Introduction

Ever since the publication of Esping-Andersen's The Three Worlds of Welfare Capitalism (Reference Esping-Andersen1990), social scientists and policy makers have shown a keen interest in the role of different welfare regimes in reducing poverty. A well-known finding is that welfare states that provide extensive social transfers are the most efficient in fighting poverty, in both the short and long terms (Fritzell Reference Fritzell1991; Goodin et al. Reference Goodin, Headey, Muffels and Dirven1999; Kenworthy Reference Kenworthy1999; Muffels and Fouarge Reference Muffels and Fouarge2004). These studies can however be criticised because they have neglected the fact that, after cash transfers, alternative forms of welfare state support also counter the risk of poverty; they are rarely taken into account. For instance, several authors have argued that evaluations that examine solely cash benefits under-estimate their social protection and redistribution roles, for a large fraction of the liberal welfare states' resources are devoted to in-kind benefits and ‘invisible’ tax-deductible transfers (e.g. Van Voorhis Reference Van Voorhis2002; Whiteford Reference Whiteford1995).

A case in point is the importance of home-ownership as a form of asset accumulation. Although buying a house requires a large personal investment, home-ownership is usually financially advantageous. For instance, over time property tends to hold its value and may thus be considered as a hedge against inflation (Davies Withers Reference Davies Withers1998). Furthermore, in most countries home-ownership is subsidised through tax measures, which benefits average and high-income households (Kendig Reference Kendig, Binstock and George1990). Finally, once a mortgage is paid off, housing costs are substantially reduced. Especially in later life, home-ownership offers protection against poverty (Castles Reference Castles1998; Conley and Gifford Reference Conley and Gifford2006). Home-ownership can therefore be considered as an alternative form of insurance that secures a valuable asset which can be drawn upon to raise economic wellbeing in old age.

The idea that housing policies can reduce poverty in later life by promoting outright ownership, which in turn provides a ‘hidden’ source of income, has been addressed by several authors (e.g. Fahey Reference Fahey2003; Fahey, Nolan and Maître Reference Fahey, Nolan and Maître2004). Inspired by Kemeny (Reference Kemeny1981), Castles (Reference Castles1998) pointed to a possible trade-off between the extent of home-ownership and the generosity of old-age pensions. In Castles's words, ‘by the time of retirement, for a large percentage of owners, the process of home purchase is likely to be complete, leaving them with a net benefit equivalent to the rent they would otherwise have to pay on the property minus outgoings for maintenance and property taxes. In other words, when individuals own their own homes, they can get by on smaller pensions’ (p. 13). Furthermore, Castles found that in countries with high ownership rates, lower income groups were more successful in accumulating housing assets. In this paper we test if and how the trade-off between pensions provision and housing policies affects the prevalence of old-age poverty.

We add to research on the topic in three ways. Firstly, we agree with Castles (Reference Castles1998) that the trade-off does not necessarily imply that high pensions and high ownership rates are functional equivalents. Indeed, the policy context is much more complicated: an in-depth analysis of social-welfare outcomes for older people must deal with the interplay between social-transfer policies and housing policies in the broadest sense. For instance, in some countries pension benefits are mainly contributory and related to pre-retirement earnings, leaving people that had ‘poor’ labour-market trajectories with pension benefits at the level of social assistance. Other countries, however, such as Australia, specifically target resources towards those on low incomes, and so provide a relatively high basic pension. Likewise, although home-ownership rates are an important outcome of housing policy, there are variations in other dimensions of government housing interventions. In many countries, for example, the provision of social housing is an equally important policy instrument. In this paper we therefore examine how both pension and housing policies influence the risk of old-age poverty.

Secondly, rather than using the macro-quantitative approach, as customary for comparative studies of the effects of welfare-state arrangements on economic wellbeing (e.g. Brady Reference Brady2005; Esping-Andersen Reference Esping-Andersen1990, Reference Esping-Andersen1999; Scruggs and Allan Reference Scruggs and Allan2006), we follow Kittel's (Reference Kittel2006) recommendation that, when measuring the impact of macro-level indicators on (aggregate) individual outcomes, one must provide for a link between both levels of analysis. Most studies of the trade-off between pension benefits and housing policies have to date been at the macro-level (Castles Reference Castles1998; Castles and Ferrera Reference Castles and Ferrera1996; Conley and Gifford Reference Conley and Gifford2006). Although individual-level data have been used to gauge the impact of ownership policies on poverty, the analyses usually focus on ‘aggregate’ country-level changes in the poverty line before and after housing costs (Fahey, Nolan and Maître Reference Fahey, Nolan and Maître2004; Ritakallio Reference Ritakallio2003). The analysis reported here employed a multi-level model that has enabled evaluation of the impact of both micro- and macro-level determinants on the individual experience of poverty (Stier Reference Stier2006; van der Lippe and van Dijk Reference van der Lippe and van Dijk2002).

Finally, most previous studies have applied an income-based approach to poverty, and not taken into account that poverty is multi-dimensional and manifests in several forms and life domains (Dewilde Reference Dewilde2004, forthcoming; Kangas and Ritakallio Reference Kangas, Ritakallio and Andreß1998; Tsakloglou and Papadopoulos Reference Tsakloglou and Papadopoulos2002; Whelan and Whelan Reference Whelan, Whelan and Room1995). In this paper, we examine the impact of welfare state arrangements on old-age poverty using both monetary and non-monetary indicators. More specifically, we distinguish between ‘income poverty’, ‘resources deprivation’, and the presence of both.

To summarise, the main research question is: to what extent can cross-national differences in the risk of old-age poverty be attributed to the interplay between welfare state arrangements in the two domains of pensions and housing policies? The multivariate analyses have used data from Wave 8 (2001) of the European Community Household Panel (ECHP) study for 10 European Union Member States. The analysis sample was restricted to those aged 65 or more years. The paper begins with a discussion on the impact of pensions and housing policies on old-age poverty, after which we formulate the hypotheses about the trade-off between them. Next, we discuss the design, methods, data and measures, and then present the analyses. The paper ends with an overview and discussion of the results.

Theoretical background

Pensions provision

Kangas and Palme's (Reference Kangas and Palme2000) study of income poverty trends from the 1960s to the 1990s demonstrated that in most welfare states, the gradual extension and maturation of pension policies had resulted in a widespread decline of old-age poverty, and in some countries its virtual eradication, although substantial cross-national differences remained. Especially in Anglo-Saxon countries, the relationship between stage in the life course and the risk of poverty was still quite strong, resulting in relatively high poverty rates among older people (see also Hedström and Ringen Reference Hedström and Ringen1987). Cross-national differences associate with the different ways in which European welfare states provide benefits for older people (Organisation for Economic Co-operation and Development (OECD) 2005). Whiteford and Whitehouse (Reference Whiteford and Whitehouse2006) identified three types of variation: in the way that benefits are calculated, whether they are publicly- or privately-managed, and the level of benefits. Concerning the first, the main distinction is in the ‘overall’ objective of pensions policy (see also Bonoli Reference Bonoli1997).

In the Bismarckian system, pension rights are acquired through social insurance, and benefits provide a ‘decent’ standard of living relative to pre-retirement earnings and reflect the recipient's former occupational status. In the Beveridgean system, on the other hand, the emphasis is on universal coverage, universal flat-rate benefits, the unity of the system, the redistribution of income towards low-income households, and the prevention of old-age poverty. In European countries, neither of these two systems is exclusively present. Most countries pursue both goals, and so have both first-tier programmes (e.g. safety nets to prevent old-age poverty) and second-tier programmes (e.g. insurance-based entitlements). There are, however, large variations in the emphasis put on each (OECD 2005; Whiteford and Whitehouse Reference Whiteford and Whitehouse2006). Secondly, while in all European countries the ‘basic’ safety net is provided by the state, earnings-related pension programmes can be either publicly or privately managed (although they are usually publicly mandated). Finally, the level of pension benefits varies, with the replacement rate ranging from 30.6 per cent in Ireland to over 100 per cent in Luxembourg (Whiteford and Whitehouse Reference Whiteford and Whitehouse2006).

To understand the cross-national variations on these dimensions, welfare regime typologies have been developed; by far the most often used is that formulated by Esping-Andersen (Reference Esping-Andersen1990, Reference Esping-Andersen1999). One category of the typology, the ‘liberal welfare’ model, occurs in Anglo-Saxon countries and is characterised by a basic, residual pension system in which the market prevails. This tends to result in a dual society, in which the poor depend on relatively low and often means-tested welfare-state transfers, while the middle classes provide for themselves through private insurance. In another category, the conservative, insurance-based systems of ‘continental’ Europe, social security tends to be occupationally segregated with extensive privileges for civil servants. Finally, the universalistic pension system that is found in the social-democratic welfare states of Northern Europe is characterised by universal and relatively generous social rights.

Several authors have added an additional category of welfare-regime for Southern European countries (e.g. Bonoli Reference Bonoli1997; Ferrera Reference Ferrera1996). Although their welfare states are sometimes considered as the ‘under-developed’ or ‘residual’ variant of the conservative regime, with the (extended) family carrying the burden of unprotected social risks, they share several specific traits, namely a highly fragmented and corporatist system of income maintenance, a universalistic health-care system, low state influence in the welfare sector, and finally the persistence of clientelism and patronage, resulting in the selective distribution of cash benefits. Concerning the pension system, replacement rates are exceptionally high, amounting to more or less complete replacement. As Castles and Ferrera (Reference Castles and Ferrera1996) noted, however, not all pensioners receive high transfers. Pension benefits in Southern Europe are in practice extremely polarised, with very high benefits for ‘core sector’ workers, and minimal transfers for those outside or on the fringes of the labour market.

Housing policy

From a comparative perspective, variations in national housing tenure patterns can be explained by many factors: historical influences, cultural variations (in particular in inter-generational transfers of wealth), economic growth, housing and financial (mortgage) markets and institutional arrangements, as well as the development of all these through previous decades. All have independent impacts on the current housing situation of older people (Kurz and Blossfeld Reference Kurz and Blossfeld2004; van der Schors, Alessie and Mastrogiacomo Reference van der Schors, Alessie and Mastrogiacomo2007). The unprecedented economic growth since 1945 has resulted in a rise of home-ownership rates in virtually all developed countries, as ‘households profited from rising incomes and inflation, which reduced the real costs of their mortgages and increased the value of their houses’ (Kurz and Blossfeld Reference Kurz and Blossfeld2004: 14). Home attainment has been strongly influenced by national policy arrangements, however, resulting in quite large differences in home-ownership rates among countries at similar levels of economic development (Boelhouwer et al. Reference Boelhouwer, Doling, Elsinga and Ford2004; Kurz and Blossfeld Reference Kurz and Blossfeld2004).

Whereas welfare arrangements concerning social security, education and health are usually well-established and mainly provided by the state, housing provision continues to hover between the private and the public spheres. This inspired Torgersen (Reference Torgersen, Turner, Kemeny and Lundqvist1987) to consider housing policy as a fourth but ‘wobbly’ pillar of the welfare state. Another complication is that institutional variations in housing do not neatly fit the patterns derived from ‘mainstream’ welfare regime theory (much to the frustration of housing researchers). Nevertheless, several attempts have recently been made to incorporate housing policy into welfare-regime theory and to incorporate housing into comparative welfare-state research. Focusing on social housing, Harloe (Reference Harloe1995) distinguished residual and mass models. Whereas the mass model of social housing focuses on a broad segment of the population, the residual model aims to provide social housing only for lower-income groups. Kemeny (Reference Kemeny1995) introduced a similar typology, between a dual and a unitary rental model. While the dual system is inspired by a market system, with the government shielding the social-rent sector as a safety net for low-income households, the unitary system is not aimed exclusively towards the poor. Next to the provision of social housing, welfare states can also intervene by stimulating home-ownership. For instance, Fahey (Reference Fahey2003) concluded that public policy can reinforce ownership by legislating for tenants' right to buy social housing, the provision of local authority mortgages, and through mortgage-interest income tax relief.

Whereas formerly in comparative welfare state analyses, the size of the social rental sector was seen as an indicator of the non-market component, recently all aspects of housing policy have been taken into account. For instance, Hoekstra and Reitsma (Reference Hoekstra and Reitsma2002) identified the following attributes: subsidies, price-setting and price-regulation, the tenure distribution of housing, the position of the renter versus the landlord, the organisation of the promotion and production of new dwellings, and fiscal arrangements related to housing. Different configurations of these dimensions result in distinct housing systems (Barlow and Duncan Reference Barlow and Duncan1994; Kurz and Blossfeld Reference Kurz and Blossfeld2004). State intervention in the liberal (i.e. free market) countries is aimed at those unable to compete in the market, and owner-occupiers are more covertly systematically supported. All this occurs in the context of a policy regime that promotes the interests of property developers, construction companies and credit institutions. By contrast, housing policy in the conservative-corporatist countries has a problem-solving and incremental character, and aims to maintain existing social differentials. Personal initiative is strongly encouraged. In the social-democratic regimes, affordable and good standard housing, whether owned or rented, is a universal right. State intervention is not limited to the social housing sector. Finally, in the rudimentary welfare states, state interference is restricted. There is little social housing, while rigid rent controls have resulted in a gradual shrinkage of private-rented accommodation. For many households, owner-occupation is thus the only available tenure (Castles and Ferrera Reference Castles and Ferrera1996). Given the lack of other investment options and the relative inaccessibility of mortgage credit, however, ‘family resources, savings and self-build play the role performed by mortgage-financed house purchase in other countries’ (Fahey, Nolan and Maître Reference Fahey, Nolan and Maître2004: 441). The absence of the state in the different sectors of the housing market also produces considerable property speculation.

The housing and pensions munificence trade-off hypothesis

According to Kemeny (Reference Kemeny1981), policies that promote home-ownership are closely related to social welfare expenditures. More specifically, he argued that there is an inverse relationship or trade-off between the prevalence of home-ownership and the level of social welfare spending: widespread ownership generates inferior welfare performance, especially in the domains of pensions and health-care. Using OECD data for 17 countries, Castles (Reference Castles1998) found a significant negative correlation between the rate of home-ownership and various measures of social expenditure, including pension benefits. He concluded that support for owner-occupation substitutes for generous pension benefits. Castles also demonstrated that in countries with high home-ownership, lower-income households are more successful in accumulating housing assets.

A first explanation for the trade-off is the affordability argument: the more states spend on subsidising home purchase, the less they can afford to increase social expenditure (Fahey Reference Fahey2003). A second and related explanation was offered by Kemeny (Reference Kemeny1981), who argued that the personal resources required to achieve ownership are so high that people are less inclined to support high personal tax rates. Finally, if the welfare impact of widespread home-ownership turns out to be beneficial, one could ‘turn around’ the affordability argument, in the sense that high levels of owner-occupation diminish the need for generous pensions (Castles Reference Castles1998).

Although the trade-off hypothesis is intuitively appealing, the empirical evidence is equivocal. Comparing Finland and Australia, Ritakallio (Reference Ritakallio2003) found that the inclusion of housing costs in the calculation of disposable income substantially reduced the rather large ‘before housing costs’ differences in poverty and equality. Conley and Gifford (Reference Conley and Gifford2006), using data from the Luxembourg Income Study (LIS) for 20 countries, found that ownership policies are an important instrument for ameliorating the detrimental social effects of market forces in the absence of redistributive programmes. On the other hand, the trade-off between high ownership rates and generous pension spending does not apply to all countries. Castles and Ferrera (Reference Castles and Ferrera1996) identified a number of countries where both ownership rates and pension expenditure are low (e.g. Japan and Portugal), or where both are relatively high (e.g. Greece, Italy, the United Kingdom and France). Furthermore, Fahey et al. (Reference Fahey, Nolan and Maître2004: 451) found among 14 European countries no effect of home-ownership in reducing poverty among older people, and concluded that ‘it is difficult to argue that high levels of home-ownership have a strong and consistent tendency to reduce poverty rates among older people. That effect is present to some degree but is weak or absent in many countries and so is difficult to present as a consistent pattern’.

To summarise, we conclude that the empirical evidence for the existence of a trade-off between high ownership rates and generous pensions is still limited. This may, however, be because both elements have been operationalised in a restricted way. A proper test of the ‘Castles-hypothesis’ needs to recognise that pension systems entail more than social spending, and that poverty outcomes are influenced by several factors including replacement rates, coverage, dependency on previous earnings and contribution records, and the level of minimum pension benefits. Likewise, it is not impossible that governments achieve similar outcomes with different housing policies. More particularly, cheap housing for older people can be accomplished by different means, such as widespread home-ownership or the provision of affordable social housing.

The examined hypotheses

For the trade-off hypothesis to be confirmed, several relationships have to be tested. A basic expectation is that home-owners have a low poverty risk (Hypothesis 1). Next, we formulate hypotheses concerning the effects of the macro-level variables. A first implication of the trade-off hypothesis is that, controlling for demographic and socio-economic differences among the countries, both types of policies have a similar effect on poverty outcomes. That is, we expect that generous pension benefits, high home-ownership rates and extensive social housing provision all have an independent negative effect on old-age poverty (Hypothesis 2). Furthermore, we expect there to be interaction effects, in that the negative effect of one type of policy (e.g. generous pensions) on the poverty risk is stronger as the ‘value’ for the other type of policy (e.g. social housing provision) is higher (Hypothesis 3). We thus expect that the negative effect of generous pensions is significantly stronger in countries with extensive social housing provision as compared to countries with less social housing. This hypothesis implies that in countries where both pension and housing provisions are well developed, there is a significantly low poverty risk. We also expect some cross-level interactions. Firstly, we expect that home-owners have a significantly lower poverty risk in countries with generous pension benefits, as they have a ‘double advantage’ (Hypothesis 4). Another implication of the trade-off hypothesis is that the effect of home-ownership rates on poverty varies with the size of the owner-occupation sector. That is, if in countries with high ownership rates there are more low-income home-owners, we would expect the poverty-reducing effect of home-ownership to be weaker (Hypothesis 5).

Sources and methods

Data

The data for the analyses were drawn from the ECHP, a comparative household panel survey in 15 European Union member states using a standardised design and common procedures (Eurostat 2003). It administers annually questions to samples of households and individuals. From such data, longitudinal databases can be created (e.g. Rose Reference Rose2000). The sample of households and individuals is representative of the population in each of the participating countries. Because of the unavailability of the monetary and non-monetary indicators on which the dependent variable is based, the analyses were limited to 10 countries: Denmark, Belgium, The Netherlands, France, Austria, Ireland, Italy, Spain, Portugal and Greece. We used the most recent panel wave (2001) and included only those aged 65 or more years. The analysis sample had 17,311 respondents, and there was valid information for 16,508. Although attrition differed by country, it is plausible to assume that it has not biased the results.Footnote 1 All results in this article are corrected for longitudinal non-response using weights provided by Eurostat.

Macro-level indicators

As stated in the introduction, the main aim was to conduct a more sophisticated test of Castles's trade-off hypothesis than hitherto using indicators of both pensions arrangements and housing policies. In the sociological literature, several approaches to the measurement of the impact of institutional arrangements can be identified. In the ‘deductive-explorative’ approach, institutions are carefully described, leading to the formulation of hypotheses concerning the interplay between individual lives and institutions. If the hypotheses are confirmed, this is taken as ‘evidence’ for the existence of an institutional effect. Recently however, researchers have sought to ‘quantify’ the impact of institutions by estimating multi-level models with both individual and institutional variables (Stier Reference Stier2006; van der Lippe and van Dijk Reference van der Lippe and van Dijk2002). For instance, Uunk (Reference Uunk2004) has shown that variations in the economic consequences of divorce for women can be explained by the availability of public child-care and the level of single parent-allowances. By using ‘domain-specific’ macro-level indicators, this type of analysis offers more clues as to how to influence individual outcomes. Furthermore, by controlling for individual characteristics, the ‘institutional’ effects are corrected for between-country variations in demographic and socio-economic attributes.

The literature review made clear that a government's housing interventions include both ownership and social housing policies, so the macro-level indicators refer to both. One indicator simply measured the size of the ownership sector and was defined as ‘the percentage of respondents aged 65 and over in outright owner-occupation’.Footnote 2 The relative importance of social housing for older people was measured as ‘the number of respondents aged 65 and over in social housing, expressed as a percentage of all older people in rented accommodation’.

Likewise, the type and generosity of pension systems was operationalised using several indicators. As a first indicator, we used the ‘empirical’ replacement rate, which is calculated as ‘the average pension income for older people (aged 65 and over) as a percentage of average earnings among respondents aged 49-60 years’.Footnote 3 In comparison to the often-used ‘theoretical’ replacement rate, which is usually defined as the hypothetical maximum contributory pension a worker on ‘average earnings’ receives as a percentage of ‘average production worker (APW) earnings’, the empirical replacement rate has several advantages (for a review see Whiteford Reference Whiteford1995). For instance, many older people do not have a full contribution social insurance record and hence do not qualify for the complete contributions (minimum) pension. Furthermore, theoretical replacement rates take no account of the fact that the purchasing power of many benefits erodes over time, and that the ‘oldest-old’ thus tend to have lower pensions. Furthermore, in many countries old-age income tends to be from a mix of public pensions, publicly-mandated private pensions and other private pensions. Finally, the cross-national comparability of the most often-used denominator (average APW-earnings) can be questioned, which compromises the validity of the theoretical replacement rate. Although the empirical replacement rate is nonetheless a somewhat crude indicator, in our view it ‘summarises’ several relevant dimensions (e.g. coverage and benefit levels) and produces a more accurate index of cross-national variations in pension systems. The second indicator is specific to the poorest elderly people: ‘the absolute level of the minimum pension for a single-person household’. Since both welfare-state generosity and the level of poverty are at least partly determined by the general level of economic welfare, the impact of institutions is estimated controlling for affluence (measured by gross domestic product (GDP) per capita). To control for cross-national differences in price levels, all monetary amounts are expressed in ‘Purchasing Power Parities’ (€).

Table 1 shows that home-ownership rates (outright owner-occupation) were high (>70%) in Ireland, Belgium and the Southern European countries, and low (<30%) in Denmark and The Netherlands. In the latter countries, however, social housing was the most important tenure for older people who were not home-owners (as was also the case for Ireland). The empirical pension replacement rates were fairly high in The Netherlands and Italy, while there were comparatively low replacement rates in Denmark, Belgium, Ireland and the Southern European countries (excluding Italy). Belgium and The Netherlands provided the highest minimum pension. Benefit levels were comparatively low in Spain and Portugal.

Table 1. Macro-level housing, pensions and income indicators, 10 European countries 2001

Notes and sources of data: 1. Outright owner-occupation. European Community Household Panel survey, Wave 8 2001, authors' calculations. 2. Per month in Purchasing Power Parities (€), European Commission (2001). 3. International Monetary Fund, World Economic Outlook Database (April 2006) [Available online at http://www.imf.org]. 4. Ministerie van Sociale Zaken en Werkgelegenheid [Ministry of Social Affairs and Employment] [Available online at http://www.szw.nl].

Significance levels: * p<0.05, ** p<0.01, *** p<0.001.

Individual-level determinants

The choice and coding of the individual-level determinants was quite straightforward. The demographic variables were sex and age and there was a measure of household type or living arrangement. We also included a dummy variable for whether the household reference person was hampered in his/her daily activities by a physical or mental health problem, illness or disability. Estimates were also included of the impact of a number of economic determinants: main source of household income (social transfers versus private income/earnings from labour), and dummy variables for whether the household had access to any private income and for tenure (outright home-owner or not).Footnote 4

The dependent variable and its categories

Despite the general agreement on the multi-dimensional nature of poverty (e.g. Tsakloglou and Papadopoulos Reference Tsakloglou and Papadopoulos2002; Whelan and Whelan Reference Whelan, Whelan and Room1995), there is much debate about its operational measurement. The key difference is between direct and indirect measurement, a distinction introduced by Ringen (Reference Ringen1988). In the former, poverty, in this context often referred to as (life-style) deprivation, is measured directly using information on living standards or consumption. In the latter, poverty is measured indirectly through indicators of the resources that people have to dispose, with income as the usual and only indicator. This debate has been animated by the repeated finding that different methods classify different groups as ‘poor’ (e.g. Whelan, Layte and Maître Reference Whelan, Layte and Maître2002), with the overlaps between different poverty measures as low as 0.1 per cent (Kangas and Ritakallio Reference Kangas, Ritakallio and Andreß1998).

Several authors have found that older people experience less deprivation than expected given their income (Muffels and Fouarge Reference Muffels and Fouarge2004; Saunders and Adelman Reference Saunders and Adelman2004). This may be partly explained by their position in the housing market (in most countries most older people are outright owners and thus have low housing costs), by an age effect, that older people have better budgeting skills, or by a cohort effect, that they grew up in an era when people had lower material demands. Furthermore, older people's incomes commonly include relatively high components from savings or investment income, which are usually not taken into account or are measured unreliably (Piachaud Reference Piachaud1987). Finally, in many countries older people have access to many in-kind benefits and services that ‘supplement’ their disposable income. In this article, rather than favouring one type of indicator above another, we have used a combination of both monetary and non-monetary indicators. To this end, we distinguish between income poverty (after housing costs), resources deprivation, and the combination of the two (cumulative deprivation).

Household income refers to ‘net disposable household income during the previous calendar year’, the sum of employment income, social transfers, capital income and private transfers for all household members. Housing costs were expenditure on rent and mortgage repayments. Income poverty (after housing costs) was measured by using a relative income poverty line set at 60 per cent of the median population income. To adjust for differences in the size and composition of households, we used the modified OECD-equivalence scale (Hagenaars, de Vos and Zaidi Reference Hagenaars, de Vos and Zaidi1994). Table 2 presents the ‘income poverty’ figures for older people before and after taking account of housing costs. As expected, in most countries controlling for housing costs results in lower poverty rates, but this was not the case for The Netherlands, where outright home-ownership is less widespread (see Table 1). Old-age poverty was fairly high in Ireland and Greece (>30%) and very low in The Netherlands. These poverty rates are comparable to those reported by Dennis and Guio (Reference Dennis and Guio2004) using the same data.

Table 2. Income poverty before and after housing costs and distribution of the dependent variable, 10 European countries 2001

Source of data: European Community Household Panel survey, Wave 8 2001.

A second measure of poverty, resources deprivation, was based on nine non-monetary indicators that refer to the financial stress and deprivation arising from a lack of economic resources (Table 3). The nine items were coded ‘1’ (deprived) or ‘0’ (not deprived) and the deprivation score was the weighted aggregate, with the weights corresponding to the country-specific proportions of the non-deprived. This way, situations of deprivation that are less common and thus lead to strong feelings of relative deprivation have stronger weights. For each country, the poverty line identified the most deprived respondents in such a way that the number of the deprived was equal to that of the income poor (for a similar approach, see Whelan, Layte and Maître Reference Whelan, Layte and Maître2004). Table 2 also presents the distribution of the dependent variable. The Netherlands and France had the highest percentages of not-poor people, and Portugal and Greece the lowest. In line with previous research, the number in cumulative deprivation was rather low, except in Greece and Portugal (also see Tsakloglou and Papadopoulos Reference Tsakloglou and Papadopoulos2002). Overall, 11,076 respondents were ‘not poor’, 1,845 were ‘income poor’ only, 2,145 were ‘deprived’ only, and 1,442 experienced both poverty forms (‘cumulative deprivation’).

Table 3. Non-monetary indicators of poverty and deprivation in the European Community Household Panel 2001

Methods

As the dependent variable had four nominal categories, the effect of the micro- and macro-determinants on the poverty risk was estimated using a multivariate multinomial or generalised logit model (Agresti Reference Agresti1990; Allison Reference Allison2005). This model is an extension of the binomial logit model and can be written as a series of such models with each category of the dependent variable being compared to a reference category – omitting the observations not belonging to one of these categories. Recent software enables estimation of the ‘full’ model, which produces more efficient parameter estimates and a global goodness-of-fit test. In the multinomial logit model, the independent variables are related to the natural logarithm of the odds of the dependent variable (defined as a series of comparisons between a specific category and the reference category – here defined as the ‘not poor’). The parameters of this model are estimated by the maximum likelihood procedure. To facilitate interpretation, especially of the interaction effects, all macro-variables were centred on their means.

Analyses

The results of the multivariate models are presented in Tables 4 to 7. We start with the impact of the individual-level variables on the chances of being poor on one or on both measures compared to not being poor (Table 4). While Model 0 estimated the impact of only the individual determinants, Model 1 additionally included country dummies. These significantly increased the goodness of fit, with Nagelkerke's R 2 increasing from 0.09 to 0.16 (likelihood ratio test, p<0.0001). The model shows that, controlling for household composition, older men had a slightly lower risk than women of being ‘income poor’ only and being ‘deprived’ only, but that their risk of being both or ‘cumulatively deprived’ compared to ‘not being poor’ was somewhat surprisingly significantly higher (only in Model 0). While the effect of age was small and insignificant, being single (compared to living in a couple) had a strong positive effect on all categories of the dependent variable. For instance, compared to respondents living as a couple, the odds of an older person living alone being ‘income poor’ compared to ‘not being poor’ were 1.52. Likewise, the odds of being ‘deprived’ only and of being ‘cumulatively deprived’ were 1.85 and 2.74 respectively (Model 0). Being in ‘other’ types of household or living arrangement also elevated the risk of both ‘deprivation’ only (not in Model 1) and ‘cumulative deprivation’. Health problems similarly increased the poverty risk in both models.

Table 4. The probability of different ‘forms’ of old-age poverty, 10 European countries 2001

Notes: Multinomial logit models, with coefficients estimated for individual-level variables. Ref: reference case or category. The reference category for the dependent variable is ‘not poor’. Standard errors are corrected for clustering among individuals and countries. Source data: European Community Household Panel survey, Wave 8 2001.

Significance levels: * p<0.05; ** p<0.01; *** p<0.001.

The effects of the socio-economic variables were equally strong and unidirectional. Respondents whose household income was mainly from pensions ran a higher risk of the various forms of poverty than those whose main sources of income were from private sources or earnings. Furthermore, having access to any private income additionally decreased the poverty risk. Being an outright home-owner also had a strong negative effect on all categories of poverty. Hypothesis 1 was thus confirmed. Compared to the reference country, Denmark, the elderly poverty risk was significantly lower in Belgium and significantly higher in Ireland, Spain, Portugal and Greece.

Table 5 presents the effects of the macro-variables on the poverty risk, when controlled for economic affluence. Models 2 and 3 estimated the impact of different welfare-state arrangements, while in Model 4 all the macro-level variables were entered simultaneously. The effect of affluence (in terms of GDP per capita) seems to have depended on the other macro-level variables. Model 2 estimated the impact of pensions provision and found that the risk of old-age poverty was lower in more affluent countries. The estimated coefficients for the risks of being ‘deprived’ only and ‘cumulatively deprived’ were also significant. Model 3 examined the impact of housing policy, and found that the effect of economic affluence was insignificant, probably because of the strong positive correlation (r=0.85) between GDP per capita and social housing provision for older people. When all the macro-level variables were entered simultaneously, affluence significantly raised the risks of income poverty and deprivation. This might indicate that in the more affluent welfare states, the benefits of economic growth, however, have been disproportionately allocated to older people.Footnote 5 This process was not mediated by pensions – their level is presumably more dependent on the level of economic welfare during the previous decades – but by other social measures for older people, such as social housing.

Table 5. Predictions of the probability of different ‘forms’ of old-age poverty from macro-level variables, 10 European countries 2001

Notes: Multinomial logit models, with coefficients estimated for macro-level variables. The reference category for the dependent variable is ‘not poor’. Standard errors are corrected for clustering within individuals and countries. Estimates for the individual determinants not reported, but available from the authors. 1. As we did not wish to control for country-level differences in home-ownership, tenure at the individual level is dropped from this model. 2. All macro-level variables entered simultaneously (and note 1 applies).

Source data: European Community Household Panel survey, Wave 8 2001.

Significance levels: * p<0.05, ** p<0.01, *** p<0.001.

Model 2 found that both indicators of pensions provision, i.e. the empirical replacement rate and the level of the minimum pension, significantly lowered the chances of being ‘income poor’ and of being ‘deprived’. Furthermore, the higher the value of the minimum pension, the lower the risk of ‘cumulative deprivation’. When all macro-level indicators were entered simultaneously (Model 4), however, all but two of the significant estimates were insignificant. Social housing provision had a strong and unidirectional negative effect on the old-age poverty risk (Models 3 and 4). The effect of the home-ownership rate was slight, with only the negative effect on deprivation reaching statistical significance. All in all, there was only partial support for Hypothesis 2. Controlling for housing policy, the poverty-reducing effect of pensions provision diminished quite significantly. Furthermore, the home-ownership rate did not substantially reduce the poverty risk. The only institutional variable that had a clear and unequivocal effect on multi-dimensional poverty was social housing provision; in the countries that provided extensive social housing for older people there was a significantly lower risk of being ‘income poor’, of being ‘deprived’ and of being ‘cumulatively deprived’.

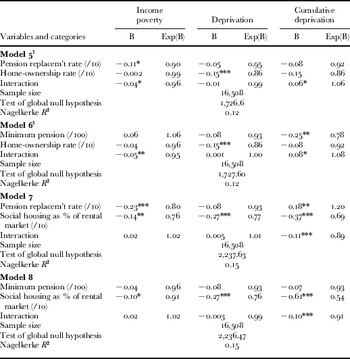

Models 5 to 8 examine the interaction effects among the institutional determinants when controlled for the individual-level variables and other macro-level factors (Table 6). Models 5 and 6 estimated the interactions between pensions provision and the home-ownership rate. In both models, the interaction with the dependent category of income poverty was negative and significant. At ‘average’ levels of home-ownership, an increase of 10 percentage points in the pensions replacement rate decreased the predicted odds of ‘income poverty’ by a multiplicative factor of 0.90. In line with Hypothesis 3, the poverty-reducing effect of pensions provision increased with a higher home-ownership rate: an increase of 10 percentage points in the home-ownership rate increased the multiplicative factor for the pension replacement rate (0.90) by a factor of 0.96.Footnote 6 Thus, in countries with both high pensions and widespread home-ownership, pensioners had a significantly lower risk of being ‘income poor’ as compared to those in countries that had promoted only one or the other. This was not the case, however, for the interaction effect of ‘cumulative deprivation’, which was positive. In both Model 5 and Model 6, the negative effect of pensions provision on the poverty risk became smaller as the home-ownership rate increased (and vice versa), which was out of line with the hypothesis. This can perhaps be explained by the fact that even in countries with high home-ownership, the cumulatively deprived were generally excluded from ownership. Furthermore, as pensions generosity and home-ownership were negatively related, we can assume that in countries with widespread home-ownership, pensions for the groups in the lowest socio-economic groups are lower than in countries with low ownership rates (the correlation between the home-ownership rate and the value of the minimum pension was −0.65).

Table 6. Interactions among the institutional factors (separately estimated) and the prevalence of different types of poverty, 10 European countries 2001

Notes: Multinomial logit models, with coefficients estimated for macro-level variables. The reference category for the dependent variable is ‘not poor’. Standard errors were corrected for clustering within individuals and countries. Estimates for the individual and other macro-level determinants not reported, but available from the authors. 1. Country-level differences in home-ownership were not controlled, so the respondent's tenure was not included. 2. All macro-level variables entered simultaneously. Source of data: European Community Household Panel survey, Wave 8 2001.

Significance levels: * p<0.05, ** p<0.01, *** p<0.001.

Looking at the interaction effects between the indicators of pensions generosity and the provision of social housing, it was again found that the poverty-reducing effect of social housing provision was larger in countries that provided more generous pensions (both indicators), again in line with Hypothesis 3. Finally, we estimated ‘cross-level’ interactions between tenure and the indicators of pensions provision, as well as the home-ownership rate (Models 9 to 11, see Table 7). In line with Hypothesis 4, we found that the negative effect on both ‘income poverty’ and ‘cumulative deprivation’ of being a home-owner was significantly larger in those countries with high pension benefits (both indicators). In countries with generous pensions, therefore, home-owners enjoyed a ‘double advantage’, although this did not reduce their chance of experiencing resource deprivation. Hypothesis 5 was also confirmed: the poverty-reducing effect of being a home-owner diminished significantly as the home-ownership rate increased, in line with Castles's finding that as more households own their own home, there are more low-income home-owners. Again, this interaction effect was evident for only ‘income poverty’ and ‘cumulative deprivation’.

Table 7. Interactions between housing tenure and the institutional factors (separately estimated), and the prevalence of different types of poverty, 10 European countries 2001

Notes: Multinomial logit models. The reference category for the dependent variable is ‘not poor’. Standard errors were corrected for clustering within individuals and countries. Estimates for the individual and other macro-level determinants not reported, but available from the authors.

Source data: European Community Household Panel survey, Wave 8 2001.

Significance levels: * p<0.05; ** p<0.01; *** p<0.001.

Discussion and conclusions

The reported analyses have provided a more elaborate empirical test than previously available of the hypothesis suggested by both Kemeny (Reference Kemeny1981) and Castles (Reference Castles1998) of a trade-off at the national level between the extent of home-ownership and the generosity of old-age pensions. We have evaluated the impact of various institutional pensions arrangements and housing policies on the risk of poverty in old-age. Both policy domains were represented by several indicators, with the important innovation of the inclusion of a measure of social housing provision, which is seen as an alternative to the encouragement of home-ownership as a strategy to promote welfare. The analyses used individual-level data for 10 European countries from the last wave (2001) of the European Community Household Panel (ECHP). In order to test the ‘independent’ effect of pensions and housing policies on the poverty risk, we estimated a multi-level model with both micro- and macro-indicators. In this way, between-country variation arising from demographic or socio-economic differences was controlled (for instance in the age structure of the elderly population). Finally, to allow for the fact that poverty manifests itself in different forms, we measured the experience of old-age poverty in several ways, and constructed a multinomial dependent variable with four categories: ‘not poor’, ‘income poor only’ (after housing costs), ‘deprived only’ and ‘cumulatively deprived’ (both ‘income poor’ and ‘deprived’).

Although there was evidence of a trade-off between generous pensions and high ownership rates, the results show that the original hypothesis needs revision in several ways. First, in line with the trade-off hypothesis, we found that at the individual level, being a home-owner effectively shielded older people from different forms of poverty: home-owners had a significantly lower risk of being income poor, of being deprived and of being cumulatively deprived. Furthermore, we found that the poverty-reducing effect of home-ownership diminished as its rate increased, in accordance with Castles's findings that in countries with high ownership rates, low-income households are more successful in acquiring housing assets. Finally, in line with expectations, in countries with more generous pensions, home-owners enjoyed a double advantage, which resulted in a significantly lower risk of being income poor and of being cumulatively deprived. There were similar indications that the stronger the assertion of one policy (e.g. more generous pensions), the greater was the poverty-reducing effect of the other (e.g. social housing provision). Thus, in countries where both policies were pursued, older people had a significantly lower risk of income poverty (so the interaction between pensions provision and home-ownership rate was significant), and a significantly lower risk of cumulative deprivation (a significant interaction between pensions provision and social housing provision).

The results also point to several shortcomings of the original trade-off hypothesis. For instance, when the impact of all institutional indicators was estimated simultaneously, it was found that the policy that most reduced the risks of all types of old-age poverty was the provision of social housing. While pensions provision and high home-ownership generally reduced poverty, the effects were modest and not (or no longer) significant. Finally, we found that the encouragement of home-ownership did not benefit all pensioners. Even in countries with high ownership rates, some older people for whatever reason had not managed to acquire their own homes. The results for ‘cumulative deprivation’ indicate that this group was not only excluded from the housing market, but also tended to benefit less from pension transfers: as the home-ownership rate increased, the poverty-reducing effect of pensions provision becomes significantly weaker. Although this interaction might arise from a selection effect, by which the higher the rate of home-ownership, the more selected are the older people who do not own their homes, we did not find a similar effect for the other types of poverty. This indicates that certain groups of older people face a double disadvantage, in both housing opportunities and pensions. Fortunately, as we saw above, social housing policies might provide the answer for these groups.

The cross-national examination of a wide set of ‘domain-specific’ welfare-state arrangements has produced findings that can be plausibly interpreted, that suggest the need for reappraisal of the original trade-off hypothesis, and that raise a number of questions for further research. Perhaps the most important limitation of the analyses derives from the fact that the housing and economic situations of older people are both the result of a myriad of historical, economic and political influences over many decades. Some may be country-specific and have different consequences for different groups of older people. For instance, two countries might have a similar level of home-ownership, but the ways in which this has been achieved may differ, as well as the profiles of the home-owners. Studies of single countries over long periods using both macro-level time series and information on individual life courses might provide more insight into the ways in which different policies influence the economic situation of older people. A related limitation is that the macro-level indicators were fairly crude and did not allow tests of the impact of finer policy differences, for example, variant tax concessions for homeowners. Furthermore, we did not test for the effect of other influences on the economic situation of older people, such as the provision of in-kind benefits, as with ‘free’ health-care (although such influences were partly taken into account by the way that the dependent variable was defined).

A related issue concerns the extent to which housing wealth can be converted into additional income, and thus alleviate income poverty among home-owners. Although there are equity release schemes in most European countries, the take-up is limited (Boelhouwer et al. Reference Boelhouwer, Doling, Elsinga and Ford2004; Leather Reference Leather1990). Furthermore, British research has shown that because of the positive association between income and home-ownership, the poverty-reducing potential of these schemes is limited: older people with the lowest incomes do not own their own home or the value of their property is too low to secure a loan, and the increase in income is often offset by the loss of means-tested benefits (Hancock Reference Hancock1998; Leather Reference Leather1990). A last important limitation of the analyses, which might influence the results, is the fact that some European countries (Sweden, the United Kingdom and Germany) that are often seen as ‘ideal-types’ for certain welfare regimes were not included. Nevertheless, we believe that the results of the reported analyses open up important policy-relevant avenues for future research.

Acknowledgements

This article was written as part of a larger research programme funded by FWO-Vlaanderen [Research Foundation – Flanders] (grant G.0043.04). The ECHP data were made available through the Panel Study of Belgian Households (PSBH), University of Antwerp. Eurostat bears no responsibility for the presented analyses and interpretations. Caroline Dewilde is a Post-doctoral Research Fellow with FWO. We thank two anonymous referees and all those who have given additional comments on this paper for their useful suggestions.