-down structure in The Netherlands, where the governing coalition along with the unions has to agree on a pension reform, slows the process down a lot. The debate has already been going on for 9 years, and recently the political system, employers, and unions agreed on a pension deal for which the retirement age has already been implemented in the law. From the Danish side, the bottom-to-top structure has led to the creation of new pension products with a delayed intervention of the regulator. There was simply a demand for these non-guarantees as the sustainability of the sector was under pressure. This enforced quick changes. The drawback, however, is that the regulator was behind and the market has become opaque and unstructured from a supervisory viewpoint possibly endangering the pension holders.

Reflecting on conversion risk, the risk that interest rates are low when the accumulated pension wealth is turned into an annuity, leads to potential improvements for both countries. In Denmark, the FSA can set protective hedging rules to mitigate the risk that annuities are expensive at retirement due to low interest rates. In The Netherlands, opaque communication can be reduced by acknowledging that there is hardly any relation between conversion risk and variable annuities. Finally, a more general learning is that a pension system that is dominated by DC products can provide a good working system and deliver an adequate pension as the Danish pension system is ranked as one of the best in the world. Thus, the “fear for the unknown” (i.e. fear for DC products) in The Netherlands is not necessarily well grounded.

7. Conclusion

We have compared the Danish and the Dutch pension systems and products. The focus in our paper has been on the shift from “safe” to “risky” pension products (for the customer) in both countries. These shifts occur because of the challenges facing pension systems worldwide, and thus in Denmark and The Netherlands too, in particular in terms of low interest rates and increasing life expectancies. This leads to the first observation that (also) a DC system can provide a good working system with adequate pensions. Other lessons are the timing issue, which implies that it is wise to determine regulations before transitions take place. Once the guarantees are given up, from a communication perspective, it is recommended that informing pension holders about the potentially higher expected returns in the unguaranteed products should be accompanied by the associated increase in uncertainty. Given that the Dutch and Danish pension systems rank high, these findings should also be relevant for other countries than Denmark and The Netherlands.

Acknowledgements

The financial support from Netspar and PeRCent is gratefully acknowledged. The authors thank Bas Werker, Theo Nijman, Henrik Ramlau-Hansen, the Danish FSA, an anonymous referee, as well as participants at PeRCent Members’ Meeting and Netspar International Pension Workshop for comments and suggestions.

Appendix

A. Macro overview

Pension savings in The Netherlands and Denmark are large. According to OECD (2015), Denmark is the country in the world with the largest private pension savings, measured in relation to GDP. Private pension savings in The Netherlands are the second largest. In 2015, private pension savings in Denmark amounted to approximately two times Danish GDP, whereas private pension savings in The Netherlands amounted to approximately 180 pct. of Dutch GDP, see Figure A.1.

In 2015, the value of pension savings in The Netherlands was USD 1,317 billion, whereas it was USD 600 billion in Denmark. Not surprisingly, the country with the nominally largest pension savings is the US, but the country with the sixth largest is The Netherlands, with Denmark right behind as the eighth largest, see Figure A.2.

Figure A.2. Value of private pension investments in USD million. Source: OECD (2015).

The typical size of a pension fund differs considerably between The Netherlands and Denmark. In The Netherlands, there are 319 private pension funds. In Denmark, there are 20. This means that the average Dutch pension fund manages assets worth USD 4 billion, whereas the average Danish pension fund manages USD 30 billion.

Life expectancy is expected to increase in The Netherlands and Denmark, like in most OECD countries. In 2010, a 65-year-old man could expect to live for 17.6 years in The Netherlands (OECD, 2015) which is slightly above the OECD average of 17.5 years. Life expectancy at 65 in Denmark was slightly lower at 17 years. In 2060, life expectancy is expected to increase to 22 years, 21.9 years, and 21.4 years for The Netherlands, OECD, and Denmark, respectively, see Figure A.3.

The increase in life expectancy, coupled with a fertility rate that is expected to remain below 2 in both Denmark and The Netherlands, implies that old-age dependency ratios are expected to increase. In Denmark, in 2015, there were 32 individuals above the age of 65 per 100 individuals in the working age, defined as those aged between 20 years and 64 years. In The Netherlands, the number was 30.5. The old-age dependency ratio increases relatively fast in The Netherlands, though not much out of line with the rest of the OECD. These numbers are expected to increase to 47.6 in Denmark and 55.9 in The Netherlands, see Figure A.4.

Figure A.4. Old-age dependency ratios.

Not least because of the expected developments in life expectancy and the consequences this has on expected developments in old-age dependency ratios, the legal retirement age will increase in both The Netherlands and Denmark. In The Netherlands, the retirement age is frozen to the current retirement age of 66 and 4 months until 2022. After 2022, the retirement age will increases over 2 years to the age of 67 in 2024. From 2024 onwards, the retirement age will depend on the development in the average life expectancy. An increase in life expectancy by one year will cause an increase of 8 months in the retirement age. These rules are the first implementations of the pension deal that was agreed upon last June 2019. Note that the retirement age discussed here applies for the first pillar pension, which is decoupled from the other pillars that currently use a retirement age of 68. In Denmark, the retirement age increases to 67 years in 2022 (from 65 years today). The retirement age will then follow the developments in life expectancies. In Denmark, the aim is that the average expected retirement period should be 14.5 years. The retirement age can be adjusted every fifth year (dependent on the development in life expectancy). In 2015, it was decided that the retirement age will be 68 in 2030. It is expected that the retirement age will be increased by 1 year every fifth year from 2035 to 2050 (Danish Ministry of Finance, 2017).

What does the large existing pension savings, but increasing life expectancy, imply for replacement ratios? The replacement ratio is the ratio between the gross income after retirement (including the first and the second pillar, see below) and the gross income before retirement. The replacement ratio is relatively high in The Netherlands and Denmark compared to other OECD countries. The ratio is about 91% and 71%, in The Netherlands and Denmark, respectively, while the European average ratio is about 54% (OECD, 2015). The OECD overestimates the Dutch rate since the underlying assumption is that a fictional person receives the median income throughout his working life of 45 years (Knoef et al., Reference Knoef, Goudswaard, Been and Caminada2015). However, pension income is, in reality, likely to be lower due to an incomplete working history. Traditionally, the ambition was to have a pension income of about 70% of the last earned gross wage which changed to 70% of the average earned salary over those years that premiums have been paid to the Dutch DB plans. In Denmark, there is no official goal of a certain replacement ratio.