In the United States, the affluent are much more likely to participate in politics than those who are not (Leighley and Nagler Reference Leighley and Nagler2013; Ojeda Reference Ojeda2018; Verba, Schlozmann, and Brady Reference Verba, Schlozman and Brady1995; Schlozman, Brady, Verba, Reference Schlozman, Brady and Verba2018; Smets and Van Ham Reference Smets and Van Ham2013; Verba and Nie Reference Verba and Nie1987). Although the presence of a participatory gap between high- and low-income individuals is well established, scholars know little about whether income is the driving force behind these gaps, or instead, income gradients in voting reflect some other unobserved social or contextual factors. As a result, we do not know whether increasing household income would actually improve overall levels of civic engagement and narrow gaps in voting behavior. This question is inherently difficult to answer, as incomes are (typically) not exogenously distributed. Moreover, there has been little research into how income interacts with the life course and whether children’s propensities to vote are affected by the family environment, by family income, or both (for a notable exception see Ojeda Reference Ojeda2018).

In this letter, we explore whether income has an effect on civic participation across two generations. To do so, we investigate the effects of a quasi-experimental unconditional cash transfer. We examine a unique longitudinal dataset from the Great Smoky Mountains Study (GSMS): a study of children in rural western North Carolina, which began in 1993 and consisted of both Native American and non–Native American families in the area. Halfway through the initial 8-year survey time frame, a casino opened on the Eastern Cherokee reservation located in this region. On its opening, a portion of the profits were distributed to all adult tribal members independent of employment status, income, or other characteristics relevant to political engagement. This exogenous unconditional income transfer, along with the unique longitudinal nature of the data, allows us to use various panel techniques to explore the effects of positive changes in household incomes on the political participation of parents and children from the same household.

We first test whether a positive change in income has an effect on parents’ voting. As we describe in the following paragraphs, the Resource Model of Voting (RMV)—and other similar voting models—suggests that positive income shocks should have a noticeable effect on voting (Verba, Schlozman, and Brady Reference Verba, Schlozman and Brady1995). However, we find a precisely estimated null effect across parents. Second, we test whether there is any impact of the additional household income on the household children. We find that average annual unconditional transfers of approximately $4,700 (in 2000 dollars) increase the initially poorer group’s voter turnout by about 8–20 percentage points, depending on the age of the recipients and the type of measures of voting considered. The effect closes the participatory gap between individuals of high- and low-income backgrounds in this rising generation.

Our work makes several important contributions. First, our study helps answer the question whether income contributes to underlying levels of voter participation. Our quasi-experiment, although (perhaps) not allowing us to draw conclusions across all space and time, does provide us with a unique circumstance in which we can make an unusually credible (local) causal estimate of the effect of income on voting. In doing so, it adds nuance to the foundational resource model of voting developed by Verba, Schlozman, and Brady (Reference Verba, Schlozman and Brady1995). Our findings are consistent with a more complex voter turnout model that allows for childhood resources to affect future civic participation in a manner consistent with the human capital formation literature from economics (e.g., Almond and Currie Reference Almond and Currie2011; Becker and Tomes Reference Becker and Tomes1986; Currie Reference Currie2009).

Second, given the intergenerational element to our analyses, the results also contribute to our understanding of political socialization. In seeking to understand why some people develop into active citizens, whereas others do not, social scientists have tended to focus almost exclusively on adult experiences—when citizens are just coming of age or are already eligible to vote—rather than on those that occur in childhood or early adolescence. Political socialization research once focused on childhood in hopes of discovering the roots of political participation (e.g., Dawson and Prewitt Reference Dawson and Prewitt1968; Greenstein Reference Greenstein1965; Langton Reference Langton1969; Miller and Saunders Reference Miller and Saunders2016; Niemi and Hepburn Reference Niemi and Hepburn1995; Sapiro Reference Sapiro2004; Searing, Schwartz, and Lind Reference Searing, Schwartz and Lind1973). Although various models have postulated that resources allocated earlier in the life course may matter more than those delivered later, little to no contemporary research has explored this possibility. The research that has focused on this topic has generally struggled to elicit causal estimates. Our work provides compelling evidence that early life experiences—in this case, the receipt of additional income—have a greater effect on participation than the same experiences among members of the same family later in life. This implies that voting propensities are not a heritable trait that is transmitted from one generation to the next, but, instead, can be influenced by malleable aspects of the household environment during the early years.

Finally, our results have implications for public policy. Discussions about the merits of various income distribution schemes are at the heart of a multitude of policy reforms. Our results suggest that income augmentation programs might be an effective means of closing the income gap in voting, as long as they are targeted early in the life course. This finding is of critical importance in a context of soaring levels of income inequality in the United States and abroad (Piketty Reference Piketty2014).

BACKGROUND AND CONCEPTUAL FRAMEWORK

Many models have been put forth to explain why individuals vote. Most of these start from the point that voting is costly. The resource model of voting (RMV) states that because voting is costly, only citizens with adequate resources will do so (Almond and Verba 1963; Schlozman, Brady, and Verba Reference Schlozman, Brady and Verba2018; Verba and Nie Reference Verba and Nie1987; Verba, Schlozmann, and Brady Reference Verba, Schlozman and Brady1995). Importantly, under the RMV, these resources act to increase the chances a person votes regardless of the timing in the life course.

The Connection between Income and Voting

Income plays an especially important role in the determination of voting behavior. Indeed, foundational models of voting behavior place income as a core voting resource—along with time and skills (Verba, Schlozman, and Brady Reference Verba, Schlozman and Brady1995). Empirically, it is a well-known fact that affluent citizens are much more likely to vote than the less affluent (Leighley and Nagler Reference Leighley and Nagler2013; Schlozman, Brady, and Verba Reference Schlozman, Brady and Verba2018; Verba and Nie Reference Verba and Nie1987).

Many attempts have been made to provide a theoretical rationale for this positive relationship. These revolve around two primary channels: human capital acquisition and social norms. Regarding the first, some have argued that income increases individual investments in education, skills, and health that make it easier for one to participate in politics (Akee et al. Reference Akee, Copeland, Costello and Simeonova2018; Denny and Doyle Reference Denny and Doyle2008; Holbein Reference Holbein2017; Verba, Schlozman, and Brady Reference Verba, Schlozman and Brady1995; Schlozman, Brady, and Verba Reference Schlozman, Brady and Verba2018; Wolfinger and Rosentstone Reference Wolfinger and Rosenstone1980, 20). Regarding the second, some have argued that income increases the likelihood of voting by enhancing citizens’ social status and social connections, that is, income makes it more likely that citizens are socialized to a norm of voting (e.g., Wolfinger and Rosenstone Reference Wolfinger and Rosenstone1980, 20–1, 104–5).

Importantly, the voting literature makes clear predictions that increasing income will exhibit diminishing returns—that is, that income may only matter up to a point (Leighley and Nagler Reference Leighley and Nagler2013; Verba, Schlozman, and Brady Reference Verba, Schlozman and Brady1995; Verba and Nie Reference Verba and Nie1987; Wolfinger and Rosentstone Reference Wolfinger and Rosenstone1980, 21). For those who are poor, income may matter a great deal for voting; for those who are well-off already, additional income may have little effect.

Moreover, there are strong theoretical reasons to suspect that income obtained in childhood may matter a great deal for voting behavior (Ojeda Reference Ojeda2018). There is evidence that the attitudes, skills, and identities governing political behavior harden by late adolescence (Holbein Reference Holbein2017; Plutzer Reference Plutzer2002; Prior Reference Prior2018). Therefore, changes in household conditions during childhood may play a more important role than similar changes later in life—when these traits, skills, and attitudes may have already been set.

Unfortunately, the empirical literature testing the link between income and voting has distinct limits. On the one hand, virtually all data sources that have measures of income and voting indicate that they exhibit a strong bivariate association (Ojeda Reference Ojeda2018).Footnote 1 On the other, however, studies that condition on observable individual and contextual characteristics are decidedly mixed. A recent meta-analysis of 90 studies shows that exactly half of studies find that income is an important predictor for voting, whereas the other half do not (Smets and Van Ham Reference Smets and Van Ham2013). Here, we argue that these mixed findings occur, in large part, because of lack of good causal identification. (We discuss some exceptions that get close to identifying the causal effect of interest in the Online Appendix: see the “Additional Relevant Literature” section.) Moreover, few studies test for diminishing marginal returns to income or test income effects across the life course.

We aim to begin to fill these gaps in this paper.

DATA

We use data from a unique quasi-experiment from western North Carolina. Specifically, we use survey data from the Great Smoky Mountain Study (GSMS)—a longitudinal study of 1,420 children and their parents that began in 1993—matched to administrative data records on voting. The survey was originally designed as a means of studying the mental health and well-being of children (Costello et al. Reference Costello, Angold, J. Burns, K. Stangl, Tweed, Erkanli and M. Worthman1996). For more details about this sample, see the Online Appendix (see the “More Information About the GSMS Sample” section).

At the beginning of the survey, the children of the three participating cohorts were 9, 11, and 13 years old. The sample was designed to be representative of the school-aged population of children in the region studied. Families were recruited from 11 counties with an oversample of children from the Eastern Band of Cherokee Indians. In the original sample, 25% of the children were Native Americans living on the Eastern Cherokee Reservation or in the rest of the 11 counties. Children and parents have been followed overtime, with attrition and nonresponse rates being statistically the same across ethnic and income groups as well as across the exogenous variation we leverage in this study. The survey is still ongoing and follows the original subjects, with the latest survey wave completed in 2015.

After the fourth wave of the survey, a casino opened on the Eastern Cherokee reservation. On the casino’s opening, all adult enrolled tribal members—regardless of whether they were living on the reservation—were eligible to receive biannual cash transfers from casino revenues. These unconditional cash transfers were sizable and gradually increased during the first years of casino operation. Comparing the estimated change in household income with the average incomes in the affected group before the casino opened reveals an increase in income of about 20–25%.

To explore the effect of casino transfers on voter turnout, in early 2016 (not long after the most recent survey-based follow up), we matched GSMS participants to public-use voter files. This match was possible because the GSMS data have been actively maintained overtime, being continuously updated to incorporate new information on subjects who have changed their names, moved, died, or gotten married. This approach involved scraping voter registration and voter history information off publicly available statewide voter portals. To do so, we followed common best practice and matched parents and children based on their name (first and last), date of birth, and, in some instances, their current location. We looked for subjects in North Carolina voting records and, for those who had moved, in the state of their current address. This matching technique mirrors that used in matching other survey data (e.g., Pew, CCES, and ANES) and academic work (Ansolabehere and Hersh Reference Ansolabehere and Hersh2012; Holbein Reference Holbein2017; Sondheimer and Green Reference Sondheimer and Green2010). More details about this match to voting records and checks of the quality of the subsequent matched data can be found in the Online Appendix (see the “Match of GSMS Participants to Voter File” section).

METHODS

To test the effect of exogenously increased household incomes on parents and children, we use several estimation strategies.Footnote 2 We first show in Appendix Figure A.6 that there is a sizeable and statistically significant change in unearned household incomes because of the casino transfer payments that accrue to households with enrolled tribal citizens after the start of casino operations. We base our analysis on this exogenous increase in household incomes for Native American households.

Given that there are strong reasons to expect heterogeneities in the estimated effects by income levels in our analyses, we test for these formally across both the adults and the children in our sample. To do so, we take two approaches: first, we stratify our regressions at the median household income level measured at baseline (before the casino opened) and second, we interact our treatment variable with the baseline household income variable.

Methods: Parents

We conduct a standard difference-in-difference analysis for the parents because they are eligible to vote before the income intervention (in 1992 and 1994), where we are able to use the same household’s voting record overtime. The comparison in the case of parents is across the same household before and after the transfers began and across AIs (eligible) and non-AI households (not eligible). Because the treatment is on the household level, we run the analysis at that level as well.Footnote 3

Equation (1) formalizes the model that we run for parents, with γ 1 being the coefficient of interest. In this case, the treatment is an indicator for household exposure to the casino transfer in the time period after the start of the casino intervention. We include a control for Native American household status and a binary variable for whether the observation is drawn from the time period after the intervention. The variable NativeAmerican i × AfterCasino i is simply the interaction between those two binary indicator variables. We also include an individual household fixed-effect α i because we observe the same household over multiple periods in our strongly-balanced panel; note that this implies that we will not be able to separately identify the level effect of Native American household in the regression equation as it will be captured in the individual household fixed-effect. Finally, we include election year fixed-effects to account for potentially different average voter turnout for presidential versus congressional-only elections θ t and an error term. Our estimation equation is given as follows:

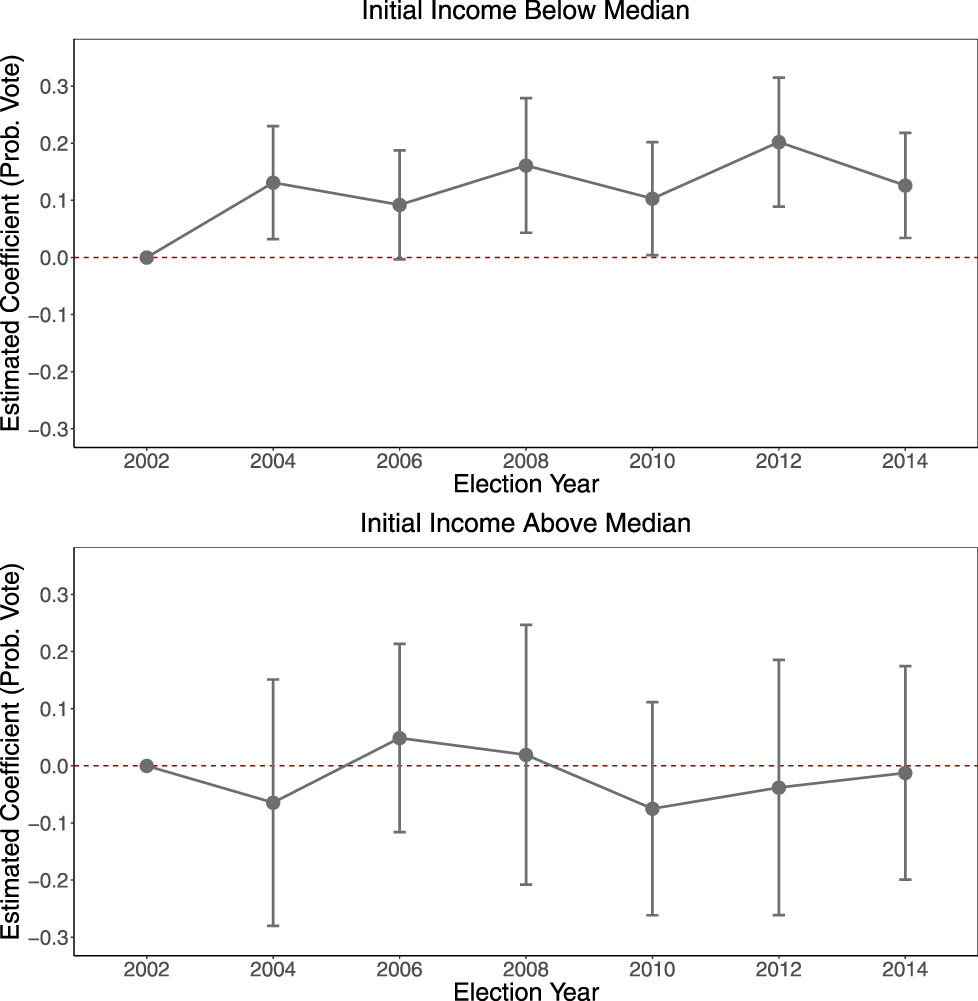

Identification in equation (1) is based on the assumption that the parallel trend assumption holds. We show pretreatment trends based on the parents’ voting records across age cohorts by race and year in Figure 1. Voting data for the years 1992 and 1994 serve as the pretreatment observations. We find no substantial differences between the two groups. This standard check provides supportive evidence of the internal validity of our quasi-experimental design—among other things, it provides evidence that before the income transfers began, the treated and untreated groups voted at indistinguishable rates.

FIGURE 1. Effect of Casino Transfers on Parental Voting by Initial Household Income Status around the Start of Casino Operations

Notes: Figure displays coefficients from event analysis model for parents’ voter turnout in the 1992-2014elections. The estimates are split by median family income levels at baseline. Standard errors are clustered at the individual level. Top panel N = 15,984 (1,332 GSMS individuals); Middle panel N =8,172 (681 GSMS individuals); Bottom panel N = 7,812 (651 GSMS individuals).

Methods: Children

For children, there is no “before” period as they are not eligible to vote as minors. Thus, we conduct a difference-in-difference analysis where we compare the voting records across cohorts of children who are exposed to the income intervention for different lengths of time. Younger children live in households with exogenously increased unearned incomes for a longer time period than their older counterparts because the income intervention started at a single point in time in this community. This approach leverages two differences: the first difference is between Native American (eligible for the transfer) and non–Native American children (not eligible) and the second difference is across age cohorts of AI children who were exposed to the income transfers at different points in the life course. Our hypothesis, consistent with Ojeda’s model (Reference Ojeda2018) and with the human capital model from economics, is that income transfers will have larger effects on the younger children in the survey.

Equation (2) formalizes the difference-in-difference model that we estimate using data on the children in the GSMS sample:

$$\eqalignb{ {Y_i} = \alpha + {\beta _1}\;AgeCohort{1_i} + {\beta _2}\;AgeCohort{2_i} + {\delta _1}\;NativeAmerica{n_i} + {\gamma _1}\;AgeCohort{1_i} \times \,NativeAmerica{n_i} + {\gamma _2}\;AgeCohort2 \times\, NativeAmerica{n_i} + X\prime \theta + {\varepsilon _i}. \cr}$$

$$\eqalignb{ {Y_i} = \alpha + {\beta _1}\;AgeCohort{1_i} + {\beta _2}\;AgeCohort{2_i} + {\delta _1}\;NativeAmerica{n_i} + {\gamma _1}\;AgeCohort{1_i} \times \,NativeAmerica{n_i} + {\gamma _2}\;AgeCohort2 \times\, NativeAmerica{n_i} + X\prime \theta + {\varepsilon _i}. \cr}$$Following the previous practice (Holbein Reference Holbein2017; Sondheimer and Green Reference Sondheimer and Green2010), in equation (2), we specify Y i in three ways—as a binary variable indicating whether an individual has ever voted, as a continuous variable measuring the proportion of elections that a person voted in, and as a measure for voting in specific elections. In equation (2), YoungestCohort i is an indicator variable for the child belonging to the youngest cohort (age 9 years at the start of the survey and age 13 years at the first cash transfer). MiddleCohort i is an indicator that the child belongs to the second youngest cohort (age 11 years at the beginning of the survey and age 15 years at the first cash transfer). The omitted group is the third (oldest) cohort, so all coefficients are interpretable as differences from that cohort. The variable NativeAmerican i is a dummy equal to one for Native Americans and zero otherwise. The vector X is a set of baseline covariates that include the parents’ voter turnout rate before the casino opened, child age, number of children younger than six years in the household, and child gender. The coefficients of interest are γ 1 and γ 2, which capture the difference-in-difference coefficient estimates.

RESULTS

Parents’ Voting Outcomes

We first estimate the effects of the casino transfer on parents’ voting rates. Figure 1 provides the event analysis for parents for the pooled sample and separately by initial household income above and below the median.Footnote 4 Note that the first two years (1992 and 1994) serve as a test of the parallel trends assumption. We plot the coefficient on the AI household dummy for all elections starting in 1992, which is before the income transfers began in 1996 (Appendix Table A.9 provides the regression results used to construct this figure.) As the figure shows, we find that the increase in household income has no economically substantive or statistically significant effect on parents’ voting probabilities. This null effect is precise. Using equivalence testing (Hartman and Hidalgo Reference Hartman and Hidalgo2018), our 95% confidence intervals allow us to confidently rule out effects larger than 2.5 percentage points. Regardless of how we specify the model, unconditional cash transfers have little to no effect on parents’ voting.Footnote 5

The figure displays coefficients from the event analysis model for parents’ voter turnout in the 1992–2014 elections. The estimates are split by median family income levels at baseline. Standard errors are clustered at the individual level.

These precisely estimated null effects are vitally important in their own right. They suggest that resource-based models of voter turnout may be oversimplified. Resources (in this case, income) when distributed in adulthood do not uniformly increase adult turnout.

Children’s Voting Outcomes

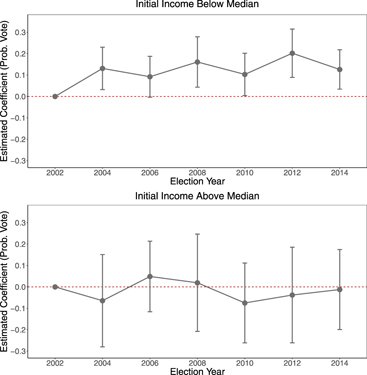

We next turn to estimating the effect of casino transfers on children’s voting patterns. Figure 2 provides a graphical depiction of the differential effect of income received earlier and later during the life course. Here, we combine cohorts 1 and 2 for readability, so the plotted coefficients represent the average effect of the transfers on the voting propensities of these two cohorts relative to the oldest cohort.Footnote 6 In the top panel, we plot the estimated coefficients for observations below the baseline median household income. The effect of the casino transfers on the younger cohorts from poorer households is positive, substantively large, and (in virtually all elections) statistically significant. The effects range from 10.3 percentage points (p < 0.05) in the 2010 election to 20.2 percentage points (p < 0.01) in the 2012 election. In the bottom panel, we provide the same analysis for individuals from above the baseline median household income level. The effect among this group of children is smaller and not statistically significant.Footnote 7

FIGURE 2. Effect of Casino Transfers on Child Voting by Initial Household Income Status

Note: The Figure displays coefficients from event analysis model for children’s voter turnout in the 2004-2014 elections. The estimates are split by median family income levels at baseline. To make visualization easier, cohorts 1 and 2 are collapsed together and compared to cohort 3. Standard errors are clustered at the individual level. Top panel N = 4,557 (651 GSMS individuals); Bottom panel N = 4,767 (681 GSMS individuals).

The figure displays coefficients from the event analysis model for children’s voter turnout in the 2004–14 elections. The estimates are split by median family income levels at baseline. To make visualization easier, cohorts 1 and 2 are collapsed together and compared with cohort 3. Standard errors are clustered at the individual level.

These results are consistent with the predictions based on a human capital perspective of voting and with the implications of Ojeda’s two-gap conceptual model (Reference Ojeda2018). They suggest that income transfers in relatively early life narrow participatory gaps considerably. For young people who are in their formative years and who have yet to finish high school, household incomes matter a great deal in determining whether they become active voters or fail to do so—with these effects concentrated among those who have the lowest initial household incomes. This suggests that voting rates are not predetermined because of household characteristics or rigidly transferred from one generation to the next. In addition to the other positive effects of elevating families out of poverty, this movement out of poverty also has large effects on children’s levels of civic participation.

We provide suggestive tests for potential mechanisms in the Appendix. Our results suggest that this effect is not likely to be driven by the transmission of voting from parents to children—one of the most commonly cited channels in the literature (e.g., Dawson and Prewitt Reference Dawson and Prewitt1968). Instead, we provide suggestive evidence that the results may, indeed, be driven by increases in educational attainment and social skill acquisition over the life course. These channels may help explain why the timing of the income intervention mattered so much for children from the youngest cohort at receipt.

CONCLUSION

In this article, we provide the first causal evidence exploring whether positive unconditional income shocks increase turnout and narrow participatory gaps for adults and children coming from the same household. The results suggest that increasing household income does, indeed, have a substantial impact on participatory inequality, but only if it is received at early ages. Cash transfers help disadvantaged children catch up with their more advantaged peers. However, the unconditional cash transfers have no effect on the parents’ generation.

Our results contribute to a broader framework for understanding what drives people to participate in politics. The resource model of voting predicts that resources uniformly increase participation, but our results suggest that models of voter turnout should more explicitly take into account the importance of human capital acquisition before individuals become eligible to vote. This makes a substantial contribution to our understanding of political socialization. At present, the political socialization literature has been woefully underdeveloped, with few examples of studies exploring the causal impact of childhood inputs on later life voting. Such a gap is unfortunate, given the abundance of evidence that voting patterns (and the inputs that predate them) harden long before many analyses even start. Our work helps to begin filling that gap.

Our work has only scratched the surface of how resources vary over the life course. Future work would do well to continue to identify causal effects of various resources across time and space. Specifically, future work should consider whether income losses have different effects than income gains (due to loss aversion) and how income transfers affect children even younger than what we have explored in this study.

Unconditional cash transfer programs appear to have broader effects than previously realized. Not only do they affect individuals’ labor, health, and schooling outcomes, but they may also influence citizens’ levels of civic engagement. This finding has special meaning, given the dismal returns of many interventions designed to increase voter turnout (Green, McGrath, and Aronow Reference Green, McGrath and Aronow2013). Our results—combined with this previous research—suggest that there may be some merit to the argument that to get meaningful increases in voter turnout, larger scale programmatic interventions might be required. Such an approach is more expensive, but is of critical importance. Inasmuch as voting participation determines representation and policy, additional resources may affect the perpetuation of the intergenerational transmission of economic inequality.

SUPPLEMENTARY MATERIAL

To view supplementary material for this article, please visit https://doi.org/10.1017/S000305541900090X.

Replication materials can be found on Dataverse at: https://doi.org/10.7910/DVN/DYCUSZ.

Comments

No Comments have been published for this article.